- WAL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Western Alliance Bancorporation (WAL) DEF 14ADefinitive proxy

Filed: 27 Apr 20, 4:40pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12

| |

Western Alliance Bancorporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary material. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

2020 Annual Meeting of Stockholders

DATE AND TIME DATE AND TIME |  LOCATION LOCATION |  RECORD DATE RECORD DATE | ||||||

|

|

| ||||||

Thursday, June 11, 2020 11:00 a.m., local time

| One E. Washington Street Suite 1400 Phoenix, Arizona*

| April 13, 2020 |

Voting Matters and Board Recommendations

|

| How to Vote

| ||||||||||||||

Proposal No. | Board Recommendation |

Internet by going to www.proxyvote.com and

Telephone by calling 1-800-690-6903 and

(if you request to receive your | ||||||||||||||

1. | Election of Directors. To elect fourteen directors to the Board of Directors for a one-year term (“Proposal No. 1” or “Election of Directors”) | “FOR” | ||||||||||||||

2. | Advisory (Non-Binding) Vote on Executive Compensation. To approve, on a non-binding advisory basis, executive compensation (“Proposal No. 2” or “Say-on-Pay”) | “FOR” | ||||||||||||||

3. | Equity Plan Amendment. To approve the amendment and restatement of the 2005 Stock Incentive Plan to increase the number of shares of our common stock available for issuance thereunder, extend the termination date of the plan to 2030, and make certain other changes (“Proposal No. 3” or “Equity Plan Amendment”) | “FOR” | ||||||||||||||

4. | Ratification of Auditor. To ratify the appointment of RSM US LLP as the Company’s independent auditor (“Proposal No. 4” or “Ratification of Auditor”) | “FOR” | ||||||||||||||

By order of the Board of Directors,

Randall S. Theisen

Secretary

Phoenix, Arizona

April 27, 2020

| * | If it becomes necessary due to COVID-19 precautions or impacts to change the date, time, location and/or means of holding the Annual Meeting (including solely by means of remote communication), we will announce the change(s) in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials. |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on June 11, 2020: This proxy statement, along with our annual report on Form 10-K for the fiscal year ended December 31, 2019, are available free of charge online at www.proxyvote.com.

WESTERN ALLIANCE | ABOUT US

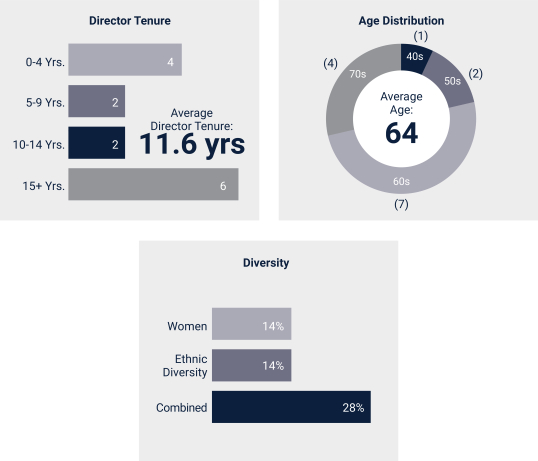

WESTERN ALLIANCE PERFORMANCE

With more than $27 billion in assets, Western Alliance Bancorporation (NYSE:WAL) is one of the country’s top-performing bank holding companies, according to Bank Director Magazine and S&P Global, and has ranked in the top 10 on the Forbes “Best Banks in America” list for five consecutive years, 2016-2020. Its primary subsidiary, Western Alliance Bank, Member FDIC, helps business clients realize their growth ambitions with local teams of experienced bankers who deliver superior service and a full spectrum of customized loan, deposit and treasury management capabilities. Business clients also benefit from a powerful array of specialized financial services that provide strong expertise and tailored solutions for a wide variety of industries and sectors. A national presence with a regional footprint, Western Alliance Bank operates individually branded, full-service banking divisions and has offices in key markets nationwide.

Top Performing Commercial Client Focused Bank

We believe shareholder value is deeply correlated to loan, deposit and revenue growth, outstanding asset quality, and predictable and sustainable earnings.

KEY

2019 Performance

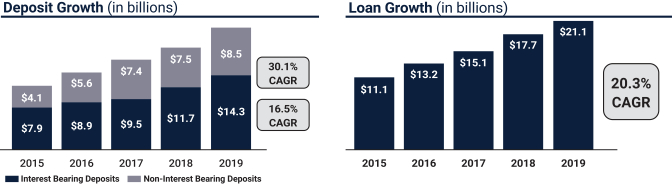

| Total Shareholder Return | Total Assets | Loan Growth | Deposit Growth | |||||||||

| 46% | $27B | $3.4B 19.1% YoY growth | $3.6B 18.9% YoY growth

| |||||||||

| Top-tier performance | Earnings 10th consecutive year of rising earnings

| ROATCE* 19.6% | Operating Efficiency Ratio* 42.7%

| |||||||||

Record revenues $1.1B Net Income of $499.2M |

ROAA 2.00% |

Earnings Per Share $4.84 11% YoY growth

| ||||||||||

| * | Non-GAAP financial measure: See our 2019 Annual Report on Form 10-K for further information and a reconciliation to the most directly comparable GAAP financial measure. |

i WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

WESTERN ALLIANCE | ABOUT US

| Significant Capital Base | Focused Asset Quality Management | Strong Liquidity Access | ||||||||||

• Tangible Common Equity/ Total Assets of 10.3%*

• Common Equity Tier 1 ratio of 10.6%

• Tangible Book Value Per Share: $26.54 (20.3% YoY growth); grown by 160% over the past 5 years* | • Strong risk management culture and framework established throughout organization

• 2019 Net Charge Offs of 2bps, compared to 15bps for peers

• Non-performing assets of 0.26%, 10bps below average of peers** | • Loan growth funded through core deposits

• $6.8B in unused borrowing capacity

• $2.5B unpledged marketable securities | ||||||||||

STRATEGIC

| Objectives | |||||

• Promote disciplined and thoughtful loan growth funded with rising deposits.

• Carefully manage our balance sheet with regards to asset sensitivity.

• De-risk our loan composition.

• Maintain industry-leading operating efficiency.

• Support foundational risk management practices with a strong capital base, focused asset quality, and access to ample liquidity. | ||||||

| ||||||

| * | Non-GAAP financial measure: See our 2019 Annual Report on Form 10-K for further information and a reconciliation to the most directly comparable GAAP financial measure. |

| ** | Peers consist of 55 major exchange traded banks with total assets between $15B and $150B as of December 31, 2019, excluding target banks of pending acquisitions. |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT ii

WESTERN ALLIANCE | ABOUT US

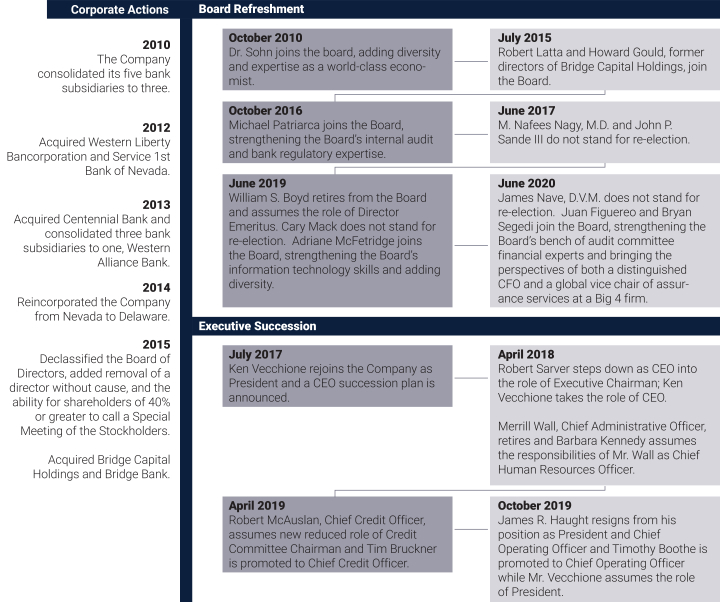

A Decade of Western Alliance

Corporate Governance Milestones

iii WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

WESTERN ALLIANCE | ABOUT US

SHAREHOLDER ENGAGEMENT

We maintain an ongoing, proactive outreach effort with our shareholders in a variety of ways. Throughout the year, our Investor Relations team and business leaders regularly meet with current shareholders, prospective investors, and investment analysts. These meetings often include our CEO, CFO, or line of business leaders in order to engage shareholders and solicit feedback on various topics relevant to the Company’s performance and strategy.

