Exhibit 99.1

Exhibit 99.1

Adams Harkness 25th Annual Summer Seminar

Safe Harbor Statement

Certain statements made in this presentation, including those related to First Advantage’s five point growth strategy, the closing of the CIG transaction, expansion into new markets, ability to pursue larger acquisitions, and 2005 pro forma revenue and earnings per share are forward looking. Risks and uncertainties exist that may cause results to differ materially from those set forth in these forward-looking statements. Factors that could cause the anticipated results to differ from those described in the forward-looking statements include: interest rate fluctuations; changes in the performance of the real estate markets; limitations on access to public records and other data; general volatility in the capital markets; changes in applicable government regulations; consolidation among both companies’ significant customers and competitors; the companies’ continued abilities to identify and complete acquisitions and successfully integrate acquired businesses; the market price of First Advantage’s Class A common stock; First Advantage’s ability to successfully raise capital; increases in First Advantage’s expenses; unanticipated technological changes and requirements; First Advantage’s ability to identify suppliers of quality and cost-effective data, and other factors described in both companies’ Annual Reports on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission. The forward-looking statements speak only as of the date they are made. Neither First American nor First Advantage undertakes to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

2

Agenda

Company Overview Reporting Segments Marketplace Fundamentals Growth Acceleration Initiatives Strategic Positioning Financial Performance Summary

3

Company Overview

A leading provider of risk mitigation and business process solutions

Formed via reverse merger and publicly listed in June 2003 (NASDAQ: FADV)

67% owned by The First American Corporation (NYSE: FAF) (as of June 30, 2005)

TSO: 23.8 million shares

- Class A Common (tradable): 7.8 million shares - Class B Common (non-tradable; owned by FAF): 16 million shares

Ranked among top three in major business lines Over 2,400 employees Serve 45,000+ clients in a variety of markets

4

Enterprise Screening

Background Verifications

- Third largest verifications provider

- 4,000+ clients

- 4.5 million verifications per year

- Service hundreds of the Fortune 1,000 companies

- Over 18,000 collection sites nationwide

- Industry leading turn-around times Verifications include:

- Criminal records check

- Employment verification

- Education verification

- Motor vehicle verification

- Credit history

- Plus 80 various searches

Occupational Health Services

- Drug testing program management

- Physical exams

- Employee assistance programs

Fingerprinting – Biometric Solutions

- Majority ownership in PrideRock Holdings, Inc. provides nationwide coverage in all 50 states

Employment Screening Services Tax Consulting Services SafeRent Services 5

Enterprise Screening

Hiring Related Credits Credits & Incentives

- 3 million employment screens per year

- Work opportunity tax credit

- Welfare to work

- State hiring credits

- Federal empowerment zone credits

- Renewal community employment credits

Location Based Incentives

- Hiring & employment related credits

- Training & economic development grants

Sales & Use Tax Consulting

- Reverse audits

- Sales & use tax compliance and defense

- Audit management, support & defense

- Utility studies

- Administrative appeals & audit protests

- Tax law research initiatives

- Training & education

Employment Screening Services Tax Consulting Services SafeRent Services

6

Enterprise Screening

Resident Screening

- Largest provider of resident screening information services with over 40 offices nationwide serving 25,000 properties and over 5 million apartment units

- Proprietary databases provide civil and criminal data and assess financial and physical risks of landlords

