Exhibit 99.1

Bancshares of Florida, Inc.

Investor Presentation November 16, 2006

Financial Data at September 30, 2006 Valuation at October 30, 2006

Forward-Looking Statements

Statements contained in this presentation which are not historical facts are forward-looking statements as that item is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from estimated results. Such risks and uncertainties are detailed in the Company’s filings with the Securities and Exchange Commission.

NASDAQ: BOFL

We Are Building

Florida’s Bank with

Vision Strength Momentum

Bank of Florida’s Story

Experienced management team Premier Florida markets Demonstrated high growth Excellent asset quality

Diminished competition through consolidation

Earnings momentum (6 consecutive rising quarters) Compelling valuation

Vision

Building’s Florida Best Bank

“The best vision, is in sight.”

- Malcolm Forbes Forbes Magazine

Vision—Building Florida’s Bank

Mission Statement:

To be the “Bank of Choice” for businesses, professionals and individuals with desire for relationship-driven financial solutions.

NASDAQ: BOFL

Vision—Building Florida’s Bank

Current Highlights

7th largest publicly-traded bank holding company headquartered in Florida based on total assets; 4th largest proforma with Old Florida Bankshares, Inc. acquisition (expected closing 1Q’07)

Independent community banks with local Boards of Directors and separate charters

Full-service commercial banking delivered in a private banking environment with limited branching

Primary focus is lending on commercial real estate properties in the $1—$15 million range

Comprehensive suite of products and services, especially cash management

Integrated wealth management strategy through Bank of Florida Trust Company

Motivated staff of experienced banking professionals

NASDAQ: BOFL

Vision—Target Client Profile

Business owners

Entrepreneurs

Executives

Professionals (doctors, attorneys, accountants)

Professional associations

Businesses

Wealthy families and individuals

Foundations and estates

NASDAQ: BOFL

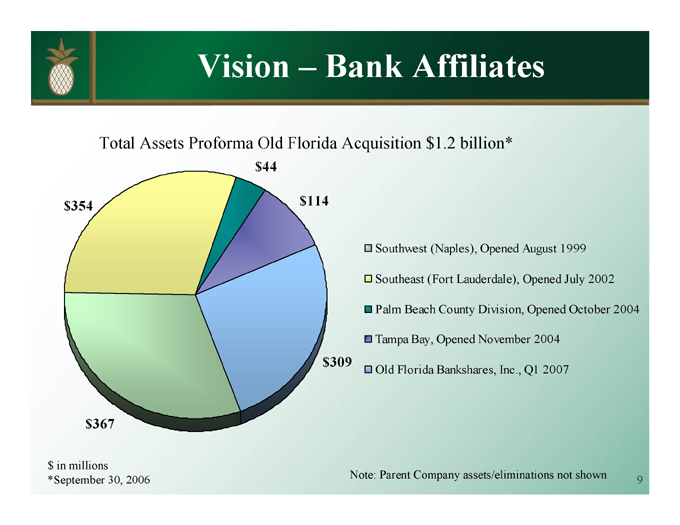

Vision – Bank Affiliates

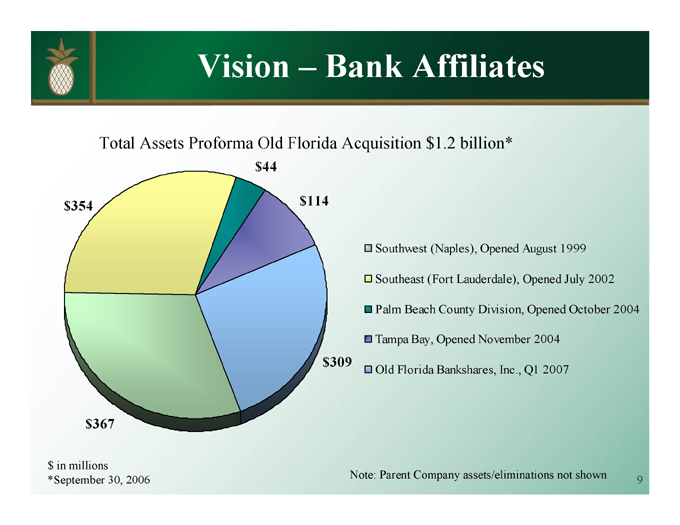

Total Assets Proforma Old Florida Acquisition $1.2 billion*

$354 $44 $114 $309 $367

Southwest (Naples), Opened August 1999 Southeast (Fort Lauderdale),

Opened July 2002 Palm Beach County Division, Opened October 2004

Tampa Bay, Opened November 2004 Old Florida Bankshares, Inc., Q1 2007

$in millions *September 30, 2006

Note: Parent Company assets/eliminations not shown

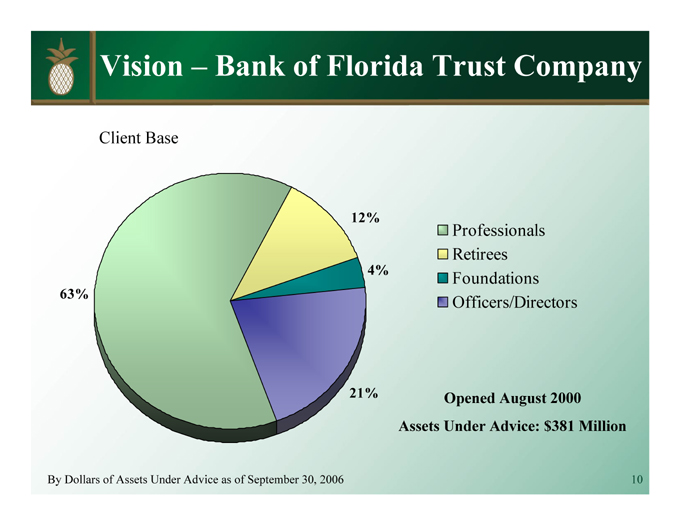

Vision – Bank of Florida Trust Company

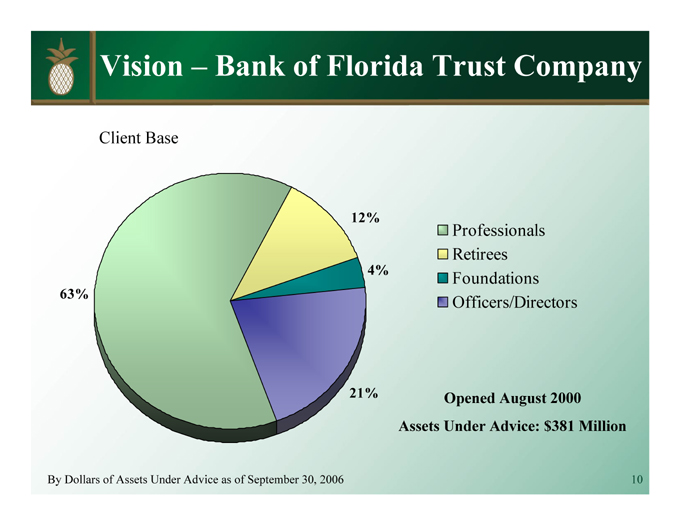

Client Base

63%

12%

4%

21%

Professionals Retirees Foundations Officers/Directors

Opened August 2000 Assets Under Advice: $381 Million

By Dollars of Assets Under Advice as of September 30, 2006

Vision – Market Expansion Opportunities

Bonita Springs: April 2006 Aventura: August 2006

Strategic Acquisition—Bristol Bank (Coral Gables): August 2006 Tampa Bay Expansion: 2006—2007 (Pinellas County) Strategic Acquisition—Old Florida Bankshares, Inc. (Fort Myers): Q1 2007 Downtown Coral Gables: Q2 2007

Current Markets (9 Locations) 2007 Expansion Markets (5 Locations)

Vision – Bristol Bank Consolidation

Successfully closed this $90 million-asset acquisition – BOFL’s first – on August 25, 2006, building Bank of Florida – Southeast’s franchise to over $350 million in assets.

Operational integration fully completed in early September, building valuable team skills for future acquisitions

Implemented in excess of $800,000 in annualized cost savings; impact to be realized in 4Q’06

New leadership in place with extensive experience in the Miami-Dade County market; recruiting of other key hires underway

Additional Downtown Coral Gables Banking Center site secured with expected opening in 2Q’07

Vision – Old Florida Bankshares Acquisition

Great Cultural Fit—emphasis on decentralized decision-making, responsive customer service, quality management team

Great Strategic Fit—an in-market transaction, increasing the combined market share in two of Florida’s top markets—Ft. Myers and Naples MSAs—from 17th to 10th

Great Financial Fit—expected to be meaningfully accretive to EPS and profitability ratios in first year

Commercial Real Estate and Construction Focus match BOFL’s core competencies, with opportunity to diversify via leveraging our new C&I team

Historically Strong Asset Quality, with lenders and many borrowers already well known to BOFL’s lending team

Deposit Mix provides opportunity to leverage BOFL’s cash management capabilities

Old Florida’s Customer Base becomes new market for BOF Trust Company’s wealth management services

Builds Combined Company to $1.2 billion in Assets and $250 million in market cap, increasing liquidity and visibility

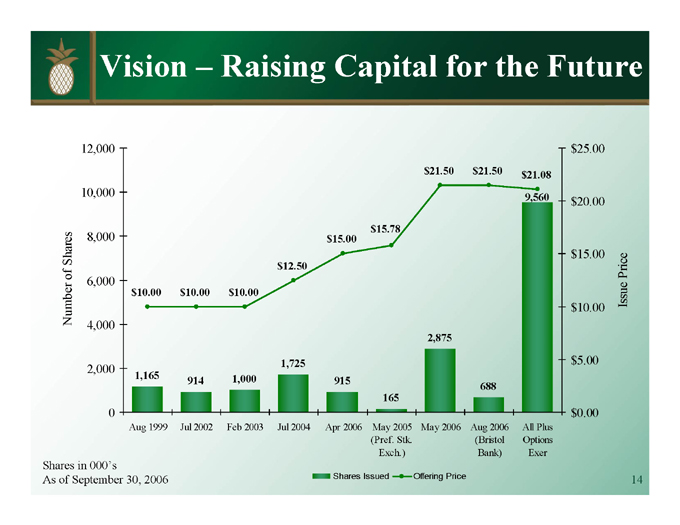

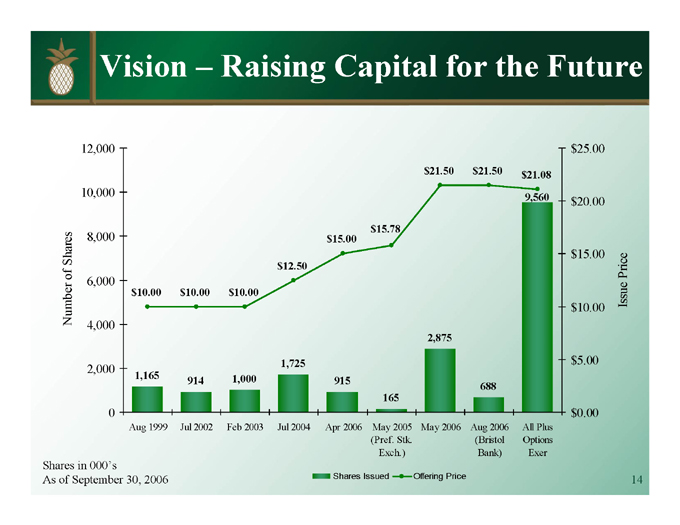

Vision – Raising Capital for the Future

Shares in 000’s

As of September 30, 2006

Number of Shares

12,000

10,000

8,000

6,000

4,000

2,000

0

$10.00 1,165 Aug 1999 $10.00 1,000 Jul 2002 $10.00 914 Feb 2003 $12.50 1,725 Jul 2004 $15.00 915 Apr 2006 $15.78 165 May 2005 (Pref. Stk. Exch.) $21.50 2,875 May 2006 $21.50 688 Aug 2006 (Bristol Bank) $21.08 9,560 All Plus Options Exer

