UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21276

J.P. Morgan Fleming Series Trust

(Exact name of registrant as specified in charter)

245 Park Avenue

New York, NY 10167

(Address of principal executive offices) (Zip code)

Stephen M. Benham

245 Park Avenue

New York, NY 10167

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2006 through December 31, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

SIX MONTHS ENDED DECEMBER 31, 2006 (UNAUDITED)

JPMorgan Multi-Manager Small Cap Value Fund

| President’s Letter | 1 | |||||

| Fund Commentaries: | ||||||

| JPMorgan Multi-Manager Small Cap Growth Fund | 2 | |||||

| JPMorgan Multi-Manager Small Cap Value Fund | 4 | |||||

| Schedules of Portfolio Investments | 6 | |||||

| Financial Statements | 23 | |||||

| Financial Highlights | 26 | |||||

| Notes to Financial Statements | 28 | |||||

| Trustees | 33 | |||||

| Officers | 34 | |||||

| Schedule of Shareholder Expenses | 36 | |||||

| Board Approval of Investment Advisory Agreement | 37 |

| • | Markets sparked by Fed’s rate pause and falling oil prices |

| • | Large-cap stocks surpassed their mid- and small-cap counterparts |

| • | Home sales stabilized toward year-end but were offset somewhat by amount of unsold homes |

| • | Consumer spending likely to moderate as job gains decrease |

JANUARY 5, 2007 (Unaudited)

| “We expect economic growth to remain subdued over the next few quarters, keeping the pressure off inflation.” | |||||

President

JPMorgan Funds

AS OF DECEMBER 31, 2006 (Unaudited)

| Fund Inception | February 28, 2003 | |||||

| Fiscal Year End | June 30 | |||||

| Net Assets as of 12/31/2006 (In Thousands) | $183,481 | |||||

| Primary Benchmark | Russell 2000 Growth Index | |||||

Q: | HOW DID THE FUND PERFORM? |

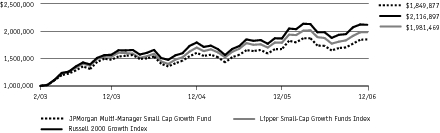

A: | The JPMorgan Multi-Manager Small Cap Growth Fund, which seeks to provide long-term capital growth by investing in equity securities of small-capitalization companies, returned 6.80% over the six months ended December 31, 2006, compared to the 6.86% return for the Russell 2000 Growth Index during the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund slightly underperformed its benchmark for the period due to stock selection in the healthcare and materials sectors. Small-cap stocks continued to generate positive returns, supported by robust corporate earnings, moderate inflation and low interest rates. |

Q: | HOW WAS THE FUND MANAGED? |

A: | We aim to invest with subadvisors that represent a complementary balance of approaches to small-cap growth investing. During the reporting period, we withdrew our allocation to Seligman, placing 15% of assets instead with ClariVest Asset Management LLC, a quantitative manager that seeks companies demonstrating accelerating growth with sustainable fundamentals that are not yet fully recognized by the market place. We believe ClariVest’s approach brings style and process diversification to our current sub-advisor mix. Our largest allocations continue to be with BlackRock and Oberweis at approximately 30% and 35%, respectively. BlackRock’s investment style of growth at a reasonable price worked well. In contrast, Oberweis, which focuses on companies demonstrating top- and bottom-line growth of at least 30% per year while trading at half its growth rate, faced a much more challenging market environment. While its approach can lead to volatility, over the long-term, Oberweis has demonstrated an ability to generate strong returns. Rounding out the Fund is UBS at approximately 20%. |

| 1. | Ceradyne, Inc. | 1.2 | % | |||||||

| 2. | Kyphon, Inc. | 1.2 | ||||||||

| 3. | SkillSoft plc ADR (Ireland) | 1.1 | ||||||||

| 4. | Focus Media Holding Ltd. ADR (China) | 1.0 | ||||||||

| 5. | Pediatrix Medical Group, Inc. | 1.0 | ||||||||

| 6. | CKX, Inc. | 0.9 | ||||||||

| 7. | Noven Pharmaceuticals, Inc. | 0.9 | ||||||||

| 8. | aQuantive, Inc. | 0.8 | ||||||||

| 9. | Orient-Express Hotels Ltd., Class H (Bermuda) | 0.8 | ||||||||

| 10. | Carrizo Oil & Gas, Inc. | 0.8 | ||||||||

| Information Technology | 30.2 | % | ||||

| Health Care | 19.6 | |||||

| Industrials | 16.1 | |||||

| Consumer Discretionary | 15.5 | |||||

| Energy | 6.8 | |||||

| Financials | 4.4 | |||||

| Materials | 3.2 | |||||

| Consumer Staples | 1.5 | |||||

| Telecommunication Services | 0.4 | |||||

| Mutual Funds | 0.4 | |||||

| Utilities | 0.2 | |||||

| Short-Term Investments | 1.7 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of December 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE | 1 YEAR | 3 YEAR | SINCE INCEPTION | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

MULTI-MANAGER SMALL CAP GROWTH FUND | 2/28/03 | 10.54 | % | 7.77 | % | 17.38 | % | |||||||||||

AS OF DECEMBER 31, 2006 (Unaudited)

| Fund Inception | February 28, 2003 | |||||

| Fiscal Year End | June 30 | |||||

| Net Assets as of 12/31/2006 | ||||||

| (In Thousands) | $336,660 | |||||

| Primary Benchmark | Russell 2000 Value Index | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Multi-Manager Small Cap Value Fund, which seeks to provide long-term capital appreciation by investing in equity securities of small-capitalization companies, returned 7.08% over the six months ended December 31, 2006, compared to the 11.81% return for the Russell 2000 Value Index over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund underperformed its benchmark for the period mainly due to stock selection in the healthcare and industrials sectors. In addition, underweight allocations in real estate investment trusts (REITs) and utilities — areas where our sub-advisors feel valuations are most stretched — detracted from returns. |

Q: | HOW WAS THE FUND MANAGED? |

A: | We aim to remain diversified across sub-advisors and multiple styles of small-cap value investing. Over the past six months, we have reduced our exposure to both JPMorgan and Earnest Partners. Both managers have reached capacity and we have moved to increase our weightings to both First Quadrant and Vaughan Nelson. Presently, JPMorgan and Earnest Partners constitute approximately 60% of the Fund, while First Quadrant and Vaughan Nelson make up the remaining 40%. |

| 1. | Cabot Oil & Gas Corp. | 1.1 | % | |||||||

| 2. | CompuCredit Corp. | 1.1 | ||||||||

| 3. | IKON Office Solutions, Inc. | 1.0 | ||||||||

| 4. | American Home Mortgage Investment Corp. | 1.0 | ||||||||

| 5. | Waste Connections, Inc. | 1.0 | ||||||||

| 6. | Raymond James Financial, Inc. | 0.9 | ||||||||

| 7. | Moog, Inc., Class A | 0.9 | ||||||||

| 8. | Phillips-Van Heusen Corp. | 0.9 | ||||||||

| 9. | Sterling Financial Corp. | 0.9 | ||||||||

| 10. | Ohio Casualty Corp. | 0.9 | ||||||||

| Financials | 31.8 | % | ||||

| Industrials | 17.3 | |||||

| Consumer Discretionary | 13.5 | |||||

| Information Technology | 9.6 | |||||

| Health Care | 7.8 | |||||

| Energy | 5.7 | |||||

| Materials | 5.6 | |||||

| Utilities | 3.0 | |||||

| Consumer Staples | 2.3 | |||||

| Telecommunication Services | 0.8 | |||||

| Mutual Funds | 0.6 | |||||

| U.S. Treasury Obligations | 0.2 | |||||

| Short-Term Investments | 1.4 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of December 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE | 1 YEAR | 3 YEAR | SINCE INCEPTION | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

MULTI-MANAGER SMALL CAP VALUE FUND | 2/28/03 | 15.25 | % | 14.10 | % | 24.90 | % | |||||||||||

AS OF DECEMBER 31, 2006 (Unaudited)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — 98.3% | |||||||||||

