- DYAI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Dyadic International (DYAI) DEF 14ADefinitive proxy

Filed: 26 Apr 22, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 14a-12

DYADIC INTERNATIONAL, INC.

DYADIC INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit as required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

| DYADIC INTERNATIONAL, INC. |

Dear Shareholder:

You are cordially invited to attend the 2022 Virtual Annual Meeting of Shareholders (“Annual Meeting”) of Dyadic International, Inc. (“Dyadic”), which will be held on Friday, June 10, 2022, at 10 a.m. Eastern Daylight Savings Time. With continued concerns around the spread of COVID-19 in the United States and globally, in order to mitigate health risks, this year’s meeting will be conducted in virtual format only. Shareholders can access the Annual Meeting by visiting www.virtualshareholdermeeting.com/DYAI2022. You will not be able to attend the Annual Meeting in person. We believe that a virtual meeting will provide meaningful shareholder access and participation and protect the health and safety of our shareholders, employees, and other stakeholders, and improve meeting efficiency and reduce costs.

At the Annual Meeting, you will be asked to consider and vote on the proposals described in the Notice of 2022 Virtual Annual Meeting of Shareholders and Proxy Statement which accompany this letter. We urge you to read these materials carefully. During the live virtual meeting, you will be able to submit questions real-time through the meeting portal.

We hope that you will be able to attend the virtual Annual Meeting, but in all events, we ask that you please vote your shares using the internet or, if you received paper copies of the proxy materials, by calling the toll-free telephone number specified in the proxy card or completing and mailing the proxy card in the postage-paid envelope provided to ensure that your shares will be represented at the Annual Meeting. Instructions on using each of these voting methods are outlined in the proxy statement. If you hold shares through a broker or other nominee, you should follow the procedures provided by your broker or nominee.

On behalf of the board of directors, I would like to express our appreciation for your continued support and interest in Dyadic. We look forward to your virtual participation at the Annual Meeting.

Sincerely, | |||||

/s/ Mark Emalfarb | |||||

Mark Emalfarb |

Jupiter, Florida

NOTICE OF 2022 VIRTUAL ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON Friday, June 10, 2022

VIRTUAL MEETING ONLY - NO PHYSICAL MEETING LOCATION

To the Shareholders of Dyadic International, Inc.:

NOTICE IS HEREBY GIVEN that the Virtual Annual Meeting of Shareholders (“Annual Meeting”) of Dyadic International, Inc., a Delaware corporation (“Dyadic,” “we,” “us”, “our”, or the “Company”), will be held on Friday, June 10, 2022 at 10 a.m. Eastern Daylight Savings Time, via live webcast at www.virtualshareholdermeeting.com/DYAI2022 for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

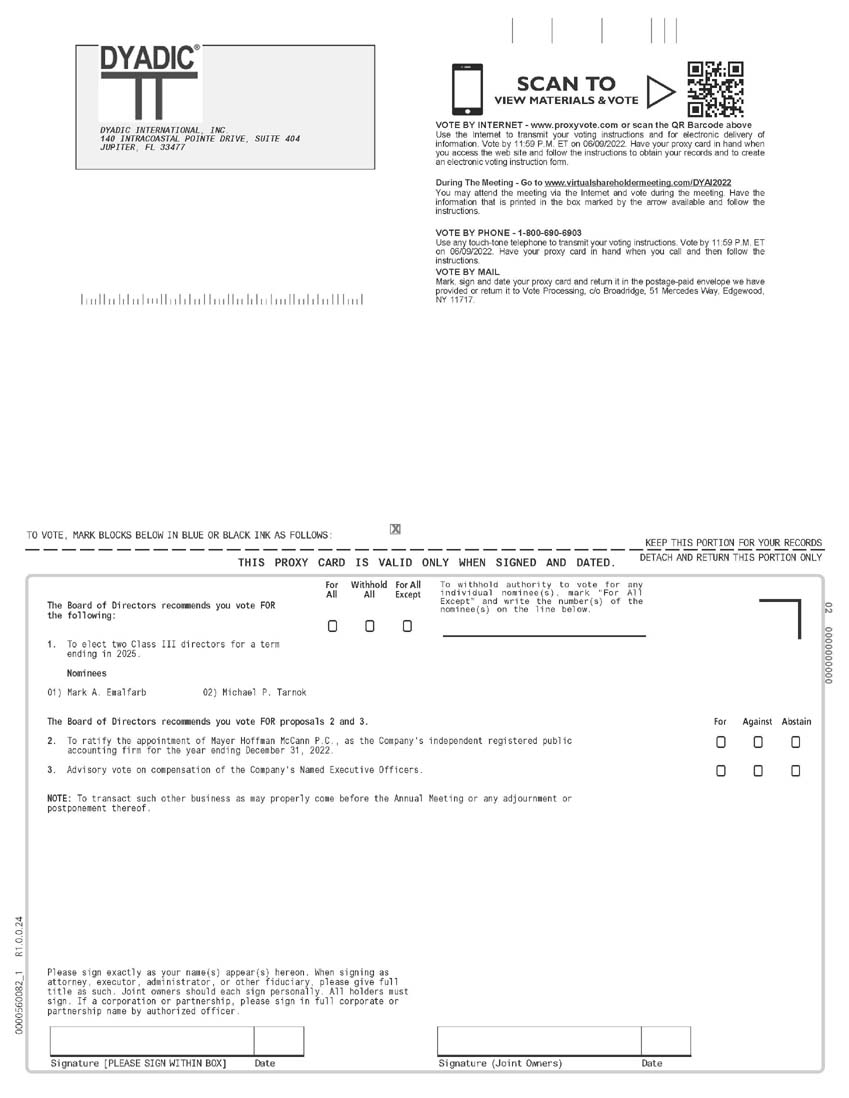

1. To elect two Class III directors to our Board of Directors (the “Board”) to serve until the Company’s 2025 Annual Meeting of Shareholders or until their successors are duly elected and qualified;

2. To ratify the appointment of Mayer Hoffman McCann P.C., as the Company’s independent registered public accounting firm for the year ending December 31, 2022;

3. To cast an advisory vote to approve the compensation of the Company’s Named Executive Officers; and

4. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to virtually attend the Annual Meeting. To participate in the Annual Meeting, you will need your 16-digit control number included on your Notice Regarding the Availability of Proxy Materials (“Notice”) or on your proxy card.

Only shareholders of record at the close of business on April 14, 2022 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. The stock transfer books of the Company will remain open between the record date and the date of the Annual Meeting. A list of registered shareholders entitled to vote at the Annual Meeting will be available for inspection by any shareholder for any purpose germane to the Annual Meeting, during regular business hours, for a period of ten days prior to the Annual Meeting, at the Company’s principal place of business at 140 Intracoastal Pointe Drive, Suite 404, Jupiter, Florida 33477. If our headquarters are closed for health and safety reasons related to the COVID-19 pandemic during such period, the list of registered shareholders entitled to vote at the Annual Meeting will be made available for inspection upon request via email to prawson@dyadic.com subject to our satisfactory verification of shareholder status. During the Annual Meeting, the list of registered shareholders entitled to vote at the Annual Meeting will be made available electronically at www.virtualshareholdermeeting.com/DYAI2022.

We encourage shareholders to vote in advance of the Annual Meeting. Whether or not you expect to attend the Annual Meeting, please promptly cast your vote in one of the ways described below:

• | Vote by Internet: www.proxyvote.com |

| Use the internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m., Eastern Daylight Savings Time, on Thursday, June 9, 2022. Have the 16-digit control number included in your Notice or your proxy card in hand when you access the above website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

• | Vote by Telephone: 1-800-690-6903 |

| If you received paper copies of the proxy materials, use any touch-tone telephone to transmit your voting instruction. Vote by 11:59 p.m., Eastern Daylight Savings Time, on Thursday, June 9, 2022. Have your proxy card in hand when you call and follow the instruction. |

• | Vote by Mail. |

| If you received paper copies of the proxy materials, please mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

• | Vote During the Annual Meeting. |

| You can vote your shares during the Annual Meeting at www.virtualshareholdermeeting.com/DYAI2022. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice or on your proxy card. |

You need only vote in one way (so that, if you vote by internet or telephone, you need not return the proxy card).

