Leslie M, Kidney Transplant Recipient Focused on improving care across the entire transplant patient journey The Transplant Company™ Earnings Presentation Q3 2022

These slides and the accompanying oral presentation contain forward-looking statements, including statements with respect to expectations regarding CareDx’s upcoming milestones, vision and 2022 revenue guidance. All statements other than statements of historical fact contained in this presentation, including statements regarding the future financial position of CareDx, Inc. (together with its subsidiaries, “CareDx” or the “Company”), including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. CareDx has based these forward-looking statements on its estimates and assumptions and its current expectations and projections about future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, general economic and market factors, global economic and marketplace uncertainties related to the COVID-19 pandemic and those contained in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q that the Company has filed or may subsequently file with the U.S. Securities and Exchange Commission (the “SEC”). In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward- looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. CareDx undertakes no obligation to update publicly or revise any forward-looking statements for any reason after the date of this presentation or to conform these statements to actual results or to changes in CareDx’s expectations. Certain data in this presentation was obtained from various external sources, and neither the Company nor its affiliates, advisers or representatives has verified such data with independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data or undertakes any obligation to update such data after the date of this presentation. Such data involves risks and uncertainties and is subject to change based on various factors. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company. Safe Harbor Statement 2

Our Mission We are committed to improving long-term outcomes by providing innovative solutions throughout the entire transplant patient journey Our Vision The leading partner for the transplant ecosystem

Q3 Earnings: Key Topics for Discussion 4 • Differentiated financial profile • Driving future growth through the 3 C’s – Catalysts, Collections, Coverage • Building leadership in the transplant ecosystem

