UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 28, 2013

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGEACT OF 1934

For the transition period from ______to ______

Commission File No.:000-50367

Crailar Technologies Inc.

(Exact name of registrant in its charter)

| British Columbia | 98-0359306 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| | |

| Suite 305 - 4420 Chatterton Way | |

| Victoria, British Columbia, Canada | V8X 5J2 |

| (Address of principal executive offices) | (Zip Code) |

(250) 658-8582

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: |

| None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, without par value

(Title of Class)

Indicate by checkmark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (i) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (ii) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ X ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if smaller reporting company) | | Smaller reporting company [X] |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately$44,399,388.

The registrant had 50,679,097 shares of common stock outstanding as of March 24, 2014.

2

TABLE OF CONTENTS

| PART I | | 4 |

| ITEM 1. | BUSINESS | 4 |

| ITEM 1A. | RISK FACTORS | 17 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 24 |

| ITEM 2. | PROPERTIES | 24 |

| ITEM 3. | LEGAL PROCEEDINGS | 25 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 25 |

| PART II | | 25 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERMATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 25 |

| ITEM 6. | SELECTED FINANCIAL DATA | 29 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION ANDRESULTS OF OPERATIONS | 29 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS | 42 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 43 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING ANDFINANCIAL DISCLOSURE | 71 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 71 |

| ITEM 9B. | OTHER INFORMATION | 71 |

| PART III | | 72 |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 72 |

| ITEM 11. | EXECUTIVE COMPENSATION | 78 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT ANDRELATED STOCKHOLDER MATTERS | 85 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | 86 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 87 |

| ITEM 15. | EXHIBITS | 88 |

3

Forward-Looking Statements

Statements made in this Form 10-K that are not historical or current facts are “forward-looking statements” as that term is defined in applicable securities laws. These statements often can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “approximate,” “potential” or “continue,” or the negative of such terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, which may cause our or our industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Available Information

We file annual, quarterly, current reports, proxy statements, and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the SEC at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C., 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also obtain copies of our SEC filings by going to the SEC’s website at www.sec.gov. In addition, we post our SEC filings, including any amendments thereto, on our Internet website at www.crailar.com as soon reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

References

As used in this annual report: (i) the terms “we,” “us,” “our,” or the “Company” refer to Crailar Technologies Inc. and our subsidiaries, unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

PART I

Corporate Structure and Subsidiaries

We were incorporated under the laws of British Columbia, Canada, on October 6, 1998, under the name “Hemptown Clothing Inc.” The current corporate structure is a single public company, incorporated under theBusiness Corporations Act (British Columbia).

On February 22, 2006, our Board of Directors authorized and approved the change in our corporate name to “Naturally Advanced Technologies Inc.” and the subsequent filing of the Amendment with the Registrar of Companies for the Province of British Columbia. This name change to Naturally Advanced Technologies Inc. became effective March 21, 2006, and our trading symbol for our shares of common stock trading on the OTC Bulletin Board was changed to “NADVF”. Our shares of common stock commenced trading under the symbol “NAT” on the TSX Venture Exchange (the “TSX-V”) at the opening of market on July 8, 2008.

4

Effective October 31, 2012, we effected a name change to Crailar Technologies Inc. This name change was effective under theBusiness Corporations Act (British Columbia) as of October 31, 2012, pursuant to a Notice of Alteration that was filed with the British Columbia Registrar of Companies on October 22, 2012. The name change became effective with the TSX-V on October 31, 2012 under the stock symbol “CL” and with the OTC Bulletin Board at the opening for trading on November 1, 2012 under the stock symbol “CRLRF”. Since July 18, 2013, our shares of common stock have been quoted on the OTCQB under the symbol “CRLRF”.

We were founded in response to the growing demand for environmentally friendly, socially responsible clothing, and we adhere to a “triple bottom line” philosophy, respecting the human rights of employees, the environmental impact of our operations and fiscal responsibility to our shareholders.

Our wholly-owned subsidiaries are as follows:

Crailar Inc. (formerly known as Naturally Advanced Technologies US Inc.)

Naturally Advanced Technologies US Inc. was incorporated under the laws of the State of Nevada on August 24, 2010, to manage our U.S. business operations. This company was also issued a Certificate of Authorization by the State of South Carolina to transact business on October 21, 2010. Effective November 30, 2012, the name of this entity was changed to “Crailar Inc.”

CRAiLAR®Fiber Technologies Inc.

Our wholly owned subsidiary CRAiLAR®Fiber Technologies Inc. (“CRAiLAR®”) was incorporated under the laws of the Province of British Columbia on April 5, 2005. It was incorporated for the purpose of developing Bast Fiber Technology for uses in textiles, cellulose pulp, paper, and composites.

HTnaturals Apparel Corp.

HTnaturals Apparel Corp. (“HTnaturals”) was incorporated under the laws of the Province of British Columbia on December 7, 2007, for the purpose of carrying out the natural and sustainable apparel portion of our business. We, through our wholly owned subsidiary HTnaturals, were also a provider of environmentally sustainable hemp, bamboo, organic cotton and soy blended apparel.

During our fiscal year ended December 31, 2009, we discontinued our apparel division in order to focus our resources on our CRAiLAR® technology, and this subsidiary has been inactive since that time.

0697872 B.C. Ltd.

Our wholly-owned subsidiary, 0697872 B.C. Ltd., was incorporated under the laws of the Province of British Columbia on June 18, 2004, and held the title to real property located in Craik, Saskatchewan. During 2008 we elected against proceeding with the intended use of the property and returned all rights to the town of Craik. This subsidiary has been inactive since that time.

5

Hemptown USA, Inc.

Our wholly-owned subsidiary, Hemptown USA, Inc., was incorporated under the laws of the State of Nevada on November 22, 2004, for factoring purposes so that business dealings could be accomplished daily without currency valuations and fluctuations, as well as to provide an American base inventory control to customers. With the closing of the apparel business, Hemptown USA, Inc. became inactive during 2009.

CRAiLAR Europe NV

Our wholly-owned subsidiary, CRAiLAR Europe NV, was incorporated under the laws of Belgium on February 11, 2014, in order facilitate our European operations.

Our principal offices are located at Suite 305, 4420 Chatterton Way, Victoria, British Columbia V8X 5J2, our telephone number is (250) 658-8582, and our web site address iswww.crailar.com.

Overview

We are focused on bringing sustainable bast fiber-based products to market that are environmentally friendly natural fiber alternatives with equivalent or superior performance characteristics to cotton, wood or fossil-fuel based fibers. Our business operations consist primarily of the deployment and production of our natural and proprietary CRAiLAR®Flax fibers, as well CRAiLAR® processing technologies targeted at the natural yarn and textile and the cellulose pulp and composites industries.

We hold the exclusive worldwide license to the patented CRAiLAR® technologies. We believe that fibers and yarns produced with the CRAiLAR®process will be competitively priced relative to current natural and synthetic fibers and have the benefit of being environmentally responsible. The CRAiLAR®patented process effectively cleans and polishes raw bast fiber, such as flax, hemp, kenaf and jute bast fibers, into fiber substantially equivalent to ginned cotton. It is our belief that the CRAiLAR®brand has the potential to become a recognized sustainable performance brand that is valued and demanded by the market.

