- WAL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Western Alliance Bancorporation (WAL) 425Business combination disclosure

Filed: 10 Mar 15, 12:00am

Exhibit 99.2

WESTERN ALLIANCE

BANCORPORATIONTM

BridgeBank

A Compelling Combination

March 9, 2015

Forward-Looking Statements

This release contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. The forward-looking statements contained herein reflect the companies’ current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. In addition to factors previously disclosed in Western Alliance Bancorporation’s (the “Company” or “WAL”) and Bridge Capital Holdings’ (“Bridge”) reports filed with the Securities and Exchange Commission (the “SEC”), some factors that could cause actual results to differ materially from historical or expected results include: failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; failure of the shareholders of Bridge to approve the merger agreement; failure to obtain governmental approvals for the merger; disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; costs or difficulties related to the integration of the business following the merger; failure to realize cost savings and other benefits of the merger; Bridge customer acceptance of the Company’s products and services; changes in general economic conditions, either nationally or locally in the areas in which each company conducts or will conduct its business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; and other factors affecting the financial services industry generally or the banking industry in particular.

We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements set forth in this presentation to reflect new information, future events or otherwise.

Estimated numbers are used for illustrative purposes only and are not forecasts, and actual results may differ materially.

2

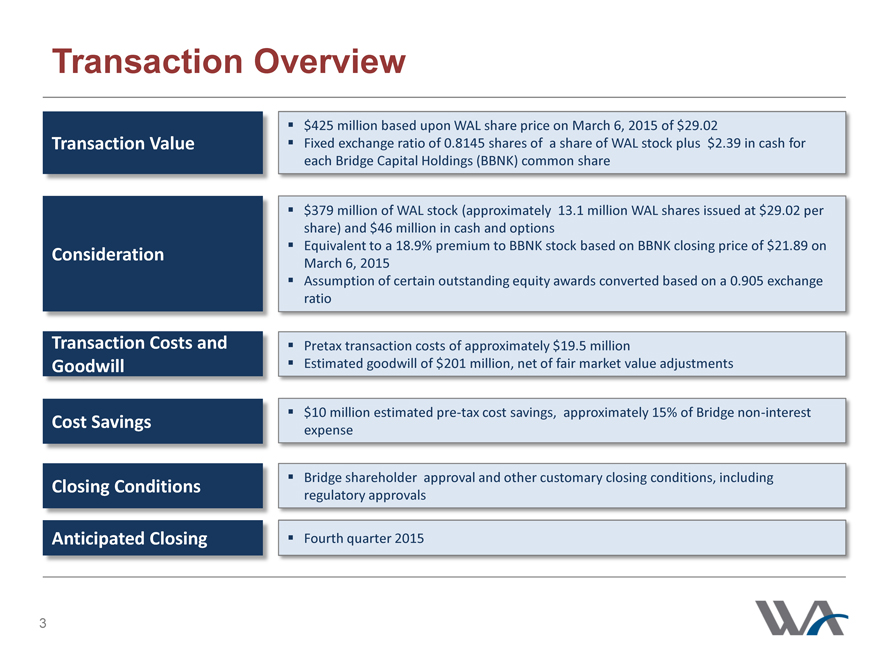

Transaction Overview

$425 million based upon WAL share price on March 6, 2015 of $29.02

Transaction Value Fixed exchange ratio of 0.8145 shares of a share of WAL stock plus $2.39 in cash for

each Bridge Capital Holdings (BBNK) common share

$379 million of WAL stock (approximately 13.1 million WAL shares issued at $29.02 per

share) and $46 million in cash and options

Consideration Equivalent to a 18.9% premium to BBNK stock based on BBNK closing price of $21.89 on

March 6, 2015

Assumption of certain outstanding equity awards converted based on a 0.905 exchange

ratio

Transaction Costs and Pretax transaction costs of approximately $19.5 million

Goodwill Estimated goodwill of $201 million, net of fair market value adjustments

$10 million estimated pre-tax cost savings, approximately 15% of Bridge non-interest

