- AXS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

AXIS Capital Holdings Limited (AXS) DEF 14ADefinitive proxy

Filed: 25 Mar 22, 8:15am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

AXIS CAPITAL HOLDINGS LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

Notice of Annual General Meeting

of Shareholders and

2022 Proxy Statement

Your vote is important

Please vote by using the Internet, the telephone,

or by mailing your completed voting information form or proxy card

March 25, 2022

Dear Shareholder:

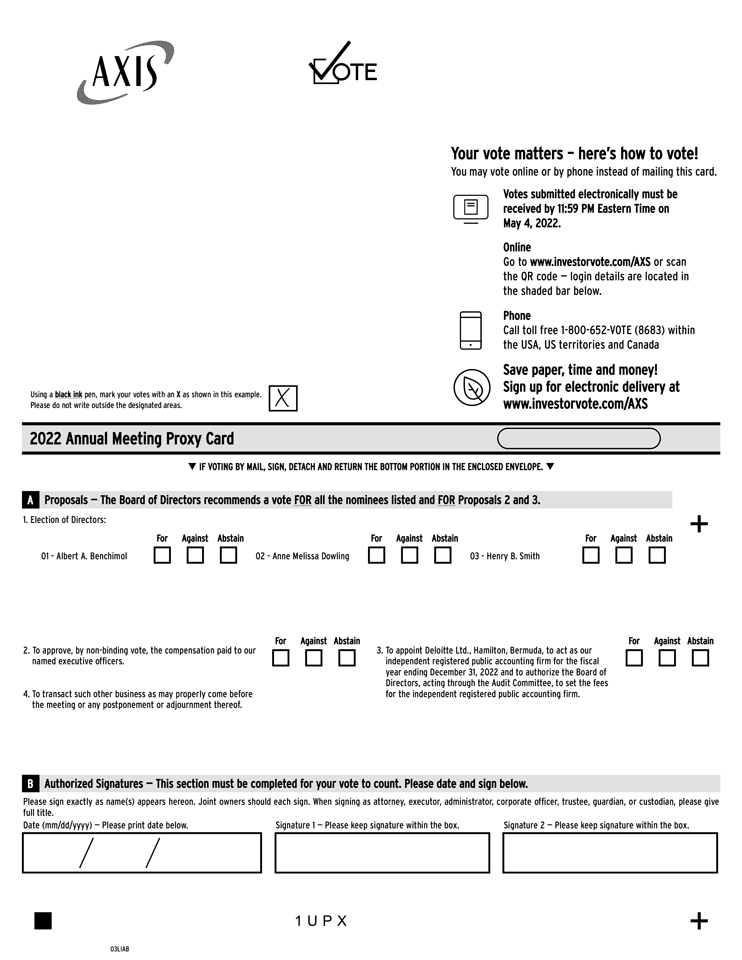

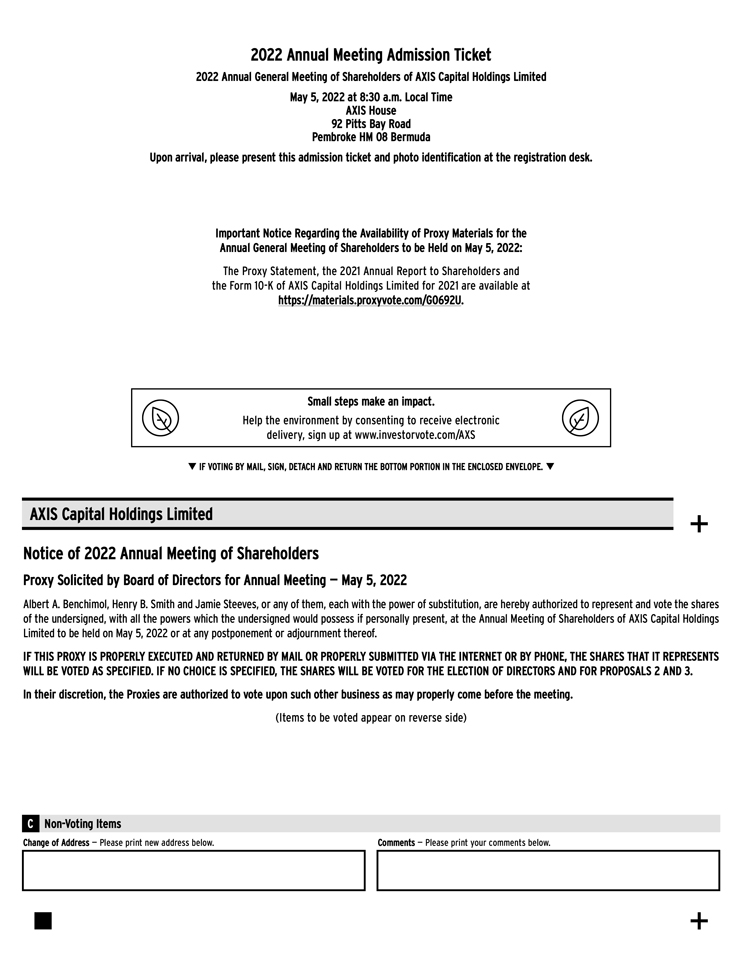

We are pleased to invite you to attend the 2022 Annual General Meeting of Shareholders of AXIS Capital Holdings Limited (“AXIS”), to be held on Thursday, May 5, 2022 at 8:30 a.m. ADT, in person at AXIS House, 92 Pitts Bay Road, Pembroke HM 08, Bermuda.

During the Annual General Meeting, we will make available information relating to the operations of AXIS during the past year. Representatives from our independent registered public accounting firm, Deloitte Ltd., will be present to respond to questions from shareholders.

Please vote via the Internet or by telephone at your earliest convenience by following the voting instructions printed on your Notice of Internet Availability of Proxy Materials or, if you received a printed copy of our proxy materials, by marking, dating, signing and returning your proxy card in the enclosed envelope. This will ensure that your shares will be represented and voted at the meeting even if you do not attend.

Sincerely,

Henry B. Smith

Chair of the Board

|

|

Thursday, May 5, 2022 at 8:30 a.m. ADT

| ||||

|

|

AXIS House 92 Pitts Bay Road Pembroke HM 08 Bermuda

Directions and instructions on how to attend the 2022 Annual General Meeting in person may be | ||||

| ||||||

| 1. | To elect the three Class III Directors listed herein to hold office until 2025; | |||||

| 2. | To approve, by non-binding vote, the compensation paid to our named executive officers; | |||||

| 3. | To appoint Deloitte Ltd., Hamilton, Bermuda, to act as our independent registered public accounting firm for the fiscal year ending December 31, 2022 and to authorize the Board of Directors, acting through the Audit Committee, to set the fees for the independent registered public accounting firm; and | |||||

| 4. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. | |||||

|

|

Close of business on March 11, 2022 | ||||

G. Christina Gray-Trefry

Corporate Secretary

March 25, 2022

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be held on May 5, 2022. This Notice of Annual General Meeting of Shareholders and proxy statement are being distributed or made available, as the case may be, on or about March 25, 2022. The proxy statement, the 2021 Annual Report to Shareholders and the Form 10-K for fiscal year 2021 are available at https://materials.proxyvote.com/G0692U.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail. You may revoke your proxy at any time before it is voted. Please refer to “Voting and Meeting Information” for additional information.

| Table of Contents |  |

| Proxy Statement Summary | 1 | |||

| Proposal 1. Election of Directors | 4 | |||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 8 | ||||

| Corporate Governance | 12 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

Human Capital and Compensation Committee Interlocks and Insider Participation | 16 | |||

| 16 | ||||

| 16 | ||||

| 16 | ||||

Code of Business Conduct and Corporate Governance Guidelines | 17 | |||

| 17 | ||||

| 21 | ||||

| Principal Shareholders | 25 | |||

| 25 | ||||

| Executive Officers | 27 | |||

| Proposal 2. Non-Binding Vote on Executive Compensation | 29 | |||

| 30 | ||||

| Compensation Discussion and Analysis | 31 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

When used in this proxy statement, the terms “we,” “us,” “our,” “the Company,” “AXIS,” and “AXIS Capital” refer to AXIS Capital Holdings Limited.

| PROXY STATEMENT SUMMARY |

This summary highlights certain information in this proxy statement. As it is only a summary, please review the complete proxy statement before you vote.

