UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21284

AllianzGI Convertible & Income Fund

(Exact name of registrant as specified in charter)

| | |

| 1633 Broadway, New York, NY | | 10019 |

| (Address of principal executive offices) | | (Zip code) |

Lawrence G. Altadonna – 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: February 28

Date of reporting period: February 28, 2017

Item 1. Report to Shareholders

AllianzGI Convertible & Income Fund

AllianzGI Convertible & Income Fund II

Annual Report

February 28, 2017

Table of Contents

Letter from the President

Thomas J. Fuccillo

President & CEO

Dear Shareholder:

The US economy continued to expand during the twelve-month fiscal reporting period ended February 28, 2017, but the overall pace was far from robust. Economic activity overseas remained generally tepid. Against this backdrop, US equities generated strong results, though international equities generated mixed results. In addition, the US bond market posted a modest return during the twelve-month period.

For the twelve-month period ended February 28, 2017

| ∎ | | AllianzGI Convertible & Income Fund returned 41.09% on net asset value (“NAV”) and 59.15% on market price. |

| ∎ | | AllianzGI Convertible & Income Fund II returned 41.68% on NAV and 56.31% on market price. |

During the twelve-month period ended February 28, 2017, the Standard & Poor’s (“S&P”) 500 Index, an unmanaged index generally representative of the US stock market, rose 24.98% and the BofA Merrill Lynch High Yield Master II Index, an unmanaged index generally representative of the high yield bond market, gained 22.30%. Convertible securities, which share characteristics of both stocks and bonds, also generated strong results. The BofA Merrill Lynch All Convertibles-All Qualities Index, an unmanaged index generally representative of the convertible securities market, returned 22.82%.

US gross domestic product (“GDP”), the value of goods and services produced in the country, which is the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 0.9% annualized pace during the first quarter of 2016. After ticking down to 0.8% in the second quarter, GDP grew at a 3.5% annualized pace during the third quarter, which represented the strongest expansion in two years. The Commerce Department’s final reading — released after the reporting period had ended — showed that GDP grew at an annualized pace of 2.1% for the fourth quarter of 2016.

The US Federal Reserve (the “Fed”) raised interest rates for the first time in nearly a decade at its meeting in December 2015. After remaining on hold at its first seven meetings in 2016, the Fed again raised interest rates 0.25% in December 2016 to a range between 0.50% and 0.75%. After remaining on hold at its first meeting in February of 2017, on March 15, 2017 — after the reporting period ended — the Fed again raised rates 0.25% to a range between 0.75% and 1.00%. Following the March 2017 meeting, the Fed maintained an unchanged position on interest rates and stated, “The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.”

| | | | |

| 2 | | Annual Report | | | February 28, 2017 |

Outlook

Looking ahead, we believe investors should expect muted growth as the US enters its late-cycle period, Japan struggles with its aging population and Europe suffers from the uncertainties of the approval by citizens of the United Kingdom, in June 2016, of a referendum to leave the European Union (“Brexit”). In our view, the US and European Union should ultimately avoid recessions, but remain mired in a relatively weak economic expansion. We expect the Fed to continue to

Receive this report electronically and eliminate paper mailings.

To enroll, go to

us.allianzgi.com/edelivery.

modestly increase interest rates in 2017, prompting central banks in emerging markets to lower their rates as inflation falls. Elsewhere, we expect the European Central Bank and Bank of Japan should maintain their accommodative monetary policies. We have passed peak global liquidity as central banks have pushed past negative interest rate policies to begin supporting government spending.

The tides of deregulation continued to shift in 2016, and nationalism and populism gained ground. Given the results of the November elections in the US and the significant elections looming in Europe in 2017, politics should remain a key investment consideration. We also believe that monetary policy will become more political. As to where governments will spend the money their central banks print, we believe domestic infrastructure and defense spending will be the focus of many countries in the coming years.

Against this backdrop, we believe markets are increasingly susceptible to volatility as politics, geopolitics, divergent monetary policies and internal market structures all converge and evolve. We believe that navigating this sea of uncertainty requires clear direction and an active management approach, with investors staying agile in their asset allocations, confident in their processes and thorough in their research.

For specific information on the Funds and their performance, please refer to the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, us.allianzgi.com/closedendfunds.

On behalf of Allianz Global Investors U.S. LLC, the Funds’ investment manager, thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

|

|

| Thomas J. Fuccillo |

| President & Chief Executive Officer |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 3 | |

Fund Insights

AllianzGI Convertible & Income Funds

February 28, 2017 (unaudited)

For the period of March 1, 2016, through February 28, 2017, as provided by Doug Forsyth, CFA, Portfolio Manager.

For the twelve-month period ended February 28, 2017, the AllianzGI Convertible & Income Fund and the AllianzGI Convertible & Income Fund II (the “Funds”) returned 41.09% and 41.68% NAV and 59.15% and 56.31% on market price, respectively.

Market Environment

Several factors influenced convertibles and high-yield bonds throughout the twelve-month period, including constructive economic trends, corporate health, the Treasury market and the Fed, US elections, risk appetite and commodity price strength.

In the US, economic reports were largely positive, signaling ongoing economic growth and supporting the market’s advance. Jobless claims remained subdued and the unemployment rate fell to a nine-year low. Housing prices continued to ascend, and in December, consumer confidence hit its highest level in more than 15 years. Overall, the trend in economic data reinforced the favorable market conditions for both convertibles and high-yield bonds.

Operating performance for most convertible and high-yield issuers met or exceeded expectations and credit metrics showed further improvement. According to Bank of America Merrill Lynch, net leverage ticked lower for a second consecutive quarter in the third quarter and interest coverage rose quarter-over-quarter for both the second and third quarters of 2016. Furthermore, earnings before interest, tax, depreciation and amortization (“EBITDA”), far exceeded the gains reported in the second quarter, spiking dramatically (on a year-over-year percentage basis) in the third quarter. These statistics provided additional proof of the underlying

fundamental strength of the convertible and high-yield bond markets.

In addition to strong absolute returns, convertible and high-yield bonds provided substantial diversification benefits, significantly outperforming core fixed income and US Treasuries. Additionally, the high-yield market responded positively to the Fed’s rate increase and commentary. On balance, a cautious Fed and a highly accommodative environment outside the US helped support the performance of risk assets over the twelve-month period.

The unexpected election of Donald Trump as the US President triggered a rotation into risk assets, with investors fleeing safe-haven investments. Despite an initial negative reaction, the market rallied through year-end into 2017. It appeared that the President’s pro-growth agenda caused an abrupt shift in sentiment in the latter months of 2016, and without hesitation, investors anticipated a more favorable corporate earnings backdrop, predicated on anticipation of positive tax reform, decreased regulation, increased fiscal spending and less congressional gridlock in the Trump administration.

After bottoming in February 2016, energy and base-metal prices stabilized, traded range-bound, and then strengthened. Crude oil benefited from an agreement by the Organization of the Petroleum Countries (“OPEC”) to cut oil production and pledges of support from non-OPEC producers. Copper and other base-metals also trended higher. A more favorable economic backdrop, along with continual improvement in industry dynamics, helped support the energy and the materials-related industries, which were the best performers of 2016, in part due to their oversold conditions exiting 2015.

| | | | |

| 4 | | Annual Report | | | February 28, 2017 |

Portfolio Review

The Funds were a natural beneficiary of the increased appetite for risk, both pre- and post-election, and were able to share in the strong capital appreciation across the asset classes that compose the portfolios. In addition to providing a strong total return, the Funds also provided a high level of income over the twelve-month period.

In the convertible sleeve, sectors that contributed positively to relative performance were energy, industrials and media. On the other hand, technology, health care and consumer staples pressured relative performance.

In the high yield sleeve, industries that aided relative performance were diversified financial services, metals/mining ex steel and steel producers/products. In contrast, energy, aerospace/defense and super retail hampered relative performance.

Outlook

Equity markets continue to record new all-time highs, volatility is near all-time lows and interest rates appear to be trending higher on an improving economic outlook. Historically, these factors have been positive indicators for both economic and corporate earnings growth and supportive of investments in risk assets.

Stress in select industries has waned, and, in our opinion, overall, balance sheets, leverage ratios and interest coverage ratios continue to support investments in high-yield and convertible asset classes. From a fundamental standpoint, as well as the observed condition of the economy, we believe defaults should trend to near the long-term historical average during 2017.

The US economy is expected to expand at a moderate pace in 2017 and both equity market performance and steepness of the Treasury yield curve support this notion. Moreover, we believe that President Trump’s agenda should result in even stronger economic growth.

Regarding corporate health, we believe that profits are poised to trend higher in 2017 after accelerating into year-end. Additionally, the new administration’s policies could create the most favorable backdrop for corporate earnings in years.

US monetary policy continues to be modestly accommodative with the Fed expected to take a gradual approach toward adjustments. Until the Fed either moves aggressively or is well into the tightening cycle, we do not expect monetary policy to drive an extended sell-off and spread-widening in high-yield and convertibles.

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 5 | |

Performance & Statistics

AllianzGI Convertible & Income Fund

February 28, 2017 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

1 Year | | | 59.15% | | | | 41.09% | |

5 Year | | | 5.68% | | | | 8.05% | |

10 Year | | | 4.51% | | | | 5.40% | |

Commencement of Operations (3/31/03) to 2/28/17 | | | 7.41% | | | | 7.82% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (3/31/03) to 2/28/17

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $6.93 | |

NAV(2) | | | $6.87 | |

Premium to NAV | | | 0.87% | |

Market Price Yield(3) | | | 11.26% | |

Leverage(4) | | | 37.10% | |

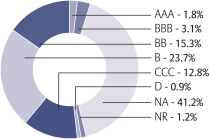

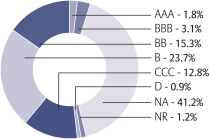

S&P Global Ratings*

(as a % of total investments)

| | | | |

| 6 | | Annual Report | | | February 28, 2017 |

Performance & Statistics

AllianzGI Convertible & Income Fund II

February 28, 2017 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

1 Year | | | 56.31% | | | | 41.68% | |

5 Year | | | 5.38% | | | | 8.11% | |

10 Year | | | 4.10% | | | | 4.64% | |

Commencement of Operations (7/31/03) to 2/28/17 | | | 6.20% | | | | 6.72% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (7/31/03) to 2/28/17

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $6.17 | |

NAV(2) | | | $6.14 | |

Premium to NAV | | | 0.49% | |

Market Price Yield(3) | | | 11.18% | |

Leverage(4) | | | 37.48% | |

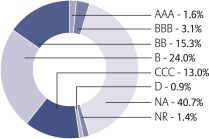

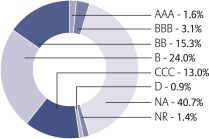

S&P Global Ratings*

(as a % of total investments)

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 7 | |

Performance & Statistics

AllianzGI Convertible & Income Funds

February 28, 2017 (unaudited)

Notes to Performance & Statistics:

* Bond ratings apply to the underlying holdings of the Funds and not the Funds themselves and are divided into categories ranging from highest to lowest credit quality, determined for purposes of presentations in this report by using ratings provided by S&P Global Ratings (“S&P”). Presentations of credit ratings information in this report use ratings provided by S&P for this purpose, among other reasons, because of the access to background information and other materials provided by S&P, as well as the Funds’ considerations of industry practice. Bonds not rated by S&P, or bonds that do not have a rating available from S&P, or bonds that had a rating withdrawn by S&P are designated as “NR” or “NA”, respectively. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by S&P or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Funds, Allianz Global Investors U.S. LLC develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return.

Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Funds, market conditions, supply and demand for each Fund’s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Funds’ financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current monthly dividend per common share (comprised of net investment income) by the market price per common share at February 28, 2017.

(4) Represents Preferred Shares (“Leverage”) outstanding, as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| | | | |

| 8 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | Corporate Bonds & Notes – 41.7% | | | | | | | | |

| | | | Advertising – 0.4% | | | | | | | | |

| | $4,515 | | | Affinion Group, Inc., 7.875%, 12/15/18 | | | | | | | $4,018,350 | |

| | | | Aerospace & Defense – 1.4% | | | | | | | | |

| | 7,135 | | | Erickson, Inc., 8.25%, 5/1/20 (b) | | | | | | | 642,150 | |

| | 6,636 | | | Kratos Defense & Security Solutions, Inc., 7.00%, 5/15/19 | | | | | | | 6,528,165 | |

| | 5,970 | | | TransDigm, Inc., 6.50%, 5/15/25 | | | | | | | 6,126,712 | |

| | | | | | | | | | | | 13,297,027 | |

| | | | Air Freight & Logistics – 0.5% | | | | | | | | |

| | 4,830 | | | XPO Logistics, Inc., 6.50%, 6/15/22 (c)(d) | | | | | | | 5,089,613 | |

| | | | Chemicals – 2.0% | | | | | | | | |

| | 7,500 | | | Chemours Co., 6.625%, 5/15/23 | | | | | | | 8,034,375 | |

| | 5,670 | | | Platform Specialty Products Corp., 6.50%, 2/1/22 (c)(d) | | | | | | | 5,953,500 | |

| | 4,875 | | | Tronox Finance LLC, 7.50%, 3/15/22 (c)(d) | | | | | | | 5,118,750 | |

| | | | | | | | | | | | 19,106,625 | |

| | | | Commercial Services – 2.4% | | | | | | | | |

| | 8,050 | | | Cenveo Corp., 6.00%, 5/15/24 (c)(d) | | | | | | | 7,224,875 | |

| | 5,164 | | | DynCorp International, Inc., 11.875%, 11/30/20 | | | | | | | 4,996,165 | |

| | 7,375 | | | Monitronics International, Inc., 9.125%, 4/1/20 | | | | | | | 7,375,000 | |

| | 3,500 | | | United Rentals North America, Inc., 5.50%, 7/15/25 | | | | | | | 3,705,625 | |

| | | | | | | | | | | | 23,301,665 | |

| | | | Commercial Services & Supplies – 0.6% | | | | | | | | |

| | 5,585 | | | West Corp., 5.375%, 7/15/22 (c)(d) | | | | | | | 5,385,336 | |

| | | | Construction Materials – 0.6% | | | | | | | | |

| | 5,665 | | | US Concrete, Inc., 6.375%, 6/1/24 | | | | | | | 6,019,063 | |

| | | | Consumer Finance – 0.9% | | | | | | | | |

| | 3,210 | | | Navient Corp., 8.45%, 6/15/18 | | | | | | | 3,438,713 | |

| | 4,935 | | | Springleaf Finance Corp., 8.25%, 10/1/23 | | | | | | | 5,249,606 | |

| | | | | | | | | | | | 8,688,319 | |

| | | | Diversified Financial Services – 2.6% | | | | | | | | |

| | 2,032 | | | Affinion International Holdings Ltd., 7.50%, 7/30/18

(acquisition cost-$1,752,910; purchased 11/9/15-10/21/16)(c)(d)(h) | | | | | | | 1,970,793 | |

| | | | Community Choice Financial, Inc., | | | | | | | | |

| | 10,085 | | | 10.75%, 5/1/19 | | | | | | | 8,723,525 | |

| | 7,130 | | | 12.75%, 5/1/20 (c)(d) | | | | | | | 5,810,950 | |

| | | | Nationstar Mortgage LLC / Nationstar Capital Corp., | | | | | | | | |

| | 2,500 | | | 7.875%, 10/1/20 | | | | | | | 2,607,813 | |

| | 5,300 | | | 9.625%, 5/1/19 | | | | | | | 5,508,687 | |

| | | | | | | | | | | | 24,621,768 | |

| | | | Diversified Telecommunications Services – 0.6% | | | | | | | | |

| | 5,290 | | | Frontier Communications Corp., 10.50%, 9/15/22 | | | | | | | 5,534,663 | |

| | | | Electronic Equipment, Instruments & Components – 0.8% | | | | | | | | |

| | 7,725 | | | Kemet Corp., 10.50%, 5/1/18 | | | | | | | 7,758,797 | |

| | | | Entertainment – 0.4% | | | | | | | | |

| | 4,000 | | | Cedar Fair LP / Canada’s Wonderland Co. / Magnum Management Corp., 5.375%, 6/1/24 | | | | | | | 4,160,000 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 9 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

February��28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Equity Real Estate Investment Trust – 0.7% | | | | | | | | |

| | $2,835 | | | Communications Sales & Leasing, Inc. / CSL Capital LLC, 8.25%, 10/15/23 | | | | | | | $3,086,606 | |

| | 3,085 | | | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | | | | | | | 3,250,819 | |

| | | | | | | | | | | | 6,337,425 | |

| | | | Health Care Providers & Services – 2.7% | | | | | | | | |

| | 5,430 | | | DaVita, Inc., 5.125%, 7/15/24 | | | | | | | 5,552,175 | |

| | 3,860 | | | Envision Healthcare Corp., 6.25%, 12/1/24 (c)(d) | | | | | | | 4,101,250 | |

| | 7,955 | | | Kindred Healthcare, Inc., 8.75%, 1/15/23 | | | | | | | 7,756,125 | |

| | | | Tenet Healthcare Corp., | | | | | | | | |

| | 3,500 | | | 5.00%, 3/1/19 | | | | | | | 3,519,880 | |

| | 4,530 | | | 8.125%, 4/1/22 | | | | | | | 4,779,150 | |

| | | | | | | | | | | | 25,708,580 | |

| | | | Healthcare-Services – 0.0% | | | | | | | | |

| | 300 | | | HCA, Inc., 7.50%, 2/15/22 | | | | | | | 346,875 | |

| | | | Holding Companies-Diversified – 0.6% | | | | | | | | |

| | 5,865 | | | Horizon Pharma, Inc., 6.625%, 5/1/23 | | | | | | | 5,744,768 | |

| | | | Hotels, Restaurants & Leisure – 1.0% | | | | | | | | |

| | 8,405 | | | MGM Resorts International, 11.375%, 3/1/18 | | | | | | | 9,213,981 | |

| | | | Household Durables – 0.7% | | | | | | | | |

| | 4,395 | | | Beazer Homes USA, Inc., 8.75%, 3/15/22 (c)(d) | | | | | | | 4,779,035 | |

| | 1,800 | | | Lennar Corp., 12.25%, 6/1/17 | | | | | | | 1,846,260 | |

| | | | | | | | | | | | 6,625,295 | |

| | | | Independent Power & Renewable Electricity Producers – 0.6% | | | | | | | | |

| | 5,585 | | | NRG Energy, Inc., 6.25%, 5/1/24 | | | | | | | 5,612,925 | |

| | | | Internet & Direct Marketing Retail – 0.3% | | | | | | | | |

| | 2,800 | | | Netflix, Inc., 5.875%, 2/15/25 | | | | | | | 3,045,000 | |

| | | | Internet Software & Services – 0.7% | | | | | | | | |

| | | | EarthLink Holdings Corp., | | | | | | | | |

| | 2,800 | | | 7.375%, 6/1/20 | | | | | | | 2,972,200 | |

| | 3,440 | | | 8.875%, 5/15/19 | | | | | | | 3,533,740 | |

| | | | | | | | | | | | 6,505,940 | |

| | | | Iron/Steel – 0.9% | | | | | | | | |

| | | | AK Steel Corp., | | | | | | | | |

| | 1,315 | | | 7.50%, 7/15/23 | | | | | | | 1,439,925 | |

| | 7,305 | | | 8.375%, 4/1/22 | | | | | | | 7,624,594 | |

| | | | | | | | | | | | 9,064,519 | |

| | | | Machinery – 1.7% | | | | | | | | |

| | 5,250 | | | BlueLine Rental Finance Corp., 7.00%, 2/1/19 (c)(d) | | | | | | | 5,381,250 | |

| | 3,997 | | | Commercial Vehicle Group, Inc., 7.875%, 4/15/19 | | | | | | | 4,026,977 | |

| | 6,755 | | | Navistar International Corp., 8.25%, 11/1/21 | | | | | | | 6,856,325 | |

| | | | | | | | | | | | 16,264,552 | |

| | | | Media – 1.8% | | | | | | | | |

| | 7,370 | | | Cablevision Systems Corp., 8.00%, 4/15/20 | | | | | | | 8,162,275 | |

| | 4,671 | | | LiveStyle, Inc., 9.625%, 2/1/19

(acquisition cost-$4,879,905; purchased 5/7/14-2/26/15)(b)(c)(d)(h) | | | | | | | 46,710 | |

