AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 22 Jul 15, 12:00am

Filed by PartnerRe Ltd.

pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: AXIS Capital Holdings Limited

Commission File No.: 001-31721

PartnerRe & AXIS: Enhanced Merger of Equals July 21, 2015

1 PartnerRe, AXIS, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of PartnerRe is set forth in its Annual Report on Form 10 - K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 1, 2014, its Quarterly Report on Form 10 - Q for the quarter ended March 31, 2015, which was filed with the SEC on May 4, 2015 and its Current Reports on Form 8 - K, which were filed with the SEC on January 29, 2015, May 16, 2014 and March 27, 2014. Information about the directors and executive officers of AXIS is set forth in its Annual Report on Form 10 - K for the year ended December 31, 2014, which was filed with the SEC on February 23, 2015, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014, its Quarterly Report on Form 10 - Q for the quarter ended March 31, 2015, which was filed with the SEC on May 4, 2015 and its Current Report on Form 8 - K, which was filed with the SEC on March 11, 2015, January 29, 2015, August 7, 2014, June 26, 2014, March 27, 2014 and February 26, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. DISCLAIMER Participants in Solicitation

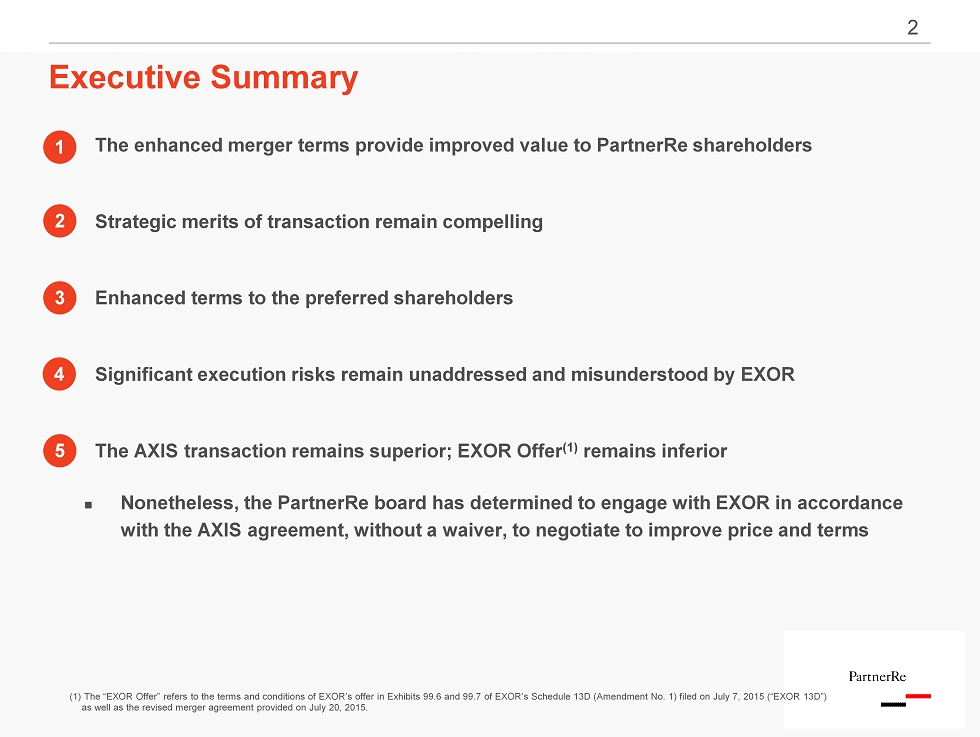

2 The enhanced merger terms provide improved value to PartnerRe shareholders Strategic merits of transaction remain compelling Enhanced terms to the preferred shareholders Significant execution risks remain unaddressed and misunderstood by EXOR The AXIS transaction remains superior; EXOR Offer (1) remains inferior Nonetheless, the PartnerRe board has determined to engage with EXOR in accordance with the AXIS agreement, without a waiver, to negotiate to improve price and terms Executive Summary 1 2 3 5 4 (1) The “EXOR Offer” refers to the terms and conditions of EXOR’s offer in Exhibits 99.6 and 99.7 of EXOR’s Schedule 13D (Ame ndm ent No. 1) filed on July 7, 2015 (“EXOR 13D”) as well as the revised merger agreement provided on July 20, 2015.

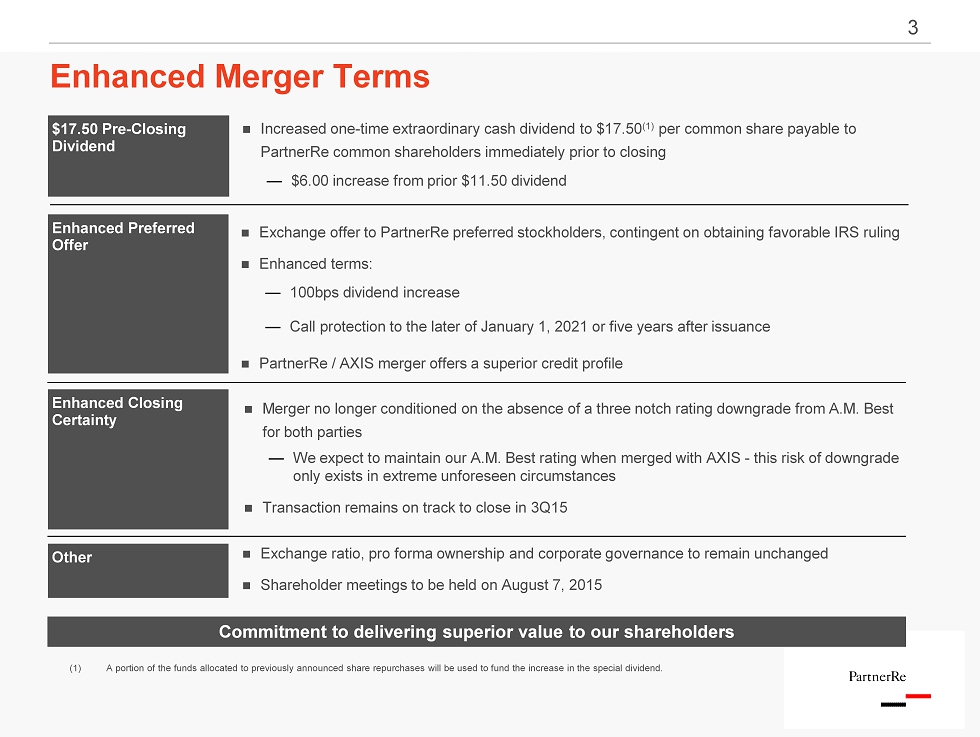

3 Enhanced Merger Terms $17.50 Pre - Closing Dividend Enhanced Preferred Offer Enhanced Closing Certainty Other Increased one - time extraordinary cash dividend to $17.50 (1) per common share payable to PartnerRe common shareholders immediately prior to closing — $6.00 increase from prior $11.50 dividend Exchange offer to PartnerRe preferred stockholders, contingent on obtaining favorable IRS ruling Enhanced terms: — 100bps dividend increase — Call protection to the later of January 1, 2021 or five years after issuance PartnerRe / AXIS merger offers a superior credit profile Merger no longer conditioned on the absence of a three notch rating downgrade from A.M. Best for both parties — We expect to maintain our A.M. Best rating when merged with AXIS - this risk of downgrade only exists in extreme unforeseen circumstances Transaction remains on track to close in 3Q15 Exchange ratio, pro forma ownership and corporate governance to remain unchanged Shareholder meetings to be held on August 7, 2015 (1) A portion of the funds allocated to previously announced share repurchases will be used to fund the increase in the special d ivi dend. Commitment to delivering superior value to our shareholders

