UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

|

| FORE HOLDINGS L.L.C. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| | (3) Per | unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on |

| | which | the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

[Message from David Hunt]

The purpose of this note and the attached proxy materials is to request your approval of an amendment to the FORE Holdings Operating Agreement that will allow the Executive Committee of FORE to dissolve the LLC. Because we are an SEC reporting company, there is necessarily some information to be shared and formalities to be observed with any vote of owners, and that is the purpose of the attached materials. If you would like the proxy materials sent to you in hardcopy, please contact Barb Checkon in Lincolnshire by reply to this note or at 847-771-6870.

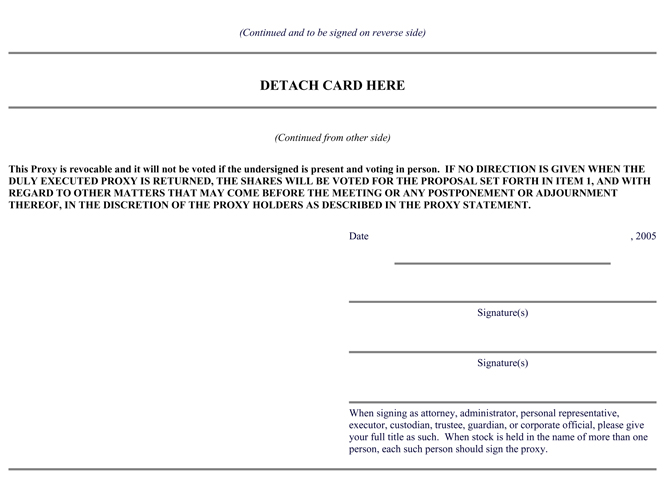

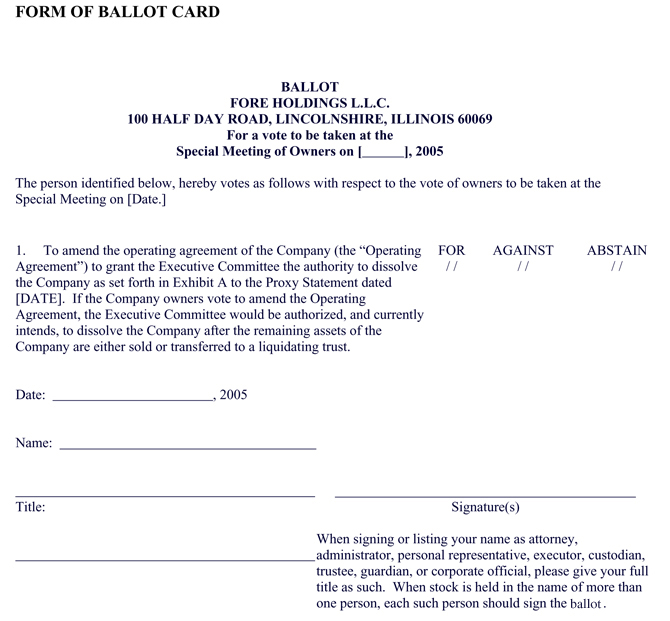

What we need you to do: Complete the attached proxy card and return it via e-mail (with an electronic signature) or by mail. You may also vote by email by returning the attached ballot to the proxy statement.

The Executive Committee of FORE Holdings intends to dissolve the LLC only after having transferred its remaining assets and liabilities to a liquidating trust. The assets of the trust are expected to be distributed to owners once contingent or actual liabilities of the trust are satisfied, likely about one year from now. In addition to explaining why we are asking for your approval to amend the Operating Agreement, it also seems that this is an appropriate time to summarize why we have existed and what has been accomplished in the last 3 years or so.

Why are we asking you for a vote to amend the Operating Agreement?

When we drafted the Agreement at the time of the IPO, we made broad provision for the Executive Committee to act on most matters. However, we did not expressly provide for the Committee to be able to dissolve the firm. Thus we need to amend the Agreement now to enable us to do so at the appropriate time, which is highly likely to be on or before September 30, 2005. Unlike voting in the past, when we were a private organization, with each owner having one vote, the current Agreement provides owners with a vote in proportion to their interest in the firm. This interest is measured by your Tranche 2 real estate percentage. Both active (at the time of the IPO) and retired (prior to the IPO) owners are included in this vote.

Why are we here?

As a part of the planning process for the IPO of Hewitt Associates, it was determined that FORE Holdings should continue to exist after the IPO, in order to continue to own the various parcels of real estate we held at that time. (The original name of the firm, Hewitt Holdings, was changed to FORE Holdings subsequent to the IPO, in order to avoid any confusion with the name of the public company -- Hewitt Associates, Inc.) We were advised to consider keeping the real estate separate in part because it was felt that additional assets on the balance sheet of the about-to-be public company of Hewitt Associates would be unlikely to materially increase the value of the stock. Since we held significant equity in our real estate parcels, we decided to retain those assets in Fore Holdings and to sell them off as soon as reasonable after the IPO, in order to maximize the combined value to our owners of the stock and the real estate.

FORE Holdings was charged in the IPO process with initially holding the owners’ shares in Hewitt Associates, with administering the various restrictions on sale of those shares, with administering any secondary or other organized offerings for owners’ shares prior to the lapse of

sales restrictions, and with the responsibility for administering the requirements that departing owners might have to redeem a portion of their shares at book value rather than market value, if the owner were to terminate prior to 4 years after the IPO and prior to eligibility for full early retirement. These requirements have resulted in some shares being reallocated to remaining owners as a result of other owners’ terminations, There will be one final allocation as of June 27, 2006, when the book-to-market adjustment will be fully phased-in so that all shares will be available to owners at full market value from that time forward. FORE was also charged with the liquidation of the real estate assets and distribution of those proceeds.

What has been accomplished since the IPO?

The Hewitt Associates stock was distributed to owners of Fore Holdings in 2003. A secondary offering and two Rule 144 sales were held in 2003 and 2004 to allow owners liquidity opportunities while sales restrictions remained. In addition, there was a gradual release of sales restrictions on the shares beginning in the fall of 2004 and ending in June, 2005. As of June 27, 2005, there are no longer any restrictions imposed by the IPO process on the sale of Hewitt shares. (There are still mandatory “hold” requirements for active owners under the terms of their stock option agreements.) The remaining book to market phase-in of goodwill shares is in its last year, and should require only minimal administrative effort. That effort can be undertaken by a smaller committee (Dave Hunt, Maryann Laketek and Gerry Wilson) which will oversee this last year.

Our timing on sales of real estate was to be guided by when we might receive good value for those assets. We did not expect to be able to liquidate several of the parcels in a short time frame because of the long term leases to Hewitt Associates, the general need for a good real estate market in multiple locations around the country so that we could find buyers willing to pay an acceptable price, and the prepayment penalties we faced on early retirement of the debt on those parcels. However, in 2005, market conditions were in fact such that we were able to sell our property in Orlando and The Woodlands, as well as the East Campus and the 4OP complex in Lincolnshire for prices we considered favorable, even in the face of the prepayment penalties we incurred when the debt was paid off. In July, 2005, we were also able to sell our last significant real estate asset, our interest in Overlook Associates.

We still retain a small piece of land (about 5 acres) with a residence on it adjacent to the East Campus. We expect to be able to sell that shortly, at which time we will own no real estate at all, and simply have a sizable amount of cash.

As was mentioned in communication with owners about the Overlook sale, we do have, in the sales agreements mentioned above, certain contingent liabilities for the representations we made to the buyers about the properties and our ownership of them. Those liabilities are capped at a total of $12,500,000 and expire one year after the sales closed. We believe that there should be no liability to FORE as a result of these representations, but we can not be certain of that. As a result, we believe it to be prudent to retain cash in that amount until the period of claims against us is ended, after which we will distribute any remaining cash, as discussed later in this material.