Since Q4 2018, as part of our proactive shareholder engagement strategy, in addition to attending numerous investment analyst-sponsored industry conferences, management undertook five separate trips to nine major US cities in order to meet in-person with more than 50 existing and prospective investors. The feedback received from our shareholders is communicated to business leaders and the Board, and helps inform our business decisions and strategy, when appropriate.

ENGAGEMENT

| Strategies | ||||||||||||

Who we engage:

∎ Institutional shareholders

∎ Retail shareholders

∎ Equity research analysts

∎ Proxy advisory firms

∎ ESG rating firms

∎ Industry thought leaders |

How we communicate:

∎ Proxy Statement

∎ Annual Report

∎ SEC Filings

∎ Press Releases

∎ Investor relations website

∎ Investor meetings

|

2019 Engagements

∎ Met with shareholders and interested investors in cities throughout the country

∎ Senior Management conducted 5 non-deal roadshows, visited 9 cities and hosted >50 investor meetings

∎ Participated in 10 investor conferences

∎ Both of our Chief Executive Officer and Chairman of the Board presented at the 2019 Annual Meeting of the Shareholders

| ||||||||||

Topics we discussed: | ||||||||||||

∎ Business strategy and execution

∎ Financial Performance

∎ Asset quality and risk oversight

∎ Executive compensation & incentives

∎ Ad hoc topics

∎ ESG disclosures

∎ Board composition

| ||||||||||||

How we engage: | ||||||||||||

∎ Shareholder engagement program

∎ Quarterly earnings calls

∎ Investor conferences

∎ Annual Shareholder Meeting

| ||||||||||||

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT iv

WESTERN ALLIANCE | ENVIRONMENTAL, SOCIAL & GOVERNANCE

CORPORATE RESPONSIBILITY: WHO WE ARE

| For Our | ||

| Community | ||

|

Affordable Housing

• We made $296.1 million in total loans and investmentssupporting affordable and low-income housing projects in 2019 alone.

• In 2019, employees provided4,132 community service hours* assisting first time homeowners who are eligible to receive down payment assistance through the Federal Home Loan Affordable Housing Programs.

• We partner with the Federal Home Loan Bank to assist low to moderate income families with acquiring a down payment toward the purchase of a home, for a total of over$3.2 million dollars during 2019. Western Alliance Bank is the largest provider of these grants year after year in all of Arizona, California, and Nevada.

| |

| Small Businesses

• $384.1 million total loans in support of small businesses in 2019.

• Invested $6.0 millionin Small Business Investment Companies in 2019.

• We provided$3.0 millionin loans and purchased$5.0 millionin small business loans by partnering with Community Development Financial Institutions to provide loans or capital to small businesses.

| |

| Education

• We underwrite the Financial Cents digital financial education program and provide it to 28 Title 1 schools. In 2019, the program provided11,429 hours of financial literacy training to2,717 students. Students’ test scores indicated that their financial knowledge improved78%.

• Employees provided1,870 service hours* teaching financial literacy to19,271 students at Title 1 schools.

| |

| For Our | ||

| Environment | ||

|

Reduce

• Through the adoption of drinking water filtration systems, which we have implemented at95% of our locations, we have significantly reduced our use of plastic water bottles. As part of the roll out, and in celebration of our reaching $25B in assets, each employee received a reusable cup to reduce single-use cups in our locations.

| |

| Reuse

• When renovating or opening new facilities, we capitalize on opportunities to refinish or reuse furniture, which reduces costs and diverts materials from landfills.

| |

| Recycle

• Active recycling programs exist at95% of our locations, targeting100% by June 30, 2020.

| |

| Environmental Risk

• Our Environmental Risk Officer has nearlytwo decades of experience performing environmental risk assessments in the private, municipal, and government sectors, and most recently served as the ERO for GE Capital-Franchise Finance.

• Through the adoption and consistent application of our Environmental Risk Policies and Procedures, we are able to identify environmental risks, establish mitigants and perform thorough due diligence.

• When environmental problems are identified, we require remediation and cleanup of properties as necessary to protect both ourselves and the environment at large.

| |

| * | All community service hours are provided during banking hours by our dedicated employees. |

v WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

WESTERN ALLIANCE | ENVIRONMENTAL, SOCIAL & GOVERNANCE

OUR CULTURE

People are the foundation of Western Alliance and we invest in their success. Our people are committed to our clients’ success and, by putting clients first, we create strong shareholderPerformance. This leads to tremendousPossibilities to fuel client growth and support our communities, and in turn provide expanding opportunities to attract and retain ourPeople.

Our Values Drive Us

Integrity

We expect everyone to apply high ethical standards and sound judgment in all we do.

Creativity

We are all part of an environment that welcomes new ideas and prizes creative, strategic thinking to benefit customers and our commitment to relationship banking.

Teamwork

We work together across departments, specialty areas and geographies in a productive, collaborative way that forwards the interests of clients and the bank.

Passion

Our passion motivates us to overcome obstacles, think big and do more.

Excellence

We strive to deliver strong performance and excellence in everything we undertake.

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT vi

WESTERN ALLIANCE | ENVIRONMENTAL, SOCIAL & GOVERNANCE

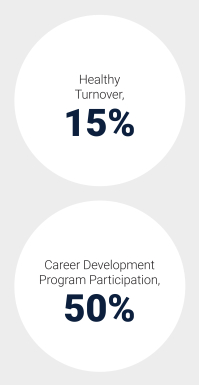

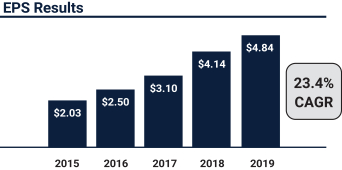

OUR PEOPLE

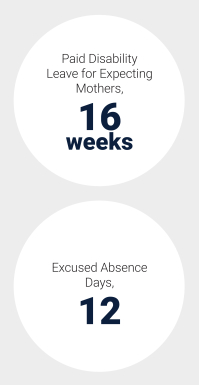

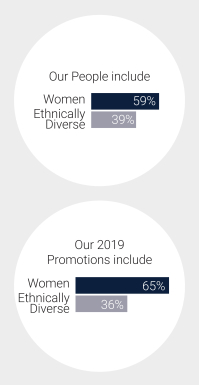

| Benefits | Diversity and Inclusion | Employee Retention and Investment | ||||||

|  |  | ||||||

Our people also enjoy: Generous Vacation Policy 11 Paid Holidays New Parent Flex Time 75% 401k Match of the First 6% | In 2019, we rolled out small group D&I trainings across the organization, and are on track for 100% completion in 2020. | We seek to source openings at all levels from the promotion of internal candidates through succession planning. Developing our people is our priority. | ||||||

OUR PEOPLE PARTICIPATE IN OUR SUCCESS Percentage of Our People Eligible

| ||||

|  |  | ||

This is the same Annual Bonus Plan Executives Participate in and can pay out at up to 150% of target. | Stock Grants ensure our people’s interests and | Our people are automatically enrolled in our 401(k) Plan, | ||

vii WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

WESTERN ALLIANCE | ENVIRONMENTAL, SOCIAL & GOVERNANCE

OUR BOARD

Board Refreshment and Diversity | Board Best Practices | Board and Committee Meetings in Fiscal 2019 | ||||||

|  |  | ||||||

New Director Nominees in 2020: Juan Figuereo Bryan Segedi | Our Leadership: Robert Sarver Executive Chairman Kenneth A. Vecchione Chief Executive Officer Bruce Beach Lead Independent Director | Committee Meetings: Audit – 11 Governance – 7 Compensation – 10 Risk – 8 Finance and Investment – 6 | ||||||

Evaluating and Improving Board Performance | Aligning Director and Shareholder Interest | |

|

| |

Board Orientation Yes | Director Stock Ownership Guidelines Yes | |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT viii

|

|

Proposal No. 1. Election of Directors | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