We believe that entering into development and supply agreements with some of the world’s largest fiber consuming companies is the best path to successful commercialization of a number of products incorporating our CRAiLAR® technologies. In execution of this strategy, we have entered into development and supply agreements with companies such as adidas AG, Georgia-Pacific, Hanesbrands Inc., IKEA, Lenzing and Levis Strauss & Co. to supply approximately 7.4 million pounds of CRAiLAR® Flax fibers in 2014 and approximately 8.5 million pounds in 2015 (when multi-year requirements are averaged to an annual amount) in order to retain their exclusive right.

Industry

With the projected increase in the global population and continued development of market economies, we expect to see a rise in the need for textile fibers worldwide. According to Gherzi, a global management consulting company focused on the textile industry, the global demand for textile fibers is expected to exceed 100 million tons by 2020.

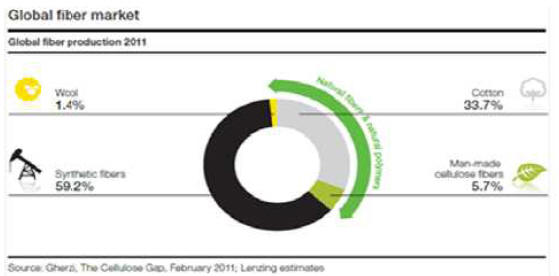

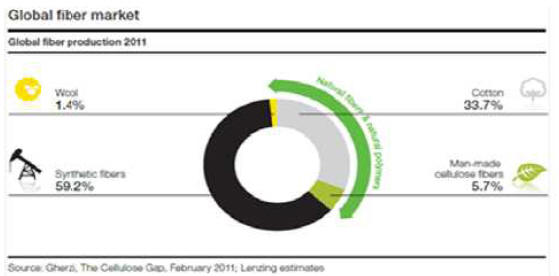

Gherzi estimates there were 81.0 million tons of fibers produced globally in 2011 and synthetic fibers (such as polyester) accounted for 59.2% of such fibers, cotton accounted for 33.7%, cellulose-based fibers (such as viscose and rayon) accounted for 5.7% and wool accounted for 1.4% . More generally, according to Gherzi, it is estimated that the demand for textile fibers is expanding approximately 3% per year, mainly due to the following two macroeconomic trends:

6

- Ongoing population growth.UNESCO expects the global population to rise from its current total of approximately 7 billion to 7.7 billion people in 2020 when global demand for fibers is expected to exceed 100 million tons.

- Increase in prosperity.Increasing prosperity generates additional demand, particularly in emerging economies as they catch up with western industrialized nations.

In addition, sustainability and climate change concerns have contributed to consumers increasingly preferring products manufactured with a minimal environmental impact and use of resources.

While some of the increase in demand is likely to be filled by synthetic fibers, we believe that the consumer preference for natural fibers will continue to rise and, as societal trends to live both sustainably and naturally increase. We believe that we have a unique opportunity to fill this shortfall through the production of CRAiLAR® fiber. With mill delivered cotton priced between $0.90 and $1.00 per pound, flax is a cost-effective raw material for fiber production. We expect our fiber will be cost competitive with other fibers currently available in the fiber industry once the Company has a fully integrated production facility in operation.

The CRAiLAR Solution

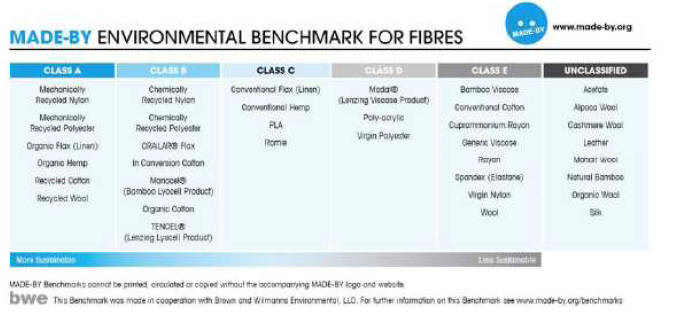

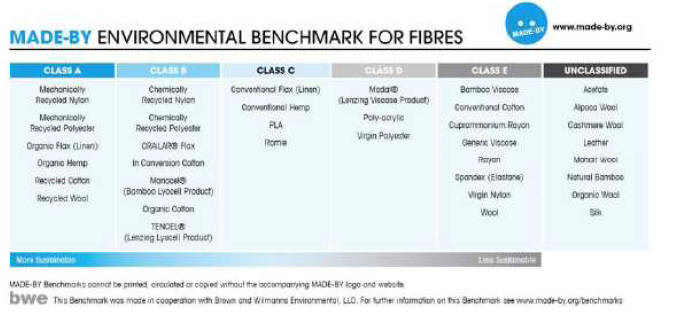

We hold the exclusive worldwide license to the patented CRAiLAR®technologies. The CRAiLAR®patented technologies and processes effectively clean and polish raw bast fiber, such as flax, hemp, kenaf and jute bast fibers, into fiber substantially equivalent to ginned cotton. This solution is clean, sustainable, and environmentally responsible. Bast fiber plants grow abundantly and, when compared with cotton, require 97% less water and substantially less herbicides, fertilizers and pesticides. In April 2012, the USDA designated CRAiLAR as a 100% BioPreferred® product. CRAiLAR® Flax fibers have been recently awarded a ‘B’ classification by the MADE-BY organization. This classification certifies that the benefits of CRAiLAR® Flax far outweigh that of polyester and conventional cotton (both ranked Less Sustainable).

MADE-BY is a European not-for-profit organization with a mission to improve environmental and social conditions in the fashion industry. The organization and environmental benchmark supports brands and manufacturers in limiting the impact of its materials on the environment and advises them on sustainable alternatives. In this benchmark, the processing of a large range of materials from raw to yarn are compared in relation to emissions produced, their use of land space, pesticides, chemicals, water and energy.

7

The CRAiLAR®fiber technology was developed by Dr. Wing Sung and his team at the National Research Council of Canada (the “NRC”). The NRC granted to us the exclusive worldwide license to the patented technology, which currently includes two patents covering the extraction of hemp fibers and preparation of bast fibers. Under development since 2004, this technology has undergone successful final demonstration scale testing and we are now delivering CRAiLAR®Flax fiber to our customers. We anticipate that CRAiLAR®Flax fibers will generally be used in union with cotton and all other mainstream fibers, which, when blended together, should result in a much better performing fabric than cotton or other mainstream fibers alone. We continue to work with NRC on the development of enhancements to our core technologies that are covered by the NRC license. The license expires upon the expiration of the last patent claim covered by the license, which is currently in December 2029.

Products

CRAiLAR®Fiber

The CRAiLAR® fiber technology is a clean, sustainable, environmentally responsible process, which works with bast fiber feedstocks. Bast fiber plants grow abundantly generally without excessive water, herbicide, fertilizer and pesticide use. As a result, CRAiLAR®was designated as a 100% BioPreferred®product by the USDA in April 2012. In December 2013, CRAiLAR® Flax fibers were awarded a ‘B’ classification by the MADE-BY organization, alongside and equal to organic cotton and Lenzing Tencel.