| | 8,355 | | | McClatchy Co., 9.00%, 12/15/22 | | | | | | | 8,835,412 | |

| | | | | | | | | | | | 17,044,397 | |

| | | | |

| 10 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Metals & Mining – 2.6% | | | | | | | | |

| | $5,100 | | | Alcoa Nederland Holding BV, 7.00%, 9/30/26 (c)(d) | | | | | | | $5,610,000 | |

| | 6,590 | | | ArcelorMittal, 10.60%, 6/1/19 | | | | | | | 7,759,725 | |

| | 3,950 | | | Joseph T Ryerson & Son, Inc., 11.00%, 5/15/22 (c)(d) | | | | | | | 4,414,125 | |

| | 5,975 | | | United States Steel Corp., 8.375%, 7/1/21 (c)(d) | | | | | | | 6,736,812 | |

| | | | | | | | | | | | 24,520,662 | |

| | | | Miscellaneous Manufacturing – 0.7% | | | | | | | | |

| | 7,350 | | | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (c)(d) | | | | | | | 7,111,125 | |

| | | | Multiline Retail – 0.3% | | | | | | | | |

| | 2,835 | | | Dollar Tree, Inc., 5.75%, 3/1/23 | | | | | | | 3,012,188 | |

| | | | Oil & Gas – 0.7% | | | | | | | | |

| | 2,700 | | | Calumet Specialty Products Partners LP / Calumet Finance Corp., 6.50%, 4/15/21 | | | | | | | 2,356,506 | |

| | 2,835 | | | NGL Energy Partners LP / NGL Energy Finance Corp., 7.50%, 11/1/23 (c)(d) | | | | | | | 2,998,012 | |

| | 820 | | | Weatherford International Ltd., 8.25%, 6/15/23 | | | | | | | 891,750 | |

| | | | | | | | | | | | 6,246,268 | |

| | | | Oil, Gas & Consumable Fuels – 5.0% | | | | | | | | |

| | 500 | | | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 | | | | | | | 508,750 | |

| | | | Cobalt International Energy, Inc. (c)(d), | | | | | | | | |

| | 14,783 | | | 7.75%, 12/1/23 | | | | | | | 7,539,330 | |

| | 16,950 | | | 10.75%, 12/1/21 | | | | | | | 16,017,750 | |

| | 3,550 | | | Energy Transfer Equity LP, 5.50%, 6/1/27 | | | | | | | 3,776,313 | |

| | 7,225 | | | EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | | | | | | | 7,098,562 | |

| | 4,895 | | | Oasis Petroleum, Inc., 6.875%, 3/15/22 | | | | | | | 5,017,375 | |

| | 3,500 | | | Rice Energy, Inc., 6.25%, 5/1/22 | | | | | | | 3,587,500 | |

| | 4,530 | | | Sanchez Energy Corp., 6.125%, 1/15/23 | | | | | | | 4,371,450 | |

| | | | | | | | | | | | 47,917,030 | |

| | | | Pharmaceuticals – 0.6% | | | | | | | | |

| | 2,290 | | | Endo Finance LLC & Endo Finco, Inc., 5.375%, 1/15/23 (c)(d) | | | | | | | 2,038,100 | |

| | 4,000 | | | Valeant Pharmaceuticals International, Inc., 7.50%, 7/15/21 (c)(d) | | | | | | | 3,687,500 | |

| | | | | | | | | | | | 5,725,600 | |

| | | | Retail – 0.6% | | | | | | | | |

| | 9,465 | | | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (c)(d) | | | | | | | 5,986,612 | |

| | | | Semiconductors & Semiconductor Equipment – 1.2% | | | | | | | | |

| | 4,645 | | | Amkor Technology, Inc., 6.375%, 10/1/22 | | | | | | | 4,830,800 | |

| | 6,210 | | | Micron Technology, Inc., 5.875%, 2/15/22 | | | | | | | 6,504,975 | |

| | | | | | | | | | | | 11,335,775 | |

| | | | Software – 0.6% | | | | | | | | |

| | 5,035 | | | Camelot Finance S.A., 7.875%, 10/15/24 (c)(d) | | | | | | | 5,374,863 | |

| | | | Specialty Retail – 0.7% | | | | | | | | |

| | 3,500 | | | Claire’s Stores, Inc., 9.00%, 3/15/19 (c)(d) | | | | | | | 1,627,500 | |

| | 5,500 | | | Conn’s, Inc., 7.25%, 7/15/22 | | | | | | | 4,826,250 | |

| | | | | | | | | | | | 6,453,750 | |

| | | | Technology Hardware, Storage & Peripherals – 0.5% | | | | | | | | |

| | 3,935 | | | Western Digital Corp., 10.50%, 4/1/24 | | | | | | | 4,608,869 | |

| | | | Telecommunications – 2.0% | | | | | | | | |

| | 7,370 | | | Consolidated Communications, Inc., 6.50%, 10/1/22 | | | | | | | 7,388,425 | |

| | 4,250 | | | Hughes Satellite Systems Corp., 7.625%, 6/15/21 | | | | | | | 4,728,125 | |

| | 7,655 | | | Windstream Services LLC, 7.50%, 4/1/23 | | | | | | | 7,386,309 | |

| | | | | | | | | | | | 19,502,859 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 11 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Trading Companies & Distributors – 0.3% | | | | | | | | |

| | $2,250 | | | H&E Equipment Services, Inc., 7.00%, 9/1/22 | | | | | | | $2,379,375 | |

| | | | Wireless Telecommunication Services – 1.0% | | | | | | | | |

| | 7,205 | | | Sprint Communications, Inc., 11.50%, 11/15/21 | | | | | | | 9,105,319 | |

| | Total Corporate Bonds & Notes (cost-$415,434,079) | | | | | | | 397,775,778 | |

| | Convertible Bonds & Notes – 34.8% | | | | | | | | |

| | | | Air Freight & Logistics – 0.2% | | | | | | | | |

| | 2,280 | | | Echo Global Logistics, Inc., 2.50%, 5/1/20 | | | | | | | 2,174,550 | |

| | | | Automobiles – 0.3% | | | | | | | | |

| | 2,850 | | | Tesla, Inc., 1.25%, 3/1/21 | | | | | | | 2,700,375 | |

| | | | Biotechnology – 0.9% | | | | | | | | |

| | 7,920 | | | Ionis Pharmaceuticals, Inc., 1.00%, 11/15/21 | | | | | | | 8,405,100 | |

| | | | Capital Markets – 1.2% | | | | | | | | |

| | 16,490 | | | Walter Investment Management Corp., 4.50%, 11/1/19 | | | | | | | 11,378,100 | |

| | | | Construction & Engineering – 0.4% | | | | | | | | |

| | 4,485 | | | Layne Christensen Co., 4.25%, 11/15/18 | | | | | | | 4,016,878 | |

| | | | Construction Materials – 0.5% | | | | | | | | |

| | 4,275 | | | Cemex SAB de CV, 3.72%, 3/15/20 | | | | | | | 4,747,922 | |

| | | | Consumer Finance – 2.2% | | | | | | | | |

| | 9,320 | | | Encore Capital Group, Inc., 3.00%, 7/1/20 | | | | | | | 9,296,700 | |

| | 12,165 | | | PRA Group, Inc., 3.00%, 8/1/20 | | | | | | | 11,678,400 | |

| | | | | | | | | | | | 20,975,100 | |

| | | | Diversified Consumer Services – 1.1% | | | | | | | | |

| | 13,510 | | | Ascent Capital Group, Inc., 4.00%, 7/15/20 | | | | | | | 10,487,137 | |

| | | | Electrical Equipment – 1.6% | | | | | | | | |

| | 16,800 | | | SolarCity Corp., 1.625%, 11/1/19 | | | | | | | 15,099,000 | |

| | | | Energy Equipment & Services – 3.1% | | | | | | | | |

| | 18,235 | | | Helix Energy Solutions Group, Inc., 3.25%, 3/15/32 | | | | | | | 18,007,062 | |

| | 16,110 | | | Hornbeck Offshore Services, Inc., 1.50%, 9/1/19 | | | | | | | 11,448,169 | |

| | | | | | | | | | | | 29,455,231 | |

| | | | Equity Real Estate Investment Trust – 0.6% | | | | | | | | |

| | 5,400 | | | Two Harbors Investment Corp., 6.25%, 1/15/22 | | | | | | | 5,437,125 | |

| | | | Health Care Equipment & Supplies – 0.7% | | | | | | | | |

| | 5,965 | | | Wright Medical Group, Inc., 2.00%, 2/15/20 | | | | | | | 6,815,013 | |

| | | | Health Care Products – 0.2% | | | | | | | | |

| | 1,710 | | | Nevro Corp., 1.75%, 6/1/21 | | | | | | | 2,135,363 | |

| | | | Health Care Providers & Services – 0.9% | | | | | | | | |

| | 2,850 | | | Brookdale Senior Living, Inc., 2.75%, 6/15/18 | | | | | | | 2,800,125 | |

| | | | Molina Healthcare, Inc., | | | | | | | | |

| | 1,500 | | | 1.125%, 1/15/20 | | | | | | | 1,999,688 | |

| | 3,645 | | | 1.625%, 8/15/44 | | | | | | | 3,941,156 | |

| | | | | | | | | | | | 8,740,969 | |

| | | | Independent Power & Renewable Electricity Producers – 0.9% | | | | | | | | |

| | 9,230 | | | NRG Yield, Inc., 3.25%, 6/1/20 (c)(d) | | | | | | | 9,045,400 | |

| | | | Insurance – 0.6% | | | | | | | | |

| | 7,680 | | | AmTrust Financial Services, Inc., 2.75%, 12/15/44 | | | | | | | 6,182,400 | |

| | | | |

| 12 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Internet Software & Services – 1.4% | | | | | | | | |

| | $4,560 | | | Blucora, Inc., 4.25%, 4/1/19 | | | | | | | $4,571,400 | |

| | 10,445 | | | Gogo, Inc., 3.75%, 3/1/20 | | | | | | | 8,382,112 | |

| | | | | | | | | | | | 12,953,512 | |

| | | | Iron/Steel – 0.3% | | | | | | | | |

| | 1,425 | | | AK Steel Corp., 5.00%, 11/15/19 | | | | | | | 2,508,000 | |

| | | | IT Services – 0.4% | | | | | | | | |

| | 3,705 | | | ServiceSource International, Inc., 1.50%, 8/1/18 | | | | | | | 3,610,059 | |

