UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedMarch 31, 2012

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number:000-50367

NATURALLY ADVANCED TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| British Columbia | 98-0359306 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 305-4420 Chatterton Way | |

| Victoria, British Columbia, Canada | V8X 5J2 |

| (Address of principal executive offices) | (Zip Code) |

(250) 658-8582

Registrant’s telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

| | |

Non-accelerated filer [ ]

(Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

42,535,133 shares of common stock as of May 3, 2012.

1

NATURALLY ADVANCED TECHNOLOGIES INC.

Quarterly Report On Form 10-Q

For The Quarterly Period Ended

March 31, 2012

INDEX

2

FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this quarterly report include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements include, but are not limited to, statements with respect to the following:

- our need for additional financing;

- the competitive environment in which we operate;

- our dependence on key personnel;

- conflicts of interest of our directors and officers;

- our ability to fully implement our business plan;

- our ability to effectively manage our growth; and

- other regulatory, legislative and judicial developments.

Forward-looking statements are made, without limitation, in relation to operating plans, property exploration and development, availability of funds, environmental reclamation, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks outlined in our annual report on Form 10-K for the year ended December 31, 2011, this quarterly report on Form 10-Q, and, from time to time, in other reports that we file with the Securities and Exchange Commission (the “SEC”). These factors may cause our actual results to differ materially from any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

3

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

The following unaudited interim financial statements of Naturally Advanced Technologies, Inc. (sometimes referred to as “we”, “us” or “our Company”) are included in this quarterly report on Form 10-Q:

4

Naturally Advanced Technologies, Inc.

(A Development Stage Company)

Consolidated Balance Sheets

(In US Dollars)

(Unaudited)

| | | March 31, | | | December 31, | |

| | | 2012 | | | 2011 | |

| ASSETS | | | | | | |

| | | | | | | |

| Current | | | | | | |

| Cash and cash equivalents | $ | 5,165,962 | | $ | 6,340,505 | |

| Receivables | | 60,733 | | | 150,914 | |

| Inventory (Note 4) | | 1,200,842 | | | 1,035,966 | |

| Prepaid expenses and other | | 39,015 | | | 47,247 | |

| | | 6,466,552 | | | 7,574,632 | |

| Property and Equipment, net(Note 5) | | 3,918,718 | | | 3,202,611 | |

| Intangible Assets | | 112,372 | | | 107,171 | |

| | $ | 10,497,642 | | $ | 10,884,414 | |

| | | | | | | |

| LIABILITIES | | | | | | |

| Current | | | | | | |

| Accounts payable | $ | 446,805 | | $ | 235,715 | |

| Accrued Liabilities | | 7,743 | | | 352,428 | |

| Derivative liability (Note 6) | | 1,443,837 | | | 1,053,498 | |

| | | 1,898,385 | | | 1,641,641 | |

| Capital Stock(Note 3 ) | | | | | | |

Authorized: 100,000,000 common shares without par value

Issued and outstanding : 42,442,804 common shares

(December 31, 2011 – 41,701,604) | | 29,036,653 | | | 27,428,844 | |

| Additional Paid-in Capital | | 5,654,287 | | | 5,174,834 | |

| Accumulated Other Comprehensive Loss | | (365,162 | ) | | (423,351 | ) |

| Deficit | | (11,485,251 | ) | | (11,485,251 | ) |

| Deficit accumulated in the development stage | | (14,241,270 | ) | | (11,452,303 | ) |

| | | 8,599,257 | | | 9,242,773 | |

| | $ | 10,497,642 | | $ | 10,884,414 | |

| Commitment (Note 7) | | | | | | |

| Subsequent Event (Note 8) | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

5

Naturally Advanced Technologies, Inc.

(A Development Stage Company)

Consolidated Statements of Operations

(In US Dollars)

(Unaudited)

| | | For the Three Month Period | | | Cumulative | |

| | | ended March 31, | | | from October 1, | |

| | | | | | | | | 2009 to March | |

| | | 2012 | | | 2011 | | | 31, 2012 | |

| | | | | | | | | | |

| Expenses | | | | | | | | | |

| Advertising and promotion | | 59,870 | | | 54,823 | | | 583,962 | |

| Amortization and depreciation | | 50,372 | | | 10,174 | | | 157,430 | |

| Consulting and contract labour (Note 3) | | 216,309 | | | 245,231 | | | 2,369,258 | |

| General and administrative | | 185,931 | | | 109,358 | | | 1,321,962 | |

| Interest | | - | | | 35,963 | | | 297,007 | |

| Professional fees | | 137,555 | | | 112,370 | | | 880,657 | |

| Research and development | | 138,436 | | | 163,197 | | | 1,729,541 | |

| Salaries and benefits (Note 3) | | 1,108,273 | | | 281,858 | | | 5,456,901 | |

| Loss before other items | | (1,896,746 | ) | | (1,012,974 | ) | | (12,796,718 | ) |

| | | | | | | | | | |

| Other Items | | | | | | | | | |

| Other income | | - | | | - | | | 1,177 | |

| Write down of equipment | | - | | | - | | | (97,254 | ) |

| Fair value adjustment of derivative liabilities (Note 6) | | (892,221 | ) | | (414,457 | ) | | (1,359,792 | ) |

| | | | | | | | | | |

| Loss from continuing operations | | (2,788,967 | ) | | (1,427,431 | ) | | (14,252,587 | ) |

| Profit from discontinued operations | | - | | | - | | | 11,317 | |

| Net loss | $ | (2,788,967 | ) | $ | (1,427,431 | ) | $ | (14,241,270 | ) |

| | | | | | | | | | |

| Loss per share (basic and diluted) | $ | (0.07 | ) | $ | (0.04 | ) | | | |

| | | | | | | | | | |

| Weighted average number of common shares outstanding (basicand diluted) | | 42,028,271 | | | 35,466,111 | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

6

Naturally Advanced Technologies, Inc.

(A Development Stage Company)

Consolidated Statements of Cash Flows

(In US Dollars)

(Unaudited)

| | | | | | | | | Cumulative from | |

| | | | | | | | | October 1, 2009 | |

| | | For three months ended March 31, | | | to | |

| | | 2012 | | | 2011 | | | March 31, 2012 | |

| Cash flows used in operating activities | | | | | | | | | |

| Net loss from continuing operations | $ | (2,788,967 | ) $ | | (1,427,431 | ) | $ | (14,252,587 | ) |

| Adjustments to reconcile net loss to net cash from operating activities | | | | | | | | | |

| Amortization and depreciation | | 50,372 | | | 10,174 | | | 157,430 | |

| Write down of equipment | | - | | | - | | | 97,254 | |

| Stock based compensation | | 743,681 | | | 375,493 | | | 4,484,171 | |

| Gain on foreign exchange | | - | | | - | | | (71,990 | ) |

| Fair value adjustment of derivative liability | | 892,221 | | | 414,457 | | | 1,359,792 | |

| Changes in working capital assets and liabilities | | | | | | | | | |

| Increase (decrease) in accounts receivable | | 90,181 | | | (38,737 | ) | | 16,214 | |

| Increase in inventory | | (164,876 | ) | | (32,000 | ) | | (1,200,842 | ) |

| Decrease (increase) in prepaid expenses | | 8,232 | | | 4,958 | | | 31,110 | |

| Increase in accounts payable | | 211,090 | | | 27,894 | | | 108,944 | |

| Increase in customer deposits | | - | | | 250,000 | | | - | |

| Decrease in accrued liabilities | | (344,685 | ) | | (28,613 | ) | | (121,946 | ) |

| Increase in due to related parties | | - | | | 69,704 | | | 56,945 | |

| Net cash used in operating activities of continuing operations | | (1,302,751 | ) | | (374,101 | ) | | (9,335,505 | ) |