Annual General Meeting Date and Time | Thursday, May 5, 2022 - 8:30 a.m. ADT |

Location | AXIS House |

92 Pitts Bay Road

Pembroke HM 08

Bermuda

| Please refer to “Voting and Meeting Information” for additional information. |

| Agenda and Vote Recommendations | Proposal | Vote Recommendation | For More Information | |||

1. Election of the three Class III directors to the Board | FOR each nominee | 4 | ||||

2. Company’s executive compensation (“Say on Pay”) | FOR | 29 | ||||

3. Appointment of Deloitte Ltd. (“Deloitte”) as the Company’s independent registered public accounting firm for the 2022 fiscal year | FOR | 73 | ||||

| We may also transact any other business that may properly come before the meeting. As of the date of this proxy statement, we are not aware of any business to be presented for consideration other than the matters described in this proxy statement. |

Record Date | March 11, 2022 |

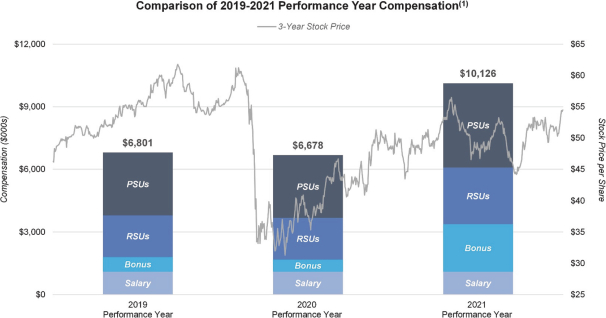

2021 Company Financial Performance | In 2021, AXIS advanced its efforts to strengthen its business, reposition its portfolio, reduce volatility, and drive profitable growth in attractive markets - while capitalizing on favorable market conditions. We are proud of the results that we delivered in 2021. |

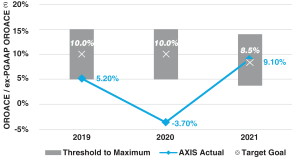

| Operating return on average common equity (“OROACE”) was the financial metric used for evaluating cash bonus awards under our Annual Incentive Plan. Relative total shareholder return (“TSR”) was the Company’s financial metric for its performance-vesting restricted stock unit awards (“PSUs”) granted in 2021. |

| AXIS’ 2021 financial results for these performance metrics on an absolute basis are set forth below: |

| Measure | Fiscal Year 2021 | Change versus Fiscal Year 2020 | ||

OROACE (1) | 9.1% | +12.8% pts | ||

ROACE (2) | 12.2% | +15.4% pts | ||

Total Shareholder Return (3) | 11.8% | +23.7% pts | ||

| (1) | See Appendix 1 for a reconciliation of non-GAAP financial measures to our results as reported under GAAP. |

| (2) | Return on average common equity. See our Annual Report on Form 10-K for the fiscal year ended December 31, 2021. |

| (3) | One-year TSR with dividends reinvested sourced from S&P Capital IQ. |

| PROXY STATEMENT SUMMARY | 1 | ||

COVID-19 Response | Throughout the ongoing COVID-19 pandemic, we have remained committed to the health, safety and wellness of our employees and focused on sustaining excellent service to our clients and partners in distribution. To support our employees during this time, we have offered educational tools and materials focused on the health and wellbeing of our employees, including remote working best practices, leading virtual teams and managing stress while working from home. We also allowed flexibility with paid time off and sick leave policies and offered employees paid time off to receive primary or booster vaccinations. |

| We continue to monitor health information in the various jurisdictions in which we operate as we implement our Flex for Your Day hybrid work format which provides most of our employees with the flexibility to work both remotely and from an AXIS office. |

| For additional information on our COVID-19 response, please refer to “Corporate Governance – Human Capital Management.” |

Human Capital Management | We believe our employees distinguish us from our competitors and are critical to our success as a (re)insurance company that leads with purpose. As a result, one of our core strategies is to invest in and support our employees, including with respect to health, safety and wellness, diversity, equity and inclusion, talent development, employee engagement and compensation and benefits. |

| For additional information on our human capital management, please refer to “Corporate Governance – Human Capital Management.” |

Corporate Citizenship | At AXIS, our purpose is clear: by helping people and organizations around the world to manage risk, we give them the confidence to pursue their goals and ambitions. Our Corporate Citizenship program, designed to address environment, social and governance (ESG) factors and focusing on issues like environment and diversity, equity and inclusion (DE&I), is one of many ways we advance this purpose. |

| For more information on the Company’s corporate citizenship initiatives, see “Corporate Governance – Corporate Citizenship & Sustainability.” |

Board Refreshment Practices and Strong Leadership Team | In 2021, the Board appointed Michael Millegan and Axel Theis to AXIS’ Board. Further, since July 2018, seven talented directors with diverse skill sets and professional backgrounds have joined our Board. These appointments demonstrate the Board’s strong commitment to Board refreshment and strengthening and diversifying the Board’s breadth of expertise and perspectives. For more information on the Board’s refreshment process, see “Corporate Governance” and “Proposal 1: Election of Directors.” |

| On the leadership front, in January 2022 we announced that Peter Wilson, Chief Executive Officer of AXIS Insurance, will be leaving the Company effective December 31, 2022 timed to the completion of his employment agreement. Mr. Wilson will serve in his current role until May 31, 2022 and will serve as an advisor from June 1 until December 31, 2022. Vincent Tizzio, who currently serves as Senior Advisor – Insurance Market Strategy, will succeed Mr. Wilson as Chief Executive Officer of AXIS Insurance effective June 1, 2022. Collectively, our executive leadership team shares a commitment to fully realize AXIS’ growth potential. |

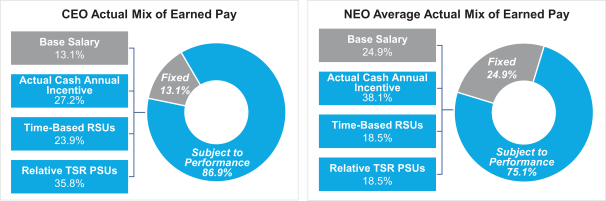

Executive Compensation | • | Bonuses made under our annual incentive plan are designed to drive our “One AXIS” approach, placing a heavier weighting on corporate financial results. |

| • | The annual incentive mix for our CEO is weighted 75% based on OROACE and 25% based on non-financial metrics. The CEOs of our business units and our Chief Investment Officer have 55% of their annual incentive mix based on Company OROACE (previously 35%) and our CFO has 70% of his annual incentive mix based on Company OROACE (previously 60%). |

| 2 | PROXY STATEMENT SUMMARY |  | ||||

| • | The non-financial objectives for the Annual Incentive Plan include metrics that assess our underwriting year performance for our business unit leaders and the NEOs’ individual contributions to our strategic goals. |

| • | The annual equity award for our CEO is weighted 60% in PSUs and 40% in time-vested stock unit awards (“RSUs”). The other NEOs’ equity awards are split evenly between PSUs and RSUs. |

| • | For 2021 equity grants, the PSU payout range had a minimum of 0% and a maximum of 200% of target. No PSU payouts vest in the case of bottom quartile performance. |

| For more information on executive compensation, see “Compensation Discussion and Analysis” and “Executive Compensation.” |

Corporate Governance Highlights | Corporate governance continues to be an area of significant focus for our Board. Our current governance practices include the following, many of which are discussed in further detail throughout this proxy statement: |

| • | Regular shareholder engagement |

| • | Annual Board and committee self-evaluations |

| • | Majority independent Board and fully independent Audit, Human Capital and Compensation, and Corporate Governance, Nominating and Social Responsibility Committees |

| • | None of our directors serve on the board of directors of more than three other publicly-held corporations |

| • | Majority vote standard for election of directors |

| • | No stockholder rights plan (“poison pill”) |

| • | Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting |

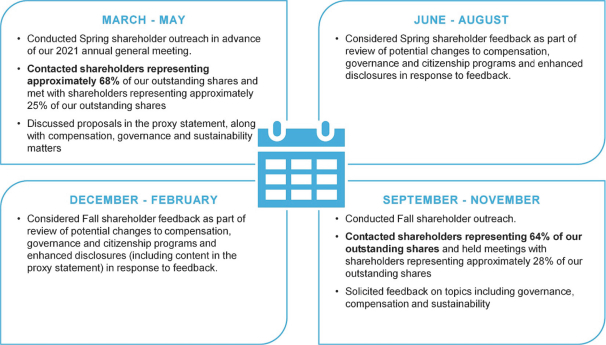

Shareholder Engagement and Responsiveness to Shareholders | In addition to our regular investor relations efforts, in 2021 we reached out to shareholders representing over 60% of our outstanding common shares. In the Spring, we held meetings with holders representing approximately 25% of our outstanding shares and in the Fall, we held meetings with holders representing approximately 28% of our outstanding shares. |

| • | Henry Smith, our Human Capital and Compensation Committee Chair and Independent Chair of the Board, led engagement efforts and actively participated in a majority of the meetings. |

| • | Discussion topics included Company performance, executive compensation and governance practices as well as environmental, social and sustainability topics. |

| For more information on shareholder engagement, see “Compensation Discussion and Analysis – Positive 2021 Say on Pay Vote and Shareholder Engagement.” |

Prompt return of your proxy will help reduce the costs of re-solicitation.

| PROXY STATEMENT SUMMARY | 3 | ||

| PROPOSAL 1. ELECTION OF DIRECTORS |

Our Board is divided into three classes, designated as Class I, Class II and Class III. The term for each Class III director expires at this year’s Annual General Meeting to be held on May 5, 2022; the term for each Class II director will expire at the Company’s Annual General Meeting in 2023; and the term for each Class I director will expire at the Company’s Annual General Meeting in 2024. At each annual general meeting of the Company, the successors of the class of directors whose term expires at that meeting will be elected for a term expiring at the annual general meeting to be held in the third year following the year of their election.

