Exhibit 99.1

BNC BANCORP

ANNUAL MEETING

JUNE 15, 2006

BNC BANCORP

Forward-Looking Statements

This presentation contains forward-looking statements as defined by federal securities laws. The written or oral statements may address issues that involve significant risks, uncertainties, estimates and assumptions made by management. Actual results could differ materially from current projections.

Please refer to BNC Bancorp’s filings with the Securities and Exchange Commission for a summary of important factors that could affect BNC Bancorp’s forward-looking statements. BNC Bancorp undertakes no obligation to revise these statements following the release of this presentation.

BNC BANCORP

2005 RESULTS

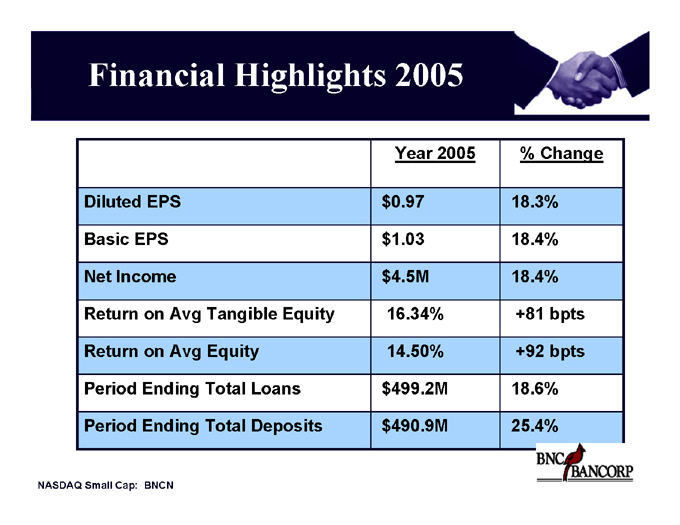

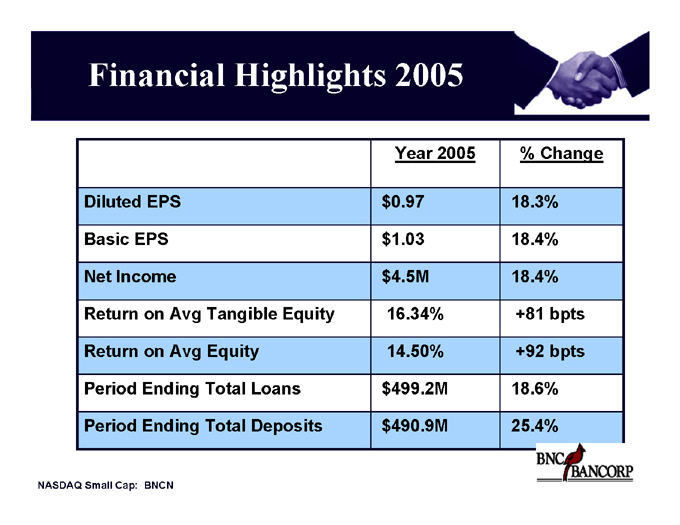

Financial Highlights 2005

Year 2005 % Change

