Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21295

JPMorgan Trust I

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2017 through August 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

EXPLANATORY NOTE

This Registrant is filing this amendment (“Amendment”) to its Form N-CSR for the period ended August 31, 2017 (the “Report”), originally filed with the Securities and Exchange Commission on November 1, 2017 (Accession Number 0001193125-17-329078) and amended on March 5, 2018 (Accession Number 0001193125-18-069828), to reflect the inclusion of the certifications of the Form N-CSR which were erroneously omitted.

Except as otherwise noted above, the Report was accurate, timely distributed to shareholders, as applicable, and contained all information required per Form N-CSR.

Items 1 through 12 to this Amendment to the Registrant’s Form N-CSR are incorporated by reference to the Form N-CSR filed on EDGAR on November 1, 2017 (Accession Number 0001193125-17-329078) and amended on March 5, 2018 (Accession Number 0001193125-18-069828).

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Table of Contents

Semi-Annual Report

J.P. Morgan Tax Aware Funds

August 31, 2017 (Unaudited)

JPMorgan Tax Aware High Income Fund

JPMorgan Tax Aware Income Opportunities Fund

Table of Contents

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund including management fees and other expenses. Please read it carefully before investing.

Table of Contents

October 11, 2017 (Unaudited)

Dear Shareholder,

The U.S. economy continued to expand through the six months ended August 31, 2017, amid continued low interest rates, rising corporate profits and growth in the leading economies of Europe, Asia and Latin America.

|

“We believe investors who maintain a properly diversified portfolio and a long term perspective will be best positioned to gain from opportunities presented by the current market environment.” — George C.W. Gatch |

Synchronized economic growth in both developed market and emerging market nations helped drive global increases in investment, trade and employment. In turn, global corporate profits rose 25% in the second quarter of 2017, driven by growth in both revenue and profit margins.

In the U.S., the economic expansion entered its 98th consecutive month in August 2017, the third longest expansion on record. Over the course of the six month reporting period, the unemployment rate fell to 4.4% from 4.5%. In response, the U.S. Federal Reserve raised interest rates in both March and June of 2017, and signaled it would raise rates once more before the end of 2017.

Meanwhile, demand from overseas and a weakening U.S. dollar helped drive U.S. corporate profits to their highest levels in 13 years. In the second quarter of 2017, more than an estimated three-fourths of the companies in the Standard & Poor’s 500 Index (the “S&P 500”) reported earnings that surpassed analysts’ consensus estimates, according to Bloomberg News. U.S. corporations also took advantage of low interest rates and issued a record $1 trillion of bonds from January through August 2017.

Equity and bond markets generally provided investors with positive returns for the six month reporting period. A rally in the U.S. stock market, which followed the Republican Party’s success in the November 8, 2016 elections, extended well into 2017 amid investor expectations for tax cuts, infrastructure spending and regulatory reform. Equity prices continued to reach new record highs through August 2017. Financial market volatility held near 10-year lows, spiking only briefly in early August 2017 amid rising military tension between the U.S. and North Korea. For the six months ended August 31, 2017, the S&P 500 returned 5.4%, while the MSCI Europe, Australasia and Far East Index returned 12.8% and the MSCI Emerging Markets Index returned 17.8%.

The leading economies of Europe, Asia and Latin America provided a notable boost to global growth during the reporting period and the world’s central banks largely maintained accommodative policies that benefitted both corporations and investors. We believe investors who maintain a properly diversified portfolio and a long term perspective will be best positioned to gain from opportunities presented by the current market environment.

We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 1 | ||||||

Table of Contents

J.P. Morgan Tax Aware Funds

SIX MONTHS ENDED AUGUST 31, 2017 (Unaudited)

Global equity and bond markets generally had positive returns for the six month reporting period amid a surge in corporate profits, continued low interest rates and relatively steady economic growth.

Within fixed-income markets, high-yield bonds (also known as “junk bonds”) continued to outperform investment grade corporate debt and U.S. Treasury bonds throughout the six month reporting period. Notably, U.S. companies sold new bonds at a record pace in 2017 — more than $1 trillion combined — amid expectations for further interest rate increases by the U.S. Federal Reserve over the course of the year. U.S. financial market volatility remained historically low through July but then spiked briefly in early August amid rising tensions between the U.S. and North Korea.

Overall, municipal bonds produced positive returns amid fading investor expectation for changes in federal tax rates or increased infrastructure spending. For the six months August 31, 2017, the Bloomberg Barclays Municipal Bond Index returned 3.79%.

| 2 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SIX MONTHS ENDED AUGUST 31, 2017 (Unaudited)

| Reporting Period Return: | ||||

| Fund (Class I Shares)1,* | 3.34% | |||

| Bloomberg Barclays Municipal Bond Index | 3.79% | |||

| Net Assets as of 8/31/2017 (In Thousands) | 100,805 | |||

| Duration as of 8/31/2017 | 6.1 years | |||

INVESTMENT OBJECTIVE**

The JPMorgan Tax Aware High Income Fund (the “Fund”) seeks to provide a high level of after-tax income from a portfolio of fixed income investments.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the six months ended August 31, 2017, the Fund’s Class I Shares underperformed the Bloomberg Barclays U.S. Municipal Bond Index (the “Benchmark”). During the reporting period, interest rates generally fell.

In the municipal bond sector, the Fund’s overall shorter duration detracted from performance relative to the Benchmark as interest generally fell during the reporting period. Duration measures the price sensitivity of a portfolio of bonds relative to changes in interest rates. Generally, bond portfolios with shorter duration will experience a smaller increase in price, compared with longer duration portfolios, when interest rates fall. The Fund’s underweight positions in local general obligation bonds and leading sector bonds also detracted from relative performance. The Fund’s slightly longer duration in bonds in the eight-to-twelve year maturity sector was a positive contributor to relative performance. The Fund’s overweight allocation to bonds rated single-A also contributed to relative performance.

In taxable leveraged loans, the Fund’s allocation to taxable high yield loans was a leading detractor from relative performance. The Fund’s underweight position in bonds rated single-B and its security selection in the energy, food and drug and health care sectors also detracted from relative performance. The Fund’s security selection in the retail and manufacturing sectors made a positive contribution to performance relative to the Benchmark.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s assets were invested among various sectors, including both high-grade debt securities and leveraged loans. Sector allocations were determined by input from analyst teams organized by sector that assessed relative value and risk, among other factors.

The Fund’s portfolio managers allocated the majority of the Fund’s assets to municipal securities and invested the remainder of the Fund’s assets mostly in taxable leveraged loans.

PORTFOLIO COMPOSITION*** | ||||

| Municipal Bonds | 88.2 | % | ||

| Loan Assignments | 7.3 | |||

| Others (each less than 1.0%) | 0.0 | (a) | ||

| Short-Term Investment | 4.5 | |||

| 1 | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | The return shown is based on the net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of August 31, 2017. The Fund’s portfolio composition is subject to change. |

| (a) | Amount rounds to less than 0.05% |

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 3 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2017 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 MONTHS* | 1 YEAR | 5 YEAR | SINCE INCEPTION | |||||||||||||||||||||||||||||||||||||||||||||||||

| Inception Date of Class | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | ||||||||||||||||||||||||||||||||||||||||

CLASS A SHARES | | September 17, 2007 | | |||||||||||||||||||||||||||||||||||||||||||||||||

With Sales Charge** | (0.58 | )% | (0.78 | )% | 0.02 | % | (2.66 | )% | (2.96 | )% | (0.73 | )% | 1.87 | % | 1.55 | % | 1.71 | % | 3.98 | % | 3.63 | % | 3.48 | % | ||||||||||||||||||||||||||||

Without Sales Charge | 3.28 | 3.07 | 2.22 | 1.17 | 0.86 | 1.47 | 2.65 | 2.33 | 2.33 | 4.38 | 4.03 | 3.82 | ||||||||||||||||||||||||||||||||||||||||

CLASS C SHARES | | September 17, 2007 | | |||||||||||||||||||||||||||||||||||||||||||||||||

With CDSC*** | 2.03 | 1.86 | 1.45 | (0.32 | ) | (0.58 | ) | 0.47 | 2.14 | 1.88 | 1.88 | 3.86 | 3.56 | 3.35 | ||||||||||||||||||||||||||||||||||||||

Without CDSC | 3.03 | 2.86 | 2.01 | 0.68 | 0.42 | 1.03 | 2.14 | 1.88 | 1.88 | 3.86 | 3.56 | 3.35 | ||||||||||||||||||||||||||||||||||||||||

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | September 17, 2007 | | 3.34 | 3.12 | 2.27 | 1.27 | 0.95 | 1.56 | 2.75 | 2.42 | 2.42 | 4.48 | 4.12 | 3.91 | |||||||||||||||||||||||||||||||||||||

| * | Not Annualized. |

| ** | Sales Charge for Class A Shares is 3.75%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