If you hold your shares through a broker, bank, or other nominee, you should receive separate voting instructions from the firm holding your shares describing the procedure for voting those shares. You may complete and mail a voting instruction card to your broker or nominee or, in most cases, submit voting instructions by telephone or the internet to your broker or nominee. If you provide specific voting instructions by mail, telephone or the internet, your broker or nominee will vote your shares as you have directed.

Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to ensure that all your shares will be voted. Your proxy is revocable in accordance with the procedures set forth in the attached proxy statement.

BY ORDER OF THE BOARD OF DIRECTORS | |||||

/s/ Mark Emalfarb | |||||

Mark Emalfarb |

Jupiter, Florida

INTERNET AVAILABILITY OF PROXY MATERIALS

*****IMPORTANT NOTICE*****

This Notice of Meeting, Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, are available online at https://dyadic-international-inc.ir.rdgfilings.com/all-sec-filings/ and can be accessed at www.proxyvote.com.

DYADIC INTERNATIONAL, INC.

140 Intracoastal Pointe Drive, Suite 404

Jupiter, Florida 33477

(561) 743-8333

________________________________________________________________

PROXY STATEMENT

_________________________________________________________________

2022 VIRTUAL ANNUAL MEETING OF SHAREHOLDERS

VIRTUAL MEETING ONLY - NO PHYSICAL MEETING LOCATION

__________________________________________________________________

The Board of Directors of the Company (the “Board”) is soliciting proxies for the 2022 Virtual Annual Meeting of Shareholders of Dyadic International, Inc. (“Annual Meeting”). This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

This proxy statement contains information related to the Annual Meeting to be held on Friday, June 10, 2022 at 10 a.m. Eastern Daylight Savings Time, and at any adjournments or postponements thereof. This year, considering the continued concerns around the spread of COVID-19 in the United States and globally, to mitigate health risks, the Annual Meeting will be conducted in virtual format only. Shareholders can access the Annual Meeting by visiting www.virtualshareholdermeeting.com/DYAI2022. Shareholders will not be able to attend the Annual Meeting in person. The Company believes that a virtual meeting will provide meaningful shareholder access and participation and protect the health and safety of our shareholders, employees, and other stakeholders, and will also improve meeting efficiency and reduce costs.

The Board set April 14, 2022, as the record date for the Annual Meeting. Shareholders who owned the Company’s common stock on that date are entitled to vote at the Annual Meeting, with each share entitled to one vote. There were 28,264,157 shares of the Company’s common stock outstanding as of the record date.

We are furnishing proxy materials to our shareholders primarily via the internet under the Securities and Exchange Commission’s (“SEC”) “Notice and Access” rules. On or about April 26, 2022, we expect to mail to our shareholders a Notice of internet Availability (the “Notice”) containing instructions on how to access our proxy materials, including our Proxy Statement and Annual Report filed on Form 10-K with the SEC (“Annual Report on Form 10-K”). The Notice also will instruct you on how to access and submit your proxy through the internet.

We are providing internet distribution of our proxy materials to expedite receipt by shareholders, reduce costs and conserve paper. However, if you would like to receive printed proxy materials, please follow the instructions on the Notice. Additionally, this proxy statement and the Annual Report on Form 10-K are available at www.dyadic.com by clicking the “Investors” link. In accordance with Securities and Exchange Commission rules, our proxy materials posted on both our website and the website described below do not contain any cookies or other tracking features.

INTERNET AVAILABILITY OF PROXY MATERIALS

*****IMPORTANT NOTICE*****

The Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

__________________________________________________________________________________

What is the purpose of the Annual Meeting?

At the Annual Meeting, we are asking shareholders:

• | To elect two Class III directors for a term ending in 2025; |

• | To ratify the appointment of Mayer Hoffman McCann P.C., (“MHM”), as our independent registered public accounting firm for the year ending December 31, 2022; |

• | To cast an advisory vote to approve the compensation of the Company’s Named Executive Officers; and |

• | To transact such other business properly brought before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

Who is entitled to notice of and to vote at the Annual Meeting?

You are entitled to vote, by proxy, at the Annual Meeting if you owned shares of our common stock as of the close of business (5:00 p.m. Eastern Daylight Savings Time) on April 14, 2022, the record date of the Annual Meeting. Holders of record of our common stock on the record date are entitled to one vote per share at the Annual Meeting.

Who can attend the Annual Meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend. Shareholders will need a control number to attend the Annual Meeting. For registered shareholders, the control number can be found on their Notice or proxy card.

What shares may I vote?

You may vote all shares you owned as of the record date. These include: (1) shares owned directly in your name as the shareholder of record and (2) shares held for you as the beneficial owner through a stockbroker, bank, or another nominee.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Most of our shareholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those beneficially owned.

If our shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered the shareholder of record regarding those shares. As the shareholder of record, you have the right to grant your proxy directly to us to vote your shares at the Annual Meeting, using the control number on the Notice of Internet Availability of Proxy Materials or proxy card to log into www.virtualshareholdermeeting.com/DYAI2022.

If you hold our shares in a stock brokerage account or through a bank or other nominee, you are considered the “beneficial owner” of the shares held in “street name”, and these proxy materials have been forwarded to you by your stockbroker, bank, or another nominee. As the beneficial owner, you have the right to direct your stockbroker, bank, or other nominee how to vote and you are also invited to attend the Annual Meeting via the internet and vote during the meeting. Beneficial owners who do not have a control number may gain access to the Annual Meeting by logging into their brokerage firm’s website. Instructions should be provided on the voting instruction card provided by your stockbroker, bank, or another nominee.

How do I vote?

Shareholders at the close of business on April 14, 2022, can vote at the Annual Meeting via proxy in the manner described herein.

Any shareholder who holds shares in “street name” through a broker, bank or other nominee should receive separate instructions from the firm holding his or her shares describing the procedure for voting those shares. You should follow the voting instructions provided by your broker, bank or other nominee when voting your shares. You may complete and mail a voting instruction card to your broker, bank, or another nominee or, in most cases, submit voting instructions by telephone or the internet to your broker or nominee. If you provide specific voting instructions by mail, telephone or the internet, your broker or nominee will vote your shares as you have directed.

Shareholders of record may vote in the following ways:

• | Vote by Internet: www.proxyvote.com |

| Use the internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m., Eastern Daylight-Saving Time, on Thursday, June 9, 2022. Have the 16-digit control number included in our Notice or your proxy card in hand when you access the above website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

• | Vote by Telephone: 1-800-690-6903 |

| If you received paper copies of the proxy materials, use any touch-tone telephone to transmit your voting instruction. Vote by 11:59 p.m., Eastern Daylight Savings Time, on Thursday, June 9, 2022. Have your proxy card in hand when you call and follow the instruction. |

• | Vote by Mail. |

| If you received paper copies of the proxy materials, please mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

• | Vote During the Annual Meeting. |

| You can vote your shares during the Annual Meeting at www.virtualshareholdermeeting.com/DYAI2022. To participate in the Annual Meeting, you will need the 16-digit control number included in your Notice or on your proxy card. |

You need only vote in one way (so that, if you vote by internet or telephone, you need not return the proxy card).

If you have any questions about how to vote or direct a vote in respect of your Dyadic common stock, you may contact either our corporate office at 140 Intracoastal Pointe Drive, Suite 404, Jupiter, Florida 33477, Attention: Heidi Zosiak, telephone: (561) 743-8333 or Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717, telephone: (631) 257-4339.

