NICE CARS INC. and |

NICE CARS CAPITAL ACCEPTANCE CORPORATION |

| |

COMBINED BALANCE SHEETS |

| |

(Stated in U.S. Dollars) |

| | | DECEMBER 31, | | DECEMBER 31, | | DECEMBER 31, | |

| | | 2005 | | 2004 | | 2003 | |

ASSETS | | | | | | | |

| | | | | | | | |

| Current Assets | | | | | | | |

| Cash and cash equivalents | | $ | 2,411,352 | | $ | 366,387 | | $ | 60,294 | |

| Principal balance accounts receivable and contracts receivable | | | 72,042,276 | | | 56,332,534 | | | 37,072,756 | |

| Allowance for credit losses | | | (18,204,549 | ) | | (17,360,535 | ) | | (11,885,216 | ) |

| Accounts receivable and contracts receivable, net | | | 53,837,727 | | | 38,971,999 | | | 25,187,540 | |

| | | | | | | | | | | |

| Inventory | | | 2,117,388 | | | 2,404,145 | | | 2,219,920 | |

| Total Current Assets | | | 58,366,467 | | | 41,742,531 | | | 27,467,754 | |

| | | | | | | | | | | |

| Property, plant and equipment, net | | | 907,462 | | | 786,355 | | | 738,194 | |

| | | | | | | | | | | |

| Other Assets | | | | | | | | | | |

| Deposits | | | — | | | — | | | 4,200 | |

| Deferred loan costs, net | | | 760,114 | | | 579,150 | | | 339,853 | |

| Deferred state income taxes | | | 133,989 | | | 21,412 | | | 59,756 | |

| Total Other Assets | | | 894,103 | | | 600,562 | | | 403,809 | |

| | | | | | | | | | | |

| Total Assets | | $ | 60,168,032 | | $ | 43,129,448 | | $ | 28,609,757 | |

| | | | | | | | | | | |

LIABILITIES | | | | | | | | | | |

| | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | |

| Accounts payable | | $ | 168,768 | | $ | 509,976 | | $ | 367,858 | |

| Accrued liabilities | | | 363,412 | | | 168,962 | | | 109,994 | |

| Participation agreements payable | | | 33,693,373 | | | 24,266,440 | | | | |

| Note payable | | | | | | | | | 13,787,527 | |

| Floor plan notes payable | | | 15,100 | | | 480,343 | | | 1,766,246 | |

| Current portion reserve for repairs | | | 3,145,900 | | | 2,327,100 | | | 1,797,200 | |

| Current portion advances from stockholder | | | | | | | | | 220,072 | |

| Current portion capital leases payable | | | 238,784 | | | 262,161 | | | 237,916 | |

| Total Current Liabilities | | | 37,625,337 | | | 28,014,982 | | | 18,286,813 | |

| | | | | | | | | | | |

| Long-term Liabilities | | | | | | | | | | |

| Reserve for repairs | | | 2,915,087 | | | 2,325,268 | | | 1,721,611 | |

| Capital leases payable | | | 86,090 | | | 120,699 | | | 144,689 | |

| Notes payable stockholder | | | 1,290,721 | | | 54,300 | | | 54,300 | |

| Advances from stockholder | | | | | | 736,421 | | | 181,148 | |

| Total Long-term Liabilities | | | 4,291,898 | | | 3,236,688 | | | 2,101,748 | |

| | | | | | | | | | | |

| Total Liabilities | | | 41,917,235 | | | 31,251,670 | | | 20,388,561 | |

| | | | | | | | | | | |

STOCKHOLDERS’ EQUITY | | | | | | | | | | |

| | | | | | | | | | | |

| Capital Stock - Nice Cars, Inc. | | | | | | | | | | |

| Authorized: | | | | | | | | | | |

| 1,000,000 common shares, no par value $1.00 per share, | | | | | | | | | | |

| 1,000 shares issues and outstanding | | | 1,000 | | | 1,000 | | | 1,000 | |

| | | | | | | | | | | |

| Capital Stock - Nice Cars Capital Acceptance Corporation. | | | | | | | | | | |

