UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21295

JPMorgan Trust I

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2022 through October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Reports. Not Applicable. Notices do not incorporate disclosures from the

shareholder report.

1 | |

2 | |

6 | |

14 | |

20 | |

22 | |

40 | |

41 | |

45 | |

47 | |

48 | |

| "The strong performance of financial markets in 2023 created wider differences in equity valuations that may provide attractive opportunities for investors. Additionally, interest rate reductions next year could benefit high-quality fixed income investments.” — Brian S. Shlissel |

President, J.P. Morgan Funds

J.P. Morgan Asset Management

1-800-480-4111 or www.jpmorganfunds.com for more information

October 31, 2023 | J.P. Morgan Specialty Funds | 1 |

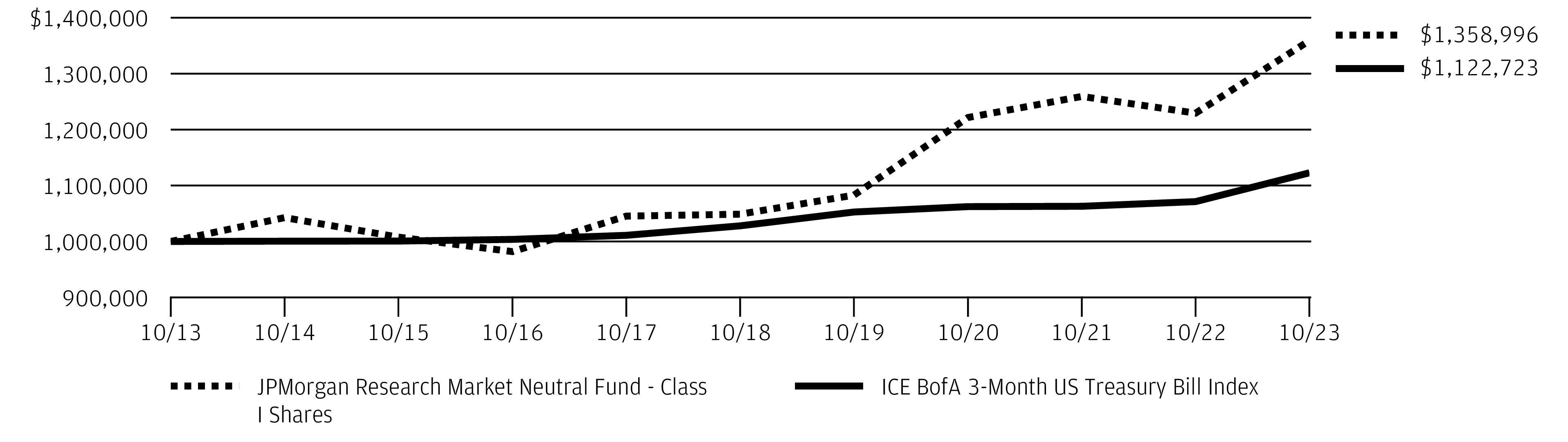

REPORTING PERIOD RETURN: | |

Fund (Class I Shares) * | 10.54% |

ICE BofA 3-Month US Treasury Bill Index | 4.80% |

Net Assets After Future Share Reacquisition Adjustment as of 10/31/2023 (In Thousands) | $225,373 |