Can I submit questions at the Annual Meeting?

Yes. During the live virtual meeting, you will be able to submit questions real-time through the meeting portal.

Can I change my vote after I return my proxy card?

Yes. If you voted by mail, you may revoke your proxy at any time before it is exercised by executing and delivering a timely and valid later-dated proxy, by voting by ballot at the Annual Meeting or by giving written notice to the Secretary. If you voted via the internet or by phone, you may change your vote with a timely and valid later internet or telephone vote, or by voting by ballot at the Annual Meeting. Attendance at the Annual Meeting will not have the effect of revoking a proxy unless (1) you give proper written notice of revocation to the Secretary before the proxy is exercised, or (2) you vote by ballot at the Annual Meeting.

If your shares are held in street name, you should contact the institution that holds your shares to change your vote.

Is my vote confidential?

Yes. All votes remain confidential unless you provide otherwise.

How are votes counted?

Before the Annual Meeting, our Board will appoint one or more inspectors of election for the Annual Meeting. The inspector(s) will determine the number of shares represented at the Annual Meeting, the existence of a quorum and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots and votes and determine the results of the voting on each matter that comes before the Annual Meeting.

Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for purposes of determining the existence of a quorum at the Annual Meeting. They will not be considered as votes for or against any matter for which the shareholder has indicated their intention to abstain or withhold their vote. Broker or nominee non-votes, which occur when shares held in street name by brokers or nominees who indicate that they do not have discretionary authority to vote on a particular matter, will not be considered as votes for or against that particular matter. Broker and nominee non-votes will be treated as present for purposes of determining the existence of a quorum and may be entitled to vote on certain matters at the Annual Meeting.

What percentage of our outstanding common stock do our directors and executive officers own?

As of April 14, 2022, our directors and executive officers owned, or have the right to acquire within 60 days through the exercise of options, approximately 27.0% of our outstanding common stock. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Managements” below for more details.

Who was our independent public accountant for the year ended December 31, 2021? Will they be represented at the Annual Meeting?

Mayer Hoffman McCann P.C is the independent registered public accounting firm that audited our financial statements for the year ended December 31, 2021. We expect a representative of Mayer Hoffman McCann P.C. to be virtually present at the Annual Meeting. The representative will have an opportunity to make a statement and will be available to answer your questions.

What are the Board’s recommendations?

The Board recommends a vote FOR:

• | The nominees for Class III directors; |

• | The proposal to ratify the appointment of Mayer Hoffman McCann P.C. (“MHM”), as our independent registered public accounting firm for the year ending December 31, 2022; and |

• | The compensation of the Company’s Named Executive Officers. |

Unless you give other instructions on your proxy card, the person named as a proxy on the proxy card will vote FOR the proposals set forth above.

We do not expect that any other matters will be brought before the Annual Meeting. If, however, other matters are properly presented, the persons named as proxies will vote the shares represented by properly executed proxies in accordance with their judgment with respect to those matters, including any proposal to adjourn or postpone the Annual Meeting. No proxy that is voted against all the proposals will be voted in favor of any adjournment or postponement of the Annual Meeting for the purpose of soliciting additional proxies.

What constitutes a quorum?

If a majority of the shares of our common stock outstanding on the record date is represented either in person or by proxy at the Annual Meeting, a quorum will be present at the Annual Meeting. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of quorum at the Annual Meeting. Shares held by persons attending the Annual Meeting but not voting, and shares represented in person or by proxy and for which the holder has abstained from voting, will be counted as present at the Annual Meeting for purposes of determining the presence or absence of a quorum.

Applicable stock exchange rules determine whether a proposal presented at a shareholder meeting is routine or non-routine. If a proposal is routine, a broker or other entity holding shares for an owner in street name may vote on the proposal without receiving voting instructions from the beneficial owner. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the beneficial owner has provided voting instructions. A broker non-vote occurs when a broker or other entity is unable to vote on a particular proposal and the broker or other entity has not received voting instructions from the beneficial owner. Therefore, if you do not give your broker or other entity specific instructions, your shares will not be voted on non-routine matters. However, the broker non-votes will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists. The election of directors is considered a non-routine proposal. The proposal to ratify the appointment of MHM to serve as our independent auditor is considered a routine proposal.

What vote is required to approve the proposals?

Proposal 1: Election of Class III Directors. The affirmative vote of a plurality of the votes cast, by proxy, at the Annual Meeting is required for the election of the Class III director nominees. You may vote for or withheld with respect to the election of each director. Only votes for are counted in determining whether a plurality has been cast in favor of a director. Votes withheld and broker non-votes are not counted for purposes of the election of directors, although they are counted for purposes of determining whether there is a quorum. Shareholders do not have the right to cumulate their votes for directors.

Proposal 2: Ratification of Appointment of MHM as our Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of all shares casting votes, by proxy, at the Annual Meeting is required to ratify the appointment of MHM as our independent registered public accounting firm for the fiscal year ending December 31, 2022. We are not required to submit this matter to a vote of shareholders for ratification; however, our Board is doing so, based upon the recommendation of its audit committee, as a matter of good corporate practice. You may vote for, against, or abstain with respect to the ratification of the appointment of MHM as our independent registered public accounting firm. A properly executed proxy marked abstain with respect to this proposal will not be voted for or against the proposal, although it will be counted for purposes of determining whether there is a quorum. Brokers have discretion to vote shares with respect to this proposal unless a shareholder directs their broker otherwise. However, in the event of a broker non-vote, such broker non-votes will not be considered as votes cast for or against this proposal although it will be counted for purposes of determining whether there is a quorum

.

Proposal 3: Advisory Vote to approve Named Executive Officers Compensation. The votes that shareholders cast “for” must exceed the votes that shareholders cast “against” to approve, on an advisory basis, the compensation of our Named Executive Officers. You may vote for, against, or abstain with respect to approval of the compensation of the Company’s Named Executive Officers. A properly executed proxy marked abstain with respect to this proposal will not be voted for or against the proposal, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes will not be considered as votes cast for or against this proposal, although it will be counted for purposes of determining whether there is a quorum.

Other Items. In the event other items are properly brought before the Annual Meeting, the affirmative vote of a majority of the votes cast, by proxy, at the Annual Meeting will be required for approval. A properly executed proxy marked abstain with respect to any such matter will not be voted for or against such items, although it will be counted for purposes of determining whether there is a quorum.

Because your votes are advisory on Proposal 3, they will not be binding on the Board or the Company. However, the Board and the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding the Named Executive Officers’ compensation or regarding the frequency of the advisory vote on the Named Executive Officers’ compensation.

Who pays for the preparation of the proxy and soliciting proxies?

We will pay the cost of preparing, assembling and mailing the proxy statement and the accompanying Notice of Annual Meeting and proxy card. In addition to the use of mail, our directors, officers, and employees may solicit proxies by telephone or other electronic means or in person. These persons will not receive additional compensation for soliciting proxies. Arrangements also will be made with brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation materials to the beneficial owners of stock held of record by these persons, and we will reimburse them for reasonable out-of-pocket expenses.

What should I have received to enable me to vote?

We are furnishing proxy materials to our shareholders primarily via the internet under the SEC’s “Notice and Access” rules. On or about April 26, 2022, we expect to mail to our shareholders a Notice of Internet Availability (the “Notice”) containing instructions on how to access our proxy materials, including our Proxy Statement and Annual Report on Form 10-K. The Notice also will instruct you on how to access and submit your proxy through the internet.

We are providing internet distribution of our proxy materials to expedite receipt by shareholders, reduce costs and conserve paper. However, if you would like to receive printed proxy materials, please follow the instructions on the Notice.

How can I obtain additional copies?

The Notice of Meeting, Proxy Statement and our Annual Report on Form 10-K are available online at https://dyadic-international-inc.ir.rdgfilings.com/all-sec-filings/ and may be accessed at https://materials.proxyvote.com/26745T.

