The Fund’s investment objective is to provide total return through a combination of capital appreciation and high current income. The Fund attempts to achieve this objective by investing in a portfolio of convertible securities and non-convertible income-producing securities.

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet been asserted. However, the Fund expects the risk of any loss to be remote.

The following is a summary of significant accounting policies followed by the Fund.

Nicholas-Applegate Convertible & Income Fund Notes to Financial Statements

August 31, 2005 (unaudited)

1. Organization and Significant Accounting Policies (continued)

(d) Dividends and Distributions — Common Stock (continued) income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions of paid-in capital in excess of par.

(e) Credit-Linked Trust Certificates

Credit-linked trust certificates are investments in a limited purpose trust or other vehicle formed under state law which, in turn, invests in a basket of derivative instruments, such as credit default swaps, interest rate swaps and other securities, in order to provide exposure to the high yield or another fixed income market.

Similar to an investment in a bond, investments in these credit-linked trust certificates represent the right to receive periodic income payments (in the form of distributions) and payment of principal at the end of the term of the certificate. However, these payments are conditioned on the trust’s receipt of payments from, and the trust’s potential obligations to, the counterparties to the derivative instruments and other securities in which the trust invests.

(f) Interest Rate Caps

In an interest rate cap, one party pays a fee while the other party pays the excess, if any, of a floating rate over a specified fixed rate. Interest rate caps are intended to manage the Fund’s exposure to changes in short-term interest rates and hedge the Auction Preferred Shares. Owning interest rate caps reduces the Fund’s duration, making it less sensitive to changes in interest rates from a market value perspective. The effect on income involves protection from rising short-term rates, which the Fund experiences primarily in the form of leverage. The Fund is exposed to credit loss in the event of non-performance by the other party to the interest rate cap.

(g) Concentration of Risk

It is the Fund’s policy to invest a significant portion of its assets in convertible securities. Although convertible securities do derive part of their value from that of the securities into which they are convertible, they are not considered derivative financial instruments. However, certain of the Fund’s investments include features which render them more sensitive to price changes in their underlying securities. Consequently, this exposes the Fund to greater downside risk than traditional convertible securities, but still less than that of the underlying common stock.

2. Investment Manager/Sub-Adviser

The Fund has entered into an Investment Management Agreement (the “Agreement”) with the Investment Manager. Subject to the supervision of the Fund’s Board of Trustees, the Investment Manager is responsible for managing, either directly or through others selected by it, the Fund’s investment activities, business affairs and administrative matters. Pursuant to the Agreement, the Investment Manager receives an annual fee, payable monthly at the annual rate of 0.70% of the Fund’s average daily total managed assets. Total managed assets refers to the total assets of the Fund (including assets attributable to any Preferred Shares or other forms of leverage that may be outstanding) minus accrued liabilities (other than liabilities representing leverage). The Investment Manager has retained its affiliate, Nicholas-Applegate Capital Management LLC (the “Sub-Adviser”), to manage the Fund’s investments. Subject to the supervision of the Investment Manager, the Sub-Adviser makes all the Fund’s investment decisions. For its services, pursuant to a Sub-Advisory Agreement, the Investment Manager and not the Fund pays the Sub-Adviser a monthly fee. The Investment Manager paid the Sub-Adviser $3,019,949 in connection with the sub-advisory service, for the six months ended August 31, 2005.

3. Investment in Securities

For the six months ended August 31, 2005, purchases and sales of investments, other than short-term securities and U.S. government obligations, were $405,246,394 and $430,988,166, respectively.

(a) Interest rate cap agreements outstanding at August 31, 2005:

| | | Notional | | | | | | | | Unrealized |

| | | Amount | | Termination | | | | Payment received | | Appreciation |

| Counterparty | | (000) | | Date | | Premium | | by Fund | | (Depreciation) |

|

|

|

|

|

|

|

|

|

|

|

| UBS AG | | $525,000 | | 1/15/06 | | $ 5,131,875 | | 1 month LIBOR-BBA | | $ 193,466 |

| | | | | | | | | over 2% strike price | | |

| |

| UBS AG | | 525,000 | | 1/15/08 | | 15,041,250 | | 1 month LIBOR-BBA | | (2,389,333) |

| | | | | | | | | |

|

| | | | | | | | | over 3% strike price | | $(2,195,867) |

| | | | | | | | | |

|

LIBOR—London Interbank Offered Rate8.31.05 | Nicholas-Applegate Convertible & Income Fund Semi-Annual Report 13