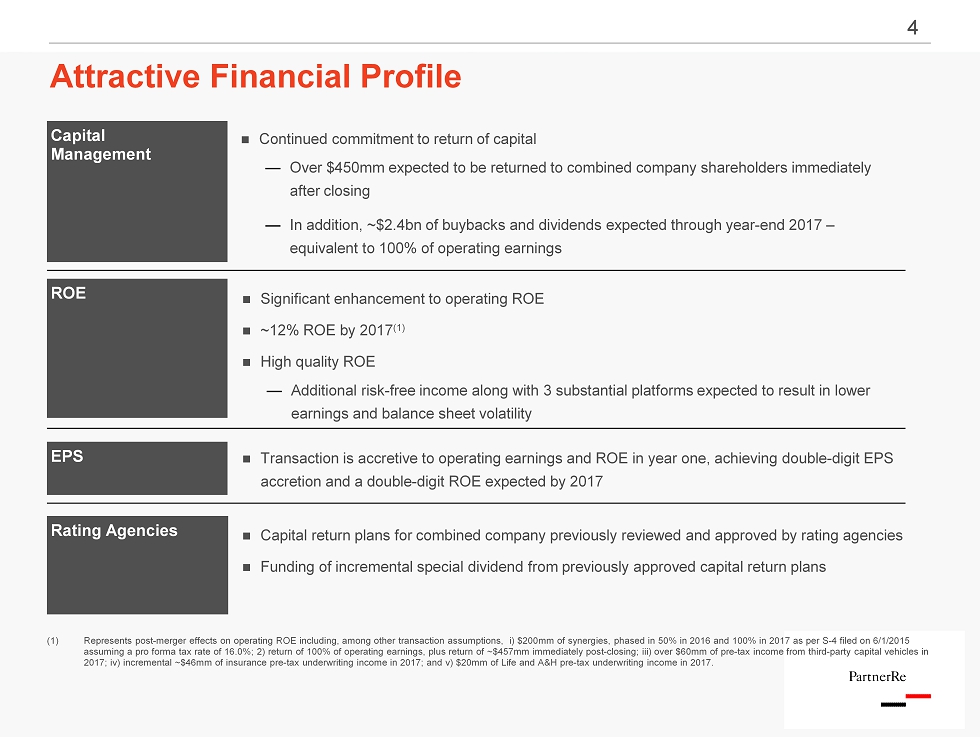

4 Attractive Financial Profile Rating Agencies Capital Management EPS ROE Capital return plans for combined company previously reviewed and approved by rating agencies Funding of incremental special dividend from previously approved capital return plans Continued commitment to return of capital — Over $450mm expected to be returned to combined company shareholders immediately after closing — In addition, ~$2.4bn of buybacks and dividends expected through year - end 2017 – equivalent to 100% of operating earnings Transaction is accretive to operating earnings and ROE in year one, achieving double - digit EPS accretion and a double - digit ROE expected by 2017 Significant enhancement to operating ROE ~12% ROE by 2017 (1) High quality ROE — Additional risk - free income along with 3 substantial platforms expected to result in lower earnings and balance sheet volatility (1) Represents post - merger effects on operating ROE including, among other transaction assumptions, i) $200mm of synergies, phased in 50% in 2016 and 100% in 2017 as per S - 4 filed on 6/1/2015 assuming a pro forma tax rate of 16.0%; 2) return of 100% of operating earnings, plus return of ~$457mm immediately post - closing ; iii) over $60mm of pre - tax income from third - party capital vehicles in 2017; iv) incremental ~$46mm of insurance pre - tax underwriting income in 2017; and v) $20mm of Life and A&H pre - tax underwriting income in 2017.

5 Improvement in Merger Terms is to the Further Benefit of PartnerRe Shareholders ▪ PartnerRe’s Board of Directors (“BoD”) previously supported the merger of equals with AXIS as delivering the most compelling opportunity for PartnerRe shareholders ─ Merger allows PartnerRe to invest in the primary insurance business without paying a control premium and benefit from the ongoing consolidation of the reinsurance industry ─ Continuity of interest allows PartnerRe shareholders to benefit from substantial financial and operational synergies and significant immediate and future value creation ─ Enhancement in merger terms makes deal even more compelling for both PartnerRe common and preferred shareholders ─ Merger continues to deliver compelling economics to both PartnerRe and AXIS shareholders, with double digit EPS accretion and double digit ROE expected by 2017 ▪ PartnerRe Board of Directors has continued to focus on doing all it can to maximize value for its shareholders ─ Circumstances allowed negotiation of improved terms with AXIS ─ In enhancing terms, PartnerRe has been able to deliver its shareholders additional cash value through the increased extraordinary dividend ─ Immediate return of capital post merger close to continue, with the return of more than a further $450mm ─ Most recent revised EXOR offer continues to validate the Board’s approach to maximize shareholder value

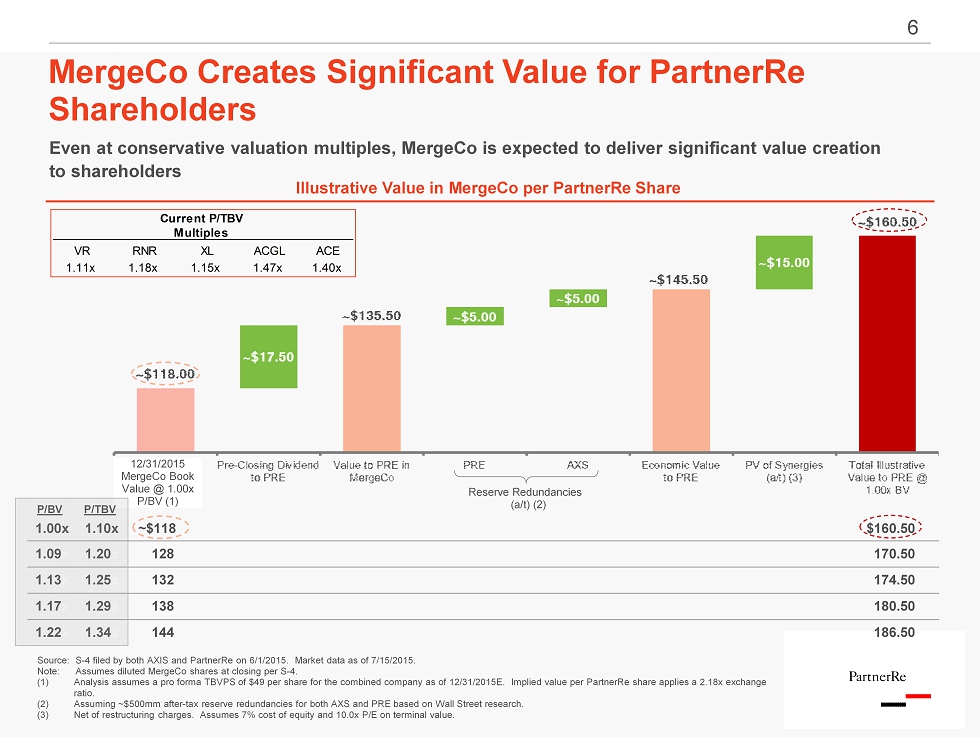

6 12/31/2015 MergeCo Book Value @ 1.00x P/BV (1) 6 MergeCo Creates Significant Value for PartnerRe Shareholders Source: S - 4 filed by both AXIS and PartnerRe on 6/1/2015. Market data as of 7/15/2015. Note: Assumes diluted MergeCo shares at closing per S - 4. (1) Analysis assumes a pro forma TBVPS of $49 per share for the combined company as of 12/31/2015E. Implied value per PartnerRe sha re applies a 2.18x exchange ratio. (2) Assuming ~$500mm after - tax reserve redundancies for both AXS and PRE based on Wall Street research. (3) Net of restructuring charges. Assumes 7% cost of equity and 10.0x P/E on terminal value. Reserve Redundancies (a/t) (2) 1.00x 1.10x ~$118 $160.50 1.09 x 1.20 x 128 170.50 1.13 x 1.25 x 132 174.50 1.17 x 1.29 x 138 180.50 1.22 x 1.34 x 144 186.50 P/BV P/TBV Illustrative Value in MergeCo per PartnerRe Share Even at conservative valuation multiples, MergeCo is expected to deliver significant value creation to shareholders Current P/TBV Multiples VR RNR XL ACGL ACE 1.11x 1.18x 1.15x 1.47x 1.40x

