As filed with the Securities and Exchange Commission on May 7, 2003.

Registration No. 333-102045

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BioProgress PLC

(Exact name of Registrant as specified in its charter)

England and Wales | | 2843 | | Not Applicable |

(State or Other Jurisdiction of | | (Primary Standard Industrial | | (IRS Employer |

Incorporation or Organization) | | Classification Code Number) | | Identification No.) |

Hostmoor Avenue

March, Cambridgeshire,

United Kingdom. PE15 0AX

+44.135.465.5674

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

BioProgress Technology International Inc.

9055 Huntcliff Trace

Atlanta, Georgia 30350-1935

United States

+1.770.649.1133

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies to:

Brian M. McCall, Esq.

Dechert

2 Serjeants’ Inn

London EC4Y 1LT

England

+44.207.583.5353

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to Be Registered

| | Amount to Be Registered(1)

| | Proposed Maximum Offering Price Per Share

| | Proposed Maximum Aggregate Offering Price(2)

| | Amount of Registration Fee

|

Ordinary shares, nominal value £0.01 each(2) | | 50,570,867 | | Not Applicable | | $ | 21,002,480 | | $ | 1,932.23 |

| (1) | | Based on the product of (a) 49,484,681 outstanding shares of common stock, par value $0.001 per share of BioProgress Technology International, Inc., and (b) a conversion ratio of 1 ordinary share of par value £0.01 per share of BioProgress PLC for each share of BioProgress Technology International, Inc. common stock. |

| (2) | | Pursuant to Rules 457(f)(1) and 457(c) under the Securities Act and solely for the purpose of calculating the registration fee, the proposed maximum aggregate offering price is equal to the market value of the approximate number of BioProgress Technology International, Inc. shares to be cancelled in the transaction and is based upon a market value of $.425 per BioProgress Technology International Inc. share of common stock being the average of the reported high bid and low ask prices per share on OTC Bulletin Board on December 16, 2002. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material Pursuant to Rule 240.14a-11(c) or Rule 240.14a-12 |

BioProgress Technology International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| | ¨ Check | | box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 7, 2003

PRELIMINARY PROXY STATEMENT/PROSPECTUS

BioProgress PLC

(incorporated under the laws of England and Wales)

50,570,867 Ordinary Shares

This proxy statement/prospectus relates to the reincorporation of BioProgress Technology International, Inc., a Nevada corporation, in England and Wales through a merger with our wholly owned subsidiary. The reincorporation has been approved by our board of directors and the board of directors of BioProgress Technology International. On or about May 15, 2003, the date the reincorporation merger is expected to occur, each of your shares of common stock in BioProgress Technology International will become one of our ordinary shares.

The transaction must be approved by the holders of a majority of the common stock of BioProgress Technology International. Our directors and officers (and their affiliates), assuming no exercise of their outstanding options, hold approximately 28.6% of the common stock. We understand that our directors, officers and their affiliates intend to give their consent to the reincorporation. We are asking you to return the enclosed written consent, in lieu of a meeting, if you approve of the transaction. As of April 25, 2003 there were 50,570,867 shares of BioProgress Technology International common stock outstanding and entitled to vote.

We will issue a total of 50,570,867 of our ordinary shares to the holders of BioProgress Technology International’s common stock on a one-for-one basis. We plan to have our ordinary shares admitted to trading on the Alternative Investment Market of the London Stock Exchange, under the symbol “BPRG”, following the reincorporation.

We are asking for your consent and you are requested to send us a written consent.

You should carefully consider therisk factors beginning on page 5 of this proxy statement/prospectus.

This proxy statement/prospectus does not cover any resales of our common stock received by BioProgress Technology International stockholders. No person is authorized to make any use of this proxy statement/prospectus in connection with any resale.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offence.

The date of this preliminary proxy statement/prospectus is May 7, 2003 and will be mailed to the shareholders of BioProgress Technology International on May , 2003.

This Proxy Statement/Prospectus does not include all of the information contained in the registration statement of which it is a part. This information is available on written or oral request. We will provide without charge to each person to whom this proxy statement/prospectus is delivered, upon written or oral request, a copy of this information. Requests for such information should be directed to Elizabeth Edwards, Company Secretary, BioProgress PLC, Hostmoor Avenue, March, Cambridgeshire, PE15 0AX, United Kingdom. +44.135.465.5674.

To obtain timely delivery of any requested copies, please write or telephone no later than May 12, 2003.

TABLE OF CONTENTS

i

ii

You should rely only on the information contained in this proxy statement/prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this proxy statement/prospectus is accurate only as of the date on the front cover of this proxy statement/prospectus. Our business, financial condition, results of operation and prospects may have changed since that date.

SUMMARY

This summary highlights selected information from the proxy statement/prospectus. It does not contain all of the information that is important to you. To understand the reincorporation fully and for a more complete description of the legal terms of the reincorporation, you should read carefully the entire proxy statement/ prospectus and the additional documents referred to in this proxy statement/prospectus. See the section headed “Where You Can Find More Information” below.

The Companies

BioProgress Technology International, Inc.

9055 Huntcliff Trace

Atlanta, Georgia 30350-1935

United States

We are engaged in the research, development, manufacturing and marketing of products that use water soluble and biodegradable films for the dietary supplement, pharmaceutical, recreational and cosmetic industries and other applications. We also develop flushable and biodegradable products for the medical and hygiene industries. Our principal research and development operations and executive offices are in the United Kingdom. Our primary focus is the development and commercialization of our unique and proprietary process, the XGel(TM) film system which comprises the equipment used to encapsulate “ingredients” in our XGel(TM) film. We have developed an ingestible and a non-ingestible form of XGel(TM) film. The ingestible form can be used for ingredients such as vitamin, herbal and mineral supplements and as oral delivery systems for drugs, and the non-ingestible form can be used for paintballs and toiletries (such as bath and aromatherapy oils). We aim to provide a cost effective and animal-free encapsulation process for liquids, tablets and powders, thereby potentially addressing the needs of the entire market for oral dosage forms while providing novel delivery mechanisms not possible with traditional processes.

BioProgress Holdings, Inc.

165 West Liberty Street, Suite 210

Reno, Nevada 89501

We are a newly formed company incorporated in the State of Nevada which was formed to accomplish the reincorporation. We will not have any assets or liabilities before the reincorporation.

BioProgress PLC

Hostmoor Avenue

March, Cambridgeshire,

PE15 0AX

United Kingdom

We are a newly formed company incorporated under the laws of England and Wales which was formed to accomplish the reincorporation. We have authorized 100,000,000 ordinary shares, par value £0.01 and 170,000 preference shares, par value £0.005. We will continue the business of BioProgress Technology International. We will not have any assets or liabilities before the reincorporation. BioProgress Technology International will become our subsidiary.