Proposal No. 2. Advisory (Non-Binding) Vote on Executive Compensation | ||||

| 30 | ||||

| 30 | ||||

| 33 | ||||

| 33 | ||||

Aligning Executive Compensation with Metrics that Drive Shareholder Value | 33 | |||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 40 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 50 | ||||

| 51 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

Policies and Procedures Regarding Transactions with Related Persons | 55 | |||

Security Ownership of Certain Beneficial Owners, Directors and Executive Officers | 56 | |||

| 58 | ||||

| 58 | ||||

| 59 | ||||

Proposal No. 3. Equity Plan Amendment | ||||

| 60 | ||||

| 60 | ||||

| 65 | ||||

Proposal No. 4. Ratification of Appointment of the Independent Auditor | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 67 | ||||

Additional Information | ||||

| 68 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| CORPORATE GOVERNANCE | ||||||||||||

BOARD OVERVIEW

PROXY STATEMENT

This proxy statement is being provided to stockholders of Western Alliance Bancorporation (“Company”) for solicitation of proxies on behalf of the Board of Directors of the Company for use at the Annual Meeting of Stockholders (“Annual Meeting”) to be held at the Company’s headquarters* at One E. Washington Street, Suite 1400, Phoenix, Arizona 85004, at 11:00 a.m., local time, on Thursday, June 11, 2020, and any and all adjournments thereof.

Our Board of Directors is responsible for ensuring effective governance over the Company’s affairs. The Company has adopted Corporate Governance Guidelines and a Code of Business Conduct and Ethics. These documents are available in the Governance Documents section of the Investor Relations page of the Company’s website atwww.westernalliancebancorporation.com or, for print copies, by writing to the Company at One E. Washington Street, Suite 1400, Phoenix, Arizona 85004, Attention: Corporate Secretary.

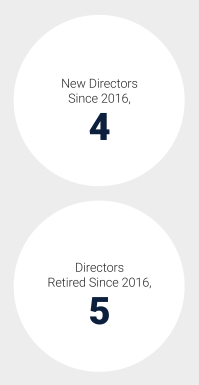

Combining Refreshment and Retention

The Board refreshment process reflects our continued growth as a Company, and our focus on having a Board composed of directors who actively contribute to the evolving needs of the Company, while maintaining the invaluable institutional knowledge brought by more tenured directors. The following information includes the two new director nominees and excludes one current director not nominated for re-election at the Annual Meeting.

| * | If it becomes necessary due to COVID-19 precautions or impacts to change the date, time, location and/or means of holding the Annual Meeting (including solely by means of remote communication), we will announce the change(s) in advance, and details on how to participate will be issued by press release, posted on our website and filed as additional proxy materials. |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 1

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD OVERVIEW

The Right Skills for our Board

As a part of the Board evaluation and director selection processes, the Nominating and Corporate Governance Committee (the “Governance Committee”) maintains a Director Skills and Traits Matrix (described further in the “Director Selection Process” section of this proxy statement). The Governance Committee and the Board believe that the director nominees for 2020 provide the Company with the right mix of skills and experience necessary for an optimally functioning Board.

Total Director Nominees with Particular Qualifications and Experience (out of 14 Directors Nominees)

12 | Corporate Strategy

Experience developing and executing long-term strategic plans to encourage innovation and growth. |

10 | Public Company Board Service

Experience as a board member of another publicly-traded company. | |||

8 | Industry Background

Experience in the financial services industry, particularly in the area of commercial banking, and proven knowledge of key customers and/or associated risks. |

12 | Corporate Finance & M&A Experience

Experience in corporate lending or borrowing, capital markets transactions, significant mergers or acquisitions, private equity, or investment banking. | |||

8 | Financial Acumen

Experience or expertise in financial accounting and reporting or the financial management of a major organization. |

7 | Technology/Information Security Experience

Understanding of information technology systems and development, and/or information security whether through academia or industry experience. | |||

11 | Highly Regulated Industry

Experience in a highly regulated industry, such as financial services, gaming, healthcare, pharmaceuticals, etc. |

10 | Geographic Expertise

Knowledge of or experience in a specific geographic area or market in which the Company and its subsidiaries operate. | |||

8 | C-Suite Leadership

Experience as a Chief Executive Officer, Chief Financial Officer, or a Chief Operating Officer of a major organization. |

9 | Risk Management

Experience assessing and mitigating significant competitive, regulatory, and technological risks across an enterprise. | |||

8 | Operations Management Expertise

Experience or expertise in managing the operations of a business or major organization |

4 | Diversity

Contributes to the gender and ethnic diversity of the Board. | |||

2 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD LEADERSHIP STRUCTURE

In accordance with the Company’s Bylaws, as amended (“Bylaws”), the Chairman of the Board of Directors (the “Chairman”) is a discretionary position whose sole stated duty is to preside at meetings of the Board of Directors and meetings of stockholders, as well as to perform such other duties as assigned to him by the Board of Directors. The Chief Executive Officer (“CEO”) is required to be a member of the Board of Directors, subject to the direction of the Board of Directors, and has general supervision, direction and control of the business and officers of the Company. The positions of Chairman and CEO may be held by the same person or may be held by two people. The Board of Directors does not have a definitive policy on whether the role of the Chairman and the CEO should be separate.

Since April 1, 2018, Robert Sarver has served as the Company’s Executive Chairman, prior to which he served as the Company’s Chairman and Chief Executive Officer. As Executive Chairman, Mr. Sarver continues to preside over Board meetings and perform other functions customary for a Chairman, along with certain other responsibilities, including, but not limited to, oversight of the Company’s mergers and acquisitions and working with the CEO, Kenneth A. Vecchione, to set the Company’s strategic objectives.

In addition to Mr. Sarver’s invaluable leadership, the Company maintains a Lead Independent Director, selected by the non-management directors. The Board of Directors believes the position contributes to improved corporate performance in the following ways: (1) supporting effective communication and building a productive relationship between the Board of Directors, the Executive Chairman, the CEO and other members of executive management; (2) leading the process for improving performance of the Board of Directors; and (3) assisting in a crisis. Bruce Beach has served as the Company’s Lead Independent Director since 2010. In addition to the duties of all directors, the specific responsibilities of the Company’s Lead Independent Director are as provided below:

Lead Independent Director Responsibilities |

| • | Assist the Executive Chairman and CEO with setting the Board agenda and schedules; |

| • | Preside at meetings in the absence of the Chairman; |

| • | Assist new Board members and provide counsel needed to enable them to become active and productive contributors; |

| • | Call for meetings of the independent and/or non-management directors as necessary, set the agenda and preside at such meetings; |

| • | Work with the Governance Committee regarding committee assignments, succession planning and Board candidates; |

| • | Lead the Board in evaluating the CEO and Executive Chairman; |

| • | Provide feedback to the CEO and management team on issues of interest or concern to the Directors, including ensuring the Board has the information it has requested; |

| • | Lead the Board process to ensure focus on strategic issues rather than minutiae; |

| • | Facilitate outside director action in a crisis; |

| • | Lead the Board to achieve consensus in its deliberations while reaching timely decisions; |

| • | Stay informed about Company activities, strategies, performance and provide counsel and feedback to the CEO; |

| • | Work with the Governance Committee to lead the Board and individual directors through an annual evaluation process; and |

| • | If requested, communicate directly with stockholders. |

The Governance Committee believes this leadership structure is the most appropriate for the Company and its stockholders. The Governance Committee based its determination on a number of reasons, the most significant of which include the following:

| • | Mr. Sarver continues to make substantial contributions to the Company’s success, and the Board benefits from his continued advice and engagement. The Company’s current CEO, Mr. Vecchione, and Mr. Sarver work together, and the Company benefits from their combined experience; and |

| • | The structure of our Board of Directors provides strong oversight by independent directors. Our Lead Independent Director’s responsibilities include leading independent and non-management sessions of the Board of Directors during which our directors meet without management. These sessions allow the Board of Directors to review key decisions and discuss matters in a manner that is independent of the CEO and Executive Chairman and, where necessary, critical of the CEO, the Executive Chairman, and senior management. In addition, each of the Board of Directors’ standing committees is chaired by an independent director. |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 3

| CORPORATE GOVERNANCE | ||||||||||||||||

DIRECTOR SELECTION PROCESS

One of the primary responsibilities of the Governance Committee is to assist the Board of Directors in identifying, and reviewing the qualifications of, prospective directors of the Company. The Board of Directors and the Governance Committee periodically review the appropriate size, composition, skills, and diversity of the Board of Directors. In considering candidates for the Board of Directors, the Governance Committee considers the entirety of each candidate’s credentials and does not have any specific minimum qualifications that must be met by a Governance Committee-recommended nominee.