| | | | Life Sciences Tools & Services – 0.1% | | | | | | | | |

| | 1,480 | | | Fluidigm Corp., 2.75%, 2/1/34 | | | | | | | 998,075 | |

| | | | Machinery – 1.9% | | | | | | | | |

| | 6,975 | | | Meritor, Inc., 7.875%, 3/1/26 | | | | | | | 11,866,219 | |

| | 6,225 | | | Navistar International Corp., 4.75%, 4/15/19 | | | | | | | 6,046,031 | |

| | | | | | | | | | | | 17,912,250 | |

| | | | Oil, Gas & Consumable Fuels – 2.1% | | | | | | | | |

| | 13,370 | | | Cheniere Energy, Inc., 4.25%, 3/15/45 | | | | | | | 9,175,163 | |

| | 1,825 | | | SM Energy Co., 1.50%, 7/1/21 | | | | | | | 1,812,453 | |

| | 9,980 | | | Whiting Petroleum Corp., 1.25%, 4/1/20 | | | | | | | 8,944,575 | |

| | | | | | | | | | | | 19,932,191 | |

| | | | Personal Products – 1.6% | | | | | | | | |

| | 16,145 | | | Herbalife Ltd., 2.00%, 8/15/19 | | | | | | | 15,438,737 | |

| | | | Pharmaceuticals – 1.7% | | | | | | | | |

| | 3,380 | | | ANI Pharmaceuticals, Inc., 3.00%, 12/1/19 | | | | | | | 3,897,563 | |

| | 3,260 | | | Horizon Pharma Investment Ltd., 2.50%, 3/15/22 | | | | | | | 3,070,513 | |

| | 9,135 | | | Teligent, Inc., 3.75%, 12/15/19 | | | | | | | 8,883,787 | |

| | | | | | | | | | | | 15,851,863 | |

| | | | Semiconductors & Semiconductor Equipment – 2.0% | | | | | | | | |

| | 2,850 | | | Cypress Semiconductor Corp., 4.50%, 1/15/22 (c)(d) | | | | | | | 3,459,188 | |

| | 1,000 | | | Inphi Corp., 0.75%, 9/1/21 (c)(d) | | | | | | | 1,098,125 | |

| | 4,570 | | | Micron Technology, Inc., 3.00%, 11/15/43 | | | | | | | 4,607,131 | |

| | | | SunPower Corp., | | | | | | | | |

| | 3,135 | | | 0.875%, 6/1/21 | | | | | | | 2,439,422 | |

| | 9,405 | | | 4.00%, 1/15/23 | | | | | | | 7,735,612 | |

| | | | | | | | | | | | 19,339,478 | |

| | | | Software – 0.9% | | | | | | | | |

| | 8,695 | | | FireEye, Inc., 1.625%, 6/1/35 | | | | | | | 7,733,115 | |

| | 570 | | | PROS Holdings, Inc., 2.00%, 12/1/19 | | | | | | | 576,769 | |

| | | | | | | | | | | | 8,309,884 | |

| | | | Specialty Retail – 1.1% | | | | | | | | |

| | | | RH (c)(d), | | | | | | | | |

| | 9,000 | | | zero coupon, 6/15/19 | | | | | | | 7,807,500 | |

| | 3,990 | | | zero coupon, 7/15/20 | | | | | | | 3,124,669 | |

| | | | | | | | | | | | 10,932,169 | |

| | | | Technology Hardware, Storage & Peripherals – 1.2% | | | | | | | | |

| | 15,785 | | | Avid Technology, Inc., 2.00%, 6/15/20 | | | | | | | 11,473,722 | |

| | | | Textiles, Apparel & Luxury Goods – 1.5% | | | | | | | | |

| | 15,150 | | | Iconix Brand Group, Inc., 1.50%, 3/15/18 | | | | | | | 14,316,750 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 13 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Thrifts & Mortgage Finance – 0.7% | | | | | | | | |

| | $6,535 | | | MGIC Investment Corp., 5.00%, 5/1/17 | | | | | | | $6,567,675 | |

| | | | Tobacco – 2.1% | | | | | | | | |

| | | | Vector Group Ltd. (e), | | | | | | | | |

| | 5,665 | | | 1.75%, 4/15/20 | | | | | | | 6,497,047 | |

| | 8,780 | | | 2.50%, 1/15/19 | | | | | | | 13,562,536 | |

| | | | | | | | | | | | 20,059,583 | |

| | | | Transportation – 0.4% | | | | | | | | |

| | 3,990 | | | Aegean Marine Petroleum Network, Inc., 4.25%, 12/15/21 (c)(d) | | | | | | | 3,907,706 | |

| | Total Convertible Bonds & Notes (cost-$306,653,690) | | | | | | | 331,907,317 | |

| | | |

| Shares | | | | | | | | | |

| | Convertible Preferred Stock – 20.6% | | | | | | | | |

| | | | Aerospace & Defense – 0.3% | | | | | | | | |

| | 70,995 | | | Arconic, Inc., 5.375%, 10/1/17 | | | | | | | 3,133,719 | |

| | | | Banks – 4.2% | | | | | | | | |

| | 12,080 | | | Bank of America Corp., Ser. L, 7.25% (f) | | | | | | | 14,375,200 | |

| | 9,695 | | | Huntington Bancshares, Inc., 8.50% (f) | | | | | | | 13,455,400 | |

| | 9,880 | | | Wells Fargo & Co., Ser. L, 7.50% (f) | | | | | | | 12,103,000 | |

| | | | | | | | | | | | 39,933,600 | |

| | | | Chemicals – 0.7% | | | | | | | | |

| | 68,495 | | | Rayonier Advanced Materials, Inc., 8.00%, 8/15/19 | | | | | | | 6,954,297 | |

| | | | Commercial Services & Supplies – 0.4% | | | | | | | | |

| | 51,125 | | | Stericycle, Inc., 5.25%, 9/15/18 | | | | | | | 3,619,650 | |

| | | | Diversified Telecommunications Services – 1.0% | | | | | | | | |

| | 155,900 | | | Frontier Communications Corp., Ser. A, 11.125%, 6/29/18 | | | | | | | 9,876,265 | |

| | | | Electric Utilities – 0.4% | | | | | | | | |

| | 85,390 | | | Exelon Corp., 6.50%, 6/1/17 | | | | | | | 4,233,636 | |

| | | | Equity Real Estate Investment Trust – 3.0% | | | | | | | | |

| | 798,310 | | | FelCor Lodging Trust, Inc., Ser. A, 1.95% (f) | | | | | | | 19,678,342 | |

| | 141,135 | | | Welltower, Inc., 6.50% (f) | | | | | | | 8,953,604 | |

| | | | | | | | | | | | 28,631,946 | |

| | | | Financial Services – 0.9% | | | | | | | | |

| | 71,475 | | | Mandatory Exchangeable Trust, 5.75%, 6/3/19 (c)(d) | | | | | | | 8,861,113 | |

| | | | Food Products – 0.4% | | | | | | | | |

| | 29,100 | | | Bunge Ltd., 4.875% (f) | | | | | | | 3,186,450 | |

| | 9,860 | | | Tyson Foods, Inc., 4.75%, 7/15/17 | | | | | | | 668,903 | |

| | | | | | | | | | | | 3,855,353 | |

| | | | Health Care Providers & Services – 1.0% | | | | | | | | |

| | 173,170 | | | Anthem, Inc., 5.25%, 5/1/18 | | | | | | | 8,686,207 | |

| | 2,280 | | | Kindred Healthcare, Inc., 7.50%, 12/1/17 | | | | | | | 1,061,910 | |

| | | | | | | | | | | | 9,748,117 | |

| | | | Independent Power & Renewable Electricity Producers – 0.5% | | | | | | | | |

| | 156,435 | | | Dynegy, Inc., 5.375%, 11/1/17 | | | | | | | 4,680,535 | |

| | | | Multi-Utilities – 2.0% | | | | | | | | |

| | 239,645 | | | AES Trust III, 6.75%, 10/15/29 | | | | | | | 12,157,191 | |

| | 128,500 | | | Dominion Resources, Inc., 6.375%, 7/1/17 | | | | | | | 6,566,350 | |

| | | | | | | | | | | | 18,723,541 | |

| | | | |

| 14 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| | | | | | | | | | | | |

| Shares | | | | | | | | Value | |

| | | | Oil, Gas & Consumable Fuels – 3.4% | | | | | | | | |

| | 159,375 | | | Anadarko Petroleum Corp., 7.50%, 6/7/18 | | | | | | | $6,956,719 | |

| | 173,410 | | | Kinder Morgan, Inc., 9.75%, 10/26/18 | | | | | | | 8,445,067 | |

| | 124,235 | | | PetroQuest Energy, Inc., 6.875% (f) | | | | | | | 1,923,158 | |

| | 230,425 | | | Sanchez Energy Corp., 6.50%, 4/6/18 (f) | | | | | | | 9,567,246 | |

| | 12,485 | | | Southwestern Energy Co., Ser. B, 6.25%, 1/15/18 | | | | | | | 240,086 | |

| | 87,160 | | | WPX Energy, Inc., 6.25%, 7/31/18 | | | | | | | 5,038,720 | |

| | | | | | | | | | | | 32,170,996 | |

| | | | Pharmaceuticals – 1.3% | | | | | | | | |

| | 19,505 | | | Teva Pharmaceutical Industries Ltd., 7.00%, 12/15/18 | | | | | | | 12,172,095 | |

| | | | Wireless Telecommunication Services – 1.1% | | | | | | | | |

| | 101,870 | | | T-Mobile US, Inc., 5.50%, 12/15/17 | | | | | | | 10,379,535 | |

| | Total Convertible Preferred Stock (cost-$191,025,163) | | | | | | | 196,974,398 | |

| | Preferred Stock (a)(c)(g) – 0.8% | | | | | | | | |

| | | | Media – 0.8% | | | | | | | | |

| | 8,339 | | | LiveStyle, Inc., Ser. A | | | | | | | 833,900 | |

| | 76,571 | | | LiveStyle, Inc., Ser. B | | | | | | | 6,925,081 | |

| | 6,750 | | | LiveStyle, Inc., Ser. B | | | | | | | 67 | |

| | Total Preferred Stock (cost-$15,074,564) | | | | | | | 7,759,048 | |

| | Common Stock (a)(c)(g) – 0.3% | | | | | | | | |

| | | | Advertising – 0.3% | | | | | | | | |

| | 173,720 | | | Affinion Group Holdings, Inc. Class A (cost-$3,080,312)