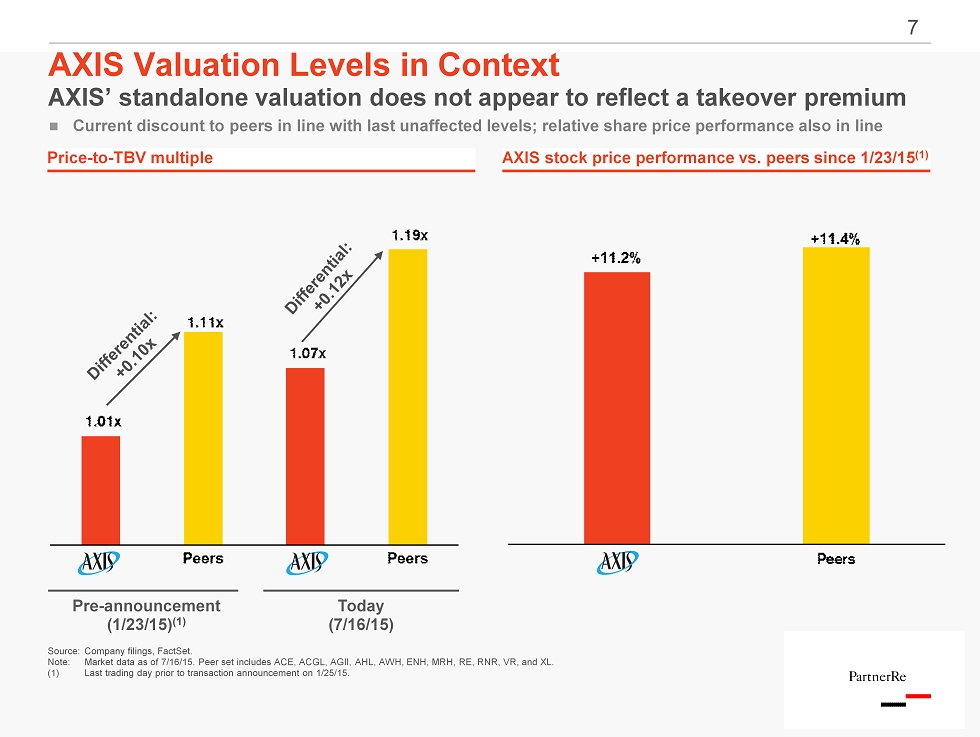

7 Source: Company filings, FactSet. Note: Market data as of 7/16/15. Peer set includes ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL. (1) Last trading day prior to transaction announcement on 1/25/15. AXIS Valuation Levels in Context AXIS’ standalone valuation does not appear to reflect a takeover premium Price - to - TBV multiple AXIS stock price performance vs. peers since 1/23/15 (1) Pre - announcement (1/23/15) (1) Today (7/16/15) Current discount to peers in line with last unaffected levels; relative share price performance also in line

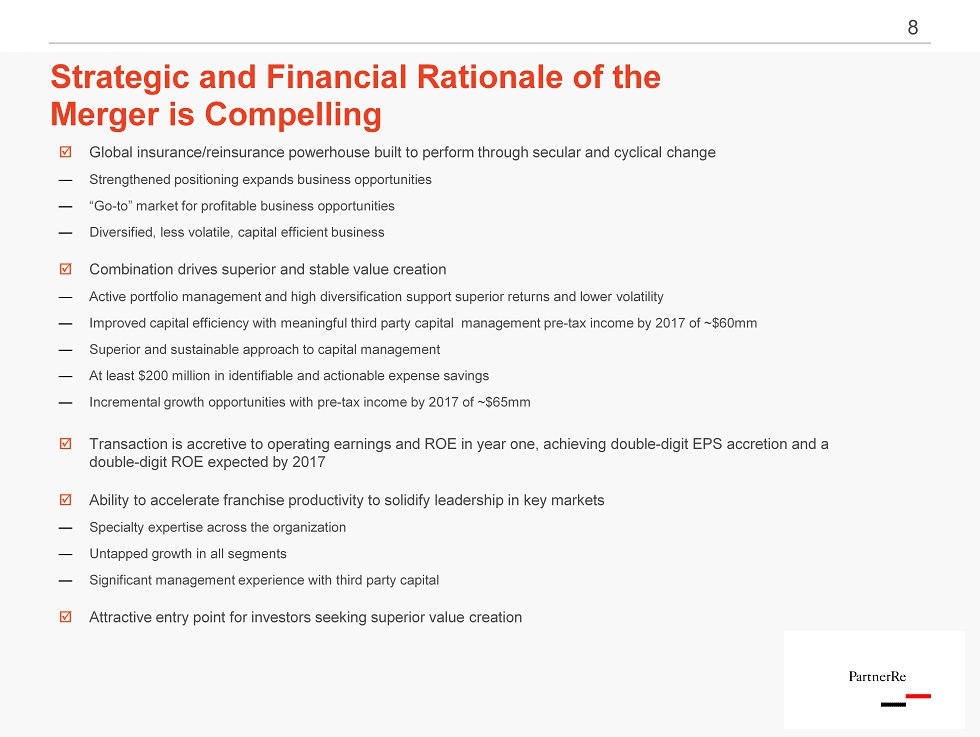

8 Strategic and Financial Rationale of the Merger is Compelling Global insurance/reinsurance powerhouse built to perform through secular and cyclical change — Strengthened positioning expands business opportunities — “Go - to” market for profitable business opportunities — Diversified, less volatile, capital efficient business Combination drives superior and stable value creation — Active portfolio management and high diversification support superior returns and lower volatility — Improved capital efficiency with meaningful third party capital management pre - tax income by 2017 of ~$60mm — Superior and sustainable approach to capital management — At least $200 million in identifiable and actionable expense savings — Incremental growth opportunities with pre - tax income by 2017 of ~$65mm Transaction is accretive to operating earnings and ROE in year one, achieving double - digit EPS accretion and a double - digit ROE expected by 2017 Ability to accelerate franchise productivity to solidify leadership in key markets — Specialty expertise across the organization — Untapped growth in all segments — Significant management experience with third party capital Attractive entry point for investors seeking superior value creation

