Exhibit 99.1

Investor Meetings Post - 4Q20

Safe Harbor Statement CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS This presentation contains forward - looking statements within the meaning of section 27 A of the Securities Act of 1933 and section 21 E of the Securities Exchange Act of 1934 . All statements, other than statements of historical facts included in this presentation, including statements regarding our estimates, beliefs, expectations, intentions, strategies or projections are forward - looking statements . We intend these forward - looking statements to be covered by the safe harbor provisions for forward - looking statements in the United States federal securities laws . In some cases, these statements can be identified by the use of forward - looking words such as "may", "should", "could", "anticipate", "estimate", "expect", "plan", "believe", "predict", "potential", "intend" or similar expressions . These forward - looking statements are not historical facts, and are based on current expectations, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond management's control . Forward - looking statements contained in this presentation may include, but are not limited to, information regarding our estimates for catastrophes and other weather - related losses, including losses related to the COVID - 19 pandemic, measurements of potential losses in the fair market value of our investment portfolio and derivative contracts, our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, the outcome of our strategic initiatives, our expectations regarding estimated synergies and the success of the integration of acquired entities, our expectations regarding the estimated benefits and synergies related to our transformation program, our expectations regarding pricing and other market conditions, our growth prospects, and valuations of the potential impact of movements in interest rates, credit spreads, equity securities' prices and foreign currency rates . Forward - looking statements only reflect our expectations and are not guarantees of performance . These statements involve risks, uncertainties, and assumptions . Accordingly, there are or will be important factors that could cause actual events or results to differ materially from those indicated in such statements . We believe that these factors include, but are not limited to, the following : • the adverse impact of the ongoing COVID - 19 pandemic on our business, results of operations, financial condition and liquidity ; • the cyclical nature of the insurance and reinsurance business leading to periods with excess underwriting capacity and unfavorable premium rates ; • the occurrence and magnitude of natural and man - made disasters ; • the impact of global climate change on our business, including the possibility that we do not adequately assess or reserve for the increased frequency and severity of natural catastrophes ; • losses from war, terrorism and political unrest or other unanticipated losses ; • actual claims exceeding our loss reserves ; • general economic, capital and credit market conditions ; • the failure of any of the loss limitation methods we employ ; • the effects of emerging claims, coverage and regulatory issues, including uncertainty related to coverage definitions, limits, terms and conditions ; • our inability to purchase reinsurance or collect amounts due to us ; • the breach by third parties in our program business of their obligations to us ; • difficulties with technology and/or data security ; • the failure of our policyholders and intermediaries to pay premiums ; • the failure of our cedants to adequately evaluate risks ; • inability to obtain additional capital on favorable terms, or at all ; • the loss of one or more of our key executives ; • a decline in our ratings with rating agencies ; • loss of business provided to us by our major brokers and credit risk due to our reliance on brokers ; • changes in accounting policies or practices ; • the use of industry catastrophe models and changes to these models ; • changes in governmental regulations and potential government intervention in our industry ; • inadvertent failure to comply with certain laws and regulations relating to sanctions and foreign corrupt practices ; • increased competition ; • changes in the political environment of certain countries in which we operate or underwrite business including the United Kingdom's withdrawal from the European Union ; • fluctuations in interest rates, credit spreads, equity securities' prices and/or foreign currency values ; • the failure to successfully integrate acquired businesses or realize the expected synergies resulting from such acquisitions ; • the failure to realize the expected benefits or synergies relating to our transformation initiative ; • changes in tax laws ; and • the other factors including but not limited to those described under Item 1 A, 'Risk Factors’ in our most recent Annual Report on Form 10 - K and Part II, Item 1 A 'Risk Factors' in our Quarterly Report on Form 10 - Q for the quarter ended September 30 , 2020 filed with the Securities and Exchange Commission ("SEC"), as those factors may be updated from time to time in our periodic and other filings with the SEC, which are accessible on the SEC's website at www . sec . gov . Readers are urged to carefully consider all such factors as the COVID - 19 pandemic may have the effect of heightening many of the other risks and uncertainties described . We undertake no obligation to update or revise publicly any forward - looking statements, whether as a result of new information, future events or otherwise . 1

Vision: Global Leadership in Specialty Risks Targeting top - quintile profitability with industry average volatility Hybrid model – Insurance & Reinsurance Franchise anchored in leadership positions in key markets and distribution relationships Strong relationships with distributors & clients based on expertise, service, agility and claims Focus on markets where we have demonstrable relevance, scale and path for profitable growth Strategic risk financing capabilities to match the right risk with the right capital Consistent Commitment to Our Strategy Commitment to underwriting excellence, top caliber talent 2

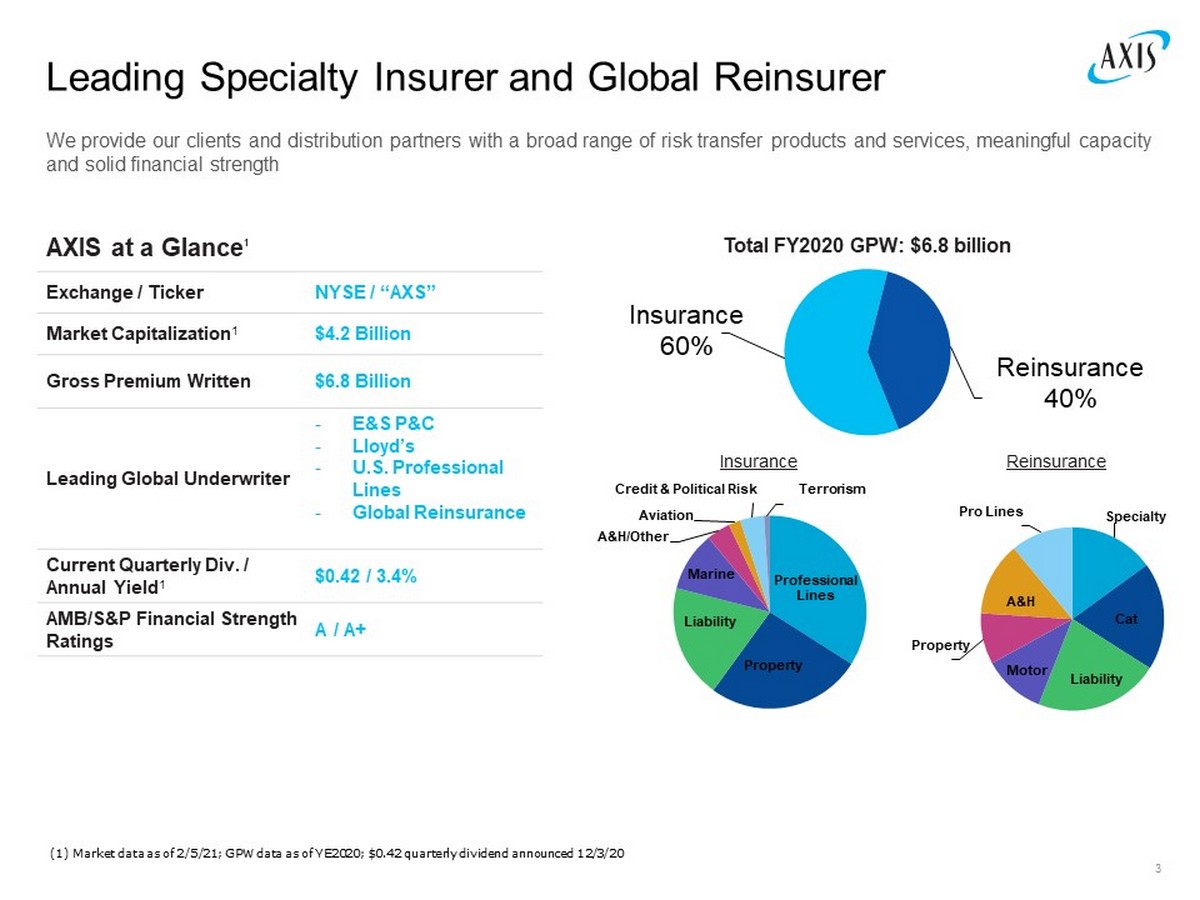

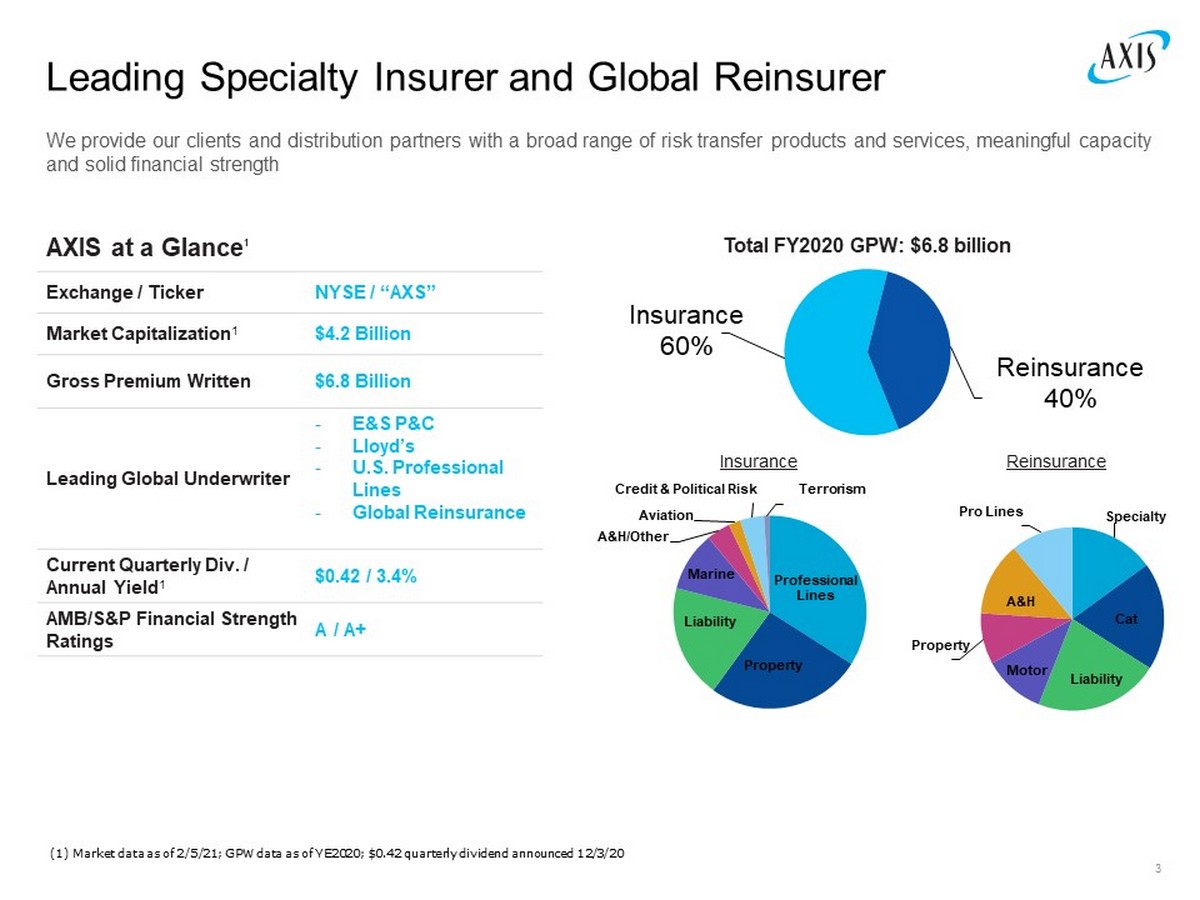

Professional Lines Property Liability Marine A&H/Other Aviation Credit & Political Risk Terrorism AXIS at a Glance 1 Exchange / Ticker NYSE / “AXS” Market Capitalization 1 $4.2 Billion Gross Premium Written $6.8 Billion Leading Global Underwriter - E&S P&C - Lloyd’s - U.S. Professional Lines - Global Reinsurance Current Quarterly Div. / Annual Yield 1 $0.42 / 3.4% AMB/S&P Financial Strength Ratings A / A+ Leading Specialty Insurer and Global Reinsurer We provide our clients and distribution partners with a broad range of risk transfer products and services, meaningful capaci ty and solid financial strength Insurance 60% Reinsurance 40% Total FY2020 GPW: $6.8 billion Specialty Cat Liability Motor Property A&H Pro Lines Insurance Reinsurance (1) Market data as of 2/5/21; GPW data as of YE2020; $0.42 quarterly dividend announced 12/3/20 3

• 100% of staff has the ability to work remotely with no loss in production or capabilities; Engagement scores have improved • Utilizing remote collaboration and meeting technology to keep teams connected, informed and safe; provided a stipend for office and technology equipment. • Allowing for flexible work schedules for employees in need of support due to COVID - 19 related circumstances, as well as a voluntary return - to - office policy through mid - 2021. • Education, training and materials are available to employees on health, mindfulness, wellbeing, and managing remotely. AXIS Responds to the Pandemic 4 CLIENTS & PARTNERS • One of the first P&C companies to release a very transparent and granular loss estimate for the pandemic: $360 million at YE2020 • Underwriting guidelines adjusted to reflect impact of the pandemic and economic uncertainty. • Utilization of collaboration tools to stay connected with our clients and distribution partners, and to quickly address any questions or concerns that may arise. • AXIS committed a $1 million donation to support COVID - 19 relief efforts, including funding to address pressing local needs in the communities where AXIS operates. • The noted contribution above includes $100,000 to support underserved communities that have been disproportionately impacted by the pandemic. COMMUNITIES EMPLOYEES AXIS is committed to supporting our clients, partners, employees and communities as the COVID - 19 situation evolves. The company has been working for a number of years to provide first - class technology platforms to all constituents. Examples of our response:

AXIS : A Profitable Growth Engine • Margin Improvement: Major repositioning of the portfolio over the past 3 years should continue to drive improving results • Attractive Market Position: Over 85% of AXIS’ insurance portfolio is in the markets seeing strong rate improvements including E&S Property, E&S Casualty, Lloyd’s, Professional Lines and a number of areas in Reinsurance • Pricing Momentum: Double - digit growth in core insurance lines of business supported by strong rate increases across virtually every line of business and expected to continue through 2021; Reinsurance pricing gained some momentum during the January renewal season and we look for continued improvement through the remainder of 2021 • Attractive Valuation : Global platform with improving profitability trading below book value with a 3.4% dividend yield (1) 5 (1) Market data for dividend yield as of 2/5/21.