At this time, we have made post-IPO cash distributions to owners totaling $136MM. And we hope to be able to distribute the additional $12.5MM being retained due to the contingent liabilities, though there can be no assurance that some or all of those funds will not be needed to satisfy claims made by the buyers. These cash distributions took place on April 2, 2003 ($6MM), May 9, 2003 ($16MM), December 2, 2004 ($4MM), June 8, 2005 ($60MM) and August 25, 2005 ($50MM).

As many of you will recall, in the IPO process we also reserved shares to be allocated in proportion to active (at the time of the IPO) owners’ real estate accounts. These shares, with an imputed value at the time of the IPO of $30MM ($2MM of which went to non-US owners) were so allocated to reflect that certain long-term leases of space to Hewitt Associates may have been at rental rates somewhat below market value, thus depressing the value of the real estate held by FORE and arguably raising the value of the stock. In the aggregate, owners have received cash of $136MM in addition to “real estate” stock valued at $30MM received at the time of the IPO.

Those owners who had retired prior to the IPO received cash for their unpaid deferred compensation related to real estate. These retirees were also provided with a contingent interest in any proceeds from the sales of real estate once active owners had received a payout of 150% of the amount of their deferred compensation related to real estate. The total amount needed to provide active owners with the 150% payout was approximately $90MM. This amount excludes owners outside the United States, whose values were commuted in 2002 in a special payout to avoid some very difficult tax and valuation situations they would otherwise have faced.

The sum of the stock ($28MM) received by US active owners, plus the initial payments of $6MM, $16MM and $4MM in 2003 and 2004 totaled approximately $54MM. Hence, we allocated the first $36MM from the May sale of the assets other than Overlook to active owners. Having thus paid them the $90MM required to reach the 150% level (which we sometimes referred to as Tranche 1 funds), we then allocated the remaining $24MM from that sale to all active and retired owners. This allocation has been in proportion to the combined interests of active and retired owners, which allocation proportions have often been called Tranche 2 allocations. The $50MM realized so far from the sale of our interest in Overlook was similarly allocated in accordance with Tranche 2, as will be any remaining funds from the liquidating trust.

In summary, retired and active owners received “150%” of their real estate account in one form or another. For retired owners, this came in the form of monthly payments after retirement and a prepayment of any remaining amount just before the IPO. For active owners, it came partially in stock at the time of the IPO and in cash as it has become available from the sale of real estate subsequent to the IPO. In addition, all retired and active owners have shared in Tranche 2 distributions of $24MM in June, 2005, $50MM in August, 2005, and will share in whatever we able to distribute of the approximately $12.5MM which is being retained until the sale contingencies have expired.

Why are we proposing to dissolve FORE Holdings now and create a liquidating trust?

The driving forces here are taxes and expense. We believe that as a liquidating trust we may be able to avoid considerable expense related to public reporting company requirements and to compliance with the Sarbanes-Oxley legislation. And we also can accelerate recognition of capital losses for tax purposes for most owners into 2005.

The liquidating trust will hold all the remaining cash of FORE Holdings (approximately $12.5MM, with a modest additional amount for expenses.) The trustees of the trust will be the current Executive Committee members.

What are the tax implications of FORE Holdings’ dissolution?

The tax discussion that follows is general, and should not be relied upon as tax advice. Owners are strongly encouraged to read the proxy material tax descriptions and to discuss their individual situations with their own tax advisors. However, we believe that a general discussion will be helpful in understanding the overall situation. Please review the section of the proxy statement entitled “Material Federal Income Tax Consequences of the Dissolution” for this discussion.

Again, a reminder - you should review this information with your tax advisor to see how it impacts you in your personal circumstances. The foregoing discussion is necessarily generic and not tax advice to any of you as individuals.

We need all owners to vote, so please give this your immediate attention.

FORE HOLDINGS L.L.C.

100 Half Day Road

Lincolnshire, Illinois 60069

(847) 295-5000

NOTICE OF SPECIAL MEETING OF OWNERS

To Be Held On [ ], 2005

NOTICE IS HEREBY GIVEN that a special meeting of the owners of FORE Holdings L.L.C., an Illinois limited liability company, will be held on [ ], 2005 at [ ] [a.m.] local time, at [location/address] for the following purposes:

| | 1. | to consider and vote upon a proposal to amend the Operating Agreement to grant the Executive Committee the authority to dissolve the Company; |

| | 2. | to transact such other business as may properly come before the meeting. |

The amendment and related items are fully discussed in the following pages, which are made part of this notice. The Executive Committee does not know of or expect any other business to be transacted at the special meeting. The Executive Committee has fixed the close of business on August 15, 2005 as the record date for determining owners entitled to notice of, and to vote at, the special meeting and any adjournment or postponement of the special meeting. A list of owners entitled to vote will be available for inspection at the [location/address], for the ten-day period immediately preceding the special meeting.

Whether or not you plan to attend the special meeting, you should complete, sign and date the accompanying proxy card and return it promptly [by fax to [fax #]] or [in the enclosed postage-paid return envelope]. Instructions are included with the proxy card. If you attend the special meeting, you may vote in person if you wish, even if you previously have returned your proxy card. You may revoke your proxy at any time prior to its exercise. If you cannot attend the metting, you may also submit your vote by email instead of sending in a proxy card. A paper version of this proxy statement and the proxy card is available upon request. Please call [NAME] at [NUMBER] to obtain a paper copy of this proxy statement and proxy card.

|

| BY ORDER OF THE EXECUTIVE COMMITTEE |

|

| David L. Hunt |

| Chairman |

Lincolnshire, Illinois

[ ], 2005

TABLE OF CONTENTS

-i-

QUESTIONS AND ANSWERS ABOUT THE PROPOSAL AND RELATED MATERIALS

| Q: | WHAT AM I BEING ASKED TO VOTE UPON? |

| A: | At the special meeting, we will ask you to vote on a proposal to amend our Operating Agreement to grant the Executive Committee the authority to take all actions necessary and advisable to dissolve the Company. The complete text of the amendment is set forth as Exhibit A to this proxy statement. |

| Q: | WHAT HAPPENS IF I DO NOT VOTE TO AMEND THE OPERATING AGREEMENT? |

| A: | If you do not vote, it will have the same effect as a voteagainstthe amendment to the Operating Agreement. |

| Q: | WHY IS THIS PROPOSAL TO AMEND THE OPERATING AGREEMENT BEING MADE? |

| A: | The Executive Committee is seeking your vote to amend the Operating Agreement so that it may dissolve the Company when it deems appropriate to do so. The Executive Committee has been selling the Company’s real estate assets since the initial public offering of Hewitt Associates, Inc. and has been distributing the proceeds to the holders of limited liability company interests in the Company, which includes former owners of the Company (“owners”). Substantially all of the Company’s real estate assets have now been sold. Once all of the Company’s remaining assets are sold or transferred to a liquidating trust and adequate provision is made to satisfy contingent claims, the Executive Committee would like the authority and intends to dissolve the Company and terminate its legal existence. |

| Q: | WHAT WILL HAPPEN IF OWNERS APPROVE THE AMENDMENT TO THE OPERATING AGREEMENT? |

| A: | If the amendment to the Operating Agreement is approved, the Executive Committee would be authorized, and currently intends, to dissolve the Company after the remaining assets of the Company are either sold or transferred to the liquidating trust which is described in greater detail below. At this point in time, the only remaining assets of the Company are an approximately five acre parcel of real estate with a residence located on Route 22 in Lincolnshire, Illinois and approximately $14 million in cash which constitutes the previously undistributed proceeds from the sale of the Company’s real estate assets. The Company is actively seeking a buyer for the residential property. The Executive Committee expects to retain the cash to pay expenses and to satisfy any contingent liabilities and then to distribute the remaining amounts to owners pursuant to the liquidating trust in accordance with the Operating Agreement. |

