UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-21293 |

Nuveen Preferred & Income Opportunities Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: January 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 January 2020

Nuveen Closed-End Funds

| | |

| JPC | | Nuveen Preferred & Income Opportunities Fund |

| JPI | | Nuveen Preferred and Income Term Fund |

| JPS | | Nuveen Preferred & Income Securities Fund |

| JPT | | Nuveen Preferred and Income 2022 Term Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Semiannual Report

Life is Complex

Nuveen makes things e-simple.

It only takes a minute to sign up fore-Reports. Once enrolled, you’ll receive ane-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within thee-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table of Contents

3

Chair’s Letter to Shareholders

Dear Shareholders,

The COVID-19 crisis is taking an unprecedented toll on our health, societies, economies and financial markets. The extreme social distancing efforts needed to contain the coronavirus are causing a severe contraction in economic activity and amplifying market volatility, as global supply chains and consumer and business demand remain significantly disrupted. However, the full economic impact remains to be seen. The number of confirmed cases is still accelerating in the U.S. and many parts of the world, and previous epidemics offer few parallels to today’s situation. The recent spike in market volatility reflects this uncertainty, and we expect that large swings in both directions are likely to continue until there is more clarity.

While we do not want to understate the dampening effect on the global economy, we also note that markets occasionally overreact. Differentiating short-term interruptions from the longer-lasting implications to the economy may provide opportunities. Some areas of the global economy were already on the mend prior to the coronavirus epidemic. Momentum could pick up again as factories come back online and consumer demand resumes once the virus is under control and temporary bans on movement and travel are lifted. Central banks and governments around the world have announced economic stimulus measures. In the U.S., the Federal Reserve has cut its benchmark interest rate to near zero and reintroduced programs that helped revive the U.S. economy after the 2008 financial crisis. The U.S. government has approved more than $100 billion in emergency spending and relief and is set to deliver a trillion-dollar package to further aid workers and businesses.

In the meantime, patience and a long-term perspective are key for investors. When market fluctuations are the leading headlines day after day, it’s tempting to do something. However, your long-term goals can’t be met with short-term thinking. We encourage you to talk to your financial advisor, who can review your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

March 24, 2020

4

Portfolio Managers’ Comments

Nuveen Preferred & Income Opportunities Fund (JPC)

Nuveen Preferred and Income Term Fund (JPI)

Nuveen Preferred & Income Securities Fund (JPS)

Nuveen Preferred and Income 2022 Term Fund (JPT)

Nuveen Asset Management, LLC (NAM) and NWQ Investment Management Company, LLC (NWQ), both affiliates of Nuveen Fund Advisors, LLC, the Funds’ investment adviser, aresub-advisers for the Nuveen Preferred & Income Opportunities Fund (JPC). NAM and NWQ each manage approximately half of the Fund’s investment portfolio. Douglas Baker, CFA and Brenda Langenfeld, CFA, are the portfolio managers for the NAM team. The NWQ income-oriented investment team is led by Thomas J. Ray, CFA and Susi Budiman, CFA. The Nuveen Preferred and Income Term Fund (JPI) features management by NAM. Douglas Baker, CFA, and Brenda Langenfeld, CFA, have served as the Fund’s portfolio managers since its inception. The Nuveen Preferred & Income Securities Fund (JPS) issub-advised by a team of specialists at Spectrum Asset Management, Inc. (Spectrum), a wholly owned subsidiary of Principal Global Investors Holding Company (U.S.), LLC. Mark Lieb and Phil Jacoby lead the team. The Nuveen Preferred and Income 2022 Term Fund (JPT) features management by NAM. Douglas Baker, CFA, and Brenda Langenfeld, CFA, have served as the Fund’s portfolio managers since its inception.

Here the team discusses their management strategies and the performance of the Funds for thesix-month reporting period ended January 31, 2020.

What key strategies were used to manage the Funds during thissix-month reporting period ended January 31, 2020 and how did these strategies influence performance?

Nuveen Preferred & Income Opportunities Fund (JPC)

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for thesix-month,one-year, five-year andten-year periods ended January 31, 2020. For thesix-month reporting period ended January 31, 2020, the Fund’s common shares at net asset value (NAV) outperformed the ICE BofA U.S. All Capital Securities Index and the JPC Blended Benchmark.

JPC seeks to provide high current income and secondarily, total return, by investing at least 80% of its managed assets in preferred securities and contingent capital securities (sometimes referred to as “CoCos”), and permitting it to invest

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments(continued)

up to 20% opportunistically over the market cycle in other types of securities, primarily income oriented securities such as corporate and taxable municipal debt and common equity.

JPC is managed by two experienced portfolio teams with distinctive, complementary approaches to the preferred market, each managing its own “sleeve” of the portfolio. NAM employs a debt-oriented approach that combines top down relative value analysis of industry sectors with fundamental credit analysis. NWQ’s investment process identifies undervalued securities within a company’s capital structure that offer the most attractive risk/reward potential. This multi-team approach gives investors access to a broader investment universe with greater diversification potential.

Nuveen Asset Management (NAM)

For the portion of the Fund managed by NAM, the Fund seeks to achieve its investment objective of providing a high level of current income and total return by investing in preferred securities and other income producing securities, which include, but are not limited to, contingent capital securities (aka, CoCos). The Fund seeks to benefit from strong credit fundamentals across the largest sectors within the issuer base, as well as the category’s healthy yield level. In addition, NAM will actively manage its sleeve to allocate both interest rate and credit risk consistent with its outlook for the broader financial markets, as well as to capitalize on inefficiencies that often arise between the $25 par retail and the $1,000 par institutional sides of the market. The Fund’s strategy has a bias toward highly regulated sectors, such banks, insurance companies and utilities, with the intent to benefit from the added security of regulatory oversight.

NAM employs a credit-based investment approach, using abottom-up approach that includes fundamental credit research, security structure selection, and option adjusted spread (OAS) analysis, while also incorporating atop-down process to position the portfolio in a manner that reflects the investment team’s overall macro-economic outlook. The process begins with identifying the primary investable universe of $1,000 par preferred, $25 par preferred, and CoCo securities. In an effort to capitalize on the inefficiencies between different investor bases within this universe, NAM tactically and strategically shifts capital between the various segments of the market. Periods of volatility may drive material differences in valuations between the $25 par preferred, $1,000 par preferred, and CoCo markets. This divergence is often related to differences in how retail and institutional investors measure and price risk, as well as differences in retail and institutional investors’ ability to source substitute investments. In addition, technical factors such as new issue supply or redemption activity may also influence the relative valuations between the $25 par preferred, $1,000 par preferred market and CoCo markets. During the reporting period, technical factors played a material role in both absolute and relative performance.

