This document is intended solely for the use of the party to whom FBR has provided it, and is not to be reprinted

or redistributed without the permission of FBR. All references to “FBR” refer to Friedman, Billings, Ramsey Group,

Inc., and its predecessors and subsidiaries as appropriate. Investment banking, sales, trading, and research

services are provided by Friedman, Billings, Ramsey & Co., Inc. (FBR & Co.), except for those online offering,

mutual fund distribution and discount brokerage services provided by FBR Investment Services, Inc. (FBRIS),

and those services in the U.K., Europe and elsewhere outside the United States and Canada provided

by Friedman, Billings, Ramsey International, Ltd. (FBRIL). FBR & Co. and FBRIS are broker-dealers registered

with the SEC and are members of the NASD. FBRIL, based in the U.K, is regulated by the Financial Services

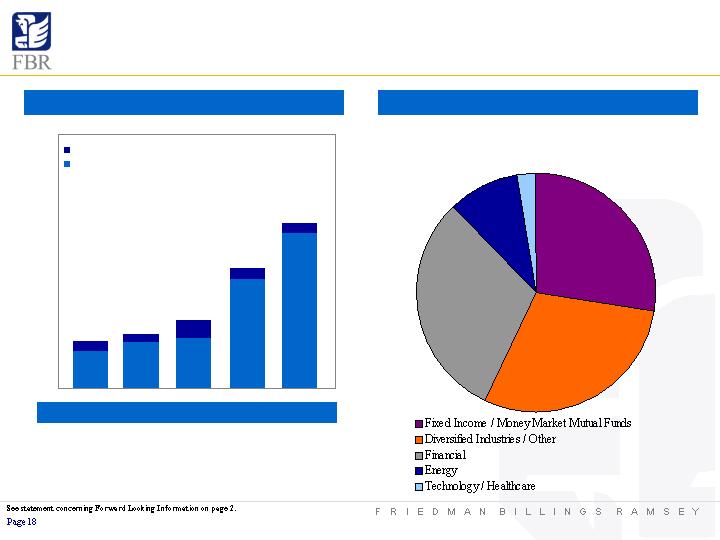

Authority. Asset management services, including managed hedge funds, mutual funds, private equity and venture

capital funds, are provided by FBR subsidiaries FBR Investment Management, Inc. (FBRIM), FBR Fund Advisers,

Inc., and Money Management Advisers, Inc., which are investment advisers registered with the SEC.

Trust services, including mutual fund custody and administration, are provided by FBR National Trust Company.

On March 31, 2003, Friedman, Billings, Ramsey Group, Inc. merged with FBR Asset Investment Corporation,

a real estate investment trust (“REIT”) managed by FBR prior to the merger. The merged company, Friedman,

Billings, Ramsey Group, Inc. is structured as a REIT for U.S. Federal Income Tax purposes and conducts its

brokerage, sales and trading, investment banking, asset management and banking business through taxable REIT

subsidiaries.

This document is intended for information purposes only, and shall not constitute a solicitation or an offer to buy

or sell, any security or services, or an endorsement of any particular investment strategy.

For additional important information, please visit our website, www.fbr.com.

CAUTIONS ABOUT FORWARD-LOOKING INFORMATION

This presentation and the information incorporated by reference in this presentation include forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “plans,” “estimates” or “anticipates” or the negative of those

words or other comparable terminology. Statements concerning projections, future performance developments, events, revenues, expenses, earnings, run rates, and any other guidance on present or future periods constitute forward-looking

statements. Such statements include, but are not limited to, those relating to the effects of growth, revenues and earnings, our principal investing activities, levels of assets under management and our current equity capital levels. Forward-looking

statements involve risks and uncertainties. You should be aware that a number of important factors could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to,

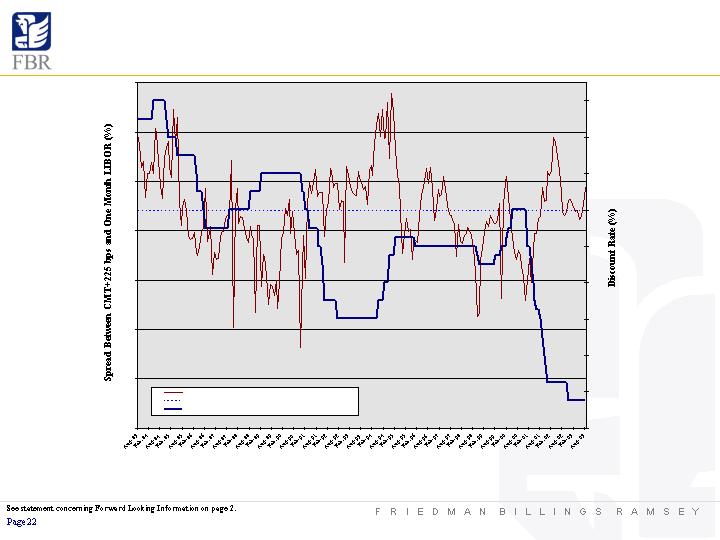

the overall environment for interest rates, repayment speeds within the mortgage backed securities market, risk associated with equity investments, the demand for public offerings, activity in the secondary securities markets, competition among

financial services firms for business and personnel, the high degree of risk associated with venture capital investments, the effect of demand for public offerings, mutual fund and 401(k) pension plan inflows or outflows in the securities markets, volatility

of the securities markets, available technologies, the effect of government regulation and of general economic conditions on our own business and on the business in the industry areas on which we focus, fluctuating quarterly operating results, the availability

of capital to us and risks related to online commerce. We will not necessarily update the information presented or incorporated by reference in this presentation if any of these forward looking statements turn out to be inaccurate. Risks affecting our

business are described throughout our Form 10-K, especially in the section entitled “Risk Factors” beginning on page 29. The entire Form 10-K, including the Consolidated Financial Statements and the notes and any other documents incorporated

by reference into the Form 10-K, as well as, the Forms 10G and 8-K filed subsequent to the forms 10K, should be read for a complete understanding of our business and the risks associated with that business.