This presentation contains forward - looking statements relating to the financial condition, results of operations and business of BNC Bancorp and its subsidiary, Bank of North Carolina . These forward - looking statements involve risks and uncertainties and are based on the beliefs and assumptions of the management of BNC Bancorp, and the information available to management at the time that this presentation was prepared . Factors that could cause actual results to differ materially from those contemplated by such forward - looking statements include, among others, the following : (i) general economic or business conditions, either nationally or regionally, may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit or other services ; (ii) changes in the interest rate environment may reduce net interest margins and/or the volumes and values of loans made or held, as well as the value of other financial assets held ; (iii) competitive pressures among depository and other financial institutions may increase significantly ; (iv) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which BNC Bancorp is engaged ; (v) local, state or federal taxing authorities may take tax positions that are adverse to BNC Bancorp ; (vi) adverse changes may occur in the securities markets ; (vii) competitors of BNC Bancorp may have greater financial resources and develop products that enable them to compete more successfully than BNC Bancorp ; (viii) expected cost savings related to the integration of Beach First National Bank, Regent Bank of SC, Blue Ridge Savings Bank, KeySource Financial, Carolina Federal Savings Bank, or First Trust Bank may not be fully realized or realized within the expected time frame ; and (ix) deposit attrition, customer loss or revenue loss following our acquisitions of Beach First, Regent, Blue Ridge, Carolina Federal, KeySource, or First Trust may be greater than expected . Additional factors affecting BNC Bancorp and Bank of North Carolina are discussed in BNC Bancorp’s filings with the Securities and Exchange Commission (the “SEC”), Annual Report on Form 10 - K, its Quarterly Reports on Form 10 - Q and its Current Reports on Form 8 - K . Please refer to the SEC‘s website at www . sec . gov where you can review those documents . BNC Bancorp does not undertake a duty to update any forward - looking statements made during this presentation . 2