Relative to existing bast fiber processing methods, the CRAiLAR®fiber enzymatic process is significantly faster, produces highly consistent results, and is environmentally low impact. The resulting CRAiLAR®fibers have characteristics that are superior to traditionally processed bast fibers for textile applications. Because the CRAiLAR®fiber enzymatic processing is very effective at cleaning bast fiber, it can be spun on traditional cotton equipment at commercially viable speeds. CRAiLAR®Flax fibers can integrate seamlessly with cotton fibers and, when blended together, results in a superior performing fabric than cotton alone. The blended fabric at 80% cotton and 20% CRAiLAR takes on many of the superior characteristics of CRAiLAR®Flax fibers, including enhanced moisture management and comfort, durability, superior dye uptake and garment shrinkage reduction.

8

CRAiLAR®Shive and Seed Products

We are already in the process of investigating by-product opportunities utilizing seed and shive. IKEA has confirmed shive suitably for use in particle board manufacturing for furnishings. We believe we have the potential ability to use the straw of the linseed flax crop, which is primarily cultivated for food and industrial applications. This straw would normally be discarded and/or burned following the seed harvest. Flax shive can be transformed into fuel pellets, animal bedding particle board, molded products and consumer goods packaging while the flax seed can be used for dietary supplements, linseed oil and feed for livestock. Making use of this waste by-product will only further enhance the CRAiLAR®Flax fiber sustainability rating and could increase potential revenues.

Our Competitive Strengths

We believe that the following strengths differentiate our company and create the foundation for continued sales and profitable growth:

Product Performance.All of our fiber products are designed to deliver superior performance. In apparel, CRAiLAR® Flax fibers will generally be blended with cotton, which should result in a better performing fabric than cotton alone. The resulting fabric, blended 80 percent cotton/20 percent CRAiLAR® fibers, takes on the many characteristics of CRAiLAR® Flax fibers. Key elements include:

A fiber with wicking characteristics greater than unblended cotton and almost as good as high performance synthetic fibers, making fabrics breathable;

Superior dye uptake resulting in a potential ten percent dye reduction for same color specification;

Reduced garment shrinkage of up to fifty percent from washing compared to unblended cotton; and

Comparable feel of comfort to cotton.

Innovative Process.We offer high quality natural fibers that provide an alternative to cotton and paper pulp users. We attribute our ability to develop superior products to a number of factors, including:

Intellectual property and patents surrounding the CRAiLAR®process and technologies;

Close collaboration with our customers to formulate innovative and technically advanced natural fabrics; and

The capital costs involved in building a commercial CRAiLAR®fibers processing facility have been determined to be relatively modest and we believe we can utilize existing industry equipment.

Experienced Management Team.We have a proven and experienced senior management team. Our Chief Executive Officer, Ken Barker, has been with us since 2007 and has significant experience in the apparel industry. Many of the members of our senior management team have extensive experience in the textile industry and with leading consumer brands.

Our Business Strategy

We believe that our market presence and revenues will continue to expand with the continued development of our growers and customers, allowing the CRAiLAR®brand to be recognized, similar to ingredient brand successes such as Gore-Tex®and Tencel®. We are pursuing the following several growth strategies to continue to build our business:

9

Further Develop Our Customer Ecosystem.We have established a strong set of relationships with other organizations in our customer ecosystem to deliver superior natural fibers to our customers. We believe these customers will enable us to increase the speed of deployment and functionality of our fibers and offer a wider range of applications to our customers. We intend to support our customers in the growth of their products, as well as increase the number of suppliers who work with our customers. We understand that in order for new initiatives to be pulled from corporate concept to market viability, support from senior management of our customers is critical. We have established relationships with large apparel and paper pulp manufacturers such as Hanesbrands and Georgia Pacific. As we expand the commercialization of our fibers, we expect our customers will successfully integrate our CRAiLAR®Flax fiber within their product categories, but are also discover benefits and enhancements that are exclusive to their developments. This allows the CRAiLAR®brand to evolve and gain greater brand recognition while servicing both the consumer and customer needs. We believe that the development of customer relationships is an important strategy and that additional relationships with consumer brands will also be important for additional branding opportunities.

Expand Penetration and Consumer Base. We intend to increase the number of consumers who buy our products by using the co-branding opportunities provided by our customers, as they communicate our sustainability and performance benefits to their consumers. We plan to further this support with grassroots marketing, social media tools and industry advertising. We believe these efforts will educate consumers about our brand and the benefits of sustainable natural fibers, creating demand for our products and, ultimately, expand our consumer base. We will continue to collaborate with our customers to formulate innovative and technically advanced fibers. We believe that our products can provide significant value to both the consumer and industrial markets. We also believe that there is a substantial opportunity for us to continue to increase the size of our customer base across a broad range of industries, given the relatively high level of performance of our products. We intend to continue to invest aggressively in our direct and indirect sales and marketing capabilities to continue to acquire new customers.

Continue Innovation and Broaden Product Offering. Our customers’ ability to deploy new products rapidly and cost-effectively will be central to our financial results. We intend to continue expanding the functionality of our products in the future. In the near term, we expect that our research and development investments will continue to be highly focused on our CRAiLAR fiber for textile applications and in high grade dissolving pulps for use in the additives, ethers and performance apparel markets. Over the longer term, we intend to continue our investment in the development of new applications that address additional market opportunities, which may include composites manufacturing, medical, dental and feminine hygiene products. By collaborating with our customers and partners in these efforts, we intend to enable our customers to increase their performance capabilities through rapid and cost-effective deployments of products incorporating our fibers.

Expand Globally. We recognize that our patented technologies have global, multi-industry applications, and represent a significant opportunity for us. We plan to expand our sales capabilities internationally by expanding our sales force and by collaborating with strategic customers and partners around the world.

Stay True to Our Values. We are a focused business with long-standing core values. We need to rapidly and positively affect the international footprint of “dirtier” fibers and processes. We continue to strive to operate in a socially responsible and environmentally sustainable manner. We believe our sustainability and performance better cultivates brand loyalty and trust with customers and helps attract consumers. We plan to work in tandem with our customers to communicate the benefits of CRAiLAR®through co-branding, ingredient call-outs, co-op marketing efforts and in-store signage.

10

Invest in Infrastructure and Capabilities. We invest in our people, supply chain and systems to ensure that our business is scalable and profitable. We expect to add new employees to our sales, marketing, operations and finance teams as necessary to support our growth. Additionally, we continue to invest in our systems and technology, to create a platform for growth and to increase efficiency.

Sales and Marketing

We are pursuing a pull-through marketing model, which focuses on working directly with some of the leading consumer brands in a variety of target markets, including apparel, textiles and industrial products, to develop additional products incorporating our CRAiLAR® fibers. In this regard, we plan to leverage our partners’ direct-to-consumer marketing programs to accelerate and expand the brand recognition for our proprietary fibers.