| Authorized: | | | | | | | | | | |

| 1,000,000 common shares, no par value $1.00 per share, | | | | | | | | | | |

| 1,000 shares issues and outstanding | | | 1,000 | | | 1,000 | | | 1,000 | |

| | | | | | | | | | | |

| Retained earnings | | | 18,248,797 | | | 11,875,778 | | | 8,219,196 | |

| Total Stockholders’ Equity | | | 18,250,797 | | | 11,877,778 | | | 8,221,196 | |

| Total Liabilities and Stockholders Equity | | $ | 60,168,032 | | $ | 43,129,448 | | $ | 28,609,757 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements

NICE CARS INC. and |

NICE CARS CAPITAL ACCEPTANCE CORPORATION |

| |

COMBINED STATEMENTS OF INCOME |

| |

(Stated in U.S. Dollars) |

| | | YEARS ENDED DECEMBER 31, | |

| | | 2005 | | 2004 | | 2003 | |

| | | | | | | | |

Revenues: | | | | | | | |

| Vehicle sales | | $ | 75,962,634 | | $ | 57,218,180 | | $ | 43,845,374 | |

| Interest income | | | 16,186,818 | | | 12,226,362 | | | 9,068,733 | |

| Document and service fees | | | 3,414,551 | | | 2,090,437 | | | 997,289 | |

| | | | 95,564,003 | | | 71,534,979 | | | 53,911,396 | |

Expenses: | | | | | | | | | | |

| Cost of sales | | | 46,573,562 | | | 35,382,541 | | | 27,379,694 | |

| Provision for credit losses | | | 30,691,630 | | | 23,547,493 | | | 17,905,774 | |

| Selling, general and administrative | | | 7,917,190 | | | 6,181,194 | | | 4,819,028 | |

| Interest expense | | | 2,631,757 | | | 1,765,997 | | | 1,149,391 | |

| Discount expenses | | | — | | | | | | 1,192,124 | |

| Depreciation and amortization | | | 567,279 | | | 637,260 | | | 437,354 | |

| Financing fees | | | 476,104 | | | | | | | |

| Other | | | 406,513 | | | 325,568 | | | 26,033 | |

| | | | 89,264,035 | | | 67,840,053 | | | 52,909,398 | |

| | | | | | | | | | | |

| Income before taxes | | | 6,299,968 | | | 3,694,926 | | | 1,001,998 | |

| | | | | | | | | | | |

| Income tax provision (benefit) | | | (73,051 | ) | | 38,344 | | | (59,756 | ) |

Net Income | | $ | 6,373,019 | | $ | 3,656,582 | | $ | 1,061,754 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements

NICE CARS INC. and |

NICE CARS CAPITAL ACCEPTANCE CORPORATION |

| |

COMBINED STATEMENTS OF CASH FLOWS |

| |

(Stated in U.S. Dollars) |

| | | YEARS ENDED DECEMBER 31, | |

| | | 2005 | | 2004 | | 2003 | |

| | | | | | | | |

| Net income | | $ | 6,373,019 | | $ | 3,656,582 | | $ | 1,061,754 | |

| | | | | | | | | | | |

Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | | | | |

| Provision for credit losses | | | 30,691,630 | | | 23,547,493 | | | 17,905,774 | |

| Deferred state income taxes | | | (112,577 | ) | | 38,344 | | | (59,756 | ) |

| Depreciation and amortization | | | 567,279 | | | 637,260 | | | 437,354 | |

| Loss on disposal of property, plant and equipment | | | — | | | | | | 26,566 | |

| Reserve for repairs | | | 1,408,619 | | | 1,133,557 | | | 918,811 | |

| | | | | | | | | | | |

| Changes in assets and liabilities: | | | | | | | | | | |

| Accounts receivable | | | (45,557,358 | ) | | (37,331,952 | ) | | (21,545,564 | ) |