- 34+ million eviction records

- 140+ million criminal records

Property Performance Analytics

- Analysis of financial performance and lease-level data

Renter’s Insurance

- Markets renters insurance to present and prospective customers

Employment Screening Services Tax Consulting Services SafeRent Services

7

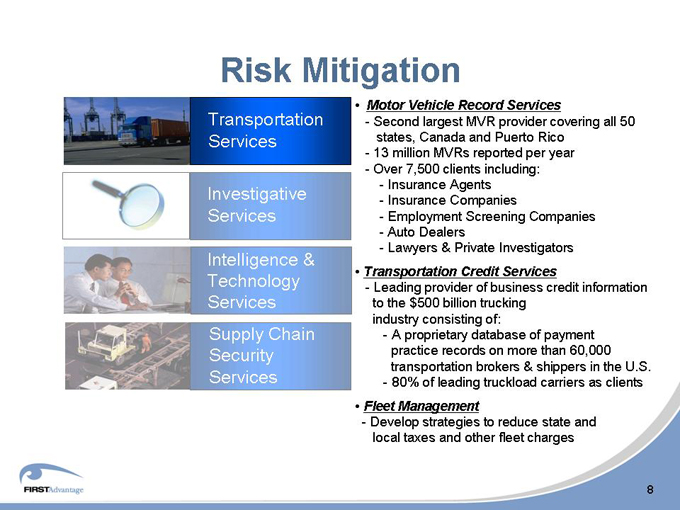

Risk Mitigation

Transportation Services

Investigative Services Intelligence & Technology Services Supply Chain Security Services

Motor Vehicle Record Services

- Second largest MVR provider covering all 50 states, Canada and Puerto Rico

- 13 million MVRs reported per year

- Over 7,500 clients including:

- Insurance Agents

- Insurance Companies

- Employment Screening Companies

- Auto Dealers

- Lawyers & Private Investigators

Transportation Credit Services

- Leading provider of business credit information to the $500 billion trucking industry consisting of:

- A proprietary database of payment practice records on more than 60,000 transportation brokers & shippers in the U.S.

- 80% of leading truckload carriers as clients

Fleet Management

Develop strategies to reduce state and local taxes and other fleet charges

8

Risk Mitigation

Transportation Services

Investigative Services Intelligence & Technology Services Supply Chain Security Services

Investigative Services

- Nationwide investigative firm specializing in the detection and exposure of workers’ compensation, liability and disability insurance fraud

- Surveillance – Comprehensive daily activity report as it relates to the claimants daily activities and reported injuries

- Background investigations – Obtain up-to-date and pertinent information on a designated subject or business

- Statements & field interviews – Written or recorded field interviews are conducted to determine the facts from insureds, claimants, and/or witnesses

- Education & training – Continued education & training of investigative team

9

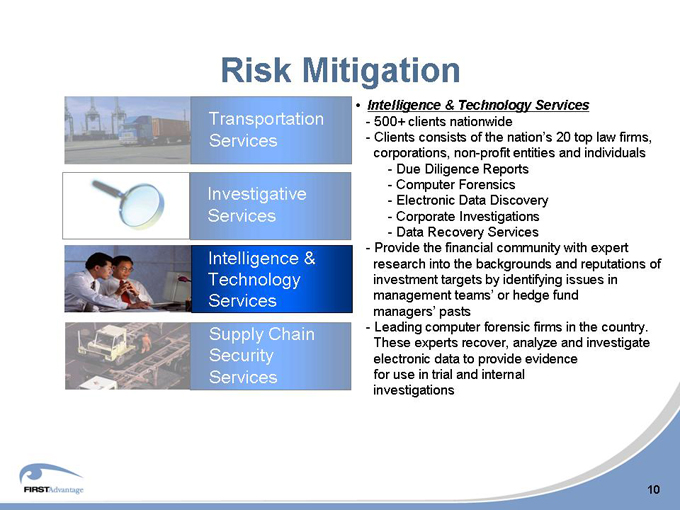

Risk Mitigation

Transportation Services

Investigative Services Intelligence & Technology Services Supply Chain Security Services

Intelligence & Technology Services

- 500+ clients nationwide

- Clients consists of the nation’s 20 top law firms, corporations, non-profit entities and individuals

- Due Diligence Reports

- Computer Forensics

- Electronic Data Discovery

- Corporate Investigations

- Data Recovery Services

- Provide the financial community with expert research into the backgrounds and reputations of investment targets by identifying issues in management teams’ or hedge fund managers’ pasts

- Leading computer forensic firms in the country. These experts recover, analyze and investigate electronic data to provide evidence for use in trial and internal investigations

10

Risk Mitigation

Transportation Services

Investigative Services

Intelligence & Technology Services

Supply Chain Security Services

Supply Chain Security

Provides financial analysis that quantifies cargo exposure during shipping

Recommend solutions that combine insurance and security programs to maximize cargo security

Assists with carrier selection, cargo routing, loss liability negotiations and implementation of U.S. government programs

11

Consumer Direct

US Search.com

5+ million unique visitors monthly 1.2 million customer database 180 million site page views per year