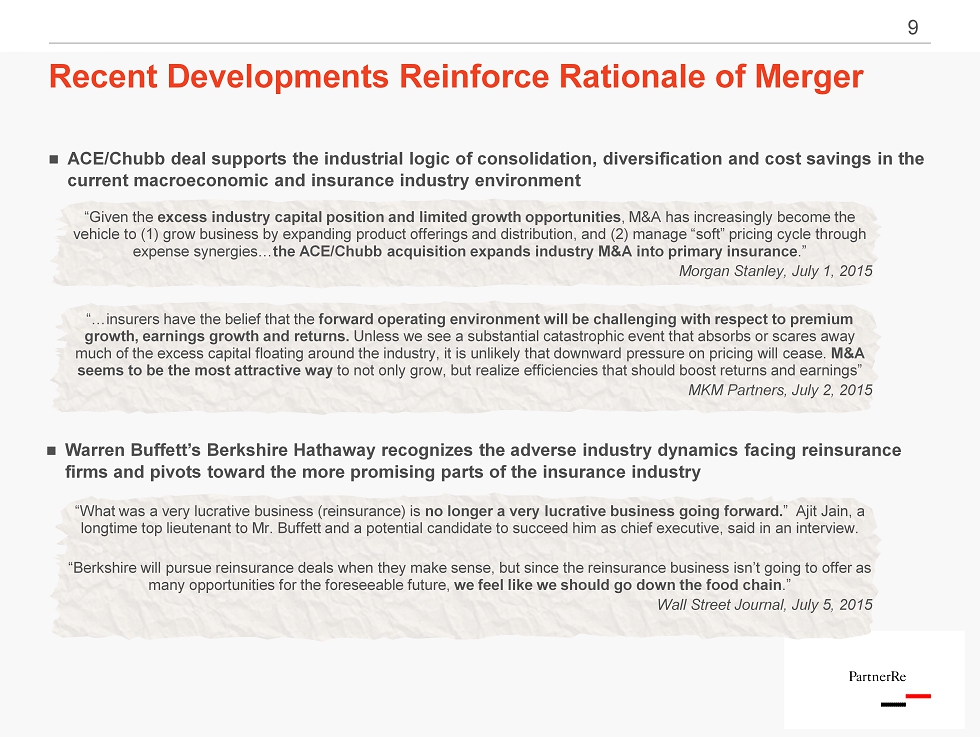

9 Recent Developments Reinforce Rationale of Merger ACE/Chubb deal supports the industrial logic of consolidation, diversification and cost savings in the current macroeconomic and insurance industry environment “What was a very lucrative business (reinsurance) is no longer a very lucrative business going forward. ” Ajit Jain, a longtime top lieutenant to Mr. Buffett and a potential candidate to succeed him as chief executive, said in an interview. “Berkshire will pursue reinsurance deals when they make sense, but since the reinsurance business isn’t going to offer as many opportunities for the foreseeable future, we feel like we should go down the food chain .” Wall Street Journal, July 5, 2015 “Given the excess industry capital position and limited growth opportunities , M&A has increasingly become the vehicle to (1) grow business by expanding product offerings and distribution, and (2) manage “soft” pricing cycle through expense synergies… the ACE/Chubb acquisition expands industry M&A into primary insurance .” Morgan Stanley, July 1, 2015 “…insurers have the belief that the forward operating environment will be challenging with respect to premium growth, earnings growth and returns. Unless we see a substantial catastrophic event that absorbs or scares away much of the excess capital floating around the industry, it is unlikely that downward pressure on pricing will cease. M&A seems to be the most attractive way to not only grow, but realize efficiencies that should boost returns and earnings” MKM Partners, July 2, 2015 Warren Buffett’s Berkshire Hathaway recognizes the adverse industry dynamics facing reinsurance firms and pivots toward the more promising parts of the insurance industry

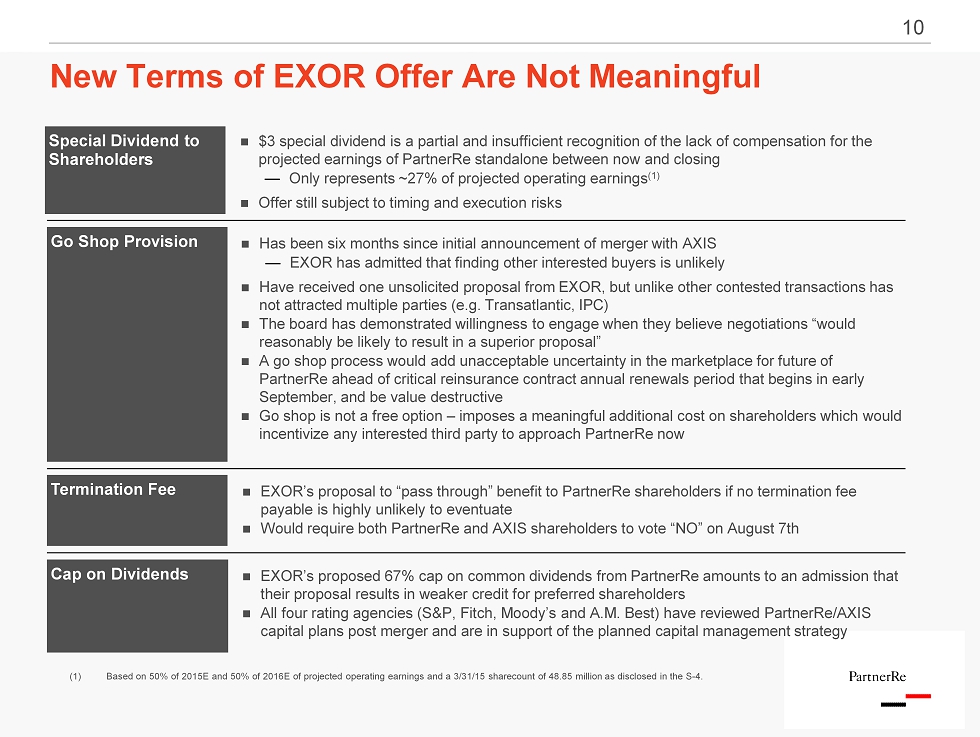

10 New Terms of EXOR Offer Are Not Meaningful Cap on Dividends Go Shop Provision Termination Fee Has been six months since initial announcement of merger with AXIS — EXOR has admitted that finding other interested buyers is unlikely Have received one unsolicited proposal from EXOR, but unlike other contested transactions has not attracted multiple parties (e.g. Transatlantic, IPC) The board has demonstrated willingness to engage when they believe negotiations “would reasonably be likely to result in a superior proposal” A go shop process would add unacceptable uncertainty in the marketplace for future of PartnerRe ahead of critical reinsurance contract annual renewals period that begins in early September, and be value destructive Go shop is not a free option – imposes a meaningful additional cost on shareholders which would incentivize any interested third party to approach PartnerRe now EXOR’s proposed 67% cap on common dividends from PartnerRe amounts to an admission that their proposal results in weaker credit for preferred shareholders All four rating agencies (S&P, Fitch, Moody’s and A.M. Best) have reviewed PartnerRe/AXIS capital plans post merger and are in support of the planned capital management strategy EXOR’s proposal to “pass through” benefit to PartnerRe shareholders if no termination fee payable is highly unlikely to eventuate Would require both PartnerRe and AXIS shareholders to vote “NO” on August 7th Special Dividend to Shareholders $3 special dividend is a partial and insufficient recognition of the lack of compensation for the projected earnings of PartnerRe standalone between now and closing — Only represents ~27% of projected operating earnings (1) Offer still subject to timing and execution risks (1) Based on 50% of 2015E and 50% of 2016E of projected operating earnings and a 3/31/15 sharecount of 48.85 million as disclosed in the S - 4.