Nicholas-Applegate Convertible & Income Fund Notes to Financial Statements

August 31, 2005 (unaudited)

4. Income Tax Information

The cost basis of portfolio securities for federal income tax purposes is $1,504,462,786. Aggregated gross unrealized appreciation for securities in which there is an excess value over tax cost is $93,785,320; aggregate gross unrealized depreciation for securities in which there is an excess of tax cost over value is $45,171,357; net unrealized appreciation for federal income tax purposes is $48,613,963.

5. Auction Preferred Shares

The Fund has issued 4,200 shares of Preferred Shares Series A, 4,200 shares of Preferred Shares Series B, 4,200 shares of Preferred Shares Series C, 4,200 shares of Preferred Shares Series D, and 4,200 shares of Preferred Shares Series E each with a net asset and liquidation value of $25,000 per share plus accrued dividends.

Dividends and distributions of long-term capital gains, if any, are accumulated daily at an annual rate set through auction procedures.

For the period ended August 31, 2005, the annualized dividend rate ranged from:

| | | High | | Low | | At August 31, 2005 |

|

|

|

|

|

|

|

| Series A | | 3.50% | | 2.57% | | 3.50% |

| Series B | | 3.50% | | 2.54% | | 3.50% |

| Series C | | 3.49% | | 2.55% | | 3.48% |

| Series D | | 3.47% | | 2.55% | | 3.35% |

| Series E | | 3.50% | | 2.60% | | 3.50% |

The Fund is subject to certain limitations and restrictions while preferred shares are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of Preferred Shares at their liquidation value.

Preferred Shares, which are entitled to one vote per share, generally vote with the common stock but vote separately as a class to elect two Trustees and on any matters affecting the rights of the Preferred Shares.

6. Subsequent Common Dividend Declarations

On September 1, 2005, a dividend of $0.125 per share was declared to common shareholders payable October 3, 2005 to shareholders of record on September 16, 2005.

On October 3, 2005, a dividend of $0.125 per share was declared to common shareholders payable November 1, 2005 to shareholders of record on October 21, 2005.

7. Legal Proceedings

On September 13, 2004, the Securities and Exchange Commission (the “Commission”) announced that the Investment Manager and certain of its affiliates (together with the Investment Manager, the “Affiliates”) had agreed to a settlement of charges that they and certain of their officers had, among other things, violated various antifraud provisions of the federal securities laws in connection with an alleged market-timing arrangement involving trading of shares of certain open-end investment companies (’’open-end funds’’) advised or distributed by these certain affiliates. In their settlement with the Commission, the Affiliates consented to the entry of an order by the Commission and, without admitting or denying the findings contained in the order, agreed to implement certain compliance and governance changes and consented to cease-and-desist orders and censures. In addition, the Affiliates agreed to pay civil money penalties in the aggregate amount of $40 million and to pay disgorgement in the amount of $10 million, for an aggregate payment of $50 million. In connection with the settlement, the Affiliates have been dismissed from the related complaint the Commission filed on May 6, 2004 in the U.S. District Court in the Southern District of New York. Neither the complaint nor the order alleges any inappropriate activity took place with respect to the Fund.

In a related action on June 1, 2004, the Attorney General of the State of New Jersey (’’NJAG’’) announced that it had entered into a settlement agreement with Allianz Global and the Affiliates, in connection with a complaint filed by the NJAG on February 17, 2004. In the settlement, Allianz Global and other named affiliates neither admitted nor denied the allegations or conclusions of law, but did agree to pay New Jersey a civil fine of $15 million and $3 million for investigative costs and further potential enforcement initiatives against unrelated parties. They also undertook to implement certain

14 Nicholas-Applegate Convertible & Income Fund Semi-Annual Report | 8.31.05

Nicholas-Applegate Convertible & Income Fund Notes to Financial Statements

August 31, 2005 (unaudited)

7. Legal Proceedings (continued)

governance changes. The complaint relating to the settlement contained allegations arising out of the same matters that were the subject of the Commission order regarding market-timing described above and does not allege any inappropriate activity took place with respect to the Fund.