Three Class III directors are to be elected at the meeting to serve until the Company’s Annual General Meeting in 2025. All of the nominees are currently directors. Our Corporate Governance, Nominating and Social Responsibility Committee recommended all of the nominees to our Board for election at the meeting and all nominees have consented to serve on our Board. We do not expect that any of the nominees will become unavailable for election as a director, but if any nominee should become unavailable prior to the Annual General Meeting, proxy cards authorizing the proxies to vote for the nominees will instead be voted for substitute nominees recommended by our Board.

Our Board has reviewed its classified board structure and continues to believe that this structure provides greater stability and continuity in the Board’s membership and in the direction and guidance that it provides to the Company’s management. As compared to an annual election process, this approach promotes a long-term perspective to our strategic objectives and has proved beneficial to our CEO and executive management in establishing the Company’s short and long-term priorities. The classified board structure also ensures that at any given time, a majority of the directors serving on the Board will have substantial knowledge of the Company and its business, values, competitive environment, risks and strategic goals. We believe directors who have experience with the Company are better positioned to make decisions that are best for the Company and its shareholders, particularly given the complexity of the (re)insurance industry. In addition, three-year terms assist in recruiting highly qualified directors who are willing to commit the time and resources to develop a deep understanding of the Company and its business, and encourages a long-term view. We believe that a classified election process remains in the best interests of our shareholders.

SKILLS, QUALIFICATIONS AND EXPERIENCE OF DIRECTORS

For the Board to satisfy its oversight responsibilities effectively, the Board seeks members who combine the highest standards of integrity with significant accomplishments in their chosen fields. The Corporate Governance, Nominating and Social Responsibility Committee is responsible for recommending qualified candidates for directorships to be filled by the Board or by our shareholders. Directors are expected to bring a diversity of experiences, skills and perspectives to our Board. The Committee considers qualities of intelligence, honesty, perceptiveness, good judgment, high ethics and standards, integrity and fairness to be of paramount importance. It also examines experience, diversity, knowledge and skills in business judgment, leadership, strategic planning, general management practices and crisis response. In addition, the Committee looks for candidates with financial expertise and a willingness and ability to commit the time required to fully discharge their responsibilities to the Board. The Committee evaluates candidates based on their qualifications and not based on the manner in which they were submitted for consideration.

The Committee views diversity as an essential element of our Board’s composition and effectiveness. Attributes that will be additive to our overall Board’s diversity, such as race, gender identity, age, sexual orientation, ethnicity and national origin, are considered in the identification and evaluation of our director candidates.

As reflected in the chart below, we believe our Board offers a diverse range of skills and experience to provide effective oversight of the Company and create long-term growth through successful execution of the Company’s strategic initiatives.

| 4 | PROPOSAL 1. ELECTION OF DIRECTORS |  | ||||

| DIRECTORS |  |

|  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||

EXPERIENTIAL CRITERIA (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||

Digital Experience |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

Insurance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||

Reinsurance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||

Finance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||

International Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||

Banking Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||

Legal/Regulatory Experience |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Current U.S.-Listed Public Boards |

| 1 |

| 0 |

| 1 |

| 0 |

| 0 |

| 2 |

| 0 |

| 0 |

| 0 |

| 3 |

| 1 | |||||||||||||||||||||||||||||||||

Average Age = 65.5 years |

| 69 |

| 64 |

| 73 |

| 63 |

| 49 |

| 63 |

| 78 |

| 73 |

| 64 |

| 62 |

| 63 | |||||||||||||||||||||||||||||||||

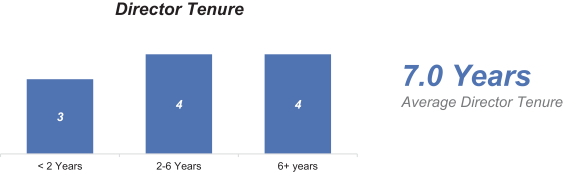

Average Tenure = 7.0 years |

| 1.8 |

| 10.2 |

| 20.3 |

| 2.2 |

| 3.3 |

| .9 |

| 12.6 |

| 17.8 |

| .9 |

| 3.7 |

| 2.9 | |||||||||||||||||||||||||||||||||

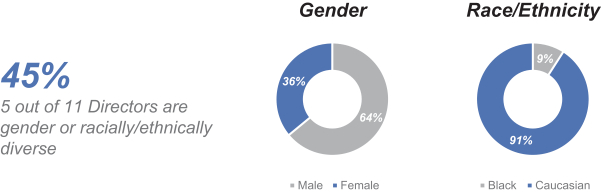

Racially/Ethnically Diverse |

| ◾ | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse |

| ◾ |

| ◾ |

| ◾ |

| ◾ | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Competencies with a “✓” indicate substantial professional experience. |

Our Board is committed to orderly director succession planning and having a diversity of perspectives, skills and experiences on our Board aligned with our long-term strategy. While our Board benefits immensely from the industry expertise of our longer-tenured directors, we recognize the importance of regular, thoughtful refreshment and have launched a thoughtful director succession planning process. The Committee identified the skills and experience which are needed to lead the Company into the future, in line with our evolving strategy, and has evaluated director candidates based upon these desired qualities, attributes and skills. Our Corporate Governance, Nominating and Social Responsibility Committee has engaged a third-party search firm to identify and evaluate potential candidates for service on our Board. This succession planning has been conducted over time, as part of a multi-stage process, to ensure that the Company continues to benefit from the Company-specific expertise of our longer-tenured directors, balanced with the fresh perspectives brought by our newer directors.

Our director succession planning and refreshment process emphasizes the importance of diversity, including diversity of age, gender, sexual orientation, race, ethnicity, geographic location and cultural background. Our process is also focused on expanding the collective skills and experience of our Board with our new directors bringing deep industry and financial expertise, regulatory experience, innovative thinking and strategic perspective. The Committee considers a broad spectrum of backgrounds, skills and personal and professional experiences to ensure a strong and effective Board.

Since July 2018, six longer-tenured directors have retired. However, as a result of the Committee’s thoughtful approach to director succession planning, the Board was positioned to nominate highly qualified directors. Since July 2018, seven talented directors with diverse skill sets and professional backgrounds have joined the Board, adding four women and one racially/ethnically diverse director.

| PROPOSAL 1. ELECTION OF DIRECTORS | 5 | ||

While we have not adopted a formal Board diversity policy, the Corporate Governance, Nominating and Social Responsibility Committee views diversity as a key element of our Board’s composition and effectiveness. The Committee also believes that it is desirable for new candidates to contribute to the variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experiences.

Highlights of our directors include the following:

The table below sets forth the names, ages, classes and positions of the nominees who are standing for election at the meeting. The biographies that follow provide business experience and U.S.-listed public company directorships held during the last five years.