The Governance Committee is guided by the following basic selection criteria for all nominees: | ||

• Whether the director/potential director has the financial acumen or other professional, educational or business experience relevant to an understanding of the Company’s business, such as experience in a regulated industry or a publicly held company; | • Whether the director/potential director would be considered a “financial expert” or “financially literate” as defined in the listing standards of the NYSE or applicable law; | |

• Whether the director/potential director meets the independence requirements of the SEC and listing standards of the NYSE; | • The director’s/potential director’s character and integrity, experience and understanding of strategy and policy-setting, reputation for working constructively with others and sufficient time to devote to matters of the Board of Directors; | |

• Whether the director/potential director possesses a willingness to challenge and stimulate management and the ability to work as part of a team in a highly regulated environment; | • Whether the director/potential director assists in achieving a mix of Board members that represents a diversity of background, perspective and experience, including with respect to age, gender, race, ethnicity, place of residence and specialized experience; and | |

• Whether the director/potential director, by virtue of particular technical expertise, experience or specialized skill relevant to the Company’s current or future business, will add specific value as a director; | • The director’s/potential director’s educational, business, non-profit or professional acumen and experience. | |

The Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Governance Committee has adopted a Director’s Skills & Traits Matrix (the “Skills Matrix”) outlining what it believes to be the key areas of expertise needed from Board members and identifying how each member contributes to the Board’s overall skillset. A summary of the Skills Matrix can be found on page 2. This practice allows the Governance Committee to assess opportunities to improve the Board’s diversity based on each member’s personal factors and professional characteristics. Using this methodology, the Governance Committee is dedicated to enhancing the skills and talent of its Board by identifying specific areas for improvement, thereby prioritizing the pool of persons considered for new Board positions.

4 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

DIRECTOR SELECTION PROCESS

IDENTIFYING DIRECTOR NOMINEES

| 1 ASSESS COMPOSITION AND DETERMINE PRIORITIES

| ||||||

|

In 2020, the Governance Committee identified as one of its top priorities the need to recruit a new director who has the experience necessary to serve as an Audit Committee Financial Expert and who would add depth in the areas of financial acumen and strategic leadership.

| |||||

| 2 SOLICIT AND SOURCE A DIVERSE POOL OF CANDIDATES

| ||||||

|

Working with the Executive Chairman of the Board, the Governance Committee sought out a diverse pool of candidates using multiple sources, engaging a third party search firm and receiving input from directors and stakeholders.

| |||||

| 3 EVALUATION OF CANDIDATES

| ||||||

|

The Governance Committee evaluated candidates based on its set priorities, and the candidates’ qualifications, independence, diversity, biographical information and references. A diverse slate of candidates were invited to interview with the Governance Committee and select members of management.

| |||||

| 4 RECOMMEND NEW DIRECTOR NOMINEE TO THE BOARD

| ||||||

|

Through this process, the Governance Committee identified a number of qualified director candidates and ultimately decided to select two candidates who together represented multi-faceted experience in the areas of finance, audit, and board level strategy and made a recommendation to the Board. The Board then nominated Messrs. Juan Figuereo and Bryan Segedi for election by a vote of the shareholders. The Governance Committee initially learned of Mr. Figuereo through a search firm and Mr. Segedi through a non-management director.

| |||||

| 5 INTRODUCING OUR NEW DIRECTOR NOMINEES

| ||||||

|

Juan Figuereo Venture Partner Ocean Azul Partners

Get to Know • Former Chief Financial Officer of Revlon, Inc. and other large publicly held companies. • Former Board Member of PVH Corp. Inc., a Fortune 500 Company. • Extensive Mergers & Acquisitions experience, including as Vice President of Mergers & Acquisitions for Wal-Mart International. • Fluent in Portuguese & Spanish.

|

Bryan Segedi Board Member Conway Mackenzie

Get to Know • Former Deputy Global Vice Chair of Ernst & Young. • Executive in Residence at Arizona State University. • Extensive experience as an external auditor of major public financial institutions worldwide.

| ||||

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 5

| CORPORATE GOVERNANCE | ||||||||||||||||

DIRECTOR SELECTION PROCESS

Shareholder Recommendations for Nominees

The Governance Committee will consider nominees for directors recommended by stockholders. A stockholder wishing to recommend a director candidate for consideration by the Committee should send such recommendation to the Company’s Corporate Secretary at the address shown on the cover page of this proxy statement, who will then forward it to the Governance Committee. Any such recommendation should include the following minimum information for each director nominee: full name, address and telephone number, age, a description of the candidate’s qualifications for service on the Board of Directors (such as principal occupation and directorships on publicly-held companies during the past five years), the candidate’s written consent to be considered for nomination and to serve if nominated and elected, and the number of shares of Company common stock owned, if any. A stockholder who wishes to nominate an individual as a director candidate at the annual meeting of stockholders, rather than recommend the individual to the Governance Committee as a nominee, must comply with certain advance notice requirements. See “Stockholder Proposals for the 2021 Annual Meeting” on page 71 for more information on these procedures.

If the Governance Committee receives a director nomination from a stockholder or group of stockholders who (individually or in the aggregate) beneficially own greater than 5% of the Company’s outstanding voting stock for at least one year as of the date of such recommendation, the Company, as required by applicable securities law, will identify the candidate and stockholder or group of stockholders recommending the candidate and will disclose in its proxy statement whether the Governance Committee chose to nominate the candidate, as well as certain other information.

Except for Messrs. Figuereo and Segedi, all of the nominees standing for election to the Company’s Board of Directors at this year’s Annual Meeting are current directors. The Governance Committee and the Board of Directors believe that all the nominees satisfy the above described director standards. Accordingly, all of such nominees were approved for election by the Board of Directors, based in part on the recommendation of the Governance Committee. With respect to this year’s Annual Meeting, no nominations for directors were received from stockholders.

6 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

The Company’s Bylaws provide that the Board of Directors will consist of not less than eight or more than seventeen directors. The Board of Directors from time to time may fix the number of directors within these limits. While the Bylaws allow for seventeen directors, at this time, the Governance Committee considers eleven to fourteen directors to be the ideal size for the Company’s Board of Directors. James E. Nave, D.V.M., a current director of the Company, has not been nominated for re-election to the Board of Directors at the Company’s 2020 Annual Meeting; however, the Board of Directors has nominated Messrs. Figuereo and Segedi in addition to the twelve directors standing for re-election. Accordingly, effective as of the date of the Annual Meeting, the Board of Directors will set the number of directors at fourteen. At the Annual Meeting, the directors will be elected to serve for one-year terms.

Information regarding each of the Company’s director nominees is set forth below. All ages are provided as of December 31, 2019.

Information as to Director Nominees

The Board of Directors has nominated the individuals listed below to be elected as directors at the Annual Meeting. See “Items of Business To Be Acted On At The Meeting – Proposal No. 1 Election of Directors” on page 29. Each of the Company’s current directors also serves a director of the Company’s wholly owned bank subsidiary, Western Alliance Bank. In connection with his or her(re-)election to the Company’s Board of Directors, these nominees will also be (re-)elected to the board of Western Alliance Bank.