On September 15, 2004, the Commission announced that the Affiliates had agreed to settle an enforcement action in connection with charges that they violated various antifraud and other provisions of federal securities laws as a result of, among other things, their failure to disclose to the board of trustees and shareholders of various open-end funds advised or distributed by the Affiliates material facts and conflicts of interest that arose from their use of brokerage commissions on portfolio transactions to pay for so-called ’’shelf space’’ arrangements with certain broker-dealers. In their settlement with the Commission, the Affiliates consented to the entry of an order by the Commission without admitting or denying the findings contained in the order. In connection with the settlement, the Affiliates agreed to undertake certain compliance and disclosure reforms and consented to cease-and-desist orders and censures. In addition, the Affiliates agreed to pay a civil money penalty of $5 million and to pay disgorgement of approximately $6.6 million based upon the aggregate amount of brokerage commissions alleged to have been paid by such open-end funds in connection with these shelf-space arrangements (and related interest). In a related action, the California Attorney General announced on September 15, 2004 that it had entered into an agreement with an affiliate of the Investment Manager in resolution of an investigation into matters that are similar to those discussed in the Commission order. The settlement agreement resolves matters described in a complaint filed contemporaneously by the California Attorney General in the Superior Court of the State of California alleging, among other things, that this affiliate violated certain antifraud provisions of California law by failing to disclose matters related to the shelf-space arrangements described above. In the settlementagreement, the affiliate did not admit to any liability but agreed to pay $5 million in civil penalties and $4 million in recognition of the California Attorney General’s fees and costs associated with the investigation and related matters. Neither the Commission order nor the California Attorney General’s complaint alleges any inappropriate activity took place with respect to the Fund.

On April 11, 2005, the Attorney General of the State of West Virginia filed a complaint in the Circuit Court of Marshall County, West Virginia (the “West Virginia Complaint”) against the Investment Manager and certain of its Affiliates based on the same circumstances as those cited in the 2004 settlements with the Commission and NJAG involving alleged “market timing” activities described above. The West Virginia Complaint alleges, among other things, that the Investment Manager and certain of its Affiliates improperly allowed broker-dealers, hedge funds and investment advisers to engage in frequent trading of various open-end funds advised or distributed by the Affiliates in violation of the funds’ stated restrictions on “market timing.” As of the date of this report, the West Virginia Complaint has not been formally served upon the Investment Manager or the Affiliates. The West Virginia Complaint also names numerous other defendants unaffiliated with the Affiliates in separate claims alleging improper market timing and/or late trading of open-end investment companies advised or distributed by such other defendants. The West Virginia Complaint seeks injunctive relief, civil monetary penalties, investigative costs and attorney’s fees. The West Virginia Complaint does not allege that any inappropriate activity took place with respect to the Fund.

Since February 2004, certain of the Affiliates and their employees have been named as defendants in a total of 14 lawsuits filed in one of the following: U.S. District Court in the Southern District of New York, the Central District of California and the Districts of New Jersey and Connecticut. Ten of those lawsuits concern ’’market timing,’’ and they have been transferred to and consolidated for pre-trial proceedings in the U.S. District Court for the District of Maryland; the remaining four lawsuits concern ’’revenue sharing’’ with brokers offering ’’shelf space’’ and have been consolidated into a single action in the U.S. District Court for the District of Connecticut. The lawsuits have been commenced as putative class actions on behalf of investors who purchased, held or redeemed shares of affiliated funds during specified periods or as derivative actions on behalf of the funds.

The lawsuits generally relate to the same facts that are the subject of the regulatory proceedings discussed above. The lawsuits seek, among other things, unspecified compensatory damages plus interest and, in some cases, punitive damages, the rescission of investment advisory contracts, the return of fees paid under those contracts and restitution. The Investment Manager believes that other similar lawsuits may be filed in federal or state courts naming as defendants the Investment Adviser, the Affiliates, Allianz Global, the Fund, other open- and closed-end funds advised or distributed by the Investment Manager and/or its affiliates, the boards of directors or trustees of those funds, and/or other affiliates and their employees. Under Section 9(a) of the 1940 Act, if any of the various regulatory proceedings or lawsuits were to result in a court injunction against the Investment Manager, Allianz Global/or their affiliates, they and their affiliates would, in the absence of exemptive relief granted by the Commission, be barred from serving as an investment

8.31.05 | Nicholas-Applegate Convertible & Income Fund Semi-Annual Report 15

Nicholas-Applegate Convertible & Income Fund Notes to Financial Statements

August 31, 2005 (unaudited)

7. Legal Proceedings (continued)

manager/sub-adviser or principal underwriter for any registered investment company, including the Fund. In connection with an inquiry from the Commission concerning the status of the New Jersey settlement described above under Section 9(a), the Investment Manager and certain of its affiliates (together, the ’’Applicants’’) have sought exemptive relief from the Commission under Section 9(c) of the 1940 Act.