$25.00

$20.00

$15.00

$10.00

$5.00

$0.00

Shares Issued Offering Price

Issue Price

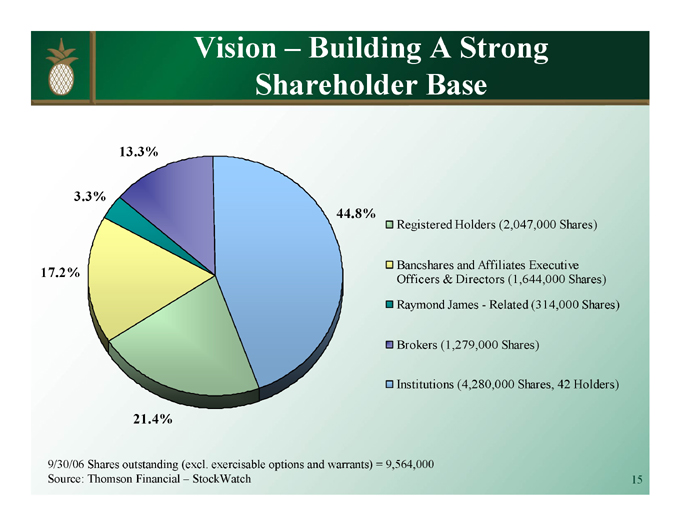

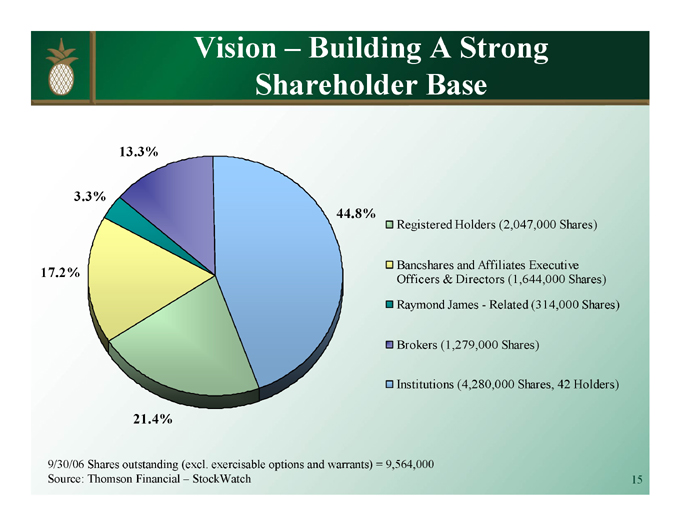

Vision – Building A Strong Shareholder Base

13.3%

44.8%

21.4%

17.2%

3.3%

Registered Holders (2,047,000 Shares)

Bancshares and Affiliates Executive Officers & Directors (1,644,000 Shares) Raymond James—Related (314,000 Shares)

Brokers (1,279,000 Shares)

Institutions (4,280,000 Shares, 42 Holders)

9/30/06 Shares outstanding (excl. exercisable options and warrants) = 9,564,000 Source: Thomson Financial – StockWatch

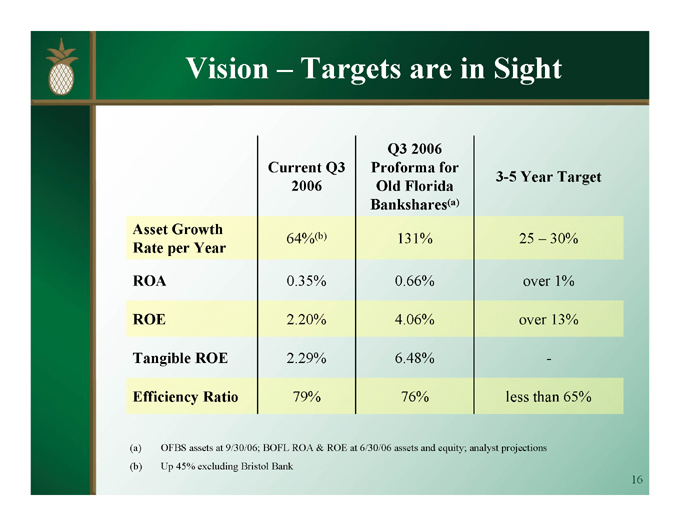

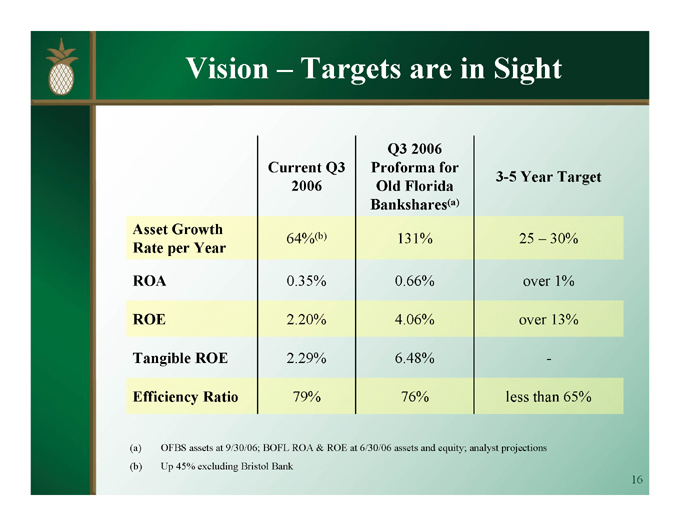

Vision – Targets are in Sight

Current Q3 2006 Q3 2006 Proforma for Old Florida Bankshares(a) 3-5 Year Target

Asset Growth

64%(b) 131% 25 – 30%

Rate per Year

ROA 0.35% 0.66% over 1%

ROE 2.20% 4.06% over 13%

Tangible ROE 2.29% 6.48% -

Efficiency Ratio 79% 76% less than 65%

(a) OFBS assets at 9/30/06; BOFL ROA & ROE at 6/30/06 assets and equity; analyst projections (b) Up 45% excluding Bristol Bank

Strength

Right Talent & Right Markets

“My strength lies solely in tenacity.”

- Louis Pasteur

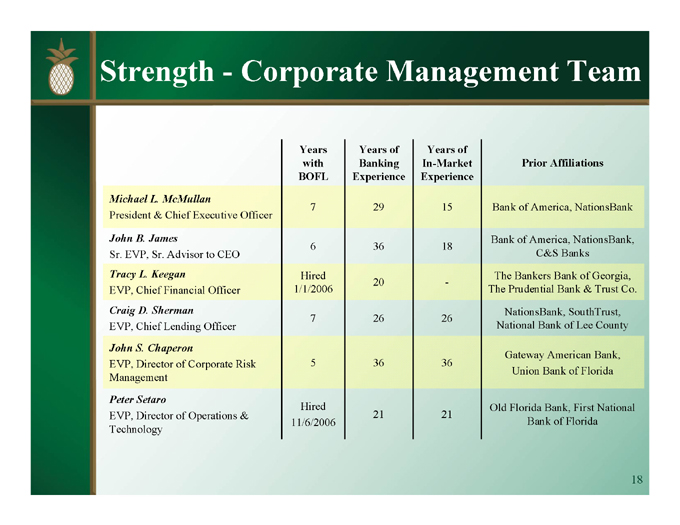

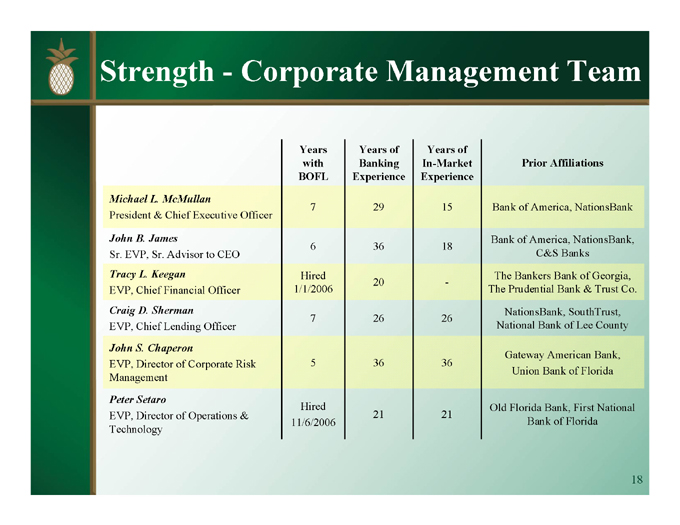

Strength—Corporate Management Team

Years with BOFL Years of Banking Experience Years of In-Market Experience Prior Affiliations

Michael L. McMullan

7 29 15 Bank of America, NationsBank

President & Chief Executive Officer

John B. James Bank of America, NationsBank,

6 36 18

Sr. EVP, Sr. Advisor to CEO C&S Banks

Tracy L. Keegan Hired The Bankers Bank of Georgia,

20 —

EVP, Chief Financial Officer 1/1/2006 The Prudential Bank & Trust Co.

Craig D. Sherman NationsBank, SouthTrust,

7 26 26

EVP, Chief Lending Officer National Bank of Lee County

John S. Chaperon

Gateway American Bank,

EVP, Director of Corporate Risk 5 36 36

Union Bank of Florida

Management

Peter Setaro

Hired Old Florida Bank, First National

EVP, Director of Operations & 21 21

11/6/2006 Bank of Florida

Technology

Strength – Affiliate Leadership

Years of Years of In-Market

Financial Experience Experience

Julie W. Husler 37 18

Bank of Florida Trust Company

James L. Goehler 32 12

Bank of Florida—Southwest

R. Mark Manitz 25 23

Bank of Florida—Southeast

Roy N. Hellwege 25 25

Bank of Florida—Tampa Bay

Charles K. Cross 25 25

Bank of Florida in Palm Beach County

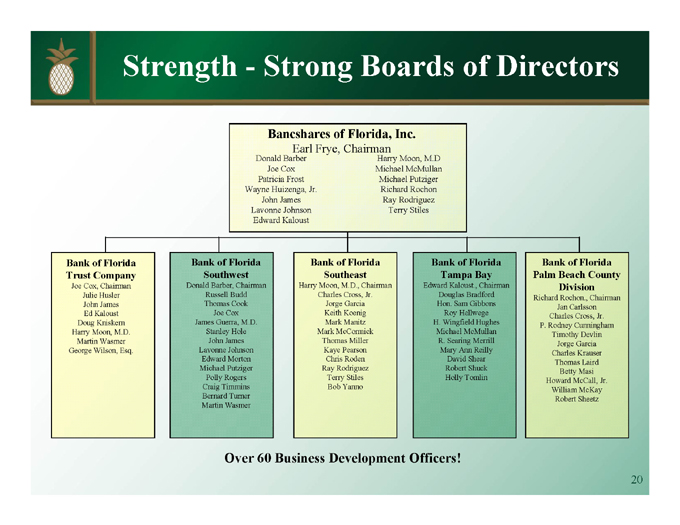

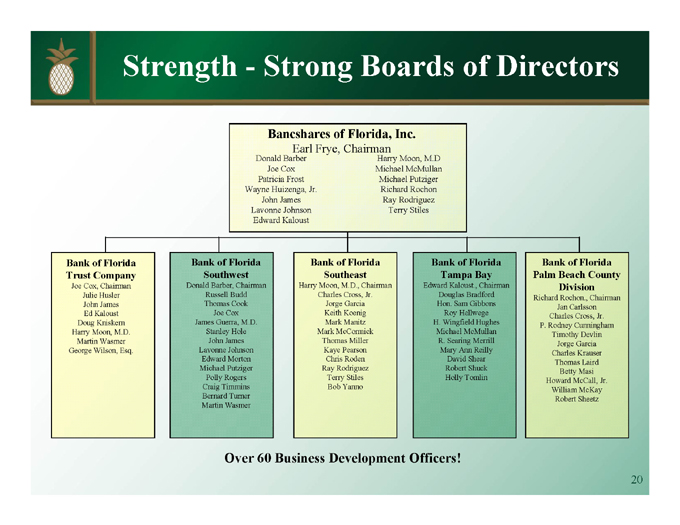

Strength—Strong Boards of Directors

Bancshares of Florida, Inc.