BRUCE BEACH, C.P.A.

| ||||

|

CHAIRMAN BeachFleischman PC

Age:70 Director since:2005 Lead Independent Director since:2010 Audit Committee Financial Expert |

Committee Membership:

• Audit Committee

• Nominating and Corporate Governance

| ||

Qualifications:

| • | Financial expert with over 45 years of experience in public accounting. |

| • | Executive management experience. |

| • | Knowledge of the Southern Arizona market and business environment. |

Biographical Information:

| • | Chairman, BeachFleischman PC, an accounting and business advisory firm in Southern Arizona, since May 1991. |

| • | Chief Executive Officer, BeachFleischman PC, from 1991 to 2015. |

| • | Board member, Arizona State Board of Accountancy, since his gubernatorial appointment in July 2018. |

| • | Board member and former Chairman, Southern Arizona Leadership Council. |

| • | Former Chairman, Vice-Chairman, and Audit Committee Chairman, Carondelet Health Network, one of the largest hospital systems in Southern Arizona. |

Education:

| • | B.S., Business Administration, University of Arizona |

| • | M.B.A., University of Arizona |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 7

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD COMPOSITION

JUAN FIGUEREO, C.P.A.

| ||||

|

VENTURE PARTNER Ocean Azul Partners

Age:64 Director Nominee |

Committee Membership:

N/A

| ||

Qualifications:

| • | Executive management experience, including service as the Chief Financial Officer of several publicly traded companies. |

| • | Public company board experience, including serving as the Audit and Risk Management Committee Chair of a fortune 500 company. |

| • | Proven driver of strategic direction and growth throughout his career in finance and accounting. |

Biographical Information:

| • | Venture Partner, Ocean Azul Partners, an early stage investment fund based in Florida, since 2018. |

| • | Board Member, Deckers Outdoor Corporation since March 2020. |

| • | Board Member, Florida International University Foundation since 2015. |

| • | Board Member and Chair of the Audit and Risk Management Committee, PVH Corp. Inc. from 2011 through 2020. |

| • | Executive Vice President & Chief Financial Officer, Revlon, Inc. from April 2016 to June 2017. |

| • | Executive Vice President & Chief Financial Officer, NII Holdings, Inc. from 2012 to 2015. |

| • | Executive Vice President & Chief Financial Officer, Newell Rubbermaid from 2009 to 2012. |

| • | Executive Vice President & Chief Financial Officer, Cott Corporation Inc. from 2007 to 2009. |

| • | Vice President Mergers & Acquisitions, Wal-Mart International from 2003 to 2007. |

| • | Vice President and Managing Director, Frito Lay Dominicana from 2000 to 2003, prior to which Mr. Figuereo served as Vice President, Business Integration of Frito Lay Europe from 1999-2000, and Vice President and Chief Financial Officer of Frito Lay South Europe from 1997-1999. |

| • | Vice President & Chief Financial Officer, Pepsi-Cola Bottling from 1996 to 1997, prior to which Mr. Figuereo served as Vice President and Chief Financial Officer of Pepsi-Cola Latin America from 1994-1996, at which time he also served as a Board Member for Grupo Embotelladoras Unidas (BMV: CULTIBAB) and Buenos Aires Embotelladoras (Formerly NYSE: BAE). Mr. Figuereo also served in a number of other key accounting and finance positions for Pepsi-Cola from 1988-1994. |

| • | Senior Audit Manager, Arthur Andersen & Company from 1981 to 1988. |

Education:

| • | B.B.A., Public Accounting, Florida International University |

8 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

HOWARD GOULD

| ||||

|

FORMER VICE CHAIRMAN CCFW, Inc. dba Carpenter & Company

Age:70 Director since:2015 |

Committee Membership:

• Risk Committee (Chair)

• Nominating and Corporate Governance

| ||

Qualifications:

| • | Experience in management at large financial institutions. |

| • | Understanding of bank regulatory framework as a former Commissioner of California’s bank regulatory agency. |

| • | Knowledge of risk management within the banking industry, including the risks presented by the information security landscape. |

Biographical Information:

| • | Vice Chairman, Carpenter and Company and Managing Partner, Carpenter Community BancFunds from 2005 until it’s dissolution in 2019. |

| • | Director, Bridge Capital Holdings, from 2009 until it merged into Western Alliance Bank in June of 2015. |

| • | California Commissioner of Financial Institutions under Governor Arnold Schwarzenegger from 2004 to 2005. |

| • | Vice Chairman, Bank of the West, from 2002 to 2003. |

| • | Vice Chairman and Chief Operating Officer, United California Bank, from 1992 until its acquisition by Bank of the West. |

| • | Managing Partner, The Secura Group, a nationwide financial services consultancy, prior to 1992. |

| • | Superintendent of Banks for the State of California under Governor George Deukmejian from 1983 to 1989. |

| • | Retail Banking, Bank of America, prior to 1983. |

| • | Statewide Corporate Public Affairs, Wells Fargo Bank, prior to 1983. |

Education:

| • | B.S., Business Administration, San Jose State University |

| • | M.B.A., California State University |

STEVEN HILTON

| ||||

|

CHIEF EXECUTIVE OFFICER Meritage Homes Corporation

Age:58 Director since:2002 |

Committee Membership:

• Finance and Investment Committee

| ||

Qualifications:

| • | Public company expertise. |

| • | Executive management and leadership experience. |

| • | Risk identification and assessment skills. |

| • | Considerable knowledge of the national real estate market. |

Biographical Information:

| • | Co-founder, Chairman and Chief Executive Officer, Meritage Homes Corporation, a publicly traded home building company listed on the NYSE. Mr. Hilton originally founded Monterey Homes, in 1985, which became publicly traded and combined with Legacy Homes in 1997, which thereafter became Meritage Homes Corporation. |

| • | Member, NAHB’s High Production Home Builders Council. |

| • | Board Member, Boys & Girls Clubs of Greater Scottsdale. |

Education:

| • | B.S., Accounting, University of Arizona |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 9

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD COMPOSITION

MARIANNE BOYD JOHNSON

| ||||

|

VICE CHAIRMAN, EXECUTIVE VICE PRESIDENT AND CHIEF DIVERSITY OFFICER Boyd Gaming Corporation

Age:61 Director since:1995 (founding) |

Committee Membership:

• Compensation Committee

• Nominating and Corporate Governance

| ||

Qualifications:

| • | Executive experience in the highly regulated gaming industry. |

| • | Knowledge of the Nevada economy and other geographically unique markets. |

| • | Considerable public company experience, and bank board experience. |

Biographical Information:

| • | Board Member, Boyd Gaming Corporation, since 1992. |

| • | Vice Chairman, Executive Vice President and Chief Diversity Officer, Boyd Gaming Corporation, since February 2001, with the position of Chief Diversity Officer added in 2019 and Executive Vice President in 2008. |

| • | Executive Vice President, Boyd Gaming Corporation, since January 2008. |

| • | Senior Vice President, Boyd Gaming Corporation, from December 2001 until December 2007. Ms. Johnson has served Boyd Gaming since 1977 in a variety of capacities, including sales and marketing. |

| • | Director, Nevada Community Bank until its sale to First Security Bank (Wells Fargo) in 1993. |

ROBERT LATTA

| ||||

|

SENIOR OF COUNSEL Wilson Sonsini Goodrich & Rosati, PC

Age:65 Director since:2015 |

Committee Membership:

• Audit Committee

• Compensation Committee

| ||

Qualifications:

| • | Public company board and audit committee experience. |

| • | Broad background in corporate and transactional matters, including company formations, venture capital financings, public offerings, and mergers and acquisitions. |

| • | In depth exposure to technology companies. |

| • | Significant corporate finance experience and familiarity with corporate governance matters. |

Biographical Information:

| • | Senior Of Counsel, Wilson Sonsini Goodrich & Rosati, one of the nation’s leading technology and growth business law firms, since 2020, prior to which he served as a Senior Partner, and where he has worked since 1979 and has served as a member of various firm management committees. |

| • | Director, Bridge Capital Holdings, from 2004 until it merged into the Company in June of 2015. |

Education:

| • | B.A., Economics, Stanford University |

| • | J.D., Stanford University |

10 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

TODD MARSHALL

| ||||

|

PRESIDENT Marshall Management Company

Age:63 Director since:1995 (founding) |

Committee Membership:

• Compensation Committee

• Finance and Investment Committee

| ||

Qualifications

| • | Leadership experience. |

| • | Knowledge of the Las Vegas retail market and community. |

| • | Experience in the highly regulated gaming industry. |

| • | Marketing and branding expertise. |

Biographical Information

| • | Owner and President, Marshall Management Co., a real estate investment and property management company in Las Vegas. |

| • | Director, Marshall Retail Group, which owns and operates stores in more than 140 locations, primarily in major casino-hotels in Nevada, Mississippi, and New Jersey, from May 1976 to 2015. |

| • | Chairman, Marshall Retail Group, until 2014. |

| • | Board Member, Consumer Health Services, from July 2007 to July 2012. |

| • | Chief Operating Officer, Consumer Health Services, from March 2011 to March 2012. |

| • | Former Chief Executive Officer, Marshall Retail Group. |

ADRIANE MCFETRIDGE

| ||||

|

DIRECTOR OF ENGINEERING— SUBSCRIPTION PLATFORM Netflix Director since:2019 Age:49 |

Committee Membership:

• Risk Committee | ||

Qualifications

| • | Technology professional with domestic and international experience working with leading edge technology companies. |

| • | Strategic and tactical experience focused on leveraging technology to expand the business footprint. |

| • | Knowledge of ecommerce, payment solutions, data mining and analytics. |

Biographical Information

| • | Director of Engineering—Subscription Platform, Netflix, since May 2017. |

| • | Member of the Advisory Council of the Computer Science Department of the University of Texas since 2016. |

| • | Vice President—Payment Software Services, Verifone, from 2015 to 2016. |

| • | Director of Product Management, StubHub, from 2014 to 2015. |

| • | Director of Cross Border Trade, Ebay, from 2012 to 2014, prior to which Ms. McFetridge served as Chief of Staff to the CEO from 2011 to 2012, and as Director, Quality Assurance from 2002-2007. |

| • | Director of Quality Operations, PayPal, from 2009 to 2011. |

| • | Chief Technology Officer, Tradera AB, an Ebay, Inc. company located in Stockholm, Sweden, from 2007 to 2009. |

| • | Various management and engineering positions at Nortel Dasa and Bell Northern Research. |

Education:

| • | B.S., Computer Science, University of Texas |

| • | M.B.A., Alliance Manchester Business School |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 11

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD COMPOSITION

MICHAEL PATRIARCA

| ||||

|

RETIRED BANK REGULATOR Age:69 Director since:2016 |

Committee Membership:

• Audit Committee (Chair)

• Risk Committee | ||

Qualifications

| • | Bank regulatory experience. |

| • | Leadership experience gained at various large financial institutions. |

| • | Management expertise in bank audit matters. |

| • | Career financial services executive with diverse experience in the banking industry. |

Biographical Information

| • | Managing Director, Promontory Financial Group, a premier financial services consulting firm, where he advised large financial institutions on risk management, audit, compliance, governance and a broad range of regulatory issues from 2009 to 2014, prior to which he served as a consultant from 2005 to 2008. |

| • | Global Head of Risk Management and Audit, Visa International, from 1999 to 2005. |

| • | General Auditor, Wells Fargo Bank, where he also held several key executive positions in the areas of audit, security, compliance, and risk management from 1992 to 1999. |

| • | Senior Regulatory Roles, Office of the Comptroller of the Currency and the Office of Thrift Supervision, with over 16 years of government service. |

Education:

| • | B.A., History, University of California-Davis |

| • | J.D., Santa Clara University School of Law |

| • | L.L.M., Administrative Law/Economic Regulation, The George Washington University Law School |

12 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

ROBERT SARVER, C.P.A.

| ||||

|

EXECUTIVE CHAIRMAN Western Alliance Bancorporation

Age:58 Director since:2002 |

Committee Membership:

N/A

| ||

Qualifications

| • | Experience in banking, real estate and executive management. |

| • | Track record as a successful leader and entrepreneur in the Southwest, where the Company operates. |

| • | Deep knowledge of the Company’s business and operations. |

Biographical Information

| • | Executive Chairman, Western Alliance Bancorporation, since April 2018, prior to which Mr. Sarver served as Chairman and Chief Executive Officer from December 2002 until April 2018. |

| • | Managing Partner, Phoenix Suns NBA basketball team. |

| • | Director, Sarver Heart Center at the University of Arizona. |

| • | Part Owner, Real Club Deportivo Mallorca, S.A.D., a Spanish professional soccer club. |

| • | Founder and Managing Principal, Southwest Value Partners Enterprises (“SVP”). |

| • | Director, Meritage Homes Corporation, until May 2019. |

| • | Director, Skywest Airlines, from 2000 to 2015. |

| • | Director and Credit Committee Member, Zions Bancorporation, from 1995 to 2001. |

| • | Executive Vice President, Zions Bancorporation, from June 1998 to March 2001. |

| • | Chairman and CEO, California Bank and Trust, from June 1998 to March 2001. |

| • | Lead Investor and Chief Executive Officer, GB Bancorporation, the former parent company of Grossmont Bank, from 1995 to 1997. |

| • | Founder and President, National Bank of Arizona, from 1984 until the bank’s time of sale in 1994 to Zions Bancorporation. |

Education:

| • | B.S., Business Administration, University of Arizona |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 13

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD COMPOSITION

BRYAN SEGEDI, C.P.A.

| ||||

|

CONWAY MACKENZIE Board Member

Age:60 Director Nominee |

Committee Membership:

N/A

| ||

Qualifications

| • | Over 30 years in public accounting at a big four firm, with senior positions held both domestically and globally. |

| • | Executive management experience of a global enterprise where he led the largest service line thereof consisting of over 77,000 professionals with $12 billion in revenue. |

| • | Private board experience, with expertise implementing strategic and growth initiatives. |

Biographical Information

| • | Board Member, Conway Mackenzie, since 2018. |

| • | Executive in Residence, Arizona State University, since 2015. |

| • | Vice Chair of the Board of Trustees, Alma College, since 2015 |

| • | Deputy Global Vice Chair, Ernst & Young, LLP, from 2012 to 2015, prior to which Mr. Segedi served as Advisory Global Markets Leader from 2010-2012, as Americas Vice Chair from 2006-2010, as Vice Chair, North Central Region from 2000-2006, and in various other leadership positions having initially joined the firm in 1982. |

| • | Internal Auditor, First National Bank of Chicago, from 1981 to 1982. |

Education:

| • | B.A., Business Administration, Alma College |

| • | M.B.A., Management, Northwestern University |

14 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

DONALD SNYDER

| ||||

|

CHAIRMAN The Smith Center for the Performing Arts

Age:72 Director since:1997(founding) |

Committee Membership:

• Nominating and Corporate Governance

• Risk Committee

| ||

Qualifications

| • | Experience serving on boards of numerous industry and community organizations. |

| • | Understanding of the Company’s business, history and organization. |

| • | Extensive leadership skills, banking and regulatory expertise and management experience. |

Biographical Information

| • | Dean, William F. Harrah College of Hotel Administration at the University of Nevada Las Vegas from June 2010 to June 2013; Executive Dean for Strategic Development from June 2013 to January 2014; President from February 2014 to January 2015; Presidential Advisor for Strategic Initiatives from January 2015 to January 2016; and Presidential Advisor in a voluntary capacity for University of Nevada Las Vegas until 2019. |

| • | Chairman, The Smith Center for the Performing Arts. |

| • | Director, Compensation Committee Chairman, Corporate Governance and Nominating Committee Member, Tutor Perini Corporation, one of the largest general contractors in the United States, publicly traded on the NYSE, from 2008 through May 2019. |

| • | Director, Nominating and Corporate Governance Committee Chairman, and Compensation Committee Member, Switch, Inc., a publicly traded data center developer and operator. |

| • | Director, NV Energy, from 2005 to 2013. |

| • | President, Boyd Gaming Corporation, from January 1997 to March 2005, having joined the company’s board of directors in April 1996 and its management team in July 1996. |

| • | Co-Founder, Western Alliance Bancorporation, through the establishment of Bank of Nevada, the Company’s first bank subsidiary (f/k/a BankWest Nevada). |

| • | President and CEO, Fremont Street Experience LLC, a private/public partnership formed to develop and operate a major redevelopment project in Downtown Las Vegas, from 1992 to July 1996. |

| • | Chairman of the board of directors and CEO, First Interstate Bank of Nevada, then Nevada’s largest full-service bank, from 1987 to 1991. During his 22 years with First Interstate Bank from 1969 to 1991, Mr. Snyder served in various management positions in retail and corporate banking, as well as international and real estate banking. |

