UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21290

Neiman Funds

(Exact name of registrant as specified in charter)

305 Spindrift Drive, Williamsville, NY 14221

(Address of principal executive offices) (Zip code)

Daniel Neiman

305 Spindrift Drive, Williamsville, NY 14221

(Name and address of agent for service)

Registrant's telephone number, including area code: (858) 336-0832

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

Item 1. Report to Stockholders.

ADVISORS CAPITAL FUNDS

ADVISORS CAPITAL US DIVIDEND FUND

Ticker ACUSX

ADVISORS CAPITAL SMALL/MID CAP FUND

Ticker ACSMX

ADVISORS CAPITAL TACTICAL FIXED INCOME FUND

Ticker ACTIX

ADVISORS CAPITAL ACTIVE ALL CAP FUND

Ticker ACALX

ANNUAL REPORT

September 30, 2023 |

| Table of Contents | |

| |

| |

| |

| ADVISORS CAPITAL FUNDS | |

| Shareholder Report | 2 |

| Sector Allocation | 7 |

| Performance Information | 9 |

| Schedules of Investments | 13 |

| Statements of Assets and Liabilities | 19 |

| Statements of Operations | 19 |

| Statements of Changes in Net Assets | 21 |

| Financial Highlights | 23 |

| NOTES TO FINANCIAL STATEMENTS | 27 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 32 |

| DISCLOSURE OF EXPENSES | 34 |

| ADDITIONAL INFORMATION | 36 |

| TRUSTEES & OFFICERS | 37 |

2023 Annual Report 1

Shareholder Report Advisors

Capital US Dividend Fund

September 30, 2023

Dear Shareholders:

The Advisors Capital US Dividend Fund (the “Fund”) commenced operations on March 19, 2021. The accompanying annual report covers the time frame from October 1, 2022 to September 30, 2023.

As of the end of the current fiscal year, the Fund had total net assets of approximately $127.69 million. The Fund had a total return for the fiscal year of 14.10% . The Fund’s benchmark, the S&P 500 had a total return of 21.62% for the same time period.

Management attributes the Fund’s performance to a variety of factors. The Fund seeks to invest long term in attractively valued, conservatively structured, dynamic companies with growing free cash flow, focusing on companies that pay cash dividends or return capital to shareholders through stock buybacks that result in net share reductions annually. Selected companies will typically have stronger balance sheets, better profitability and lower earnings volatility relative to peers. The Fund also focuses on companies that have a competitive advantage in their space and tries to avoid companies who are in extremely competitive businesses./ The companies in the portfolio are typically one of the three largest in their area of focus and tend to have size advantages against their smaller competitors./The Fund is actively managed and although each investment has an intended two to four year time frame, companies may be held longer if fundamentals remain favorable, or sold earlier if fundamentals weaken.

The S&P 500 is a passive basket of 500 stocks, that is market capitalization weighted, meaning the largest companies have the biggest impact on the index’s performance. The performance of the market cap weighted S&P 500 is heavily concentrated in the seven largest stocks in the index. Those seven stocks performed extremely well during the first nine months of 2023 (average return + 88%), while the average stock in the remainder of the index was up less than 2% during the same period. While the U.S. Dividend strategy holds a few of those seven super performers such as Microsoft, Apple and Google, other don’t meet the investment criteria of the strategy as they either don’t return capital to shareholders, don’t consistently grow free cash flow, or are trading at a level of valuation that doesn’t meet our investment discipline.

While the economy proved to be more resilient than expected during the first three quarters of 2023 even as the Federal Reserve was raising rates significantly, we continue to expect the economy to slow over the next year. We have made a number of changes in the portfolio to prepare for higher rates and an eventual economic slowdown. We continue to be encouraged by the free cash flow growth of the companies in the portfolio as well as the ability of many of the companies to increase their dividends and buy back significant amounts of stock.

Thank you for your investment in the Advisors Capital US Dividend Fund. We will continue to focus on the fundamentals of our strategy to seek long term capital appreciation over time.

Kenneth Deane, President

AC Funds, LLC

Past performance does not guarantee future results. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-247-3841.

The Advisors Capital Funds’ prospectus contains important information about the Funds’ investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. You may obtain a current copy of the Funds’ prospectus by calling 1-888-247-3841. Distributed by Arbor Court Capital, LLC–Broadview Heights, OH 44147.

2023 Annual Report 2

Shareholder Report

Advisors Capital Small/Mid Cap Fund

September 30, 2023

Dear Shareholders:

The Advisors Capital Small/Mid Cap Fund (the “Fund”) commenced operations on March 19, 2021. The accompanying annual report covers the time frame from October 1, 2022 to September 30, 2023.

As of the end of the current fiscal year, the Fund had total net assets of approximately $49.54 million. The Fund had a total return for the fiscal year of 15.68% . The Fund’s benchmark, the Russell 2500 Index had a total return of 11.28% for the same time period. The Fund’s return advantage for the 12-month period primarily reflects security selection in the Industrials, Financials, Communication Services, and Health Care sectors.

The Fund seeks to invest long term in attractively valued, conservatively structured, dynamic companies with growing free cash flow, emphasizing companies that typically focus on one business and exhibit dominance within a specialized niche. Selected companies will generally have higher market share, exercise more pricing power, have better operating profit margins and exhibit superior profitability metrics relative to peers over the full market cycle. The Fund is actively managed and management continually reviews the companies held to confirm that each stock continues to hold promise for future appreciation.

Small cap stocks rallied in each the first three fiscal quarters, before pulling back in the final quarter of the fiscal year ending September 30, 2023. The December 2022 quarter posted the strongest quarterly return for the benchmark (+7.95%) . Economic data suggesting an inflation peak boosted investor optimism for an end to the historic interest rate hike campaign by the Federal Reserve. Interest rates did move lower with the 10-year US Treasury yield declining from an October 2022 high of 4.33% to an early February 2023 low of 3.33% . This sparked a strong small cap rally in January with the benchmark gaining 10.14% . Markets weakened after January on recalcitrant inflation and continued rate hikes by the Federal Reserve combined with reports of bank stress highlighted by two notable bank failures, Silicon Valley Bank and Signature Bank in early March. The benchmark fell for the four months February through May by 8.80% . Subsequently, equities rallied in June and July by 14.08%, reacting favorably to Congressional action averting a looming US debt default, suspending the debt ceiling until 2025, and more importantly, responding to the rate-hike pause by the Federal Reserve. The last two months of the fiscal year, August and September, saw a fading of a number of factors boosting investor confidence in early 2023. This included low energy prices, expectations for less hawkish monetary policy by the world’s central banks, and perceptions of globally resilient economies. Resultingly, equities pulled back 9.13% .

As usual the consensus macroeconomic view keeps changing, but this year seemed especially volatile with consensus moving from no recession, to mild recession, to financial crisis, back to mild but possibly longer recession. Considering what we’ve dealt with over the last three years it’s easy to understand the seemingly manic-depressive changes in outlook. To review, markets were dealt a once-in-a-century pandemic, shutting down many parts of the global economy, and causing significant ongoing economic disruption due to broken supply chains. Policy makers responded with unprecedented monetary and fiscal stimulus, leading to the sharpest inflationary surge in four decades. This, in turn, forced the Federal Reserve to pursue an ultra-aggressive rate hiking cycle resulting in a 2022 market rout, and 2023 banking crisis. Truly, given what we’ve been through, it’s a wonder the market doesn’t exhibit greater schizophrenia. What’s next? The events thus far this decade illustrate the difficulty, some would even say futility, of economic projections. On that note, given where we’ve been, we believe it’s likely the business cycle becomes more volatile with policy makers less capable of supplying countercyclical monetary and fiscal stimulus. Although showing impressive resiliency thus far in 2023, some near-term slowing by the economy seems inevitable, but the depth, timing, and length of the slowing is not yet determinable.

2023 Annual Report 3

Certainly, the macro environment reflects challenges, but we believe the strength of our companies’ business models should continue to excel in this environment. We note investing based on short-term economic projections is not a strategy for long-term equity investing success. Better to look for quality businesses with strong management teams trading at attractive valuations that can deliver earnings and positive free cash flow over multiple economic and market cycles. We focus on building a diversified portfolio of such companies. This has helped us deliver competitive returns over time.

Kenneth Deane, President

AC Funds, LLC

Past performance does not guarantee future results. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-247-3841.

The Advisors Capital Funds’ prospectus contains important information about the Funds’ investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. You may obtain a current copy of the Funds’ prospectus by calling 1-888-247-3841. Distributed by Arbor Court Capital, LLC–Broadview Heights, OH 44147.