The Reincorporation

Under the reincorporation:

| | • | | BioProgress Holdings Inc. will merge with BioProgress Technology International, which will become a wholly-owned subsidiary of BioProgress PLC (other than shares representing approximately 1.2% of the voting and economic rights in BioProgress Technology International which will continue to be owned by one of the directors of BioProgress PLC). |

1

| | • | | You will receive one of our ordinary shares in exchange for each share of common stock of BioProgress Technology International which you own. |

| | • | | Our ordinary shares will be admitted to trading on the Alternative Investment Market of the London Stock Exchange. |

Tax Consequences of the Reincorporation

Stockholders are urged to read the more detailed summary of the tax consequences of the reincorporation set forth under “Material Tax Consequences”.

Reasons for the Reincorporation

We have proposed the reincorporation to obtain a trading facility on the Alternative Investment Market in London. We believe that due to BioProgress Technology International’s:

| | • | | small size and early stage of development, |

| | • | | location of facilities and management outside the US, and |

| | • | | control by foreign shareholders, |

BioProgress Technology International has experienced low market interest among analysts and institutional investors in the US. BioProgress Technology International is proposing the reincorporation so as to become the subsidiary of a UK company whose shares will be traded on the Alternative Investment Market of the London Stock Exchange. We believe, based on the advice of our financial advisor, Collins Stewart Limited, that a UK company with shares traded on the Alternative Investment Market may potentially generate more market interest in its home country than in the US and could potentially have better access to future capital raising in the UK and Europe. See “Background and Reasons for the Reincorporation”.

Your Consent is Needed to Approve the Reincorporation

The reincorporation must be approved by holders of a majority of the common stock of BioProgress Technology International. We are asking you to return the enclosed Form of Written Consent in Lieu of a Meeting, if you approve of the transaction. If you change your mind you may revoke your consent prior to the time at which we have received the consent of a majority of the common stock. We expect the reincorporation to occur on or about May 15, 2003, assuming we receive written consents in favor of the transaction representing at least a majority of the common stock of BioProgress Technology International and we will issue a press release and file a report on Form 8-K announcing the exact date the reincorporation becomes effective. We believe that our directors and officers (and their affiliates) intend to support the reincorporation. We expect them to execute and deliver written consents that, together, will make up approximately 28.6% of the voting stock. See “Solicitation of Written Consent”.

Ownership after the Reincorporation

The result of the proposed reincorporation is that our shares will be owned directly and in the same proportions by the same persons who currently own the shares of BioProgress Technology International.

Conditions to the Reincorporation

Completion of the reincorporation is conditional on a number of factors including, among others, the registration statement of which this proxy statement/prospectus is a part remaining effective, receipt of the required written consents of the shareholders of BioProgress Technology International and the continued validity of certain UK tax clearances which have been obtained.

Regulatory Requirements

The reincorporation is not subject to any regulatory requirements other than the US federal securities laws. BioProgress Technology International and BioProgress PLC have filed a registration statement on Form F-4 which includes this proxy statement/prospectus to comply with those requirements. For our admission to the Alternative Investment Market we must produce an admission document disclosing the information specified in the London Stock Exchange’s rules relating to the Alternative Investment Market of the London Stock Exchange.

2

In addition, an admission application form and declaration from Collins Stewart Limited, our nominated adviser for the purposes of the London Stock Exchange’s rules relating to the Alternative Investment Market, must be prepared.

Comparison of the Laws of Nevada and England and Wales

There are differences between the rights of stockholders under the law of Nevada and the law of England and Wales. In addition, there are differences between the current articles of incorporation and by-laws of BioProgress Technology International and the memorandum of association and articles of association of BioProgress PLC. See “Comparison of the Laws of Nevada and England and Wales” and “Description of BioProgress Ordinary Shares” for further details.

Expected Trading Market for the Ordinary Shares

It is intended that our ordinary shares will be admitted to trading on the Alternative Investment Market of the London Stock Exchange under the symbol “BPRG”.

Risk Factors

This proxy statement/prospectus includes certain additional factors related to our operations and strategies and the reincorporation. Stockholders should read carefully the section entitled “Risk Factors” below.

Exchange of Certificates

You do not need to do anything with your share certificates. After the reincorporation they will be deemed to represent ordinary shares of BioProgress PLC.

Restrictions on U.S. Persons Holding Ordinary Shares

Non UK persons are free to acquire and hold BioProgress PLC shares, however, unless you have or establish a relationship with a broker or nominee who has an account with CREST, the UK’s electronic settlement system, you will have to hold your ordinary shares and settle in certificated form.

Dissenters’ Rights

Holders of common stock of BioProgress Technology International will not be entitled to dissenters’ rights under Nevada law in connection with the reincorporation. See “the Reincorporation—Dissenters’ Rights”.

3

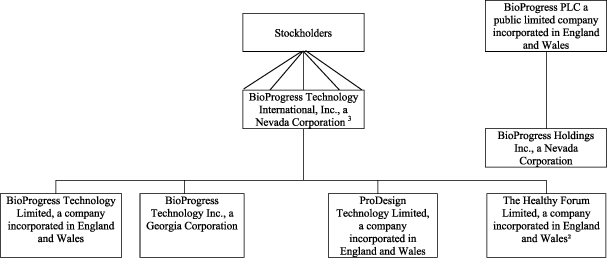

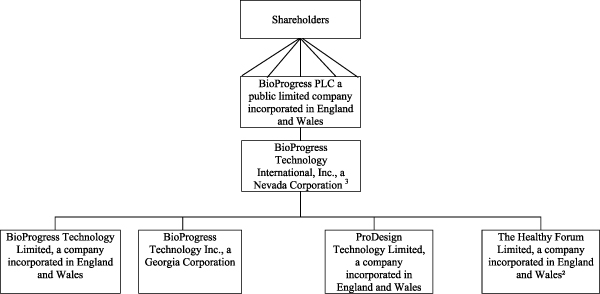

Structure Chart

The following charts shows the corporate structures before and immediately after the reincorporation:

Before the Reincorporation(1)

| (1) | | Dormant companies are not shown on this chart |

| (2) | | Owned 46.6% by BioProgress Technology International. |

| (3) | | Series C Preferred Stock is owned by one US director representing approximately 1.2% of the voting and economic rights in this Company. |

After the Reincorporation(1)

| (1) | | Dormant companies are not shown on this chart |

| (2) | | Owned 46.6% by BioProgress Technology International. |

| (3) | | Series C Preferred Stock is owned by one US director representing approximately 1.2% of the voting and economic rights in this Company. |

4

RISK FACTORS

Statements concerning our future results of operations, our financial condition and business are “forward-looking” statements as defined in the Securities Act of 1933 and the Securities Exchange Act of 1934. Investors are cautioned that information contained in these forward-looking statements is inherently uncertain, and that actual performance and results may differ materially due to numerous risk factors, including, but not limited to, the risks outlined below. You should carefully consider the following factors, which BioProgress Technology International and BioProgress PLC consider to be the material risk factors relating to an investment in BioProgress PLC ordinary shares at this time, as well as other information regarding BioProgress PLC, BioProgress Technology International and the reincorporation contained in this proxy statement/prospectus.

Certain Risks Associated with the Reincorporation

U.S. Holders of BioProgress Technology International Stock May Owe U.S. Tax on the Reincorporation.

