UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811‑21293 |

Nuveen Preferred & Income Opportunities Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: July 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | | | | | | | |

| | | | Closed‑End Funds | | | | July 31, 2023 |

Nuveen

Closed‑End Funds

| | | | | | |

| | | |

| | |

| | Nuveen Preferred & Income Opportunities Fund | | | JPC | |

| | | |

| | |

| | | Nuveen Preferred and Income Term Fund | | | JPI | |

| | | |

| | |

| | Nuveen Preferred & Income Securities Fund | | | JPS | |

| | | |

| | |

| | Nuveen Preferred and Income Fund | | | JPT | |

| | | |

| | |

| | Nuveen Variable Rate Preferred & Income Fund | | | NPFD | |

| | | |

Annual

Report

Table

of Contents

| | | | |

| |

| | | 3 | |

| |

| | | 4 | |

| |

| | | 5 | |

| |

| | | 11 | |

| |

| | | 13 | |

| |

| | | 15 | |

| |

| | | 17 | |

| |

| | | 27 | |

| |

| | | 29 | |

| |

| | | 31 | |

| |

| | | 67 | |

| |

| | | 68 | |

| |

| | | 69 | |

| |

| | | 72 | |

| |

| | | 74 | |

| |

| | | 81 | |

| |

| | | 99 | |

| |

| | | 138 | |

| |

| | | 140 | |

| |

| | | 141 | |

| |

| | | 142 | |

| |

| | | 150 | |

2

Chair’s Letter

to Shareholders

| | |

| | Dear Shareholders, Inflation concerns have continued to dominate the investment landscape in 2023. While inflation rates have fallen meaningfully from post-pandemic highs, helped by the significant policy interest rate increases from the U.S. Federal Reserve (Fed) and other global central banks since 2022 and the normalization of supply chains, they currently remain above the levels that central banks consider supportive of their economies’ long-term growth. Core inflation measures, which exclude volatile food and energy prices, in particular remain above central banks’ targeted levels. At the same time, the U.S. and other large economies have remained relatively resilient, even as financial conditions have tightened. U.S. gross domestic product increased to 2.1% in the second quarter of 2023 from 2.0% in the first quarter of 2023, after growing 2.1% in 2022 overall compared to 2021. Consider that much of this growth occurred while the Fed was raising interest rates in one of the fastest hiking cycles in its history. From March 2022 to July 2023 (with only a brief pause in June 2023), the Fed increased the target fed funds rate from near zero to a range of 5.25% to 5.50% as of July 2023. Despite historically high inflation and rapidly rising interest rates, the jobs market has remained relatively strong, helping to support consumer sentiment and spending. However, markets are concerned that these conditions could keep upward pressure on prices and wages while the impact of the collapse of three regional U.S. banks (Silicon Valley Bank, Signature Bank and First Republic Bank) and major European bank Credit Suisse in March 2023 adds to uncertainty. Given the lingering upside risks to inflation and the lagging impact of tighter credit conditions on the economy, Fed officials are closely monitoring incoming inflation data and other economic measures to modify their rate setting activity based upon these factors on a meeting‑by‑meeting basis. The Fed remains committed to acting until it sees sustainable progress toward its inflation goals. Additionally, market concerns surrounding the U.S. debt ceiling faded after the government agreed in June 2023 to suspend the nation’s borrowing limit until January 2025, averting a near-term default scenario. In the meantime, markets are likely to continue reacting in the short term to news about inflation data, economic indicators and central bank policy. We encourage investors to keep a long-term perspective amid the short-term turbulence. Your financial professional can help you review how well your portfolio is aligned with your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead. Terence J. Toth Chair of the Board September 22, 2023 |

3

Important Notices

Nuveen Preferred & Income Opportunities Fund (JPC), Nuveen Preferred & Income Securities Fund (JPS) and Nuveen Preferred and Income Fund (JPT) Fund Mergers

On April 12, 2023, the mergers of JPS and JPT into JPC were approved by each Fund’s Board of Trustees. The merger of each JPS and JPT is pending shareholder approval, and the closing of each merger is contingent upon obtaining shareholder approvals and satisfying other closing conditions. The mergers are not contingent on each other.

Recent Market Factors

Each of the Funds covered by this Report have substantial allocations to preferred and contingent capital securities issued by U.S. and non‑U.S. banks and other financial institutions. Given recent increases in prevailing interest rates and other market factors, these securities are subject to heightened volatility and default risk and may, ultimately, detract from Fund performance. The Funds’ investments may also be subject to the risk that central bank or other extraordinary government intervention may negatively impact the priority or likelihood of repayment. In addition, recent bank failures may have a destabilizing impact on the broader banking industry or markets generally, which may also heighten volatility and reduce liquidity.

4

Portfolio Managers’

Comments

Nuveen Preferred & Income Opportunities Fund

Nuveen Preferred and Income Term Fund

Nuveen Preferred & Income Securities Fund

Nuveen Preferred and Income Fund

Nuveen Variable Rate Preferred & Income Fund

Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Funds’ investment adviser, is the sub‑adviser for the Nuveen Preferred & Income Opportunities Fund (JPC), Nuveen Preferred and Income Term Fund (JPI), Nuveen Preferred and Income Fund (JPT) and Nuveen Variable Rate Preferred & Income Fund (NPFD). The Funds’ portfolio managers are Douglas M. Baker, CFA and Brenda A. Langenfeld, CFA. The Nuveen Preferred & Income Securities Fund (JPS) is sub‑advised by a team of specialists at Spectrum Asset Management, Inc. (Spectrum), a wholly owned subsidiary of Principal Global Investors Holding Company (U.S.), LLC. The portfolio managers for JPS are L. Phillip Jacoby and Mark A. Lieb.

In April 2023, the Board of Trustees for the Nuveen Preferred and Income Fund (JPT), Nuveen Preferred & Income Securities Fund (JPS), and the Nuveen Preferred & Income Opportunities Fund (JPC) approved a proposal to merge JPS and JPT into JPC. The merger is subject to shareholder approval.

Here the Funds’ portfolio management teams review economic and market conditions, key investment strategies and the Funds’ performance for the twelve-month reporting period July 31, 2023. For more information on the Funds’ investment objectives and policies, please refer to the Shareholder Update section of the report.

What factors affected the economy and the market conditions during the twelve-month annual reporting period ended July 31, 2023?

The U.S. economy performed better than expected despite persistent inflationary pressure and rising interest rates during the twelve-month period ended July 31, 2023. In the second quarter of 2023, the economy grew at an annualized rate of 2.1%, according to the second estimate from the U.S. Bureau of Economic Analysis, compared to 2.0% in the first quarter and in line with 2.1% in 2022 overall. Early in the reporting period, inflation rose sharply because of supply chain disruptions and high food and energy prices, the Russia-Ukraine war and China’s zero‑COVID restrictions (eventually lifted in December 2022). During the reporting period, U.S. inflation reached its peak level in August 2022. Since then, price pressures have eased given normalization in supply chains, falling energy prices and aggressive measures by the U.S. Federal Reserve (Fed) and other global central banks to tighten financial conditions and slow demand in their economies. Nevertheless, during the reporting period inflation levels remained much higher than central banks’ target levels.

