AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 9 Mar 15, 12:00am

Filed by AXIS Capital Holdings Limited

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: PartnerRe Ltd.

Commission File No.: 001-14536

Email Communication

To: AXIS Employees

From: Albert Benchimol

Date: March 9, 2015

Subject:PartnerRe and AXIS Merger Update

Dear PartnerRe and AXIS colleagues,

Since our last message numerous meetings have taken place to progress the merger transaction and lay the foundation for integration. We would like to update you on the latest developments.

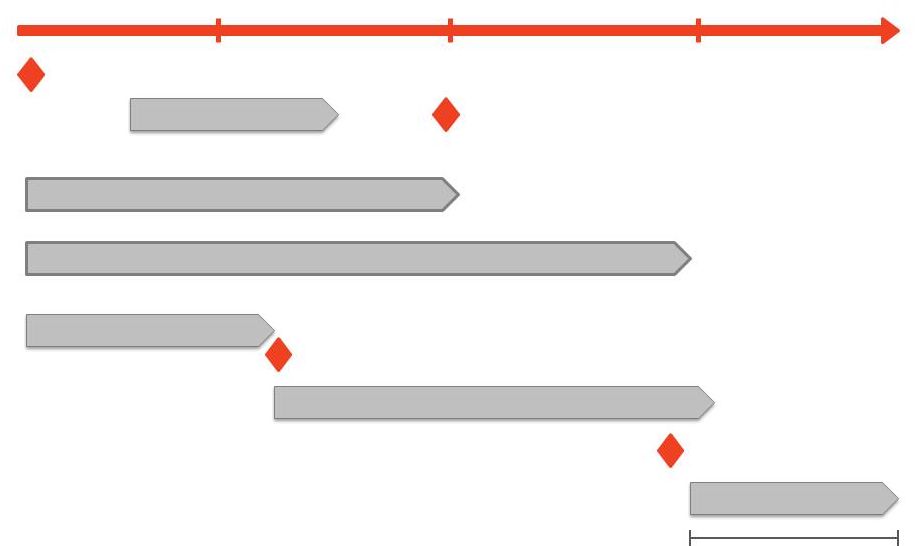

You will find attached a document with a high-level timeline outlining expected progress of both the integration and transaction processes. The high-level timeline sets out the key transaction milestones between now and close, noting that timing may be subject to change.

We are mindful, even at this early stage, of your need for information and clarity about our activities and direction. Equally, it is important that we build the foundation for our future company with great care. As a merger of equals, which involves the amalgamation of two companies, the integration process is more complex than other types of deals, requiring a high level of coordination between the two companies. In tandem, we are creating an entirely new and exciting value proposition and operating plan for the combined entity which will transform how we do business and differentiate us from our competitors.