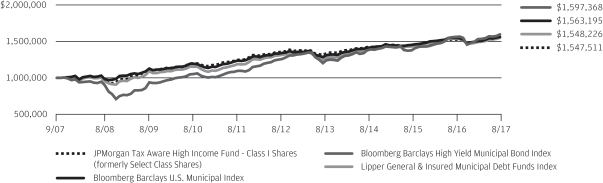

LIFE OF FUND PERFORMANCE (9/17/07 TO 8/31/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on September 17, 2007.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Tax Aware High Income Fund, the Bloomberg Barclays U.S. Municipal Index, the Bloomberg Barclays High Yield Municipal Bond Index and the Lipper General & Insured Municipal Debt Funds Index from September 17, 2007 to August 31, 2017. The performance of the Lipper General & Insured Municipal Debt Funds Index reflects an initial investment at the end of the month closest to the Fund’s inception. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. Municipal Index and the Bloomberg Barclays High Yield Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmarks, if applicable. The performance of the Lipper General & Insured Municipal Debt

Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. Municipal Index is a total return performance benchmark for the long-term, investment-grade tax-exempt bond market. The Bloomberg Barclays High Yield Municipal Bond Index is an unmanaged index made up of bonds that are non-investment grade, unrated, or rated below Ba1 by Moody’s Investors Service with a remaining maturity of at least one year. The Lipper General & Insured Municipal Debt Funds Index represents total returns of the funds in the indicated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 4 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

JPMorgan Tax Aware Income Opportunities Fund

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2017 (Unaudited)

REPORTING PERIOD RETURN: | ||||

| Fund (Class I Shares)1,* | 1.50% | |||

| Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index | 3.24% | |||

| Net Assets as of 8/31/2017 (In Thousands) | $245,391 | |||

| Duration as of 8/31/2017 | 2.1 years | |||

INVESTMENT OBJECTIVE**

The JPMorgan Tax Aware Income Opportunities Fund (the “Fund”) seeks to provide total return.

HOW DID THE FUND AIM TO MEET ITS INVESTMENT OBJECTIVE?

The Fund has an absolute return orientation, which means that it was not managed relative to a benchmark during the reporting period. The Fund attempted to provide a positive total return in diverse market environments and accordingly, the Fund was not required to meet target benchmark weights, allowing the Fund’s portfolio managers to avoid sectors that they believed were unattractive. While the Fund was not managed to a benchmark, its return is compared to the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (the “Index”).

WHAT WERE THE MAIN DRIVERS OF THE FUND’S RETURN?

For the six months ended August 31, 2017, the Fund’s Class I Shares underperformed the Index. The Fund’s allocation investment grade debt and emerging markets debt was the main detractor from relative performance.

The Fund’s allocation to high yield bonds (also known as “junk bonds”) and high yield credit default swaps — was a leading contributor to performance relative to the Index. The Fund’s overweight position in municipal bonds, particularly in the housing sector, also helped relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund employed a bottom-up, security-selection-based investment approach and sought to take advantage of opportunities in the municipal bond market stemming from increased volatility, supply pressures and headline credit risk.

In addition, when the Fund’s portfolio managers believed that credit default swaps were attractively valued, they used these instruments to initiate long and short exposures in different sectors of the fixed income market.

PORTFOLIO COMPOSITION*** | ||||

| Municipal Bonds | 90.5 | % | ||

| Corporate Bonds | 2.8 | |||

| Asset-Backed Securities | 2.4 | |||

| Collateralized Mortgage Obligations | 1.8 | |||

| Others (each less than 1.0%) | 2.4 | |||

| Short-Term Investments | 0.1 | |||

| 1 | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages are based on total investments as of August 31, 2017. The Fund’s portfolio composition is subject to change. |

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 5 | ||||||

Table of Contents

JPMorgan Tax Aware Income Opportunities Fund

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2017 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 MONTHS* | 1 YEAR | 5 YEAR | SINCE INCEPTION | |||||||||||||||||||||||||||||||||||||||||||||||||

| Inception Date of Class | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | Before Taxes | After Taxes on Distributions | After Taxes on Distributions and Sale of Fund Shares | ||||||||||||||||||||||||||||||||||||||||

CLASS A SHARES | | March 1, 2011 | | |||||||||||||||||||||||||||||||||||||||||||||||||

With Sales Charge** | (2.47 | )% | (2.62 | )% | (1.14 | )% | (2.43 | )% | (2.72 | )% | (0.88 | )% | 0.25 | % | 0.01 | % | 0.23 | % | 0.89 | % | 0.66 | % | 0.73 | % | ||||||||||||||||||||||||||||

Without Sales Charge | 1.37 | 1.22 | 1.05 | 1.38 | 1.09 | 1.30 | 1.02 | 0.78 | 0.82 | 1.49 | 1.25 | 1.19 | ||||||||||||||||||||||||||||||||||||||||

CLASS C SHARES | | March 1, 2011 | | |||||||||||||||||||||||||||||||||||||||||||||||||

With CDSC*** | 0.13 | 0.01 | 0.27 | (0.13 | ) | (0.35 | ) | 0.29 | 0.40 | 0.22 | 0.30 | 0.85 | 0.67 | 0.64 | ||||||||||||||||||||||||||||||||||||||

Without CDSC | 1.13 | 1.01 | 0.84 | 0.86 | 0.64 | 0.86 | 0.40 | 0.22 | 0.30 | 0.85 | 0.67 | 0.64 | ||||||||||||||||||||||||||||||||||||||||

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | March 1, 2011 | | 1.50 | 1.33 | 1.16 | 1.61 | 1.28 | 1.49 | 1.14 | 0.88 | 0.92 | 1.60 | 1.35 | 1.29 | |||||||||||||||||||||||||||||||||||||

| * | Not annualized. |

| ** | Sales Charge for Class A Shares is 3.75%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year period and 0% CDSC thereafter. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

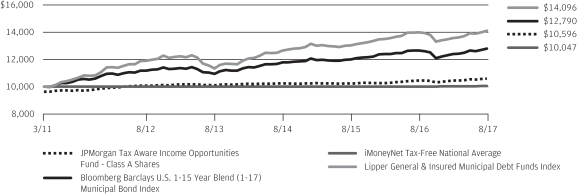

LIFE OF FUND PERFORMANCE (3/1/11 TO 8/31/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 1, 2011.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Tax Aware Income Opportunities Fund, the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index, the iMoneyNet Tax-Free National Average and the Lipper General & Insured Municipal Debt Funds Index from March 1, 2011 to August 31, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Bloomberg Barclays U.S. 1-15 Year Blend (1-17 Year) Municipal Bond Index and the iMoneyNet Tax-Free National Average does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmarks, if applicable. The performance of the Lipper General & Insured Municipal Debt Funds Index includes expenses associated with a mutual fund,

such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index represents the performance of municipal bonds with maturities from 1-17 years. The iMoneyNet Tax-Free National Average is an average of all tax-free and municipal, U.S.-domiciled institutional and retail money market funds. The Lipper General & Insured Municipal Debt Funds Index represents total returns of the funds in the indicated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 3.75% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| 6 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — 87.4% (t) | ||||||||

Alabama — 0.6% | ||||||||

Utility — 0.6% | ||||||||

| 500 | The Lower Alabama Gas District, Gas Project, Series A, Rev., 5.00%, 09/01/2031 | 598 | ||||||

|

| |||||||

Alaska — 0.4% | ||||||||

Housing — 0.1% | ||||||||

| 80 | Alaska Housing Finance Corp., General Mortgage, Series A, Rev., 4.00%, 06/01/2040 | 81 | ||||||

|

| |||||||

Industrial Development Revenue/Pollution Control Revenue — 0.3% |

| |||||||

| 325 | Alaska Industrial Development & Export Authority, Providence Health & Services, Series A, Rev., 5.50%, 10/01/2041 | 362 | ||||||

|

| |||||||

Total Alaska | 443 | |||||||

|

| |||||||

Arizona — 0.6% | ||||||||

Education — 0.3% | ||||||||

| 300 | Arizona School Facilities Board, State School Trust, Rev., AMBAC, 5.00%, 07/01/2018 | 310 | ||||||

|

| |||||||

Utility — 0.3% | ||||||||

| 200 | City of Mesa, Utility Systems, Rev., AGM, 5.25%, 07/01/2029 | 251 | ||||||

|

| |||||||

Total Arizona | 561 | |||||||

|

| |||||||

California — 4.4% | ||||||||

Education — 0.1% | ||||||||

| 200 | California School Facilities Financing Authority, Capital Appreciation, Azusa Unified School District, Series A, Rev., AGM, Zero Coupon, 08/01/2030 | 136 | ||||||

|

| |||||||

General Obligation — 0.5% | ||||||||

| 160 | Pomona Unified School District, Series C, GO, 6.00%, 08/01/2029 (p) | 227 | ||||||

| 100 | San Mateo Union High School District, Capital Appreciation, Election of 2006, Series A, GO, Zero Coupon, 09/01/2028 | 67 | ||||||

| 175 | Sunnyvale Elementary School District, Election 2004, Series C, GO, 5.50%, 09/01/2034 | 237 | ||||||

