EARNINGS CALL 4th Quarter 2021 JANUARY 28, 2022

Forward-Looking Statements This presentation contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and operating results, future economic performance and dividends. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and the Company’s subsequent Quarterly Reports on Form 10-Q, each as filed with the Securities and Exchange Commission; the potential adverse effects of unusual and infrequently occurring events such as the COVID-19 pandemic and any governmental or societal responses thereto; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this press release to reflect new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the Company’s press release as of and for the quarter ended December 31, 2021. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 2

4th Quarter 2021 | Financial Highlights Earnings & Profitability Q4-21 Q3-21 Q4-20 Net Income $246.0 $236.9 $193.6 Net Revenue $561.0 $548.5 $338.6 Pre Provision Net Revenue1 $325.9 $317.1 $206.4 EPS – Adjusted1 $2.34 $2.30 $1.93 Net Interest Margin 3.33% 3.43% 3.84% Efficiency Ratio1 41.3% 41.5% 38.2% ROAA 1.69% 1.83% 2.22% ROTCE1 25.8% 26.6% 25.7% Balance Sheet & Capital Total Loans $39,075 $34,802 $27,053 Total Deposits $47,612 $45,283 $31,931 CET1 Ratio 9.1% 8.7% 9.9% TCE Ratio1 7.3% 6.9% 8.6% Tangible Book Value per Share1 $37.84 $34.67 $30.90 Asset Quality Provision for (Recovery of) Credit losses $13.2 $12.3 $(34.2) Net Charge-Offs $1.4 $3.0 $3.9 Net Charge-Offs/Avg. Loans 0.02% 0.04% 0.06% Total Loan ACL/Funded Loans3 0.74% 0.80% 1.17% NPAs2/Total Assets 0.15% 0.17% 0.32% Net Income $246.0 million EPS $2.32 EPS, Adjusted1 $2.34 PPNR1 Growth Q4: $8.8 million 58% YoY ROTCE1 25.8% Loan Growth Q4: $4.3 billion 44% YoY Deposit Growth Q4: $2.3 billion 49% YoY Tangible Book Value PER SHARE1 $37.84 22% YoY NPAs2/ Total Assets 0.15% 3 Dollars in millions, except EPS 1) Non-GAAP income statement metrics have been adjusted to exclude the impact of acquisition and restructure expenses and loss on debt extinguishment. Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Nonperforming assets includes nonaccrual loans and repossessed assets. 3) Ratio includes an allowance for credit losses of $7.2 million as of December 31, 2021 related to an $6.4 billion pool of loans covered under 2 separate credit linked notes. Highlights

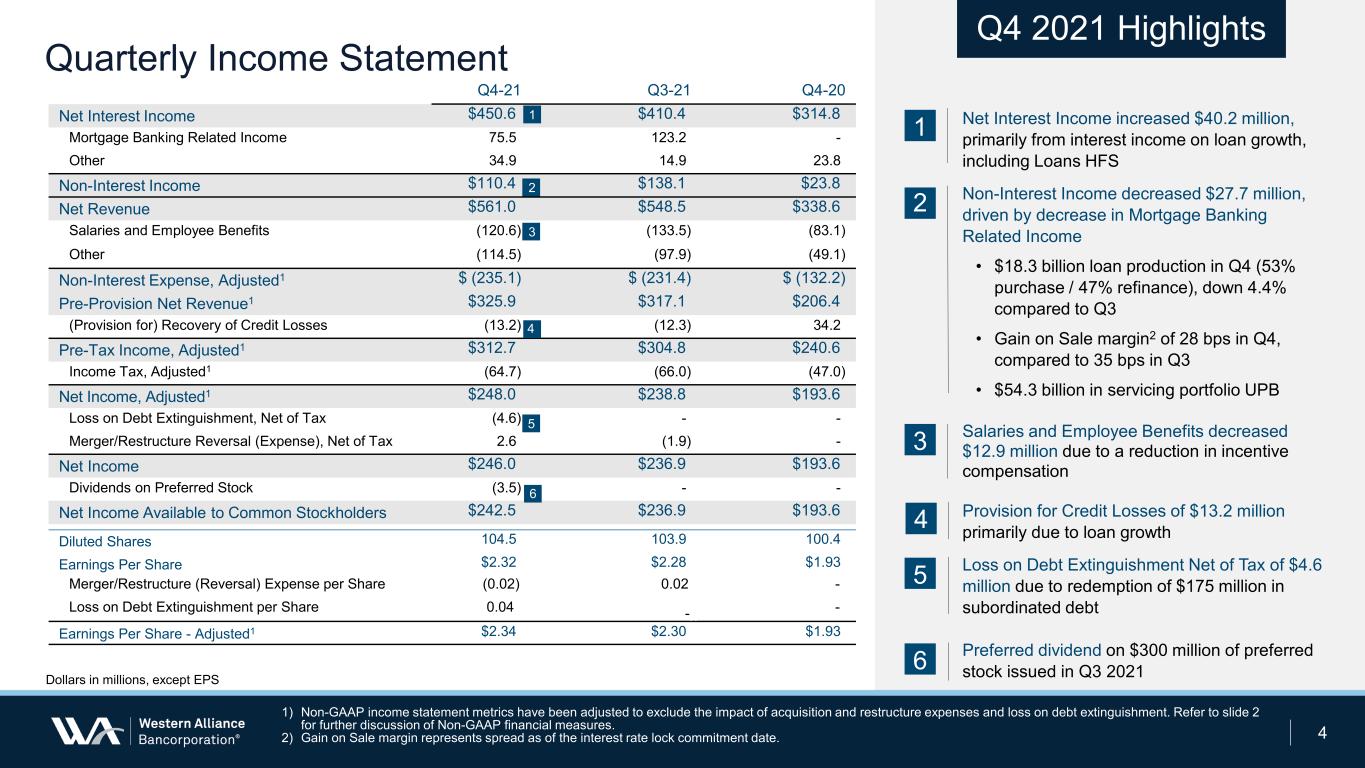

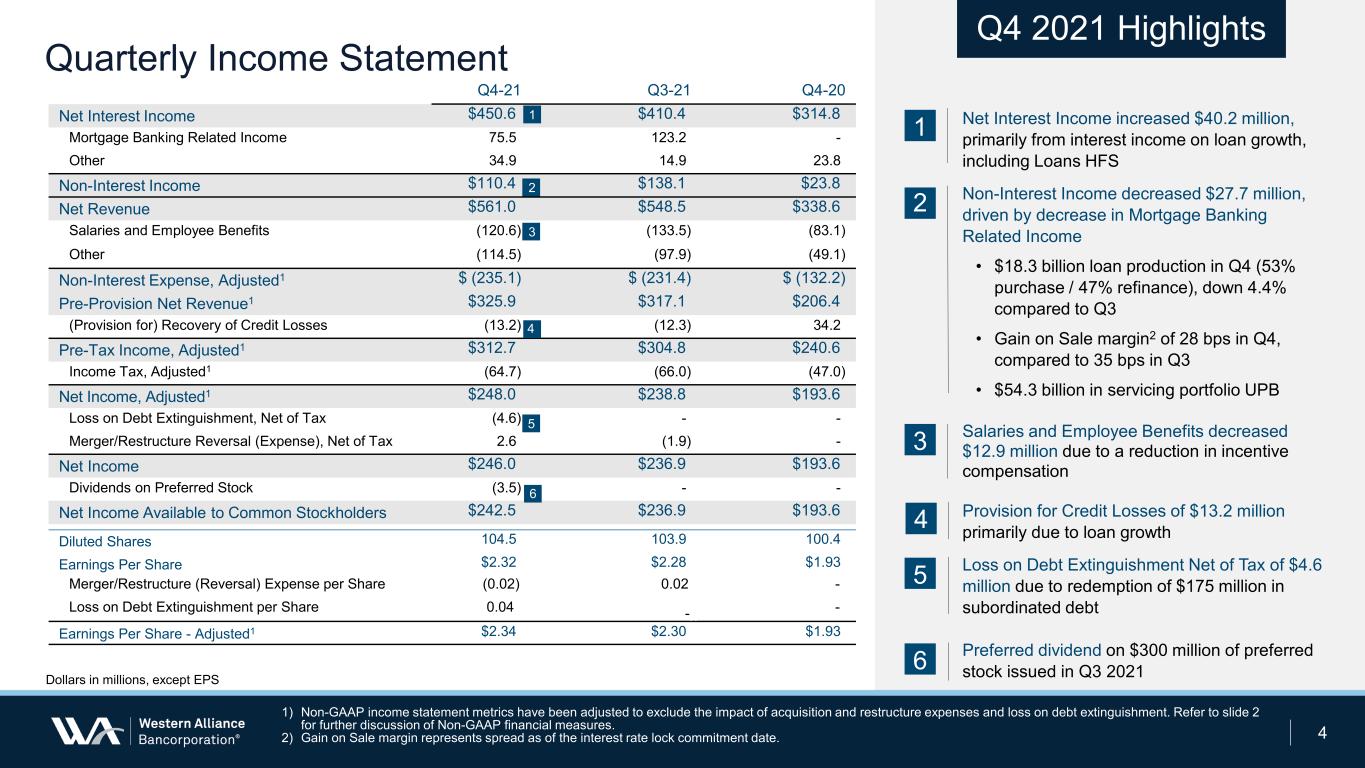

Quarterly Income Statement Net Interest Income increased $40.2 million, primarily from interest income on loan growth, including Loans HFS Non-Interest Income decreased $27.7 million, driven by decrease in Mortgage Banking Related Income • $18.3 billion loan production in Q4 (53% purchase / 47% refinance), down 4.4% compared to Q3 • Gain on Sale margin2 of 28 bps in Q4, compared to 35 bps in Q3 • $54.3 billion in servicing portfolio UPB Salaries and Employee Benefits decreased $12.9 million due to a reduction in incentive compensation Provision for Credit Losses of $13.2 million primarily due to loan growth Loss on Debt Extinguishment Net of Tax of $4.6 million due to redemption of $175 million in subordinated debt Preferred dividend on $300 million of preferred stock issued in Q3 2021 4 1 2 3 Dollars in millions, except EPS Q4 2021 Highlights 1) Non-GAAP income statement metrics have been adjusted to exclude the impact of acquisition and restructure expenses and loss on debt extinguishment. Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Gain on Sale margin represents spread as of the interest rate lock commitment date. 5 4 Q4-21 Q3-21 Q4-20 Net Interest Income $450.6) $410.4) $314.8) Mortgage Banking Related Income 75.5) 123.2) -) Other 34.9) 14.9) 23.8) Non-Interest Income $110.4) $138.1) $23.8) Net Revenue $561.0) $548.5) $338.6) Salaries and Employee Benefits (120.6) (133.5) (83.1) Other (114.5) (97.9) (49.1) Non-Interest Expense, Adjusted1 $ (235.1) $ (231.4) $ (132.2) Pre-Provision Net Revenue1 $325.9) $317.1) $206.4) (Provision for) Recovery of Credit Losses (13.2) (12.3) 34.2) Pre-Tax Income, Adjusted1 $312.7) $304.8) $240.6) Income Tax, Adjusted1 (64.7) (66.0) (47.0) Net Income, Adjusted1 $248.0) $238.8) $193.6) Loss on Debt Extinguishment, Net of Tax (4.6) -) -) Merger/Restructure Reversal (Expense), Net of Tax 2.6) (1.9) -) Net Income $246.0) $236.9) $193.6) Dividends on Preferred Stock (3.5) -) -) Net Income Available to Common Stockholders $242.5) $236.9) $193.6) Diluted Shares 104.5) 103.9) 100.4) Earnings Per Share $2.32) $2.28) $1.93) Merger/Restructure (Reversal) Expense per Share (0.02) 0.02 - Loss on Debt Extinguishment per Share 0.04 -)) - Earnings Per Share - Adjusted1 $2.34) $2.30) $1.93) 1 3 5 4 2 6 6