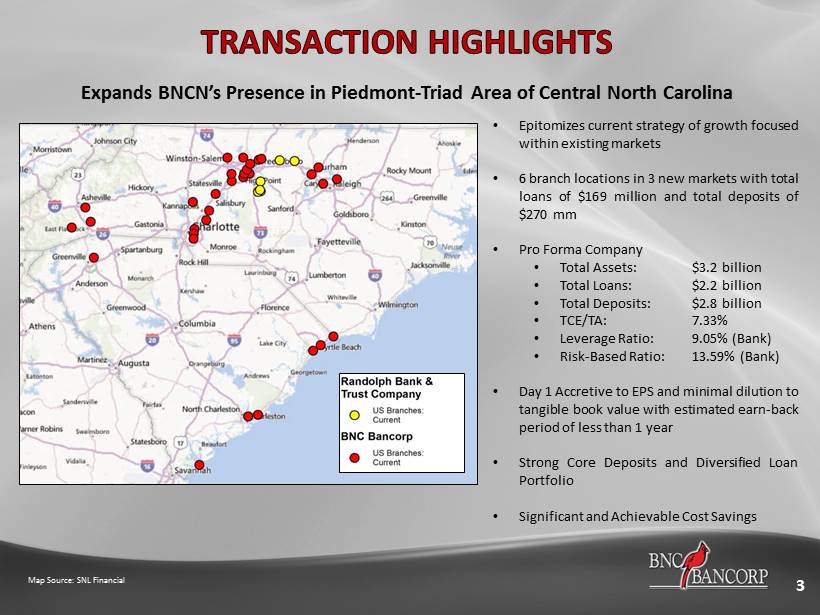

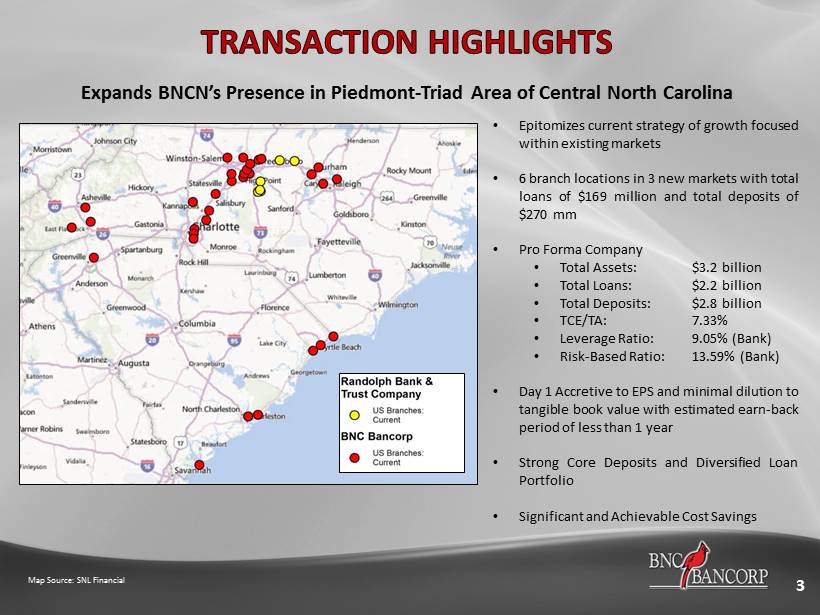

3 Map Source: SNL Financial Expands BNCN’s Presence in Piedmont - Triad Area of Central North Carolina • Epitomizes current strategy of growth focused within existing markets • 6 branch locations in 3 new markets with total loans of $ 169 million and total deposits of $ 270 mm • Pro Forma Company • Total Assets : $ 3 . 2 billion • Total Loans : $ 2 . 2 billion • Total Deposits : $ 2 . 8 billion • TCE/TA : 7 . 33 % • Leverage Ratio : 9 . 05 % (Bank) • Risk - Based Ratio : 13 . 59 % (Bank) • Day 1 Accretive to EPS and minimal dilution to tangible book value with estimated earn - back period of less than 1 year • Strong Core Deposits and Diversified Loan Portfolio • Significant and Achievable Cost Savings