The Commission has granted the Applicants a temporary exemption from the provisions of Section 9(a) with respect to the New Jersey settlement until the earlier of (i) September 13, 2006 and (ii) the date on which the Commission takes final action on their application for a permanent order. There is no assurance that the Commission will issue a permanent order. If the West Virginia Attorney General were to obtain a court injunction against the Investment Manager or the Affiliates, the Investment Manager or the Affiliates would, in turn, seek exemptive relief under Section 9(c) with respect to that matter, although there is no assurance that such exemptive relief would be granted.

A putative class action lawsuit captioned Charles Mutchka et al. v. Brent R. Harris, et al., filed in January 2005 by and on behalf of individual shareholders of certain open-end funds that hold equity securities and that are sponsored by the Investment Manager and the Affiliates, is currently pending in the federal district court for the Central District of California. The plaintiff alleges that fund trustees, investment advisers and affiliates breached fiduciary duties and duties of care by failing to ensure that the open-end funds participated in securities class action settlements for which those funds were eligible. The plaintiff has claimed as damages disgorgement of fees paid to the investment advisers, compensatory damages and punitive damages.

The Investment Manager believes that the claims made in the lawsuit against the Investment Manager and the Affiliates are baseless, and the Investment Manager and the Affiliates intend to vigorously defend the lawsuit. As of the date hereof, the Investment Manager believes a decision, if any, against the defendants would have no material adverse effect on the Fund or the ability of the Investment Manager or the Sub-Advisers to perform their duties under the investment management or portfolio management agreements, as the case may be. It is possible that these matters and/or other developments resulting from these matters could lead to a decrease in the market price of the Fund’s shares or other adverse consequences to the Fund and its shareholders. However, the Investment Manager and the Sub-Advisers believe that these matters are not likely to have a material adverse effect on the Fund or on the Investment Manager’s or the Sub-Adviser’s ability to perform their respective investment advisory services related to the Fund.

The foregoing speaks only as of the date hereof. There may be additional litigation or regulatory developments in connection with the matters discussed above.

16 Nicholas-Applegate Convertible & Income Fund Semi-Annual Report | 8.31.05

Nicholas-Applegate Convertible & Income Fund Financial Highlights

For a share of common stock outstanding throughout each period:

|

| | | Six Months | | Year | | For the Period |

| | | ended | | ended | | March 31, 2003* |

| | | August 31, 2005 | | February 28, | | through |

| | | (unaudited) | | 2005 | | February 29, 2004 |

| |

|

|

| |

|

|

| |

|

|

|

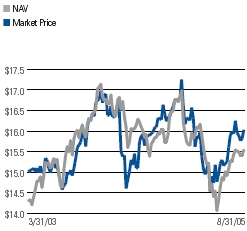

| Net asset value, beginning of period | | $ | 16.07 | | | $ | 16.67 | | | $ | 14.33 | ** |

| |

|

|

| |

|

|

| |

|

|

|

| Income from Investment Operations: | | | | | | | | | | | | |

| Net investment income | | | 0.73 | | | | 1.48 | | | | 1.28 | |

| |

|

|

| |

|

|

| |

|

|

|

| Net realized and unrealized gain (loss) on investments | | | (0.39 | ) | | | 0.38 | | | | 2.61 | |

| |

|

|

| |

|

|

| |

|

|

|

| Total from investment operations | | | 0.34 | | | | 1.86 | | | | 3.89 | |

| |

|

|

| |

|

|

| |

|

|

|

| Dividends and Distributions on Preferred | | | | | | | | | | | | |

| Shares from: | | | | | | | | | | | | |

| Net investment income | | | (0.12 | ) | | | (0.12 | ) | | | (0.07 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Net realized gains | | | — | | | | (0.02 | ) | | | — | |

