EARNINGS CALL 4th Quarter 2023 JANUARY 26, 2024

Forward-Looking Statements This presentation contains forward-looking statements that relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Examples of forward-looking statements include, among others, statements we make regarding our expectations with regard to our business, financial and operating results, future economic performance and dividends. The forward-looking statements contained herein reflect our current views about future events and financial performance and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Some factors that could cause actual results to differ materially from historical or expected results include, among others: the risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Company’s subsequent Quarterly Reports on Form 10-Q, each as filed with the Securities and Exchange Commission; adverse developments in the financial services industry generally such as the bank failures in 2023 and any related impact on depositor behavior; risks related to the sufficiency of liquidity; the potential adverse effects of unusual and infrequently occurring events such as the COVID-19 pandemic and any governmental or societal responses thereto; changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; the impact on financial markets from geopolitical conflicts such as the wars in Ukraine and the Middle East; inflation, interest rate, market and monetary fluctuations; increases in competitive pressures among financial institutions and businesses offering similar products and services; higher defaults on our loan portfolio than we expect; changes in management’s estimate of the adequacy of the allowance for credit losses; legislative or regulatory changes or changes in accounting principles, policies or guidelines; supervisory actions by regulatory agencies which may limit our ability to pursue certain growth opportunities, including expansion through acquisitions; additional regulatory requirements resulting from our continued growth; management’s estimates and projections of interest rates and interest rate policy; the execution of our business plan; and other factors affecting the financial services industry generally or the banking industry in particular. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not intend and disclaim any duty or obligation to update or revise any industry information or forward-looking statements, whether written or oral, that may be made from time to time, set forth in this press release to reflect new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains both financial measures based on GAAP and non-GAAP based financial measures, which are used where management believes them to be helpful in understanding the Company’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the Company’s press release as of and for the quarter ended December 31, 2023. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. 2

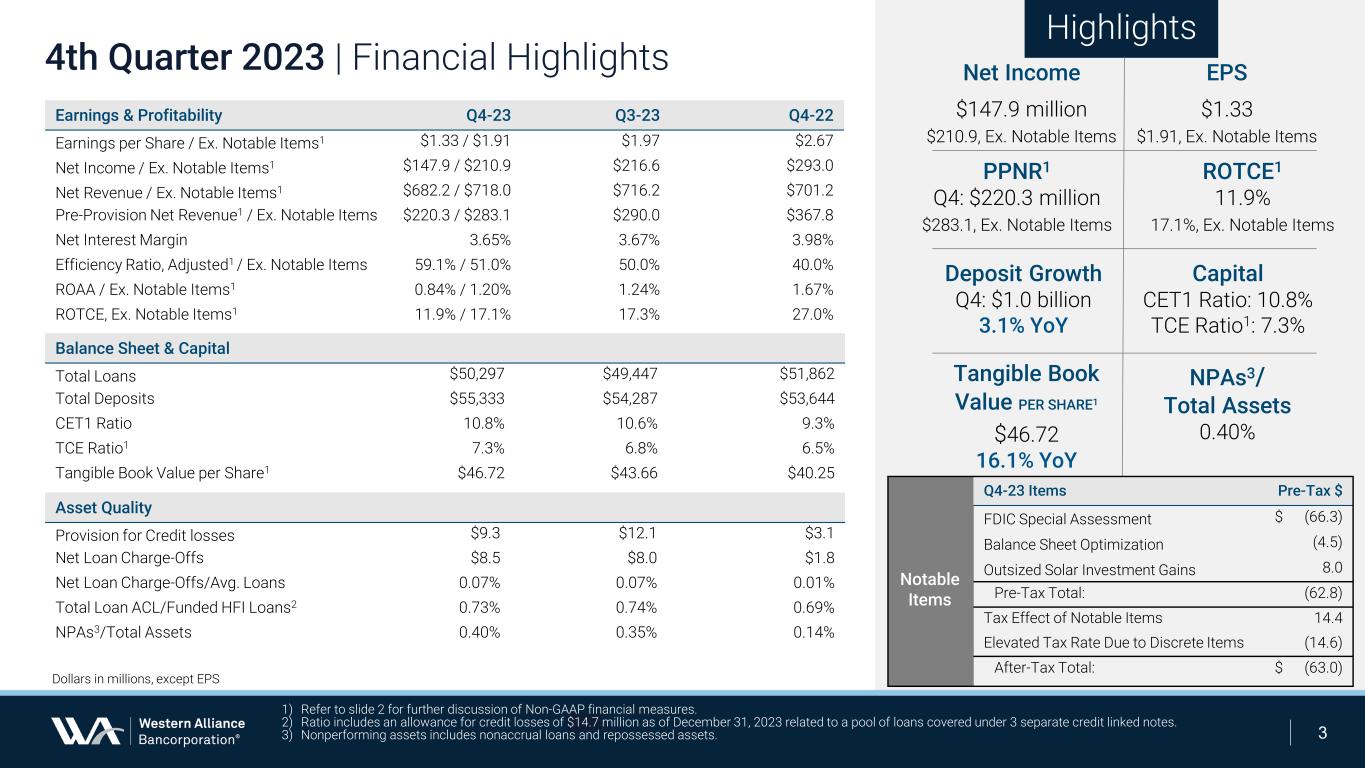

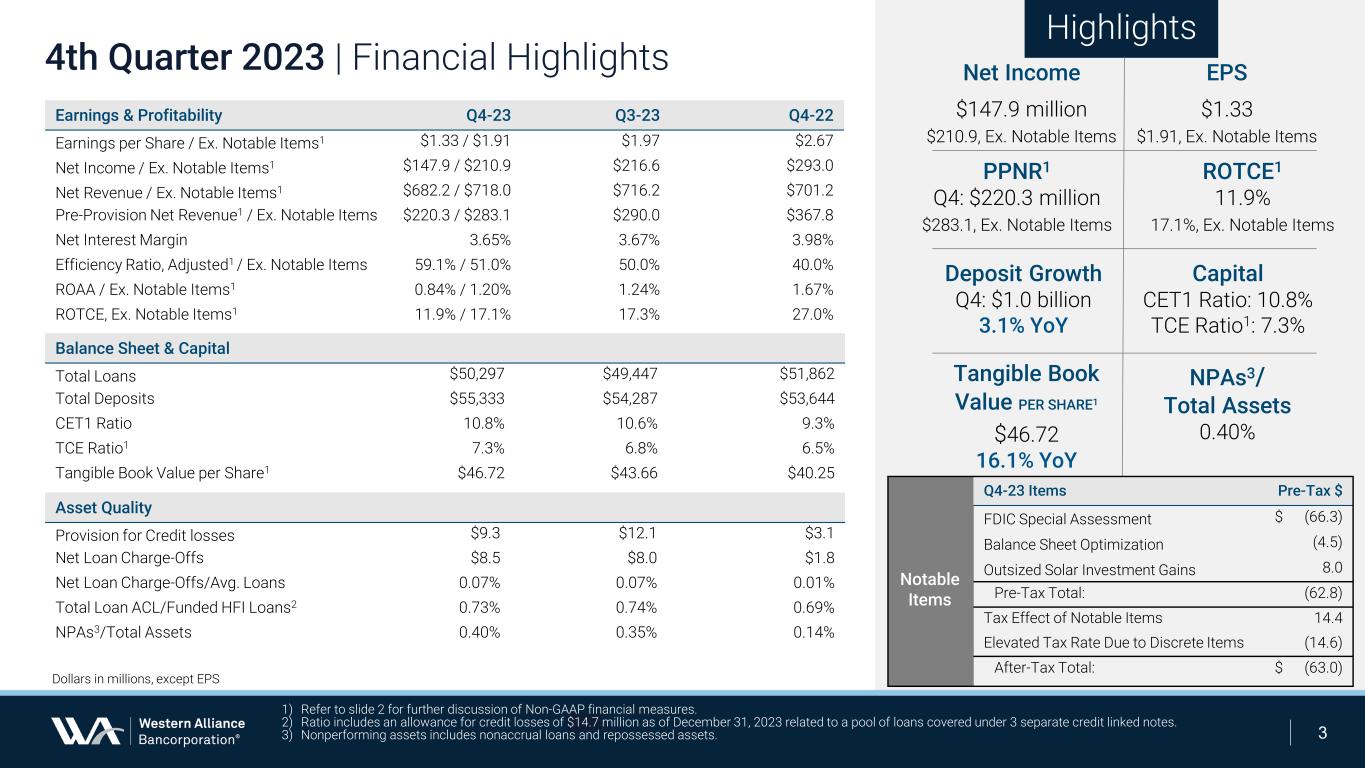

4th Quarter 2023 | Financial Highlights Earnings & Profitability Q4-23 Q3-23 Q4-22 Earnings per Share / Ex. Notable Items1 $1.33 / $1.91 $1.97 $2.67 Net Income / Ex. Notable Items1 $147.9 / $210.9 $216.6 $293.0 Net Revenue / Ex. Notable Items1 $682.2 / $718.0 $716.2 $701.2 Pre-Provision Net Revenue1 / Ex. Notable Items $220.3 / $283.1 $290.0 $367.8 Net Interest Margin 3.65% 3.67% 3.98% Efficiency Ratio, Adjusted1 / Ex. Notable Items 59.1% / 51.0% 50.0% 40.0% ROAA / Ex. Notable Items1 0.84% / 1.20% 1.24% 1.67% ROTCE, Ex. Notable Items1 11.9% / 17.1% 17.3% 27.0% Balance Sheet & Capital Total Loans $50,297 $49,447 $51,862 Total Deposits $55,333 $54,287 $53,644 CET1 Ratio 10.8% 10.6% 9.3% TCE Ratio1 7.3% 6.8% 6.5% Tangible Book Value per Share1 $46.72 $43.66 $40.25 Asset Quality Provision for Credit losses $9.3 $12.1 $3.1 Net Loan Charge-Offs $8.5 $8.0 $1.8 Net Loan Charge-Offs/Avg. Loans 0.07% 0.07% 0.01% Total Loan ACL/Funded HFI Loans2 0.73% 0.74% 0.69% NPAs3/Total Assets 0.40% 0.35% 0.14% 3 Dollars in millions, except EPS 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Ratio includes an allowance for credit losses of $14.7 million as of December 31, 2023 related to a pool of loans covered under 3 separate credit linked notes. 3) Nonperforming assets includes nonaccrual loans and repossessed assets. Highlights Notable Items Q4-23 Items Pre-Tax $ FDIC Special Assessment $ (66.3) Balance Sheet Optimization (4.5) Outsized Solar Investment Gains 8.0 Pre-Tax Total: (62.8) Tax Effect of Notable Items 14.4 Elevated Tax Rate Due to Discrete Items (14.6) After-Tax Total: $ (63.0) PPNR1 Q4: $220.3 million $283.1, Ex. Notable Items ROTCE1 11.9% 17.1%, Ex. Notable Items Tangible Book Value PER SHARE1 $46.72 16.1% YoY NPAs3/ Total Assets 0.40% Capital CET1 Ratio: 10.8% TCE Ratio1: 7.3% Net Income $147.9 million $210.9, Ex. Notable Items EPS $1.33 $1.91, Ex. Notable Items Deposit Growth Q4: $1.0 billion 3.1% YoY

