viability of companies in an industry. In addition, at times, such industry or industry group may be out of favor and underperform other industries or the market as a whole.

Investments in Business Development Companies (“BDCs”) Risk. Certain Funds invest in BDCs. There are certain risks inherent in investing in BDCs, whose principal business is to invest in, and lend capital or provide services to, privately held companies. BDCs generally invest in less mature private companies, which involve greater risk than well-established publicly traded companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed evaluation of a BDC and its portfolio of investments. In addition, investments made by BDCs generally are subject to legal and other restrictions on resale and otherwise are less liquid than publicly traded securities. With respect to a BDC’s investment in debt instruments, there is a risk that the issuer may default on its payments or declare bankruptcy. Investment advisers to BDCs may be entitled to compensation based on the BDC’s performance, which may result in riskier or more speculative investments in an effort to maximize incentive compensation and higher fees. In addition, to the extent that a Fund invests a portion of its assets in BDCs, a shareholder in the Fund not only will bear his or her proportionate share of the expenses of the Fund, but also will bear indirectly the expenses of the BDCs.

Listed Private Equity Companies Risk. There are certain risks inherent in investing in listed private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to or provide services to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision. A Fund is also subject to the underlying risks which affect the listed private equity companies in which the financial institutions or vehicles held by the Fund invest. Listed private equity companies are subject to various risks depending on their underlying investments, which include additional liquidity risk, industry risk, foreign security risk, currency risk, valuation risk and credit risk. Listed private equity companies may have relatively concentrated investment portfolios, consisting of a relatively small number of holdings, which may be adversely impacted by the poor performance of a small number of investments. By investing in companies in the capital markets whose business is to lend money, there is a risk that the issuer may default on its payments or declare bankruptcy.

Market Risk. Securities in each Underlying Index are subject to market fluctuations. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the securities in an Underlying Index. Additionally, natural or environmental disasters, widespread disease or other public health issues, war, military conflicts, acts of terrorism, economic crises or other events could result in increased premiums or discounts to each Fund’s NAV.

Momentum Investing Risk. For certain Funds, the momentum style of investing is subject to the risk that the securities may be more volatile than the market as a whole, or that the returns on securities that previously have exhibited price momentum are less than returns on other styles of investing. Momentum can turn quickly, and stocks that previously have exhibited high momentum may not experience continued positive momentum. In addition, there may be periods when the momentum style of investing is out of favor and therefore, the investment performance of a Fund may suffer.

Non-Correlation Risk. Each Fund’s return may not match the return of its corresponding Underlying Index for a number of reasons. For example, each Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of its corresponding Underlying Index. In addition, the performance of each Fund and its corresponding Underlying Index may vary due to asset valuation differences and differences between each Fund’s portfolio and its corresponding Underlying Index resulting from legal restrictions, costs or liquidity constraints.

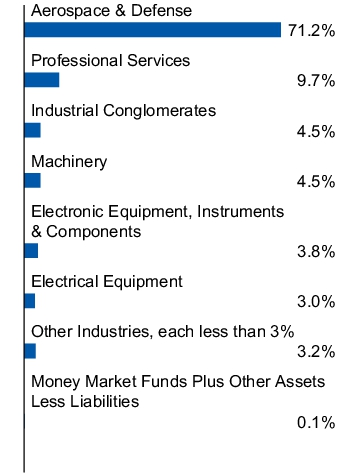

Non-Diversified Fund Risk. Because Aerospace & Defense ETF, Golden Dragon China ETF, S&P Spin-Off ETF and Water Resources ETF are non-diversified, and to the extent certain Funds become non-diversified, and can invest a greater portion of their respective assets in securities of individual issuers than can a diversified fund, changes in the market value of a single investment could cause greater fluctuations in Share price than would occur in a diversified fund. This may increase a Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on a Fund’s performance.

Portfolio Turnover Risk. Certain Funds may engage in frequent trading of their portfolio securities in connection with the rebalancing or adjustment of their respective Underlying Index. A portfolio turnover rate of 200%, for example, is equivalent to a Fund buying and selling all of its securities two times during the course of a year. A high portfolio turnover rate (such as 100% or more) could result in high brokerage costs for a Fund. While a high portfolio turnover rate can result in an increase in taxable capital gains distributions to a Fund’s shareholders, a Fund will seek to utilize the in-kind creation and redemption mechanism to minimize the realization of capital gains to the extent possible.

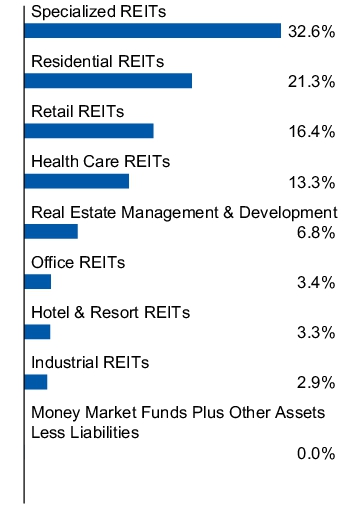

REIT Risk. REITs are pooled investment vehicles that trade like stocks and invest substantially all of their assets in real estate and may qualify for special tax considerations. REITs are subject to certain risks inherent in the direct ownership of real estate, including without limitation, a possible lack of mortgage funds and associated interest rate risks, overbuilding, property vacancies, increases in property taxes and operating expenses, changes in zoning laws, losses due to environmental damages and changes in neighborhood values and appeal to purchasers. Further, failure of a company to qualify as a REIT under federal tax law may have adverse consequences to the REIT’s shareholders. In addition, REITs may have expenses, including advisory and administration expenses, and REIT shareholders will incur a proportionate share of the underlying expenses.

Small- and Mid-Capitalization Company Risk. Investing in securities of small- and mid-capitalization companies involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies. These securities may have returns that vary,