Hudson Global at a Glance Factsheet – May 2022 $mm, except per share amounts # of Employees(7) 1,300 # of Countries(7) 14 Grow RPO ► Global RPO market expected to grow CAGR of 16.9% from 2020 to 2028(8) ► Hudson RPO’s goal is to exceed market growth rate (i.e., gain share) • Superior service and delivery • Go deeper and broader with existing clients • Grow in existing markets and expand into new markets to support our clients’ needs • Add new clients then “land and expand” ► Hudson RPO is investing in people and technology to accelerate its growth(2) ► Leverage existing strong reputation by expanding marketing efforts, including social media and website Keep Overhead Expenses Low ► Reduced complexity left over from legacy businesses ► Both corporate and regional ► No impact on revenues or growth Investigate Acquisition Opportunities ► Expand capabilities and capacity, not just growth for growth’s sake ► Deepen geographic and/or sector presence ► Add new talent and skill sets ► Immediately accretive ► Utilize NOL Repurchase Stock ► Will be opportunistic/price sensitive ► Goal is to maximize long-term value per share, not just “return cash” ► Balance with acquisition opportunities (8) Global Recruitment Process Outsourcing Market (2020 to 2028) - https://ca.finance.yahoo.com/news/global-recruitment-process-outsourcing-market-111000468.html Business Strategy Manila, Philippines Shanghai, China Edinburgh, Scotland Tampa, Florida, US India Centers of Excellence $mm 2019 2020 2021 Revenue $93.8 $101.4 $169.2 Adjusted Net Revenue $43.6 $39.1 $68.2 Adj EBITDA-RPO(1) $4.5 $2.9 $13.5 % of Adj Net Revenue 10.4% 7.5% 19.8% Corp Costs(1) $4.1 $3.3 $3.4 Adj EBITDA(1) $0.5 $(0.4) $10.0 ► Hudson Global, Inc. (Nasdaq: HSON) (“Hudson Global” or “the Company”) owns Hudson RPO, a pure-play Total Talent Solutions provider ► Nasdaq-listed; spun-off from Monster.com in 2003 ► Strong financial position: $19.5(3) million of cash and $312(4) million of usable NOL carryforwards ► Stock buyback: shares outstanding reduced by approximately 12% since 12/31/18 ► Owner mindset: board and management own approximately 15%(6) of