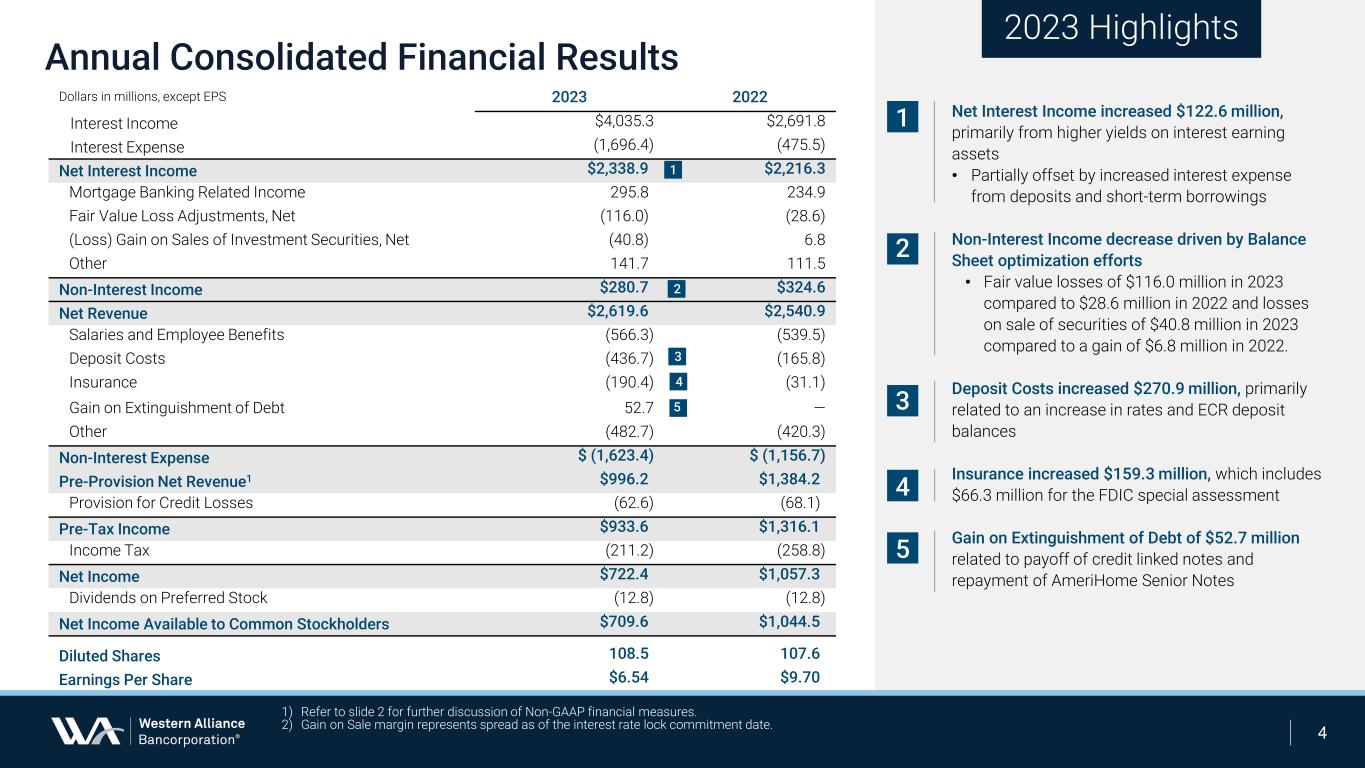

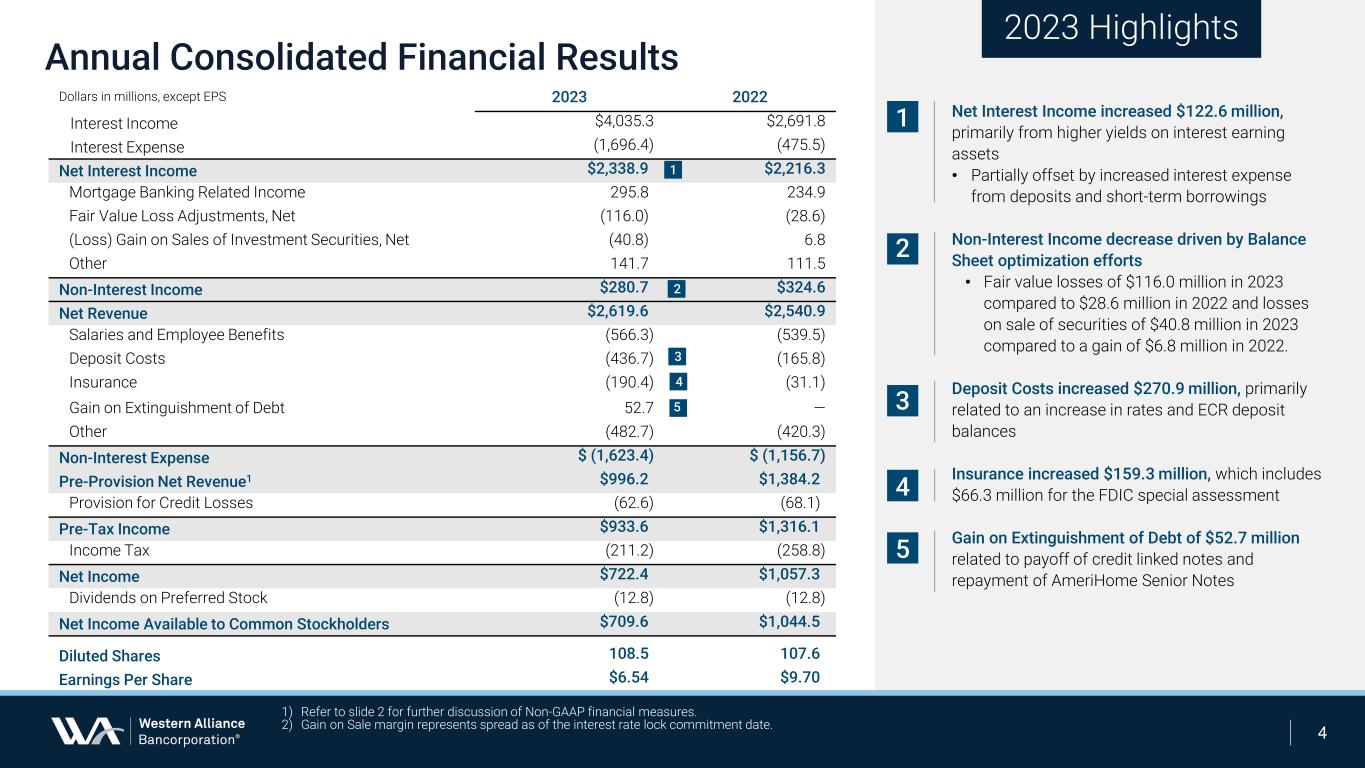

2023 2022 Interest Income $4,035.3 $2,691.8 Interest Expense (1,696.4) (475.5) Net Interest Income $2,338.9) $2,216.3 Mortgage Banking Related Income 295.8) 234.9 Fair Value Loss Adjustments, Net (116.0)) (28.6) (Loss) Gain on Sales of Investment Securities, Net (40.8)) 6.8 Other 141.7) 111.5 Non-Interest Income $280.7) $324.6 Net Revenue $2,619.6) $2,540.9 Salaries and Employee Benefits (566.3) (539.5) Deposit Costs (436.7) (165.8) Insurance Gain on Extinguishment of Debt (190.4) 52.7 (31.1) ― Other (482.7) (420.3) Non-Interest Expense $ (1,623.4) $ (1,156.7) Pre-Provision Net Revenue1 $996.2) $1,384.2) Provision for Credit Losses (62.6) (68.1)) Pre-Tax Income $933.6) $1,316.1) Income Tax (211.2) (258.8) Net Income $722.4) $1,057.3) Dividends on Preferred Stock (12.8) (12.8) Net Income Available to Common Stockholders $709.6) $1,044.5) Diluted Shares 108.5) 107.6) Earnings Per Share $6.54) $9.70) Annual Consolidated Financial Results 4 1 2 4 Dollars in millions, except EPS 2023 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Gain on Sale margin represents spread as of the interest rate lock commitment date. 5 1 4 5 2 3 3 Net Interest Income increased $122.6 million, primarily from higher yields on interest earning assets • Partially offset by increased interest expense from deposits and short-term borrowings Non-Interest Income decrease driven by Balance Sheet optimization efforts • Fair value losses of $116.0 million in 2023 compared to $28.6 million in 2022 and losses on sale of securities of $40.8 million in 2023 compared to a gain of $6.8 million in 2022. Deposit Costs increased $270.9 million, primarily related to an increase in rates and ECR deposit balances Insurance increased $159.3 million, which includes $66.3 million for the FDIC special assessment Gain on Extinguishment of Debt of $52.7 million related to payoff of credit linked notes and repayment of AmeriHome Senior Notes