(acquisition cost-$3,080,312; purchased 11/9/15-11/12/15) (h) | | | | | | | 2,581,479 | |

| | | | Media – 0.0% | | | | | | | | |

| | 90,406 | | | LiveStyle, Inc. | | | | | | | 9 | |

| | Total Common Stock (cost-$3,080,312) | | | | | | | 2,581,488 | |

| | | |

| Units | | | | | | | | | |

| | Warrants (a)(c)(g) – 0.0% | | | | | | | | |

| | | | Commercial Services – 0.0% | | | | | | | | |

| | 2,062,338 | | | Cenveo Corp., strike price $12.00, expires 6/10/24 | | | | | | | 449,705 | |

| | | | Media – 0.0% | | | | | | | | |

| | 19,500 | | | LiveStyle, Inc., Ser. C, expires 11/30/21 | | | | | | | 2 | |

| | Total Warrants (cost-$246,984) | | | | | | | 449,707 | |

| | | |

Principal

Amount

(000s) | | | | | | | | | |

| | Short-Term Investment – 1.8% | | | | | | | | |

| | | | Time Deposit – 1.8% | | | | | | | | |

| | $17,416 | | | Deutsche Bank-Grand Cayman, 0.27%, 3/1/17 (cost-$17,416,139) | | | | | | | 17,416,139 | |

| | Total Investments (cost-$948,930,931) – 100.0% | | | | | | | $954,863,875 | |

Notes to Schedule of Investments:

| (a) | | Non-income producing. | |

| (c) | | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $168,097,735, representing 17.6% of total investments. | |

| (d) | | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $157,307,492, representing 16.5% of total investments. | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 15 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

| (e) | | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. | |

| (f) | | Perpetual maturity. The date shown, if any, is the next call date. | |

| (g) | | Fair-Valued–Securities with an aggregate value of $10,790,243, representing 1.1% of total investments. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. | |

| (h) | | Restricted. The aggregate acquisition cost is $9,713,127. The aggregate value is $4,598,982, representing 0.5% of total investments. | |

| (i) | | Fair Value Measurements–See Note 1(b) to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

2/28/17 | |

Investments in Securities – Assets | | | | | | | | | | | | | |

Corporate Bonds & Notes: | | | | | | | | | | | | | | | | |

Commercial Services | | $ | – | | | | $16,076,790 | | | | $7,224,875 | | | | $23,301,665 | |

All Other | | | – | | | | 374,474,113 | | | | – | | | | 374,474,113 | |

Convertible Bonds & Notes | | | – | | | | 331,907,317 | | | | – | | | | 331,907,317 | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | |

Chemicals | | | – | | | | 6,954,297 | | | | – | | | | 6,954,297 | |

Financial Services | | | – | | | | 8,861,113 | | | | – | | | | 8,861,113 | |

Food Products | | | 668,903 | | | | 3,186,450 | | | | – | | | | 3,855,353 | |

Health Care Providers & Services | | | 8,686,207 | | | | 1,061,910 | | | | – | | | | 9,748,117 | |

Oil, Gas & Consumable Fuels | | | 20,680,592 | | | | 11,490,404 | | | | – | | | | 32,170,996 | |

Pharmaceuticals | | | – | | | | 12,172,095 | | | | – | | | | 12,172,095 | |

All Other | | | 123,212,427 | | | | – | | | | – | | | | 123,212,427 | |

Preferred Stock | | | – | | | | – | | | | 7,759,048 | | | | 7,759,048 | |

Common Stock: | | | | | | | | | | | | | | | | |

Advertising | | | – | | | | – | | | | 2,581,479 | | | | 2,581,479 | |

Media | | | – | | | | – | | | | 9 | | | | 9 | |

Warrants: | | | | | | | | | | | | | | | | |

Commercial Services | | | – | | | | – | | | | 449,705 | | | | 449,705 | |

Media | | | – | | | | – | | | | 2 | | | | 2 | |

Short-Term Investment | | | – | | | | 17,416,139 | | | | – | | | | 17,416,139 | |

Totals | | $ | 153,248,129 | | | $ | 783,600,628 | | | $ | 18,015,118 | | | $ | 954,863,875 | |

At February 28, 2017, a security valued at $13,455,400 was transferred from Level 2 to Level 1. This transfer was a result of the security having used an evaluated price from a third-party independent pricing vendor at February 29, 2016, and used an exchange-traded closing price on February 28, 2017.

| | | | |

| 16 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the year ended February 28, 2017, was as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Balance

2/29/16 | | | Purchases | | | Sales | | | Accrued

Discounts

(Premiums) | | | Net

Realized

Gain (Loss) | |

Investments in Securities – Assets | | | | | | | | | | | | | |

Corporate Bonds & Notes: | | | | | | | | | | | | | |

Commercial Services | | $ | – | | | | $11,247,777 | ** | | $ | – | | | | $(567,337 | ) | | | $ – | |

Diversified Financial Services | | | 3,328,050 | | | | – | | | | – | | | | (60,110 | ) | | | – | |

Oil, Gas & Consumable Fuels | | | 1,744,050 | | | | – | | | | – | | | | 14,837 | | | | – | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | | | | | |

Health Care Providers & Services | | | 28,514,755 | | | | – | | | | (34,697,388 | )† | | | – | | | | – | |

Technology Hardware, Storage & Peripherals | | | 14,628,600 | | | | – | | | | (19,068,350 | )† | | | – | | | | – | |

Preferred Stock | | | 67 | | | | 8,324,564 | †† | | | – | | | | – | | | | – | |

Senior Loans | | | 5,922,105 | | | | 2,402,459 | * | | | (8,324,564 | )†† | | | – | | | | – | |

Common Stock: | | | | | | | | | | | | | | | | | | | | |

Advertising | | | 3,635,960 | | | | – | | | | – | | | | – | | | | – | |

Media | | | – | | | | – | †† | | | – | | | | – | | | | – | |

Warrants: | | | | | | | | | | | | | | | | | | | | |

Commercial Services | | | – | | | | 246,984 | ** | | | – | | | | – | | | | – | |

Media | | | – | | | | – | †† | | | – | | | | �� | | | | – | |

Totals | | | $57,773,587 | | | | $22,221,784 | | | | $(62,090,302 | ) | | | $(612,610 | ) | | | $ – | |

| | | | | | | | | | | | | | | | |

| | | Net Change

in Unrealized

Appreciation/

Depreciation | | | Transfers

into

Level 3 | | | Transfers

out of

Level 3# | | | Ending

Balance

2/28/17 | |

Investments in Securities – Assets (continued) | | | | | | | | | |

Corporate Bonds & Notes: | | | | | | | | | |

Commercial Services | | | $(3,455,565 | ) | | $ | – | | | $ | – | | | | $7,224,875 | |

Diversified Financial Services | | | 5,455,585 | | | | – | | | | (8,723,525 | ) | | | – | |

Oil, Gas & Consumable Fuels | | | 2,612,563 | | | | – | | | | (4,371,450 | ) | | | – | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | |

Health Care Providers & Services | | | 6,182,633 | | | | – | | | | – | | | | – | |

Technology Hardware, Storage & Peripherals | | | 4,439,750 | | | | – | | | | – | | | | – | |

Preferred Stock | | | (565,583 | ) | | | – | | | | – | | | | 7,759,048 | |

Senior Loans | | | – | | | | – | | | | – | | | | – | |

Common Stock: | | | | | | | | | | | | | | | | |

Advertising | | | (1,054,481 | ) | | | – | | | | – | | | | 2,581,479 | |

Media | | | 9 | | | | – | | | | – | | | | 9 | |

Warrants: | | | | | | | | | | | | | | | | |

Commercial Services | | | 202,721 | | | | – | | | | – | | | | 449,705 | |

Media | | | 2 | | | | – | | | | – | | | | 2 | |

Totals | | | $13,817,634 | | | | $ – | | | | $(13,094,975 | ) | | | $18,015,118 | |

| †† | | Issued/removed via reorganization | |

| * | | PIK payments and funding of unfunded commitment | |

| ** | | Issued via corporate action | |

| # | | Transferred out of Level 3 into Level 2 because an evaluated price from a third-party independent pricing vendor was used on February 28, 2017. | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 17 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2017 (continued)

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at February 28, 2017:

| | | | | | | | | | | | | | |

| | | Ending Balance

at 2/28/17 | | | Valuation

Technique Used | | Unobservable

Inputs | | | Input Values | |

Investments in Securities – Assets | | | | | | | | |

Corporate Bonds & Notes | | | $7,224,875 | | | Third-Party Pricing Vendor | | | Single Broker Quote | | | | $89.75 | |

Preferred Stock | | | $7,758,981 | | | Model Price | |

| Proprietary Data

Used in Model |

| | | $90.44 – $100.00 | |

| | | $67 | | | Liquidation Value | | | Price of Stock | | | | $0.01* | |

Common Stock | | | $2,581,488 | | | Model Price | |

| Proprietary Data

Used in Model |

| | | $0.0001 – $14.86 | |

Warrant | | | $449,705 | | | Fundamental Analytical Data

Relating to the Investment | | | Price of Warrant | | | | $0.218056 | |

| | | $2 | | | Model Price | |

| Proprietary Data

Used in Model |

| | | $0.0001 | |

| * | | Preferred stock trades are in lots of 1,000. | |

The net change in unrealized appreciation/depreciation of Level 3 investments held at February 28, 2017, was $(4,872,897). Net realized gain (loss) and change in unrealized appreciation/depreciation is reflected on the Statements of Operations.