| Q: | WHAT WILL HAPPEN IF OWNERS DO NOT APPROVE THE AMENDMENT TO THE OPERATING AGREEMENT? |

| A: | If owners do not approve the amendment to the Operating Agreement, the Executive Committee will nonetheless proceed with the transfer of assets to the liquidating trust and distribute the beneficial interests in the liquidating trust to owners as described in this proxy statement pursuant to the authority which the Executive Committee currently has under the Operating Agreement. Without the amendment to the Operating Agreement, the Company would continue its legal existence since the Executive Committee would not have the authority to file Articles of Dissolution with the Illinois Secretary of State. As a result, the Company would continue to be subject to all of the regulatory requirements to which it is currently subject, including obligations under the Securities Exchange Act of 1934 (the “Exchange Act”) and the Sarbanes-Oxley Act. Compliance with these regulatory requirements has resulted in significant costs to the Company in the past. Future costs would ultimately reduce the amounts available for distribution to the owners. |

| Q: | DO YOU HAVE AGREEMENTS TO SELL THE COMPANY’S REMAINING ASSETS? |

| A: | As of the date of this proxy statement, we have sold all of the Company’s real estate assets other than the residential property in Lincolnshire, Illinois. We are actively seeking a buyer for the residential property. |

| Q: | WHAT IS A LIQUIDATING TRUST? |

| A: | A liquidating trust is a trust organized for the primary purpose of liquidating and distributing the assets transferred to it. We currently intend to form a liquidating trust and transfer our remaining assets to the liquidating trust prior to September 30, 2005. If we form a liquidating trust, we will distribute to the owners beneficial interests in the liquidating trust. These interests will generally not be transferable by you. We currently anticipate that the trustees of the liquidating trust will be the members of the Executive Committee |

| Q: | WHAT WILL OWNERS RECEIVE IN THE LIQUIDATION? |

| A: | We currently estimate that the aggregate amount available for distribution to owners, whether upon dissolution of the Company or from the liquidating trust, will be approximately $13 million. We expect to make these distributions in one or more payments. |

However, the amount that we expect to distribute to owners in the liquidation also depends upon the amount of our liabilities and expenses and the amount we receive in the liquidation of our remaining real estate asset. If our liabilities and expenses are greater than we currently expect and/or if the sales price of our remaining real estate asset is less than we expect, the amount that is available for distribution to owners will be less than we expect. For a discussion of these and other risks which may adversely impact the timing and amount of your distributions, you should review “Risk Factors.”

| Q: | WHEN WILL I RECEIVE MY DISTRIBUTION? |

| A: | We expect to make a final distribution to the owners after we sell our remaining real estate asset, pay all of our known liabilities and provide for unknown liabilities. We expect this distribution to occur approximately one year after we sell our remaining real estate asset. |

The actual amount and time of the distribution will be determined by the trustees of the liquidating trust in their discretion.

| Q: | WHAT WILL HAPPEN TO MY INTERESTS? |

| A: | If the owners vote to amend the Operating Agreement and our Executive Committee decides to dissolve the Company, all limited liability company interests will be cancelled at the time we file Articles of Dissolution with the Illinois Secretary of State. |

| Q: | WHAT ARE THE TAX CONSEQUENCES OF THE LIQUIDATION? |

| A: | In general, you will recognize your share of the gain or loss triggered upon the sale of our assets, as allocated to you under the Operating Agreement. When the Company liquidates by distributing cash and beneficial interests in the liquidating trust, for federal income tax purposes you will be treated as receiving your share of the assets held by the liquidating trust. If the Company has disposed of the five acre parcel at the time of the liquidation, the following will apply. You will recognize gain to the extent that the cash distributed (including your share of the cash held in the liquidating trust) exceeds the federal income tax basis of your limited liability company interests. You will recognize loss to the extent that the cash distributed (including your share of cash held in the liquidating trust) is less than the federal income tax basis of your limited liability company interests. |

If the Company has not disposed of the five acre parcel at the time of the liquidation and establishment of the liquidating trust, you will report gain as described above related to the cash distributed, but you will not report any gain related to the five acre parcel nor will you recognize any loss related to the disposition of your limited liability company interests on the liquidation. Rather, the final measurement of gain or loss will not occur until the five acre parcel is sold. And, following the liquidation, you will be required to report any items of income, deduction or credit attributable to the assets held by the liquidating trust on your personal income tax return as though you owned such assets directly regardless of whether the liquidating trust makes any distributions to you. A summary of the possible tax consequences to you begins on page [ ] of this proxy statement. You should consult your tax advisor as to the tax effect of your particular circumstances.

2

| Q: | WHAT IS THE RECOMMENDATION OF THE EXECUTIVE COMMITTEE WITH RESPECT TO THE PROPOSAL? |

| A: | The Executive Committee unanimously determined that approval of the amendment to the Operating Agreement is advisable. Accordingly, the Executive Committee unanimously recommends that you vote FOR the amendment to the Operating Agreement to grant the Executive Committee the authority to dissolve the Company. |

| Q: | WHAT VOTE OF OWNERS IS REQUIRED TO APPROVE THE PROPOSAL? |

| A: | The affirmative vote of seventy-five percent (75%) of all the votes entitled to be cast by the owners of limited liability company interests, which includes former owners, is required to approve the amendment to the Operating Agreement. |

| Q: | WHAT DO I NEED TO DO NOW? |

| A: | You should complete, date and sign your proxy card and return it promptly by fax to [fax #]] or mail it in the enclosed postage-paid return envelope, as soon as possible so that your interests will be represented at the special meeting, even if you plan to attend the special meeting in person. If you cannot attend the meeting, you may also submit your vote by email instead of faxing or mailing in a proxy card. |

| Q: | MAY I CHANGE MY VOTE AFTER I HAVE MAILED MY SIGNED PROXY CARD OR EMAILED MY BALLOT CARD? |

| A: | Yes. You can change your vote by sending in a later dated, signed proxy card or ballot card or a written revocation before the special meeting or by attending the special meeting and voting in person. Your attendance at the special meeting will not, by itself, revoke your proxy or ballot card. |

| Q: | WHAT HAPPENS IF I DO NOT GIVE MY PROXY OR IF I ABSTAIN FROM VOTING? |

| A: | If you do not give your proxy or if you abstain from voting, it will have the same effect as a voteagainstthe proposal to amend the Operating Agreement. |

| Q: | DO I HAVE APPRAISAL RIGHTS? |

| A: | No. Under the Illinois Limited Liability Company Act, you are not entitled to any dissenters’ or appraisal rights in connection with the amendment to the Operating Agreement or a subsequent dissolution of the Company. |

| Q: | WHO CAN HELP ANSWER MY QUESTIONS? |

| A: | If you have additional questions about this proposal, or would like additional copies of the proxy statement, you should contact [contact person, phone]. |

3

SUMMARY TERM SHEET

This summary highlights selected information from this proxy statement and may not contain all of the information that is important to you. For additional information concerning this proposal to amend our Operating Agreement, you should read carefully this entire proxy statement, including the exhibit, and the other documents referred to in this proxy statement. The text of the amendment to the Operating Agreement is included in this proxy statement as Exhibit A. The following summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information appearing elsewhere in this proxy statement.

Background

The Company was founded in 1940 and operated as a general partnership until 1994 when it converted to a limited liability company structure. In 1994, the Company formed Hewitt Associates LLC as a wholly-owned subsidiary of the Company and transferred its operating business to Hewitt Associates LLC. The real estate assets owned by the Company were not contributed to Hewitt Associates LLC but were retained by the Company. The Company held some real estate assets directly and others through separate real estate entities which, in turn, leased the properties to Hewitt Associates LLC. Investments in the real estate entities were historically funded through capital contributions from owners and third party debt.

