AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 26 Jan 15, 12:00am

A Global Leader in Specialty Insurance and Reinsurance January 26, 2015 PartnerRe and AXIS: Exhibit 99.1 |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 2 Disclaimer Important Information For Investors And Stockholders This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between PartnerRe Ltd. (“PartnerRe”) and AXIS Capital Holdings Limited (“AXIS”). In connection with this proposed business combination, PartnerRe and/or AXIS may file one or more proxy statements, registration statements, proxy statement/prospectus or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document PartnerRe and/or AXIS may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF PARTNERRE AND AXIS ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of PartnerRe and/or AXIS, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by PartnerRe and/or AXIS through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by PartnerRe will be available free of charge on PartnerRe’s internet website at http://www.partnerre.com or by contacting PartnerRe’s Investor Relations Director by email at robin.sidders@partnerre.com or by phone at 1-441-294- 5216. Copies of the documents filed with the SEC by AXIS will be available free of charge on AXIS’ internet website at http://www.axiscapital.com or by contacting AXIS’ Investor Relations Contact by email at linda.ventresca@axiscapital.com or by phone at 1-441-405-2727. |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 3 Disclaimer Participants in Solicitation PartnerRe, AXIS, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of PartnerRe is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 27, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 1, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 31, 2014 and its Current Reports on Form 8-K, which were filed with the SEC on May 16, 2014 and March 27, 2014. Information about the directors and executive officers of AXIS is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 21, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 which was filed with the SEC on October 31, 2014 and its Current Report on Form 8-K, which was filed with the SEC on August 7, 2014, June 26, 2014, March 27, 2014 and February 26, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 4 Disclaimer Forward Looking Statements Certain statements in this communication regarding the proposed transaction between PartnerRe and AXIS are “forward-looking” statements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,” “strategy,” and similar expressions, and the negative thereof, are intended to identify forward-looking statements. These forward-looking statements, which are subject to risks, uncertainties and assumptions about PartnerRe and AXIS, may include projections of their respective future financial performance, their respective anticipated growth strategies and anticipated trends in their respective businesses. These statements are only predictions based on current expectations and projections about future events. There are important factors that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including the risk factors set forth in PartnerRe’s and AXIS’ most recent reports on Form 10-K, Form 10-Q and other documents on file with the SEC and the factors given below: Failure to obtain the approval of shareholders of PartnerRe or AXIS in connection with the proposed transaction; The failure to consummate or delay in consummating the proposed transaction for other reasons; The timing to consummate the proposed transaction; The risk that a condition to closing of the proposed transaction may not be satisfied; The risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obtained AXIS’ or PartnerRe’s ability to achieve the synergies and value creation contemplated by the proposed transaction; The ability of either PartnerRe or AXIS to effectively integrate their businesses; and The diversion of management time on transaction-related issues. PartnerRe’s forward-looking statements are based on assumptions that PartnerRe believes to be reasonable but that may not prove to be accurate. AXIS’ forward-looking statements are based on assumptions that PartnerRe believes to be reasonable but that may not prove to be accurate. Neither PartnerRe nor AXIS can guarantee future results, level of activity, performance or achievements. Moreover, neither PartnerRe nor AXIS assumes responsibility for the accuracy and completeness of any of these forward-looking statements. PartnerRe and AXIS assume no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 5 A Global Leader in Specialty Insurance and Reinsurance Combination will be a (re)insurance powerhouse with approximately $13bn combined shareholders equity (1) » Brings together two strong, world-class, successful companies building on existing strengths » Transaction creates a top 5 global reinsurance franchise with leading position in the broker channel » Primary specialty platform with $2.5bn+ in premiums across a diversified array of product lines » Significant player in Life, Accident & Health market Value creation through combined franchise strengths including significant capital efficiencies and meaningful synergies » Expanded ability to invest in growing specialty franchises and to return capital to shareholders » Enhanced ability to partner with other capital providers to deliver value to all stakeholders » Over $200 million in identifiable, actionable and concrete expense savings » Transaction expected to be meaningfully accretive to earnings and return on equity Clear common vision accelerates strategies for both companies » Growth accompanied by excellence in risk management » Best-in-class talent across all aspects of business » Compatible cultures facilitate integration (1) Financial data as of 9/30/14. |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 6 A Merger of Equals: Overview Structure 100% stock Merger of Equals structured as an amalgamation Shares in PartnerRe and AXIS to convert to new shares in the Amalgamated company at a fixed exchange ratio Preferred shares to remain outstanding as preferred shares of the Amalgamated company Deal Value $11 billion pro forma market capitalization AXIS shareholders will receive 1 common share and PartnerRe shareholders will receive 2.18 common shares in the amalgamated company for each share they own Pro Forma Ownership PartnerRe will own approximately 51.6 percent of the amalgamated company AXIS will own approximately 48.4 percent of the amalgamated company Corporate Governance of Combined Company Board of Directors to comprise 14 members, consisting of seven AXIS appointees and seven PartnerRe appointees Management teams to reflect balance, leveraging talent from both organizations Approvals Customary regulatory approvals PartnerRe and AXIS shareholder approvals Expected close in the second half of 2015 |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 7 World-Class Management Team * Assuming the role of CFO no later than July, 2016 Non-executive Chairman Jean-Paul L. Montupet, Chairman PartnerRe Chairman Emeritus Michael A. Butt, Chairman AXIS Capital CEO Albert A. Benchimol, CEO AXIS Capital CFO Joseph Henry, CFO AXIS Capital Bill Babcock, PartnerRe CFO CEO, Reinsurance Emmanuel Clarke, CEO PartnerRe Global CEO, Insurance Peter Wilson, CEO AXIS Insurance CEO, Life, Accident & Health Chris DiSipio, CEO AXIS Accident & Health John “Jay” Nichols, CEO AXIS Re Capital Solutions Head of Strategic Business Development and Deputy CFO and Lead Integration Officer* |