Glossary:

| | | | | | |

| 18 | | Annual Report | | | February 28, 2017 | | | See accompanying Notes to Financial Statements |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | Corporate Bonds & Notes – 42.1% | | | | | |

| | | | Advertising – 0.4% | | | | | | | | |

| | $3,485 | | | Affinion Group, Inc., 7.875%, 12/15/18 | | | | | | | $3,101,650 | |

| | | | Aerospace & Defense – 1.4% | | | | | | | | |

| | 5,465 | | | Erickson, Inc., 8.25%, 5/1/20 (b) | | | | | | | 491,850 | |

| | 5,071 | | | Kratos Defense & Security Solutions, Inc., 7.00%, 5/15/19 | | | | | | | 4,988,597 | |

| | 4,545 | | | TransDigm, Inc., 6.50%, 5/15/25 | | | | | | | 4,664,306 | |

| | | | | | | | | | | | 10,144,753 | |

| | | | Air Freight & Logistics – 0.6% | | | | | | | | |

| | 3,920 | | | XPO Logistics, Inc., 6.50%, 6/15/22 (c)(d) | | | | | | | 4,130,700 | |

| | | | Chemicals – 2.0% | | | | | | | | |

| | 5,500 | | | Chemours Co., 6.625%, 5/15/23 | | | | | | | 5,891,875 | |

| | 4,330 | | | Platform Specialty Products Corp., 6.50%, 2/1/22 (c)(d) | | | | | | | 4,546,500 | |

| | 3,965 | | | Tronox Finance LLC, 7.50%, 3/15/22 (c)(d) | | | | | | | 4,163,250 | |

| | | | | | | | | | | | 14,601,625 | |

| | | | Commercial Services – 2.4% | | | | | | | | |

| | 5,974 | | | Cenveo Corp., 6.00%, 5/15/24 (c)(d) | | | | | | | 5,361,665 | |

| | 3,888 | | | DynCorp International, Inc., 11.875%, 11/30/20 | | | | | | | 3,761,355 | |

| | 5,925 | | | Monitronics International, Inc., 9.125%, 4/1/20 | | | | | | | 5,925,000 | |

| | 2,500 | | | United Rentals North America, Inc., 5.50%, 7/15/25 | | | | | | | 2,646,875 | |

| | | | | | | | | | | | 17,694,895 | |

| | | | Commercial Services & Supplies – 0.6% | | | | | | | | |

| | 4,265 | | | West Corp., 5.375%, 7/15/22 (c)(d) | | | | | | | 4,112,526 | |

| | | | Construction Materials – 0.6% | | | | | | | | |

| | 4,335 | | | US Concrete, Inc., 6.375%, 6/1/24 | | | | | | | 4,605,938 | |

| | | | Consumer Finance – 1.0% | | | | | | | | |

| | 2,605 | | | Navient Corp., 8.45%, 6/15/18 | | | | | | | 2,790,606 | |

| | 3,865 | | | Springleaf Finance Corp., 8.25%, 10/1/23 | | | | | | | 4,111,394 | |

| | | | | | | | | | | | 6,902,000 | |

| | | | Diversified Financial Services – 2.6% | | | | | | | | |

| | 1,564 | | | Affinion International Holdings Ltd., 7.50%, 7/30/18

(acquisition cost-$1,349,093; purchased 11/9/15-10/21/16)(c)(d)(h) | | | | | | | 1,516,782 | |

| | 7,465 | | | Community Choice Financial, Inc.,

10.75%, 5/1/19 | | | | | | | 6,457,225 | |

| | 5,370 | | | 12.75%, 5/1/20 (c)(d) | | | | | | | 4,376,550 | |

| | 2,000 | | | Nationstar Mortgage LLC / Nationstar Capital Corp.,

7.875%, 10/1/20 | | | | | | | 2,086,250 | |

| | 4,250 | | | 9.625%, 5/1/19 | | | | | | | 4,417,344 | |

| | | | | | | | | | | | 18,854,151 | |

| | | | Diversified Telecommunications Services – 0.6% | | | | | | | | |

| | 4,045 | | | Frontier Communications Corp., 10.50%, 9/15/22 | | | | | | | 4,232,081 | |

| | | | Electronic Equipment, Instruments & Components – 0.8% | | | | | | | | |

| | 5,815 | | | Kemet Corp., 10.50%, 5/1/18 | | | | | | | 5,840,441 | |

| | | | Entertainment – 0.4% | | | | | | | | |

| | 3,045 | | | Cedar Fair LP / Canada’s Wonderland Co. / Magnum Management Corp.,

5.375%, 6/1/24 | | | | | | | 3,166,800 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 19 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Equity Real Estate Investment Trust – 0.7% | | | | | | | | |

| | $2,165 | | | Communications Sales & Leasing, Inc. / CSL Capital LLC, 8.25%, 10/15/23 | | | | | | | $2,357,144 | |

| | 2,345 | | | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | | | | | | | 2,471,044 | |

| | | | | | | | | | | | 4,828,188 | |

| | | | Health Care Providers & Services – 2.7% | | | | | | | | |

| | 4,125 | | | DaVita, Inc., 5.125%, 7/15/24 | | | | | | | 4,217,812 | |

| | 2,950 | | | Envision Healthcare Corp., 6.25%, 12/1/24 (c)(d) | | | | | | | 3,134,375 | |

| | 6,045 | | | Kindred Healthcare, Inc., 8.75%, 1/15/23 | | | | | | | 5,893,875 | |

| | 2,750 | | | Tenet Healthcare Corp.,

5.00%, 3/1/19 | | | | | | | 2,765,620 | |

| | 3,470 | | | 8.125%, 4/1/22 | | | | | | | 3,660,850 | |

| | | | | | | | | | | | 19,672,532 | |

| | | | Holding Companies-Diversified – 0.6% | | | | | | | | |

| | 4,425 | | | Horizon Pharma, Inc., 6.625%, 5/1/23 | | | | | | | 4,334,288 | |

| | | | Hotels, Restaurants & Leisure – 1.0% | | | | | | | | |

| | 6,395 | | | MGM Resorts International, 11.375%, 3/1/18 | | | | | | | 7,010,519 | |

| | | | Household Durables – 0.7% | | | | | | | | |

| | 3,365 | | | Beazer Homes USA, Inc., 8.75%, 3/15/22 (c)(d) | | | | | | | 3,659,034 | |

| | 1,500 | | | Lennar Corp., 12.25%, 6/1/17 | | | | | | | 1,538,550 | |

| | | | | | | | | | | | 5,197,584 | |

| | | | Independent Power & Renewable Electricity Producers – 0.6% | | | | | | | | |

| | 4,265 | | | NRG Energy, Inc., 6.25%, 5/1/24 | | | | | | | 4,286,325 | |

| | | | Internet & Direct Marketing Retail – 0.3% | | | | | | | | |

| | 2,200 | | | Netflix, Inc., 5.875%, 2/15/25 | | | | | | | 2,392,500 | |

| | | | Internet Software & Services – 0.7% | | | | | | | | |

| | 2,200 | | | EarthLink Holdings Corp.,

7.375%, 6/1/20 | | | | | | | 2,335,300 | |

| | 2,598 | | | 8.875%, 5/15/19 | | | | | | | 2,668,795 | |

| | | | | | | | | | | | 5,004,095 | |

| | | | Iron/Steel – 1.0% | | | | | | | | |

| | 1,005 | | | AK Steel Corp.,

7.50%, 7/15/23 | | | | | | | 1,100,475 | |

| | 5,600 | | | 8.375%, 4/1/22 | | | | | | | 5,845,000 | |

| | | | | | | | | | | | 6,945,475 | |

| | | | Machinery – 1.8% | | | | | | | | |

| | 4,225 | | | BlueLine Rental Finance Corp., 7.00%, 2/1/19 (c)(d) | | | | | | | 4,330,625 | |

| | 3,435 | | | Commercial Vehicle Group, Inc., 7.875%, 4/15/19 | | | | | | | 3,460,762 | |

| | 5,495 | | | Navistar International Corp., 8.25%, 11/1/21 | | | | | | | 5,577,425 | |

| | | | | | | | | | | | 13,368,812 | |

| | | | Media – 1.8% | | | | | | | | |

| | 5,630 | | | Cablevision Systems Corp., 8.00%, 4/15/20 | | | | | | | 6,235,225 | |

| | 3,589 | | | LiveStyle, Inc., 9.625%, 2/1/19

(acquisition cost-$3,749,795; purchased 5/7/14-2/26/15)(b)(c)(d)(h) | | | | | | | 35,890 | |

| | 6,645 | | | McClatchy Co., 9.00%, 12/15/22 | | | | | | | 7,027,087 | |

| | | | | | | | | | | | 13,298,202 | |

| | | | Metals & Mining – 2.6% | | | | | | | | |

| | 3,900 | | | Alcoa Nederland Holding BV, 7.00%, 9/30/26 (c)(d) | | | | | | | 4,290,000 | |

| | 5,050 | | | ArcelorMittal, 10.60%, 6/1/19 | | | | | | | 5,946,375 | |

| | 3,050 | | | Joseph T Ryerson & Son, Inc., 11.00%, 5/15/22 (c)(d) | | | | | | | 3,408,375 | |

| | | | |

| 20 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Metals & Mining (continued) | | | | | | | | |

| | $4,525 | | | United States Steel Corp., 8.375%, 7/1/21 (c)(d) | | | | | | | $5,101,937 | |

| | | | | | | | | | | | 18,746,687 | |

| | | | Miscellaneous Manufacturing – 0.8% | | | | | | | | |

| | 5,650 | | | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (c)(d) | | | | | | | 5,466,375 | |

| | | | Multiline Retail – 0.3% | | | | | | | | |

| | 2,165 | | | Dollar Tree, Inc., 5.75%, 3/1/23 | | | | | | | 2,300,313 | |

| | | | Oil & Gas – 0.7% | | | | | | | | |

| | 2,300 | | | Calumet Specialty Products Partners LP / Calumet Finance Corp.,

6.50%, 4/15/21 | | | | | | | 2,007,394 | |

| | 2,165 | | | NGL Energy Partners LP / NGL Energy Finance Corp., 7.50%, 11/1/23 (c)(d) | | | | | | | 2,289,488 | |

| | 630 | | | Weatherford International Ltd., 8.25%, 6/15/23 | | | | | | | 685,125 | |

| | | | | | | | | | | | 4,982,007 | |

| | | | Oil, Gas & Consumable Fuels – 5.0% | | | | | | | | |

| | 11,154 | | | Cobalt International Energy, Inc. (c)(d),

7.75%, 12/1/23 | | | | | | | 5,688,540 | |

| | 12,800 | | | 10.75%, 12/1/21 | | | | | | | 12,096,000 | |

| | 2,715 | | | Energy Transfer Equity LP, 5.50%, 6/1/27 | | | | | | | 2,888,081 | |