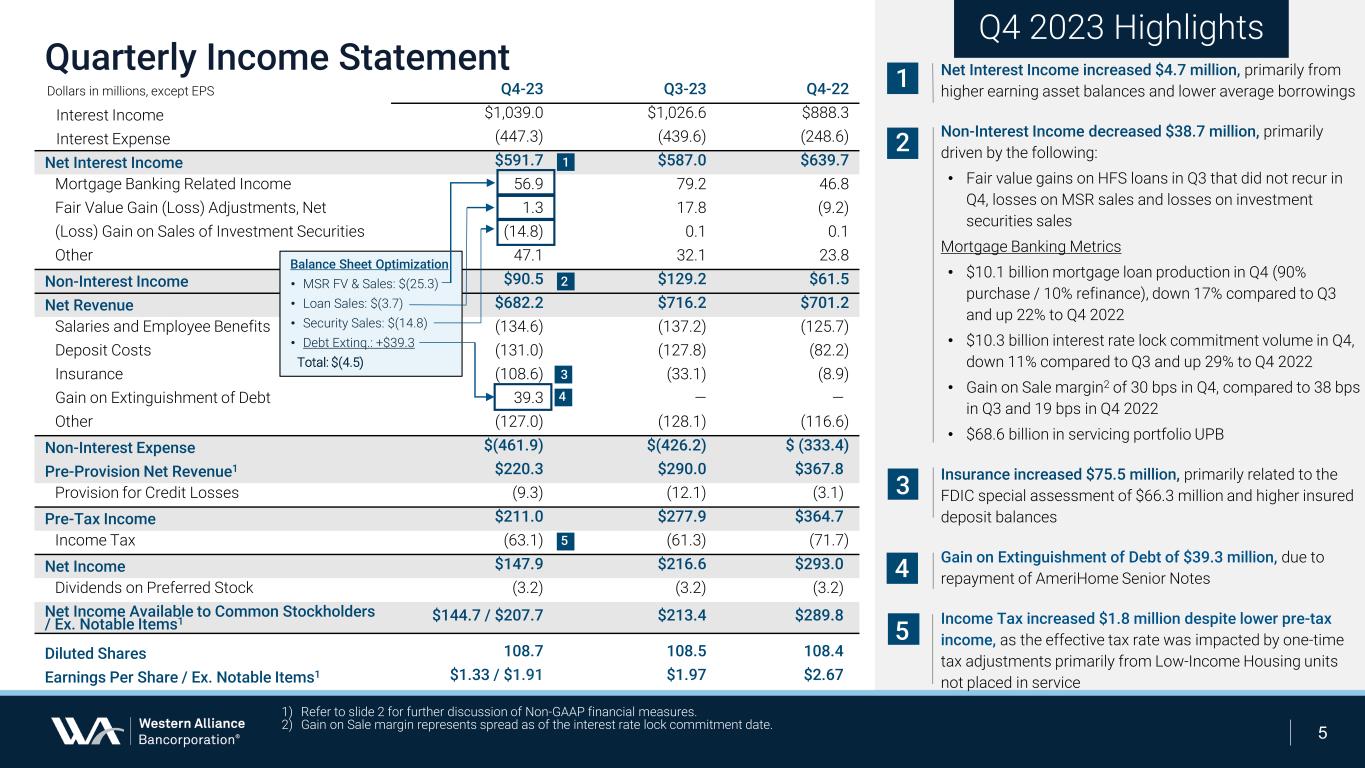

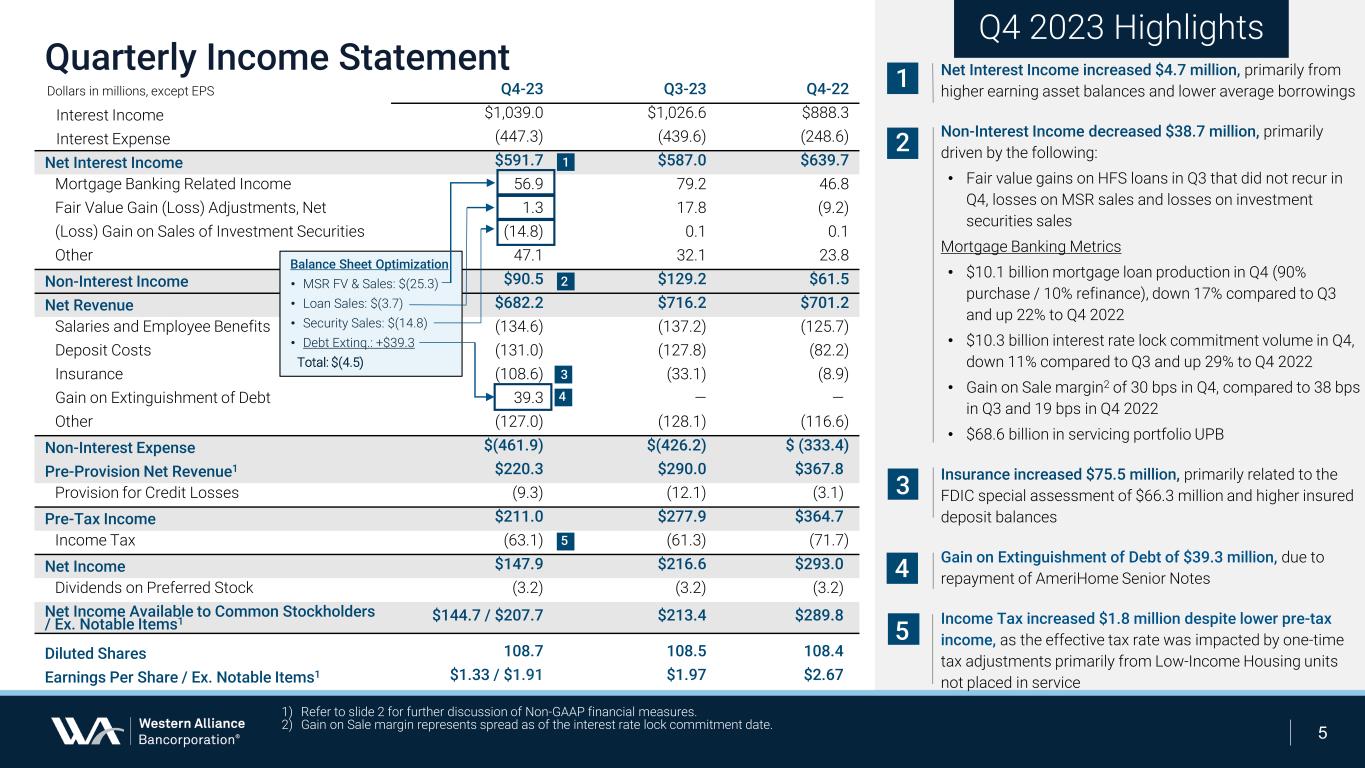

Q4-23 Q3-23 Q4-22 Interest Income $1,039.0 $1,026.6 $888.3 Interest Expense (447.3) (439.6) (248.6) Net Interest Income $591.7 $587.0 $639.7 Mortgage Banking Related Income 56.9 79.2 46.8 Fair Value Gain (Loss) Adjustments, Net 1.3 17.8 (9.2) (Loss) Gain on Sales of Investment Securities (14.8) 0.1 0.1 Other 47.1 32.1 23.8 Non-Interest Income $90.5 $129.2 $61.5 Net Revenue $682.2 $716.2 $701.2 Salaries and Employee Benefits (134.6) (137.2) (125.7) Deposit Costs (131.0) (127.8) (82.2) Insurance (108.6) (33.1) (8.9) Gain on Extinguishment of Debt 39.3 ― ―) Other (127.0) (128.1) (116.6) Non-Interest Expense $(461.9) $(426.2) $ (333.4) Pre-Provision Net Revenue1 $220.3 $290.0 $367.8) Provision for Credit Losses (9.3) (12.1) (3.1)) Pre-Tax Income $211.0 $277.9 $364.7) Income Tax (63.1) (61.3) (71.7) Net Income $147.9 $216.6 $293.0) Dividends on Preferred Stock (3.2) (3.2) (3.2)) Net Income Available to Common Stockholders / Ex. Notable Items1 $144.7 / $207.7 $213.4 $289.8) Diluted Shares 108.7 108.5 108.4) Earnings Per Share / Ex. Notable Items1 $1.33 / $1.91 $1.97 $2.67) Quarterly Income Statement Net Interest Income increased $4.7 million, primarily from higher earning asset balances and lower average borrowings Non-Interest Income decreased $38.7 million, primarily driven by the following: • Fair value gains on HFS loans in Q3 that did not recur in Q4, losses on MSR sales and losses on investment securities sales Mortgage Banking Metrics • $10.1 billion mortgage loan production in Q4 (90% purchase / 10% refinance), down 17% compared to Q3 and up 22% to Q4 2022 • $10.3 billion interest rate lock commitment volume in Q4, down 11% compared to Q3 and up 29% to Q4 2022 • Gain on Sale margin2 of 30 bps in Q4, compared to 38 bps in Q3 and 19 bps in Q4 2022 • $68.6 billion in servicing portfolio UPB Insurance increased $75.5 million, primarily related to the FDIC special assessment of $66.3 million and higher insured deposit balances Gain on Extinguishment of Debt of $39.3 million, due to repayment of AmeriHome Senior Notes Income Tax increased $1.8 million despite lower pre-tax income, as the effective tax rate was impacted by one-time tax adjustments primarily from Low-Income Housing units not placed in service 5 1 2 3 Q4 2023 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Gain on Sale margin represents spread as of the interest rate lock commitment date. 3 4 Dollars in millions, except EPS 2 1 5 4 5 Balance Sheet Optimization • MSR FV & Sales: $(25.3) • Loan Sales: $(3.7) • Security Sales: $(14.8) • Debt Extinq.: +$39.3 Total: $(4.5)

Q4-23 Q3-23 Q4-22 Investments & Cash $14,569 $14,920 $9,803 HFS Loans 1,402 1,766 1,184 HFI Loans, Net 50,297 49,447 51,862 Allowance for Loan Losses (337) (327) (310) Mortgage Servicing Rights 1,124 1,233 1,148 Goodwill and Intangibles, Net 669 672 680 Other Assets 3,138 3,180 3,367 Total Assets $70,862 $70,891 $67,734 Deposits 55,333 $54,287 $53,644 Borrowings 8,125 9,635 7,192 Other Liabilities 1,326 1,223 1,542 Total Liabilities $64,784 $65,145 $62,378 Accumulated Other Comprehensive Loss (513) (733) (661) Total Shareholders’ Equity 6,078 5,746 5,356 Total Liabilities and Equity $70,862 $70,891 $67,734 Tangible Book Value Per Common Share1 $46.72 $43.66 $40.25 Investments & Cash decreased $351 million to $14.6 billion, or (2.4%), primarily due to paydown of debt HFI Loans increased $850 million, or 1.7%, and decreased $1.6 billion, or (3.0%), over prior year Deposits increased $1.0 billion to $55.3 billion, or 1.9%, and are $1.7 billion higher, or 3.1%, over the prior year Borrowings decreased $1.5 billion over prior quarter primarily related to repayment of BTFP borrowings, repo facilities and AmeriHome Senior Notes Shareholders’ Equity increased $332 million as a function of net income and OCI gains, partially offset by dividends Tangible Book Value/Share1 increased $3.06, or 7.0%, over prior quarter and increased $6.47, or 16.1%, over prior year Consolidated Balance Sheet 6 1 3 4 2 3 6 Q4 2023 Highlights 4 5 6 5 Dollars in millions, except per share data 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 1 2

Five Quarter Loan Composition 7 ($1.6) Billion Year-Over-Year Change Quarter-over-quarter loan increase of $850 million driven by (in millions): C&I $759 Construction & Land 220 CRE, OO 39 Offset by decrease in: CRE, non-OO (160) Residential & Consumer (8) Total $850 $20.7 $15.5 $16.7 $18.3 $19.1 $1.8 $1.8 $1.8 $1.8 $1.8 $9.4 $9.6 $9.9 $9.8 $9.7 $4.0 $4.4 $4.4 $4.7 $4.9 $16.0 $15.1 $15.1 $14.8 $14.8 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Residential & Consumer Construction & Land CRE, Non-Owner Occupied CRE, Owner Occupied Commercial & Industrial Dollars in billions, unless otherwise indicated Total Loans, HFI $51.9 $46.4 $47.9 $49.4 $50.3 Qtr. Change -$0.3 -$5.4 +$1.4 +$1.6 +$0.9 30.8% 7.7% 18.1% 3.5% 39.9% 38.0% 3.6% 19.2% 9.7% 29.5%30.0% 9.5% 19.8% 3.6% 37.1% 1) Average yields on loans have been adjusted to a tax equivalent basis. 2) Decrease in HFI loan balance includes $6.0 billion of loans reclassified from HFI to HFS. 3) Increase in HFI loan balance includes $1.0 billion of loans reclassified from HFS to HFI. 4) Increase in HFI loan balance includes $1.3 billion of loans reclassified from HFS to HFI. Q4 2023 Highlights Q4-23 Avg. Yields1 4.25% 7.71% 5.88% 9.33% 7.40% Total Yield 6.65% 2 3 4 Year-over-year loan decrease of ($1.6) billion driven by (in millions): C&I ($1,607) Residential & Consumer (1,157) CRE, OO (8) Offset by increase in: Construction & Land 876 CRE, non-OO 331 Total ($1,565)

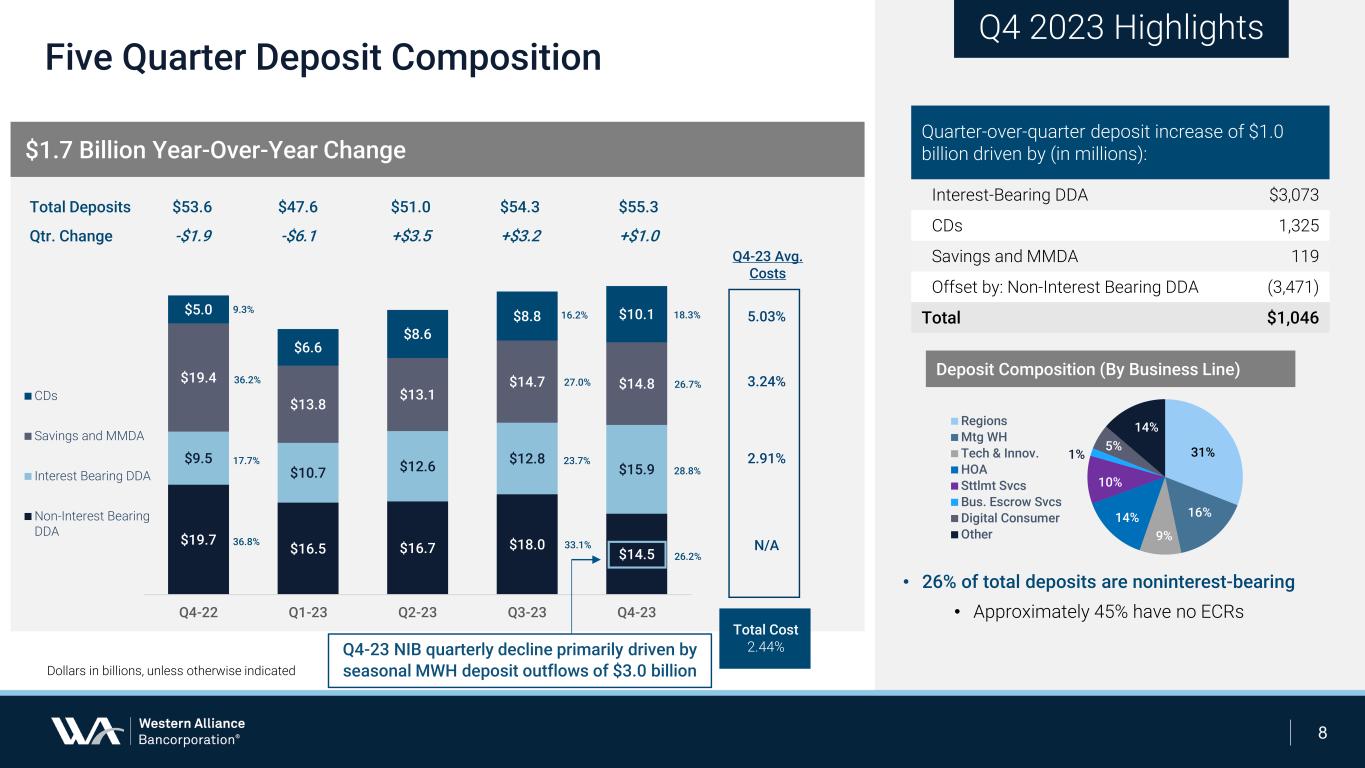

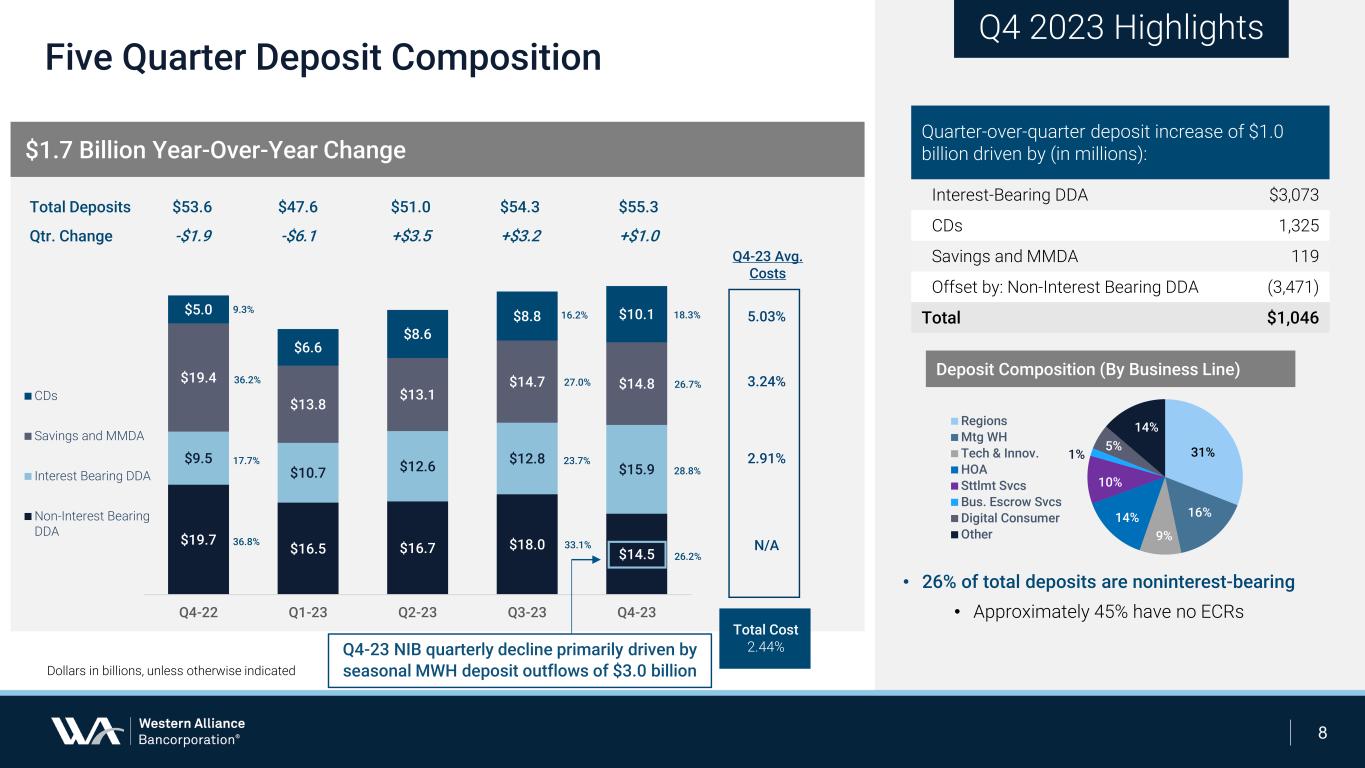

$19.7 $16.5 $16.7 $18.0 $14.5 $9.5 $10.7 $12.6 $12.8 $15.9 $19.4 $13.8 $13.1 $14.7 $14.8 $5.0 $6.6 $8.6 $8.8 $10.1 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 CDs Savings and MMDA Interest Bearing DDA Non-Interest Bearing DDA 16.2% 27.0% 23.7% 33.1% Five Quarter Deposit Composition 8 $1.7 Billion Year-Over-Year Change Quarter-over-quarter deposit increase of $1.0 billion driven by (in millions): Interest-Bearing DDA $3,073 CDs 1,325 Savings and MMDA 119 Offset by: Non-Interest Bearing DDA (3,471) Total $1,046 Dollars in billions, unless otherwise indicated Total Deposits $53.6 $47.6 $51.0 $54.3 $55.3 Qtr. Change -$1.9 -$6.1 +$3.5 +$3.2 +$1.0 9.3% 36.2% 17.7% 36.8% 26.2% 28.8% 26.7% 18.3% Q4 2023 Highlights 5.03% 3.24% 2.91% N/A Deposit Composition (By Business Line) Q4-23 Avg. Costs 31% 16% 9% 14% 10% 1% 5% 14%Regions Mtg WH Tech & Innov. HOA Sttlmt Svcs Bus. Escrow Svcs Digital Consumer Other • 26% of total deposits are noninterest-bearing • Approximately 45% have no ECRs Total Cost 2.44%Q4-23 NIB quarterly decline primarily driven by seasonal MWH deposit outflows of $3.0 billion

