"Agreement"

|

this agreement for the sale and purchase of the Sale Shares, as amended or supplemented from time to time;

|

| |

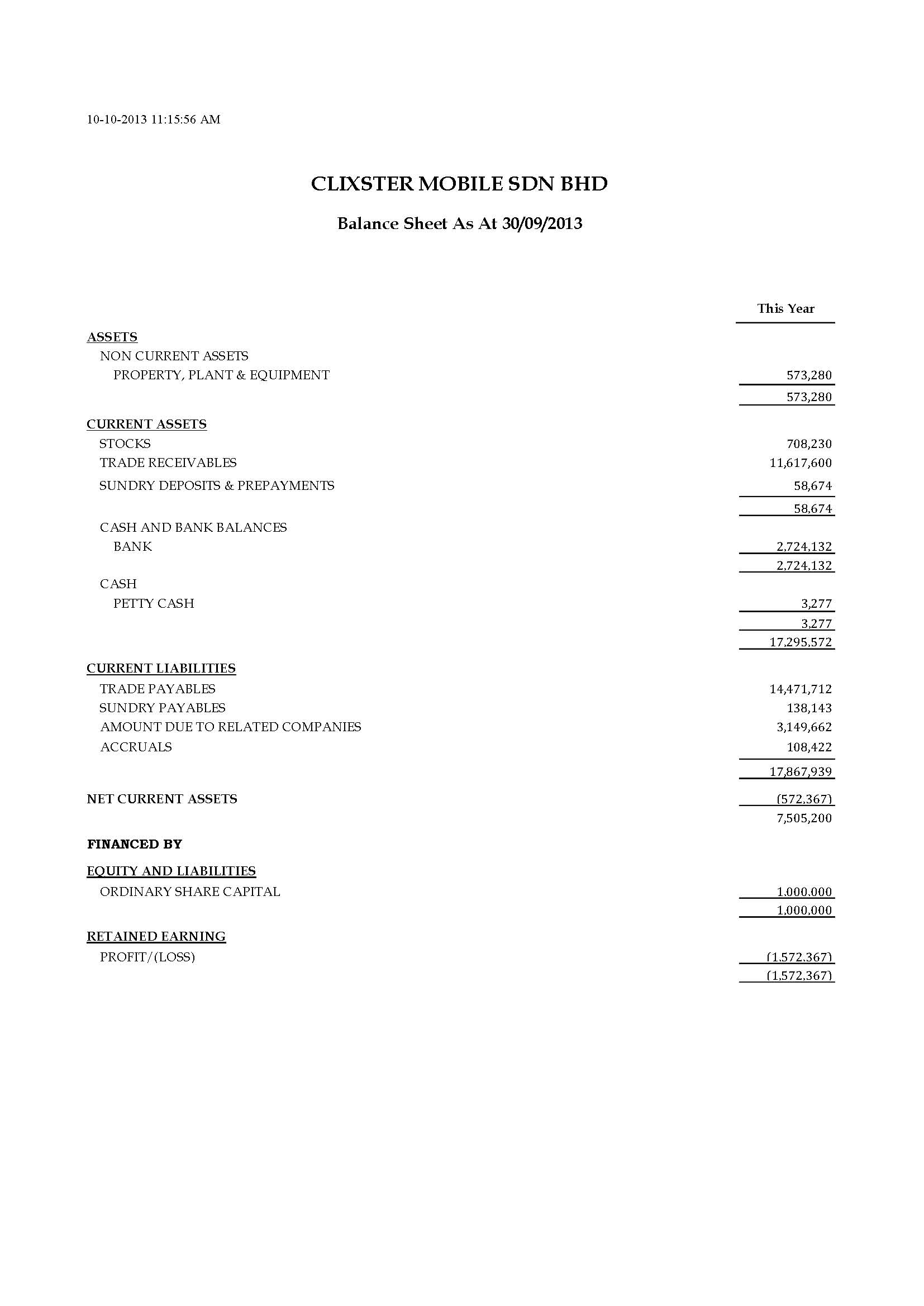

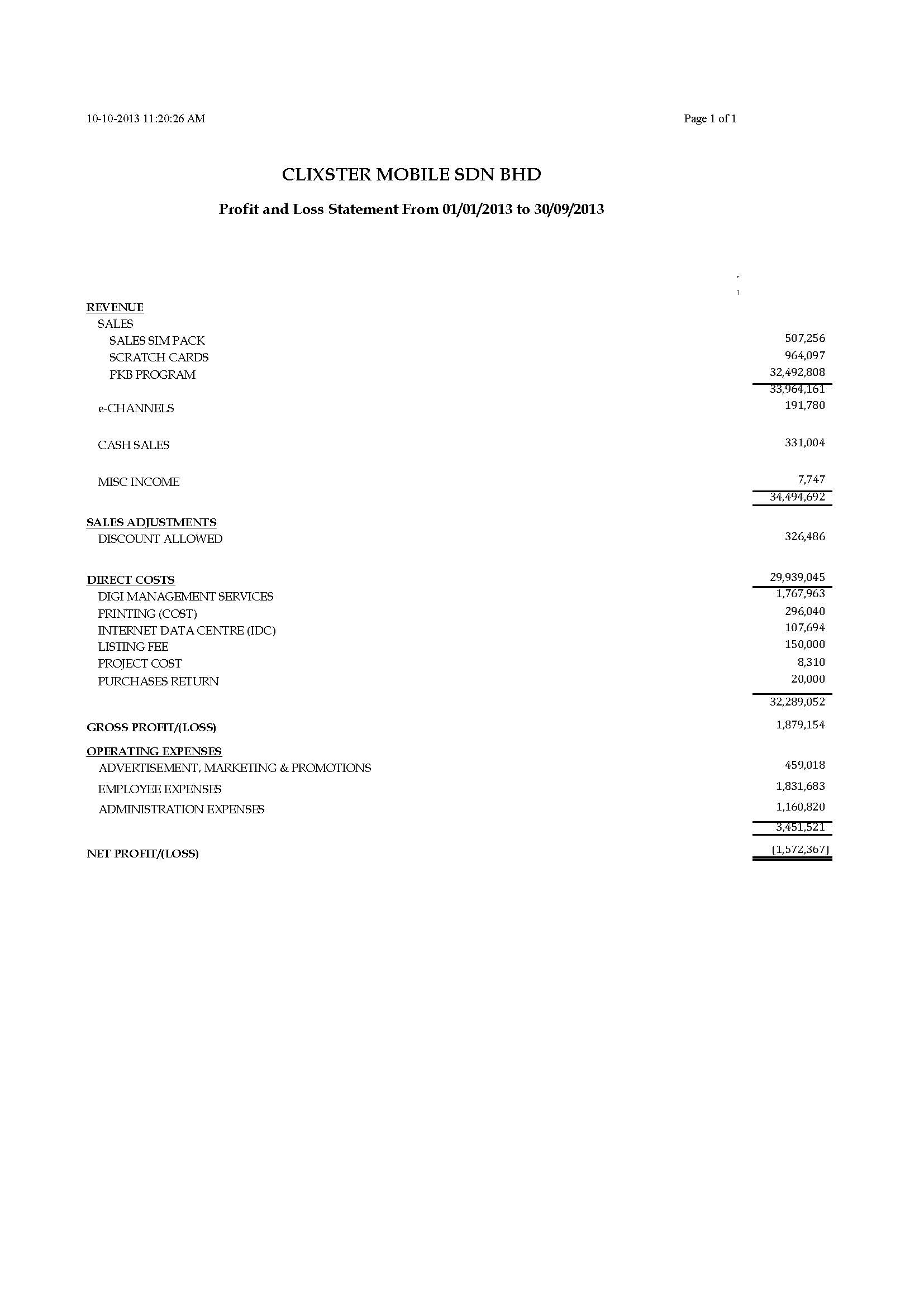

"2012 Accounts" | in respect of both the Company and the Purchaser, their balance sheet made up as at 31st December 2012 and the profit and loss accounts for the year ended on 31st December 2012 respectively; |

| |

"Audited Profits" | the audited consolidated profits attributable to shareholders of the Company for the relevant period prepared under the accounting principals of the Company consistently applied; |

| |

"Auditors" | the auditors from time to time appointed by the Company (or such replacement approved by the Purchaser); |

| |

"Business" | such business being engaged by the Company from time to time; |

| |

"Business Day" | a day (other than Saturdays) on which banks in Malaysia are generally open for the transaction of normal banking business; |

| |

"Completion Accounts" | in respect of both the Company and the Purchaser, their unaudited balance sheet as at the Completion Date and the unaudited profit and loss account for the period from 1st January 2013 to the Completion Date to be prepared by the Company and the Purchaser respectively; |

| |

"Completion Date" | the date falling on the fifth (5th) Business Day after all the conditions set out in Clause 3.1 have been fulfilled or waived by the Purchaser and or the Vendor; |

| |

"Completion" | completion of the sale and purchase of the Sale Shares in accordance with the terms and conditions of this Agreement; |

| |

"Consideration" | the aggregate consideration payable by the Purchaser for the purchase of the Sale Shares pursuant to Clause 4.1; |

| |

"Consideration Shares" | means the 10,193,609,664 shares, representing 90% of the enlarged common stocks in the Purchaser issued to the Vendor as consideration for the Sale Shares set out in Clause 2; |

| |