2023 Annual Report 4

Shareholder Report

Advisors Capital Tactical Fixed Income Fund

September 30, 2023

Dear Shareholders:

The Advisors Capital Tactical Fixed Income Fund (the “Fund”) commenced operations on March 19, 2021. The accompanying annual report covers the time frame from October 1, 2022 to September 30, 2023.

As of the end of the current fiscal year, the Fund had total net assets of approximately $68.29 million. The Fund had a total return for the fiscal year of 3.05% . The Fund’s benchmark, the Bloomberg US Intermediate Corporate Index had a total return of 4.11% for the same time period.

Management attributes the Fund’s performance to a variety of factors. The Fund seeks to invest in fixed-income securities through ETFs that invest in fixed or floating rate debt instruments (including Preferreds). The Fund uses an opportunistic and unconstrained investment strategy to access what it believes to be the most attractive total return opportunities based upon prevailing market conditions. The Fund is actively managed and management continually reviews the spectrum of ETFs confirm that the selected holdings continue to hold promise for future appreciation in current market conditions. The Bloomberg US Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market whose maturity ranges between 1 and 9.9999 years. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Interest rates have risen substantially over the past two years due to high levels of inflation and the corresponding actions of the Federal Reserve to address such inflation. The yield on the 10-year Treasury, has risen from 0.7% at the end of 3Q’21 to nearly 4.6% at the end of 3Q’23, and the Federal Reserve raised its key policy tool, the overnight Federal Funds Rate, from 0%-0.25% to 5.25% -5.50% . Currently, the market is pricing in a small probability of potentially one more 0.25% hike, by January 2024. The market is then assuming the Fed Funds rate gets will get cut by more than 0.75% by January 2025. As always, the Fed remains data dependent and changes to the inflationary or economic outlook could significantly alter the Fed's actions. Credit spreads, while still elevated over the past two years, declined over the 12-month period as the economy has proven more resilient than expected combined with increased investor interest in fixed income given the current yields. Two factors that positively contributed to performance over the past twelve months, were a focus on variable rate preferreds rather than fixed rate, and keeping duration low. For example, we owned two short-dated high yield bond ETFs which significantly outperformed the Fund’s benchmark.

While the rising rate environment of the past two years has been challenging, such a high interest rate environment creates a very compelling opportunity in fixed income. We continue to maintain a relatively short duration in the Fund to reduce the overall volatility that we have seen in this market.

Thank you for your investment in the Advisors Capital Tactical Fixed Income Fund. We will continue to focus on the fundamentals of our strategy to seek total return with capital preservation over time.

Kenneth Deane, President

AC Funds, LLC

Past performance does not guarantee future results. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-247-3841.

The Advisors Capital Funds’ prospectus contains important information about the Funds’ investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. You may obtain a current copy of the Funds’ prospectus by calling 1-888-247-3841. Distributed by Arbor Court Capital, LLC–Broadview Heights, OH 44147.

2023 Annual Report 5

Shareholder Report

Advisors Capital Active All Cap Fund

September 30, 2023

Dear Shareholders:

The Advisors Capital Active All Cap Fund (the “Fund”) commenced operations on November 9, 2022 and commenced Investment Operations on December 1, 2022. The accompanying annual report covers the time frame from November 9, 2022 to September 30, 2023.

As of the end of the current fiscal year, the Fund had total net assets of approximately $34.41 million. For the period from the Commencement of Investment Operations (December 1, 2022) through September 30, 2023, the Fund had a total return for the fiscal period of 4.22% . The Fund’s benchmark, the S&P 500 had a total return of 6.55% for the same time period. Management attributes the Fund’s performance to a variety of factors.

The Fund seeks both long-term capital appreciation and income by investing at least 80% of its assets in a mix of exchange-traded funds and/or mutual funds in different combinations and weightings. The goal is to produce risk-adjusted returns in line with the comparative equity index.

The largest exposure in the Fund is to the S&P 500. The S&P 500 is a passive basket of 500 stocks, that is market capitalization weighted, meaning the largest companies have the biggest impact on the index’s performance. The performance of the market cap weighted S&P 500 is heavily concentrated in the seven largest stocks in the index. Those seven stocks performed extremely well during the first nine months of 2023 (average return + 88%), while the average stock in the remainder of the index was up less than 2% during the same period. Large capitalization stocks continued to outperform both small and mid cap stocks during the period, as they now have for a number of years. Similarly, growth stocks outperformed value stocks significantly during the last twelve months.

While the economy proved to be more resilient than expected during the first three quarters of 2023 even as the Federal Reserve was raising rates significantly, we continue to expect the economy to slow over the next year. We believe that the Fund is well positioned for higher rates and an eventual economic slowdown.

Thank you for your investment in the Advisors Capital Active All Cap Fund. We will continue to focus on the fundamentals of our strategy to seek long term capital appreciation over time.

Kenneth Deane, President

AC Funds, LLC

Past performance does not guarantee future results. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-247-3841.

The Advisors Capital Funds’ prospectus contains important information about the Funds’ investment objectives, potential risks, management fees, charges and expenses, and other information and should be read and considered carefully before investing. You may obtain a current copy of the Funds’ prospectus by calling 1-888-247-3841. Distributed by Arbor Court Capital, LLC–Broadview Heights, OH 44147.

2023 Annual Report 6

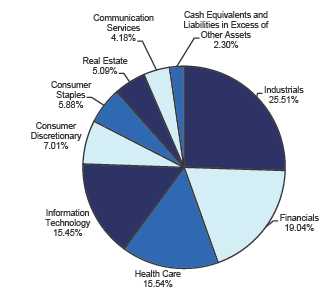

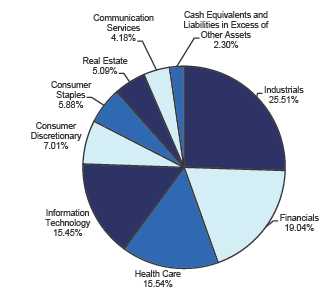

Advisors Capital Funds (Unaudited)

ADVISORS CAPITAL US DIVIDEND FUND

Sector Allocation as of September 30, 2023

(As a Percentage of Net Assets Held) |

| | ADVISORS CAPITAL SMALL/MID CAP FUND

Sector Allocation as of September 30, 2023

(As a Percentage of Net Assets Held) |

2023 Annual Report 7

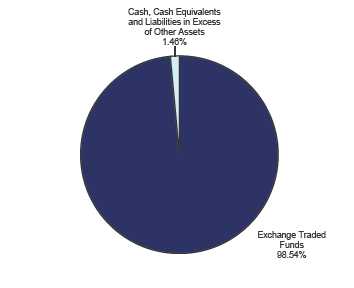

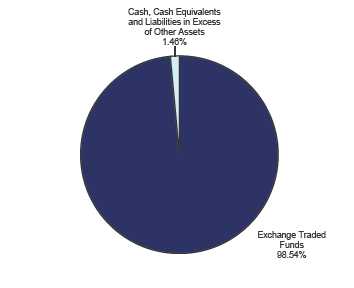

Advisors Capital Funds (Unaudited)

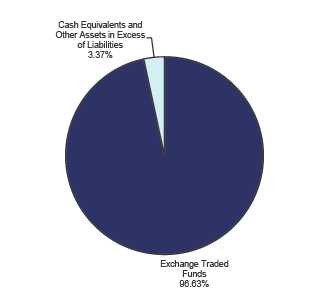

ADVISORS CAPITAL TACTICAL FIXED INCOME FUND

Sector Allocation as of September 30, 2023

(As a Percentage of Net Assets Held) |

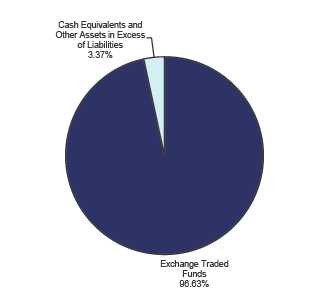

| | ADVISORS CAPITAL ACTIVE ALL CAP FUND

Sector Allocation as of September 30, 2023

(As a Percentage of Net Assets Held) |

2023 Annual Report 8

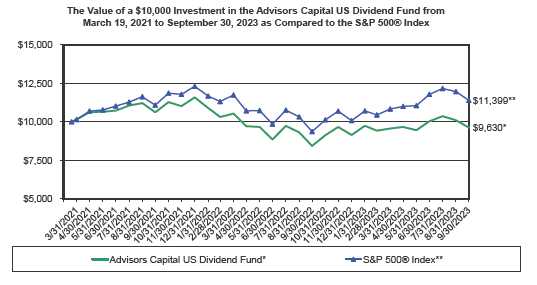

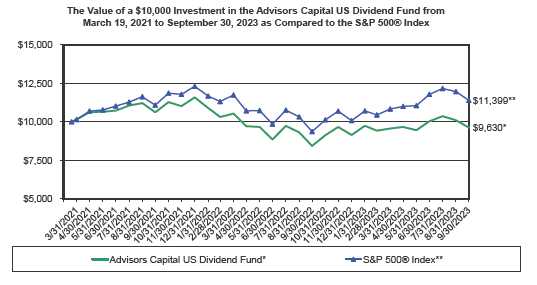

Advisors Capital US Dividend Fund (Unaudited)

PERFORMANCE INFORMATION

AVERAGE ANNUAL TOTAL RATE OF RETURN (%) AS OF SEPTEMBER 30, 2023

September 30, 2023 NAV $9.63

| | | | Since | |

| | 1 Year(A) | | Inception(A) | |

| Advisors Capital US Dividend Fund | 14.10% | | -1.48% | |

| S&P 500® Index (B) | 21.62% | | 5.31% | |

Annual Fund Operating Expense Ratio (from 9/1/2023 Supplement to the 1/30/2023 Prospectus): 1.87%

The Fund’s expense ratio for the fiscal year ended September 30, 2023, can be found in the financial highlights included within this report. The Annual Fund Operating Expense Ratio reported above will not correspond to the expense ratio in the Fund's financial highlights due to a change in the management fee which became effective September 1, 2023 (see Note 4).