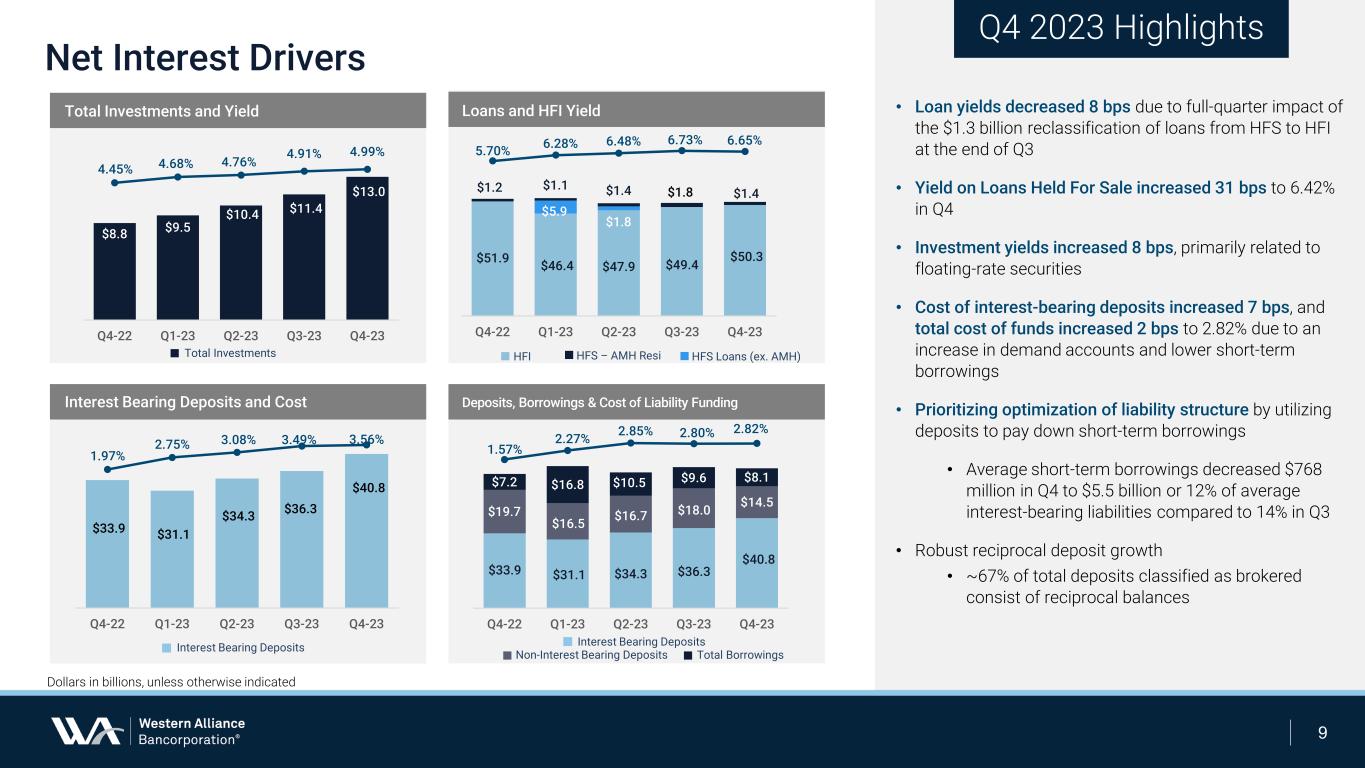

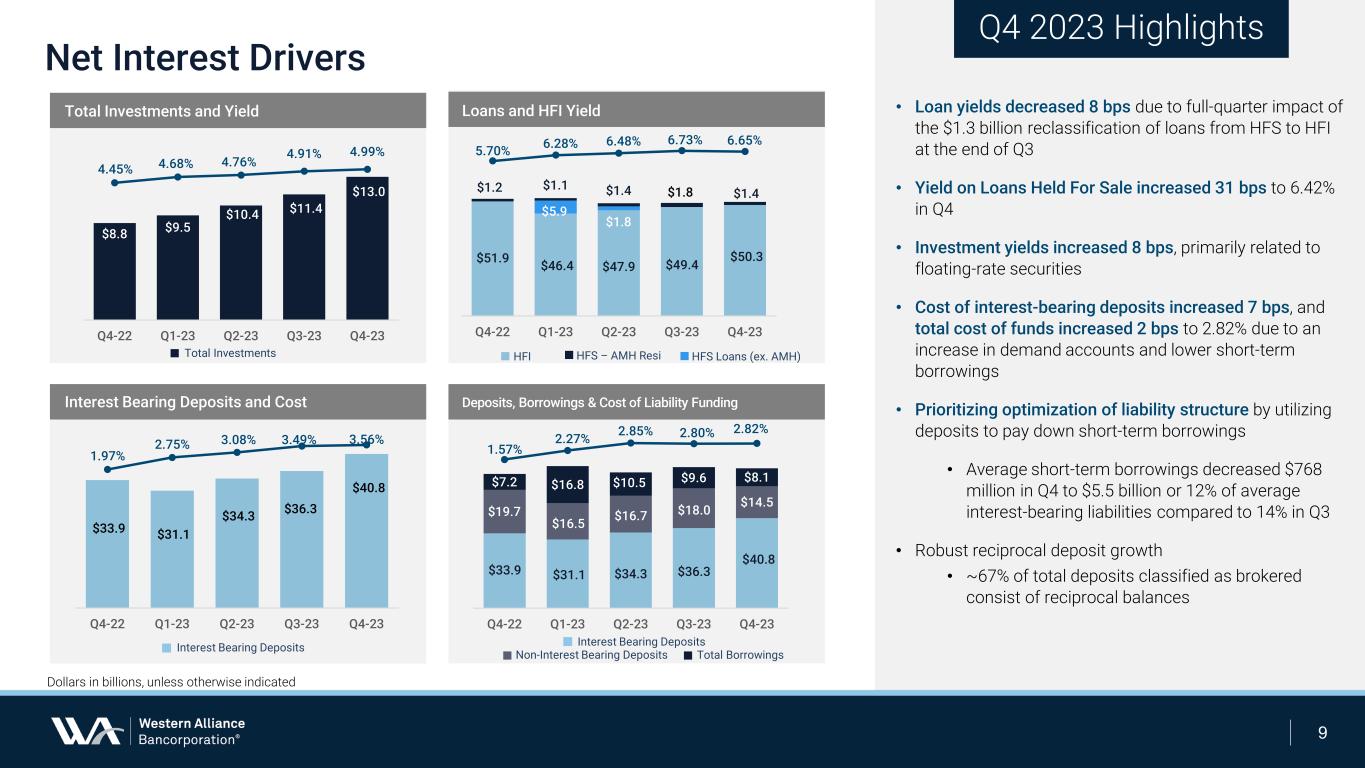

Total Investments and Yield Interest Bearing Deposits and Cost Loans and HFI Yield Deposits, Borrowings & Cost of Liability Funding Net Interest Drivers 9 • Loan yields decreased 8 bps due to full-quarter impact of the $1.3 billion reclassification of loans from HFS to HFI at the end of Q3 • Yield on Loans Held For Sale increased 31 bps to 6.42% in Q4 • Investment yields increased 8 bps, primarily related to floating-rate securities • Cost of interest-bearing deposits increased 7 bps, and total cost of funds increased 2 bps to 2.82% due to an increase in demand accounts and lower short-term borrowings • Prioritizing optimization of liability structure by utilizing deposits to pay down short-term borrowings • Average short-term borrowings decreased $768 million in Q4 to $5.5 billion or 12% of average interest-bearing liabilities compared to 14% in Q3 • Robust reciprocal deposit growth • ~67% of total deposits classified as brokered consist of reciprocal balances $51.9 $46.4 $47.9 $49.4 $50.3 $1.8 $1.2 $1.1 $1.4 $1.8 $1.4 5.70% 6.28% 6.48% 6.73% 6.65% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $5.9 $33.9 $31.1 $34.3 $36.3 $40.8 1.97% 2.75% 3.08% 3.49% 3.56% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $8.8 $9.5 $10.4 $11.4 $13.0 4.45% 4.68% 4.76% 4.91% 4.99% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Non-Interest Bearing Deposits Total Borrowings Q4 2023 Highlights HFI HFS Loans (ex. AMH) Interest Bearing DepositsInterest Bearing Deposits Dollars in billions, unless otherwise indicated Total Investments $33.9 $31.1 $34.3 $36.3 $40.8 $19.7 $16.5 $16.7 $18.0 $14.5 $7.2 $16.8 $10.5 $9.6 $8.1 1.57% 2.27% 2.85% 2.80% 2.82% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 HFS – AMH Resi

$52.2 $52.0 $46.8 $48.1 $49.6 $2.7 $2.1 $6.3 $3.1 $1.8 $8.5 $8.8 $9.9 $10.4 $11.3 $1.3 $3.3 $2.6 $2.9 $2.6 5.50% 5.99% 6.17% 6.37% 6.37% $64.7 $66.2 $65.6 $64.5 $65.3 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $639.7 $609.9 $591.7 $550.3 $587.0 3.98% 3.79% 3.42% 3.67% 3.65% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Net Interest Income 10 • Net Interest Income increased $4.7 million, or 0.8%, over prior quarter primarily due to a higher average earning assets balance and lower short-term borrowings • Average Earning Assets increased $843 million, or 1.3%, over prior quarter • NIM decreased 2 bps, driven by higher interest expense on deposits Net Interest Income and Net Interest Margin Average Earning Assets & Average Yield Net Interest Income Net Interest Margin Q4 2023 Highlights Dollars in millions Dollars in billions Cash & Other Securities Loans Held for Sale Loans Average Yield 13% 4%4% 17% 3% 76% 16% 5% 75% 4% 81% 2%

Non-Interest Expenses and Efficiency1 11 • Adjusted efficiency ratio1 (excluding deposit costs and notable items) increased 100 bps to 51.0% from the prior quarter, driven primarily by higher insurance expense, which includes $66.3 million for the FDIC special assessment • Efficiency ratio1 increased 8.0% to 66.8% compared to the prior quarter and 19.9% from the same period last year • Notable Items increased non-interest expense by $27.0 million in Q4-23 • FDIC Special Assessment: $66.3 million • Debt Repayment at Discount: $(39.3) million • Deposit Costs increased $3.2 million to $131.0 million from higher average ECR-related deposit balances • Total ECR-related deposit balances of $17.8 billion in Q4-23 • Average ECR-related deposits of $19.9 billion in Q4-23 compared to $17.1 billion in Q3-23 and $15.4 billion in Q4-22 Dollars in millions Q4 2023 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) Q1-23 is adjusted to exclude $147.6 million of pre-tax net non-operating charges. 3) Q4-23 adjusted efficiency ratio excludes pre-tax notable items as detailed on slide 20. Non-Interest Expenses and Efficiency Ratio Breakdown of Non-Interest Expenses Non-Interest Expenses Efficiency Ratio Other ExpensesDeposit Costs Salaries & Employee Benefits Adj. Efficiency Ratio (Ex. Notable Items) $333.4 $347.9 $387.4 $426.2 $461.9 46.9% 62.0% 57.1% 58.8% 66.8% 40.0% 43.2% 50.5% 50.0% 51.0% Q4-22 Q1-23 Q2-23 Q3-23 Q4-232 $116.6 $96.5 $117.8 $128.1 $87.7 $125.7 $148.9 $145.6 $137.2 $134.6 $82.2 $86.9 $91.0 $127.8 $131.0 $8.9 $15.7 $33.0 $33.1 $108.6 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Insurance Net Notable Items: $27.0 mm FDIC Special Assessment: $66.3 mm Debt Repayment at Discount: $(39.3) mm 3