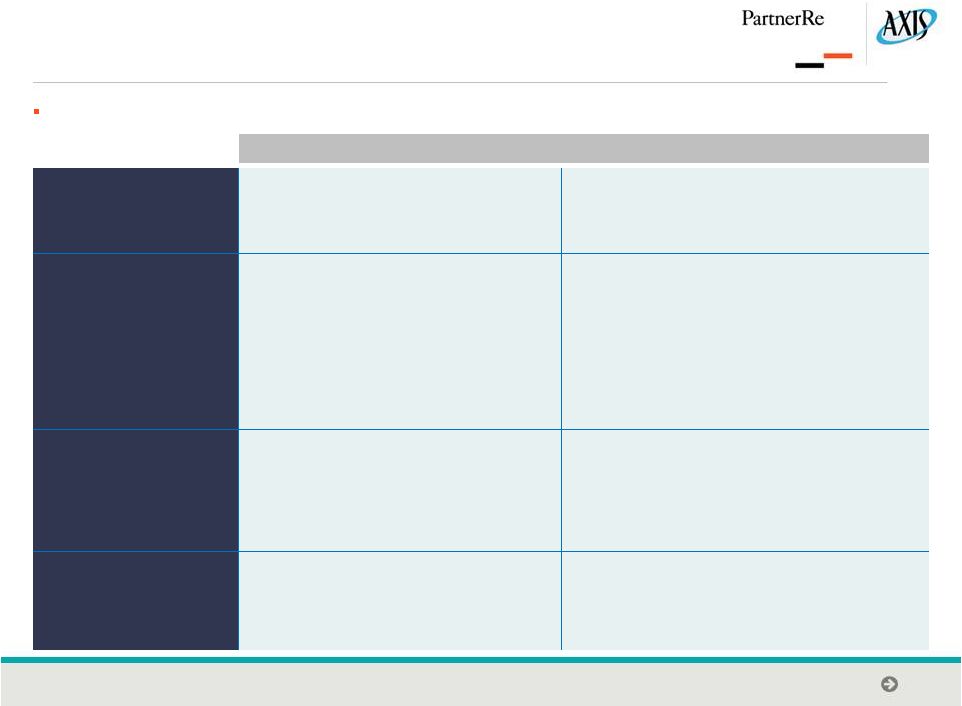

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 8 Building on Existing Strengths KEY CAPABILITY METRIC PartnerRe AXIS Value Creation BVPS + Dividend growth (2002 – 2014 YTD growth) (1) 13.1% 13.0% Excellence in underwriting 2002 – 2014YTD avg. combined ratio (2) 93.9% 87.1% Conservative reserving philosophy Years of favorable reserve development 16 of 21 years since inception and every year since 2003 12 of 12 years since inception Robust balance sheet Total capitalization at 9/30/14 (3) $7.8bn $6.8bn Financial strength A.M. Best S&P A+ A+ A+ A+ (1) Calculations based on diluted shares, calculated using the Treasury Stock Method. (2) Combined ratio of PartnerRe’s Non-life segment only. Excludes Life and Health and certain corporate expenses. (3) Excluding non-controlling interests and AXIS capitalization pro forma for $500M of senior notes that matured in December 2014. |

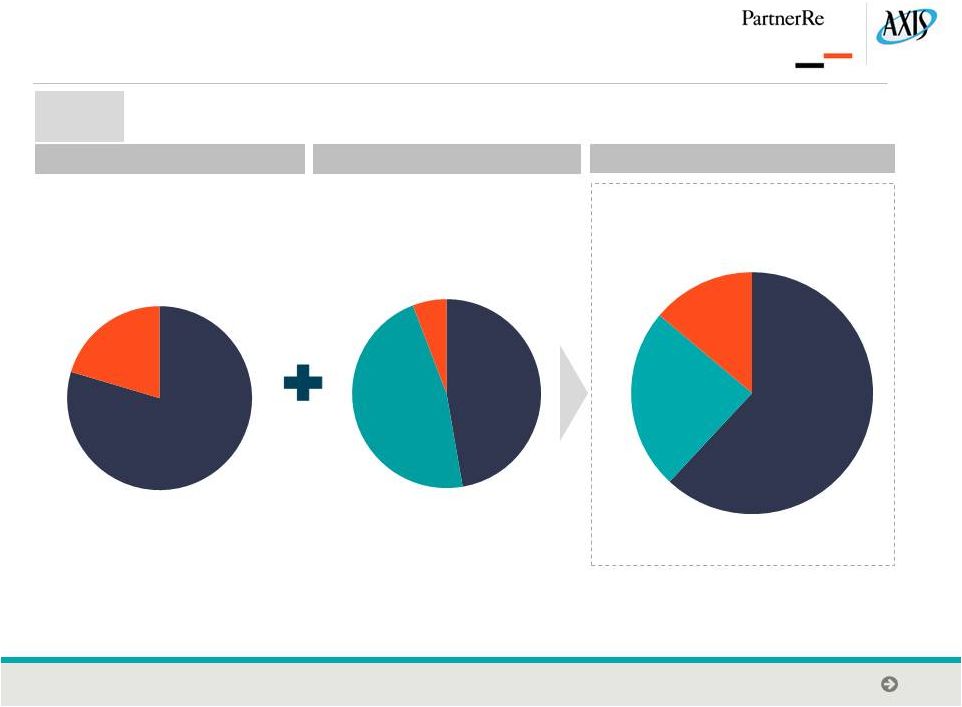

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 9 Strong Position in Three Attractive Businesses 9/30/14 LTM GPW $5.9B PartnerRe Pro Forma Combined $4.8B Non-Life Reinsurance 79% $10.7B AXIS Life and Health 21% P&C Reinsurance 47% A&H 6% Insurance 47% P&C Reinsurance 62% Insurance 24% Life, A&H 14% BUSINESS OVERVIEW |