(A) 1 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The Advisors Capital US Dividend Fund commenced investment operations on March 19, 2021.

(B) The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-888-247-3841. AN INVESTMENT IN THE FUND IS SUBJECT TO INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. THE FUND'S DISTRIBUTOR IS ARBOR COURT CAPITAL, LLC.

2023 Annual Report 9

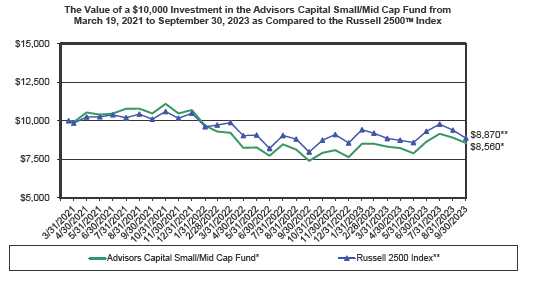

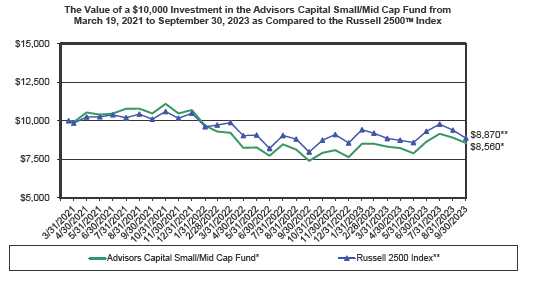

Advisors Capital Small/Mid Cap Fund (Unaudited)

PERFORMANCE INFORMATION

AVERAGE ANNUAL TOTAL RATE OF RETURN (%) AS OF SEPTEMBER 30, 2023

September 30, 2023 NAV $8.56

| | | | Since | |

| | 1 Year(A) | | Inception(A) | |

| Advisors Capital Small/Mid Cap Fund | 15.68% | | -5.95% | |

| Russell 2500TM Index (B) | 11.28% | | -4.62% | |

Annual Fund Operating Expense Ratio (from 9/1/2023 Supplement to the 1/30/2023 Prospectus): 1.87%

The Fund’s expense ratio for the fiscal year ended September 30, 2023, can be found in the financial highlights included within this report. The Annual Fund Operating Expense Ratio reported above will not correspond to the expense ratio in the Fund's financial highlights due to a change in the management fee which became effective September 1, 2023 (see Note 4).

(A) 1 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The Advisors Capital Small/Mid Cap Fund commenced investment operations on March 19, 2021.

(B) The Russell 2500TM Index is an unmanaged market capitalization-weighted index measuring the performance of the 2,500 smallest companies in the Russell 3000 Index.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-888-247-3841. AN INVESTMENT IN THE FUND IS SUBJECT TO INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. THE FUND'S DISTRIBUTOR IS ARBOR COURT CAPITAL, LLC.

2023 Annual Report 10

Advisors Capital Tactical Fixed Income Fund (Unaudited)

PERFORMANCE INFORMATION

AVERAGE ANNUAL TOTAL RATE OF RETURN (%) AS OF SEPTEMBER 30, 2023

September 30, 2023 NAV $9.03

| | | | Since | |

| | 1 Year(A) | | Inception(A) | |

| Advisors Capital Tactical Fixed Income Fund | 3.05% | | -3.36% | |

| Bloomberg US Intermediate Corporate Bond Index (B) | 4.11% | | -2.78% | |

Annual Fund Operating Expense Ratio (from 9/1/2023 Supplement to the 1/30/2023 Prospectus): 2.06%

The Fund’s expense ratio for the fiscal year ended September 30, 2023, can be found in the financial highlights included within this report. The Annual Fund Operating Expense Ratio reported above may not correlate to the expense ratio in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds and (b) due to a change in the management fee which became effective September 1, 2023 (see Note 4).

(A) 1 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The Advisors Capital Tactical Fixed Income Fund commenced investment operations on March 19, 2021.

(B) The Bloomberg US Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market whose maturity ranges between 1 and 9.9999 years. It includes USD denominated securities publicly issued by US and non-US industrial, utility, and financial issuers

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-888-247-3841. AN INVESTMENT IN THE FUND IS SUBJECT TO INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. THE FUND'S DISTRIBUTOR IS ARBOR COURT CAPITAL, LLC.

2023 Annual Report 11

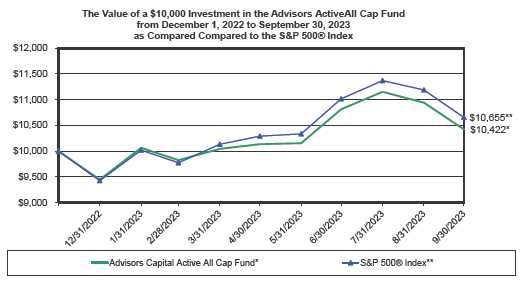

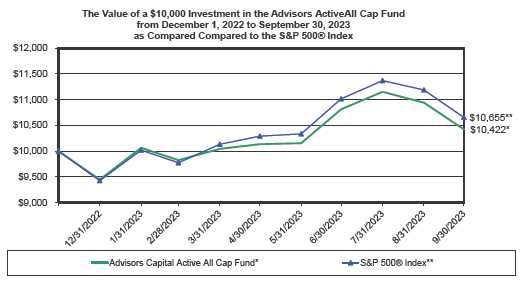

Advisors Capital Active All Cap Fund (Unaudited)

PERFORMANCE INFORMATION

TOTAL RETURNS AS OF SEPTEMBER 30, 2023 September 30, 2023 NAV $10.42

| | Since | |

| | Inception(A) | |

| Advisors Capital Active All Cap Fund | 4.22% | |

| S&P 500® Index (B) | 6.55% | |

Annual Fund Operating Expense Ratio (from 9/1/2023 Supplement to the 11/9/2022 Prospectus): 1.91%

The Fund’s expense ratio for the period November 9, 2022 through September 30, 2023, can be found in the financial highlights included within this report. The Annual Fund Operating Expense Ratio reported above may not correlate to the expense ratio in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds and (b) due to a change in the management fee which became effective September 1, 2023 (see Note 4).

(A) Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions since the commencement of investment operations. The Advisors Capital Active All Cap Fund commenced investment operations on December 1, 2022.

(B) The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-888-247-3841. AN INVESTMENT IN THE FUND IS SUBJECT TO INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. THE FUND'S DISTRIBUTOR IS ARBOR COURT CAPITAL, LLC.