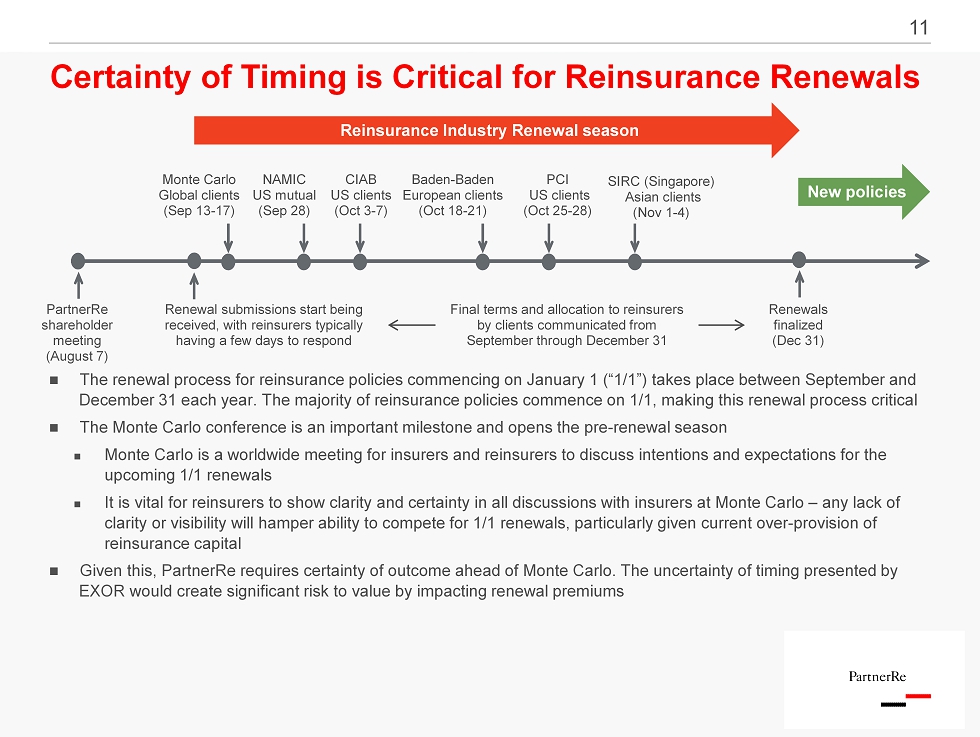

11 Certainty of Timing is Critical for Reinsurance Renewals Monte Carlo Global clients (Sep 13 - 17) PartnerRe shareholder meeting (August 7) The renewal process for reinsurance policies commencing on January 1 (“1/1”) takes place between September and December 31 each year. The majority of reinsurance policies commence on 1/1, making this renewal process critical The Monte Carlo conference is an important milestone and opens the pre - renewal season Monte Carlo is a worldwide meeting for insurers and reinsurers to discuss intentions and expectations for the upcoming 1/1 renewals It is vital for reinsurers to show clarity and certainty in all discussions with insurers at Monte Carlo – any lack of clarity or visibility will hamper ability to compete for 1/1 renewals, particularly given current over - provision of reinsurance capital Given this, PartnerRe requires certainty of outcome ahead of Monte Carlo. The uncertainty of timing presented by EXOR would create significant risk to value by impacting renewal premiums Reinsurance Industry Renewal season CIAB US clients (Oct 3 - 7) Baden - Baden European clients (Oct 18 - 21) PCI US clients (Oct 25 - 28) SIRC (Singapore) Asian clients (Nov 1 - 4) Renewals finalized (Dec 31) Renewal submissions start being received, with reinsurers typically having a few days to respond Final terms and allocation to reinsurers by clients communicated from September through December 31 New policies NAMIC US mutual (Sep 28)

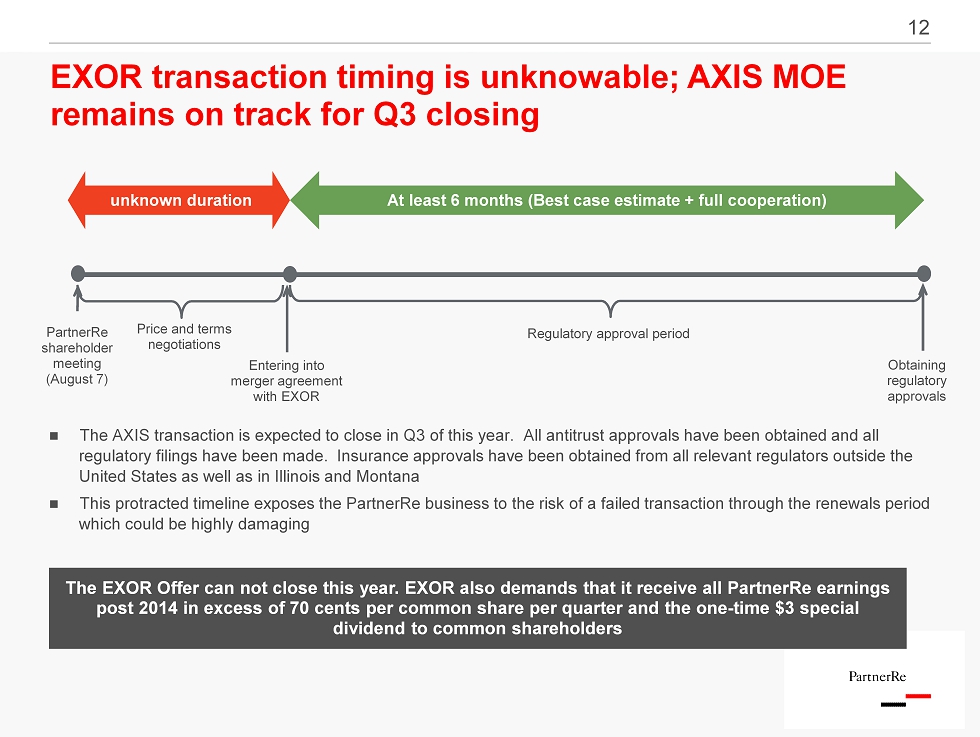

12 EXOR transaction timing is unknowable; AXIS MOE remains on track for Q3 closing Entering into merger agreement with EXOR unknown duration At least 6 months (Best case estimate + full cooperation) PartnerRe shareholder meeting (August 7) Regulatory approval period The EXOR Offer can not close this year. EXOR also demands that it receive all PartnerRe earnings post 2014 in excess of 70 cents per common share per quarter and the one - time $3 special dividend to common shareholders The AXIS transaction is expected to close in Q3 of this year. All antitrust approvals have been obtained and all regulatory filings have been made. Insurance approvals have been obtained from all relevant regulators outside the United States as well as in Illinois and Montana This protracted timeline exposes the PartnerRe business to the risk of a failed transaction through the renewals period which could be highly damaging Obtaining regulatory approvals Price and terms negotiations