During the reporting period, the Blended Benchmark Index for the sleeve managed by NAM, which represents the combined preferred securities and CoCos markets, returned 6.30%. This figure fell between both comparable financial senior debt and financial equities. NAM typically expects the Blended Benchmark Index to perform between these two categories given the hybrid nature of its constituent securities. While investment performance was positive across broad categories within our market, performance varied. For example, CoCos outperformed all other components of the market. While $1,000 par preferreds underperformed CoCos, they outperformed $25 par preferreds, which lagged all other broad categories within the investable universe.

Looking more closely at asset class level performance, the positive absolute returns were broadly due to a combination of a rally in U.S. treasury rates and credit spread compression, as defined by OAS. The Federal Reserve (Fed) cut interest rates on three occasions in 2019 in response to the global economic downshift and trade-related uncertainties in a benign inflation environment. U.S. Treasury yields declined in response to the Fed cuts, illustrated by a yield decrease of 51 basis points on the U.S.10-year Treasury, which drove prices higher. Within the Blended Benchmark Index, OAS compressed disproportionately more for the CoCo segment of our universe. The CoCo segment’s outperformance was primarily due to United Kingdom election results and subsequent Brexit passage in late January 2020, eliminating some uncertainty surrounding Brexit and its possible carryover issues to other European countries. Meanwhile, the domestic

6

$1,000 par market experienced modest spread compression as a favorable supply technical bolstered that side of the market. Even before the start of this reporting period, most U.S. banks already had issued enough preferreds to meet, or even slightly exceed, their Additional Tier 1 regulatory capital requirements. As a result, NAM had expected that net new issue supply out of the U.S. bank sector would be relatively flat for the foreseeable future. In the $25 par segment of the universe, NAM witnessed a moderate amount of new issuance, which did put some pressure on valuations, thus the reason for its relative underperformance during the reporting period.

Importantly, the fundamental credit story of NAM’s largest sector, the bank sector, continued to improve during the reporting period. During 2018, and for the first time ever, the six largest U.S. banks generated aggregate profits exceeding $100 billion for a calendar year. The trend continued in 2019 where those banks posted approximately $120 billion in net income, slightly higher than that of 2018. In addition to recent record profitability, bank balance sheet metrics continued to display incredible strength. 2019 U.S. bank stress tests again validated the resiliency of U.S. bank balance sheets as the sector was subject to conditions worse than the 2008 - 2009 Great Financial Crisis itself. Like last year, this year’s stress test results were so convincing that even the sector’s toughest critic and regulator, the Fed, allowed the banks once again to increase the amount of capital returned to common shareholders via both higher dividends and additional share buybacks.

NAM incorporated several active themes relative to the Blended Benchmark Index during the reporting period, including an underweight to CoCos and a corresponding overweight to domestic issuers, an overweight to the $1,000 par side of the market and an overweight to securities that have coupons with reset features (floating rate,fixed-to-floating rate,fixed-to-fixed rate).

During the reporting period, the underweight to CoCos detracted modestly from performance relative to the Blended Benchmark Index, as CoCos outperformed during the reporting period. As of January 31, 2020, the Fund had an allocation of approximately 32% to CoCos, well below the 40% allocation within the Blended Benchmark Index. The average OAS for the CoCos segment of the Blended Benchmark tightened approximately 80 basis points, significantly more than the preferred securities segment of NAM’s universe, which was essentially flat. In December 2019, Boris Johnson won the United Kingdom election which paved the way for the United Kingdom to officially leave the European Union on January 31, 2020. This provided the market with some much needed clarity on Brexit. United Kingdom CoCos rallied on the news as well as their European banking counterparts, which moved in sympathy with United Kingdom banks.

Within the investable universe, $25 par preferred securities on average underperformed $1,000 par preferred securities. Given the underperformance of the $25 par preferred retail side of the market during the reporting period, NAM’s underweight to those structures was accretive to the Fund’s relative performance. As has been the case for some time, NAM maintained an overweight to $1,000 par securities for two primary reasons, relative value and interest rate risk management. First, with respect to relative value, the $1,000 par side of the market continues to be significantly cheaper than the $25 par side of the market on an OAS basis. As previously mentioned, new issue supply within the $25 par side of the market pressured valuations, which resulted in its underperformance. Meanwhile, and also previously mentioned, the $1,000 par segment of our universe experienced minimal new issuance and this supply technical helped the segment to outperform.

With respect to managing interest rate risk, NAM’s underweight to the $25 par preferred securities was due to NAM’s desire for greater exposure to securities that have coupons with reset features, like floating rate coupons,fixed-to-floating rate coupons andfixed-to-fixed rate coupons. These structures are more common on the institutional $1,000 par preferred side of the market and help to mitigate duration and duration extension risk during a rising interest rate environment. Duration extension can be a significant risk for callable securities with fixed-rate coupons. As of January 31, 2020, the Fund had about 91% of its assets invested in securities that have coupons with reset features, compared to approximately 74% within the Blended Benchmark Index.

7

Portfolio Managers’ Comments(continued)

Fixed rate coupon structures meaningfully underperformednon-fixed rate coupon securities during the reporting period. In NAM’s opinion, underperformance of the fixed rate coupon structures was due to an ancillary effect from the underperformance of $25 par preferred securities, as a vast majority of that universe is indeed comprised of fixed rate coupon structures.

The Fund used short interest rate futures during the reporting period to manage its exposure to various points along the yield curve, with a net effect of decreasing the Fund’s overall interest rate sensitivity. During the reporting period, the interest rate futures had a negligible impact on overall Fund performance.

NWQ

For the portion of the Fund managed by NWQ, NWQ seeks to achieve high income and a measure of capital appreciation. While the Fund’s investments are primarily preferred securities, a portion of the Fund allows the flexibility to invest across the capital structure in any type of debt, preferred or equity securities offered by a particular company. The portfolio management team then evaluates all available investment choices within a selected company’s capital structure to determine the portfolio investment that may offer the most favorable risk-adjusted return potential. The Fund’s portfolio is constructed with an emphasis on seeking a sustainable level of income and an overall analysis for downside risk management.

During the reporting period, NWQ’s preferred, high yield bond, equity and investment grade bond holdings contributed to performance, while the Fund’s preferred holdings were the top performers for the reporting period on an absolute basis. Those industries that contributed to the Fund’s performance included NWQ’s holdings in utilities, insurance and industrials, while the Fund’s banking and financials’ holdings were the largest detractors on an absolute basis.