Hewitt Associates LLC is a global provider of human resources outsourcing and consulting services. In 2002, the Company decided to take Hewitt Associates LLC public and formed Hewitt Associates, Inc. as a Delaware corporation to serve as the vehicle for its public offering. In May, 2002, the Company transferred all of its ownership interests in Hewitt Associates LLC to Hewitt Associates, Inc. in exchange for shares of Hewitt Associates, Inc.’s Class B common stock. Hewitt Associates, Inc. completed the initial public offering of its Class A common stock in June 2002. The Company held the shares of Class B common stock which were issued to it at the time of the initial public offering until July 2003, when the Company distributed these shares to its owners, with the exception of shares held on behalf of certain owners who reside outside the United States. All of the shares held on behalf of foreign owners have now been distributed to those owners and the Company no longer holds any shares of Hewitt Associates, Inc.’s stock.

Following the initial public offering, the Company’s primary assets consisted of commercial real estate that was owned directly or through subsidiary entities. The sole business of the Company has been to own, finance, lease and sell real estate assets which are primarily used by Hewitt Associates, Inc. in operating its business. The Company has been systematically selling its real estate assets and distributing the proceeds to its owners. All of the Company’s commercial real estate properties have now been sold.

The Executive Committee

The Company is managed by an Executive Committee which has full and complete powers of management and administration over the affairs of the Company, including the authority to sell and otherwise deal with the assets of the Company.

The Special Meeting

The special meeting will be held at [ ] a.m., local time, on [ ], 2005, at [location of special meeting].

Vote Required

The affirmative vote of seventy-five percent (75%) of all the votes entitled to be cast by the owners of limited liability company interests is required to approve the amendment to the Operating Agreement. If you do not give your proxy or if you abstain from voting, it will have the same effect as a vote against the proposal to amend the Operating Agreement.

4

Record Date for Voting

The close of business on August 15, 2005 is the record date for determining eligibility to vote at the special meeting. Each holder of limited liability company interests at that time will be entitled to vote in proportion to its relative percentage interest in the Company.

The Amendment

At the special meeting, we will ask you to approve an amendment to the Operating Agreement to grant the Executive Committee the authority to dissolve the Company. The complete text of the amendment is set forth on Exhibit A to this proxy statement. The Company, under the direction of the Executive Committee, has already sold substantially all of its real estate assets pursuant to the authority granted to the Executive Committee under the current Operating Agreement. The amendment to the Operating Agreement which you are being asked to approve is necessary to allow the Executive Committee to formally dissolve the Company. Upon receipt of the requisite owner approval, the Executive Committee anticipates it will exercise the authority granted to it pursuant to the amendment and dissolve the Company. At that time, the Executive Committee would file Articles of Dissolution with the Illinois Secretary of State. Our registration under the Exchange Act would then terminate and we would cease filing reports with the SEC.

Remaining Assets

Since the time of the initial public offering of Hewitt Associates, the Company has sold all of its commercial real estate assets. The remaining assets which the Company holds as of the date of this proxy statement are as follows:

| | • | | Five Acre Parcel with a Residence in Lincolnshire, Illinois.This parcel is located adjacent to one of Hewitt Associate Inc.’s buildings on Route 22 in Lincolnshire, Illinois although it is not currently leased. The Company has leased the parcel to various individuals as a residence from time to time. This parcel is not used in the business of Hewitt Associates. The Company is actively seeking a buyer. |

| | • | | Cash. The Company holds approximately $14 million in cash for the purpose of satisfying contingent liabilities, including liabilities in connection with the sale of its real estate assets. |

Plan of Disposition

The Executive Committee has approved a plan of disposition which provides that:

| | • | | the Executive Committee will pursue the orderly disposition of the Company’s assets pursuant to the authority granted to the Executive Committee under the Operating Agreement; |

| | • | | the Company will cease to carry on any trade or business except as may be necessary or incidental to the winding down of the Company’s affairs in accordance with the plan; |

| | • | | the Executive Committee will sell or otherwise dispose of any and all of the properties and assets of the Company that in their judgment should be sold or disposed of to wind down the business and affairs of the Company; |

| | • | | the Company will pay and discharge or make adequate provisions to pay (including by means of a liquidating trust) all debts, liabilities and obligations of the Company; |

| | • | | after paying the Company’s debts, or making reasonable provision therefore, the Company will distribute all of its remaining property and assets to a liquidating trust established for the benefit of the owners, the purpose of which will be to satisfy contingent liabilities, to conserve and protect the assets transferred to it, to realize the value attributable to such assets and to distribute the proceeds therefrom to owners; and |

5

| | • | | after the distribution of the assets of the Company pursuant to the plan and subject to the approval of the amendment to the Operating Agreement by owners, file Articles of Dissolution with the Illinois Secretary of State to dissolve the Company. |

The Executive Committee intends to take each of the actions listed above, other than filing the Articles of Dissolution with the Illinois Secretary of State, irrespective of whether owners approve the amendment to the Operating Agreement. The amendment to the Operating Agreement is only required to complete the formal dissolution of the Company.

Reasons for the Dissolution

In reaching its determination to dissolve the Company, the Executive Committee considered the following factors:

| | • | | as part of the planning process for the initial public offering of Hewitt Associates, the owners intended that the Company would remain in existence only for a limited period of time until all of its real estate assets were sold; |

| | • | | the Company has sold all of its real estate assets (other than the five acre parcel in Lincolnshire, Illinois) and distributed the proceeds to owners, the aggregate amount of such distributions totaling approximately $136 million since the time of the initial public offering of Hewitt Associates; |

| | • | | continued reporting under the Exchange Act is not necessary to protect the interests of owners since (i) the only assets of the Company consist of cash and the five acre parcel in Lincolnshire, Illinois for which the Company is actively seeking a buyer and (ii) the liquidating trust to which the Executive Committee intends to transfer the remaining assets will provide annual reports, including financial statements, to the owners of percentage interests and will provide updates of any material events; and |

| | • | | the costs and expenses associated with continuing the Company’s legal existence will ultimately reduce the amounts available for distribution to owners, particularly in light of the expenses associated with reporting under the Exchange Act and Sarbanes-Oxley compliance. |

Recommendation of the Executive Committee

The Executive Committee has unanimously determined the amendment to the Operating Agreement is in the best interests of owners and unanimously recommends that you vote FOR the amendment to the Operating Agreement which grants the Executive Committee the authority to dissolve the Company.

6

RISK FACTORS

In addition to general risks and the other information contained in this proxy statement, you should carefully consider the following important factors in evaluating the proposal to be voted on at the special meeting.

We currently estimate that the aggregate amount available for distribution to owners, whether upon dissolution of the Company or from the liquidating trust, will be approximately $13 million. We anticipate this amount will be paid approximately twelve months after we sell our remaining real estate asset. However, our expectations about the amount of liquidating distributions we will make and when we will make them are based on many estimates and assumptions, one or more of which may prove to be incorrect. As a result, the actual amount of liquidating distributions we pay to you may be more or less than we predict in this proxy statement. In addition, the liquidating distributions may be paid later than we predict. Factors that could cause actual payments to be later or lower than we expect include, among others, the following:

If we are unable to find a buyer for our remaining real estate asset at our expected sales prices, our liquidating distributions may be delayed or reduced.