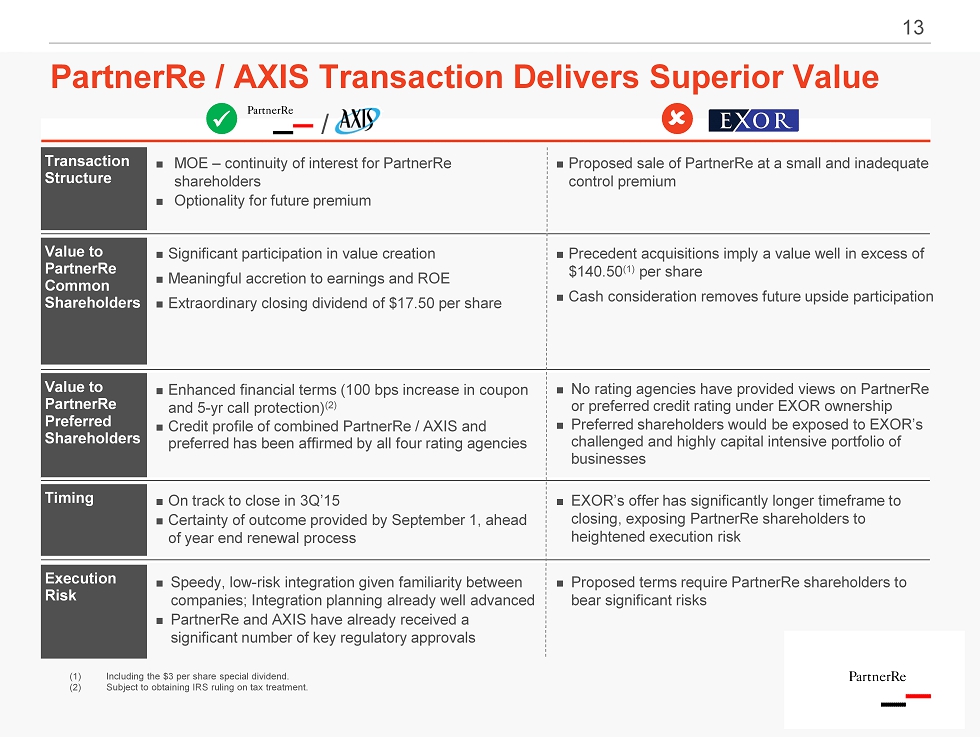

13 PartnerRe / AXIS Transaction Delivers Superior Value Transaction Structure Value to PartnerRe Common Shareholders Value to PartnerRe Preferred Shareholders Precedent acquisitions imply a value well in excess of $140.50 (1) per share Cash consideration removes future upside participation No rating agencies have provided views on PartnerRe or preferred credit rating under EXOR ownership Preferred shareholders would be exposed to EXOR’s challenged and highly capital intensive portfolio of businesses / Proposed sale of PartnerRe at a small and inadequate control premium Significant participation in value creation Meaningful accretion to earnings and ROE Extraordinary closing dividend of $17.50 per share Enhanced financial terms (100 bps increase in coupon and 5 - yr call protection) (2) Credit profile of combined PartnerRe / AXIS and preferred has been affirmed by all four rating agencies MOE – continuity of interest for PartnerRe shareholders Optionality for future premium Execution Risk Proposed terms require PartnerRe shareholders to bear significant risks Speedy, low - risk integration given familiarity between companies; Integration planning already well advanced PartnerRe and AXIS have already received a significant number of key regulatory approvals x Timing EXOR’s offer has significantly longer timeframe to closing, exposing PartnerRe shareholders to heightened execution risk On track to close in 3Q’15 Certainty of outcome provided by September 1, ahead of year end renewal process (1) Including the $3 per share special dividend. (2) Subject to obtaining IRS ruling on tax treatment.

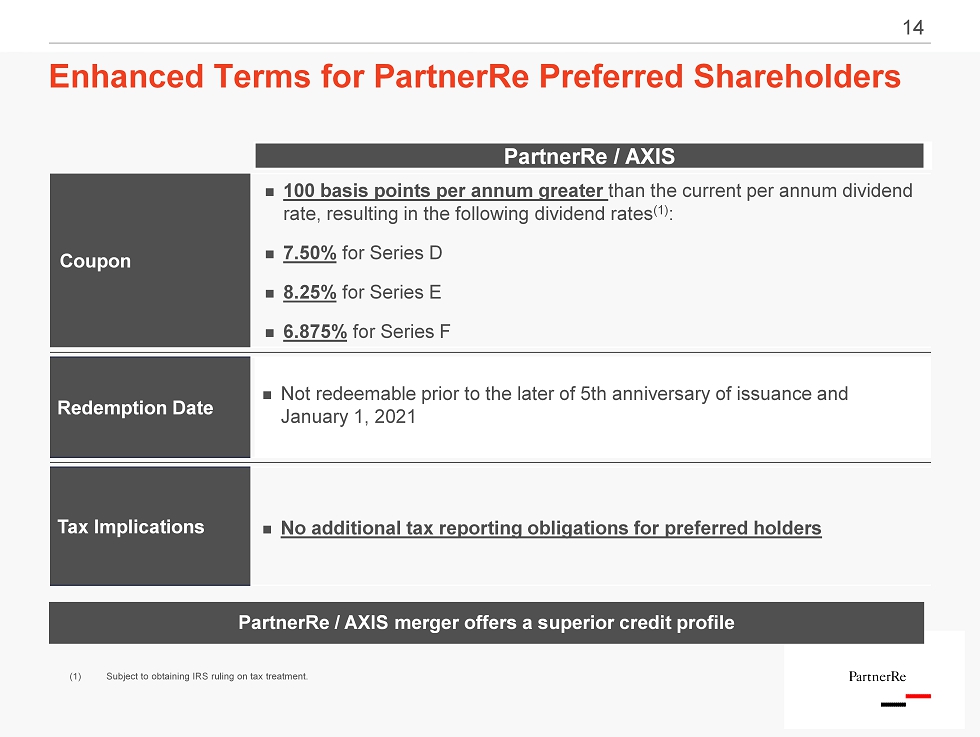

14 PartnerRe / AXIS Coupon 100 basis points per annum greater than the current per annum dividend rate, resulting in the following dividend rates (1) : 7.50% for Series D 8.25% for Series E 6.875% for Series F Redemption Date Not redeemable prior to the later of 5th anniversary of issuance and January 1, 2021 Tax Implications No additional tax reporting obligations for preferred holders Enhanced Terms for PartnerRe Preferred Shareholders (1) Subject to obtaining IRS ruling on tax treatment. PartnerRe / AXIS merger offers a superior credit profile

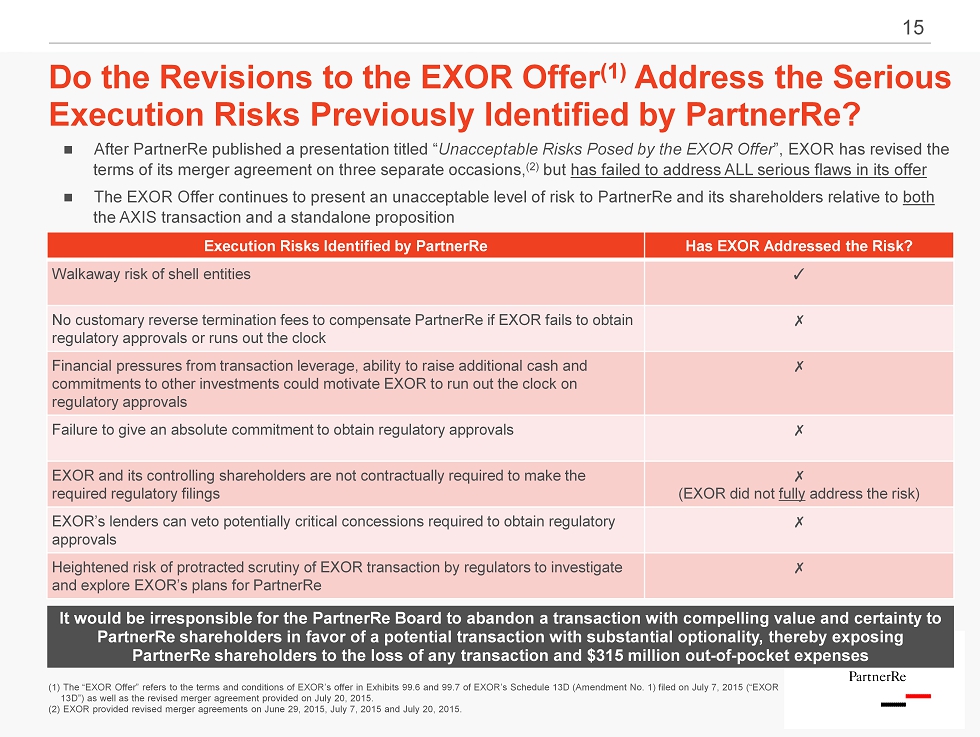

15 Do the Revisions to the EXOR Offer (1) Address the Serious Execution Risks Previously Identified by PartnerRe? After PartnerRe published a presentation titled “ Unacceptable Risks Posed by the EXOR Offer ”, EXOR has revised the terms of its merger agreement on three separate occasions, (2) but has failed to address ALL serious flaws in its offer The EXOR Offer continues to present an unacceptable level of risk to PartnerRe and its shareholders relative to both the AXIS transaction and a standalone proposition Execution Risks Identified by PartnerRe Has EXOR Addressed the Risk? Walkaway risk of shell entities ✓ No customary reverse termination fees to compensate PartnerRe if EXOR fails to obtain regulatory approvals or runs out the clock ✗ Financial pressures from transaction leverage, ability to raise additional cash and commitments to other investments could motivate EXOR to run out the clock on regulatory approvals ✗ Failure to give an absolute commitment to obtain regulatory approvals ✗ EXOR and its controlling shareholders are not contractually required to make the required regulatory filings ✗ (EXOR did not fully address the risk) EXOR’s lenders can veto potentially critical concessions required to obtain regulatory approvals ✗ Heightened risk of protracted scrutiny of EXOR transaction by regulators to investigate and explore EXOR’s plans for PartnerRe ✗ (1) The “EXOR Offer” refers to the terms and conditions of EXOR’s offer in Exhibits 99.6 and 99.7 of EXOR’s Schedule 13D (Ame ndm ent No. 1) filed on July 7, 2015 (“EXOR 13D”) as well as the revised merger agreement provided on July 20, 2015. (2) EXOR provided revised merger agreements on June 29, 2015, July 7, 2015 and July 20, 2015. It would be irresponsible for the PartnerRe Board to abandon a transaction with compelling value and certainty to PartnerRe shareholders in favor of a potential transaction with substantial optionality, thereby exposing PartnerRe shareholders to the loss of any transaction and $315 million out - of - pocket expenses