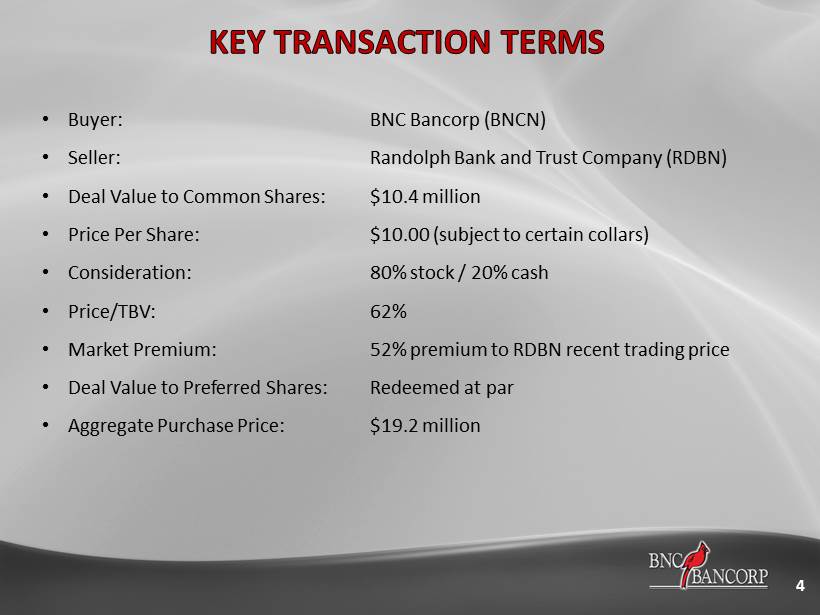

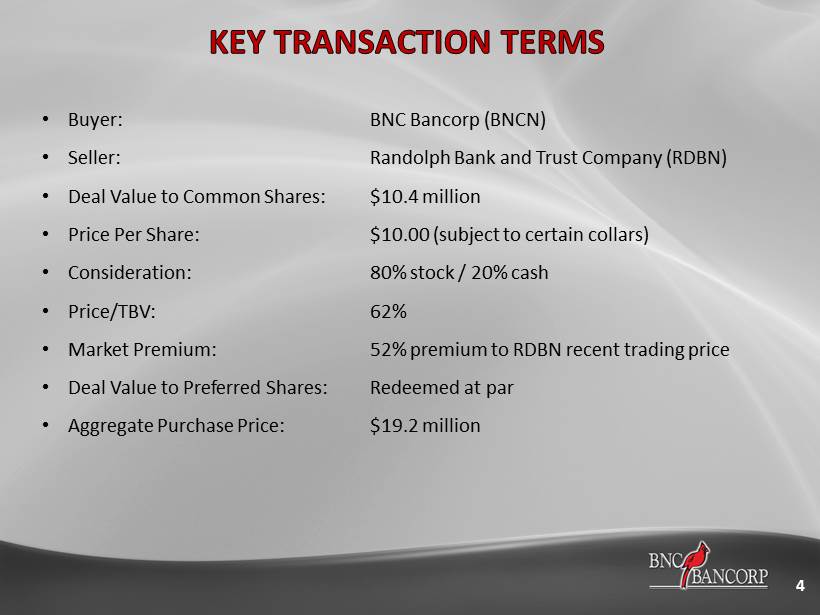

4 • Buyer: BNC Bancorp (BNCN) • Seller: Randolph Bank and Trust Company (RDBN) • Deal Value to Common Shares: $10.4 million • Price Per Share: $10.00 (subject to certain collars) • Consideration: 80% stock / 20% cash • Price/TBV: 62% • Market Premium: 52% premium to RDBN recent trading price • Deal Value to Preferred Shares: Redeemed at par • Aggregate Purchase Price: $19.2 million