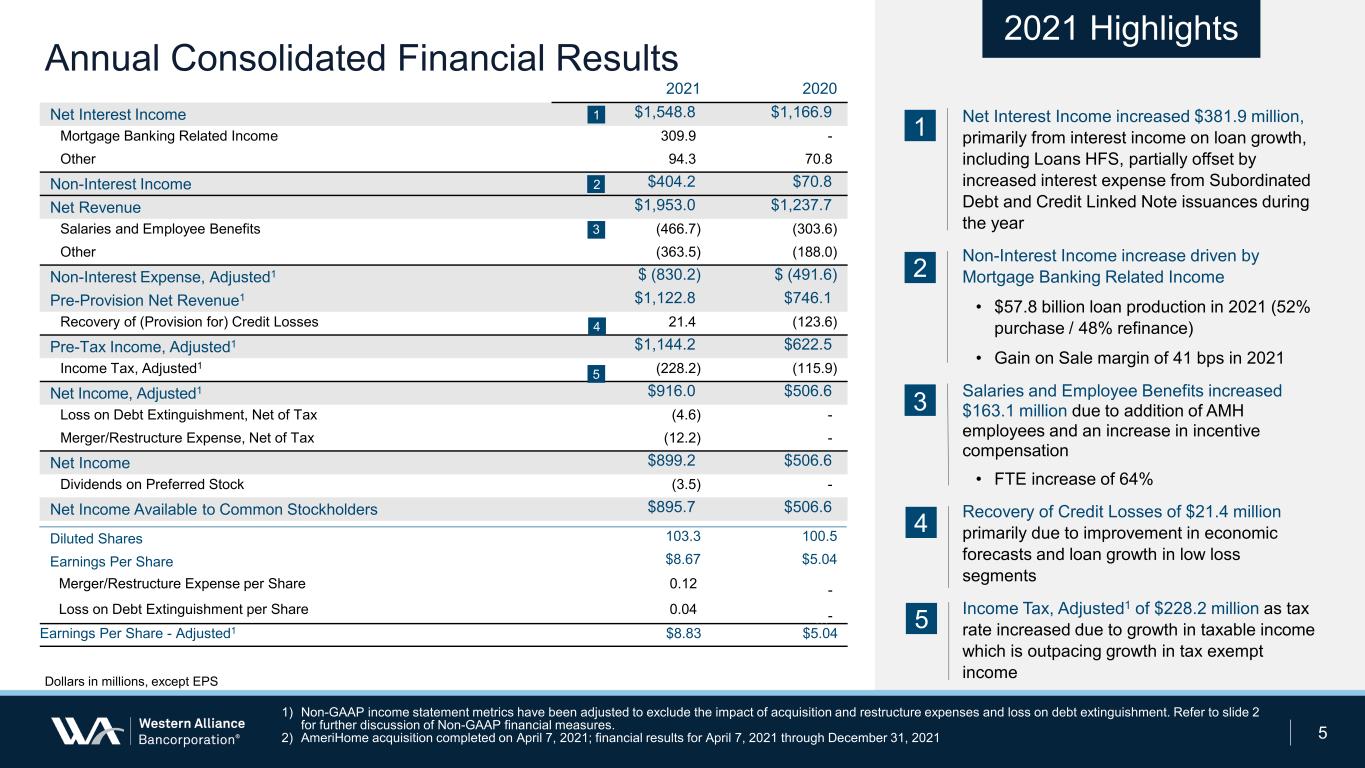

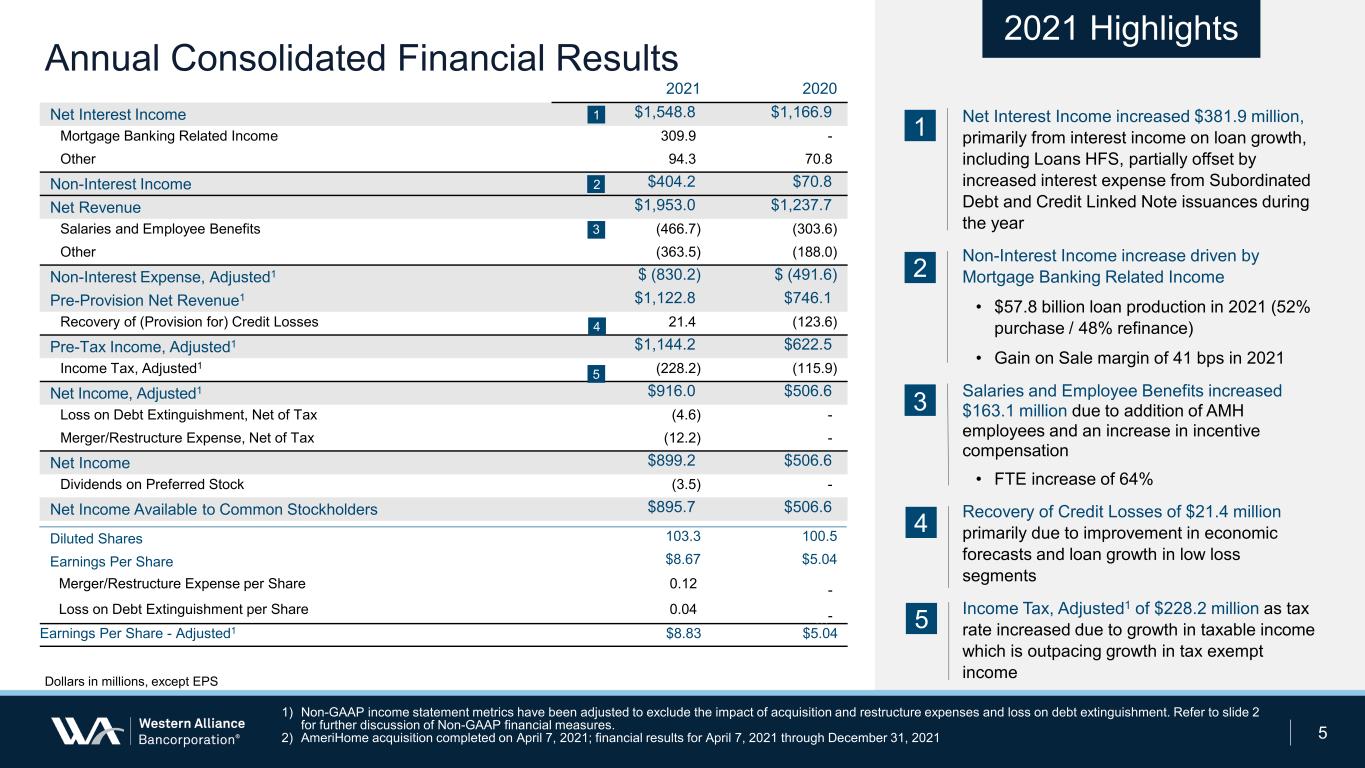

Annual Consolidated Financial Results Net Interest Income increased $381.9 million, primarily from interest income on loan growth, including Loans HFS, partially offset by increased interest expense from Subordinated Debt and Credit Linked Note issuances during the year Non-Interest Income increase driven by Mortgage Banking Related Income • $57.8 billion loan production in 2021 (52% purchase / 48% refinance) • Gain on Sale margin of 41 bps in 2021 Salaries and Employee Benefits increased $163.1 million due to addition of AMH employees and an increase in incentive compensation • FTE increase of 64% Recovery of Credit Losses of $21.4 million primarily due to improvement in economic forecasts and loan growth in low loss segments Income Tax, Adjusted1 of $228.2 million as tax rate increased due to growth in taxable income which is outpacing growth in tax exempt income 5 1 2 3 Dollars in millions, except EPS 2021 Highlights 1) Non-GAAP income statement metrics have been adjusted to exclude the impact of acquisition and restructure expenses and loss on debt extinguishment. Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) AmeriHome acquisition completed on April 7, 2021; financial results for April 7, 2021 through December 31, 2021 4 2021 2020 Net Interest Income $1,548.8) $1,166.9) Mortgage Banking Related Income 309.9) -) Other 94.3) 70.8) Non-Interest Income $404.2) $70.8) Net Revenue $1,953.0) $1,237.7) Salaries and Employee Benefits (466.7) (303.6) Other (363.5) (188.0) Non-Interest Expense, Adjusted1 $ (830.2) $ (491.6) Pre-Provision Net Revenue1 $1,122.8) $746.1) Recovery of (Provision for) Credit Losses 21.4) (123.6) Pre-Tax Income, Adjusted1 $1,144.2) $622.5) Income Tax, Adjusted1 (228.2) (115.9) Net Income, Adjusted1 $916.0) $506.6) Loss on Debt Extinguishment, Net of Tax (4.6) -) Merger/Restructure Expense, Net of Tax (12.2) -) Net Income $899.2) $506.6) Dividends on Preferred Stock (3.5) -) Net Income Available to Common Stockholders $895.7) $506.6) Diluted Shares 103.3 100.5 Earnings Per Share $8.67 $5.04 Merger/Restructure Expense per Share 0.12 (((- Loss on Debt Extinguishment per Share 0.04 (((- Earnings Per Share - Adjusted1 $8.83)) $5.04)) 1 3 4 2 5 5