For copies of this proxy statement and the enclosed proxy card, please contact either our corporate office at 140 Intracoastal Pointe Drive, Suite 404, Jupiter, Florida 33477, Attention: Heidi Zosiak, telephone: (561) 743-8333 or Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717, telephone: (631) 257-4339.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 14, 2022 (except as noted below), by:

• | each person known by us to be the beneficial owner of more than 5% of the outstanding shares of our common stock; |

• | each of our directors, named executive officers; and |

• | all our directors and executive officers as a group. |

The amounts and percentages of common stock beneficially owned are reported based on regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power, which includes the power to vote or direct the voting of a security, or investment power, which includes the power to dispose of or to direct the disposition of a security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within sixty (60) days of April 14, 2022. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners listed has, to our knowledge, sole voting, and investment power with respect to the indicated shares of common stock.

As of April 14, 2022, the Company has shares of common stock issued and 28,264,157 shares of common stock outstanding with the remaining 12,253,502 shares held in treasury. The beneficial ownership table below includes those shares of common stock underlying options that are currently exercisable or exercisable within sixty (60) days of April 14, 2022, but excludes those shares issued or repurchased after April 14, 2022.

Number of | Percentage of | |||||||||||||||

Common | Common | |||||||||||||||

Share | Share | |||||||||||||||

Number of | Options | Equivalents | Equivalents | |||||||||||||

Common | Exercisable | Beneficially | Beneficially | |||||||||||||

Name and Address of Beneficial Owner (1) | Shares Held | within 60 Days | Owned | Owned (%) (2) | ||||||||||||

5% Shareholders: | ||||||||||||||||

Mark A. Emalfarb (3) | 4,394,015 | 770,000 | 5,164,015 | 17.8 | % | |||||||||||

The Francisco Trust U/A/D February 28, 1996 (4) | 3,548,528 | — | 3,548,528 | 12.6 | % | |||||||||||

Bandera Master Fund L.P.(5) | 1,566,908 | — | 1,566,908 | 5.5 | % | |||||||||||

Named Executive Officers and Directors: | ||||||||||||||||

Mark A. Emalfarb (3) | 4,394,015 | 770,000 | 5,164,015 | 17.8 | % | |||||||||||

Michael P. Tarnok | 188,929 | 398,125 | 587,054 | 2.0 | % | |||||||||||

Jack L. Kaye | 72,707 | 393,438 | 466,145 | 1.6 | % | |||||||||||

Seth J, Herbst, M.D. | 105,000 | 350,625 | 455,625 | 1.6 | % | |||||||||||

Arindam Bose, Ph.D. | — | 393,438 | 393,438 | 1.4 | % | |||||||||||

Barry C. Buckland, Ph.D. | — | 160,625 | 160,625 | * | ||||||||||||

Patrick Lucy | — | 35,000 | 35,000 | * | ||||||||||||

Ping Rawson | 45,500 | 448,140 | 493,640 | 1.7 | % | |||||||||||

Ronen Tchelet, Ph.D. | — | 552,500 | 552,500 | 1.9 | % | |||||||||||

Matthew Jones | — | 390,000 | 390,000 | 1.4 | % | |||||||||||

All current executive officers and directors as a group | 4,806,151 | 3,891,891 | 8,698,042 | 27.0 | % | |||||||||||

(10 persons) | ||||||||||||||||

______________

Notes:

(*) Less than 1%.

(1) | Except as otherwise noted, the address for each shareholder is c/o Dyadic International, Inc., 140 Intracoastal Pointe Drive, Suite 404, Jupiter, FL 33477. |

(2) | Based on 28,264,157 shares of common stock outstanding as of April 14, 2022. Shares of common stock subject to options that are currently exercisable or exercisable within 60 days are deemed outstanding for purposes of computing the percentage of the person holding such options but are not deemed outstanding for purposes of computing the percentage of any other person. |

(3) | Includes 3,548,528 shares held by Mark A. Emalfarb beneficially through the MAE Trust U/A/D October 1, 1987, of which Mr. Emalfarb is the sole beneficiary and serves as sole trustee. In addition, Mr. Emalfarb holds 770,000 shares of common stock underlying options that are presently exercisable. Based on the information available to us, the address of the MAE Trust U/A/D October 1, 1987, is 193 Spyglass Court, Jupiter, FL 33477. |

| (4) | The trustee of the Francisco Trust is Adam Morgan, and the beneficiaries thereof are the spouse and descendants of Mark A. Emalfarb. The address of the Francisco Trust is 3128 San Michele Drive, Palm Beach Gardens, FL 33418. Mr. Emalfarb disclaims beneficial ownership of such shares. |

(5) | Based on a Schedule 13G filed by Bandera Partners LLC, a Delaware limited liability company (“Bandera Partners”), Gregory Bylinsky and Jefferson Gramm on February 14, 2022. Per the Schedule 13G, Bandera Partners has sole voting and dispositive power over 1,566,908 shares of common stock, and Messrs. Bylinsky and Graham each have shared voting and dispositive power over 1,566,908 shares of common stock. The address for each of Bandera Partners, Mr. Bylinsky and Mr. Gramm is 50 Broad Street, Suite 1820, New York, NY 10004. |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Our Board has determined that the audit committee of the Board (the “Audit Committee”) is best suited to review and approve transactions with related persons. Prior to entering into a transaction with a related person, (a) the director, executive officer, nominee or significant holder who has a material interest (or whose immediate family member has a material interest) in the transaction or (b) the business unit or function/department leader responsible for the potential transaction with a related person is required to provide notice to the Chairman of the Audit Committee (“Audit Committee Chairman”) of the material facts and circumstances of the potential transaction with a related person and such information concerning the transaction as the Audit Committee Chairman may reasonably request. If the Audit Committee Chairman determines that the proposed transaction is a related person transaction, the proposed related person transaction must be submitted to the Audit Committee for consideration at the next Audit Committee meeting or, in those instances in which the Audit Committee Chairman determines that it is not practicable or desirable for the Company to wait until the next Audit Committee meeting, the Audit Committee Chairman possesses delegated authority to act between Committee meetings.

The Audit Committee will consider all the relevant facts and circumstances available to the Audit Committee, including (if applicable) but not limited to: (a) the benefits to the Company; (b) the availability of other sources for comparable products or services; (c) the terms of the transaction; and (d) the terms available to unrelated third parties or to employees generally. No member of the Audit Committee will participate in any review, consideration, or approval of any related person transaction if such member, or any of his or her immediate family members, is the related person. The Audit Committee or Audit Committee Chairman, as applicable, will convey the approval or disapproval of the transaction to the Chief Executive Officer or Secretary, who will convey the decision to the appropriate persons within the Company. The Audit Committee Chairman will report to the Audit Committee at the next Audit Committee meeting any approval under this policy made by the chairperson pursuant to delegated authority.

In the event we become aware of a related person transaction that has not been previously approved or previously ratified under this procedure, and such transaction is pending or ongoing, it will be submitted to the Audit Committee or Audit Committee Chairman, as applicable, promptly, and the Audit Committee or Audit Committee Chairman will consider all the relevant facts and circumstances available to the Audit Committee or Audit Committee Chairman as provided above. Based on the conclusions reached, the Audit Committee or Audit Committee Chairman, as applicable, will evaluate all options, including but not limited to, ratification, amendment, or termination of the related person transaction.

The Company entered into no such transaction during its last fiscal year or the previous fiscal year, and no such transaction is currently proposed.

CORPORATE GOVERNANCE AND RELATED MATTERS

General

The following discussion summarizes certain corporate governance matters relating to the Company, including information about director independence, Board and Committee structure, function and composition, charters, policies, and procedures. For additional information on the Company’s corporate governance, including copies of the charters approved by the Board for the Audit Committee, the Compensation Committee of the Board (“Compensation Committee”), the Nominating Committee of the Board (“Nominating Committee”), the Sciences and Technology Committee of the Board (“Science and Technology Committee”), and the Company’s Code of Conduct and Ethics, please visit the “Investors” section of the Company’s web site at https://dyadic-international-inc.ir.rdgfilings.com/ under Corporate Governance.