Common Stocks — 97.9% | |||||||||||

Aerospace & Defense — 3.3% | |||||||||||

| 15 | AAR Corp. (a) | 423 | |||||||||

| 10 | Armor Holdings, Inc. (a) | 526 | |||||||||

| 40 | BE Aerospace, Inc. (a) | 1,030 | |||||||||

| 39 | Ceradyne, Inc. (a) | 2,219 | |||||||||

| 3 | DRS Technologies, Inc. | 146 | |||||||||

| 9 | Essex Corp. (a) | 225 | |||||||||

| 22 | Ladish Co., Inc. (a) | 824 | |||||||||

| 9 | LMI Aerospace, Inc. (a) | 132 | |||||||||

| 33 | Orbital Sciences Corp. (a) | 605 | |||||||||

| 6,130 | |||||||||||

Air Freight & Logistics — 0.4% | |||||||||||

| 17 | Hub Group, Inc., Class A (a) | 465 | |||||||||

| 12 | UTI Worldwide, Inc. (United Kingdom) | 359 | |||||||||

| 824 | |||||||||||

Airlines — 0.0% (g) | |||||||||||

| 1 | Allegiant Travel Co. (a) | 36 | |||||||||

Auto Components — 0.3% | |||||||||||

| 17 | China Automotive Systems, Inc. (China) (a) | 211 | |||||||||

| 13 | LKQ Corp. (a) | 294 | |||||||||

| 505 | |||||||||||

Beverages — 0.2% | |||||||||||

| 12 | MGP Ingredients, Inc. | 280 | |||||||||

Biotechnology — 2.5% | |||||||||||

| 4 | Alexion Pharmaceuticals, Inc. (a) | 158 | |||||||||

| 18 | BioMarin Pharmaceuticals, Inc. (a) | 293 | |||||||||

| 6 | Cubist Pharmaceuticals, Inc. (a) | 110 | |||||||||

| 22 | Digene Corp. (a) | 1,035 | |||||||||

| 12 | Emergent Biosolutions, Inc. (a) | 132 | |||||||||

| 14 | Isis Pharmaceuticals, Inc. (a) | 155 | |||||||||

| 11 | Keryx Biopharmaceuticals, Inc. (a) | 145 | |||||||||

| 24 | Martek Biosciences Corp. (a) | 562 | |||||||||

| 6 | Myriad Genetics, Inc. (a) | 172 | |||||||||

| 9 | Nuvelo, Inc. (a) | 37 | |||||||||

| 37 | Omrix Biopharmaceuticals, Inc. (a) | 1,118 | |||||||||

| 15 | Regeneron Pharmaceuticals, Inc. (a) | 303 | |||||||||

| 10 | Renovis, Inc. (a) | 33 | |||||||||

| 24 | SIGA Technologies, Inc. (a) | 88 | |||||||||

| 20 | Trimeris, Inc. (a) | 257 | |||||||||

| 4,598 | |||||||||||

Building Products — 0.1% | |||||||||||

| 5 | Insteel Industries, Inc. | 94 | |||||||||

Capital Markets — 2.4% | |||||||||||

| 5 | Affiliated Managers Group, Inc. (a) | 504 | |||||||||

| 23 | Apollo Investment Corp. | 506 | |||||||||

| 4 | Evercore Partners, Inc., Class A (a) | 144 | |||||||||

| 7 | Greenhill & Co., Inc. | 509 | |||||||||

| 26 | Investment Technology Group, Inc. (a) | 1,115 | |||||||||

| 11 | Investors Financial Services Corp. | 474 | |||||||||

| 1 | KBW, Inc. (a) | 15 | |||||||||

| 20 | MCG Capital Corp. | 396 | |||||||||

| 49 | TradeStation Group, Inc. (a) | 680 | |||||||||

| 4,343 | |||||||||||

Chemicals — 1.9% | |||||||||||

| 14 | Agrium, Inc. (Canada) | 447 | |||||||||

| 18 | Airgas, Inc. | 709 | |||||||||

| 25 | CF Industries Holdings, Inc. | 638 | |||||||||

| — | (h) | FMC Corp. | 30 | ||||||||

| 2 | HB Fuller Co. | 62 | |||||||||

| 9 | Hercules, Inc. (a) | 170 | |||||||||

| 6 | Lubrizol Corp. | 301 | |||||||||

| 22 | Spartech Corp. | 585 | |||||||||

| 29 | Zoltek Cos, Inc. (a) | 577 | |||||||||

| 3,519 | |||||||||||

Commercial Banks — 0.8% | |||||||||||

| 16 | Signature Bank (a) | 480 | |||||||||

| 22 | UCBH Holdings, Inc. | 392 | |||||||||

| 15 | UMB Financial Corp. | 537 | |||||||||

| 1,409 | |||||||||||

Commercial Services & Supplies — 5.5% | |||||||||||

| 14 | Advisory Board Co. (The) (a) | 734 | |||||||||

| 20 | American Ecology Corp. | 373 | |||||||||

| 21 | CRA International, Inc. (a) | 1,121 | |||||||||

| 110 | Diamond Management & Technology Consultants, Inc. | 1,362 | |||||||||

| 37 | Healthcare Services Group, Inc. | 1,060 | |||||||||

| 33 | IHS, Inc., Class A (a) | 1,291 | |||||||||

| 24 | Kenexa Corp. (a) | 807 | |||||||||

| 5 | Korn/Ferry International (a) | 110 | |||||||||

| 19 | Labor Ready, Inc. (a) | 348 | |||||||||

| 33 | LECG Corp. (a) | 612 | |||||||||

| 10 | PeopleSupport, Inc. (a) | 206 | |||||||||

| 38 | TeleTech Holdings, Inc. (a) | 910 | |||||||||

| 25 | Watson Wyatt Worldwide, Inc., Class A | 1,111 | |||||||||

| 10,045 | |||||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Communications Equipment — 4.4% | |||||||||||

| 49 | Acme Packet, Inc. (a) | 1,006 | |||||||||

| 20 | C-COR, Inc. (a) | 225 | |||||||||

| 26 | EMS Technologies, Inc. (a) | 515 | |||||||||

| 34 | Foundry Networks, Inc. (a) | 508 | |||||||||

| 25 | Harmonic, Inc. (a) | 183 | |||||||||

| 18 | Nice Systems Ltd., ADR (Israel) (a) | 557 | |||||||||

| 51 | Occam Networks, Inc. (a) | 833 | |||||||||

| 46 | Oplink Communications, Inc. (a) | 936 | |||||||||

| 34 | Optium Corp. (a) | 838 | |||||||||

| 15 | Polycom, Inc. (a) | 458 | |||||||||

| 50 | Redback Networks, Inc. (a) | 1,259 | |||||||||

| 51 | Sierra Wireless (Canada) (a) | 723 | |||||||||

| 11 | UTStarcom, Inc. (a) | 95 | |||||||||

| 8,136 | |||||||||||

Computers & Peripherals — 0.7% | |||||||||||

| 12 | Neoware Systems, Inc. (a) | 153 | |||||||||

| 22 | Rackable Systems, Inc. (a) | 684 | |||||||||

| 36 | SimpleTech, Inc. (a) | 462 | |||||||||

| 1,299 | |||||||||||

Construction & Engineering — 0.5% | |||||||||||

| 16 | EMCOR Group, Inc. (a) | 887 | |||||||||

Consumer Finance — 0.1% | |||||||||||

| 2 | Cash America International, Inc. | 94 | |||||||||

Containers & Packaging — 0.5% | |||||||||||

| 5 | Greif, Inc., Class A | 639 | |||||||||

| 3 | Myers Industries, Inc. | 53 | |||||||||

| 11 | Rock-Tenn Co., Class A | 293 | |||||||||

| 985 | |||||||||||

Distributors — 0.1% | |||||||||||

| 5 | Core-Mark Holding Co., Inc. (a) | 164 | |||||||||

Diversified Consumer Services — 0.3% | |||||||||||

| 12 | Laureate Education, Inc. (a) | 603 | |||||||||

Diversified Telecommunication Services — 0.4% | |||||||||||

| 17 | Atlantic Tele-Network, Inc. | 503 | |||||||||

| 12 | CT Communications, Inc. | 268 | |||||||||

| 771 | |||||||||||

Electrical Equipment — 0.9% | |||||||||||

| 28 | Canadian Solar, Inc. (China) (a) | 297 | |||||||||

| 4 | Energy Conversion Devices, Inc. (a) | 132 | |||||||||

| 5 | First Solar, Inc. (a) | 161 | |||||||||

| 6 | Genlyte Group, Inc. (a) | 430 | |||||||||

| 21 | Magnetek, Inc. (a) | 119 | |||||||||

| 9 | Regal-Beloit Corp. | 488 | |||||||||

| 1,627 | |||||||||||

Electronic Equipment & Instruments — 1.5% | |||||||||||

| 16 | Benchmark Electronics, Inc. (a) | 395 | |||||||||

| 13 | Cognex Corp. | 317 | |||||||||

| 30 | Daktronics, Inc. | 1,105 | |||||||||

| 3 | Insight Enterprises, Inc. (a) | 56 | |||||||||

| 9 | IPG Photonics Corp. (a) | 204 | |||||||||

| 28 | Pemstar, Inc. (a) | 108 | |||||||||

| 10 | Radisys Corp. (a) | 165 | |||||||||

| 13 | SYNNEX Corp. (a) | 279 | |||||||||

| 4 | Zygo Corp. (a) | 59 | |||||||||

| 2,688 | |||||||||||

Energy Equipment & Services — 3.8% | |||||||||||

| 24 | Allis-Chalmers Energy, Inc. (a) | 556 | |||||||||

| 12 | Atwood Oceanics, Inc. (a) | 597 | |||||||||

| 17 | Bronco Drilling Co., Inc. (a) | 285 | |||||||||

| 4 | Core Laboratories N.V. (Netherlands) (a) | 316 | |||||||||

| 15 | Dril-Quip, Inc. (a) | 591 | |||||||||

| 22 | Hercules Offshore, Inc. (a) | 644 | |||||||||

| 8 | Lufkin Industries, Inc. | 493 | |||||||||

| 16 | Oceaneering International, Inc. (a) | 615 | |||||||||

| 20 | Parker Drilling Co. (a) | 159 | |||||||||

| 12 | Patterson-UTI Energy, Inc. | 279 | |||||||||

| 11 | Pioneer Drilling Co. (a) | 150 | |||||||||

| 33 | Superior Energy Services, Inc. (a) | 1,088 | |||||||||

| 29 | Tetra Technologies, Inc. (a) | 742 | |||||||||

| 10 | Unit Corp. (a) | 460 | |||||||||

| 6,975 | |||||||||||

Food & Staples Retailing — 0.7% | |||||||||||

| 40 | Central European Distribution Corp. (a) | 1,174 | |||||||||

| 5 | Spartan Stores, Inc. | 109 | |||||||||

| 1,283 | |||||||||||

Food Products — 0.1% | |||||||||||

| 29 | SunOpta, Inc. (Canada) (a) | 253 | |||||||||

Health Care Equipment & Supplies — 7.3% | |||||||||||

| 20 | Abaxis, Inc. (a) | 381 | |||||||||

| 35 | Adeza Biomedical Corp. (a) | 526 | |||||||||

| 83 | Align Technology, Inc. (a) | 1,158 | |||||||||

| 28 | Arthrocare Corp. (a) | 1,125 | |||||||||

| 8 | Aspect Medical Systems, Inc. (a) | 141 | |||||||||

| 20 | Cholestech Corp. (a) | 370 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Health Care Equipment & Supplies — Continued | |||||||||||