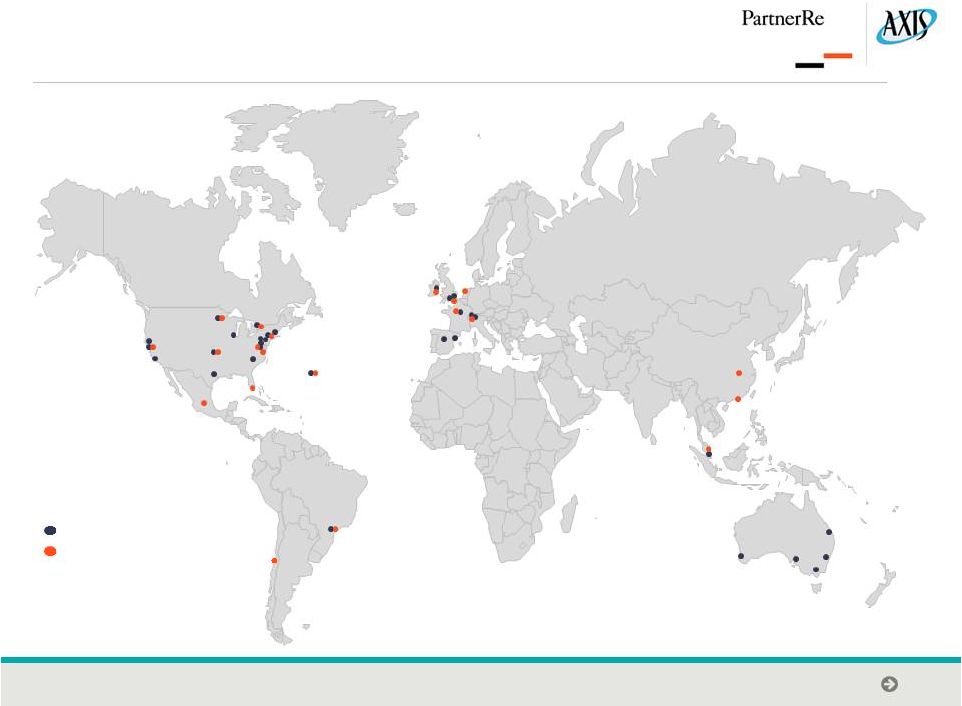

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 10 Global Reach with Opportunities for Consolidating Locations AXIS Office Locations PartnerRe Office Locations |