| | | | | | | | | | |

| Net cash provided by discontinued operations | | - | | | 2,346 | | | 79,982 | |

| | | | | | | | | | |

| Cash flows used in investing activities | | | | | | | | | |

| Purchase of property and equipment | | (756,227 | ) | | (15,801 | ) | | (3,975,704 | ) |

| Acquisition of trademarks and license | | (15,453 | ) | | (2,896 | ) | | (90,054 | ) |

| Net cash flows used in investing activities | | (771,680 | ) | | (18,697 | ) | | (4,065,758 | ) |

| | | | | | | | | | |

| Cash flows used in financing activities | | | | | | | | | |

| Issuance of capital stock and warrants | | 841,699 | | | 653,484 | | | 18,856,772 | |

| Note payable | | - | | | - | | | (200,000 | ) |

| Related party payments | | - | | | - | | | (1,025,960 | ) |

| Net cash flows from financing activities | | 841,699 | | | 653,484 | | | 17,630,812 | |

| | | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | $ | 58,199 | | $ | (23,507 | ) | $ | (197,016 | ) |

| Increase (decrease) in cash | | (1,174,543 | ) | | 239,525 | | | 4,112,515 | |

| | | | | | | | | | |

| Cash and cash equivalents, beginning | | 6,340,505 | | | 18,493 | | | 1,053,447 | |

| Cash and cash equivalents, ending | $ | 5,165,962 | | $ | 258,018 | | $ | 5,165,962 | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | | | | | | | |

| AND NON-CASH FINANCING AND INVESTING ACTIVITIES: | | | | | | | | | |

| Cash paid for interest | $ | - | | $ | 419 | | | | |

| Cash paid for income taxes | $ | - | | $ | - | | | | |

| Agent warrants issued as share issue costs | $ | - | | $ | - | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

7

NATURALLY ADVANCED TECHNOLOGIES INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2012

(Unaudited)

| 1. | Basis of Presentation |

| | | |

| These unaudited consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles for interim financial reporting and the rules and regulations of the U.S. Securities and Exchange Commission. They do not include all information and footnotes required by United States generally accepted accounting principles (“U.S. GAAP”) for complete financial statement disclosure. However, except as disclosed herein, there have been no material changes in the information contained in the audited consolidated financial statements for the year ended December 31, 2011, included in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission. Operating results for the three months ended March 31, 2012 are not necessarily indicative of the results that may be expected for the year ending December 31, 2012. These interim unaudited consolidated financial statements should be read in conjunction with the information included in the Company’s Form 10-K filed on March 22, 2012 with the U.S. Securities and Exchange Commission. |

| | | |

| In the opinion of management, the accompanying balance sheet and related interim statement of operations and cash flows include all adjustments, consisting only of normal recurring items, necessary for their fair presentation in conformity with U.S. GAAP. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions. |

| | | |

| The Company evaluated events occurring between the end of its fiscal quarter, March 31, 2012 and the date financial statements were issued. |

| | | |

| Recent accounting pronouncements with future effective dates are not expected to have an impact on the Company’s financial statements. |

| | | |

| 2. | Related Parties Transactions |

| | | |

| During the three month period ended March 31, 2011, $225,757 (2011 - $130,167) was incurred for remuneration to officers and directors of the Company. Of this amount, $225,757 (2011 - $82,167) was recorded as salaries and benefits expense and $nil (2011 - $48,000) was recorded as consulting and contract labour expense. |

| | | |

| 3. | Capital Stock |

| | | |

| During the three month period ended March 31, 2012, the Company issued shares as follows: |

| | | |

| a) | A total of 451,200 shares were issued pursuant to the exercise of employee and consultants options for proceeds of $473,999. A total 352,300 options with total proceeds of $369,826 were exercised by the directors and officers of the Company. |

| | | |

| b) | A total of 290,000 shares issued pursuant to the exercise of warrants for proceeds of $367,700. |

8

NATURALLY ADVANCED TECHNOLOGIES INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2012

(In US Dollars)

| | Share purchase warrants outstanding are: | | | | | | |

| | | | | | | Weighted- | |

| | | | | | | Average | |

| | | | Shares | | | Exercise Price | |

| | Warrants outstanding at December 31, 2011 | | 3,294,219 | | $ | 3.57 | |

| | Warrants exercised during the period | | (290,000 | ) | | 1.27 | |

| | Warrants outstanding at March 31, 2012 | | 3,004,219 | | $ | 3.79 | |

The weighted average remaining contractual life at March 31, 2012 is 1.16 years.

| | Stock options outstanding at March 31, 2012 are summarized as follows: |

| | | | Weighted | | | |

| | | | Average | Weighted | | Weighted |

| | Range of | | Remaining | Average | | Average |

| | Exercise | Number | Contractual | Exercise | Number | Exercise |

| | Prices | Outstanding | Life (yr) | Price | Exercisable | Price |

| | $0.87 - $3.05 | 4,955,745 | 3.54 | $1.54 | 3,664,494 | $1.42 |

| | Stock options outstanding are: | | | | | | |

| | | | | | | Weighted-Average | |

| | | | Shares | | | Exercise Price | |

| | Options outstanding, December 31, 2011 | | 5,281,945 | | | 1.48 | |

| | Options granted during the period | | 125,000 | | | 2.46 | |

| | Options exercised during the period | | (451,200 | ) | | 1.05 | |

| | Options outstanding, March 31, 2012 | | 4,955,745 | | $ | 1.54 | |

9

NATURALLY ADVANCED TECHNOLOGIES INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2012

(In US Dollars)

| 3. | Capital Stock (cont.) |

| | |

| During the three month period ended March 31, 2012, 451,200 options were exercised and a total of $264,228 has been reclassified from additional paid-in capital to capital stock. |

| | |

| During the three month period ended March 31, 2012, the Company granted a total of 125,000, five year common stock options to employees, exercisable between $1.91- $3.05 per share, with a fair value of $210,136. These options were granted under the terms of the Company’s 2011 Fixed Share Option Plan. |

| | |

| The fair value of options issued during the period ended March 31, 2012, was determined using the Black-Scholes option pricing model with the following assumptions: |

| | Risk-free interest rate | 0.78% to .89% |

| | Volatility factor | 88% to 89% |

| | Expected life of options, in years | 5 |

| | Weighted average fair value of options granted | $1.68 |

| During the three month period ended March 31, 2012, 671,250 (2011: 401,676) options vested under the Company’s 2011 Fixed Share Option Plan. A total expense of $743,681 (2011: $375,493) were recorded as stock- based compensation, of this amount $107,236 (2011-$193,838) was included in Consulting and Contract Labour expense and $636,445 (2011- $181,655) was included in Salaries and benefits expense. |

| | |

| 4. | Inventory |

| | |

| As at March 31, 2012, the inventory consists of the cost of flax seed planted and to be planted and $163,087 of indirect costs capitalized for payment to farmers. |

| | |

| 5. | Property and Equipment |

| | |

| During 2011, the Company signed agreements to purchase equipment for a total price of $7,686,252 ( Euro 5,590,815), which is payable in installments and due upon the achievement of certain milestones. Full payment is expected within 2012. The Company paid $2,749,453 (Euro 1,935,642) as deposits. No amortization will be taken until the equipment is in production. |

| | |

| 6. | Derivative liability |

| | |

| Derivative liability consists of warrants that were originally issued in private placements which have exercise prices denominated in United States dollars (a currency other than the Company’s functional currency). The fair value of these warrants was determined using the Black-Scholes option pricing model. The fair value adjustment on derivative liability has no net effect on the Company’s consolidated statement of cash flows. |

| | |

| 7. | Commitment |

| | |

| During the three month period ended March 31, 2012, the Company signed a lease for an industrial and office building. The initial term of the lease is for ten years with two additional five-year extension terms. Commencing January 1, 2014, the annual basic rent will be $146,930 and increasing to $220,395 from June 1, 2018 to May 31, 2022. |

| | |

| 8. | Subsequent Events |

| | |

| Subsequent to March 31, 2012, 68,329 options were exercised for proceeds of $91,708 and 23,000 warrants were exercised for proceeds of $33,750. |

10

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our results of operations and financial position should be read in conjunction with our financial statements and the notes thereto included elsewhere in this Report. Our consolidated financial statements are prepared in accordance with U.S. GAAP. All references to dollar amounts in this section are in U.S. dollars unless expressly stated otherwise.