Earl Frye, Chairman

Donald Barber Joe Cox Patricia Frost Wayne Huizenga, Jr. John James Lavonne Johnson Edward Kaloust

Harry Moon, M.D Michael McMullan Michael Putziger Richard Rochon Ray Rodriguez Terry Stiles

Bank of Florida Trust Company

Joe Cox, Chairman Julie Husler John James Ed Kaloust Doug Kniskern Harry Moon, M.D. Martin Wasmer George Wilson, Esq.

Bank of Florida Southwest

Donald Barber, Chairman Russell Budd Thomas Cook Joe Cox James Guerra, M.D. Stanley Hole John James Lavonne Johnson Edward Morton Michael Putziger Polly Rogers Craig Timmins Bernard Turner Martin Wasmer

Bank of Florida Southeast

Harry Moon, M.D., Chairman Charles Cross, Jr. Jorge Garcia Keith Koenig Mark Manitz Mark McCormick Thomas Miller Kaye Pearson Chris Roden Ray Rodriguez Terry Stiles Bob Yanno

Bank of Florida Tampa Bay

Edward Kaloust., Chairman Douglas Bradford Hon. Sam Gibbons Roy Hellwege H. Wingfield Hughes Michael McMullan R. Searing Merrill Mary Ann Reilly David Shear Robert Shuck Holly Tomlin

Bank of Florida Palm Beach County Division

Richard Rochon., Chairman Jan Carlsson Charles Cross, Jr. P. Rodney Cunningham Timothy Devlin Jorge Garcia Charles Krauser Thomas Laird Betty Masi Howard McCall, Jr. William McKay Robert Sheetz

Over 60 Business Development Officers!

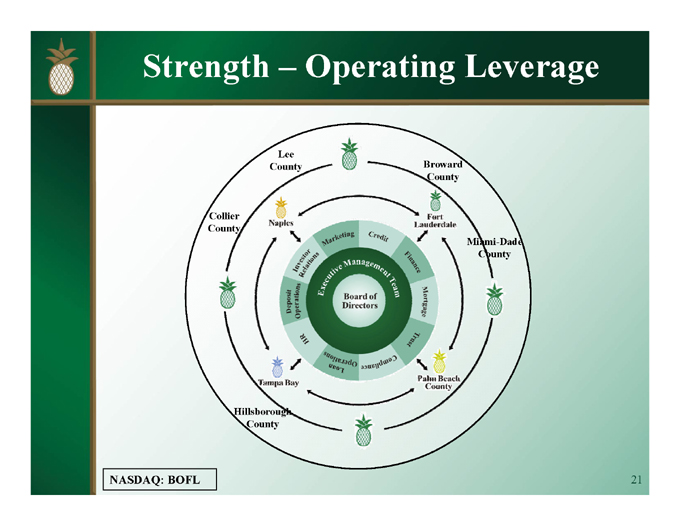

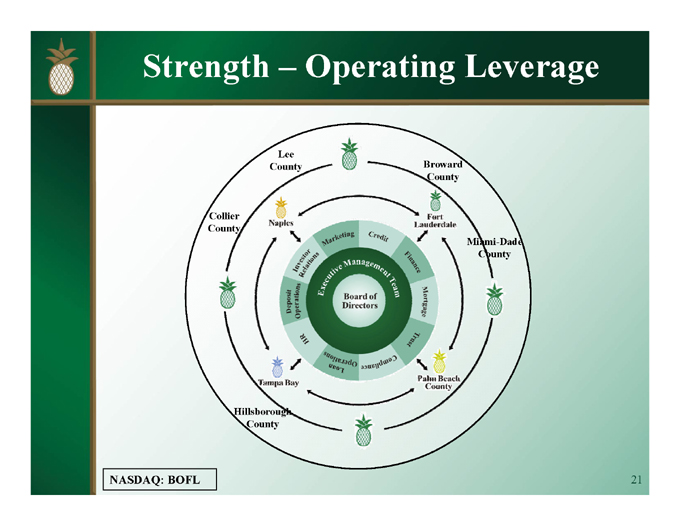

Strength – Operating Leverage

NASDAQ: BOFL

Collier County Lee County Broward County Fort Lauderdale Miami-Date County Palm Beach County Naples Tampa Bay Hillsborough County

Investor Relations Marketing Credit Finance Mortgage Trust Compliance Loan Operations HR Deposit Operations

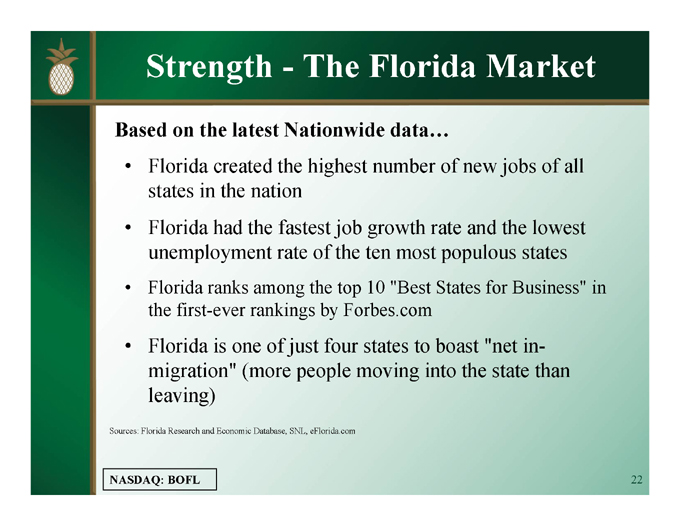

Strength—The Florida Market

Based on the latest Nationwide data…

Florida created the highest number of new jobs of all states in the nation

Florida had the fastest job growth rate and the lowest unemployment rate of the ten most populous states

Florida ranks among the top 10 “Best States for Business” in the first-ever rankings by Forbes.com

Florida is one of just four states to boast “net in-migration” (more people moving into the state than leaving)

Sources: Florida Research and Economic Database, SNL, eFlorida.com

NASDAQ: BOFL

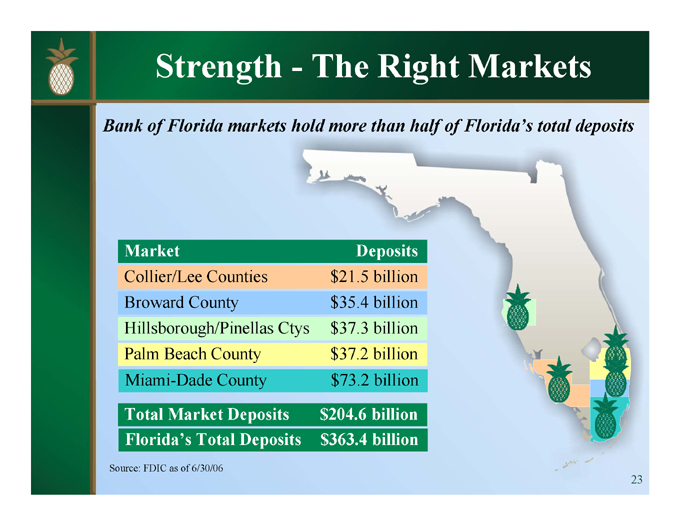

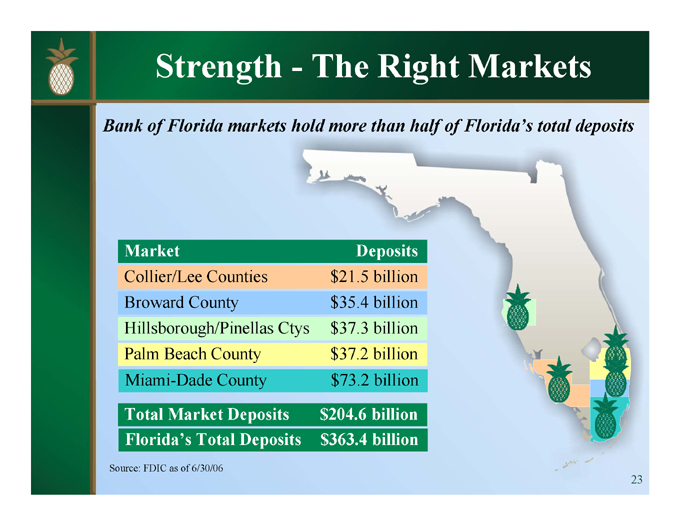

Strength—The Right Markets

Bank of Florida markets hold more than half of Florida’s total deposits

Market Deposits

Collier/Lee Counties $21.5 billion

Broward County $35.4 billion

Hillsborough/Pinellas Ctys $37.3 billion

Palm Beach County $37.2 billion

Miami-Dade County $73.2 billion

Total Market Deposits $204.6 billion

Florida’s Total Deposits $363.4 billion

Source: FDIC as of 6/30/06

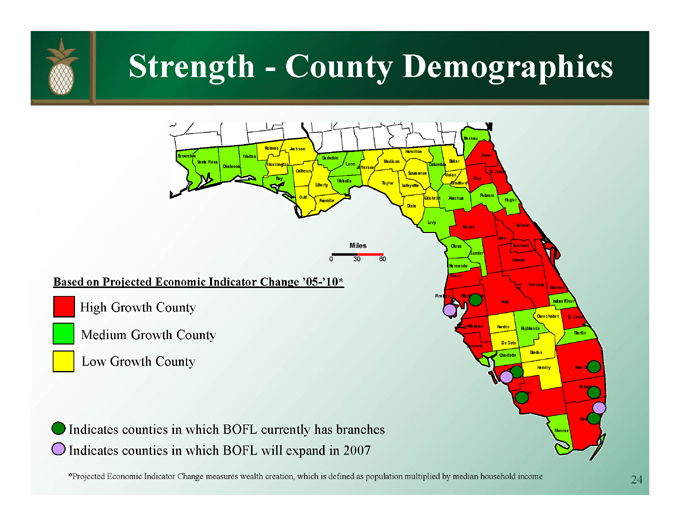

Strength—County Demographics

Nassau

Holmes Jackson

Hamilton

Escambia Walton Duval

Gadsden

Santa Rosa Madison Baker

Okaloosa Washington Columbia

Leon Jefferson

Calhoun St. Johns

Suwannee Union

Bay Clay

Wakulla

Liberty Taylor Bradford

Lafayette

Gulf Putnam

Gilchrist Alachua Flagler

Franklin

Dixie

Levy

Marion Volusia

Lake

Citrus Seminole

Sumter

Orange

Hernando

Pasco

Osceola

Brevard

Pinellas Hillsborough

Polk Indian River

Okeechobee St. Lucie

Manatee Hardee

Highlands

Martin

De Soto

Sarasota

Glades

Charlotte

Hendry Palm Beach

Lee

Broward

Collier

Dade

Monroe

Miles

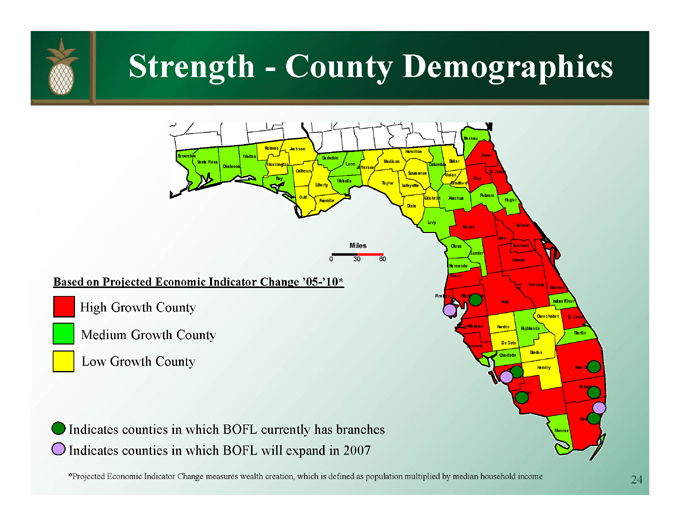

Based on Projected Economic Indicator Change ‘05-’10*

High Growth County Medium Growth County Low Growth County

Indicates counties in which BOFL currently has branches Indicates counties in which BOFL will expand in 2007