Our parcel of residential real estate in Lincolnshire, Illinois (the “Parcel”) is not currently subject to a sale agreement. In calculating our estimated liquidating distributions, we assumed that we will be able to find a buyer for the Parcel at an amount based on our estimate of its fair market value. However, we may have overestimated the sales price that we will ultimately be able to obtain for the Parcel. For example, in order to find a buyer in a timely manner, we may be required to lower our asking price below our estimate of the Parcel’s fair value. If we are not able to find a buyer for the Parcel in a timely manner or if we have overestimated the sales price we will receive, our liquidating payments to the owners may be delayed or reduced. In addition, unknown liabilities, if any, at our Parcel could adversely impact the sales price of this asset.

Potential purchasers of the Parcel may try to take advantage of our liquidation process and offer less-than-optimal prices for the Parcel. We intend to seek and obtain the highest sales price reasonably available for the Parcel, and believe that we can out-wait bargain-hunters; however, we cannot predict how changes in local real estate markets or in the national economy may affect the price that we can obtain in the liquidation process. Therefore, there can be no assurance that the announcement of our intention to dissolve will not hinder the Executive Committee’s ability to obtain the best price possible in the liquidation of our remaining real estate asset.

We do not know the exact amount or timing of liquidation distributions.

We cannot assure you of the precise nature and amount of any distribution to the owners following our dissolution. The timing of our distributions will also be affected, in part, by our ability to sell the Parcel in a timely and orderly manner.

The methods used by our Executive Committee in estimating the value of our remaining real estate asset and our liabilities are based on estimates and may not approximate values actually realized or the actual costs incurred. The Executive Committee’s assessment assumes that the estimates of our assets, liabilities and operating costs are accurate, but those estimates are subject to numerous uncertainties beyond our control, including any new contingent liabilities that may materialize and other matters discussed below. Because of this, the actual net proceeds distributed to owners in liquidation may be significantly less than the estimated amounts.

We currently estimate that approximately $13 million will be available for distribution to owners. The actual amount available for distribution could be substantially less or could be delayed, depending on a number of other factors including (i) unknown liabilities or claims, including potential claims by purchasers of our real estate assets, (ii) unexpected or greater than expected expenses, and (iii) less than anticipated net proceeds from the sale of our remaining real estate asset.

We are currently unable to predict the precise timing of any distributions to owners. The timing of any distribution will depend upon and could be delayed by, among other things, the timing of the sale of the Parcel. Additionally, a creditor could seek an injunction against our making distributions to the owners on the ground that the amounts to be distributed were needed for the payment of the liabilities and expenses. Any action of this type could delay or substantially diminish the amount, if any, available for distribution to our owners.

7

Our owners could vote against amending the Operating Agreement.

Our owners could vote against amending the Operating Agreement. If our owners do not approve the amendment to the Operating Agreement, we would not be able to dissolve the Company. As a result, the Company would remain in existence and would continue to be subject to all of the regulatory requirements to which it is currently subject, including oblations under the Exchange Act and the Sarbanes-Oxley Act. These obligations have resulted in significant costs to the Company in the past. Future costs would reduce the amounts ultimately available for distribution to owners.

If we are unable to satisfy all of our obligations to creditors, or if we have underestimated our future expenses, the amount of liquidation proceeds will be reduced.

We have current and future obligations to creditors. Claims, liabilities and expenses from operations (such as operating costs, taxes, legal and accounting fees and miscellaneous office expenses) will continue to be incurred through the liquidation process. As part of this process, we will attempt to satisfy any obligations with creditors remaining after the sale of our assets. These expenses will reduce the amounts ultimately available for distribution to our owners. To the extent our liabilities exceed the estimates that we have made, the amount of liquidation proceeds will be reduced.

Owners may be liable to our creditors for amounts received from us if our reserves are inadequate.

If the amendment to the Operating Agreement is authorized by owners, we intend to file Articles of Dissolution with the Illinois Secretary of State promptly after the sale of our remaining real estate asset or at such time as our Executive Committee has transferred the Company’s remaining assets, subject to its liabilities, into a liquidating trust.

Under the Illinois Limited Liability Company Act, certain obligations or liabilities imposed by law on our owners or the Executive Committee cannot be avoided by the dissolution of a company. For example, if we make distributions to our owners without making adequate provisions for payment of creditors’ claims, our owners would be liable to the creditors to the extent of the unlawful distributions. The liability of any owner is, however, limited to the amounts previously received by such owner from us (and from any liquidating trust). Accordingly, in such event, an owner could be required to return all liquidating distributions previously made to such owner and an owner could receive nothing from us in connection with the dissolution of the Company. Moreover, in the event an owner has paid taxes on amounts previously received as a liquidation distribution, a repayment of all or a portion of such amount could result in an owner incurring a net tax cost if the owner’s repayment of an amount previously distributed does not cause a commensurate reduction in taxes payable. Therefore, to the extent that we have underestimated the size of our contingent liabilities and distributions to our owners have already been made, our owners may be required to return some or all of such distributions.

Your ability to transfer limited liability company interests will be further limited after we transfer our remaining assets to a liquidating trust.

Under the Operating Agreement, you are only permitted to transfer your limited liability company interests with the consent of the Executive Committee, which consent has only been granted in limited circumstances involving transfers to estate planning vehicles. If we transfer our remaining assets to a liquidating trust, your interests in the liquidating trust will only be transferable upon your death or by operation of law.

8

Our Executive Committee may chose not to dissolve the Company even if our owners approve the amendment to the Operating Agreement.

Even if our owners vote to amend the Operating Agreement, our Executive Committee may chose not to dissolve the Company. Thus, we may decide to conduct the liquidation differently than described in this proxy statement, to the extent we are permitted to do so by Illinois law.

Our methodology of accounting could change as we pursue dissolution, which may require us to reduce the net carrying value of our assets.

We may be required to change our basis of accounting from the going-concern basis to that of the liquidation basis of accounting as we pursue dissolution of the Company.

In order for our financial statements to be in accordance with generally accepted accounting principles under the liquidation basis of accounting, all of our assets must be stated at their estimated net realizable value, and all of our liabilities must be recorded at the estimated amounts at which the liabilities are expected to be settled. Based on the most recent available information, we expect to make liquidating distributions that exceed the carrying amount of our net assets. However, we cannot assure you what the ultimate amounts of such liquidating distributions will be. Therefore, there is a risk that the liquidation basis of accounting may entail write downs of certain of our assets to values substantially less than their current respective carrying amounts, and may require that certain of our liabilities be increased or certain other liabilities be recorded to reflect the anticipated effects of an orderly liquidation.

We intend to continue to use the going-concern basis of accounting until the Executive Committee takes further steps toward dissolution of the Company. Under the going-concern basis, assets and liabilities are expected to be realized in the normal course of business. However, long-lived assets to be sold or disposed of should be reported at the lower of carrying amount or estimated fair value less costs to sell. For long-lived assets to be held and used, when a change in circumstances occurs, the Executive Committee must assess whether we can recover the carrying amounts of our long-lived assets. If the Executive Committee determines that, based on all of the available information, we cannot recover those carrying amounts, an impairment of value of our long-lived assets has occurred and the assets would be written down to their estimated fair value.

We do not expect to register as an investment company under the Investment Company Act of 1940 and therefore we will not be subject to the requirements imposed on an investment company by such Act.

We believe that we will not operate in a manner that requires us to register as an “investment company” under the Investment Company Act of 1940 (the “1940 Act”). Investment companies subject to the 1940 Act are required to comply with a variety of substantive requirements such as requirements relating to:

| | • | | limitations on the capital structure of the entity; |

| | • | | restrictions on certain investments; |

| | • | | prohibitions on transactions with affiliated entities; and |

| | • | | public reporting disclosures, record keeping, voting procedures, proxy disclosure and similar corporate governance rules and regulations. |

Many of these requirements are intended to provide benefits or protections to security holders of investment companies. Because we do not expect to be subject to these requirements, you will not be entitled to these benefits or protections.

9

If we are required to register as an investment company under the 1940 Act, the additional expenses and operational limitations associated with such registration may reduce your investment return.