Total Investments and Yield Interest Bearing Deposits and Cost Loans and HFI Yield Deposits, Borrowings & Cost of Liability Funding Net Interest Drivers 6 • Loan yields decreased 25 bps following continued mix shift into residential loans and lower yields across most loan types • Yield on Loans Held for Sale of 3.04%, decreased from 3.35% in Q3 • Cost of interest-bearing deposits decreased 1 bps, and total cost of funds decreased 3 bps to 0.25% due to lower cost on short-term borrowings and redemption of subordinated debt $18.5 $20.9 $21.8 $24.2 $26.3 $13.4 $17.5 $20.1 $21.1 $21.3 0.22% 0.19% 0.27% 0.28% 0.25% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 $18.5 $20.9 $21.8 $24.2 $26.3 0.25% 0.22% 0.22% 0.21% 0.20% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 $5.5 $7.9 $7.8 $7.7 $7.5 2.61% 2.37% 2.47% 2.46% 2.51% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Non-Interest Bearing Deposits Total Borrowings Q4 2021 Highlights $27.1 $28.7 $30.0 $34.8 $39.1 $5.6 4.67% 4.59% 4.48% 4.28% 4.03% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Loans Loans, HFS $4.5 $6.5 Interest Bearing DepositsInterest Bearing Deposits Dollars in billions, unless otherwise indicated Total Investments

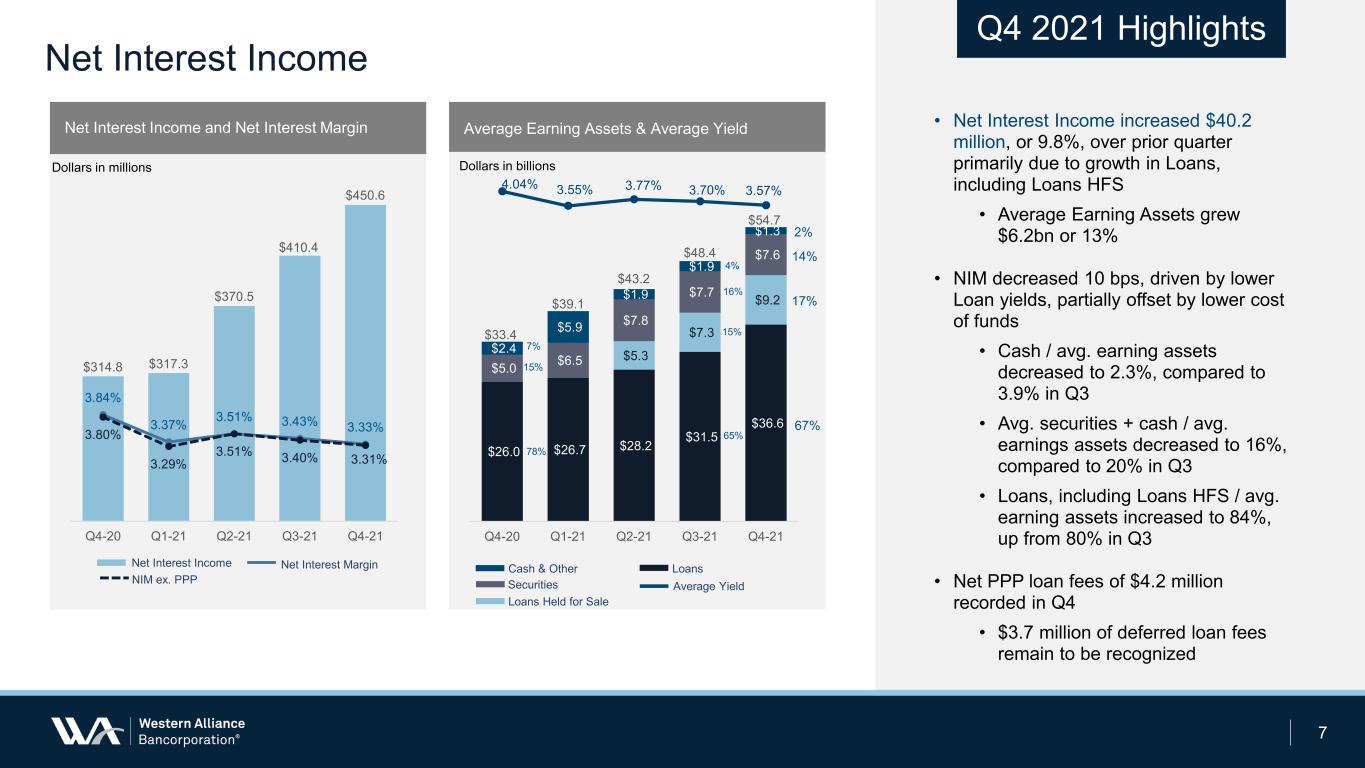

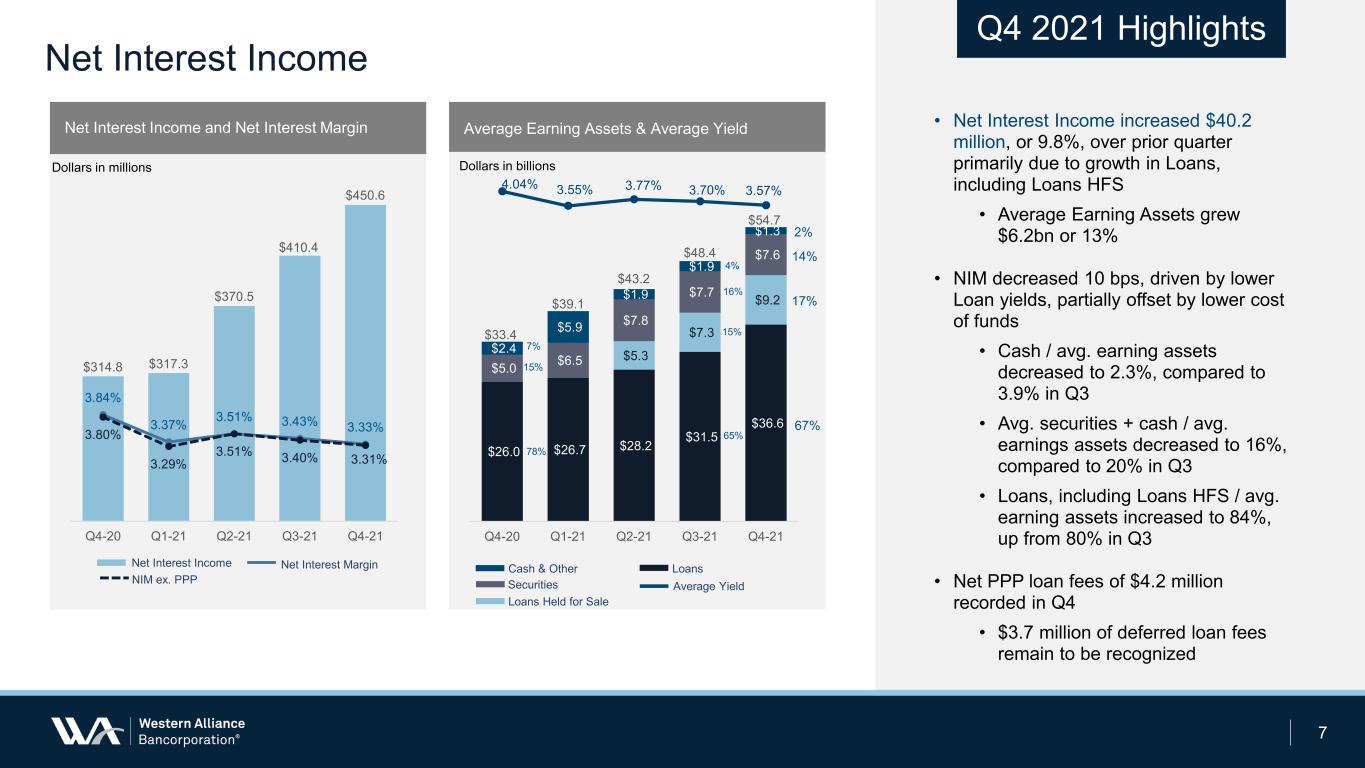

$314.8 $317.3 $370.5 $410.4 $450.6 3.84% 3.37% 3.51% 3.43% 3.33%3.80% 3.29% 3.51% 3.40% 3.31% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Net Interest Income 7 • Net Interest Income increased $40.2 million, or 9.8%, over prior quarter primarily due to growth in Loans, including Loans HFS • Average Earning Assets grew $6.2bn or 13% • NIM decreased 10 bps, driven by lower Loan yields, partially offset by lower cost of funds • Cash / avg. earning assets decreased to 2.3%, compared to 3.9% in Q3 • Avg. securities + cash / avg. earnings assets decreased to 16%, compared to 20% in Q3 • Loans, including Loans HFS / avg. earning assets increased to 84%, up from 80% in Q3 • Net PPP loan fees of $4.2 million recorded in Q4 • $3.7 million of deferred loan fees remain to be recognized Net Interest Income and Net Interest Margin Average Earning Assets & Average Yield Net Interest Income Net Interest Margin NIM ex. PPP Q4 2021 Highlights Dollars in millions 65% 16% 15% 4% 65% 13% 18% 4% Dollars in billions Cash & Other Securities Loans Held for Sale Loans Average Yield 80% 14% 6% $26.0 $26.7 $28.2 $31.5 $36.6 $5.3 $7.3 $9.2 $5.0 $6.5 $7.8 $7.7 $7.6 $2.4 $5.9 $1.9 $1.9 $1.3 4.04% 3.55% 3.77% 3.70% 3.57% $33.4 $39.1 $43.2 $48.4 $54.7 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Dollars in b llions 2% 14% 17% 67% 7% 15% 78% 4% 16% 15% 65%