*Projected Economic Indicator Change measures wealth creation, which is defined as population multiplied by median household income

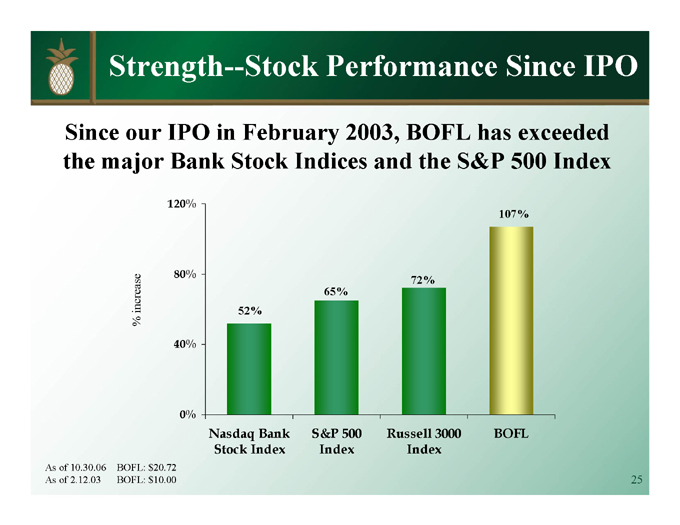

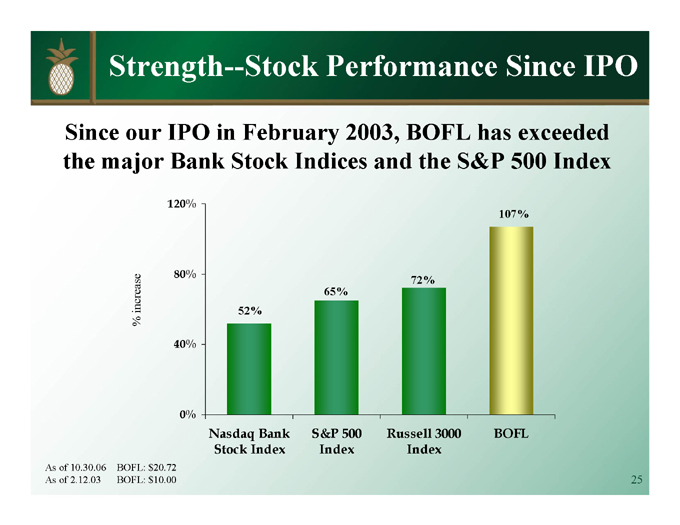

Strength—Stock Performance Since IPO

% increase

120%

80%

40%

0%

52% Nasdaq Bank Stock Index 65% S&P 500 Index 72% Russell 3000 Index 107% BOFL

Since our IPO in February 2003, BOFL has exceeded the major Bank Stock Indices and the S&P 500 Index

As of 10.30.06 BOFL: $20.72

As of 2.12.03 BOFL: $10.00

Momentum

Sustainable Growth & Rising Profitability

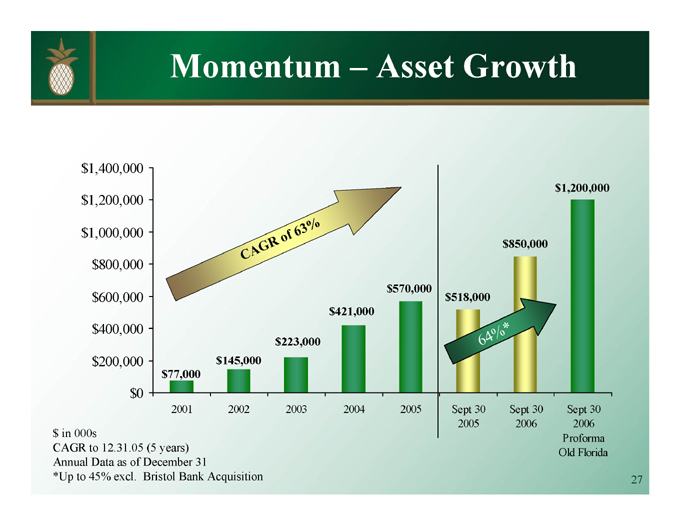

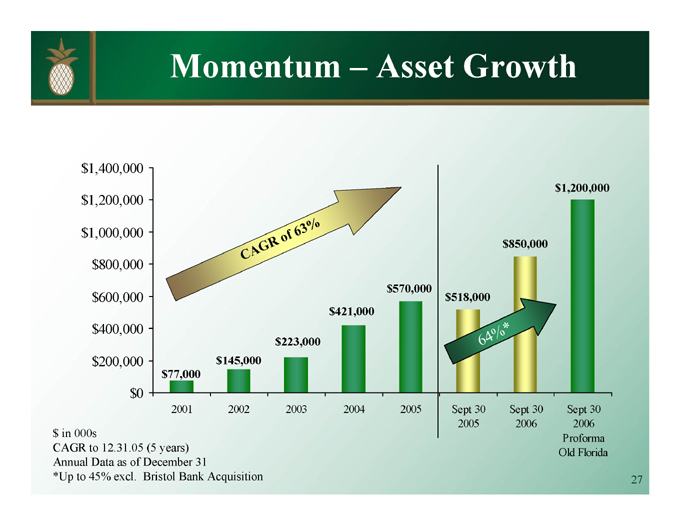

Momentum – Asset Growth

$1,400,000

$1,200,000

$1,000,000

$800,000

$600,000

$400,000

$200,000

$0

CAGR of 63%

$77,000 $145,000 $223,000 $421,000 570,000 $518,000 $850,000 $1,200,000

64%*

2001 2002 2003 2004 2005 Sept 30 2005 Sept 30 2006 Sept 30 2006 Proforma Old Florida

$in 000s

CAGR to 12.31.05 (5 years) Annual Data as of December 31

*Up to 45% excl. Bristol Bank Acquisition

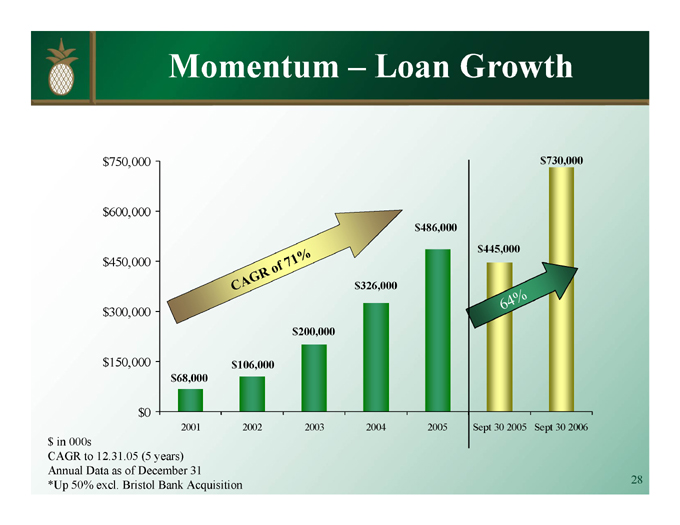

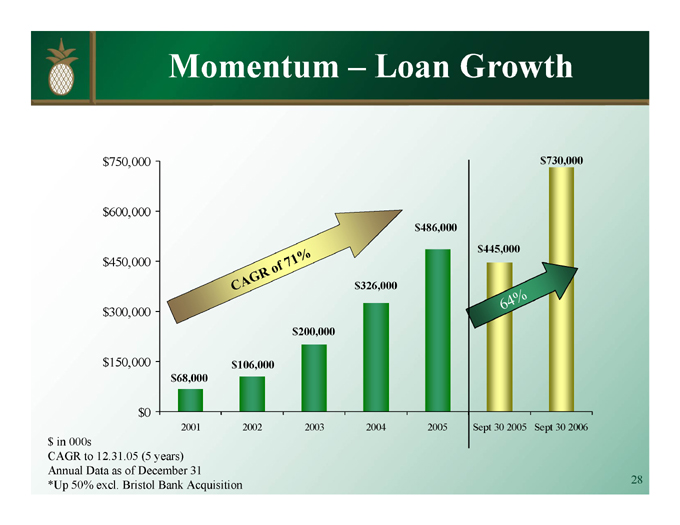

Momentum – Loan Growth

$750,000

$600,000

$450,000

$300,000

$150,000

$0

CAGR of 71%

$68,000 $106,000 $200,000 $326,000 $486,000 $445,000 $730,000

64%

2001 2002 2003 2004 2005 Sept 30 2005 Sept 30 2006

$in 000s

CAGR to 12.31.05 (5 years) Annual Data as of December 31 *Up 50% excl. Bristol Bank Acquisition