2023 Annual Report 12

| Advisors Capital US Dividend Fund | | | | |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | % of Net Assets |

| |

| COMMON STOCKS | | | | |

| Aircraft Engines & Engine Parts | | | | |

| 14,100 Honeywell International Inc. | $ | 2,604,834 | 2.04 | % |

| Auto Controls for Regulating Residential & Commercial Environments | | | | |

| 6,400 Trane Technologies PLC (Ireland) | | 1,298,624 | 1.02 | % |

| Ball & Roller Bearings | | | | |

| 16,400 The Timken Company | | 1,205,236 | 0.94 | % |

| Electric Services | | | | |

| 38,200 NextEra Energy, Inc. | | 2,188,478 | 1.71 | % |

| Electromedical & Electrotherapeutic Apparatus | | | | |

| 27,800 Medtronic PLC (Ireland) | | 2,178,408 | 1.71 | % |

| Electronic Computers | | | | |

| 36,300 Apple Inc. | | 6,214,923 | 4.87 | % |

| Farm Machinery & Equipment | | | | |

| 7,300 Deere & Company | | 2,754,874 | 2.16 | % |

| Guided Missiles & Space Vehicles & Parts | | | | |

| 7,200 Lockheed Martin Corporation | | 2,944,512 | 2.31 | % |

| Hospital & Medical Service Plans | | | | |

| 5,500 UnitedHealth Group Incorporated | | 2,773,045 | 2.17 | % |

| Industrial Inorganic Chemicals | | | | |

| 6,400 Air Products and Chemicals, Inc. | | 1,813,760 | 1.42 | % |

| Industrial Organic Chemicals | | | | |

| 18,700 International Flavors & Fragrances , Inc. | | 1,274,779 | 1.00 | % |

| Insurance Agents, Brokers & Service | | | | |

| 8,000 Aon PLC - Class A (Ireland) | | 2,593,760 | 2.03 | % |

| Investment Advice | | | | |

| 35,400 Blackstone Inc. | | 3,792,756 | 2.97 | % |

| Measuring & Controlling Devices, NEC | | | | |

| 6,900 Thermo Fisher Scientific Inc. | | 3,492,573 | 2.73 | % |

| Miscellaneous Food Preparations & Kindred Products | | | | |

| 117,700 Utz Brands, Inc. - Class A | | 1,580,711 | 1.24 | % |

| Miscellaneous Industrial & Commercial Machinery & Equipment | | | | |

| 12,800 Eaton Corporation PLC (Ireland) | | 2,729,984 | 2.14 | % |

| National Commercial Banks | | | | |

| 19,500 JPMorgan Chase & Co. | | 2,827,890 | | |

| 78,100 Truist Financial Corporation | | 2,234,441 | | |

| 49,500 Wells Fargo & Company | | 2,022,570 | | |

| | | 7,084,901 | 5.55 | % |

| Natural Gas Transmission | | | | |

| 79,800 The Williams Companies, Inc. | | 2,688,462 | 2.11 | % |

| Orthopedic, Prosthetic & Surgical Appliances & Supplies | | | | |

| 11,000 STERIS PLC (Ireland) | | 2,413,620 | 1.89 | % |

| Petroleum Refining | | | | |

| 22,000 Chevron Corporation | | 3,709,640 | 2.91 | % |

| Pharmaceutical Preparations | | | | |

| 26,600 Abbott Laboratories | | 2,576,210 | | |

| 23,000 Johnson & Johnson | | 3,582,250 | | |

| 34,000 Pfizer, Inc. | | 1,127,780 | | |

| 16,400 Zoetis Inc. - Class A | | 2,853,272 | | |

| | | 10,139,512 | 7.94 | % |

| Radio & TV Broadcasting & Communications Equipment | | | | |

| 22,000 QUALCOMM Incorporated | | 2,443,320 | 1.91 | % |

| Retail - Drug Stores & Proprietary Stores | | | | |

| 33,400 CVS Health Corporation | | 2,331,988 | 1.83 | % |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 13

| Advisors Capital US Dividend Fund | |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | | | % of Net Assets |

| |

| COMMON STOCKS | | | | | | |

| Retail - Lumber & Other Building Materials Dealers | | | | | | |

| 8,200 The Home Depot, Inc. | $ | 2,477,712 | | | 1.94 | % |

| Retail - Retail Stores, NEC | | | | | | |

| 3,800 Ulta Beauty, Inc. * | | 1,517,910 | | | 1.19 | % |

| Retail - Variety Stores | | | | | | |

| 3,600 Costco Wholesale Corp. | | 2,033,856 | | | | |

| 17,029 Target Corporation | | 1,882,896 | | | | |

| | | 3,916,752 | | | 3.07 | % |

| Security & Commodity Brokers, Dealers, Exchanges & Services | | | | | | |

| 10,300 CME Group Inc. | | 2,062,266 | | | 1.61 | % |

| Security Brokers, Dealers & Flotation Companies | | | | | | |

| 3,700 BlackRock, Inc. | | 2,392,013 | | | 1.87 | % |

| Semiconductors & Related Devices | | | | | | |

| 4,800 Broadcom Inc. | | 3,986,784 | | | | |

| 14,100 Texas Instruments Incorporated | | 2,242,041 | | | | |

| | | 6,228,825 | | | 4.88 | % |

| Services - Amusements & Recreation Services | | | | | | |

| 110,000 Universal Music Group N.V. ADR | | 1,431,100 | | | 1.12 | % |

| Services - Business Services, NEC | | | | | | |

| 13,200 Accenture PLC - Class A (Ireland) | | 4,053,852 | | | | |

| 6,800 MasterCard Incorporated - Class A | | 2,692,188 | | | | |

| | | 6,746,040 | | | 5.28 | % |

| Services - Computer Programming, Data Processing, Etc. | | | | | | |

| 34,000 Alphabet, Inc. - Class A * | | 4,449,240 | | | 3.48 | % |

| Services - Miscellaneous Amusement & Recreation | | | | | | |

| 21,500 The Walt Disney Company * | | 1,742,575 | | | 1.36 | % |

| Services - Prepackaged Software | | | | | | |

| 4,500 Adobe, Inc. * | | 2,294,550 | | | | |

| 23,300 Microsoft Corporation | | 7,356,975 | | | | |

| 18,600 Oracle Corporation | | 1,970,112 | | | | |

| | | 11,621,637 | | | 9.10 | % |

| Wholesale - Electronic Parts & Equipment, NEC | | | | | | |

| 21,000 TE Connectivity Ltd. (Switzerland) | | 2,594,130 | | | 2.03 | % |

| Wholesale - Miscellaneous Durable Goods | | | | | | |

| 4,400 Pool Corporation | | 1,566,840 | | | 1.23 | % |

| Total for Common Stocks (Cost - $119,732,083) | | 120,999,740 | | | 94.76 | % |

| REAL ESTATE INVESTMENT TRUSTS | | | | | | |

| 21,100 Prologis, Inc. | | 2,367,631 | | | 1.85 | % |

| Total for Real Estate Investment Trusts (Cost $2,638,806) | | | | | | |

| MONEY MARKET FUNDS | | | | | | |

| 4,578,774 Fidelity Investments Money Market Government Portfolio - | | 4,578,774 | | | 3.59 | % |

| Class I 5.23% ** | | | | | | |

| Total for Money Market Funds (Cost $4,578,774) | | | | | | |

| Total Investments (Cost - $126,949,663) | | 127,946,145 | | | 100.20 | % |

| Liabilities in Excess of Other Assets | | (252,712 | ) | | -0.20 | % |

| Net Assets | $ | 127,693,433 | | | 100.00 | % |

ADR - American Depositary Receipt.

* Non-Income Producing Securities.

** The rate shown represents the 7-day yield at September 30, 2023.

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 14

| Advisors Capital Small/Mid Cap Fund | | | | |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | % of Net Assets |