Cost Savings expense

Closing Conditions Bridge shareholder approval and other customary closing conditions, including

regulatory approvals

Anticipated Closing Fourth quarter 2015

3

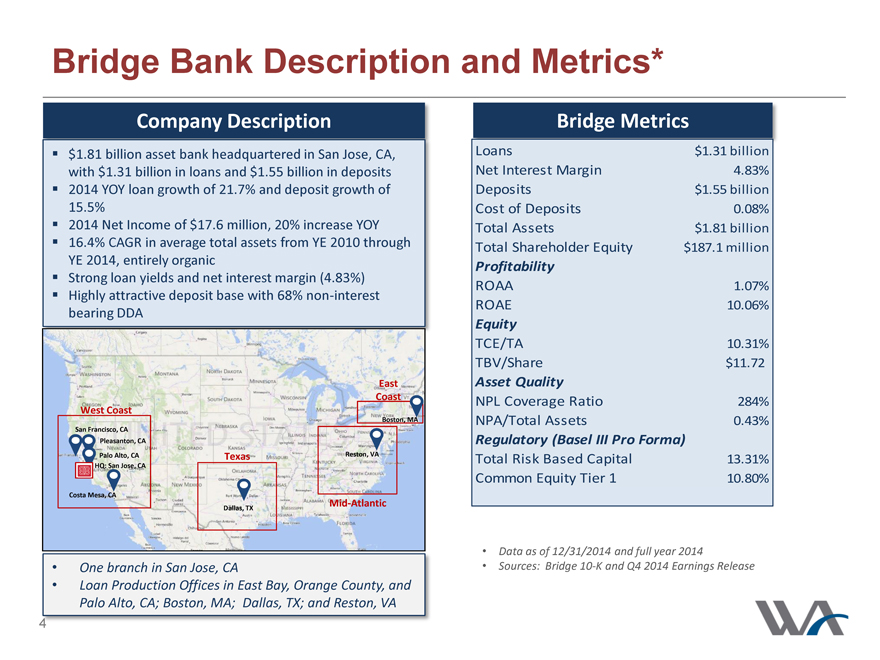

Bridge Bank Description and Metrics*

Company Description

$1.81 billion asset bank headquartered in San Jose, CA,

with $1.31 billion in loans and $1.55 billion in deposits

2014 YOY loan growth of 21.7% and deposit growth of

15.5%

2014 Net Income of $17.6 million, 20% increase YOY

16.4% CAGR in average total assets from YE 2010 through

YE 2014, entirely organic

Strong loan yields and net interest margin (4.83%)

Highly attractive deposit base with 68% non-interest

bearing DDA

East

Coast

West Coast

Boston, MA

San Francisco, CA

Pleasanton, CA

Palo Alto, CA Texas Reston, VA

HQ: San Jose, CA

Costa Mesa, CA

Mid-Atlantic

Dallas, TX

One branch in San Jose, CA

Loan Production Offices in East Bay, Orange County, and

Palo Alto, CA; Boston, MA; Dallas, TX; and Reston, VA

Bridge Metrics

Loans $1.31 billion

Net Interest Margin 4.83%

Deposits $1.55 billion

Cost of Deposits 0.08%

Total Assets $1.81 billion

Total Shareholder Equity $187.1 million

Profitability

ROAA 1.07%

ROAE 10.06%

Equity

TCE/TA 10.31%

TBV/Share $11.72

Asset Quality

NPL Coverage Ratio 284%

NPA/Total Assets 0.43%

Regulatory (Basel III Pro Forma)