Name | Age | Class | Position | Since | ||||

Albert A. Benchimol | 64 | III | Chief Executive Officer and President | January 2012 | ||||

Anne Melissa Dowling (1) | 63 | III | Independent Director | January 2020 | ||||

Henry B. Smith | 73 | III | Independent Director | May 2004 | ||||

| (1) | Ms. Dowling was identified as a director candidate by a third-party search firm as part of our Board refreshment process. Upon recommendation by our Corporate Governance, Nominating and Social Responsibility Committee, Ms. Dowling was unanimously appointed by the Board effective January 1, 2020. |

| 6 | PROPOSAL 1. ELECTION OF DIRECTORS |  | ||||

Albert A. Benchimol | Experience: |

| • | Has served as our President and Chief Executive Officer since May 2012. He previously served as our Executive Vice President and Chief Financial Officer from January 2011 until May 2012. |

| • | Served as Executive Vice President and Chief Financial Officer of PartnerRe Ltd. from April 2000 through September 2010 and as Chief Executive Officer of PartnerRe Ltd.’s Capital Markets Group business unit from June 2007 through September 2010. |

| • | Prior to joining PartnerRe, Mr. Benchimol was Senior Vice President and Treasurer at Reliance Group Holdings, Inc. for 11 years and was previously with the Bank of Montreal from 1982 to 1989. |

| Education: B.S. from McGill University and M.B.A. from McGill University |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes that Mr. Benchimol is qualified to serve as a director based on his 40 years of experience in corporate finance, investments, the finance and insurance industry and his specific background as the Company’s Chief Executive Officer and President and former Chief Financial Officer. |

| Committee Membership: Executive and Risk Committees |

Anne Melissa Dowling | Experience: |

| • | Served as Director of Insurance for the State of Illinois from 2015 to 2017 and as Deputy (and Acting) Commissioner of Insurance for the State of Connecticut from 2011 to 2015. |

| • | Held executive management roles in the areas of investments, treasury, strategic planning and marketing and governance at Massachusetts Mutual Financial Group; Connecticut Mutual Life Insurance Company; Travelers Insurance Company; and at Aetna Life & Casualty, where she began her career in 1982. |

| • | Holds the Chartered Financial Analyst designation. |

| Education: B.A. from Amherst College and M.B.A. from Columbia Business School |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes that Ms. Dowling is qualified to serve as a director based on her insurance industry expertise including 25 years of executive management in the private sector and, most recently in the public sector, as Director of the Illinois Department of Insurance. |

| Committee Membership: Audit, Corporate Governance, Nominating and Social Responsibility, Finance and Risk Committees |

Henry B. Smith | Experience: |

| • | Served as the Chief Executive Officer and President of W.P. Stewart & Co., Ltd. from May 2005 to March 2006. |

| • | Former Chief Executive Officer of the Bank of Bermuda Limited from March 1997 to March 2004. |

| • | Joined the Bank of Bermuda in 1973 serving in various senior positions including Executive Vice President and Chief Operations Officer; Executive Vice President Europe; and Senior Vice President and General Manager, Retail Banking. |

| Education: B.A. from Trinity College-Hartford |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes that Mr. Smith is qualified to serve as a director based on his background and extensive international banking experience, including his 31-year career with the Bank of Bermuda. |

| PROPOSAL 1. ELECTION OF DIRECTORS | 7 | ||

| Committee Membership: Chair of the Executive and Human Capital and Compensation Committees and member of the Corporate Governance, Nominating and Social Responsibility Committee |

Recommendation of the Board

The Board recommends that you vote “FOR” the election of these nominees.

DIRECTORS CONTINUING IN OFFICE

The table below sets forth the names, ages, classes and positions of the directors who are not standing for election at the Annual General Meeting but whose term of office will continue after the meeting. The biographies that follow provide business experience and U.S.-listed public company directorships held during the last five years.

| Name | Age | Class | Position | Since | ||||

| W. Marston Becker | 69 | II | Independent Director | June 2020 | ||||

| Charles A. Davis | 73 | I | Independent Director | November 2001 | ||||

| Elanor R. Hardwick | 49 | I | Independent Director | November 2018 | ||||

| Michael Millegan | 63 | II | Independent Director | April 2021 | ||||

| Thomas C. Ramey | 78 | II | Independent Director | July 2009 | ||||

| Axel Theis | 64 | I | Independent Director | April 2021 | ||||

| Barbara A. Yastine | 62 | I | Independent Director | July 2018 | ||||

| Lizabeth H. Zlatkus | 63 | II | Independent Director | March 2019 | ||||

W. Marston Becker | Experience: |

| • | Served as Chairman of the Board of QBE Insurance Group from 2014 until April 2020. |

| • | Served as Chairman and Chief Executive Officer of: Alterra Capital Holdings Limited from 2006 to 2013, Trenwick Group, Ltd. from 2002 to 2005, the run-off for LaSalle Re Holdings from 2002 to 2008 and Orion Capital Corporation from 1996 to 2000. |

| • | Served as President and Chief Executive Officer of McDonough Caperton Insurance Group, Inc. from 1987 to 1994. |

| • | Holds the Chartered Financial Analyst designation and is an admitted attorney in West Virginia. |

| Education: B.S. from West Virginia University and J.D. from West Virginia University |

| U.S. Public Company Boards: MVB Financial Corp. |

| Key Qualifications: The Board believes that Mr. Becker is qualified to serve as a director based on his 36 years of experience, including Chief Executive Officer and Chairman leadership positions in the insurance and financial industries. |

| Committee Membership: Chair of the Risk Committee and Member of the Audit, Executive and Human Capital and Compensation Committees |

Charles A. Davis | Experience: |

| • | Current Chief Executive Officer of Stone Point Capital LLC, serving since June 2005. |

| • | Held various executive positions at MMC Capital, Inc., a subsidiary of Marsh & McLennan Companies, Inc., from 1998 until May 2005, serving as the Chief Executive Officer from 1999 to 2005 and as Chairman from 2002 to 2005. Also served as a Vice Chairman of Marsh & McLennan Companies, Inc. from 1999 to November 2004. |

| 8 | PROPOSAL 1. ELECTION OF DIRECTORS |  | ||||

| • | Spent 23 years at Goldman Sachs & Co. LLC, where, among other positions, Mr. Davis served as head of Investment Banking Services worldwide; head of the Financial Services Industry Group; General Partner; Senior Director; and Limited Partner. |

| Education: B.A. from the University of Vermont and M.B.A. from Columbia Business School |

| U.S. Public Company Boards: The Progressive Corporation. Former director of The Hershey Company from 2007 to 2021. |

| Key Qualifications: The Board believes that Mr. Davis is qualified to serve as a director based on his distinguished career in investment banking, his extensive knowledge of corporate finance and his experience in the insurance industry. |

| Committee Membership: Chair of Finance Committee and member of the Executive and Risk Committees |

Elanor R. Hardwick | Experience: |

| • | Former Chief Digital Officer of UBS, leading the bank’s innovation and digitization activities across all business lines and functions globally, serving from 2018 to June 2020. |

| • | Served as Head of Innovation of Deutsche Bank from 2016 to 2018, leading innovation across business lines and functions globally and supporting the company’s digital strategy development. |

| • | Served as Chief Executive Officer from 2011 to 2016, of Credit Benchmark Ltd., a FinTech start-up and provider of credit risk data, leading the company from its foundation. |

| • | Held a succession of senior leadership positions at Thomson Reuters from 2005 to 2011 including Global Head of Strategy, Investment and Advisory; Global Head of Professional Publishing; and Head of Strategy for Europe and Asia. |

| • | Held positions at Morgan Stanley International from 2002 to 2005; Booz-Allen & Hamilton from 1997 to 2000; and the United Kingdom’s Department of Trade and Industry from 1995 to 1997. |

| Education: M.A. from the University of Cambridge and M.B.A. from Harvard Business School |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes that Ms. Hardwick is qualified to serve as a director based on her leadership positions in the financial services and FinTech industries, including her experience leading global innovation and digital strategy initiatives at UBS and Deutsche Bank. |

| Committee Membership: Human Capital and Compensation, Corporate Governance, Nominating and Social Responsibility, and Risk Committees. |