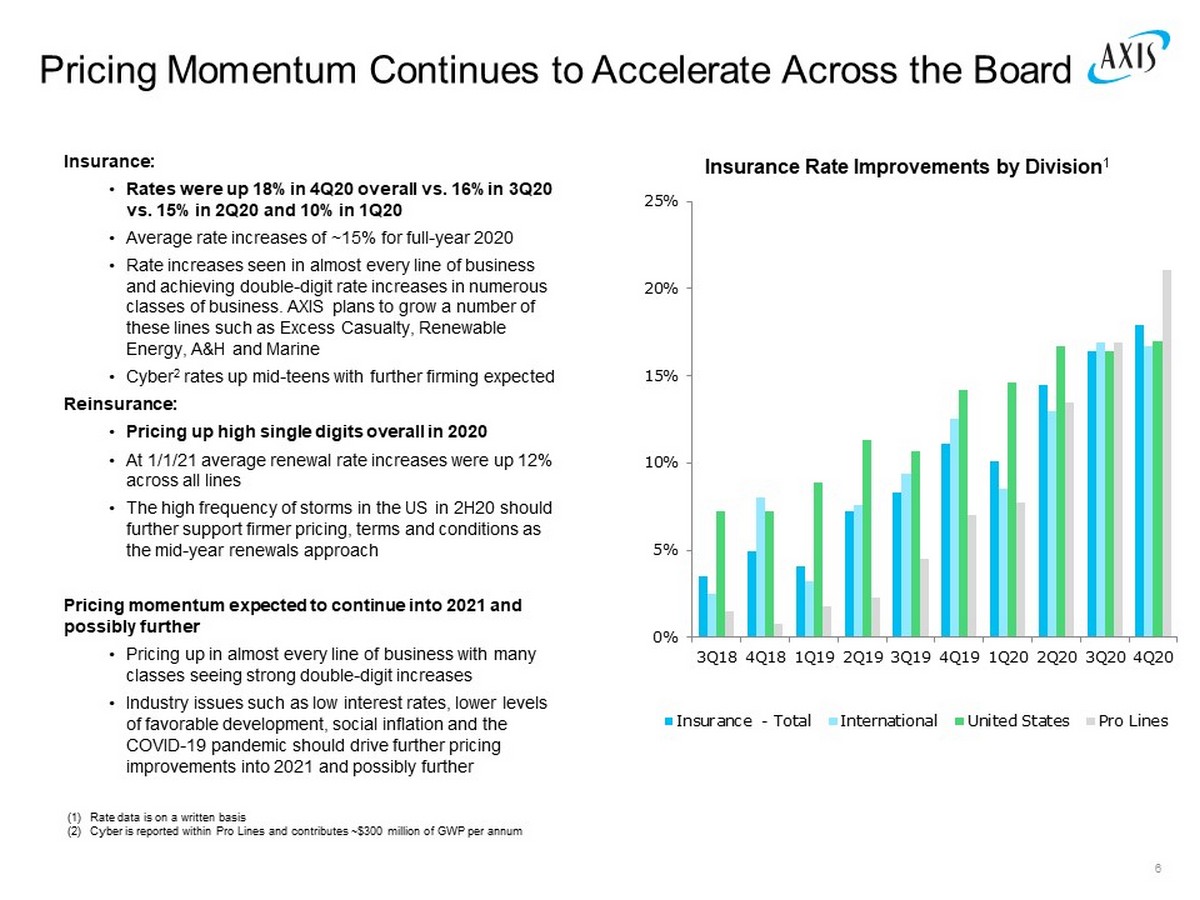

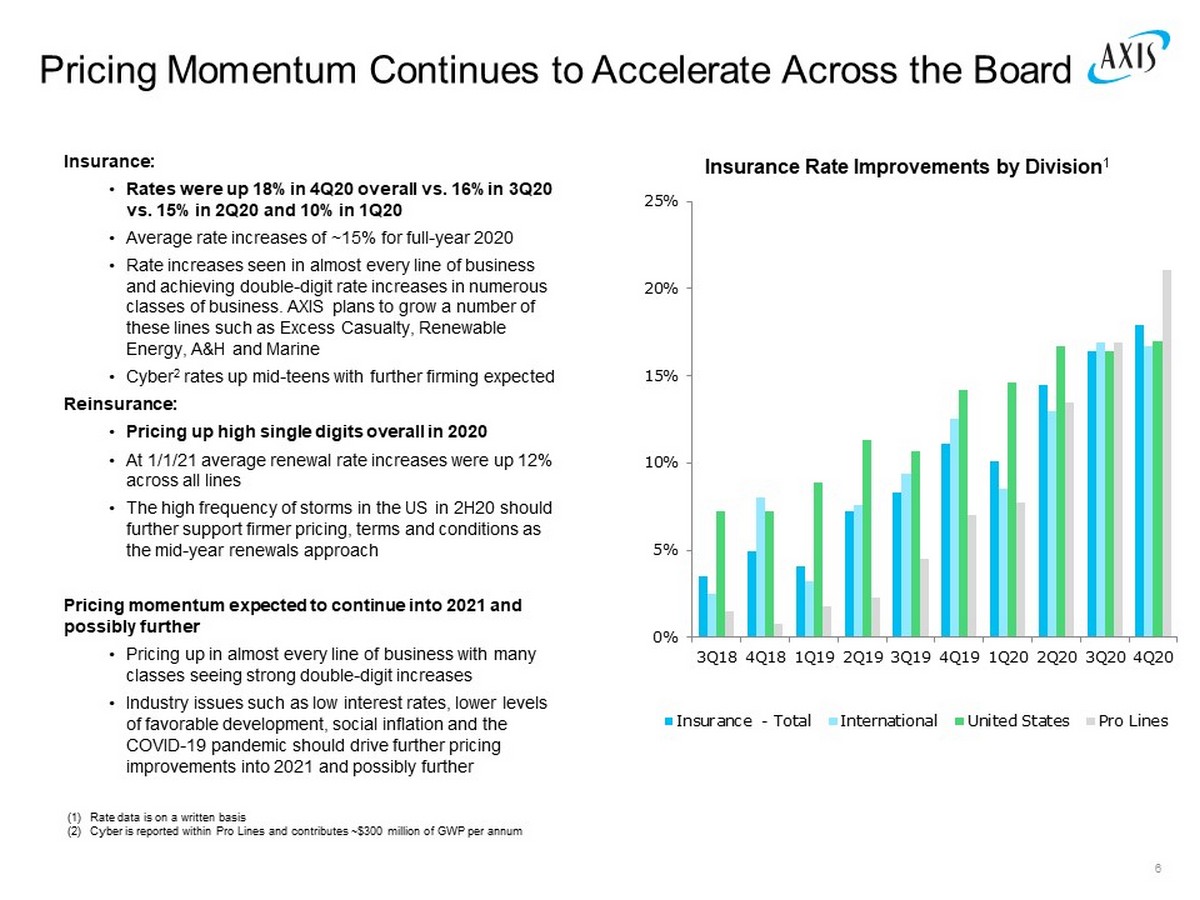

Insurance: • Rates were up 18% in 4Q20 overall vs. 16% in 3Q20 vs. 15% in 2Q20 and 10% in 1Q20 • Average rate increases of ~15% for full - year 2020 • Rate increases seen in almost every line of business and achieving double - digit rate increases in numerous classes of business. AXIS plans to grow a number of these lines such as Excess Casualty, Renewable Energy, A&H and Marine • Cyber 2 rates up mid - teens with further firming expected Reinsurance: • Pricing up high single digits overall in 2020 • At 1/1/21 average renewal rate increases were up 12% across all lines • The high frequency of storms in the US in 2H20 should further support firmer pricing, terms and conditions as the mid - year renewals approach Pricing momentum expected to continue into 2021 and possibly further • Pricing up in almost every line of business with many classes seeing strong double - digit increases • Industry issues such as low interest rates, lower levels of favorable development, social inflation and the COVID - 19 pandemic should drive further pricing improvements into 2021 and possibly further Pricing Momentum Continues to Accelerate Across the Board 6 (1) Rate data is on a written basis (2) Cyber is reported within Pro Lines and contributes ~$300 million of GWP per annum 0% 5% 10% 15% 20% 25% 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Insurance - Total International United States Pro Lines Insurance Rate Improvements by Division 1