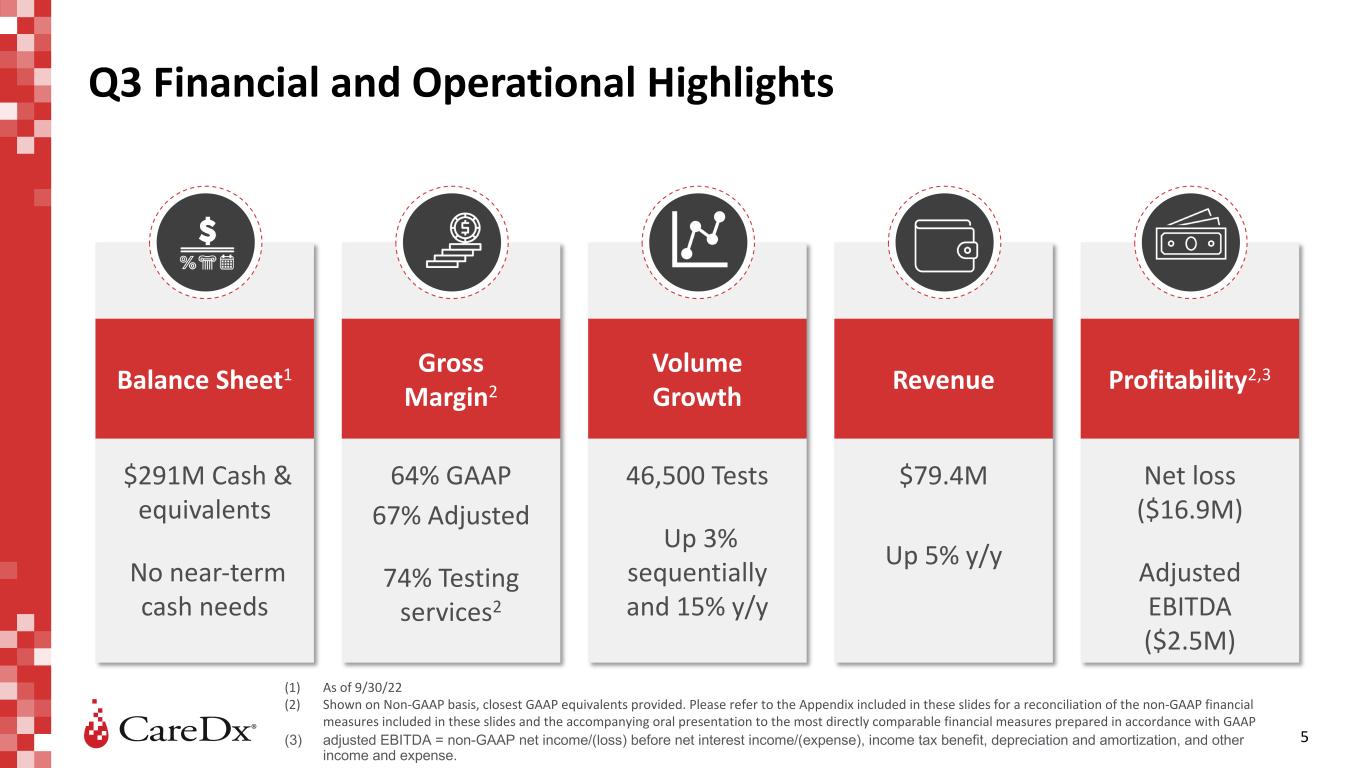

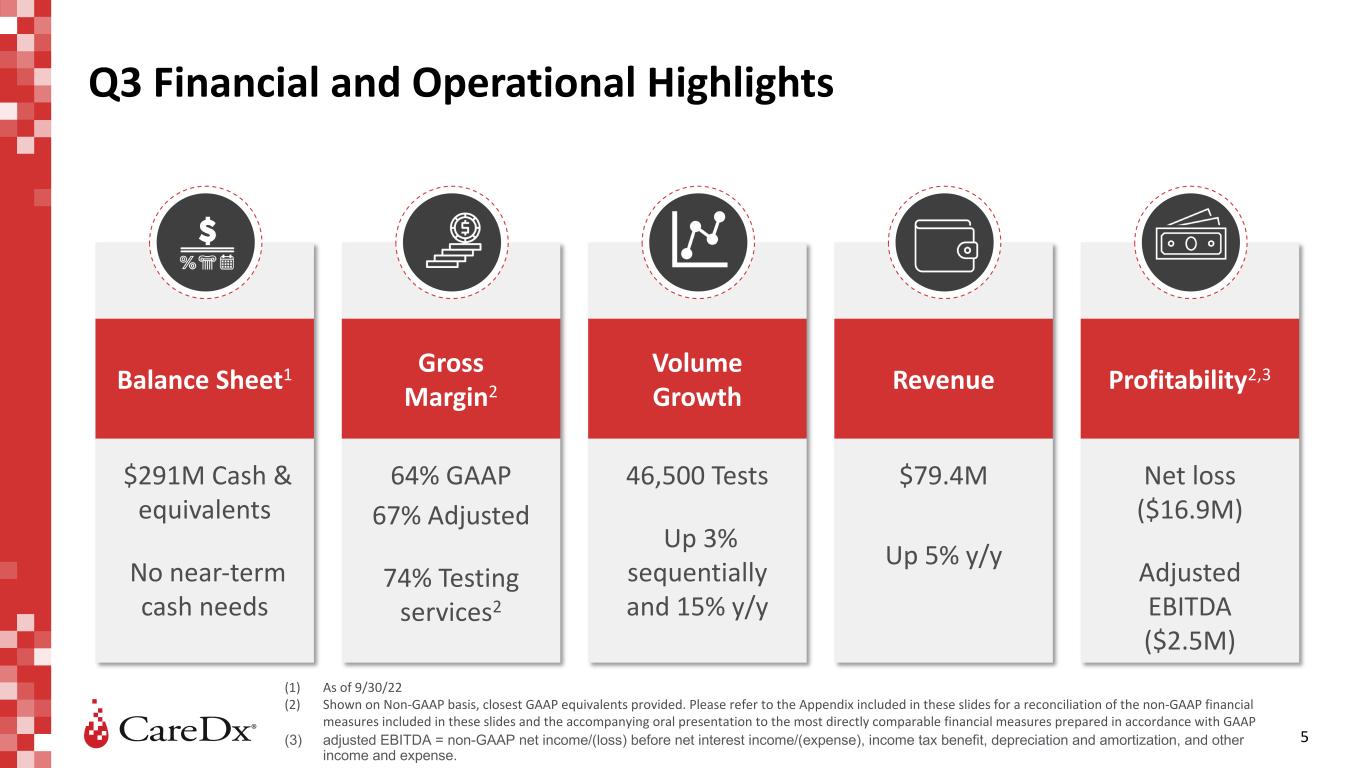

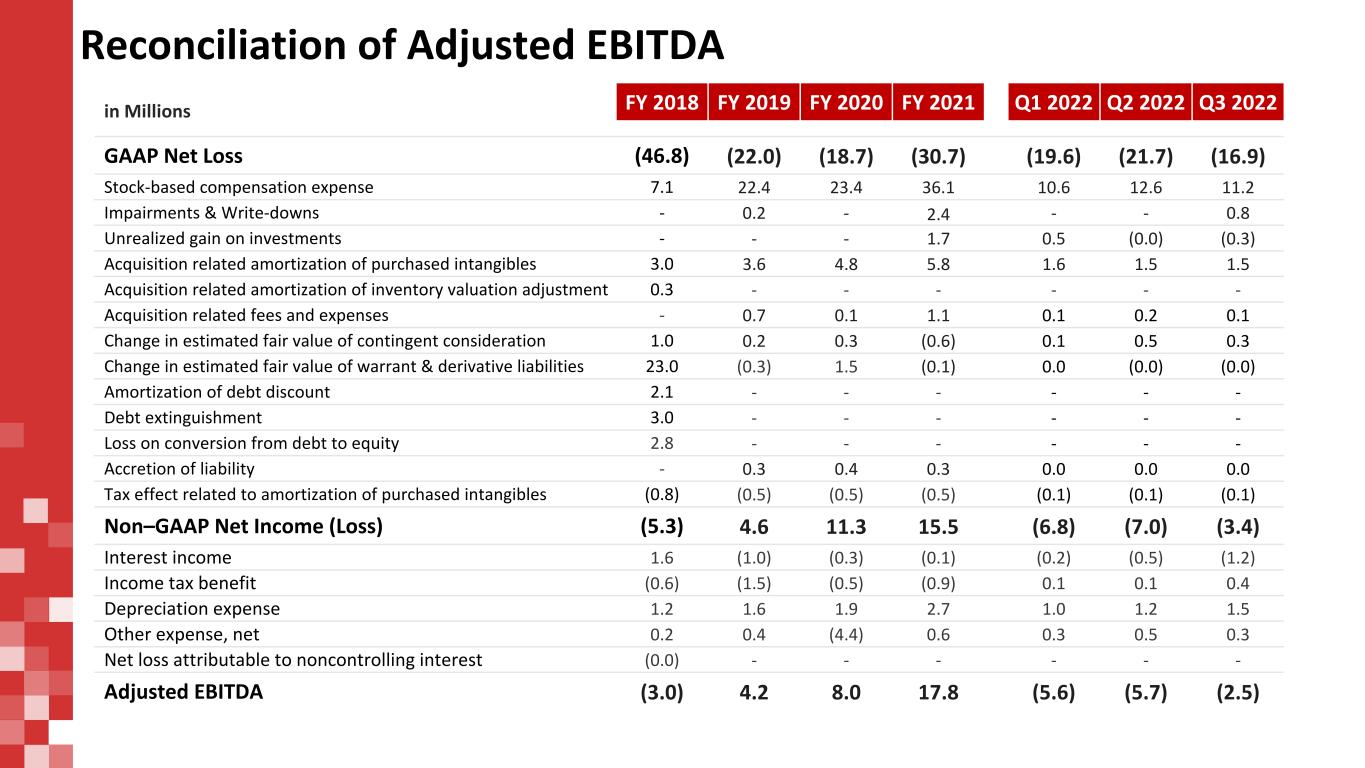

Q3 Financial and Operational Highlights 5 $291M Cash & equivalents No near-term cash needs Balance Sheet1 64% GAAP 67% Adjusted 74% Testing services2 Gross Margin2 46,500 Tests Up 3% sequentially and 15% y/y Volume Growth $79.4M Up 5% y/y Revenue Net loss ($16.9M) Adjusted EBITDA ($2.5M) Profitability2,3 (1) As of 9/30/22 (2) Shown on Non-GAAP basis, closest GAAP equivalents provided. Please refer to the Appendix included in these slides for a reconciliation of the non-GAAP financial measures included in these slides and the accompanying oral presentation to the most directly comparable financial measures prepared in accordance with GAAP (3) adjusted EBITDA = non-GAAP net income/(loss) before net interest income/(expense), income tax benefit, depreciation and amortization, and other income and expense.