| 23 | Cutera, Inc. (a) | 629 | |||||||||

| 11 | DexCom, Inc. (a) | 108 | |||||||||

| 18 | Foxhollow Technologies, Inc. (a) | 379 | |||||||||

| 11 | Hansen Medical, Inc. (a) | 125 | |||||||||

| 13 | Hologic, Inc. (a) | 634 | |||||||||

| 19 | Immucor, Inc. (a) | 564 | |||||||||

| 42 | Intralase Corp. (a) | 947 | |||||||||

| 52 | Kyphon, Inc. (a) | 2,118 | |||||||||

| 20 | LifeCell Corp. (a) | 471 | |||||||||

| 2 | Mentor Corp. | 93 | |||||||||

| 34 | Natus Medical, Inc. (a) | 565 | |||||||||

| 9 | Palomar Medical Technologies, Inc. (a) | 470 | |||||||||

| 5 | Resmed, Inc. (a) | 222 | |||||||||

| 33 | Spectranetics Corp. (a) | 369 | |||||||||

| 7 | Syneron Medical Ltd. (Israel) (a) | 190 | |||||||||

| 16 | Viasys Healthcare, Inc. (a) | 437 | |||||||||

| 60 | Wright Medical Group, Inc. (a) | 1,404 | |||||||||

| 13,426 | |||||||||||

Health Care Providers & Services — 5.1% | |||||||||||

| 10 | Chindex International, Inc. (a) | 189 | |||||||||

| 2 | Corvel Corp. (a) | 95 | |||||||||

| 13 | Cross Country Healthcare, Inc. (a) | 288 | |||||||||

| 31 | HealthExtras, Inc. (a) | 751 | |||||||||

| 43 | HealthSpring, Inc. (a) | 883 | |||||||||

| 14 | Healthways, Inc. (a) | 650 | |||||||||

| 17 | inVentiv Health, Inc. (a) | 595 | |||||||||

| 17 | LHC Group, Inc. (a) | 476 | |||||||||

| 37 | Nighthawk Radiology Holdings, Inc. (a) | 951 | |||||||||

| 38 | Pediatrix Medical Group, Inc. (a) | 1,878 | |||||||||

| 17 | Psychiatric Solutions, Inc. (a) | 653 | |||||||||

| 36 | Symbion, Inc. (a) | 674 | |||||||||

| 12 | United Surgical Partners International, Inc. (a) | 326 | |||||||||

| 23 | VCA Antech, Inc. (a) | 727 | |||||||||

| 12 | Visicu, Inc. (a) | 130 | |||||||||

| 9,266 | |||||||||||

Health Care Technology — 1.4% | |||||||||||

| 40 | Allscripts Healthcare Solutions, Inc. (a) | 1,073 | |||||||||

| 7 | Dendrite International, Inc. (a) | 77 | |||||||||

| 30 | Emageon, Inc. (a) | 467 | |||||||||

| 11 | Phase Forward, Inc. (a) | 157 | |||||||||

| 15 | Systems Xcellence, Inc. (Canada) (a) | 298 | |||||||||

| 16 | Vital Images, Inc. (a) | 565 | |||||||||

| 2,637 | |||||||||||

Hotels, Restaurants & Leisure — 3.5% | |||||||||||

| 6 | Buffalo Wild Wings, Inc. (a) | 297 | |||||||||

| 13 | California Pizza Kitchen, Inc. (a) | 430 | |||||||||

| 27 | CKE Restaurants, Inc. | 491 | |||||||||

| 10 | Ctrip.com International Ltd. ADR (China) | 595 | |||||||||

| 1 | Jack in the Box, Inc. (a) | 67 | |||||||||

| 31 | Orient-Express Hotels Ltd., Class H (Bermuda) | 1,453 | |||||||||

| 22 | Red Robin Gourmet Burgers, Inc. (a) | 771 | |||||||||

| 21 | Scientific Games Corp., Class A (a) | 647 | |||||||||

| 20 | Shuffle Master, Inc. (a) | 533 | |||||||||

| 13 | Triarc Cos., Inc., Class B | 258 | |||||||||

| 19 | Vail Resorts, Inc. (a) | 834 | |||||||||

| 6,376 | |||||||||||

Household Durables — 1.0% | |||||||||||

| 15 | Desarrolladora Homex S.A. de C.V. ADR (Mexico) (a) | 867 | |||||||||

| 17 | Helen of Troy Ltd. (Bermuda) (a) | 417 | |||||||||

| 14 | Interface, Inc., Class A (a) | 203 | |||||||||

| 45 | Syntax-Brillian Corp. (a) | 390 | |||||||||

| 1,877 | |||||||||||

Household Products — 0.2% | |||||||||||

| 9 | Central Garden & Pet Co. (a) | 412 | |||||||||

Industrial Conglomerates — 0.1% | |||||||||||

| 3 | Teleflex, Inc. | 161 | |||||||||

Insurance — 0.1% | |||||||||||

| 10 | eHealth, Inc. (a) | 209 | |||||||||

Internet & Catalog Retail — 0.7% | |||||||||||

| 54 | Gmarket, Inc. ADR (South Korea) (a) | 1,292 | |||||||||

Internet Software & Services — 5.6% | |||||||||||

| 62 | aQuantive, Inc. (a) | 1,533 | |||||||||

| 34 | Art Technology Group, Inc. (a) | 79 | |||||||||

| 37 | DealerTrack Holdings, Inc. (a) | 1,097 | |||||||||

| 26 | DivX, Inc. (a) | 602 | |||||||||

| 12 | Greenfield Online, Inc. (a) | 177 | |||||||||

| 41 | Interwoven, Inc. (a) | 596 | |||||||||

| 50 | Online Resources Corp. (a) | 514 | |||||||||

| 29 | Perficient, Inc. (a) | 483 | |||||||||

| 323 | SkillSoft plc ADR (Ireland) (a) | 2,008 | |||||||||

| 140 | SonicWALL, Inc. (a) | 1,181 | |||||||||

| 17 | SupportSoft, Inc. (a) | 93 | |||||||||

| 17 | Travelzoo, Inc. (a) | 502 | |||||||||

| 53 | ValueClick, Inc. (a) | 1,249 | |||||||||

| 14 | Vignette Corp. (a) | 241 | |||||||||

| 10,355 | |||||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

IT Services — 5.0% | |||||||||||

| 16 | CACI International, Inc., Class A (a) | 921 | |||||||||

| 15 | Convergys Corp. (a) | 354 | |||||||||

| 28 | Covansys Corp. (a) | 636 | |||||||||

| 24 | eFunds Corp. (a) | 652 | |||||||||

| 51 | ExlService Holdings, Inc. (a) | 1,083 | |||||||||

| 46 | Forrester Research, Inc. (a) | 1,250 | |||||||||

| 29 | Gartner, Inc. (a) | 576 | |||||||||

| 19 | Infocrossing, Inc. (a) | 311 | |||||||||

| 6 | infoUSA, Inc. | 70 | |||||||||

| 1 | Isilon Systems, Inc. (a) | 28 | |||||||||

| 12 | Lightbridge, Inc. (a) | 161 | |||||||||

| 34 | RightNow Technologies, Inc. (a) | 580 | |||||||||

| 13 | SI International, Inc. (a) | 434 | |||||||||

| 8 | Tyler Technologies, Inc. (a) | 107 | |||||||||

| 16 | VeriFone Holdings, Inc. (a) | 574 | |||||||||

| 14 | WNS Holdings, Ltd. ADS (India) (a) | 432 | |||||||||

| 33 | Wright Express Corp. (a) | 1,038 | |||||||||

| 9,207 | |||||||||||

Leisure Equipment & Products — 0.2% | |||||||||||

| 5 | Nautilus Group, Inc. | 63 | |||||||||

| 7 | RC2 Corp. (a) | 317 | |||||||||

| 380 | |||||||||||

Life Sciences Tools & Services — 0.7% | |||||||||||

| 43 | Bruker BioSciences Corp. (a) | 326 | |||||||||

| 5 | Charles River Laboratories International, Inc. (a) | 217 | |||||||||

| 15 | Exelixis, Inc. (a) | 132 | |||||||||

| 9 | Icon plc ADR (Ireland) (a) | 328 | |||||||||

| 6 | Illumina, Inc. (a) | 220 | |||||||||

| 1,223 | |||||||||||

Machinery — 4.1% | |||||||||||

| 12 | Actuant Corp., Class A | 557 | |||||||||

| 20 | Bucyrus International, Inc. | 1,017 | |||||||||

| 7 | Cascade Corp. | 376 | |||||||||

| 18 | Dynamic Materials Corp. | 516 | |||||||||

| 9 | ESCO Technologies, Inc. (a) | 423 | |||||||||

| 29 | Gardner Denver, Inc. (a) | 1,093 | |||||||||

| 4 | Harsco Corp. | 274 | |||||||||

| 18 | Kadant, Inc. (a) | 449 | |||||||||

| 10 | Kaydon Corp. | 409 | |||||||||

| 4 | Middleby Corp. (The) (a) | 366 | |||||||||

| 18 | Mueller Water Products. Inc., Class A | 274 | |||||||||

| 15 | RBC Bearings, Inc. (a) | 418 | |||||||||

| 16 | Robbins & Myers, Inc. | 716 | |||||||||

| 20 | TurboChef Technologies, Inc. (a) | 339 | |||||||||

| 1 | Valmont Industries, Inc. | 61 | |||||||||

| 6 | Wabtec Corp. | 170 | |||||||||

| 7,458 | |||||||||||

Marine — 0.9% | |||||||||||

| 34 | Diana Shipping, Inc. (Greece) | 542 | |||||||||

| 7 | Excel Maritime Carriers Ltd. (Greece) (a) | 95 | |||||||||

| 9 | Genco Shipping & Trading Ltd. | 246 | |||||||||

| 14 | Horizon Lines Inc., Class A | 383 | |||||||||

| 27 | Quintana Maritime Ltd. (Greece) | 300 | |||||||||

| 1,566 | |||||||||||

Media — 2.7% | |||||||||||

| 143 | CKX, Inc. (a) | 1,677 | |||||||||

| 29 | Focus Media Holding Ltd. ADR (China) (a) | 1,904 | |||||||||

| 29 | Journal Register Co. | 213 | |||||||||

| 57 | Outdoor Channel Holdings, Inc. (a) | 737 | |||||||||

| 23 | World Wrestling Entertainment, Inc., Class A | 375 | |||||||||

| 4,906 | |||||||||||

Metals & Mining — 0.6% | |||||||||||

| 11 | Century Aluminum Co. (a) | 495 | |||||||||

| 5 | Reliance Steel & Aluminum Co. | 209 | |||||||||

| 14 | Steel Dynamics, Inc. | 451 | |||||||||

| 1,155 | |||||||||||

Multi-Utilities — 0.2% | |||||||||||

| 13 | PNM Resources, Inc. | 414 | |||||||||

Multiline Retail — 0.3% | |||||||||||

| 27 | Big Lots, Inc. (a) | 628 | |||||||||

Oil, Gas & Consumable Fuels — 3.0% | |||||||||||

| 16 | ATP Oil & Gas Corp. (a) | 637 | |||||||||

| 2 | Calumet Specialty Products Partners LP | 96 | |||||||||

| 48 | Carrizo Oil & Gas, Inc. (a) | 1,404 | |||||||||

| 23 | Comstock Resources, Inc. (a) | 702 | |||||||||

| 29 | EXCO Resources, Inc. (a) | 492 | |||||||||

| 9 | Goodrich Petroleum Corp. (a) | 329 | |||||||||

| 16 | Massey Energy Co. | 379 | |||||||||

| 13 | Parallel Petroleum Corp. (a) | 228 | |||||||||

| 86 | PetroHawk Energy Corp. (a) | 984 | |||||||||

| 6 | Quicksilver Resources, Inc. (a) | 209 | |||||||||

| 5,460 | |||||||||||

Paper & Forest Products — 0.2% | |||||||||||

| 23 | Mercer International, Inc. (a) | 278 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Personal Products — 0.2% | |||||||||||