We do not expect that we will operate in a manner that requires us to register as an “investment company” under the 1940 Act. However, the analysis relating to whether a company qualifies as an investment company can involve technical and complex rules and regulations. If we own assets that qualify as “investment securities” as such term is defined under the 1940 Act and the value of such assets exceeds 40% of the value of our total assets, we may be deemed to be an investment company.

If we held investment securities and the value of these securities exceeded 40% of the value of our total assets we may be required to register as an investment company. Investment companies are subject to a variety of substantial requirements that could significantly impact our operations. The costs and expenses we would incur to register and operate as an investment company, as well as the limitations placed on our operations, could reduce the amounts available for distribution to owners.

If we were required to register as an investment company but failed to do so, civil and criminal actions could be brought against us, certain of our contracts would be unenforceable unless a court were to require enforcement, and a court could appoint a receiver to take control of us and liquidate our business.

If our liquidation costs or unpaid liabilities are greater than we expect, our distributions may be delayed or reduced.

Before making the final distribution, we or the liquidating trust will need to pay or arrange for the payment of all transaction costs in the liquidation and all valid claims of creditors. Our Executive Committee or the trustees of the liquidating trust may also decide to establish a reserve fund to pay for these contingent claims. None of those amounts are yet final and we have used estimates in calculating the amount of our projected liquidating distributions. To the extent that we have underestimated them in calculating our projections, our actual aggregate liquidating distributions will be lower than we have projected. Further, if a reserve fund is established, payment of liquidating distributions to our owners may be delayed or reduced.

We will continue to incur costs in connection with Exchange Act compliance until the Company is dissolved and we may become subject to liability for any failure to comply.

As a result of our obligation to register our securities with the SEC under the Exchange Act, we are subject to the rules of the Exchange Act and related reporting requirements. This compliance with the reporting requirements of the Exchange Act requires timely filing of Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K, among other actions. Further, recently enacted laws, regulations and standards relating to corporate governance and disclosure requirements applicable to public companies, including the Sarbanes-Oxley Act and SEC regulations have increased the costs of corporate governance, reporting and disclosure practices which are now required of us. Our efforts to comply with applicable laws and regulations, including requirements of the Exchange Act and the Sarbanes-Oxley Act, are expected to involve significant, and potentially increasing, costs. In addition, these laws, rules and regulations create new legal bases for administrative enforcement, civil and criminal proceedings against us in case of non-compliance, thereby increasing its risks of liability and potential sanctions. Any liability or sanctions incurred in connection with such actions or proceedings could reduce or delay our liquidating distributions. We were formed prior to the enactment of these new corporate governance standards and did not intend to become subject to those provisions.

10

THE SPECIAL MEETING

Owners Entitled to Vote at the Meeting

Only the owners of record of limited liability company interests at the close of business on August 15, 2005 are entitled to notice of and to vote at the Special Meeting. Each owner of limited liability company interests is entitled to vote in proportion to its percentage interest in the Company.

How to Vote Your Interests

Your vote is important. Your limited liability company interests can be voted at the Special Meeting only if you are present in person or represented by proxy. Even if you plan to attend the meeting, we urge you to vote now by completing and submitting the enclosed proxy card. You may cast your vote by marking your proxy card, and then dating, signing, and returning it [by fax to [fax #]] or [in the postage-paid return envelope provided].

How to Revoke Your Proxy

You may revoke your proxy at any time before it is voted at the meeting by:

| | • | | properly executing and delivering a later-dated proxy; |

| | • | | voting by ballot at the meeting; or |

| | • | | sending a written notice of revocation to the inspectors of election in care of the Secretary of the Company at the address disclosed on the cover of this proxy statement. |

Voting at the Special Meeting

The method by which you vote will in no way limit your right to vote at the Special Meeting if you later decide to attend in person.

Your limited liability company interests will be voted at the meeting as directed by the instructions on your proxy card if: (i) you are entitled to vote, (ii) your proxy was properly executed, (iii) we received your proxy prior to the Special Meeting, and (iv) you did not revoke your proxy prior to the meeting.

The Executive Committee’s Recommendation

If you send a properly executed proxy card without specific voting instructions, your limited liability company interests represented by that proxy will be voted as recommended by the Executive Committee FOR approving the amendment to the Operating Agreement that grants the Executive Committee the authority to dissolve the Company.

The Company does not presently know of any other business which may come before the Special Meeting.

Votes Required to Approve Amendment

The affirmative vote of seventy-five percent (75%) of all the votes entitled to be cast by the owners of limited liability company interests is required to approve the amendment to the Operating Agreement. If you do not give your proxy or if you abstain from voting, it will have the same effect as a vote against the proposal to amend the Operating Agreement.

As of August 15, 2005, the members of the Executive Committee collectively owned an aggregate of 4.28% of all outstanding limited liability company interests.

11

PROPOSAL

What You Are Being Asked To Approve

You are being asked to approve an amendment to our Operating Agreement to grant our Executive Committee the authority to dissolve the Company. The complete text of the amendment is set forth in Exhibit A to this proxy statement.

The Executive Committee’s Recommendation

THE EXECUTIVE COMMITTEE RECOMMENDS THAT YOU VOTE “FOR” APPROVING THE AMENDMENT TO THE OPERATING AGREEMENT THAT GRANTS OUR EXECUTIVE COMMITTEE THE AUTHORITY TO DISSOLVE THE COMPANY.

Plan of Disposition.

The Executive Committee has already approved a plan of disposition which provides that:

| | • | | the Executive Committee will pursue the orderly disposition of the Company’s assets pursuant to the authority granted to the Executive Committee under the Operating Agreement; |

| | • | | the Company will cease to carry on any trade or business except as may be necessary or incidental to the winding down of the Company’s affairs in accordance with the plan; |

| | • | | the Executive Committee will sell or otherwise dispose of any and all of the properties and assets of the Company that in their judgment should be sold or disposed of to wind down the business and affairs of the Company; |

| | • | | the Company will pay and discharge or make adequate provisions to pay (including by means of a liquidating trust) all debts, liabilities and obligations of the Company; |

| | • | | after paying the Company’s debts, or making reasonable provision therefore, the Company will distribute all of its remaining property and assets to a liquidating trust established for the benefit of the owners, the purpose of which will be to satisfy contingent liabilities, to conserve and protect the assets transferred to it, to realize the value attributable to such assets and to distribute the proceeds therefrom to owners in accordance with the Operating Agreement; and |

| | • | | after the distribution of the assets of the Company pursuant to the plan and subject to the approval of the amendment to the Operating Agreement by owners, file Articles of Dissolution with the Illinois Secretary of State to dissolve the Company. |

The Executive Committee intends to take each of the actions listed above (other than filing the Articles of Dissolution with the Illinois Secretary of State) irrespective of whether owners approve the amendment to the Operating Agreement. The amendment to the Operating Agreement is only required to complete the formal dissolution of the Company.

12

Reasons for the Dissolution.