Education:

| • | B.S. Business Administration, University of Wyoming |

| • | Graduate School of Credit & Financial Management, Stanford University |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 15

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD COMPOSITION

SUNG WON SOHN, PH.D.

| ||||

|

PROFESSOR OF FINANCE & ECONOMICS Loyola Marymount University

Age:75 Director since:2010 |

Committee Membership:

• Finance and Investment Committee (Chair)

• Audit Committee

| ||

Qualifications

| • | Economic forecasting experience and abilities. |

| • | Management experience in the banking industry, including at one of the largest banks in the country. |

| • | �� | Knowledge of the Southern California market. |

Biographical Information

| • | Professor of Finance & Economics, Loyola Marymount University, beginning in 2019. |

| • | Commissioner, Los Angeles City Employees Retirement System (LACERS) Board of Administration. |

| • | Board Member, National Association of Corporate Directors Southern California. |

| • | Former Smith Professor of Economics and Finance, California State University. |

| • | Former Vice Chairman, Forever 21, a multi-national retailer. |

| • | President and Chief Executive Officer of Hanmi Financial Corporation, a commercial bank in Los Angeles, California, from 2005 to 2007. |

| • | Executive Vice President and Chief Economic Officer, Wells Fargo Bank, from 1998 to 2005. |

| • | Senior Economist, the President’s Council of Economic Advisors in the White House, prior to 1974. |

| • | Tenured Professor, Pennsylvania State University System, prior to his time at the White House. |

| • | Author of two books, Global Financial Crisis and Exit Strategy and The New Economy. |

| • | Prior Board Member, Port of Los Angeles, First California Bank, Foreign Affairs Council of Los Angeles, Children’s Bureau of Los Angeles, Ministers Mutual Life Insurance Company, L.A. Music Center (Performing Arts), Park Nicollet Health Services, The Blake School, Minnesota Community College System, North Memorial Medical Center, Harvard Business School Association of Minnesota, and the American Heart Association of Minnesota. |

Education:

| • | B.S., Economics, University of Florida |

| • | Master’s Degree in Economics, Wayne State University |

| • | Ph.D. in Economics, University of Pittsburgh |

| • | Professional Master’s Degree, Harvard Business School |

| • | Real Estate Finance Certificate, MIT |

16 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD COMPOSITION

KENNETH A. VECCHIONE

| ||||

|

PRESIDENT & CHIEF EXECUTIVE OFFICER Western Alliance Bancorporation

Age:65 Director since:2007 |

Committee Membership:

• Finance and Investment Committee

| ||

Qualifications

| • | Extensive public company experience and strong day-to-day knowledge of the Company. |

| • | Proven executive leadership abilities. |

| • | Impressively diverse banking and financial institution background. |

| • | Multi-faceted Board experience at both public and private companies. |

| • | Solid expertise and deep understanding of the current trends and regulatory issues within the financial services industry, with an understanding of risk management priorities. |

Biographical Information

| • | President and Chief Executive Officer, Western Alliance Bancorporation, since April 1, 2018, after rejoining the company as President in July 2017. Mr. Vecchione assumed the role of President again in October 2019. |

| • | President, Chief Executive Officer, and Director, Encore Capital Group (“Encore”), starting in April 2013, adding the position of Chief Executive Officer as of June 2013 through his June 2017 departure. |

| • | Chairman, Cabot Credit Management, Encore’s largest majority owned international subsidiary, during his time with Encore. |

| • | Chairman of Western Alliance Bank, from January 2014 to December 2015. |

| • | President and Chief Operating Officer, Western Alliance Bancorporation, from April 2010 to April 2013. |

| • | Board Member, Federal Home Loan Bank of San Francisco, from 2012 to 2013. |

| • | Director and Audit Committee Chairman, International Securities Exchange, from 2007 to June 2016. |

| • | Director and Audit Committee Chairman, Affinion Group, until January 2011. |

| • | Chief Financial Officer, Apollo Global Management, LLC, from 2007 to 2010. |

| • | Vice Chairman and Chief Financial Officer and multiple other positions, MBNA Corporation, from 1998 to 2006, with three years in the above listed titles. |

| • | Executive Vice President and Chief Financial Officer, AT&T Universal Card Services, from 1997 to 1998. |

| • | Chief Financial Officer, Citicorp Credit Services, from 1990 to 1994. |

| • | Current Board Member of the Phoenix Symphony. |

Education:

| • | B.A., Accounting, State University of New York at Albany |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 17

| CORPORATE GOVERNANCE | �� | |||||||||||||||

DIRECTOR INDEPENDENCE

The Company’s common stock is traded on the NYSE. The NYSE’s rules require that a majority of directors of NYSE-listed companies be “independent.” For a director to be “independent” under the NYSE’s rules, the Board of Directors must affirmatively determine that the director has no material relationship with the Company, including its subsidiaries, either directly or as a partner, stockholder, or officer of an organization that has a relationship with the Company, and a director must satisfy all categorical standards relating to independence, as set forth in Section 303A of the NYSE Listed Company Manual.

Of the 14 persons nominated for election to the Board of Directors, the Board of Directors affirmatively determined 12 to be independent under NYSE standards. The Board of Directors based these determinations primarily on the recommendations of the Governance Committee, which performed a detailed review of the Company’s internal records and the responses of the directors to questions regarding employment and compensation history, affiliations and family and other relationships, and on discussions with such directors. As part of its review, the Governance Committee considered, among other things, the nature and extent of each director’s business relationships and transactions with the Company, its subsidiaries, and its executive officers and their affiliated business entities, including personal investment activities, professional services, involvement in charitable or non-profit organizations, and those relationships and transactions described in each of the “Certain Transactions with Related Persons” and the “Certain Business Relationships” sections herein, located on page 55.

Based on these factors, the Board of Directors determined that Messrs. Sarver and Vecchione are not independent because both serve as executive officers of the Company. In previous years, the Board of Directors also classified Mr. Hilton as a non-independent director, due in large part to the interlocking directorships created by Mr. Sarver’s service on the Meritage Homes Corporation (“Meritage”) Board of Directors, of which Mr. Hilton serves as Chairman and CEO. However, the Board of Directors re-evaluated Mr. Hilton’s independence following Mr. Sarver’s retirement from the Meritage Board and determined that in the absence of these interlocking directorships, and given Mr. Hilton’s satisfaction of all NYSE categorical standards for independence, Mr. Hilton is now an independent director.

Meetings of the Board of Directors

The Board of Directors held seven meetings in 2019. Each current director attended at least 75% of the meetings of the Board of Directors and meetings of committees on which he or she served in 2019. The Company invites and encourages all of its directors to attend the Company’s annual meetings of stockholders, and all of the directors attended the 2019 annual meeting of stockholders.

Executive sessions of non-management/independent directors (consisting of all directors other than Messrs. Sarver and Vecchione) are periodically scheduled and held during the Company’s quarterly Board of Directors meetings.

18 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

BOARD ROLE IN RISK OVERSIGHT

Under the Company’s governance structure and applicable law, the Board of Directors is ultimately responsible for overseeing the Company’s risk management processes. The Company has adopted a three lines of defense risk management model, and the Board has distributed certain oversight responsibilities to its committees in keeping with the Board’s obligation to oversee and monitor the three lines of defense.