| Inventory | | | 286,757 | | | (184,225 | ) | | 59,576 | |

| Accounts payable | | | (341,208 | ) | | 142,118 | | | 92,216 | |

| Accrued liabilities | | | 194,450 | | | 58,968 | | | 109,994 | |

| Net cash used in operating activities | | | (6,489,389 | ) | | (8,301,855 | ) | | (993,275 | ) |

| | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | |

| Purchases of property, plant and equipment | | | (575,936 | ) | | (557,561 | ) | | (551,473 | ) |

| Deposits | | | | | | 4,200 | | | | |

| Deferred loan costs | | | (293,414 | ) | | (367,157 | ) | | (409,728 | ) |

| Distributions to stockholder | | | | | | | | | (131,000 | ) |

| Net cash used in investing activities | | | (869,350 | ) | | (920,518 | ) | | (1,092,201 | ) |

| | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | |

| Proceeds from participation agreements payable | | | 9,426,933 | | | 24,266,440 | | | | |

| Proceeds from (repayments of) note payable,net | | | | | | (13,787,527 | ) | | 1,653,896 | |

| Proceeds from (repayments of) floor plan notes | | | | | | | | | | |

| payable, net | | | (465,243 | ) | | (1,285,903 | ) | | 62,425 | |

| Proceeds from (repayments of) notes payable | | | | | | �� | | | | |

| stockholder, net | | | 1,236,421 | | | | | | | |

| Proceeds from (repayments of) advances from | | | | | | | | | | |

| stockholder, net | | | (736,421 | ) | | 335,201 | | | 133,362 | |

| Proceeds from (repayments of) capital leases | | | | | | | | | | |

| payable, net | | | (57,986 | ) | | 255 | | | 107,573 | |

| Net cash used by financing activities | | | 9,403,704 | | | 9,528,466 | | | 1,957,256 | |

| | | | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | 2,044,965 | | | 306,093 | | | (128,220 | ) |

| | | | | | | | | | | |

| Cash and cash equivalents at beginning of year | | | 366,387 | | | 60,294 | | | 188,514 | |

| Cash and cash equivalents at end of year | | $ | 2,411,352 | | $ | 366,387 | | $ | 60,294 | |

| | | | | | | | | | | |

| Supplemental schedule of financing activities: | | | | | | | | | | |

| Interest paid | | $ | 2,799,856 | | $ | 1,705,032 | | $ | 1,071,311 | |

| State income taxes paid | | $ | | | $ | | | $ | | |

| | | | | | | | | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of these interim financial statements

NICE CARS INC. and |

NICE CARS CAPITAL ACCEPTANCE CORPORATION |

| |

COMBINED STATEMENTS OF STOCKHOLDERS' EQUITY |

FOR THE YEARS ENDEDE DECEMBER 31, 2005, 2004, 2003 |

| |

(Stated in U.S. Dollars) |

| | | Common Stock | | Retained | |

| | | Shares | | Amount | | Earnings | |

| | | | | | | | |

| Balance at December 31, 2002 | | | 2,000 | | $ | 2,000 | | $ | 7,288,442 | |

| | | | | | | | | | | |

| Net income | | | | | | | | | 1,061,754 | |

| Distributions to stockholder | | | | | | | | | (131,000 | ) |

| Balance at December 31, 2003 | | | 2,000 | | | 2,000 | | | 8,219,196 | |

| | | | | | | | | | | |

| Net income | | | | | | | | | 3,656,582 | |

| Balance at December 31, 2004 | | | 2,000 | | | 2,000 | | | 11,875,778 | |

| | | | | | | | | | | |

| Net income | | | | | | | | | 6,373,019 | |

| Balance at December 31, 2005 | | | 2,000 | | $ | 2,000 | | $ | 18,248,797 | |

| | | | | | | | | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of these interim financial statements

NICE CARS, INC.