The matters discussed in these sections that are not historical or current facts deal with potential future circumstances and developments. Such forward-looking statements include, but are not limited to, the development plans for the Company’s growth, trends in the results of the Company’s development, anticipated development plans, operating expenses and the Company’s anticipated capital requirements and capital resources. As such, these forward-looking statements may include words such as “plans”, “intends”, “anticipates”, “should”, “estimates”, “expects”, “believes”, “indicates”, “targeting”, “suggests” and similar expressions. The actual results are expected to differ from these forward-looking statements and these differences may be material.

In this Report, “NAT”, “we”, “us”, “our” and the “Company” refer to Naturally Advanced Technologies Inc. and its subsidiaries, unless the context otherwise requires.

OVERVIEW

Naturally Advanced Technologies (NAT) is bringing sustainable bast fiber-based products to market, providing environmentally friendly natural fiber alternatives for a broad range of existing and emerging product applications, with equivalent or superior performance characteristics to cotton, wood or fossil-fuel based competitors. As of the date of this Report, our business operations consists primarily of the deployment and execution of our proprietary and natural CRAiLAR®Flax Fibers, as well as our CRAiLEXTMhigh grade dissolving pulp technology, which are bast fiber processing technologies targeted at the textile, pulping, composite and plastics industries.

With a projected increase of global population and continued development of market economies, we expect to see a rise in the need for fibers worldwide. Management estimates that global demand for fiber will increase by almost 30million tons in the next ten years. We do not believe that this increased demand can be met by the existing natural fibers market. While some demand is likely to be filled by synthetic fibers, management expects that the desires for consumers to live both sustainably and naturally will outweigh their desire for un-naturally derived products. We believe that the Company has a unique opportunity to fill this shortfall through the production of CRAiLAR®fiber.

CRAiLAR®Fiber processing involves the enzymatic processing of bast fibers, by removing the lignin which binds the fibers together, to produce individual, separated fibers into the equivalent of ginned cotton. The CRAiLAR®Fiber technology has been developed by Dr. Wing Sung and his team at the National Research Council of Canada. Under development since 2004, this technology has undergone successful final demonstration scale testing. The technology involves the use of enzymes to effectively clean and polish the raw bast fiber such as flax and hemp.

The CRAiLAR®Fiber enzymatic process is significantly faster than existing methods of bast fiber processing, produces highly consistent results, and is environmentally benign, as compared to the toxic chemical baths employed elsewhere for the processing of bast fibers. The resulting CRAiLAR®Fibers are vastly superior to traditionally processed bast fibers for textile applications, and integrate seamlessly with cotton fibers. Because the CRAiLAR®Fiber enzymatic processing is so effective at cleaning bast fiber, it can be spun on traditional cotton equipment at commercially viable speeds.

The capital costs involved in building a commercial CRAiLAR®Fibers processing facility have been determined to be relatively modest. All of our final products can be processed utilizing existing industry equipment.

CRAiLEX Advanced Materials technology was developed with Alberta Innovates — Technology Futures. The unique pulping process does not require the numerous harsh chemicals or expensive pressurized equipment used in the traditional kraft pulping industry. The result is a superior dissolving pulp from the flax and hemp plants to be used in performance yarns, industrial additives and absorbent pulp and paper products.

Naturally Advanced Technologies holds the exclusive worldwide license to these patented technologies.

CRAiLAR®is a versatile technology which performs well on all bast fiber crops. At the end of April of 2010, we announced that we had successfully spun flax-cotton and help-cotton yarns. We found the CRAiLAR®flax to be of very high quality and ideally suited for fine knit items such as T-shirts. The environmental sustainability of flax is virtually identical to hemp. Differences are that hemp produces more biomass per acre while flax generates a higher percentage of bast fiber. We feel for a wide range of applications and a superior hand-feel that flax is the right crop with which to launch our CRAiLAR®brand.

11

Flax has the potential to be a zero waste crop. We are already in the process of investigating by-product opportunities that are beneficial to both the consumer and economy (those by-products being seed and shive).

Flax has been used for textile applications for thousands of years and is known as linen when it is processed using traditional mechanical techniques. It is labor intensive, costly to process and has a rougher hand feel than cotton and polyester. In addition, it is prone to wrinkling and high shrinkage if washed in hot water and tumble dried. Traditionally processed flax must also be spun on specialty linen machinery making it unviable for mass production.

Flax is a cost-effective raw material for fiber production. Flax is easy to grow with minimal use of herbicides, and requires only regular rainfall for irrigation, which significantly reduces costs as compared to other natural fibers.

We also enjoy the ability to use the straw of the oilseed flax crop, which is cultivated for food and industrial applications. This straw would normally be discarded and burned following the seed harvest. Making use of this waste byproduct will only further enhance the CRAiLAR®Flax Fiber sustainability rating.

With mill delivered cotton priced between $0.95 to $1.05 per pound, flax is a cost-effective raw material for fiber production. Flax is easy to grow with minimal use of herbicides, pesticides and engineered irrigation that significantly reduces costs as compared to other natural fibers.

The CRAiLAR®Fiber process is a clean, sustainable, environmentally responsible process, which works with bast fiber feed stocks. Bast fiber plants grow abundantly, without excessive water, herbicide, fertilizer and pesticide use. Initially, CRAiLAR®Flax Fibers will be used in union with cotton, which when blended together, results in a much better performing fabric than cotton alone. The resulting fabric (if simply an 80/20 blend) takes on the characteristics of CRAiLAR®Flax Fibers, which are enhanced moisture management and comfort (wicking), durability, superior dye uptake characteristics (a potential minimal dye reduction of 10%), and garment shrinkage reduction (a potential minimum of 50%).

Recent Developments

On September 20, 2010, we announced that we have created a sustainable, commercially viable complement to cotton using flax as a raw material. After successfully transforming hemp fibers into yarns and fabrics with the desirable qualities of cotton, we are now engaged in a strategic shift to use flax fibers as the foundation for the next phase of our proprietary CRAiLAR®Fiber technology.

We believe that compared to current cotton prices, flax is a cost-effective raw material for fiber production. The CRAiLAR®process can also be used with the stalk portion of the oilseed flax plant – traditionally cultivated for food and industrial applications – which would normally be discarded during processing. We believe that making use of this byproduct, in addition to processing fiber-variety flax, enhances CRAiLAR®’s sustainability factor.

The all-natural CRAiLAR®process removes the binding agents from flax that contribute to its stiff texture. The process bathes bast fibers in a proprietary enzyme wash that transforms them into soft, yet strong and durable textile fibers, which can be used in both fashion and industrial applications. We believe that fibers made through the CRAiLAR®process have the comfort and breathability of cotton, with the strength, moisture-wicking properties and shrink-resistance of sturdy bast fibers. Our recent trials have shown that flax can be spun on existing machinery to produce a yarn that can be used alone or blended with other fibers.