During the reporting period, several individual holdings contributed to performance, including the L Brands Inc. The bonds moved higher during the reporting period as the continued bifurcation of performance between Victoria Secret and Bath & Body Works prompted suggestions that the business be split, after rumors that the company held preliminary discussions on strategic alternatives for the brands. This could prompt management to address the debt load depending on how the transaction, if any, will be structured. In addition, The Southern Co. mandatory convertible preferred contributed to performance. The underlying Southern Co. common stock rallied on progress in the Vogtle nuclear project and a favorable rate hike for its biggest subsidiary, Georgia Power. Lastly, Sempra Energy convertible preferred stock outperformed as the underlying Sempra common stock moved higher on better than expected earnings. Furthermore, recent developments at Sempra including the recent Cameron refinancing, South America asset sales, favorable rate case and revised liquefied natural gas (LNG) financing expectations all point to improved outlook for Sempra’s already diversified portfolio of assets.

Several holdings detracted from absolute performance, including the preferred stock of CenterPoint Energy Inc. Their preferred stock shares fell sharply after the Public Utilities Commission of Texas (PUCT) discussion of CenterPoint Energy’s outstanding Houston electric rate case indicated a lower than expected return on equity. Investors expected that there would be potential significant equity needs if the final decision is in line with what the PUCT discussed. The Fund no longer holds the preferred stock of CenterPoint Energy. Also detracting from performance was Stifel Financial Corp preferred stock. Cost pressure at Stifel has been intense as advisor count has stayed almost flat. Net interest revenue is expected to dip due to Fed rate cuts. The Fund no longer holds Stifel. Lastly, the notes of Apollo Investment Corp detracted from performance. The Apollo notes short duration detracted from performance. In addition, the issuer redeemed the notes during the reporting period.

8

Nuveen Preferred and Income Term Fund (JPI)

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for thesix-month,one-year, five-year and since inception periods ended January 31, 2020. For thesix-month reporting period ended January 31, 2020, the Fund’s common shares at net asset value (NAV) outperformed the ICE BofA U.S. All Capital Securities Index and the JPI Blended Benchmark Index.

The Fund seeks to achieve its investment objective of providing a high level of current income and total return by investing in preferred securities and other income producing securities, which include, but are not limited to, contingent capital securities (CoCos). The Fund seeks to benefit from strong credit fundamentals across the asset class’ largest sectors, as well as the category’s healthy yield. In addition, the management team will actively allocate to both interest rate and credit risk consistent with its outlook for the broader financial markets, while seeking to capitalize on inefficiencies that often arise between the $25 par retail and the $1,000 par institutional sides of the market. The Fund’s strategy has a bias toward highly regulated sectors, such banks, insurance companies and utilities, with the intent to benefit from the added security of regulatory oversight.

NAM employs a credit-based investment approach, using abottom-up approach that includes fundamental credit research, security structure selection, and option adjusted spread (OAS) analysis, while also incorporating atop-down process to position the portfolio in a manner that reflects the investment team’s overall macro-economic outlook. The process begins with identifying the primary investable universe of $1,000 par preferred, $25 par preferred, and CoCo securities. In an effort to capitalize on the inefficiencies between different investor bases within this universe, NAM tactically and strategically shifts capital between the various segments of the market. Periods of volatility may drive material differences in valuations between the $25 par preferred, $1,000 par preferred, and CoCo markets. This divergence is often related to differences in how retail and institutional investors measure and price risk, as well as differences in retail and institutional investors’ ability to source substitute investments. In addition, technical factors such as new issue supply or redemption activity may also influence the relative valuations between the $25 par preferred, $1,000 par preferred market and CoCo markets. During the reporting period, technical factors played a material role in both absolute and relative performance.

During the reporting period, the Blended Benchmark Index, which represents the combined preferred securities and CoCos markets, returned 6.30%. This figure fell between both comparable financial senior debt and financial equities. NAM typically expects the Blended Benchmark Index to perform between these two categories given the hybrid nature of its constituent securities. While investment performance was positive across broad categories within our market, performance varied. For example, CoCos outperformed all other components of the market. While $1,000 par preferreds underperformed CoCos, they outperformed $25 par preferreds, which lagged all other broad categories within the investable universe.

Looking more closely at asset class level performance, the positive absolute returns were broadly due to a combination of a rally in U.S. treasury rates and credit spread compression, as defined by OAS. The Federal Reserve (Fed) cut interest rates on three occasions in 2019 in response to the global economic downshift and trade-related uncertainties in a benign inflation environment. U.S. Treasury yields declined in response to the Fed cuts, illustrated by a yield decrease of 51 basis points on the U.S.10-year Treasury, which drove prices higher. Within the Blended Benchmark Index, OAS compressed disproportionately more for the CoCo segment of our universe. The CoCo segment’s outperformance was primarily due to United Kingdom election results and subsequent Brexit passage in late January 2020, eliminating some uncertainty surrounding Brexit and its possible carryover issues to other European countries. Meanwhile, the domestic $1,000 par market experienced modest spread compression as a favorable supply technical bolstered that side of the market. Even before the start of this reporting period, most U.S. banks already had issued enough preferreds to meet, or even slightly exceed, their Additional Tier 1 regulatory capital requirements. As a result, NAM had expected that net new issue supply out of the U.S. bank sector would be relatively flat for the near future. In the $25 par segment of the

9

Portfolio Managers’ Comments(continued)

universe, NAM witnessed a moderate amount of new issuance, which did put some pressure on valuations, thus the reason for its relative underperformance during the reporting period.

Importantly, the fundamental credit story of NAM’s largest sector, the bank sector, continued to improve during the reporting period. During 2018, and for the first time ever, the six largest U.S. banks generated aggregate profits exceeding $100 billion for a calendar year. The trend continued in 2019 where those banks posted approximately $120 billion in net income, slightly higher than that of 2018. In addition to recent record profitability, bank balance sheet metrics continued to display incredible strength. 2019 U.S. bank stress tests again validated the resiliency of U.S. bank balance sheets as the sector was subject to conditions worse than the 2008 - 2009 Great Financial Crisis itself. Like last year, this year’s stress test results were so convincing that even the sector’s toughest critic and regulator, the Fed, allowed the banks once again to increase the amount of capital returned to common shareholders via both higher dividends and additional share buybacks.

NAM incorporated several active themes relative to the Blended Benchmark Index during the reporting period, including an underweight to CoCos and a corresponding overweight to domestic issuers, an overweight to the $1,000 par side of the market, and an overweight to securities that have coupons with reset features (floating rate,fixed-to-floating rate,fixed-to-fixed rate).