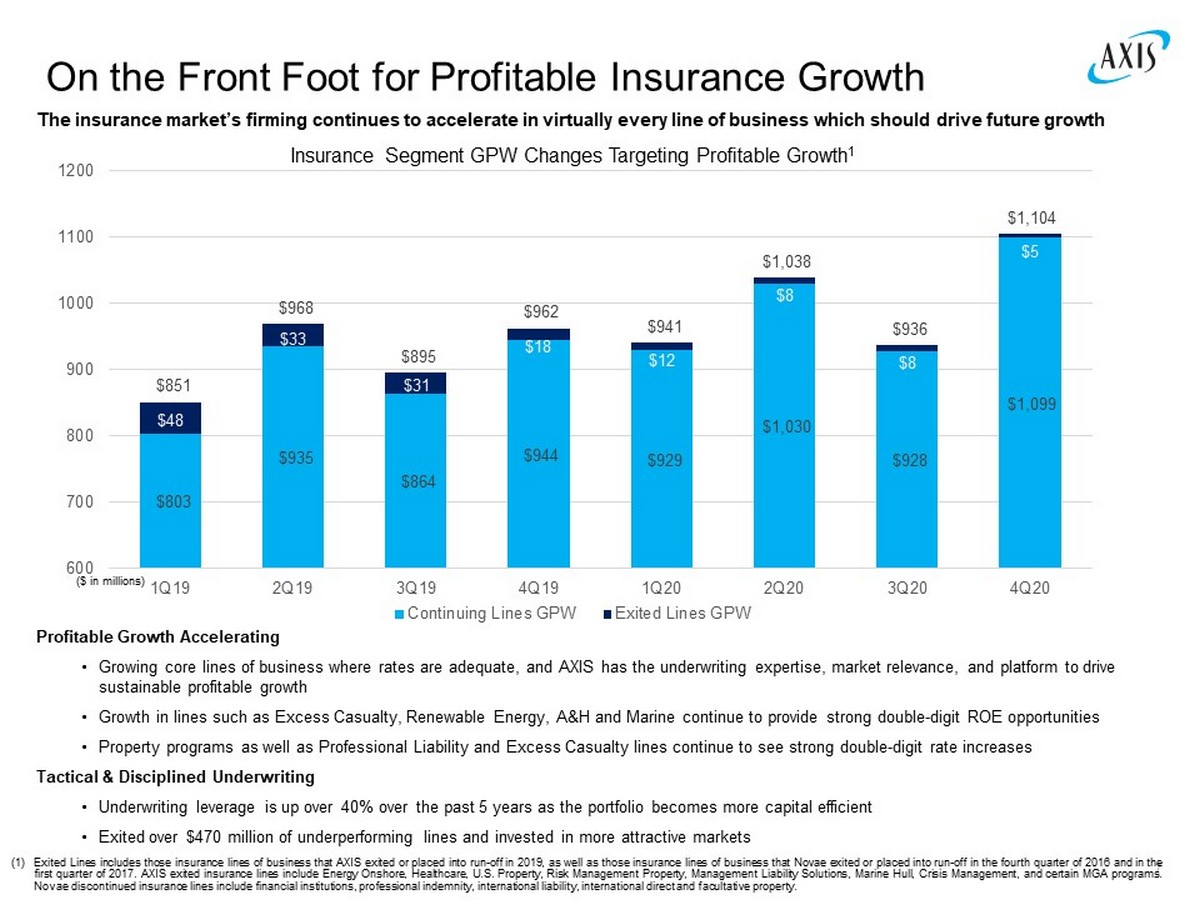

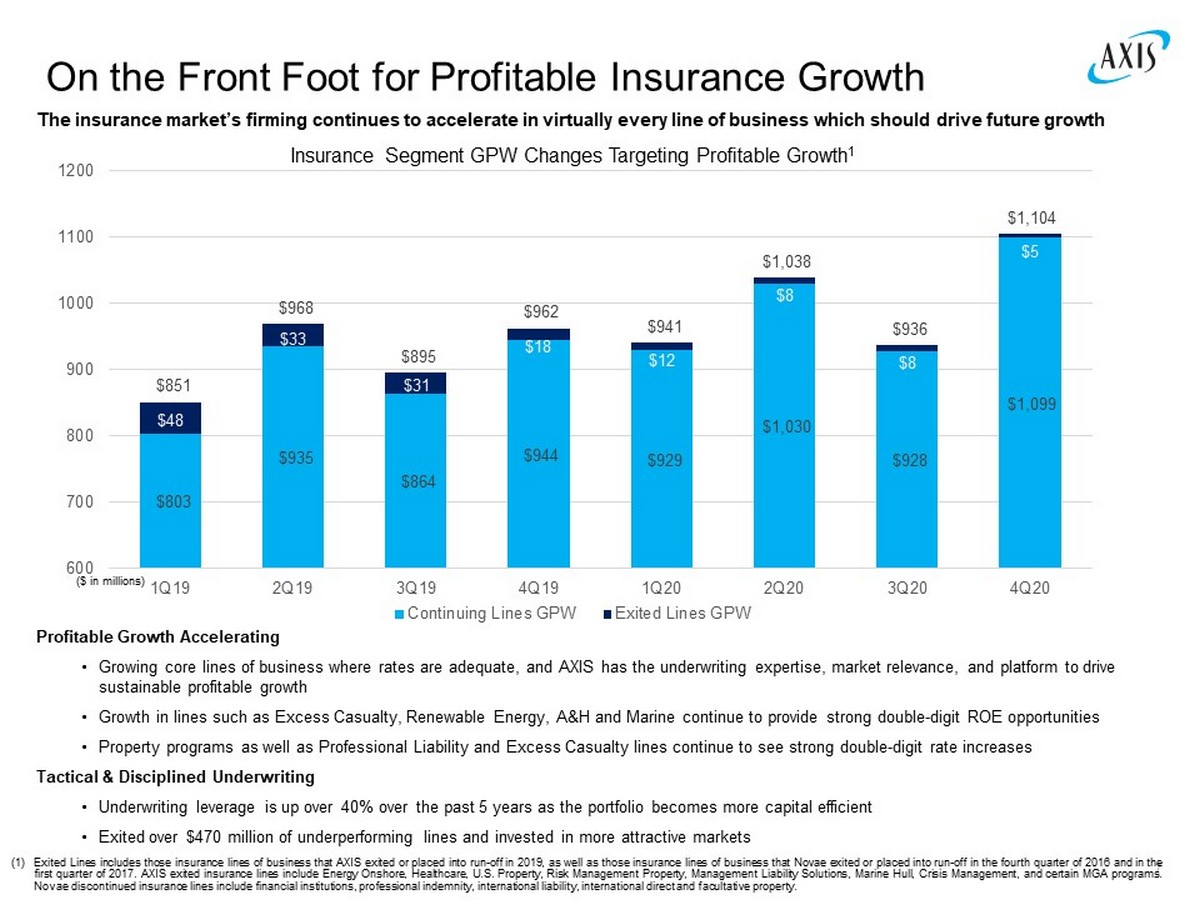

Profitable Growth Accelerating • Growing core lines of business where rates are adequate, and AXIS has the underwriting expertise, market relevance, and platf orm to drive sustainable profitable growth • Growth in lines such as Excess Casualty, Renewable Energy, A&H and Marine continue to provide strong double - digit ROE opportunit ies • Property programs as well as Professional Liability and Excess Casualty lines continue to see strong double - digit rate increases Tactical & Disciplined Underwriting • Underwriting leverage is up over 40% over the past 5 years as the portfolio becomes more capital efficient • Exited over $470 million of underperforming lines and invested in more attractive markets On the Front Foot for Profitable Insurance Growth 7 ($ in millions) (1) Exited Lines includes those insurance lines of business that AXIS exited or placed into run - off in 2019 , as well as those insurance lines of business that Novae exited or placed into run - off in the fourth quarter of 2016 and in the first quarter of 2017 . AXIS exited insurance lines include Energy Onshore, Healthcare, U . S . Property, Risk Management Property, Management Liability Solutions, Marine Hull, Crisis Management, and certain MGA programs . Novae discontinued insurance lines include financial institutions, professional indemnity, international liability, international direct and facultative property . The insurance market’s firming continues to accelerate in virtually every line of business which should drive future growth $803 $935 $864 $944 $929 $1,030 $928 $1,099 $48 $33 $31 $18 $12 $8 $8 $5 $851 $968 $895 $962 $941 $1,038 $936 $1,104 600 700 800 900 1000 1100 1200 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Insurance Segment GPW Changes Targeting Profitable Growth 1 Continuing Lines GPW Exited Lines GPW

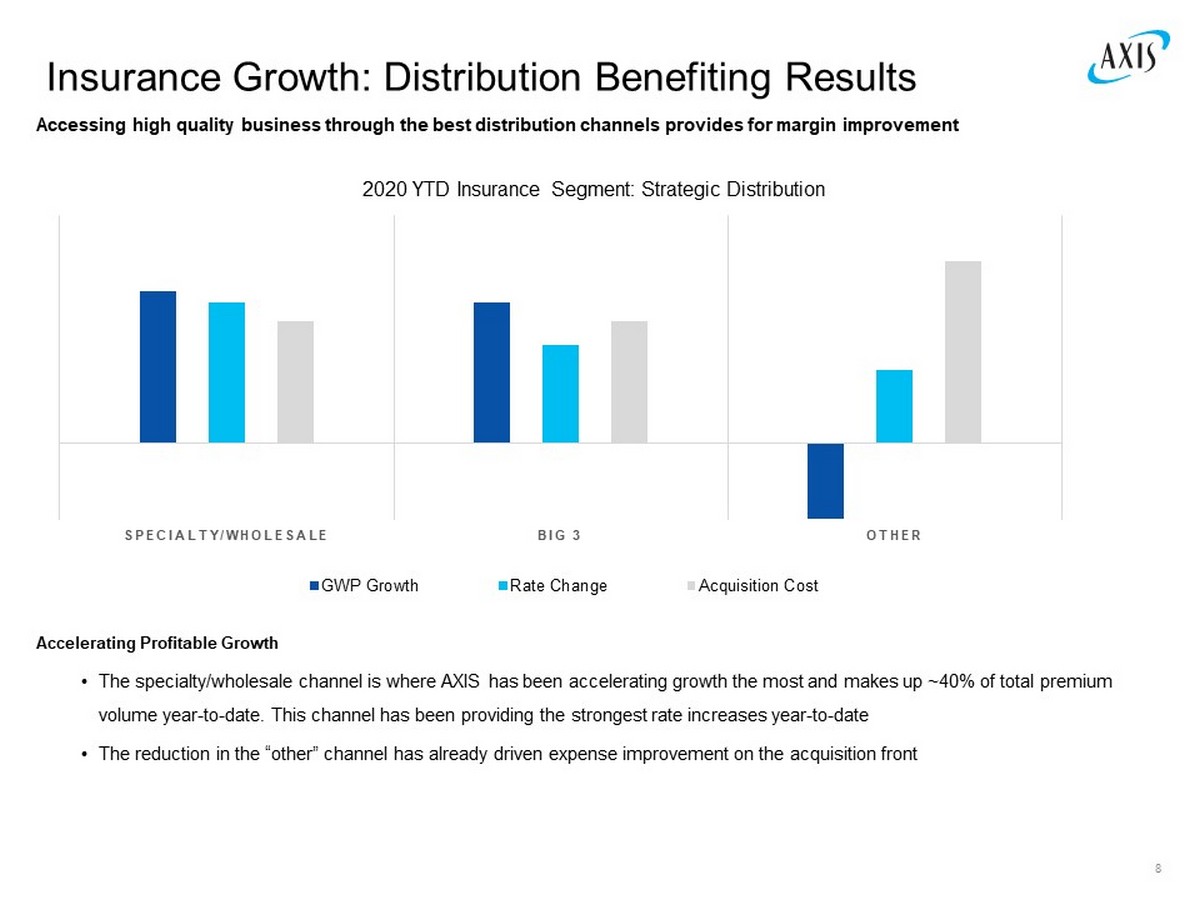

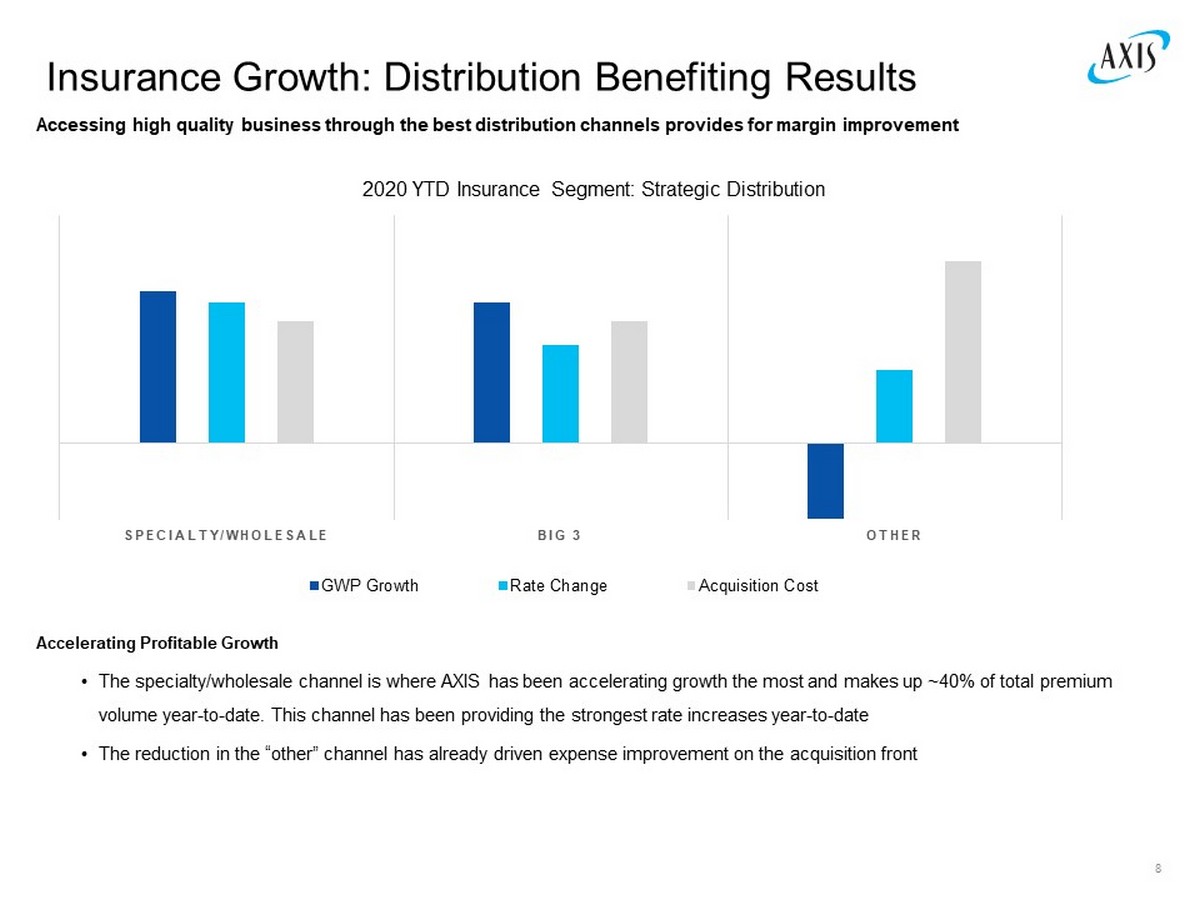

SPECIALTY/WHOLESALE BIG 3 OTHER GWP Growth Rate Change Acquisition Cost Accelerating Profitable Growth • The specialty/wholesale channel is where AXIS has been accelerating growth the most and makes up ~40% of total premium volume year - to - date. This channel has been providing the strongest rate increases year - to - date • The reduction in the “other” channel has already driven expense improvement on the acquisition front Insurance Growth: Distribution Benefiting Results 8 2020 YTD Insurance Segment: Strategic Distribution Accessing high quality business through the best distribution channels provides for margin improvement