On January 18, 2011, we announced that we have joined forces with Hanesbrands Inc. and the U.S. Department of Agriculture’s Agricultural Research Service (USDA-ARS) in a cooperative research project designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR®technology. The project takes place in South Carolina and has an initial term of one year with a renewal option for two additional years.

On March 17, 2011, we announced that we signed a ten-year CRAiLAR®fiber supply agreement with Hanesbrands Inc. to commercialize the Company’s proprietary fibers.

On April 14, 2011, we announced that we had entered into a short term CRAiLAR®Flax fiber development agreement with Levi Strauss & Co. beginning in April 2011 to support evaluation of processing CRAiLAR®flax fiber in woven casual apparel products, specifically denim and non-denim, bottom and top weight fabrics.

In June 2011 the Company entered into a short-term CRAiLAR®Flax fiber development agreement with Cintas Corporation beginning June 2011 to support evaluation of processing CRAiLAR®flax fiber in corporate identity uniform programs.

In June 2011 the Company entered into a joint development agreement with Hercules Incorporated, a subsidiary of Ashland Inc., beginning June 2011 to support evaluation of CRAiLEXTMcellulosic products for multiple products.

12

On July 14, 2011 the Company entered into an agreement with Carolina Eastern Precision Ag, of Pamplico, S.C., to provide agronomic consultation to the Company and its contractors in the region. Under the terms of the agreement, Carolina Eastern will assist NAT in the recruitment of growers and contractors, and advise on all cultivation related to flax that will be turned into its branded CRAiLAR®fiber including seeding rates, fertilization, and weed control.

On July 8, 2011 the Company completed the public offering of 3,800,000 units (the “Units”) of the Company at a price of C$3.45 per Unit for aggregate gross proceeds of C$13,110,000 (the “Offering”). Each Unit is comprised of one common share and one half of one common share purchase warrant of the Company (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of C$4.50 per common share at any time prior to July 8, 2013.

On July 20, 2011 the Underwriter’s over-allotment option was partially exercised and the Underwriters purchased an additional 212,500 units (each a “Over-Allotment Unit”), at C$3.45 per Over-Allotment Unit, and 100,445 warrants (each a “Over-Allotment Warrant”) of the Company, at C$0.32 per Over-Allotment Warrant, for aggregate gross proceeds to the Company of approximately C$765,267. Each Over-Allotment Unit is comprised of one common share and one half of one common share purchase warrant of the Company. Each whole warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of C$4.50 per common share at any time prior to July 8, 2013.

The Company plans to use the net proceeds from the Offering (including the net proceeds from the over-allotment option exercise) for capacity expansion, debt repayment, working capital and other general corporate purposes.

In August 2011, the Company named Jay Nalbach to the role of Chief Marketing Officer. Mr. Nalbach was previously Brand Director at adidas Group Japan KK, and Global Head of Men’s Lifestyle Footwear for Reebok International.

In September, 2011, the Company entered into a three year CRAiLAR®Fiber supply agreement with Georgia Pacific Consumer Products LLC, for the use of CRAiLAR®fiber in formed substrates for the industrial and personal care markets. The agreement is automatically extendable to ten years upon notification by GP of the intention to do so.

In September, 2011, the Company announced the appointment of Tom Robinson to the role of Chief Operating Officer, and the transition of Jason Finnis, the Company’s co-founder, to the role of Chief Innovation Officer. Mr. Robinson joins the company after twenty-seven years of experience in the textile industry. He joins the Company from International Textile Group, where he was most recently Vice President of Cotton Operations Planning and Technical Support in the company’s apparel division. Mr. Finnis’ newly created role will focus on ways to improve NAT’s processing techniques, throughput efficiencies, and yield.

In September, 2011, the Company entered into an agreement with Westex Inc, for the evaluation and development of CRAiLAR®Fibers in flame and arc resistant fabrics for the industrial, military and service sector industries. Westex Inc. is the market leader in this category.

In September, 2011, the Company entered into a purchasing agreement for a minimum of one and a half million pounds of CRAiLAR®Flax fiber with Brilliant Global LTD, the Hong Kong-based private label knitwear manufacturer which produces a broad spectrum of sweater and accessory items in natural fibers for globally recognized brands and retailers. The first retail introduction of CRAiLAR®fibers in this market is expected to be at the beginning of the second quarter 2012.

In October 2011, the Company entered into an agreement with Carhartt Inc., for the evaluation and development of CRAiLAR®Fiber in work wear apparel. Carhartt are the industry leader in work wear apparel, with a broad distribution of product in both retail and corporate markets. CRAiLAR®Fibers are expected to add performance improvements to Carhartt garments in durability, moisture management and dye chemical savings.

In December 2011, the Company entered into an agreement with Target to evaluate the use of its CRAiLAR®Flax fiber in Target’s domestic textiles category beginning December 1, 2011. The agreement includes two years of exclusivity in the category and calls for target’s evaluation of CRAiLAR®Flax in a number of products including sheets, top or bed, shower curtains, window treatments, table linens, decorative pillows, towels, and more.

In January 2012, the Company entered into a non-exclusive and non-transferable license with Tuscarora Yarns, one of the world’s premier yarn innovators, to explore a host of new blended yarns and related products using CRAiLAR®Flax, which Tuscarora is expected to design and manufacture for sale and distribution to third party licensees of CRAiLAR®.

In February 2012, the Company appointed Mr. Scott Staff as a director of the Company. Mr. Staff serves as the Director of Business Development for Perkins Coie LLP, an international law firm where he leads the firm's business development strategy, and oversees its client service interview, client service and industry teams programs. Mr. Staff joined Perkins Coie in 2004 and currently works out of the Seattle office. Mr. Staff is on the boards of advisors of DNA Response Inc. and Rouxbe Video Technologies.

13

In February 2012, the Company appointed Mr. Gregg Wright as Vice President of Strategic Fiber Markets, with an initial focus on the distribution of secondary fiber and byproducts from the CRAiLAR®decortication platform.

In March 2012, the Company appointed Mr. Steve Sandroni as Vice President of Agriculture. Mr. Sandroni brings more than 34 years of experience working in various aspects of agribusiness to the Company.

In March 2012, the Company entered into arrangement whereby it has partnered with Barnhardt Manufacturing Company to further expand its manufacturing capacity by having Barnhardt executing the CRAiLAR®enzymatic process exclusively for the Company.

In April 2012, the Company entered into a short term CRAiLAR®Flax fiber development agreement with PVH Corp. to support evaluation of processing CRAiLAR®Flax fiber in dress and sports shirt lines.

In April 2012, the Company earned the USDA Certified Biobased Product Label for its CRAiLAR®Flax fiber, which verifies that the product’s amount of renewable biobased ingredients meets or exceeds prescribed USDA standards.

In May 2012, the Company entered into a joint development agreement with Austria-based Lenzing Group (Vienna) to evaluate the blending of CRAiLAR®Flax fiber with TENCEL®(Lyocell) and Lenzing Modal®.

RESULTS OF OPERATIONS

Three Month Period Ended March 31, 2012, Compared to three Month Period Ended March 31, 2011

| Three months ended March 31st |

| | 2012 | 2011 | % Change |

| Loss from Continuing Operations | ($2,788,967) | ($1,427,431) | (95%) |

| Net Loss | ($2,788,967) | ($1,427,431) | (95%) |

| Loss/share continuing operations | ($0.07) | ($0.04) | |

Revenue and Gross Margins

Our net operational loss from continuing operations during the three-month period ended March 31, 2012, was ($2,788,967) compared to ($1,427,431) during the three-month period ended March 31, 2011 (an increase in loss of $1,361,536). The increase in loss was due to an increase in salaries & benefits expense, stock based compensation, an increase in general and administrative expense, professional fees, as well as a loss from the fair value adjustment of a derivative liability.