During the reporting period, the underweight to CoCos detracted modestly from performance relative to the Blended Benchmark Index, as CoCos outperformed during the reporting period. As of January 31, 2020, the Fund had an allocation of approximately 31% to CoCos, well below the 40% allocation within the Blended Benchmark Index. The average OAS for the CoCos segment of the Blended Benchmark tightened approximately 80 basis points, significantly more than the preferred securities segment of our universe which was essentially flat. In December 2019, Boris Johnson won the United Kingdom election, which paved the way for the United Kingdom to officially leave the European Union on January 31, 2020. This provided the market with some much needed clarity on Brexit. United Kingdom CoCos rallied on the news as well as their European banking counterparts, which moved in sympathy with United Kingdom banks.

Within the investable universe, $25 par preferred securities on average underperformed $1,000 par preferred securities. Given the underperformance of the $25 par preferred retail side of the market during the reporting period, NAM’s underweight to those structures was accretive to the Fund’s relative performance. As has been the case for some time, NAM maintained an overweight to $1,000 par securities for two primary reasons, relative value and interest rate risk management. First, with respect to relative value, the $1,000 par side of the market continues to be significantly cheaper than the $25 par side of the market on an OAS basis. As previously mentioned, new issue supply within the $25 par side of the market pressured valuations which resulted in its underperformance. Meanwhile and also previously mentioned, the $1000 par segment of NAM’s universe experienced minimal new issuance and this supply technical helped the segment to outperform.

With respect to managing interest rate risk, NAM’s underweight to the $25 par preferred securities was due to NAM’s desire for greater exposure to securities that have coupons with reset features, like floating rate coupons,fixed-to-floating rate coupons andfixed-to-fixed rate coupons. These structures are more common on the institutional $1,000 par preferred side of the market and help to mitigate duration and duration extension risk during a rising interest rate environment. Duration extension can be a significant risk for callable securities with fixed-rate coupons. As of January 31, 2020, the Fund had about 90% of its assets invested in securities that have coupons with reset features, compared to approximately 74% within the Blended Benchmark Index.

Fixed rate coupon structures meaningfully underperformednon-fixed rate coupon securities during the reporting period. In NAM’s opinion, underperformance of the fixed rate coupon structures was due to an ancillary effect from the underperformance of $25 par preferred securities, as a vast majority of that universe is indeed comprised of fixed rate coupon structures.

10

The Fund used short interest rate futures during the reporting period to manage its exposure to various points along the yield curve, with a net effect of decreasing the Fund’s overall interest rate sensitivity. During the reporting period, the interest rate futures had a negligible impact on overall Fund performance.

Nuveen Preferred & Income Securities Fund (JPS)

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for thesix-month,one-year, five-year andten-year periods ended January 31, 2020. For thesix-month reporting period ended January 31, 2020, the Fund’s common shares at net asset value (NAV) outperformed the ICE BofA U.S. All Capital Securities Index and the JPS Blended Benchmark.

The investment objective of the Fund is to seek high current income consistent with capital preservation with a secondary objective to enhance portfolio value relative to the broad market for preferred securities. Under normal market conditions, the Fund seeks to invest at least 80% of its net assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities (CoCos). At least 50% is invested in securities that are rated investment grade

The basic strategy of the Fund calls for investing in junior subordinated, high income securities of companies with investment grade ratings. Spectrum has tactical exposure to both institutional sectors of the junior subordinated capital securities, which includes both preferred and CoCos.

The Federal Reserve (Fed) announced additional rate cuts in July, September and October 2019, but has been on hold since then. The big news for the market was in September 2019 when funding markets faced a spike in short-term rates which forced the Fed to intervene in the repurchase (repo) market after two years of automatic balance sheet run offs or reductions. This sent equities soaring and spreads tighter. The market systems had become dependent on the trillions of cash that had been injected over the course of the past ten years. More recently, the Fed had allowed its balance sheet torun-off and in the process, had taken back massive amounts of cash that served the purpose of bidding up risk assets and bidding down yields to perpetuate the economic expansion. This has been ongoing in Europe and by October 2019, the Fed announced its third cut of 2019, which was a jolt for the equity markets and impetus for the yield curve to steepen a bit helping to ease deflation concerns. Fed policy combined with already active qualitative easing QE in Europe was the primary driver and the most significant factor of positive performance during the reporting period.

During the reporting period, the Fund was tactically 17% overweight the $1,000 par institutional sector of the preferred securities market and 17% underweight the retail $25 par sector and was equally weighted to the CoCo sector compared to the benchmark, the ICE BofA U.S. All Capital Securities Index. The institutional preferred securities sector traded in a range of 154 basis points and 334 basis points wider on spread compared to the retail $25 par sector, which explains the primary reason for being overweight the higher yielding institutional sector. In general, the CoCo sector was cheaper than the institutional sector, which allows the Fund to earn higher income in the sector compared to preferred securities and is the primary reason for the Fund’s equal weight.

Spreads tightened significantly during the reporting period, so the sectors with the highest duration outperformed. Overall, the Fund’s 63% allocation to the middle of the yield curve the3-10 year sector contributed about 70% of the total return for the reporting period. The Fund’s 4.1 year modified duration was modestly longer compared to the Fund’s combined benchmark.

All of the Fund’s security sectors contributed positively during the reporting period. The top three performing sectors were the $25 par dividend received deduction (DRD), CoCos and utility hybrids. There were few (if any) constraining factors during the reporting period. The bottom performing sectors, though still positive, were cash, corporate hybrids and subordinated debt.

11

Portfolio Managers’ Comments(continued)

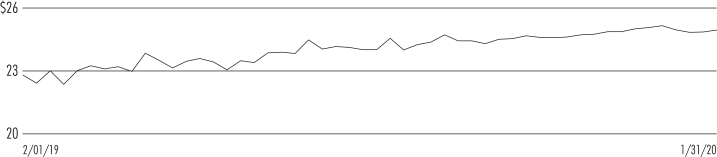

Nuveen Preferred and Income 2022 Term Fund (JPT)

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for thesix-month,one-year and since inception periods ended January 31, 2020. For thesix-month reporting period ended January 31, 2020, the Fund’s common shares at net asset value (NAV) outperformed the ICE BofA U.S. All Capital Securities Index.

The Fund seeks to achieve its investment objective of providing a high level of current income and total return by investing in preferred securities and other income producing securities. The Fund’s portfolio is actively managed, seeking to capitalize on strong credit fundamentals and intense regulatory oversight across our largest sectors, the category’s healthy yield level, and inefficiencies that often evolve between the $25 par retail and the $1,000 par institutional sides of the market. The Fund’s strategy has a bias toward highly regulated industries, like utilities, banks and insurance companies, with a current emphasis broadly on financial services companies. The Fund does not invest in contingent capital securities (otherwise known as CoCos).