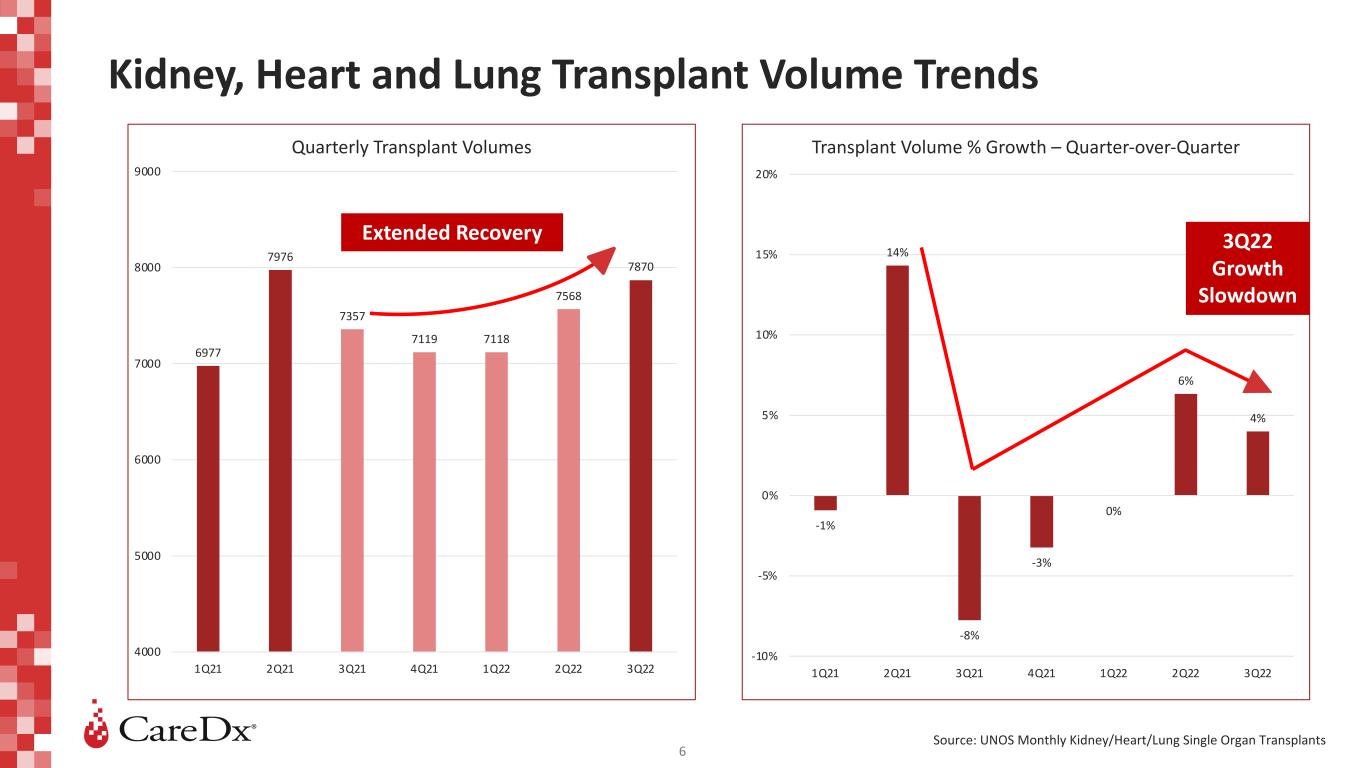

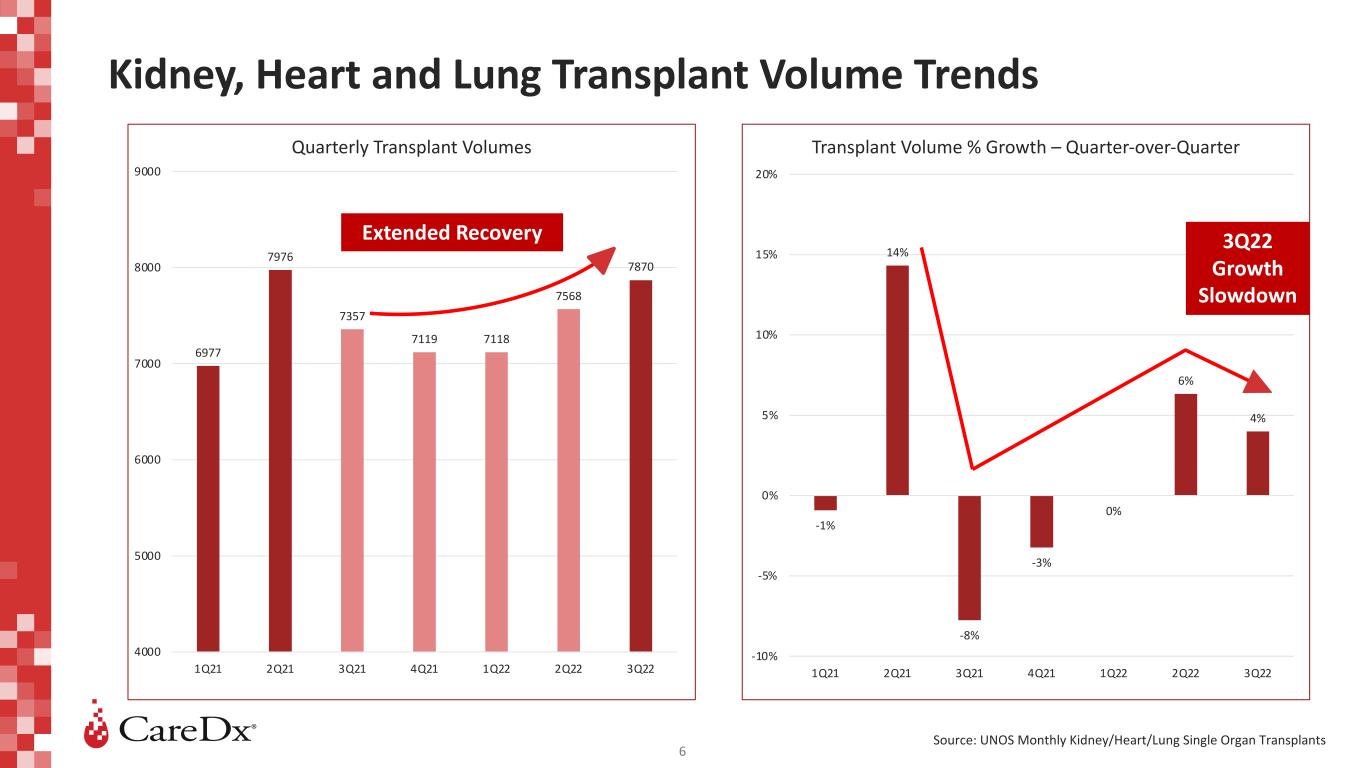

Kidney, Heart and Lung Transplant Volume Trends 6 Source: UNOS Monthly Kidney/Heart/Lung Single Organ Transplants 6977 7976 7357 7119 7118 7568 7870 4000 5000 6000 7000 8000 9000 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Quarterly Transplant Volumes -1% 14% -8% -3% 0% 6% 4% -10% -5% 0% 5% 10% 15% 20% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Transplant Volume % Growth – Quarter-over-Quarter Extended Recovery 3Q22 Growth Slowdown

Extending Leadership in Transplant Strong Progress Across All Organs 7 >90% Center penetration >95% HeartCare attach rate Heart Testing Services Launched 2005 >75% Center penetration >100 Protocols Kidney Testing Services Launched 2017 60% Center penetration >2,000 Tests Lung Testing Services Launched Q4 2021 Source: data on file as of 9/30/22