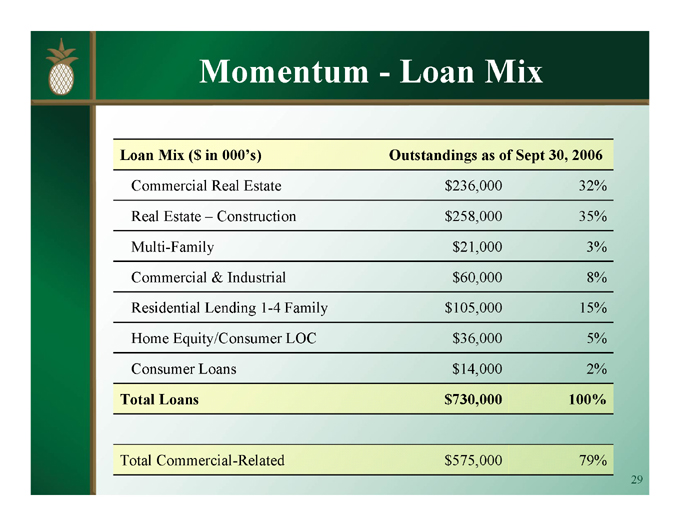

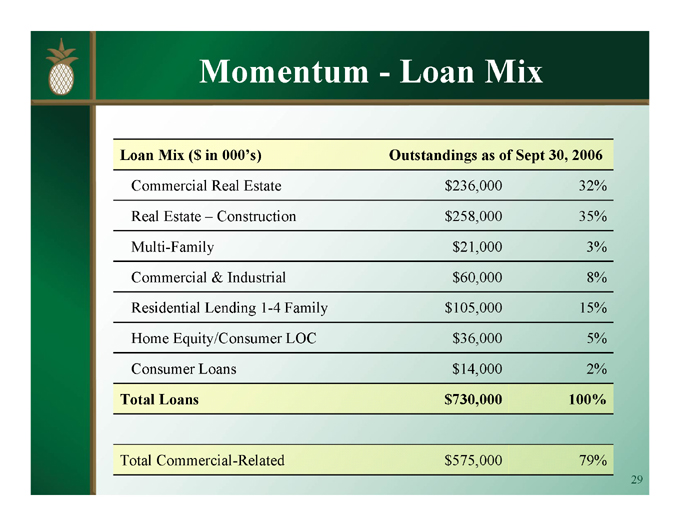

Momentum—Loan Mix

Loan Mix ($in 000’s) Outstandings as of Sept 30, 2006

Commercial Real Estate $236,000 32%

Real Estate – Construction $258,000 35%

Multi-Family $21,000 3%

Commercial & Industrial $60,000 8%

Residential Lending 1-4 Family $105,000 15%

Home Equity/Consumer LOC $36,000 5%

Consumer Loans $14,000 2%

Total Loans $730,000 100%

Total Commercial-Related $575,000 79%

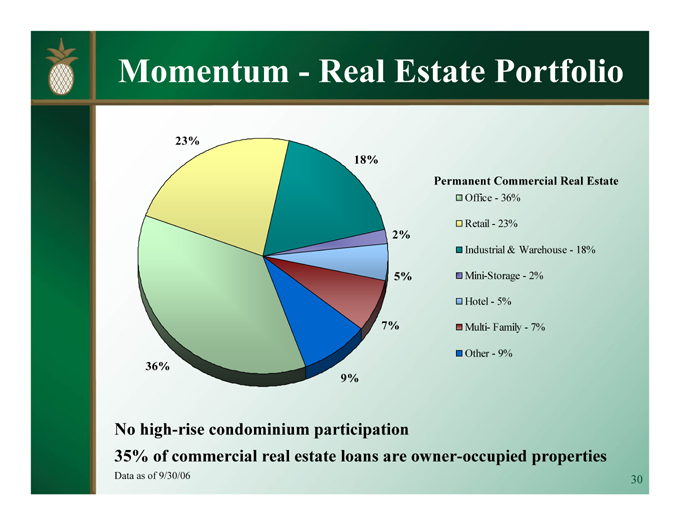

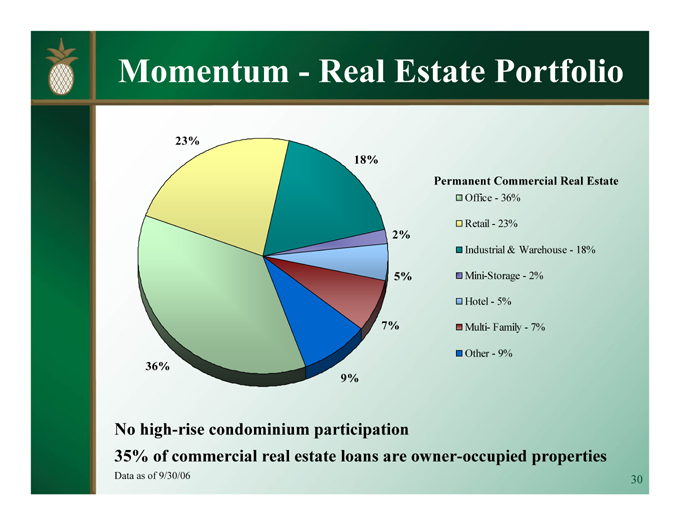

Momentum—Real Estate Portfolio

23%

18%

2%

5%

7%

9%

36%

Permanent Commercial Real Estate

Office—36%

Retail—23%

Industrial & Warehouse—18% Mini-Storage—2% Hotel—5% Multi- Family—7% Other—9%

No high-rise condominium participation

35% of commercial real estate loans are owner-occupied properties

Data as of 9/30/06

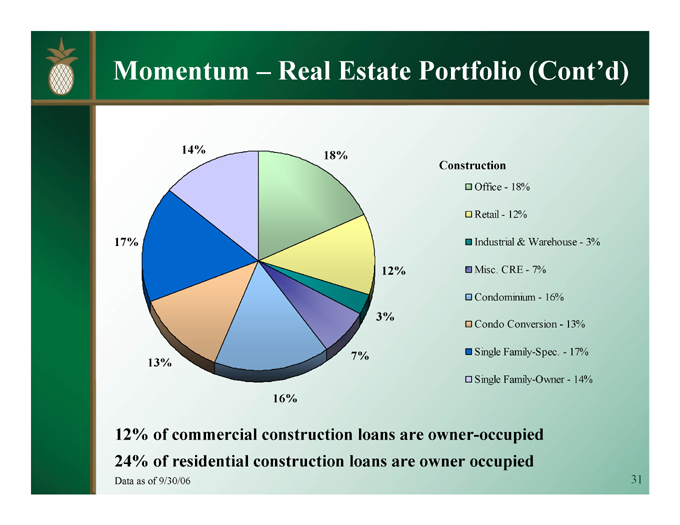

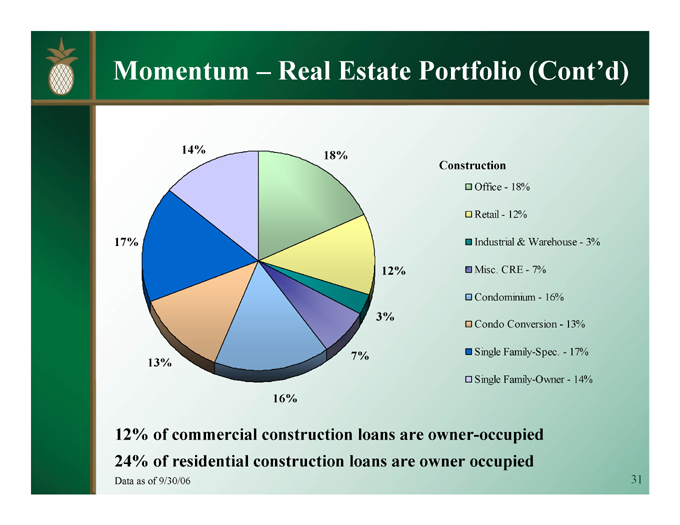

Momentum – Real Estate Portfolio (Cont’d)

14%

18%

12%

3%

7%

16%

13%

17%

Construction

Office—18%

Retail—12%

Industrial & Warehouse—3%

Misc. CRE—7%

Condominium—16%

Condo Conversion—13%

Single Family-Spec.—17%

Single Family-Owner—14%

12% of commercial construction loans are owner-occupied 24% of residential construction loans are owner occupied

Data as of 9/30/06

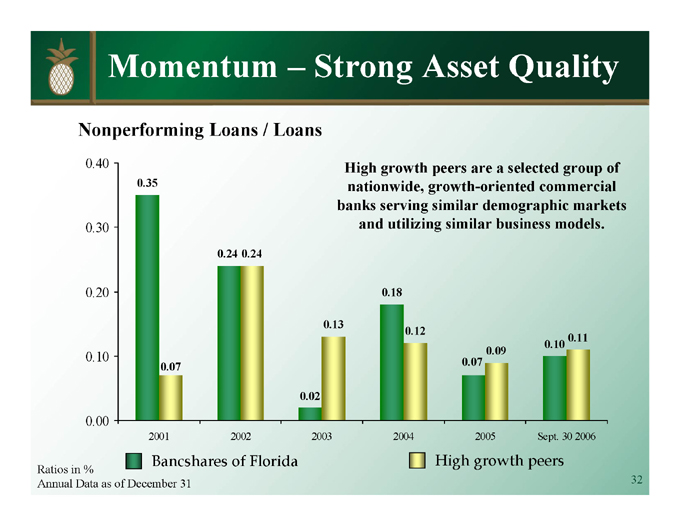

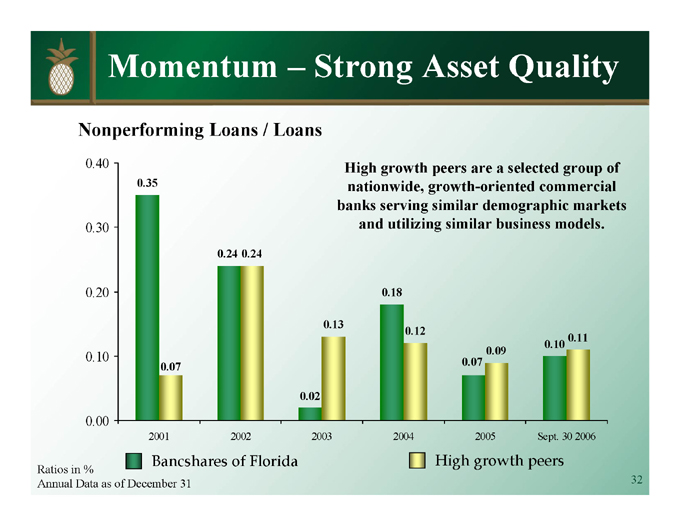

Momentum – Strong Asset Quality

Nonperforming Loans / Loans

High growth peers are a selected group of nationwide, growth-oriented commercial banks serving similar demographic markets and utilizing similar business models.