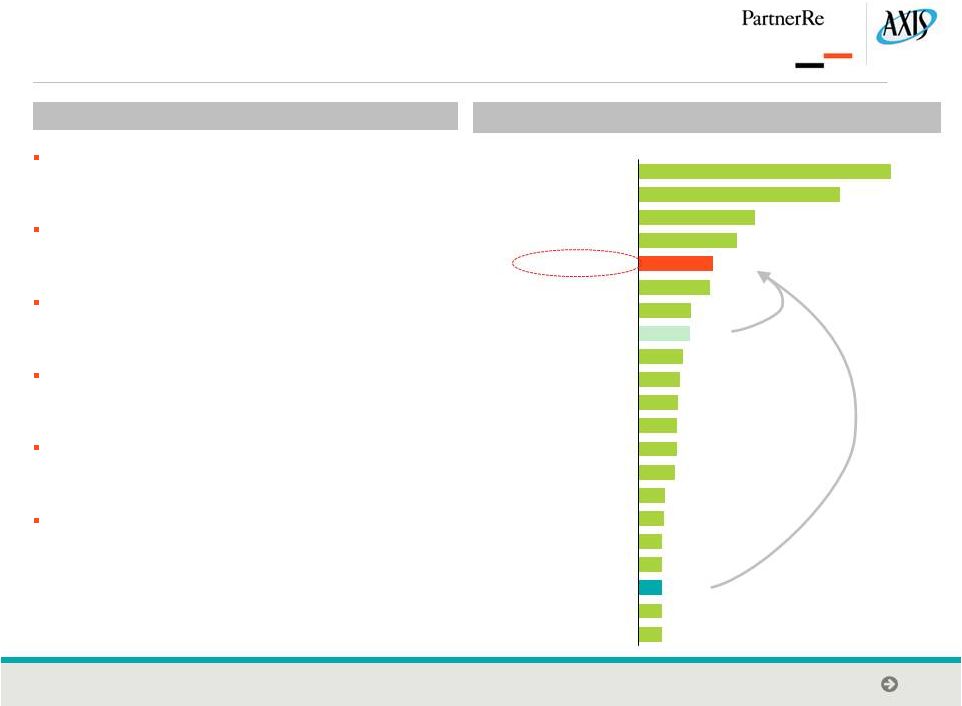

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 11 Transformative Combination Creating a Leading Global Reinsurance Platform Top 5 global reinsurer with approximately $7 billion in GPW Leading position among broker-based reinsurers Strong positions in specialty reinsurance lines Combination of two additive platforms with highly regarded UW and service capabilities Limited overlap in current portfolios suggesting manageable attrition Ability to channel third-party capital to deliver expanded client solutions Note: Chart excludes life and health reinsurance GPW if publicly disclosed. Excludes Lloyd’s. (1) Rankings are by 2013 GPW. (2) Berkshire Hathaway Reinsurance includes General Re. Corp. (3) GPW not disclosed. Indicated values are on a NPW basis. Market position Top Global P&C Reinsurers by P&C Reinsurance GPW (1) ($ in billions) (2) (3) Generali RenRe / Platinum AXIS Mitsui Sumitomo Fairfax Financial Sompo Japan General Insurance Co. of India Mapfre Allianz Alleghany Korean Re XL / Catlin Everest Re PartnerRe China Re SCOR PartnerRe + AXIS Berkshire Re Hannover Re Swiss Re Munich Re $2.1 $2.1 $2.1 $2.1 $2.1 $2.3 $2.4 $3.3 $3.4 $3.4 $3.5 $3.7 $4.0 $4.6 $4.7 $6.4 $6.7 $8.8 $10.4 $18.0 $22.6 |