| |

|

|

| |

|

|

| |

|

|

|

| Total dividends and distributions on preferred shares | | | (0.12 | ) | | | (0.14 | ) | | | (0.07 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Net increase in net assets applicable to common | | | | | | | | | | | | |

| shareholders resulting from investment operations | | | 0.22 | | | | 1.72 | | | | 3.82 | |

| |

|

|

| |

|

|

| |

|

|

|

| Dividends and Distributions to Common | | | | | | | | | | | | |

| Shareholders from: | | | | | | | | | | | | |

| Net investment income | | | (0.75 | ) | | | (1.50 | ) | | | (1.33 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Net realized gains | | | — | | | | (0.82 | ) | | | (0.03 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Total dividends and distributions to common shareholders | | | (0.75 | ) | | | (2.32 | ) | | | (1.36 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Capital Share Transactions: | | | | | | | | | | | | |

| Common stock offering costs charged to paid-in | | | | | | | | | | | | |

| capital in excess of par | | | — | | | | — | | | | (0.03 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Preferred shares offering costs/underwriting discounts | | | | | | | | | | | | |

| charged to paid-in capital in excess of par | | | — | | | | — | | | | (0.09 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Total capital share transactions | | | — | | | | — | | | | (0.12 | ) |

| |

|

|

| |

|

|

| |

|

|

|

| Net asset value, end of period | | $ | 15.54 | | | $ | 16.07 | | | $ | 16.67 | |

| |

|

|

| |

|

|

| |

|

|

|

| Market price, end of period | | $ | 16.03 | | | $ | 15.82 | | | $ | 16.38 | |

| |

|

|

| |

|

|

| |

|

|

|

| Total Investment Return (1) | | | 6.46 | % | | | 11.53 | % | | | 18.98 | % |

| |

|

|

| |

|

|

| |

|

|

|

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets applicable to common shareholders, end of | | | | | | | | | | | | |

| period (000) | | $ | 1,057,383 | | | $ | 1,086,001 | | | $ | 1,101,833 | |

| |

|

|

| |

|

|

| |

|

|

|

| Ratio of expenses to average net assets (2) | | | 1.26 | %(3) | | | 1.24 | % | | | 1.17 | %(3) |

| |

|

|

| |

|

|

| |

|

|

|

| Ratio of net investment income to average net assets (2) | | | 9.60 | %(3) | | | 9.20 | % | | | 8.97 | %(3) |

| |

|

|

| |

|

|

| |

|

|

|

| Preferred shares asset coverage per share | | $ | 75,334 | | | $ | 76,698 | | | $ | 77,460 | |

| |

|

|

| |

|

|

| |

|

|

|

| Portfolio turnover | | | 27 | % | | | 70 | % | | | 86 | % |

| |

|

|

| |

|

|

| |

|

|

|

| * | Commencement of operations. |

| ** | Initial public offering price of $15.00 per share less underwriting discount of $0.675 per share. |

| (1) | Total investment return is calculated assuming a purchase of a share of common stock at the current market price on the first day of the period and a sale of a share of common stock at the current market price on the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions or sales charges. Total investment return for a period of less than one year is not annualized. |

| (2) | Calculated on the basis of income and expenses applicable to both common shares and preferred shares relative to the average net assets of common shareholders. |

| (3) | Annualized. |

| |

See accompanying Notes to Financial Statements | 8.31.05 | Nicholas-Applegate Convertible & Income Fund Semi-Annual Report 17

Nicholas-Applegate Convertible & Income Fund | Matters Relating to the Trustees |

| Consideration of the Investment |

| Management and Portfolio |

| Management Agreements |

| (unaudited) |

The Investment Company Act of 1940 requires that both the full Board of Trustees (the “Trustees”) and a majority of the non-interested (“independent”) Trustees, voting separately, annually approve the continuation of the Fund’s Investment Management Agreement with the Investment Manager and Portfolio Management Agreement between the Investment Manager and the Sub-Adviser (together the “Agreements”). The Trustees consider matters bearing on the Fund and its investment management arrangements at their meetings throughout the year, including a review of performance data at each regular meeting. In addition, the Trustees met on June 15 and 16, 2005 (the “contract review meeting”) for the specific purpose of considering whether to approve the continuation of the Investment Management Agreement and the Portfolio Management Agreement. The independent Trustees were assisted in their evaluation of the Agreements by independent legal counsel, from whom they received separate legal advice and with whom they met separately from Fund management during the contract review meeting.