Michael Millegan | Experience: |

| • | Has served as Founder and Chief Executive Officer of Millegan Advisory Group-3 LLC, a strategic advisory firm for early-stage companies since February 2014. |

| • | Held executive leadership and management roles at Verizon over the course of his 33-year tenure, including President of Verizon Global Wholesale Group, Area President of Verizon Midwest Region and Senior Vice President of Verizon Enterprise Operations. |

| Education: B.A. from Angelo State University and M.B.A. from Angelo State University |

| U.S. Public Company Boards: Portland General Electric Company and Wireless Telecom Group, Inc. Former director of CoreSite Realty Corporation from February to December 2021 prior to its acquisition by American Tower Corporation. |

| PROPOSAL 1. ELECTION OF DIRECTORS | 9 | ||

| Key Qualifications: The Board believes Mr. Millegan is qualified to serve as a director based on his 33 years of leadership experience, including his experience running a business to business network and working with global companies, along with his knowledge in the areas of digital technology and platforms, cybersecurity, supply chain management, sales, marketing and operations. |

| Committee Membership: Audit and Human Capital and Compensation Committees |

Axel Theis | Experience: |

| • | Served in various management roles during his distinguished 33-year career with Allianz SE, including as a member of the Allianz Board of Management from 2015 to 2020; Chief Executive Officer of Allianz Global Corporate & Specialty SE from 2006 to 2014; and Chief Executive Officer of Allianz Global Risks Ruckversicherungs from 2004 to 2006. |

| • | Also served on Allianz’s U.K. subsidiary board as Chairman from 2015 to 2018, as a member of the U.S. and Irish subsidiaries of Allianz from 2015 to 2018 and as Chairman of Allianz’ French credit insurance company, Euler Hermes from 2015 to 2019. |

| Education: Ph.D. from the Eberhard Karls Universität Tübingen |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes Dr. Theis is qualified to serve as a director based on his 33 years of multinational experience at Allianz and his experience leading (re)insurance and asset management businesses of significant scale across the European and global markets. |

| Committee Membership: Audit and Risk Committees |

Thomas C. Ramey | Experience: |

| • | Former Chairman and President of Liberty International, a wholly owned subsidiary of Liberty Mutual Group, from 1997 to 2009. Also served as Executive Vice President of Liberty Mutual Group from 1995 through 2009. |

| • | Served as President and Chief Executive Officer of American International Healthcare, a subsidiary of AIG. |

| • | Founder and President of an international healthcare trading company. |

| Education: B.A. from Texas Tech University and M.A. from Tulane University |

| U.S. Public Company Boards: None |

| Key Qualifications: The Board believes Mr. Ramey is qualified to serve as a director based on his extensive insurance industry knowledge and significant background in international insurance operations, acquisitions and management. |

| Committee Membership: Audit, Corporate Governance, Nominating and Social Responsibility and Human Capital and Compensation Committees |

Barbara A. Yastine | Experience: |

| • | Former Chair and Chief Executive Officer of Ally Bank, a digital banking leader. Served as Chair from 2010 to 2015 and became interim Chief Executive Officer and President in 2011 before serving as Chief Executive Officer and President beginning in 2012. Also served as Chief Administrative Officer of Ally Financial from 2010 to 2012. |

| • | Previously served on the Board of First Data Corporation from 2016 to July 2019 and also as a director and co-Chief Executive Officer of privately held Lebenthal Holdings, LLC from September 2015 to June 2016. In November 2017, Lebenthal and certain of its subsidiaries filed voluntary petitions for bankruptcy under Chapter 7 of the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York. |

| 10 | PROPOSAL 1. ELECTION OF DIRECTORS |  | ||||

| • | Held various executive roles at Citigroup and Credit Suisse First Boston spanning over 17 years. |

| Education: B.A. in Journalism from New York University and M.B.A. from New York University |

| U.S. Public Company Boards: Primerica, Inc., Zions Bancorporation and Alkami Technology, Inc. Former director of First Data Corporation from 2016 to 2019. |

| Key Qualifications: The Board believes that Ms. Yastine is qualified to serve as a director based on her more than 30 years of management experience in the financial services and risk management sectors, including her prior role as Chair, Chief Executive Officer and President of Ally Bank. |

| Committee Membership: Chair of the Corporate Governance, Nominating and Social Responsibility Committee and member of the Audit and Risk Committees |

Lizabeth H. Zlatkus | Experience: |

| • | Served in various senior leadership positions during her tenure with The Hartford Financial Services Group from 1983 to 2011, including Chief Financial Officer and Chief Risk Officer of the firm and Co-President of Hartford Life Insurance Companies and as Executive Vice President of The Hartford’s international operations and the group life and disability divisions. |

| Education: B.S. from Pennsylvania State University |

| U.S. Public Company Boards: Meta Financial Group, Inc. Former director of Computer Sciences Corporation from 2016 to 2017 and Boston Private Financial Holdings, Inc. from 2015 to 2021. |

| Key Qualifications: The Board believes that Ms. Zlatkus is qualified to serve as a director based upon her leadership experience with insurance organizations, including her prior roles as Chief Financial Officer and Co-President as well as her executive management background in risk and operations during her 28-year career with The Hartford Financial Services Group. |

| Committee Membership: Chair of the Audit Committee and member of the Human Capital and Compensation and Finance Committees |

| PROPOSAL 1. ELECTION OF DIRECTORS | 11 | ||

| CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate governance is an area of significant focus for our Board and is a critical component of our success in driving sustained shareholder value. Highlights of our corporate governance standards are provided below:

| ✓ | Majority vote standard for election of directors. Each director must be elected by a majority of votes cast, not a plurality. |

| ✓ | No “over-boarding.” None of our directors serve on the board of directors of more than three other publicly held corporations. |

| ✓ | Regular shareholder engagement. We engage with our shareholders to better understand their perspectives. |

| ✓ | Regular Board and Committee self-evaluation process |

| ✓ | Active Board refreshment process |

| ✓ | No hedging the economic risk of owning AXIS stock or pledging of AXIS stock for loans or other obligations |

| ✓ | Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting |

| ✓ | Majority independent Board. All of our directors are independent, except for our CEO. |

| ✓ | Independent Audit, Human Capital and Compensation and Corporate Governance, Nominating and Social Responsibility Committees |

| ✓ | Robust Code of Business Conduct. AXIS is committed to operating its business with the highest level of ethical conduct and has adopted a Code of Business Conduct that applies to all employees and officers as well as the Board of Directors. Our Code of Business Conduct is available at www.axiscapital.com. |

Under the Company’s Corporate Governance Guidelines, our Board must be composed of a majority of directors who are independent of the Company’s management. For a director to be deemed independent, the Board must affirmatively determine that he or she does not have a direct or indirect material relationship with the Company. In addition, the director must meet the independence requirements of the New York Stock Exchange (“NYSE”).

Our Board currently consists of 11 directors, ten of whom are independent. The Board has affirmatively determined that each of Messrs. Becker, Davis, Millegan, Ramey, Smith and Theis and Mses. Dowling, Hardwick, Yastine and Zlatkus are independent in accordance with the Company’s Corporate Governance Guidelines and the listing standards of the NYSE, including with respect to committee service. Mr. Benchimol serves as our Chief Executive Officer and President and therefore is not independent. The Board has made these determinations based primarily on a review of the responses of the directors to questions regarding employment and compensation history, family relationships and affiliations and discussions with the directors. The Board also considers the recommendations of the Corporate Governance, Nominating and Social Responsibility Committee which thoughtfully assesses independence on an annual basis, regularly tracks and considers fees paid to Stone Point Capital LLC and its affiliates (“Stone Point”) and other factors and considers the advice of outside counsel experienced in these matters.

With respect to Charles A. Davis, the Board reviewed his current relationship with Stone Point and assets that we currently have under management with affiliates of Stone Point, along with his indirect share ownership of the Company through Stone Point affiliated entities (refer to “Principal Shareholders” later in this proxy statement). The Board determined that none of these relationships constitute a material relationship with us as defined in the listing standards of the NYSE and in accordance with the Company’s Corporate Governance Guidelines. For more details about these relationships and the related transactions, see “Certain Relationships and Related Transactions” below.

BOARD AND COMMITTEE EVALUATIONS

We believe that a robust Board and committee evaluation process is an essential component of good governance. At AXIS, our Board and committee members conduct annual self-evaluations covering a range of topics. The self-evaluation process is facilitated and overseen by our Corporate Governance, Nominating and Social Responsibility Committee to ensure a rigorous assessment of Board and committee effectiveness, priorities, and composition and to inform our refreshment and succession planning efforts. During 2021, the Corporate Governance, Nominating and Social Responsibility Committee Chair held both group and one-on-one discussions with directors

| 12 | CORPORATE GOVERNANCE |  | ||||

to obtain and compile responses to the self-evaluation. The Corporate Governance, Nominating and Social Responsibility Committee reported and implemented actionable feedback to further improve the process. The Corporate Governance, Nominating and Social Responsibility Committee considers the one-on-one discussions as an added benefit which deepens its assessment of the overall effectiveness of the Board and its committees.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures for Transactions with Related Persons. We have established procedures for reviewing transactions between us and any director, executive officer or holder of five percent or more of our voting securities, or an immediate family member of any such person. These procedures help us evaluate whether any such related person transaction could impair the independence of a director or present a conflict of interest on the part of a director or executive officer. With the assistance of the Company’s General Counsel, our Corporate Governance, Nominating and Social Responsibility Committee is required to consider and approve all transactions in which AXIS participates where a related person may have a direct or indirect material interest which involves an amount greater than $120,000. When reviewing transactions, the Corporate Governance, Nominating and Social Responsibility Committee considers any factors it deems relevant, including (i) whether the transaction is in the ordinary course of business of the Company, (ii) whether the transaction is on terms no less favorable than terms available to an unaffiliated third party, (iii) the related party’s interest in the transaction, (iv) the approximate dollar value of the transaction, (v) the purpose of the transaction, (vi) the disclosure obligations of the Company, (vii) the conflict of interest provisions of our Code of Business Conduct; and (viii) any other information that may be considered material.