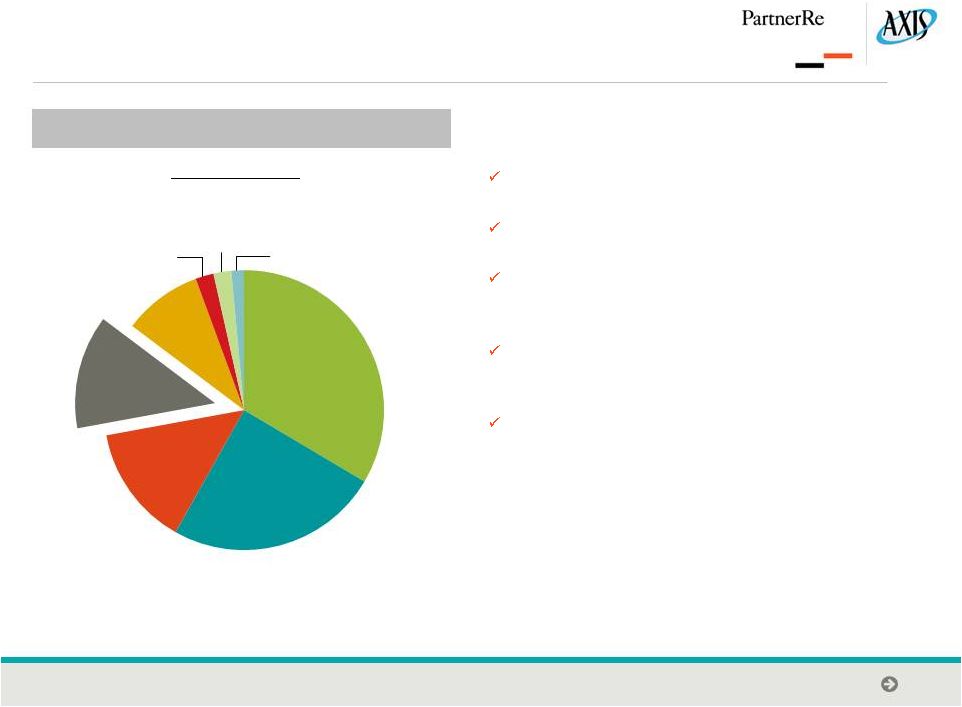

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 12 Diversified Global Specialty Insurance Business Balanced portfolio mix between segments Almost no business overlap in existing books Optionality to further accelerate growth in desirable segments Growing visibility among clients / distribution partners / talent PartnerRe’s D&F business complementary to insurance Pro Forma Combined Insurance Breakdown 9/30/14 LTM GPW By Line of Business Total Insurance GPW: $2.6B Professional Lines 34% Property 25% Liability 14% PartnerRe’s D&F and Wholesale Insurance 13% Marine 9% Aviation 2% Credit & Political Risk 2% Terrorism 1% |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 13 A leading Life, Accident & Health franchise with limited product overlap with truly global reach Premiums Written Life: $ 945m A&H: $ 256m $ 278m Recent Growth Highlights • 31% LTM GPW • Significant recent growth in A&H aided by Presidio acquisition • Strong and stable growth in Life portfolio • 30% GPW CAGR since 2011 • Mix of 51% Insurance / 49% Reinsurance for 9/30/14 LTM Leading Lines of Business Life Re U.S. Health Accident Specialty Health Travel Geographic Reach U.S. Continental Europe U.S. U.K. / London Market Continental Europe Middle East Leadership in Life and A&H with High Growth Potential PartnerRe AXIS LTM Gross |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 14 Combination of Two Strong Balance Sheets with Potential Capital Synergies ($ in billions) As at 9/30/14 Cash & Investments (1) Shareholders Equity (2) Total Capitalization (2)(3) Total Debt + Preferred / Total Capitalization $17.5 7.0 7.8 21.3% $15.5 5.8 6.8 23.8% $33.0 12.8 14.6 22.4% + Excludes purchase accounting adjustments and transaction fees. (1) Includes PartnerRe’s Funds Held – Directly Managed portfolio. (2) Excluding non-controlling interest. (3) Excluding non-controlling interests and AXIS capitalization pro forma for $500M of senior notes that matured in December 2014. |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 15 Tremendous Opportunity for Value Creation Profitable growth » Sustainable, long-term commercial growth prospects through