| |

| COMMON STOCKS | | | | |

| Abrasive, Asbestos & Miscellaneous Nonmetallic Mineral Products | | | | |

| 15,800 Owens Corning | $ | 2,155,278 | 4.35 | % |

| Ball & Roller Bearings | | | | |

| 10,700 RBC Bearings Incorporated * | | 2,505,191 | | |

| 23,100 The Timken Company | | 1,697,619 | | |

| | | 4,202,810 | 8.48 | % |

| Glass Containers | | | | |

| 62,400 Stevanato Group S.p.A. (Italy) | | 1,854,528 | 3.74 | % |

| Industrial & Commercial Fans & Blowers & Air Purifing Equipment | | | | |

| 14,200 Donaldson Company, Inc. | | 846,888 | 1.71 | % |

| Investment Advice | | | | |

| 7,900 Evercore Inc. - Class A | | 1,089,252 | | |

| 29,300 PJT Partners Inc. - Class A | | 2,327,592 | | |

| | | 3,416,844 | 6.90 | % |

| Laboratory Analytical Instruments | | | | |

| 75,200 Avantor, Inc. * | | 1,585,216 | 3.20 | % |

| Miscellaneous Food Preparations & Kindred Products | | | | |

| 71,200 Utz Brands, Inc. - Class A | | 956,216 | 1.93 | % |

| Motorcycles, Bicycles & Parts | | | | |

| 10,600 Fox Factory Holding Corp. * | | 1,050,248 | 2.12 | % |

| National Commercial Banks | | | | |

| 14,800 Pinnacle Financial Partners, Inc. | | 992,192 | 2.00 | % |

| Pharmaceutical Preparations | | | | |

| 28,500 Catalent, Inc. * | | 1,297,605 | | |

| 44,600 Cryoport, Inc. * | | 611,466 | | |

| | | 1,909,071 | 3.85 | % |

| Real Estate Agents & Managers (For Others) | | | | |

| 7,910 FirstService Corporation (Canada) | | 1,151,221 | | |

| 9,700 Jones Lang LaSalle Incorporated * | | 1,369,446 | | |

| | | 2,520,667 | 5.09 | % |

| Retail - Auto Dealers & Gasoline Stations | | | | |

| 7,200 Casey's General Stores, Inc. | | 1,954,944 | 3.95 | % |

| Security Brokers, Dealers & Flotation Companies | | | | |

| 74,600 Virtu Financial, Inc. - Class A | | 1,288,342 | 2.60 | % |

| Services - Business Services, NEC | | | | |

| 27,400 Accolade, Inc. * | | 289,892 | 0.59 | % |

| Services - Detective, Guard & Armored Car Services | | | | |

| 9,000 Allegion plc (Ireland) | | 937,800 | 1.89 | % |

| Services - Management Consulting Services | | | | |

| 7,000 FTI Consulting, Inc. * | | 1,248,870 | 2.52 | % |

| Services - Medical Laboratories | | | | |

| 41,900 Castle Biosciences, Inc. * | | 707,691 | 1.43 | % |

| Services - Miscellaneous Amusement & Recreation | | | | |

| 5,500 Madison Square Garden Sports Corp. - Class A | | 969,650 | 1.96 | % |

| Services - Prepackaged Software | | | | |

| 5,868 AppFolio, Inc. - Class A * | | 1,071,673 | | |

| 30,500 Bentley Systems, Incorporated - Class B | | 1,529,880 | | |

| 18,500 BlackLine, Inc. * | | 1,026,195 | | |

| 16,100 Guidewire Software, Inc. * | | 1,449,000 | | |

| 29,500 nCino, Inc. * | | 938,100 | | |

| 25,100 Procore Technologies, Inc. * | | 1,639,532 | | |

| | | 7,654,380 | 15.45 | % |

| State Commercial Banks | | | | |

| 60,500 Coastal Financial Corporation * | | 2,596,055 | 5.24 | % |

* Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 15

| Advisors Capital Small/Mid Cap Fund | |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | | | % of Net Assets |

| COMMON STOCKS | | | | | | |

| Surgical & Medical Instruments & Apparatus | | | | | | |

| 30,900 AtriCure, Inc. * | $ | 1,353,420 | | | 2.73 | % |

| Television Broadcasting Stations | | | | | | |

| 30,800 Atlanta Braves Holdings, Inc. - Series C * | | 1,100,484 | | | 2.22 | % |

| Title Insurance | | | | | | |

| 20,200 First American Financial Corporation | | 1,141,098 | | | 2.30 | % |

| Transportation Services | | | | | | |

| 20,600 GXO Logistics, Inc. * | | 1,208,190 | | | 2.44 | % |

| Wholesale - Hardware & Plumbing & Heating Equipment & Supplies | | | | | | |

| 5,400 Watsco, Inc. | | 2,039,688 | | | 4.12 | % |

| Wholesale - Miscellaneous Durable Goods | | | | | | |

| 6,800 Pool Corporation | | 2,421,480 | | | 4.89 | % |

| Total for Common Stocks (Cost - $48,354,650) | | 48,401,942 | | | 97.70 | % |

| MONEY MARKET FUNDS | | | | | | |

| 1,255,884 Fidelity Investments Money Market Government Portfolio - | | 1,255,884 | | | 2.54 | % |

| Class I 5.23% ** | | | | | | |

| Total for Money Market Funds (Cost $1,255,884) | | | | | | |

| Total Investments (Cost - $49,610,534) | | 49,657,826 | | | 100.24 | % |

| Liabilities in Excess of Other Assets | | (118,616 | ) | | -0.24 | % |

| Net Assets | $ | 49,539,210 | | | 100.00 | % |

* Non-Income Producing Securities.

** The rate shown represents the 7-day yield at September 30, 2023.

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 16

| Advisors Capital Tactical Fixed Income Fund |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | | | % of Net Assets |

| |

| EXCHANGE TRADED FUNDS | | | | | | |

| Fixed Income | | | | | | |

| 166,400 iShares 0-5 Year High Yield Corporate Bond ETF | $ | 6,827,392 | | | | |

| 278,700 SPDR® Bloomberg Short Term High Yield Bond ETF | | 6,817,002 | | | | |

| 434,600 SPDR® Portfolio Intermediate Term Corporate Bond ETF | | 13,668,170 | | | | |

| 89,200 Vanguard Intermediate-Term Corporate Bond Index Fund ETF | | 6,777,416 | | | | |

| | | 34,089,980 | | | 49.92 | % |

| Target Maturity Fixed Income | | | | | | |

| 310,600 Invesco BulletShares 2026 Corporate Bond ETF | | 5,834,714 | | | | |

| 296,400 iShares iBonds Dec 2027 Term Corporate ETF | | 6,858,696 | | | | |

| 355,700 iShares iBonds Dec 2028 Term Corporate ETF | | 8,547,471 | | | | |

| 233,800 iShares iBonds Dec 2029 Term Corporate ETF | | 5,120,220 | | | | |

| | | 26,361,101 | | | 38.60 | % |

| US Fund Preferred Stock | | | | | | |

| 305,800 Invesco Variable Rate Preferred ETF | | 6,840,746 | | | 10.02 | % |

| Total for Exchange Traded Funds (Cost - $68,324,272) | | 67,291,827 | | | 98.54 | % |

| MONEY MARKET FUNDS | | | | | | |

| 1,142,784 Fidelity Investments Money Market Government Portfolio - | | 1,142,784 | | | 1.67 | % |

| Class I 5.23% ** | | | | | | |

| Total for Money Market Funds (Cost $1,142,784) | | | | | | |

| |

| Total Investments (Cost - $69,467,056) | | 68,434,611 | | | 100.21 | % |

| Liabilities in Excess of Other Assets | | (144,779 | ) | | -0.21 | % |

| Net Assets | $ | 68,289,832 | | | 100.00 | % |

** The rate shown represents the 7-day yield at September 30, 2023.

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 17

| Advisors Capital Active All Cap Fund | |

| |

| | | Schedule of Investments |

| | | September 30, 2023 |

| Shares | | Fair Value | | % of Net Assets |

| |

| EXCHANGE TRADED FUNDS | | | | | |

| Equity | | | | | |

| 31,300 iShares Core S&P 500 ETF (a) | $ | 13,441,159 | | | |

| 6,790 iShares Core S&P Mid-Cap ETF | | 1,693,087 | | | |

| 40,600 Schwab U.S. Small-Cap ETF | | 1,681,652 | | | |

| 95,900 SPDR® Portfolio S&P 1500 Composite Stock Market ETF | | 5,033,791 | | | |

| 21,100 Vanguard Growth Index Fund ETF | | 5,745,741 | | | |

| 41,000 Vanguard Value Index Fund ETF | | 5,655,130 | | | |

| Total for Exchange Traded Funds (Cost - $32,962,233) | | 33,250,560 | | 96.63 | % |

| MONEY MARKET FUNDS | | | | | |

| 1,147,986 Fidelity Investments Money Market Government Portfolio - | | 1,147,986 | | 3.34 | % |

| Class I 5.23% ** | | | | | |

| Total for Money Market Funds (Cost $1,147,986) | | | | | |

| |

| Total Investments (Cost - $34,110,219) | | 34,398,546 | | 99.97 | % |

| Other Assets in Excess of Liabilities | | 10,113 | | 0.03 | % |

| Net Assets | $ | 34,408,659 | | 100.00 | % |

(a) Additional information, including current Prospectus and Annual Report, is available at:

https://www.blackrock.com/us/individual/resources/regulatory-documents?cid=vanity:regulatory:ishares#etfs