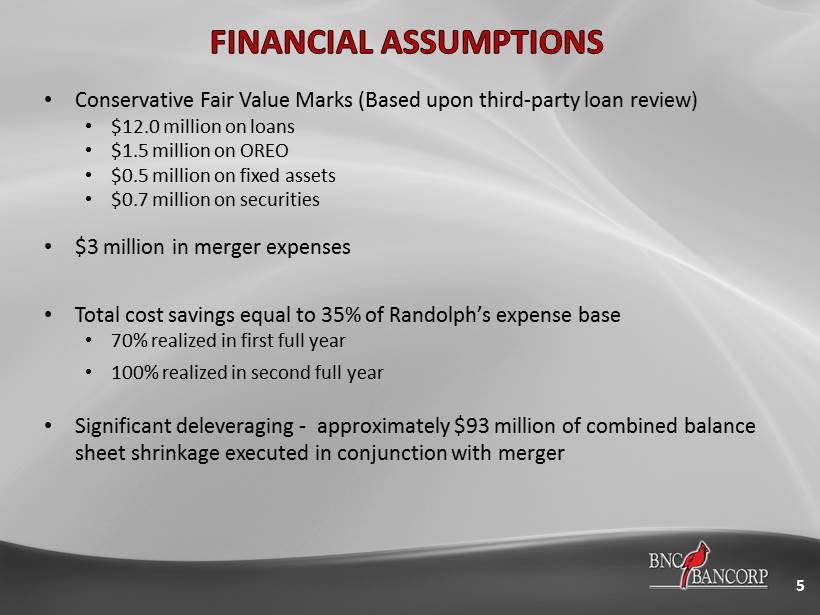

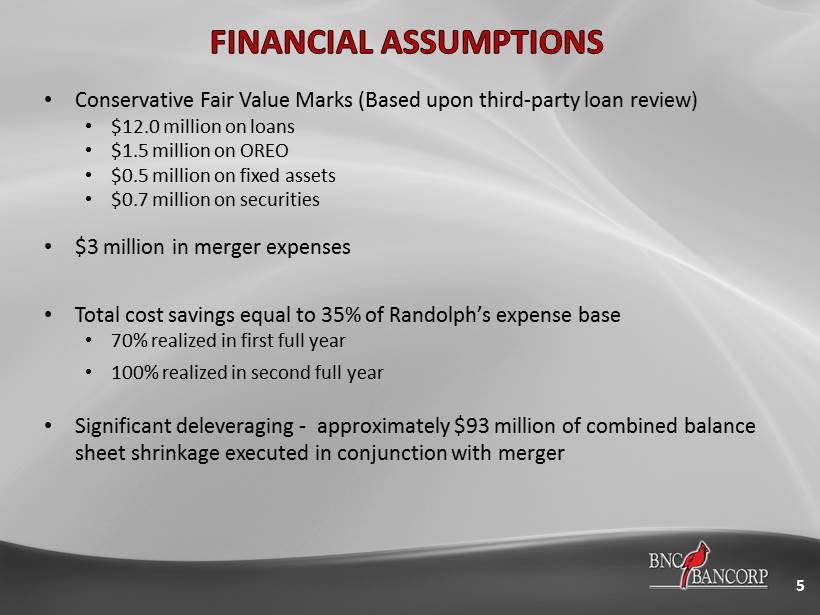

5 • Conservative Fair Value Marks (Based upon third - party loan review) • $12.0 million on loans • $1.5 million on OREO • $0.5 million on fixed assets • $0.7 million on securities • $3 million in merger expenses • Total cost savings equal to 35% of Randolph’s expense base • 70% realized in first full year • 100% realized in second full year • Significant deleveraging - approximately $93 million of combined balance sheet shrinkage executed in conjunction with merger