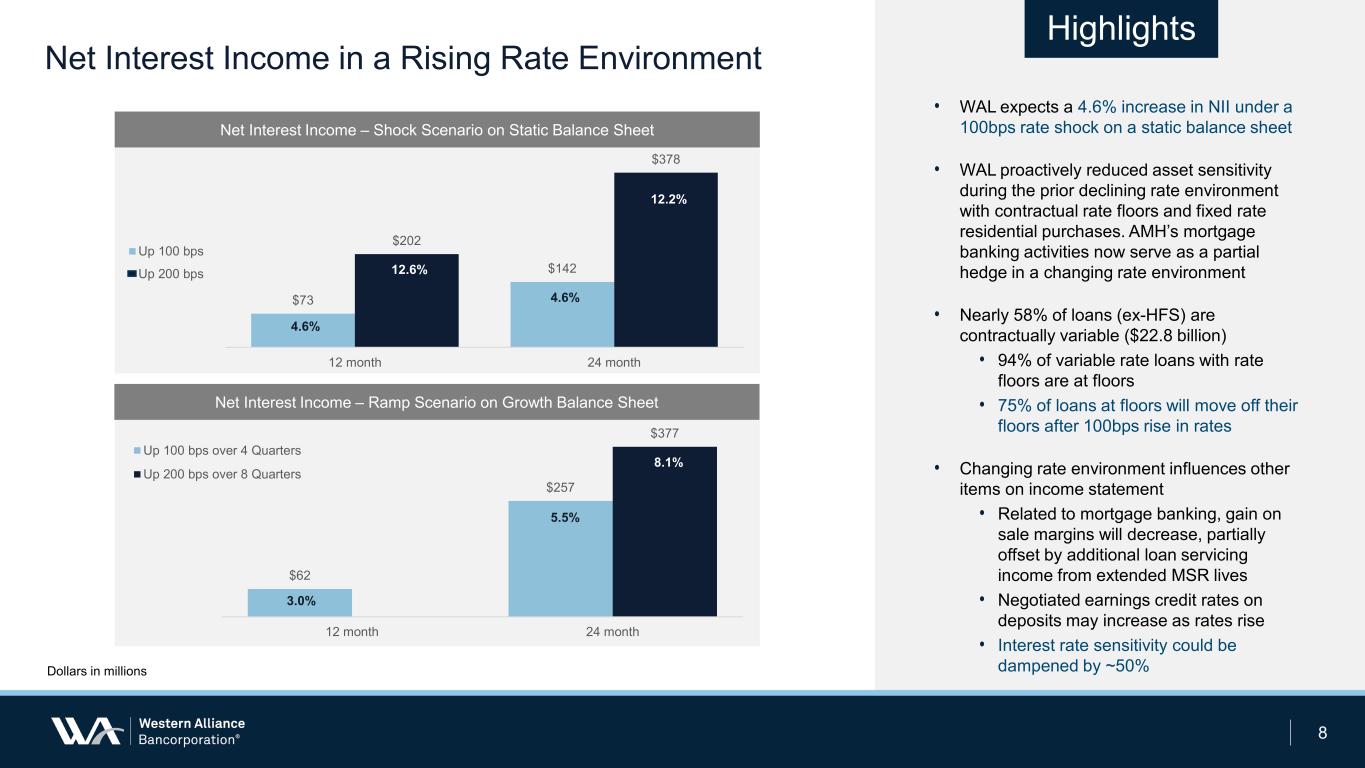

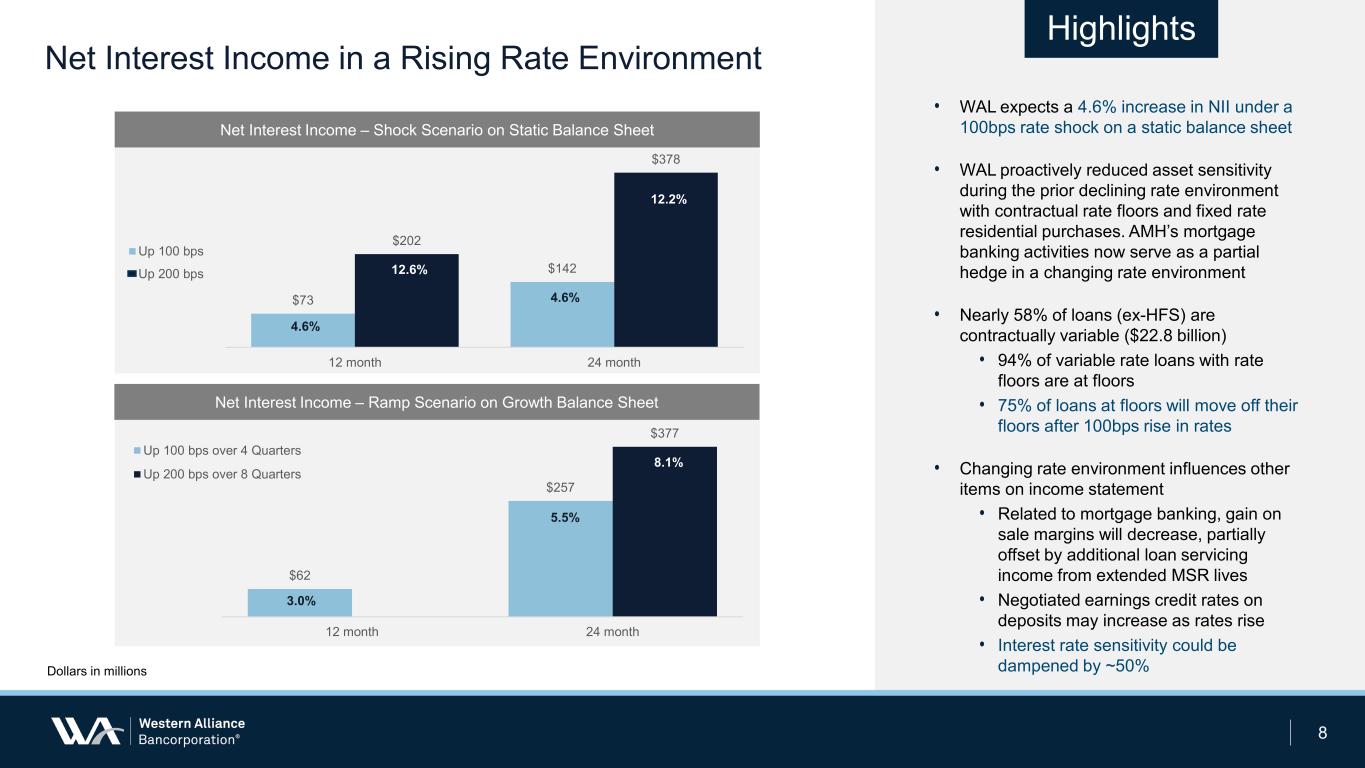

Net Interest Income in a Rising Rate Environment 8 Highlights Net Interest Income – Ramp Scenario on Growth Balance Sheet • WAL expects a 4.6% increase in NII under a 100bps rate shock on a static balance sheet • WAL proactively reduced asset sensitivity during the prior declining rate environment with contractual rate floors and fixed rate residential purchases. AMH’s mortgage banking activities now serve as a partial hedge in a changing rate environment • Nearly 58% of loans (ex-HFS) are contractually variable ($22.8 billion) • 94% of variable rate loans with rate floors are at floors • 75% of loans at floors will move off their floors after 100bps rise in rates • Changing rate environment influences other items on income statement • Related to mortgage banking, gain on sale margins will decrease, partially offset by additional loan servicing income from extended MSR lives • Negotiated earnings credit rates on deposits may increase as rates rise • Interest rate sensitivity could be dampened by ~50% Dollars in millions Net Interest Income – Shock Scenario on Static Balance Sheet $73 $142 $202 $378 12 month 24 month Up 100 bps Up 200 bps 12.6% 4.6% 4.6% 12.2% $62 $257 $377 12 month 24 month Up 100 bps over 4 Quarters Up 200 bps over 8 Quarters 3.0% 5.5% 8.1%

Expenses and Efficiency1 9 • Efficiency ratio1 decreased 20 bps to 41.3% compared to the prior quarter and increased 310 bps from the same period last year • Improvement in efficiency ratio1 as net revenue growth outpaced expense growth • Excluding PPP net loan fees and interest, efficiency ratio1 was 41.7% Non-Interest Expenses and Efficiency Ratio Dollars in millions $132.2 $134.6 $229.1 $231.4 $235.1 38.2% 39.0% 44.5% 41.5% 41.3% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Non-Interest Expenses Efficiency Ratio Q4 2021 Highlights 1) Non-GAAP income statement metrics have been adjusted to exclude the impact of acquisition and restructure expenses and loss on debt extinguishment. Refer to slide 2 for further discussion of Non-GAAP financial measures.