|

| |||||||

| 531 | ||||||||

|

| |||||||

Hospital — 1.5% | ||||||||

| 500 | California Health Facilities Financing Authority, Children’s Hospital, Series A, Rev., 5.00%, 08/15/2047 | 564 | ||||||

| 200 | California Municipal Finance Authority, Eisenhower Medical Center, Series B, Rev., 5.00%, 07/01/2047 | 226 | ||||||

| 200 | California Public Finance Authority, Henry Mayo Newhall Hospital, Rev., 5.00%, 10/15/2029 | 228 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Hospital — continued | ||||||||

| 375 | Palomar Health, Rev., 5.00%, 11/01/2026 | 445 | ||||||

|

| |||||||

| 1,463 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control Revenue — 0.3% | ||||||||

| 250 | California Pollution Control Financing Authority, Solid Waste Disposal, Waste Management, Inc. Project, Series B-2, Rev., AMT, 3.13%, 11/03/2025 (z) | 261 | ||||||

|

| |||||||

Transportation — 1.4% | ||||||||

| 620 | Foothill Eastern Transportation Corridor Agency, Capital Appreciation, Senior Lien, Series A, Rev., Zero Coupon, 01/01/2024 (p) | 560 | ||||||

| 785 | Harbor Department of Los Angeles, Series A, Rev., AMT, 5.00%, 08/01/2035 | 898 | ||||||

|

| |||||||

| 1,458 | ||||||||

|

| |||||||

Utility — 0.6% | ||||||||

| 250 | Los Angeles Department of Water & Power, Power System, Series B, Rev., 5.00%, 07/01/2043 | 288 | ||||||

| 250 | Los Angeles Department of Water & Power, Water System, Series A, Rev., 5.25%, 07/01/2039 | 285 | ||||||

|

| |||||||

| 573 | ||||||||

|

| |||||||

Total California | 4,422 | |||||||

|

| |||||||

Colorado — 1.2% | ||||||||

Hospital — 1.1% | ||||||||

| 1,000 | Colorado Health Facilities Authority, Frasier Meadows Retirement Community Project, Series A, Rev., 5.25%, 05/15/2028 | 1,105 | ||||||

|

| |||||||

Housing — 0.0% (g) | ||||||||

| 15 | El Paso County, Single Family Mortgage, Southern Front Range Region Program, Series E, Rev., AMT, GNMA/FNMA/FHLMC, 5.85%, 04/01/2041 | 15 | ||||||

|

| |||||||

Utility — 0.1% | ||||||||

| 110 | Public Authority for Colorado Energy, Natural Gas Purchase, Series 2008, Rev., 6.13%, 11/15/2023 | 133 | ||||||

|

| |||||||

Total Colorado | 1,253 | |||||||

|

| |||||||

Connecticut — 1.4% | ||||||||

Education — 1.2% | ||||||||

Connecticut State Higher Education Supplemental Loan Authority, CHESLA Loan Program, | ||||||||

| 945 | Series A, Rev., 4.00%, 11/15/2019 | 990 | ||||||

| 200 | Series A, Rev., 5.25%, 11/15/2024 | 224 | ||||||

|

| |||||||

| 1,214 | ||||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 7 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Housing — 0.2% | ||||||||

| 165 | Connecticut Housing Finance Authority, Housing Mortgage Finance Program, Subseries A-1, Rev., 4.00%, 11/15/2045 | 180 | ||||||

|

| |||||||

Total Connecticut | 1,394 | |||||||

|

| |||||||

Delaware — 0.3% |

| |||||||

Housing — 0.3% |

| |||||||

Delaware State Housing Authority, Senior Single Family Mortgage, | ||||||||

| 305 | Series A-1, Rev., AMT, 4.90%, 07/01/2029 | 325 | ||||||

| 25 | Series D-1, Rev., AMT, GNMA/FNMA/FHLMC, 4.63%, 01/01/2023 | 25 | ||||||

|

| |||||||

Total Delaware | 350 | |||||||

|

| |||||||

District of Columbia — 1.9% |

| |||||||

Transportation — 1.9% |

| |||||||

| 100 | Metropolitan Washington Airports Authority, Series C, Rev., AMT, 5.00%, 10/01/2022 | 115 | ||||||

| 1,500 | Washington Metropolitan Area Transit Authority, Gross Revenue Transit Bonds, Series B, Rev., 5.00%, 07/01/2036 | 1,796 | ||||||

|

| |||||||

Total District of Columbia | 1,911 | |||||||

|

| |||||||

Florida — 9.4% |

| |||||||

Certificate of Participation/Lease — 1.8% |

| |||||||

| 750 | Broward County School Board, Series A, COP, 5.00%, 07/01/2024 | 911 | ||||||

| 750 | South Florida Water Management District, COP, 5.00%, 10/01/2032 | 885 | ||||||

|

| |||||||

| 1,796 | ||||||||

|

| |||||||

Education — 0.5% |

| |||||||

| 500 | Lakeland Educational Facilities, Southern College Project, Series A, Rev., 5.00%, 09/01/2025 | 569 | ||||||

|

| |||||||

Hospital — 2.0% |

| |||||||

| 995 | Alachua County Health Facilities Authority, Shands Teaching Hospital and Clinics, Inc., Series A, Rev., 5.00%, 12/01/2026 | 1,170 | ||||||

| 200 | County of Sumter, Industrial Development Authority, Central Florida Health Alliance Projects, Series A, Rev., 5.00%, 07/01/2018 | 206 | ||||||

| 545 | Miami Beach Health Facilities Authority, Mount Sinai Medical Center, Rev., 5.00%, 11/15/2029 | 614 | ||||||

|

| |||||||

| 1,990 | ||||||||

|

| |||||||

Housing — 0.2% |

| |||||||

| 45 | Florida Housing Finance Corp., Series 1, Rev., AMT, 5.00%, 07/01/2041 | 47 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Housing — continued |

| |||||||

| 150 | Florida Housing Finance Corp., Homeowner Mortgage Special Program, Series A-1, Rev., GNMA/FNMA/FHLMC, 5.00%, 07/01/2028 | 154 | ||||||

|

| |||||||

| 201 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 500 | Broward County Fuel System, Fort Lauderdale Fuel Facilities LLC Project, Series A, Rev., AMT, AGM, 5.00%, 04/01/2024 | 575 | ||||||

| 500 | County of Escambia, Pollution Control, Gulf Power Company Project, Rev., 2.10%, 04/11/2019 (z) | 506 | ||||||

|

| |||||||

| 1,081 | ||||||||

|

| |||||||

Prerefunded — 0.1% |

| |||||||

| 70 | City of Charlotte, Rev., AGM, 5.25%, 10/01/2021 (p) | 82 | ||||||

|

| |||||||

Transportation — 2.1% |

| |||||||

| 100 | County of Broward, Port Facilities, Series A, Rev., 5.00%, 09/01/2021 | 108 | ||||||

| 155 | Orlando-Orange County Expressway Authority, Series B, Rev., AGM, 4.00%, 07/01/2021 | 166 | ||||||

| 625 | State of Florida, Department of Transportation, Seaport Investment Program, Rev., 5.00%, 07/01/2037 | 723 | ||||||

| 1,000 | Tampa-Hillsborough County Expressway Authority, Series A, Rev., 5.00%, 07/01/2027 | 1,151 | ||||||

|

| |||||||

| 2,148 | ||||||||

|

| |||||||

Utility — 1.6% |

| |||||||

| 130 | City of Charlotte, Rev., AGM, 5.25%, 10/01/2024 | 151 | ||||||

| 200 | Florida Municipal Power Agency, All Requirements Power Supply Project, Series A, Rev., 5.00%, 10/01/2030 | 241 | ||||||

| 500 | JEA Electric System Revenue, Subseries B, Rev., 5.00%, 10/01/2034 | 563 | ||||||

| 500 | Tampa Bay Water Utility System, Revenue Refunding & Improvement, Series A, Rev., NATL-RE, 6.00%, 10/01/2029 | 679 | ||||||

|

| |||||||

| 1,634 | ||||||||

|

| |||||||

Total Florida | 9,501 | |||||||

|

| |||||||

Georgia — 1.8% |

| |||||||

Hospital — 0.5% |

| |||||||

| 430 | Gainesville & Hall County Hospital Authority, Northeast Georgia Health System, Inc. Project, Series A, Rev., RAN, 5.00%, 02/15/2026 | 517 | ||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 8 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Housing — 0.4% |

| |||||||

Georgia Housing & Finance Authority, Non Single Family, | ||||||||

| 65 | Series B, Rev., 4.00%, 12/01/2029 | 67 | ||||||

| 345 | Subseries A-1, Rev., 4.00%, 06/01/2044 | 366 | ||||||

|

| |||||||

| 433 | ||||||||

|

| |||||||

Other Revenue — 0.3% |

| |||||||

| 240 | Downtown Smyrna Development Authority, Rev., 5.25%, 02/01/2028 | 295 | ||||||