The Fed raised its target fed funds rate seven times during the reporting period, bringing it to a range of 5.25% to 5.50% as of July 2023. One of the Fed’s rate increases occurred in March 2023, a decision that was closely watched because of the failure of Silicon Valley Bank and Signature Bank during the same month and uncertainty around the economic impact of these failures. Additionally, in March 2023, Swiss bank UBS agreed to buy Credit Suisse, which was considered to be vulnerable in the current environment. For much of the reporting period, the Fed’s activity led to significant volatility in bond and stock markets. In addition, it contributed to an increase in the U.S. dollar’s value relative to major world currencies, which acts as a headwind to the profits of international companies and U.S. domestic companies with overseas earnings. Global currency and bond markets were further roiled in September 2022 by an unpopular fiscal spending proposal in the U.K. but recovered after the plans were abandoned.

During the reporting period, elevated inflation and higher borrowing costs weighed on some segments of the economy, including the real estate market. Consumer spending, however, has remained more resilient than expected, in part because of a still-strong labor market, another key gauge of the economy’s health. As of July 2023, the unemployment rate remained near its pre‑pandemic low of 3.5%, although monthly job growth appeared to be slowing. The strong labor market and wage gains helped provide a measure of resilience to the U.S. economy during the reporting period, even as the Fed sought to soften job growth to help curb inflation pressures.

The preferred securities market struggled through two periods of volatility during the reporting period. The first three months of the reporting period were challenged by increasing market yields in U.S. Treasuries, which caused preferred securities’ yields to rise as well. The meaningfully higher yields negatively impacted the U.S. banking system, causing certain regional banks with outsized deposit concentrations to fail. This was largely the result of these particular banks realizing significant losses in their liquidity

5

Portfolio Managers’ Comments (continued)

portfolios to meet demands from sudden deposit outflows. Concern spread to the European banking system, which caused Credit Suisse to be absorbed by UBS. The preferred and contingent capital (CoCos) securities markets were volatile during a six‑week period between February and March 2023. The Fed stepped in to offer emergency deposit liquidity with a new Bank Term Funding Program, which effectively backstopped the U.S. banking system and helped prices in preferred and capital securities markets to recover from the banking-related volatility.

Nuveen Preferred & Income Opportunities Fund (JPC)

What key strategies were used to manage the Fund during the twelve-month reporting period ended July 31, 2023?

The Fund seeks to provide high current income and secondarily, total return, by investing at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities (CoCos). The Fund invests up to 20% opportunistically in other securities, primarily income-oriented securities such as corporate and taxable municipal debt and common equity. Additionally, at least 50% is invested in securities that are rated investment grade at the time of purchase or, if non‑rated, judged to be of comparable quality by the Fund’s portfolio management team. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage section of this report.

During the reporting period, the portfolio management team incorporated several active themes within the Fund relative to the JPC Blended Benchmark, including an overweight to $1,000 par preferred securities and securities that have coupons with reset features (floating rate, fixed‑to‑floating rate, fixed‑to‑fixed rate), an underweight to CoCos and a corresponding overweight to U.S.-domiciled issuers. The CoCo segment faced significant volatility amid banking concerns, including the announcement of UBS’s takeover of Credit Suisse in March 2023. While the Fund’s absolute exposure to the CoCo sector only modestly decreased from the prior annual reporting period, the composition of CoCo exposure within its portfolio materially shifted. Most notably, the Fund’s Credit Suisse Additional Tier 1 (AT1) CoCos were written down to zero by the Swiss government and regulators during the March banking crisis. Following statements by the European Central Bank and Bank of England confirming that AT1 CoCos from banks under their purview have hierarchy over common equity, the portfolio management team increased the Fund’s exposure to non‑Swiss AT1 CoCos, beginning in April 2023.

How did the Fund perform during the twelve-month reporting period ended July 31, 2023?

For the twelve-month reporting period ended July 31, 2023, JPC underperformed the JPC Blended Benchmark. For the purposes of this Performance Commentary, references to relative performance are in comparison to the JPC Blended Benchmark, which consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index.

The Fund’s use of leverage through bank borrowings, reverse repurchase agreements and the issuance of preferred shares significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

In addition, the Fund’s overweight to the U.S. regional bank sector detracted from relative performance. Although the Fund benefited from either no exposure or an underweight to the U.S. banks that failed in the first half of 2023, the Fund’s overweight to the regional bank sector detracted because the sector materially underperformed U.S. money center banks and super-regional banks. Negative security selection within the CoCo segment also detracted from relative performance because the developed market banks that the Fund favored generally underperformed emerging market (EM) banks during the reporting period. Consistent with its mandate, the Fund had limited EM exposure. In addition, the Fund’s overweight exposure to SBL Holdings, a mid‑sized U.S. annuity provider, detracted from relative performance as its preferred securities experienced selling pressure. The Fund continues to hold these securities based on the company’s solid credit metrics.

Partially offsetting the Fund’s underperformance was its overweight to $1,000 par preferred securities, which gave it greater exposure to securities that have coupons with reset features. These investments outperformed securities with fixed-rate coupons because they generally demonstrated lower sensitivity to rising interest rates during the reporting period. The Fund’s shorter effective duration versus the benchmark also contributed to relative performance because it decreased the portfolio’s sensitivity to interest rate changes as rates moved materially higher. In addition, the Fund benefited from its lack of exposure to the real estate investment trust (REIT) preferred sector, particularly office REITs, which underperformed the broader market.

6

Nuveen Preferred and Income Term Fund (JPI)

What key strategies were used to manage the Fund during the twelve-month reporting period ended July 31, 2023?

The Fund seeks to provide a high level of current income and total return by investing at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities (CoCos), with a focus on securities issued by financial and insurance firms. At least 50% of its managed assets are rated investment grade at the time of purchase or, if unrated, judged to be of comparable quality by the Fund’s portfolio management team. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage section of this report.

During the reporting period, the portfolio management team incorporated several active themes within the Fund relative to the JPI Blended Benchmark, including an overweight to $1,000 par preferred securities and securities that have coupons with reset features (floating rate, fixed‑to‑floating rate, fixed‑to‑fixed rate), an underweight to CoCos and a corresponding overweight to U.S.-domiciled issuers. The CoCo segment faced significant volatility amid banking concerns, including the announcement of UBS’s takeover of Credit Suisse in March 2023. While the Fund’s absolute exposure to the CoCo sector only modestly decreased compared to the prior reporting period, the composition of CoCo exposure within its portfolio materially shifted. Most notably, the Fund’s Credit Suisse Additional Tier 1 (AT1) CoCos were written down to zero by the Swiss government and regulators during the March 2023 banking crisis. Following statements by the European Central Bank and Bank of England confirming that AT1 CoCos from banks under their purview have hierarchy over common equity, the portfolio management team increased the Fund’s exposure to non‑Swiss AT1 CoCos, beginning in April 2023.

How did the Fund perform during the twelve-month reporting period ended July 31, 2023?

For the twelve-month reporting period ended July 31, 2023, JPI underperformed the JPI Blended Benchmark. For the purposes of this Performance Commentary, references to relative performance are in comparison to the JPI Blended Benchmark, which consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index.