Board of Directors and Committees

Board of Directors and Leadership Structure

The Board is responsible for directing and overseeing the business and affairs of the Company. The Board represents the Company’s shareholders, and its primary purpose is to build long-term shareholder value. The Board meets on a regularly scheduled basis during the year to review significant developments affecting the Company and to act on matters that, in accordance with good corporate governance, require Board approval. It also holds annual meetings and acts by unanimous written consent when an important matter requires Board action between scheduled meetings. The Board held nine (9) meetings during 2021 and each of our directors attended all those meetings in person or by teleconference.

We have a classified Board currently fixed at seven members. The Board has four committees: Audit Committee, Compensation Committee, Nominating Committee, and Science and Technology Committee. Currently, Mr. Michael Tarnok serves as Chairman of the Board and Chairman of the Compensation Committee. Mr. Jack Kaye serves as Audit Committee Chairman, Dr. Seth Herbst serves as Chairman of the Nominating Committee, and Dr. Arindam Bose serves as Chairman of the Science and Technology Committee.

We separate the roles of Chairman of the Board and Chief Executive Officer. We believe that having an independent Chairman promotes a greater role for the independent directors in the oversight of the Company, including oversight of material risks facing the Company, encourages active participation by the independent directors in the work of our Board, enhances our Board’s role of representing shareholders’ interests and improves our Board’s ability to supervise and evaluate our Chief Executive Officer and other executive officers. Further, separation of the Chairman and Chief Executive Officer roles allows our Chief Executive Officer to focus on operating and managing the Company while leveraging our independent Chairman’s experience and perspectives.

The Board’s Role in Risk Oversight

Our Board, as a whole and at the committee level, has an active role in overseeing management of the Company’s risks. The Board regularly reviews information regarding the Company’s business and operations, including with respect to liquidity, financial reporting, governance and compliance, information technology and data security, as well as the risks associated with these activities. Management actively assesses the impact of COVID-19 on the Company and reports to the Board on an as-needed basis.

Independence of Directors

In evaluating the independence of its members and the composition of the committees of the Board, the Board utilizes the definition of independence as that term is defined under the published listing requirements of NASDAQ. The NASDAQ independence definition includes a series of objective tests. For example, an independent director may not be employed by us and may not engage in certain types of business dealings with the Company. In addition, as further required by NASDAQ rules, the Board has made a subjective determination as to each independent director that no relation exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and by the Company each director’s business and personal activities as they may relate to the Company and the Company’s management. We believe that Drs. Herbst, Bose and Buckland, as well as Messrs. Kaye, Lucy and Tarnok qualify as independent directors. In addition, our Board has determined that each member of our Audit Committee is independent and is otherwise qualified to be a member of the Audit Committee in accordance with the rules of the SEC and NASDAQ.

Committees of the Board

The Board has established an Audit Committee, a Compensation Committee, a Nominating Committee and a Science and Technology Committee to devote attention to specific subjects and to assist the Board in the discharge of its responsibilities. The following table provides membership and meeting information for each of the Board committees:

Name | Audit | Compensation | Nominating | Science and Technology | ||||||||

Michael P. Tarnok | X | X* | X | — | ||||||||

Seth J. Herbst, M.D. | — | X | X* | X | ||||||||

Arindam Bose, Ph.D. | X | — | — | X* | ||||||||

Jack L. Kaye | X* | X | — | — | ||||||||

Barry C. Buckland, Ph.D. | — | — | X | X | ||||||||

Patrick Lucy | — | — | — | X | ||||||||

Mark A. Emalfarb | — | — | — | X |

_______________________________________________

* Committee Chairman

Audit Committee. The Audit Committee held six (6) meetings during the year ended December 31, 2021. The Audit Committee has oversight responsibility for the quality and integrity of our consolidated financial statements. A copy of the Charter of the Audit Committee is available on our website, located at www.dyadic.com. The Audit Committee meets privately with members of our independent registered public accounting firm, has the sole authority to retain and dismiss the independent registered public accounting firm and reviews its performance and independence from management. The independent registered public accounting firm has unrestricted access and reports directly to the Audit Committee. The primary functions of the Audit Committee are to oversee (i) the audit of our consolidated financial statements and (ii) our internal financial and accounting processes.

The SEC and NASDAQ have established rules and regulations regarding the composition of audit committees and the qualifications of audit committee members. Our Board has examined the composition of our Audit Committee and the qualification of our Audit Committee members in considering the current rules and regulations governing audit committees. Based upon this examination, our Board has determined that each member of our Audit Committee is independent and is otherwise qualified to be a member of our Audit Committee in accordance with the rules of the SEC and NASDAQ.

Additionally, the SEC requires that at least one member of the audit committee have a heightened level of financial and accounting sophistication. Such a person is known as the “audit committee financial expert” under the SEC’s rules. Our Board has determined that Mr. Kaye is an “audit committee financial expert”, as defined in Item 407(d)(5) of Regulation S-K and is an independent member of our Board and our Audit Committee. Please see Mr. Kaye’s biography included in this proxy statement for a description of his relevant experience.

Compensation Committee. The Compensation Committee held three (3) meetings during the year ended December 31, 2021. The duties and responsibilities of the Compensation Committee are set forth in the Charter of the Compensation Committee. A copy of the Charter of the Compensation Committee is available on our website, located at www.dyadic.com. As discussed in its charter, among other things, the duties and responsibilities of the Compensation Committee include evaluating the performance of the Chief Executive Officer, Chief Financial Officer, and other key personnel of the Company, including, but not limited to, our incentive and equity-based plans. The Compensation Committee evaluates the performance of the Chief Executive Officer, Chief Financial Officer, and other key personnel of the Company on an annual basis and reviews and approves on an annual basis all compensation programs and awards relating to such officers and key personnel. From time to time, the Company engages compensation consultants to evaluate compensation of all Company officers and Board members. The Compensation Committee then uses discretion in applying these ranges to the individual executive compensation packages to ensure compliance with the Company’s compensation philosophy. The Chief Executive Officer makes recommendations to the Compensation Committee with respect to the compensation packages for officers other than himself.

Nominating Committee. The Nominating Committee held four (4) meetings during the year ended December 31, 2021. The Nominating Committee’s functions include: establishing criteria for the selection of new directors to serve on the Board; identifying individuals believed to be qualified as candidates to serve on the Board; recommending candidates for all directorships to be filled by the Board or by the shareholders at an annual or special meeting; reviewing the Board’s committee structure and recommending to the Board the directors to serve on the committees of the Board; recommending members of the Board to serve as the respective chairs of the committees of the Board; developing and recommending to the Board, for its approval, a periodical self-evaluation process of the Board and its committees and, based on those results, making recommendations to the Board regarding those board processes; and performing any other activities consistent with the committee’s charter, our bylaws and applicable law as the committee or the Board deems appropriate. A copy of the Charter of the Nominating Committee is available on our website, located at www.dyadic.com.

The Nominating Committee does not currently have any formal minimum qualification requirements that must be met by a nominee to serve as a member of the Board. The Nominating Committee will consider all factors it considers appropriate, which may include experience, accomplishments, education, understanding of the business and the industries in which we operate, specific skills, general business acumen and the highest personal and professional integrity. The Nominating Committee generally seeks individuals with broad experience at the policy-making level in business, or with industry expertise. While we do not have a formal diversity policy for Board membership, we look for potential candidates that help ensure that the Board has the benefit of a wide range of attributes. We believe that all our directors should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Each director must also represent the interests of all shareholders.