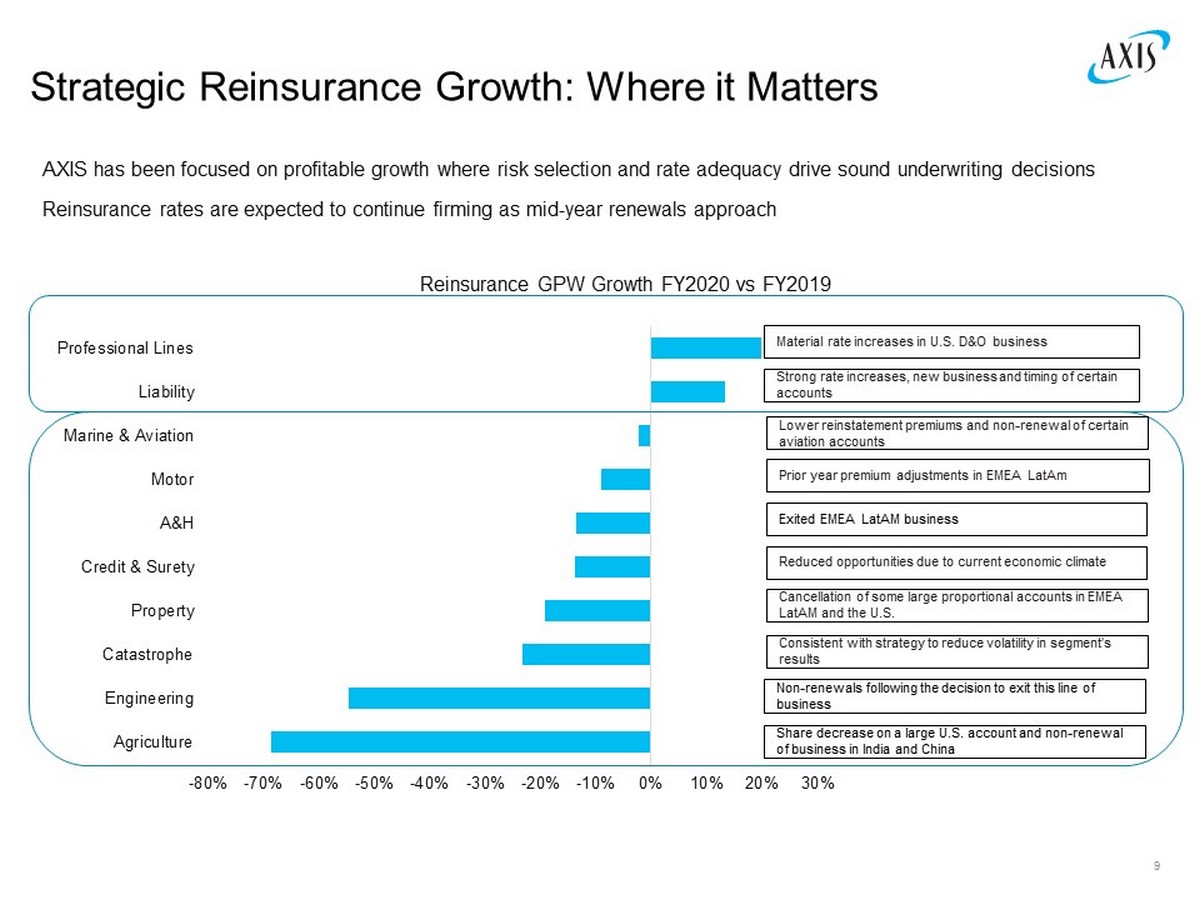

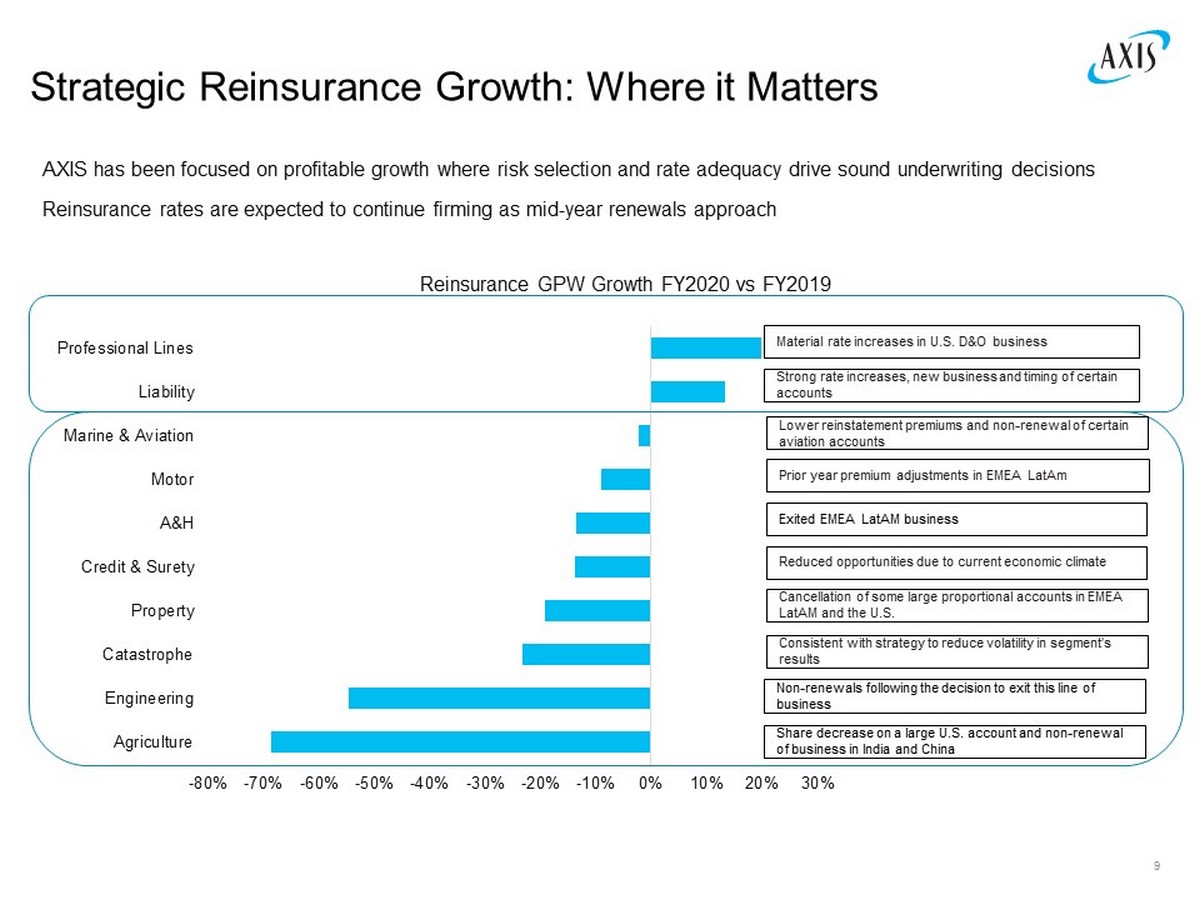

-80% -70% -60% -50% -40% -30% -20% -10% 0% 10% 20% 30% Agriculture Engineering Catastrophe Property Credit & Surety A&H Motor Marine & Aviation Liability Professional Lines Reinsurance GPW Growth FY2020 vs FY2019 Strategic Reinsurance Growth: Where it Matters AXIS has been focused on profitable growth where risk selection and rate adequacy drive sound underwriting decisions Reinsurance rates are expected to continue firming as mid - year renewals approach 9 Material rate increases in U.S. D&O business Prior year premium adjustments in EMEA LatAm Exited EMEA LatAM business Reduced opportunities due to current economic climate Cancellation of some large proportional accounts in EMEA LatAM and the U.S. Consistent with strategy to reduce volatility in segment’s results Strong rate increases, new business and timing of certain accounts Lower reinstatement premiums and non - renewal of certain aviation accounts Non - renewals following the decision to exit this line of business Share decrease on a large U.S. account and non - renewal of business in India and China

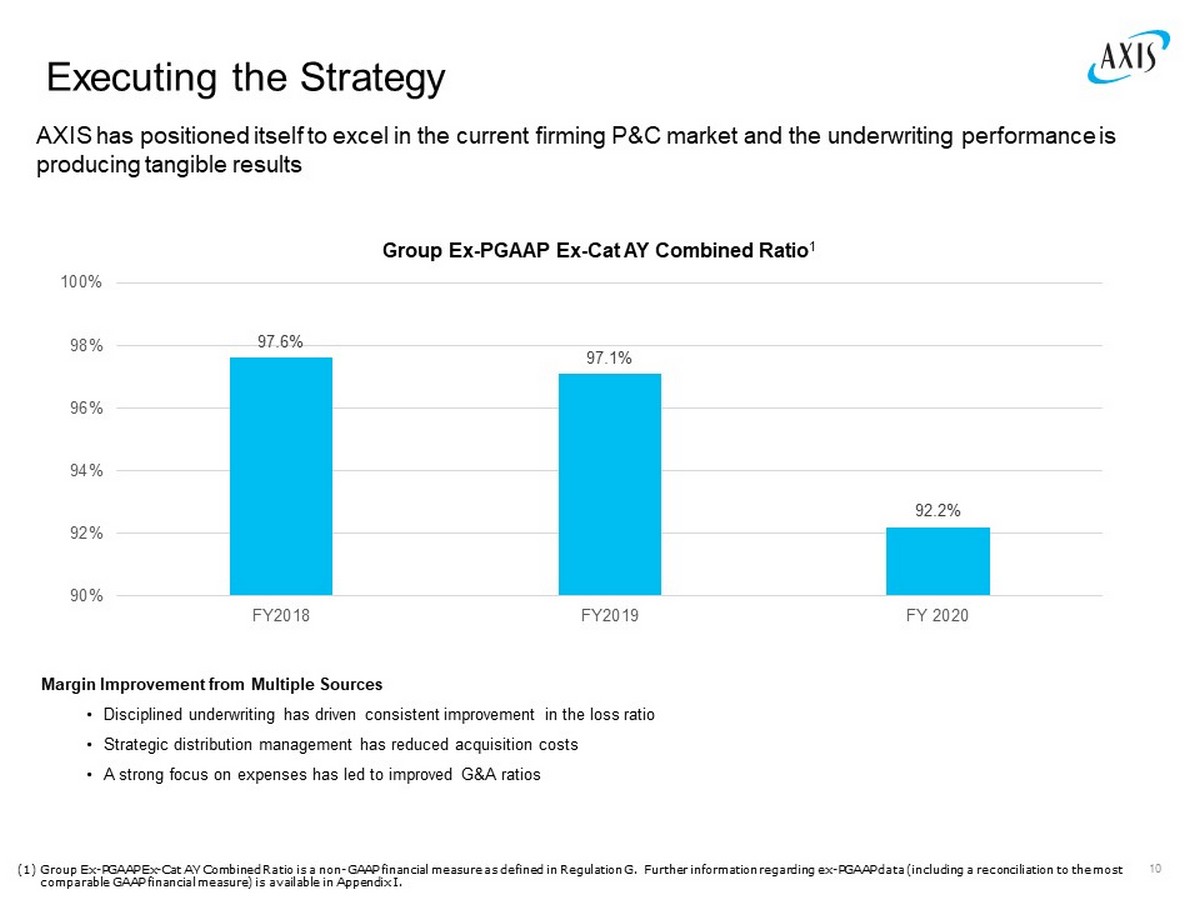

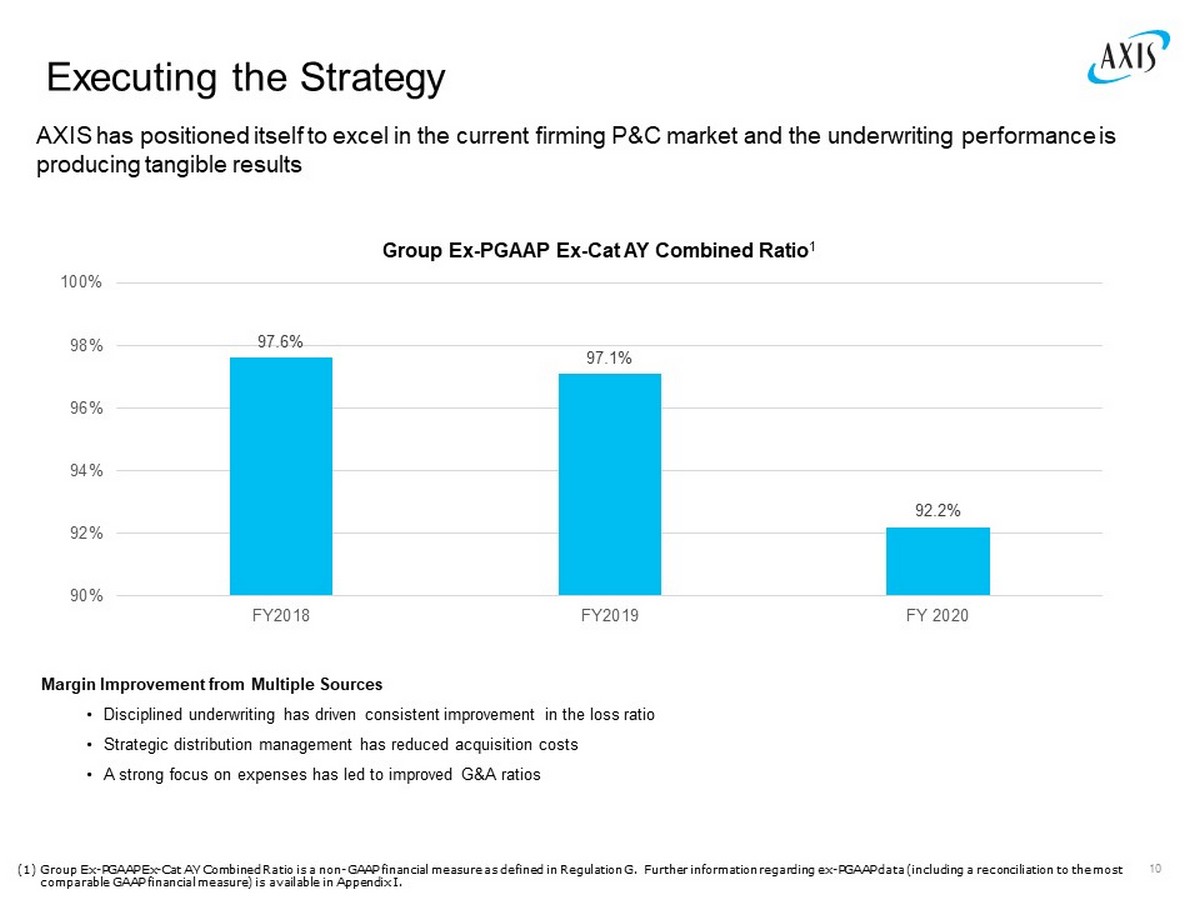

Executing the Strategy 10 Group Ex - PGAAP Ex - Cat AY Combined Ratio 1 (1) Group Ex - PGAAP Ex - Cat AY Combined Ratio is a non - GAAP financial measure as defined in Regulation G. Further information regardi ng ex - PGAAP data (including a reconciliation to the most comparable GAAP financial measure) is available in Appendix I. AXIS has positioned itself to excel in the current firming P&C market and the underwriting performance is producing tangible results 97.6% 97.1% 92.2% 90% 92% 94% 96% 98% 100% FY2018 FY2019 FY 2020 Margin Improvement from Multiple Sources • Disciplined underwriting has driven consistent improvement in the loss ratio • Strategic distribution management has reduced acquisition costs • A strong focus on expenses has led to improved G&A ratios