If you are a United States holder (as defined in Material Tax Consequences, below), you will recognize gain, if any, but not loss, upon the receipt of BioProgress PLC ordinary shares in exchange for BioProgress Technology International stock pursuant to the reorganization. That gain generally will equal the excess, if any, of the fair market value of the ordinary shares received in exchange for BioProgress Technology International stock in the merger. That gain generally will be taxed as capital gain. If you are an individual and have held the common stock for more than one year, you generally will be taxed at a maximum rate of 20% on the exchange.

You will not be permitted to recognize any loss on your exchange of BioProgress Technology International stock for BioProgress PLC ordinary shares. Instead, if you would have recognized a loss, your aggregate tax basis in the BioProgress PLC shares you receive will equal your aggregate tax basis in the BioProgress Technology International stock you surrender.

You May be Subject to Additional Tax if BioProgress PLC Decides to Pay Dividends.

BioProgress PLC has no immediate plans to pay dividends after the reincorporation. However, if it does, you will be taxed on the dividend. If you are a United States holder that is a corporation incorporated in the United States, you may not be able to claim a dividends received deduction because we will not be a corporation incorporated in the United States. Because the distributions would come from a foreign corporation, some or all of them may be deemed to have come from foreign sources for purposes of calculating any foreign tax credit that may be available to you. The foreign tax credit rules are complex, subject to interpretation, and limited by many specific requirements that are unique to individual taxpayers. As a result, we urge you to consult with your own tax advisor regarding the possible foreign tax credit consequences of any future distributions.

WE URGE YOU TO CONSULT YOUR TAX ADVISORS REGARDING THE TAX CONSEQUENCES TO YOU OF ANY FUTURE DISTRIBUTIONS FROM US.

BioProgress PLC Could be Taxed in the United States as a Result of Legislation Currently Under Consideration.

BioProgress Technology International is currently subject to U.S. corporate income tax on its worldwide income. After the reorganization, BioProgress Technology International will continue to be subject to U.S. corporate income tax, including U.S. tax on certain operations of the U.K. subsidiaries of BioProgress Technology International . If BioProgress PLC establishes new subsidiaries outside the U.S., those subsidiaries ordinarily would not be subject to tax in the United States. However, several members of the United States Congress have introduced legislation that, if enacted, could have significant tax consequences to us. All proposals discussed below originally were introduced in the prior Congress and would need to be reproposed in the current Congressional term. Some already have been reproposed, and the number of proposals and the continued attention given to “expatriation” transactions mean that legislation resembling one or more if the proposals discussed below may be enacted.

One group of proposals would treat a foreign corporation, like BioProgress PLC, who undertake a corporate expatriation transaction, such as the reorganization, as a domestic corporation. These proposals have various effective dates, but all would apply retroactively and would cause BioProgress PLC to be treated as a domestic corporation. If any of these proposals ultimately is adopted, BioProgress PLC will be taxed in the United States on its worldwide income, including certain income earned by its subsidiaries that are not United States corporations, much as BioProgress Technology International is now. In addition, we may lose the ability to claim certain tax losses in the United States.

5

Under some proposals, BioProgress Technology International could be subject to a tax at the time of the reincorporation on the excess of our assets’ fair market value over their basis.

Another proposal would deny a foreign corporation that may otherwise be entitled to certain benefits under a tax treaty between the United States and a foreign country those treaty benefits, unless that foreign corporation is predominantly owned by individuals who are residents of such foreign country. If this proposal is enacted, the United States may deny us the benefits of the United States-United Kingdom tax treaty.

Due to the preliminary nature of these proposals and as BioProgress Technology International has never been profitable and has not paid U.S. tax we cannot quantify the effect these proposals may have.

U.S. Tax Consequences to Holders of BioProgress PLC Shares Could Change if the Legislation Currently Under Consideration is Enacted.

If BioProgress PLC is treated as a United States corporation as a result of the proposed legislation discussed in “Risk Factors—BioProgress PLC Could be Taxed in the United States as a Result of Legislation Currently Under Consideration,” above, your tax treatment may differ from that described under “Certain United States Tax Consequences of the Reincorporation.”

If BioProgress PLC Becomes a Passive Foreign Investment Company, U.S. Shareholders could suffer adverse tax consequences.

If BioProgress PLC acquires significant passive assets, such as cash or marketable securities, or engages in transactions producing passive income, it could be classified as a passive foreign investment company or PFIC for United States federal income tax purposes. A sale of all or most of BioProgress PLC’s business could result in the acquisition of a substantial amount of passive assets and, in certain circumstances, may result in BioProgress PLC being classified as a PFIC. If BioProgress PLC becomes a PFIC, United States holders of its stock would be subject to a special tax regime imposed upon PFICs. If BioProgress PLC becomes a PFIC, United States holders will be taxed at ordinary income rates (rather than favorable capital gains rates) when they sell BioProgress PLC stock, and they will also be taxed on an imputed interest amount.

The reincorporation into a company incorporated in England and Wales may materially affect stockholders’ rights.

BioProgress PLC was formed solely to accomplish the reincorporation of BioProgress Technology International into an English company. The laws of England and Wales may be materially different than the laws of Nevada, under which BioProgress Technology International is incorporated. The differences between the laws of England and Wales and Nevada may materially affect your interests. For a discussion of material differences between the laws of England and Wales and Nevada see “Comparison of the Laws of Nevada and England and Wales” in this document. Examples of important negative differences include the following:

| | • | | English law contains restrictions on BioProgress PLC’s ability to make a distribution (which includes the payment of a dividend to shareholders and the redemption of its own shares) out of profits available for the purpose. Although similar requirements exist in Nevada, the specific requirements of English law, in general, make it more difficult to declare a dividend. |

| | • | | English law and the provisions of the UK takeover code make it extremely difficult for management to adopt defenses to unwanted takeovers whereas in the US takeover defenses are more acceptable. |

| | • | | Unlike Nevada companies, directors of BioProgress PLC are elected until they resign or are removed. The constitutional documents of BioProgress PLC require its directors to resign every three years (staggered among the different directors), although they are permitted to offer themselves for re-election by shareholders at the shareholders’ meeting at which they resign. Shareholders may, however, remove directors by a majority vote at any meeting called for that purpose. This process of staggering resignations over a three year period may prevent or frustrate attempts by shareholders to replace the management of BioProgress PLC. |

| | • | | A quorum for a meeting of shareholders of BioProgress PLC is only two shareholders present in person or by proxy and who are entitled to vote, regardless of the number of shares they hold. This could permit shareholders who own a small percentage of shares to constitute a quorum to approve resolutions. |

6

| | • | | Unless a poll vote is called, voting at shareholders’ meetings in a UK company is by a show of hands (with each shareholder present at the meeting having one vote) not by a count of the number of shares voting. A proxy cannot vote on a resolution decided on a show of hands. A poll may only be called by the chairman of the meeting, or three shareholders present in person or by proxy or a shareholder present in person or by proxy holding 10% of the total voting rights of all the shareholders entitled to attend and vote at the meeting or 10% of the total sum paid up on the shares conferring a right to attend and vote at the meeting . Thus, if you vote by proxy, your influence may be less than in a Nevada company. |

| | • | | Unlike BioProgress Technology International, BioProgress PLC will need unanimous approval of any action taken by written consent of shareholders in lieu of a meeting which could impact the efficiency of taking corporate action. |

You may not be able to enforce a U.S. judgment against us or our officers and directors in England.