Based on their evaluation of factors that they deemed to be material, including those factors described below, the Board of Trustees, including a majority of the independent Trustees, unanimously concluded that the Fund’s Investment Management Agreement and Portfolio Management Agreement should be continued for an additional one-year period.

In connection with their deliberations regarding the continuation of the Agreements, the Trustees, including the Independent Trustees, considered such information and factors as they believed, in light of the legal advice furnished to them and their own business judgment, to be relevant. As described below, the Trustees considered the nature, quality and extent of the various investment management, administrative and other services performed by the Investment Manager and the Sub-Adviser under the Agreements.

In connection with their contract review meeting, the Trustees received and relied upon materials provided by the Investment Manager which included, among other items: (i) information provided by Lipper Inc. on the total return investment performance (based on net assets) of the Fund for various time periods and the investment performance of a group of funds with substantially similar investment classifications/objectives, (ii) information provided by Lipper Inc., on the Fund’s management fee and other expenses and the management fee and other expenses of comparable funds identified by Lipper Inc. (iii) information regarding the investment performance and management fees of comparable portfolios of other clients of the Sub-Adviser, including institutional separate account and other clients, (iv) an estimate of the profitability to the Investment Manager from its relationship with the Fund for the twelve months ended March 31, 2005, (v) descriptions of various functions performed by the Investment Manager and the Sub-Adviser for the Fund, such as compliance monitoring and portfolio trading practices, and (vi) information regarding the overall organization of the Investment Manager and the Sub-Adviser, including information regarding senior management, portfolio managers and other personnel providing investment management, administrative and other services to the Fund.

The Trustees’ conclusions as to the continuation of the Agreements were based on a comprehensive consideration of all information provided to the Trustees and not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are decribed below, although individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors.

As part of their review, the Trustees examined the Investment Manager’s Sub-Adviser’s abilities to provide high quality investment management and other services to the Fund. The Trustees considered the investment philosophy and research and decision-making processes of the Sub-Adviser: the experience of key advisory personnel of the Sub-Adviser responsible for portfolio management of the Fund: the ability of the Investment Manager and Sub-Adviser to attract and retain capable personnel; the capability and integrity of the senior management and staff of the Investment Manager and Sub-Adviser; and the level of skill required to manage the Fund. In addition, the Trustees reviewed the quality of the Investment Manager’s and Sub-Adviser’s services with respect to regulatory compliance and compliance with the investment policies of the Fund; the nature and quality of certain administrative sevices the Investment Manager is responsible for providing to the Fund; and conditions that might affect the Investment Manager’s or Sub-Adviser’s ability to provide high quality services to the Fund in the future under the Agreements, including each organization’s respective business reputation, financial condition and operational stability. Based on the foregoing, the Trustees concluded that the Sub-Adviser’s investment process, research capabilities and philosophy were well suited to the Fund given its investment objectives and policies, and that the Investment Manager and Sub-Adviser would be able to meet any reasonably foreseeable obligations under the Agreements.

18 Nicholas-Applegate Convertible & Income Fund Semi-Annual Report | 8.31.05

Nicholas-Applegate Convertible & Income Fund | Matters Relating to the Trustees |

| | Consideration of the Investment |

| | Management and Portfolio |

| | Management Agreements |

| | (unaudited) (continued) |

Based on information provided by Lipper Inc. the Trustees also reviewed the Fund’s total return investment performance as well as the performance of comparable funds identified by Lipper Inc. In the course their deliberations, the Trustees took into account information provided by the Investment Manager in connection with the contract review meeting, as well as during investment review meetings conducted with portfolio management personnel during the course of the year regarding the Fund’s performance. After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that they were satisfied with the Investment Manager’s and Sub-Adviser’s responses and efforts relating to investment performance.

In assessing the reasonableness of the Fund’s fees under the Agreements, the Trustees considered, among other information, the Fund’s management fee and the total expense ratio as a percentage of average net assets attributable to common shares and the management fee and total expense ratios of comparable funds identified by Lipper Inc.