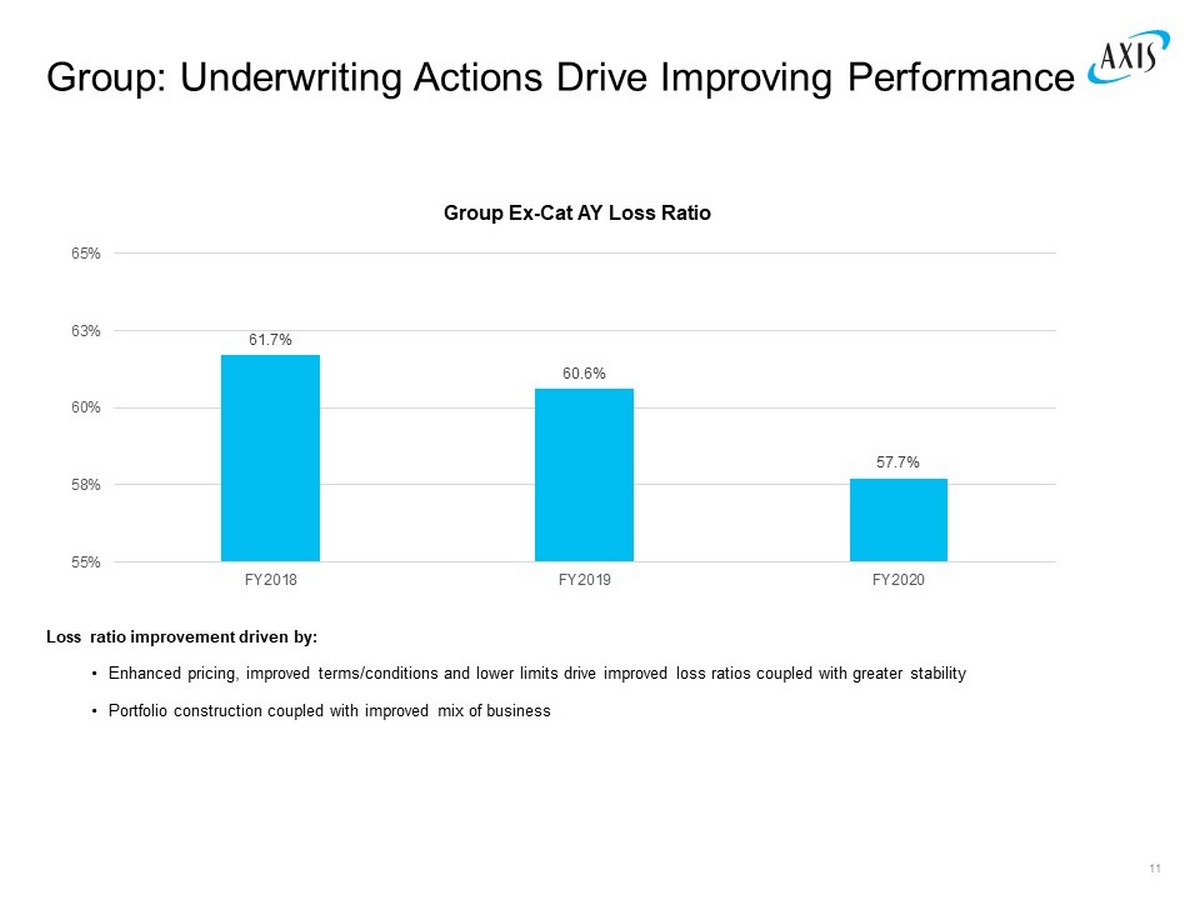

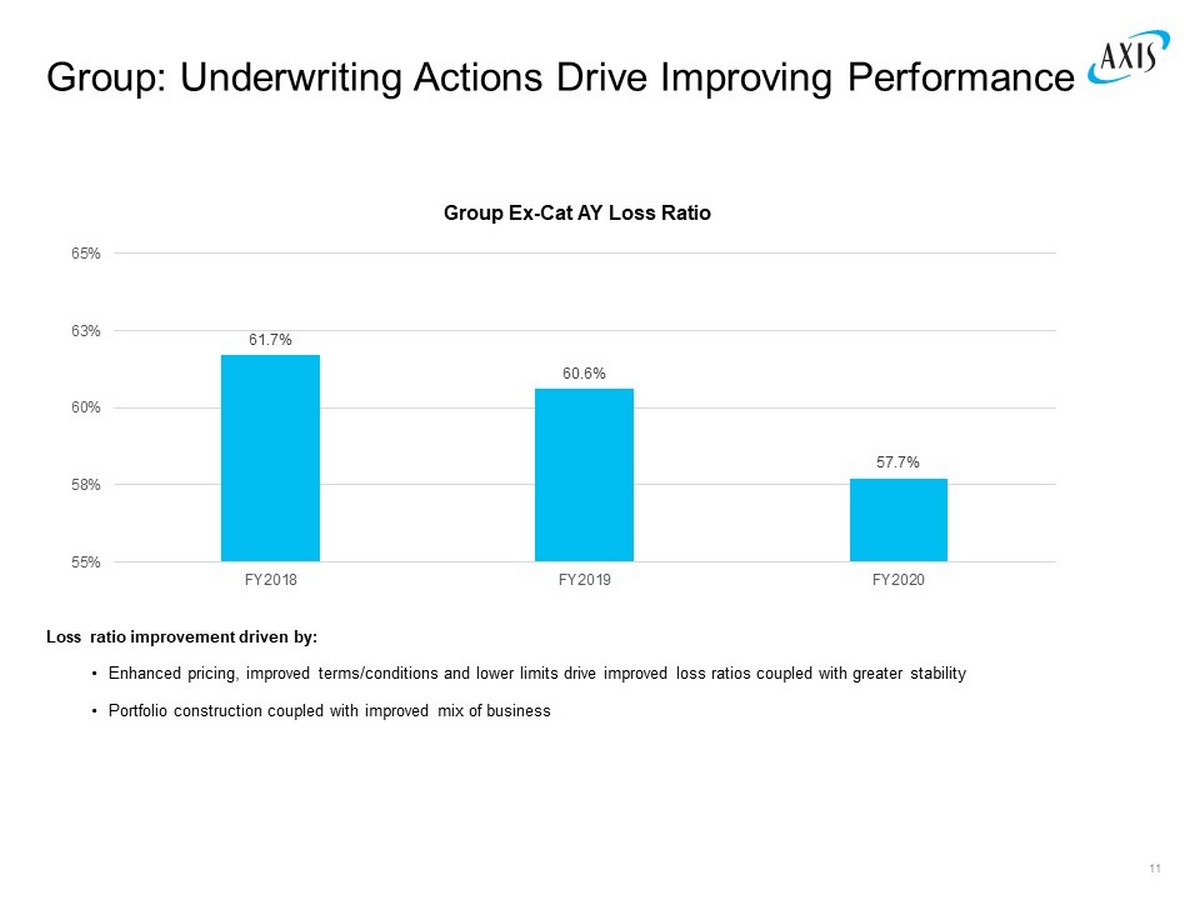

Group: Underwriting Actions Drive Improving Performance 11 Loss ratio improvement driven by: • Enhanced pricing, improved terms/conditions and lower limits drive improved loss ratios coupled with greater stability • Portfolio construction coupled with improved mix of business 61.7% 60.6% 57.7% 55% 58% 60% 63% 65% FY2018 FY2019 FY2020 Group Ex - Cat AY Loss Ratio