The Nominating Committee currently has no fixed process for identifying new nominees for election as a director, thereby retaining the flexibility to adapt its process to the circumstances. The Nominating Committee has the ability, if it deems it necessary or appropriate, to retain the services of an independent search firm to identify new director candidates. The Nominating Committee has determined that it will consider any potential candidate proposed by a member of our Board or senior management. Any director candidate so proposed will be personally interviewed by at least one member of the Nominating Committee and our Chief Executive Officer and their assessment of his or her qualifications will be provided to the full Nominating Committee.

Our policy and procedures regarding director candidates recommended by shareholders are contained in the Nominating Committee’s charter. The Nominating Committee may consider for inclusion in its nominations for new directors any candidates recommended by shareholders, but must consider any candidate for director recommended by (i) any shareholder beneficially owning more than 5% of our outstanding common stock for at least one year as of the date the recommendation was made or (ii) a group of shareholders that beneficially owned, in the aggregate, more than 5% of our outstanding common stock, with each of the shares used to calculate that ownership held for at least one year as of the date the recommendation was made. The Nominating Committee will consider the candidate based on the same criteria established for selection of director nominees generally. The Nominating Committee reserves the right to reject any candidate in its discretion, including, without limitation, rejection of a candidate who has a special interest agenda other than the best interests of the Company and the shareholders, generally. Any shareholder who wishes to recommend for the Nominating Committee’s consideration a director candidate should abide by the following procedures:

• | Submit the following written information about the candidate by mail to the Nominating Committee, c/o Dyadic International, Inc., 140 Intracoastal Pointe Drive, Suite 404, Jupiter, Florida 33477, Attention: Chair of Nominating Committee, the name, mailing address, telephone number, e-mail address, resume, business history, listing of other past and present directorships and director committees, any biotech industry experience and other relevant information; |

• | Explain in the submission why the shareholder believes the candidate would be an appropriate member of our Board and the benefits and attributes that the candidate will provide to us in serving as a director; |

• | Provide evidence of the submitting party’s requisite ownership of our common stock along with the recommendation; and |

• | Indicate whether we may identify the shareholder in any public disclosures that we make regarding the consideration of the director candidate. |

For a director candidate to be considered by the Nominating Committee for nomination at the Annual Meeting, the submission must have been received by us no later than March 13, 2022. No such submission was received.

Science and Technology Committee. The Science and Technology Committee held five (5) meetings during the year ended December 31, 2021. The duties and responsibilities of the Science and Technology Committee are set forth in the Charter of the Science and Technology Committee. A copy of the Charter of the Science and Technology Committee is available on our website located at www.dyadic.com. As discussed in its charter, among other things, the duties and responsibilities of the Science and Technology Committee are following:

1) | Review, evaluate and report to the Board regarding the performance of the Vice-President, Research and Development (and his or her team), the contract research organizations being considered or working on behalf of the Company in achieving the strategic goals and objectives and the quality and direction of the Company’s biopharmaceutical research and development programs. |

2) | Identify and discuss significant emerging science and technology issues and trends. |

3) | Review the Company’s approaches to acquiring and maintaining a range of distinct technology positions (including but not limited to contracts, grants, collaborative efforts, alliances, and capital investments). |

4) | Evaluate the soundness/risks associated with the technologies in which the Company is investing its research and development efforts. |

5) | Periodically review the Company’s overall patent strategies. |

Shareholder Communications

Our Board believes that it is important for our shareholders to have a process to send communications to the Board. Accordingly, shareholders desiring to send a communication to the Board, or to a specific director, may do so by delivering a letter to the Secretary of the Company at 140 Intracoastal Pointe Drive, Suite 404, Jupiter, Florida 33477. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “shareholder-director communication.” All such letters must identify the author as the shareholder and clearly state whether the intended recipients of the letter are all the members of our Board or certain specified individual directors. The Secretary will open such communications, make copies, and then circulate them to the appropriate director or directors.

Human Capital

The Company believes that its success depends on the ability to attract, develop, retain, and incentivize our existing and new employees, consultants, and key personnel. It also believes that the skills, experience, and industry knowledge of its key personnel significantly benefits its operations and performance. The principal purposes of equity and cash incentive plans are to attract, retain and reward personnel through the granting of stock-based and cash-based compensation awards, to increase shareholder value and the success of our company by motivating such individuals to perform to the best of their abilities and achieve our objectives.

Employee health and safety in the workplace is one of the Company’s core values. The COVID-19 pandemic has underscored the importance of keeping employees safe and healthy. In response to the COVID-19 pandemic, the Company has taken actions aligned with the World Health Organization and the Centers for Disease Control and Prevention to protect the Company’s workforce so they can more safely and effectively perform their work. These actions include shutting down its headquarters for some months during 2020, wearing facemasks in common areas in the office, and allowing employees to work from home.

Employee levels are managed to align with the pace of business and management believes it has sufficient human capital, along with the third-party research organizations with who we have collaboration agreements, to operate its business successfully.

Policy Concerning Director Attendance at Annual Meetings of Shareholders

While we encourage all members of our Board to attend the annual meetings of our shareholders, there is no formal policy as to their attendance at such meetings. All members of the Board attended the 2021 Annual Meeting of Shareholders.

Code of Conduct and Ethics

We have adopted a Code of Conduct and Ethics, as amended, that applies to all employees, key consultants, officers, and directors of our company, including our principal executive officer, principal financial officer and principal accounting officer, or persons performing similar functions. Our Code of Conduct and Ethics is available on the “Corporate Governance” page of the “Investors” section of our website at www.dyadic.com. A copy of our Code of Conduct and Ethics can also be obtained free of charge by contacting our Secretary, c/o Dyadic International, Inc, 140 Intracoastal Pointe Drive, Suite 404, Jupiter, FL 33477. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of our Code of Conduct and Ethics by posting such information on our website.

Hedging

We have not adopted any practices or policies regarding the ability of our employees (including officers) or directors, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities.

Compensation of Directors

The following table sets forth the total compensation for our non-employee directors for the year ended December 31, 2021:

Nonqualified | ||||||||||||||||||||||||||||

Fees earned | Options | Non-equity | deferred | All other | ||||||||||||||||||||||||

or paid in | Stock awards | awards | incentive plan compensation | compensation | compensation | |||||||||||||||||||||||

Name (4) | cash (1) | ($) | ($) (1)(2)(3) | ($) | earnings ($) | ($) | Total ($) | |||||||||||||||||||||

Michael P. Tarnok | $ | 75,000 | $ | — | $ | 131,023 | $ | — | $ | — | $ | — | $ | 206,023 | ||||||||||||||

Jack L. Kaye | $ | 75,000 | $ | — | $ | 131,023 | $ | — | $ | — | $ | — | $ | 206,023 | ||||||||||||||

Seth J. Herbst, MD | $ | 60,000 | $ | — | $ | 87,349 | $ | — | $ | — | $ | — | $ | 147,349 | ||||||||||||||

Arindam Bose, Ph.D. | $ | 75,000 | $ | — | $ | 131,023 | $ | — | $ | — | $ | — | $ | 206,023 | ||||||||||||||

Barry C. Buckland, Ph.D. | $ | 60,000 | $ | — | $ | 87,349 | $ | — | $ | — | $ | — | $ | 147,349 | ||||||||||||||

Patrick Lucy | $ | 58,870 | $ | — | $ | 93,463 | $ | — | $ | — | $ | — | $ | 152,333 | ||||||||||||||

___________________

Notes:

(1) | Directors who are also employees or officers of the Company or any of its subsidiaries do not receive any separate compensation as a director. Non-employee directors receive an annual retainer for Board service of $60,000, paid in equal monthly installments. The annual stock option award for non-employee directors was 35,000 options per year effective 2021. In addition, a director who serves as Chairman of the Board, Chair of the Audit Committee, and Chair of the Science and Technology Committee receives an additional annual retainer of $15,000 and 17,500 options per year effective 2021. All options granted to directors will vest upon the one-year anniversary after the grant date. |