|

| |||||||

Transportation — 0.6% |

| |||||||

| 500 | City of Atlanta, Airport, Series C, Rev., AMT, 5.00%, 01/01/2042 | 544 | ||||||

|

| |||||||

Total Georgia | 1,789 | |||||||

|

| |||||||

Guam — 1.1% |

| |||||||

Water & Sewer — 1.1% |

| |||||||

Guam Government Waterworks Authority, Water & Waste Water System, | ||||||||

| 200 | Rev., 5.00%, 07/01/2019 | 212 | ||||||

| 275 | Rev., 5.00%, 07/01/2024 | 320 | ||||||

| 525 | Rev., 5.00%, 07/01/2025 | 614 | ||||||

|

| |||||||

Total Guam | 1,146 | |||||||

|

| |||||||

Idaho — 0.4% |

| |||||||

Housing — 0.4% |

| |||||||

| 415 | Idaho Housing & Finance Association, Single Family Mortgage, Series A-2, Class I, Rev., AMT, 4.00%, 07/01/2034 | 444 | ||||||

|

| |||||||

Illinois — 3.7% |

| |||||||

General Obligation — 1.0% |

| |||||||

| 125 | Des Plaines Valley Public Library District, GO, 5.50%, 01/01/2030 | 136 | ||||||

| 50 | Greater Chicago Metropolitan Water Reclamation District, Series C, GO, 5.25%, 12/01/2027 | 62 | ||||||

| 150 | Lake County Community Consolidated School District No. 50 Woodland, Series C, GO, 5.25%, 01/01/2024 | 169 | ||||||

| 625 | State of Illinois, Series A, GO, 5.00%, 06/01/2019 | 654 | ||||||

|

| |||||||

| 1,021 | ||||||||

|

| |||||||

Hospital — 0.9% |

| |||||||

| 750 | Illinois Finance Authority, Rush University Medical Center Obligated Group, Series A, Rev., 5.00%, 11/15/2028 | 869 | ||||||

|

| |||||||

Housing — 0.7% |

| |||||||

Illinois Housing Development Authority, Homeowner Mortgage, | ||||||||

| 405 | Series C, Rev., 3.50%, 08/01/2046 | 430 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Housing — continued |

| |||||||

| 295 | Subseries A-2, Rev., AMT, 4.00%, 02/01/2035 | 309 | ||||||

|

| |||||||

| 739 | ||||||||

|

| |||||||

Other Revenue — 0.4% |

| |||||||

Railsplitter Tobacco Settlement Authority, | ||||||||

| 180 | Rev., 5.13%, 06/01/2019 | 192 | ||||||

| 130 | Rev., 5.25%, 06/01/2021 | 149 | ||||||

|

| |||||||

| 341 | ||||||||

|

| |||||||

Transportation — 0.5% |

| |||||||

| 200 | City of Chicago, O’Hare International Airport, Third Lien, Series C, Rev., AGC, 5.25%, 01/01/2025 | 218 | ||||||

| 250 | Regional Transportation Authority, Series A, Rev., NATL-RE, 6.00%, 07/01/2024 | 316 | ||||||

|

| |||||||

| 534 | ||||||||

|

| |||||||

Water & Sewer — 0.2% |

| |||||||

| 150 | City of Chicago, Waterworks, Second Lien, Rev., AMBAC, BHAC-CR, 5.75%, 11/01/2030 | 187 | ||||||

|

| |||||||

Total Illinois | 3,691 | |||||||

|

| |||||||

Indiana — 4.6% |

| |||||||

Education — 1.1% |

| |||||||

| 1,000 | Indiana Finance Authority, Educational Facilities, Valparaiso University, Rev., 5.00%, 10/01/2038 | 1,151 | ||||||

|

| |||||||

Hospital — 1.3% |

| |||||||

| 330 | Indiana Health Facility Financing Authority, Ascension Health Credit Group, Series A-1, Rev., 5.00%, 11/15/2034 | 382 | ||||||

| 840 | St. Joseph County Hospital Authority, Beacon Health System Obligation Group, Rev., 5.00%, 08/15/2036 | 956 | ||||||

|

| |||||||

| 1,338 | ||||||||

|

| |||||||

Housing — 0.1% |

| |||||||

Indiana Housing & Community Development Authority, Home First Mortgage, | ||||||||

| 35 | Series A, Rev., GNMA/FNMA/FHLMC, 4.50%, 06/01/2028 | 37 | ||||||

| 60 | Series C, Rev., GNMA/FNMA/FHLMC, 4.50%, 12/01/2027 | 63 | ||||||

|

| |||||||

| 100 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 1,500 | County of St. Joseph, Economic Development, St. Mary’s College Project, Series A, Rev., 5.00%, 04/01/2027 | 1,807 | ||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 9 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Water & Sewer — 0.3% |

| |||||||

| 250 | Indiana State Finance Authority, Wastewater Utility, First Lien, Series A, Rev., 5.25%, 10/01/2031 | 289 | ||||||

|

| |||||||

Total Indiana | 4,685 | |||||||

|

| |||||||

Iowa — 0.0% (g) |

| |||||||

Housing — 0.0% (g) |

| |||||||

| 10 | Iowa Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, Series 1, Rev., GNMA/FNMA/FHLMC, 5.00%, 07/01/2028 | 10 | ||||||

|

| |||||||

Kentucky — 0.0% (g) |

| |||||||

Housing — 0.0% (g) |

| |||||||

| 10 | Kentucky Housing Corp., Series A, Rev., 5.00%, 01/01/2027 | 10 | ||||||

|

| |||||||

Louisiana — 2.1% |

| |||||||

Hospital — 1.1% |

| |||||||

| 500 | Louisiana Local Government Environmental Facilities & Community Development Authority, Woman’s Hospital Foundation Project, Series A, Rev., 5.00%, 10/01/2044 | 564 | ||||||

| 500 | Louisiana Public Facilities Authority, Ochsner Clinic Foundation Project, Rev., 5.00%, 05/15/2042 | 567 | ||||||

|

| |||||||

| 1,131 | ||||||||

|

| |||||||

Housing — 0.1% |

| |||||||

East Baton Rouge Mortgage Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, | ||||||||

| 15 | Series A-2, Rev., GNMA/FNMA/FHLMC, 3.90%, 04/01/2019 | 16 | ||||||

| 45 | Series A-2, Rev., GNMA/FNMA/FHLMC, 4.75%, 10/01/2029 | 46 | ||||||

| 10 | Series A-2, Rev., GNMA/FNMA/FHLMC, 5.25%, 10/01/2039 | 10 | ||||||

|

| |||||||

| 72 | ||||||||

|

| |||||||

Transportation — 0.4% |

| |||||||

| 250 | New Orleans Aviation Board, General Airport, North Terminal Project, Series B, Rev., AMT, 5.00%, 01/01/2048 | 284 | ||||||

| 125 | New Orleans Aviation Board, Gulf Opportunity Zone, Consolidated Rental Car, Series A, Rev., 5.50%, 01/01/2019 | 131 | ||||||

|

| |||||||

| 415 | ||||||||

|

| |||||||

Water & Sewer — 0.5% |

| |||||||

| 400 | City of New Orleans, Sewerage Service, Rev., 5.00%, 06/01/2021 | 453 | ||||||

|

| |||||||

Total Louisiana | 2,071 | |||||||

|

| |||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Maine — 1.3% |

| |||||||

Education — 0.3% |

| |||||||

| 275 | Maine Health & Higher Educational Facilities Authority, Series A, Rev., 5.00%, 07/01/2025 | 320 | ||||||

|

| |||||||

Housing — 1.0% |

| |||||||

Maine State Housing Authority, | ||||||||

| 335 | Series A, Rev., 4.00%, 11/15/2045 | 362 | ||||||

| 335 | Series A-1, Rev., AMT, 4.50%, 11/15/2028 | 351 | ||||||

| 235 | Series B, Rev., 4.00%, 11/15/2043 | 248 | ||||||

|

| |||||||

| 961 | ||||||||

|

| |||||||

Prerefunded — 0.0% (g) |

| |||||||

| 25 | Maine Health & Higher Educational Facilities Authority, Series A, Rev., 5.00%, 07/01/2023 (p) | 30 | ||||||

|

| |||||||

Total Maine | 1,311 | |||||||

|

| |||||||

Maryland — 1.1% |

| |||||||

Housing — 0.5% |

| |||||||

| 500 | Montgomery County Housing Opportunities Commission, Series A, Rev., 4.00%, 07/01/2048 | 546 | ||||||

|

| |||||||

Special Tax — 0.5% |

| |||||||

| 400 | County of Anne Arundel, Consolidated Special Taxing District, The Villages of Dorchester and Farmington Village Projects, Rev., 5.00%, 07/01/2021 | 455 | ||||||

|

| |||||||

Transportation — 0.1% |

| |||||||

| 95 | Maryland Economic Development Corp., Series A, Rev., 5.13%, 06/01/2020 | 100 | ||||||