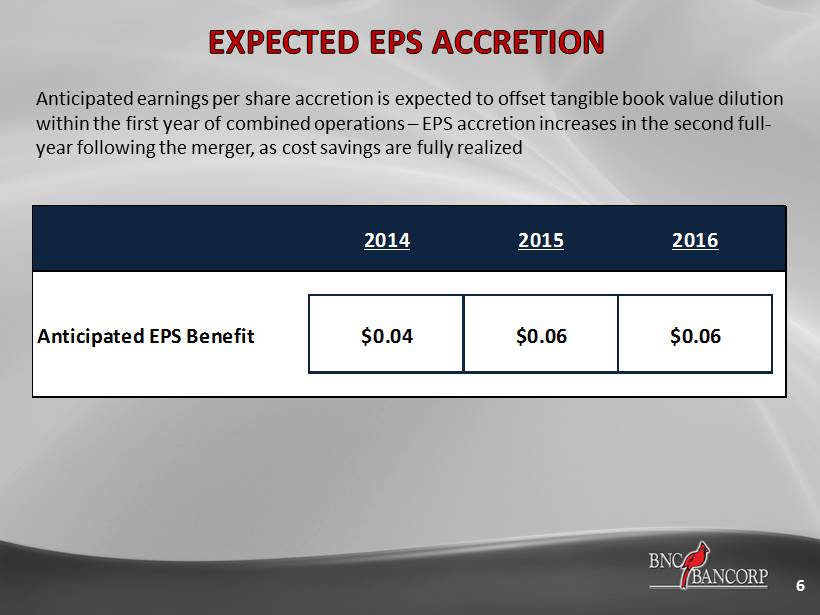

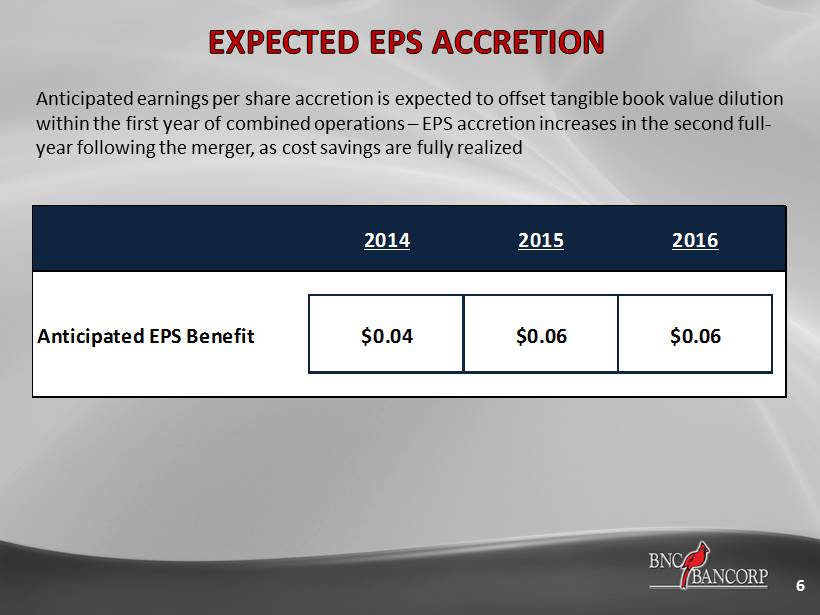

6 Anticipated earnings per share accretion is expected to offset tangible book value dilution within the first year of combined operations – EPS accretion increases in the second full - year following the merger, as cost savings are fully realized 2014 2015 2016 Anticipated EPS Benefit $0.04 $0.06 $0.06