In reaching its determination to dissolve the Company, the Executive Committee considered the following factors:

| | • | | as part of the planning process for the initial public offering of Hewitt Associates, our owners intended that the Company would remain in existence only for a limited period of time until all of its real estate assets were sold; |

| | • | | the Company has sold all of its real estate assets (other than the five acre parcel in Lincolnshire, Illinois) and distributed the proceeds to owners, the aggregate amount of such distributions totaling approximately $136 million since the time of the initial public offering of Hewitt Associates; |

| | • | | continued reporting under the Exchange Act is not necessary to protect the interests of owners since (i) the only assets of the Company consist of cash and the five acre parcel in Lincolnshire, Illinois for which the Company is actively seeking a buyer and (ii) the liquidating trust to which the Executive Committee intends to transfer the remaining assets will provide annual reports, including financial statements, to our owners and will provide updates of any material events; and |

| | • | | the costs and expenses associated with continuing the Company’s legal existence will ultimately reduce the amounts available for distribution to owners, particularly in light of the expenses associated with reporting under the Exchange Act and Sarbanes-Oxley compliance. |

The Executive Committee believed that each of the above factors generally supported its determination and recommendation. The Executive Committee also considered and reviewed potentially negative factors concerning the dissolution of the Company, including those listed below:

| | • | | our owners will no longer participate in any future earnings or growth from any additional investments or from acquisitions of additional assets; |

| | • | | there can be no assurance that the Company would be successful in disposing of its remaining real estate asset for an amount equal to or exceeding its estimates or that its disposition would occur as early as expected; |

| | • | | the establishment of a liquidating trust will provide for a prohibition on the transfer of trust interests, subject to certain limited exceptions; |

| | • | | the costs to be incurred by the Company in connection with the liquidation process, including significant accounting and legal fees; |

| | • | | the possibility that owners may, depending on their tax basis in their limited liability company interests, recognize taxable gains (ordinary and/or capital gains) in connection with the completion of the liquidation; and |

| | • | | the fact that no fairness opinion with respect to the liquidation was obtained, nor were there any formal third-party appraisals made of our remaining real estate asset to determine its liquidation value. |

The above discussion concerning the information and factors considered by the Executive Committee is not intended to be exhaustive, but includes the material factors considered by the Executive Committee in making its determination. In view of the variety of factors considered in connection with its evaluation of the Plan dissolution of the Company, the Executive Committee did not quantify or otherwise attempt to assign relative weights to the specific factors it considered. In addition, individual members of the Executive Committee may have given different weight to different factors and, therefore, may have viewed certain factors more positively or negatively than others.

13

EXPECTED DISTRIBUTIONS

Timing and Amount

We may make one or more distributions from time to time, after providing for or reserving for the payment of our obligations and liabilities, as we sell or otherwise liquidate our assets. We expect to transfer our remaining assets to a liquidating trust prior to September 30, 2005 and issue each owner an interest, which will not be certificated, in such liquidating trust. All distributions will be paid to owners of record at the close of business on the record dates to be determined by the Executive Committee, pro rata based on the capital accounts by each owner.

Although we cannot be sure of the amounts, we currently believe that cash distributions from the liquidating trust to owners will total approximately $13 million. However, should actual circumstances differ from our assumptions, owners could receive more or less than that amount. The indicated amount and timing of the distributions represent our current estimates, but it is not possible to determine with certainty the aggregate net proceeds that may ultimately be available for distribution to owners. See “Risk Factors.” The actual amount, timing of and record dates for owner distributions will be determined prior to our distribution by the Executive Committee and thereafter the trustees of the liquidating trust in their sole discretion and will depend upon the timing and proceeds of the sale of our remaining real estate asset, and the amounts deemed necessary by our Executive Committee to pay or provide for all of our liabilities and obligations.

Calculation of Estimated Distributions

To estimate the amounts that may be available for distribution from the liquidation proceeds, we estimated the costs of liquidation. We also estimated general and administrative costs during the liquidation process. The payment of the distributions is in each case subject to the payment or provision for payment of our obligations to the extent not assumed by any purchasers of our assets and any tax liabilities. We believe that we will have sufficient cash and cash equivalents to pay all of our current and accrued obligations as a result of cash from operations and asset sales. However, if contingent or unknown liabilities exist, distributions to owners may be reduced or delayed. Also, claims, liabilities and expenses will continue to accrue, as the expenses that we have estimated for professional fees and other expenses of liquidation are significant. These expenses will reduce the amount of cash available for ultimate distribution to owners. See “Risk Factors” for a more detailed discussion of these risks.

We based our estimates of the net proceeds from the sale of our remaining real estate asset from a variety of sources, including information from and discussions that we have had with local real estate brokers, our analysis of comparable sales figures and other analyses. We neither have obtained nor will obtain formal independent appraisals of the fair market value of our remaining real estate asset or any fairness opinions with respect to the liquidation.

Uncertainties Relating to Estimated Distributions

Our estimates of potential distributions were prepared solely for internal planning purposes. The preparation of these estimates involved judgments and assumptions with respect to the liquidation process that, although considered reasonable at the time by the Executive Committee, may not be realized. We cannot assure you that actual results will not vary materially from the estimates. As we have disclosed under “Risk Factors,” certain examples of uncertainties that could cause the aggregate amount of distributions to be less than our estimates include the following:

| | • | | The value of our remaining real estate asset and the time required to sell it may change due to a number of factors beyond our control, including market conditions in the real estate market and the length of time it takes to sell our remaining real estate asset. |

| | • | | Our estimate of distributable cash resulting from our liquidation is based on estimates of the costs and expenses of the liquidation and operating the Company. If actual costs and expenses exceed such estimated amount aggregate distributions to owners from liquidation could be less than estimated. |

14

| | • | | If liabilities, unknown or contingent at the time of the delivery of this proxy statement, later arise which must be satisfied or reserved for, the aggregate amount of distributions to owners could be less than estimated. |

| | • | | Delays in consummating the dissolution of the Company could result in additional expenses and result in actual aggregate distributions to owners less than our estimated amounts. |

We do not anticipate updating or otherwise publicly revising the estimates presented in this document to reflect circumstances existing or developments occurring after the preparation of these estimates or to reflect the occurrence of anticipated events. The estimates have not been audited, reviewed or compiled by independent auditors.

Dissolution

We expect to file Articles of Dissolution with the Illinois Secretary of State to dissolve the Company after receipt of owner approval of the amendment to the Operating Agreement. The dissolution will become effective upon filing of the Articles of Dissolution with the Illinois Secretary of State. The existence of the Company will terminate and all limited liability company interests will be cancelled at that time.

Liquidating Trust

We expect that, prior to September 30, 2005, we will transfer our remaining assets to a liquidating trust, including those assets not sold or distributed prior to that time. If a liquidating trust is established, we would distribute the beneficial interests in the liquidation trust to the holders of limited liability company membership interests in the Company in proportion to the limited liability company interests owned by such owners. The sole purpose of the liquidating trust would be to liquidate any remaining assets on terms satisfactory to the liquidating trustees and, after paying any of our remaining liabilities, distribute the proceeds of the sale of assets formerly owned by us to the holders of the interests in the liquidating trust. The liquidating trust will also be obligated to pay any of our expenses and liabilities that remain unsatisfied.

We anticipate that the members of the Executive Committee will serve as trustees of the liquidating trust. The liquidating trust agreement provides that the remaining assets of the Company will be transferred to the trust immediately prior to the distribution of interests in the trust to the owners and that the trust property will be held in trust for the benefit of the owner beneficiaries subject to the terms of the liquidating trust agreement. The owners’ interests in the trust will be represented by noting such interests in the trust’s records, i.e. there will be no certificates or other tangible evidence of trust interests. No owner will be required to pay any cash or other consideration for the interests to be received in the distribution of interests in the liquidating trust or to surrender or exchange any limited liability company interests in order to receive the beneficial interests in the liquidating trust. In addition, the trust will be irrevocable and will terminate after the earliest of (i) the date the trust property is fully distributed, or (ii) the third anniversary after the creation of the trust. The life of the trust, however, may be extended to more than three years if the trustees are then currently engaged in the determination, defense or settlement of a claim by or against the liquidating trust.

The interests in the liquidating trust will not be freely transferable except in limited circumstances, such as death of the holder of trust interests. Therefore, the recipients of the interests in the liquidating trust will not realize any value from these interests unless and until the trust distributes cash or other assets to them, which will be solely in the discretion of the trustees.