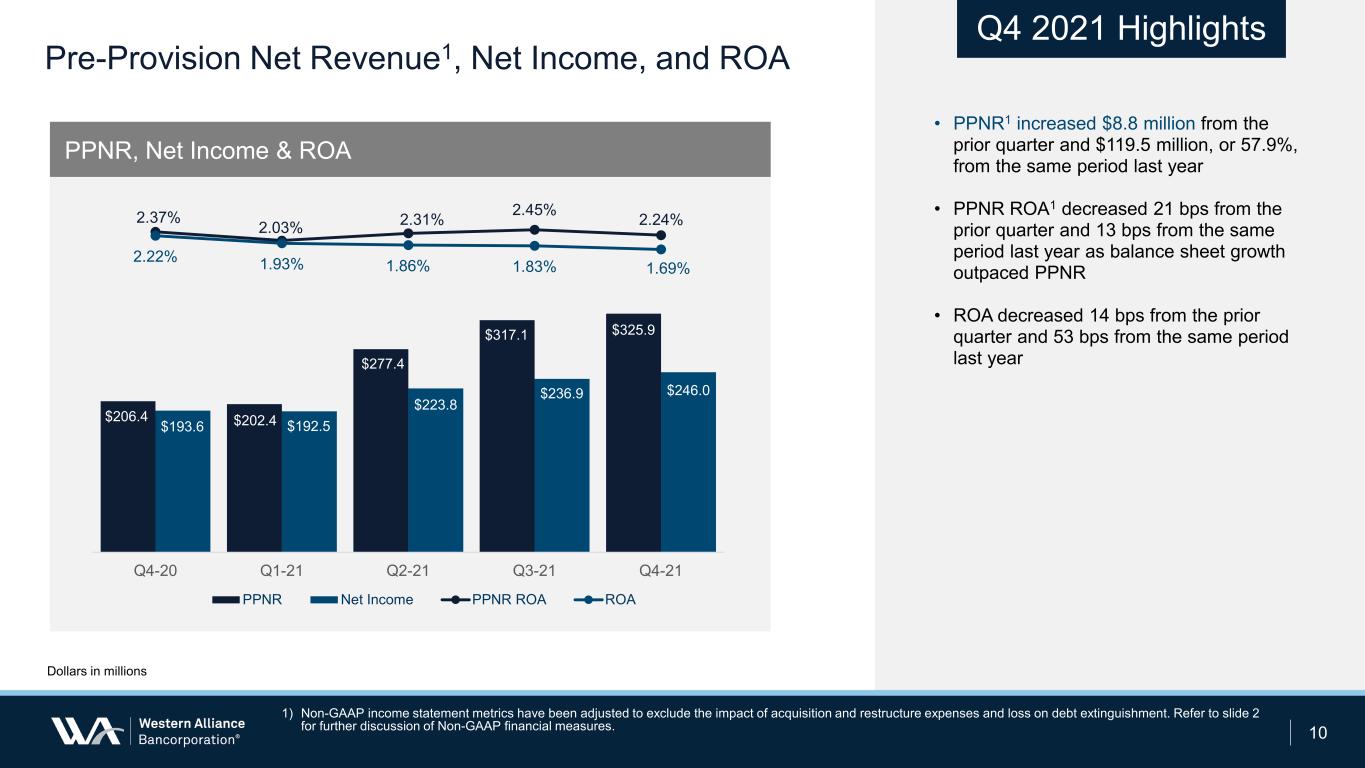

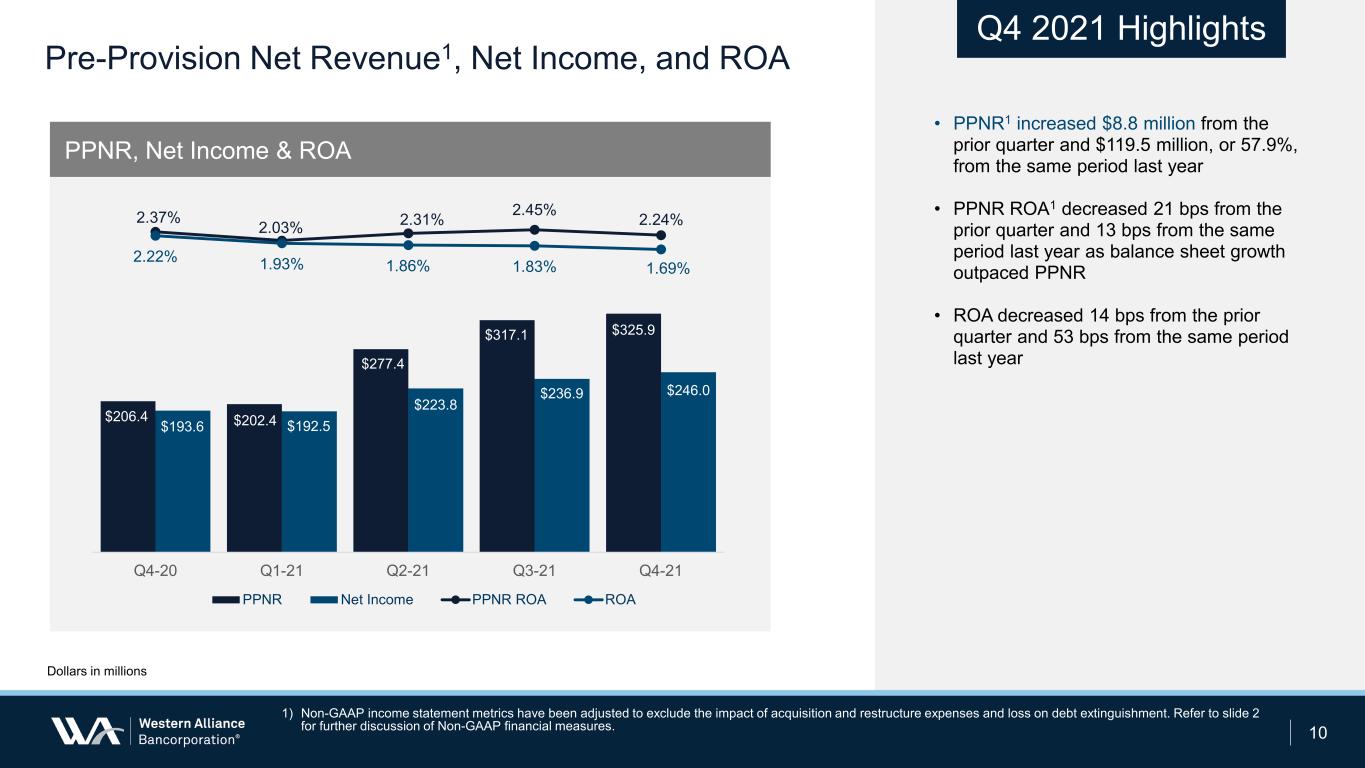

Pre-Provision Net Revenue1, Net Income, and ROA 10 • PPNR1 increased $8.8 million from the prior quarter and $119.5 million, or 57.9%, from the same period last year • PPNR ROA1 decreased 21 bps from the prior quarter and 13 bps from the same period last year as balance sheet growth outpaced PPNR • ROA decreased 14 bps from the prior quarter and 53 bps from the same period last year PPNR, Net Income & ROA Dollars in millions $206.4 $202.4 $277.4 $317.1 $325.9 $193.6 $192.5 $223.8 $236.9 $246.0 2.37% 2.03% 2.31% 2.45% 2.24% 2.22% 1.93% 1.86% 1.83% 1.69% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 PPNR Net Income PPNR ROA ROA Q4 2021 Highlights 1) Non-GAAP income statement metrics have been adjusted to exclude the impact of acquisition and restructure expenses and loss on debt extinguishment. Refer to slide 2 for further discussion of Non-GAAP financial measures.