0.40

0.30

0.20

0.10

0.00

0.35 0.07

0.24 0.24 0.02 0.13 0.18 0.12 0.07 0.09 0.10 0.11

2001 2002 2003 2004 2005 Sept. 30 2006

Bancshares of Florida High growth peers

Ratios in %

Annual Data as of December 31

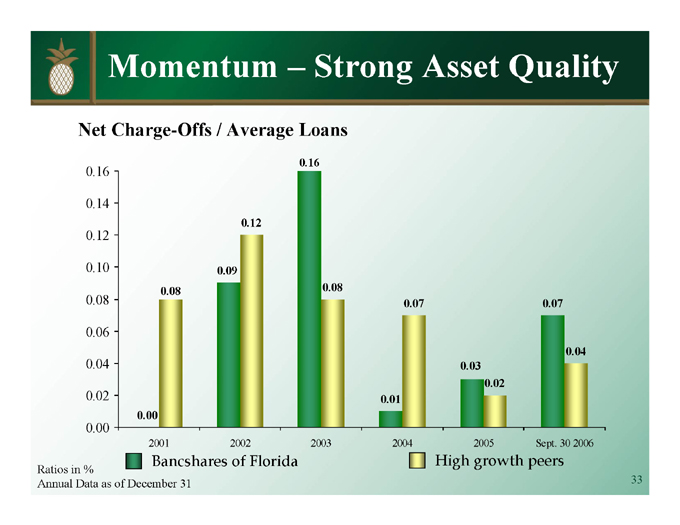

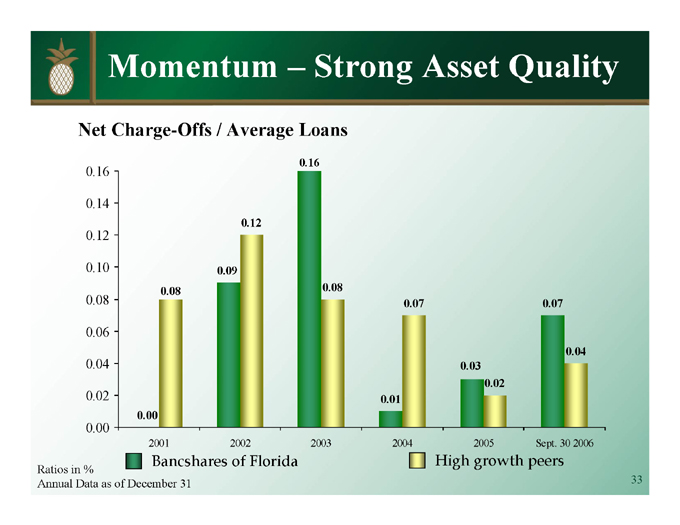

Momentum – Strong Asset Quality

0.16

0.14

0.12

0.10

0.08

0.06

0.04

0.02

0.00

2001 2002 2003 2004 2005 Sept. 30 2006

0.00 0.08 0.09 0.12 0.16 0.08 0.01 0.07 0.03 0.02 0.07 0.04

Bancshares of Florida High growth peers

Net Charge-Offs / Average Loans

Ratios in %

Annual Data as of December 31

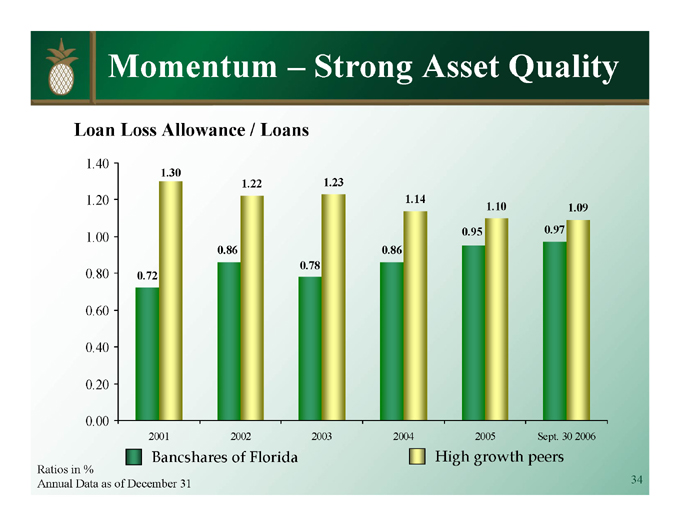

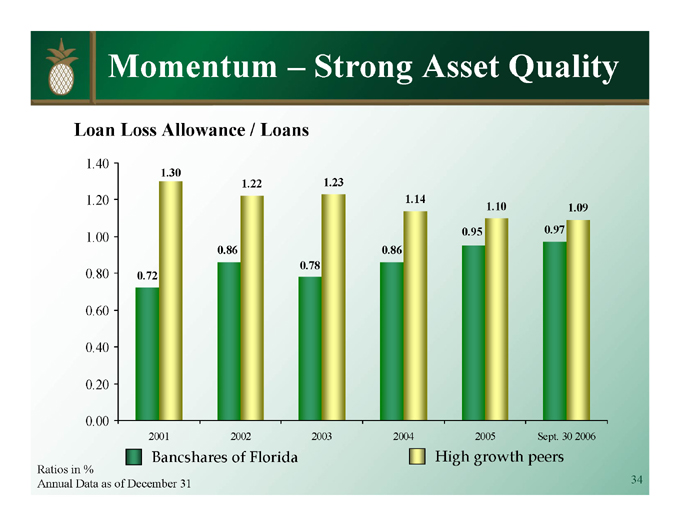

Momentum – Strong Asset Quality

Loan Loss Allowance / Loans

1.40

1.20

1.00

0.80

0.60

0.40

0.20

0.00

0.72 1.30 0.86 1.22 0.78 1.23 0.86 1.14 0.95 1.10 0.97 1.09

2001 2002 2003 2004 2005 Sept. 30 2006

Bancshares of Florida High growth peers

Ratios in %

Annual Data as of December 31

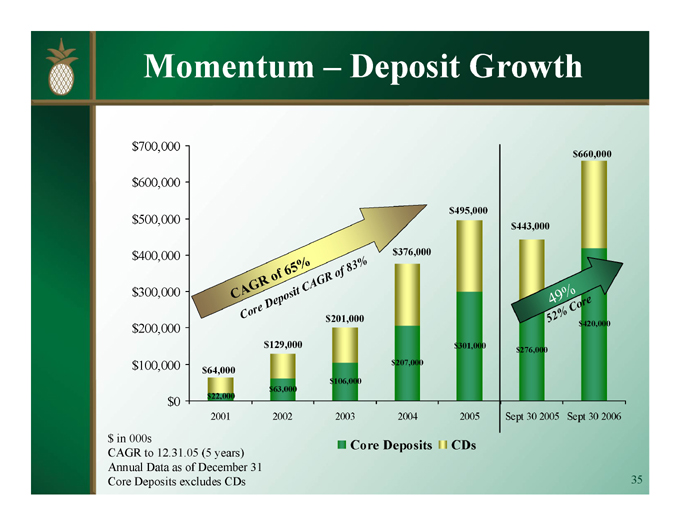

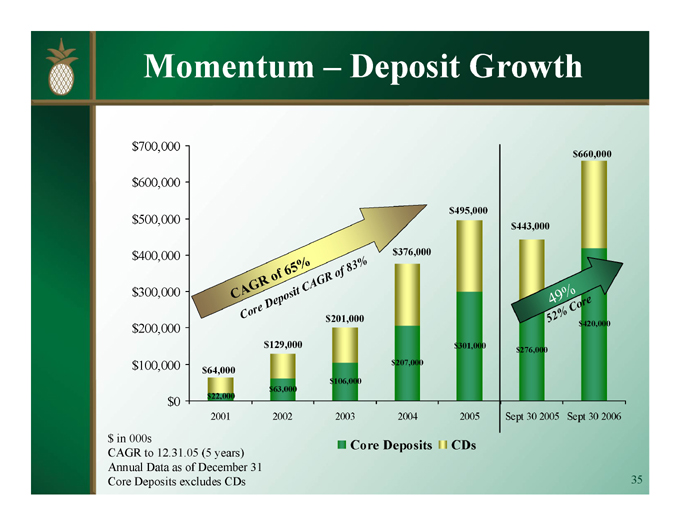

Momentum – Deposit Growth $in 000s

$700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $0

CAGR of 65%

Core Deposit of CAGR of 83%

$64,000 $22,000 2001 $129,000 $63,000 2002

$201,000 $106,000 2003

$376,000 $207,000 2004

$495,000 $301,000 2005

$443,000 $276,000 Sept 30 2005

$660,000 $420,000 Sept 30 2006

49%

52% Core

Core Deposits CDs

CAGR to 12.31.05 (5 years) Annual Data as of December 31 Core Deposits excludes CDs

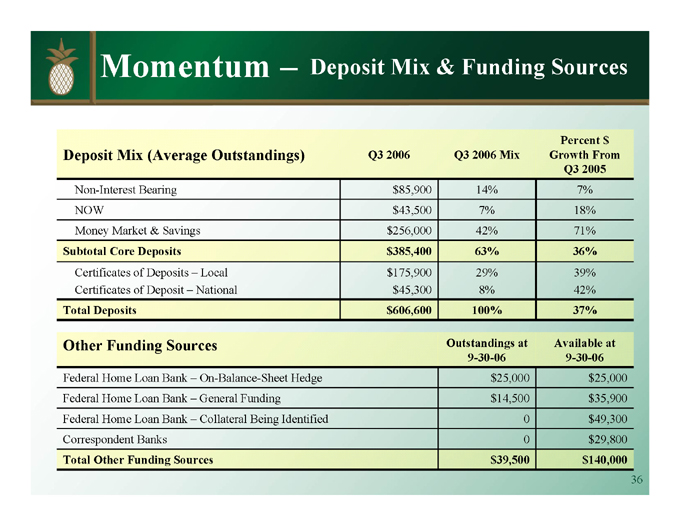

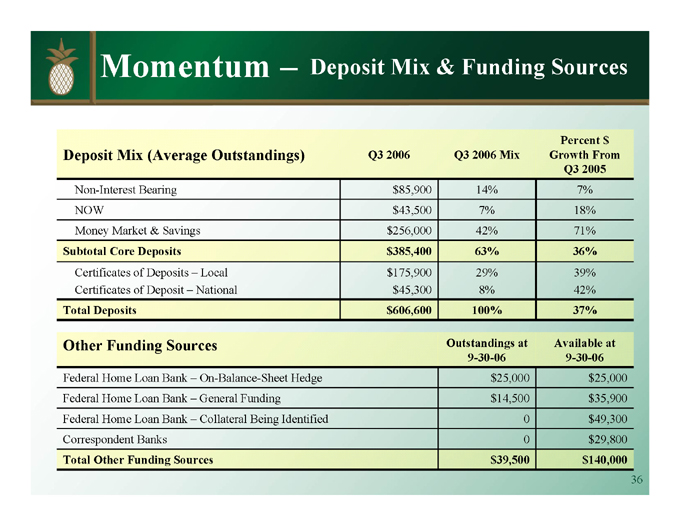

Momentum – Deposit Mix & Funding Sources

Deposit Mix (Average Outstandings) Q3 2006 Q3 2006 Mix Percent $ Growth From Q3 2005

Non-Interest Bearing $85,900 14% 7%

NOW $43,500 7% 18%

Money Market & Savings $256,000 42% 71%

Subtotal Core Deposits $385,400 63% 36%

Certificates of Deposits – Local $175,900 29% 39%

Certificates of Deposit – National $45,300 8% 42%

Total Deposits $606,600 100% 37%

Other Funding Sources Outstandings at Available at

9-30-06 9-30-06

Federal Home Loan Bank – On-Balance-Sheet Hedge $25,000 $25,000

Federal Home Loan Bank – General Funding $14,500 $35,900

Federal Home Loan Bank – Collateral Being Identified 0 $49,300

Correspondent Banks 0 $29,800

Total Other Funding Sources $39,500 $140,000

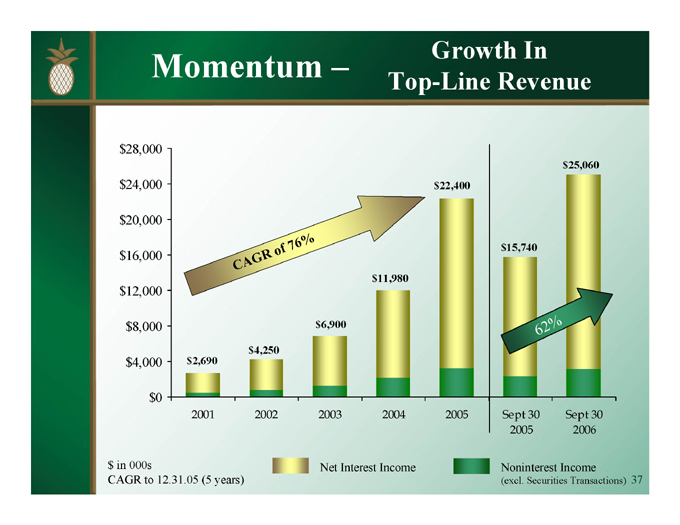

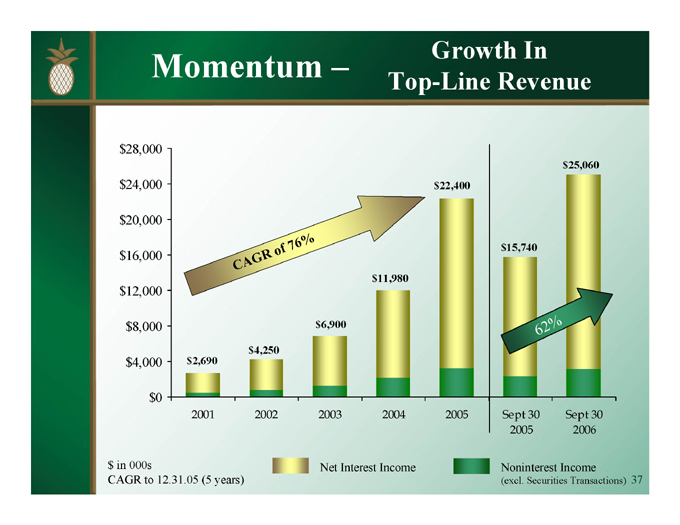

Momentum – Growth In

$28,000 $24,000 $20,000 $16,000 $12,000 $8,000 $4,000 $0

CAGR of 76%

$2,690

2001

$4,250

2002

$6,900

2003

$11, 980

2004

$22,400

2005

$15,740

Sept 30 2005 $25,060

Sept 30 2006

Net Interest Income Noninterest Income

(excl. Securities Transactions)

Top-Line Revenue $ in 000s

CAGR to 12.31.05 (5 years)