Consumer Services

12

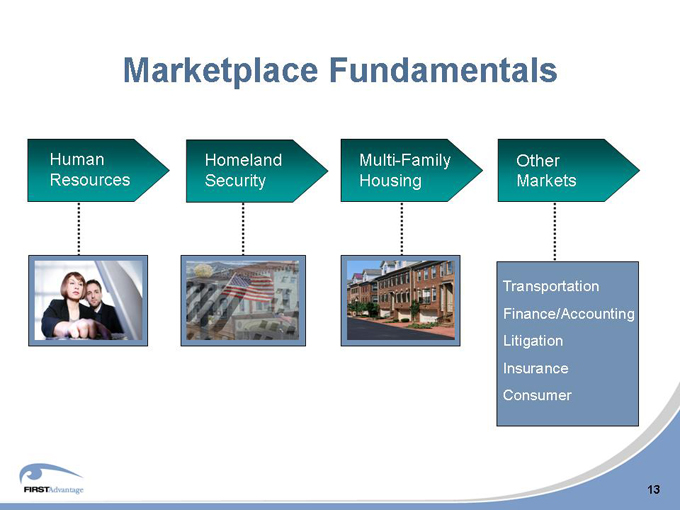

Marketplace Fundamentals

Human Resources

Homeland Security

Multi-Family Housing

Other Markets

Transportation Finance/Accounting Litigation Insurance Consumer

13

Growth Acceleration Initiatives

2003

2004

2005

Enterprise Screening Risk Mitigation Consumer Direct

27 ACQUISITIONS TO DATE

Reverse Merger June 5, 2003

First American Registry American Driving Records Substance Abuse Mgt.

SafeRent

Employee Health Programs

HireCheck

Agency Records, Inc.

Omega Insurance Services

Credential Check & Personnel Services, Inc. MedTech Diagnostics Inc.

Greystone Health Sciences Employee Info. Services Continental Compliance Total Information Source Liberatore Services

Compunet Credit Services

BackTrack Reports, Inc.

CoreFacts, Inc.

MVR’s Inc.

Quantitative Risk Solutions

Realeum, Inc.

U.D. Registry, Inc. Landlord Protect, Inc. Alameda Company Nat’l Background Data CIC Enterprises, Inc.

Infocheck Ltd. Background Info Services ProudFoot Reports, Inc.

Data Recovery Services

Quest Research Ltd.

Priderock Holding Co.

Itax Group, Inc.

PENDING

Credit Information Group

14

Strategic Positioning

Five Point Growth Strategy:

Acquire for Scale/ Margin

Acquire for Product Expansion

Cross-Sell Services

Pursue Vertical Markets

Expand Overseas

15

Strategic Positioning

Five Point Growth Strategy:

Acquire for Scale/ Margin

Improvement in Existing Business Lines

Employment Background Verifications Resident Screening Tax Credits and Incentives Surveillance Computer Forensics

16

Strategic Positioning

Five Point Growth Strategy:

Acquire for Product Expansion

Potential Product Expansion

Applicant Tracking Skills Assessment Psychological Testing Payroll Benefits Administration Biometrics Electronic Discovery Boutique Databases

17

Strategic Positioning

Five Point Growth Strategy:

Cross-Sell Services

Cross-Sell Initiatives

Implement and Build First Advantage Brand Initiate Cross-Sell Programs

18

Strategic Positioning

Five Point Growth Strategy:

Pursue Vertical Markets

Verticals of Interest

Government Multifamily Retail Hospitality Transportation Healthcare Insurance

19

Strategic Positioning

Five Point Growth Strategy:

Expand Overseas

Geographies of Interest

Asia Europe

20

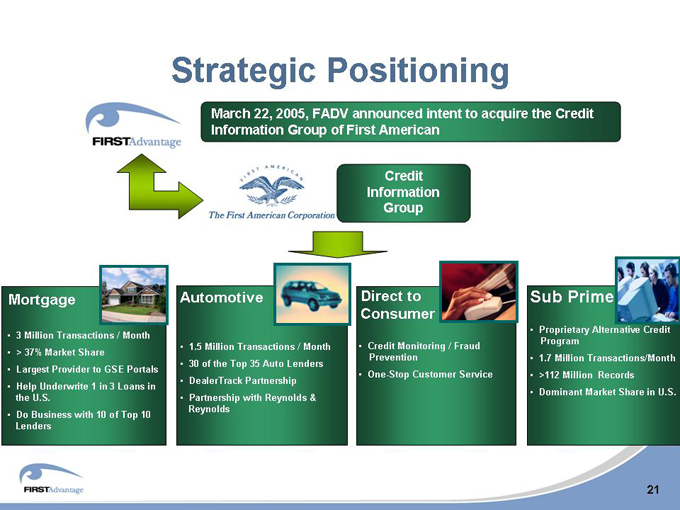

Strategic Positioning

March 22, 2005, FADV announced intent to acquire the Credit Information Group of First American

Credit Information Group

Mortgage

3 Million Transactions / Month > 37% Market Share Largest Provider to GSE Portals Help Underwrite 1 in 3 Loans in the U.S.

Do Business with 10 of Top 10 Lenders

Automotive

1.5 Million Transactions / Month 30 of the Top 35 Auto Lenders DealerTrack Partnership Partnership with Reynolds & Reynolds

Direct to Consumer

Credit Monitoring / Fraud Prevention One-Stop Customer Service

Sub Prime

Proprietary Alternative Credit Program 1.7 Million Transactions/Month >112 Million Records Dominant Market Share in U.S.

21

Strategic Positioning

Impact of Strategic Growth

Set to close in September Strong Balance Sheet $1 Billion + Market Cap Additional Debt Capacity

Pro Forma 2005 Revenue of Approximately $600 Million and $100 Million in Pre-Tax Earnings Pro Forma 2005 EBITDA Per Share of $2.25—$2.50 Pro Forma 2005 EPS of $1.00—$1.15 (including acquisition costs related to this transaction)

22

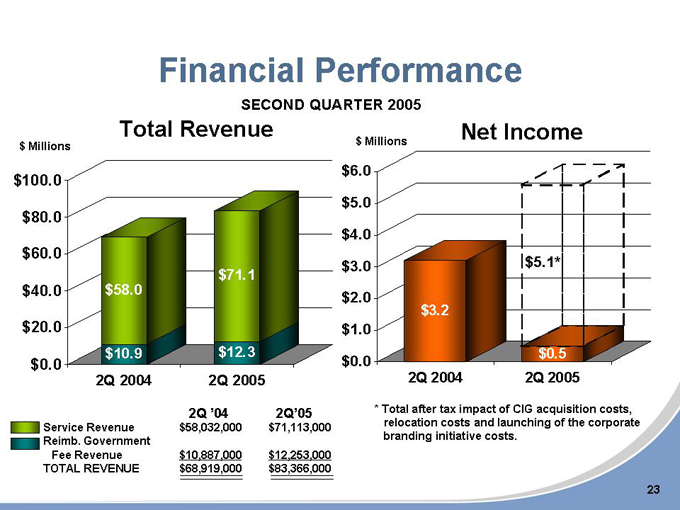

Financial Performance

SECOND QUARTER 2005

Total Revenue

Net Income $ Millions $ Millions $100.0 $80.0 $60.0 $40.0 $20.0 $0.0

2Q 2004 2Q 2005 $58.0

$10.9 $71.1

$12.3 $6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0

2Q 2004 2Q 2005 $3.2 $5.1* $0.5

2Q ‘04 2Q’05

Service Revenue $58,032,000 $71,113,000

Reimb. Government

Fee Revenue $10,887,000 $12,253,000

TOTAL REVENUE $68,919,000 $83,366,000

* Total after tax impact of CIG acquisition costs, relocation costs and launching of the corporate branding initiative costs.