Appraisal Rights of Owners

Under the Illinois Limited Liability Company Act, you are not entitled to any dissenters’ or appraisal rights in connection with the amendment to the Operating Agreement or a subsequent dissolution of the Company.

15

Material Federal Income Tax Consequences of the Dissolution

The following discussion summarizes the material U.S. federal income tax considerations that may be relevant to you with regard to the dissolution of the Company, including establishing the liquidating trust, described in this proxy statement. This discussion is based on current law and is not exhaustive of all possible tax considerations. This summary does not address any state, local or foreign tax considerations nor does it discuss all of the aspects of U.S. federal income taxation that may be relevant to you in light of your particular circumstances or to certain types of owners subject to special treatment under the U.S. federal income tax laws. This discussion is not intended to be, and should not be construed as, tax advice to any of our owners. The tax implications to you of the transactions contemplated herein are based upon your particular circumstances, which may differ from those of other owners. Accordingly, the following discussion may not apply to your particular situation.

YOU ARE STRONGLY ADVISED TO CONSULT WITH YOUR TAX ADVISOR REGARDING THE SPECIFIC TAX CONSEQUENCES TO YOU FROM YOUR RECEIPT OF DISTRIBUTIONS FROM THE COMPANY IN THE LIQUIDATION.

Liquidating Trust

The Company believes that the liquidating trust will be classified as a “liquidating trust” and a grantor trust for U.S. federal income tax purposes. For federal income tax purposes, the transfer of assets by the Company to the liquidating trust, followed by the issuance to the owners of beneficial interests in the liquidating trust, will be treated as though the Company had distributed the transferred assets to the owners on a pro rata basis and the owners had then contributed such assets to the liquidating trust. The tax consequences of the deemed distribution of the assets to the owners are described below under the heading Liquidation of the Company. An owner will not recognize gain or loss on the deemed contribution of the assets to the liquidating trust.

The liquidating trust generally will not be subject to income tax. Instead, each owner, as a beneficiary of the liquidating trust, will be required to report his or her pro rata share of the income, deductions and credits of the liquidating trust on his or her income tax return regardless of whether the liquidating trust makes any distributions to the owner. Distributions by the liquidating trust to an owner, whether made currently or in connection with the dissolution of the liquidating trust, will not be taxable to such owner for federal income tax purposes.

If the liquidating trust is required to make payments relating to claims for breaches of representations and warranties made in connection with prior sales of real estate by the Company, any such payments likely would be treated as a capital loss to the owners. If an owner were not able to fully utilize the capital loss in the year of payment, the owner may be able to take a credit against the owner’s federal income tax liability in the year of payment of the claim in an amount equal to the difference between the actual tax liability reported for the year of the sale and the income tax liability for the year of sale as recalculated taking into account payment of the claim.

Liquidation of the Company

The distribution of cash by the Company to its owners and the transfer of cash (and the five acre parcel, if not previously sold) to a liquidating trust followed by the transfer of the beneficial interests in the liquidating trust to its owners will be treated for federal income tax purposes as a distribution by the Company of all of its assets (including the assets transferred to the liquidating trust) to its owners in liquidation of the Company. For federal income tax purposes, the Company will not recognize gain or loss with respect to the liquidating distributions. The extent of gain or loss reportable by an owner at the time of the distribution will depend on whether the five acre parcel has been sold.

If the five acre parcel has been sold before the distribution and the distribution consists entirely of cash, gain will be recognized by an owner to the extent cash distributed (including an owner’s share of the cash held in the liquidating trust) exceeds the adjusted basis of such owner’s limited liability company interest immediately before the distribution. In such instance, loss will be recognized to the extent cash distributed (including an owner’s share of the cash held in the liquidating trust) is less than the adjusted basis of such owner’s limited liability company interest immediately before the distribution. Any gain or loss recognized by an owner will be treated as gain or loss from the sale or exchange of a capital asset.

16

If the five acre parcel has not been sold, gain will be recognized at the time of distribution to the extent cash distributed (including an owner’s share of cash held in the liquidating trust) exceeds the adjusted basis of the owner’s limited liability company interest immediately before the distribution. However, any gain related to the sale of the five acre parcel or any overall loss related to the disposition of an owner’s limited liability company interest will not be recognized until the five acre parcel is sold. Each owner will take a federal income tax basis in its share of the five acre parcel deemed received equal to the basis of such owner’s limited liability company interests immediately prior to the distribution, reduced by any cash received (including the owner’s share of the cash held in the liquidating trust). Upon the disposition of the five acre parcel by the liquidating trust, each owner will recognize gain or loss equal to the difference between the owner’s basis in the parcel and the owner’s allocable share of consideration paid for the parcel. Any gain recognized should be capital gain. If the sale occurs prior to December 31, 2005, any loss recognition would be available to offset against gains from sales during the calendar year.

FINANCIAL STATEMENTS

Summary Financial Information

The following tables set forth summary consolidated statement of operations and summary consolidated balance sheet data for the Company for each of the fiscal years ended September 30, 2004, 2003, 2002, 2001 and 2000 and for the nine months ended June 30, 2005 and 2004. This information should be read in conjunction with our consolidated financial statements including the notes thereto, and all other disclosures included in our most recent Quarterly Report on Form 10-Q filed on August 9, 2005 and in our Annual Report on Form 10-K filed on December 8, 2004, which reports are incorporated by reference into this proxy statement.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

June 30,

| | | Fiscal Year Ended September 30,

|

(In thousands) | | 2005 (1) (2)

| | 2004 (1) (2)

| | | 2004 (2)

| | | 2003 (2)

| | | 2002 (2) (3) (4)

| | 2001 (2) (5)

| | 2000 (2) (5)

|

Total revenues | | $ | — | | $ | 17 | | | $ | 23 | | | $ | 1,501 | | | $ | 1,754 | | $ | 1,506 | | $ | 1,306 |

Income from continuing operations before owner distributions | | | 8 | | | | | | | | | | | | | | | | | | | | | |

Income before taxes, minority interest and owner distributions | | | 51 | | | 3 | | | | 4 | | | | 171 | | | | 222 | | | 170 | | | 169 |

Income after taxes and minority interest and before owner distributions | | | | | | | | | | | | | | 107 | | | | 186 | | | | | | |

| | | | | | | |

As of September 30: | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | $ | 253 | | | $ | 261 | | | $ | 1,664 | | $ | 1,187 | | $ | 1,032 |

Long-term portion of debt and capital lease obligations | | | | | | | | | | 196 | | | | 206 | | | | 426 | | | 395 | | | 427 |

Working capital | | | | | | | | | | (3 | ) | | | (4 | ) | | | 235 | | | 77 | | | 121 |

| | | | | | | |

As of June 30: | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 30 | | $ | 254 | | | | | | | | | | | | | | | | | | |

Long-term portion of debt and capital lease obligations | | | — | | | 198 | | | | | | | | | | | | | | | | | | |

Working capital | | | 8 | | | (3 | ) | | | | | | | | | | | | | | | | | |

| (1) | On May 20, 2005, FORE Holdings, through its subsidiaries, Hewitt Properties I LLC, Hewitt Properties II LLC, Hewitt Properties III LLC and Hewitt Properties IV LLC, sold substantially all of its properties except its interest in Overlook Associates and subsequently retired the related debt obligations in June 2005. Subsequent to the sale, FORE Holdings no longer has any revenue producing operations except its interest in Overlook Associates. The results related to the sold properties have been reclassified to discontinued operations and as such, are not presented in the table above. On July 28, 2005, in a series of related transactions, FORE Holdings disposed of its entire 51% interest in Overlook Associates and the underlying real estate owned by Overlook Associates for a sales price of $52 million less closing expenses. We refer you to the consolidated financial statements and related notes to the 10-Q Report for the period ended June 30, 2005, filed on August 9, 2005, for additional information. |