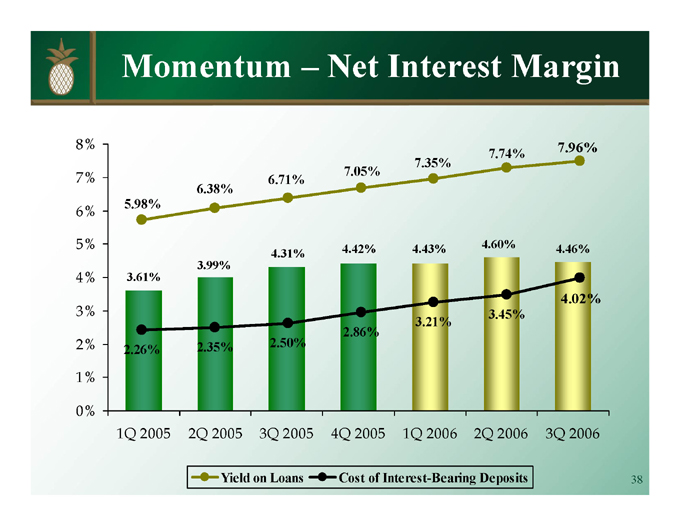

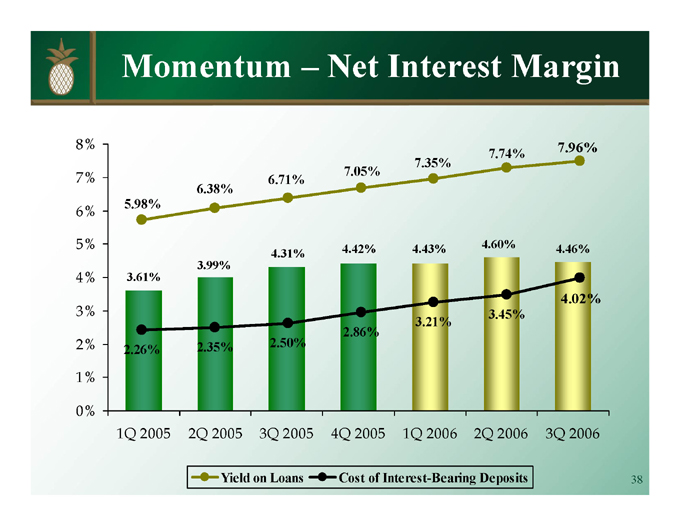

Momentum – Net Interest Margin

8%

7%

6%

5%

4%

3%

2%

1%

0%

5.98% 3.61% 2.26% 1Q 2005

6.38% 3.99% 2.35% 2Q 2005

6.71% 4.31% 2.50% 3Q 2005

7.05% 4.42% 2.86% 4Q 2005

7.35% 4.43% 3.21% 1Q 2006

7.74% 4.60% 3.45% 2Q 2006

7.96% 4.46% 4.02% 3Q 2006

Yield on Loans Cost of Interest-Bearing Deposits

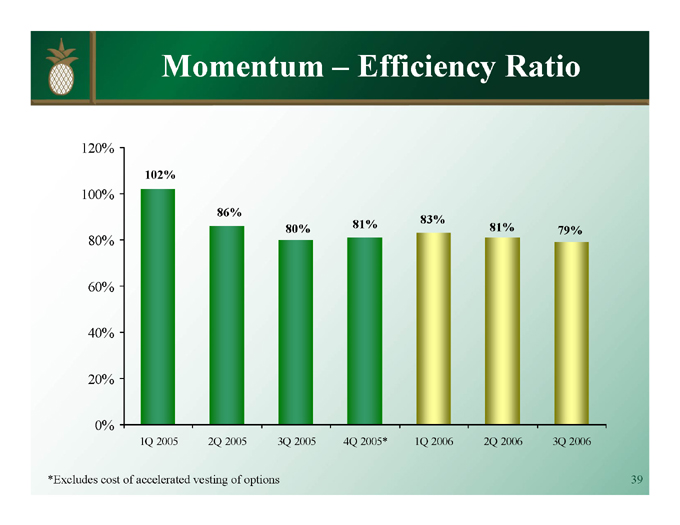

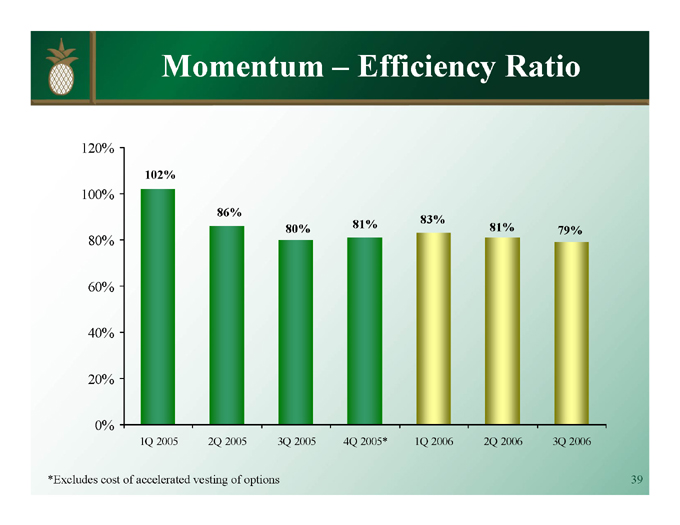

Momentum – Efficiency Ratio

120%

100%

80%

60%

40%

20%

0%

102% 1Q 2005 86% 2Q 2005 80% 3Q 2005 81% 4Q 2005* 83% 1Q 2006 81% 2Q 2006 79% 3Q 2006

*Excludes cost of accelerated vesting of options

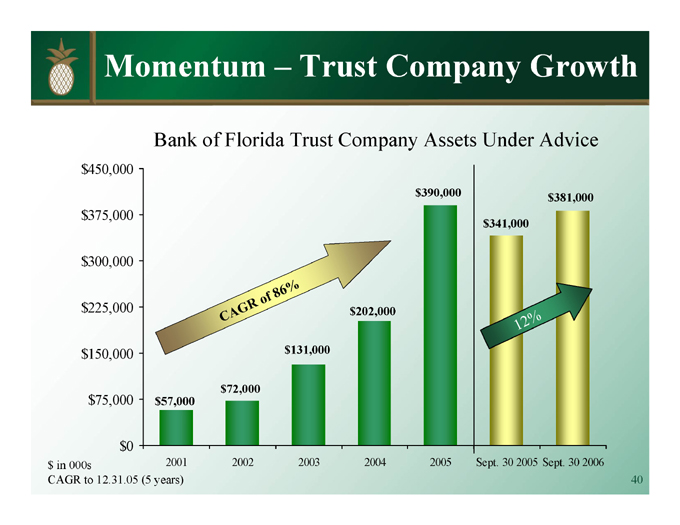

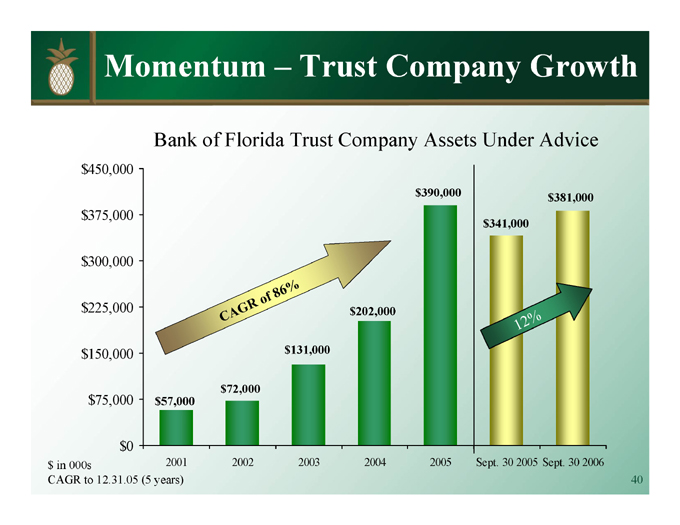

Momentum – Trust Company Growth

$450,000

$375,000

$300,000

$225,000

$150,000

$75,000

$0

CAGR of 86%

$57,000 2001 $72,000 2002

$131,000 2003

$202,000 2004

$390,000 2005

$341,000 Sept. 30 2005

$381,000 Sept. 30 2006

12%

Bank of Florida Trust Company Assets Under Advice $in 000s

CAGR to 12.31.05 (5 years)

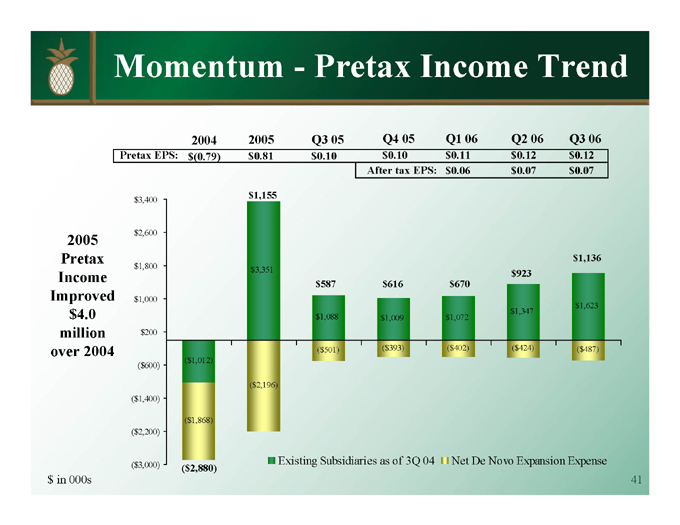

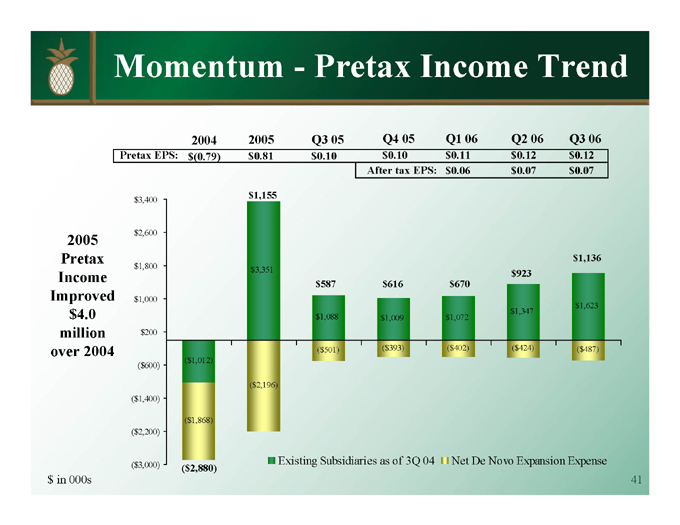

Momentum—Pretax Income Trend $in 000s

2004 2005 Q3 05 Q4 05 Q1 06 Q2 06 Q3 06

Pretax EPS: $(0.79) $0.81 $0.10 $0.10 $0.11 $0.12 $0.12

After tax EPS: $0.06 $0.07 $0.07

2005 Pretax Income Improved $4.0 million over 2004

$3,400

$2,600

$1,800

$1,000

$200

($600)

($1,400)

($2,200)

($3,000)

($1,012) ($1,868) ($2,880) $1,155 $3,351 ($2,196) $587 $1,088 ($501) $616 $1,009 ($393) $670 $1,072 ($402) $923 $1,347 ($424) $1,136 $1,623 ($487)

Existing Subsidiaries as of 3Q 04 Net De Novo Expansion Expense

Valuation

A Compelling Story

Valuation – The Right Markets

“They’re expanding in probably three of the largest and fastest-growing markets in Florida, being in the Greater Miami market, the Fort Myers/Naples market area and then, third, the Tampa market. You add on top of that they have two non-banking companies, if you will — they have a mortgage company and a wealth management company — so they really have all of their bases covered down there, so we think the prospects are very bright for them.”

Wilson L. .Smith, CFA Director of Financial Services Research Boenning & Scattergood, Inc.

NASDAQ: BOFL

Valuation – The Right Markets

“We are initiating coverage of Bancshares of Florida, Inc. with an investment rating of Outperform. Bancshares is rapidly emerging as one of Florida’s largest and fastest growing community banks (loans, deposits and EPS), capitalizing on an attractive competitive landscape in one of the nation’s premier banking environments. We expect several years of rapid EPS growth (50%-plus), rising profitability, and increasing franchise value as management leverages the company’s substantial infrastructure and capital base.”