Operating Expenses

During the three-month period ended March 31, 2012, we recorded operating expenses of $1,896,746 compared to operating expenses of $1,012,974 for the same period in 2011. Operating expenses consisted of:

- $59,870 (2011: $54,823) in advertising and promotion, an increase of 9%

- $50,372 (2011: $10,174) in amortization and depreciation, an increase of 395%;

- $216,309 (2011: $245,231) in consulting and contract labour, an decrease of 11%;

14

- $185,931 (2011: $109,358) in general and administrative, an increase of 70 %;

- $ Nil (2011: $35,963) in interest, a decrease of 100%;

- $137,555 (2011: $112,370) in professional fees, an increase of 22%;

- $138,436 (2011:$163,197) in research and development, a decrease of 15%; and

- $1,108,273 (2011: $281,858) in salaries and benefits, an increase of 293%

Advertising and promotion expenses increased to $59,870 for the three-month period ended March 31, 2012, from $54,823 for the same period in 2011. The increase in advertising and promotion was primarily due to an increase in public relations costs.

Amortization and depreciation expenses increased to $50,372 for the three-month period ended March 31, 2012, from $10,174 for the same period in 2011. The increase in plant equipment depreciation was the cause for the increase in expense.

Consulting and contract labor expenses decreased to $216,309 for the three-month period ended March 31, 2012, from $245,231, compared to the same period in 2011 was primarily due to decrease in stock-based compensation.

General and administrative expenses decreased to $185,931 for the three-month period ended March 31, 2012, compared to $109,358 for the same period in 2011. The increase in general and administrative expenses was primarily due to travel and office costs.

Interest expenses decreased to ($nil) for the three-month period ended March 31, 2012, compared to $35,963 for the same period in 2011. The decrease is attributable to the repayment of all outstanding loans.

Professional fees were $137,555 for the three-month period ended March 31, 2012, compared to $112,370 for the same three-month period in 2011. The primary cause for the increase was associated with the new facility in South Carolina.

Research and development costs were $138,436 for the three-month period ended March 31, 2012, compared to $163,197 for the same three-month period in 2011. During the period equipment modification, the processing of CRAiLAR®fiber for our development partners and the quarterly payment to the NRC have been our principle research and development cost. Our development partners purchased approximately $6,563 of Crailar fiber which has been subtracted from those costs.

Salaries and benefits expenses increased to $1,108,273 for the three-month period ended March 31, 2012, compared with $281,858 for the same period in 2011. This increase was caused by additional hires and an increase in stock based compensation.

Net Loss

Our net loss during the three-month period ended March 31, 2012, was ($2,788,967), or $0.07 per share compared to ($1,427,431) or $0.04 per share during the three-month period ended March 31, 2011, which represents an increase in net loss of 95%. The increase in loss was due primarily to, an increase in general and administrative expense, salaries and benefits expense as well as a loss from the fair value adjustment of a derivative liability. For the three-month period ended March 31, 2012, the weighted average number of shares outstanding was 42,028,271 compared to 35,466,111 at March 31, 2011.

Liquidity and Capital Resources

For the three-month period ended March 31, 2012, our current assets were $6,466,552 (2011 - $7,574,632) and our current liabilities were $ 1,898,385 (2011 - $1,641,641) which resulted in working capital of $4,568,167 (2011 - $5,932,991). As at March 31, 2012, total assets were $10,497,642, consisting of:

- $5,165,962 in cash and cash equivalents;

- $60,733 in accounts receivable;

- $1,200,842 in inventory;

- $39,015 in prepaid expenses and other;

- $3,918,718 in property and equipment; and

- $112,372 in intangible assets.

15

As at March 31, 2012, total liabilities were $1,898,385 and were comprised of:

- $446,805 in accounts payable;

- $7,743 in accrued liabilities; and

- $1,443,837 in derivative liabilities.

Stockholders’ Equity decreased by ($643,516) from $9,242,773, at December 31, 2011, to $8,599,257 at March 31, 2012.

Cash Flows from Operating Activities

The cash flows used in operations of continuing operations for the three-month period ended March 31, 2012, were ($1,302,751) compared with ($374,101) for the same period in 2011. Cash flows used in operations for the three-month period ended March 31, 2012, consisted primarily of a net loss of ($2,788,967) (2011 – ($1,427,431)) from continuing operations, offset by certain items, stock based compensation of $743,681 (2011 - $375,493), fair value adjustment of derivative liability $892,221 (2011 – $414,457); an increase in accounts receivable $90,181, (2011 – ($38,737)); and increase in inventory ($164,876), (2011 – ($32,000)); a decrease in prepaid expenses of $8,232, (2011 - $ 4,958); increase in accounts payable of $211,090 (2011 – $27,894), and a decrease in accrued liabilities of ($344, 685), (2011 – ($28,613)).

Cash Flows from Investing Activities

The cash flows used in investing activities for the three-month period ended March 31, 2012, were ($771,680) compared to ($18,697) for the same period in 2011. Cash flows used in investing activities consisted of a purchase of property and equipment totaling ($756,227) in (2011 – ($15,801)) and the acquisition of trademarks and licenses totaling ($15,453) in (2011 – ($2,896)).

Cash Flows from Financing Activities

Cash flows provided by financing activities for the three-month period ended March 31, 2012, totaled $841,699 versus $653,484 during the same period in 2011. The Company issued capital stock for proceeds of $841,699 (2011 - $653,484).

Effect of Exchange Rate

The effect of exchange rates on cash resulted in an unrealized gain of $58,189 for the three-months ended March 31, 2012, as compared with an unrealized loss of ($23,507) in the same period of 2011.

Discontinued Operations - HTNaturals

During fiscal 2009, we closed our apparel business, which operated under the brand name “HTnaturals”. The apparel business is classified as discontinued operations in our consolidated financial statements. We decided to close our apparel division to focus on our CRAiLAR®and CRAiLEXTMtechnology. The warehouse lease was not renewed, the sales team was terminated and all other elements of our apparel division were discontinued.

PLAN OF OPERATION

Because CRAiLAR®Fibers can be an ingredient in countless products, management believes that partnering with the largest, most successful brands, all of which are top of mind to the North American consumer, is the path to successful commercialization. The Company has signed development and supply agreements with some of the world’s largest fiber consuming companies such as Hanesbrands Inc, Levis Strauss & Co., Georgia-Pacific, and Target. Sustainability, risk mitigation, consumer satisfaction and product enhancement are all offered within the CRAiLAR®experience.

As we move forward to commercialization, our partners are not only successfully integrating our CRAiLAR®flax fiber within their biggest product categories, but as well, discovering benefits and enhancements which are exclusive to their developments, allowing the CRAiLAR®brand to evolve and grow, while servicing both the consumer and business needs.

In the near future, we will be working in tandem with our partners to extoll the virtues of CRAiLAR®through co-branding, ingredient call-outs, co-op marketing efforts, in-store signage, point of purchase and naturally, with links to the relevant social media networks and websites that have taken the communications world by storm. Our own presence and prosperity will grow in concert with the growth of our growers and business partners, allowing CRAiLAR®to be top of mind, similar to great ingredient brand successes such as Gore-Tex®and Intel®.

16

Partnerships and Industry Expertise

The Company has identified the Williamsburg County / Florence County regions of South Carolina as ideal region for growing winter flax crops.

As a result of identifying this geographical area as an ideal growing region, we incorporated a wholly owned subsidiary, Naturally Advanced Technologies, US Inc. The purpose of this subsidiary is to develop a US based flax fiber industry based around our CRAiLAR®fiber technology; from the contracting of crops through to the processing of the fiber.