NAM employs a credit-based investment approach, using abottom-up approach that includes fundamental credit research, security structure selection and option adjusted spread (OAS) analysis, while also incorporating atop-down process to position the portfolio in a manner that reflects the investment team’s overall macro-economic outlook. The process begins with identifying the primary investable universe of $1,000 par preferred and $25 par preferred securities. In an effort to capitalize on the inefficiencies between different investor bases within this universe, NAM tactically and strategically shifts capital between the various segments of the market. Periods of volatility may drive material differences in valuations between the $1,000 par preferred and $25 par preferred markets. This divergence is often related to differences in how retail and institutional investors measure and price risk, as well as differences in retail and institutional investors’ ability to source substitute investments. In addition, technical factors such as new issue supply or redemption activity may also influence the relative valuations between the $1,000 par preferred and the $25 par preferred markets.

Within JPT, NAM incorporated several prominent active themes within the Fund relative to its benchmark during the reporting period, of particular note an overweight to the $1,000 par versus $25 par side of the market, and an overweight to securities that have coupons with reset features (floating rate,fixed-to-floating rate,fixed-to-fixed rate).

Given the underperformance of the $25 par preferred side of the market during the reporting period, NAM’s overweight to $1,000 par preferred structures was accretive to the Fund’s relative results. As has been the case for several quarters, NAM maintained an overweight to $1,000 par securities for two primary reasons, relative value and interest rate risk management.

First, from a relative value perspective, the $1,000 par side of the market continued to be significantly cheaper than the $25 par side of the market on an OAS basis. In general, OAS for $25 par preferred securities has been driven lower by retail investors’ disproportionate bias for income-generating investment solutions, exacerbated by a prolonged period of low interest rates. Within the preferred securities universe, the $25 par preferred side of the market is best positioned to meet this retail demand given the small denomination and the ease of sourcing these securities as most are exchange-traded. During the reporting period, new issue supply within the $25 par side of the market did pressure valuations which resulted in its underperformance relative to the other segments of NAM’s universe. Because of this, the relative underweight was accretive to performance during thesix-month reporting period. Despite the underperformance, $25 par securities as of the end of the reporting period were still less attractive from a credit spread perspective.

Second, with respect to interest rate risk, NAM’s overweight to $1,000 par securities allows NAM to gain greater exposure to securities that have coupons with reset features, like floating rate coupons,fixed-to-floating rate coupons andfixed-to-fixed rate coupons. These structures are more common on the institutional $1,000 par side of the market

12

and help to mitigate duration and duration extension risk during a rising interest rate environment. Duration extension can be a significant risk for callable securities with fixed-rate coupons.

As of January 31, 2020, the Fund had about 83% of its assets invested in securities that have coupons with reset features, compared to approximately 60% within the ICE BofA U.S. All Capital Securities Index. Interest rates dropped considerably during the reporting period, as evidenced by the 10 year U.S. Treasury yield moving from 2.01% to 1.51%. All else equal, fixed rate coupon structures would typically outperform in this rate environment. Contrary to expectations, securities that have coupons with reset features outperformed their fixed rate counterparts. NAM believes this was due to a positive supply technical where issuance in $1,000 par space was muted during the reporting period that increased demand for those securities.

The Fund used short interest rate futures during the reporting period to manage its exposure to various points along the yield curve, with a net effect of decreasing the Fund’s overall interest rate sensitivity. During the reporting period, the interest rate futures had a negligible impact on overall Fund performance.

An Update on COVID-19 Coronavirus

The COVID-19 coronavirus pandemic has delivered an exogenous shock to the global economy. Containment efforts around the world have halted business and manufacturing operations and restricted people’s movement and travel. The disruptions to global supply chains, consumer demand, business investment and the global financial system are just beginning to be seen.

Although the virus was detected in China as early as December 2019, markets didn’t fully acknowledge the risks until February 2020, when large outbreaks were reported outside of China. Global stock markets sold off severely, reaching a bear market (a 20% drop from the previous high) within three weeks, the fastest bear market decline in history. Demand for safe-haven assets, along with mounting recession fears, drove the yield on the 10-year U.S. Treasury note below 1% in March, an all-time low. Additionally, oil prices collapsed to an 18-year low in March on supply glut concerns, as shutdowns across the global economy curb oil demand while Saudi Arabia and Russia are flooding the market with cheap oil in a price war.

Central banks and governments have responded with liquidity injections to ease the strain on financial systems and stimulus measures to buffer the shock to businesses and consumers. But markets will likely remain volatile until the health crisis itself is under control (via fewer new cases, slower spread and/or verified treatments). There are still many unknowns and new information is incoming daily, compounding the difficulty of modeling outcomes for epidemiologists and economists alike.

Nuveen is monitoring the situation carefully and continuously refining our views. Our portfolio management teams remain attuned to opportunities to seek risk-adjusted returns through all market environments.

13

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through bank borrowings as well as the use of reverse repurchase agreements for JPC, JPI and JPS. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that a Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage. This has been particularly true in the recent market environment where short-term rates have been low by historical standards.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term tax-exempt interest rates. While fund leverage expenses are somewhat higher than their all-time lows after the 2007-2009 financial crisis, which has contributed to a reduction in common share net income and long-term total return potential, leverage nevertheless continues to provide the opportunity for incremental common share income. Management believes that the potential benefits from leverage continue to outweigh the associated increase in risk and volatility previously described.

The Funds’ use of leverage had a positive impact on total return performance during this reporting period. Subsequent to the close of the reporting period, the outbreak of the COVID-19 pandemic led to a significant downturn in global economies and capital markets. As security prices fell, each Fund’s use of leverage impacted total returns negatively. In response, the Funds have been taking steps to reduce risk by paying down leverage levels pursuant to their leverage risk management protocols, as summarized in “The Funds’ Leverage” section below.

JPC, JPI and JPS continued to use forward starting interest rate swap contracts to partially hedge the interest cost of leverage, which as mentioned previously, is through the use of bank borrowings. During this reporting period, these swap contracts had a negative impact to overall Fund total return performance.