$351 $320 $694 $668 $641 0.68% 0.69% 1.45% 1.35% 1.27% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $11 $11 $11 $8 $8$85 $107 $256 $237 $273 $297 $341 $337 $394 $392 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Asset Quality 12 • Asset quality remained stable, as the aggregate net change in Special Mention Loans and Classified Assets was only $7 million • Special Mention Loans decreased $27 million to $641 million (127 bps to Funded Loans) • Total Classified Assets increased $34 million to $673 million (95 bps to Total Assets) • Non-Performing Assets (Non-Performing Loans + OREO) increased $36 million to $281 million (40 bps to Total Assets) • Over last 10+ years, only ~1% of Special Mention Loans have migrated to loss Special Mention Loans Dollars in millions Classified Assets Special Mention Loans OREO Non-Performing Loans Classified Accruing Assets $393 $459 $604 $639 SM / Funded Loans Q4 2023 Highlights $673 Asset Quality Ratios 0.58% 0.65% 0.89% 0.90% 0.95% 0.14% 0.17% 0.39% 0.35% 0.40% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 Classified Assets / Total Assets NPLs + OREO / Total Assets Classified Assets Mix 26% 10% 11% 8% 2% CRE Investor C&I Resi Construction CRE OO Securities 22% Hotel 18% Office 3% Other

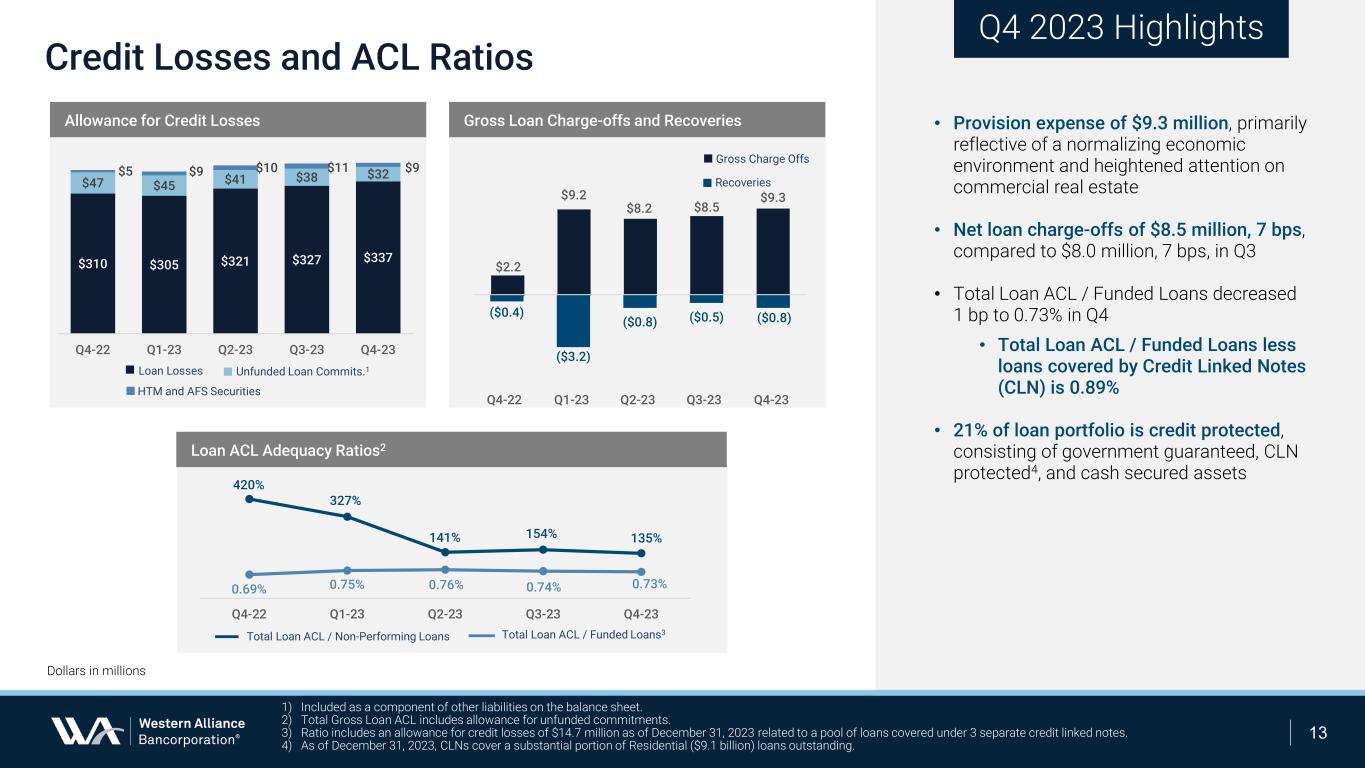

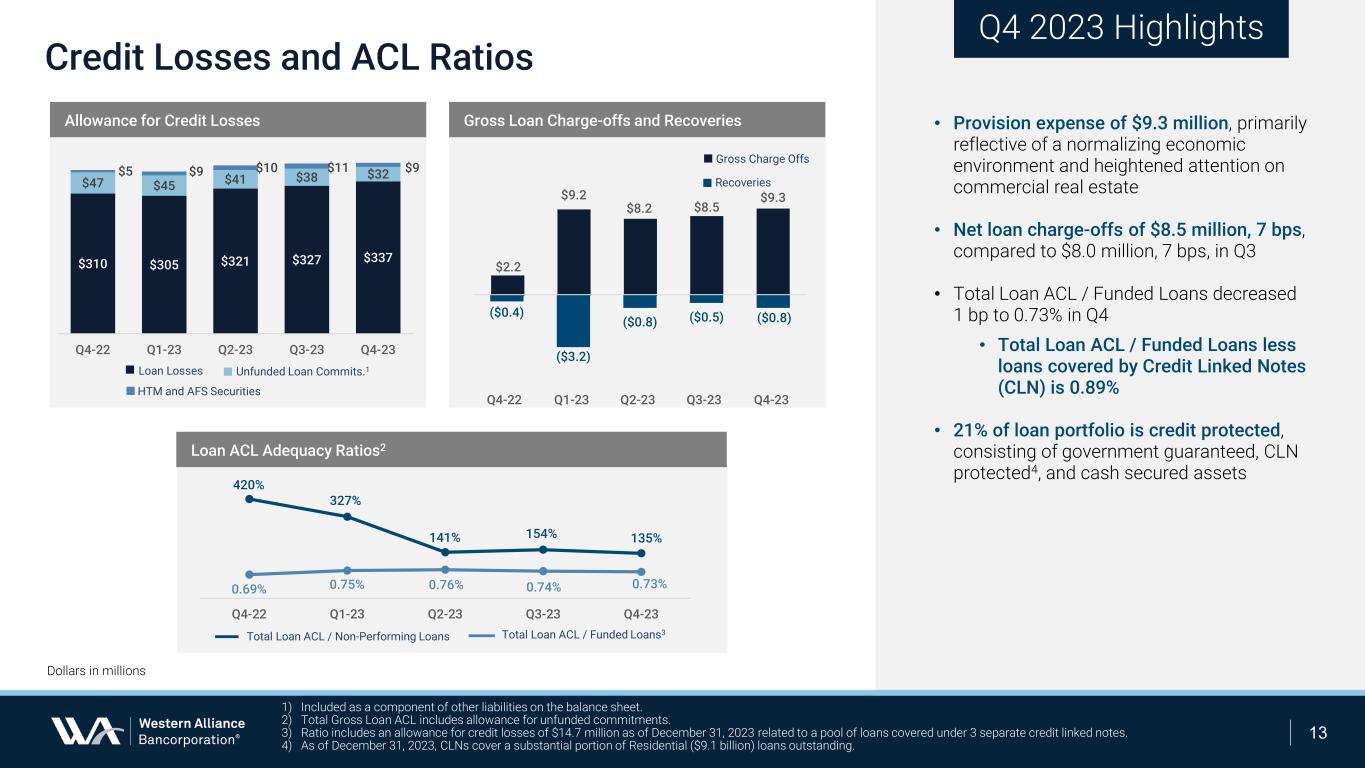

$310 $305 $321 $327 $337 $47 $45 $41 $38 $32$5 $9 $10 $11 $9 Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 $2.2 $9.2 $8.2 $8.5 $9.3 ($0.4) ($3.2) ($0.8) ($0.5) ($0.8) Credit Losses and ACL Ratios 13 • Provision expense of $9.3 million, primarily reflective of a normalizing economic environment and heightened attention on commercial real estate • Net loan charge-offs of $8.5 million, 7 bps, compared to $8.0 million, 7 bps, in Q3 • Total Loan ACL / Funded Loans decreased 1 bp to 0.73% in Q4 • Total Loan ACL / Funded Loans less loans covered by Credit Linked Notes (CLN) is 0.89% • 21% of loan portfolio is credit protected, consisting of government guaranteed, CLN protected4, and cash secured assets Dollars in millions Allowance for Credit Losses Gross Loan Charge-offs and Recoveries Loan ACL Adequacy Ratios2 Total Loan ACL / Non-Performing Loans Total Loan ACL / Funded Loans3 Loan Losses Unfunded Loan Commits.1 HTM and AFS Securities Gross Charge Offs Recoveries Q4 2023 Highlights 1) Included as a component of other liabilities on the balance sheet. 2) Total Gross Loan ACL includes allowance for unfunded commitments. 3) Ratio includes an allowance for credit losses of $14.7 million as of December 31, 2023 related to a pool of loans covered under 3 separate credit linked notes. 4) As of December 31, 2023, CLNs cover a substantial portion of Residential ($9.1 billion) loans outstanding. Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 0.69% 0.75% 0.76% 0.74% 0.73% 420% 327% 141% 154% 135% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23