AND

NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Combined Financial Statements

Years Ended December 31, 2005, 2004 and 2003

[Letterhead of Rodefer Moss & Co, PLLC]

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Nice Cars, Inc. and

Nice Cars Capital Acceptance Corporation

Fort Oglethorpe, Georgia

We have audited the accompanying combined balance sheets of Nice Cars, Inc. and Nice Cars Capital Acceptance Corporation as of December 31, 2005, 2004 and 2003 and the related combined statements of income, changes in stockholders’ equity and cash flows for the years then ended. These combined financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these combined financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the combined financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the combined financial statements referred to above present fairly, in all material respects, the financial position of Nice Cars, Inc. and Nice Cars Capital Acceptance Corporation as of December 31, 2005, 2004 and 2003, and the results of its operations and cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ Rodefer Moss & Co, PLLC

Knoxville, Tennessee

August 28, 2006

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements

For the Years ended December 31, 2005, 2004 and 2003

NOTE 1. ORGANIZATION, OPERATION AND BASIS OF PRESENTATION

Nice Cars, Inc. (“NCI”) (an S Corporation) was incorporated in the State of Georgia on May 21, 1998. NCI operates five used vehicle buy here and pay here lots located in the Northwest Georgia and Southeast Tennessee geographical areas.

Nice Cars, Inc. is authorized to issue 1,000,000 shares of no par common stock. At December 31, 2005, 2004 and 2003, 1,000 shares were issued and outstanding.

Nice Cars Capital Acceptance Corporation (“NCCAC”) (an S Corporation) was incorporated in the State of Georgia on April 3, 2000. NCCAC is a captive financial services company of NCI, with common stockholders and officers. NCCAC purchases substantially all of the retail sales financing contracts of Nice Cars, Inc. at discounts ranging from 30% to 40%. All purchases are non-recourse.

Nice Cars Capital Acceptance Corporation is authorized to issue 1,000,000 shares of no par common stock. At December 31, 2005, 2004 and 2003, 1,000 shares are issued and outstanding.

The accompanying financial statements present the combined operations of the entities as of and for the years ended December 31, 2005, 2004 and 2003. All inter-entity transactions have been eliminated in the combined financial statements. For both federal and state income tax reporting, the companies are separate legal entities with each company filing separate income tax returns.

NCI and NCCAC’s (collectively “the Company”) corporate offices are located in Fort Oglethorpe, Georgia.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Revenue, Costs and Expense Recognition

The Company recognizes revenues from vehicle sales, and the related cost of sales, upon delivery to the customer. Selling, general and administrative expenses are recorded on the accrual basis.

Interest and discount income are recognized using the interest method, generally as payments are received on the sales contracts. Interest and discount income are suspended when a contract is two payment periods (weekly, bi-weekly or monthly) delinquent. Recognition of interest and discount income resumes if the contract becomes contractually current. Past-due interest and discount income are also recognized at that time. In addition, a detailed review of contracts receivable will cause earlier suspension of recognition of interest and discount income if collection is doubtful, or if other facts related to the contracts become known.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES-continued

Revenue, Costs and Expense Recognition-Continued

Contracts receivable are reported at their outstanding principal balances, net of amounts estimated to be uncollectible, deferred interest on the purchased contracts, and sales taxes due from customers but not payable to the applicable states until collected.

Allowance for uncollectible contracts is increased by charges to income, and decreased by charge-offs, net of recoveries. Management’s periodic evaluation of the adequacy of the allowance is based upon the Company’s past loss experience, known and inherent risk, adverse situations that may affect the customer’s ability to make payments as agreed, the estimated fair market value of the underlying collateral, and current economic conditions. Contracts receivable are classified as delinquent after one missed payment. After two missed payments, repossession proceedings of the collateral underlying the contract are commenced. Upon repossession of the collateral, the contract is charged off.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with a maturity at the date of purchase of three months or less to be cash equivalents.

Inventory

Inventory is stated at the lower of cost or market on a specific identification basis.

Property, Plant and Equipment

Property and equipment are recorded at cost. Expenditures for repairs and maintenance are charged to expense as incurred. Expenditures for additions and improvements that significantly extend the lives of assets are capitalized. Upon the sale or other retirement of depreciable property, the cost and accumulated depreciation are eliminated from the related accounts and any gain or loss is reflected in operations. Depreciation is computed on the straight line and accelerated methods over the estimated useful lives of the depreciable assets, which range from 3-10 years.