total shares outstanding and expect to own more over time ► Maximizing stockholder value: through internal investments in our growing, high-margin RPO business, bolt-on acquisitions, and stock buybacks Stock Price(2) $32.97 Shares Outstanding(5) 2.80 Market Capitalization(2) $92.5 Cash(3) $19.5 Debt(3) $2.0 Usable NOL Carryforward(4) $312 ___________________________________________ ___________________________________________ (1) Adjusted EBITDA and Corporate Costs are non-GAAP measures. Reconciliations of non-GAAP measures can be found in the appendix to the investor presentation posted to our website on May 11, 2022. (2) As of April 29, 2022. Market Capitalization defined as Shares Outstanding times Stock Price. (3) As of March 31, 2022. Cash includes $0.4m of restricted cash. Debt excludes operating lease obligations, but includes $2m of notes payable related to an acquisition. (4) As of December 31, 2021 as disclosed in 2021 Form 10-K. NOL carryforward is for U.S. federal and state tax expense. (5) 2.80 million shares outstanding as of April 23, 2022. Does not include unissued or unvested RSUs. (6) Includes unvested share units and share units that will be issued up to 90 days after a director’s/officer’s separation from service. (7) As of December 31, 2021. . Coit Group: October 2020 ► Significantly expanded Hudson RPO’s tech presence in the US; new Hudson office in San Francisco ► Established, profitable business with strong client base ► Coit’s founders (Joe Belluomini and Tim Farrelly) became co-CEOs of Hudson RPO’s newly formed Technology Group ► Combination of cash, shares, promissory note, and earn-out agreements Coit Group: One year later ► Clients: signed several large and fast- growing accounts in the tech sector ► Headcount: increased to 100 (from 25 a year earlier); hired very experienced tech recruiters throughout North America Disciplined Acquisition Strategy Karani: November 2021 ► Expanded Hudson RPO’s global delivery capability by adding substantial presence in India and Philippines ► Strong partnership with recruitment and staffing firms ► Large and growing client base supported by approx. 