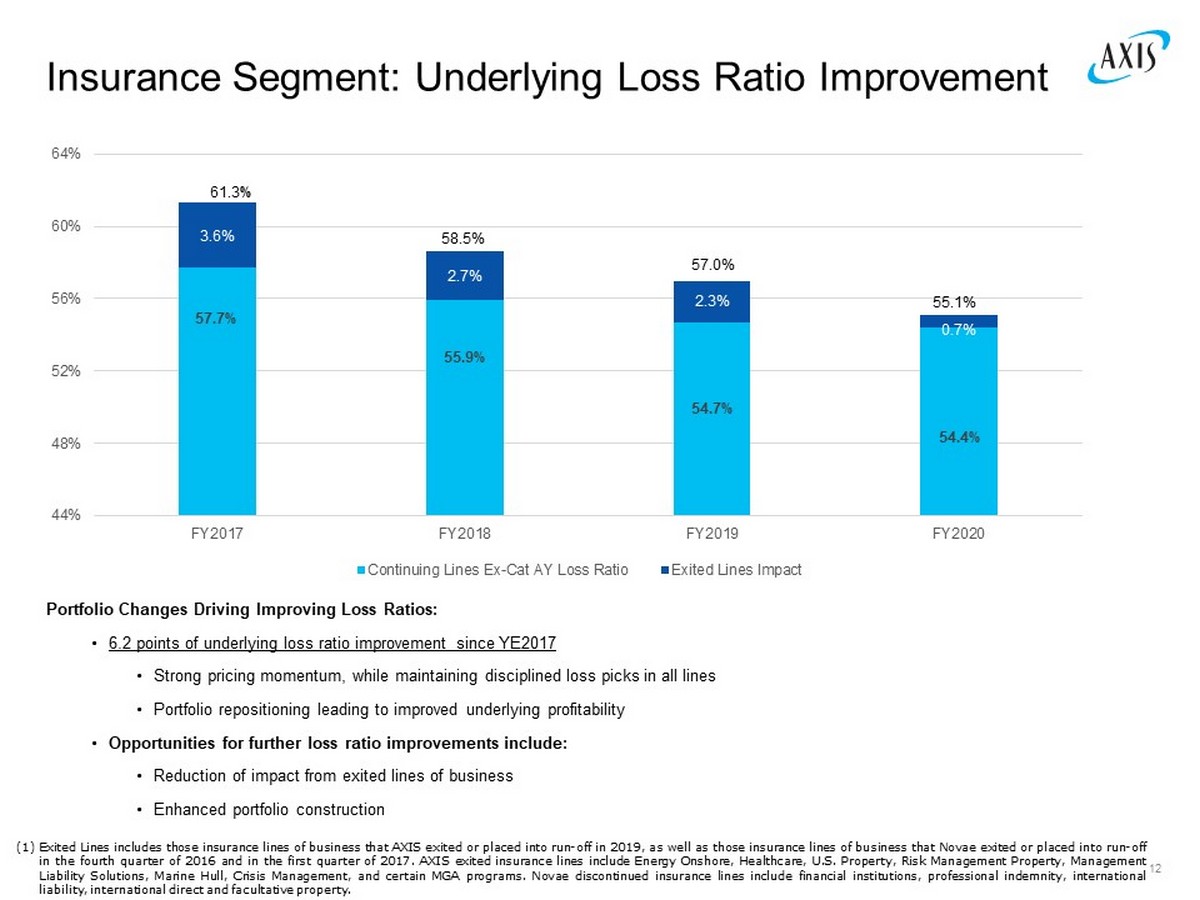

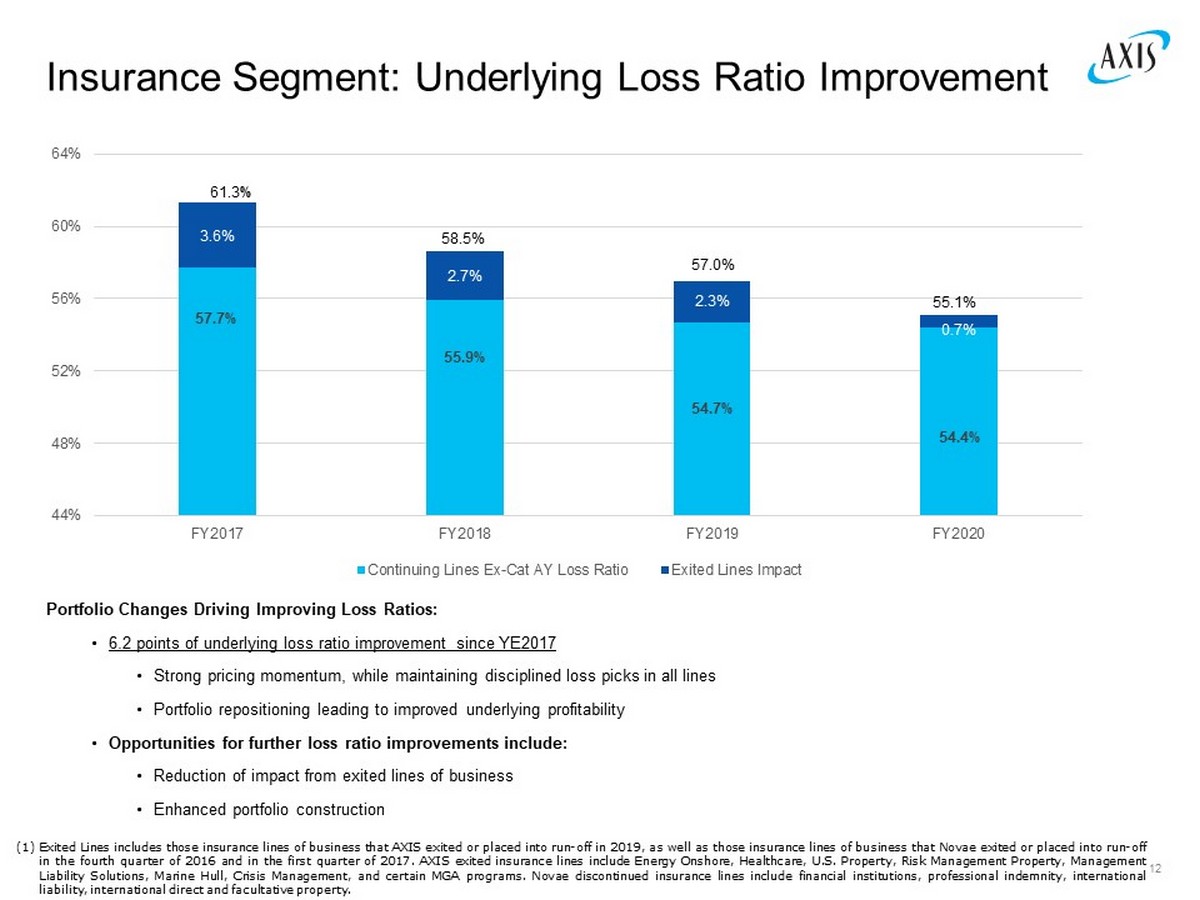

57.7% 55.9% 54.7% 54.4% 3.6% 2.7% 2.3% 0.7% 44% 48% 52% 56% 60% 64% FY2017 FY2018 FY2019 FY2020 Continuing Lines Ex-Cat AY Loss Ratio Exited Lines Impact 58.5% 57.0% 55.1% Insurance Segment: Underlying Loss Ratio Improvement 12 Portfolio Changes Driving Improving Loss Ratios: • 6.2 points of underlying loss ratio improvement since YE2017 • Strong pricing momentum, while maintaining disciplined loss picks in all lines • Portfolio repositioning leading to improved underlying profitability • Opportunities for further loss ratio improvements include: • Reduction of impact from exited lines of business • Enhanced portfolio construction 61.3 % (1) Exited Lines includes those insurance lines of business that AXIS exited or placed into run - off in 2019 , as well as those insurance lines of business that Novae exited or placed into run - off in the fourth quarter of 2016 and in the first quarter of 2017 . AXIS exited insurance lines include Energy Onshore, Healthcare, U . S . Property, Risk Management Property, Management Liability Solutions, Marine Hull, Crisis Management, and certain MGA programs . Novae discontinued insurance lines include financial institutions, professional indemnity, international liability, international direct and facultative property .

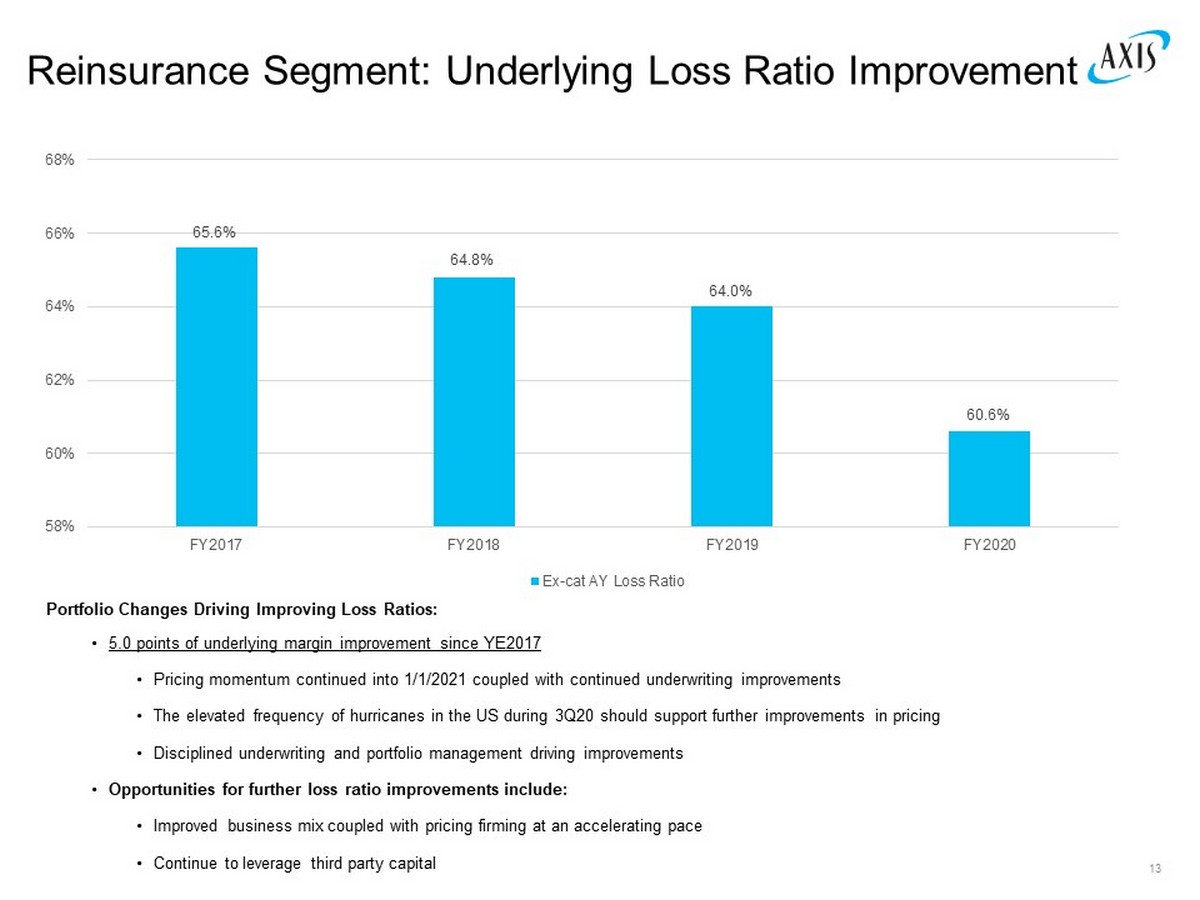

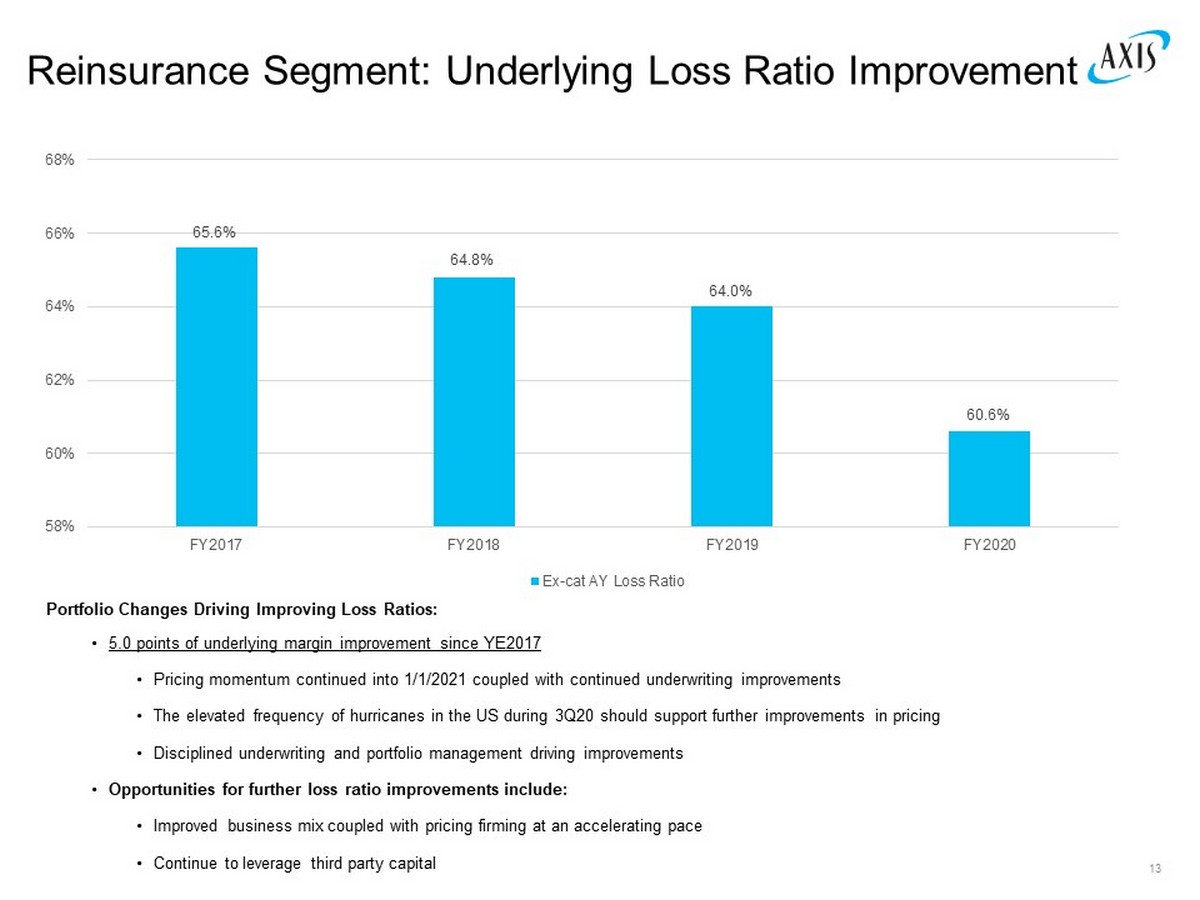

65.6% 64.8% 64.0% 60.6% 58% 60% 62% 64% 66% 68% FY2017 FY2018 FY2019 FY2020 Ex-cat AY Loss Ratio Reinsurance Segment: Underlying Loss Ratio Improvement 13 Portfolio Changes Driving Improving Loss Ratios: • 5.0 points of underlying margin improvement since YE2017 • Pricing momentum continued into 1/1/2021 coupled with continued underwriting improvements • The elevated frequency of hurricanes in the US during 3Q20 should support further improvements in pricing • Disciplined underwriting and portfolio management driving improvements • Opportunities for further loss ratio improvements include: • Improved business mix coupled with pricing firming at an accelerating pace • Continue to leverage third party capital