The Fund’s use of leverage through bank borrowings and reverse repurchase agreements significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

In addition, the Fund’s overweight to the U.S. regional bank sector detracted from relative performance. Although the Fund benefited from either no exposure or an underweight to the U.S. banks that failed in the first half of 2023, the Fund’s overweight to the regional bank sector detracted because the sector materially underperformed U.S. money center banks and super-regional banks. Negative security selection within the CoCo segment also detracted from relative performance because the developed market banks that the Fund favored generally underperformed emerging market (EM) banks during the reporting period. Consistent with its mandate, the Fund had limited EM exposure. In addition, the Fund’s overweight exposure to SBL Holdings, a mid‑sized U.S. annuity provider, detracted from relative performance as its preferred securities experienced selling pressure. The Fund continues to hold these securities based on the company’s solid credit metrics.

Partially offsetting the Fund’s underperformance was its overweight to $1,000 par preferred securities, which gave it greater exposure to securities that have coupons with reset features. These investments outperformed securities with fixed-rate coupons because they generally demonstrated lower sensitivity to rising interest rates during the reporting period. The Fund’s shorter effective duration versus the benchmark also contributed to relative performance because it decreased the portfolio’s sensitivity to interest rate changes as rates moved materially higher. In addition, the Fund benefited from its lack of exposure to the real estate investment trust (REIT) preferred sector, particularly office REITs, which underperformed the broader market.

Nuveen Preferred & Income Securities Fund (JPS)

What key strategies were used to manage the Fund during the twelve-month reporting period ended July 31, 2023?

The Fund primarily seeks to offer high current income consistent with capital preservation. The Fund invests at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities (CoCos). At least 50% is invested in securities that are rated investment grade. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage section of this report.

7

Portfolio Managers’ Comments (continued)

During the reporting period, the Fund was overweight $1,000 par preferred securities, underweight $25 par preferred securities and underweight CoCos based on the portfolio management team’s relative value assessment. As interest rates are expected to be elevated for some time, the Fund maintained an overall shorter-duration profile relative to the JPS Blended Benchmark.

How did the Fund perform during this twelve-month reporting period ended July 31, 2023?

For the twelve-month reporting period ended July 31, 2023, JPS performed in line with the JPS Blended Benchmark. For the purposes of this Performance Commentary, references to relative performance are in comparison to the JPS Blended Benchmark, which consists of: 1) 60% ICE BofA U.S. All Capital Securities Index, and 2) 40% ICE USD Contingent Capital Index.

Security selection within CoCos was the top contributor to relative performance during the reporting period. The Fund sold out of its positions in Credit Suisse CoCos prior to UBS announcing its plans to take over Credit Suisse, which resulted in the securities being written down to zero. Additionally, an underweight to and security selection within $25 par preferred securities contributed to relative performance. An overweight to $1,000 par preferred securities also contributed to relative performance as a result of their predominantly variable rate coupon structure amid rising interest rates. The Fund’s shorter-duration positioning relative to the benchmark also contributed to performance amid the rising interest rates.

Partially offsetting these relative contributors was the Fund’s use of leverage through bank borrowings, reverse repurchase agreements and the issuance of preferred shares, which significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

In addition, an overweight to U.S. regional banks, which were volatile during the reporting period, detracted from relative performance as they underperformed the broader preferred securities market.

Nuveen Preferred and Income Fund (JPT)

What key strategies were used to manage the Fund during the twelve-month reporting period ended July 31, 2023?

The Fund seeks to provide a high level of current income and total return. The Fund provides access to both the exchange-traded and over‑the‑counter preferred securities markets, seeking to capitalize on price discrepancies that may occur between these two markets. The Fund also has the flexibility to opportunistically invest in preferred securities with various coupon structures, including fixed‑to‑floating structures, which may help reduce interest rate risk and enhance performance in a rising rate environment. The Fund invests at least 80% of its managed assets in preferred and other income-producing securities, including hybrid securities such as contingent capital securities (CoCos). The Fund may invest without limit in below investment grade securities but no more than 10% in securities rated below B‑/B3 at the time of investment. Up to 40% of its managed assets may be in securities issued by companies located anywhere in the world, but no more than 10% in securities of issuers in emerging markets countries, and 100% in U.S. dollar-denominated securities. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage section of this report.

During the reporting period, the portfolio management team incorporated several active themes within the Fund relative to the JPT Blended Benchmark, including an overweight to $1,000 par preferred securities and securities that have coupons with reset features (floating rate, fixed‑to‑floating rate, fixed‑to‑fixed rate), an underweight to CoCos and a corresponding overweight to U.S.-domiciled issuers. The CoCo segment faced significant volatility amid banking concerns, including the announcement of UBS’s takeover of Credit Suisse in March 2023. While the Fund’s absolute exposure to the CoCo sector only modestly decreased from the prior fiscal year end, the composition of CoCo exposure within its portfolio materially shifted. Most notably, the Fund’s Credit Suisse Additional Tier 1 (AT1) CoCos were written down to zero by the Swiss government and regulators during the March 2023 banking crisis. Following statements by the European Central Bank and Bank of England confirming that AT1 CoCos from banks under their purview have hierarchy over common equity, the portfolio management team increased the Fund’s exposure to non‑Swiss AT1 CoCos, beginning in April 2023.

How did the Fund perform during the twelve-month reporting period ended July 31, 2023?

For the twelve-month reporting period ended July 31, 2023, JPT underperformed the JPT Blended Benchmark. For the purposes of this Performance Commentary, references to relative performance are in comparison to the JPT Blended Benchmark, which consists of: 1) 60% ICE BofA U.S. All Capital Securities Index, and 2) 40% ICE USD Contingent Capital Index.

8

The Fund’s use of leverage through bank borrowings and reverse repurchase agreements significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

In addition, the Fund’s overweight to the U.S. regional bank sector detracted from relative performance. Although the Fund benefited from either no exposure or an underweight to the U.S. banks that failed in the first half of 2023, the Fund’s overweight to the regional bank sector detracted because the sector materially underperformed U.S. money center banks and super-regional banks. Negative security selection within the CoCo segment also detracted from relative performance because the developed market banks that the Fund favored generally underperformed emerging market (EM) banks during the reporting period. Consistent with its mandate, the Fund had limited EM exposure. In addition, the Fund’s overweight exposure to SBL Holdings, a mid‑sized U.S. annuity provider, detracted from relative performance as its preferred securities experienced selling pressure. The Fund continues to hold these securities based on the company’s solid credit metrics.

Partially offsetting the Fund’s underperformance was its overweight to $1,000 par preferred securities, which gave it greater exposure to securities that have coupons with reset features. These investments outperformed securities with fixed-rate coupons because they generally demonstrated lower sensitivity to rising interest rates during the reporting period. The Fund’s shorter effective duration versus the benchmark also contributed to relative performance because it decreased the portfolio’s sensitivity to interest rate changes as rates moved materially higher. In addition, the Fund benefited from its lack of exposure to the real estate investment trust (REIT) preferred sector, particularly office REITs, which underperformed the broader market.

Nuveen Variable Rate Preferred & Income Fund (NPFD)

What key strategies were used to manage the Fund during the twelve-month reporting period ended July 31, 2023?

The Fund seeks to provide a high level of current income and total return by investing in primarily investment grade, variable rate preferred securities and other variable rate income-producing securities from high quality, highly regulated companies such as banks, utilities and insurance companies. All, or almost all, of the Fund’s distributions of net investment income are expected to be treated as qualified dividend income (QDI), which is generally taxed at a lower rate than interest and ordinary dividend income, assuming holding period and certain other requirements are met.