BioProgress PLC is an English company and a majority of its officers and directors are residents of various jurisdictions outside the United States. A substantial portion of our and such persons’ assets are located outside the United States. As a result, it may be difficult for U.S. investors to effect service of process within the United States upon such persons or to enforce in United States courts judgements obtained against such persons including judgements of United States courts predicated under United States securities laws. BioProgress PLC will arrange that it may be served with process with respect to actions based on offers and sales of securities made hereby in the United States by serving BioProgress Technology International, Inc., 9055 Huntcliff Trace, Atlanta, Georgia 30350-1935, United States, as United States agent appointed for that purpose. We have been advised by our English counsel, Dechert, that there is doubt as to whether English courts would enforce judgements of United States courts obtained in actions against such persons or us that are predicated upon the civil liability provisions of the Securities Act. There is no treaty in effect between the United States and England providing for such enforcement, and there are grounds upon which English courts may enforce judgements of United States courts. BioProgress PLC has been advised by its English legal counsel, Dechert, that there is also doubt as to the direct enforceability in England against any of these persons in an original action of civil liabilities predicated solely upon the federal securities laws of the United States.

BioProgress Technology International’s former use of Arthur Andersen LLP as its Independent Public Accountants may pose risks to us and will limit your ability to seek potential recoveries from them related to their work.

Arthur Andersen LLP, independent accountants, were engaged as the principal accountants to audit BioProgress Technology International’s financial statements until they resigned on July 18, 2002. BioProgress Technology International engaged Grant Thornton in their place on November 14, 2002. In June 2002, Arthur Andersen was convicted on a federal obstruction of justice charge. Some investors, including institutional investors, may choose not to invest in or hold securities of a company whose prior financial statements were audited by Arthur Andersen, which may serve to, among other things, suppress the price of our shares. In addition, SEC rules require us to present our audited financial statements in various SEC filings, along with Arthur Andersen’s consent to our inclusion of its audit report in those filings. The SEC has provided temporary regulatory relief designed to allow companies that file reports with the SEC to dispense with the requirement to file a consent of Arthur Andersen in certain circumstances. Notwithstanding the SEC’s temporary regulatory relief, the inability of Arthur Andersen to provide its consent or to provide assurance services to us with regard to future SEC filings could negatively affect our ability to, among other things, access capital markets.

We cannot assure you that BioProgress PLC’s will be able to continue to rely on the temporary relief granted by the SEC. If the SEC no longer accepts financial statements audited by Arthur Andersen, this may affect BioProgress PLC’s ability to access the public capital markets in the future unless BioProgress PLC’s current independent auditors or another independent accounting firm is able to audit the financial statements originally audited by Arthur Andersen. Any delay or inability to access the capital markets at a time when additional capital is needed may have an adverse impact on our business. After reasonable efforts, BioProgress PLC’s has not been able to obtain Arthur Andersen’s consent to the inclusion in this prospectus of its audit reports. Accordingly, investors will not be able to sue Arthur Andersen under Section 11 of the Securities Act of 1933 for material misstatements or omissions, if any, in this prospectus or the registration statement including the financial statements covered by their previously issued reports. Moreover, Arthur Andersen has ceased operations. Should it declare bankruptcy or avail itself of other forms of protection from creditors, it is unlikely you would be able to recover damages from Arthur Andersen for any claim against them.

7

Risks Relating to our Business

We need additional cash to operate our business and our viability as a going concern is uncertain.

Since our inception, we have incurred significant losses and negative cash flow from operations, and as of December 31, 2002, we had an accumulated deficit of approximately $28,691,539. Based on our present operating expenses, taking into account available cash reserves, we will not be able to continue as a going concern beyond this current year without an increase in cash flow from operations and/or the infusion of addition capital to fund operations. We expect to meet our working capital obligations and other cash requirements with cash derived from operations and from placement of additional equity by issuance of ordinary or preference shares of BioProgress PLC. To that end, BioProgress PLC currently intends to raise up to £4 million by issuing new ordinary shares to institutional investors in the UK shortly after completion of the reincorporation. The shares to be offered and sold in the UK will be offered and sold pursuant to Regulation S under the Securities Act and will not be offered or sold to or for the account or benefit of any US person (as defined in Regulation S).

Cash from operations and the other sources described above (including the expected issue to UK institutions) may not be sufficient for our operating needs. We may not be able to achieve profitability on a consistent basis, if at all and our ability to continue as a going concern could thus be impaired. In the event that cash flow from operations is less than anticipated and we are unable to secure additional funding, in order to preserve cash, we would be required to further reduce expenditures and effect further reductions in our corporate infrastructure, either of which could restrict our ability to continue our operations. Even if we obtain additional working capital in the near future, the need for additional funding may be accelerated and additional funding may not be available on terms acceptable to us, if at all.

Our limited operating history makes evaluating our business difficult.

We began demonstrations of our XGel(TM) product during the early part of 2000 and executed the first sale of a license of XGel(TM) film systems during August 2000. Accordingly, we have only a limited operating history in order to evaluate our business. The risks, expenses and difficulties that an early-stage company like ours faces must be considered. These risks include our ability to successfully complete the production engineering, manufacture and commissioning of each of the five XGel(TM) products that currently form our product offering. We must:

| | • | | successfully respond to competitive developments; |

| | • | | continue to upgrade our products and service offerings; |

| | • | | continue to attract, retain and motivate qualified personnel; and |

| | • | | continue to attract financing to support the planned growth of our business. |

We believe that period-to-period comparisons of our operating results are not meaningful.

Growth of our business may suffer if new customers do not accept our product offerings.

BioProgress Technology International has historically derived its revenues (other than immaterial amounts) from XGel(TM) products and associated services in the form of fees pursuant to research and development contracts. We anticipate that these sources together with XGel(TM) related license fees, sales of XGel(TM) film and film systems will continue to account for almost all of our revenues for the foreseeable future. Neither we nor our customers have yet introduced commercialized versions of gelatin replacement encapsulation products. As a result, our business will suffer if the market does not accept our product offerings and our future enhancements of these product offerings. If demand for our product offerings drops as a result of competition, technological change or other factors, our revenue could decrease.

The market for gelatin replacement materials and means of processing is still emerging and it may not continue to grow. Even if the market does grow, businesses may not adopt our product offerings as gelatin substitutes. We have expended, and intend to continue to expend, considerable resources educating potential customers about the XGel(TM) products and our services in general and about the features of the XGel(TM) film system and new product development opportunities afforded by it in particular. However, our product offerings may not achieve any additional degree of market acceptance.

8

We depend on a few industries for most of our sales, and we may not be successful in expanding beyond those limited markets.

A substantial portion of our revenues has been derived from sales to manufacturers of fast moving consumer goods, vitamins herbs and minerals and confectionery products. We may not continue to be successful in these markets. These markets may not be large enough to generate sufficient revenue for our products. In addition, we may not be successful in achieving significant market acceptance in other markets that we target.