| 11 | American Oriental Bioengineering, Inc. (China) (a) | 133 | |||||||||

| 5 | NBTY, Inc. (a) | 212 | |||||||||

| 345 | |||||||||||

Pharmaceuticals — 2.6% | |||||||||||

| 29 | Adams Respiratory Therapeutics, Inc. (a) | 1,170 | |||||||||

| 65 | Noven Pharmaceuticals, Inc. (a) | 1,659 | |||||||||

| 10 | Penwest Pharmaceuticals Co. (a) | 168 | |||||||||

| 49 | Salix Pharmaceuticals Ltd. (a) | 598 | |||||||||

| 62 | Santarus, Inc. (a) | 484 | |||||||||

| 33 | Sciele Pharma, Inc. (a) | 783 | |||||||||

| 4,862 | |||||||||||

Real Estate Investment Trusts (REITs) — 0.6% | |||||||||||

| 10 | Anthracite Capital, Inc. | 131 | |||||||||

| 7 | BioMed Realty Trust, Inc. | 209 | |||||||||

| 4 | JER Investors Trust, Inc. | 85 | |||||||||

| 14 | Luminent Mortgage Capital, Inc. | 139 | |||||||||

| 14 | Ventas, Inc. | 571 | |||||||||

| 1,135 | |||||||||||

Real Estate Management & Development — 0.4% | |||||||||||

| 139 | Move, Inc. (a) | 766 | |||||||||

Road & Rail — 0.3% | |||||||||||

| 12 | Landstar System, Inc. | 470 | |||||||||

Semiconductors & Semiconductor Equipment — 6.2% | |||||||||||

| 30 | Amkor Technology, Inc. (a) | 283 | |||||||||

| 11 | Asyst Technologies, Inc. (a) | 83 | |||||||||

| 35 | Atheros Communications, Inc. (a) | 742 | |||||||||

| 92 | Credence Systems Corp. (a) | 476 | |||||||||

| 10 | Cymer, Inc. (a) | 431 | |||||||||

| 16 | Diodes, Inc. (a) | 582 | |||||||||

| 12 | Exar Corp. (a) | 151 | |||||||||

| 7 | Hittite Microwave Corp. (a) | 236 | |||||||||

| 49 | Micrel, Inc. (a) | 527 | |||||||||

| 51 | Microsemi Corp. (a) | 996 | |||||||||

| 3 | NVE Corp. (a) | 92 | |||||||||

| 12 | Photronics, Inc. (a) | 188 | |||||||||

| 41 | PLX Technology, Inc. (a) | 538 | |||||||||

| 9 | Power Integrations, Inc. (a) | 213 | |||||||||

| 17 | Rudolph Technologies, Inc. (a) | 263 | |||||||||

| 22 | Sigma Designs, Inc. (a) | 573 | |||||||||

| 25 | Silicon Image, Inc. (a) | 312 | |||||||||

| 32 | Skyworks Solutions, Inc. (a) | 225 | |||||||||

| 38 | Standard Microsystems Corp. (a) | 1,060 | |||||||||

| 19 | Supertex, Inc. (a) | 741 | |||||||||

| 25 | Tessera Technologies, Inc. (a) | 1,027 | |||||||||

| 72 | Trident Microsystems, Inc. (a) | 1,311 | |||||||||

| 9 | Varian Semiconductor Equipment Associates, Inc. (a) | 405 | |||||||||

| 11,455 | |||||||||||

Software — 6.7% | |||||||||||

| 11 | Actuate Corp. (a) | 66 | |||||||||

| 36 | Aladdin Knowledge Systems (Israel) (a) | 696 | |||||||||

| 16 | Ansoft Corp. (a) | 448 | |||||||||

| 31 | Blackboard, Inc. (a) | 925 | |||||||||

| 35 | CDC Corp., Class A (Hong Kong) (a) | 334 | |||||||||

| 12 | CommVault Systems, Inc. (a) | 248 | |||||||||

| 49 | Concur Technologies, Inc. (a) | 781 | |||||||||

| 4 | Double-Take Software, Inc. (a) | 49 | |||||||||

| 6 | Factset Research Systems, Inc. | 353 | |||||||||

| 8 | Fair Isaac Corp. | 342 | |||||||||

| 45 | FalconStor Software, Inc. (a) | 390 | |||||||||

| 32 | i2 Technologies Inc. (a) | 723 | |||||||||

| 25 | Interactive Intelligence, Inc. (a) | 558 | |||||||||

| 14 | Kronos, Inc. (a) | 500 | |||||||||

| 5 | Manhattan Associates, Inc. (a) | 153 | |||||||||

| 11 | Mentor Graphics Corp. (a) | 204 | |||||||||

| 13 | MICROS Systems, Inc. (a) | 664 | |||||||||

| 1 | MicroStrategy, Inc., Class A (a) | 91 | |||||||||

| 33 | Net 1 UEPS Technologies Inc. (South Africa) (a) | 984 | |||||||||

| 35 | Nuance Communications, Inc. (a) | 401 | |||||||||

| 8 | Parametric Technology Corp. (a) | 148 | |||||||||

| 12 | Progress Software Corp. (a) | 321 | |||||||||

| 17 | Secure Computing Corp. (a) | 114 | |||||||||

| 12 | Shanda Interactive Entertainment Ltd. ADR (China) (a) | 262 | |||||||||

| 6 | THQ, Inc. (a) | 198 | |||||||||

| 35 | Transaction Systems Architechs, Inc. (a) | 1,143 | |||||||||

| 72 | Vasco Data Security International (a) | 853 | |||||||||

| 9 | Verint Systems, Inc. (a) | 307 | |||||||||

| 12,256 | |||||||||||

Specialty Retail — 3.3% | |||||||||||

| 3 | Aeropostale, Inc. (a) | 80 | |||||||||

| 3 | Buckle, Inc. | 127 | |||||||||

| 7 | Charlotte Russe Holding, Inc. (a) | 209 | |||||||||

| 17 | Children’s Place Retail Stores, Inc. (The) (a) | 1,061 | |||||||||

| 22 | Christopher & Banks Corp. | 412 | |||||||||

| 19 | Citi Trends, Inc. (a) | 752 | |||||||||

| 15 | Dick’s Sporting Goods, Inc. (a) | 735 | |||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Specialty Retail — Continued | |||||||||||

| 10 | Dress Barn, Inc. (a) | 233 | |||||||||

| 4 | DSW, Inc., Class A (a) | 143 | |||||||||

| 43 | Golfsmith International Holdings, Inc. (a) | 416 | |||||||||

| 3 | Group 1 Automotive, Inc. | 176 | |||||||||

| 6 | Guitar Center, Inc. (a) | 268 | |||||||||

| 4 | Rent-A-Center, Inc. (a) | 127 | |||||||||

| 14 | Tween Brands, Inc. (a) | 571 | |||||||||

| 24 | Zumiez, Inc. (a) | 721 | |||||||||

| 6,031 | |||||||||||

Textiles, Apparel & Luxury Goods — 3.1% | |||||||||||

| 9 | Brown Shoe Co., Inc. | 444 | |||||||||

| 6 | Deckers Outdoor Corp. (a) | 330 | |||||||||

| 11 | Heelys, Inc. (a) | 356 | |||||||||

| 42 | Iconix Brand Group, Inc. (a) | 805 | |||||||||

| 12 | Perry Ellis International, Inc. (a) | 476 | |||||||||

| 13 | Phillips-Van Heusen Corp. | 657 | |||||||||

| 4 | Skechers U.S.A., Inc., Class A (a) | 140 | |||||||||

| 12 | Steven Madden Ltd. | 416 | |||||||||

| 24 | Volcom Inc. (a) | 706 | |||||||||

| 51 | Warnaco Group, Inc. (The) (a) | 1,291 | |||||||||

| 2 | Wolverine World Wide, Inc. | 69 | |||||||||

| 5,690 | |||||||||||

Thrifts & Mortgage Finance — 0.0% (g) | |||||||||||

| — | (h) | New York Community Bancorp, Inc. | — | (h) | |||||||

Tobacco — 0.1% | |||||||||||

| 26 | Alliance One International, Inc. (a) | 184 | |||||||||

Trading Companies & Distributors — 0.1% | |||||||||||

| 7 | Beacon Roofing Supply, Inc. (a) | 132 | |||||||||

| Total Common Stocks (Cost $143,549) | 179,560 | ||||||||||

Investment Company — 0.4% | |||||||||||

Equity Fund — 0.4% | |||||||||||

| 10 | iShares Russell 2000 Index Fund (Cost $713) | 741 | |||||||||

| Total Long-Term Investments (Cost $144,262) | 180,301 | ||||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Short-Term Investments — 1.7% | |||||||||||

Discount Note — 0.2% | |||||||||||

| 380 | Federal Home Loan Bank, 4.80%, 01/02/07 (n) (Cost $380) | 380 | |||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE ($) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Investment Company — 1.5% | ||||||||||

| 2,760 | JPMorgan Prime Money Market Fund (b) (Cost $2,760) | 2,760 | ||||||||

| Total Short-Term Investments (Cost $3,140) | 3,140 | |||||||||

Total Investments — 100.0% (Cost $147,402) | 183,441 | |||||||||

Other Assets in Excess of Liabilities — 0.0% (g) | 40 | |||||||||

NET ASSETS — 100.0% | $183,481 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — 98.0% | |||||||||||

Common Stocks — 97.4% | |||||||||||

Aerospace & Defense — 2.4% | |||||||||||

| 3 | AAR Corp. (a) (m) | 79 | |||||||||

| 22 | Alliant Techsystems, Inc. (a) | 1,734 | |||||||||

| 2 | Ceradyne, Inc. (a) | 136 | |||||||||

| 10 | Curtiss-Wright Corp. | 363 | |||||||||

| 9 | DRS Technologies, Inc. | 491 | |||||||||

| 7 | Esterline Technologies Corp. (a) | 286 | |||||||||

| 1 | Heico Corp. | 47 | |||||||||

| 93 | Hexcel Corp. (a) | 1,626 | |||||||||

| 82 | Moog, Inc., Class A (a) | 3,143 | |||||||||

| 6 | Orbital Sciences Corp. (a) | 101 | |||||||||

| 3 | Triumph Group, Inc. | 152 | |||||||||

| 8,158 | |||||||||||

Airlines — 1.0% | |||||||||||

| 42 | Alaska Air Group, Inc. (a) | 1,663 | |||||||||

| 6 | Continental Airlines, Inc., Class B (a) | 264 | |||||||||

| 19 | ExpressJet Holdings, Inc. (a) | 157 | |||||||||

| 9 | Mesa Air Group, Inc. (a) | 81 | |||||||||

| 20 | Republic Airways Holdings, Inc. (a) | 342 | |||||||||

| 28 | Skywest, Inc. | 702 | |||||||||

| 3,209 | |||||||||||

Auto Components — 0.6% | |||||||||||

| 7 | Aftermarket Technology Corp. (a) | 145 | |||||||||

| 3 | American Axle & Manufacturing Holdings, Inc. | 63 | |||||||||

| 29 | ArvinMeritor, Inc. | 530 | |||||||||

| 2 | Lear Corp. | 68 | |||||||||

| 7 | Modine Manufacturing Co. | 165 | |||||||||

| 5 | Quantum Fuel Systems Technologies Worldwide, Inc. (a) | 8 | |||||||||

| 3 | Sauer-Danfoss, Inc. | 90 | |||||||||

| 42 | Tenneco, Inc. (a) | 1,038 | |||||||||

| 8 | Visteon Corp. (a) | 70 | |||||||||

| 2,177 | |||||||||||

Automobiles — 0.2% | |||||||||||

| 16 | Winnebago Industries, Inc. | 520 | |||||||||

Biotechnology — 0.1% | |||||||||||

| 5 | Applera Corp. - Celera Group (a) | 64 | |||||||||

| 3 | Arena Pharmaceuticals, Inc. (a) | 44 | |||||||||

| 3 | Cubist Pharmaceuticals, Inc. (a) | 49 | |||||||||

| — | (h) | Martek Biosciences Corp. (a) | 9 | ||||||||

| 3 | Progenics Pharmaceuticals, Inc. (a) | 85 | |||||||||

| 3 | Savient Pharmaceuticals, Inc. (a) | 34 | |||||||||

| 2 | United Therapeutics Corp. (a) | 103 | |||||||||

| 388 | |||||||||||

Building Products — 1.2% | |||||||||||

| 3 | Ameron International Corp. | 199 | |||||||||

| 4 | Apogee Enterprises, Inc. | 75 | |||||||||

| 2 | Builders FirstSource, Inc. (a) | 37 | |||||||||

| 62 | Griffon Corp. (a) | 1,568 | |||||||||

| 31 | Jacuzzi Brands, Inc. (a) | 389 | |||||||||

| 46 | Lennox International, Inc. | 1,412 | |||||||||

| 4 | NCI Building Systems, Inc. (a) | 223 | |||||||||

| 6 | Universal Forest Products, Inc. | 266 | |||||||||

| 4,169 | |||||||||||

Capital Markets — 3.9% | |||||||||||

| 14 | Affiliated Managers Group, Inc. (a) | 1,451 | |||||||||

| 76 | Apollo Investment Corp. | 1,711 | |||||||||

| 49 | Calamos Asset Management, Inc., Class A | 1,309 | |||||||||

| 61 | Eaton Vance Corp. | 2,000 | |||||||||

| — | (h) | Greenhill & Co., Inc. | 30 | ||||||||

| 73 | Jefferies Group, Inc. | 1,961 | |||||||||

| 18 | Knight Capital Group, Inc., Class A (a) | 345 | |||||||||

| 38 | LaBranche & Co., Inc. (a) | 373 | |||||||||

| 9 | MCG Capital Corp. | 177 | |||||||||

| 2 | Piper Jaffray Cos. (a) | 143 | |||||||||

| 105 | Raymond James Financial, Inc. | 3,183 | |||||||||

| 21 | Technology Investment Capital Corp. | 334 | |||||||||

| 13,017 | |||||||||||

Chemicals — 2.6% | |||||||||||

| 6 | CF Industries Holdings, Inc. | 164 | |||||||||

| 18 | Cytec Industries, Inc. | 1,020 | |||||||||

| 11 | FMC Corp. | 875 | |||||||||

| 9 | Georgia Gulf Corp. | 178 | |||||||||

| 13 | H.B. Fuller Co. | 328 | |||||||||

| 20 | Hercules, Inc. (a) | 380 | |||||||||

| 2 | Innospec, Inc. (United Kingdom) | 107 | |||||||||

| 2 | Minerals Technologies, Inc. | 135 | |||||||||

| 2 | NewMarket Corp. | 130 | |||||||||

| 3 | OM Group, Inc. (a) | 136 | |||||||||

| 24 | PolyOne Corp. (a) | 181 | |||||||||

| 7 | Rockwood Holdings, Inc. (a) | 174 | |||||||||

| 53 | Scotts Miracle-Gro Co. (The), Class A | 2,740 | |||||||||

| 13 | Sensient Technologies Corp. | 312 | |||||||||

| 9 | Spartech Corp. | 225 | |||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Chemicals — Continued | |||||||||||