| | 6,180 | | | EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | | | | | | | 6,071,850 | |

| | 3,745 | | | Oasis Petroleum, Inc., 6.875%, 3/15/22 | | | | | | | 3,838,625 | |

| | 2,500 | | | Rice Energy, Inc., 6.25%, 5/1/22 | | | | | | | 2,562,500 | |

| | 3,470 | | | Sanchez Energy Corp., 6.125%, 1/15/23 | | | | | | | 3,348,550 | |

| | | | | | | | | | | | 36,494,146 | |

| | | | Pharmaceuticals – 0.6% | | | | | | | | |

| | 1,755 | | | Endo Finance LLC & Endo Finco, Inc., 5.375%, 1/15/23 (c)(d) | | | | | | | 1,561,950 | |

| | 3,000 | | | Valeant Pharmaceuticals International, Inc., 7.50%, 7/15/21 (c)(d) | | | | | | | 2,765,625 | |

| | | | | | | | | | | | 4,327,575 | |

| | | | Retail – 0.5% | | | | | | | | |

| | 5,785 | | | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (c)(d) | | | | | | | 3,659,012 | |

| | | | Semiconductors & Semiconductor Equipment – 1.1% | | | | | | | | |

| | 2,875 | | | Amkor Technology, Inc., 6.375%, 10/1/22 | | | | | | | 2,990,000 | |

| | 4,740 | | | Micron Technology, Inc., 5.875%, 2/15/22 | | | | | | | 4,965,150 | |

| | | | | | | | | | | | 7,955,150 | |

| | | | Software – 0.6% | | | | | | | | |

| | 3,850 | | | Camelot Finance S.A., 7.875%, 10/15/24 (c)(d) | | | | | | | 4,109,875 | |

| | | | Specialty Retail – 0.7% | | | | | | | | |

| | 4,500 | | | Claire’s Stores, Inc., 9.00%, 3/15/19 (c)(d) | | | | | | | 2,092,500 | |

| | 4,000 | | | Conn’s, Inc., 7.25%, 7/15/22 | | | | | | | 3,510,000 | |

| | | | | | | | | | | | 5,602,500 | |

| | | | Technology Hardware, Storage & Peripherals – 0.5% | | | | | | | | |

| | 3,155 | | | Western Digital Corp., 10.50%, 4/1/24 | | | | | | | 3,695,294 | |

| | | | Telecommunications – 2.1% | | | | | | | | |

| | 5,630 | | | Consolidated Communications, Inc., 6.50%, 10/1/22 | | | | | | | 5,644,075 | |

| | 3,500 | | | Hughes Satellite Systems Corp., 7.625%, 6/15/21 | | | | | | | 3,893,750 | |

| | 5,845 | | | Windstream Services LLC, 7.50%, 4/1/23 | | | | | | | 5,639,840 | |

| | | | | | | | | | | | 15,177,665 | |

| | | | Trading Companies & Distributors – 0.3% | | | | | | | | |

| | 1,750 | | | H&E Equipment Services, Inc., 7.00%, 9/1/22 | | | | | | | 1,850,625 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 21 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Wireless Telecommunication Services – 1.0% | | | | | | | | |

| | $5,545 | | | Sprint Communications, Inc., 11.50%, 11/15/21 | | | | | | | $7,007,494 | |

| | Total Corporate Bonds & Notes (cost-$318,641,550) | | | | | | | 305,100,798 | |

| | Convertible Bonds & Notes – 34.5% | | | | | | | | |

| | | | Air Freight & Logistics – 0.2% | | | | | | | | |

| | 1,720 | | | Echo Global Logistics, Inc., 2.50%, 5/1/20 | | | | | | | 1,640,450 | |

| | | | Automobiles – 0.3% | | | | | | | | |

| | 2,150 | | | Tesla, Inc., 1.25%, 3/1/21 | | | | | | | 2,037,125 | |

| | | | Biotechnology – 0.9% | | | | | | | | |

| | 5,980 | | | Ionis Pharmaceuticals, Inc., 1.00%, 11/15/21 | | | | | | | 6,346,275 | |

| | | | Capital Markets – 1.2% | | | | | | | | |

| | 12,440 | | | Walter Investment Management Corp., 4.50%, 11/1/19 | | | | | | | 8,583,600 | |

| | | | Construction & Engineering – 0.4% | | | | | | | | |

| | 3,390 | | | Layne Christensen Co., 4.25%, 11/15/18 | | | | | | | 3,036,169 | |

| | | | Construction Materials – 0.5% | | | | | | | | |

| | 3,225 | | | Cemex SAB de CV, 3.72%, 3/15/20 | | | | | | | 3,581,766 | |

| | | | Consumer Finance – 2.2% | | | | | | | | |

| | 7,030 | | | Encore Capital Group, Inc., 3.00%, 7/1/20 | | | | | | | 7,012,425 | |

| | 9,160 | | | PRA Group, Inc., 3.00%, 8/1/20 | | | | | | | 8,793,600 | |

| | | | | | | | | | | | 15,806,025 | |

| | | | Diversified Consumer Services – 1.1% | | | | | | | | |

| | 10,220 | | | Ascent Capital Group, Inc., 4.00%, 7/15/20 | | | | | | | 7,933,275 | |

| | | | Electrical Equipment – 1.6% | | | | | | | | |

| | 12,690 | | | SolarCity Corp., 1.625%, 11/1/19 | | | | | | | 11,405,137 | |

| | | | Energy Equipment & Services – 3.1% | | | | | | | | |

| | 13,775 | | | Helix Energy Solutions Group, Inc., 3.25%, 3/15/32 | | | | | | | 13,602,812 | |

| | 12,155 | | | Hornbeck Offshore Services, Inc., 1.50%, 9/1/19 | | | | | | | 8,637,647 | |

| | | | | | | | | | | | 22,240,459 | |

| | | | Equity Real Estate Investment Trust – 0.6% | | | | | | | | |

| | 4,100 | | | Two Harbors Investment Corp., 6.25%, 1/15/22 | | | | | | | 4,128,188 | |

| | | | Health Care Equipment & Supplies – 0.7% | | | | | | | | |

| | 4,490 | | | Wright Medical Group, Inc., 2.00%, 2/15/20 | | | | | | | 5,129,825 | |

| | | | Health Care Products – 0.2% | | | | | | | | |

| | 1,290 | | | Nevro Corp., 1.75%, 6/1/21 | | | | | | | 1,610,887 | |

| | | | Health Care Providers & Services – 0.9% | | | | | | | | |

| | 2,150 | | | Brookdale Senior Living, Inc., 2.75%, 6/15/18 | | | | | | | 2,112,375 | |

| | 1,100 | | | Molina Healthcare, Inc.,

1.125%, 1/15/20 | | | | | | | 1,466,437 | |

| | 2,750 | | | 1.625%, 8/15/44 | | | | | | | 2,973,438 | |

| | | | | | | | | | | | 6,552,250 | |

| | | | Independent Power & Renewable Electricity Producers – 0.9% | | | | | | | | |

| | 6,905 | | | NRG Yield, Inc., 3.25%, 6/1/20 (c)(d) | | | | | | | 6,766,900 | |

| | | | Insurance – 0.6% | | | | | | | | |

| | 5,790 | | | AmTrust Financial Services, Inc., 2.75%, 12/15/44 | | | | | | | 4,660,950 | |

| | | | Internet Software & Services – 1.3% | | | | | | | | |

| | 3,440 | | | Blucora, Inc., 4.25%, 4/1/19 | | | | | | | 3,448,600 | |

| | 7,880 | | | Gogo, Inc., 3.75%, 3/1/20 | | | | | | | 6,323,700 | |

| | | | | | | | | | | | 9,772,300 | |

| | | | |

| 22 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Iron/Steel – 0.3% | | | | | | | | |

| | $1,075 | | | AK Steel Corp., 5.00%, 11/15/19 | | | | | | | $1,892,000 | |

| | | | IT Services – 0.4% | | | | | | | | |

| | 2,795 | | | ServiceSource International, Inc., 1.50%, 8/1/18 | | | | | | | 2,723,378 | |

| | | | Life Sciences Tools & Services – 0.1% | | | | | | | | |

| | 1,120 | | | Fluidigm Corp., 2.75%, 2/1/34 | | | | | | | 755,300 | |

| | | | Machinery – 1.8% | | | | | | | | |

| | 5,255 | | | Meritor, Inc., 7.875%, 3/1/26 | | | | | | | 8,940,068 | |

| | 4,675 | | | Navistar International Corp., 4.75%, 4/15/19 | | | | | | | 4,540,594 | |

| | | | | | | | | | | | 13,480,662 | |

| | | | Oil, Gas & Consumable Fuels – 2.1% | | | | | | | | |

| | 10,095 | | | Cheniere Energy, Inc., 4.25%, 3/15/45 | | | | | | | 6,927,694 | |

| | 1,375 | | | SM Energy Co., 1.50%, 7/1/21 | | | | | | | 1,365,547 | |

| | 7,525 | | | Whiting Petroleum Corp., 1.25%, 4/1/20 | | | | | | | 6,744,281 | |

| | | | | | | | | | | | 15,037,522 | |

| | | | Personal Products – 1.6% | | | | | | | | |

| | 12,175 | | | Herbalife Ltd., 2.00%, 8/15/19 | | | | | | | 11,642,405 | |

| | | | Pharmaceuticals – 1.6% | | | | | | | | |

| | 2,550 | | | ANI Pharmaceuticals, Inc., 3.00%, 12/1/19 | | | | | | | 2,940,469 | |

| | 2,460 | | | Horizon Pharma Investment Ltd., 2.50%, 3/15/22 | | | | | | | 2,317,012 | |

| | 6,890 | | | Teligent, Inc., 3.75%, 12/15/19 | | | | | | | 6,700,525 | |

| | | | | | | | | | | | 11,958,006 | |

| | | | Semiconductors & Semiconductor Equipment – 2.0% | | | | | | | | |

| | 2,150 | | | Cypress Semiconductor Corp., 4.50%, 1/15/22 (c)(d) | | | | | | | 2,609,563 | |