The Fund may invest up to 20% of managed assets in contingent convertible securities or contingent capital securities (CoCos) and up to 15% in companies located in emerging market countries but may only invest in U.S. dollar denominated securities. More than 25% of managed assets are invested in securities of companies in the financial services sector. The Fund uses leverage and has a 12‑year term with the potential to convert to perpetual. Leverage is discussed in more detail later in the Fund Leverage section of this report.

During the reporting period, the portfolio management team incorporated several active themes within the Fund relative to the NPFD Blended Benchmark, including an underweight to CoCos and corresponding overweights to U.S.-domiciled issuers and the insurance sector. The CoCo segment faced significant volatility amid banking concerns, including the announcement of UBS’s takeover of Credit Suisse in March 2023. While the Fund’s absolute exposure to the CoCo sector only modestly decreased from the prior annual reporting period, the composition of CoCo exposure within its portfolio materially shifted. Most notably, the Fund’s Credit Suisse Additional Tier 1 (AT1) CoCos were written down to zero by the Swiss government and regulators during the March 2023 banking crisis. Following statements by the European Central Bank and Bank of England confirming that AT1 CoCos from banks under their purview have hierarchy over common equity, the portfolio management team increased the Fund’s exposure to non‑Swiss AT1 CoCos, beginning in April 2023.

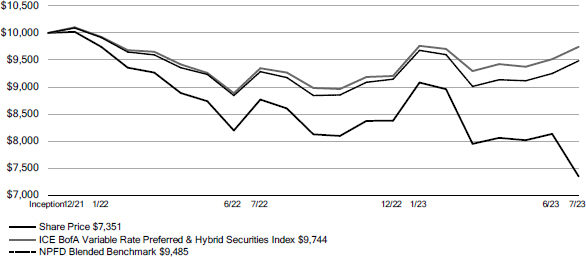

How did the Fund perform during the twelve-month reporting period ended July 31, 2023?

For the twelve-month reporting period ended July 31, 2023, NPFD significantly underperformed the NPFD Blended Benchmark. For the purposes of this Performance Commentary, references to relative performance are in comparison to the NPFD Blended Benchmark, which consists of: 1) 80% ICE Variable Rate Preferred & Hybrid Securities Index, and 2) 20% ICE USD Contingent Capital Index.

The Fund’s use of leverage through bank borrowings, reverse repurchase agreements and the issuance of preferred shares significantly detracted from relative performance during the reporting period. However, the Fund’s use of leverage was accretive to overall common share income. Leverage is discussed in more detail in the Fund Leverage section of this report.

9

Portfolio Managers’ Comments (continued)

In addition to the use of leverage, the Fund’s overweight to the U.S. regional bank sector detracted from relative performance. Although the Fund benefited from either no exposure or an underweight to the U.S. banks that failed in the first half of 2023, the Fund’s overweight to the regional bank sector detracted because the sector materially underperformed U.S. money center banks and super-regional banks. Negative security selection within the CoCo segment also detracted from relative performance because the developed market banks that the Fund favored generally underperformed emerging market (EM) banks during the reporting period. Consistent with its mandate, the Fund had limited EM exposure.

In addition, the Fund’s overweight exposure to SBL Holdings, a mid‑sized U.S. annuity provider, detracted from relative performance as its preferred securities experienced selling pressure. The Fund continues to hold these securities based on the company’s solid credit metrics.

Partially offsetting the Fund’s underperformance were overweights to Truist Financial Corporation and NuStar Energy LP. As a super-regional bank, Truist Financial materially outperformed both the regional bank and U.S. money center bank sectors of the preferred securities market. This floating-rate security experienced strong performance as interest rates rose during the reporting period, resulting in higher coupon rates. The pipeline and storage company NuStar Energy also benefited from the floating-rate nature of its securities and the positive growth backdrop experienced during the reporting period. The Fund maintains overweights to both issuers. During the reporting period, the Fund used interest rate futures to reduce the duration of the portfolio. The interest rate futures contributed to relative performance during the reporting period.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

10

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through bank borrowings, Taxable Fund Preferred Shares (TFP) for JPC, JPS and NPFD and reverse repurchase agreements. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that a Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term interest rates. While fund leverage expenses are higher than their prior year lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

The Funds’ use of leverage significantly detracted to relative performance over this reporting period. However, the Funds’ use of leverage was accretive to overall common share income.

JPC, JPI and JPS continued to use interest rate swap contracts to partially hedge the interest cost of leverage. The interest rate swaps in JPC and JPS contributed to relative performance during the period. The interest rate swaps in JPI had a negligible impact on relative performance during the reporting period.

As of July 31, 2023, the Funds’ percentages of leverage are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | | | NPFD | |

Effective Leverage* | | | 37.59% | | | | 36.93% | | | | 35.47% | | | | 34.29% | | | | 36.49% | |

Regulatory Leverage* | | | 32.07% | | | | 30.10% | | | | 27.07% | | | | 30.03% | | | | 33.90% | |

* Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day‑to‑day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940.

THE FUNDS’ LEVERAGE

Bank Borrowings

As noted previously, the Funds employs leverage through the use of bank borrowings. The Funds’ bank borrowings activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of the Reporting Period | |

| Fund | | Outstanding Balance as of August 1, 2022 | | | Draws | | | Paydowns | | | Outstanding Balance as of July 31, 2023 | | | Average Balance Outstanding | | | Draws | | | Paydowns | | | Outstanding Balance as of September 22, 2023 | |

| JPC | | $ | 423,400,000 | | | $ | 36,700,000 | | | $ | (240,500,000) | | | $ | 219,600,000 | | | $ | 243,901,096 | | | | $8,100,000 | | | $ | - | | | | $227,700,000 | |

| JPI | | $ | 216,000,000 | | | $ | 31,400,000 | | | $ | (66,500,000) | | | $ | 180,900,000 | | | $ | 194,243,562 | | | | $ - | | | $ | - | | | | $180,900,000 | |

| JPS | | $ | 499,300,000 | | | $ | - | | | $ | (198,000,000) | | | $ | 301,300,000 | | | $ | 408,598,630 | | | | $ - | | | $ | - | | | | $301,300,000 | |

| JPT | | $ | 47,000,000 | | | $ | 3,300,000 | | | $ | (14,945,000) | | | $ | 35,355,000 | | | $ | 42,171,589 | | | | $3,445,000 | | | $ | - | | | | $ 38,800,000 | |

| NPFD | | $ | 188,600,000 | | | $ | 39,814,000 | | | $ | (80,800,000) | | | $ | 147,614,000 | | | $ | 152,174,055 | | | | $9,700,000 | | | $ | - | | | | $157,314,000 | |

Refer to Notes to Financial Statements for further details.

Reverse Repurchase Agreements

As noted previously, the Funds used reverse repurchase agreements, in which the Funds sell to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Funds’ transactions in reverse repurchase agreements are as shown in the accompanying table.