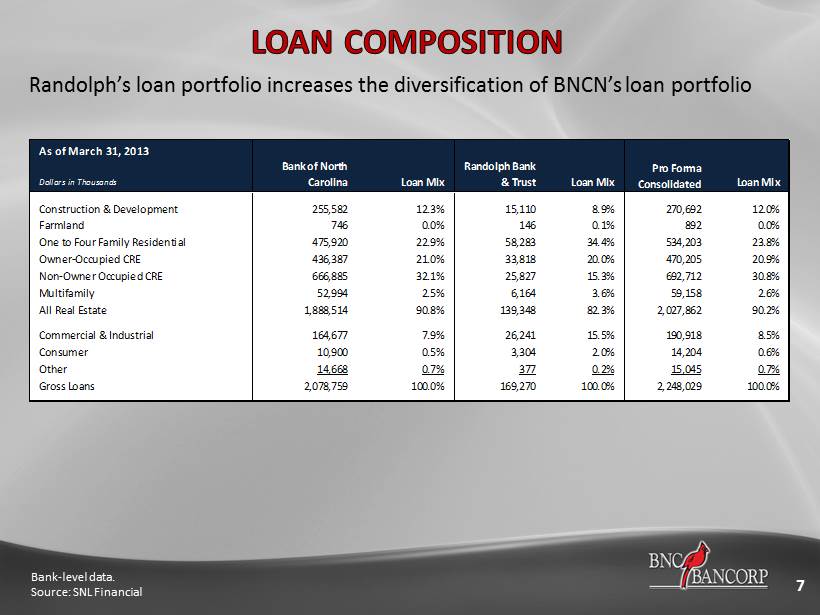

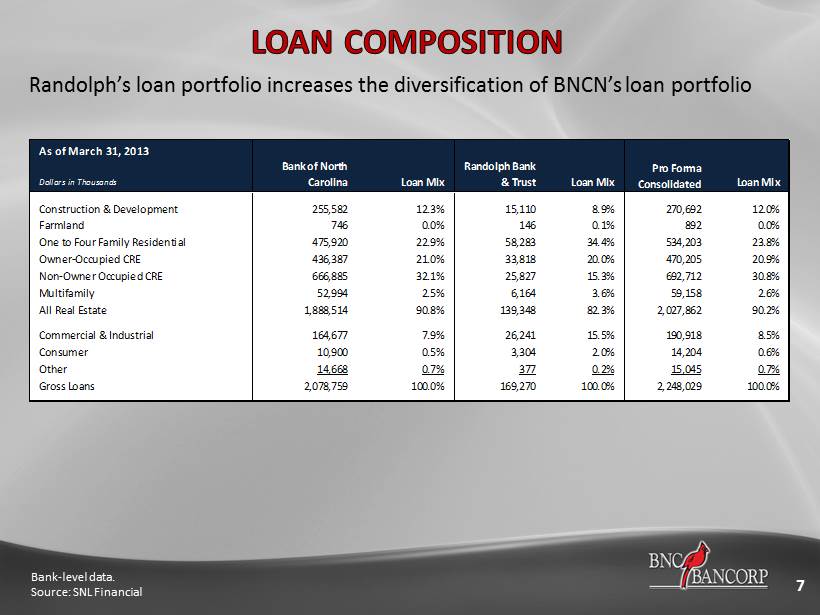

7 Randolph’s loan portfolio increases the diversification of BNCN’s loan portfolio Bank - level data. Source: SNL Financial As of March 31, 2013 Dollars in Thousands Bank of North Carolina Loan Mix Randolph Bank & Trust Loan Mix Loan Mix Construction & Development 255,582 12.3% 15,110 8.9% 270,692 12.0% Farmland 746 0.0% 146 0.1% 892 0.0% One to Four Family Residential 475,920 22.9% 58,283 34.4% 534,203 23.8% Owner-Occupied CRE 436,387 21.0% 33,818 20.0% 470,205 20.9% Non-Owner Occupied CRE 666,885 32.1% 25,827 15.3% 692,712 30.8% Multifamily 52,994 2.5% 6,164 3.6% 59,158 2.6% All Real Estate 1,888,514 90.8% 139,348 82.3% 2,027,862 90.2% Commercial & Industrial 164,677 7.9% 26,241 15.5% 190,918 8.5% Consumer 10,900 0.5% 3,304 2.0% 14,204 0.6% Other 14,668 0.7% 377 0.2% 15,045 0.7% Gross Loans 2,078,759 100.0% 169,270 100.0% 2,248,029 100.0% Pro Forma Consolidated

