Effective January 1, 2021, the Partnership pays to DCM a monthly management fee equal to 1/12 of 0.75% (0.75% per year) of month-end net assets of the Partnership allocated to DCM. Effective February 1, 2023, the Partnership pays to Drury a monthly management fee equal to 1/12 of 0.50% (0.50% per year) of month-end net assets of the Partnership allocated to Drury. Effective November 1, 2020, the Partnership pays to Episteme a monthly management fee equal to 1/12 of 1.0% (1.0% per year) of month-end net assets of the Partnership allocated to Episteme. Effective January 1, 2020, the Partnership pays to Millburn a monthly management fee equal to 1/12 of 0.25%, 0.375% or 0.50% (0.25%, 0.375% or 0.5% per year), depending on account leverage, of month-end net assets of the Partnership allocated to Millburn. Month-end net assets, for purposes of calculating management fees, are net assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s incentive fee accruals, the monthly management fees, the General Partner fee and any redemptions or distributions as of the end of such month. An Advisor’s management fee is allocated proportionately to each Class based on the net asset value of the respective Class.

Prior to its termination effective December 31, 2022, the Partnership paid to ISAM SM a monthly management fee equal to 1/12 of 1.0% (1.0% per year) of month end net assets of the Partnership allocated to ISAM SM. Prior to FORT’s termination on October 31, 2021, the Partnership paid to FORT a monthly management fee equal to 1/12 of 0.75% (0.75% per year) of month-end net assets of the Partnership allocated to FORT’s Global Trend Trading Program.

In addition, effective January 1, 2021, the Partnership is obligated to pay DCM an incentive fee, payable quarterly, equal to 15% of the New Trading Profits, as defined in the Management Agreement, earned by DCM. Effective February 1, 2023, the Partnership is obligated to pay Drury an incentive fee, payable annually, equal to 25% of the New Trading Profits, as defined in the Management Agreement, earned by Drury. Effective November 1, 2020, the Partnership is obligated to pay Episteme an incentive fee, payable quarterly, equal to 22.5% of the New Trading Profits, as defined in the Management Agreement, earned by Episteme. Effective January 1, 2020, the Partnership is obligated to pay Millburn an incentive fee, payable annually, equal to 28% of the New Trading Profits, as defined in the Management Agreement, earned by Millburn. To the extent an Advisor incurs a loss for the Partnership, the Advisor will not be paid incentive fees until the Advisor recovers the net loss incurred and earns additional new trading profits for the Partnership. An Advisor’s incentive fee is allocated proportionately to each Class based on the net asset value of the respective Class.

Prior to its termination effective December 31, 2022, ISAM SM was eligible to receive an incentive fee, payable quarterly, equal to 25% of the New Trading Profits, as defined in the Management Agreement, earned by ISAM SM.

The Partnership has entered into a customer agreement with MS&Co. (the “Partnership Customer Agreement”). Under the Partnership Customer Agreement and the foreign exchange brokerage account agreement, the Partnership pays trading fees for the clearing and, where applicable, execution of transactions, as well as exchange, user, give-up, floor brokerage and National Futures Association (“NFA”) fees (collectively, the “clearing fees”). Clearing fees will be paid for the life of the Partnership, although the rate at which such fees are paid may be changed. The Partnership’s cash deposited with MS&Co. were held in segregated bank accounts to the extent required by Commodity Futures Trading Commission (“CFTC”) regulations. The Partnership’s restricted cash is equal to the cash portion of assets on deposit to meet margin requirements, as determined by the exchange or counterparty, and required by MS&Co. At December 31, 2023 and 2022, the amount of cash held by the Partnership for margin requirements was $9,285,004 and $12,210,997, respectively. Cash that is not classified as restricted cash is therefore classified as unrestricted cash. The Partnership receives monthly interest on 100% of the average daily equity maintained in cash in the Partnership’s brokerage account at MS&Co. during each month at a rate equal to the monthly average of the 4-week U.S. Treasury bill discount rate. For purposes of these interest credits, daily funds did not include monies due to futures, forward, or option contracts that had not been received. The Partnership Customer Agreement may generally be terminated upon notice by either party.