Total Risk Based Capital 13.31%

Common Equity Tier 1 10.80%

Data as of 12/31/2014 and full year 2014

Sources: Bridge 10-K and Q4 2014 Earnings Release

4

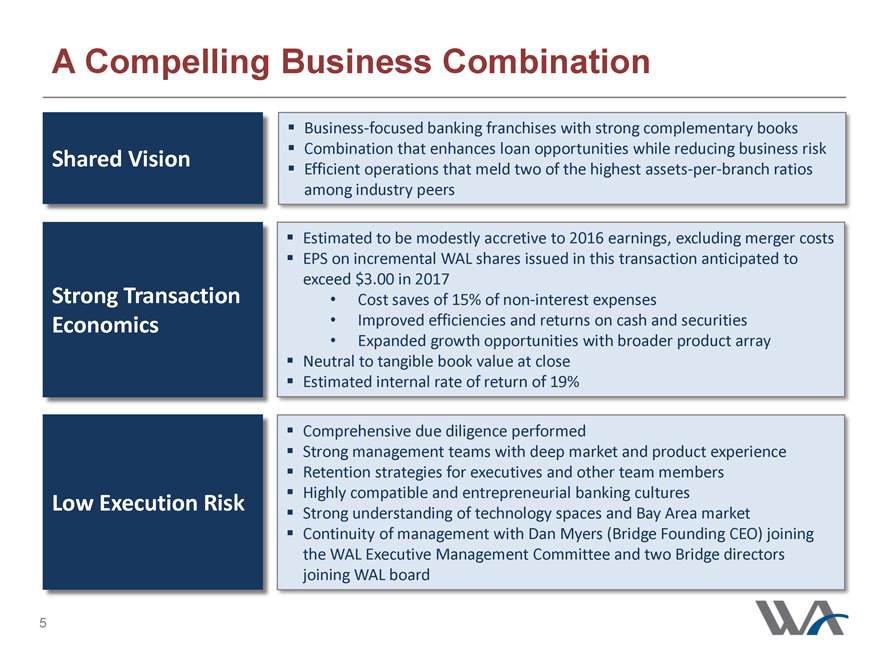

A Compelling Business Combination

Business-focused banking franchises with strong complementary books

Combination that enhances loan opportunities while reducing business risk

Shared Vision

Efficient operations that meld two of the highest assets-per-branch ratios among industry peers

Estimated to be modestly accretive to 2016 earnings, excluding merger costs

EPS on incremental WAL shares issued in this transaction anticipated to exceed $3.00 in 2017

Strong Transaction

Cost saves of 15% of non-interest expenses

Economics

Improved efficiencies and returns on cash and securities

Expanded growth opportunities with broader product array

Neutral to tangible book value at close

Estimated internal rate of return of 19%

Comprehensive due diligence performed

Strong management teams with deep market and product experience

Retention strategies for executives and other team members

Highly compatible and entrepreneurial banking cultures

Low Execution Risk

Strong understanding of technology spaces and Bay Area market

Continuity of management with Dan Myers (Bridge Founding CEO) joining the WAL Executive Management Committee and two Bridge directors joining WAL board