John A. Pandtle, CFA Senior Vice President Financial Services Equity Research Raymond James & Associates

NASDAQ: BOFL

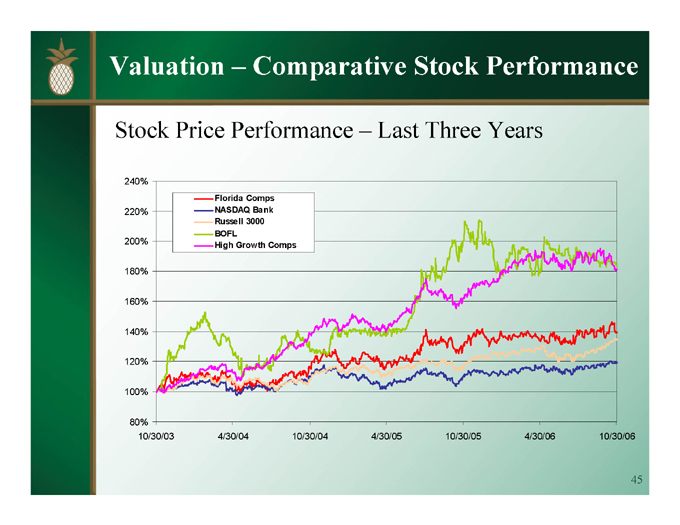

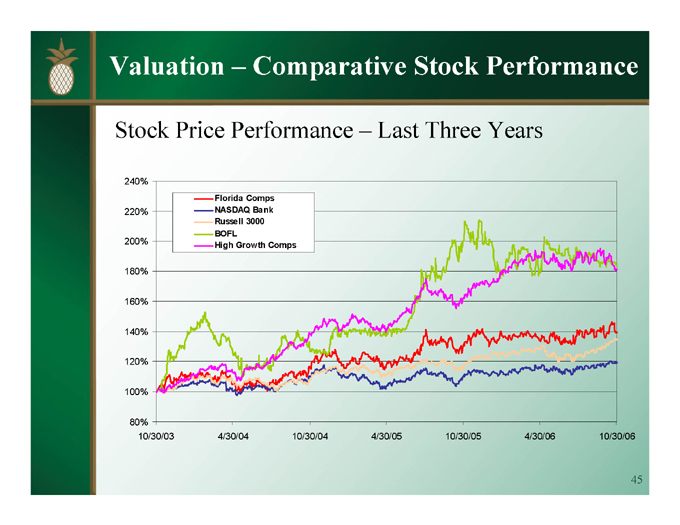

Valuation – Comparative Stock Performance

240%

220%

200%

180%

160%

140%

120%

100%

80%

Florida Comps NASDAQ Bank Russell 3000 BOFL

High Growth Comps

10/30/03 4/30/04 10/30/04 4/30/05 10/30/05 4/30/06 10/30/06

Stock Price Performance – Last Three Years

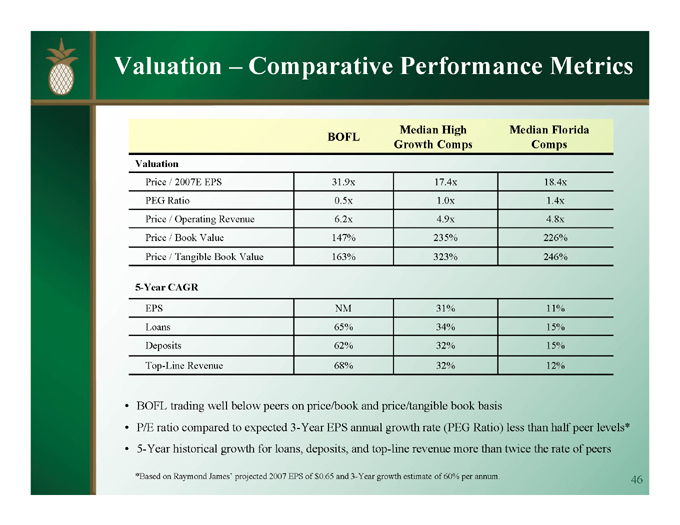

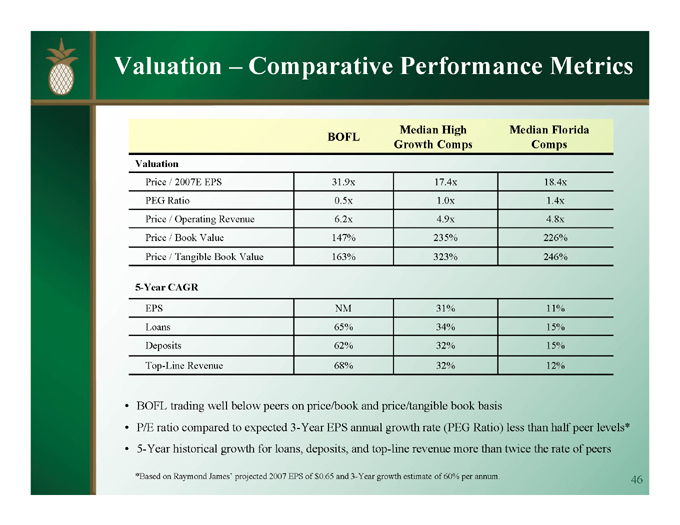

Valuation – Comparative Performance Metrics

BOFL Median High Growth Comps Median Florida Comps

Valuation

Price / 2007E EPS 31.9x 17.4x 18.4x

PEG Ratio 0.5x 1.0x 1.4x

Price / Operating Revenue 6.2x 4.9x 4.8x

Price / Book Value 147% 235% 226%

Price / Tangible Book Value 163% 323% 246%

5-Year CAGR

EPS NM 31% 11%

Loans 65% 34% 15%

Deposits 62% 32% 15%

Top-Line Revenue 68% 32% 12%

BOFL trading well below peers on price/book and price/tangible book basis

P/E ratio compared to expected 3-Year EPS annual growth rate (PEG Ratio) less than half peer levels*

5-Year historical growth for loans, deposits, and top-line revenue more than twice the rate of peers

*Based on Raymond James’ projected 2007 EPS of $0.65 and 3-Year growth estimate of 60% per annum.

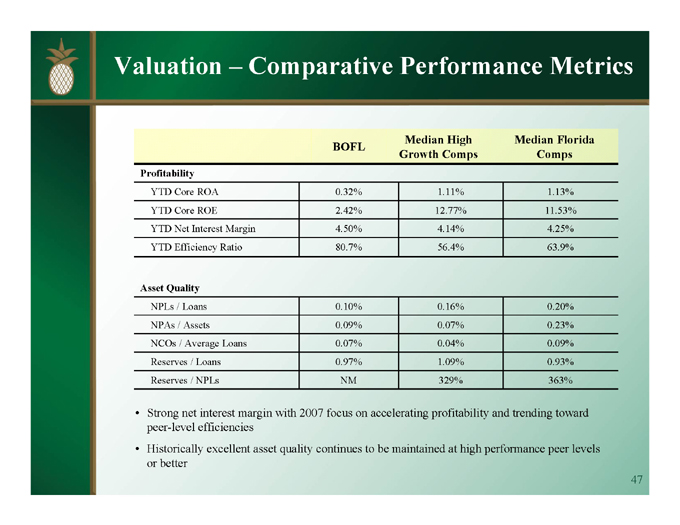

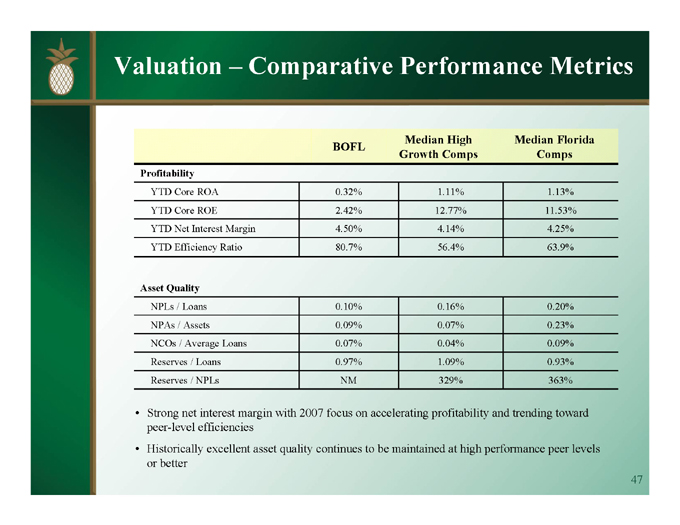

Valuation – Comparative Performance Metrics

BOFL Median High Growth Comps Median Florida Comps

Profitability

YTD Core ROA 0.32% 1.11% 1.13%

YTD Core ROE 2.42% 12.77% 11.53%

YTD Net Interest Margin 4.50% 4.14% 4.25%

YTD Efficiency Ratio 80.7% 56.4% 63.9%

Asset Quality

NPLs / Loans 0.10% 0.16% 0.20%

NPAs / Assets 0.09% 0.07% 0.23%

NCOs / Average Loans 0.07% 0.04% 0.09%

Reserves / Loans 0.97% 1.09% 0.93%

Reserves / NPLs NM 329% 363%

Strong net interest margin with 2007 focus on accelerating profitability and trending toward peer-level efficiencies

Historically excellent asset quality continues to be maintained at high performance peer levels or better

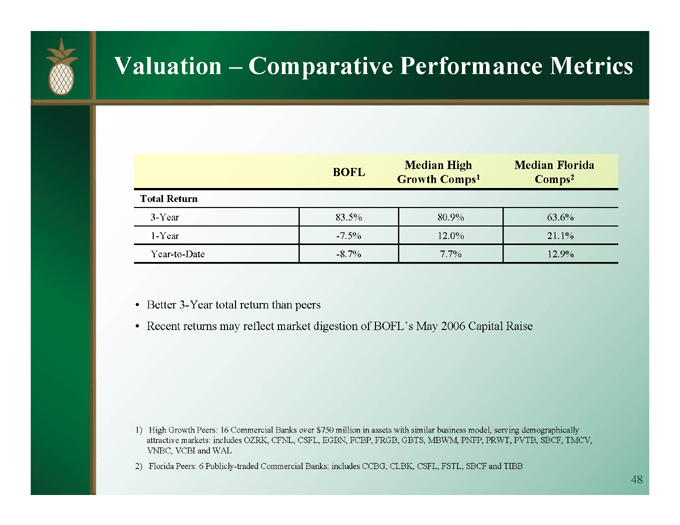

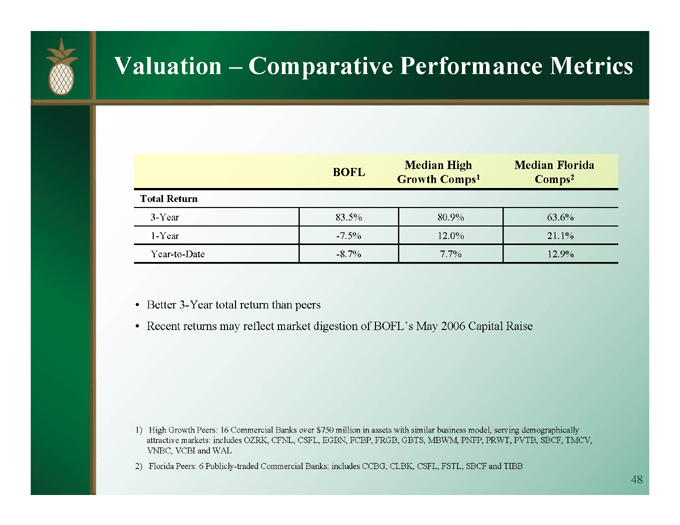

Valuation – Comparative Performance Metrics

BOFL Median High Growth Comps1 Median Florida Comps2

Total Return

3-Year 83.5% 80.9% 63.6%

1-Year -7.5% 12.0% 21.1%

Year-to-Date -8.7% 7.7% 12.9%

Better 3-Year total return than peers

Recent returns may reflect market digestion of BOFL’s May 2006 Capital Raise

1) High Growth Peers: 16 Commercial Banks over $750 million in assets with similar business model, serving demographically attractive markets: includes OZRK, CFNL, CSFL, EGBN, FCBP, FRGB, GBTS, MBWM, PNFP, PRWT, PVTB, SBCF, TMCV, VNBC, VCBI and WAL

2) Florida Peers: 6 Publicly-traded Commercial Banks: includes CCBG, CLBK, CSFL, FSTL, SBCF and TIBB

Investment Considerations

Experienced management team

Premier Florida markets

Demonstrated high growth

Excellent asset quality

Diminished competition through consolidation

Earnings momentum (6 consecutive rising quarters)

Compelling valuation

NASDAQ: BOFL

Questions & Answers

Closing Remarks Thank You!