Diluted EPS $0.97 18.3%

Basic EPS $1.03 18.4%

Net Income $4.5M 18.4%

Return on Avg Tangible Equity 16.34% +81 bpts

Return on Avg Equity 14.50% +92 bpts

Period Ending Total Loans $499.2M 18.6%

Period Ending Total Deposits $490.9M 25.4%

NASDAQ Small Cap: BNCN

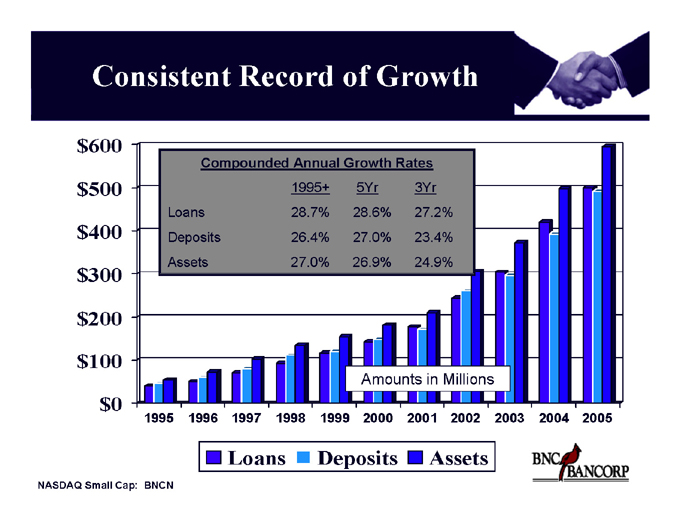

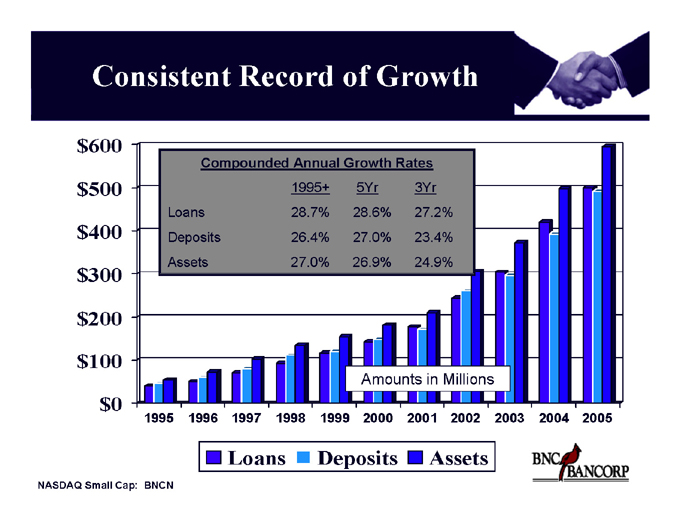

Consistent Record of Growth $600 $500 $400 $300 $200 $100 $0

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

Compounded Annual Growth Rates

1995+ 5Yr 3Yr

Loans 28.7% 28.6% 27.2%

Deposits 26.4% 27.0% 23.4%

Assets 27.0% 26.9% 24.9%

Amounts in Millions

Loans Deposits Assets

NASDAQ Small Cap: BNCN

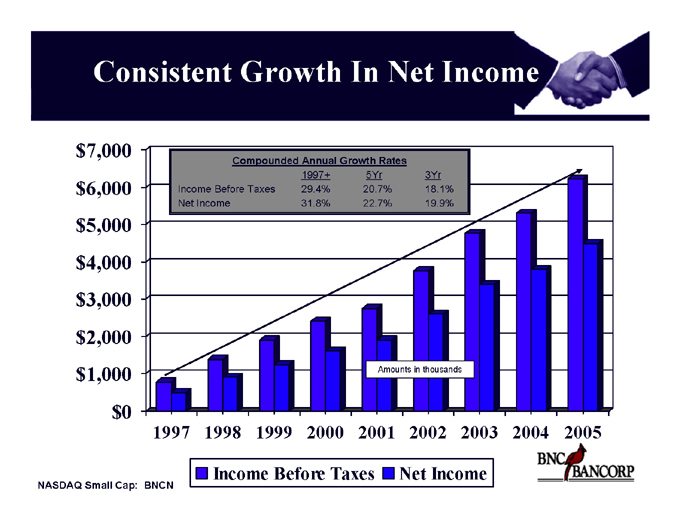

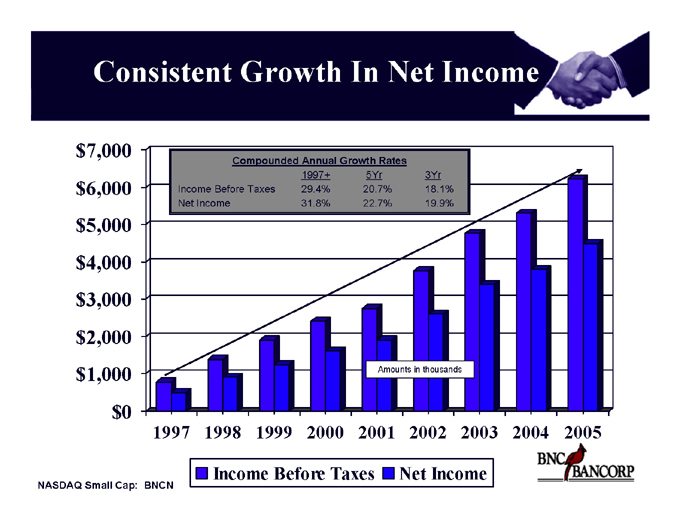

Consistent Growth In Net Income $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0