Related persons include any of our directors, director nominees or executive officers, certain of our shareholders and their respective immediate family members. A conflict of interest occurs when an individual’s private interest interferes, or appears to interfere, in any way with our interests.

Our Code of Business Conduct requires all directors, officers and employees who may have either a potential or apparent conflict of interest to promptly disclose such conflict to our General Counsel. We seek affirmative confirmation of compliance with our Code of Business Conduct from our directors, officers and employees annually. Additionally, each year, our directors and executive officers complete questionnaires that require the identification of any arrangements or transactions in which they or their family members have an interest. Further, directors are requested to disclose any new conflicts of interest at each quarterly board meeting, and they would be expected to recuse themselves from any matters involving a potential conflict.

The following is a summary of transactions between the Company and affiliates of Stone Point, a private equity firm that specializes in the insurance and financial services industry, including owning several specialized investment managers. Charles A. Davis is the Chief Executive Officer of Stone Point.

| • | In the ordinary course of business, the Company engages SKY Harbor Capital Management, LLC, an affiliate of Stone Point, to manage certain of our high yield debt portfolios representing approximately 7% of our total investments. In 2021, we paid $2 million to SKY Harbor Capital Management, LLC in fees relating to these portfolios. |

| • | We have an investment of $47 million in the Freedom Consumer Credit Fund, LLC Series B, the manager of which is Freedom Financial Asset Management, LLC, an indirect subsidiary of Pantheon Partners, LLC (“Pantheon”). Investment funds managed by Stone Point own approximately 14.5% of Pantheon. During 2021, fees paid to Freedom Financial Asset Management, LLC totaled $3 million. |

| • | We have a $79 million investment in Stone Point’s private equity fund, Trident VIII L.P. and co-investments of $25 million. In 2021, we paid $4 million in fees to Stone Point in connection with our investment in Trident VIII L.P. We pay no fees to Stone Point in connection with our co-investments. |

| • | We have a $20 million investment in Rialto Real Estate IV-Property and co-investments of $16 million with Rialto Real Estate Fund IV-Property, a fund managed by a portfolio company of Stone Point’s private equity fund, Trident VII L.P. In 2021, we paid $1 million in fees in connection with these investments. |

| • | We have a $12 million investment in Stone Point Credit Corporation. In 2021, $120,000 in fees were paid relating to this investment. |

| CORPORATE GOVERNANCE | 13 | ||

The Corporate Governance, Nominating and Social Responsibility Committee reviewed each of the transactions with affiliates of Stone Point before approval to confirm each transaction was no less favorable than those provided to other investors. In addition, the Committee reviews all relationships with Stone Point affiliates annually and whenever a new transaction is proposed to the Committee.

Our Board maintains Audit, Human Capital and Compensation, Corporate Governance, Nominating and Social Responsibility, Finance, Risk and Executive Committees. Current copies of the charter for each of these committees, as well as our Corporate Governance Guidelines, are available on our website at https://investor.axiscapital.com/corporate-governance/committee-composition/default.aspx. The table below provides current membership and meeting information for each committee. In addition, the table identifies the independent directors, as determined by our Board based on the NYSE listing standards and our Corporate Governance Guidelines.

| Name | Audit | Human Capital and Compensation | Corporate Governance, Nominating | Finance | Risk | Executive | Independent Director | |||||||

| W. Marston Becker | Member | Member | Chair | Member | X | |||||||||

| Albert A. Benchimol | Member | Member | ||||||||||||

| Charles A. Davis | Chair | Member | Member | X | ||||||||||

| Anne Melissa Dowling | Member | Member | Member | Member | X | |||||||||

| Elanor R. Hardwick | Member | Member | Member | X | ||||||||||

| Michael Millegan | Member | Member | X | |||||||||||

| Thomas C. Ramey | Member | Member | Member | X | ||||||||||

| Henry B. Smith | Chair | Member | Chair | X | ||||||||||

| Axel Theis | Member | Member | X | |||||||||||

| Barbara A. Yastine | Member | Chair | Member | X | ||||||||||

| Lizabeth H. Zlatkus | Chair | Member | Member | X | ||||||||||

| 2021 Meetings | 8 | 8 | 5 | 5 | 4 | 0 | ||||||||

Audit Committee. The Audit Committee has general responsibility for the oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, our independent auditor’s qualifications and independence and the performance of our internal audit functions and independent auditors. The Committee appoints, retains and determines the compensation for our independent auditors, pre-approves the fees and services of the independent auditors and reviews the scope and results of their audit. The Audit Committee has been established in accordance with Rule 10A-3 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member of the Audit Committee is a non-management director and is independent based on the listing standards of the NYSE and our Corporate Governance Guidelines. Our Board has determined that each of Messrs. Becker, Ramey and Theis and Mses. Dowling, Yastine and Zlatkus qualify as an audit committee financial expert pursuant to the rules and regulations of the SEC.

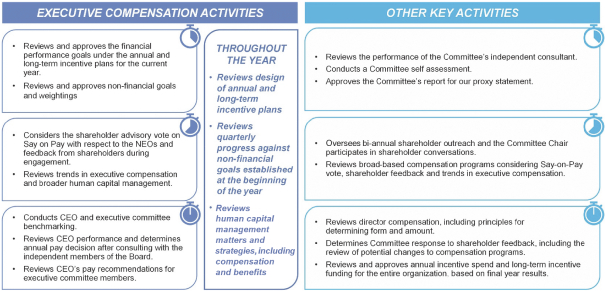

Human Capital and Compensation Committee. The Human Capital and Compensation Committee establishes compensation for our Chief Executive Officer and certain other executives in light of our established corporate performance goals and reviews and approves overall officer, management and employee compensation policies, incentive compensation plans, equity-based plans and director compensation. In 2021, the Human Capital and Compensation Committee expanded and formalized its responsibilities upon delegation from the Corporate Governance, Nominating and Social Responsibility Committee to include primary oversight of the Company’s human capital management efforts, including diversity, equity and inclusion, human rights, talent development and employee engagement (as delegated by the Corporate Governance, Nominating and Social Responsibility Committee). In addition, the Committee, formerly known as the Compensation Committee, was renamed to reflect its new responsibilities and to emphasize the Company’s commitment to human capital management. Each member of this Committee is a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act and is independent as defined in the listing standards of the NYSE and in accordance with our Corporate Governance Guidelines. For a description of our processes and procedures for the consideration and determination of executive and director compensation, see “Compensation Discussion and Analysis” and “2021 Directors Compensation” later in this proxy statement.

| 14 | CORPORATE GOVERNANCE |  | ||||

Corporate Governance, Nominating and Social Responsibility Committee. The Corporate Governance, Nominating and Social Responsibility Committee takes a leadership role in shaping our corporate governance by identifying and proposing qualified director nominees, overseeing the purpose, structure and composition of our Board committees and periodically reviewing our Code of Business Conduct and Corporate Governance Guidelines. The Committee also establishes and oversees our Board and committee evaluation process which occurs annually. Additionally, the Committee oversees our ESG and sustainability initiatives which are considered to be an essential part of our governance and are discussed in detail further in this proxy statement. In 2021, the Committee delegated oversight of human capital management, a component of the Company’s ESG program, to the Company’s Human Capital and Compensation Committee. In addition, the Committee, formerly known as the Corporate Governance and Nominating Committee, was renamed to reflect and formalize its primary responsibility for ESG and sustainability. Each member of this Committee is a non-management director and is independent as defined in the listing standards of the NYSE and in accordance with our Corporate Governance Guidelines.

Finance Committee. The Finance Committee oversees the investment and treasury functions of the Company, including the investment of funds and financing facilities. Its responsibilities include: approving our investment policies and guidelines, reviewing the performance of the investment portfolio, monitoring the need for additional financing and overseeing compliance with outstanding debt facility covenants.

Risk Committee. The Risk Committee assists the Board in its oversight of risks to which the Company is exposed and monitors our compliance with our aggregate risk standards and risk appetite. The Risk Committee also reviews compensation practices to determine whether our policies and plans are consistent with the Company’s risk framework and do not encourage excessive risk taking.