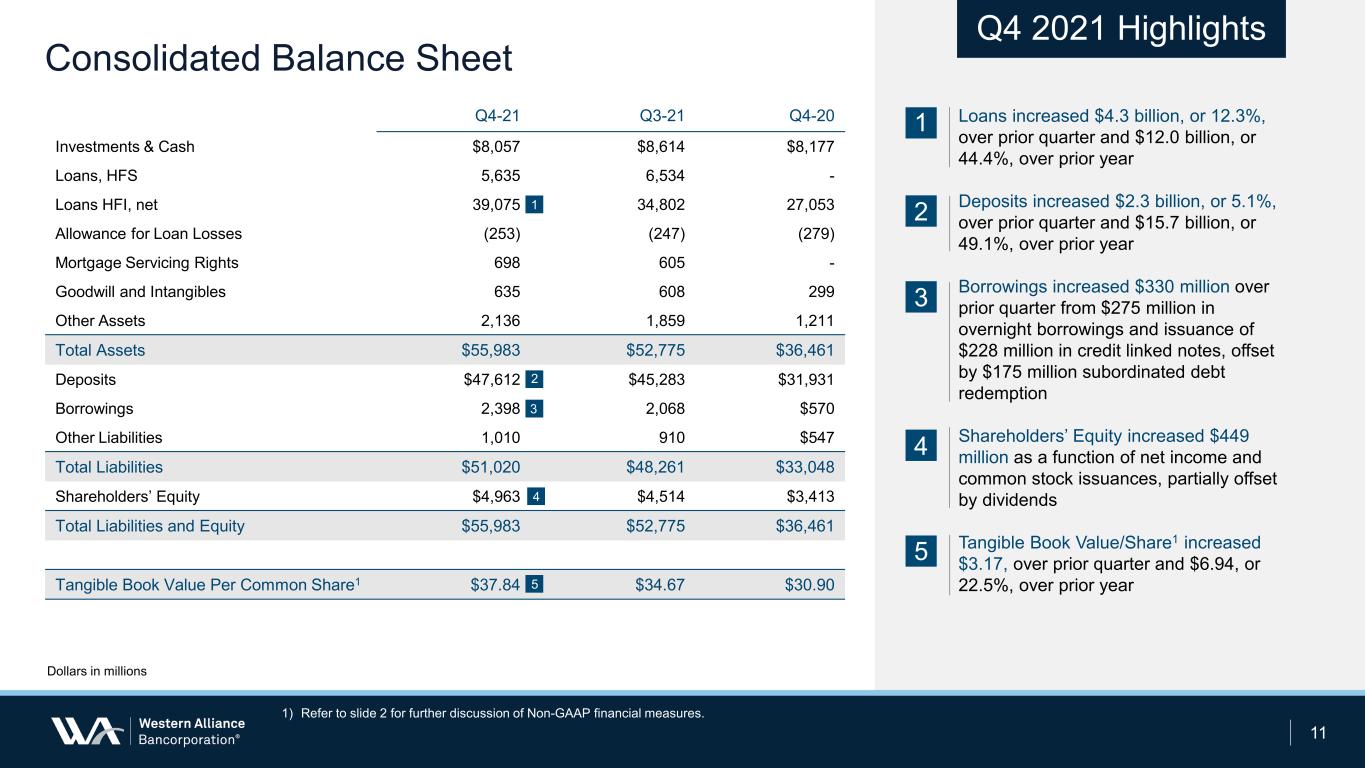

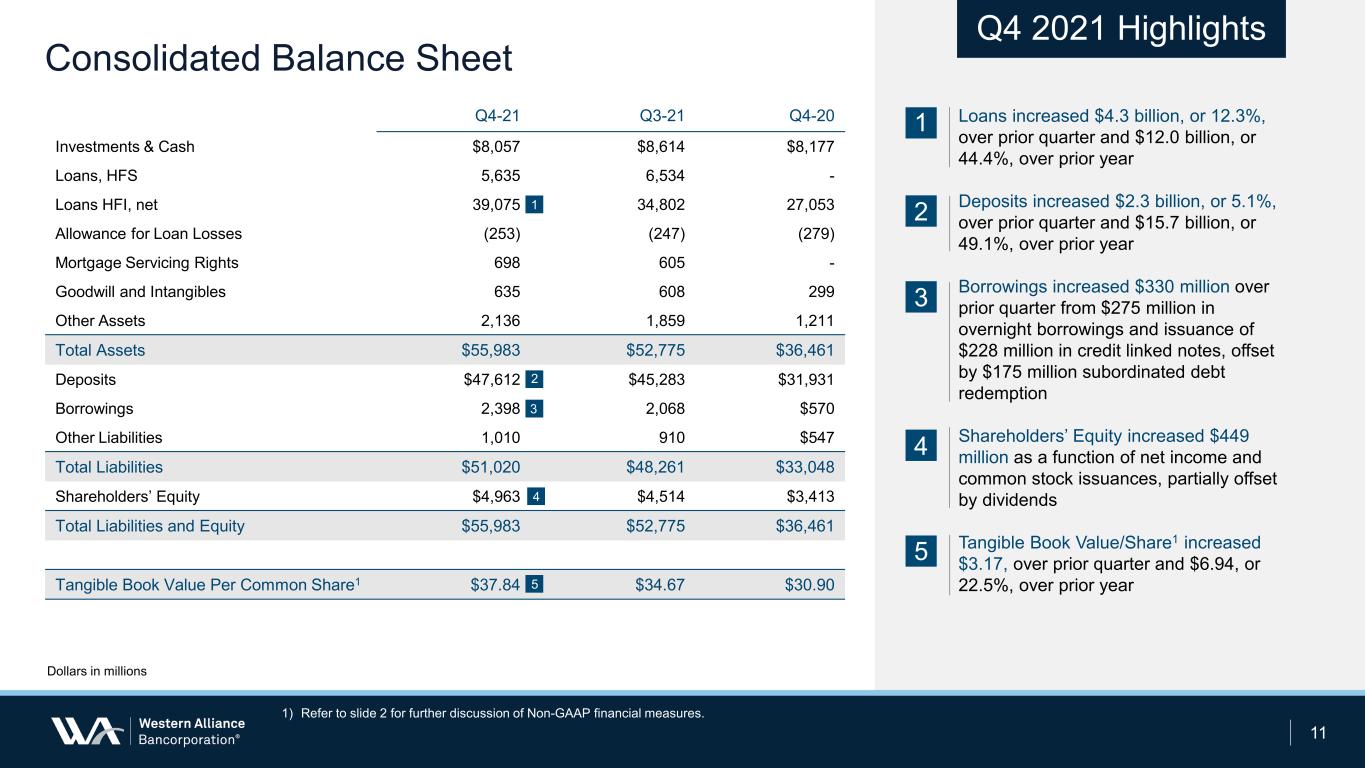

Consolidated Balance Sheet Loans increased $4.3 billion, or 12.3%, over prior quarter and $12.0 billion, or 44.4%, over prior year Deposits increased $2.3 billion, or 5.1%, over prior quarter and $15.7 billion, or 49.1%, over prior year Borrowings increased $330 million over prior quarter from $275 million in overnight borrowings and issuance of $228 million in credit linked notes, offset by $175 million subordinated debt redemption Shareholders’ Equity increased $449 million as a function of net income and common stock issuances, partially offset by dividends Tangible Book Value/Share1 increased $3.17, over prior quarter and $6.94, or 22.5%, over prior year 11 1 2 3 Q4-21 Q3-21 Q4-20 Investments & Cash $8,057 $8,614 $8,177 Loans, HFS 5,635 6,534 - Loans HFI, net 39,075 34,802 27,053 Allowance for Loan Losses (253) (247) (279) Mortgage Servicing Rights 698 605 - Goodwill and Intangibles 635 608 299 Other Assets 2,136 1,859 1,211 Total Assets $55,983 $52,775 $36,461 Deposits $47,612 $45,283 $31,931 Borrowings 2,398 2,068 $570 Other Liabilities 1,010 910 $547 Total Liabilities $51,020 $48,261 $33,048 Shareholders’ Equity $4,963 $4,514 $3,413 Total Liabilities and Equity $55,983 $52,775 $36,461 Tangible Book Value Per Common Share1 $37.84 $34.67 $30.90 1 2 5 Dollars in millions Q4 2021 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 3 4 5 4

Five Quarter Loan Growth and Composition 12 $12.0 Billion Year-Over-Year Growth Quarter-over-quarter loan growth of $4.3 billion driven by (in millions): Residential & Consumer $1,838 C&I1 1,773 CRE, Non-OO 683 Construction & Land 79 Offset by decrease in: CRE, OO (99) Total $4,274 Year-over-year loan growth of $12.0 billion driven by (in millions): Residential & Consumer $6,845 C&I1 3,973 Construction & Land 591 CRE, Non-OO 872 Offset by decrease in: CRE, OO (259) Total $12,022 $14.3 $15.1 $14.3 $16.5 $18.3 $2.2 $2.0 $2.0 $2.0 $1.9$5.7 $5.7 $5.7 $5.9 $6.5$2.4 $2.8 $2.9 $2.9 $3.0 $2.5 $3.1 $5.1 $7.5 $9.3 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Residential & Consumer Construction & Land CRE, Non-Owner Occupied CRE, Owner Occupied Commercial & Industrial Dollars in billions, unless otherwise indicated Total Loans, HFI $27.1 $28.7 $30.0 $34.8 $39.1 Qtr. Change +$1.1 +$1.6 +$1.3 +$4.8 +$4.3 9.2% 9.0% 20.9% 8.0% 52.9% 46.8% 4.9% 16.7% 7.7% 23.9% Highlights 1) Includes Round 1 and Round 2 PPP loans of $412 million as of December 31, 2021. During Q4-21, PPP payoffs of approximately $200 million 21.5% 8.5% 16.8% 5.7% 47.5%

$13.5 $17.5 $20.1 $21.1 $21.4 $4.4 $3.9 $4.2 $5.0 $6.9$12.4 $15.3 $15.8 $17.4 $17.3 $1.7 $1.7 $1.8 $1.8 $2.0 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 CDs Savings and MMDA Interest Bearing DDA Non-Interest Bearing DDA Five Quarter Deposit Growth and Composition 13 $15.7 Billion Year-Over-Year Growth Quarter-over-quarter deposit growth of $2.3 billion driven by (in millions): Interest-Bearing DDA $1,970 Non-Interest Bearing DDA 295 CD 226 Offset by decrease in: Savings and MMDA (162) Total $2,329 Year-over-year deposit growth of $15.7 billion driven by (in millions): Non-Interest Bearing DDA $7,890 Savings and MMDA 4,865 Interest-Bearing DDA 2,527 CDs 399 Total $15,681 Dollars in billions, unless otherwise indicated Total Deposits $31.9 $38.4 $41.9 $45.3 $47.6 Qtr. Change +$3.1 +$6.5 +$3.5 +$3.4 +$2.3 5.2% 38.9% 13.8% 42.1% 44.9% 14.5% 36.3% 4.3% Highlights 4.0% 38.5% 11.0% 46.5%