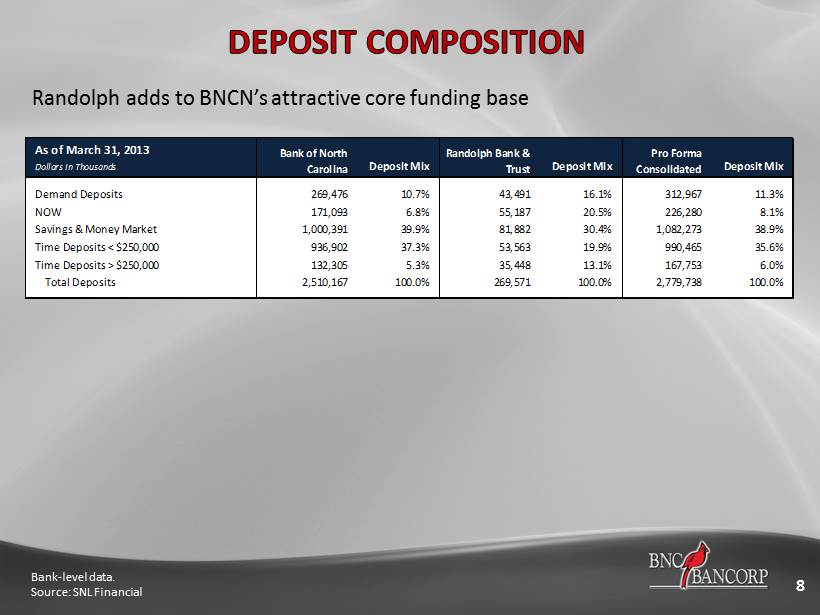

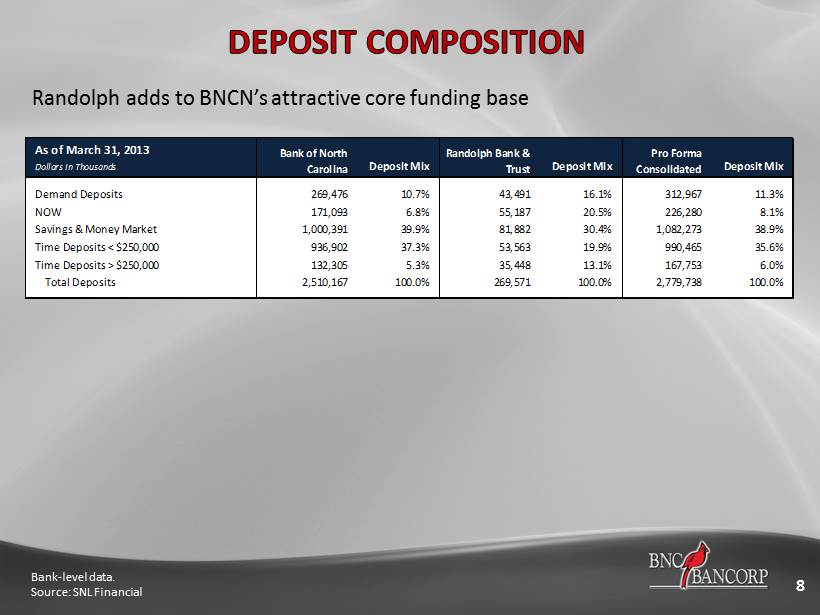

8 Bank - level data. Source: SNL Financial Randolph adds to BNCN’s attractive core funding base As of March 31, 2013 Dollars in Thousands Deposit Mix Deposit Mix Deposit Mix Demand Deposits 269,476 10.7% 43,491 16.1% 312,967 11.3% NOW 171,093 6.8% 55,187 20.5% 226,280 8.1% Savings & Money Market 1,000,391 39.9% 81,882 30.4% 1,082,273 38.9% Time Deposits < $250,000 936,902 37.3% 53,563 19.9% 990,465 35.6% Time Deposits > $250,000 132,305 5.3% 35,448 13.1% 167,753 6.0% Total Deposits 2,510,167 100.0% 269,571 100.0% 2,779,738 100.0% Pro Forma Consolidated Bank of North Carolina Randolph Bank & Trust

9 • Aligns with strategy of growth focused within existing markets by expanding BNCN’s Piedmont - Triad footprint and filling in I - 85 corridor to Research Triangle franchise • Improves value for both BNCN and RDBN shareholders • Immediately accretive to EPS and minimal dilution to tangible book value estimated to be earned - back within 1 year • Significant operational efficiencies based upon cost savings, similar cultures and combined management talent • Another big step in building a premier franchise in the Carolinas

10 • In connection with the proposed merger, BNC Bancorp will file with the Securities and Exchange Commission a Registration Statement on Form S - 4 that will include a Proxy Statement of Randolph Bank & Trust and a Prospectus of BNC Bancorp, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN THEY BECOME AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about BNC Bancorp, may be obtained after their filing at the SEC’s Internet site ( http://www.sec.gov ). In addition, free copies of documents filed by BNC Bancorp with the SEC may be obtained on the BNC Bancorp website at www.bncbancorp.com . Copies of the reports Randolph Bank & Trust files with the FDIC may be obtained by contacting the FDIC in writing at FDIC, Accounting and Securitie s Disclosure Section, 550 17 th Street, N.W., Washington, DC 20429 or by e - mail at PublicBankReports@fdic.gov . You may also obtain copies of any documents filed with the FDIC by Randolph Bank & Trust, without charge, by directing a request to the President , Randolph Bank & Trust Company, 175 North Fayetteville Street, Asheboro, NC 27203, telephone (336) 625 - 1000 . • BNC Bancorp and Randolph Bank & Trust and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Randolph Bank & Trust’s shareholders in connection with this transaction. Information abo ut the directors and executive officers of BNC Bancorp and Randolph Bank & Trust and information about other persons who may be deemed participants in this solicitation will be included in the Proxy Statement/Prospectus. Information about BNC Bancorp’s executive officers and directors can be found in BNC Bancorp’s definitive proxy statement in connection with its 2013 Annual Meeting of Shareholders filed with the SEC on April 16, 2013. Information about Randolph Bank & Trust’s executive officers an d directors can be found in Randolph Bank & Trust’s definitive proxy statement in connection with its 2013 Annual Meeting of Shareholders filed with the FDIC on April 15, 2013. Additional information regarding the interests of those persons and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. You may obtain free copies of this document as described in the preceding paragraph.