** The rate shown represents the 7-day yield at September 30, 2023. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 18

| Advisors Capital Funds |

| | |

| Statements of Assets and Liabilities | | US Dividend | | | | Small/Mid | | |

| September 30, 2023 | | Fund | | | | Cap Fund | | |

| | |

| Assets: | | | | | | | | |

| Investment at Fair Value* | $ | 127,946,145 | | | $ | 49,657,826 | | |

| Receivable for Fund Shares Sold | | 2,549 | | | | 637 | | |

| Dividends Receivable | | 84,535 | | | | 10,151 | | |

| Total Assets | | 128,033,229 | | | | 49,668,614 | | |

| Liabilities: | | | | | | | | |

| Payable for Fund Shares Redeemed | | 6,250 | | | | 10,100 | | |

| Management Fees Payable | | 175,076 | | | | 66,484 | | |

| Distribution Fees Payable | | 158,470 | | | | 52,820 | | |

| Total Liabilities | | 339,796 | | | | 129,404 | | |

| Net Assets | $ | 127,693,433 | | | $ | 49,539,210 | | |

| Net Assets Consist of: | | | | | | | | |

| Paid In Capital | $ | 132,813,673 | | | $ | 52,959,611 | | |

| Total Accumulated Deficit | | (5,120,240 | ) | | | (3,420,401 | ) | |

| Net Assets | $ | 127,693,433 | | | $ | 49,539,210 | | |

| | |

| Net Asset Value, Offering Price and Redemption Price per Share | $ | 9.63 | | | $ | 8.56 | | |

| | |

| * Investments at Identified Cost | $ | 126,949,663 | | | $ | 49,610,534 | | |

| | |

| Shares Outstanding (Unlimited number of shares | | 13,253,842 | | | | 5,786,669 | | |

| authorized without par value) | | | | | | | | |

| | |

| Statements of Operations | | | | | | | | |

| For the fiscal year ended September 30, 2023 | | | | | | | | |

| | |

| Investment Income: | | | | | | | | |

| Dividends (Net of foreign withholding tax of $0 and $3,228, respectively) | $ | 2,376,088 | | | $ | 442,267 | | |

| Total Investment Income | | 2,376,088 | | | | 442,267 | | |

| Expenses: | | | | | | | | |

| Management Fees (Note 4) | | 1,896,726 | | | | 784,223 | | |

| Distribution Fees (Note 5) | | 281,699 | | | | 116,434 | | |

| Total Expenses | | 2,178,425 | | | | 900,657 | | |

| | |

| Net Investment Income (Loss) | | 197,663 | | | | (458,390 | ) | |

| | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| Net Realized Loss on Investments | | (3,706,616 | ) | | | (2,148,440 | ) | |

| Net Change in Net Unrealized Appreciation on Investments | | 14,963,426 | | | | 9,089,054 | | |

| Net Realized and Unrealized Gain on Investments | | 11,256,810 | | | | 6,940,614 | | |

| | |

| Net Increase in Net Assets from Operations | $ | 11,454,473 | | | $ | 6,482,224 | | |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 19

| Advisors Capital Funds |

| | |

| Statements of Assets and Liabilities | | Tactical Fixed | | | | Active | | |

| September 30, 2023 | | Income | | | | All Cap | | |

| | | Fund | | | | Fund | | |

| | |

| Assets: | | | | | | | | |

| Investment at Fair Value* | $ | 68,434,611 | | | $ | 34,398,546 | | |

| Cash | | 1,000 | | | | - | | |

| Receivable for Securities Sold | | 6,843,001 | | | | - | | |

| Dividends Receivable | | 5,166 | | | | 72,314 | | |

| Total Assets | | 75,283,778 | | | | 34,470,860 | | |

| Liabilities: | | | | | | | | |

| Payable for Fund Shares Redeemed | | 8,012 | | | | - | | |

| Payable for Securities Purchased | | 6,826,098 | | | | - | | |

| Management Fees Payable | | 92,783 | | | | 43,915 | | |

| Distribution Fees Payable | | 67,053 | | | | 18,286 | | |

| Total Liabilities | | 6,993,946 | | | | 62,201 | | |

| Net Assets | $ | 68,289,832 | | | $ | 34,408,659 | | |

| Net Assets Consist of: | | | | | | | | |

| Paid In Capital | $ | 70,911,068 | | | $ | 34,101,149 | | |

| Total Distributable Earnings (Accumulated Deficit) | | (2,621,236 | ) | | | 307,510 | | |

| Net Assets | $ | 68,289,832 | | | $ | 34,408,659 | | |

| | |

| Net Asset Value, Offering Price and Redemption Price per Share | $ | 9.03 | | | $ | 10.42 | | |

| | |

| * Investments at Identified Cost | $ | 69,467,056 | | | $ | 34,110,219 | | |

| | |

| Shares Outstanding (Unlimited number of shares | | 7,558,518 | | | | 3,302,059 | | |

| authorized without par value) | | | | | | | | |

| | |

| Statements of Operations | | | | | | | | |

| For the period ended September 30, 2023 ** | | | | | | | | |

| | |

| Investment Income: | | | | | | | | |

| Dividends (Net of foreign withholding tax of $0 and $0, respectively) | $ | 2,518,813 | | | $ | 276,046 | | |

| Total Investment Income | | 2,518,813 | | | | 276,046 | | |

| Expenses: | | | | | | | | |

| Management Fees (Note 4) | | 1,008,355 | | | | 212,891 | | |

| Distribution Fees (Note 5) | | 149,758 | | | | 31,774 | | |

| Total Expenses | | 1,158,113 | | | | 244,665 | | |

| | |

| Net Investment Income | | 1,360,700 | | | | 31,381 | | |

| | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| Net Realized Loss on Investments | | (1,583,502 | ) | | | (7,048 | ) | |

| Net Change in Net Unrealized Appreciation (Depreciation) on Investments | | 1,471,333 | | | | 288,327 | | |

| Net Realized and Unrealized Gain (Loss) on Investments | | (112,169 | ) | | | 281,279 | | |

| | |

| Net Increase in Net Assets from Operations | $ | 1,248,531 | | | $ | 312,660 | | |

** The Statement of Operations for Tactical Fixed Income Fund represents the fiscal year ended

September 30, 2023, and the Statement of Operations for Active All Cap Fund represents the period from

November 9, 2022 (Commencement of Operations) to September 30, 2023. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 20

| Advisors Capital Funds |

| | |

| Statements of Changes in Net Assets | | US Dividend Fund | | | | Small/Mid Cap Fund | | |

| | |

| | | 10/1/2022 | | | | 10/1/2021 | | | | 10/1/2022 | | | | 10/1/2021 | | |

| | | to | | | | to | | | | to | | | | to | | |

| | | 9/30/2023 | | | | 9/30/2022 | | | | 9/30/2023 | | | | 9/30/2022 | | |

| From Operations: | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | $ | 197,663 | | | $ | (148,585 | ) | | $ | (458,390 | ) | | $ | (274,378 | ) | |

| Net Realized Loss on Investments | | (3,706,616 | ) | | | (2,328,109 | ) | | | (2,148,440 | ) | | | (935,915 | ) | |

| Net Change in Unrealized Appreciation (Depreciation) | | | | | | | | | | | | | | | | |

| on Investments | | 14,963,426 | | | | (13,588,248 | ) | | | 9,089,054 | | | | (9,024,781 | ) | |

| Net Increase (Decrease) in Net Assets from Operations | | 11,454,473 | | | | (16,064,942 | ) | | | 6,482,224 | | | | (10,235,074 | ) | |

| From Distributions to Shareholders: | | - | | | | - | | | | - | | | | - | | |

| From Capital Share Transactions: | | | | | | | | | | | | | | | | |

| Proceeds From Sale of Shares | | 62,322,022 | | | | 75,836,832 | | | | 13,273,718 | | | | 39,432,561 | | |

| Shares Issued on Reinvestment of Dividends | | - | | | | - | | | | - | | | | - | | |

| Cost of Shares Redeemed | | (22,502,095 | ) | | | (7,987,654 | ) | | | (9,868,415 | ) | | | (3,031,000 | ) | |

| Net Increase from Shareholder Activity | | 39,819,927 | | | | 67,849,178 | | | | 3,405,303 | | | | 36,401,561 | | |

| Net Increase in Net Assets | | 51,274,400 | | | | 51,784,236 | | | | 9,887,527 | | | | 26,166,487 | | |

| | |

| Net Assets at Beginning of Year | | 76,419,033 | | | | 24,634,797 | | | | 39,651,683 | | | | 13,485,196 | | |

| | |

| Net Assets at End of Year | $ | 127,693,433 | | | $ | 76,419,033 | | | $ | 49,539,210 | | | $ | 39,651,683 | | |

| | |

| | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Issued | | 6,512,223 | | | | 7,585,434 | | | | 1,620,145 | | | | 4,429,035 | | |

| Reinvested | | - | | | | - | | | | - | | | | - | | |

| Redeemed | | (2,311,031 | ) | | | (852,837 | ) | | | (1,188,332 | ) | | | (360,540 | ) | |

| Net Increase in Shares | | 4,201,192 | | | | 6,732,597 | | | | 431,813 | | | | 4,068,495 | | |

| Shares Outstanding Beginning of Year | | 9,052,650 | | | | 2,320,053 | | | | 5,354,856 | | | | 1,286,361 | | |

| Shares Outstanding End of Year | | 13,253,842 | | | | 9,052,650 | | | | 5,786,669 | | | | 5,354,856 | | |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 21

| Advisors Capital Funds |

| | |

| | | | | | | | | | | Active All Cap | | |

| Statements of Changes in Net Assets | | Tactical Fixed Income Fund | | | | Fund | | |