|

| |||||||

Total Maryland | 1,101 | |||||||

|

| |||||||

Massachusetts — 6.2% |

| |||||||

Education — 2.0% |

| |||||||

Massachusetts Educational Financing Authority, Education Loan, | ||||||||

| 300 | Rev., AMT, 5.00%, 07/01/2023 | 346 | ||||||

| 500 | Series J, Rev., AMT, 5.00%, 07/01/2018 | 516 | ||||||

| 535 | Massachusetts Health & Educational Facilities Authority, Massachusetts Institute of Technology, Series L, Rev., 5.25%, 07/01/2033 | 716 | ||||||

| 350 | Massachusetts State College Building Authority, Series B, Rev., XLCA, 5.50%, 05/01/2028 | 433 | ||||||

|

| |||||||

| 2,011 | ||||||||

|

| |||||||

Housing — 1.0% |

| |||||||

Massachusetts Housing Finance Agency, Single Family Housing, | ||||||||

| 205 | Series 160, Rev., AMT, 3.75%, 06/01/2034 | 211 | ||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 10 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Housing — continued |

| |||||||

| 720 | Series 169, Rev., 4.00%, 12/01/2044 | 756 | ||||||

|

| |||||||

| 967 | ||||||||

|

| |||||||

Other Revenue — 0.1% |

| |||||||

| 95 | Massachusetts Development Finance Agency, Evergreen Center, Inc., Rev., 5.50%, 01/01/2020 | 95 | ||||||

|

| |||||||

Transportation — 1.8% |

| |||||||

| 300 | Massachusetts Bay Transportation Authority, Series B, Rev., NATL-RE, 5.50%, 07/01/2028 | 393 | ||||||

Massachusetts Port Authority, | ||||||||

| 500 | Series A, Rev., 5.00%, 07/01/2044 | 582 | ||||||

| 770 | Series A, Rev., AMT, 5.00%, 07/01/2037 | 854 | ||||||

|

| |||||||

| 1,829 | ||||||||

|

| |||||||

Water & Sewer — 1.3% |

| |||||||

Massachusetts Water Resources Authority, | ||||||||

| 500 | Series B, Rev., AGM, 5.25%, 08/01/2029 | 654 | ||||||

| 100 | Series B, Rev., AGM, 5.25%, 08/01/2032 | 133 | ||||||

| 500 | Series D, Rev., 5.00%, 08/01/2044 | 582 | ||||||

|

| |||||||

| 1,369 | ||||||||

|

| |||||||

Total Massachusetts | 6,271 | |||||||

|

| |||||||

Michigan — 1.8% |

| |||||||

Education — 1.1% |

| |||||||

| 500 | Eastern Michigan University, Series A, Rev., 5.00%, 03/01/2036 | 582 | ||||||

| 500 | Michigan Finance Authority, Student Loan, Series 25-A, Rev., AMT, 5.00%, 11/01/2022 | 570 | ||||||

|

| |||||||

| 1,152 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 165 | Saginaw County Economic Development Corp., BGI South LLC-Recovery Zone, Rev., 5.00%, 12/01/2020 | 181 | ||||||

|

| |||||||

Transportation — 0.5% |

| |||||||

| 400 | Wayne County Airport Authority, Detroit Metropolitan Airport, Series B, Rev., AMT, 5.00%, 12/01/2021 | 456 | ||||||

|

| |||||||

Total Michigan | 1,789 | |||||||

|

| |||||||

Minnesota — 1.5% |

| |||||||

Hospital — 0.2% |

| |||||||

| 200 | Meeker County, Gross Revenue, Hospital Facilities, Memorial Hospital Project, Rev., 5.25%, 11/01/2017 | 201 | ||||||

|

| |||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Housing — 1.3% |

| |||||||

Minneapolis/St. Paul Housing Finance Board, Single Family Mortgage, Mortgage-Backed Securities Program, City Living Home Programs, | ||||||||

| 14 | Series A-1, Rev., GNMA/FNMA/FHLMC, 5.25%, 12/01/2040 | 14 | ||||||

| 125 | Series A-2, Rev., GNMA/FNMA/FHLMC, 5.52%, 03/01/2041 | 132 | ||||||

| 50 | Minnesota Housing Finance Agency, Homeownership Finance, Mortgage-Backed Securities Program, Series A, Rev., GNMA/FNMA/FHLMC, 4.25%, 07/01/2028 | 51 | ||||||

Minnesota Housing Finance Agency, Residential Housing Finance, | ||||||||

| 380 | Series A, Rev., 4.00%, 07/01/2038 | 402 | ||||||

| 310 | Series B, Rev., 4.00%, 01/01/2038 | 329 | ||||||

| 355 | Series C, Rev., AMT, GNMA/FNMA/FHLMC, 4.00%, 01/01/2045 | 379 | ||||||

| 20 | Series D, Rev., GNMA/FNMA/FHLMC, 4.00%, 07/01/2040 | 21 | ||||||

|

| |||||||

| 1,328 | ||||||||

|

| |||||||

Total Minnesota | 1,529 | |||||||

|

| |||||||

Mississippi — 0.3% |

| |||||||

Other Revenue — 0.3% |

| |||||||

Mississippi Development Bank, Harrison County, Coliseum & Convention Center, | ||||||||

| 160 | Series A, Rev., 5.25%, 01/01/2030 | 205 | ||||||

| 100 | Series A, Rev., 5.25%, 01/01/2034 | 131 | ||||||

|

| |||||||

Total Mississippi | 336 | |||||||

|

| |||||||

Missouri — 1.7% |

| |||||||

General Obligation — 0.3% |

| |||||||

| 250 | Independence School District, Direct Deposit Program, Series A, GO, 5.25%, 03/01/2031 | 285 | ||||||

|

| |||||||

Housing — 0.9% |

| |||||||

| 545 | Missouri Housing Development Commission, Single Family Mortgage, First Place Homeownership Loan Program, Series B, Rev., GNMA/FNMA/FHLMC COLL, 3.50%, 05/01/2041 | 585 | ||||||

Missouri Housing Development Commission, Single Family Mortgage, Special Homeownership Loan Program, | ||||||||

| 140 | Series A, Rev., GNMA/FNMA/FHLMC, 4.00%, 11/01/2041 | 148 | ||||||

| 85 | Series E-3, Rev., GNMA/FNMA/FHLMC, 4.63%, 05/01/2028 | 88 | ||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 11 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Housing — continued |

| |||||||

| 90 | Series E-4, Rev., GNMA/FNMA/FHLMC, 4.25%, 11/01/2030 | 93 | ||||||

|

| |||||||

| 914 | ||||||||

|

| |||||||

Transportation — 0.5% |

| |||||||

| 400 | Bi-State Development Agency, Metropolitan District, St. Clair County Metrolink Project, Rev., AGM, 5.25%, 07/01/2025 | 498 | ||||||

|

| |||||||

Total Missouri | 1,697 | |||||||

|

| |||||||

Montana — 0.3% |

| |||||||

Housing — 0.2% |

| |||||||

| 220 | Montana Board of Housing, Single Family Homeownership, Series A-2, Rev., AMT, 4.00%, 12/01/2038 | 230 | ||||||

|

| |||||||

Transportation — 0.1% |

| |||||||

| 100 | City of Billings, Airport, Series A, Rev., AMT, 5.00%, 07/01/2020 | 107 | ||||||

|

| |||||||

Total Montana | 337 | |||||||

|

| |||||||

Nebraska — 1.1% |

| |||||||

General Obligation — 0.7% |

| |||||||

Omaha City Convention Center/Arena Project, | ||||||||

| 295 | GO, 5.25%, 04/01/2025 | 368 | ||||||

| 285 | GO, 5.25%, 04/01/2027 | 363 | ||||||

|

| |||||||

| 731 | ||||||||

|

| |||||||

Utility — 0.4% |

| |||||||

| 360 | Central Plains Energy Project, Gas Project No. 3, Rev., 5.00%, 09/01/2027 | 402 | ||||||

|

| |||||||

Total Nebraska | 1,133 | |||||||

|

| |||||||

New Hampshire — 0.5% |

| |||||||

Education — 0.4% |

| |||||||

City of Manchester, School Facilities, | ||||||||

| 200 | Rev., NATL-RE, 5.50%, 06/01/2026 | 255 | ||||||

| 100 | Rev., NATL-RE, 5.50%, 06/01/2027 | 129 | ||||||

|

| |||||||

| 384 | ||||||||

|

| |||||||

Housing — 0.1% |

| |||||||

| 60 | New Hampshire Housing Finance Authority, Single Family Mortgage, Series A, Rev., 5.25%, 07/01/2028 | 63 | ||||||

| 30 | New Hampshire Housing Finance Authority, Single Family Mortgage, Acquisition, Series B, Rev., 5.00%, 07/01/2027 | 31 | ||||||

|

| |||||||

| 94 | ||||||||

|

| |||||||

Total New Hampshire | 478 | |||||||

|

| |||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

New Jersey — 3.2% |

| |||||||

Education — 1.1% |

| |||||||

| 250 | New Jersey Educational Facilities Authority, College of New Jersey Issue, Series A, Rev., 5.00%, 07/01/2018 | 258 | ||||||