1997 1998 1999 2000 2001 2002 2003 2004 2005

Compounded Annual Growth Rates

1997+ 5Yr 3Yr

Income Before Taxes 29.4% 20.7% 18.1%

Net Income 31.8% 22.7% 19.9%

Amounts in thousands

Income Before Taxes Net Income

NASDAQ Small Cap: BNCN

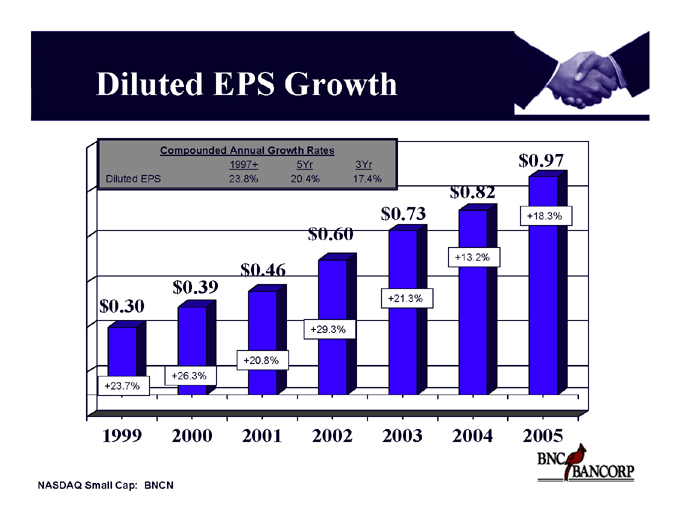

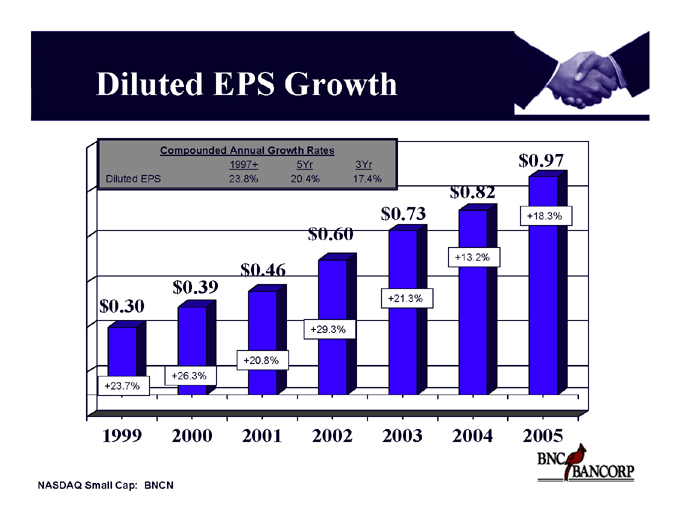

Diluted EPS Growth

Compounded Annual Growth Rates

1997+ 5Yr 3Yr

Diluted EPS 23.8% 20.4% 17.4%

$0.30 $0.39 $0.46 $0.60 $0.73 $0.82 $0.97

+23.7%

+26.3%

+20.8%

+29.3%

+21.3%

+13.2%

+18.3%

1999 2000 2001 2002 2003 2004 2005

NASDAQ Small Cap: BNCN

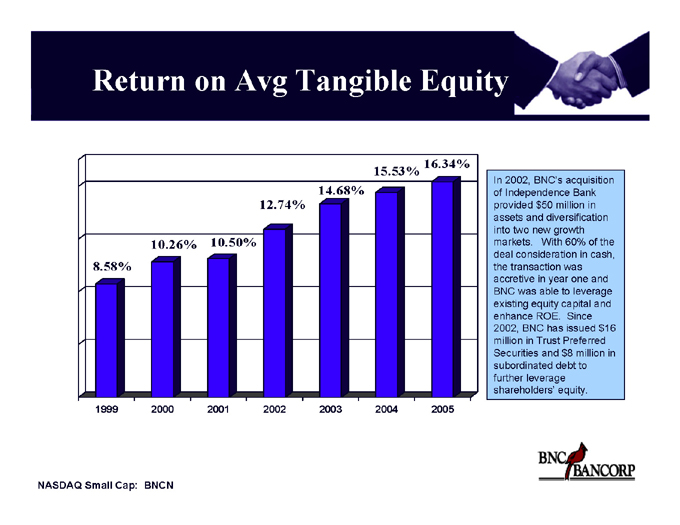

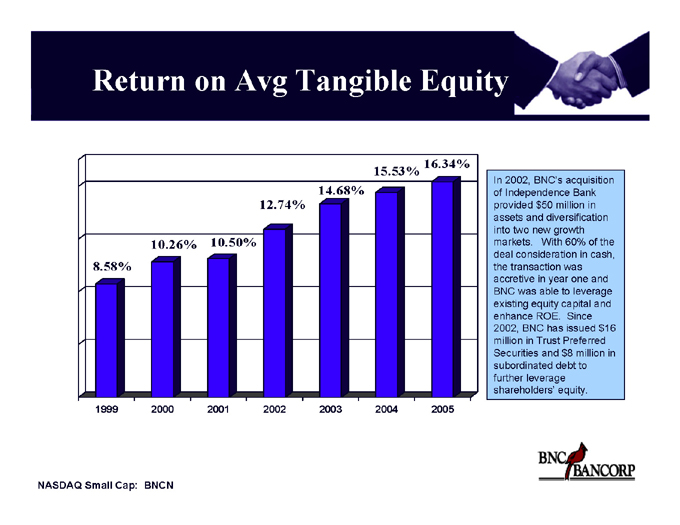

Return on Avg Tangible Equity

15.53% 16.34% 14.68% 12.74%

10.26% 10.50% 8.58%

1999 2000 2001 2002 2003 2004 2005

In 2002, BNC’s acquisition of Independence Bank provided $50 million in assets and diversification into two new growth markets. With 60% of the deal consideration in cash, the transaction was accretive in year one and BNC was able to leverage existing equity capital and enhance ROE. Since 2002, BNC has issued $16 million in Trust Preferred Securities and $8 million in subordinated debt to further leverage shareholders’ equity.