| | |

| | | 10/1/2022 | | | | 10/1/2021 | | | | 11/9/2022* | | |

| | | to | | | | to | | | | to | | |

| | | 9/30/2023 | | | | 9/30/2022 | | | | 9/30/2023 | | |

| From Operations: | | | | | | | | | | | | |

| Net Investment Income | $ | 1,360,700 | | | $ | 336,611 | | | $ | 31,381 | | |

| Capital Gain Distributions from Underlying Funds | | - | | | | 29,349 | | | | - | | |

| Net Realized Loss on Investments | | (1,583,502 | ) | | | (1,083,556 | ) | | | (7,048 | ) | |

| Net Change in Unrealized Appreciation (Depreciation) | | | | | | | | | | | | |

| on Investments | | 1,471,333 | | | | (2,457,157 | ) | | | 288,327 | | |

| Net Increase (Decrease) in Net Assets from Operations | | 1,248,531 | | | | (3,174,753 | ) | | | 312,660 | | |

| | |

| From Distributions to Shareholders: | | (589,215 | ) | | | (71,400 | ) | | | (5,150 | ) | |

| | |

| From Capital Share Transactions: | | | | | | | | | | | | |

| Proceeds From Sale of Shares | | 39,417,002 | | | | 37,101,463 | | | | 35,442,058 | | |

| Shares Issued on Reinvestment of Dividends | | 589,215 | | | | 71,400 | | | | 5,150 | | |

| Cost of Shares Redeemed | | (13,148,739 | ) | | | (3,559,900 | ) | | | (1,346,059 | ) | |

| Net Increase from Shareholder Activity | | 26,857,478 | | | | 33,612,963 | | | | 34,101,149 | | |

| | |

| Net Increase in Net Assets | | 27,516,794 | | | | 30,366,810 | | | | 34,408,659 | | |

| | |

| Net Assets at Beginning of Period | | 40,773,038 | | | | 10,406,228 | | | | - | | |

| | |

| Net Assets at End of Period | $ | 68,289,832 | | | $ | 40,773,038 | | | $ | 34,408,659 | | |

| | |

| | |

| Share Transactions: | | | | | | | | | | | | |

| Issued | | 4,337,494 | | | | 3,956,564 | | | | 3,429,023 | | |

| Reinvested | | 65,834 | | | | 7,090 | | | | 554 | | |

| Redeemed | | (1,446,087 | ) | | | (386,252 | ) | | | (127,518 | ) | |

| Net Increase in Shares | | 2,957,241 | | | | 3,577,402 | | | | 3,302,059 | | |

| Shares Outstanding Beginning of Period | | 4,601,277 | | | | 1,023,875 | | | | - | | |

| Shares Outstanding End of Period | | 7,558,518 | | | | 4,601,277 | | | | 3,302,059 | | |

* Commencement of Operations.

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 22

| Advisors Capital US Dividend Fund |

| | |

| Financial Highlights | | | | | | | | | | | | |

| | |

| Selected data for a share outstanding throughout the period: | | 10/1/2022 | | | | 10/1/2021 | | | | 3/19/2021* | | |

| | | to | | | | to | | | | to | | |

| | | 9/30/2023 | | | | 9/30/2022 | | | | 9/30/2021 | | |

| Net Asset Value - Beginning of Period | $ | 8.44 | | | $ | 10.62 | | | $ | 10.00 | | |

| Net Investment Income (Loss) (a) | | 0.02 | | | | (0.03 | ) | | | (0.02 | ) | |

| Net Gain (Loss) on Investments (Realized and Unrealized) (b) | | 1.17 | | | | (2.15 | ) | | | 0.64 | | |

| Total from Investment Operations | | 1.19 | | | | (2.18 | ) | | | 0.62 | | |

| Distributions (From Net Investment Income) | | - | | | | - | | | | - | | |

| Distributions (From Capital Gains) | | - | | | | - | | | | - | | |

| Total Distributions | | - | | | | - | | | | - | | |

| Net Asset Value - End of Period | $ | 9.63 | | | $ | 8.44 | | | $ | 10.62 | | |

| Total Return (c) | | 14.10 | % | | | (20.53 | )% | | | 6.20 | % | ** |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets - End of Period (Thousands) | $ | 127,693 | | | $ | 76,419 | | | $ | 24,635 | | |

| Ratio of Expenses to Average Net Assets | | 1.93 | % | | | 1.95 | % | | | 1.99 | % | *** |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | 0.18 | % | | | (0.30 | )% | | | (0.39 | )% | *** |

| Portfolio Turnover Rate | | 12.70 | % | | | 18.84 | % | | | 19.32 | % | ** |

* Commencement of Operations.

** Not Annualized.

*** Annualized.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to recon-

cile the change in net asset value for the period, and may not reconcile with the aggregate gains and losses in the

Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends and distributions, if any. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 23

| Advisors Capital Small/Mid Cap Fund |

| | |

| Financial Highlights | | | | | | | | | | | | |

| | |

| Selected data for a share outstanding throughout the period: | | 10/1/2022 | | | | 10/1/2021 | | | | 3/19/2021* | | |

| | | to | | | | to | | | | to | | |

| | | 9/30/2023 | | | | 9/30/2022 | | | | 9/30/2021 | | |

| Net Asset Value - Beginning of Period | $ | 7.40 | | | $ | 10.48 | | | $ | 10.00 | | |

| Net Investment Loss (a) | | (0.08 | ) | | | (0.10 | ) | | | (0.08 | ) | |

| Net Gain (Loss) on Investments (Realized and Unrealized) (b) | | 1.24 | | | | (2.98 | ) | | | 0.56 | | |

| Total from Investment Operations | | 1.16 | | | | (3.08 | ) | | | 0.48 | | |

| Distributions (From Net Investment Income) | | - | | | | - | | | | - | | |

| Distributions (From Capital Gains) | | - | | | | - | | | | - | | |

| Total Distributions | | - | | | | - | | | | - | | |

| Net Asset Value - End of Period | $ | 8.56 | | | $ | 7.40 | | | $ | 10.48 | | |

| Total Return (c) | | 15.68 | % | | | (29.39 | )% | | | 4.80 | % | ** |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets - End of Period (Thousands) | $ | 49,539 | | | $ | 39,652 | | | $ | 13,485 | | |

| Ratio of Expenses to Average Net Assets | | 1.93 | % | | | 1.95 | % | | | 1.99 | % | *** |

| Ratio of Net Investment Loss to Average Net Assets | | (0.98 | )% | | | (1.11 | )% | | | (1.32 | )% | *** |

| Portfolio Turnover Rate | | 14.64 | % | | | 14.66 | % | | | 13.22 | % | ** |

* Commencement of Operations.

** Not Annualized.

*** Annualized.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to recon-

cile the change in net asset value for the period, and may not reconcile with the aggregate gains and losses in the

Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends and distributions, if any. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 24

| Advisors Capital Tactical Fixed Income Fund |

| | |

| Financial Highlights | | | | | | | | | | | | |

| | |

| Selected data for a share outstanding throughout the period: | | 10/1/2022 | | | | 10/1/2021 | | | | 3/19/2021* | | |

| | | to | | | | to | | | | to | | |

| | | 9/30/2023 | | | | 9/30/2022 | | | | 9/30/2021 | | |

| Net Asset Value - Beginning of Period | $ | 8.86 | | | $ | 10.16 | | | $ | 10.00 | | |

| Net Investment Income (a) (e) | | 0.21 | | | | 0.15 | | | | 0.03 | | |

| Net Gain (Loss) on Investments (Realized and Unrealized) (b) | | 0.06 | | | | (1.41 | ) | | | 0.13 | | |

| Total from Investment Operations | | 0.27 | | | | (1.26 | ) | | | 0.16 | | |

| Distributions (From Net Investment Income) | | (0.10 | ) | | | - | | | | - | | |

| Distributions (From Capital Gains) | | - | | | | (0.04 | ) | | | - | | |

| Total Distributions | | (0.10 | ) | | | (0.04 | ) | | | - | | |

| Net Asset Value - End of Period | $ | 9.03 | | | $ | 8.86 | | | $ | 10.16 | | |

| Total Return (c) | | 3.05 | % | | | (12.41 | )% | | | 1.60 | % | ** |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets - End of Period (Thousands) | $ | 68,290 | | | $ | 40,773 | | | $ | 10,406 | | |

| Ratio of Expenses to Average Net Assets (d) | | 1.93 | % | | | 1.95 | % | | | 1.99 | % | *** |

| Ratio of Net Investment Income to Average Net Assets (d) (e) | | 2.27 | % | | | 1.60 | % | | | 0.54 | % | *** |

| Portfolio Turnover Rate | | 56.70 | % | | | 80.56 | % | | | 0.00 | % | ** |

* Commencement of Operations.