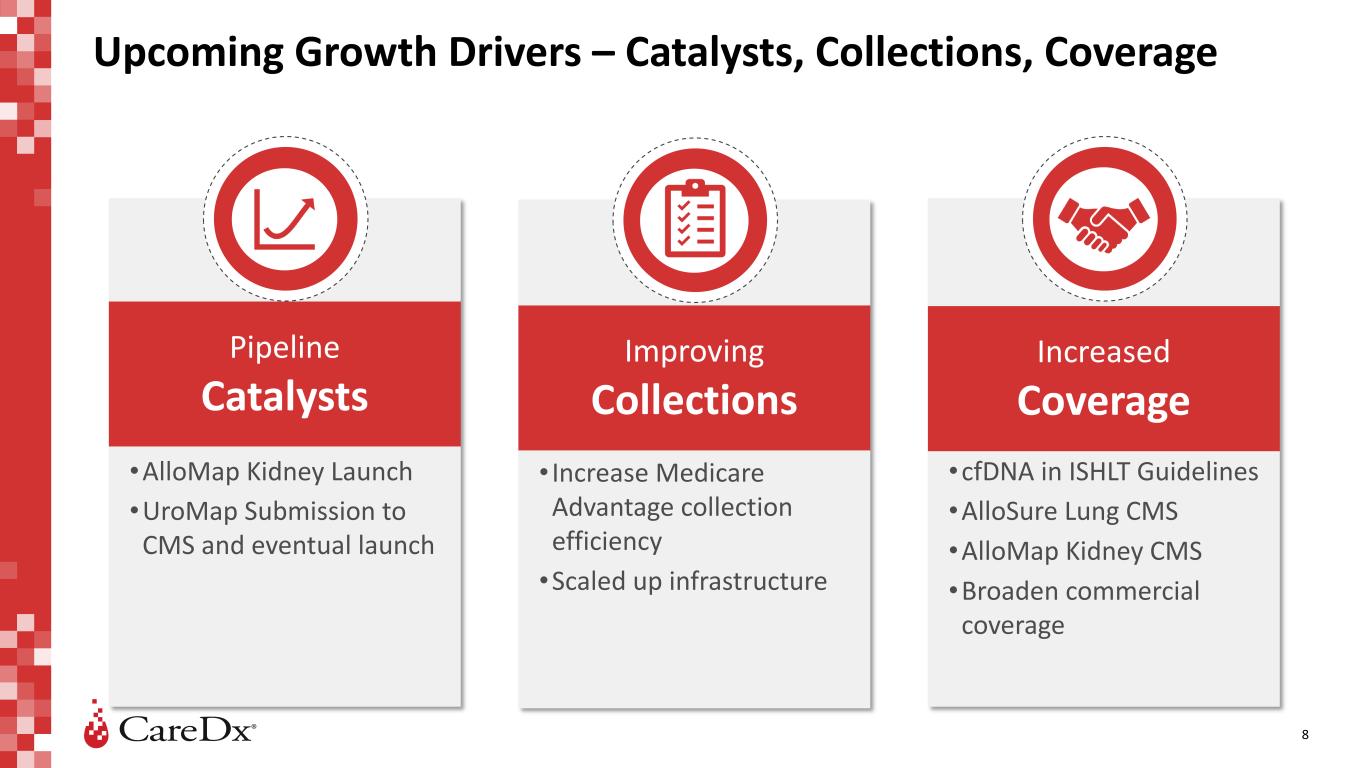

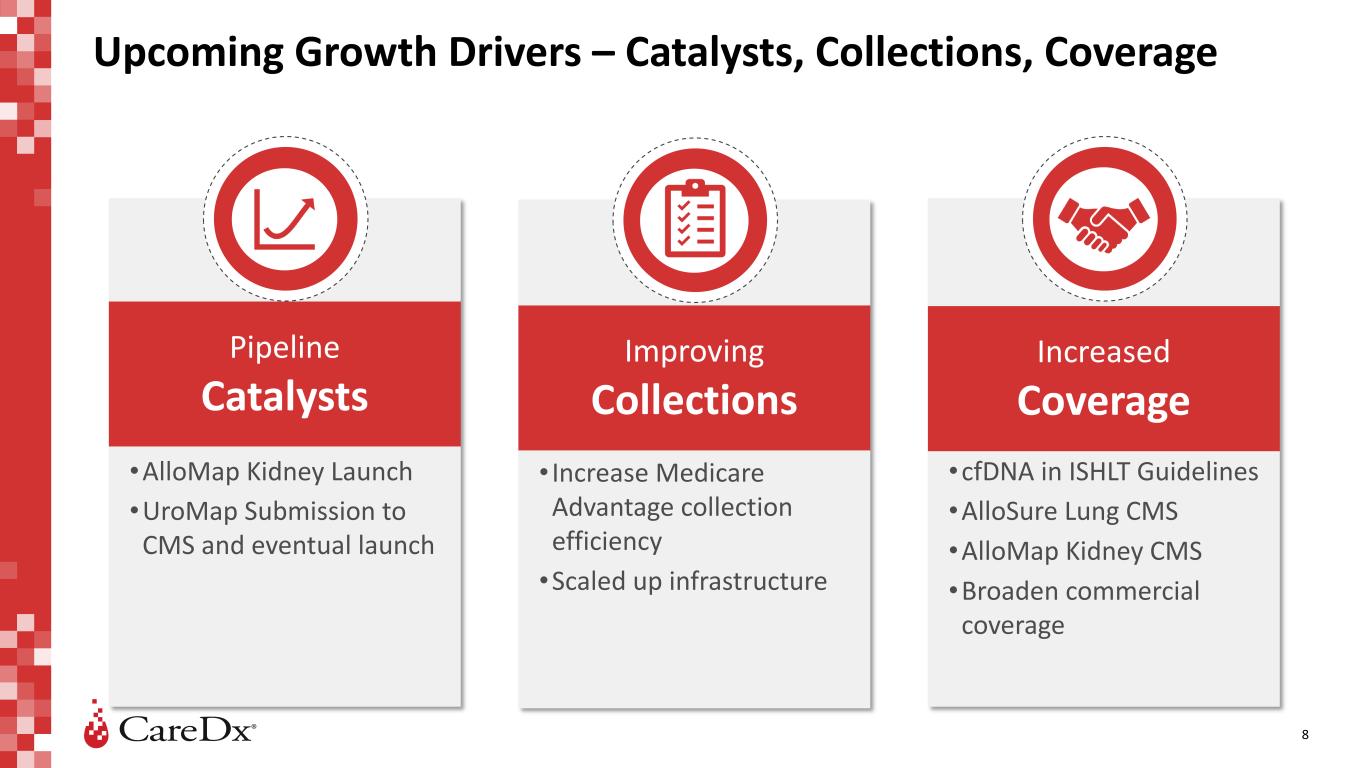

Upcoming Growth Drivers – Catalysts, Collections, Coverage 8 •AlloMap Kidney Launch •UroMap Submission to CMS and eventual launch Pipeline Catalysts • Increase Medicare Advantage collection efficiency •Scaled up infrastructure Improving Collections •cfDNA in ISHLT Guidelines •AlloSure Lung CMS •AlloMap Kidney CMS •Broaden commercial coverage Increased Coverage

9 ASP on Reimbursed Tests $- $1,000 $2,000 $3,000 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 All Paid Test ASP Trend (Testing Qtr) FLAT Source: data on file as of 9/30/22

Post Transplant Biomarkers Our Vision: The Leader in The Transplant Ecosystem 11 Leadership across the patient journey Electronic Medical Records Quality & Analytics Transplant focused App Medication Discharge CareDx is #1 CareDx is #1 CareDx is #1 CareDx is #2 CareDx is #2 Over 100,000 transplant patients have received a CareDx post-transplant surveillance test NGS HLA Typing CareDx is #1 Transplant Patient Referrals CareDx is #1

15

Appendix 16

Reconciliation of Non-GAAP Gross Margin FY 2018 FY 2019 FY 2020 FY 2021 Q1 2022 Q2 2022 Q3 2022 Revenue 76.6 127.1 192.2 296.4 79.4 80.6 79.4 GAAP Cost of Revenue 33.0 45.5 63.1 97.4 26.9 27.5 28.3 Stock-based compensation expense (0.8) (2.2) (2.3) (3.7) (0.4) (1.4) (1.1) Acquisition related amortization of purchased intangibles (2.2) (2.4) (3.3) (3.9) (1.0) (1.0) (1.0) Non-GAAP Cost of Revenue 30.0 40.9 57.5 89.8 25.5 25.2 26.2 Non-GAAP Gross Profit 46.6 86.2 134.7 206.6 53.9 55.5 53.1 Non-GAAP Gross Margin % 61% 68% 70% 70% 68% 69% 67% in Millions (except %)