(2) | The Stock Option Awards represented the grant date fair market value of each option granted in 2021, computed in accordance with FASB ASC Topic 718. These amounts do not correspond to the actual value that will be recognized by the named directors. The assumptions used in the valuation of these awards are consistent with the valuation methodologies specified in the notes to our consolidated financial statements. |

(3) | Options to purchase 407,500 shares (Mr. Tarnok), 407,500 shares (Mr. Kaye), 385,000 shares (Mr. Herbst), 407,500 shares (Dr. Bose), 170,000 shares (Dr. Buckland) and 35,000 shares (Mr. Lucy) were outstanding at December 31, 2021. |

| (4) | Mr. Lucy was appointed to the Board on January 8, 2021. |

COMPENSATION AND OTHER INFORMATION CONCERNING OFFICERS

Philosophy and Objectives

The philosophy underlying our executive compensation program is to provide an attractive, flexible, and market-based total compensation program tied to performance and aligned with the interests of our shareholders. Our objective is to recruit and retain the caliber of executive officers and other key employees necessary to deliver sustained high performance to our shareholders, customers, and communities where we have a strong presence. Our executive compensation program is an important component of these overall human resources policies. Equally important, we view compensation practices as a means for communicating our goals and standards of conduct and performance and for motivating and rewarding employees in relation to their achievements. The organization’s executive compensation program is designed to:

• | Encourage the attraction and retention of high-caliber executives. |

• | Provide a competitive total compensation package, including benefits. |

• | Reinforce the goals of the organization by supporting teamwork and collaboration. |

• | Ensure that pay is perceived to be fair and equitable. |

• | Be flexible to potentially reward individual accomplishments as well as organizational success. |

• | Ensure that the program is easy to explain, understand, and administer. |

• | Balance the needs of both the Company and employees to be competitive with the limits of available financial resources. |

• | Ensure that the program complies with state and federal legislation. |

From time to time, the Company will consult with a compensation specialist to determine whether its overall compensation practices and policies are appropriate for the specific market conditions for the Company and the industries in which it operates.

Executive Officers

Name | Age | Current Position(s) |

Mark A. Emalfarb | 67 | President, Chief Executive Officer, Director |

Ping Rawson | 46 | Chief Financial Officer |

Joseph Hazelton (1) | 46 | Chief Business Officer |

Ronen Tchelet, Ph.D. | 64 | Vice President of Research and Business Development |

Matthew Jones (2) | 44 | Managing Director of Business Development and Licensing |

_________________

Notes:

(1) The Company appointed Mr. Hazelton as its Chief Business Officer, effective November 9, 2021.

(2) Mr. Jones will cease providing services to the Company effective July 21, 2022.

Mark A. Emalfarb, President, Chief Executive Officer and Director

Mark A. Emalfarb is the founder of Dyadic, and currently serves as the Chief Executive Officer and a member of the Board of Directors of the Company. He has been a member of Dyadic’s board of directors and has previously served as its Chairman from October 2004 until April 2007 and from June 2008 until January 2015. Since founding the predecessor to Dyadic in 1979, Mr. Emalfarb has served as a Director, President and Chief Executive Officer for substantially all of that time and has successfully led and managed the evolution of Dyadic from its origins as a pioneer and leader in providing ingredients used in the stone-washing of blue jeans to the discovery, development, manufacturing and commercialization of specialty enzymes used in various industrial applications and the development of an integrated technology platform based on Dyadic’s patented and proprietary C1 fungal microorganism. Mr. Emalfarb is an inventor of over 25 U.S. and foreign biotechnology patents and patent applications resulting from discoveries related to the patented and proprietary C1 fungus and has been the architect behind its formation of several strategic research and development, manufacturing and marketing relationships with U.S. and international partners. Mr. Emalfarb earned his B.A. degree from the University of Iowa in 1977.

Ping Rawson, MBA, Chief Financial Officer

Ping Rawson has been our Chief Financial Officer since June 2019, and she previously served as the Company's Chief Accounting Officer and Director of Financial Reporting. She is currently responsible for all aspects of the Company's finance, tax and treasury. Prior to joining Dyadic in June 2016, Ms. Rawson served as a technical accounting management position for ADT security services, where she led accounting and financial reporting workstream for acquisition, integration and restructuring. Prior to that, Ms. Rawson was an accounting research principal for NextEra Energy, Inc. (Florida Power & Light Company), where she was responsible for accounting research and new standards implementation. Previously, Ms. Rawson was a manager at Deloitte in New York City, where she was a subject matter specialist for derivatives, financial instruments and valuation, providing audit, SEC reporting, and capital markets consulting services to large banking and multinational public companies. Ms. Rawson holds both a M.B.A. in Finance, and a M.S. in Accounting from the State University of New York at Buffalo, and a B.S. in Economics from Guangdong University of Foreign Studies.

Joseph Hazelton, Chief Business Officer

Joseph Hazelton joined the Company in November 2021, as its Chief Business Officer. Mr. Hazelton brings over 20 years of pharmaceutical industry experience to Dyadic in key growth areas of product and business development, licensing, and commercialization. He joins Dyadic from Charleston Laboratories, Inc. ("Charleston”), where he has served as Chief Operating Officer and Chief Commercial Officer, responsible for the strategic management of Charleston’s product and portfolio management, alliance management, regulatory oversight, and global commercialization activities. Prior to Charleston, Mr. Hazelton began his career at Novartis Pharmaceuticals Corporation ("Novartis”), where over 15 years, he ascended to roles of increasing responsibility based on his leadership, innovation, and results. While at Novartis, Mr. Hazelton held leadership positions within the core functions of sales, marketing, market access, pricing, contracting, and strategic alliances for various retail and specialty pharmaceuticals across a broad spectrum of therapeutic areas and several blockbuster products. Neither Charleston nor Novartis is a parent, subsidiary or other affiliate of Dyadic. Mr. Hazelton earned his B.A. from the College of the Holy Cross in Worcester, MA.

Ronen Tchelet, Ph.D., Vice President of Research and Business Development

Ronen Tchelet, Ph.D. joined Dyadic in May 2014, and has been our Vice President of Research and Business Development since January 2016. Since joining Dyadic, Dr. Tchelet has been a key contributor to Dyadic’s transformation into a pharmaceutical biotech company. Prior to joining Dyadic, Dr. Tchelet was the founder and Managing Director of Codexis Laboratories Hungary kft. ("CLH”) and a Vice President of Codexis Inc. from 2007 through 2014. While at CLH, Dr. Tchelet established a state-of-the-art laboratory for strain engineering and all aspects of fermentation including process optimization and scale up. During this time period, Dr. Tchelet also led a collaboration that successfully developed C1 technology for the Biofuel and the Bio-Industrial enzymes applications. Dr. Tchelet’s experience in the pharmaceutical industry includes prior employment at TEVA Pharmaceutical Industries LTD ("TEVA”), API Division during the late 2000’s to 2006. While at TEVA, he served as a Chief Technology Officer of Biotechnology and head of TEVA’s Biotechnology Research and Development fermentation plant in Hungary. Also, during the period of 2000 through 2005, Dr. Tchelet was the Director of Quality Assurance for TEVA’s flag ship innovative drug, COPAXONE®. Throughout his career, Dr. Tchelet has led several Biotechnology projects that have encompassed all aspects of research and development, operations management, and manufacturing of API’s and biologics. Dr. Tchelet received his Ph.D. in Molecular Microbiology and Biotechnology from Tel Aviv University in 1993 and did his postdoctoral work as an EERO fellow at the Institute of Environmental Science and Technology (EAWAG) in Switzerland.