Income Taxes

The Company, with the consent of stockholders, has elected to be taxed as S Corporations. In lieu of federal corporation income taxes, under an S Corporation election, the stockholders of the Company are taxed on their proportionate share of the Company’s taxable income. Therefore, no provision or liability for federal income taxes has been included in the accompanying combined financial statements.

The portion of the Company’s State of Tennessee operations, approximately 26%, is subject to corporate state income taxes. Income taxes are provided for the tax effects of transactions reported in the combined financial statements and consist of any taxes currently due, plus deferred taxes. Deferred taxes are derived primarily from timing differences in the deductibility of bad debts for financial and income tax reporting, and

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES-continued

operating losses that are available to offset future state taxable income.

Advertising

The Company expenses advertising production and communication costs as they are incurred. The total advertising expense for the years ended December 31, 2005, 2004 and 2003 were $1,562,279, $1,194,184 and $900,583, respectively.

Deferred loan costs

Loan and debt issuance costs related to financings are stated at cost and are amortized over the life of the obligation using methods approximating the interest method. Upon retirement of the related debt, any unamortized loan costs are charged to expense.

Estimates

The preparation of the combined financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were used.

New Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board ("FASB") revised Statement of Financial Accounting Standard No. 123, ACCOUNTING FOR STOCK-BASED COMPENSATION ("SFAS No. 123"), by issuing SHARE-BASED PAYMENT ("SFAS 123(R)"). SFAS 123(R) requires us to recognize, in the determination of income, the grant date fair value of all stock options and other equity based compensation issued to employees. In April 2005, the Securities and Exchange Commission announced that it would provide for a phased-in implementation process for SFAS No. 123(R), which will require the Company to adopt SFAS No. 123(R) no later than January 1, 2006. Adoption of SFAS No. 123(R) is not expected to have any current impact on the Company’s financial statements. The statement applies to all awards granted after the required effective date and to awards modified, repurchased, or cancelled after that date. The Company has no present plans to use stock-based compensation or to modify existing stock-based compensation.

Statement of Financial Accounting Standards No. 151, INVENTORY COSTS, an amendment of ARB No. 43, Chapter 4 (SFAS 151) was issued in November 2004 and becomes effective for inventory costs incurred during fiscal years beginning after June 15, 2005. The statement clarifies the accounting for abnormal amounts of idle facility expense, freight, handling costs, and wasted material. The Company does not expect that SFAS 151 will have any effect on future financial statements.

Statement of Financial Accounting Standards No. 154, ACCOUNTING CHANGES AND ERROR CORRECTIONS, a replacement of APB Opinion No. 20 and FASB

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES-continued

New Accounting Pronouncements - continued

Statement of Financial Accounting Standards No. 155, ACCOUNTING FOR CERTAIN HYBRID FINANCIAL INSTRUMENTS--AN AMENDMENT OF FASB STATEMENTS NO. 133 AND 140, was issued in February 2006 and is effective for all financial instruments acquired or issued after the beginning of an entity's first fiscal year that begins after September 15, 2006. Certain parts of this Statement may be applied prior to the adoption of this Statement. Earlier adoption is permitted as of the beginning of an entity's fiscal year, provided the entity has not yet issued financial statements, including financial statements for any interim period for that fiscal year. Provisions of this Statement may be applied to instruments that an entity holds at the date of adoption on an instrument-by-instrument basis. The Company does not expect that SFAS 155 will have any significant effect on future financial statements.

In March 2006, the FASB issued SFAS No. 156, ACCOUNTING FOR SERVICING OF FINANCIAL ASSETS - AN AMENDMENT OF FASB STATEMENT NO. 140, with respect to the accounting for separately recognized servicing assets and servicing liabilities. SFAS 156 permits the choice of the amortization method or the fair value measurement method, with changes in fair value recorded in income, for the subsequent measurement for each class of separately recognized servicing assets and servicing liabilities. The statement is effective for years beginning after September 15, 2006, with earlier adoption permitted. The Company is currently evaluating the effect that adopting this statement will have on the Company's financial position and results of operations.