5

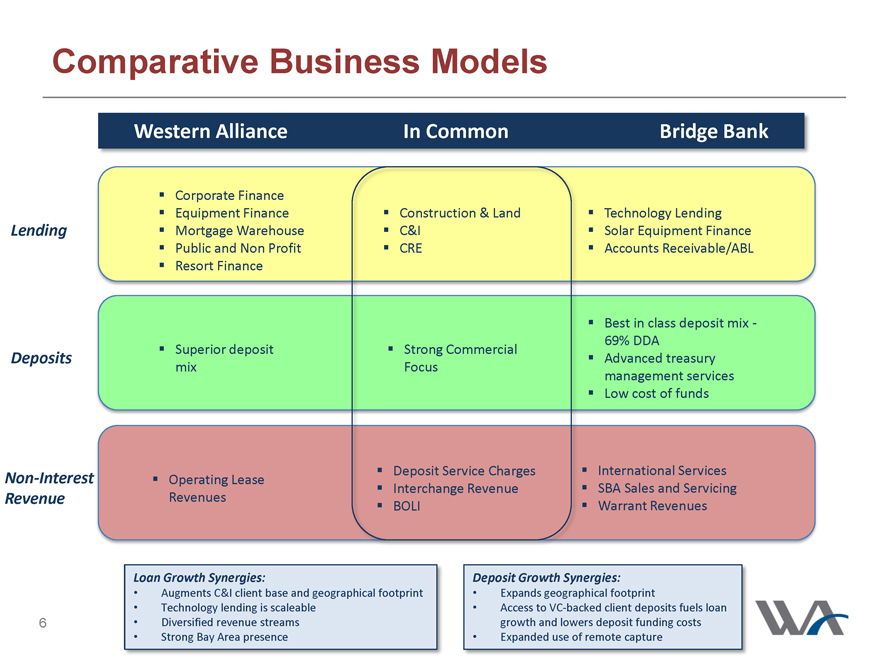

Comparative Business Models

Western Alliance

In Common

Bridge Bank

Corporate Finance

Equipment Finance

Construction & Land

Technology Lending

Lending

Mortgage Warehouse

C&I

Solar Equipment Finance

Public and Non Profit

CRE

Accounts Receivable/ABL

Resort Finance

Best in class deposit mix -

Superior deposit

Strong Commercial

69% DDA

Deposits

Advanced treasury

mix

Focus

management services

Low cost of funds

Non-Interest

Operating Lease

Deposit Service Charges

International Services

Interchange Revenue

SBA Sales and Servicing

Revenue

Revenues

BOLI

Warrant Revenues

Loan Growth Synergies:

Augments C&I client base and geographical footprint

Technology lending is scaleable

Diversified revenue streams

Strong Bay Area presence

Deposit Growth Synergies:

Expands geographical footprint

Access to VC-backed client deposits fuels loan growth and lowers deposit funding costs