11

Fund Leverage (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | Subsequent to the Close of the Reporting Period | |

| Fund | | Outstanding Balance as of August 1, 2022 | | | Sales | | | Purchases | | | Outstanding Balance as of July 31, 2023 | | | Average Balance Outstanding | | | Sales | | | Purchases | | | Outstanding Balance as of September 22, 2023 | |

| JPC | | | $102,100,000 | | | | $- | | | | $- | | | | $102,100,000 | | | | $102,100,000 | | | | $ - | | | | $ - | | | | $102,100,000 | |

| JPI | | | $65,000,000 | | | | $- | | | | $- | | | | $65,000,000 | | | | $65,000,000 | | | | $ - | | | | $ - | | | | $ 65,000,000 | |

| JPS | | | $275,000,000 | | | | $- | | | | $- | | | | $275,000,000 | | | | $275,000,000 | | | | $ - | | | | $ - | | | | $275,000,000 | |

| JPT | | | $- | | | | $32,435,000 | | | | $(24,790,000) | | | | $7,645,000 | | | | $2,172,071* | | | | $5,853,000 | | | | $(7,645,000) | | | | $ 5,853,000 | |

| NPFD | | | $103,402,000 | | | | $506,559,000 | | | | $(581,978,000) | | | | $27,983,000 | | | | $42,189,945 | | | | $55,966,000 | | | | $(55,966,000) | | | | $ 27,983,000 | |

* For the period September 26, 2022 (initial purchase of reverse repurchase agreements) through July 31, 2023.

Taxable Fund Preferred Shares

As noted previously, in addition to bank borrowings, JPC, JPS and NPFD also issued TFP. The Fund’s transactions in TFP are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | Subsequent to the Close of the Reporting Period | |

| Fund | | Outstanding Balance as of August 1, 2022 | | | Issuance | | | Redemptions | | | Outstanding Balance as of July 31, 2023 | | | Average

Balance

Outstanding | | | Sales | | | Purchases | | | Outstanding

Balance as of

September 22,

2023 | |

| JPC | | | $- | | | | $150,000,000 | | | | $- | | | | $150,000,000 | | | | $150,000,000* | | | | $ - | | | | $ - | | | | $150,000,000 | |

| JPS | | | $270,000,000 | | | | $- | | | | $- | | | | $270,000,000 | | | | $270,000,000 | | | | $ - | | | | $ - | | | | $270,000,000 | |

| NPFD | | | $- | | | | $85,000,000 | | | | $- | | | | $85,000,000 | | | | $85,000,000** | | | | $ - | | | | $ - | | | | $85,000,000 | |

* For the period August 18, 2022 (first issuance date of shares) through July 31, 2023.

** For the period September 1, 2022 (first issuance date of shares) through July 31, 2023.

Refer to Notes to Financial Statements for further details on TFP.

12

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of July 31, 2023. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | Per Common Share Amounts | |

| | | | |

| Monthly Distributions (Ex‑Dividend Date) | | JPC | | | JPI | | | JPS | | | JPT | | | NPFD | |

| | |

| August | | | $0.0530 | | | | $0.1305 | | | | $0.0435 | | | | $0.1255 | | | | $0.1380 | |

| September | | | 0.0530 | | | | 0.1305 | | | | 0.0435 | | | | 0.1255 | | | | 0.1380 | |

| October | | | 0.0530 | | | | 0.1240 | | | | 0.0435 | | | | 0.1205 | | | | 0.1195 | |

| November | | | 0.0530 | | | | 0.1240 | | | | 0.0435 | | | | 0.1205 | | | | 0.1195 | |

| December | | | 0.0530 | | | | 0.1240 | | | | 0.0435 | | | | 0.1205 | | | | 0.1195 | |

| January | | | 0.0470 | | | | 0.1150 | | | | 0.0405 | | | | 0.1070 | | | | 0.0960 | |

| February | | | 0.0470 | | | | 0.1150 | | | | 0.0405 | | | | 0.1070 | | | | 0.0960 | |

| March | | | 0.0470 | | | | 0.1150 | | | | 0.0405 | | | | 0.1070 | | | | 0.0960 | |

| April | | | 0.0440 | | | | 0.0980 | | | | 0.0380 | | | | 0.0930 | | | | 0.0865 | |

| May | | | 0.0440 | | | | 0.0980 | | | | 0.0380 | | | | 0.0930 | | | | 0.0865 | |

| June | | | 0.0440 | | | | 0.0980 | | | | 0.0380 | | | | 0.0930 | | | | 0.0865 | |

| July | | | 0.0440 | | | | 0.0980 | | | | 0.0380 | | | | 0.0930 | | | | 0.0865 | |

| | |

| Total Distributions from Net Investment Income | | | $0.5820 | | | | $1.3700 | | | | $0.4910 | | | | $1.3055 | | | | $1.2685 | |

| | |

| | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | | | NPFD | |

| | |

| Current Distribution Rate* | | | 8.00% | | | | 6.67% | | | | 6.95% | | | | 6.82% | | | | 6.33% | |

| | |

* Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes.

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to the Notes to Financial Statements for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/ or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in the Notes to Financial Statements of this report.

NUVEEN CLOSED‑END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed‑End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed‑end fund resource page, which is at https://www.nuveen.com/resource‑center‑closed‑end‑funds, along with other Nuveen closed‑end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

13

Common Share Information (continued)

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, JPC and JPS were authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, JPC and JPS, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings, are as shown in the accompanying table.

| | | | | | | | |

| | | JPC | | | JPS | |

| | |

| | |

| Maximum aggregate offering | | | Unlimited | | | | Unlimited | |

| | |

During the current reporting period, JPS and JPC did not sell any common shares through their Shelf Offerings.

Refer to Notes to Financial Statements for further details of Shelf Offerings and each Fund’s transactions.

COMMON SHARE REPURCHASES

The Funds’ Board of Trustees authorized an open-market common share repurchase program, allowing each fund to repurchase and retire an aggregate of up to approximately 10% of its outstanding common shares.

During the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of July 31, 2023, (and since the inception of the Funds’ repurchase programs), each Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | | | NPFD | |

| | |

| Common shares cumulatively repurchased and retired | | | 2,826,100 | | | | 0 | | | | 38,000 | | | | 0 | | | | 0 | |

| Common shares authorized for repurchase | | | 10,505,000 | | | | 2,275,000 | | | | 20,570,000 | | | | 435,000 | | | | 2,415,000 | |