NOTE 3. ACCOUNTS RECEIVABLE AND CONTRACTS RECEIVABLE

Contracts receivable are recorded at their outstanding principal balances, reduced by any charge-offs or specific valuation accounts, deferred interest and sale taxes due from customers. The Company finances vehicle sales to selected customers over periods ranging from 12 to 42 months, with interest at 26%. The allowance for uncollectible accounts is based upon the Company’s historical loss percentage relative to the fair value of the contracts’ underlying collateral.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 3. ACCOUNTS RECEIVABLE AND CONTRACTS RECEIVABLE-continued

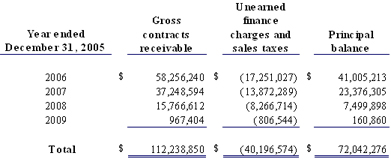

The estimated future maturities of contracts receivable at December 31, 2005, 2004 and 2003 using forty months as the average contract term remaining, are as follows:

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 3. ACCOUNTS RECEIVABLE AND CONTRACTS RECEIVABLE-continued

The above tabulation should not be regarded as a forecast of future cash collections. During the years ended December 31, 2005, 2004 and 2003, cash collections of principal and ratio of cash collections to the average principal balances were as follows:

| | | 2005 | | 2004 | | 2003 | |

| | | | | | | | |

| Total cash collections | | $ | 29,142,724 | | $ | 13,101,612 | | $ | 10,674,530 | |

| | | | | | | | | | | |

| Ratio to average principal balance | | | 48.6 | % | | 25.6 | % | | 28.0 | % |

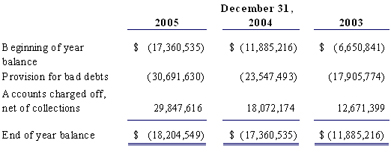

Changes in the allowance for uncollectible accounts are as follows:

NOTE 4. SALES OF CONTRACTS RECEIVABLE

During the year ended December 31, 2003, the Company sold contracts to an unrelated finance company as follows:

Proceeds realized from the sale of contracts were $4,540,401 during 2003.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 4. SALES OF CONTRACTS RECEIVABLE-continued

During the year ended December 31, 2003, the Company provided all the servicing and collections on the contracts for a fee of 24% of all collections. Service fee income relative to the contracts totaled $132,485.

The terms of the recourse sales require that the Company repurchase any contracts in default at the original discount rate multiplied by the total remaining contract payments, plus any fees incurred by the financing company. In the event of default, the Company would repossess and resell the vehicle. Management believes that the exposure for repossession losses under the recourse contracts is not significant and, therefore, no provision has been made for future losses that may result thereunder.

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at December 31, 2005, 2004 and 2003 consisted of the following:

NOTE 6. FLOOR PLAN NOTE PAYABLE

At December 31, 2005, 2004 and 2003, the Company’s floor plan note payable consisted of the following:

The floor plan note payable consists of a revolving $1,500,000 bank line of credit, renewable annually in February. Interest is due monthly at the Wall Street Journal Prime Rate, as defined, plus 2%, currently 9.25%. The note payable is collateralized by the automobile inventory. The principal balance at December 31, 2005 was $15,100.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 6. FLOOR PLAN NOTE PAYABLE-continued

In addition to the revolving line of credit described above, the Company has established a $100,000 and a $1,500,000 floor plan line of credit with two additional financial institutions. The $100,000 line of credit is unsecured with a scheduled maturity on June 19, 2006. Interest on any borrowing is due at 10.50%. Interest paid on the line of credit during 2005 totaled $763. The balance on the $100,000 line of credit at December 31, 2005 was zero.

The $1,500,000 floor plan line of credit is scheduled to mature on May 15, 2006. Interest is due at prime plus 1.50%. The line of credit is secured by equipment and inventory of the Company. There were no borrowings and no interest payments on the floor plan line of credit during the year ended December 31, 2005.