** Not Annualized.

*** Annualized.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to recon-

cile the change in net asset value for the period, and may not reconcile with the aggregate gains and losses in the

Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends and distributions, if any.

(d) These ratios exclude the impact of expenses of the underlying investment security holdings listed in the

Schedule of Investments.

(e) Recognition of the net investment income by the Fund is affected by the timing of the declaration of dividends

by the underlying investment security holdings listed on the Schedule of Investments. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 25

| Advisors Capital Active All Cap Fund |

| | |

| Financial Highlights | | | | |

| | |

| Selected data for a share outstanding throughout the period: | | 11/9/2022* | | |

| | | to | | |

| | | 9/30/2023 | | |

| Net Asset Value - Beginning of Period | $ | 10.00 | | |

| Net Investment Income (a) (e) | | 0.02 | | |

| Net Gain on Investments (Realized and Unrealized) (b) | | 0.42 | | |

| Total from Investment Operations | | 0.44 | | |

| Distributions (From Net Investment Income) | | (0.02 | ) | |

| Distributions (From Capital Gains) | | - | | |

| Total Distributions | | (0.02 | ) | |

| Net Asset Value - End of Period | $ | 10.42 | | |

| Total Return (c) | | 4.22 | % | ** (f) |

| Ratios/Supplemental Data | | | | |

| Net Assets - End of Period (Thousands) | $ | 34,409 | | |

| Ratio of Expenses to Average Net Assets (d) | | 1.92 | % | *** |

| Ratio of Net Investment Income to Average Net Assets (d) (e) | | 0.25 | % | *** |

| Portfolio Turnover Rate | | 7.84 | % | ** |

* Commencement of Operations.

** Not Annualized.

*** Annualized.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to recon-

cile the change in net asset value for the period, and may not reconcile with the aggregate gains and losses in the

Statement of Operations due to share transactions for the period.

(c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund

assuming reinvestment of dividends and distributions, if any.

(d) These ratios exclude the impact of expenses of the underlying investment security holdings listed in the

Schedule of Investments.

(e) Recognition of the net investment income by the Fund is affected by the timing of the declaration of dividends

by the underlying investment security holdings listed on the Schedule of Investments.

(f) Total return was determined beginning from the Commencement of Investment Operations, December 1, 2022. |

The accompanying notes are an integral part of these

financial statements. |

2023 Annual Report 26

NOTES TO FINANCIAL STATEMENTS

ADVISORS CAPITAL FUNDS

SEPTEMBER 30, 2023 |

1.) ORGANIZATION

The Advisors Capital Funds (each a “Fund” and collectively the “Funds”) are series of Neiman Funds (the “Trust”). The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated January 3, 2003, that offers shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. Advisors Capital US Dividend Fund (“US Dividend Fund”), Advisors Capital Small/Mid Cap Fund (“Small/Mid Cap Fund”), and Advisors Capital Tactical Fixed Income Fund (“Tactical Fixed Income Fund”) were each organized as diversified series of the Trust, on February 1, 2021, and commenced operations on March 19, 2021. The Advisors Capital Active All Cap Fund (“Active All Cap Fund”) was organized as a diversified series of the Trust, on November 9, 2022, commenced operations on November 9, 2022, and investment operations commenced on December 1, 2022. The investment advisor to the Funds is AC Funds, LLC (the “Advisor”). The sub-advisor to the Funds is Advisors Capital Management, LLC (the “Sub-Advisor”). The investment objective of US Dividend Fund, Small/Mid Cap Fund, and Active All Cap Fund is to seek long-term capital appreciation. The investment objective of Tactical Fixed Income Fund is total return with capital preservation as a secondary objective.

2.) SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Funds follow the significant accounting policies described in this section.

SECURITY VALUATION

All investments in securities are recorded at their estimated fair value, as described in Note 3.

FEDERAL INCOME TAXES

The Funds’ policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of their taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Funds’ policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Funds’ policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Funds recognize the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Funds’ tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Funds identify their major tax jurisdictions as U.S. Federal and State tax authorities; however the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. During the Period Ended September 30, 2023*, the Funds did not incur any interest or penalties.

DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividends paid deduction. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset values per share of any Fund.

USE OF ESTIMATES

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OTHER

The Funds record security transactions based on a trade date. Dividend income is recognized on the ex-dividend date, and interest income, if any, is recognized on an accrual basis. The Funds use the specific identification method in computing gain or loss on the sale of investment securities. Long-term capital gain distributions received are recorded as capital gain distributions from investment companies, and short-term capital

* Throughout the Notes to the Financial Statements, the "Period Ended September

30, 2023" represents the fiscal year ended September 30, 2023 for the US

Dividend Fund, Small/Mid Cap Fund, and Tactical Fixed Income Fund, and the peri-

od from November 9, 2022 (Commencement of Operations) through September

30, 2023 for the Active All Cap Fund. |

2023 Annual Report 27

Notes to Financial Statements - continued

gain distributions received are recorded as dividend income. The Funds may invest in real estate investment trusts (“REITs”) that pay distributions to their shareholders based on available funds from operations. It is common for these distributions to exceed the REITs’ taxable earnings and profits resulting in the excess portion of such distribution to be designated as return of capital. Distributions received from REITs are generally recorded as dividend income and, if necessary, are reclassified annually in accordance with tax information provided by the underlying REITs.

EXPENSES

Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual Fund based on each Fund’s relative net assets or by another appropriate method.

ORGANIZATIONAL & OFFERING EXPENSES

All costs incurred by the Active All Cap Fund in connection with the organization, offering and initial registration of the Fund, principally professional fees, were paid on behalf of the Fund by the Advisor and will not be borne by the Fund and are not recoupable in the future.

3.) SECURITIES VALUATIONS

The Funds utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Funds’ major categories of assets measured at fair value on a recurring basis follows.

Equity securities (common stocks, including ADRs, ETFs and REITs). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when a Fund believes such prices accurately reflect the fair value of such securities. Securities that are traded on an exchange or on the NASDAQ over-the-counter market are generally valued at the last quoted sale price. Lacking a last sale price an equity security is generally valued at the last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security, and if an equity security is valued by the pricing service at its last bid, it is generally categorized as a level 2 security. If market prices are not available or, in the opinion of Fund management including as informed by the Adviser's opinion, market prices do not reflect fair value, or if an event occurs after the close of trading (but prior to the time the NAV is calculated) that materially affects fair value, the Fund through the Adviser may value the Fund's assets at their fair value according to policies approved by the Fund's Board of Trustees (the “Trustees” or the “Board”). Such securities are categorized in level 2 or level 3, when appropriate.

Money market funds. Money market funds are valued at net asset value provided by the funds and are classified in level 1 of the fair value hierarchy.

The following tables summarize the inputs used to value each Fund’s assets measured at fair value as of September 30, 2023:

| US Dividend Fund: | | | | | | |

| Valuation Inputs of Assets | | Level 1 | Level 2 | Level 3 | | Total |

| Common Stocks | | $120,999,740 | $ - | $ - | | $120,999,740 |

| Real Estate Investment Trusts | | 2,367,631 | - | - | | 2,367,631 |

| Money Market Funds | | 4,578,774 | - | - | | 4,578,774 |

| Total | | $127,946,145 | $ - | $ - | | $127,946,145 |

2023 Annual Report 28

| Notes to Financial Statements - continued | | | | |

| |

| Small/Mid Cap Fund: | | | | | | |

| Valuation Inputs of Assets | | Level 1 | Level 2 | Level 3 | | Total |

| Common Stocks | | $48,401,942 | $ - | $ - | | $48,401,942 |

| Money Market Funds | | 1,255,884 | - | - | | 1,255,884 |

| Total | | $49,657,826 | $ - | $ - | | $49,657,826 |

| |

| Tactical Fixed Income Fund: | | | | | | |

| Valuation Inputs of Assets | | Level 1 | Level 2 | Level 3 | | Total |

| Exchange Traded Funds | | $67,291,827 | $ - | $ - | | $67,291,827 |

| Money Market Funds | | 1,142,784 | - | - | | 1,142,784 |

| Total | | $68,434,611 | $ - | $ - | | $68,434,611 |

| |

| Active All Cap Fund: | | | | | | |

| Valuation Inputs of Assets | | Level 1 | Level 2 | Level 3 | | Total |

| Exchange Traded Funds | | $33,250,560 | $ - | $ - | | $33,250,560 |

| Money Market Funds | | 1,147,986 | - | - | | 1,147,986 |

| Total | | $34,398,546 | $ - | $ - | | $34,398,546 |

The Funds did not hold any level 3 assets during the Period Ended September 30, 2023. The Funds did not invest in derivative instruments during Period Ended September 30, 2023.

4.) INVESTMENT ADVISORY AGREEMENT