| | |

OTHER COMMON SHARE INFORMATION

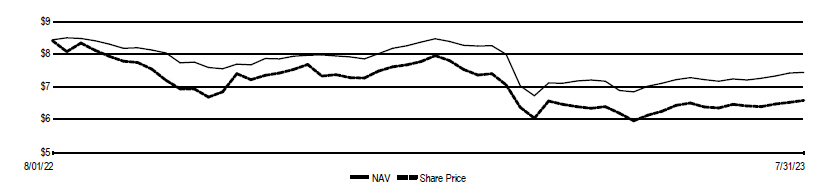

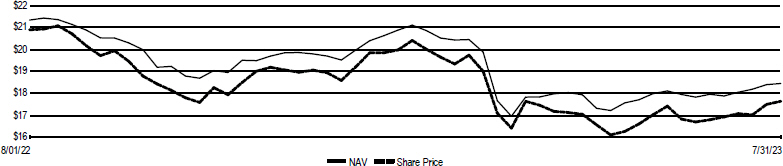

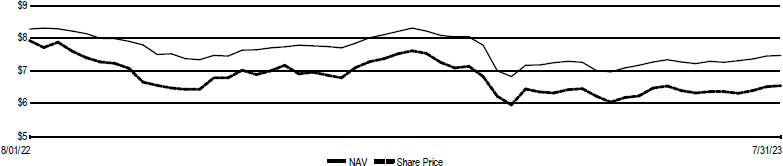

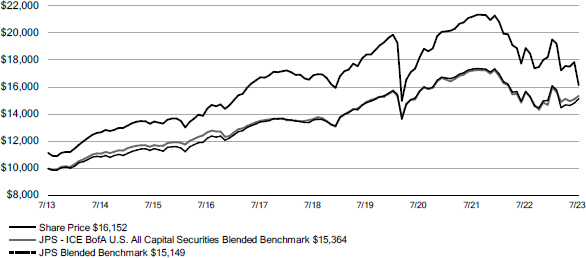

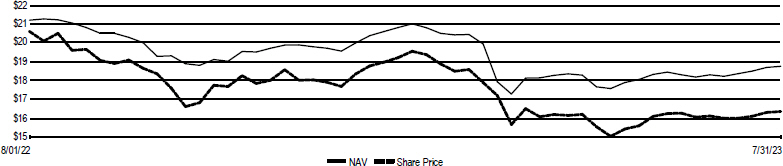

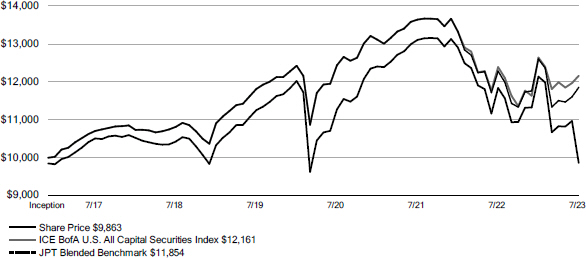

As of July 31, 2023, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | JPC | | | JPI | | | JPS | | | JPT | | | NPFD | |

| | |

| Common share NAV | | | $7.45 | | | | $18.44 | | | | $7.48 | | | | $18.76 | | | | $18.77 | |

| Common share price | | | $6.60 | | | | $17.63 | | | | $6.56 | | | | $16.36 | | | | $16.39 | |

| Premium/(Discount) to NAV | | | (11.41)% | | | | (4.39)% | | | | (12.30)% | | | | (12.79)% | | | | (12.68)% | |

| Average premium/(discount) to NAV | | | (8.40)% | | | | (4.31)% | | | | (10.61)% | | | | (9.19)% | | | | (11.19)% | |

| | |

14

About the Funds’ Benchmarks

Bloomberg Capital Securities Index: An index designed to measure the performance of USD‑denominated preferred securities, including Tier 1 and Tier 2 securities. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

Bloomberg Capital Securities Tier‑1 Index: An index designed to measure the performance of hybrid fixed-income securities, including Tier 1 securities. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

ICE BofA Fixed Rate Preferred Securities Index: An index designed to measure the performance of investment grade fixed-rate, USD‑denominated preferred securities issued in the U.S. domestic market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

ICE BofA U.S. All Capital Securities Index: An index designed to measure the performance of investment grade and below investment grade fixed rate and fixed‑to‑floating rate, USD‑denominated hybrid corporate and preferred securities publicly issued in the U.S. domestic market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

ICE USD Contingent Capital Index (CDLR): An index designed to measure the performance of USD denominated contingent capital debt publicly issued in the major domestic and Eurobond markets, including investment grade and below investment grade issues. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

ICE Variable Rate Preferred & Hybrid Securities Index: An index designed to measure the performance of floating- and variable-rate investment grade and below investment grade USD‑denominated preferred stock and hybrid debt publicly issued by corporations in the U.S. domestic market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPC Blended Benchmark (effective April 1, 2022): Consists of: 1) 60% ICE BofA U.S. All Capital Securities Index (defined herein), and 2) 40% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPC Blended Benchmark (from December 31, 2013 through March 31, 2022): Consists of: 1) 50% ICE BofA Fixed Rate Preferred Securities Index (defined herein), 2) 30% ICE BofA U.S. All Capital Securities Index (defined herein), and

3) 20% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPC Blended Benchmark (through December 30, 2013): Consists of: 1) 82.5% ICE BofA Fixed Rate Preferred Securities Index, (defined herein), and 2) 17.5% Bloomberg Capital Securities Index (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPI Blended Benchmark (effective December 31, 2013): Consists of: 1) 60% ICE BofA U.S. All Capital Securities Index (defined herein), and 2) 40% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPI Blended Benchmark (through December 30, 2013): Consists of: 1) 65% ICE BofA Fixed Rate Preferred Securities Index (defined herein), and 2) 35% Bloomberg Capital Securities Index (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPS Blended Benchmark (effective December 31, 2013): Consists of: 1) 60% ICE BofA U.S. All Capital Securities Index (defined herein), and 2) 40% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPS Blended Benchmark (through December 30, 2013): Consists of: 1) 55% ICE BofA Fixed Rate Preferred Securities

15

About the Funds’ Benchmarks (continued)

Index (defined herein), and 2) 45% Bloomberg Capital Securities Tier‑1 Index (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

JPT Blended Benchmark (effective February 28, 2022): Consists of: 1) 60% ICE BofA U.S. All Capital Securities Index (defined herein), and 2) 40% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

NPFD Blended Benchmark: Consists of: 1) 80% ICE Variable Rate Preferred & Hybrid Securities Index (defined herein), and 2) 20% ICE USD Contingent Capital Index (CDLR) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

16

| | |

| JPC | | Nuveen Preferred & Income Opportunities Fund Performance Overview and Holdings Summaries as of July 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Returns as of | |

| | | | | | | | | July 31, 2023 | |

| | | | | | | | |

| | | | | | | | | Average Annual | |

| | | | | | | | |

| | | Inception | | | | | | | | | | | | | |

| | | Date | | | | | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| | |

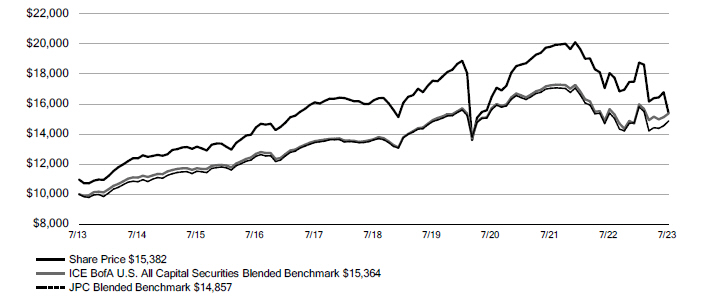

| JPC at Common Share NAV | | | 3/26/03 | | | | | | | | (4.47)% | | | | 1.00% | | | | 4.21% | |

| | |

| JPC at Common Share Price | | | 3/26/03 | | | | | | | | (12.60)% | | | | 0.37% | | | | 4.40% | |

| | |

| ICE BofA U.S. All Capital Securities Index | | | – | | | | | | | | (1.85)% | | | | 2.38% | | | | 4.39% | |

| | |

| JPC Blended Benchmark | | | – | | | | | | | | (3.47)% | | | | 1.77% | | | | 4.04% | |

| | |

*For purposes of Fund performance, relative results are measured against the JPC Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). Refer to About the Funds’ Benchmarks for further details on the Fund’s Blended Benchmark compositions through March 31, 2022.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of July 31, 2023 - Common Share Price

17

Performance Overview and Holdings Summaries as of July 31, 2023 (continued)