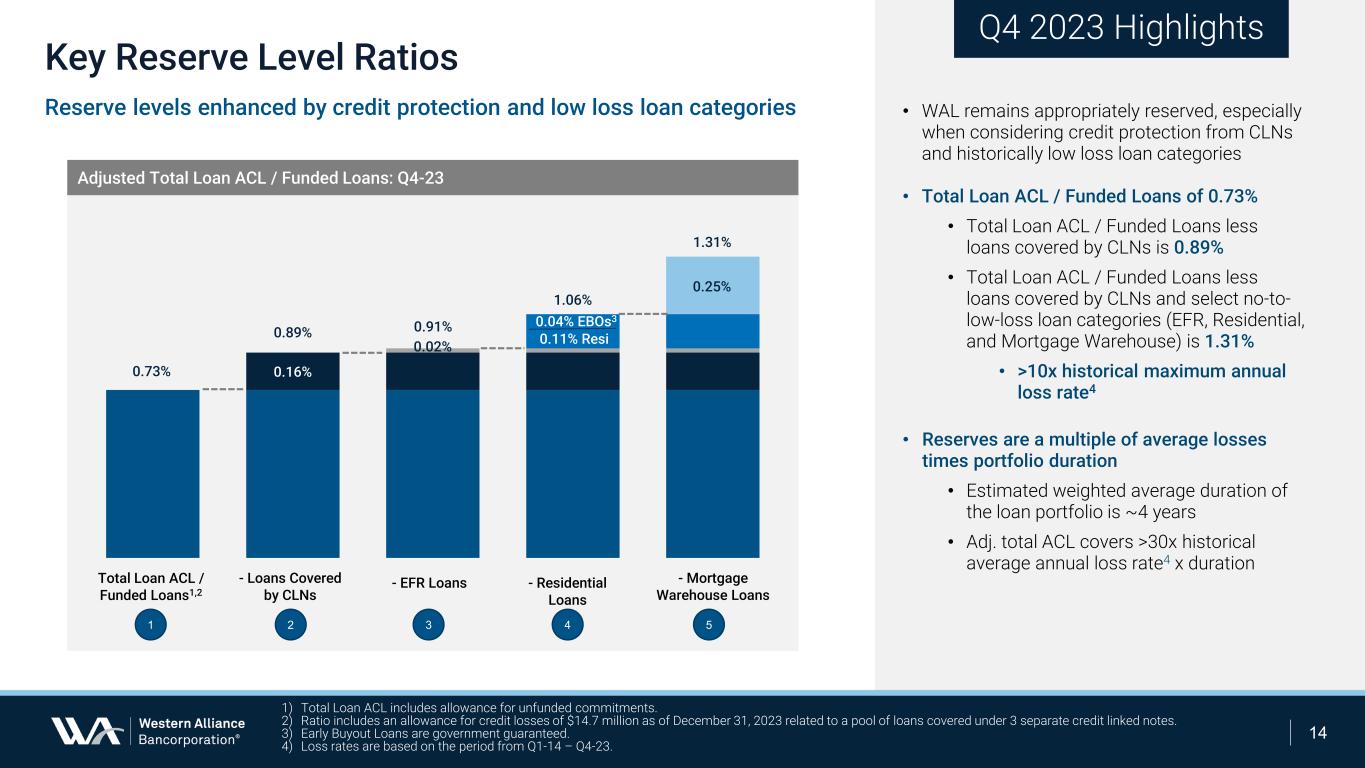

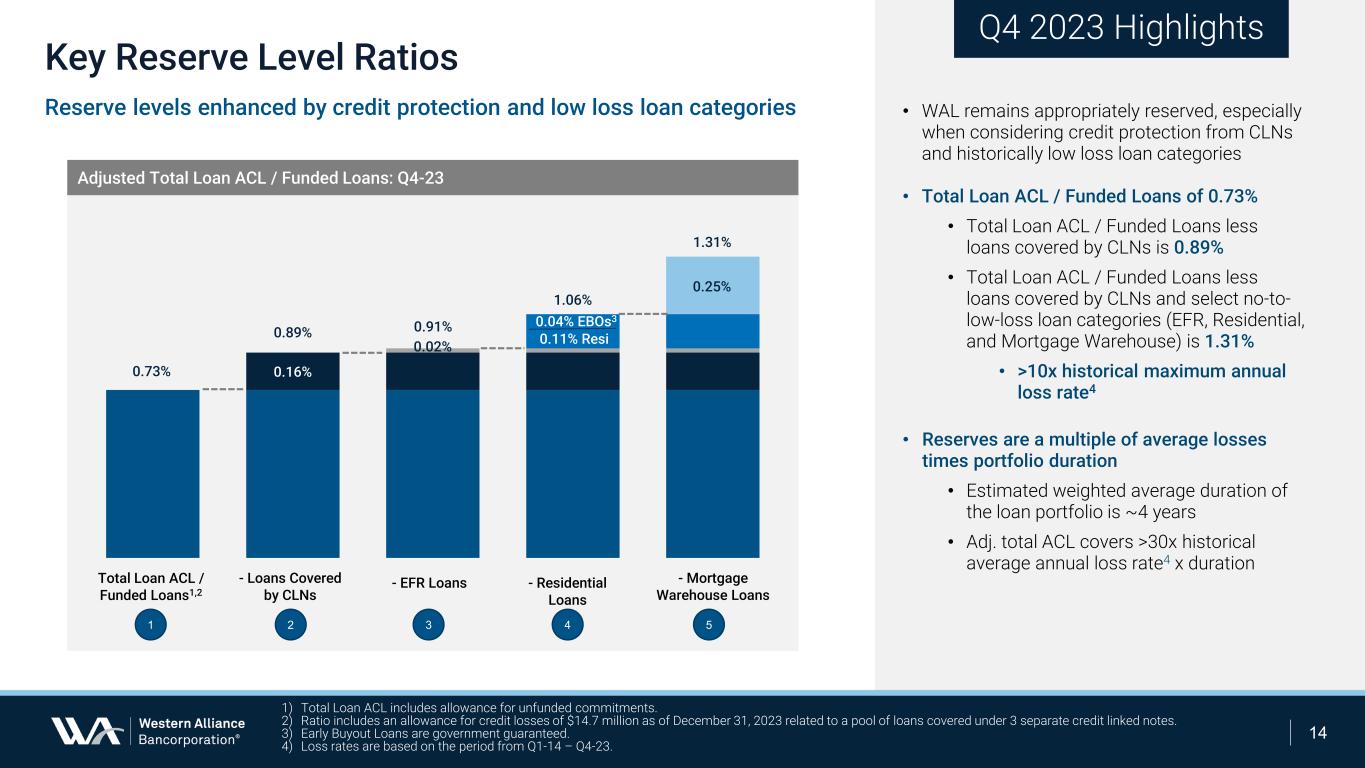

14 • WAL remains appropriately reserved, especially when considering credit protection from CLNs and historically low loss loan categories • Total Loan ACL / Funded Loans of 0.73% • Total Loan ACL / Funded Loans less loans covered by CLNs is 0.89% • Total Loan ACL / Funded Loans less loans covered by CLNs and select no-to- low-loss loan categories (EFR, Residential, and Mortgage Warehouse) is 1.31% • >10x historical maximum annual loss rate4 • Reserves are a multiple of average losses times portfolio duration • Estimated weighted average duration of the loan portfolio is ~4 years • Adj. total ACL covers >30x historical average annual loss rate4 x duration Key Reserve Level Ratios Reserve levels enhanced by credit protection and low loss loan categories 0.89% 0.91% 1.06% 1.31% 0.73% Total Loan ACL / Funded Loans1,2 - Loans Covered by CLNs 1 2 - EFR Loans 3 4 - Residential Loans 5 - Mortgage Warehouse Loans 0.04% EBOs3 Adjusted Total Loan ACL / Funded Loans: Q4-23 1) Total Loan ACL includes allowance for unfunded commitments. 2) Ratio includes an allowance for credit losses of $14.7 million as of December 31, 2023 related to a pool of loans covered under 3 separate credit linked notes. 3) Early Buyout Loans are government guaranteed. 4) Loss rates are based on the period from Q1-14 – Q4-23. 0.11% Resi 0.25% 0.02% 0.16% Q4 2023 Highlights

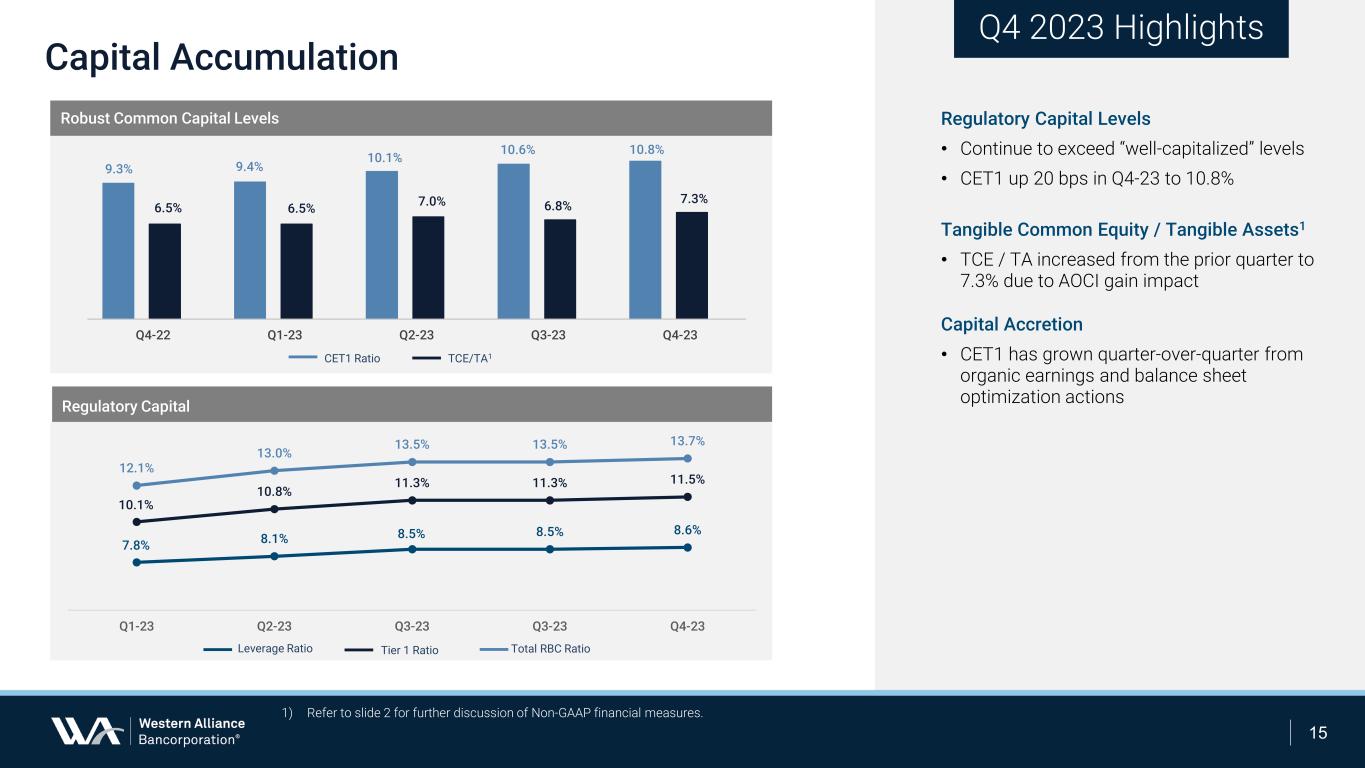

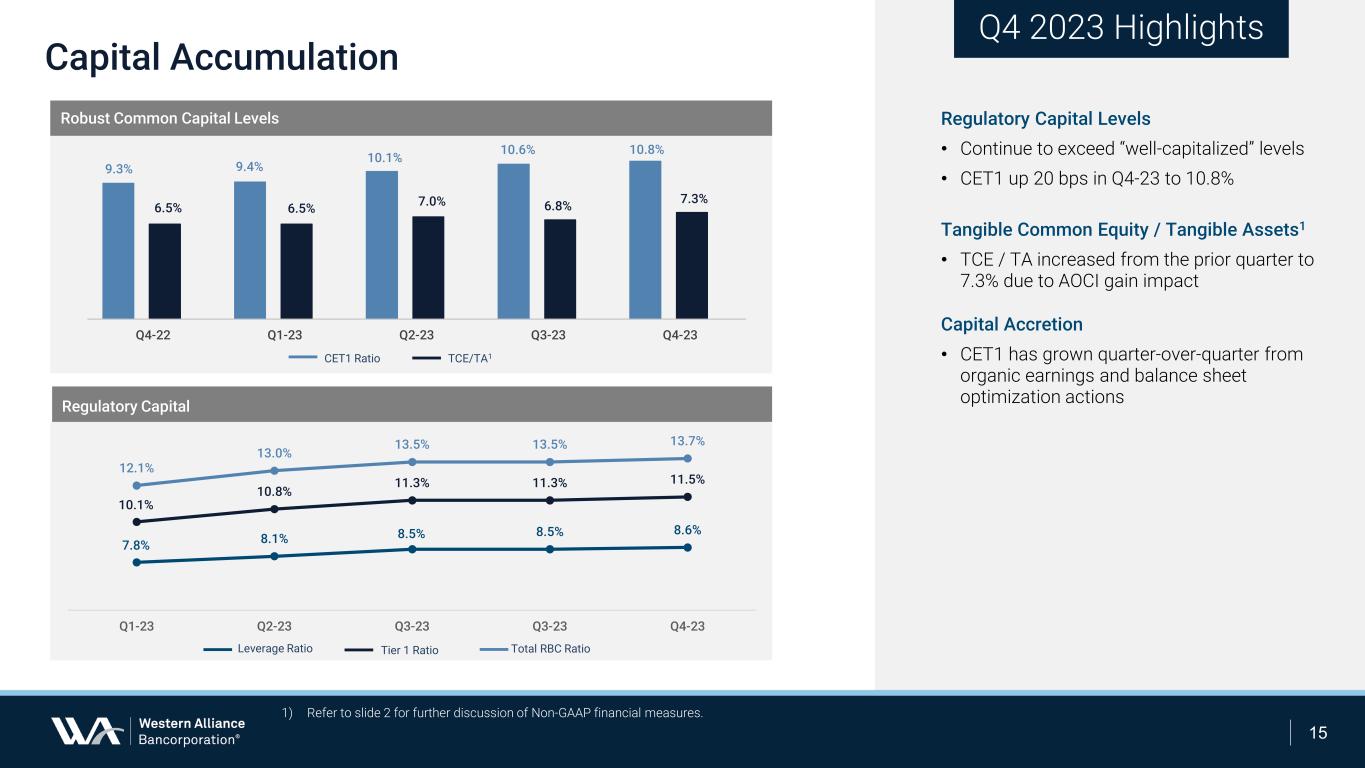

Capital Accumulation 15 Regulatory Capital Levels • Continue to exceed “well-capitalized” levels • CET1 up 20 bps in Q4-23 to 10.8% Tangible Common Equity / Tangible Assets1 • TCE / TA increased from the prior quarter to 7.3% due to AOCI gain impact Capital Accretion • CET1 has grown quarter-over-quarter from organic earnings and balance sheet optimization actions Robust Common Capital Levels Regulatory Capital 9.3% 9.4% 10.1% 10.6% 10.8% 6.5% 6.5% 7.0% 6.8% 7.3% Q4-22 Q1-23 Q2-23 Q3-23 Q4-23 CET1 Ratio TCE/TA1 Q4 2023 Highlights 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. Total RBC RatioTier 1 RatioLeverage Ratio 7.8% 8.1% 8.5% 8.5% 8.6% 10.1% 10.8% 11.3% 11.3% 11.5% 12.1% 13.0% 13.5% 13.5% 13.7% Q1-23 Q2-23 Q3-23 Q3-23 Q4-23

493% 562% 58% 111% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 MRQ 16 Tangible Book Value per Share1 • TBVPS increased $3.06 to $46.72 from prior quarter from improvement in AOCI and organic earnings • Increased 7.1% quarter-over-quarter, non-annualized • Increased 16.2% year-over-year • 19.5% CAGR since year end 2013 • TBVPS has increased 8.5x that of peers • Quarterly common stock cash dividend of $0.37 per share Long-Term Growth in TBV per Share1 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 2) MRQ is Q4-23 for WAL and Q3-23 for WAL Peers. Note: Peers consist of the 18 major exchange traded US banks with total assets between $50 bn and $250 bn as of September 30, 2023, excluding target banks of pending acquisitions. TSR performance is through December 31, 2023. S&P Global Market Intelligence. WAL WAL with Dividends Added Back Peer Median Peer Median with Dividends Added Back 2 Tangible Book Value Growth Q4 2023 Highlights 1x 2x 3x 4x 5x 6x WAL Peer Top Quartile Peer Median KRE 1-Year 14% 13% 1% -8% 3-Year 17% 40% 24% 9% 5-Year 84% 79% 45% 29% 10-Year 204% 155% 96% 62% Total Shareholder Returns