As of January 31, 2020, the Funds’ percentages of leverage are shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | |

Effective Leverage* | | | 36.02 | % | | | 33.31 | % | | | 36.79 | % | | | 19.82 | % |

Regulatory Leverage* | | | 30.50 | % | | | 28.46 | % | | | 30.26 | % | | | 19.82 | % |

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of the Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

14

THE FUNDS’ LEVERAGE

Bank Borrowings

As noted above, the Funds employ regulatory leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table. Paydowns reflect on-going leverage management activity that seeks to maintain each Fund’s leverage ratio within a specified internal operating range.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | Outstanding

Balance as of

August 1, 2019 | | | Draws | | | Paydowns | | | Outstanding

Balance as of

January 31, 2020 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | Outstanding

Balance as of

March 27, 2020 | |

JPC | | $ | 455,000,000 | | | $ | 22,000,000 | | | $ | — | | | $ | 477,000,000 | | | $ | 465,315,217 | | | | | | | $ | — | | | $ | (170,690,000 | ) | | $ | 306,310,000 | |

JPI | | $ | 210,000,000 | | | $ | 25,000,000 | | | $ | — | | | $ | 235,000,000 | | | $ | 218,804,348 | | | | | | | $ | — | | | $ | (79,300,000 | ) | | $ | 155,700,000 | |

JPS | | $ | 853,300,000 | | | $ | 55,000,000 | | | $ | — | | | $ | 908,300,000 | | | $ | 859,876,087 | | | | | | | $ | — | | | $ | (333,000,000 | ) | | $ | 575,300,000 | |

JPT | | $ | 42,500,000 | | | $ | — | | | $ | — | | | $ | 42,500,000 | | | $ | 42,500,000 | | | | | | | $ | 3,000,000 | | | $ | (18,200,000 | ) | | $ | 27,300,000 | |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage, Borrowings and Note 10 – Subsequent Events, Borrowing for further details.

Reverse Repurchase Agreements

As noted above, JPC, JPI and JPS used reverse repurchase agreements, in which the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Funds’ transactions in reverse repurchase agreements are as shown in the accompanying table. Sales reflect on-going leverage management activity that seeks to maintain each Fund’s leverage ratio within a specified internal operating range.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of the Reporting Period | |

| Fund | | Outstanding

Balance as of

August 1, 2019 | | | Sales | | | Purchases | | | Outstanding

Balance as of

January 31, 2020 | | | Average Balance

Outstanding | | | | | | Sales | | | Purchases | | | Outstanding

Balance as of

March 27, 2020 | |

| JPC | | $ | 135,000,000 | | | $ | — | | | $ | — | | | $ | 135,000,000 | | | $ | 135,000,000 | | | | | | | $ | 108,500,000 | | | $ | 23,500,000 | | | $ | 50,000,000 | |

| JPI | | $ | 60,000,000 | | | $ | — | | | $ | — | | | $ | 60,000,000 | | | $ | 60,000,000 | | | | | | | $ | 35,000,000 | | | $ | 5,000,000 | | | $ | 30,000,000 | |

| JPS | | $ | 260,000,000 | | | $ | — | | | $ | 50,000,000 | | | $ | 310,000,000 | | | $ | 265,978,261 | | | | | | | $ | 117,000,000 | | | $ | — | | | $ | 193,000,000 | |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage, Reverse Repurchase Agreements and Note 10 – Subsequent Events, Reverse Repurchase Agreements for further details.

15

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of January 31, 2020. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | Per Common Share Amounts | |

| Monthly Distributions(Ex-Dividend Date) | | JPC | | | JPI | | | JPS | | | JPT | |

August 2019 | | $ | 0.0610 | | | $ | 0.1355 | | | $ | 0.0560 | | | $ | 0.1185 | |

September | | | 0.0610 | | | | 0.1355 | | | | 0.0560 | | | | 0.1185 | |

October | | | 0.0610 | | | | 0.1355 | | | | 0.0560 | | | | 0.1185 | |

November | | | 0.0610 | | | | 0.1355 | | | | 0.0560 | | | | 0.1185 | |

December | | | 0.0610 | | | | 0.1355 | | | | 0.0560 | | | | 0.1185 | |

January 2020 | | | 0.0610 | | | | 0.1355 | | | | 0.0560 | | | | 0.1185 | |

Total Distributions from Net Investment Income | | $ | 0.3660 | | | $ | 0.8130 | | | $ | 0.3360 | | | $ | 0.7110 | |

| | | | | | | | | | | | | | | | | |

Current Distribution Rate* | | | 7.00 | % | | | 6.25 | % | | | 6.59 | % | | | 5.69 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Funds during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

CHANGE IN METHOD OF PUBLISHING NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

During November 2019, the Nuveen Closed-End Funds discontinued the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted and can be found on Nuveen’s enhanced closed-end fund resource page, which is at www.nuveen.com/closed-end-fund-distributions, along with other Nuveen closed-end fund product updates. Shareholders can expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be activated at this link here, or at this web page (www.nuveen.com/en-us/people/about-nuveen/for-the-media).

16

COMMON SHARE REPURCHASES

During August 2019, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of January 31, 2020, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | |

Common shares cumulatively repurchased and retired | | | 2,826,100 | | | | 0 | | | | 38,000 | | | | 0 | |

Common shares authorized for repurchase | | | 10,335,000 | | | | 2,275,000 | | | | 20,380,000 | | | | 685,000 | |

During the current reporting period, the Funds did not repurchase any of their outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of January 31, 2020, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | |

Common share NAV | | $ | 10.52 | | | $ | 25.95 | | | $ | 10.27 | | | $ | 25.16 | |

Common share price | | $ | 10.45 | | | $ | 26.02 | | | $ | 10.20 | | | $ | 25.01 | |

Premium/(Discount) to NAV | | | (0.67 | )% | | | 0.27 | % | | | (0.68 | )% | | | (0.60 | )% |

6-month average premium/(discount) to NAV | | | (1.42 | )% | | | (0.89 | )% | | | (0.67 | )% | | | (0.24 | )% |

17

Risk Considerations and Investment Policy Updates

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Preferred & Income Opportunities Fund (JPC)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure, and therefore are subject to greater credit risk.Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Certain types of preferred or debt securities with special loss absorption provisions, such ascontingent capital securities (CoCos), may be or become so subordinated that they present risks equivalent to, or in some cases even greater than, the same company’s common stock. These loss absorption features work to the benefit of the security issuer, not the investor. These and other risk considerations such asconcentration andforeign securities risk are described in more detail on the Fund’s web page atwww.nuveen.com/JPC.

Nuveen Preferred and Income Term Fund (JPI)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure, and therefore are subject to greater credit risk.Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Certain types of preferred or debt securities with special loss absorption provisions, such ascontingent capital securities (CoCos), may be or become so subordinated that they present risks equivalent to, or in some cases even greater than, the same company’s common stock. These loss absorption features work to the benefit of the security issuer, not the investor. For these and other risks, including the Fund’slimited term andconcentration risk, see the Fund’s web page atwww.nuveen.com/JPI.