Holdings Summaries as of July 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | | | |

| Fund Allocation | | | |

| (% of net assets) | | | |

| | |

| $1,000 Par (or similar) | | | | |

| Institutional Preferred | | | 81.0% | |

| | |

| Contingent Capital Securities | | | 48.3% | |

| | |

| $25 Par (or similar) Retail | | | | |

| Preferred | | | 28.3% | |

| | |

| Corporate Bonds | | | 0.4% | |

| | |

| Common Stocks | | | 0.0% | |

| | |

| Repurchase Agreements | | | 0.7% | |

| | |

| Other Assets & Liabilities, Net | | | 1.5% | |

| | |

| Reverse Repurchase | | | | |

| Agreements, including accrued interest | | | (13.1)% | |

| | |

| Borrowings | | | (28.0)% | |

| | |

| TFP Shares, Net | | | (19.1)% | |

| | |

| Net Assets | | | 100% | |

| | |

| | | | |

| Portfolio Composition1 | | | |

| (% of total investments) | | | |

| | |

| Banks | | | 51.5% | |

| | |

| Insurance | | | 14.1% | |

| | |

| Capital Markets | | | 9.3% | |

| | |

| Food Products | | | 4.7% | |

| | |

| Financial Services | | | 4.2% | |

| | |

| Trading Companies & | | | | |

| Distributors | | | 3.1% | |

| | |

| Oil, Gas & Consumable Fuels | | | 3.1% | |

| | |

| Other | | | 9.5% | |

| | |

| Repurchase Agreements | | | 0.5% | |

| | |

| Total | | | 100% | |

| | |

| |

| Country Allocation2 | | | |

| (% of total investments) | | | |

| | |

| United States | | | 61.0% | |

| | |

| United Kingdom | | | 13.0% | |

| | |

| France | | | 5.9% | |

| | |

| Switzerland | | | 3.4% | |

| | |

| Spain | | | 2.7% | |

| | |

| Netherlands | | | 2.4% | |

| | |

| Canada | | | 2.3% | |

| | |

| Australia | | | 2.2% | |

| | |

| Germany | | | 1.7% | |

| | |

| Ireland | | | 1.7% | |

| | |

| Bermuda | | | 1.3% | |

| | |

| Other | | | 2.4% | |

| | |

| Total | | | 100% | |

| | |

| | | | |

| Top Five Issuers | | | |

| (% of total long-term investments) | | | |

| | |

| Citigroup Inc | | | 4.0% | |

| | |

| HSBC Holdings PLC | | | 3.8% | |

| | |

| Barclays PLC | | | 3.4% | |

| | |

| UBS Group AG | | | 3.3% | |

| | |

| Wells Fargo & Co | | | 3.0% | |

| | |

| |

| Portfolio Credit Quality | | | |

(% of total long-term fixed‑income

investments) | | | |

| | |

| BBB | | | 69.0% | |

| | |

| BB or Lower | | | 28.8% | |

| | |

| N/R (not rated) | | | 2.2% | |

| | |

| Total | | | 100% | |

| | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | Includes 2.3% (as a percentage of total investments) in emerging market countries. |

18

| | |

| JPl | | Nuveen Preferred and Income Term Fund Performance Overview and Holdings Summaries as of July 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Returns as of | |

| | | | | | | | | July 31, 2023 | |

| | | | | | | | |

| | | | | | | | | Average Annual | |

| | | | | | | | |

| | | Inception | | | | | | | | | | | | | |

| | | Date | | | | | | 1‑Year | | | 5‑Year | | | 10‑Year | |

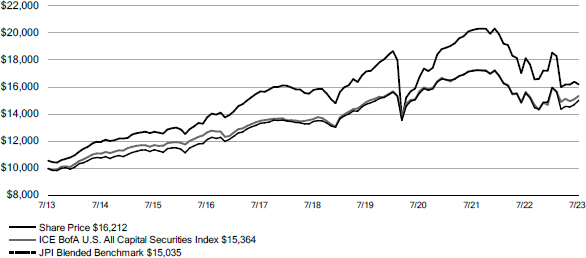

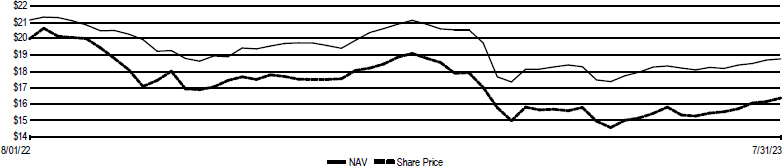

| JPI at Common Share NAV | | | 7/26/12 | | | | | | | | (6.85)% | | | | 1.21% | | | | 4.46% | |

| JPI at Common Share Price | | | 7/26/12 | | | | | | | | (7.39)% | | | | 1.58% | | | | 4.95% | |

| ICE BofA U.S. All Capital Securities Index | | | – | | | | | | | | (1.85)% | | | | 2.38% | | | | 4.39% | |

| JPI Blended Benchmark | | | – | | | | | | | | (3.47)% | | | | 2.20% | | | | 4.16% | |

*For purposes of Fund performance, relative results are measured against the JPI Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). Refer to About the Funds’ Benchmarks for further details on the Fund’s Blended Benchmark compositions through December 30, 2013.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of July 31, 2023 - Common Share Price

19

Performance Overview and Holdings Summaries as of July 31, 2023 (continued)

Holdings Summaries as of July 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | | | |

| Fund Allocation | | | |

| (% of net assets) | | | |

| $1,000 Par (or similar) | | | | |

| Institutional Preferred | | | 79.5% | |

| Contingent Capital Securities | | | 48.5% | |

| $25 Par (or similar) Retail | | | | |

| Preferred | | | 27.7% | |

| Corporate Bonds | | | 0.2% | |

| Repurchase Agreements | | | 0.7% | |

| Other Assets & Liabilities, Net | | | 2.1% | |

| Reverse Repurchase | | | | |

| Agreements, including accrued interest | | | (15.6)% | |

| Borrowings | | | (43.1)% | |

| Net Assets | | | 100% | |

| | | | |

| Portfolio Composition1 | | | |

| (% of total investments) | | | |

| Banks | | | 50.6% | |

| Insurance | | | 14.1% | |

| Capital Markets | | | 9.2% | |

| Financial Services | | | 5.2% | |

| Food Products | | | 5.1% | |

| Trading Companies & | | | | |

| Distributors | | | 3.2% | |

| Oil, Gas & Consumable Fuels | | | 3.1% | |

| Other | | | 9.1% | |

| Repurchase Agreements | | | 0.4% | |

| Total | | | 100% | |

| |

| Top Five Issuers | | | |

| (% of total long-term investments) | | | |

| Citigroup Inc | | | 4.1% | |

| HSBC Holdings PLC | | | 3.8% | |

| Barclays PLC | | | 3.4% | |

| UBS Group AG | | | 3.2% | |

| Wells Fargo & Co | | | 3.0% | |

| | | | |

| Portfolio Credit Quality | | | |

(% of total long-term fixed‑income

investments) | | | |

| BBB | | | 70.3% | |

| BB or Lower | | | 27.5% | |

| N/R (not rated) | | | 2.2% | |

| Total | | | 100% | |

| |

| Country Allocation2 | | | |

| (% of total investments) | | | |

| United States | | | 60.3% | |

| United Kingdom | | | 13.4% | |

| France | | | 5.9% | |

| Switzerland | | | 3.4% | |

| Spain | | | 2.8% | |

| Netherlands | | | 2.5% | |

| Australia | | | 2.4% | |

| Canada | | | 2.4% | |

| Germany | | | 1.9% | |

| Ireland | | | 1.3% | |

| Bermuda | | | 1.1% | |

| Other | | | 2.6% | |

| Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | Includes 2.2% (as a percentage of total investments) in emerging market countries. |