| 55 | Valspar Corp. | 1,526 | |||||||||

| 9 | W.R. Grace & Co. (a) | 172 | |||||||||

| 8,783 | |||||||||||

Commercial Banks — 6.1% | |||||||||||

| 3 | 1st Source Corp. | 102 | |||||||||

| 3 | Amcore Financial, Inc. | 101 | |||||||||

| 2 | AmericanWest Bancorp | 46 | |||||||||

| 4 | Ameris Bancorp | 99 | |||||||||

| 2 | BancFirst Corp. | 124 | |||||||||

| 5 | Bank of Granite Corp. | 88 | |||||||||

| 2 | Banner Corp. | 84 | |||||||||

| 20 | Boston Private Financial Holdings, Inc. | 550 | |||||||||

| 2 | Camden National Corp. | 111 | |||||||||

| 1 | Capital Corp. of the West | 46 | |||||||||

| 3 | Capitol Bancorp Ltd. | 134 | |||||||||

| 1 | Cardinal Financial Corp. | 11 | |||||||||

| 3 | Cathay General Bancorp | 93 | |||||||||

| 10 | Central Pacific Financial Corp. | 368 | |||||||||

| 4 | Chemical Financial Corp. | 134 | |||||||||

| 8 | City Holding Co. | 315 | |||||||||

| 11 | Colonial BancGroup, Inc. (The) | 281 | |||||||||

| 3 | Columbia Banking System, Inc. | 121 | |||||||||

| 4 | Community Bank System, Inc. | 90 | |||||||||

| 5 | Community Trust Bancorp, Inc. | 211 | |||||||||

| 8 | Cullen/Frost Bankers, Inc. | 435 | |||||||||

| 2 | Farmers Capital Bank Corp. | 51 | |||||||||

| 73 | First Bancorp | 693 | |||||||||

| 3 | First Community Bancshares, Inc. | 115 | |||||||||

| 2 | First Regional Bancorp (a) | 75 | |||||||||

| 7 | First Republic Bank | 268 | |||||||||

| 19 | FirstMerit Corp. | 447 | |||||||||

| 2 | FNB Corp. | 96 | |||||||||

| 3 | Great Southern Bancorp, Inc. | 86 | |||||||||

| 9 | Greater Bay Bancorp | 226 | |||||||||

| 2 | Greene County Bancshares, Inc. | 64 | |||||||||

| 28 | Hanmi Financial Corp. | 638 | |||||||||

| 2 | Heartland Financial USA, Inc. | 61 | |||||||||

| 1 | Heritage Commerce Corp. | 29 | |||||||||

| 2 | Horizon Financial Corp. | 54 | |||||||||

| 10 | IBERIABANK Corp. | 579 | |||||||||

| 8 | Independent Bank Corp. of Massachusetts | 281 | |||||||||

| 9 | Independent Bank Corp. of Michigan | 235 | |||||||||

| 4 | Integra Bank Corp. | 116 | |||||||||

| 3 | Intervest Bancshares Corp. (a) | 114 | |||||||||

| 20 | Investors Bancorp, Inc. (a) | 311 | |||||||||

| 10 | Irwin Financial Corp. | 219 | |||||||||

| 1 | Lakeland Financial Corp. | 36 | |||||||||

| 5 | MainSource Financial Group, Inc. | 80 | |||||||||

| 30 | MB Financial, Inc. | 1,122 | |||||||||

| 2 | MBT Financial Corp. | 34 | |||||||||

| 3 | Mercantile Bank Corp. | 123 | |||||||||

| 4 | Mid-State Bancshares | 149 | |||||||||

| 4 | Nara Bancorp, Inc. | 73 | |||||||||

| 5 | National Penn Bancshares, Inc. | 110 | |||||||||

| — | (h) | Old Second Bancorp, Inc. | 6 | ||||||||

| 27 | Oriental Financial Group | 345 | |||||||||

| 49 | Pacific Capital Bancorp | 1,645 | |||||||||

| 3 | Peoples Bancorp, Inc. | 96 | |||||||||

| 14 | PrivateBancorp, Inc. | 576 | |||||||||

| 4 | Prosperity Bancshares, Inc. | 121 | |||||||||

| 5 | Provident Bankshares Corp. | 171 | |||||||||

| 82 | R&G Financial Corp., Class B | 625 | |||||||||

| 3 | Renasant Corp. | 106 | |||||||||

| 26 | Republic Bancorp, Inc. | 352 | |||||||||

| 1 | Republic Bancorp, Inc., Class A | 21 | |||||||||

| — | (h) | Royal Bancshares of Pennsylvania | 3 | ||||||||

| 1 | Santander BanCorp | 18 | |||||||||

| — | (h) | SCBT Financial Corp. | 17 | ||||||||

| 3 | Security Bank Corp. | 73 | |||||||||

| — | (h) | Sierra Bancorp | 12 | ||||||||

| 3 | Simmons First National Corp., Class A | 91 | |||||||||

| 9 | Southwest Bancorp, Inc. | 256 | |||||||||

| 14 | Sterling Bancshares, Inc. | 182 | |||||||||

| 6 | Sterling Financial Corp. | 147 | |||||||||

| 89 | Sterling Financial Corp. | 3,021 | |||||||||

| 3 | Taylor Capital Group, Inc. | 110 | |||||||||

| 3 | TriCo Bancshares | 84 | |||||||||

| 16 | UCBH Holdings, Inc. | 279 | |||||||||

| 9 | Umpqua Holdings Corp. | 273 | |||||||||

| 10 | Union Bankshares Corp. | 317 | |||||||||

| 3 | United Bancshares, Inc. | 100 | |||||||||

| 15 | West Coast Bancorp | 530 | |||||||||

| 6 | Westamerica Bancorp | 314 | |||||||||

| 4 | Wintrust Financial Corp. | 211 | |||||||||

| 9 | Yardville National Bancorp | 347 | |||||||||

| 20,478 | |||||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Commercial Services & Supplies — 5.2% | |||||||||||

| 23 | Administaff, Inc. | 1,001 | |||||||||

| 122 | Allied Waste Industries, Inc. (a) | 1,502 | |||||||||

| 1 | Banta Corp. | 51 | |||||||||

| 3 | Consolidated Graphics, Inc. (a) | 177 | |||||||||

| — | (h) | CRA International, Inc. (a) | 21 | ||||||||

| 10 | Deluxe Corp. | 252 | |||||||||

| 2 | Ennis, Inc. | 59 | |||||||||

| 10 | GEO Group, Inc. (The) (a) | 356 | |||||||||

| 44 | Healthcare Services Group, Inc. | 1,262 | |||||||||

| 21 | HNI Corp. | 915 | |||||||||

| 210 | IKON Office Solutions, Inc. | 3,433 | |||||||||

| 5 | John H. Harland Co. | 231 | |||||||||

| 7 | Kforce, Inc. (a) | 82 | |||||||||

| 23 | McGrath Rentcorp | 715 | |||||||||

| 7 | On Assignment, Inc. (a) | 80 | |||||||||

| 41 | Pike Electric Corp. (a) | 674 | |||||||||

| 27 | School Specialty, Inc. (a) | 1,027 | |||||||||

| 11 | Sirva, Inc. (a) | 40 | |||||||||

| 16 | Spherion Corp. (a) | 116 | |||||||||

| 20 | Team, Inc. (a) | 679 | |||||||||

| 11 | TeleTech Holdings, Inc. (a) | 267 | |||||||||

| 1 | Tetra Tech, Inc. (a) | 18 | |||||||||

| 5 | United Stationers, Inc. (a) | 252 | |||||||||

| 6 | Viad Corp. | 227 | |||||||||

| — | (h) | Volt Information Sciences, Inc. (a) | 20 | ||||||||

| 80 | Waste Connections, Inc. (a) | 3,320 | |||||||||

| 2 | Waste Services, Inc. (Canada) (a) | 24 | |||||||||

| 15 | Watson Wyatt Worldwide, Inc., Class A | 673 | |||||||||

| 17,474 | |||||||||||

Communications Equipment — 1.4% | |||||||||||

| 33 | Arris Group, Inc. (a) | 418 | |||||||||

| 8 | Avocent Corp. (a) | 257 | |||||||||

| 3 | Bel Fuse, Inc., Class B | 108 | |||||||||

| 4 | Black Box Corp. | 147 | |||||||||

| 4 | C-COR, Inc. (a) | 39 | |||||||||

| 12 | Ciena Corp. (a) | 319 | |||||||||

| 26 | CommScope, Inc. (a) | 789 | |||||||||

| 5 | Digi International, Inc. (a) | 74 | |||||||||

| 4 | Ditech Networks, Inc. (a) | 28 | |||||||||

| 10 | Finisar Corp. (a) | 31 | |||||||||

| 6 | Foundry Networks, Inc. (a) | 96 | |||||||||

| 7 | Inter-Tel, Inc. | 153 | |||||||||

| 8 | MasTec, Inc. (a) | 88 | |||||||||

| 5 | MRV Communications, Inc. (a) | 18 | |||||||||

| 9 | Optical Communication Products, Inc. (a) | 15 | |||||||||

| 3 | Polycom, Inc. (a) | 102 | |||||||||

| 16 | Powerwave Technologies, Inc. (a) | 101 | |||||||||

| 2 | Redback Networks, Inc. (a) | 37 | |||||||||

| 3 | SafeNet, Inc. (a) | 78 | |||||||||

| 10 | Sycamore Networks, Inc. (a) | 36 | |||||||||

| 56 | Tekelec (a) | 824 | |||||||||

| 104 | UTStarcom, Inc. (a) | 906 | |||||||||

| 4,664 | |||||||||||

Computers & Peripherals — 0.6% | |||||||||||

| 15 | Adaptec, Inc. (a) | 70 | |||||||||

| 41 | Brocade Communications Systems, Inc. (a) | 340 | |||||||||

| 10 | Electronics for Imaging, Inc. (a) | 274 | |||||||||

| 3 | Emulex Corp. (a) | 62 | |||||||||

| 13 | Gateway, Inc. (a) | 26 | |||||||||

| 5 | Hutchinson Technology, Inc. (a) | 113 | |||||||||

| 5 | Hypercom Corp. (a) | 34 | |||||||||

| 9 | Imation Corp. | 437 | |||||||||

| 3 | Komag, Inc. (a) | 129 | |||||||||

| 33 | McData Corp., Class A (a) | 182 | |||||||||

| 15 | Palm, Inc. (a) | 207 | |||||||||

| 59 | Quantum Corp. (a) | 137 | |||||||||

| 2,011 | |||||||||||

Construction & Engineering — 0.6% | |||||||||||

| 2 | EMCOR Group, Inc. (a) | 131 | |||||||||

| 4 | Granite Construction, Inc. | 191 | |||||||||

| 34 | URS Corp. (a) | 1,457 | |||||||||

| 4 | Washington Group International, Inc. (a) | 233 | |||||||||

| 2,012 | |||||||||||

Construction Materials — 0.4% | |||||||||||

| 4 | Eagle Materials, Inc. | 169 | |||||||||

| 53 | Headwaters, Inc. (a) | 1,272 | |||||||||

| 1,441 | |||||||||||

Consumer Finance — 2.3% | |||||||||||

| 7 | Advanta Corp., Class B | 288 | |||||||||

| 15 | Cash America International, Inc. | 689 | |||||||||

| 92 | CompuCredit Corp. (a) | 3,651 | |||||||||

| 4 | Dollar Financial Corp. (a) | 124 | |||||||||

| 36 | First Cash Financial Services, Inc. (a) | 919 | |||||||||

| 8 | Student Loan Corp. | 1,596 | |||||||||

| 11 | World Acceptance Corp. (a) | 493 | |||||||||

| 7,760 | |||||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Containers & Packaging — 0.7% | |||||||||||