Managing Integration

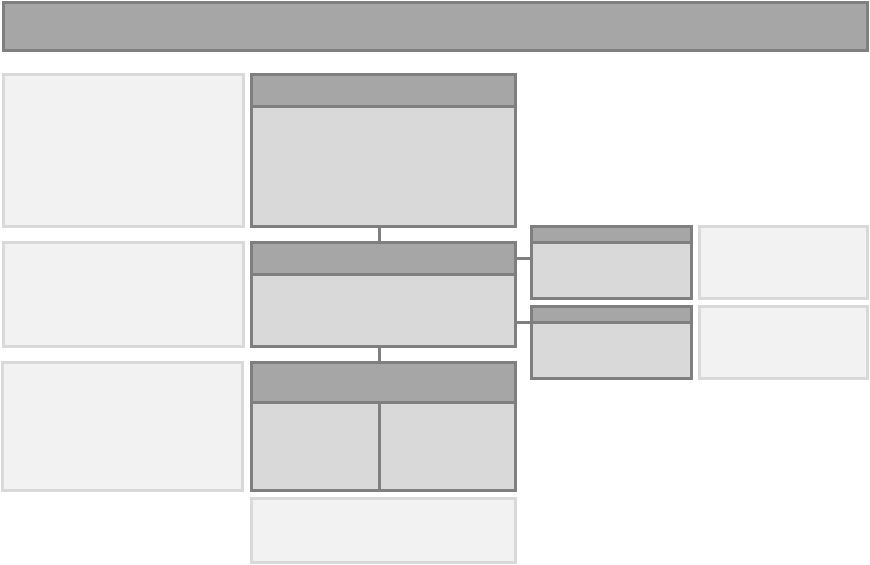

We have established the integration governance structure. An Integration Steering Committee has been appointed, supported by the Integration Director and Advisors, and by specialist teams for project management and communications. The committee and positions are comprised of equal representatives from both companies. An Integration Working Committee will report to the Integration Director. It will comprise multiple business and functional workstream leaders who will be announced together with their sub-groups in mid-April. More information on the structure, roles and responsibilities is attached for reference.

Other Progress to Date

During the pre-integration meeting held in Bermuda two weeks ago, business and functional leaders were tasked with foundational work to guide us in our planning efforts. To do this, they have recruited colleagues for support. This initial visioning and scoping work will provide the foundation for establishing the final work streams that will design and implement integration plans.

1

Finally, we have engaged EY as consultants to provide support and guidance during the integration phase.

Naming the Future Company

We have received 500 suggested names for the future company - thank you for your enthusiastic participation in this process. This week we will engage a branding firm to take us through a comprehensive process that will help us select a final name and develop our brand strategy.

Preserving Value

Last week, management of both companies met with members of the investment community to ensure the value proposition of this merger of equals is well understood. In addition, representatives from both companies met jointly with Standard & Poor’s last week to address outstanding questions associated with the merger. We are optimistic that the credit watch on respective financial strength ratings will be favorably resolved.

In the meantime, we are focused on achieving our stand alone business plans, while helping our clients and brokers understand the benefits our larger, stronger company will bring them in the future. Our priority is to be out in the market, deploying all tactics available with clients and brokers, to maximize business retention.

Progressing the Transaction

The transaction itself is progressing. We have made our initial anti-trust filings, with other required filings and approvals in progress. We’re conscious of the importance of timing for business retention and our legal teams are doing their utmost to complete the transaction as soon as possible.

Next Steps

While still early days, all of this foundational work is critical to ensuring that the amalgamation of our companies will achieve our vision of a new market leader for a new world. In the coming weeks, we expect to make more progress on all these fronts and will continue to provide as much information as possible.

Regards,

David Zwiener

Interim CEO

PartnerRe Ltd.

Albert Benchimol

President and CEO

AXIS Capital

2

Important Information For Investors And Stockholders

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between PartnerRe Ltd. (“PartnerRe”) and AXIS Capital Holdings Limited (“AXIS”). In connection with this proposed business combination, PartnerRe and/or AXIS may file one or more proxy statements, registration statements, proxy statement/prospectus or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document PartnerRe and/or AXIS may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF PARTNERRE AND AXIS ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of PartnerRe and/or AXIS, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by PartnerRe and/or AXIS through the website maintained by the SEC athttp://www.sec.gov. Copies of the documents filed with the SEC by PartnerRe will be available free of charge on PartnerRe’s internet website athttp://www.partnerre.com or by contacting PartnerRe’s Investor Relations Director by email atrobin.sidders@partnerre.com or by phone at 1-441-294-5216. Copies of the documents filed with the SEC by AXIS will be available free of charge on AXIS’ internet website athttp://www.axiscapital.com or by contacting AXIS’ Investor Relations Contact by email atlinda.ventresca@axiscapital.com or by phone at 1-441-405-2727.