The Partnership has entered into a selling agreement with Morgan Stanley Wealth Management (the “Selling Agreement”). Under the Selling Agreement, the Partnership pays Morgan Stanley Wealth Management a monthly ongoing selling agent fee equal to 0.75% per year of adjusted month-end net assets for Class A Redeemable Units. The Partnership pays Morgan Stanley Wealth Management a monthly ongoing selling agent fee equal to 0.75% per year of the adjusted month-end net assets for Class D Redeemable Units. Morgan Stanley Wealth Management pays a portion of its ongoing selling agent fees to properly registered or exempted financial advisors who have sold Class A and Class D Redeemable Units. Class Z Redeemable Units are not subject to an ongoing selling agent fee. Month-end net assets, for the purpose of calculating ongoing selling agent fees are Net Assets, as defined in the Limited Partnership Agreement, for the Class, prior to the reduction of the current month’s ongoing selling agent fee, incentive fee accrual, management fee, General Partner fee and other expenses and any redemptions or distributions as of the end of such month.

As of November 1, 2018, the Partnership entered into an alternative investment placement agent agreement (the “Harbor Selling Agreement”), by and among the Partnership, the General Partner, Morgan Stanley Distribution Inc. (“MSDI”) and Harbor Investment Advisory, LLC, a Maryland limited liability company (“Harbor”), which supersedes and replaces the alternative investment selling agent agreement, dated January 19, 2018, between the Partnership, the General Partner and Harbor. Pursuant to the Harbor Selling Agreement, MSDI and Harbor have been appointed as a non-exclusive selling agent and sub-selling agent, respectively, of the Partnership for the purpose of finding eligible investors for Redeemable Units through offerings that are exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) thereof and Rule 506 of Regulation D promulgated thereunder and for Harbor to serve as an investment advisor to its customers investing in one or more of the partnerships party to the Harbor Selling Agreement; provided, that, included within such appointment, Harbor will provide certain services to certain holders of Redeemable Units of the Partnership, who had acquired such Redeemable Units prior to such holders becoming clients of Harbor. The Harbor Selling Agreement continues in effect until September 30, 2024 unless terminated in certain circumstances as set forth in the Harbor Selling Agreement, including by any party on thirty days’ prior written notice, after which the General Partner or the Partnership may, in its sole discretion, renew the Harbor Selling Agreement for additional one year periods. Pursuant to the Harbor Selling Agreement, the Partnership pays Harbor an ongoing selling agent fee equal to 1/12 of 0.75% (a 0.75% annual rate) of the adjusted month-end net asset value per Redeemable Unit for certain holders of Class A Redeemable Units in the Partnership. The Partnership pays Harbor an ongoing selling agent fee equal to 1/12 of 0.75% (a 0.75% annual rate) of the adjusted month-end net asset value per Redeemable Unit for certain holders of Class D Redeemable Units in the Partnership.

The General Partner has delegated certain administrative functions to SS&C Technologies, Inc., a Delaware corporation, currently doing business as SS&C GlobeOp (the “Administrator”). Pursuant to a master services agreement, the Administrator furnishes certain administrative, accounting, regulatory reporting, tax and other services as agreed from time to time. In addition, the Administrator maintains certain books and records of the Partnership. The cost of retaining the Administrator is allocated among the pools operated by the General Partner, including the Partnership.

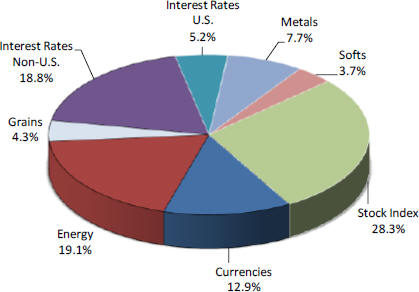

(b) Financial Information about Segments. The Partnership’s business consists of only one segment, speculative trading of commodity interests. The Partnership does not engage in sales of goods or services. The Partnership’s capital as of December 31, 2023 was $53,044,907.

(c) Narrative Description of Business.

See Paragraphs (a) and (b) above.

4