| 3 | Greif, Inc., Class A | 391 | |||||||||

| 12 | Myers Industries, Inc. | 194 | |||||||||

| 12 | Rock-Tenn Co., Class A | 322 | |||||||||

| 32 | Silgan Holdings, Inc. | 1,410 | |||||||||

| 2,317 | |||||||||||

Distributors — 0.1% | |||||||||||

| 7 | Building Material Holding Corp. | 180 | |||||||||

| 3 | Keystone Automotive Industries, Inc. (a) | 85 | |||||||||

| 265 | |||||||||||

Diversified Consumer Services — 0.5% | |||||||||||

| 21 | Regis Corp. | 845 | |||||||||

| 29 | Stewart Enterprises, Inc., Class A | 178 | |||||||||

| 14 | Universal Technical Institute, Inc. (a) | 321 | |||||||||

| 5 | Vertrue, Inc. (a) | 207 | |||||||||

| 1,551 | |||||||||||

Diversified Financial Services — 0.6% | |||||||||||

| 53 | Asset Acceptance Capital Corp. (a) | 885 | |||||||||

| 31 | Financial Federal Corp. | 909 | |||||||||

| 3 | Marlin Business Services Corp. (a) | 82 | |||||||||

| 5 | Medallion Financial Corp. | 61 | |||||||||

| 1,937 | |||||||||||

Diversified Telecommunication Services — 0.8% | |||||||||||

| 10 | Broadwing Corp. (a) | 150 | |||||||||

| 220 | Cincinnati Bell, Inc. (a) | 1,007 | |||||||||

| 2 | Commonwealth Telephone Enterprises, Inc. | 96 | |||||||||

| 13 | CT Communications, Inc. | 296 | |||||||||

| 7 | General Communication, Inc., Class A (a) | 107 | |||||||||

| 3 | North Pittsburgh Systems, Inc. | 70 | |||||||||

| 37 | Premiere Global Services, Inc. (a) | 347 | |||||||||

| 2 | SureWest Communications | 63 | |||||||||

| 2 | Time Warner Telecom, Inc., Class A (a) | 46 | |||||||||

| 38 | Windstream Corp. | 545 | |||||||||

| 2,727 | |||||||||||

Electric Utilities — 0.9% | |||||||||||

| 9 | Cleco Corp. | 235 | |||||||||

| 15 | El Paso Electric Co. (a) | 365 | |||||||||

| 8 | Idacorp, Inc. | 298 | |||||||||

| 2 | UIL Holdings Corp. | 96 | |||||||||

| 18 | UniSource Energy Corp. | 661 | |||||||||

| 48 | Westar Energy, Inc. | 1,234 | |||||||||

| 2,889 | |||||||||||

Electrical Equipment — 0.9% | |||||||||||

| 19 | A.O. Smith Corp. | 729 | |||||||||

| 7 | Acuity Brands, Inc. | 344 | |||||||||

| 3 | Belden CDT, Inc. | 129 | |||||||||

| 3 | Encore Wire Corp. | 57 | |||||||||

| 28 | General Cable Corp. (a) | 1,216 | |||||||||

| 2 | Genlyte Group, Inc. (a) | 172 | |||||||||

| 7 | Regal-Beloit Corp. | 383 | |||||||||

| 3,030 | |||||||||||

Electronic Equipment & Instruments — 2.4% | |||||||||||

| 10 | Aeroflex, Inc. (a) | 115 | |||||||||

| 11 | Agilysis, Inc. | 179 | |||||||||

| 4 | Anixter International, Inc. (a) | 212 | |||||||||

| 62 | Benchmark Electronics, Inc. (a) | 1,522 | |||||||||

| 30 | Brightpoint, Inc. (a) | 406 | |||||||||

| 69 | Checkpoint Systems, Inc. (a) | 1,388 | |||||||||

| 3 | Coherent, Inc. (a) | 82 | |||||||||

| 10 | CTS Corp. | 151 | |||||||||

| 1 | Electro Scientific Industries, Inc. (a) | 26 | |||||||||

| 71 | FLIR Systems, Inc. (a) | 2,273 | |||||||||

| — | (h) | Global Imaging Systems, Inc. (a) | 4 | ||||||||

| 3 | Insight Enterprises, Inc. (a) | 53 | |||||||||

| 5 | Itron, Inc. (a) | 261 | |||||||||

| 5 | KEMET Corp. (a) | 35 | |||||||||

| 9 | Newport Corp. (a) | 182 | |||||||||

| 3 | Park Electrochemical Corp. | 69 | |||||||||

| 2 | Paxar Corp. (a) | 44 | |||||||||

| 3 | Plexus Corp. (a) | 60 | |||||||||

| 3 | Radisys Corp. (a) | 52 | |||||||||

| 279 | Sanmina-SCI Corp. (a) | 963 | |||||||||

| 1 | SYNNEX Corp. (a) | 31 | |||||||||

| 3 | Technitrol, Inc. | 64 | |||||||||

| 6 | TTM Technologies, Inc. (a) | 69 | |||||||||

| 8,241 | |||||||||||

Energy Equipment & Services — 2.0% | |||||||||||

| 3 | Bristow Group, Inc. (a) | 105 | |||||||||

| 3 | Hanover Compressor Co. (a) | 64 | |||||||||

| 14 | Hornbeck Offshore Services, Inc. (a) | 514 | |||||||||

| 3 | Lone Star Technologies, Inc. (a) | 145 | |||||||||

| 57 | Oceaneering International, Inc. (a) | 2,245 | |||||||||

| 28 | Oil States International, Inc. (a) | 912 | |||||||||

| 5 | RPC, Inc. | 77 | |||||||||

| 13 | Trico Marine Services, Inc. (a) | 502 | |||||||||

| 5 | Union Drilling, Inc. (a) | 75 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Energy Equipment & Services — Continued | |||||||||||

| 28 | Universal Compression Holdings, Inc. (a) | 1,732 | |||||||||

| 5 | Veritas DGC, Inc. (a) | 385 | |||||||||

| 6,756 | |||||||||||

Food & Staples Retailing — 1.1% | |||||||||||

| 3 | Casey’s General Stores, Inc. | 78 | |||||||||

| 9 | Great Atlantic & Pacific Tea Co., Inc. | 229 | |||||||||

| 1 | Nash Finch Co. | 38 | |||||||||

| 44 | Pantry, Inc. (The) (a) | 2,056 | |||||||||

| 21 | Pathmark Stores, Inc. (a) | 239 | |||||||||

| 29 | Ruddick Corp. | 799 | |||||||||

| 7 | Smart & Final, Inc. (a) | 125 | |||||||||

| 14 | Spartan Stores, Inc. | 295 | |||||||||

| 3,859 | |||||||||||

Food Products — 0.9% | |||||||||||

| 14 | Chiquita Brands International, Inc. | 222 | |||||||||

| 12 | Corn Products International, Inc. | 431 | |||||||||

| 3 | Delta & Pine Land Co. | 125 | |||||||||

| 4 | Flowers Foods, Inc. | 111 | |||||||||

| 3 | J & J Snack Foods Corp. | 120 | |||||||||

| 2 | Premium Standard Farms, Inc. | 30 | |||||||||

| 3 | Ralcorp Holdings, Inc. (a) | 148 | |||||||||

| 4 | Reddy Ice Holdings, Inc. | 101 | |||||||||

| 53 | Sanderson Farms, Inc. | 1,593 | |||||||||

| 2,881 | |||||||||||

Gas Utilities — 1.4% | |||||||||||

| 10 | Laclede Group, Inc. (The) | 333 | |||||||||

| 10 | New Jersey Resources Corp. | 491 | |||||||||

| 7 | Nicor, Inc. | 337 | |||||||||

| 19 | Northwest Natural Gas Co. | 807 | |||||||||

| 35 | ONEOK, Inc. | 1,518 | |||||||||

| 15 | South Jersey Industries, Inc. | 491 | |||||||||

| 16 | Southwest Gas Corp. | 598 | |||||||||

| 4,575 | |||||||||||

Health Care Equipment & Supplies — 0.9% | |||||||||||

| 2 | Biosite, Inc. (a) | 93 | |||||||||

| 2 | CONMED Corp. (a) | 53 | |||||||||

| 33 | Cooper Cos., Inc. (The) | 1,486 | |||||||||

| 2 | Greatbatch, Inc. (a) | 48 | |||||||||

| 5 | HealthTronics, Inc. (a) | 33 | |||||||||

| 1 | ICU Medical, Inc. (a) | 53 | |||||||||

| 13 | Invacare Corp. | 307 | |||||||||

| 4 | LifeCell Corp. (a) | 99 | |||||||||

| 24 | Medical Action Industries, Inc. (a) | 784 | |||||||||

| 3 | STERIS Corp. | 83 | |||||||||

| — | (h) | SurModics, Inc. (a) | 6 | ||||||||

| 2 | Viasys Healthcare, Inc. (a) | 64 | |||||||||

| 3,109 | |||||||||||

Health Care Providers & Services — 3.8% | |||||||||||

| 14 | Alliance Imaging, Inc. (a) | 94 | |||||||||

| 13 | Amedisys, Inc. (a) | 422 | |||||||||

| 63 | AMERIGROUP Corp. (a) | 2,261 | |||||||||

| 8 | AMN Healthcare Services, Inc. (a) (m) | 226 | |||||||||

| 2 | Apria Healthcare Group, Inc. (a) | 61 | |||||||||

| 46 | Centene Corp. (a) | 1,123 | |||||||||

| — | (h) | Genesis HealthCare Corp. (a) | 14 | ||||||||

| 20 | Gentiva Health Services, Inc. (a) | 385 | |||||||||

| 2 | HealthSpring, Inc. (a) | 47 | |||||||||

| 36 | Healthways, Inc. (a) | 1,722 | |||||||||

| 6 | Kindred Healthcare, Inc. (a) | 144 | |||||||||

| 25 | LHC Group, Inc. (a) | 723 | |||||||||

| 53 | Magellan Health Services, Inc. (a) | 2,291 | |||||||||

| 2 | Molina Healthcare, Inc. (a) | 65 | |||||||||

| 28 | Pediatrix Medical Group, Inc. (a) | 1,391 | |||||||||

| 8 | PSS World Medical, Inc. (a) | 156 | |||||||||

| 9 | Psychiatric Solutions, Inc. (a) | 334 | |||||||||

| 2 | Res-Care, Inc. (a) | 38 | |||||||||

| 44 | Sunrise Senior Living, Inc. (a) | 1,352 | |||||||||

| 12,849 | |||||||||||

Health Care Technology — 0.1% | |||||||||||

| 1 | Computer Programs & Systems, Inc. | 31 | |||||||||

| 10 | Per-Se Technologies, Inc. (a) | 283 | |||||||||

| 314 | |||||||||||

Hotels, Restaurants & Leisure — 2.7% | |||||||||||

| 1 | Ameristar Casinos, Inc. | 40 | |||||||||

| 3 | Aztar Corp. (a) | 163 | |||||||||

| — | (h) | Bob Evans Farms, Inc. | 3 | ||||||||

| 47 | Brinker International, Inc. | 1,419 | |||||||||

| 14 | Domino’s Pizza, Inc. | 386 | |||||||||

| 9 | Jack in the Box, Inc. (a) | 531 | |||||||||

| 4 | Papa John’s International, Inc. (a) | 125 | |||||||||

| 43 | Pinnacle Entertainment, Inc. (a) | 1,408 | |||||||||

| 31 | Six Flags, Inc. (a) | 162 | |||||||||

| 99 | Sonic Corp. (a) | 2,383 | |||||||||

| 75 | Triarc Cos., Inc., Class B | 1,505 | |||||||||

| 20 | Vail Resorts, Inc. (a) | 910 | |||||||||

| 9,035 | |||||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Household Durables — 3.0% | |||||||||||