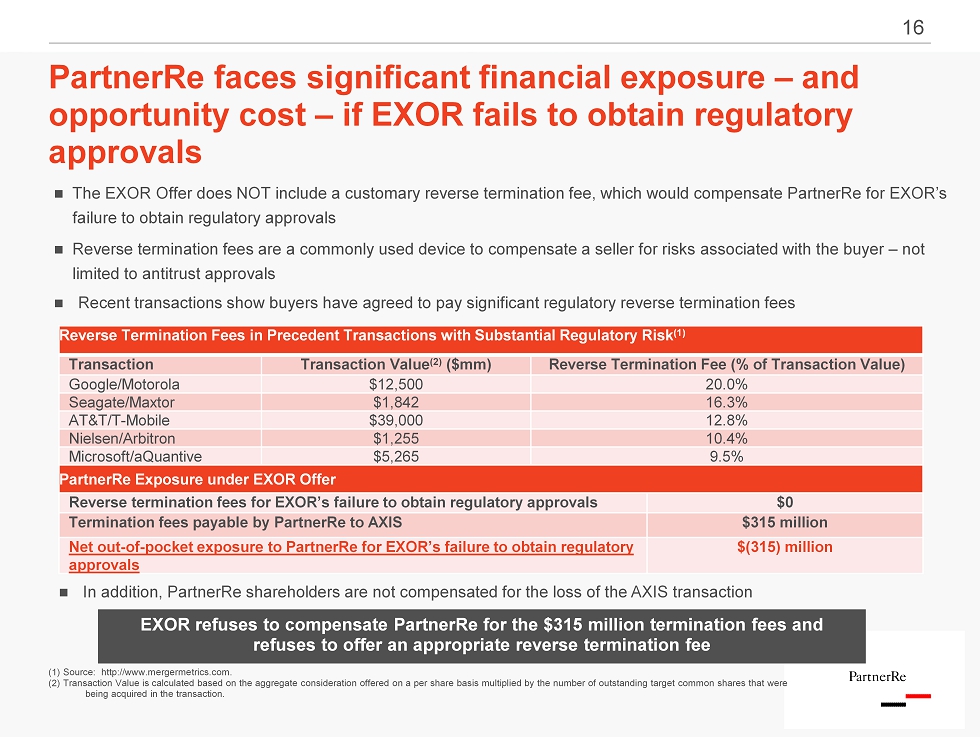

16 PartnerRe faces significant financial exposure – and opportunity cost – if EXOR fails to obtain regulatory approvals (1) Source: http://www.mergermetrics.com. (2) Transaction Value is calculated based on the aggregate consideration offered on a per share basis multiplied by the numbe r o f outstanding target common shares that were being acquired in the transaction. The EXOR Offer does NOT include a customary reverse termination fee, which would compensate PartnerRe for EXOR’s failure to obtain regulatory approvals Reverse termination fees are a commonly used device to compensate a seller for risks associated with the buyer – not limited to antitrust approvals Recent transactions show buyers have agreed to pay significant regulatory reverse termination fees Reverse Termination Fees in Precedent Transactions with Substantial Regulatory Risk (1) Transaction Transaction Value (2) ($mm) Reverse Termination Fee (% of Transaction Value) Google/Motorola $12,500 20.0% Seagate/Maxtor $1,842 16.3% AT&T/T - Mobile $39,000 12.8% Nielsen/Arbitron $1,255 10.4% Microsoft/aQuantive $5,265 9.5% PartnerRe Exposure under EXOR Offer Reverse termination fees for EXOR’s failure to obtain regulatory approvals $0 Termination fees payable by PartnerRe to AXIS $315 million Net out - of - pocket exposure to PartnerRe for EXOR’s failure to obtain regulatory approvals $(315) million In addition, PartnerRe shareholders are not compensated for the loss of the AXIS transaction EXOR refuses to compensate PartnerRe for the $315 million termination fees and refuses to offer an appropriate reverse termination fee

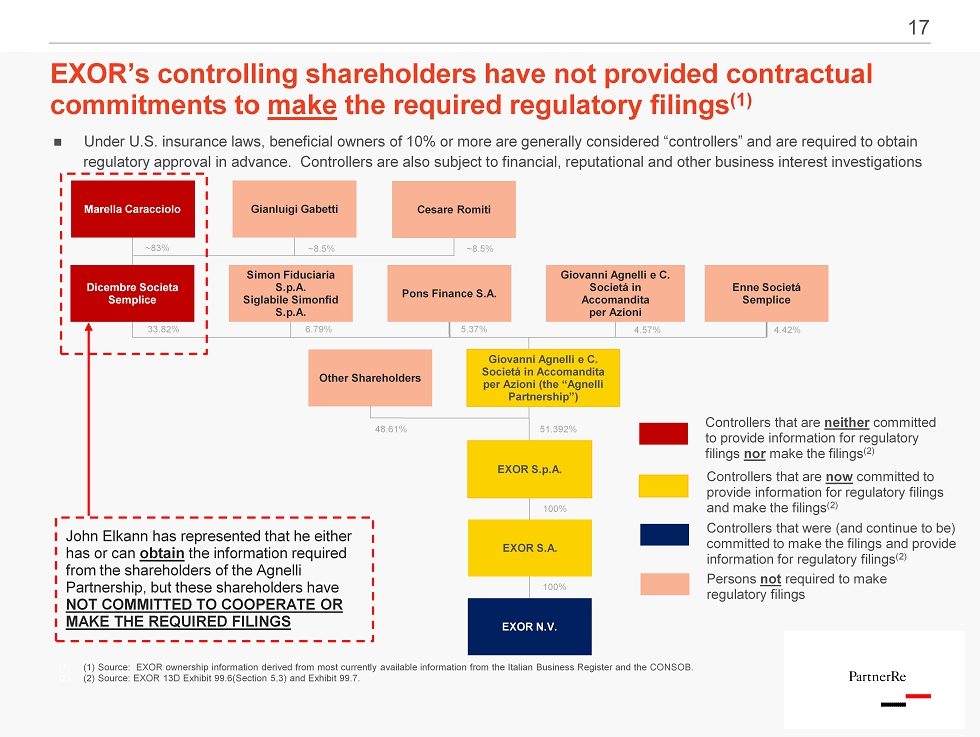

17 EXOR’s controlling shareholders have not provided contractual commitments to make the required regulatory filings (1) Dicembre Societa Semplice Simon Fiduciaria S.p.A. Siglabile Simonfid S.p.A. Pons Finance S.A. Giovanni Agnelli e C. Societá in Accomandita per Azioni Enne Societá Semplice EXOR S.p.A. EXOR S.A. EXOR N.V. Other Shareholders (1) (1) Source: EXOR ownership information derived from most currently available information from the Italian Business Register and the CONSOB. (2) (2) Source: EXOR 13D Exhibit 99.6(Section 5.3) and Exhibit 99.7. 33.82% 6.79% 5.37% 4.57% 4.42% 48.61% 51.392% 100% 100% Marella Caracciolo Controllers that are now committed to provide information for regulatory filings and make the filings (2) Gianluigi Gabetti Cesare Romiti ~83% ~8.5% ~8.5% John Elkann has represented that he either has or can obtain the information required from the shareholders of the Agnelli Partnership, but these shareholders have NOT COMMITTED TO COOPERATE OR MAKE THE REQUIRED FILINGS Under U.S. insurance laws, beneficial owners of 10% or more are generally considered “controllers” and are required to obtain regulatory approval in advance. Controllers are also subject to financial, reputational and other business interest investig ati ons Giovanni Agnelli e C. Societá in Accomandita per Azioni (the “Agnelli Partnership”) Controllers that are neither committed to provide information for regulatory filings nor make the filings (2) Controllers that were (and continue to be) committed to make the filings and provide information for regulatory filings (2) Persons not required to make regulatory filings