New Jersey Higher Education Student Assistance Authority, Senior Student Loan, | ||||||||

| 500 | Series 1A, Rev., AMT, 5.00%, 12/01/2019 | 538 | ||||||

| 250 | Series 1A, Rev., AMT, 5.00%, 12/01/2024 | 291 | ||||||

|

| |||||||

| 1,087 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 500 | Gloucester County Improvement Authority, Solid Waste Resource Recovery, Waste Management, Inc. Project, Series A, Rev., 2.13%, 12/01/2017 (z) | 501 | ||||||

|

| |||||||

Other Revenue — 1.2% |

| |||||||

New Brunswick Parking Authority, City Guaranteed Parking, | ||||||||

| 385 | Rev., 5.00%, 09/01/2027 | 459 | ||||||

| 590 | Rev., 5.00%, 09/01/2028 | 697 | ||||||

|

| |||||||

| 1,156 | ||||||||

|

| |||||||

Transportation — 0.4% |

| |||||||

| 380 | New Jersey EDA, Motor Vehicle Surplus, Series A, Rev., NATL-RE, 5.25%, 07/01/2024 | 444 | ||||||

|

| |||||||

Total New Jersey | 3,188 | |||||||

|

| |||||||

New Mexico — 0.6% |

| |||||||

Housing — 0.2% |

| |||||||

New Mexico Mortgage Finance Authority, Single Family Mortgage Program, | ||||||||

| 50 | Series A, Class I, Rev., GNMA/FNMA/FHLMC, 5.00%, 09/01/2030 | 53 | ||||||

| 85 | Series B, Class I, Rev., GNMA/FNMA/FHLMC, 5.00%, 03/01/2028 | 92 | ||||||

| 5 | Series B-2, Class I, Rev., GNMA/FNMA/FHLMC, 5.65%, 09/01/2039 | 5 | ||||||

|

| |||||||

| 150 | ||||||||

|

| |||||||

Other Revenue — 0.4% |

| |||||||

| 350 | Bernalillo County, Gross Receipts, Rev., AMBAC, 5.25%, 10/01/2026 | 439 | ||||||

|

| |||||||

Total New Mexico | 589 | |||||||

|

| |||||||

New York — 8.3% |

| |||||||

Education — 0.2% |

| |||||||

| 250 | Niagara Area Development Corp., Niagara University Project, Series A, Rev., 5.00%, 05/01/2018 | 256 | ||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 12 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Housing — 1.5% |

| |||||||

New York Mortgage Agency, Homeowner Mortgage, | ||||||||

| 355 | Series 191, Rev., AMT, 3.50%, 10/01/2034 | 369 | ||||||

| 595 | Series 195, Rev., 4.00%, 10/01/2046 | 652 | ||||||

| 485 | Series 197, Rev., 3.50%, 10/01/2044 | 522 | ||||||

|

| |||||||

| 1,543 | ||||||||

|

| |||||||

Other Revenue — 1.8% |

| |||||||

| 525 | New York Liberty Development Corp., Goldman Sachs Headquarters, Rev., 5.25%, 10/01/2035 | 671 | ||||||

| 390 | New York State Environmental Facilities Corp., Revolving Funds, Pooled Financing, Series B, Rev., 5.50%, 10/15/2030 (p) | 536 | ||||||

| 325 | Niagara Tobacco Asset Securitization Corp., Tobacco Settlement Asset-Backed Bonds, Rev., 5.00%, 05/15/2021 | 364 | ||||||

| 200 | TSASC, Inc., Tobacco Settlement, Series B, Rev., 5.00%, 06/01/2021 | 218 | ||||||

|

| |||||||

| 1,789 | ||||||||

|

| |||||||

Special Tax — 0.6% |

| |||||||

| 500 | New York State Urban Development Corp., State Personal Income Tax, General Purpose, Series A-1, Rev., 5.00%, 03/15/2043 | 566 | ||||||

|

| |||||||

Transportation — 1.8% |

| |||||||

| 1,000 | Metropolitan Transportation Authority, Dedicated Tax Fund, Series A, Rev., 5.00%, 11/15/2047 | 1,174 | ||||||

| 500 | Port Authority of New York & New Jersey, Consolidated, 194th Series, Rev., 5.00%, 10/15/2030 | 605 | ||||||

|

| |||||||

| 1,779 | ||||||||

|

| |||||||

Water & Sewer — 2.4% |

| |||||||

New York City Municipal Water Finance Authority, Second General Resolution, | ||||||||

| 250 | Series BB, Rev., 5.25%, 06/15/2044 | 285 | ||||||

| 440 | Series EE, Rev., 5.38%, 06/15/2043 | 497 | ||||||

| 500 | New York City Municipal Water Finance Authority, Water & Sewer System, Second General Resolution, Fiscal Year 2013, Series DD, Rev., 5.00%, 06/15/2034 | 583 | ||||||

| 500 | New York City Municipal Water Finance Authority, Water & Sewer System, Second General Resolution, Fiscal Year 2015, Series FF, Rev., 5.00%, 06/15/2031 | 601 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Water & Sewer — continued |

| |||||||

| 305 | New York State Environmental Facilities Corp., State Clean Water & Drinking, Revolving Funds, Pooled Financing Program, Series B, Rev., 5.50%, 04/15/2035 (p) | 429 | ||||||

|

| |||||||

| 2,395 | ||||||||

|

| |||||||

Total New York | 8,328 | |||||||

|

| |||||||

North Dakota — 0.5% |

| |||||||

Housing — 0.3% |

| |||||||

North Dakota Housing Finance Agency, Home Mortgage Finance Program, | ||||||||

| 110 | Series A, Rev., 3.75%, 07/01/2042 | 114 | ||||||

| 155 | Series A, Rev., 4.00%, 07/01/2034 | 163 | ||||||

|

| |||||||

| 277 | ||||||||

|

| |||||||

Utility — 0.2% |

| |||||||

| 210 | McLean County, Solid Waste Facilities, Great River Energy Project, Series A, Rev., 4.88%, 07/01/2026 | 224 | ||||||

|

| |||||||

Total North Dakota | 501 | |||||||

|

| |||||||

Ohio — 2.4% |

| |||||||

Education — 0.4% |

| |||||||

| 365 | Ohio State University, General Receipts, Special Purpose, Series A, Rev., 5.00%, 06/01/2043 | 418 | ||||||

|

| |||||||

General Obligation — 0.3% |

| |||||||

| 185 | County of Hamilton, Cincinnati City School District, Board of Education, Classroom Facilities Construction & Improvement, GO, NATL-RE, 5.25%, 12/01/2025 | 231 | ||||||

| 45 | Greene County, Series A, GO, AMBAC, 5.25%, 12/01/2028 | 57 | ||||||

|

| |||||||

| 288 | ||||||||

|

| |||||||

Hospital — 0.5% |

| |||||||

| 380 | City of Centerville, Graceworks Lutheran Services, Rev., 5.00%, 11/01/2027 | 416 | ||||||

| 100 | Franklin County Health Care Improvement, Presbyterian Services, Series A, Rev., 5.00%, 07/01/2020 | 100 | ||||||

|

| |||||||

| 516 | ||||||||

|

| |||||||

Housing — 0.2% |

| |||||||

Ohio Housing Finance Agency, Single Family Mortgage, | ||||||||

| 80 | Series 1, Rev., GNMA/FNMA/FHLMC, 5.00%, 11/01/2028 | 83 | ||||||

| 60 | Series 2, Rev., GNMA/FNMA/FHLMC, 4.50%, 11/01/2028 | 62 | ||||||

|

| |||||||

| 145 | ||||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 13 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Prerefunded — 0.4% |

| |||||||

| 395 | Cleveland-Cuyahoga County, Port Authority Development, Port of Cleveland Bond Fund, One Community Project, Series C, Rev., 5.00%, 11/15/2020 (p) | 445 | ||||||

|

| |||||||

Utility — 0.6% |

| |||||||

| 500 | American Municipal Power, Inc., Meldahl Hydroelectric Project, Series A, Rev., 5.00%, 02/15/2032 | 582 | ||||||

| 5 | American Municipal Power, Inc., Unrefunded Balance, Prairie State Energy Campus Project, Series A, Rev., 5.25%, 02/15/2021 | 5 | ||||||