| 6 | Ethan Allen Interiors, Inc. | 202 | |||||||||

| 5 | Furniture Brands International, Inc. | 75 | |||||||||

| 23 | Harman International Industries, Inc. | 2,258 | |||||||||

| 41 | Hovnanian Enterprises, Inc., Class A (a) | 1,397 | |||||||||

| 7 | Kimball International, Inc., Class B | 165 | |||||||||

| 12 | M/I Homes, Inc. | 447 | |||||||||

| 32 | Meritage Homes Corp. (a) | 1,508 | |||||||||

| 7 | Sealy Corp. | 97 | |||||||||

| 32 | Snap-On, Inc. | 1,520 | |||||||||

| 61 | Standard-Pacific Corp. | 1,631 | |||||||||

| 33 | Tupperware Brands Corp. | 744 | |||||||||

| 3 | WCI Communities, Inc. (a) | 65 | |||||||||

| 2 | Yankee Candle Co., Inc. | 72 | |||||||||

| 10,181 | |||||||||||

Household Products — 0.0% (g) | |||||||||||

| 3 | Spectrum Brands, Inc. (a) | 35 | |||||||||

Independent Power Producers & Energy Traders — 0.1% | |||||||||||

| 5 | Black Hills Corp. | 177 | |||||||||

Industrial Conglomerates — 0.3% | |||||||||||

| 17 | Teleflex, Inc. | 1,072 | |||||||||

Insurance — 6.8% | |||||||||||

| 220 | American Equity Investment Life Holding Co. | 2,870 | |||||||||

| 3 | American Physicians Capital, Inc. (a) | 138 | |||||||||

| 8 | Argonaut Group, Inc. (a) | 279 | |||||||||

| 3 | Clark, Inc. | 45 | |||||||||

| 54 | Delphi Financial Group, Inc. | 2,168 | |||||||||

| 3 | Direct General Corp. | 66 | |||||||||

| 3 | Harleysville Group, Inc. | 115 | |||||||||

| 34 | HCC Insurance Holdings, Inc. | 1,103 | |||||||||

| 7 | Hilb, Rogal & Hobbs Co. | 305 | |||||||||

| 4 | Infinity Property & Casualty Corp. | 194 | |||||||||

| 31 | LandAmerica Financial Group, Inc. | 1,975 | |||||||||

| 4 | Navigators Group, Inc. (a) | 169 | |||||||||

| 3 | Odyssey Re Holdings Corp. | 127 | |||||||||

| 100 | Ohio Casualty Corp. | 2,993 | |||||||||

| 60 | Philadelphia Consolidated Holding Co. (a) | 2,656 | |||||||||

| 3 | Phoenix Cos., Inc. (The) | 54 | |||||||||

| 33 | PMA Capital Corp., Class A (a) | 301 | |||||||||

| — | (h) | ProAssurance Corp. (a) | 20 | ||||||||

| 23 | Protective Life Corp. | 1,111 | |||||||||

| 1 | RLI Corp. | 79 | |||||||||

| 8 | Safety Insurance Group, Inc. | 406 | |||||||||

| 6 | Selective Insurance Group | 326 | |||||||||

| 45 | State Auto Financial Corp. | 1,559 | |||||||||

| 32 | Stewart Information Services Corp. | 1,387 | |||||||||

| 56 | United Fire & Casualty Co. | 1,975 | |||||||||

| 13 | Zenith National Insurance Corp. | 624 | |||||||||

| 23,045 | |||||||||||

Internet & Catalog Retail — 0.1% | |||||||||||

| 10 | FTD Group, Inc. (a) | 184 | |||||||||

| 7 | Systemax, Inc. (a) | 126 | |||||||||

| 310 | |||||||||||

Internet Software & Services — 0.6% | |||||||||||

| 62 | Ariba, Inc. (a) | 482 | |||||||||

| 10 | Interwoven, Inc. (a) | 144 | |||||||||

| 4 | iPass, Inc. (a) | 25 | |||||||||

| 16 | SAVVIS, Inc. (a) | 557 | |||||||||

| 8 | SonicWALL, Inc. (a) | 69 | |||||||||

| 23 | United Online, Inc. | 299 | |||||||||

| 27 | Vignette Corp. (a) | 453 | |||||||||

| 10 | webMethods, Inc. (a) | 73 | |||||||||

| 2,102 | |||||||||||

IT Services — 2.3% | |||||||||||

| 38 | BearingPoint, Inc. (a) | 300 | |||||||||

| 8 | CACI International, Inc., Class A (a) | 435 | |||||||||

| 12 | CIBER, Inc. (a) | 80 | |||||||||

| 7 | Covansys Corp. (a) | 158 | |||||||||

| 69 | CSG Systems International, Inc. (a) | 1,836 | |||||||||

| 10 | Gartner, Inc. (a) | 188 | |||||||||

| 44 | Global Payments, Inc. | 2,046 | |||||||||

| 1 | infoUSA, Inc. | 11 | |||||||||

| 4 | Lightbridge, Inc. (a) | 56 | |||||||||

| 3 | Mantech International Corp., Class A (a) | 111 | |||||||||

| 1 | MAXIMUS, Inc. | 43 | |||||||||

| 46 | MoneyGram International, Inc. | 1,439 | |||||||||

| 12 | Perot Systems Corp., Class A (a) | 200 | |||||||||

| 2 | SI International, Inc. (a) | 71 | |||||||||

| 2 | StarTek, Inc. | 28 | |||||||||

| 6 | SYKES Enterprises, Inc. (a) | 101 | |||||||||

| 3 | TALX Corp. | 77 | |||||||||

| 31 | Tyler Technologies, Inc. (a) | 439 | |||||||||

| 7,619 | |||||||||||

Leisure Equipment & Products — 0.3% | |||||||||||

| 11 | Brunswick Corp. | 355 | |||||||||

| 10 | JAKKS Pacific, Inc. (a) | 223 | |||||||||

| 14 | K2, Inc. (a) | 178 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Leisure Equipment & Products — Continued | |||||||||||

| 4 | RC2 Corp. (a) | 189 | |||||||||

| 3 | Steinway Musical Instruments, Inc. (a) | 106 | |||||||||

| 1,051 | |||||||||||

Life Sciences Tools & Services — 1.7% | |||||||||||

| 3 | Bio-Rad Laboratories, Inc., Class A (a) | 281 | |||||||||

| 41 | Covance, Inc. (a) | 2,409 | |||||||||

| 2 | Medivation, Inc. (a) | 35 | |||||||||

| 1 | Molecular Devices Corp. (a) | 23 | |||||||||

| 4 | Nektar Therapeutics (a) | 61 | |||||||||

| 88 | Pharmaceutical Product Development, Inc. | 2,822 | |||||||||

| 5,631 | |||||||||||

Machinery — 3.2% | |||||||||||

| 17 | Actuant Corp., Class A | 793 | |||||||||

| 2 | Astec Industries, Inc. (a) | 77 | |||||||||

| 18 | Barnes Group, Inc. | 387 | |||||||||

| 15 | Briggs & Stratton Corp. | 394 | |||||||||

| 38 | Bucyrus International, Inc. | 1,970 | |||||||||

| 3 | Cascade Corp. | 175 | |||||||||

| 3 | CIRCOR International, Inc. | 125 | |||||||||

| 4 | EnPro Industries, Inc. (a) | 136 | |||||||||

| 2 | Gehl Co. (a) | 50 | |||||||||

| 2 | Greenbrier Cos., Inc. | 60 | |||||||||

| 22 | Harsco Corp. | 1,690 | |||||||||

| 17 | IDEX Corp. | 813 | |||||||||

| — | (h) | Kadant, Inc. (a) | 7 | ||||||||

| 4 | Mueller Industries, Inc. | 127 | |||||||||

| 2 | NACCO Industries, Inc., Class A | 232 | |||||||||

| 22 | Nordson Corp. | 1,111 | |||||||||

| 3 | Tecumseh Products Co., Class A (a) | 46 | |||||||||

| 3 | Tennant Co. | 96 | |||||||||

| 51 | Timken Co. | 1,479 | |||||||||

| 8 | Valmont Industries, Inc. | 438 | |||||||||

| 11 | Wabtec Corp. | 334 | |||||||||

| 4 | Watts Water Technologies, Inc., Class A | 177 | |||||||||

| 10,717 | |||||||||||

Media — 0.8% | |||||||||||

| 2 | Arbitron, Inc. | 65 | |||||||||

| — | (h) | Carmike Cinemas, Inc. | 4 | ||||||||

| 89 | Charter Communications, Inc., Class A (a) | 271 | |||||||||

| 14 | Cox Radio, Inc., Class A (a) | 227 | |||||||||

| 10 | Entercom Communications Corp., Class A | 268 | |||||||||

| 7 | Journal Register Co. | 52 | |||||||||

| 22 | Lee Enterprises, Inc. | 683 | |||||||||

| 1 | Lin TV Corp., Class A (a) | 7 | |||||||||

| 12 | LodgeNet Entertainment Corp. (a) | 293 | |||||||||

| 2 | Media General, Inc., Class A | 85 | |||||||||

| 4 | ProQuest Co. (a) | 37 | |||||||||

| 31 | Radio One, Inc., Class D (a) | 209 | |||||||||

| 7 | Scholastic Corp. (a) | 254 | |||||||||

| 2 | Sinclair Broadcast Group, Inc., Class A | 20 | |||||||||

| 3 | Valassis Communications, Inc. (a) | 44 | |||||||||

| 11 | Westwood One, Inc. | 78 | |||||||||

| 2,597 | |||||||||||

Metals & Mining — 1.7% | |||||||||||

| 17 | Century Aluminum Co. (a) | 772 | |||||||||

| 8 | Chaparral Steel Co. | 350 | |||||||||

| 55 | Cleveland-Cliffs, Inc. | 2,644 | |||||||||

| 12 | Commercial Metals Co. | 304 | |||||||||

| 6 | Compass Minerals International, Inc. | 196 | |||||||||

| 13 | Gibraltar Industries, Inc. | 313 | |||||||||

| 7 | NN, Inc. | 92 | |||||||||

| 3 | Oregon Steel Mills, Inc. (a) | 168 | |||||||||

| 20 | Quanex Corp. | 687 | |||||||||

| 2 | Ryerson, Inc. | 58 | |||||||||

| 3 | Schnitzer Steel Industries, Inc. | 115 | |||||||||

| 5 | Steel Dynamics, Inc. | 165 | |||||||||

| 5,864 | |||||||||||

Multi-Utilities — 0.7% | |||||||||||

| 23 | Avista Corp. | 592 | |||||||||

| 3 | CH Energy Group, Inc. | 174 | |||||||||

| 39 | PNM Resources, Inc. | 1,199 | |||||||||

| 20 | Vectren Corp. | 562 | |||||||||

| 2,527 | |||||||||||

Multiline Retail — 0.2% | |||||||||||

| 16 | Big Lots, Inc. (a) | 360 | |||||||||

| 4 | Bon-Ton Stores, Inc. (The) | 125 | |||||||||

| 7 | Retail Ventures, Inc. (a) | 131 | |||||||||

| 616 | |||||||||||

Oil, Gas & Consumable Fuels — 3.7% | |||||||||||

| 3 | Alon USA Energy, Inc. | 66 | |||||||||

| 31 | Arena Resources, Inc. (a) | 1,344 | |||||||||

| 39 | Arlington Tankers Ltd. (Bermuda) | 916 | |||||||||

| 4 | Bois d’Arc Energy, Inc. (a) | 60 | |||||||||

| 61 | Cabot Oil & Gas Corp. | 3,697 | |||||||||

| 3 | Callon Petroleum Co. (a) | 39 | |||||||||

| 5 | Comstock Resources, Inc. (a) | 155 | |||||||||

| 6 | Energy Partners Ltd. (a) | 144 | |||||||||

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Oil, Gas & Consumable Fuels — Continued | |||||||||||