Our first commercialization partner, Hanesbrands, is headquartered in North Carolina. Hanesbrands uses contract spinners located throughout the states of North and South Carolina. Therefore, being able to procure textile grade fiber in this region allows the Company to take advantage of strategic logistical opportunities.

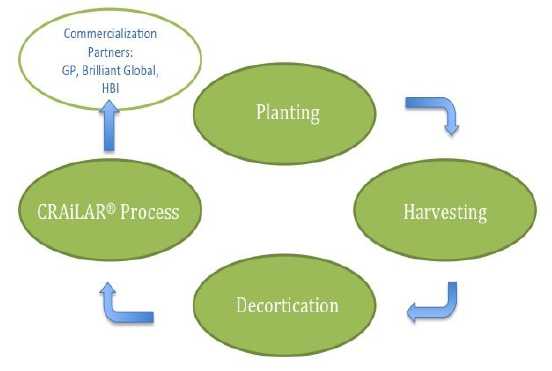

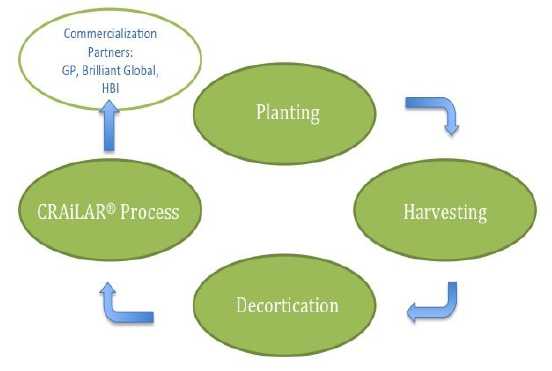

We entered into a sub lease of a mid volume decortication facility located in Kingstree, South Carolina, in early August of 2010. The facility was originally established under a USDA flax initiative that failed to reach commercial viability. The equipment in this facility is designed to mechanically separate the flax fiber from the rest of the plant. This stage is called decortication. This is the first step of our process before it goes through our patented CRAiLAR®wet process. We have used this facility to prove out the viability of flax farming in this region, perfect our decortication process and to commence early volumes of CRAiLAR®fiber to our commercial partners. In August 2011, we took over the lease for a term of one year.

In March 2012, we signed a lease for an approximately 147,000 square foot building on 52 acres outside of Pamplico, South Carolina. The building is currently undergoing the renovations necessary to process Crailar fiber. In the first stage, the decortication process will begin in Q3 of 2012 with wet processing planned to begin in early 2013.

In addition to signing our joint development agreements with Hanesbrands and Georgia Pacific, we licensed a third party processor of natural fibers, Littlewoods Inc. of Philadelphia, to run interim scale quantities of up to 40,000 pounds per week of CRAiLAR®Fiber, to feed our commercialization scale up and additional market development plans, in denim, work wear, knit garments, domestic textiles and home furnishings. To support that strategy, we also licensed our first commercial spinner of CRAiLAR®Fiber yarns, Patrick Yarns of Kings Mountain, North Carolina. To date Patrick Yarns have shown CRAiLAR®Fiber at the Outdoor Retail Show, and are sampling fiber to customers in the above mentioned industries. In addition, they are capable of supporting our development partners with scale up quantities to commercialization, should they be called upon to do so.

In late January of 2012, we announced that we had signed our second yarn development partner, Tuscarora Yarns of Greensboro NC. Tuscarora are a highly innovative yarn spinner, capable of blending Crailar with fibers other than cotton, to broaden our market capabilities in performance sportswear, higher end fashion and outerwear. This is a strategic initiative that will add to the CRAiLAR®list of performance attributes, while strengthening our brand capabilities at the consumer interface.

In March 2012 we entered into an agreement with Tintoria Piana to execute the CRAiLAR®enzymatic process, augmenting the Company’s plans for manufacturing capacity. The agreement calls for Tintoria to commence production in Q3 2012. Tintoria’s history in textiles dates to 1582 in Biella, Italy. The privately held, family-owned business has dyed fiber for the traditional apparel business for more than 60 years, and operates principally out of Cartersville, Georgia in North America.

In March 2012 we announced that we had partnered with Barnhardt Manufacturing Company to further expand its manufacturing capacity. The agreement calls for Barnhardt to execute the CRAiLAR enzymatic process exclusively for NAT, and expands upon manufacturing plans announced earlier this month.

Founded in 1929, Charlotte, N.C.-based Barnhardt is a global supplier of cotton for medical, health and beauty aids, and nonwoven fabrics. It currently supplies processed fiber to companies that demand similar standards to those of NAT's global brand partners, and this third-party manufacturing agreement gives NAT the ability to scale to demand from existing and future partners. Barnhardt will commence production for NAT in Q3 2012.

17

PROCESS FLOW

Agronomics Plan - USDA

We announced in January of 2011 that we had entered into growing trials with Hanesbrands and the USDA-ARS, further developing our agronomic know-how and our ability to produce fiber capable of being spun into finer-gauge yarns suitable for undergarments, shirting and finer-knit garments. These trials were designed to enable us to move to an unprecedented level of flax-fiber refinement by allowing us to develop flax strains capable of accessing all sectors of the industry. The research project has resulted in 200 acres of flax being planted in the Kingstree region this past winter. The trial crop was harvested in mid May and will dew ret in the fields before being baled and then entering the CRAiLAR®process. Summer crops such as cotton and soybeans will be planted in time for a full summer season proving the viability of flax as a winter rotation crop in the South East. We expect to contract significantly higher acreage for the 2011/2012 growing season. We have also identified other suitable North American growing regions, such as the Willamette Valley in Oregon, Southern Vermont, and growing regions in Michigan and Maine

In July 2011, we entered into an agreement with Carolina Eastern to provide agronomic consultation. Carolina Eastern will assist in the recruitment of growers and contractors and advise on all cultivation plans regarding flax. The Company has planted enough acres to produce roughly 5,000,000 lbs of CRAiLAR®. To assist on the recruitment of growers Carolina Eastern and the Company hosted a farm day in Kingstree, South Carolina in August of 2011, which was attended by approximately 90 growers interested in growing flax.

In March 2012, the Company appointed Mr. Steve Sandroni as Vice President of Agriculture. Mr. Sandroni brings more than 34 years of experience working in various aspects of agribusiness to the Company. Mr. Sandroni will oversee the Company’s global agricultural efforts. He will liase with farmers and hire regional support staff in all of the Companies growing regions.

PRODUCTION PLAN

With the completion of our financing in July 2011, we intend to install our first fully integrated CRAiLAR®Fiber processing facility in the Florence region of South Carolina. The company is finalizing the lease of an existing building in the region, for the housing of its first fully integrated decortication and enzyme treatment processing facility. Purchase orders plus deposits for the equipment needed to both decorticate and enzymatically process CRAiLAR®Fiber have been issued, and installation of that equipment in the new facility is expected to commence in the second quarter of 2012. The company expects the new facility to become operational in the 3rd quarter of 2012, and to ramp up production through 2012. At full capacity, the new facility will be capable of producing 620,000 pounds of CRAiLAR®Fiber per week. Feedstock will come from the prairies, the American Southeast, Northeast, Northwest and Europe.

18

In March 2012, we announced an improvement of our CRAiLAR®wet process time by 40 percent, therefore significantly increasing anticipated volume capabilities at planned facilities. The evaluation and resulting improvements were conducted internally in conjunction with research partners. The resulting changes encompass processes, as well as the utilization of industry standard equipment, including that which was purchased by the Company for its first production facility.