"Encumbrance" | any mortgage, charge, pledge, lien (otherwise than arising by statute or operation of law), equities, hypothecation or other encumbrance, priority or security interest, deferred purchase, title retention, leasing, sale-and-repurchase or sale-and-leaseback arrangement whatsoever over or in any property, assets or rights of whatsoever nature and includes any agreement for any of the same; |

| |

"Long Stop Date" | 30th November, 2013 (or such later date the parties to this Agreement may agree in writing); |

| |

"RM" | means Ringgit Malaysia; |

| |

"Sale Shares" | 632,000 Shares to be sold by the Vendor to the Purchaser which constitute 63.2% of the total issued share capital of the Company (consisting of 510,000 Shares (51%) from Samata Ventures Sdn Bhd and 122,000 Shares (12.2%) from Clixster Sdn Bhd) as at the Completion Date; |

| |

"Shares" | shares in the share capital of the Company; |

| |

"Subsidiaries" | the subsidiaries of the Purchaser as listed in Schedule 4; |

| |

"Taxation" | all forms of taxation whenever created or imposed and whether in Malaysia or elsewhere and without limiting the generality of the foregoing, includes all forms of profits tax, interest tax, salaries tax, property tax, estate duty, stamp duty, sales tax, any provisional tax, customs and import duty and any amount equal to any deprivation of any relief, allowance, set off, deduction in computing profits or rights to repayment of taxation granted by or pursuant to any legislation concerning or otherwise relating to taxation and also includes in addition and without prejudice to the foregoing, all fines, penalties, costs, charges, expenses and interests relating thereto; |

| |

"Warranties" | (a) in respect of the Company, the representations and warranties set out in Clause 7 and Schedule 2; (b) in respect of the Purchaser, the representations and warranties set out in Clause 8 and Schedule 3; |

| |

"USD" | means United States Dollars. |