Expanded use of remote capture

6

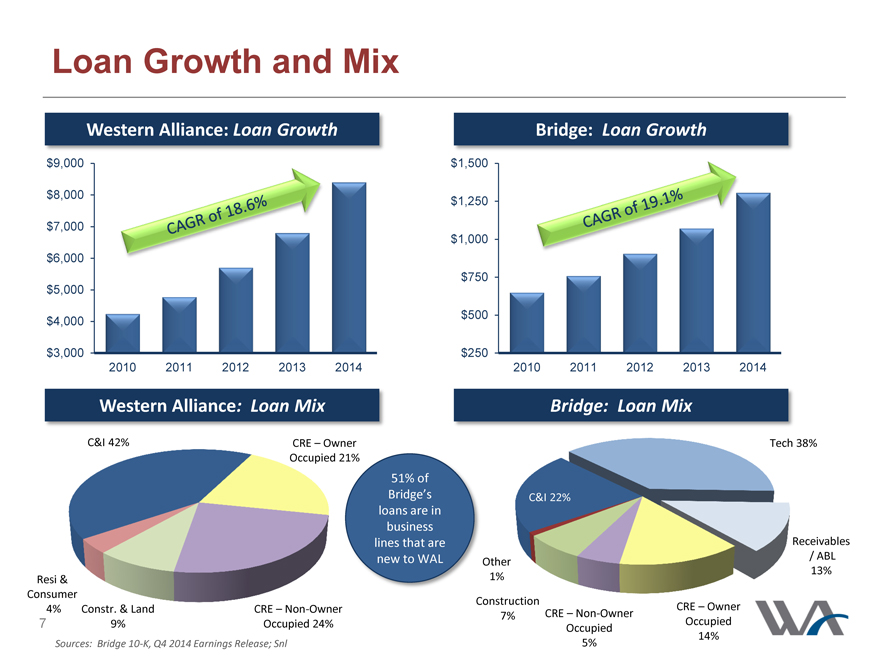

Loan Growth and Mix

Western Alliance: Loan Growth

$ 9,000

$ 8,000

$ 7,000

$ 6,000

$ 5,000

$ 4,000

$ 3,000

2010 2011 2012 2013 2014

Western Alliance: Loan Mix Bridge: Loan Mix

C&I 42% CRE Owner Tech 38%

Occupied 21%

51% of

Bridge’s C&I 22%

loans are in

business

lines that are Receivables

new to WAL Other / ABL

Resi & 1% 13%

Consumer Construction

4% Constr. & Land CRE Non-Owner CRE Owner

7% CRE Non-Owner

7 9% Occupied 24% Occupied Occupied

14%

Sources: Bridge 10-K, Q4 2014 Earnings Release; Snl 5%

Bridge: Loan Growth

$1,500

$1,250

$1,000

$750

$500

$250

2010 2011 2012 2013 2014

7

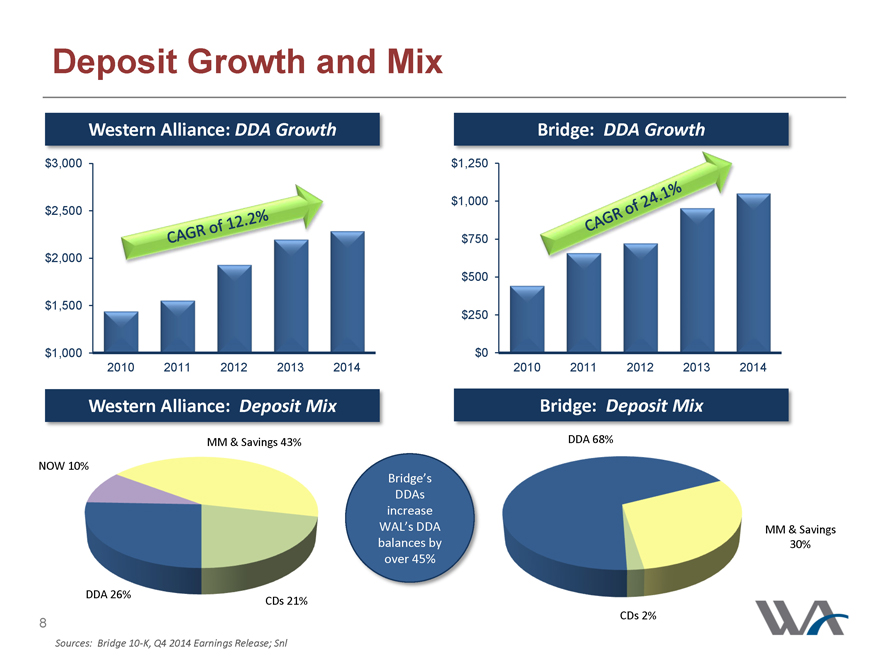

Deposit Growth and Mix

Western Alliance: DDA Growth

$3,000

$2,500

$2,000 CAGR of 12.2%

$1,500

$1,000

2010 2011 2012 2013 2014

Bridge: DDA Growth

$1,250

$1,000

$750 CAGR of 24.1%

$500

$250

$0

2010 2011 2012 2013 2014

Western Alliance: Deposit Mix

MM & Savings 43%

NOW 10%

DDA 26% CDs 21%

Sources: Bridge 10-K, Q4 2014 Earnings Release; Snl

Bridge’s

DDAs increase

WAL’s DDA balances by over 45%

Bridge: Deposit Mix

DDA 68%

MM & Savings

30%

CDs 2%

WA

8

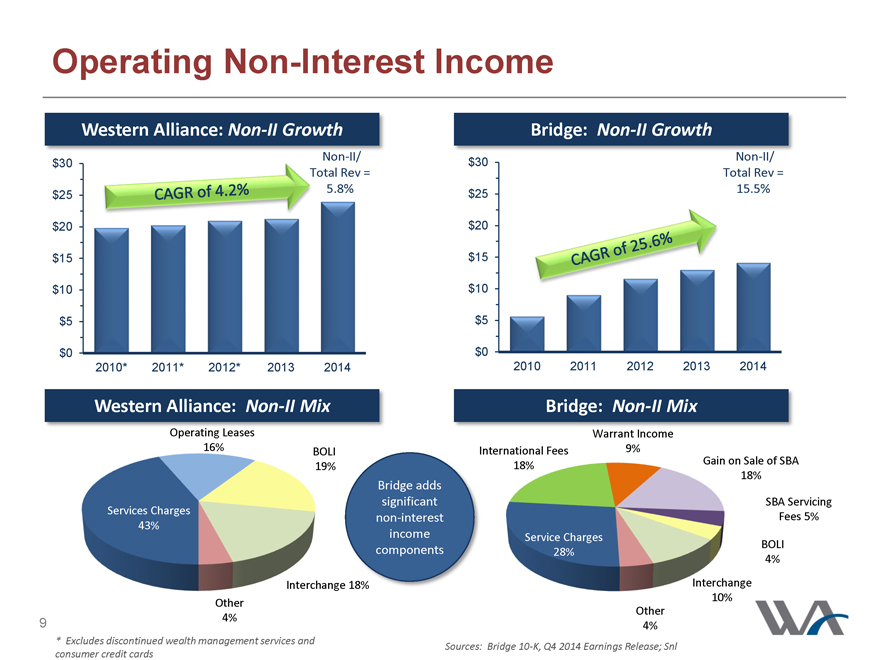

Operating Non-Interest Income

Western Alliance: Non-II Growth

$30 Non-II/

Total Rev =

$25 CAGR of 4.2% 5.8%

$20

$15

$10

$5

$0

2010* 2011* 2012* 2013 2014

Bridge: Non-II Growth

$30 Non-II/

Total Rev =

$25 15.5%

$20

$15

$10 CAGR of 25.6%

$5

$0

2010 2011 2012 2013 2014

Western Alliance: Non-II Mix

Operating Leases

16% BOLI

19%

Services Charges

43%

Interchange 18%

Other

4%

* Excludes discontinued wealth management services and consumer credit cards

Bridge adds significant non-interest income components

Bridge: Non-II Mix

Warrant Income

International Fees 9%

18% Gain on Sale of SBA

18%

SBA Servicing

Fees 5%

Service Charges

BOLI

28%

4%

Interchange

10%

Other

4%

Sources: Bridge 10-K, Q4 2014 Earnings Release; Snl

WA

9

Summary

Enhanced Product Offerings New business lines in technology, international services, and accounts receivable/ABL diversify and may accelerate loan growth while improving fee income

Large, low-cost deposit base has attractive mix and increases liquidity to fund core C&I and CRE lines

Proven Record of Growth 19% CAGR in loan growth and 24.1% CAGR in deposit growth since 2010

26% CAGR in non-interest income as well as higher proportion of revenue from non-interest services highlights potential of combined organization

Experienced management and entrepreneurial teams aligned with and complement WAL culture

Franchise Strength High asset-to-office and employees ratios for both institutions highlight efficient operational structure