23

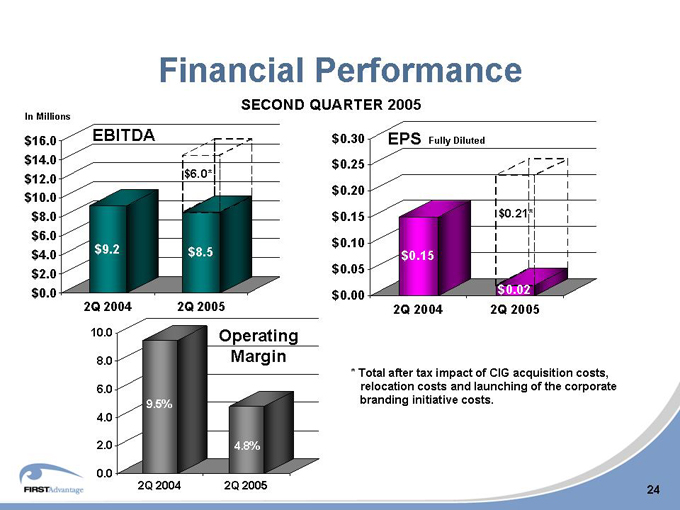

Financial Performance

SECOND QUARTER 2005

EBITDA

EPS Fully Diluted

In Millions $16.0 $14.0 $12.0 $10.0 $8.0 $6.0 $4.0 $2.0 $0.0

2Q 2004 2Q 2005 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05

$0.00

2Q 2004 2Q 2005 $9.2 $6.0* $8.5 $0.15 $0.21* $0.02

10.0 8.0 6.0 4.0 2.0 0.0

2Q 2004 2Q 2005

9.5%

4.8%

Operating Margin

* Total after tax impact of CIG acquisition costs, relocation costs and launching of the corporate branding initiative costs.