Strategic Relationships/Customer Developments

Because CRAiLAR® fibers can be an ingredient in a broad range of products, we believe that entering into development and supply agreements with large, successful consumer brands is the path to successful commercialization. We believe that these relationships will allow us to leverage the considerable branding and marketing talent of these brands to increase the power of the CRAiLAR®brand.

To grow our business and our brand, we have entered into a number of development and supply agreements including, among others:

Cone Denim LLC. On March 11, 2013, we entered into a Marketing and Development Agreement with Cone Denim LLC (“Cone”) to market and develop the use of CRAiLAR®fiber in Cone’s denim fabric line. We are working directly with Cone and its customer, Levi Strauss & Co., for the development of certain denim products using our CRAiLAR®Flax fiber. Subject to certain exceptions, CRAiLAR has agreed to not sell CRAiLAR®fiber to any other denim manufacturer through December 31, 2015 without providing Cone with a right of first refusal on any denim development opportunity. We believe our relationship with Cone and Levi Strauss should expand the demand for our fiber in the denim market.

Cotswold Industries Inc.On February 12, 2013, we entered into a Development Agreement with Cotswold Industries Inc. (“Cotswold”). CRAiLAR and Cotswold will try to develop or create commercially viable pocketing, interlining and waist banding products containing our CRAiLAR® fibers.

Hanesbrands Inc.In January 2011, we announced a cooperative research project with Hanesbrands Inc. and the U.S. Department of Agriculture’s Agricultural Research Service designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR®technology. In March 2011, we entered into a ten-year CRAiLAR®fiber supply agreement with Hanesbrands Inc. to commercialize our proprietary fibers. Hanesbrands may terminate the agreement with 180 days’ advance notice to us, and we can terminate the agreement beginning January 1, 2022 with 180 days’ advanced notice to Hanesbrands. During the term of the agreement, we may not supply our proprietary fibers to third parties for knit apparel applications.

Georgia Pacific Consumer Products LLC. In September 2011, we entered into a three year CRAiLAR®fiber supply agreement with Georgia Pacific Consumer Products LLC, for the use of CRAiLAR®fiber in formed substrates for the industrial and personal care markets provided that Georgia Pacific continues to meet annual minimum purchase requirements. Georgia Pacific may automatically extend the agreement for an additional seven years by notifying us at least six months before the expiration of the initial term.

11

Target Corp.In November 2011, we entered into an agreement with Target to evaluate the use of our CRAiLAR®Flax fiber in Target’s domestic textiles category beginning December 1, 2011. In connection with this agreement, Target has used our CRAiLAR®Flax fiber in certain domestic textile products, including in a drapery line. While our agreement with Target has expired, we continue to work with Target in connection with the development of certain woven and knit apparel using our CRAiLAR®fibers.

Lenzing AG.In April 2012, we entered into a joint development agreement with Lenzing, headquartered in Austria, and one of the world’s largest suppliers of viscose, Modal and Tencel®to the apparel, non-woven and auto industries. CRAiLAR and Lenzing are jointly developing fiber solutions in the performance apparel industries for global athletic brands as well as fashion brands.

IKEA.In December 2013, we entered into a general supply agreement and development agreement with IKEA. The general supply agreement provides exclusivity in certain domestic textile categories as long as IKEA meets specified minimum order quantities. The agreement expires on December 31, 2016 but IKEA may extend the term up to two times for 3 years each by notifying us at least six months before the expiration of the then effective term. We have received orders and have begun flax fiber production at our European production facility for IKEA.

adidas AG.In December 2013, adidas AG took a shareholder position in CRAiLAR through their investment arm, Hydra Ventures BV. As one of the largest athletic brands in the world, adidas is a driving force in innovation and performance for athletes and fashionistas alike. CRAiLAR is working in close tandem with adidas to further their development and execution of sustainable production practices, with a goal of reducing the brand’s dependency on conventional cotton and petro-chemical fibers.

We are currently evaluating additional opportunities for multiple product development and commercialization of our proprietary CRAiLAR®technology for environmentally sustainable bast fiber processing and production. Exclusive international licensing rights allow us to protect our investment to date in the development of CRAiLAR®and while confidently moving forward in seeking appropriate development and commercialization relationships.

Plan of Operation

Production Plan

One of the keys to the successful adoption of CRAiLAR® into the mainstream textile market is the scale up of our in-house production capabilities.

In December 2013 we acquired a European fiber dyeing facility with similar equipment used to produce CRAiLAR® Flax fiber. The acquisition was made pursuant to an Asset Purchase Agreement dated November 6, 2013, which was amended and restated on December 13, 2013. The new plant allowed us to accelerate our timeline for establishing a company-controlled CRAiLAR® enzyme processing capability. Production of CRAiLAR® fibers at this facility commenced in January 2014. We believe the plant has the capacity to produce over 280,000 pounds (127 metric tons) of CRAiLAR® Flax fiber per week with space to expand the capacity to over 800,000 pounds per week. We are presently relying on a third party processor to do one step of the CRAiLAR process and have purchased the equipment for this step. Installation of this equipment and overhauling existing equipment to optimize the plant is currently underway and we expect completion by the end of Q-2 2014.

12

The facility was previously family owned and operated for four generations and offers access to considerable textile expertise. The facility is located in an area of flax growing excellence and offers an abundant supply of feedstock from a by-product of the linen industry. Purchasing the by-product of the linen industry has significant working capital advantages because it is bought as needed and is processed, shipped and billed shortly after receipt. This compares with straw purchased directly from farmers for approximately the same cost where a year’s supply of straw must be paid when harvested by the farmer. We have developed relationships with various European and Eastern European flax processors and brokers to purchase cleaned feedstock. We have also purchased equipment to clean the feedstock for CRAiLAR®processing that will allow us to buy partially cleaned fiber, providing access to additional sources of feedstock. We expect to have this equipment installed by the end of 2014. On an annual basis, the amount of fiber created in Europe during the linen scutching processing ranges from 80,000 to 140,000 metric tons.

We also believe that it is necessary to develop contracted acreage of flax to avoid disrupting supply and demand for by-product of the linen industry. We believe that there are opportunities to secure farm acreage dedicated to supplying our plants. This would require a decortication capability in these growing regions. Our suppliers also believe that additional farmers would be attracted to grow flax for CRAiLAR because the farming techniques are very simple and efficient compared with traditional linen flax farming techniques. Also, the retting requirements for the CRAiLAR® process are less stringent than for linen flax.

We commenced operations in Pamplico, South Carolina in January 2013. We encountered problems with the bale opening system and have suspended operations until new equipment can be built and installed. This fiber will be used for CRAiLAR® Flax in Belgium or sold into the U.S. paper market. We do not plan on planting flax in the U.S. this fall given that we have enough supply from the 2013 crop to last through the year. Also, given our focus on Europe we will have reduced operations in the U.S. unless a strategic customer will support our presence in South Carolina. Some of the assets used in Pamplico could be redeployed to other locations. We currently lease a 147,000 square foot building on 52 acres outside of Pamplico, South Carolina, which we plan to use as an integrated processing facility.