The Company has guaranteed the repayment of the participation agreements described below. As a result of the guarantees, all collateral and guarantees applicable to the floor plan notes payable listed above are subordinated to the participation agreements.

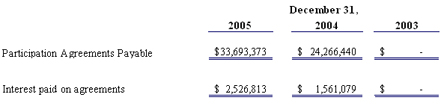

NOTE 7. PARTICIPATION AGREEMENTS PAYABLE

During the years ended December 31, 2005 and 2004, the Company entered into various contract receivable Participation Agreements (the “Agreements”) with a finance company and credit unions to provide the necessary working capital to finance the operations.

The amounts due on the participation agreements at December 31, 2005, 2004 and 2003 are as follows:

During the year ended December 31, 2005, the Company entered into participation agreements with a finance company (“Finance Company Agreements”). The Finance Company Agreements provide that the finance company will advance the Company, with recourse, 60% of the principal due on specific retail vehicle sales contracts. The Finance Company Agreements further provide that the Company will provide a monthly accounting of the principal collected on the vehicle sales contracts, and repay the finance company its share of the advanced principal plus 8.50% interest on the balance of advanced funds. The amount due under the Finance Company Agreements at December 31, 2005 is $33,693,373.

The total approximate amount of accounts receivable assets pledged as collateral as of December 31, 2005 was $56,000,000.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 7. PARTICIPATION AGREEMENTS PAYABLE-continued

On June 7, 2004, the Company, with borrowings obtained from two credit unions, repaid the remaining balance due on a $15,000,000 revolving credit line with Wells Fargo Financial Preferred Capital, Inc. (“WFFPC”). Concurrent with the repayment, the Company canceled the revolving credit line and recognized a loss on the refinancing of $325,568. The loss was comprised of prepaid loan fees incurred in obtaining the revolving credit line.

NOTE 8. NOTE PAYABLE

The note payable at December 31, 2003 represents the balance which was repaid from borrowings from the credit unions as discussed in Note 7. On April 21, 2003, the Company established a $15,000,000 revolving line of credit with WFFPC. The credit line was collateralized by sales contracts, and cross collateralized by substantially all other assets of the Company, and personal guarantees of the stockholders.

NOTE 9. NOTE PAYABLE TO STOCKHOLDER

The note payable balance at December 31, 2005, 2004 and 2003 and interest paid during 2005, 2004 and 2003 are detailed below. The note payable to stockholder consists of various working capital loans to the Company per the terms of a demand note payable dated June 1, 1998. Interest on the note is paid monthly at a rate of 12%. The note is subordinated to the notes and contingent liabilities described at Notes 6, 7 and 8. Management does not anticipate any repayments on the note before the year ended December 31, 2006.

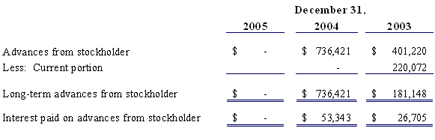

NOTE 10. ADVANCES FROM STOCKHOLDERS

Advances from stockholder consist of working capital advances made to the Company by one of the stockholders, generally derived from the stockholder drawing funds from personal lines of credit. The Company replaced the advances and accrued interest via the note payable to stockholder (see Note 9). The advances were to be repaid at interest rates from 4.50% to 11.50%. Interest paid on the advances during the years ended December 31, 2004 and 2003 was $53,343 and $26,705, respectively.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 10. ADVANCES FROM STOCKHOLDERS-continued

NOTE 11. RESERVE FOR REPAIRS

The Company incurs costs as a result of additional service primarily related to customer service actions. Estimated additional service costs for each vehicle sold by the Company are accrued for at the time of sale. Accruals for estimated additional service costs are based on historical experience and subject to adjustment from time to time depending on actual experience.

Changes in the reserve for repairs account (included in cost of sales) are as follows:

NOTE 12. CAPITAL LEASES

The Company has purchased equipment under leases that are classified as capital leases. The net book value, cost less accumulated depreciation, of the equipment at December 31, 2005, 2004 and 2003 is detailed below. Title to the equipment will vest with the Company upon expiration of the leases.