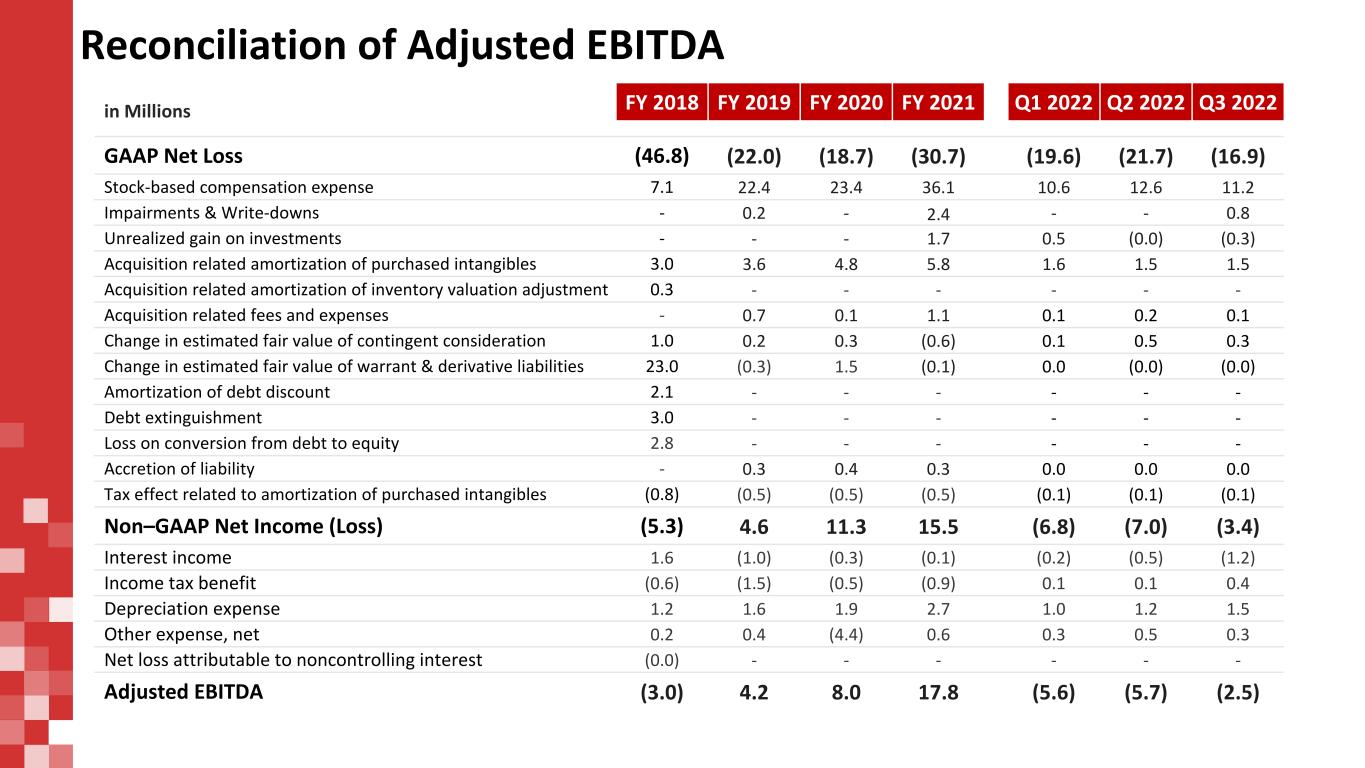

Reconciliation of Adjusted EBITDA FY 2018 FY 2019 FY 2020 FY 2021 Q1 2022 Q2 2022 Q3 2022 GAAP Net Loss (46.8) (22.0) (18.7) (30.7) (19.6) (21.7) (16.9) Stock-based compensation expense 7.1 22.4 23.4 36.1 10.6 12.6 11.2 Impairments & Write-downs - 0.2 - 2.4 - - 0.8 Unrealized gain on investments - - - 1.7 0.5 (0.0) (0.3) Acquisition related amortization of purchased intangibles 3.0 3.6 4.8 5.8 1.6 1.5 1.5 Acquisition related amortization of inventory valuation adjustment 0.3 - - - - - - Acquisition related fees and expenses - 0.7 0.1 1.1 0.1 0.2 0.1 Change in estimated fair value of contingent consideration 1.0 0.2 0.3 (0.6) 0.1 0.5 0.3 Change in estimated fair value of warrant & derivative liabilities 23.0 (0.3) 1.5 (0.1) 0.0 (0.0) (0.0) Amortization of debt discount 2.1 - - - - - - Debt extinguishment 3.0 - - - - - - Loss on conversion from debt to equity 2.8 - - - - - - Accretion of liability - 0.3 0.4 0.3 0.0 0.0 0.0 Tax effect related to amortization of purchased intangibles (0.8) (0.5) (0.5) (0.5) (0.1) (0.1) (0.1) Non–GAAP Net Income (Loss) (5.3) 4.6 11.3 15.5 (6.8) (7.0) (3.4) Interest income 1.6 (1.0) (0.3) (0.1) (0.2) (0.5) (1.2) Income tax benefit (0.6) (1.5) (0.5) (0.9) 0.1 0.1 0.4 Depreciation expense 1.2 1.6 1.9 2.7 1.0 1.2 1.5 Other expense, net 0.2 0.4 (4.4) 0.6 0.3 0.5 0.3 Net loss attributable to noncontrolling interest (0.0) - - - - - - Adjusted EBITDA (3.0) 4.2 8.0 17.8 (5.6) (5.7) (2.5) in Millions