Board of Directors

The first line of defense is primarily evaluated by the full Board, and the Company’s executive officers make reports to the full Board of Directors regarding the risks within their areas of responsibility. Additionally, certain first line areas requiring special attention are delegated to Board Committees for in depth review. The supervision of the second and third lines of defense are described below.

| ||||||||||||||

i

| i

| i

| ||||||||||||

|

|

| ||||||||||||

The Company’s Chief Risk Officer (“CRO”) reports to both the Risk Committee and the Company’s General Counsel. The Company’s CRO oversees periodic company-wide risk assessments and manages the Company’s enterprise risk management program. The CRO chairs the Enterprise Risk Management Committee (“ERMC”), which is composed of many of the Company’s senior executives and subject matter experts. Under its charter, the ERMC meets on a regular basis throughout the year and is responsible for: (1) identifying and prioritizing business and financial risks, consistent with the Company’s Risk Appetite Statement; (2) oversight of business process risk; (3) ensuring that any identified risk control gaps are adequately addressed; and (4) continually improving the Company’s risk management infrastructure. The CRO provides regular reports on ERMC activities to the Risk Committee and the full Board of Directors.

|

The Board has assigned primary oversight for the second line of defense (including the compliance and risk management functions) to the Directors’ Risk Committee (the “Risk Committee”), including credit, concentration, operational, market and information technology risks, among others. The Risk Committee is also responsible for compliance oversight, except where responsibility for compliance with particular laws and regulations have been specifically assigned to a different Board Committee (e.g., compliance with financial reporting regulations, which is overseen by the Audit Committee). The Risk Committee reports regularly to the Board of Directors regarding material matters discussed at meetings of the Risk Committee, as well as the current status of risk and action items. The Risk Committee assists the Board of Directors and its other committees with their risk-related activities, and acts as a resource to management, including the Company’s ERMC.

|

Primary oversight of the third line of defense is assigned to the Audit Committee, which is tasked with oversight of the Company’s audit function and financial reporting. The Audit Committee oversees the evaluation of the adequacy of the Company’s internal controls and its major financial risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee, along with all of the Board Committees, regularly reports to the full Board on their risk management activities.

| ||||||||||||

As discussed above, the Company’s CRO plays a vital role in the Company’s risk management and acts as a key management liaison to the Board’s Risk Committee with respect to risk oversight. In 2019, the Company underwent a search for a highly qualified Chief Risk Officer. Through this process, the Company identified Emily Nachlas as uniquely qualified to lead the Company’s risk management teams. Ms. Nachlas brings nearly 20 years of experience in the financial services industry and most recently served as Executive Vice President and Director of Enterprise Risk Management at IBERIABANK. During her tenure, she developed and had oversight of a comprehensive second line of defense Enterprise Risk Management Framework, was a key member of the mergers and acquisition team and helped drive the strategic risk management vision. In her career she has held previous positions at HSBC, Amegy Bank and Hibernia National Bank, specializing in developing risk management programs.

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 19

| CORPORATE GOVERNANCE | ||||||||||||||||

BOARD ROLE IN RISK OVERSIGHT

Ms. Nachlas holds a B.S. from Tulane University and an M.B.A. from University of New Orleans. The Board believes the addition of Ms. Nachlas not only strengthens the Company’s leadership team, but the Board’s effectiveness in its risk oversight duties.

Finally, because the Board of Directors believes that skilled and well-informed directors are vital to effectively fulfilling the governance responsibilities of the Board of Directors, including oversight of the Company’s risk management processes, it has adopted and implemented a formal Director Training and Education Program.

Non-Employee Director Stock Ownership Guidelines

The Board of Directors adopted Stock Ownership Guidelines for directors and executive officers because it believes that it is important to the Company’s future success that senior management and directors own and hold a minimum number of shares of common stock of the Company in order to further align their interests and actions with the interests of the Company’s stockholders. The Stock Ownership Guidelines require non-employee directors to own a minimum number of shares of the Company’s common stock, which is the number of shares having a value at least equal to five times such director’s annual cash compensation as reported in the Company’s most recent proxy statement, based on a rolling six month average of the Company’s share price. The Stock Ownership Guidelines provide for a transition period of five years during which new directors must achieve full compliance with these requirements. The Stock Ownership Guidelines are administered and enforced by the Governance Committee of the Board of Directors, and compliance is monitored and reported to the Committee by the Company’s General Counsel. Each director is in full compliance with these requirements. Stock Ownership Guidelines for the Company’s executive officers can be found on page 43.

The Company understands that hedging and significant amounts of pledging of Company stock by directors and executive officers may skew the alignment of the interests between Company insiders and Company stockholders. Therefore, the Stock Ownership Guidelines specifically prohibit any hedging or pledging of Company stock held by directors and executive officers. Notwithstanding the foregoing, certain limited exceptions for pledging exist, including (a) shares of Company common stock held in a margin account or pledged as collateral for a loan prior to July 30, 2019, and (b) where the executive or director demonstrates the financial capacity to repay the loans without resorting to the pledged stock, such exception to be granted at the sole discretion of the Governance Committee. Any pledged shares are excluded from required ownership levels, and subject to both individual and collective maximums on Company shares that may be placed in a margin account or otherwise pledged.

Communication with the Board of Directors and its Committees

Any stockholder or other interested person may communicate with the Board of Directors, a specified director (including the Lead Independent Director), the non-management directors as a group, or a committee of the Board of Directors by directing correspondence to their attention, in care of the Corporate Secretary, Western Alliance Bancorporation, One E. Washington Street, Suite 1400, Phoenix, Arizona 85004. Anyone who wishes to communicate with a specific director, the non-management directors only or a specific committee should send instructions asking that the material be forwarded to the appropriate director, group of directors or committee chairman. All communications so received from stockholders or other interested parties will be forwarded to the director or directors designated.

20 WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||||||

COMMITTEES OF THE BOARD OF DIRECTORS

Committees of the Board of Directors

The Company’s Board of Directors has five standing committees:

| • | Audit Committee |

| • | Compensation Committee |

| • | Nominating and Corporate Governance Committee |

| • | Finance and Investment Committee |

| • | Risk Committee |

Information with respect to each of these committees is set forth below.

The Company may appoint additional, or modify existing, committees of the Board of Directors in the future, including ad hoc committees to address items requiring special attention, such as potential merger or acquisition opportunities, and for purposes of complying with all applicable corporate governance rules of the NYSE. Membership information and charter documents for each of the Company’s five committees listed above are available in the Investors Relations section of the Company’s website at www.westernalliancebancorporation.com. For printed copies of the charters, send a request to the Company at One E. Washington Street, Suite 1400, Phoenix, Arizona 85004, Attention: Corporate Secretary.

Board Committee and Membership | Primary Responsibilities | |

Audit Committee

Mr. Patriarca, Chairman Mr. Beach, Financial Expert Mr. Latta Dr. Sohn

All Independent All Financially Literate

11 Meetings during 2019 | • Serve as an independent and objective body and to otherwise assist the Board of Directors in its oversight of (a) the qualifications, independence and performance of the registered public accounting firm employed by the Company, (b) the integrity of the Company’s financial statements, (c) the performance of the Company’s internal audit function, and (d) the Company’s compliance with regulatory, legal and ethical requirements;

• Be directly responsible for the appointment, compensation and oversight of any registered public accounting firm employed by the Company, or other firm, for the purpose of preparing or issuing an audit report or related work;

• Pre-approve all auditing services and non-audit services provided to the Company by the independent auditor;

• Prepare, or direct to be prepared, and review the report required by the proxy rules of the SEC to be included in the Company’s annual proxy statement;

• Support an open avenue of communication among the independent auditor, financial and senior management, internal audit, and the Board of Directors;

• Be directly responsible for the hiring, annual performance evaluation, compensation and oversight of the Chief Audit Executive (“CAE”);

• Support the stature and independence of internal audit by meeting directly with the CAE regarding the internal audit function, organizational concerns, and industry concerns;

• Support internal audit’s budget, staffing, and system relative to the firm’s asset size and complexity and the pace of technological and other changes;

• Review the status of actions recommended by internal audit and external auditors to remediate and resolve material or persistent deficiencies identified by internal audit and findings identified by supervisors;

• Oversee the third line of defense in the Company’s Three Lines of Defense Model;

• Review the independent auditor’s qualifications and independence;

• Oversee the Company’s compliance with the rules and regulations related to the preparation and presentation of financial statements; and

• Provide regular reports to the Board of Directors of the Company and its bank subsidiary.

| |

WESTERN ALLIANCE BANCORPORATION 2020 PROXY STATEMENT 21

| CORPORATE GOVERNANCE | ||||||||||||||||

COMMITTEES OF THE BOARD OF DIRECTORS

Board Committee and Membership | Primary Responsibilities | |

Compensation Committee

Dr. Nave, Chairman Ms. Johnson Mr. Latta Mr. Marshall

All Independent

10 Meetings during 2019 | • Annually review and approve corporate goals and objectives relevant to the CEO’s compensation, assist the Lead Independent Director in the Board of Directors’ evaluation of the CEO’s and Executive Chairman’s performance in light of those goals and objectives, and recommend compensation levels for the CEO to the full Board of Directors;