The Trustees also considered the management fees charged by the Sub-Adviser to other clients, including institutional separate accounts with investment strategies similar to those of the Fund. Regarding the institutional separate accounts, they noted that the management fee paid by the Fund is generally higher than the fees paid by these clients of the Sub-Adviser, but were advised that the administrative burden for the Investment Manager and the Sub-Adviser wth respect to the Fund are also relatively higher, due in part to the more extensive regulatory regime to which the Fund is subject in comparison to institutional accounts. The Trustees noted that the management fee paid by the Fund is generally higher than the fees paid by the open-end Funds but were advised that there are additional portfolio management challenges in managing the Fund such as the use of leverage and meeting a regular dividend. The Trustees noted that the Fund was above average for the one-year period ended May 31, 2005 and poor for the year-to-date period ended May 31, 2005 in total return. Performance for the month of May, however, was strong. The Trustees also noted that the Fund’s expense ratio was below the average and median for its peer group.

The Trustees also took into account that the Fund has preferred shares outstanding, which increases the amount of fees received by the Investment Manager and Sub-Adviser under the Agreements (because the fees are calculated based on the Fund’s total managed assets, including assets attributable to preferred shares and other forms of leverage outstanding). In this regard, the Trustees took into account that the Investment Manager and Sub-Adviser have a financial incentive for the Fund to continue to have preferred shares outstanding, which may create a conflict of interest between the Investment Manager and Sub-Adviser, on one hand, and the Fund’s common shareholders, on the other. In this regard, the Trustees considered information provided by the Investment Manager and Sub-Adviser indicating that the Fund’s use of leverage through preferred shares continues to be appropriate and in the interests of the Fund’s common shareholders.

Based on a profitability analysis provided by the Investment Manager, the Trustees also considered the estimated profitability of the Investment Manager from its relationship with the Fund and determined that such profitability was not excessive.

The Trustees also took into account that, as a closed-end investment company, the Fund does not currently intend to raise additional assets, so the assets of the Fund will grow (if at all) only through the investment performance of the Fund. Therefore, the Trustees did not consider potential economies of scale as a principal factor in assessing the fee rates payable under the Agreements.

Additionally, the Trustees considered so-called ”fall-out benefits” to the Investment Manager and Sub-Adviser, such as reputational value derived from serving as investment manager and sub-adviser to the Fund.

After reviewing these and other factors described herein, the Trustees concluded, within the context of their overall conclusions regarding the Agreements, that the fees payable under the Agreements represent reasonable compensation in light of the nature and quality of the services being provided by the Investment Manager and Sub-Adviser to the Fund.

8.31.05 | Nicholas-Applegate Convertible & Income Fund Semi-Annual Report 19

Nicholas-Applegate Convertible & Income Fund | Annual Shareholder Meeting |

| Results |

|

|

The Fund held its annual meeting of shareholders on October 18, 2005. Common and Preferred shareholders voted to elect R. Peter Sullivan III and David C. Flattum as trustees to serve until 2008, and 2006, respectively. Preferred shareholders voted to elect John J. Dalessandro II as a trustee to serve until 2008. Mr. Robert E. Connor*, Mr. Paul Belica and Mr. Hans W. Kertess, continue to serve as trustees of the Fund

| | | | | Withhold | |

| | | Affirmative | | Authority | |

|

|

|

|

|

|

| Election of David C. Flattum | | 55,176,791 | | 505,908 | |

| | | | | | |

| Election of R. Peter Sullivan III | | 55,169,028 | | 513,671 | |

| | | | | | |

| Election of John J. Dalessandro II | | 15,656 | | 53 | |

* Preferred Shares trustee

20 Nicholas-Applegate Convertible & Income Fund Semi-Annual Report | 8.31.05

| Trustees and Principal Officers | | |

| Robert E. Connor | | Newton B. Schott, Jr. |

| Trustee, Chairman of the Board of Trustees | | Vice President |

| Paul Belica | | Douglas Forsyth |

| Trustee | | Vice President |

| John J. Dalessandro II | | Lawrence G. Altadonna |

| Trustee | | Treasurer, Principal Financial & Accounting Officer |

| David C. Flattum | | Thomas J. Fuccillo |

| Trustee | | Secretary |

| Hans W. Kertess | | Youse Guia |

| Trustee | | Chief Compliance Officer |

| R. Peter Sullivan III | | Jennifer A. Patula |

| Trustee | | Assistant Secretary |

| Brian S. Shlissel | | |

| President & Chief Executive Officer | | |

Investment Manager

Allianz Global Investors Fund Management LLC

1345 Avenue of the Americas

New York, NY 10105

Sub-Adviser

Nicholas-Applegate Capital Management LLC

600 West Broadway, 30th Fl

San Diego, CA 92101

Custodian & Accounting Agent

Brown Brothers Harriman & Co.