20

| | |

| JPS | | Nuveen Preferred & Income Securities Fund Performance Overview and Holdings Summaries as of July 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Returns as of | |

| | | | | | | | | July 31, 2023 | |

| | | | | | | | |

| | | | | | | | | Average Annual | |

| | | | | | | | |

| | | Inception | | | | | | | | | | | | | |

| | | Date | | | | | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| JPS at Common Share NAV | | | 9/24/02 | | | | | | | | (3.29)% | | | | 1.40% | | | | 4.73% | |

| JPS at Common Share Price | | | 9/24/02 | | | | | | | | (9.26)% | | | | 0.79% | | | | 4.91% | |

| ICE BofA U.S. All Capital Securities Index | | | – | | | | | | | | (1.85)% | | | | 2.38% | | | | 4.39% | |

| JPS Blended Benchmark | | | – | | | | | | | | (3.47)% | | | | 2.20% | | | | 4.24% | |

*For purposes of Fund performance, relative results are measured against the JPS Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). Refer to About the Funds’ Benchmarks for further details on the Fund’s Blended Benchmark compositions through December 30, 2013.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of July 31, 2023 - Common Share Price

21

Performance Overview and Holdings Summaries as of July 31, 2023 (continued)

Holdings Summaries as of July 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | | | |

| Fund Allocation | | | |

| (% of net assets) | | | |

| $1,000 Par (or similar) | | | | |

| Institutional Preferred | | | 76.8% | |

| Contingent Capital Securities | | | 52.5% | |

| $25 Par (or similar) Retail | | | | |

| Preferred | | | 14.4% | |

| Corporate Bonds | | | 4.7% | |

| Convertible Preferred Securities | | | 1.4% | |

| Investment Companies | | | 1.1% | |

| Repurchase Agreements | | | 3.0% | |

| Other Assets & Liabilities, Net | | | 1.2% | |

| Reverse Repurchase | | | | |

| Agreements, including accrued interest | | | (18.0)% | |

| Borrowings | | | (19.6)% | |

| TFP Shares, Net | | | (17.5)% | |

| Net Assets | | | 100% | |

| | | | |

| Portfolio Composition1 | | | |

| (% of total investments) | | | |

| Banks | | | 56.3% | |

| Insurance | | | 13.1% | |

| Capital Markets | | | 11.8% | |

| Multi-Utilities | | | 2.5% | |

| Electric Utilities | | | 2.5% | |

| Consumer Finance | | | 2.5% | |

| Financial Services | | | 2.3% | |

| Other | | | 6.4% | |

| Investment Companies | | | 0.7% | |

| Repurchase Agreements | | | 1.9% | |

| Total | | | 100% | |

| |

| Top Five Issuers | | | |

| (% of total long-term investments) | | | |

| BNP Paribas SA | | | 4.3% | |

| UBS Group AG | | | 4.2% | |

| Wells Fargo & Co | | | 4.0% | |

| Barclays PLC | | | 3.8% | |

| Societe Generale SA | | | 3.6% | |

| | | | |

| Portfolio Credit Quality | | | |

(% of total long-term fixed‑income

investments) | | | |

| A | | | 6.2% | |

| BBB | | | 83.8% | |

| BB or Lower | | | 10.0% | |

| N/R (not rated) | | | 0.0% | |

| Total | | | 100% | |

| |

| Country Allocation2 | | | |

| (% of total investments) | | | |

| United States | | | 53.1% | |

| United Kingdom | | | 12.4% | |

| France | | | 10.1% | |

| Switzerland | | | 6.0% | |

| Canada | | | 3.6% | |

| Finland | | | 3.3% | |

| Spain | | | 2.5% | |

| Netherlands | | | 1.5% | |

| Australia | | | 1.4% | |

| Norway | | | 1.3% | |

| Japan | | | 1.2% | |

| Other | | | 3.6% | |

| Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the table above. |

| 2 | Includes less than 0.1% (as a percentage of total investments) in emerging market countries. |

22

| | |

| JPT | | Nuveen Preferred and Income Fund Performance Overview and Holdings Summaries as of July 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Returns as of | |

| | | | | | | | | July 31, 2023 | |

| | | | | | | | |

| | | | | | | | | Average Annual | |

| | | | | | | | |

| | | Inception | | | | | | | | | | | | Since | |

| | | Date | | | | | | 1‑Year | | | 5‑Year | | | Inception | |

| JPT at Common Share NAV | | | 1/26/17 | | | | | | | | (5.15)% | | | | 1.42% | | | | 1.97% | |

| JPT at Common Share Price | | | 1/26/17 | | | | | | | | (13.03)% | | | | (0.49)% | | | | (0.21)% | |

| ICE BofA U.S. All Capital Securities Index | | | – | | | | | | | | (1.85)% | | | | 2.38% | | | | 3.05% | |

| JPT Blended Benchmark | | | – | | | | | | | | (3.47)% | | | | 1.85% | | | | 2.65% | |

*For purposes of Fund performance, relative results are measured against the JPT Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 60% ICE BofA U.S. All Capital Securities Index and 2) 40% ICE USD Contingent Capital Index (CDLR). The Fund’s performance was measured against the ICE BofA U.S. All Capital Securities Index through February 27, 2022.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of July 31, 2023 - Common Share Price

23

Performance Overview and Holdings Summaries as of July 31, 2023 (continued)

Holdings Summaries as of July 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | | | |

| Fund Allocation | | | |

| (% of net assets) | | | |

| $1,000 Par (or similar) | | | | |

| Institutional Preferred | | | 79.1% | |

| Contingent Capital Securities | | | 46.9% | |

| $25 Par (or similar) Retail | | | | |

| Preferred | | | 24.8% | |

| Corporate Bonds | | | 1.6% | |

| Other Assets & Liabilities, Net | | | (0.2)% | |

| Reverse Repurchase | | | | |

| Agreements, including accrued interest | | | (9.3)% | |

| Borrowings | | | (42.9)% | |

| Net Assets | | | 100% | |

| |

| Top Five Issuers | | | |

| (% of total long-term investments) | |

| Citigroup Inc | | | 4.0% | |

| HSBC Holdings PLC | | | 3.8% | |

| UBS Group AG | | | 3.8% | |

| Barclays PLC | | | 3.3% | |

| Wells Fargo & Co | | | 3.0% | |

| | | | |

| Portfolio Composition1 | | | |

| (% of total investments) | | | |

| Banks | | | 50.0% | |

| Insurance | | | 14.9% | |

| Capital Markets | | | 9.6% | |

| Food Products | | | 5.5% | |

| Financial Services | | | 4.7% | |

| Oil, Gas & Consumable Fuels | | | 3.0% | |

| Trading Companies & | | | | |

| Distributors | | | 3.0% | |

| Other | | | 9.3% | |

| Total | | | 100% | |

| |

| Portfolio Credit Quality | | | |