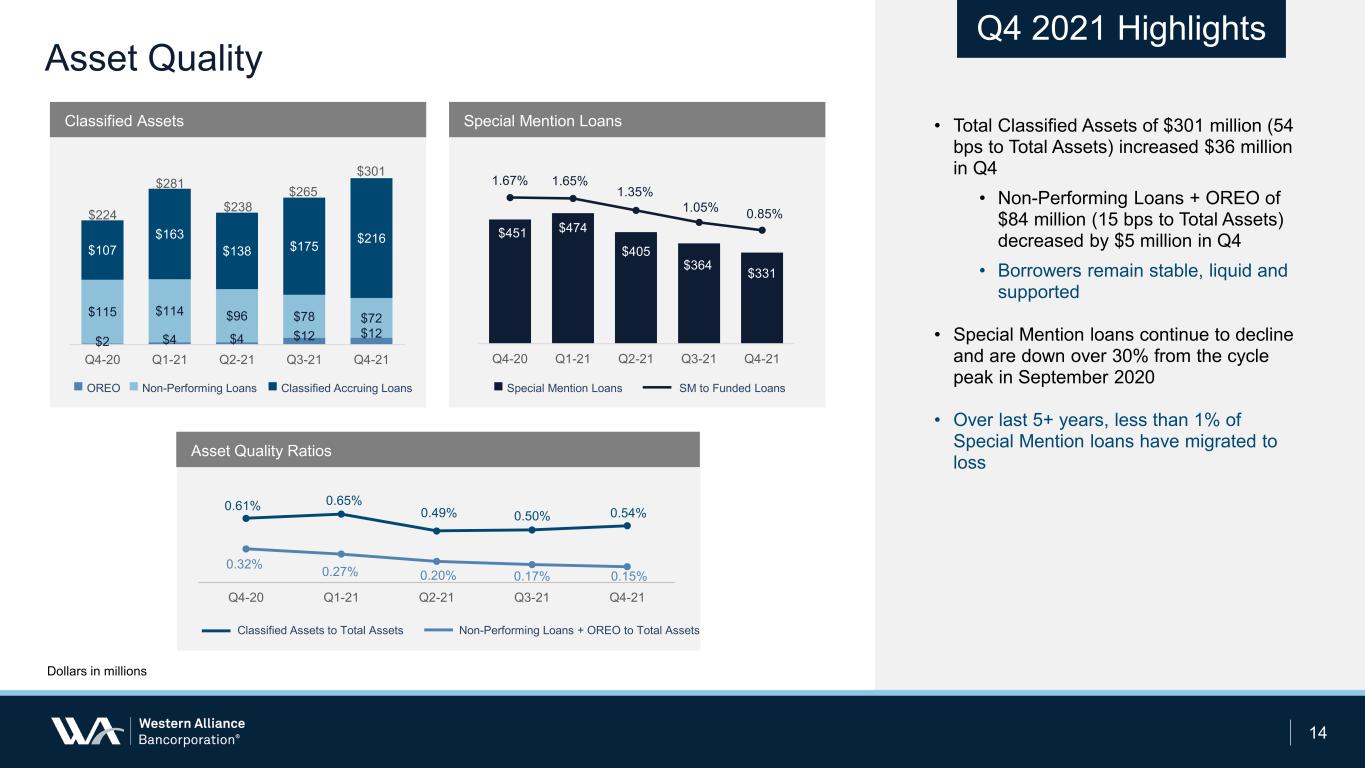

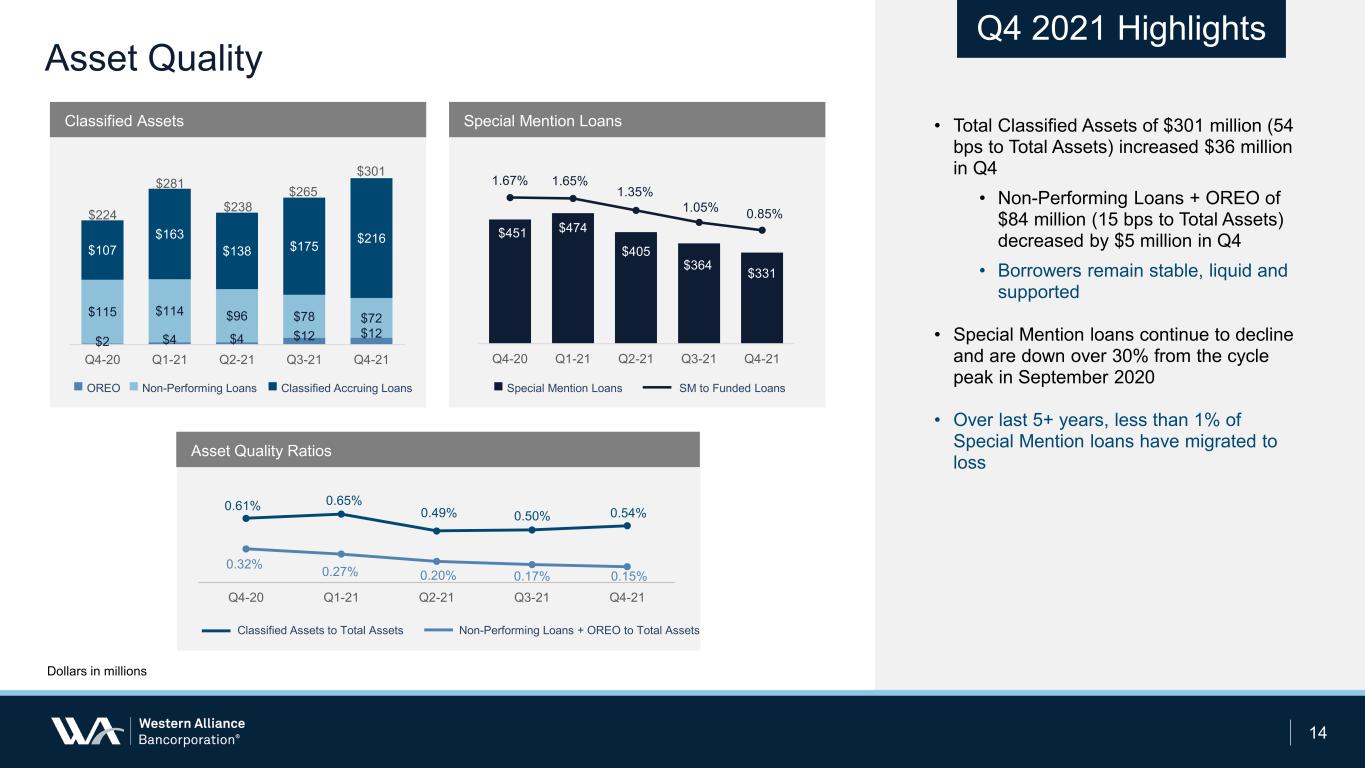

$451 $474 $405 $364 $331 1.67% 1.65% 1.35% 1.05% 0.85% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 $2 $4 $4 $12 $12 $115 $114 $96 $78 $72 $107 $163 $138 $175 $216 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Asset Quality 14 • Total Classified Assets of $301 million (54 bps to Total Assets) increased $36 million in Q4 • Non-Performing Loans + OREO of $84 million (15 bps to Total Assets) decreased by $5 million in Q4 • Borrowers remain stable, liquid and supported • Special Mention loans continue to decline and are down over 30% from the cycle peak in September 2020 • Over last 5+ years, less than 1% of Special Mention loans have migrated to loss Special Mention Loans Dollars in millions Classified Assets Special Mention Loans Asset Quality Ratios OREO Non-Performing Loans Classified Accruing Loans $224 $281 $238 $265 SM to Funded Loans 0.61% 0.65% 0.49% 0.50% 0.54% 0.32% 0.27% 0.20% 0.17% 0.15% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Classified Assets to Total Assets Non-Performing Loans + OREO to Total Assets Q4 2021 Highlights $301

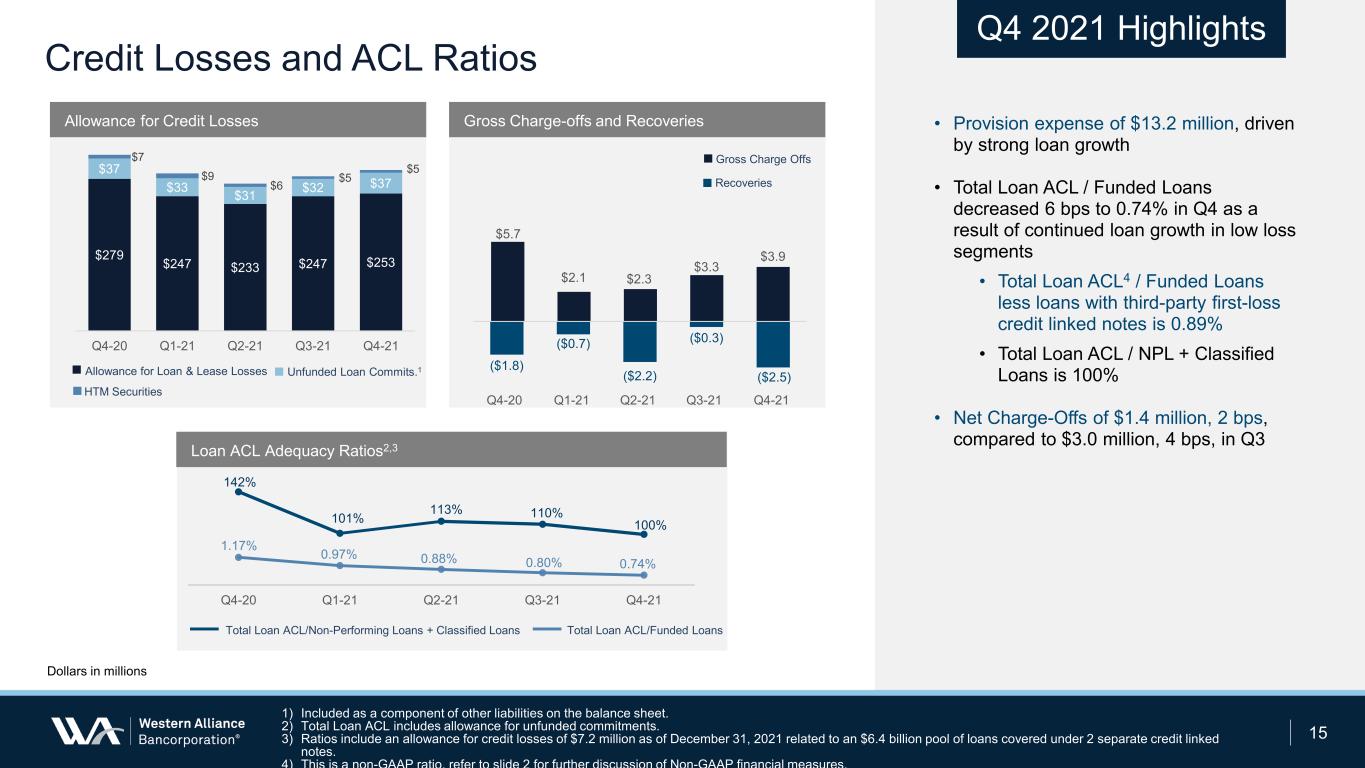

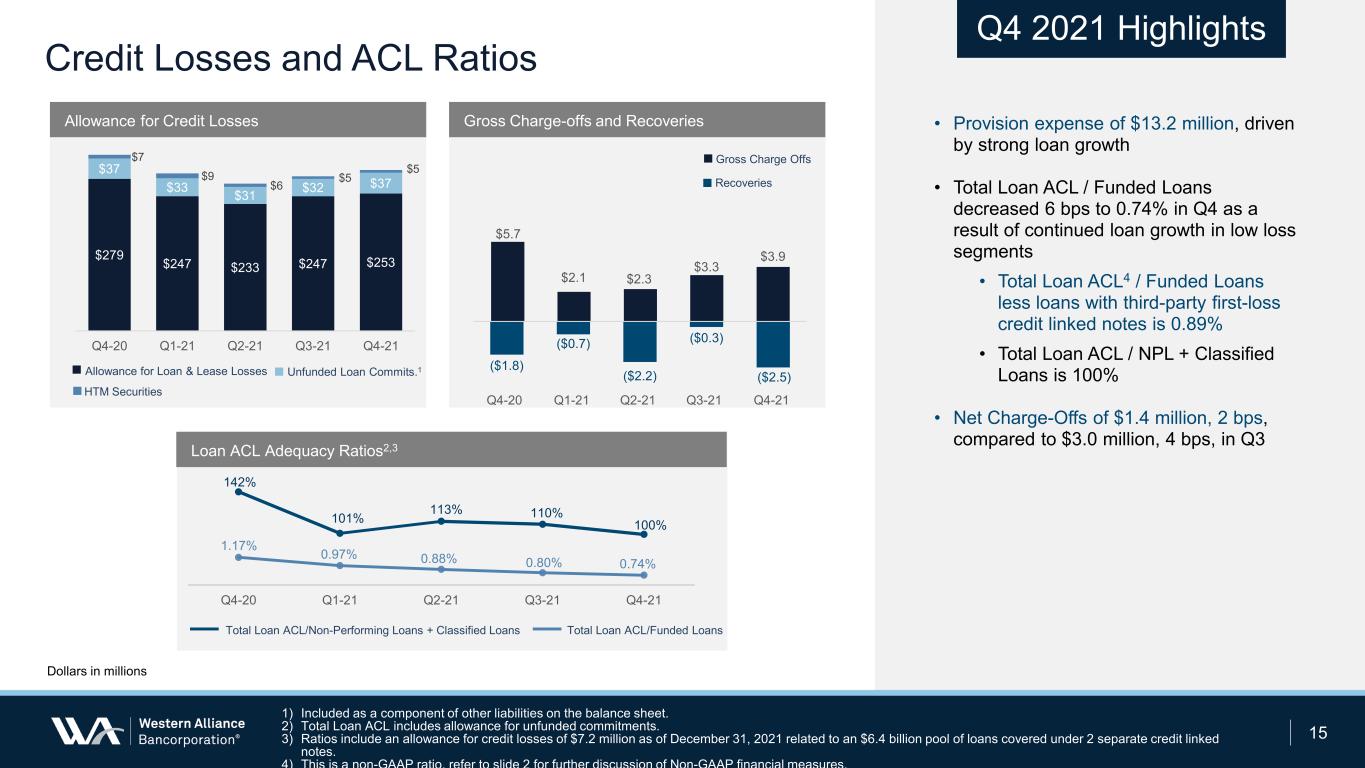

$5.7 $2.1 $2.3 $3.3 $3.9 ($1.8) ($0.7) ($2.2) ($0.3) ($2.5) $279 $247 $233 $247 $253 $37 $33 $31 $32 $37 $7 $9 $6 $5 $5 Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Credit Losses and ACL Ratios 15 • Provision expense of $13.2 million, driven by strong loan growth • Total Loan ACL / Funded Loans decreased 6 bps to 0.74% in Q4 as a result of continued loan growth in low loss segments • Total Loan ACL4 / Funded Loans less loans with third-party first-loss credit linked notes is 0.89% • Total Loan ACL / NPL + Classified Loans is 100% • Net Charge-Offs of $1.4 million, 2 bps, compared to $3.0 million, 4 bps, in Q3 Dollars in millions Allowance for Credit Losses Gross Charge-offs and Recoveries Loan ACL Adequacy Ratios2,3 Total Loan ACL/Non-Performing Loans + Classified Loans Total Loan ACL/Funded Loans Allowance for Loan & Lease Losses Unfunded Loan Commits.1 HTM Securities Gross Charge Offs Recoveries 1.17% 0.97% 0.88% 0.80% 0.74% 142% 101% 113% 110% 100% 0.50% 1.50% 2.50% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 Q4 2021 Highlights 1) Included as a component of other liabilities on the balance sheet. 2) Total Loan ACL includes allowance for unfunded commitments. 3) Ratios include an allowance for credit losses of $7.2 million as of December 31, 2021 related to an $6.4 billion pool of loans covered under 2 separate credit linked notes. 4) This is a non-GAAP ratio, refer to slide 2 for further discussion of Non-GAAP financial measures. Q4-20 Q1-21 Q2-21 Q3-21 Q4-21