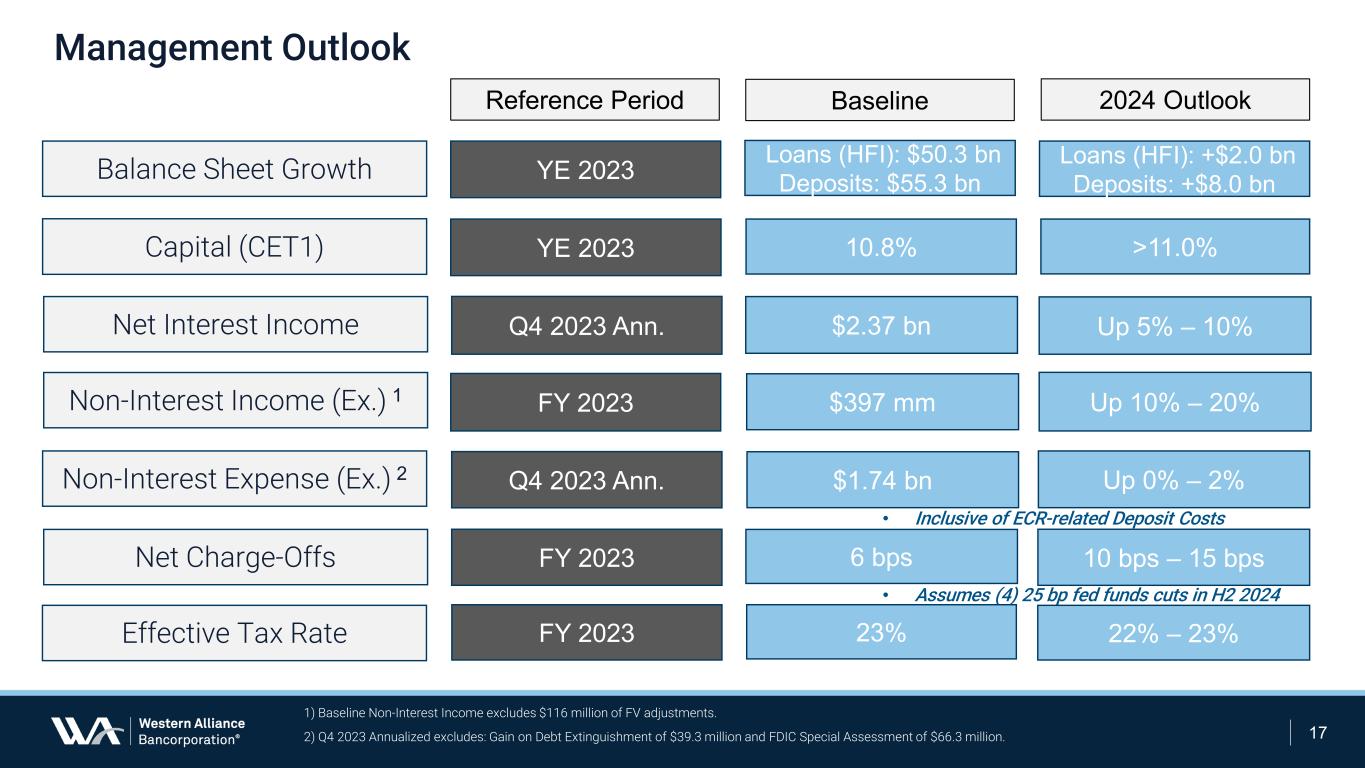

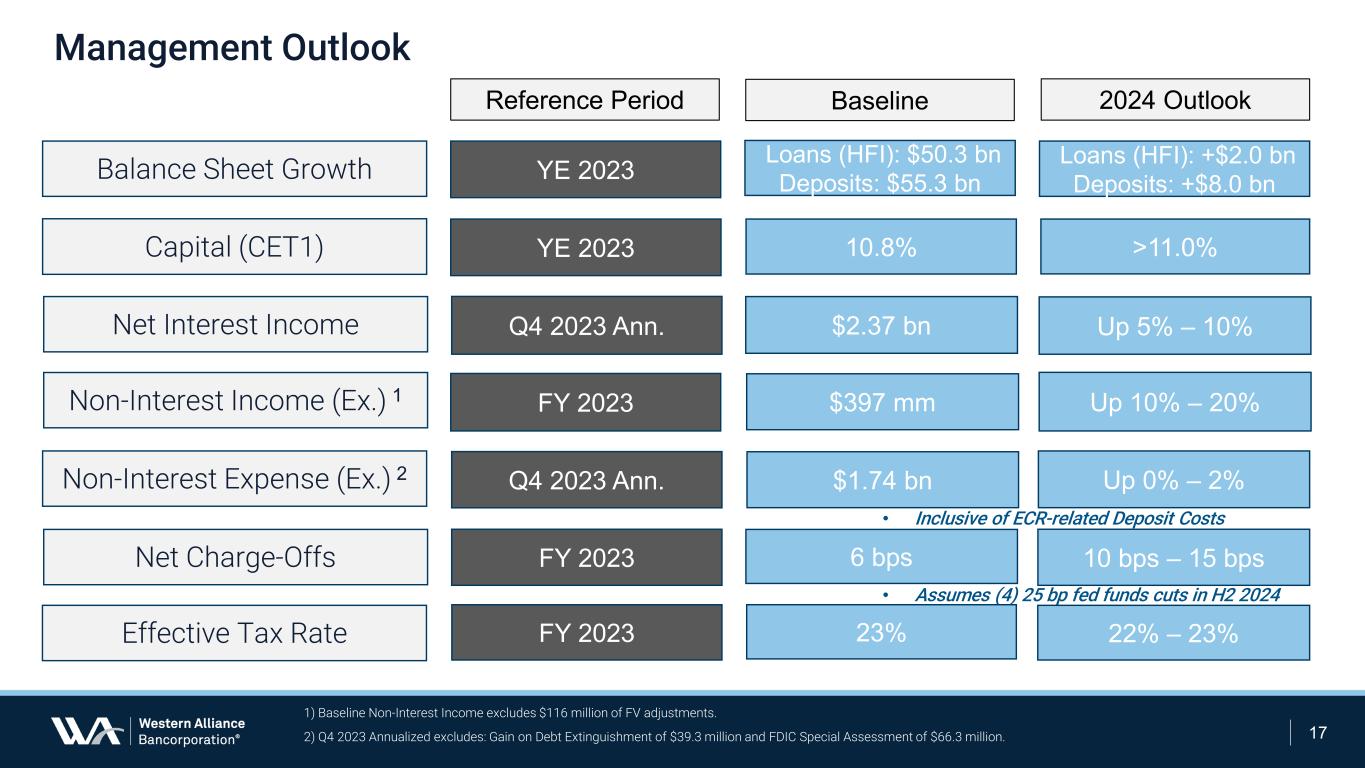

Management Outlook 17 Loans (HFI): +$2.0 bn Deposits: +$8.0 bn >11.0% Up 5% – 10% Up 10% – 20% Up 0% – 2% 10 bps – 15 bps 2024 OutlookBaseline Loans (HFI): $50.3 bn Deposits: $55.3 bn 10.8% $2.37 bn $397 mm $1.74 bn 6 bps • Assumes (4) 25 bp fed funds cuts in H2 2024 • Inclusive of ECR-related Deposit Costs 1) Baseline Non-Interest Income excludes $116 million of FV adjustments. Reference Period YE 2023 YE 2023 Q4 2023 Ann. FY 2023 Q4 2023 Ann. FY 2023 2) Q4 2023 Annualized excludes: Gain on Debt Extinguishment of $39.3 million and FDIC Special Assessment of $66.3 million. 22% – 23%23%FY 2023 Balance Sheet Growth Capital (CET1) Net Interest Income Non-Interest Income (Ex.) 1 Non-Interest Expense (Ex.) 2 Net Charge-Offs Effective Tax Rate