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 12. CAPITAL LEASES - continued

The aggregate future minimum lease payments follow:

| | | Principal | | Interest | | Total | |

Year ended December 31, 2005 | | | | | | | |

| Due in one year | | $ | 238,784 | | $ | 20,379 | | $ | 259,163 | |

| Due in two years | | | 72,476 | | | 2,450 | | | 74,926 | |

| Due in three years | | | 13,614 | | | 430 | | | 14,044 | |

Total | | $ | 324,874 | | $ | 23,259 | | $ | 348,133 | |

| | | | | | | | | | | |

A description of the leases at December 31, 2005 follows:

| Multiple purchases on a master lease payable to manufacturer, due monthly on varying dates over the next twenty-three months. Cumulative monthly lease payments under the master lease range from $218 to $26,792 all including interest at 11.00%. The leases are collateralized by vehicle starter interrupt devices. | | $ | 300,383 | |

| Capital lease payable to finance company, due in thirty-four remaining payments of $1,407, including interest imputed at 7.25%. The leases are collateralized by security cameras. | | | 47,750 | |

| Aggregate future minimum lease payments as of December 31, 2005 | | $ | 348,133 | |

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 13. OPERATING LEASES

The Company leases administrative and sales facilities at various locations in the Northwest Georgia and Southeast Tennessee geographical areas, under operating leases with terms ranging from 36 to 84 months. At December 31, 2005, the aggregate future minimum lease payments due under the operating leases are as follows:

Total building and equipment rent expense for the years ended December 31, 2005, 2004 and 2003 were $477,380, $407,622 and $249,238, respectively.

The Company also leases office equipment under month-to-month operating leases for various terms.

NOTE 14. INCOME TAXES

The provision for state income tax benefit (expense) of the Company consists of deferred State of Tennessee excise (income) taxes. The summary below details the asset recorded at December 31, 2005, 2004 and 2003. Additionally, the Company has state income tax loss carry-forwards that are expected to benefit future periods. Management believes realization of the asset is more likely than not, and therefore, a valuation allowance has not been recorded.

The income tax provisions charged (benefit credited) for the years ended December 31, 2005, 2004, and 2003 were as follows:

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 14. INCOME TAXES - continued

Income tax expense differs from expected corporate rates because the Company has elected Sub-S status and pays only nominal state income taxes on its Tennessee operations.

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets were as follows:

NOTE 15. CONCENTRATION OF CREDIT RISK

The Company’s customer base is concentrated in the Northwest Georgia and Southeast Tennessee geographical areas. Due to the nature of the Company’s business, many of its customers are considered substandard credit risks.

The Company has concentrated cash deposits in multiple high credit quality financial institutions. The amounts on deposit at December 31, 2005, 2004 and 2003 and during various periods during the year exceeded the federally insured deposit limit.

The Company is exposed to various risks of loss related to torts, theft of, damage to and destruction of assets, errors and omissions and natural disasters. The Company has purchased third party liability and property damage insurance to protect against these claims and losses.

The Company is also party to various legal disputes and proceedings arising from the ordinary course of general business activities. While, in the opinion of management, resolution of these matters is not expected to have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows, the ultimate outcome of any litigation is uncertain.

NOTE 16. FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company’s financial instruments, none of which are held for trading, include cash, contracts receivable, accounts payable, accrued expenses, floor plan notes payable and capital leases payable. The Company estimates that the fair value of all financial instruments at December 31, 2005, 2004 and 2003 does not differ materially from the

NICE CARS, INC. AND NICE CARS CAPITAL ACCCEPTANCE CORPORATION

Notes to Combined Financial Statements-continued

NOTE 16. FAIR VALUE OF FINANCIAL INSTRUMENTS-continued

aggregate carrying values of the financial instruments recorded in the accompanying combined financial statements. The estimated fair value amounts have been determined by using available market information and appropriate data to develop the estimates of fair value, and accordingly, the estimates are not necessarily indicative of the amounts that could be realized in a current market exchange. The use of different market assumptions or methodologies could have a material effect on the estimated fair value amounts.