The loss of one of our largest customers could cause our revenues to drop quickly and unexpectedly.

In fiscal 2000, our top three customers accounted for 96% of total revenues, with Proctor and Gamble accounting for 67.5% of total revenues and the remaining 28.5% attributable to Boots and EcoProgress Canada Holdings. In fiscal 2001, our top five customers accounted for 93% of total revenues, with Proctor and Gamble accounting for 43% and the four other customers (Boots, EcoProgress, Peter Black and VAX) contributing the remaining 50%. In fiscal 2002, our top three customers accounted for approximately 78% of our total revenues with EcoProgress, Boots and Peter Black accounting for approximately 56%, 11% and 11%, respectively. All revenue from EcoProgress related to the release of deferred revenue under research and development contracts. We have renegotiated our agreements with EcoProgress and will not recognize any further revenue under these research and development contracts. Excluding the EcoProgress deferred revenue that was released, Boots, Peter Black, Convatec and Bristol-Myers would have accounted for approximately 25%, 25%, 17% and 15% of total revenues. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our contract with the Proctor & Gamble Company has been completed. Our contracts with Bristol-Myers Squibb expires in 2022. Our contract with Convatec expires in 2022. Our contracts with Peter Black expire on the later of 2022 or ten years after products using our technology are first put on the market in the European Union. Our contract with Farmasierra expires in 2022 and our contract with Boots expires in 2022. Although we have written agreements with these customers the revenue generated from these contracts depends upon the successful commercialization of consumer products using our technology. We cannot be certain that our customers will continue to do business with us after the contracts expire, that business from existing customers will continue at the levels of previous periods, or that we will be able to do a significant amount of business with new customers. If we lose one of our customers, our revenues could drop more quickly than we could reduce expenses. This could substantially harm our financial results.

We depend upon licenses with manufacturers for revenues which makes our revenues dependant upon the success of our customers to commercialize and sell products incorporating our technology.

Revenues from our technologies will be dependent upon the production and sale of products utilizing our technologies. We do not currently possess the ability or resources necessary to complete on our own the development, testing, regulatory approval process and commercialization for products utilizing our technologies and we do not currently intend independently to market products incorporating our technologies in the foreseeable future. It is our strategy to seek to enter into agreements with manufacturers which will assist us in developing, testing and obtaining governmental approval for, and the marketing and commercialization of, the various formulations of our technologies. Although we attempt to obtain minimum license payments, the amount of revenue we will earn under our customer contracts is dependant upon our licensee’s ability to commercialize products using our XGel(TM) technology. We may be unable to enter into additional collaborative arrangements with respect to product development utilizing our technologies. Existing or future collaborative arrangements may not lead to successful consumer product sales. Milestones to receive revenue in such agreements may not be met. If we are unable to obtain development assistance and funds from manufacturers to fund a portion of our product development costs and to commercialize products, we may have to delay, scale back or curtail one or more of our activities.

We have no control over the resources and attention devoted by our collaborative partners to the development of a product candidate and, to the extent resources devoted are limited, products using our technology may not be commercially successful. If any of our collaborators breaches or terminates its agreement with us or otherwise fails to conduct its collaborative activities in a timely manner, the development or commercialization of the product candidate or research program under such collaborative agreement may be delayed, and we may be required to devote unforeseen additional resources to continue such development or commercialization, or terminate such programs. Disputes may arise in the future with respect to the ownership of rights to any technology developed with third parties. These and other possible disagreements with collaborators

9

could lead to delays in the collaborative research, development or commercialization of certain product candidates, or could require or result in litigation or arbitration, which would be time consuming and expensive

Our stock price or our business could be adversely affected if we are not able to efficiently integrate acquisitions. During June, 2001 we acquired ProDesign Technology Ltd.

We have consummated and we may continue to pursue acquisitions that provide new technologies, products or service offerings. Due to our limited cash resources, future acquisitions by us may involve potentially dilutive issuances of equity securities. We also may incur substantial additional liabilities and expenses, such as debt or amortization expenses related to intangible assets. Acquisitions involve numerous risks, including:

| | • | | difficulties in the assimilation of the operations, technologies; |

| | • | | integration of products and personnel of the acquired company; |

| | • | | the diversion of our small management team’s attention from other business concerns; |

| | • | | risks of entering markets in which we have no or limited prior experience; and |

| | • | | the potential loss of key employees of the acquired company. |

Any or all of the above could reduce our revenue or delay or restrict the growth of our business. During 2002, we determined that goodwill relating to ProDesign had been impaired to zero value due to technological advances.

We have a limited ability to protect our intellectual property rights and others could infringe on or misappropriate our proprietary rights.

Our success and ability to compete are substantially dependent on our internally developed technologies and trademarks, which we protect through a combination of patent, trademark and trade secret laws, confidentiality procedures and contractual provisions.

As a small company with limited resources to devote to protecting our intellectual property we may not have protected all of our intellectual property rights. In addition, despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our technology or to obtain and use information that we regard as proprietary. Policing unauthorized use of our technology is difficult. In addition, the laws of some foreign countries do not protect our proprietary rights to the same extent as the laws of the United States and certain European countries. Furthermore, our competitors may independently develop technology similar to ours.

The number of intellectual property claims may increase as the number of competing products grows and the functionality of products in different industry segments overlaps. Although we are not aware that any of our products infringe upon the proprietary rights of third parties, third parties may still claim infringement by us with respect to current or future products. Any of these claims, with or without merit, could be time-consuming to address, result in costly litigation, cause product shipment delays or require us to enter into royalty or licensing agreements. These royalty or licensing agreements, if required, might not be available on terms acceptable to us or at all.

We depend on key personnel for our success, the loss of any of whom could affect the growth and development of our business.

Our success depends upon the continued contributions of our executive officers and scientific and technical personnel especially Graham Hind, Malcolm Brown, Louise Mulroy, Stephen Kessel, Edward Nowak and Jason Teckoe. During our operating history, many key responsibilities have been assigned to a relatively small number of individuals. The competition for qualified personnel is intense, and the loss of services of certain key personnel could adversely affect the growth and development of our business. We have employment agreements with each of our senior management and certain key scientific personnel and they have each confirmed their intention to remain with us following the reincorporation.

Our founders, officers and principal stockholders have substantial control over our voting stock and have the ability to make decisions that could adversely affect our stock price.

As of April 25, 2003, our directors and officers (and their affiliates), assuming exercise of all of their outstanding options, held 18,303,660 shares, or approximately 33.6%, or 28.6% assuming no exercise of options, of BioProgress Technology International’s outstanding common stock. Consequently, this group will be able to significantly influence the outcome of all matters submitted for stockholder action, including the election of

10

members to the board of directors and the approval of significant change in control transactions, which may have the effect of delaying or preventing a change in control. Representatives of the controlling stockholders constitute all six directors and will therefore have significant influence in directing the actions of the board of directors.

We may be subject to future product liability claims which could be time consuming and costly.