Matthew Jones, Managing Director of Business Development and Licensing

Matthew Jones joined Dyadic in May 2016 and until July 21, 2022 will serve as our Managing Director of Business Development and Licensing to lead Dyadic’s strategic partnerships, licensing and commercial opportunities within and across the biopharmaceutical industry. A veteran of the life sciences industry with two decades of commercial deal making and leadership experience, Mr. Jones has developed and implemented strategies which have delivered revenue growth, organically and through acquisitions, for a diverse range of life science businesses both in Europe and the US. Prior to joining Dyadic, Mr. Jones served as Chief Commercial Officer for Concept Life Sciences from its formation until 2016. Prior to that, Mr. Jones was Vice President of Global Sales & Business Development at Lonza Biologics, where he implemented new income-generating revenue streams and captured enterprise synergies in manufacturing, research and client/vendor relationships. From 2009 to 2012, Mr. Jones served as Executive Vice President of Business Development & Marketing at Ricerca Biosciences LLC, responsible for strategic partnerships, royalty and asset license optimization and marketing effectiveness and where Mr. Jones supported the Bain Ventures trade sale of the business toward WiL research. From 2003 to 2009, Mr. Jones was Senior Vice President of Business Development at MDS Pharma Services Inc., where he was responsible for global biopharmaceutical and clinical commercial growth strategies. Earlier in his career, Mr. Jones also held senior level leadership roles within the biopharmaceutical industry with Alkermes, Inc. and GlaxoSmithKline plc. Mr. Jones is a graduate of Warwick University and London Business School.

Summary Compensation Table

The following table summarizes the compensation paid or accrued to our “named executive officers” (as defined by the SEC’s disclosure requirements) during the fiscal years 2021 and 2020:

Salary | Bonus | Stock Awards | Option Awards | Nonequity incentive plan compensation | Nonqualified deferred compensation earnings | All other payments | |||||||||||||||||||||||||||

Name and Principal Position | Year | ($) | ($)(1) | ($) | ($)(2)(3) | ($) | ($) | ($) (4) | Total ($) | ||||||||||||||||||||||||

Mark A. Emalfarb (*) | 2021 | $ | 525,000 | $ | 210,000 | $ | — | $ | 531,168 | $ | — | $ | — | $ | 24,491 | $ | 1,290,659 | ||||||||||||||||

President, CEO and Director | 2020 | $ | 500,000 | $ | 200,000 | $ | — | $ | 657,342 | $ | — | $ | — | $ | 24,291 | $ | 1,381,633 | ||||||||||||||||

Ping Rawson | 2021 | $ | 238,703 | $ | 59,676 | $ | — | $ | 199,188 | $ | — | $ | — | $ | 11,600 | $ | 509,167 | ||||||||||||||||

Chief Financial Officer | 2020 | $ | 231,750 | $ | 57,938 | $ | — | $ | 164,336 | $ | — | $ | — | $ | 11,400 | $ | 465,424 | ||||||||||||||||

Joseph Hazelton (5) | 2021 | $ | 34,545 | $ | 12,000 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 46,545 | ||||||||||||||||

Chief Business Officer | 2020 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

Ronen Tchelet, Ph.D. (6) | 2021 | $ | 232,776 | $ | 22,467 | $ | — | $ | 168,458 | $ | — | $ | — | $ | — | $ | 423,701 | ||||||||||||||||

VP of Research and Business Development | 2020 | $ | 217,865 | $ | 42,052 | $ | — | $ | 154,301 | $ | — | $ | — | $ | — | $ | 414,218 | ||||||||||||||||

Matthew Jones (7) | 2021 | $ | 309,813 | $ | 23,164 | $ | — | $ | 187,175 | $ | — | $ | — | $ | — | $ | 520,152 | ||||||||||||||||

Managing Dir. of Bus. Dev and Licensing | 2020 | $ | 276,410 | $ | 88,906 | $ | — | $ | 154,301 | $ | — | $ | — | $ | — | $ | 519,617 | ||||||||||||||||

___________________

Notes:

(*) Mr. Emalfarb also serves on the Board, for which he receives no direct, indirect, or incremental compensation.

(1) | All 2021 bonuses were accrued as of December 31, 2021, and paid in January 2022. All 2020 bonuses were accrued as of December 31, 2020, and paid in January 2021. |

(2) | The Option Awards amount reported in this column represented stock options granted in 2021 and 2020 (including annual share-based compensation awards for all named executives), vesting upon grant, or the one or four-year anniversary in accordance with their individual employment agreement or consulting agreement. |

(3) | The Option Awards amount reported in this column represented the grant date fair market value of each option granted, computed in accordance with FASB ASC Topic 718. These amounts do not correspond to the actual value that will be recognized by the named executive officers. The assumptions used in the valuation of these awards are consistent with the valuation methodologies specified in the notes to our consolidated financial statements. The table above does not include the value of 75,000 performance-based vesting stock options, as the achievement of the conditions was not deemed probable at the grant date, and the value of the awards was deemed zero in accordance with ASC 718 for Mr. Hazelton. The value of the performance-based stock options at the grant date would be $175,000, assuming the highest level of performance for the options granted during 2021. |

(4) | Other payments include following: |

• | Mr. Emalfarb received $12,891 for car allowance for each of 2021 and 2020. The Company’s contribution to the 401(k) retirement plan were $11,600 and $11,400 for 2021 and 2020, respectively. |

• | Ms. Rawson received $11,600 and $11,400 for the Company’s contribution to the 401(k) retirement plan in 2021 and 2020, respectively. |

| (5) | The Company appointed Mr. Hazelton as its Chief Business Officer, effective November 9, 2021. | |

(6) | The amounts represent the compensation for services of Mr. Tchelet for the year ended December 31, 2021, and 2020, in accordance with the Sky Blue Biotech Agreement indicated below. |

(7) | The amounts represent the compensation for services of Mr. Jones for the year ended December 31, 2021, and 2020, in accordance with the Jones Consultant Agreement indicated below. Mr. Jones will cease providing services to the Company effective July 21, 2022. |

Employment Arrangements

Mark A. Emalfarb

On June 21, 2016, the Company entered into an employment agreement (the “Emalfarb Agreement”) with Mr. Emalfarb. The Emalfarb Agreement has an initial term of three years and automatic renewals of two years at the end of each term, unless either party provides a notice of nonrenewal, and provides that Mr. Emalfarb be employed as our President and Chief Executive Officer and that we will cause Mr. Emalfarb to be elected as a member of the Board. The material terms of the Emalfarb Agreement are summarized below:

Base Salary and Bonus. The Emalfarb Agreement provided for an annual base salary of $375,000, which was increased to $405,000 in January 2019, to $475,000 in June 2019, to $500,000 in January 2021, and to $525,000 in January 2022. The Emalfarb Agreement also provided for an annual bonus award, with the timing and amount of any such bonus determined in the sole discretion of the Compensation Committee of the Board, which determined to award Mr. Emalfarb a cash bonus of $200,000 for 2020 and 2021.

Performance Stock Options. The Emalfarb Agreement provided Mr. Emalfarb the opportunity to be awarded annual stock option grants, each such annual option incentive stock option grant will be to purchase up to three hundred thousand (300,000) shares of common stock (the “Maximum Option Bonus”) based on performance achievements. Performance incentives will be based solely on the Compensation Committee’s evaluation of Mr. Emalfarb’s performance during that period.

For fiscal year 2021, Mr. Emalfarb was awarded a stock option grant to purchase 200,000 shares of common stock for his annual performance (granted in 2022), representing 66.7% of the Maximum Option Bonus. For each of fiscal years 2020 and 2019, Mr. Emalfarb was awarded 300,000 shares of common stock for his annual performance (granted in 2021 and 2020, respectively), representing 100% of the Maximum Option Bonus.

All options granted to Mr. Emalfarb for fiscal years 2021, 2020, and 2019 vest annually in equal installments over four years and have a ten-year term from the date of grant. All options granted to Mr. Emalfarb for prior fiscal years vested immediately upon grant and have a five-year term from the date of grant.