Nuveen Preferred & Income Securities Fund (JPS)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure, and therefore are subject to greater credit risk.Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Certain types of preferred or debt securities with special loss absorption provisions, such ascontingent capital securities (CoCos), may be or become so subordinated that they present risks equivalent to, or in some cases even greater than, the same company’s common stock. These loss absorption features work to the benefit of the security issuer, not the investor. These and other risks such asconcentration andforeign securities risk are described in more detail on the Fund’s web page atwww.nuveen.com/JPS.

18

Nuveen Preferred and Income 2022 Term Fund (JPT)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Preferred securities are subordinated to bonds and other debt instruments in a company’s capital structure, and therefore are subject to greater credit risk.Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. For these and other risks, including the Fund’slimited term andconcentration risk, see the Fund’s web page atwww.nuveen.com/JPT.

Investment Policy Updates

Change in Investment Policy

The Funds have recently adopted the following policy regarding limits to investments in illiquid securities:

While there are no such limits imposed by applicable regulations, certain Nuveen Closed-End Funds formerly had investment policies that placed limits on a Fund’s ability to invest in illiquid securities. All exchange-listed Nuveen Closed-End Funds now have no formal limit on their ability to invest in such illiquid securities, but each Fund’s portfolio management team will monitor such investments in the regular, overall management of the Fund’s portfolio securities.

19

| | |

| JPC | | Nuveen Preferred & Income Opportunities Fund Performance Overview and Holding Summaries as of January 31, 2020 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2020

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| JPC at Common Share NAV | | | 7.49% | | | | 17.16% | | | | 7.84% | | | | 10.19% | |

| JPC at Common Share Price | | | 9.29% | | | | 22.26% | | | | 10.23% | | | | 12.35% | |

| ICE BofA U.S. All Capital Securities Index | | | 5.18% | | | | 13.93% | | | | 6.40% | | | | 8.19% | |

| JPC Blended Benchmark(1) | | | 5.28% | | | | 13.59% | | | | 6.86% | | | | 7.56% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment. Performance for indexes that were created after the Fund’s inception are linked to the Fund’s previous benchmark.

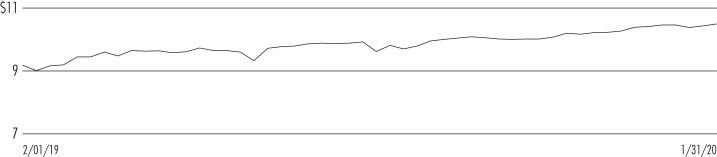

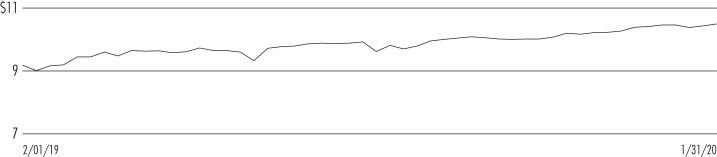

Common Share Price Performance —Weekly Closing Price

| 1. | The Blended Index consists of: 1) 50% of the return of the ICE BofA Preferred Securities Fixed Rate Index, 2) 30% of the return the ICE BofA U.S. All Capital Securities Index and 3) 20% of the return of the ICE BofA Contingent Capital Securities USD Hedged Index. |

20

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| $1,000 Par (or similar) Institutional Preferred | | | 76.3% | |

| $25 Par (or similar) Retail Preferred | | | 44.2% | |

| Contingent Capital Securities | | | 26.8% | |

| Corporate Bonds | | | 4.7% | |

| Convertible Preferred Securities | | | 3.2% | |

| Common Stocks | | | 0.3% | |

| Repurchase Agreements | | | 0.9% | |

| Other Assets Less Liabilities | | | (0.1)% | |

Net Assets Plus Borrowings and Reverse Repurchase Agreements | | | 156.3% | |

| Borrowings | | | (43.9)% | |

| Reverse Repurchase Agreements | | | (12.4)% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

Banks | | | 30.1% | |

Diversified Financial Services | | | 15.1% | |

Insurance | | | 13.1% | |

Capital Markets | | | 10.8% | |

Food Products | | | 5.0% | |

Consumer Finance | | | 4.2% | |

Electric Utilities | | | 2.8% | |

Other | | | 18.3% | |

Repurchase Agreements | | | 0.6% | |

Total | | | 100% | |

Country Allocation1

(% of total investments)

| | | | |

United States | | | 73.0% | |

United Kingdom | | | 7.5% | |

France | | | 4.2% | |

Switzerland | | | 4.1% | |

Canada | | | 2.5% | |

Spain | | | 2.1% | |

Australia | | | 1.7% | |

Netherlands | | | 1.5% | |

Ireland | | | 1.0% | |

Italy | | | 0.9% | |

Other | | | 1.5% | |

Total | | | 100% | |

Top Five Issuers

(% of total long-term

investments)

| | | | |

| Citigroup Inc. | | | 3.9% | |

| JPMorgan Chase & Company | | | 3.8% | |

| Bank of America Corporation | | | 3.2% | |

| Morgan Stanley | | | 2.7% | |

| Wells Fargo & Company | | | 2.7% | |

Portfolio Credit Quality

(% of total long-term fixed-income investments)

| | | | |

| A | | | 0.6% | |

| BBB | | | 51.8% | |

| BB or Lower | | | 41.0% | |

| N/R (not rated) | | | 6.6% | |

Total | | | 100% | |

| 1 | Includes 1.1% (as a percentage of total investments) in emerging market countries. |

21

| | |

| JPI | | Nuveen Preferred and Income Term Fund Performance Overview and Holding Summaries as of January 31, 2020 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2020

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | Since

Inception | |

| JPI at Common Share NAV | | | 8.61% | | | | 18.98% | | | | 8.40% | | | | 9.24% | |

| JPI at Common Share Price | | | 10.73% | | | | 25.89% | | | | 10.30% | | | | 9.04% | |

| ICE BofA U.S. All Capital Securities Index | | | 5.18% | | | | 13.93% | | | | 6.40% | | | | 7.48% | |

| JPI Blended Benchmark(1) | | | 6.30% | | | | 14.87% | | | | 7.46% | | | | 6.75% | |

Since inception returns are from 7/26/12. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