NASDAQ Small Cap: BNCN

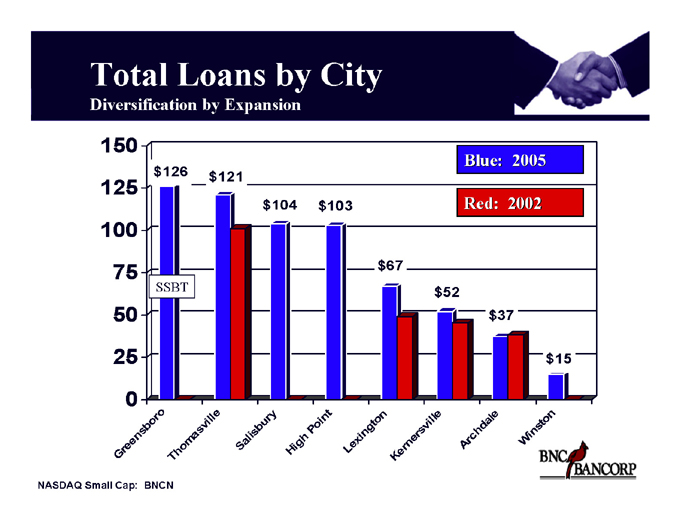

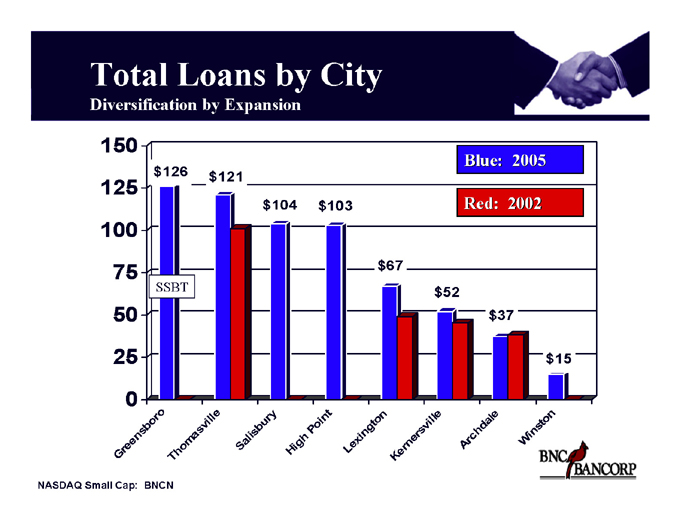

Total Loans by City

Diversification by Expansion

150 125 100 75 50 25 0 $126 $121 $104 $103 $67 $52 $37

$15

SSBT

Blue: 2005

Red: 2002

NASDAQ Small Cap: BNCN

Greensboro Thomasville Salisbury High Point Lexington Kernersville Archdale Winston

BNC BANCORP

BNC Bancorp Acquires SterlingSouth

Overview of SterlingSouth

Operations began in October 2000 in Greensboro, North Carolina (Guilford County)