In addition to the installation of our full scale processing line, CRAiLAR continues to improve upon its patented enzymatic process thereby increasing efficiencies. In March 2012, we announced an improvement of our CRAiLAR® wet process time by 40 percent, thereby significantly increasing anticipated volume capabilities at planned facilities. The evaluation and resulting improvements were conducted internally in conjunction with research partners. The resulting changes encompass processes, as well as the utilization of industry standard equipment.

13

Production Model

Note on Plan of Operation

While we expect that profitable operations will be achieved in the future, there can be no assurance that revenue, margins, or profitability will increase, or be sufficient to support operations over the long term. We expect that we will need to raise additional capital to meet short and long-term operating requirements. We may also encounter business endeavors that require significant cash commitments or unanticipated problems or expenses that could result in a requirement for additional cash. If we raise additional funds through the issuance of equity or convertible debt securities other than to current shareholders, the percentage ownership of current shareholders would be reduced, and such securities might have rights, preferences or privileges senior to our common stock. Additional financing may not be available upon acceptable terms, on a timely basis, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to take advantage of prospective business endeavors or opportunities, which could significantly and materially restrict business operations. We are continuing to pursue external financing alternatives to improve our working capital position and to grow the business to the greatest possible extent.

Raw Materials

Flax is the principal raw material used in the manufacture of our natural fibers products. Flax is a cost-effective raw material for fiber production because it is generally easy to grow with minimal use of herbicides and requires only regular rainfall for irrigation, which significantly reduces costs as compared to other natural fibers.

We have relationships with several European companies to supply feedstock to our European facility. The European feedstock is a linen industry waste product or fiber unsuitable for linen due to fiber length. As there are approximately 640,276 acres of flax under cultivation in Western Europe for the linen industry and a similar acreage under cultivation in Eastern Europe and Russia, we believe these regions represent a significant source of available feedstock. We have also identified other suitable Eastern European and North American growing regions should we decide to contract directly with farmers, and we have developed improved planting and harvesting techniques from our agronomic experience in North America. These techniques include improved planting and harvesting techniques in North America which should allow us to increase the yield per acre and faster and more cost effective harvesting techniques.

14

Seasonality

Our operating results are subject to some variability due to seasonality and other factors. Sales levels in any period are also impacted by customers’ decisions to increase or decrease their inventory levels in response to anticipated consumer demand.

Collaboration and Research Agreements

National Research Council of Canada

In October 2007, we entered into a joint collaboration agreement with the National Research Council of Canada to continue to develop a patentable enzyme technology for the processing of hemp fibers. The agreement was for three years and initially expired on May 9, 2010. On February 19, 2010, we signed an amendment to the agreement to extend the term of the agreement to May 9, 2012. While this agreement has expired, we continue to work with the NRC on certain enhancements and additions to the NRC technology and negotiations are underway to continue our joint collaboration.

De Montfort University

In 2011, we entered into a research and development agreement with De Montfort University in Leicester, United Kingdom. De Montfort’s textile division is renowned for their work on bast fibers such as flax and hemp and specializes in their textile applications. De Montfort has been working on process optimization and works closely with CRAiLAR’s wet processing partners. In addition to processing improvements, De Montfort has experience with flax and hemp agronomics and has recommended various harvesting improvements that have been implemented into our CRAiLAR® technologies.

Intellectual Property

Under the CRAiLAR®technology platform, we have secured the exclusive worldwide licensing rights to the patented intellectual property arising from our collaborative research agreements with the NRC. The NRC license covers our proprietary processes and includes a license to two patents covering the extraction of hemp fibers and preparation of bast fibers. The patents have been issued or allowed in the U.S., Canada, China, Europe and certain other jurisdictions, and are based on applications filed under the Patent Cooperation Treaty. We pay an ongoing royalty of 3% of sales of products derived from the CRAiLAR®process to the NRC with a minimum annual payment set at $14,750 (CAD$15,000) per year. Once we have reached $44,450,000 (CAD$50,000,000) in CRAiLAR® sales, the royalty percentage drops to 1.5% . The license expires upon the expiration of the last patent claim covered by the license, which is currently in December 2029, but may be terminated earlier by NRC upon our breach of the license agreement or in the event we become bankrupt or insolvent.

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our primary trademark is CRAiLAR®, which is registered with the U.S. Patent and Trademark Office and in Canada. We also rely on unpatented proprietary expertise, formulations, continuing innovation and other trade secrets to develop and maintain our competitive position.

15

Research and Development

We have invested a considerable amount of time and effort into product research and development. Research and development costs are charged to operations as incurred. Our research and development costs for the fiscal year ended December 28, 2013, the fiscal year ended December 31, 2012 and the fiscal year ended December 31, 2011 were $355,099, $660,229 and $757,443, respectively, all of which were attributable to our CRAiLAR® and related bast fiber technology development.

Competition

There are relatively few specialty natural bast fibers producers when compared with the much larger cotton and paper pulp commodity markets. The technical demands and patented processes of CRAiLAR® differentiates us on the basis of our ability to meet the customer’s particular set of needs, rather than simply focusing only on pricing alone.

Employees

CRAiLAR had a total of 16 full-time employees and one part-time employee as of December 28, 2013 located in the United States, Canada and Europe. Employee relations are considered to be good. None of our employees are subject to a collective bargaining agreement.

Backlog

CRAiLAR does not have any order backlog as of December 28, 2013.

Properties

On June 30, 2011, we entered into a lease for our principal offices, consisting of approximately 1,571 square feet of office space in Victoria, British Columbia for a monthly basic net rent of CAD$2,749.25 (US$2,763.34 based on the exchange rate on December 31, 2012 of CAD$1.00 = US$1.0051) . The lease is for a term of three years commencing on August 1, 2011 and expires on July 31, 2014 with one renewal term of three years.

Effective August 9, 2010, we signed a ten-month sublease of a facility at 164 County Camp Road, Kingstree, South Carolina, at a rental cost of $4,400 per month. We attained the space for use as an initial scale-up flax fiber facility to conduct the decortication process of CRAiLAR®fibers. The property is housed near 300 acres of flax crops that we intend to use to conduct our flax fiber growing trials. On July 1, 2011, we signed a one year lease, through June 30, 2012, for this same property and facility for a monthly rent of $3,300. Subsequent to June 30, 2012, we agreed to continue to lease the facility for a monthly rent of $3,400 until March 31, 2014.

Effective August 15, 2011, we entered into a lease for 1,468 square feet of office space in Lake Oswego, Oregon for a monthly rent of $3,000 during the first year, $3,500 during the second year and $4,000 during the third year. This lease is for a term of three years expiring on August 14, 2014.

In March 2012, we entered into a lease for a 147,000 square foot building on 52 acres outside of Pamplico, South Carolina. We plan to use this building as an integrated processing facility. The initial term of the lease is for ten years with two additional five-year extension terms. No rent was due prior to January 1, 2014.

16

Commencing January 1, 2014, the annual basic rent will be $146,930 per year, increasing to $220,395 per year from June 1, 2018 to May 31, 2022.