|

| |||||||

| 587 | ||||||||

|

| |||||||

Total Ohio | 2,399 | |||||||

|

| |||||||

Oklahoma — 1.4% |

| |||||||

Transportation — 0.8% |

| |||||||

Tulsa Airports Improvement Trust, | ||||||||

| 300 | Series A, Rev., AMT, 5.00%, 06/01/2024 | 352 | ||||||

| 420 | Series A, Rev., AMT, 5.00%, 06/01/2025 | 490 | ||||||

|

| |||||||

| 842 | ||||||||

|

| |||||||

Water & Sewer — 0.6% |

| |||||||

Oklahoma City Water Utilities Trust, Water & Sewer System, | ||||||||

| 285 | Rev., 5.00%, 07/01/2030 | 344 | ||||||

| 220 | Rev., 5.38%, 07/01/2040 | 250 | ||||||

|

| |||||||

| 594 | ||||||||

|

| |||||||

Total Oklahoma | 1,436 | |||||||

|

| |||||||

Oregon — 1.2% |

| |||||||

Education — 0.6% |

| |||||||

| 500 | University of Oregon, Series A, Rev., 5.00%, 04/01/2045 | 572 | ||||||

|

| |||||||

General Obligation — 0.2% |

| |||||||

| 165 | Clackamas County School District No. 7J, Lake Oswego, GO, AGM, 5.25%, 06/01/2025 | 209 | ||||||

| 20 | Linn County Community School District No. 9 Lebanon, GO, NATL-RE, 5.50%, 06/15/2030 | 26 | ||||||

|

| |||||||

| 235 | ||||||||

|

| |||||||

Housing — 0.3% |

| |||||||

Oregon State Housing & Community Services Department, Single Family Mortgage Program, | ||||||||

| 190 | Series B, Rev., 5.00%, 07/01/2020 | 210 | ||||||

| 50 | Series B, Rev., AMT, 5.00%, 07/01/2030 | 53 | ||||||

|

| |||||||

| 263 | ||||||||

|

| |||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Prerefunded — 0.1% |

| |||||||

| 105 | State of Oregon, University Systems Projects, Series G, GO, 5.25%, 08/02/2021 (p) | 122 | ||||||

|

| |||||||

Total Oregon | 1,192 | |||||||

|

| |||||||

Pennsylvania — 1.0% |

| |||||||

Education — 0.2% |

| |||||||

| 160 | Allegheny County Higher Education Building Authority, Duquesne University, Series A, Rev., 5.00%, 03/01/2020 | 174 | ||||||

|

| |||||||

Housing — 0.4% |

| |||||||

Pennsylvania Housing Finance Agency, Single Family Mortgage, | ||||||||

| 95 | Series 112, Rev., 5.00%, 04/01/2028 | 100 | ||||||

| 10 | Series 118A, Rev., AMT, 3.50%, 04/01/2040 | 11 | ||||||

| 285 | Series 122, Rev., 4.00%, 10/01/2046 | 308 | ||||||

|

| |||||||

| 419 | ||||||||

|

| |||||||

Transportation — 0.4% |

| |||||||

| 350 | Allegheny County Airport Authority, Pittsburgh International Airport, Series A-1, Rev., AMT, 5.00%, 01/01/2026 | 387 | ||||||

|

| |||||||

Total Pennsylvania | 980 | |||||||

|

| |||||||

Rhode Island — 1.0% |

| |||||||

Education — 0.7% |

| |||||||

| 500 | Rhode Island Student Loan Authority, Series A, Rev., AMT, 5.00%, 12/01/2023 | 566 | ||||||

| 100 | Rhode Island Student Loan Authority, Senior, Series A, Rev., AMT, 5.00%, 12/01/2024 | 117 | ||||||

|

| |||||||

| 683 | ||||||||

|

| |||||||

Transportation — 0.3% |

| |||||||

| 250 | Rhode Island Economic Development Corp., Series B, Rev., 5.00%, 07/01/2022 | 284 | ||||||

|

| |||||||

Total Rhode Island | 967 | |||||||

|

| |||||||

South Carolina — 1.6% |

| |||||||

Education — 0.6% |

| |||||||

| 500 | Charleston Educational Excellence Financing Corp., Charleston County School District Project, Rev., 5.00%, 12/01/2024 | 602 | ||||||

|

| |||||||

Housing — 0.1% |

| |||||||

| 100 | South Carolina State Housing Finance & Development Authority, Series A, Rev., 4.00%, 01/01/2047 | 109 | ||||||

|

| |||||||

Transportation — 0.9% |

| |||||||

| 750 | South Carolina State Ports Authority, Rev., AMT, 5.00%, 07/01/2031 | 866 | ||||||

|

| |||||||

Total South Carolina | 1,577 | |||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 14 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

South Dakota — 0.7% |

| |||||||

Education — 0.6% |

| |||||||

| 500 | South Dakota State Health & Educational Facilities Authority, Sanford Health, Rev., 5.00%, 11/01/2045 | 567 | ||||||

|

| |||||||

Housing — 0.1% |

| |||||||

| 105 | South Dakota Housing Development Authority, Homeownership Mortgage, Series A, Rev., AMT, 4.50%, 05/01/2031 | 112 | ||||||

|

| |||||||

Total South Dakota | 679 | |||||||

|

| |||||||

Tennessee — 1.2% |

| |||||||

Housing — 0.2% |

| |||||||

Tennessee Housing Development Agency, Homeownership Program, | ||||||||

| 155 | Series 1A, Rev., AMT, 4.50%, 01/01/2038 | 163 | ||||||

| 80 | Series A, Rev., AMT, 4.50%, 07/01/2031 | 85 | ||||||

|

| |||||||

| 248 | ||||||||

|

| |||||||

Other Revenue — 0.1% |

| |||||||

| 120 | Memphis-Shelby County Sports Authority, Inc., Arena Project, Series D, Rev., NATL-RE, 5.00%, 11/01/2019 | 130 | ||||||

|

| |||||||

Utility — 0.9% |

| |||||||

Tennessee Energy Acquisition Corp., Gas Project, | ||||||||

| 370 | Series A, Rev., 5.25%, 09/01/2021 | 416 | ||||||

| 375 | Series A, Rev., 5.25%, 09/01/2023 | 437 | ||||||

|

| |||||||

| 853 | ||||||||

|

| |||||||

Total Tennessee | 1,231 | |||||||

|

| |||||||

Texas — 7.8% |

| |||||||

Education — 0.9% |

| |||||||

| 170 | Tarrant County Cultural Education Facilities Finance Corp., Hospital, Cook Children’s Medical Center, Series A, Rev., 5.25%, 12/01/2039 | 194 | ||||||

University of Texas System, | ||||||||

| 140 | Series B, Rev., 5.25%, 07/01/2028 | 181 | ||||||

| 395 | Series B, Rev., 5.25%, 07/01/2030 | 513 | ||||||

|

| |||||||

| 888 | ||||||||

|

| |||||||

General Obligation — 0.5% |

| |||||||

| 250 | Dallas County Utility and Reclamation District, GO, 5.00%, 02/15/2023 | 293 | ||||||

| 200 | North East Independent School District, GO, PSF-GTD, 5.25%, 02/01/2027 | 255 | ||||||

|

| |||||||

| 548 | ||||||||

|

| |||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Housing — 0.1% |

| |||||||

| 65 | Texas Department of Housing & Community Affairs, Residential Mortgage, Series A, Rev., GNMA/FNMA/FHLMC, 5.00%, 07/01/2029 | 68 | ||||||

| 40 | Texas State Affordable Housing Corp., Single Family Mortgage, Series D, Rev., AMT, GNMA/FNMA/FHLMC, 5.85%, 04/01/2041 | 42 | ||||||

|

| |||||||

| 110 | ||||||||

|

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 100 | Harris County Industrial Development Corp., Solid Waste Disposal, Deer Park Refining Limited Partnership Project, Rev., 4.70%, 05/01/2018 | 102 | ||||||

| 500 | Mission Economic Development Corp., Solid Waste Disposal, Waste Management, Inc. Project, Rev., 2.50%, 08/01/2020 | 511 | ||||||

|

| |||||||

| 613 | ||||||||

|

| |||||||

Prerefunded — 1.3% |

| |||||||

| 1,000 | Harris County Industrial Development Corp., Solid Waste Disposal, Deer Park Refining Limited Partnership Project, Rev., 5.00%, 12/01/2019 (p) | 1,090 | ||||||

| 80 | La Vernia Higher Education Finance Corp., Lifeschool of Dallas, Series A, Rev., 6.25%, 08/15/2019 (p) | 88 | ||||||

| 100 | Texas State Public Finance Authority Charter School Finance Corp., Cosmos Foundation, Inc., Series A, Rev., 6.00%, 02/15/2020 (p) | 112 | ||||||

|

| |||||||

| 1,290 | ||||||||

|

| |||||||

Transportation — 2.4% |

| |||||||

| 1,000 | Central Texas Regional Mobility Authority, Rev., 5.00%, 01/01/2046 | 1,129 | ||||||

Dallas Area Rapid Transit, Senior Lien, | ||||||||

| 130 | Rev., AMBAC, 5.25%, 12/01/2029 | 166 | ||||||

| 700 | Series A, Rev., 5.00%, 12/01/2032 | 831 | ||||||

| 200 | Texas Transportation Commission, Turnpike System, Second Tier, Series C, Rev., 5.00%, 08/15/2025 | 237 | ||||||

|

| |||||||

| 2,363 | ||||||||

|

| |||||||

Water & Sewer — 2.0% |

| |||||||

| 1,250 | City of Austin, Water & Wastewater System, Rev., 5.00%, 11/15/2037 | 1,504 | ||||||

| 425 | City of Dallas, Waterworks & Sewer System, Rev., 5.00%, 10/01/2042 | 488 | ||||||

| 30 | City of Houston, Capital Appreciation, Series A, Rev., AGM, Zero Coupon, 12/01/2027 (p) | 24 | ||||||

|

| |||||||

| 2,016 | ||||||||

|

| |||||||

Total Texas | 7,828 | |||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| AUGUST 31, 2017 | J.P. MORGAN TAX AWARE FUNDS | 15 | ||||||