Loan and deposit growth over 30% for last three years

Dynamic banking market located within the Greensboro-High Point MSA

#8 community banking market share

Three full service branches in Guilford County

Insiders collectively own 35% of the Company

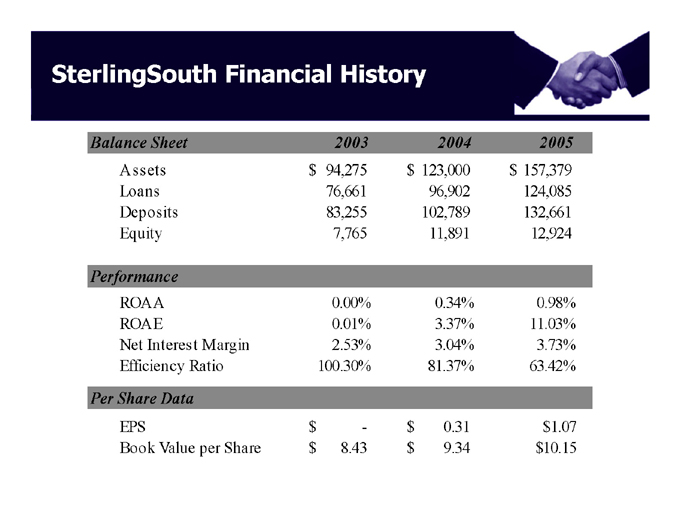

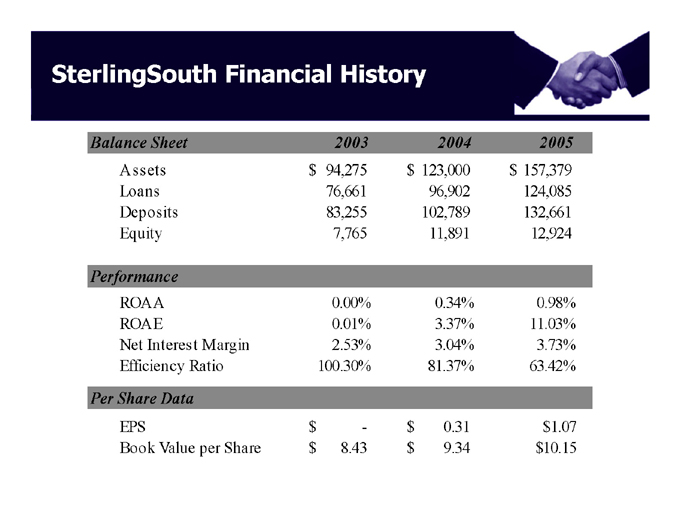

SterlingSouth Financial History

Balance Sheet 2003 2004 2005

Assets $94,275 $123,000 $157,379

Loans 76,661 96,902 124,085

Deposits 83,255 102,789 132,661

Equity 7,765 11,891 12,924

Performance

ROAA 0.00% 0.34% 0.98%

ROAE 0.01% 3.37% 11.03%

Net Interest Margin 2.53% 3.04% 3.73%

Efficiency Ratio 100.30% 81.37% 63.42%

Per Share Data

EPS $— $0.31 $1.07

Book Value per Share $8.43 $9.34 $10.15

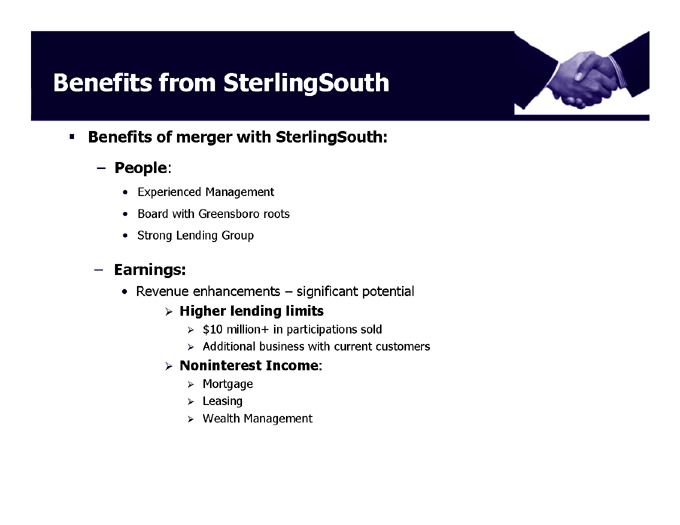

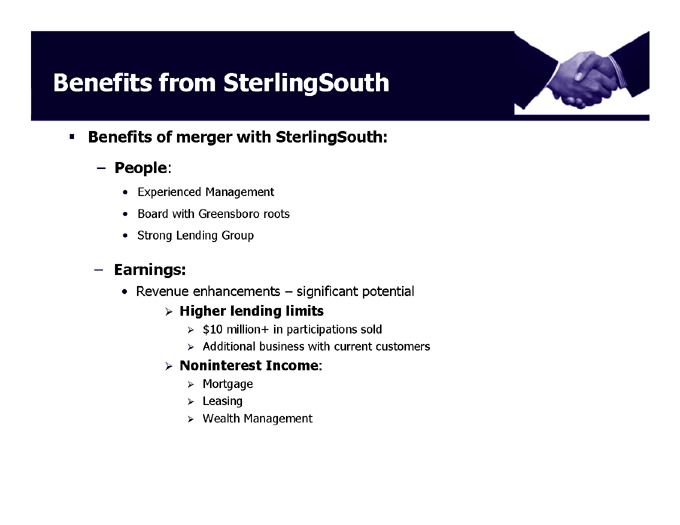

Benefits from SterlingSouth

Benefits of merger with SterlingSouth:

People:

Experienced Management Board with Greensboro roots Strong Lending Group

Earnings:

Revenue enhancements – significant potential

Higher lending limits $10 million+ in participations sold

Additional business with current customers

Noninterest Income:

Mortgage Leasing

Wealth Management

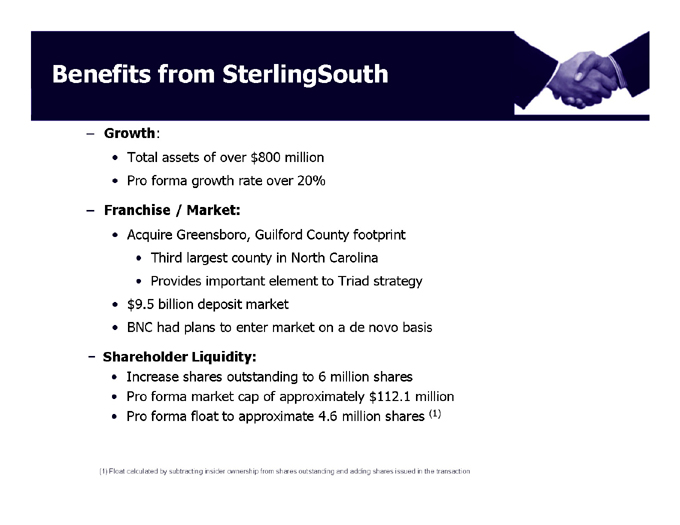

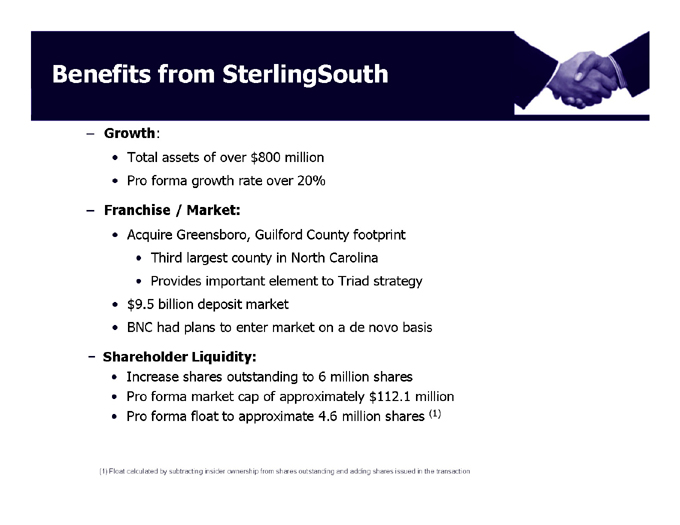

Benefits from SterlingSouth

Growth:

Total assets of over $800 million Pro forma growth rate over 20%

Franchise / Market:

Acquire Greensboro, Guilford County footprint

Third largest county in North Carolina

Provides important element to Triad strategy $9.5 billion deposit market

BNC had plans to enter market on a de novo basis

Shareholder Liquidity:

Increase shares outstanding to 6 million shares Pro forma market cap of approximately $112.1 million Pro forma float to approximate 4.6 million shares (1)

(1) Float calculated by subtracting insider ownership from shares outstanding and adding shares issued in the transaction