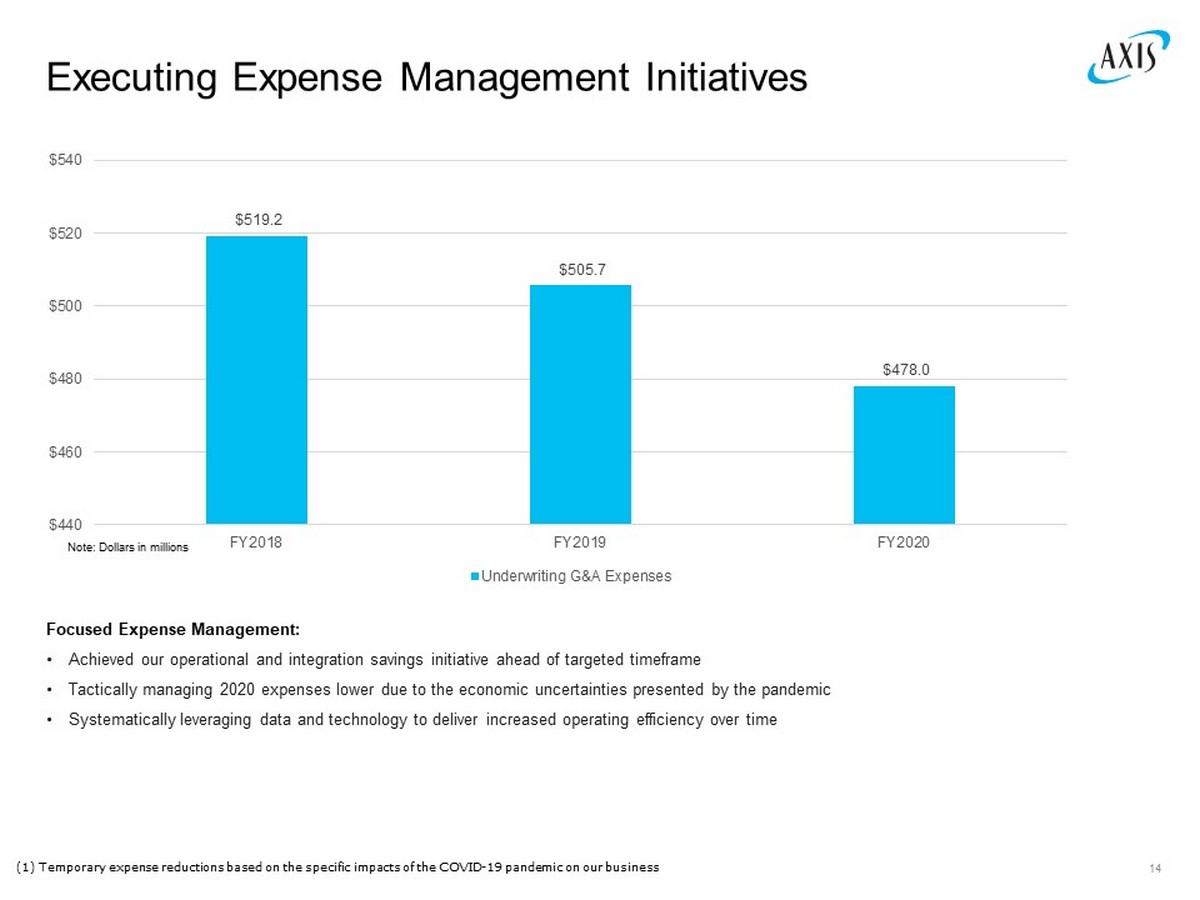

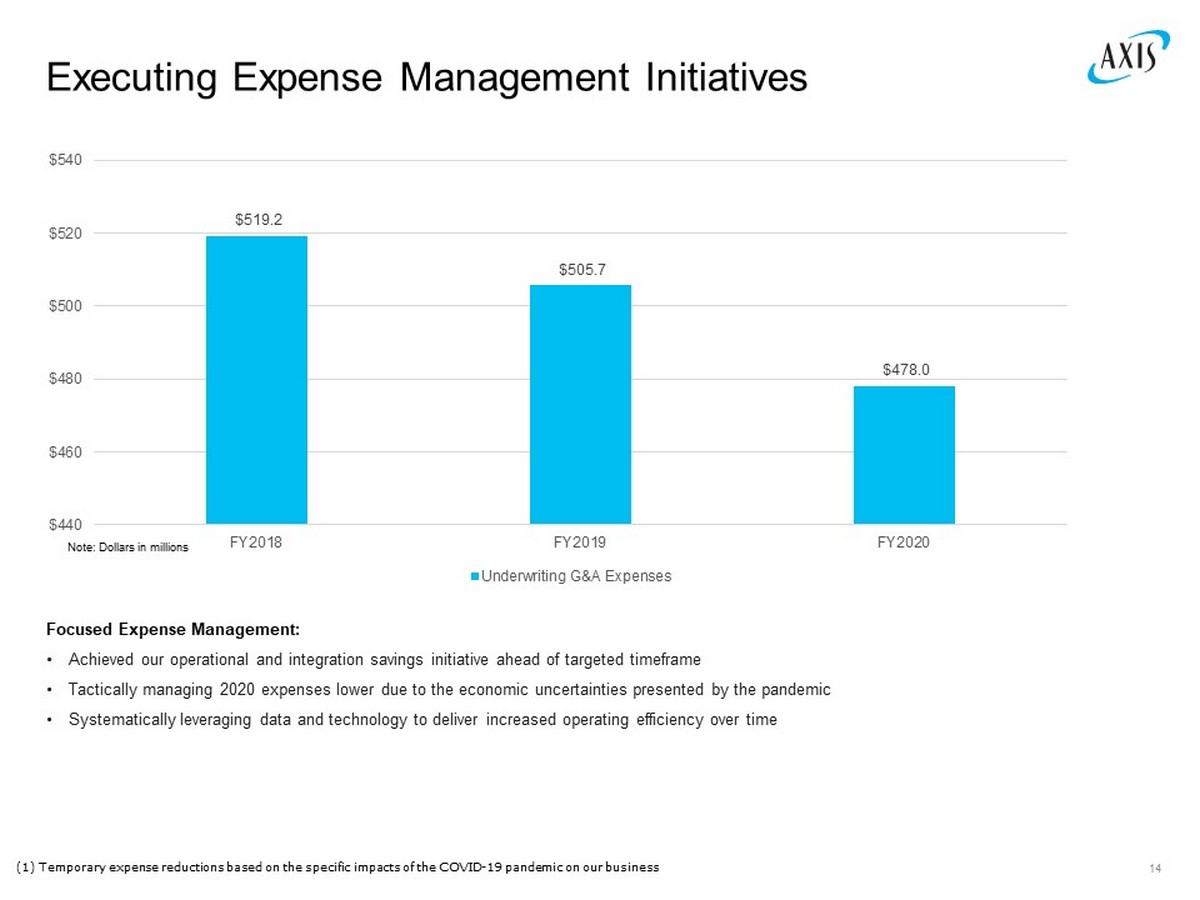

Executing Expense Management Initiatives 14 Focused Expense Management: • Achieved our operational and integration savings initiative ahead of targeted timeframe • Tactically managing 2020 expenses lower due to the economic uncertainties presented by the pandemic • Systematically leveraging data and technology to deliver increased operating efficiency over time Note: Dollars in millions $519.2 $505.7 $478.0 $440 $460 $480 $500 $520 $540 FY2018 FY2019 FY2020 Underwriting G&A Expenses (1) Temporary expense reductions based on the specific impacts of the COVID - 19 pandemic on our business

$912 $1,003 $778 $489 $304 $105 $49 2020 2019 2018 2017 2016 2015 2014 Strategic Capital Partners Drive Fee Income Strategic Capital Partners Fee Income (1) Strategic Capital Partners AUM Growth Premium Ceded to Strategic Capital Partners 2 ($ in millions) ($ in millions) 15 $6.3 $8.5 $21.8 $36.0 $48.0 $80.3 $60.5 2014 2015 2016 2017 2018 2019 2020 (1) Additional disclosures regarding fee income can be found in our Investor Financial Supplement (2) Full year data only displayed $0.0bn $0.5bn $1.0bn $1.5bn $2.0bn 2015 2016 2017 2018 2019 2020 AUM Growth ($bn) Harrington AVRL Other Strategic Partners Alturas

$438.5 $478.6 $349.6 $0 $200 $400 $600 FY2018 FY2019 FY2020 Net Investment Income Interest Rates Remain a Headwind to Investment Income 16 • With the 10 - Year US Treasury Note yield down ~35% 1 since the beginning of 2020 due to the COVID - 19 pandemic investment income faces a headwind • The current book yield is ~2.3% and the new money yield is ~1.3% 2 • AXIS maintains a conservative investment portfolio with a duration of ~3.3 years • AXIS will continue to focus on improving underwriting margins and maintaining its disciplined investment approach • Low interest rates remain a key reason that pricing momentum should continue through 2021 Note: Dollars in millions (1) Market data as of 2/5/21 (2) Book yield and new money yield as of 12/31/20