Participants in Solicitation

PartnerRe, AXIS, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of PartnerRe is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 27, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 1, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014, which was filed with the SEC on October 31, 2014 and its Current Reports on Form 8-K, which were filed with the SEC on March 27, 2014, May 16, 2014 and January 29, 2015. Information about the directors and executive officers of AXIS is set forth in its Annual Report on Form 10-K for the year ended December 31, 2013, which was filed with the SEC on February 21, 2014, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014, its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014, which was filed with the SEC on October 31, 2014 and its Current Reports on Form 8-K, which were filed with the SEC on January 29, 2015, August 7, 2014, June 26, 2014, March 27, 2014 and February 26, 2014.

These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction between PartnerRe and AXIS are “forward-looking” statements. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely,” “plan,” “positioned,” “strategy,” and similar expressions, and the negative thereof, are intended to identify forward-looking statements. These forward-looking statements, which are subject to risks, uncertainties and assumptions about PartnerRe and AXIS, may include projections of their respective future financial performance, their respective anticipated growth strategies and anticipated trends in their respective businesses. These statements are only predictions based on current expectations and projections about future events. There are important factors that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or

3

implied by the forward-looking statements, including the risk factors set forth in PartnerRe’s and AXIS’ most recent reports on Form 10-K, Form 10-Q and other documents on file with the SEC and the factors given below:

| • | the failure to obtain the approval of shareholders of PartnerRe or AXIS in connection with the proposed transaction; |

| • | the failure to consummate or delay in consummating the proposed transaction for other reasons; |

| • | the timing to consummate the proposed transaction; |

| • | the risk that a condition to closing of the proposed transaction may not be satisfied; |

| • | the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obtained subject to conditions that are not anticipated; |

| • | AXIS’ or PartnerRe’s ability to achieve the synergies and value creation contemplated by the proposed transaction; |

| • | the ability of either PartnerRe or AXIS to effectively integrate their businesses; and |

| • | the diversion of management time on transaction-related issues. |

PartnerRe’s forward-looking statements are based on assumptions that PartnerRe believes to be reasonable but that may not prove to be accurate. AXIS’ forward-looking statements are based on assumptions that AXIS believes to be reasonable but that may not prove to be accurate. Neither PartnerRe nor AXIS can guarantee future results, level of activity, performance or achievements. Moreover, neither PartnerRe nor AXIS assumes responsibility for the accuracy and completeness of any of these forward-looking statements. PartnerRe and AXIS assume no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

4

PartnerRe/AXIS Capital High-Level Amalgamation Process Estimated Transaction Close 18+ months Integration Readiness Integration Planning Integration Execution Antitrust approvals Q1 Q2 Q3 Q4 Finalize Integration Structure Announcement S4 filing and SEC review Shareholder vote Regulatory approvals |

Integration Steering Committee Albert Benchimol – Chair Dave Zwiener Joe Henry Rick Gieryn Laurie Desmet Rich Strachan Bill Babcock Senior Integration Advisory Integration Working Committee TBD – Comprised of Key Workstream Leads + Business Workstreams Functional Workstreams Communications IMO Communications will help maintain a consistent flow of information throughout the process. The Integration Management Office (IMO), will provide structure and tools to the work streams. Project Merge Phase I Governance Structure Rich Strachan-AXS Joe Henry-AXS Laurie Desmet-PRE Celia Powell PRE Lead Linda Ventresca AXS Lead Shelly Hosford AXS Lead Martin Kuepfer PRE Lead The Integration Steering Committee will be responsible for defining integration strategy, governance, and establishing integration priorities The Integration Director, Bill Babcock, assisted by the Senior Integration is responsible for providing leadership to the Integration Working Committee. The Integration Working Committee will be responsible for ensuring completion of integration milestones with the support of their working groups. Advisory, NOTE: Leads, sub-leads and teams will be identified and communicated by mid-April. Workstreams and sub-workstreams - TBD Leads - TBD Workstreams and sub-workstreams - TBD Leads - TBD Integration Director – Bill Babcock |