Our business exposes us to potential product liability risks that are inherent in the testing, manufacturing and marketing of products used for human ingestion. Product liability results from harm to end users using our products that were either not communicated as a potential side-effect or were more extreme than communicated. Although we believe that the ingredients used in our products are not harmful, the risk of accidental contamination of or injury from our products cannot be completely eliminated.

While our license agreements with our customers typically contain provisions designed to limit our exposure to potential product liability claims, it is possible that these provisions may not be effective under the laws of certain jurisdictions. Although we believe our products contain suitable substances for human ingestion, products using our technology have not been distributed widely yet and therefore adverse reactions may occur once our products are available on a wide scale basis. While we have not experienced any product liability claims to date, we may be subject to such claims in the future. Defending these claims, regardless of merit, could entail substantial expense and require the time and attention of key management personnel.

We are dependent on a small number of suppliers with whom we do not have formal agreements guaranteeing a source of supply.

We currently contract with Speciality Films, George Listers, Monosol and Polymer Films, as suppliers to produce the film we use in our XGel(TM) film system. There are currently no formal agreements in place with any supplier. There are a limited number of producers capable of producing film for us and it could take an extended period of time to transition to a new supplier. A loss of one of our sources of supply could prevent us from meeting customer orders and damage our customer relations.

Risks Relating to our Industry

Our business will not be successful if we do not keep up with the rapid changes in our industry.

Vitamin, mineral, supplement and drug delivery, biotechnology, pharmaceutical science and manufacturing are evolving fields in which developments are expected to continue at a rapid pace. Our success depends, in part, upon maintaining a competitive position in the development of products and technologies in our areas of focus. Our competitors may succeed in developing competing technologies or obtaining regulatory approval for products more rapidly than we or our customers are able. Future developments by others may render our products or the compounds used in combination with our products uncompetitive or obsolete.

We face strong competition.

Our competitors may be able to develop products and services that are more attractive to businesses than our products and services. Most of our competitors, such as Banner Pharmacaps, Swiss Caps and Eurocaps GlaxoSmithKline, have longer operating histories, significantly greater financial, technical, marketing and other resources, greater name recognition and larger customer bases. As a result, they may be able to adapt more quickly to new or emerging technologies and changes in customer requirements. They also may be able to devote greater resources to the promotion and sale of their products and services than us. If these companies introduce products and services that effectively competed with our products and services, they could be in a position to charge lower prices. This could give them a competitive advantage over us.

In order to be successful in the future, we must continue to respond promptly and effectively to the challenges of technological change and competitors’ innovations. If we cannot compete successfully with existing or new competitors, we may have to reduce prices on our products, which could lead to reduced profits.

Risks Related to our Shares

Exchange rate fluctuations may reduce the value of BioProgress PLC shares for U.S. holders.

Individuals and entities located in the U.S. who hold our ordinary shares will bear exchange rate risk. Our ordinary shares issued in the merger will be traded on the Alternative Investment Market of the London Stock Exchange and will be priced in pounds sterling. As a result, US holders of our ordinary shares who would like to sell their shares on a market must sell them on the Alternative Investment Market and have the proceeds of the sale converted into dollars. Holders may receive a reduced dollar value upon the sale of their shares as the result of the dollar/pound sterling exchange rate in effect at that time.

11

FORWARD LOOKING STATEMENTS

We have made forward looking statements in this proxy statement/prospectus that are based on the beliefs of our management as well as assumptions made by, and information currently available to, us. These statements include the receipt of regulatory approvals, the adequacy of our capital resources, trends relating to our business and others. When used in this document, the words “anticipate,” “believe,” “estimate,” “expect,” “plan,” and “intend” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements.

Forward-looking statements reflect the current view of our management with respect to future events and are subject to certain risks, uncertainties and assumptions. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by the forward-looking statements, including, among others, those set forth in “Risk Factors” and the following:

| | • | | the failure to maintain adequate capital resources; |

| | • | | competition to the businesses; |

| | • | | the lack of acceptance of any new products we may develop; |

| | • | | changes in currency exchange rates; |

| | • | | changes in general economic and business conditions; |

| | • | | changes in business strategy; and |

| | • | | any significant delay in the expected completion of the reincorporation and risks that the benefits anticipated from the reincorporation may not be fully realized. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this proxy statement/prospectus as anticipated, believed, estimated, expected, planned or intended.

In addition, the terrorist attacks on September 11, 2001 have adversely affected the economy generally. These developments in the economy generally have affected, and could continue to, adversely affect our business, although we are not able to quantify or reliably estimate the future impact that these matters may have on our businesses, results of operations or financial condition.

SOLICITATION OF WRITTEN CONSENT

BioProgress Technology International is mailing a copy of this proxy statement/prospectus to each holder of record of common stock. Solicitations of written consent will be made by mail and may also be made by our officers, or by other regular employees, personally, by telephone or by other electronic means. We do not presently intend to but may also request that brokers and other nominees solicit written consents from stockholders whose shares are held in accounts, street name, or at brokerage firms. BioProgress Technology International will bear the cost of the solicitation of written consent from its stockholders. We understand that directors and officers of BioProgress Technology International (and their affiliates) holding approximately 28.6% of the common stock, assuming no exercise of outstanding options, intend to give their consent. Once we have received the written consent of more than 50% of BioProgress Technology International common stock we intend to complete the reincorporation as quickly as possible once other conditions have been fulfilled. If you approve of the reincorporation please complete and return the Written Consent of Stockholders in Lieu of a Meeting which can be found at Annex B to this prospectus and return it to the address indicated on such form. If you change your mind after returning such form you may revoke your consent by sending BioProgress Technology International a written notice which includes your name (as it appeared on your original consent) and the number of shares as to which you wish to revoke your consent. Such notice must be received by BioProgress Technology International at the address identified in Annex B prior to the time at which BioProgress Technology International has received the written consent of at least a majority of the outstanding common stock. BioProgress Technology International will determine the validity of all written consents and purported notices of revocation.

12

WHERE YOU CAN FIND MORE INFORMATION

BioProgress Technology International, is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, is required to file reports and other information with the Securities and Exchange Commission relating to its business, financial condition and other matters. Certain information as of particular dates concerning its directors and officers and other matters, the principal holders of its securities and any material interest of such persons in transactions with it is required to be disclosed in proxy statements distributed to stockholders and filed with the SEC.

BioProgress Technology International. files annual, quarterly and special reports, and other information with the SEC. Its SEC file number is 0-24736. Copies of the Annual Report on Form 10-KSB for the fiscal years ended December 31, 2002 and other reports are available for inspection at the locations referred to below. The financial statements of BioProgress Technology International, Inc. for the fiscal year ended December 31, 2001, have been restated as describe in Note 2 to the financial statements for the year ended December 31, 2002.

The reports and other information should be available for inspection at the SEC’s public reference facilities of the SEC at 450 Fifth Street, N.W., Washington, DC 20549. Please call the Commission at 1-800-SEC-0330 for further information. Copies of such information should be obtainable, by mail, upon payment of the SEC’s customary charges, by writing to the SEC’s principal office at 450 Fifth Street, N.W., Washington, DC 20549. The Commission also maintains a web site on the Internet (at http://www.sec.gov/) that contains reports and other information regarding registrants that file electronically with the Commission.