| 2 | Giant Industries, Inc. (a) | 165 | |||||||||

| 53 | �� | Gulfport Energy Corp. (a) | 716 | ||||||||

| 47 | Harvest Natural Resources, Inc. (a) | 502 | |||||||||

| 1 | Helix Energy Solutions Group, Inc. (a) | 24 | |||||||||

| 31 | Houston Exploration Co. (a) | 1,590 | |||||||||

| 7 | PetroHawk Energy Corp. (a) | 77 | |||||||||

| 47 | Rosetta Resources, Inc. (a) | 870 | |||||||||

| 7 | Stone Energy Corp. (a) | 237 | |||||||||

| 38 | Swift Energy Co. (a) | 1,680 | |||||||||

| 16 | USEC, Inc. (a) | 204 | |||||||||

| 4 | Western Refining, Inc. | 104 | |||||||||

| 12,590 | |||||||||||

Paper & Forest Products — 0.1% | |||||||||||

| 10 | Buckeye Technologies, Inc. (a) | 115 | |||||||||

| 5 | Glatfelter | 76 | |||||||||

| 8 | Schweitzer-Mauduit International, Inc. | 201 | |||||||||

| 392 | |||||||||||

Personal Products — 0.2% | |||||||||||

| 5 | Elizabeth Arden, Inc. (a) | 95 | |||||||||

| 12 | NBTY, Inc. (a) | 495 | |||||||||

| 11 | Prestige Brands Holdings, Inc. (a) | 143 | |||||||||

| 733 | |||||||||||

Pharmaceuticals — 1.1% | |||||||||||

| 3 | Adams Respiratory Therapeutics, Inc. (a) | 106 | |||||||||

| 4 | Adolor Corp. (a) | 28 | |||||||||

| 19 | Alpharma, Inc., Class A | 451 | |||||||||

| 3 | AtheroGenics, Inc. (a) | 27 | |||||||||

| 12 | AVANIR Pharmaceuticals, Class A (a) | 27 | |||||||||

| 20 | Barr Pharmaceuticals, Inc. (a) | 1,010 | |||||||||

| 12 | Cypress Bioscience, Inc. (a) | 91 | |||||||||

| 91 | Perrigo Co. | 1,578 | |||||||||

| 20 | Sciele Pharma, Inc. (a) | 475 | |||||||||

| 3 | Valeant Pharmaceuticals International | 48 | |||||||||

| 3,841 | |||||||||||

Real Estate Investment Trusts (REITs) — 7.0% | |||||||||||

| 41 | Alesco Financial, Inc. | 438 | |||||||||

| 96 | American Home Mortgage Investment Corp. | 3,358 | |||||||||

| 33 | Anthracite Capital, Inc. | 421 | |||||||||

| 157 | Anworth Mortgage Asset Corp. | 1,493 | |||||||||

| 43 | Ashford Hospitality Trust, Inc. | 541 | |||||||||

| 10 | BioMed Realty Trust, Inc. | 272 | |||||||||

| 3 | Capital Trust, Inc., Class A (m) | 150 | |||||||||

| 2 | Columbia Equity Trust, Inc. | 46 | |||||||||

| 13 | Equity Inns, Inc. | 204 | |||||||||

| 5 | Equity Lifestyle Properties, Inc. | 272 | |||||||||

| 3 | Extra Space Storage, Inc. | 53 | |||||||||

| 46 | FelCor Lodging Trust, Inc. | 1,011 | |||||||||

| 9 | First Potomac Realty Trust (m) | 274 | |||||||||

| 89 | Friedman Billings Ramsey Group, Inc., Class A | 714 | |||||||||

| 10 | Government Properties Trust, Inc. | 102 | |||||||||

| 10 | Hersha Hospitality Trust | 111 | |||||||||

| 23 | Highland Hospitality Corp. | 323 | |||||||||

| 84 | Impac Mortgage Holdings, Inc. | 738 | |||||||||

| 27 | Innkeepers USA Trust | 419 | |||||||||

| 18 | JER Investors Trust, Inc. | 371 | |||||||||

| 7 | Kilroy Realty Corp. | 507 | |||||||||

| 7 | LaSalle Hotel Properties | 307 | |||||||||

| 34 | Lexington Realty Trust | 758 | |||||||||

| 7 | LTC Properties, Inc. | 191 | |||||||||

| 4 | Maguire Properties, Inc. | 164 | |||||||||

| 159 | MFA Mortgage Investments, Inc. | 1,221 | |||||||||

| 6 | National Health Investors, Inc. | 191 | |||||||||

| 2 | Omega Healthcare Investors, Inc. | 39 | |||||||||

| 4 | Parkway Properties, Inc. | 189 | |||||||||

| 16 | Pennsylvania Real Estate Investment Trust | 626 | |||||||||

| 20 | Post Properties, Inc. | 905 | |||||||||

| 15 | RAIT Financial Trust | 521 | |||||||||

| 44 | Redwood Trust, Inc. | 2,581 | |||||||||

| 8 | Saul Centers, Inc. | 430 | |||||||||

| 16 | Senior Housing Properties Trust | 399 | |||||||||

| 17 | SL Green Realty Corp. | 2,271 | |||||||||

| 37 | Spirit Finance Corp. | 461 | |||||||||

| 16 | Sunstone Hotel Investors, Inc. | 420 | |||||||||

| 8 | Winston Hotels, Inc. | 105 | |||||||||

| 23,597 | |||||||||||

Real Estate Management & Development — 0.0% (g) | |||||||||||

| 5 | Housevalues, Inc. (a) | 30 | |||||||||

Road & Rail — 1.1% | |||||||||||

| 10 | AMERCO, Inc. (a) | 839 | |||||||||

| 1 | Arkansas Best Corp. | 50 | |||||||||

| 17 | Dollar Thrifty Automotive Group, Inc. (a) | 775 | |||||||||

| 32 | Genesee & Wyoming, Inc., Class A (a) | 841 | |||||||||

| 24 | Landstar System, Inc. | 930 | |||||||||

| — | (h) | Marten Transport Ltd. (a) | 2 | ||||||||

| 12 | RailAmerica, Inc. (a) | 196 | |||||||||

| 2 | Saia, Inc. (a) | 51 | |||||||||

AS OF DECEMBER 31, 2006 (Unaudited) (continued)

| SHARES | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Road & Rail — Continued | |||||||||||

| 2 | U.S. Xpress Enterprises, Inc., Class A (a) | 28 | |||||||||

| 2 | Werner Enterprises, Inc. | 38 | |||||||||

| 3,750 | |||||||||||

Semiconductors & Semiconductor Equipment — 1.3% | |||||||||||

| 4 | Actel Corp. (a) | 64 | |||||||||

| 4 | Advanced Energy Industries, Inc. (a) | 76 | |||||||||

| 4 | AMIS Holdings, Inc. (a) | 39 | |||||||||

| 14 | Amkor Technology, Inc. (a) | 129 | |||||||||

| 28 | Applied Micro Circuits Corp. (a) | 99 | |||||||||

| 15 | Asyst Technologies, Inc. (a) | 110 | |||||||||

| 30 | ATMI, Inc. (a) | 907 | |||||||||

| 13 | Axcelis Technologies, Inc. (a) | 75 | |||||||||

| 13 | Brooks Automation, Inc. (a) | 186 | |||||||||

| 10 | Cirrus Logic, Inc. (a) | 67 | |||||||||

| 4 | Cohu, Inc. | 81 | |||||||||

| 84 | Conexant Systems, Inc. (a) | 170 | |||||||||

| 64 | Credence Systems Corp. (a) | 332 | |||||||||

| 4 | DSP Group, Inc. (a) | 80 | |||||||||

| 15 | Entegris, Inc. (a) | 167 | |||||||||

| 35 | Exar Corp. (a) | 451 | |||||||||

| 3 | Genesis Microchip, Inc. (a) | 25 | |||||||||

| 2 | Kopin Corp. (a) | 6 | |||||||||

| 7 | Kulicke & Soffa Industries, Inc. (a) | 61 | |||||||||

| 11 | Lattice Semiconductor Corp. (a) | 68 | |||||||||

| 18 | LTX Corp. (a) | 103 | |||||||||

| 3 | Mattson Technology, Inc. (a) | 31 | |||||||||

| 17 | Microsemi Corp. (a) | 337 | |||||||||

| 7 | MKS Instruments, Inc. (a) | 160 | |||||||||

| 11 | ON Semiconductor Corp. (a) | 80 | |||||||||

| 3 | Pericom Semiconductor Corp. (a) | 29 | |||||||||

| 5 | Photronics, Inc. (a) | 80 | |||||||||

| 27 | RF Micro Devices, Inc. (a) | 181 | |||||||||

| 5 | Silicon Storage Technology, Inc. (a) | 23 | |||||||||

| 9 | Skyworks Solutions, Inc. (a) | 62 | |||||||||

| 4 | Standard Microsystems Corp. (a) | 106 | |||||||||

| 4 | Zoran Corp. (a) | 60 | |||||||||

| 4,445 | |||||||||||

Software — 0.9% | |||||||||||

| 4 | Altiris, Inc. (a) | 94 | |||||||||

| 8 | Aspen Technology, Inc. (a) | 87 | |||||||||

| 14 | Blackbaud, Inc. | 376 | |||||||||

| 4 | JDA Software Group, Inc. (a) | 54 | |||||||||

| 12 | Lawson Software, Inc. (a) | 86 | |||||||||

| 3 | Macrovision Corp. (a) | 82 | |||||||||

| 6 | Magma Design Automation, Inc. (a) | 55 | |||||||||

| 15 | Mentor Graphics Corp. (a) | 265 | |||||||||

| 20 | MICROS Systems, Inc. (a) | 1,028 | |||||||||

| 10 | Parametric Technology Corp. (a) | 184 | |||||||||

| 4 | Progress Software Corp. (a) | 114 | |||||||||

| 2 | QAD, Inc. | 18 | |||||||||

| 4 | Quest Software, Inc. (a) | 62 | |||||||||

| 1 | SPSS, Inc. (a) | 39 | |||||||||

| 21 | Sybase, Inc. (a) | 509 | |||||||||

| 7 | TIBCO Software, Inc. (a) | 61 | |||||||||

| 3,114 | |||||||||||

Specialty Retail — 3.1% | |||||||||||

| 86 | Aaron Rents, Inc. (m) | 2,488 | |||||||||

| 17 | Asbury Automotive Group, Inc. | 403 | |||||||||

| 11 | Blockbuster, Inc., Class A (a) | 58 | |||||||||

| 3 | Build-A-Bear Workshop, Inc. (a) | 70 | |||||||||

| 41 | Charming Shoppes, Inc. (a) | 552 | |||||||||

| 7 | Christopher & Banks Corp. | 123 | |||||||||

| 9 | CSK Auto Corp. (a) | 146 | |||||||||

| 4 | Dress Barn, Inc. (a) | 84 | |||||||||

| 3 | Genesco, Inc. (a) | 127 | |||||||||

| 6 | Group 1 Automotive, Inc. | 305 | |||||||||

| 24 | Guitar Center, Inc. (a) | 1,081 | |||||||||

| 6 | Lithia Motors, Inc., Class A | 184 | |||||||||

| 18 | Men’s Wearhouse, Inc. | 698 | |||||||||

| 22 | Monro Muffler, Inc. | 761 | |||||||||

| 7 | Payless ShoeSource, Inc. (a) | 226 | |||||||||

| 9 | Rent-A-Center, Inc. (a) | 271 | |||||||||

| 2 | Shoe Carnival, Inc. (a) | 73 | |||||||||

| 3 | Sonic Automotive, Inc., Class A | 99 | |||||||||

| 21 | Stage Stores, Inc. | 625 | |||||||||

| 52 | Stein Mart, Inc. | 692 | |||||||||

| 4 | Talbots, Inc. | 96 | |||||||||

| 7 | Tween Brands, Inc. (a) | 260 | |||||||||