Questions & Answers

Appendix

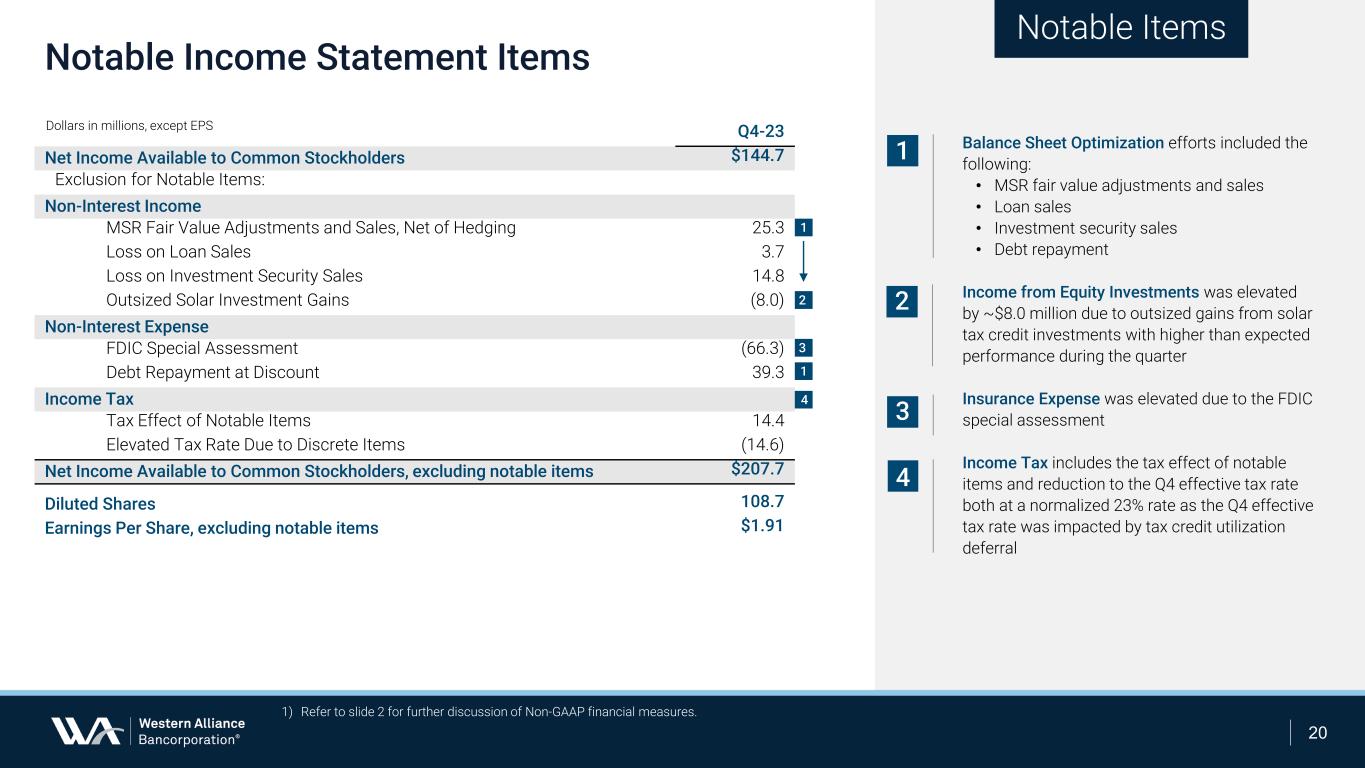

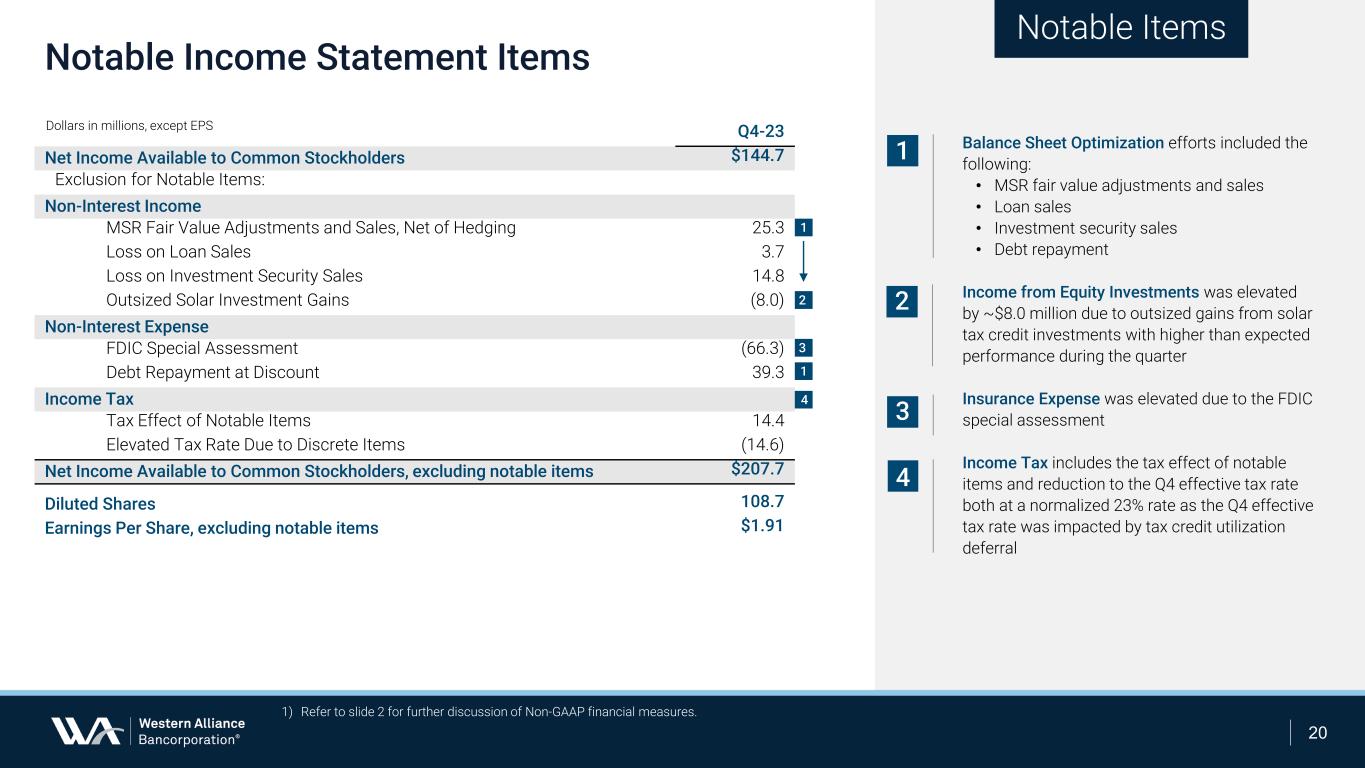

Q4-23 Net Income Available to Common Stockholders $144.7 Exclusion for Notable Items: Non-Interest Income MSR Fair Value Adjustments and Sales, Net of Hedging 25.3 Loss on Loan Sales 3.7 Loss on Investment Security Sales 14.8 Outsized Solar Investment Gains (8.0) Non-Interest Expense FDIC Special Assessment (66.3) Debt Repayment at Discount 39.3 Income Tax Tax Effect of Notable Items 14.4 Elevated Tax Rate Due to Discrete Items (14.6) Net Income Available to Common Stockholders, excluding notable items $207.7 Diluted Shares 108.7 Earnings Per Share, excluding notable items $1.91 Dollars in millions, except EPS Notable Income Statement Items 20 1 3 4 Notable Items 1) Refer to slide 2 for further discussion of Non-GAAP financial measures. 4 3 1 Balance Sheet Optimization efforts included the following: • MSR fair value adjustments and sales • Loan sales • Investment security sales • Debt repayment Income from Equity Investments was elevated by ~$8.0 million due to outsized gains from solar tax credit investments with higher than expected performance during the quarter Insurance Expense was elevated due to the FDIC special assessment Income Tax includes the tax effect of notable items and reduction to the Q4 effective tax rate both at a normalized 23% rate as the Q4 effective tax rate was impacted by tax credit utilization deferral 1 2 2

Commercial Real Estate Investor Statistics 21 CRE Investor Portfolio ($9.6 Billion; 19% of Total Loans) Distribution by LTV Underwriting Criteria and Mitigating Factors 23% 25% 29% 14% 4% 5% <=40% 41-50% 51-60% 61-70% 71-80% >80% • Low LTV & LTC (50% to low 60%) range underwriting in areas minimizes tail risk • Simple capital structure - no junior liens or mezzanine debt permitted within our structures • Majority of CRE Investor (bulk of total CRE) is located in our core footprint states • Early elevation, proactive and comprehensive review of CRE portfolio and re-margin discussions with sponsors where sweep/re-margin provisions have been triggered Note: LTV data assumes all loans are fully funded; based on most recent appraisals and utilizing, in most cases, “as stabilized” values for income producing properties. 44% 25% 8% 6% 6% 4% 2% 1% 1% 1% 2% 48% 59% 61% 50% 50% 35% 42% 51% 25% 49% 48% -50% -30% -10% 10% 30% 50% 70% 0% 10% 20% 30% 40% 50% 60% Outstanding LTV Low uncovered risk with re-margin provisions

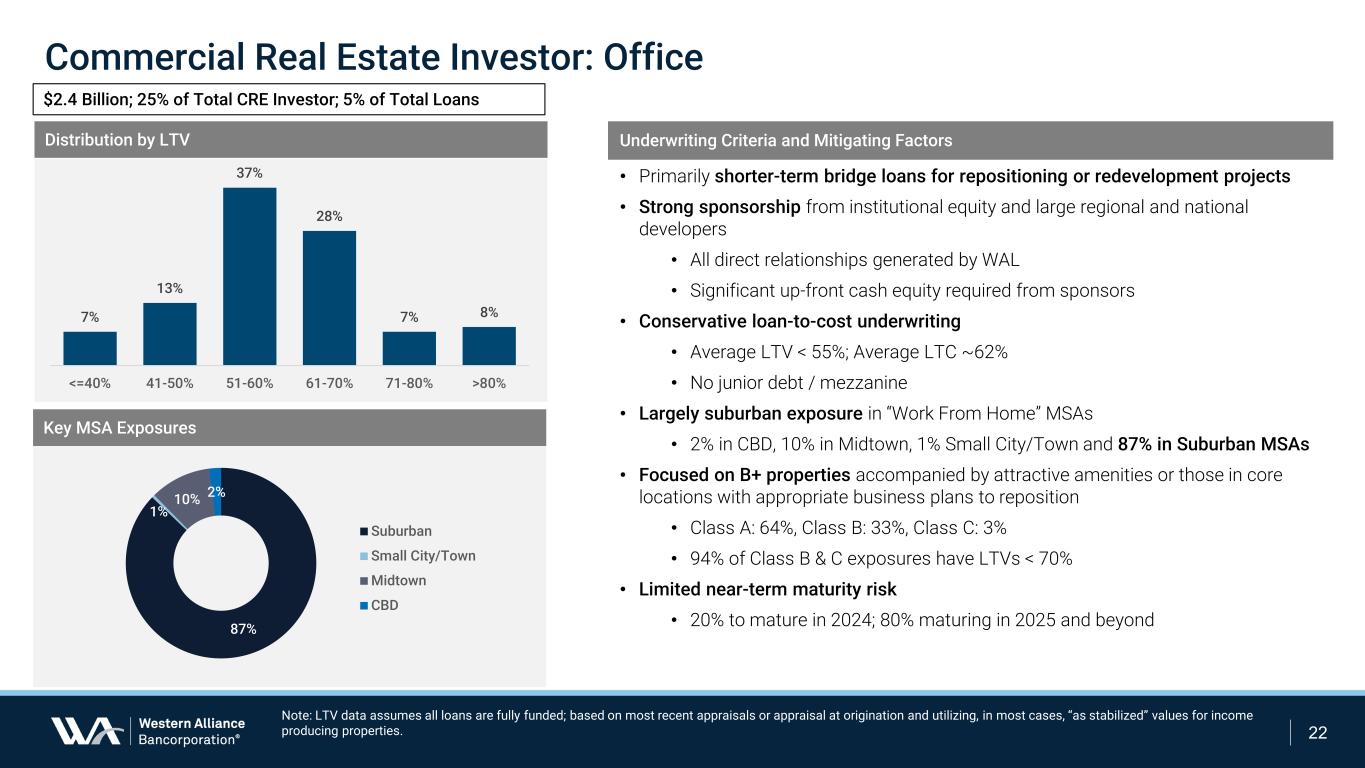

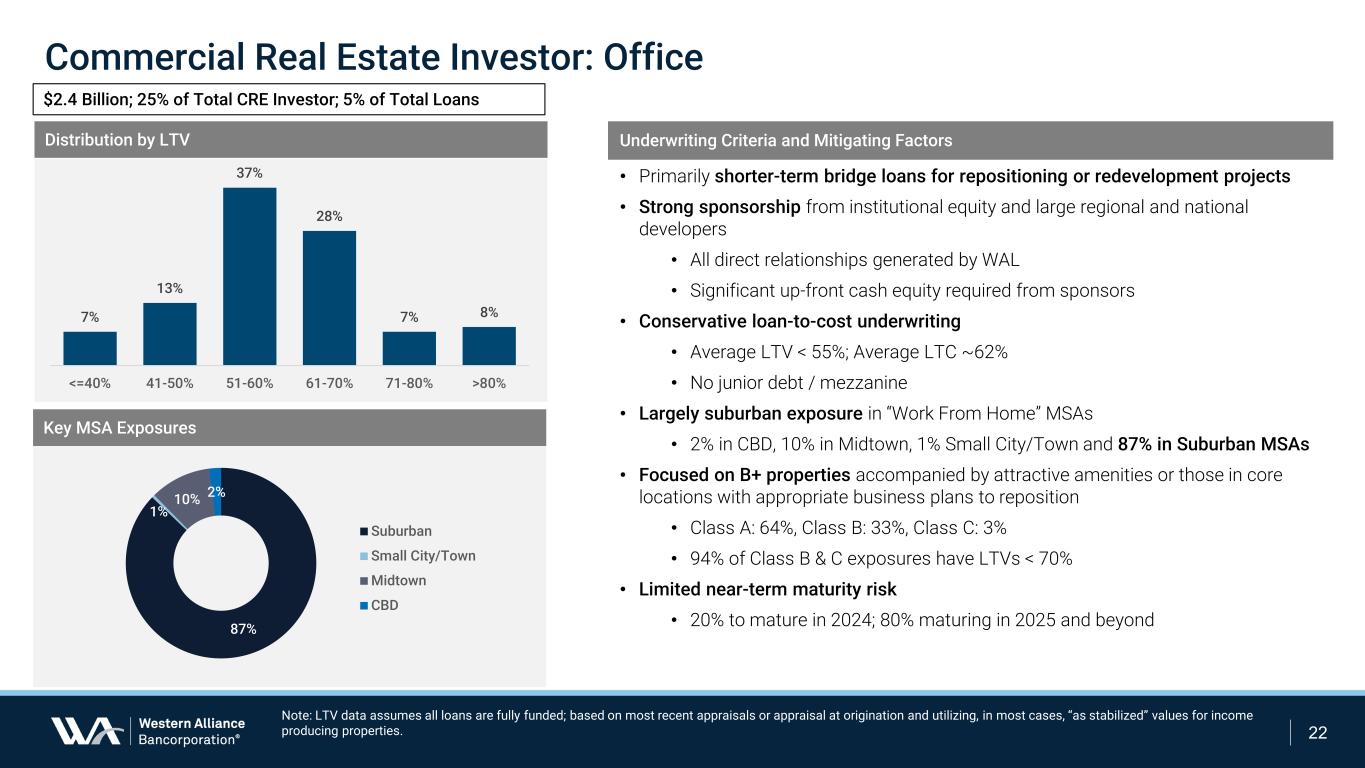

Commercial Real Estate Investor: Office 22 Distribution by LTV Underwriting Criteria and Mitigating Factors • Primarily shorter-term bridge loans for repositioning or redevelopment projects • Strong sponsorship from institutional equity and large regional and national developers • All direct relationships generated by WAL • Significant up-front cash equity required from sponsors • Conservative loan-to-cost underwriting • Average LTV < 55%; Average LTC ~62% • No junior debt / mezzanine • Largely suburban exposure in “Work From Home” MSAs • 2% in CBD, 10% in Midtown, 1% Small City/Town and 87% in Suburban MSAs • Focused on B+ properties accompanied by attractive amenities or those in core locations with appropriate business plans to reposition • Class A: 64%, Class B: 33%, Class C: 3% • 94% of Class B & C exposures have LTVs < 70% • Limited near-term maturity risk • 20% to mature in 2024; 80% maturing in 2025 and beyond Key MSA Exposures $2.4 Billion; 25% of Total CRE Investor; 5% of Total Loans 7% 13% 37% 28% 7% 8% <=40% 41-50% 51-60% 61-70% 71-80% >80% 87% 1% 10% 2% Suburban Small City/Town Midtown CBD Note: LTV data assumes all loans are fully funded; based on most recent appraisals or appraisal at origination and utilizing, in most cases, “as stabilized” values for income producing properties.

Superior Deposit Liquidity and Fortified Adjusted Capital 23 Excellent Combined Insured/Collateralized Deposits & CET1 Capital Adjusting for AOCI Securities Marks Insured/collateralized deposits for peers from SEC filings or 9/30/23 RC-O data and Collateralized deposits for peers uses YE22 RC-E data. Includes Top-50 publicly traded banks headquartered in the US by assets as of September 30, 2023. Source: S&P Global Market Intelligence, Call reports. Insured Deposits % vs. CET1 Adj. (Incl. of AOCI Unrealized Securities Marks) for Top 50 Banks by Assets ABCB ASB BAC BANC BKU BOKF BPOP C CADE CBSH CFG CFR CMA COLB EWBC FCNC.A FHB FHN FIBK FITB FNB FULT GBCI HBAN HWC JPM KEY MTB NYCB ONB OZK PB PNC PNFP RF SFNC SNV SSB TCBI TFC UBSI UCBI UMBF USB VLY WAL WBS WFC WTFC ZION 50% 55% 60% 65% 70% 75% 80% 85% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 11.5% 12.0% 12.5% 13.0% 13.5% 14.0% 14.5% 15.0% 15.5% *I ns ur ed /C ol la te ra liz ed D ep os its % (Q 3- 23 ) CET1 adj. for AOCI (Q3-23) WAL Adj. CET1: 9.8% (Q4-23)