In November 2013, in connection with the acquisition of our European production facility in Ieper, Belgium, we committed to lease the building housing the facilityPursuant to an oral agreement, the initial term of the lease commitment is ten years with the option to extend the lease for an additional ten-year term. Commencing on December 1, 2013, the annual basic rent will be $62,636 for the first year with annual rent adjustments calculated as the sum of €1,300,000 multiplied by the Belgium risk-free interest rate. After five years the building will be reappraised and the base rents will be calculated using the new appraisal value. Pursuant to the agreement, we have the option to purchase the building for its appraised value after the fifth anniversary. We are currently in the process of formalizing the foregoing oral arrangements.

Government Regulation

Trade Regulation

Our operations are subject to the effects of international treaties and regulations such as the North American Free Trade Agreement (NAFTA). We are also subject to the effects of international trade agreements and embargoes by entities such as the World Trade Organization. Generally, these international trade agreements benefit our business rather than burden it because they tend to reduce trade quotas, duties, taxes and similar impositions. However, these trade agreements may also impose restrictions that could have an adverse impact on our business, by limiting the countries from whom we can purchase our fabric or other component materials, or limiting the countries where we may market and sell our products.

Environmental Regulation

Our operations are subject to various environmental and occupational health and safety laws and regulations. We believe that we are in compliance with all applicable regulatory requirements. We will continue to make expenditures to comply with these requirements, and we do not believe that compliance will have a material adverse effect on our business. As is the case with manufacturers in general, if a release of hazardous substances occurs on or from our properties or any associated offsite disposal locations, or if contamination from prior activities is discovered at any of our properties, we may be held liable. While the amount of such liability could be material, we endeavor to conduct our operations in a manner that reduces such risks.

Transfer Agent

Our transfer agent is Computershare Investor Services Inc., 510 Burrard Street, 2nd Floor, Vancouver, BC V6C 3B9.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

17

Risks Related to Our Business

We Have a History of Operating Losses and There Can Be No Assurance We Will Be Profitable in the Future.

We have a history of operating losses, expect to continue to incur losses, may never be profitable, and must be considered to be in the development stage. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred net losses totaling approximately $15,169,933 for our fiscal year ended December 28, 2013 (“Fiscal 2013”), $9,135,360 for the year ended December 31, 2012 and $6,998,922 for the year ended December 31, 2011. As of December 28, 2013, we had accumulated deficits of $35,937,596. As at December 28, 2013 we had cash and cash equivalents of $1,193,365 and a working capital deficit of $3,426,427.

We Will Need to Raise Capital to Continue Our Operations.

Based upon our historical losses from operations, we anticipate we will require additional funding after the offering. If we cannot obtain capital through additional financings or otherwise, our ability to execute our development plans and achieve profitable operational levels will be greatly limited. Historically, we have funded our operations through the issuance of equity and convertible debentures and bank debt financing arrangements. We may not be able to obtain additional financing on favorable terms, on a timely basis, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including the demand for and market acceptance of CRAiLAR® technologies. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds on acceptable terms on a timely basis, it would have a material adverse effect upon our operations.

We May Have Insufficient Earnings Or Liquidity to Meet Our Future Debt Obligations.

We currently have outstanding convertible debentures and other debt (including a debt repayment obligation relating to our European production facility, a loan from IKEA and loans from two of our officers and a director) in the aggregate principal amount of $23,033,246. We intend to use a portion of the proceeds from this offering to repay the loans from our officers and director in the aggregate principal amount of $621,406. The maturity dates of the remaining debt and convertible debentures range from 2016 to 2017. The interest payments on our outstanding debentures and loans are expected to be $1,865,960 and $1,862,582 for 2014 and 2015, respectively. Our inability to generate cash flow sufficient to satisfy our debt obligations, or to refinance our obligations on commercially reasonable terms, could materially and adversely affect our business. In addition, servicing these debt obligations will reduce the availability of our cash flow to fund working capital and capital expenditures to continue to expand our business and operations.

Our Success Is Dependent upon the Acceptance of CRAiLAR® Technology.

Our success depends upon our achieving significant market acceptance of our CRAiLAR® technology and products containing our CRAiLAR® fiber. Acceptance of our CRAiLAR® technology will depend on the success of our and our customers’ promotional and marketing efforts and ability to attract customers. If such efforts fail to develop an awareness of and demand for our CRAiLAR® technology and products, we may never be able to generate any significant future revenues. Even if awareness of our CRAiLAR® technology increases, we may not be able to timely produce enough of our fibers to meet demand.

In addition, the acceptance of our CRAiLAR® technology may be adversely affected by decreases in the price of cotton. A decrease in the price of cotton could reduce our customers’ desire for natural fiber alternatives, and thereby reduce the demand for and acceptance of our proprietary fibers, which could have a material adverse effect on our financial results.

18

We Are Dependent upon Third Parties to Increase the Awareness of and Demand for Our Crailar® Fibers and Technology.

We are pursuing a pull-through marketing model, which focuses on working directly with some of the leading consumer brands in a variety of target markets to develop additional products incorporating our CRAiLAR® fibers. To date, we have not spent significant funds on marketing and promotional efforts, but we expect our customers to spend a significant amount on promotion, marketing and advertising of the benefits of our fibers and their products containing such fibers in the future, which we believe will increase awareness of our products. However, we do not currently have any customer agreements which require any significant expenditures to be made by the customer specifically to promote our brand or our products. In addition, we have little control over the actions of our customers with respect to the specific products and quality and number of such products that our customers sell or market that include our CRAiLAR® fibers, or the relative mix of our fibers in such products, all of which can have an effect on the perception and acceptance of our products. If our customers do not promote and market our products in the future as we expect or their products are not well-accepted in the market or do not effectively demonstrate the benefits of our products and technologies, the acceptance of our brand and products may suffer or we may be required to incur significant additional costs for promotion and marketing, which would adversely affect our financial results and condition.

An Early Termination of the NRC License Will Have a Material Adverse Effect on Our Business.

Our CRAiLAR® technologies are based on patents and other intellectual property licensed to us from the NRC. The license agreement expires upon the expiration of the last patent claim covered by the license, which is currently in December 2029, but may be terminated earlier by the NRC upon our breach of the license agreement or in the event we become bankrupt or insolvent. An early termination of the license agreement would have an immediate and material adverse effect on our business. In addition, due to the substantial dependence of our technologies on the patents held by the NRC, our business and financial results may be adversely affected if such patents are not adequately enforced or protected.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Our financial statements have been prepared under the assumption that we will continue as a going concern. Our independent registered public accounting firm has issued a report that included an explanatory paragraph expressing substantial doubt as to our ability to continue as a going concern in light of our continuing net losses and anticipated future operating losses. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our ability to continue as a going concern is dependent upon our ability to obtain additional financings or other capital, reduce expenditures or attain further operating efficiencies and generate revenue. If adequate funds are not available to us when we need it, or we are unable to generate revenues as required, we will be required to curtail our operations which would, in turn, further raise substantial doubt about our ability to continue as a going concern.

A Commercial Market Must Be Found for Our By-products.