BNC BANCORP

New Offices New People Building Infrastructure

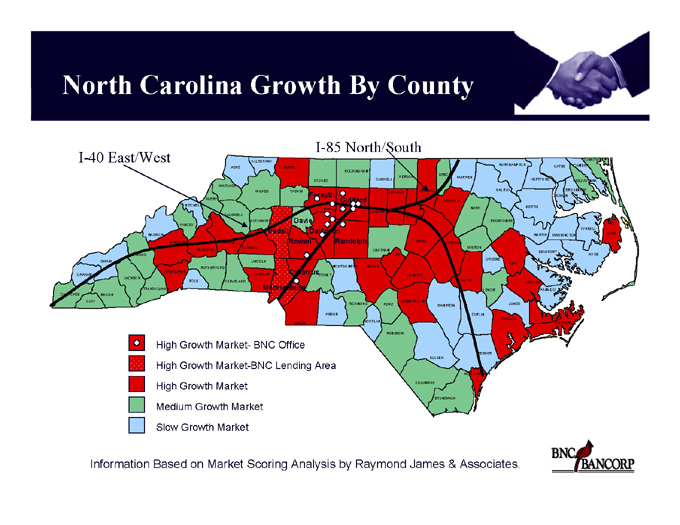

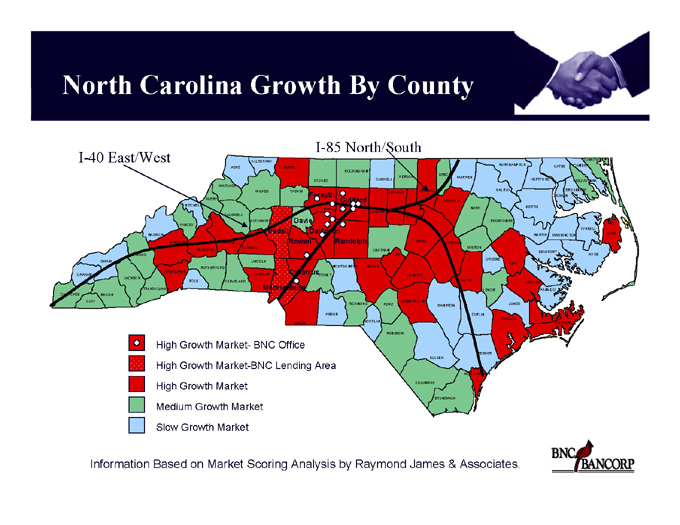

North Carolina Growth By County

ALLEGHANY ASHE

WATAUGA

WILKES

AVERY MITCHELL

CALDWELL

ALEXANDER YANCEY

MADISON

BUNCOMBE

HAYWOOD SWAIN

HENDERSON GRAHAM

JACKSON

TRANSYLVANIA CHEROKEE MACON

CLAY

BURKE

CATAWBA MCDOWELL

RUTHERFORD

POLK

CLEVELAND

LINCOLN

GASTON

SURRY

ROCKINGHAM

VANCE

PERSON WARREN STOKES CASWELL

YADKIN GRANVILLE

Forsyth ORANGE

Guilford FRANKLIN

NASH ALAMANCE

DURHAM

Davie

Iredell Davidson Rowan Randolph

CHATHAM

WAKE

JOHNSTON

WILSON

MONTGOMERY MOORE

Cabarrus STANLY

LEE

Mecklenburg

RICHMOND

ANSON

UNION

HARNETT

WAYNE

CUMBERLAND HOKE

SAMPSON

SCOTLAND

ROBESON

BLADEN

COLUMBUS

BRUNSWICK

CURRITUCK NORTHAMPTON CAMDEN

GATES

HERTFORD PASQUOTANK

HALIFAX PERQUIMANS

CHOWAN

BERTIE

EDGECOMBE

TYRRELL

MARTIN DARE

WASHINGTON

BEAUFORT

HYDE GREENE

PITT

CRAVEN

LENOIR PAMLICO

JONES

DUPLIN

ONSLOW

CARTERET

PENDER

NEW HANOVER

High Growth Market- BNC Office High Growth Market-BNC Lending Area High Growth Market Medium Growth Market Slow Growth Market

Information Based on Market Scoring Analysis by Raymond James & Associates.

I-40 East/West

I-85 North/South

BNC BANCORP

SHAREHOLDER RETURNS

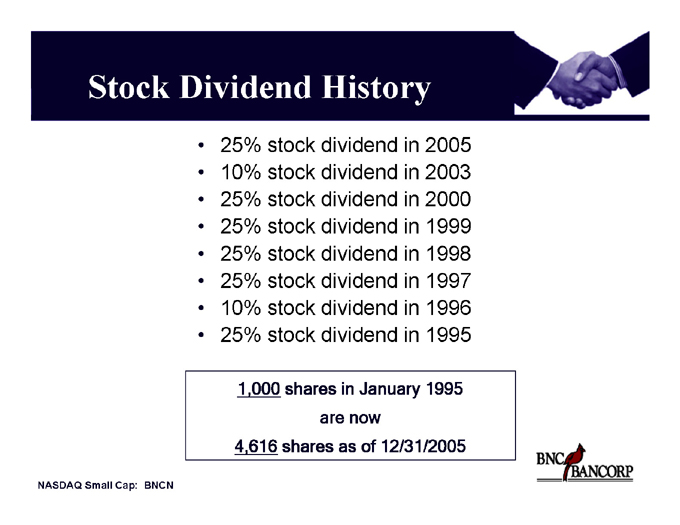

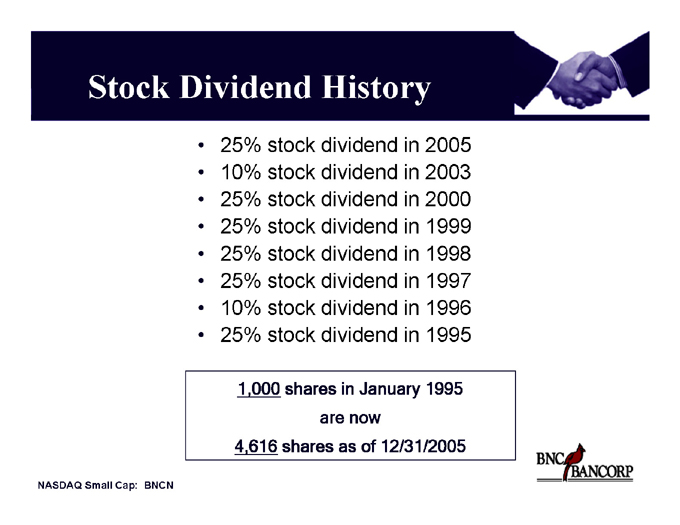

Stock Dividend History

25% stock dividend in 2005 10% stock dividend in 2003 25% stock dividend in 2000 25% stock dividend in 1999 25% stock dividend in 1998 25% stock dividend in 1997 10% stock dividend in 1996 25% stock dividend in 1995