24

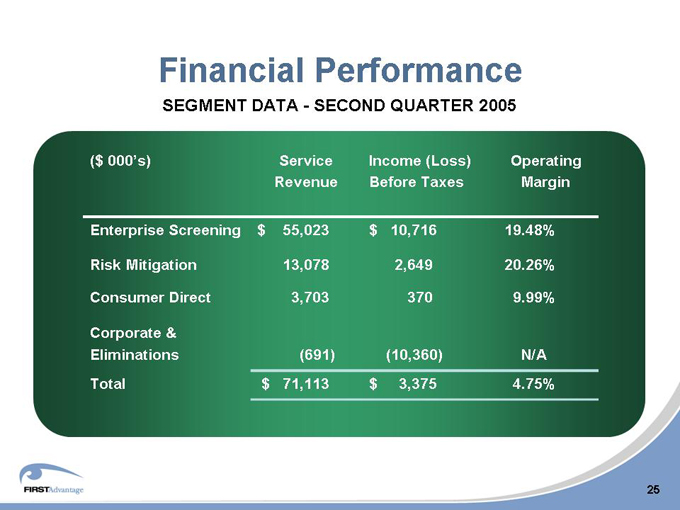

Financial Performance

SEGMENT DATA—SECOND QUARTER 2005

($ 000’s) Service Revenue Income (Loss) Before Taxes Operating Margin

Enterprise Screening $55,023 $10,716 19.48%

Risk Mitigation 13,078 2,649 20.26%

Consumer Direct 3,703 370 9.99%

Corporate &

Eliminations (691) (10,360) N/A

Total $71,113 $3,375 4.75%

25

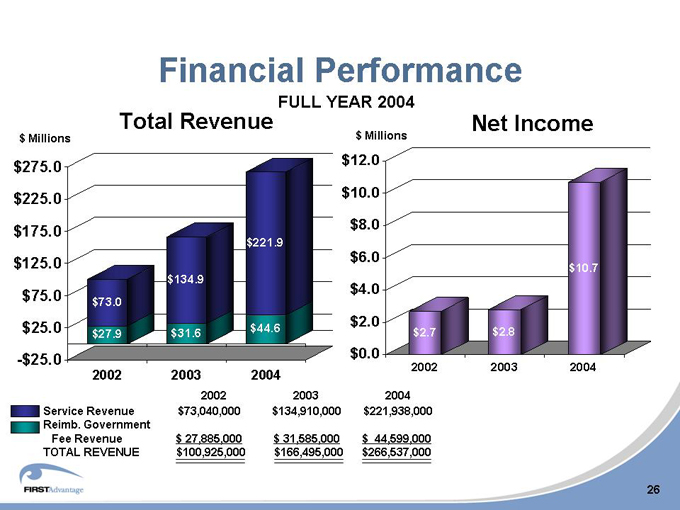

Financial Performance

FULL YEAR 2004

Total Revenue

Net Income $ Millions $ Millions $275.0 $225.0 $175.0 $125.0 $75.0 $25.0

-$25.0

2002 2003 2004 $73.0

$27.9 $134.9

$31.6 $221.9

$44.6 $12.0 $10.0 $8.0 $6.0 $4.0 $2.0 $0.0

2002 2003 2004 $2.7 $2.8 $10.7

2002 2003 2004

Service Revenue $73,040,000 $134,910,000 $221,938,000

Reimb. Government

Fee Revenue $27,885,000 $31,585,000 $44,599,000

TOTAL REVENUE $100,925,000 $166,495,000 $266,537,000

26

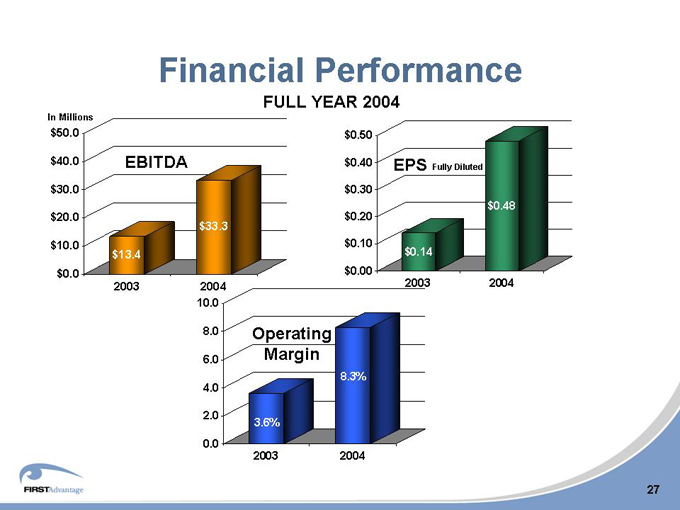

Financial Performance

FULL YEAR 2004

In Millions

$50.0 $40.0 $30.0 $20.0 $10.0 $0.0

2003 2004 $13.4 $33.3

EBITDA

$0.50 $0.40 $0.30 $0.20 $0.10 $0.00

EPS Fully Diluted

$0.14 $0.48

2003 2004

10.0 8.0 6.0 4.0 2.0 0.0

Operating Margin

3.6%

8.3%

2003 2004

27

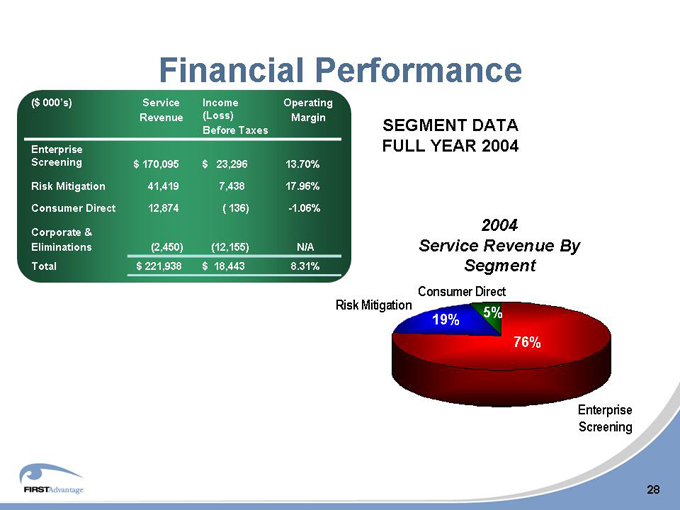

Financial Performance

($ 000’s) Service Revenue Income (Loss) Before Taxes Operating Margin

Enterprise

Screening $170,095 $23,296 13.70%

Risk Mitigation 41,419 7,438 17.96%

Consumer Direct 12,874 (136) -1.06%

Corporate &

Eliminations (2,450) (12,155) N/A

Total $221,938 $18,443 8.31%

SEGMENT DATA FULL YEAR 2004

2004 Service Revenue By Segment

Risk Mitigation

Consumer Direct

19%

5%

76%

Enterprise Screening

28

Summary

Significant future opportunities for growth and expansion of the industry

Continued security concerns

Anticipated improvement in employment Numerous acquisition prospects

Leader in all business lines

Improving operational efficiency as consolidation process matures Cross-sell opportunities within and between business lines Significant opportunities for geographic expansion Seasoned management with proven expertise in consolidation strategies

29

Adams Harkness 25th Annual Summer Seminar