500 employees in India and 125 in the Philippines ► Expanded Hudson RPO’s expertise in technology recruitment ► All current employees of Karani and its subsidiaries joined Hudson RPO, except for owner and CEO who retired ► Combination of cash and promissory note Investor Relations The Equity Group Inc. Lena Cati 212-836-9611 lcati@equityny.com Hudson Global, Inc. Jeffrey E. Eberwein CEO 203-489-9501 ir@hudsonrpo.com Contact Us:

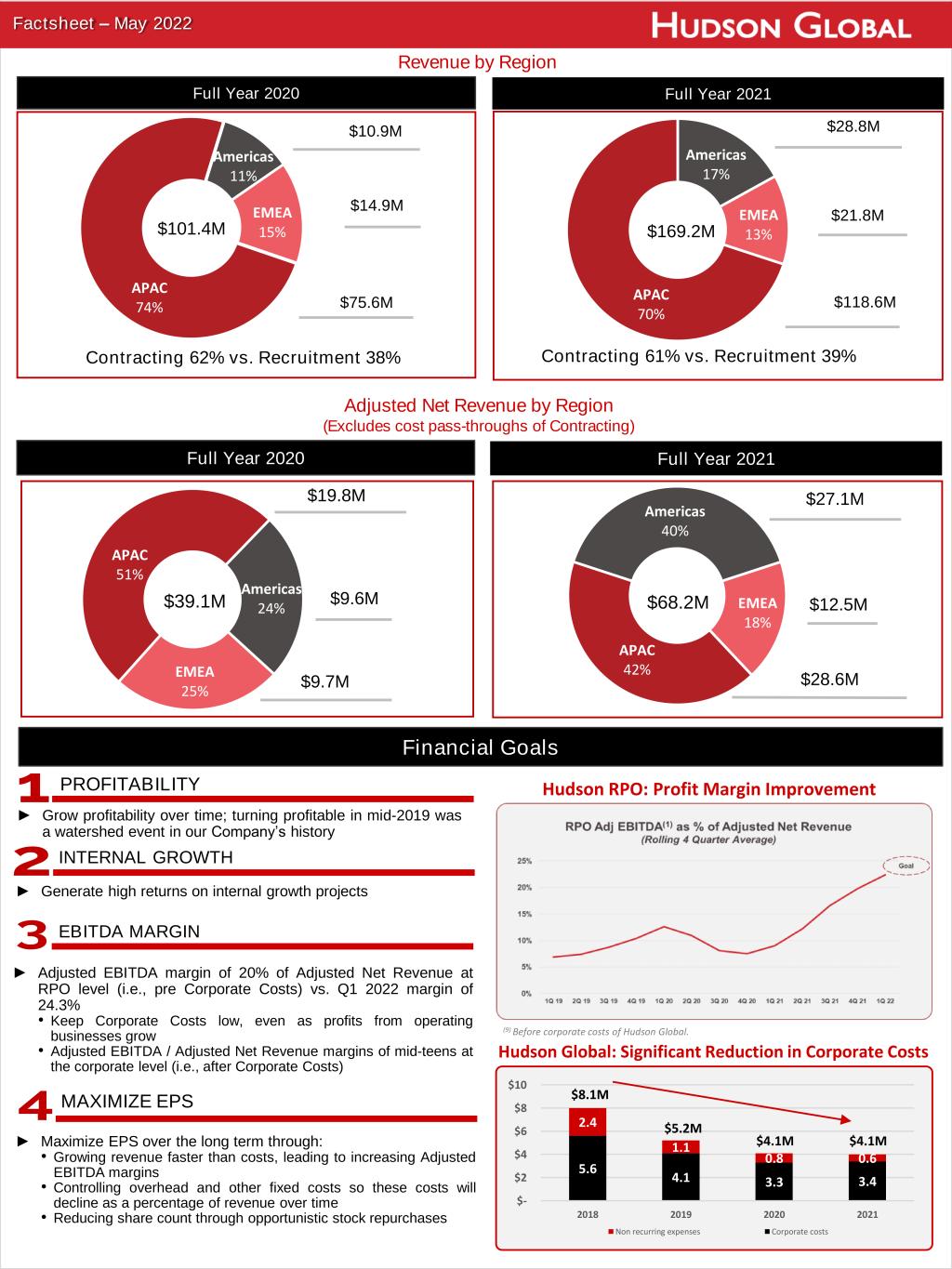

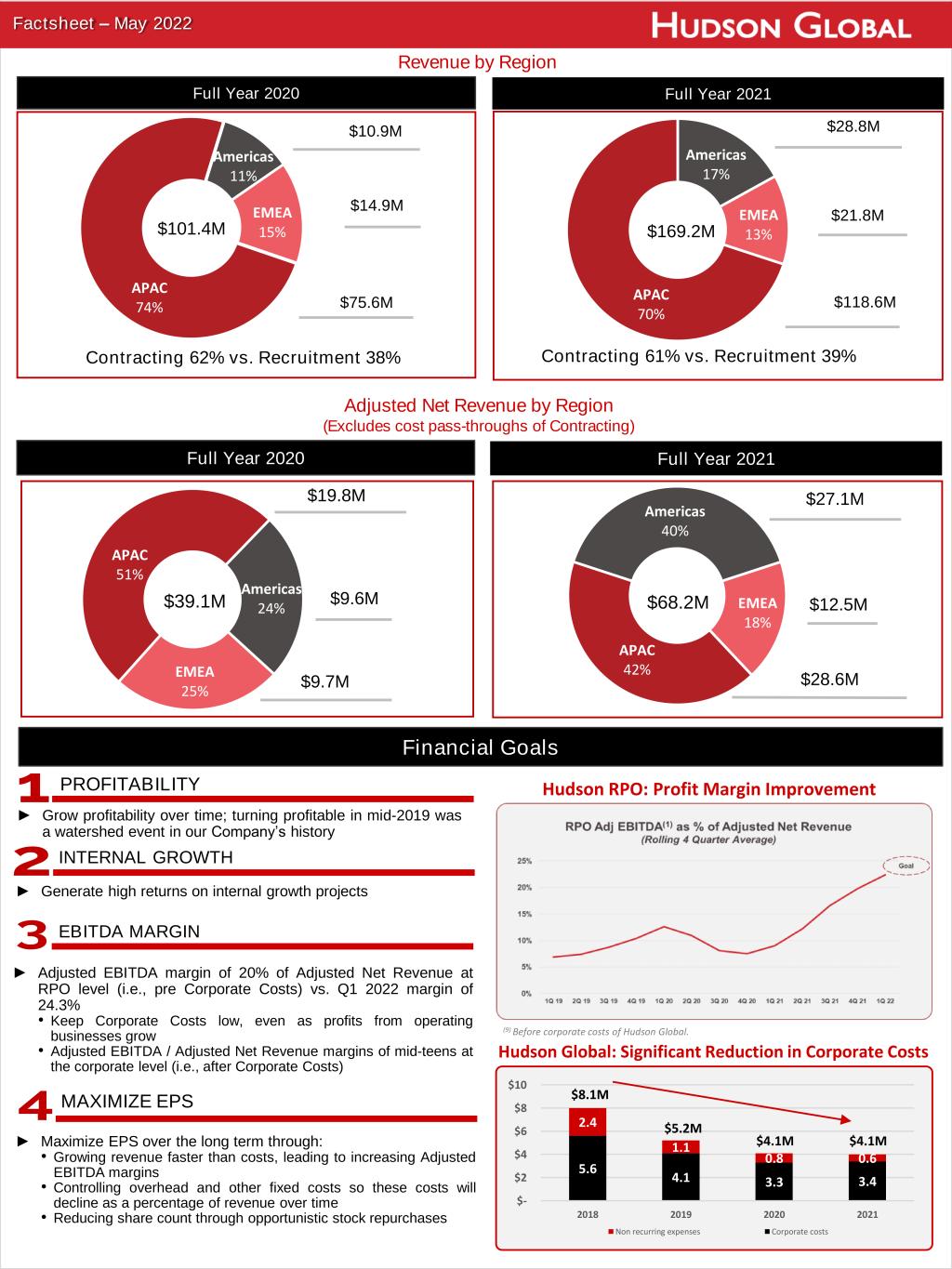

Revenue by Region Factsheet – May 2022 Full Year 2020 Americas 11% EMEA 15% APAC 74% $101.4M $10.9M $14.9M $75.6M Americas 17% EMEA 13% APAC 70% $169.2M $28.8M $21.8M $118.6M Americas 24% EMEA 25% APAC 51% $39.1M Americas 40% EMEA 18% APAC 42% $68.2M $19.8M $9.6M $9.7M $27.1M $12.5M $28.6M Adjusted Net Revenue by Region (Excludes cost pass-throughs of Contracting) Contracting 62% vs. Recruitment 38% Contracting 61% vs. Recruitment 39% Full Year 2020 Full Year 2021 ► Grow profitability over time; turning profitable in mid-2019 was a watershed event in our Company’s history ► Generate high returns on internal growth projects ► Adjusted EBITDA margin of 20% of Adjusted Net Revenue at RPO level (i.e., pre Corporate Costs) vs. Q1 2022 margin of 24.3% • Keep Corporate Costs low, even as profits from operating businesses grow • Adjusted EBITDA / Adjusted Net Revenue margins of mid-teens at the corporate level (i.e., after Corporate Costs) ► Maximize EPS over the long term through: • Growing revenue faster than costs, leading to increasing Adjusted EBITDA margins • Controlling overhead and other fixed costs so these costs will decline as a percentage of revenue over time • Reducing share count through opportunistic stock repurchases Financial Goals 5.6 4.1 3.3 3.4 2.4 1.1 0.8 0.6 $- $2 $4 $6 $8 $10 2018 2019 2020 2021 Non recurring expenses Corporate costs $8.1M $5.2M $4.1M PROFITABILITY INTERNAL GROWTH EBITDA MARGIN MAXIMIZE EPS Hudson Global: Significant Reduction in Corporate Costs Hudson RPO: Profit Margin Improvement (9)Before corporate costs of Hudson Global. Full Year 2021 $4.1M