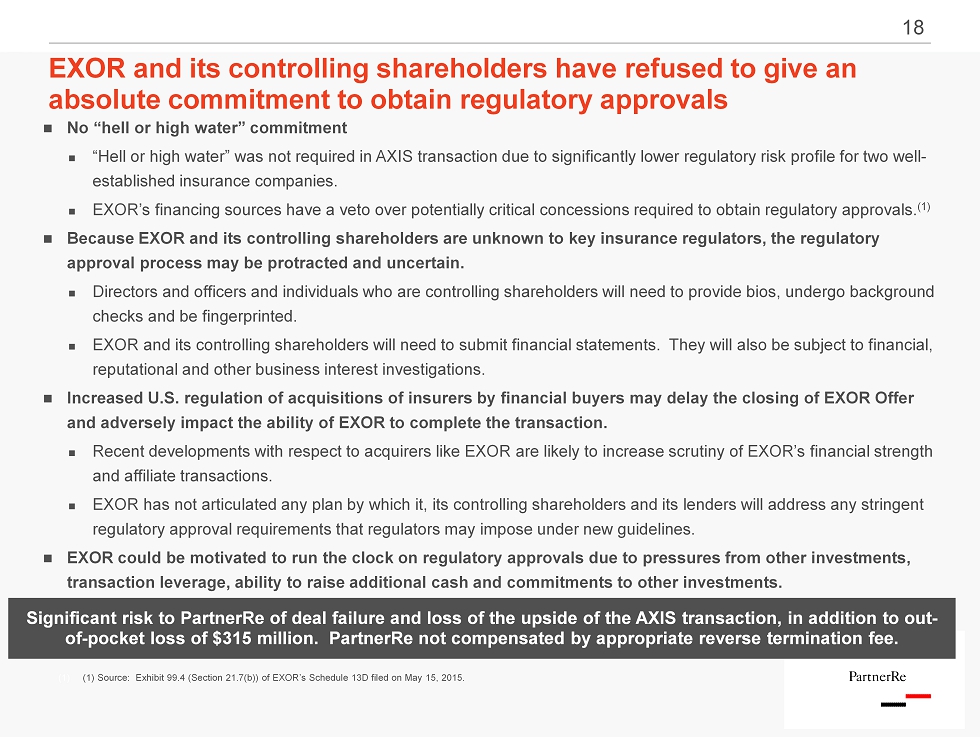

18 No “hell or high water” commitment “ Hell or high water” was not required in AXIS transaction due to significantly lower regulatory risk profile for two well - established insurance companies . EXOR’s financing sources have a veto over potentially critical concessions required to obtain regulatory approvals. (1) Because EXOR and its controlling shareholders are unknown to key insurance regulators , the regulatory approval process may be protracted and uncertain . Directors and officers and individuals who are controlling shareholders will need to provide bios, undergo background checks and be fingerprinted. EXOR and its controlling shareholders will need to submit financial statements. They will also be subject to financial, reputational and other business interest investigations. Increased U.S. regulation of acquisitions of insurers by financial buyers may delay the closing of EXOR Offer and adversely impact the ability of EXOR to complete the transaction. Recent developments with respect to acquirers like EXOR are likely to increase scrutiny of EXOR’s financial strength and affiliate transactions. EXOR has not articulated any plan by which it, its controlling shareholders and its lenders will address any stringent regulatory approval requirements that regulators may impose under new guidelines. EXOR could be motivated to run the clock on regulatory approvals due to pressures from other investments, transaction leverage, ability to raise additional cash and commitments to other investments. EXOR and its controlling shareholders have refused to give an absolute commitment to obtain regulatory approvals Significant risk to PartnerRe of deal failure and loss of the upside of the AXIS transaction, in addition to out - of - pocket loss of $315 million. PartnerRe not compensated by appropriate reverse termination fee. (1) (1) Source: Exhibit 99.4 (Section 21.7(b)) of EXOR’s Schedule 13D filed on May 15, 2015.

19 19 This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between PartnerRe Ltd. (“ PartnerRe ”) and AXIS Capital Holdings Limited (“ AXIS ”). In connection with this proposed business combination, PartnerRe and AXIS have filed a registration statement on Form S - 4 with the Securities and Exchange Commission (the “ SEC ”), and a definitive joint proxy statement/prospectus of PartnerRe and AXIS and other documents related to the proposed transaction. This communication is not a substitute for any such documents. The registration statement was declared effective by the SEC on June 1, 2015 and the definitive proxy statement/prospectus has been mailed to shareholders of PartnerRe and AXIS. INVESTORS AND SECURITY HOLDERS OF PARTNERRE AND AXIS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement has been mailed to shareholders of PartnerRe and AXIS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by PartnerRe and/or AXIS through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by PartnerRe are available free of charge on PartnerRe’s internet website at http://www.partnerre.com or by contacting PartnerRe’s Investor Relations Director by email at robin.sidders@partnerre.com or by phone at 1 - 441 - 294 - 5216. Copies of the documents filed with the SEC by AXIS are available free of charge on AXIS’ internet website at http://www.axiscapital.com or by contacting AXIS’ Investor Relations Contact by email at linda.ventresca@axiscapital.com or by phone at 1 - 441 - 405 - 2727. DISCLAIMER Important Information for Investors and Shareholders

20 20 Certain statements in this communication regarding the proposed transaction between PartnerRe and AXIS are “forward - looking” sta tements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “illustrative,” “intend,” “estimate,” “probable,” “project,” “fo rec asts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned ,” “strategy,” and similar expressions, and the negative thereof, are intended to identify forward - looking statements. These forward - looking statements, w hich are subject to risks, uncertainties and assumptions about PartnerRe and AXIS, may include projections of their respective future fin ancial performance, their respective anticipated growth strategies and anticipated trends in their respective businesses. These sta tem ents are only predictions based on current expectations and projections about future events. There are important factors that could cause act ual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achie vem ents expressed or implied by the forward - looking statements, including the risk factors set forth in PartnerRe’s and AXIS’ most recent reports on Form 10 - K, Form 10 - Q and other documents on file with the SEC and the factors given below: the failure to obtain the approval of shareholders of PartnerRe or AXIS in connection with the proposed transaction; the failure to consummate or delay in consummating the proposed transaction for other reasons; the timing to consummate the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obta ine d subject to conditions that are not anticipated; AXIS’ or PartnerRe’s ability to achieve the synergies and value creation contemplated by the proposed transaction; the ability of either PartnerRe or AXIS to effectively integrate their businesses; and the diversion of management time on transaction - related issues. PartnerRe’s forward - looking statements are based on assumptions that PartnerRe believes to be reasonable but that may not prove to be accurate. AXIS’ forward - looking statements are based on assumptions that AXIS believes to be reasonable but that may not prove t o be accurate. Neither PartnerRe nor AXIS can guarantee future results, level of activity, performance or achievements. Moreover , n either PartnerRe nor AXIS assumes responsibility for the accuracy and completeness of any of these forward - looking statements. Partner Re and AXIS assume no obligation to update or revise any forward - looking statements as a result of new information, future events or otherwise, except as may be required by law. Readers are cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof. DISCLAIMER Forward Looking Statements