1,000 shares in January 1995 are now 4,616 shares as of 12/31/2005

NASDAQ Small Cap: BNCN

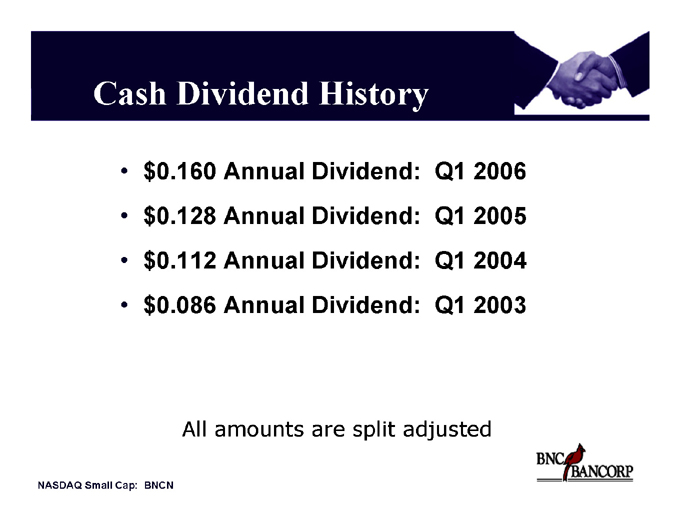

Cash Dividend History $0.160 Annual Dividend: Q1 2006 $0.128 Annual Dividend: Q1 2005 $0.112 Annual Dividend: Q1 2004 $0.086 Annual Dividend: Q1 2003

All amounts are split adjusted

NASDAQ Small Cap: BNCN

Growth of Investment in BNCN

$90,000 $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000

1998 1999 2000 2001 2002 2003 2004 2005

23.5% Compound Annual Return since 1998

NASDAQ Small Cap: BNCN

BNC BANCORP

Historical Performance Future Projections

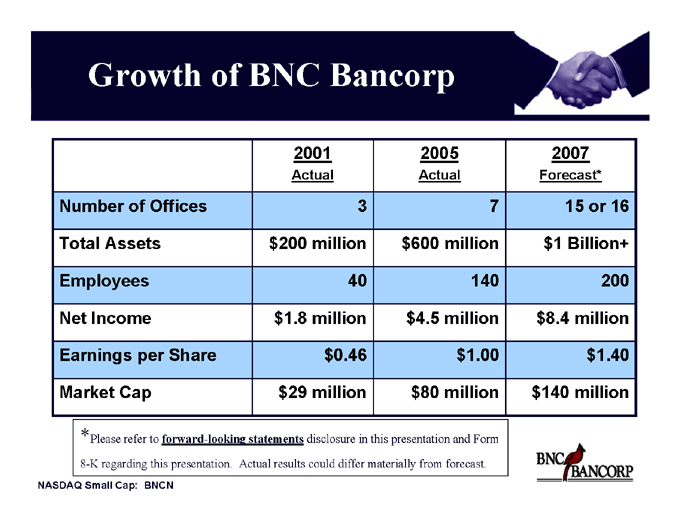

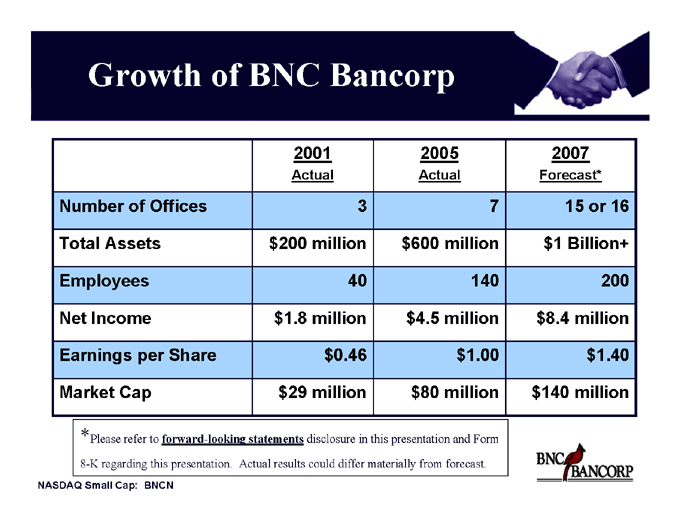

Growth of BNC Bancorp

2001 2005 2007

Actual Actual Forecast*

Number of Offices 3 7 15 or 16

Total Assets $200 million $600 million $1 Billion+

Employees 40 140 200

Net Income $1.8 million $4.5 million $8.4 million

Earnings per Share $0.46 $1.00 $1.40

Market Cap $29 million $80 million $140 million

* Please refer to forward-looking statements disclosure in this presentation and Form 8-K regarding this presentation. Actual results could differ materially from forecast.

NASDAQ Small Cap: BNCN