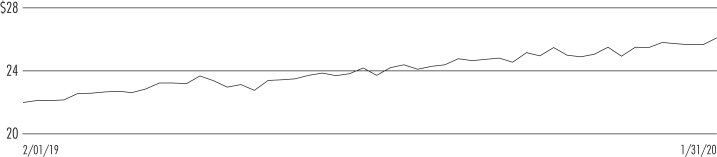

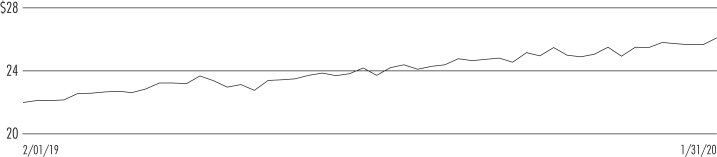

Common Share Price Performance —Weekly Closing Price

| 1. | The Blended Index consists of: 1) 60% of the return of the ICE BofA U.S. All Capital Securities Index and 2) 40% of the return the ICE BofA Contingent Capital Index. |

22

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| $1,000 Par (or similar) Institutional Preferred | | | 69.6% | |

| Contingent Capital Securities | | | 45.7% | |

| $25 Par (or similar) Retail Preferred | | | 34.0% | |

| Other Assets Less Liabilities | | | 0.7% | |

Net Assets Plus Borrowings and Reverse Repurchase Agreements | | | 150.0% | |

| Borrowings | | | (39.8)% | |

| Reverse Repurchase Agreements | | | (10.2)% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

Banks | | | 35.3% | |

Diversified Financial Services | | | 17.3% | |

Insurance | | | 13.4% | |

Capital Markets | | | 12.2% | |

Food Products | | | 4.6% | |

Other | | | 17.2% | |

Total | | | 100% | |

Country Allocation1

(% of total investments)

| | | | |

United States | | | 58.8% | |

United Kingdom | | | 11.1% | |

France | | | 7.4% | |

Switzerland | | | 7.3% | |

Spain | | | 3.9% | |

Australia | | | 3.1% | |

Netherlands | | | 2.1% | |

Ireland | | | 1.8% | |

Italy | | | 1.6% | |

Canada | | | 1.4% | |

Other | | | 1.5% | |

Total | | | 100% | |

Top Five Issuers

(% of total long-term

investments)

| | | | |

| JPMorgan Chase & Company | | | 4.0% | |

| Credit Suisse Group AG | | | 3.8% | |

| Citigroup Inc. | | | 3.8% | |

| UBS Group AG | | | 3.2% | |

| Credit Agricole SA | | | 3.1% | |

Portfolio Credit Quality

(% of total long-term fixed-income

investments)

| | | | |

| A | | | 0.8% | |

| BBB | | | 54.2% | |

| BB or Lower | | | 42.6% | |

| N/R (not rated) | | | 2.4% | |

Total | | | 100% | |

| 1 | Includes 0.7% (as a percentage of total investments) in emerging market countries. |

23

| | |

| JPS | | Nuveen Preferred & Income Securities Fund Performance Overview and Holding Summaries as of January 31, 2020 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of January 31, 2020

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| JPS at Common Share NAV | | | 7.91% | | | | 18.09% | | | | 8.24% | | | | 10.47% | |

| JPS at Common Share Price | | | 7.74% | | | | 19.62% | | | | 9.67% | | | | 11.51% | |

| ICE BofA U.S. All Capital Securities Index | | | 5.18% | | | | 13.93% | | | | 6.40% | | | | 7.14% | |

| JPS Blended Benchmark(1) | | | 6.30% | | | | 14.87% | | | | 7.46% | | | | 8.10% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment. Performance for indexes that were created after the Fund’s inception are linked to the Fund’s previous benchmark.

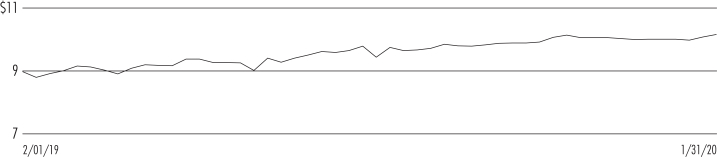

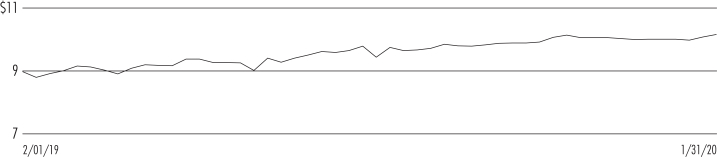

Common Share Price Performance —Weekly Closing Price

| 1. | The Blended Index consists of: 1) 60% of the return of the ICE BofA U.S. All Capital Securities Index and 2) 40% of the return the ICE BofA Contingent Capital Securities USD Hedged Index. |

24

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| $1,000 Par (or similar) Institutional Preferred | | | 71.5% | |

| Contingent Capital Securities | | | 62.1% | |

| $25 Par (or similar) Retail Preferred | | | 17.7% | |

| Investment Companies | | | 1.3% | |

| Convertible Preferred Securities | | | 0.9% | |

| Corporate Bonds | | | 0.9% | |

| Repurchase Agreements | | | 2.7% | |

| Other Assets Less Liabilities | | | 1.1% | |

Net Assets Plus Borrowings and Reverse Repurchase Agreements | | | 158.2% | |

| Borrowings | | | (43.4)% | |

| Reverse Repurchase Agreements | | | (14.8)% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

Banks | | | 43.9% | |

Insurance | | | 18.0% | |

Diversified Financial Services | | | 11.8% | |

Capital Markets | | | 9.5% | |

Electric Utilities | | | 3.6% | |

Other | | | 10.7% | |

| Investment Companies | | | 0.8% | |

| Repurchase Agreements | | | 1.7% | |

Total | | | 100% | |

Country Allocation

(% of total investments)

| | | | |

United States | | | 46.7% | |

United Kingdom | | | 20.2% | |

France | | | 10.6% | |

Switzerland | | | 7.2% | |

Canada | | | 2.9% | |

Finland | | | 2.7% | |

Australia | | | 2.6% | |

Netherlands | | | 1.6% | |

Sweden | | | 1.2% | |

Norway | | | 1.0% | |

Other | | | 3.3% | |

Total | | | 100% | |

Top Five Issuers

(% of total long-term

investments)

| | | | |

Barclays PLC | | | 4.3% | |

BNP Paribas SA | | | 3.9% | |

Credit Suisse | | | 3.5% | |

Royal Bank of Scotland Group PLC | | | 3.5% | |

JPMorgan Chase & Co | | | 3.5% | |

Portfolio Credit Quality

(% of total long-term fixed-income investments)

| | | | |