North American markets need to be found and developed for the by-products of our decortication process. Although several opportunities for the sale of our by-products are being explored, no contracts for the off take of our by-products have been signed as of the date of this annual report, and we cannot assume that we will enter into any such contracts in the future or that such development will lead to usable products.

19

We May Be Unable to Retain Key Employees or Management Personnel.

The loss of any of our key officers and management personnel would have an adverse impact on our future development and could impair our ability to succeed. Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Mr. Kenneth Barker, and our Chief Innovation Officer, Mr. Jason Finnis, and other key management personnel and our ability to continue to hire and retain such personnel. It may be difficult to find sufficiently qualified individuals to replace Messrs. Barker and Finnis or other key management personnel, including Mr. Ted Sanders, our Chief Financial Officer and Treasurer, Mr. Jay Nalbach, our Chief Marketing Officer, and Mr. Guy Prevost, our Corporate Controller and Compliance Officer, if we lose any one or more of them. The loss of any such persons could have a material adverse effect on our business, development, financial condition, and operating results. We maintain “key person” life insurance on our senior executive officers.

Our Officers and Directors May Be Subject to Conflicts of Interest.

Certain of our officers and directors may be subject to conflicts of interest. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Certain of our directors devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to other entities. Because of these relationships, such directors may be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest. However, such directors have acknowledged their fiduciary duty to perform their duties in our best interest and those of our shareholders.

Government Regulation and Trade Restrictions Could Have a Negative Impact on Our Business.

Governments or special interest groups may attempt to protect existing industries through the use of duties, tariffs or public relations campaigns. These efforts may adversely affect interest in and demand for our CRAiLAR®technology.

Moreover, any negative changes to international treaties and regulations such as NAFTA and international trade agreements, and embargoes imposed by entities such as the World Trade Organization, which could result in a rise in trade quotas, duties, taxes and similar impositions or which could limit the countries from whom we can purchase component materials, or which could limit the countries where we or our customers might market and sell products created using CRAiLAR® technology, could have an adverse effect on our business.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

20

If Our Competitors Misappropriate Unpatented Proprietary Know-How and Our Trade Secrets, It May Have a Material Adverse Effect on Our Business.

The loss of or inability to enforce our CRAiLAR®trademark and our proprietary know-how and trade secrets could adversely affect our business. We depend heavily on trade secrets and the design expertise of our employees. If any of our competitors copy or otherwise gains access to our trade secrets or develops similar technologies or processes independently, we would not be able to compete as effectively. The measures we take to protect our trade secrets and design expertise may not be adequate to prevent their unauthorized use. Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversion of resources. In addition, notwithstanding the rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate and therefore could have an adverse effect on our business and financial condition.

Currency Fluctuations May Cause Translation Gains and Losses.

A significant portion of our expenses are incurred in Canadian dollars and Euros. As a result, appreciation in the value of these currencies relative to the United States dollar could adversely affect our operating results. Foreign currency translation gains and losses arising from normal business operations are credited to or charged against other income for the period incurred. Fluctuations in the value of Canadian dollars and Euros relative to United States dollars may cause currency translation gains and losses.

We May Not Successfully Identify or Complete Future Acquisitions, Which Could Have a Material Adverse Effect on Our Business, Financial Condition, Results of Operations and Cash Flow.

We may seek to expand our business partly through acquisitions. However, if any reasonable acquisition candidates were to be identified, we cannot assure you that we will succeed in:

- completing acquisitions;

- integrating acquired operations into our existing operations; or

- expanding into new markets.

We also cannot assure you that any current or future acquisitions will not have an adverse effect on our operating results, particularly in the fiscal quarters immediately following their completion while we integrate the operations of the acquired business. The integration of newly acquired businesses or operations may prove to be more challenging, take more time than originally anticipated and result in significant additional costs and/or operational issues, all of which could adversely affect our financial condition and result of operations. Once integrated, acquired operations may not achieve levels of revenues, profitability or productivity comparable with those achieved by our existing operations, or otherwise perform as expected.

21

Risks Related to Our Common Stock

Sales of a Substantial Number of Shares of Our Common Stock May Result in Significant Downward Pressure on the Price of Our Common Stock and Could Affect Your Ability to Realize the Current Trading Price of Our Common Stock.

As of December 28, 2013, there were 47,806,031 shares of our common stock issued and outstanding (as of March 24, 2014, there were 50,679,097 shares of our common stock issued and outstanding). Further, as of December 28, 2013, there were outstanding options exercisable into 6,468,799 shares of common stock at a weighted average exercise price of $1.81 per share and warrants exercisable into 6,887,580 shares of common stock at a weighted average exercise price of $1.15 per share. We also completed three convertible debenture offerings of $10,051,262 (CAD$10,000,000), $4,943,642 (CAD$5,000,000) and $3,363,606 (CAD$3,535,000) on September 20, 2012 (the “2012 Notes”), February 25, 2013 (the “February 2013 Notes”) and July 26, 2013 (the “July 2013 Notes”), respectively. Holders of the 2012 Notes and the February 2013 Notes have the option to convert such notes at a price of $2.85 (CAD$2.90) per share of common stock at any time prior to September 30, 2017. Holders of the July 2013 Notes have the option to convert such notes at a price of $1.21 (CAD$1.25) per share of common stock at any time prior to July 26, 2016. Any sales in the public market of the common shares issuable upon exercise or conversion of the outstanding options and warrants, the 2012 Notes, the February 2013 Notes and the July 2013 Notes may dilute our stockholders’ ownership percentages and could result in a decrease in the market value of our equity securities.

In addition, any significant downward pressure on the price of our common stock as certain stockholders sell their shares of our common stock may encourage short sales. Any such short sales could place further downward pressure on the price of our common stock.

The Trading Price of Our Common Stock on the OTCQB Has Been and May Continue to Fluctuate Significantly and Stockholders May Have Difficulty Reselling Their Shares.

During Fiscal 2013, our common stock has traded as low as $0.36 and as high as $2.63. In addition to volatility associated with OTCQB securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- changes in the demand for flax and other eco-friendly products;

- market acceptance of our products and the products that incorporate our CRAiLAR®fiber;

- disappointing results from our or our customers’ marketing and sales efforts;

- failure to meet our revenue or profit goals or operating budget;

- decline in demand for our common stock;

- downward revisions in securities analysts’ estimates or changes in general market conditions;

- lack of funding generated for our operations and existing debt obligations;

- investor perception of our industry or our business prospects; and

- general economic trends.

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to sell their shares at a fair price and you may lose all or part of your investment.

22

Additional Issuances of Equity Securities May Result in Dilution to Our Existing Stockholders.

Our Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire shares of our common stock, your proportionate ownership interest and voting power could be decreased. Further, any such issuances could result in a change of control.

We are not authorized to issue shares of preferred stock. However, there are provisions of British Columbia law that permit a company’s board of directors, without shareholder approval, to issue shares of preferred stock with rights superior to the rights of the holders of shares of common stock. As a result, shares of preferred stock could be issued quickly and easily, adversely affecting the rights of holders of shares of common stock and could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult. Although we currently do not have any authorized preferred stock, have no plans to create authorized preferred stock, and have no present plans to issue any shares of preferred stock, any creation and issuance of preferred stock in the future could adversely affect the rights of the holders of common stock and reduce the value of the common stock.