Capital Accumulation 16 Regulatory Capital Levels • Exceed “well-capitalized” levels and have rebounded from initial impact of the AmeriHome transaction • CET1 at 9.1% Tangible Common Equity / Tangible Assets1 • TCE / TA increased 40 bps from the prior quarter to 7.3% due to common stock issuances under the ATM 2021 Capital Actions • Issued $209 million of common stock (2.3 million shares) to support the AmeriHome transaction • Issued $600 million of subordinated debt • Issued $70 million of common stock (700 thousand shares) under at-the-market (ATM) offering • Issued $242 million aggregate principal amount of senior unsecured credit linked notes (CLN) • Issued $300 million of preferred stock • Redeemed $75 million of subordinated debt • Increased quarterly common stock cash dividend to $0.35 per share • Redeemed $175 million of subordinated debt • Issued $261 million of common stock (2.4 million shares) under ATM offering • Issued $228 million aggregate principal amount of senior CLN Robust Common Capital Levels Regulatory Capital 9.9% 10.3% 9.2% 8.7% 9.1%8.6% 7.9% 7.1% 6.9% 7.3% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21 CET1 Ratio TCE/TA1 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures Total RBC RatioTier 1 RatioLeverage Ratio Q1 Q2 Q3 Q4 9.2% 8.8% 7.3% 7.9% 7.8% 10.2% 10.6% 9.4% 9.6% 9.9% 12.5% 12.6% 12.8% 12.6% 12.3% Q4-20 Q1-21 Q2-21 Q3-21 Q4-21

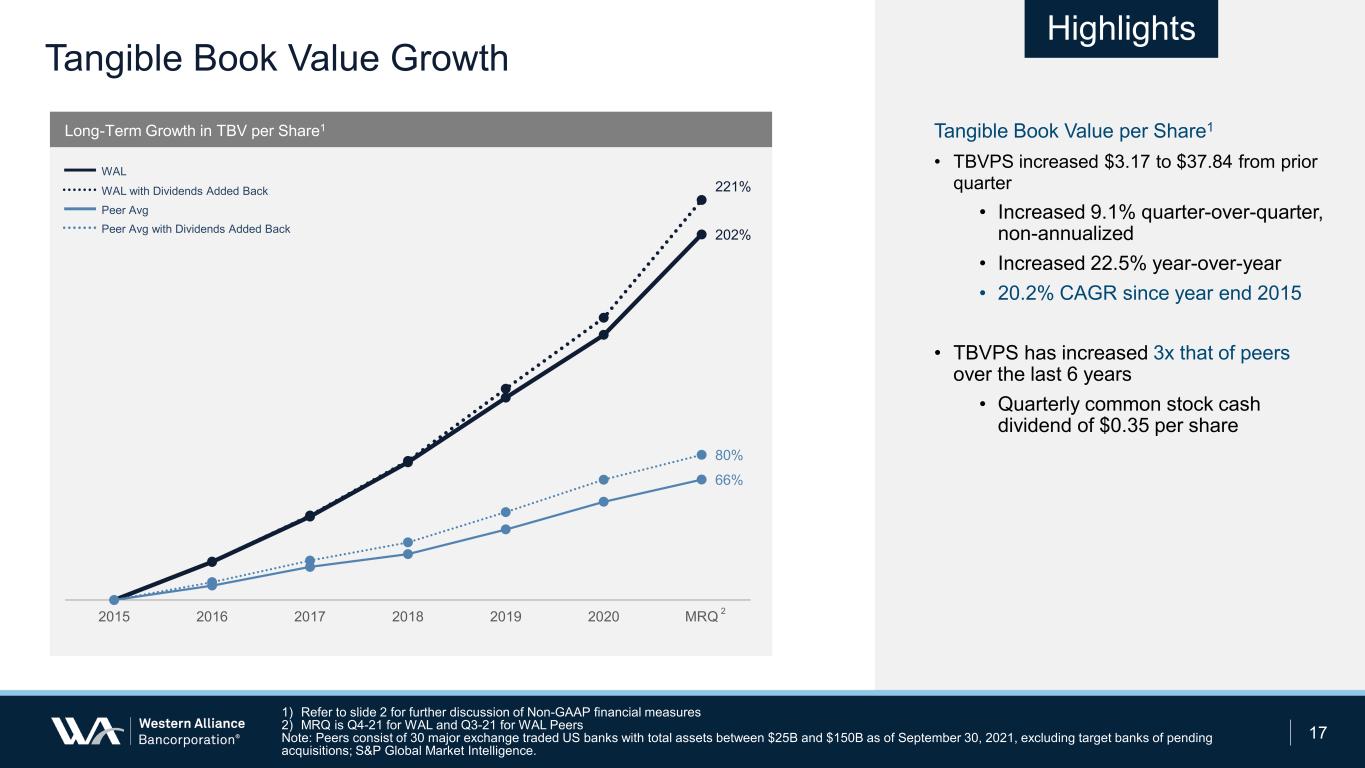

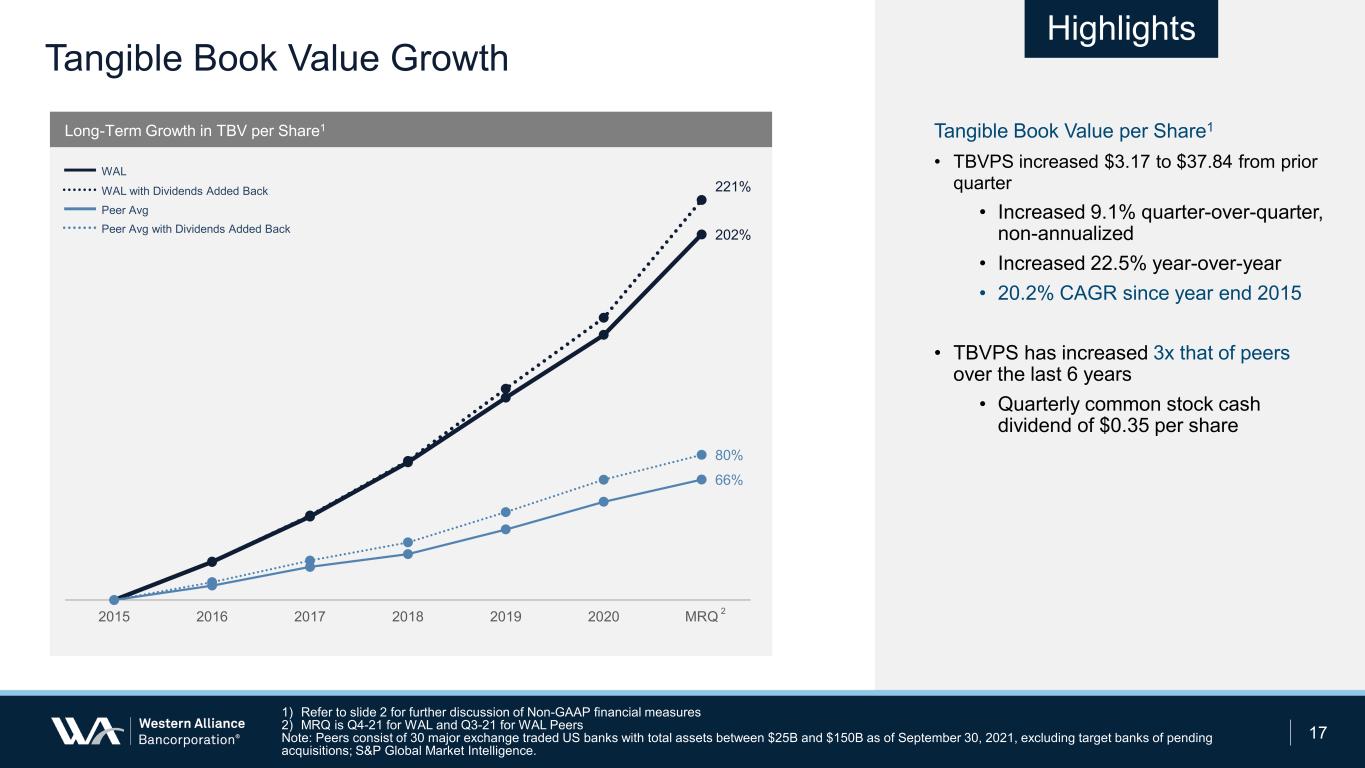

Tangible Book Value Growth 17 Tangible Book Value per Share1 • TBVPS increased $3.17 to $37.84 from prior quarter • Increased 9.1% quarter-over-quarter, non-annualized • Increased 22.5% year-over-year • 20.2% CAGR since year end 2015 • TBVPS has increased 3x that of peers over the last 6 years • Quarterly common stock cash dividend of $0.35 per share Long-Term Growth in TBV per Share1 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures 2) MRQ is Q4-21 for WAL and Q3-21 for WAL Peers Note: Peers consist of 30 major exchange traded US banks with total assets between $25B and $150B as of September 30, 2021, excluding target banks of pending acquisitions; S&P Global Market Intelligence. 202% 221% 66% 80% 2015 2016 2017 2018 2019 2020 MRQ WAL WAL with Dividends Added Back Peer Avg Peer Avg with Dividends Added Back 2

Management Outlook Balance Sheet Growth Net Interest Income Pre-Provision Net Revenue Capital and Liquidity 18

Questions & Answers