These reductions in overall cycle time increase throughput and production capacity in each planned facility. These efficiencies also allowed the Company to evaluate third-party manufacturers to increase overall production volume of CRAiLAR®Flax through a quicker expansion model.

As a result of this optimized process, we entered into the agreements with Tintoria Piana and Barnhardt Manufacturing to execute the CRAiLAR®enzymatic process, augmenting the Company’s plans for manufacturing capacity.

The Company believes that outsourced manufacturing allows for faster expansion of our technology proposition while significantly reducing the capital requirements to scale up to meet demand.

CRAILEX

Finally, the testing and evaluation of our CRAiLEXTMAdvanced Materials pulping technology continues with a joint development agreement with Hercules Incorporated, a subsidiary of Ashland Inc.

CRAiLEXTMis the brand name for the purified pulp created from a patented process that is exclusively held by the Company. In recent tests, CRAiLEXTMhas proven to exhibit higher-grade value pulps than other hard or soft-wood pulps. This is due to the unique cellular structure of bast fibers, namely hemp, and the less damaging CRAiLEXTMpulping process which preserves the fiber integrity. The pulps are used by Ashland to create its line of cellulosic products including ethers and additives for multiple industries. We would create market opportunities in the higher end cellulosic yarns market, which we plan to market to our growing roster of global apparel brands. We expect the completion of the final round of evaluation and testing of our dissolving pulp qualities to be confirmed by Ashland in Q2 of 2012, whereafter the structure of commercialization of the technology will become a key priority.

INTEGRATED PRODUCTION MODEL

CRAiLAR®and CRAiLEXTMproduction models integrate seamlessly at the agricultural and decortication level. The separation into the two distinctive patented manufacturing process thereafter creates the two unique opportunities in the natural fiber and dissolving pulp markets, with go to market strategies overlapping in the natural fiber and cellulosic yarn markets, along with composites and non-woven manufacturing. The additives and ethers market dominated by Ashland Inc, would potentially be controlled by Ashland in an integrated business venture with Ashland.

With the necessary strategic partnerships and management team in place the Company believes it is well positioned to execute its commercial roll out plan in 2012.

Note on Plan of Operation

While the Company expects that profitable operations will be achieved in the future, there can be no assurance that revenue, margins, and profitability will increase, or be sufficient to support operations over the long term. Management expects that the Company will need to raise additional capital to meet short and long-term operating requirements. Management believes that private placements of equity capital and debt financing may be adequate to fund the Company’s long-term operating requirements. Management may also encounter business endeavors that require significant cash commitments or unanticipated problems or expenses that could result in a requirement for additional cash. If the Company raises additional funds through the issuance of equity or convertible debt securities other than to current shareholders, the percentage ownership of current shareholders would be reduced, and such securities might have rights, preferences or privileges senior to the Company’s common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, the Company may not be able to take advantage of prospective business endeavors or opportunities, which could significantly and materially restrict business operations. Management is continuing to pursue external financing alternatives to improve the Company’s working capital position and to grow the business to the greatest possible extent.

19

MATERIAL COMMITMENTS

Production Equipment

At March 31, 2012, the Company had commitments of $5,024,744 (Euro 3,654,360) to purchase production equipment to begin commercial production of Crailar fiber. The Company intends to fulfill these commitments with a mixture of cash and debt.

Annual Leases

The Company is committed to current annual lease payments totaling $688,257 for premises under lease over the next 5 years. Approximate minimum lease payments over the 5 year period are as follows:

| | | $ | |

| 2012 | | 81,511 | |

| 2013 | | 100,814 | |

| 2014 | | 212,072 | |

| 2015 | | 146,930 | |

| 2016 | | 146,930 | |

| | | | |

| Total | | 688,257 | |

NRC Agreements

Collaboration Agreement

In October 2007, the Company entered into a joint collaboration agreement with the NRC to continue to develop a patentable enzyme technology for the processing of hemp fibres. The agreement was for three years and was set to expire on May 9, 2010. On February 19, 2010, the Company signed an amendment to the agreement which will now expire on May 9, 2012. The Company will continue its joint collaboration of enzyme technology with the NRC, however the research will refocus on cellulose technology for the production of lignocellulosic ethanol. The NRC is to be paid as it conducts work on the joint collaboration. There are no further costs or other off-balance sheet liabilities associated with the NRC agreement.

Over the term of the amended agreement, the Company will pay the NRC a total of $280,536 divided into nine payments up to May 9, 2012. As of the date of these statements all payments due in 2012($41,620) have been paid.

Technology License Agreement

On November 1, 2006, the Company entered into a technology license agreement with the NRC. The license agreement provides the Company a worldwide license to use and sublicense the NRC technology called CRAiLAR®. The Company paid an initial $25,000 (CDN $25,000) fee and will pay an ongoing royalty of 3% on the first $50,000,000 of sales, with the royalty dropping to 1.5% of sales over $50,000,000 of products derived from the CRAiLAR®process to the NRC with a minimum annual payment set at $15,000 (CDN$15,000) per year.

Alberta Innovates – Technology Futures

In June 2007, the Company's subsidiary, Crailar Fiber Technologies Inc. ("CFT"), entered into a Master Agreement for Technology Development with the Alberta Research Council ("ARC") now know as Alberta Innovates-Technology Futures (“AITF”) (the "Technology Agreement") to further develop and commercialize bast fiber technology. The Technology Agreement is intended to act as an umbrella agreement for further bast fiber development planned to be performed by the AITF under separate Project Agreements. During 2011 the Company paid the ARC for specific tasks to further the development of AITF's Technology, the amount paid was $135,890, no monies were paid or owing Q1 of 2012. Under the terms of the Project Agreements signed with AITF the Company will be entitled to an exclusive, worldwide, royalty-bearing license to use any new intellectual property developed pursuant to the Project Agreements. The royalty based on this option will be 3% of gross sales for the first $50,000,000 and 1.5% of gross sales on excess of $50,000,000. The Technology Agreement is in effect as long as there is an active Project Agreement.

20

Investor Relations Agreement

On August 9, 2011, the Company renewed the agreement for a firm to perform investor relations activities. The agreement term is one year with ninety days notice of termination by either party. The monthly fee is $10,000 with 70,000 stock options exercisable at $2.77 expiring August 19, 2016.The options were granted under the 2010 Option Stock Plan and were valued at $148,862 using the Black-Scholes option pricing model.

Research Agreement

Starting in December 2010, a co-operative research project designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR®technology was signed with the United States Department of Agriculture, HanesBrands and the Company. The project has an initial term of one year with a renewal option for two additional years. We will contribute annually $51,000 of in-kind expenses towards the project.

Farming and Consulting Agreements

During the year ended December 31, 2011, the Company signed agreements with farmers to plant and to produce flax using the seed provided by the Company. Flax straw and flax seed harvested will be purchased by the Company at the agreed prices.

The Company signed a consulting agreement for identifying, securing and providing agronomic supports to farmers, and the Company will pay $6.50 per acre under successful cultivation.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this Report, we do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with us is a party, under which we have any obligation arising under a guarantee contract, derivative instrument or variable interest; or a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

SUBSEQUENT EVENTS

Subsequent to March 31, 2012, 68,329 shares were issued pursuant to the exercise of stock options at prices between $0.87 and $2.77 per share for total proceeds of $91,708.

Subsequent to March 31, 2012, 23,000 shares were issued pursuant to the exercise of warrants at prices between $1.25 and $1.50 per share for total proceeds of $33,750.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Currency risk

Although the Company conducts its business principally in Canada, the majority of its purchases are made in U.S. currency. Additionally, the majority of the Company's debt is denominated in U.S. currency. The Company does not currently hedge its foreign currency exposure and accordingly is at risk for foreign currency exchange fluctuations.