Continuity of Bridge Bank brand in Northern CA and in nationwide offices

Solid ROAA and asset quality metrics

Portfolios well-positioned for a rising interest rate environment

Attractive Profile Improved diversification, liquidity and fee sources and broader growth platform

WA

10

Further Disclosures

Non-GAAP Information

This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America. These non-GAAP measures are believed to provide information to investors that is useful in understanding Bridge’s financial condition. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP performance measures that may be presented by other companies.

Additional Information

This communication is being made in respect of the proposed merger involving the Company and Bridge and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger with Bridge, the Company will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Bridge that also constitutes a prospectus of the Company. Bridge will mail the proxy statement/prospectus to its shareholders. Investors and security holders are urged to read the proxy statement/prospectus regarding the proposed merger when it becomes available because it will contain important information. You may obtain a free copy of the proxy statement/prospectus (when available) and other related documents filed by the Company and Bridge with the SEC at the SEC’s website at www.sec.gov. The proxy statement/prospectus (when it is available) and the other documents may also be obtained for free by accessing the Company’s website at www.westernalliancebancorp.com under the tab “Investor Relations” and then under the heading “Financial Documents” or by accessing Bridge’s website at www.bridgebank.com under the tab “About Us—Investor Relations” and then under the heading “Documents & SEC Filings”.

Participants in the Transactions

The Company, Bridge and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Bridge shareholders in favor of the merger with the Company. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Bridge shareholders in connection with the proposed merger will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about the executive officers and directors of the Company in its Annual Report on Form 10-K for the year ended December 31, 2014 and in its definitive proxy statement filed with the SEC on April 2, 2014, as amended. You can find information about Bridge’s executive officers and directors in its Annual Report on Form 10-K for the year ended December 31, 2014 and in its definitive proxy statement filed with the SEC on April 15, 2014. You can obtain free copies of these documents from the Company or Bridge using the information above.

WA

11