| | 755 | | | Inphi Corp., 0.75%, 9/1/21 (c)(d) | | | | | | | 829,084 | |

| | 3,430 | | | Micron Technology, Inc., 3.00%, 11/15/43

| | | | | | | 3,457,869 | |

| | 2,365 | | | SunPower Corp.,

0.875%, 6/1/21 | | | | | | | 1,840,266 | |

| | 7,095 | | | 4.00%, 1/15/23 | | | | | | | 5,835,637 | |

| | | | | | | | | | | | 14,572,419 | |

| | | | Software – 0.9% | | | | | | | | |

| | 6,555 | | | FireEye, Inc., 1.625%, 6/1/35 | | | | | | | 5,829,853 | |

| | 430 | | | PROS Holdings, Inc., 2.00%, 12/1/19 | | | | | | | 435,106 | |

| | | | | | | | | | | | 6,264,959 | |

| | | | Specialty Retail – 1.1% | | | | | | | | |

| | 6,785 | | | RH (c)(d),

zero coupon, 6/15/19 | | | | | | | 5,885,988 | |

| | 3,010 | | | zero coupon, 7/15/20 | | | | | | | 2,357,206 | |

| | | | | | | | | | | | 8,243,194 | |

| | | | Technology Hardware, Storage & Peripherals – 1.2% | | | | | | | | |

| | 11,915 | | | Avid Technology, Inc., 2.00%, 6/15/20 | | | | | | | 8,660,716 | |

| | | | Textiles, Apparel & Luxury Goods – 1.5% | | | | | | | | |

| | 11,450 | | | Iconix Brand Group, Inc., 1.50%, 3/15/18 | | | | | | | 10,820,250 | |

| | | | Thrifts & Mortgage Finance – 0.7% | | | | | | | | |

| | 4,965 | | | MGIC Investment Corp., 5.00%, 5/1/17 | | | | | | | 4,989,825 | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 23 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | | Value | |

| | | | Tobacco – 2.1% | | | | | | | | |

| | $4,335 | | | Vector Group Ltd. (e),

1.75%, 4/15/20 | | | | | | | $4,971,703 | |

| | 6,620 | | | 2.50%, 1/15/19 | | | | | | | 10,225,967 | |

| | | | | | | | | | | | 15,197,670 | |

| | | | Transportation – 0.4% | | | | | | | | |

| | 3,010 | | | Aegean Marine Petroleum Network, Inc., 4.25%, 12/15/21 (c)(d) | | | | | | | 2,947,919 | |

| | Total Convertible Bonds & Notes (cost-$231,354,230) | | | | | | | 250,417,806 | |

| | | |

| Shares | | | | | | | | | |

| | Convertible Preferred Stock – 20.4% | | | | | | | | |

| | | | Aerospace & Defense – 0.3% | | | | | | | | |

| | 53,595 | | | Arconic, Inc., 5.375%, 10/1/17 | | | | | | | 2,365,683 | |

| | | | Banks – 4.2% | | | | | | | | |

| | 9,140 | | | Bank of America Corp., Ser. L, 7.25% (f) | | | | | | | 10,876,600 | |

| | 7,455 | | | Huntington Bancshares, Inc., 8.50% (f) | | | | | | | 10,346,571 | |

| | 7,435 | | | Wells Fargo & Co., Ser. L, 7.50% (f) | | | | | | | 9,107,875 | |

| | | | | | | | | | | | 30,331,046 | |

| | | | Chemicals – 0.7% | | | | | | | | |

| | 51,505 | | | Rayonier Advanced Materials, Inc., 8.00%, 8/15/19 | | | | | | | 5,229,303 | |

| | | | Commercial Services & Supplies – 0.4% | | | | | | | | |

| | 38,485 | | | Stericycle, Inc., 5.25%, 9/15/18 | | | | | | | 2,724,738 | |

| | | | Diversified Telecommunications Services – 1.0% | | | | | | | | |

| | 117,480 | | | Frontier Communications Corp., Ser. A, 11.125%, 6/29/18 | | | | | | | 7,442,358 | |

| | | | Electric Utilities – 0.9% | | | | | | | | |

| | 134,610 | | | Exelon Corp., 6.50%, 6/1/17 | | | | | | | 6,673,964 | |

| | | | Equity Real Estate Investment Trust – 3.0% | | | | | | | | |

| | 610,095 | | | FelCor Lodging Trust, Inc., Ser. A, 1.95% (f) | | | | | | | 15,038,842 | |

| | 106,440 | | | Welltower, Inc., 6.50% (f) | | | | | | | 6,752,553 | |

| | | | | | | | | | | | 21,791,395 | |

| | | | Financial Services – 0.9% | | | | | | | | |

| | 53,995 | | | Mandatory Exchangeable Trust, 5.75%, 6/3/19 (c)(d) | | | | | | | 6,694,030 | |

| | | | Food Products – 0.4% | | | | | | | | |

| | 20,900 | | | Bunge Ltd., 4.875% (f) | | | | | | | 2,288,550 | |

| | 7,330 | | | Tyson Foods, Inc., 4.75%, 7/15/17 | | | | | | | 497,267 | |

| | | | | | | | | | | | 2,785,817 | |

| | | | Health Care Providers & Services – 1.0% | | | | | | | | |

| | 130,760 | | | Anthem, Inc., 5.25%, 5/1/18 | | | | | | | 6,558,921 | |

| | 1,720 | | | Kindred Healthcare, Inc., 7.50%, 12/1/17 | | | | | | | 801,090 | |

| | | | | | | | | | | | 7,360,011 | |

| | | | Independent Power & Renewable Electricity Producers – 0.5% | | | | | | | | |

| | 117,560 | | | Dynegy, Inc., 5.375%, 11/1/17 | | | | | | | 3,517,395 | |

| | | | Multi-Utilities – 1.3% | | | | | | | | |

| | 186,560 | | | AES Trust III, 6.75%, 10/15/29 | | | | | | | 9,464,189 | |

| | | | |

| 24 | | Annual Report | | | February 28, 2017 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| | | | | | | | | | | | |

| Shares | | | | | | | | Value | |

| | | | Oil, Gas & Consumable Fuels – 3.4% | | | | | | | | |

| | 120,125 | | | Anadarko Petroleum Corp., 7.50%, 6/7/18 | | | | | | | $5,243,456 | |

| | 130,590 | | | Kinder Morgan, Inc., 9.75%, 10/26/18 | | | | | | | 6,359,733 | |

| | 94,905 | | | PetroQuest Energy, Inc., 6.875% (f) | | | | | | | 1,469,130 | |

| | 173,845 | | | Sanchez Energy Corp., 6.50%, 4/6/18 (f) | | | | | | | 7,218,044 | |

| | 8,585 | | | Southwestern Energy Co., Ser. B, 6.25%, 1/15/18 | | | | | | | 165,090 | |

| | 65,805 | | | WPX Energy, Inc., 6.25%, 7/31/18 | | | | | | | 3,804,187 | |

| | | | | | | | | | | | 24,259,640 | |

| | | | Pharmaceuticals – 1.3% | | | | | | | | |

| | 14,705 | | | Teva Pharmaceutical Industries Ltd., 7.00%, 12/15/18 | | | | | | | 9,176,655 | |

| | | | Wireless Telecommunication Services – 1.1% | | | | | | | | |

| | 76,840 | | | T-Mobile US, Inc., 5.50%, 12/15/17 | | | | | | | 7,829,228 | |

| | Total Convertible Preferred Stock (cost-$140,971,578) | | | | | | | 147,645,452 | |

| | Preferred Stock (a)(c)(g) – 1.1% | | | | | | | | |

| | | | Media – 1.1% | | | | | | | | |

| | 8,339 | | | LiveStyle, Inc., Ser. A | | | | | | | 833,900 | |

| | 76,571 | | | LiveStyle, Inc., Ser. B | | | | | | | 6,925,081 | |

| | 5,000 | | | LiveStyle, Inc., Ser. B | | | | | | | 50 | |

| | Total Preferred Stock (cost-$13,324,564) | | | | | | | 7,759,031 | |

| | Common Stock (a)(c)(g) – 0.3% | | | | | | | | |

| | | | Advertising – 0.3% | | | | | | | | |

| | 133,715 | | | Affinion Group Holdings, Inc. Class A (cost-$2,371,020) (acquisition cost-$2,371,020; purchased 11/9/15-11/12/15) (h) | | | | | | | 1,987,005 | |

| | | | Media – 0.0% | | | | | | | | |

| | 90,406 | | | LiveStyle, Inc. | | | | | | | 9 | |

| | Total Common Stock (cost-$2,371,020) | | | | | | | 1,987,014 | |

| | | |

| Units | | | | | | | | | |

| | Warrants (a)(c)(g) – 0.0% | | | | | | | | |

| | | | Commercial Services – 0.0% | | | | | | | | |

| | 1,562,241 | | | Cenveo Corp., strike price $12.00, expires 6/10/24 | | | | | | | 340,656 | |

| | | | Media – 0.0% | | | | | | | | |

| | 19,500 | | | LiveStyle, Inc., Ser. C, expires 11/30/21 | | | | | | | 2 | |

| | Total Warrants (cost-$183,305) | | | | | | | 340,658 | |

| | | |

Principal

Amount

(000s) | | | | | | | | | |

| | Short-Term Investment – 1.6% | |

| | | | Time Deposit – 1.6% | | | | | | | | |

| | $11,783 | | | Deutsche Bank-Grand Cayman, 0.27%, 3/1/17 (cost-$11,783,144) | | | | | | | 11,783,144 | |

| | Total Investments (cost-$718,629,391) – 100.0% | | | | | | | $725,033,903 | |

Notes to Schedule of Investments:

| (a) | | Non-income producing. | |

| (c) | | Private Placement—Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $130,074,967 , representing 17.9% of total investments. | |

| | | | | | |

| February 28, 2017 | | | Annual Report | | | 25 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2017 (continued)

| (d) | | 144A—Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $119,988,264, representing 16.5% of total investments. | |

| (e) | | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. | |

| (f) | | Perpetual maturity. The date shown, if any, is the next call date. | |

| (g) | | Fair-Valued—Securities with an aggregate value of $10,086,703, representing 1.4% of total investments. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. | |

| (h) | | Restricted. The aggregate acquisition cost is $7,469,908. The aggregate value is $3,539,677, representing 0.5% of total investments. | |

| (i) | | Fair Value Measurements—See Note 1(b) in Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

2/28/17 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | |

Corporate Bonds & Notes: | | | | | | | | | | | | | | | | |