BioProgress PLC, has filed a registration statement on Form F-4 to register its ordinary shares to be issued to stockholders of BioProgress Technology International in the reincorporation. This proxy statement/prospectus is a part of that registration statement and constitutes a prospectus of BioProgress PLC in addition to being a proxy statement of BioProgress Technology International as allowed by SEC rules, this proxy statement/prospectus does not contain all the information you can find in the registration statement or the exhibits to the registration statement.

Upon completion of the reincorporation, BioProgress PLC will be subject to the informational requirements of the Exchange Act, as they apply to a foreign private issuer, and will file annual reports on Form 20-F and current reports on Form 6-K and other information with the Commission. As a foreign private issuer, it will be exempt from Exchange Act rules regarding the content and furnishing of proxy statements to stockholders and rules relating to short swing profits reporting and liability.

BioProgress PLC will also be subject to the informational requirements of UK company legislation, in particular the Companies Acts 1985 and 1989 (as amended), the Public Offers of Securities Regulations 1995 (as amended), the Criminal Justice Act 1993 (as amended) and the Financial Services and Markets Act 2000, and will be required to file annual accounts and certain other administrative information with the Registrar of Companies in England and Wales. BioProgress PLC must file an annual return containing basic company information with the Registrar of Companies in England and Wales within 28 days after each anniversary of the company’s incorporation date. Under the Companies Act 1985 BioProgress PLC, as a public company, must deliver audited accounts to the Registrar of Companies in England and Wales within seven months of the end of each financial year. As long as BioProgress PLC’s shares are admitted to trading on the Alternative Investment Market, it must follow the requirements of the Alternative Investment Market Rules (which include requirements to publish half-yearly reports and annual audited accounts). As a public limited company, it must also follow the requirements of the City Code on Takeovers and Mergers and the Rules governing Substantial Acquisition of Shares. Such reports and other information will be available from the Registrar of Companies in England and Wales or through a regulatory information service approved by the London Stock Exchange or through the Alternative Investment Market section of the London Stock Exchange website (http://www.londonstockexchange.com) as applicable.

13

THE REINCORPORATION

General

BioProgress PLC and BioProgress Technology International propose the following reincorporation (the “Reincorporation”) of the current business of BioProgress Technology International. The Reincorporation will be implemented pursuant to an agreement and plan of merger (the “Reincorporation Plan”) included as Annex A of the proxy statement/prospectus the terms of which are incorporated herein by reference .

Details of the Reincorporation

1. BioProgress Holdings, Inc. a wholly owned subsidiary of BioProgress PLC will be merged with and into BioProgress Technology International (the “Merger”). Pursuant to the Merger, stockholders will receive one ordinary share in BioProgress PLC, par value £0.01 for each BioProgress Technology International share of common stock, par value $.001 per share owned, and one preference share of BioProgress PLC, par value £0.005, for each BioProgress Technology International share of Series B preferred stock, par value $.01 per share owned. Shares of series C Preferred Stock will not be exchanged in the Reincorporation.

2. BioProgress Technology International will survive the Merger as a wholly owned subsidiary of BioProgress PLC (other than 1.2% which will be owned by Larry Shattles, a U.S. director of BioProgress PLC, in the form of Series C Preferred Stock). The board of directors of BioProgress PLC intend to seek admission of BioProgress PLC’s ordinary shares to trading on the Alternative Investment Market of the London Stock Exchange in London, England.

3. On December 18, 2002, the Board of Directors of BioProgress Technology International unanimously approved the terms of the Reincorporation Plan. The Reincorporation Plan was unanimously approved by the directors of BioProgress PLC on December 18, 2002.

BioProgress Technology International is requesting that stockholders of BioProgress Technology International approve the Merger and Reincorporation Plan by written consent in lieu of a meeting (“Stockholder Action”). BioProgress Technology International is proposing the Merger be consummated on or about May 15, 2003 assuming Stockholder Action has occurred by then. Upon consummation of the Merger, stockholders of BioProgress Technology International, other than Mr. Shattles, will receive the same number of ordinary shares and/or preference shares in BioProgress PLC as they currently hold in BioProgress Technology International. We will issue a press release and file a report of Form 8-K announcing the exact date on which the reincorporation occurs.

Background and Reasons for the Reincorporation

The common stock of BioProgress Technology International is currently quoted on the Over the Counter Bulletin Board. The average daily trading volume during the two year period of 2001 and 2002 was approximately 24,000 shares. Over the entire two year period only approximately 18 million shares were traded in total. We have not benefited from securities analysts coverage or institutional interest in our shares. We believe that more than 50% of BioProgress Technology International shares are owned by non-US persons (primarily English shareholders). Of those shareholders we believe to be US persons, we believe that in excess of three quarters of the US shareholders own only one or two shares (or less than 0.0001% of all outstanding shares of common stock). Also, our business is conducted and managed in England. We believe the lack of interest on the part of analysts and US institutions is due to the fact that BioProgress is essentially a small English business operated and managed from the UK and controlled by non US shareholders and thus of little interest to US investors. This lack of general market interest has, we believe, led to difficulties in maintaining a liquid market for BioProgress Technology International stock and to raising additional capital on favorable terms. As a result and based on advice of our financial advisor, Collins Stewart Limited, we have concluded that if BioProgress Technology International were owned by an English incorporated company whose shares were traded in London we could potentially attract more attention from English and European institutions and analysts than we have historically in the US. We believe, based on advice of our financial advisor, Collins Stewart Limited, that as a UK company whose shares are traded on the Alternative Investment Market in London we may face better prospects to raise capital on favorable terms than we would as a US company.

14

The Reincorporation Plan

The Reincorporation will be effected by the merger of BioProgress Holdings into BioProgress Technology International. The terms of the Merger are set forth in the Reincorporation Plan which is included herein as Annex A. Pursuant to the Reincorporation Plan:

| | • | | BioProgress Holdings will merge with BioProgress Technology International and BioProgress Technology International will be the surviving corporation. |

| | • | | Each outstanding share of common stock of BioProgress Technology International will automatically be converted into one ordinary share of BioProgress PLC. |

| | • | | Each outstanding share of Series B preferred stock of BioProgress Technology International will automatically be converted into one preference share of BioProgress PLC. |

| | • | | Each share of Series C Preferred Stock will remain outstanding representing approximately 1.2% of the voting and economic rights of BioProgress Technology International. |

| | • | | Any options or warrants exercisable for shares of BioProgress Technology International common stock issued and outstanding immediately prior to the effective time will become exercisable for an equal number of ordinary shares of BioProgress PLC in accordance with the terms of such options. |

Conditions to the Merger

The Merger is subject to the following conditions:

| | • | | the Merger must be adopted and approved by the stockholders of BioProgress Technology International; |

| | • | | the registration statement must remain effective under the Securities Act of 1933; |

| | • | | the UK Inland Revenue tax clearances which have been obtained must remain valid; and |

| | • | | the documents required by the Nevada Private Corporation Law must be filed with the Secretary of State in Nevada. |

Dissenters’ Rights

Provided that at the effective time of the Merger BioProgress Technology International still has in excess of 2,000 record holders, stockholders of BioProgress Technology International common stock do not have dissenters’ rights with respect to the reincorporation. As at March 31, 2003 there were 2,716 record holders. Holders of BioProgress Technology International Preferred Stock who properly perfect their right may have dissenters’ rights.