Our Common Stock is Classified as a “Penny Stock” Under SEC Rules Which Limits the Market for Our Common Stock.

Because our stock is not traded on any national securities exchange in the U.S. and because the market price of the common stock is less than $5 per share, the common stock is classified as a “penny stock.” Our stock has never traded above $5 per share. SEC Rule 15g-9 under the Exchange Act imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customers concerning the risk of penny stocks. Many broker-dealers decline to participate in penny stock transactions because of the extra requirements imposed on penny stock transactions. Application of the penny stock rules to our common stock reduces the market liquidity of our shares, which in turn affects the ability of holders of our common stock to resell the shares they purchase, and they may not be able to resell at prices at or above the prices they paid.

We Are a Canadian Company and a Majority of Our Directors and Many of Our Officers Are Canadian Citizens and/or Residents, Which Could Make It Difficult for Investors to Enforce Judgments Against Us in the United States.

We are a company incorporated under the laws of the Province of British Columbia, Canada and a majority of our directors and many of our officers reside in Canada. Therefore, it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers. All or a substantial portion of such persons’ assets may be located outside the United States. As a result, it may be difficult for investors to effect service of process on our directors or officers, or enforce within the United States or Canada any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under U.S. federal securities laws against them. In addition, investors may not be able to commence an action in a Canadian court predicated upon the civil liability provisions of the securities laws of the United States. We have been advised by our Canadian counsel that there is doubt as to the enforceability, in original actions in Canadian courts, of liability based upon the U.S. federal securities laws and as to the enforceability in Canadian courts of judgments of U.S. courts obtained in actions based upon the civil liability provisions of the U.S. federal securities laws. Therefore, it may not be possible to enforce those actions against us or any of our directors or officers.

23

A Decline in the Price of Our Common Stock Could Affect Our Ability to Raise Further Working Capital and Adversely Impact Our Operations.

A decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise additional capital for our operations. Because our operations to date have been principally financed through the sale of equity securities, a decline in the price of our common stock could have an adverse effect upon our liquidity and our continued operations. A reduction in our ability to raise equity capital in the future would have a material adverse effect upon our business plan and operations, including our ability to continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

As of the date of this Annual Report, there are no unresolved comments pending from either the SEC or the British Columbia Securities Commission.

On June 30, 2011, we entered into a lease for our principal offices, consisting of approximately 1,571 square feet of office space in Victoria, British Columbia for a monthly basic net rent of CAD$2,749.25 (US$2,763.34 based on the exchange rate on December 31, 2012 of CAD$1.00 = US$1.0051) . The lease is for a term of three years commencing on August 1, 2011 and expires on July 31, 2014 with one renewal term of three years.

Effective August 9, 2010, we signed a ten-month sublease of a facility at 164 County Camp Road, Kingstree, South Carolina, at a rental cost of $4,400 per month. We attained the space for use as an initial scale-up flax fiber facility to conduct the decortication process of CRAiLAR®fibers. The property is housed near 300 acres of flax crops that we intend to use to conduct our flax fiber growing trials. On July 1, 2011, we signed a one year lease, through June 30, 2012, for this same property and facility for a monthly rent of $3,300. Subsequent to June 30, 2012, we agreed to continue to lease the facility for a monthly rent of $3,400 until March 31, 2014.

Effective August 15, 2011, we entered into a lease for 1,468 square feet of office space in Lake Oswego, Oregon for a monthly rent of $3,000 during the first year, $3,500 during the second year and $4,000 during the third year. This lease is for a term of three years expiring on August 14, 2014.

In March 2012, we entered into a lease for a 147,000 square foot building on 52 acres outside of Pamplico, South Carolina. We plan to use this building as an integrated processing facility. The initial term of the lease is for ten years with two additional five-year extension terms. No rent was due prior to January 1, 2014. Commencing January 1, 2014, the annual basic rent will be $146,930 per year, increasing to $220,395 per year from June 1, 2018 to May 31, 2022.

In November 2013, in connection with the acquisition of our European production facility in Ieper, Belgium, we committed to lease the building housing the facility. Pursuant to an oral agreement, the initial term of the lease commitment is ten years with the option to extend the lease for an additional ten-year term. Commencing on December 1, 2013, the annual basic rent will be $62,636 for the first year with annual rent adjustments calculated as the sum of €1,300,000 multiplied by the Belgium risk-free interest rate. After five years the building will be reappraised and the base rents will be calculated using the new appraisal value. Pursuant to the agreement, we have the option to purchase the building for its appraised value after the fifth anniversary. We are currently in the process of formalizing the foregoing oral arrangements.

24

Management is not aware of any material legal proceedings pending or contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Annual Report, no director, officer or affiliate is a party adverse to us in any legal proceeding, or has an adverse interest to us in any legal proceedings. Management is not aware of any other material legal proceedings pending or that have been threatened against us or our properties.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATEDSTOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market for Common Stock

Shares of our common stock have been quoted on the OTC Bulletin Board from March 21, 2006 until July 18, 2013, when the quotation moved to the OTCQB. Our shares were quoted initially under the symbol “NADVF” (until October 31, 2012) and now under the symbol “CRLRF” (since November 1, 2012). The market for our common stock is limited, and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on a quarterly basis for the periods indicated as quoted by the OTC Bulletin Board (until July 18, 2013) and the OTCQB (from and after July 18, 2013). These quotations reflect inter-dealer prices without retail mark-up, mark-down, or commissions, and may not reflect actual transactions.

| Quarter Ended | High Bid | Low Bid |

| December 28, 2013 | $0.995 | $0.42 |

| September 28, 2013 | $1.27 | $0.36 |

| June 29, 2013 | $2.30 | $0.95 |

| March 30, 2013 | $2.63 | $2.05 |

| December 31, 2012 | $2.71 | $1.90 |

| September 30, 2012 | $2.75 | $2.00 |

| June 30, 2012 | $3.54 | $2.39 |

| March 31, 2012 | $3.58 | $1.75 |

In addition, shares of our common stock have been listed on the TSX-V since July 8, 2008, initially under the symbol under the symbol “NAT” (until October 30, 2012) and now under the symbol “CL” (since October 31, 2012). The following table sets forth the high and low sales prices of our common stock on a quarterly basis for the periods indicated as quoted by the TSX-V.

25

| Quarter Ended | High | Low |

| December 28, 2013 | CAD$1.10 | CAD$0.48 |

| September 28, 2013 | CAD$1.30 | CAD$0.375 |

| June 29, 2013 | CAD$2.25 | CAD$0.99 |

| March 30, 2013 | CAD$2.76 | CAD$2.05 |

| December 31, 2012 | CAD$2.71 | CAD$1.95 |

| September 30, 2012 | CAD$2.75 | CAD$2.01 |

| June 30, 2012 | CAD$3.50 | CAD$2.28 |

| March 31, 2012 | CAD$3.59 | CAD$1.76 |