Executive Committee. The Executive Committee may exercise the authority of the Board when the entire Board is not available to meet, except in cases where the action of the entire Board is required by our memorandum of association, our bye-laws or applicable law.

MEETINGS OF THE BOARD AND ITS COMMITTEES

Pursuant to our Corporate Governance Guidelines, we expect our directors to attend all meetings of our Board, all meetings of all committees of the Board on which they serve and each annual general meeting, absent exigent circumstances. Our Board met five times during the year ended December 31, 2021. No director attended fewer than 75% of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which the director served (during the period that each director served on the Board or such committee(s)). Nine of our directors then in office attended our 2021 Annual General Meeting.

MEETINGS OF NON-MANAGEMENT DIRECTORS

The Board believes that one of the key elements of effective, independent oversight is for the independent directors to meet in executive session on a regular basis without the presence of management. In 2021, the independent directors met in executive session at each of our four regularly scheduled Board meetings. Mr. Smith, our independent Chair, chaired these sessions.

The Board believes that the decision of whether to combine or separate the positions of Chief Executive Officer and Chair varies from company to company and depends upon a company’s particular circumstances at a given point in time. The Board continues to believe that separating the Chief Executive Officer and Chair positions is the appropriate leadership structure for our company and is in the best interests of our shareholders. Mr. Smith serves as our Chair of the Board, while Mr. Benchimol serves as our Chief Executive Officer and President. Our Board believes that this structure best encourages the free and open dialogue of alternative views and provides for strong checks and balances. Additionally, the Chair’s attention to Board and committee matters allows Mr. Benchimol to focus more specifically on overseeing the Company’s day-to-day operations and underwriting activities as well as strategic opportunities and planning.

Under the Company’s Corporate Governance Guidelines, the Company is not required to have a Lead Independent Director since Mr. Smith qualifies as an Independent Chair.

| CORPORATE GOVERNANCE | 15 | ||

HUMAN CAPITAL AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal year 2021, Messrs. Smith, Becker, Millegan and Ramey and Mses. Hardwick and Zlatkus served on our Human Capital and Compensation Committee. During fiscal year 2021, none of our executive officers served on the compensation committee (or its equivalent) or on the board of directors of another entity where one of our Human Capital and Compensation Committee members was an executive officer.

CONSIDERATION OF DIRECTOR NOMINEES

The Corporate Governance, Nominating and Social Responsibility Committee will consider candidates recommended by shareholders to be nominated to our Board for election at the Annual General Meeting. A shareholder who wishes to submit a candidate for consideration must be a shareholder of record at the time that such shareholder submits a candidate for nomination and must be entitled to vote for the candidate at the meeting. For a shareholder nominee to be considered for inclusion in the Company’s proxy materials, our Corporate Secretary must receive the written proposal no later than 120 days prior to the anniversary of the annual general meeting for the prior year; provided, that, if the date of the annual general meeting is moved more than 30 days before or after the anniversary date of the annual general meeting for the prior year, the deadline will instead be a reasonable time before we begin to print and mail our proxy materials. The notice must include:

| • | the name, age and business and residence addresses of the candidate; |

| • | the principal occupation or employment of the candidate; |

| • | the number of common shares or other securities of the Company beneficially owned by the candidate; |

| • | all other information relating to the candidate that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and |

| • | the candidate’s written consent to be named in the proxy statement and to serve as a director if elected. |

The notice also must include information on the shareholder submitting the nomination, including the shareholder’s name and address as it appears on our share register and the number of our common shares beneficially owned by the shareholder.

COMMUNICATIONS WITH BOARD OF DIRECTORS

Shareholders and other interested parties may send communications to our Board by sending written notice to our Corporate Secretary at our headquarters at AXIS House, 92 Pitts Bay Road, Pembroke HM 08, Bermuda. The notice may specify whether the communication is directed to the entire Board, to the non-management directors or to a particular Board committee or other director. Our Corporate Secretary will handle routine inquiries and requests for information or will otherwise determine whether the communication is made for a valid purpose and is relevant to the Company and its business and, if the Corporate Secretary so determines, will forward the communication to our Chair of the Board, to the non-management directors or to the appropriate committee chair or director. At each meeting of our Board, our Corporate Secretary presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the directors upon request.

BOARD OVERSIGHT OF RISK AND RISK MANAGEMENT

With assistance from the Risk Committee of the Board of Directors, the Board oversees the integrity and effectiveness of our enterprise risk management framework and ensures that our risk assumption and risk mitigation activities are consistent with that framework. The Risk Committee reviews, approves and monitors our overall risk strategy, risk appetite and key risk limits and receives regular reports from the Group Risk Management function to ensure any significant risk issues are being addressed by management. Further, the Risk Committee reviews, with management and Internal Audit, the Company’s general policies and procedures and ensures that effective systems of risk management and controls are established and maintained. Among its other responsibilities, the Risk Committee also reviews and approves the Company’s annual Own Risk and Solvency Assessment report. The Risk Committee assesses the independence and objectivity of our Group Risk Management function, approves its terms of reference and reviews its ongoing activities.

| 16 | CORPORATE GOVERNANCE |  | ||||

Following a recommendation by the Chief Executive Officer, the Risk Committee also conducts a review and provides a recommendation to the Board of Directors regarding the appointment and/or removal of the Chief Risk Officer. The Risk Committee meets with the Chief Risk Officer in executive sessions on a regular basis.

The Finance Committee of the Board of Directors oversees the Company’s investment of funds and adequacy of financing facilities. This includes approval of our strategic asset allocation ranges. The Audit Committee of the Board of Directors, which is supported by Internal Audit, is responsible for overseeing internal controls and compliance procedures, and also reviews our policies regarding risk assessment and risk management with management and the Chair of the Risk Committee.

Climate Change Risk. Our Board, along with our Risk Committee, oversees the risks and opportunities related to the Company’s climate change exposure and initiatives and receives periodic reports relating to climate change as part of their standing agendas.

Information Security Risk. The Board, along with the Risk and Audit Committees of the Board, oversees our information security program. In 2021, our Risk, Board and Audit Committees received periodic updates throughout the year on cybersecurity matters, and these updates are part of their standing agendas.

Compensation Risk. For information regarding compensation-related risks, see “Compensation Discussion and Analysis – Risk Management and Compensation.”

CODE OF BUSINESS CONDUCT AND CORPORATE GOVERNANCE GUIDELINES

Our Corporate Governance Guidelines, along with our Code of Business Conduct and the charters of each of the committees of our Board, provide a framework for the corporate governance of the Company addressing matters such as director qualification standards, director responsibilities and duties and compensation of our directors. Our Corporate Governance Guidelines and our Code of Business Conduct apply to all of our directors, officers and employees, including our Chief Executive Officer and President, Chief Financial Officer and Global Corporate Controller, and are available on our website at www.axiscapital.com. We intend to disclose on our website any required amendment to, or waiver of, a provision of the Code of Business Conduct that applies to our Chief Executive Officer and President, our Chief Financial Officer or our Global Corporate Controller. In addition, waivers of the Code of Business Conduct for our directors and executive officers may be made only by our Board or the Corporate Governance, Nominating and Social Responsibility Committee and will be promptly disclosed to shareholders on our website in accordance with the listing standards of the NYSE. All directors and employees are required to certify their compliance with our Code of Business Conduct and Corporate Governance Guidelines annually.

CORPORATE CITIZENSHIP & SUSTAINABILITY

Our corporate citizenship program identifies, assesses and manages on an ongoing basis the environmental, social and governance, or ESG, factors that are relevant to our long-term financial performance. We take into account the input of core stakeholders, including our colleagues, our shareholders, our clients and our communities, and consider material ESG factors in our strategic planning and risk oversight process. We are committed to enhancing our sustainability practices. To that end, a strategic enterprise goal for 2021 was to elevate the Company’s people and culture, including driving positive results with the Company’s diversity, equity and inclusion initiative and corporate citizenship and ESG initiatives. Similarly, in 2022, a strategic enterprise goal is to further commit to our core values by delivering measurable impact on our culture, diversity, equity and inclusion and climate initiatives. At the end of each year, management’s performance in advancing these citizenship initiatives will be considered by the Human Capital and Compensation Committee when they determine the non-financial portion of our annual incentive plan funding.