40 Water Street

Boston, MA 02109

Transfer Agent, Dividend Paying Agent and Registrar

PFPC Inc.

P.O. Box 43027

Providence, RI 02940-3027

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

300 Madison Avenue

New York, NY 10017

Legal Counsel

Ropes & Gray LLP

One International Place

Boston, MA 02210-2624

This report, including the financial information herein, is transmitted to the shareholders of Nicholas Applegate Convertible & Income Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

The financial information included herein is taken from the records of the Fund without examination by an independent registered public accounting firm, who did not express an opinion hereon.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase shares of its common stock in the open market.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of its fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The information on Form N-Q is also available on the Fund’s website at www.allianzinvestors.com.

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities held during the twelve months ended June 30, 2005 is available (i) without charge, upon request by calling the Fund’s transfer agent at (800) 331-1710; (ii) on the Fund’s website at www.allianzinvestors.com; and (iii) on the Securities and Exchange Commission’s website at www.sec.gov.

Information on the Fund is available at www.allianzinvestors.com or by calling the Fund’s transfer agent at (800) 331-1710.

ITEM 2. CODE OF ETHICS

Not required in this filing.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT

Not required in this filing

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Not required in this filing

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANT

Not required in this filing

ITEM 6. SCHEDULE OF INVESTMENTS Schedule of Investments is included as part of

the report to shareholders filed under Item 1 of this form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES

Not required in this filing

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not required in this filing

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED COMPANIES.

TOTAL NUMBER MAXIMUM NUMBER OF

OF SHARES PURCHASED SHARES THAT MAY

TOTAL NUMBER AVERAGE AS PART OF PUBLICLY YET BE PURCHASED

OF SHARES PRICE PAID ANNOUNCED PLANS UNDER THE PLANS

PERIOD PURCHASED PER SHARE OR PROGRAMS OR PROGRAMS

------ --------- --------- ---------- -----------

March 2005 N/A N/A N/A N/A

April 2005 N/A N/A N/A N/A

May 2005 N/A 14.44 118,272 N/A

June 2005 N/A 14.78 117,275 N/A

July 2005 N/A 15.08 114,831 N/A

August 2005 N/A 15.54 110,355 N/A

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There have been no material changes to the procedures by which shareholders

may recommend nominees to the Fund's Board of Trustees since the Fund last

provided disclosure in response to this item. The Nominating Committee Charter

governing the affairs of the Nominating Committee of the Board is posted on the

Allianz Funds website at www.allianzinvestors.com.

ITEM 11. CONTROLS AND PROCEDURES

(a) The registrant's President and Chief Executive Officer and Principal

Financial Officer have concluded that the registrant's disclosure controls and

procedures (as defined in Rule 30a-2(c) under the Investment Company Act of

1940, as amended are effective based on their evaluation of these controls and

procedures as of a date within 90 days of the filing date of this document.

(b) There were no significant changes in the registrant's internal controls

or in factors that could affect these controls subsequent to the date of their

evaluation, including any corrective actions with regard to significant

deficiencies and material weaknesses.

ITEM 12. EXHIBITS

(a)(1) Exhibit 99 Cert. - Certification pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

(b) Exhibit 99.906 Cert. - Certification pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

Nicholas-Applegate Convertible & Income Fund

By /s/ Brian S. Shlissel

- ------------------------

Brian S. Shlissel, President & Chief Executive Officer

Date: November 2, 2005

By /s/ Lawrence G. Altadonna

- ----------------------------

Lawrence G. Altadonna, Treasurer, Principal Financial & Accounting Officer

Date: November 2, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By /s/ Brian S. Shlissel

- ------------------------

Brian S. Shlissel, President & Chief Executive Officer

Date: November 2, 2005

By /s/ Lawrence G. Altadonna

- ----------------------------

Lawrence G. Altadonna, Treasurer, Principal Financial & Accounting Officer

Date: November 2, 2005