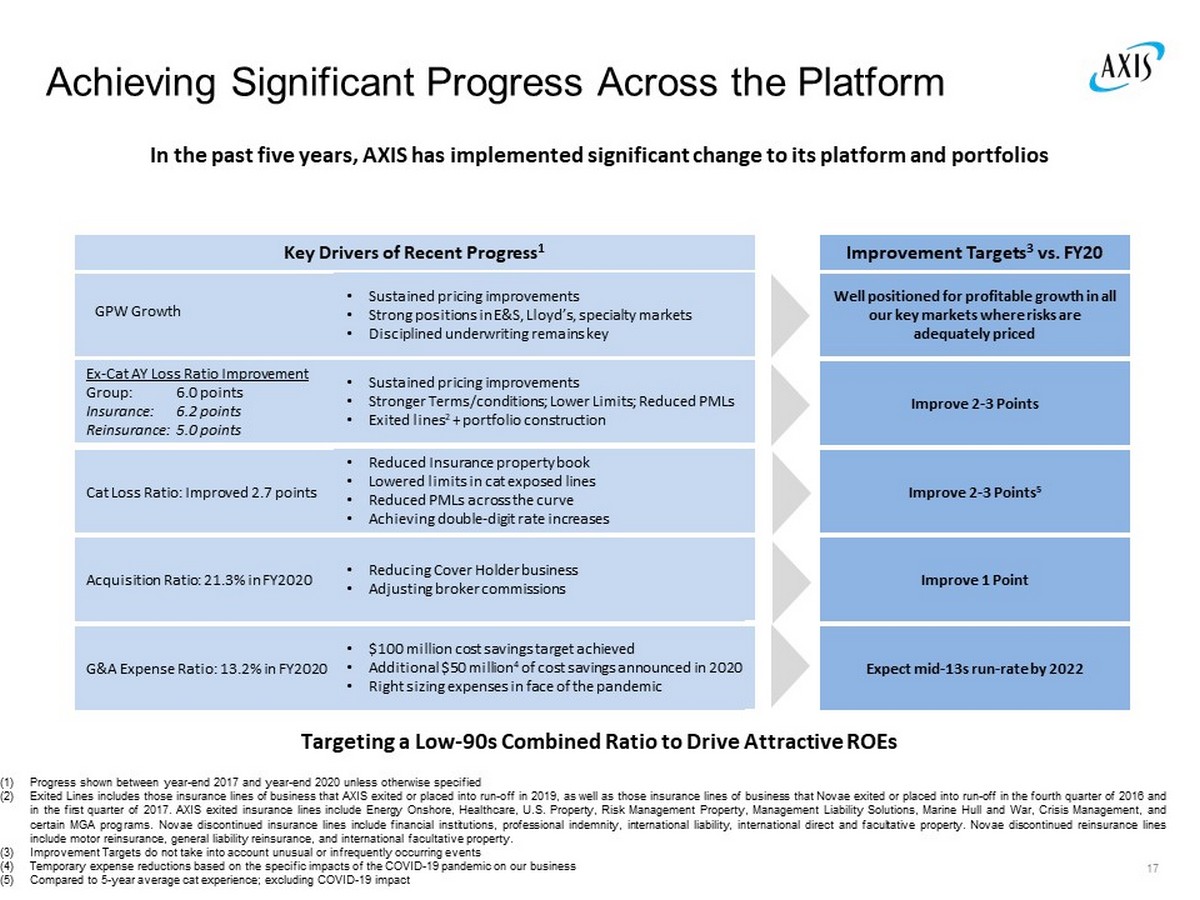

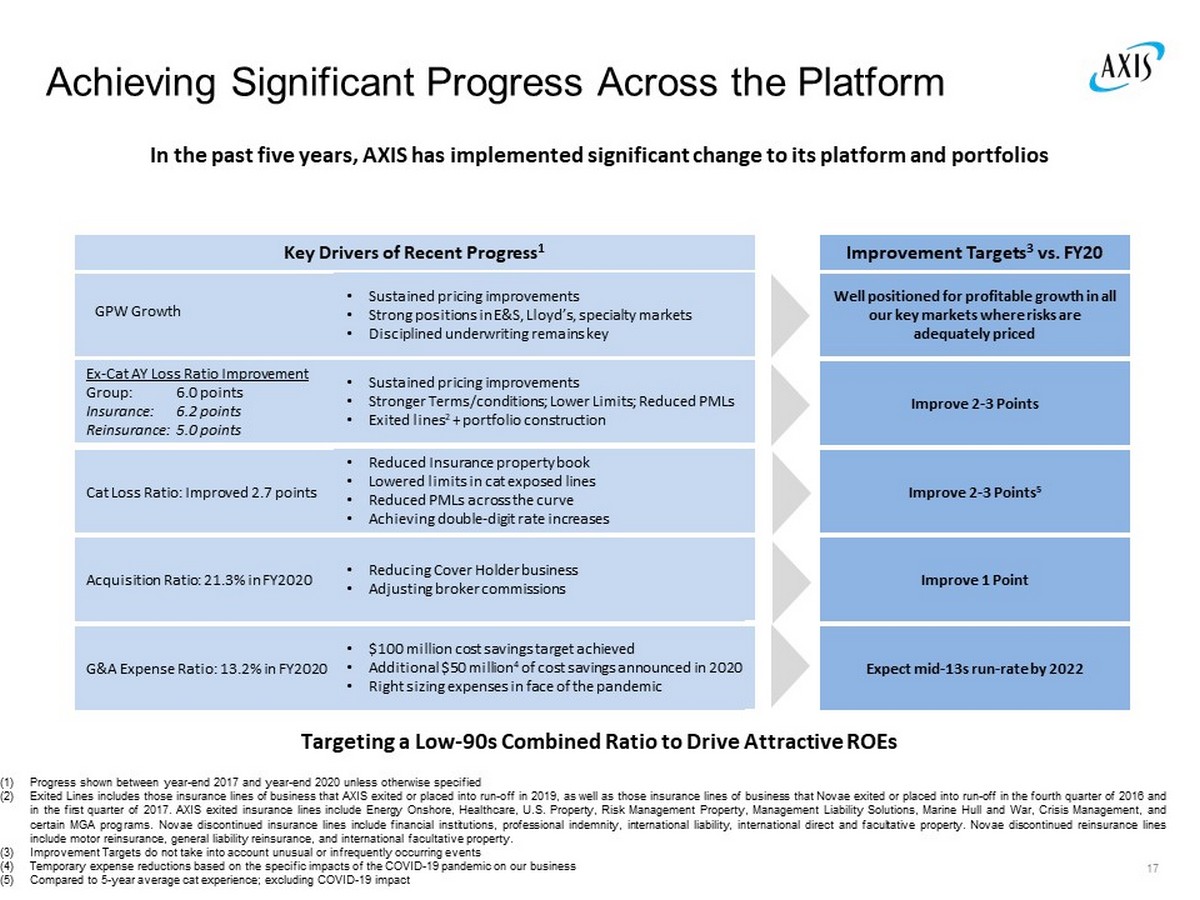

Key Drivers of Recent Progress 1 Cat Loss Ratio: Improved 2.7 points Acquisition Ratio: 21.3% in FY2020 G&A Expense Ratio: 13.2% in FY2020 GPW Growth Achieving Significant Progress Across the Platform In the past five years, AXIS has implemented significant change to its platform and portfolios 17 Improve 2 - 3 Points Improvement Targets 3 vs. FY20 • Reduced Insurance property book • Lowered limits in cat exposed lines • Reduced PMLs across the curve • Achieving double - digit rate increases • Reducing Cover Holder business • Adjusting broker commissions • $100 million cost savings target achieved • Additional $50 million 4 of cost savings announced in 2020 • Right sizing expenses in face of the pandemic Improve 1 - 2 Points 13.5% Run - Rate by YE2020 Ex - Cat AY Loss Ratio Improvement Group: 6.0 points Insurance: 6.2 points Reinsurance: 5.0 points • Sustained pricing improvements • Stronger Terms/conditions; Lower Limits; Reduced PMLs • Exited lines 2 + portfolio construction (1) Progress shown between year - end 2017 and year - end 2020 unless otherwise specified (2) Exited Lines includes those insurance lines of business that AXIS exited or placed into run - off in 2019 , as well as those insurance lines of business that Novae exited or placed into run - off in the fourth quarter of 2016 and in the first quarter of 2017 . AXIS exited insurance lines include Energy Onshore, Healthcare, U . S . Property, Risk Management Property, Management Liability Solutions, Marine Hull and War, Crisis Management, and certain MGA programs . Novae discontinued insurance lines include financial institutions, professional indemnity, international liability, international direct and facultative property . Novae discontinued reinsurance lines include motor reinsurance, general liability reinsurance, and international facultative property . (3) Improvement Targets do not take into account unusual or infrequently occurring events (4) Temporary expense reductions based on the specific impacts of the COVID - 19 pandemic on our business (5) Compared to 5 - year average cat experience ; excluding COVID - 19 impact Improve 2 - 3 Points 5 Expect mid - 13s run - rate by 2022 Improve 1 Point Well positioned for profitable growth in all our key markets where risks are adequately priced Targeting a Low - 90s Combined Ratio to Drive Attractive ROEs • Sustained pricing improvements • Strong positions in E&S, Lloyd’s, specialty markets • Disciplined underwriting remains key

Corporate Social Responsibility at AXIS Philanthropy – supporting charitable causes that align with our values; Donated $1 million to COVID - 19 relief effort Diversity & Inclusion – implementing practices to enhance D&I within our Company as well as the larger profession Corporate Purpose: Living our values, giving back to our communities, and contributing to a more sustainable future Advocacy – advocate for issues that help our industry, our customers and our communities AXIS has long been a values - based organization and over the past year we have significantly scaled up our efforts by launching a formalized corporate social responsibility program with four core pillars: Environmental – enhancing our corporate and business practices to help ensure a more sustainable future 18

Our Purpose, Strategic Vision and Values 19 Our Purpose ( who we are ) Our Strategic Vision ( what we do ) Our Values ( how we do it ) We are One AXIS. We build positive energy and a collaborative environment where diversity of teams and perspectives is respected and valued. We insist on a culture of inclusivity and empathy – where we invest in and support one another. We deliver on our promises. Our clients, brokers and communities are at the center of all that we do and we stand by them. We measure ourselves on how well we have served our customers and helped them to pursue their goals. We never compromise our integrity. We are compelled to do what is right and just, guided by our moral compass. Trust, transparency, and accountability are paramount. We are passionate. We are relentless in our execution, disciplined in our pursuits, and resilient through challenges. We set ambitious goals, raising the bar for each other and celebrating our collective achievements. We are dynamic. We are intellectually curious – continuously learning, adapting, and improving. We are bold, innovative, and take ownership of our future. In a world filled with risk and uncertainty, we give people and organizations the confidence they need to pursue their goals and ambitions. Be leaders in our chosen markets, standing apart for delivering services and products that directly meet our clients' needs. • Win with our Partners • Deliver Innovative Underwriting • Be Nimble, Be Adaptive

Conclusion AXIS is a leading specialty insurer and global reinsurer Strong franchise with superior position in chosen specialty markets that are exhibiting the most attractive opportunities Completed repositioning of the portfolio. Pace of underwriting margin improvement should continue given ongoing portfolio improvements and acceleration in pricing Enhanced use of reinsurance, retro and third - party capital driving better risk adjusted returns with lower volatility Building a stronger, more profitable and more stable underwriter of specialty risks 20

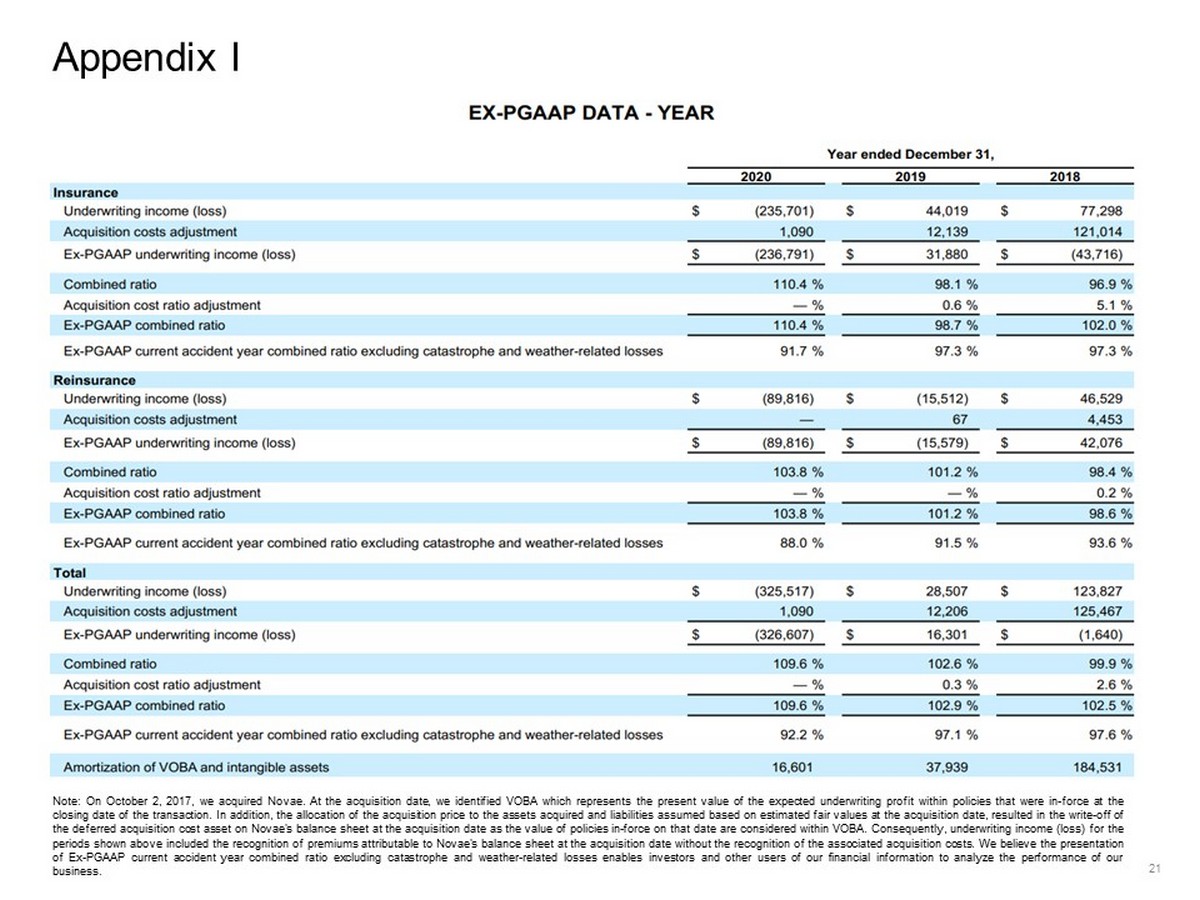

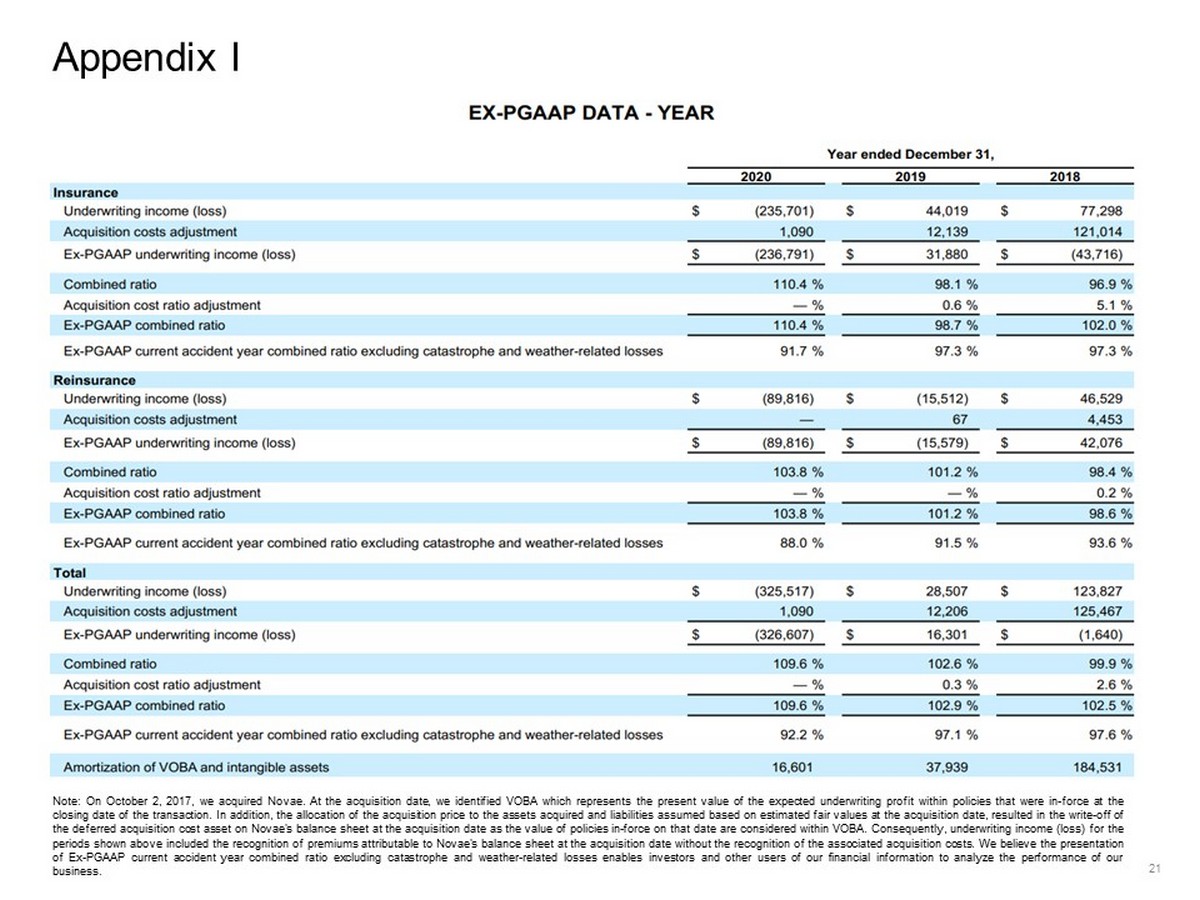

21 Appendix I Note : On October 2 , 2017 , we acquired Novae . At the acquisition date, we identified VOBA which represents the present value of the expected underwriting profit within policies that were in - force at the closing date of the transaction . In addition, the allocation of the acquisition price to the assets acquired and liabilities assumed based on estimated fair values at the acquisition date, resulted in the write - off of the deferred acquisition cost asset on Novae's balance sheet at the acquisition date as the value of policies in - force on that date are considered within VOBA . Consequently, underwriting income (loss) for the periods shown above included the recognition of premiums attributable to Novae's balance sheet at the acquisition date without the recognition of the associated acquisition costs . We believe the presentation of Ex - PGAAP current accident year combined ratio excluding catastrophe and weather - related losses enables investors and other users of our financial information to analyze the performance of our business .

22