combined scale, efficiencies and expanded product capability » Meaningful capital synergies generating further flexibility to support growth and capital management initiatives At least $200M of annual run-rate quantified expense synergies expected to be realized within first 18 months operations » Concrete, achievable expense savings » Principal sources include staff redundancies, systems and infrastructure and holding company expenses |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 16 Meaningfully accretive to shareholders of both companies » Earnings per share » Return on equity Limited execution risk of integration given: » Quality of both companies’ balance sheets » Familiarity between the companies’ management teams » Shared philosophy of underwriting conservatism » True merger of equals led by CEO with deep knowledge of both organizations Attractive Financial Implications |

© 2015. PartnerRe and Axis Capital. All rights reserved. Proprietary and confidential. 17 Conclusion Combination will be a (re)insurance powerhouse with approximately $13bn combined shareholders equity (1) » Brings together two strong, world-class, successful companies building on existing strengths » Transaction creates a top 5 global reinsurance franchise with leading position in the broker channel » Primary specialty platform with $2.5bn+ in premiums across a diversified array of product lines » Significant player in Life, Accident & Health market Value creation through combined franchise strengths including significant capital efficiencies and meaningful synergies » Expanded ability to invest in growing specialty franchises and to return capital to shareholders » Enhanced ability to partner with other capital providers to deliver value to all stakeholders » Over $200 million in identifiable, actionable and concrete expense savings » Transaction expected to be meaningfully accretive to earnings and return on equity Clear common vision accelerates strategies for both companies » Growth accompanied by excellence in risk management » Best-in-class talent across all aspects of business » Compatible cultures facilitate integration (1) Financial data as of 9/30/14. |