Table of Contents

JPMorgan Tax Aware High Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2017 (Unaudited) (continued)

(Amounts in thousands)

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Municipal Bonds — continued | ||||||||

Utah — 1.2% |

| |||||||

Other Revenue — 0.6% |

| |||||||

Utah Transit Authority, Sales Tax, | ||||||||

| 40 | Series C, Rev., AGM, 5.25%, 06/15/2025 | 50 | ||||||

| 450 | Series C, Rev., AGM, 5.25%, 06/15/2032 | 588 | ||||||

|

| |||||||

| 638 | ||||||||

|

| |||||||

Water & Sewer — 0.6% |

| |||||||

| 500 | Central Utah Water Conservancy District, Series C, Rev., 5.00%, 10/01/2042 | 574 | ||||||

|

| |||||||

Total Utah | 1,212 | |||||||

|

| |||||||

Vermont — 2.4% |

| |||||||

Education — 0.9% |

| |||||||

| 750 | Vermont Student Assistance Corp., Education Loan, Series A, Rev., AMT, 5.00%, 06/15/2024 | 868 | ||||||

|

| |||||||

Housing — 1.5% |

| |||||||

Vermont Housing Finance Agency, Multiple Purpose, | ||||||||

| 350 | Series A, Rev., AMT, 4.00%, 11/01/2047 | 380 | ||||||

| 350 | Series B, Rev., 4.00%, 11/01/2044 | 372 | ||||||

| 565 | Series B, Rev., AMT, 3.75%, 11/01/2045 | 597 | ||||||

| 150 | Series B, Rev., AMT, 4.13%, 11/01/2042 | 155 | ||||||

|

| |||||||

| 1,504 | ||||||||

|

| |||||||

Total Vermont | 2,372 | |||||||

|

| |||||||

Virginia — 0.3% |

| |||||||

Industrial Development Revenue/Pollution Control |

| |||||||

| 250 | York County Economic Development Authority, Pollution Control, Electric & Power Company Project, Series A, Rev., 1.88%, 05/16/2019 (z) | 253 | ||||||

|

| |||||||

Prerefunded — 0.1% |

| |||||||

| 70 | Virginia Resources Authority, Infrastructure, Pooled Financing Program, Series A, Rev., 5.00%, 11/01/2021 (p) | 81 | ||||||

|

| |||||||

Total Virginia | 334 | |||||||

|

| |||||||

Washington — 1.0% |

| |||||||

Hospital — 0.4% |

| |||||||

| 375 | Washington Health Care Facilities Authority, Virginia Mason Medical Center, Rev., 5.00%, 08/15/2026 | 446 | ||||||

|

| |||||||

Housing — 0.6% |

| |||||||

| 85 | Washington State Housing Finance Commission, Homeownership Program, Series A, Rev., GNMA/FNMA/FHLMC, 4.50%, 04/01/2029 | 88 | ||||||

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Housing — continued |

| |||||||

| 505 | Washington State Housing Finance Commission, Single Family Program, Series 2A-R, Rev., AMT, 3.50%, 06/01/2044 | 526 | ||||||

|

| |||||||

| 614 | ||||||||

|

| |||||||

Total Washington | 1,060 | |||||||

|

| |||||||

West Virginia — 0.6% |

| |||||||

Hospital — 0.6% |

| |||||||

| 500 | Monongalia County Building Commission, Rev., 5.00%, 07/01/2023 | 586 | ||||||

|

| |||||||

Wisconsin — 0.9% |

| |||||||

Education — 0.6% |

| |||||||

| 500 | Wisconsin Health & Educational Facilities Authority, Rogers Memorial Hospital, Inc., Series A, Rev., 5.00%, 07/01/2025 | 583 | ||||||

|

| |||||||

Prerefunded — 0.3% |

| |||||||

| 35 | State of Wisconsin, Annual Appropriation, Series A, Rev., 5.75%, 05/01/2019 (p) | 38 | ||||||

| 240 | Wisconsin State Department of Transportation, Series 1, Rev., 5.00%, 07/01/2023 (p) | 290 | ||||||

|

| |||||||

| 328 | ||||||||

|

| |||||||

Total Wisconsin | 911 | |||||||

|

| |||||||

Wyoming — 0.4% |

| |||||||

Hospital — 0.4% |

| |||||||

| 375 | Laramie County, Wyoming Hospital, Cheyenne Regional Medical Center Project, Rev., 4.00%, 05/01/2018 | 383 | ||||||

|

| |||||||

Housing — 0.0% (g) |

| |||||||

| 30 | Wyoming Community Development Authority Housing, Series 1, Rev., AMT, 4.00%, 06/01/2032 | 30 | ||||||

|

| |||||||

Total Wyoming | 413 | |||||||

|

| |||||||

Total Municipal Bonds | 88,044 | |||||||

|

| |||||||

| SHARES | ||||||||

Common Stocks — 0.0% (g) | ||||||||

Energy — 0.0% (g) |

| |||||||

Oil, Gas & Consumable Fuels — 0.0% (g) |

| |||||||

| 35 | Sabine Oil & Gas Holdings, Inc. (a) | 1 | ||||||

| 33 | Southcross Holdco Equity (a) (bb) | 23 | ||||||

|

| |||||||

Total Common Stocks | 24 | |||||||

|

| |||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 16 | J.P. MORGAN TAX AWARE FUNDS | AUGUST 31, 2017 | ||||

Table of Contents

| PRINCIPAL AMOUNT($) | SECURITY DESCRIPTION | VALUE($) | ||||||

Loan Assignments — 7.3% (cc) | ||||||||

Consumer Discretionary — 1.8% |

| |||||||

Diversified Consumer Services — 0.3% |

| |||||||

| 239 | Spin Holdco, Inc., Term Loan B, (2 Month LIBOR + 3.75%), 5.01%, 11/14/2022 (aa) | 240 | ||||||

|

| |||||||

Media — 1.0% |

| |||||||

| 46 | Mission Broadcasting, Inc., Term B-2 Loan, (1 Month LIBOR + 2.50%), 3.73%, 01/17/2024 (aa) | 46 | ||||||

| 452 | MTL Publishing LLC, 1st Lien Term Loan, (1 Month LIBOR + 2.50%), 3.73%, 08/21/2023 (aa) | 453 | ||||||

| 373 | Nexstar Broadcasting, Inc., Term B-2 Loan, (1 Month LIBOR + 2.50%), 3.73%, 01/17/2024 (aa) | 373 | ||||||

| 100 | Tribune Media Co., Term Loan B, (1 Month LIBOR + 3.00%), 4.24%, 12/27/2020 (aa) | 100 | ||||||

| 54 | Univision Communications, Inc., 1st Lien Term Loan C-5, (1 Month LIBOR + 2.75%), 3.99%, 03/15/2024 (aa) | 53 | ||||||

|

| |||||||

| 1,025 | ||||||||

|

| |||||||

Multiline Retail — 0.4% |

| |||||||

| 493 | Neiman Marcus Group, Inc., Other Term Loan, (1 Month LIBOR + 3.25%), 4.48%, 10/25/2020 (aa) | 362 | ||||||

|

| |||||||

Textiles, Apparel & Luxury Goods — 0.1% |

| |||||||

| 166 | Nine West Holdings, Inc., Initial Loan, (3 Month LIBOR + 3.75%), 5.05%, 10/08/2019 (aa) | 139 | ||||||

|

| |||||||

Total Consumer Discretionary | 1,766 | |||||||

|

| |||||||

Consumer Staples — 0.8% |

| |||||||

Food & Staples Retailing — 0.8% |

| |||||||

Albertson’s LLC, 1st Lien Term Loan, | ||||||||

| 744 | (3 Month LIBOR + 3.00%), 4.29%, 12/21/2022 (aa) | 722 | ||||||

| 99 | (3 Month LIBOR + 3.00%), 4.32%, 06/22/2023 (aa) | 95 | ||||||

|

| |||||||

Total Consumer Staples | 817 | |||||||

|

| |||||||

Energy — 1.2% |

| |||||||

Oil, Gas & Consumable Fuels — 1.2% |

| |||||||

| 16 | Alon USA Partners LP, MLP Term Loans, (1 Month LIBOR + 8.00%), 9.25%, 11/26/2018 (aa) | 16 | ||||||

| 1,163 | Gulf Finance LLC, 1st Lien Term Loan B, (3 Month LIBOR + 5.25%), 6.55%, 08/25/2023 (aa) | 1,051 | ||||||