Credit risk

Credit risk is managed by dealing with customers whose credit standing meets internally approved policies, and by ongoing monitoring of credit risk. The risk in cash accounts is managed through the use of a major financial institution which has high credit quality as determined by the rating agencies. As at March 31, 2012, the Company does not have significant concentrations of credit exposure.

21

Interest rate risk

All term debt has fixed interest rates and the Company has no significant exposure to interest rate fluctuation risk other than at renewal.

Item 4. Controls and Procedures

Disclosure Controls and Procedures

Kenneth Barker, our Chief Executive Officer, and Guy Prevost, our Chief Financial Officer, have evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act) as of the end of the period covered by this Quarterly Report. Based on that evaluation, they concluded that our disclosure controls and procedures were effective as of March 31, 2012.

No Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during our fiscal quarter ended March 31, 2012 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Report, no director, officer or affiliate is a party adverse to us in any legal proceeding, or has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Item 1A. Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We Have a History of Operating Losses and There Can Be No Assurance We Will Be Profitable in the Future.

We have a history of operating losses, expect to continue to incur losses, may never be profitable, and must be considered to be in the development stage. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred losses totaling approximately $2,788,967, $6,907,844 and $3,293,439, respectively, for the three month period ended March 31, 2012, and the fiscal years ended December 31, 2011 and 2010. As of March 31, 2012, we had accumulated deficits of $14,241,270. As at March 31, 2012 we had cash and cash equivalents of $5,165,962 and working capital of $4,568,167. Further, we do not expect positive cash flow from operations until Q4 2012. There is no assurance that actual cash requirements will not exceed our estimates.

22

We May Need to Raise Capital To Continue Our Operations.

Based upon our historical losses from operations, we may require additional funding in the future. If we cannot obtain capital through financings or otherwise, our ability to execute our development plans and achieve profitable operational levels will be greatly limited. Historically, we have funded our operations through the issuance of equity and short-term debt financing arrangements. We may not be able to obtain additional financing on favorable terms, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including demand for CRAiLAR®and CRAiLEXTMtechnologies. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds, it would have a material adverse effect upon our operations.

Our Success is Dependent Upon the Acceptance of CRAiLAR®and CRAiLEXTMTechnologies.

Our success depends upon our achieving significant market acceptance of our CRAiLAR®and CRAiLEXTMTechnology and demand for alternative bio-based products. Acceptance of our CRAiLAR®and CRAiLEXTMTechnology will depend on the success of our and our partners’ promotional and marketing efforts and ability to attract customers. To date, we have not spent significant funds on marketing and promotional efforts, although in order to increase awareness of our products we expect our partners to spend a significant amount on promotion, marketing and advertising in the future. If these expenses fail to develop an awareness of our CRAiLAR®and CRAiLEXTMTechnologies and products, these expenses may never be recovered and we may never be able to generate any significant future revenues. In addition, even if awareness of our CRAiLAR®and CRAiLEXTMTechnology increases, we may not be able to produce enough product to meet demand.

We May Be Unable to Retain Key Employees or Management Personnel.

The loss of Messrs. Kenneth Barker, Jason Finnis, Guy Prevost, Tom Robinson, Jay Nalbach, Ms. Larisa Harrison or any of our key management personnel would have an adverse impact on our future development and could impair our ability to succeed. Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Mr. Kenneth Barker and our Chief Innovation Officer, Mr. Jason Finnis, and other key management personnel and our ability to continue to hire and retain such personnel. Messrs. Barker, Finnis, Prevost, Robinson and Nalbach spend substantially all, or most, of their working time with us and our subsidiaries. It may be difficult to find sufficiently qualified individuals to replace Mr. Barker, Mr. Finnis, Mr. Prevost, Mr. Robinson, Mr. Nalbach, Ms. Harrison or other key management personnel if we were to lose any one or more of them. The loss of Mr. Barker, Mr. Finnis, Mr. Robinson, Mr. Nalbach or Mr. Prevost, or any of our other key management personnel could have a material adverse effect on our business, development, financial condition, and operating results. We maintain “key person” life insurance on our senior executive officers.

Our Officers and Directors May Be Subject to Conflicts of Interest.

Certain of our officers and directors may be subject to conflicts of interest. Certain of our directors devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, certain of our directors may be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest. However, such directors have acknowledged their fiduciary duty to perform their duties in our best interest and those of our shareholders.

Government Regulation and Trade Restrictions Could Have a Negative Impact on Our Business.

Governments or special interest groups may attempt to protect existing industries through the use of duties, tariffs or public relations campaigns. These efforts may adversely affect interest in and demand for our CRAiLAR®and CRAiLEXTMTechnology.

Moreover, any negative changes to international treaties and regulations such as NAFTA and to the effects of international trade agreements and embargoes imposed by such entities such as the World Trade Organization which could result in a rise in trade quotas, duties, taxes and similar impositions or which could limit the countries from whom we can purchase component materials, or which could limit the countries where we or our customers might market and sell products created using CRAiLAR®Technology, which could have an adverse effect on our business.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

23

If Our Competitors Misappropriate Unpatented Proprietary Know-How and Our Trade Secrets, It May Have a Material Adverse Affect on Our Business.

The loss of or inability to enforce our trademark CRAiLAR®and other proprietary know-how, including our CRAiLAR®and CRAiLEXTMprocess, and trade secrets could adversely affect our business. We depend heavily on trade secrets and the design expertise of our employees. If any of our competitors copies or otherwise gains access to our trade secrets or develops similar technologies or processes independently, we would not be able to compete as effectively. The measures we take to protect our trade secrets and design expertise may not be adequate to prevent their unauthorized use. Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding the rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate and therefore could have an adverse affect on our business.

Currency Fluctuations May Cause Translation Gains and Losses.

A significant portion of our expenses are incurred in Canadian dollars. As a result, appreciation in the value of these currencies relative to the United States dollar could adversely affect our operating results. Foreign currency translation gains and losses arising from normal business operations are credited to or charged against other income for the period incurred. Fluctuations in the value of Canadian dollars relative to United States dollars may cause currency translation gains and losses.

Risks Related to Our Common Stock

Sales of a Substantial Number of Shares of Our Common Stock May Result in Significant Downward Pressure on the Price of Our Common Stock and Could Affect Your Ability to Realize the Current Trading Price of Our Common Stock.

As of March 31, 2012, there were 42,442,804 shares of our common stock issued and outstanding. (As of May 3, 2012, there were 42,535,133 shares of our common stock issued and outstanding). Further, as of March 31, 2012 there were an aggregate of 4,955,745 Stock Options and 3,004,219 share purchase warrants outstanding that are exercisable into 4,955,745 shares of common stock (at a weighted average exercise price of $1.54) and 3,004,219 shares of common stock (at a weighted average exercise price of $3.79), respectively.

Any significant downward pressure on the price of our common stock as certain stockholders sell their shares of our common stock may encourage short sales. Any such short sales could place further downward pressure on the price of our common stock.

The Trading Price of Our Common Stock on the OTC Bulletin Board Has Been and May Continue to Fluctuate Significantly and Stockholders May Have Difficulty Reselling Their Shares.

During our fiscal year ended December 31, 2011, our common stock has traded as low as $1.03 and as high as $4.50. In addition to volatility associated with Bulletin Board securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- changes in the demand for flax and other eco-friendly products;

- disappointing results from our or our partners’ marketing and sales efforts;

- failure to meet our revenue or profit goals or operating budget;

- decline in demand for our common stock;

- downward revisions in securities analysts’ estimates or changes in general market conditions;

- lack of funding generated for operations;