In 2021, we continued to take steps to improve our transparency and accountability on corporate citizenship matters. AXIS published our inaugural Communication on Progress as a signatory of the United Nations Global Compact and our inaugural annual disclosure as a signatory of the Principles for Sustainable Insurance, both of which we adopted in 2020. We also disclosed our measured greenhouse gas (GHG) emissions for the first time and published our second report aligned with the Sustainable Accounting Standards Board, a voluntary public disclosure that provides ESG information. We are proud that our citizenship initiatives earned us the top ranking in the category of overall commitment to ESG in The Insurer’s inaugural Lloyd’s ESG survey, a #5 ranking out of 44

| CORPORATE GOVERNANCE | 17 | ||

evaluated insurance companies in JUST Capital’s 2022 Rankings of America’s Most JUST Companies, recognition as one of Achievers’ 50 Most Engaged Organizations, and the Cigna Well-being Award for our workplace wellness program.

Our program focuses on two strategic pillars: the environment (which includes environmental sustainability and climate-risk mitigation) and diversity, equity and inclusion (“DE&I”). Further, AXIS took steps in 2021 to further align our philanthropic giving to both climate and DE&I. For example, we focused our global giving on causes that support underserved communities, committed to focus a majority of local community donations to related causes, and included climate and DE&I causes in employee engagement campaigns.

Select initiatives in each of these areas are discussed below.

Our Planet: Environment

We recognize that climate-related risks are among the biggest threats to our planet today. To help manage these risks, we assess and mitigate the environmental impact of our business and exposures as well as our operations.

Our Business – We believe that (re)insurers have an important role to play in mitigating climate risk, transitioning to a low-carbon economy and protecting our planet. Examples include:

| • | Thermal coal and oil sands. We strengthened our fossil fuels policy, initially announced in 2019, to include restrictions for thermal coal developers and for activities in the Arctic National Wildlife Refuge. |

| • | Underwriting and product. We were proud to continue to be a top global player in the renewable energy insurance space – a line of business in which we continue to invest. We completed a focused review of our portfolio’s climate risks across our product lines in the UK to understand our portfolio’s transition risk, and we expect to expand this assessment globally in 2022. We will use this information to inform our go-forward strategy. |

| • | Investment. We continue to consider ESG matters in our investment decisions and developed an ESG manager scorecard for use in 2022. We also announced a $20 million investment in BlackRock’s Climate Finance Partnership, a fund focused on renewable energy projects in emerging markets. |

| • | Climate risk analysis. We have continued to advance and monitor the latest science on climate change through our NatCat Centre of Excellence, the AXIS Research Center at the University of Illinois, our global climate change working group and local modeling teams. We also model and review peril regions most likely to be affected by climate risk. |

Our Operations – In addition to disclosing our measured 2019 GHG emissions, we continue to actively track the results of our assessment to inform our strategy to mitigate our environmental footprint and minimize our operational impact. AXIS’ successful transition to remote work during the COVID-19 pandemic accelerated business decisions that will reduce emissions, including a reduction of office space and reduction of commuting emissions through the introduction of more flexible working arrangements. Additional initiatives intended to address the environmental impact of our operations can be found in the AXIS Capital Holdings Limited Statement and Policy on Climate Risk and the Environment on our website.

Our Philanthropy – Our support of environmental causes included:

| • | AXIS again continued a partnership with the global organization Adara, an organization whose work includes helping families future-proof their communities. In addition, in 2022 we started partnerships with Ocean Conservancy and the World Wildlife Fund for Nature (WWF). |

| • | We also offered opportunities to give back through our internal Employee Recognition Program, AXIS Applause, on climate matters. For example, on Earth Day, every recognition resulted in a donation to onetreeplanted.org. |

| 18 | CORPORATE GOVERNANCE |  | ||||

Our Voice – We are committed to using our voice to advocate on climate issues and are proud and active participants in industry-wide initiatives. Examples include:

| • | Sustainable Markets Initiative. AXIS is a member of the Sustainable Products and Services Workstream and of the Multilateral Development Bank Insurance workstream of the Sustainable Markets Initiative Insurance Task Force, convened by HRH Prince of Wales and chaired by Lloyd’s. The Company’s participation in the SMI Insurance Task Force has included the contribution of information relating to AXIS’ insurance coverage of renewable energy assets for inclusion in the SMI Insurance Task Force report on how the specialty insurance market is driving insurance product and service innovation to encourage greener business practices. AXIS has also partnered with Lloyd’s and the SMI to convene and moderate a roundtable with renewable energy insurance market insurers and brokers to discuss challenges and solutions for supporting the development of insurance coverage of renewable energy assets in developing markets. The Sustainable Markets Initiative is an insurance industry task force to drive positive climate action and support the global transition to a sustainable future. |

| • | AIR Worldwide (Verisk), the University of Illinois and The Brookings Institution. AXIS partnered with AIR Worldwide and scholars from the University of Illinois and The Brookings Institution to publish “Quantifying the Impact from Climate Change on U.S. Hurricane Risk,” a research study addressing how climate change may affect hurricane risk in the United States by 2050, specifically related to residential and commercial properties (released January 2021). AXIS also partnered with Verisk and scholars from the University of Illinois and The Brookings Institution to publish “Quantifying the Impacts of Climate Change on U.S. Corn Yields” (released April 2021). These papers included information from University of Illinois research fellows sponsored and funded by AXIS. |

| • | University of Illinois – Gies College of Business. AXIS continues to partner with leading researchers and students through a corporate partnership at the University of Illinois’ Office of Risk Management and Insurance Research. Additionally, through the AXIS Risk Management Academy, students from a variety of disciplines across the university can investigate professional development resources and opportunities in the risk management and (re)insurance fields. |

| • | Insurance Development Forum. AXIS continues to be an active member of the Insurance Development Forum, or IDF, a public-private partnership among the World Bank, the United Nations and members of the insurance industry, that seeks to optimize and extend the use of insurance to address social, economic and environmental issues. We continue to play a leadership role as our CEO, Albert Benchimol, serves on the IDF Steering Committee. In addition, we continue to participate in IDF working groups, including the Sovereign & Humanitarian Solutions working group. In connection with our role in the Sovereign & Humanitarian Solutions working group, we are an industry participant in the Insurance and Risk Finance Facility (IRFF) launched in September 2021 through the United Nations Development Programme (UNDP). |

| • | The Geneva Association. AXIS remains a member of The Geneva Association, the international think tank of the industry. |

Our People: Diversity, Equity and Inclusion

A key pillar of our corporate citizenship platform is diversity, equity and inclusion. Encouraging a wide range of experiences, backgrounds and perspectives and ensuring equal treatment for all makes AXIS a more rewarding place to work, enables us to attract talented teammates, enriches our perspectives and makes us stronger as a global organization. Below are recent strategies and initiatives enacted in partnership with the AXIS volunteer Diversity & Inclusion Council and Diversity & Inclusion Advocates to foster a diverse, equitable and inclusive culture:

| • | Internal Education and Awareness. AXIS continued to host various diversity, equity and inclusion educational initiatives, including monthly diversity, equity and inclusion learning experiences created by AXIS employees and internal education events, such as the annual Diversity & Inclusion Forum (2021 focused on mental health) and a Women in Technology Panel. In addition, we sponsored initiatives, curated resources, provided donation opportunities for Juneteenth, Pride Month, Mental Health Awareness Month and International Women’s Day. We continued mandatory unconscious bias training for new hires. |

| • | Recruitment and Mobility. We continued to broaden our recruiting strategies to identify, recruit and develop a diverse pipeline of candidates. Recent initiatives include: |

| – | Continuing to build pipelines through diverse apprenticeship and internship programs in Bermuda, London and the U.S; |

| CORPORATE GOVERNANCE | 19 | ||

| – | Further building out our internship program with increased diverse representation; |

| – | Including our diversity, equity and inclusion values in recruitment materials; and |

| – | Launching a pilot recruitment source in the UK with a program that brings women back to the workforce. |

| • | Support of Diverse Colleagues in Their Careers. |

| – | Launching employee resource groups (ERGs), employee-led groups comprised of individuals with common interests, backgrounds or demographic factors. AXIS hosts ERGs for women, parents, veterans, LGBTQ+ and ethnically diverse employees; |

| – | Launching a leadership coaching program with 50% diverse employee participation; and |

| – | Enrolling 28 AXIS women in a 12-month “Emerging Leaders” program. |

| • | Tools and Measurement. AXIS continued its quarterly measurement of diverse hiring, turnover, promotions, succession planning and candidate slates. In support of this work, AXIS also measures gender pay gap and conducts pay audits on an annual basis. We continue to scale up our analytics capabilities to help us set, track and consistently improve our diversity, equity and inclusion efforts. |

| • | Our Voice. AXIS is also proud to promote diversity, equity and inclusion issues, policies and initiatives to drive significant change in the (re)insurance industry. Representative 2021 advocacy efforts include the following: |