Effective Time

We expect that on or about May 15, 2003, assuming Stockholder Action has been achieved, the corporate existence of BioProgress Holdings will cease upon the filing of the Articles of Merger with the Nevada Secretary of State and BioProgress Technology International will become a subsidiary of BioProgress PLC. The Reincorporation Plan provides that the Merger may be abandoned by BioProgress PLC or BioProgress Technology International prior to the filing of the Articles of Merger.

United States Federal Securities Laws Consequences

This proxy statement/prospectus does not cover any resales of BioProgress PLC ordinary shares received nor the issue of any ordinary shares pursuant to the exercise of options or warrants. No person is authorized to make any use of this proxy statement/prospectus in connection with any such resale or exercise.

All the ordinary shares received by you in the Reincorporation will be freely transferable, unless you are deemed to be an affiliate of BioProgress PLC under United States federal securities laws at the effective time of the Merger (unless you have contracted to limit your ability to sell). If you are deemed to be such an affiliate, the ordinary shares received in the Merger may be resold by you only in transactions permitted by Rule 145 under the United States securities Act of 1933 or as otherwise permitted under the Securities Act.

Persons who may be deemed to be affiliates of BioProgress PLC for the above purposes generally include individuals or entities that control, are controlled by, or are under common control with BioProgress PLC and may include officers, directors and principal shareholders of BioProgress Technology International.

15

Exchange of Share Certificates

As of the effective time of the Merger, the stockholders of BioProgress Technology International immediately before the effective time will automatically become the owners of BioProgress PLC ordinary shares and, as of the effective time, will cease to be owners of BioProgress Technology International’s common stock. The articles of association of BioProgress PLC provide that share certificates representing the BioProgress Technology International’s common stock, as of the effective time, will be deemed to represent an equivalent number of BioProgress PLC ordinary shares. Holders of the BioProgress Technology International’s common stock will not be required to exchange their share certificates as a result of the reincorporation. Should a shareholder desire to sell some or all of his, her or its ordinary shares in BioProgress PLC, delivery of the share certificate or certificates which previously represented the BioProgress Technology International’s common stock will be sufficient.

Certificates bearing the name of BioProgress PLC will be issued in the normal course upon surrender of outstanding BioProgress Technology International common stock certificates for transfer or exchange. If any stockholder surrenders a certificate representing BioProgress Technology International’s common stock for exchange or transfer and the new certificate to be issued is to be issued in a name other than that appearing on the surrendered certificate representing BioProgress Technology International’s common stock, it will be a condition to such exchange or transfer that the surrendered certificate be properly endorsed and otherwise be in proper form for transfer and that the person requesting such exchange or transfer either: (1) pays us or our agents any taxes or other governmental charges required by reason of the issuance of a certificate registered in a name other than that appearing on the surrendered certificate; or (2) establishes to our satisfaction or our agents that those taxes or other governmental charges have been paid.

For those stockholders of BioProgress Technology International who hold their shares in uncertificated form through the Depositary Trust Company (“DTC”) you must either: (1) if your bank or broker/dealer has the capacity, request that your bank or broker/dealer open an account for you with the CREST settlement service (“CREST”) in London where the DTC or your bank or broker/dealer will transfer your ordinary shares in BioProgress PLC; or (2) if your bank or broker/dealer does not have the capacity to open a foreign account, you, or your bank or broker/dealer will be issued a new share certificate representing BioProgress PLC ordinary shares. You should contact the person through whom you hold your shares to make these arrangements.

Description of the CREST System

CREST is a paperless settlement procedure enabling securities to be evidenced otherwise than by a certificate and transferred other than by a written instrument. BioProgress PLC’s articles of association will permit the holding of ordinary shares in BioProgress PLC in uncertificated form under the CREST system. U.S. and other non UK persons may hold shares in CREST through a CREST participant in London.

Accounting Treatment

The reincorporation will be accounted for using merger accounting rules under generally accepted accounting principles in the United Kingdom and as a recapitalization under US GAAP.

Share Quote

Application will be made for the ordinary shares of BioProgress PLC to be admitted to trading on the Alternative Investment Market of the London Stock Exchange under the symbol “BPRG”. It is expected that admission of those securities to trading on the Alternative Investment Market of the London Stock Exchange will become effective and dealings for normal settlement will commence shortly after the Effective Time of the Merger.

16

MATERIAL TAX CONSEQUENCES

United States Federal Income Tax Consequences

The following discussion summarizes material U.S. federal income tax consequences of the Reincorporation and ownership of BioProgress PLC shares to holders of BioProgress Technology International stock.

A “U.S. holder” is:

| | • | | a citizen or resident of the U.S.; |

| | • | | a corporation or partnership (including an entity treated as a corporation or a partnership for federal income tax purposes) created or organized in or under the laws of the U.S., any state thereof or the District of Columbia (unless, in the case of a partnership, Treasury Regulations are adopted that provide otherwise); |

| | • | | an estate whose income is subject to U.S. federal income tax regardless of its source; or |

| | • | | a trust if a court within the U.S. is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust (or, in the case of certain trusts in existence on August 20, 1996, if the trust elects to be treated as a U.S. person). |

• You are a “Non-U.S. holder” if you are not a U.S. holder.

The following discussion applies only if you hold BioProgress Technology International stock, and will hold BioProgress PLC shares, as a capital asset, and not through a partnership or other flow-through entity; you do not hedge your investment in the BioProgress Technology International stock or BioProgress PLC shares; and you hold less than 10% of the BioProgress Technology International stock and will continue to hold less than 10% of the BioProgress PLC shares after the reincorporation. This discussion is based on the Internal Revenue Code, Treasury Regulations, cases and rulings in effect as of the date hereof and except as expressly noted does not take into account any possible future changes in the law or interpretations thereof. We have not requested a ruling from the Internal Revenue Service (“IRS”) on the tax consequences of the reincorporation. As a result, the IRS could disagree with portions of this discussion

WE URGE YOU TO CONSULT YOUR OWN TAX ADVISOR REGARDING YOUR PARTICULAR TAX CONSEQUENCES AS A RESULT OF THE REINCORPORATION.

United States Federal Income Tax Consequences to U.S. Holders of Current Shares

Taxation upon receipt of BioProgress PLC shares

You will have taxable gain, if any, but not loss, upon the receipt of BioProgress PLC shares in exchange for BioProgress Technology International stock pursuant to the reorganization. You will not, however, be permitted to claim a tax loss upon the receipt of BioProgress PLC shares.

Your taxable gain generally will equal the excess, if any, of the fair market value of BioProgress PLC shares received in exchange for BioProgress Technology International stock. That gain generally will be taxed as capital gain, and will be long-term capital gain if you have held the BioProgress Technology International stock for more than one year. If you are an individual, long-term capital gain will be taxed at a maximum rate of 20%.