2 | J.P. Morgan Specialty Funds | October 31, 2023 |

October 31, 2023 | J.P. Morgan Specialty Funds | 3 |

TOP TEN LONG POSITIONS OF THE PORTFOLIO AS OF October 31, 2023 | PERCENT OF TOTAL INVESTMENTS | |

1. | Progressive Corp. (The) | 1.9 % |

2. | NXP Semiconductors NV (China) | 1.9 |

3. | Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | 1.7 |

4. | Meta Platforms, Inc., Class A | 1.7 |

5. | Seagate Technology Holdings plc | 1.6 |

6. | Amazon.com, Inc. | 1.5 |

7. | Mastercard, Inc., Class A | 1.4 |

8. | NVIDIA Corp. | 1.4 |

9. | Howmet Aerospace, Inc. | 1.3 |

10. | Endeavor Group Holdings, Inc., Class A | 1.2 |

TOP TEN SHORT POSITIONS OF THE PORTFOLIO AS OF October 31, 2023 | PERCENT OF TOTAL INVESTMENTS | |

1. | Applied Materials, Inc. | 2.9 % |

2. | Broadcom, Inc. | 2.9 |

3. | Cisco Systems, Inc. | 2.4 |

4. | Microchip Technology, Inc. | 2.1 |

5. | Kroger Co. (The) | 2.0 |

6. | Hewlett Packard Enterprise Co. | 1.8 |

7. | Fox Corp., Class A | 1.7 |

8. | Intel Corp. | 1.5 |

9. | NetApp, Inc. | 1.5 |

10. | Apple, Inc. | 1.5 |

LONG POSITION PORTFOLIO COMPOSITION BY SECTOR AS OF October 31, 2023 | PERCENT OF TOTAL INVESTMENTS |

Information Technology | 18.2% |

Financials | 14.8 |

Industrials | 8.9 |

Consumer Discretionary | 7.8 |

Health Care | 7.4 |

Communication Services | 6.5 |

Consumer Staples | 3.8 |

Energy | 3.1 |

Utilities | 2.9 |

Real Estate | 1.9 |

Materials | 1.3 |

Short-Term Investments | 23.4 |

SHORT POSITION PORTFOLIO COMPOSITION BY SECTOR AS OF October 31, 2023 | PERCENT OF TOTAL INVESTMENTS |

Information Technology | 22.4% |

Financials | 18.3 |

Industrials | 16.2 |

Health Care | 9.5 |

Consumer Staples | 7.8 |

Communication Services | 7.7 |

Consumer Discretionary | 6.9 |

Utilities | 4.5 |

Energy | 3.3 |

Real Estate | 2.5 |

Materials | 0.9 |

4 | J.P. Morgan Specialty Funds | October 31, 2023 |

INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |

CLASS A SHARES | February 28, 2002 | |||

With Sales Charge * | 4.47 % | 3.86 % | 2.27 % | |

Without Sales Charge | 10.24 | 4.98 | 2.82 | |

CLASS C SHARES | November 2, 2009 | |||

With CDSC ** | 8.69 | 4.46 | 2.41 | |

Without CDSC | 9.69 | 4.46 | 2.41 | |

CLASS I SHARES | November 2, 2009 | 10.54 | 5.25 | 3.08 |

* | Sales Charge for Class A Shares is 5.25%. |

** | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

October 31, 2023 | J.P. Morgan Specialty Funds | 5 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Long Positions—98.7% | ||

Common Stocks—75.7% | ||

Aerospace & Defense—1.7% | ||

Howmet Aerospace, Inc. (a) | 64 | 2,809 |

RTX Corp. | 14 | 1,131 |

3,940 | ||

Air Freight & Logistics — 0.3% | ||

FedEx Corp. | — | 96 |

United Parcel Service, Inc., Class B | 4 | 535 |

631 | ||

Automobile Components — 0.5% | ||

Aptiv plc * | 5 | 395 |

Lear Corp. | 1 | 139 |

Mobileye Global, Inc., Class A (Israel) * | 15 | 539 |

1,073 | ||

Banks—2.6% | ||

Bank of America Corp. | 32 | 836 |

Fifth Third Bancorp | 61 | 1,447 |

First Citizens BancShares, Inc., Class A | 1 | 616 |

KeyCorp | 30 | 311 |

Truist Financial Corp. | 30 | 851 |

Wells Fargo & Co. (a) | 46 | 1,827 |

5,888 | ||

Beverages — 1.0% | ||

Coca-Cola Co. (The) | 7 | 412 |

Keurig Dr Pepper, Inc. | 4 | 114 |

Monster Beverage Corp. * | 24 | 1,241 |

PepsiCo, Inc. | 3 | 388 |

2,155 | ||

Biotechnology—3.8% | ||

AbbVie, Inc. | 16 | 2,228 |

Biogen, Inc. * | 6 | 1,592 |

BioMarin Pharmaceutical, Inc. * | 13 | 1,068 |

Regeneron Pharmaceuticals, Inc. * | 2 | 1,620 |

Sarepta Therapeutics, Inc. * | 11 | 727 |

Vertex Pharmaceuticals, Inc. * (a) | 4 | 1,434 |

8,669 | ||

Broadline Retail — 1.5% | ||

Amazon.com, Inc. * (a) | 25 | 3,357 |

Building Products — 1.1% | ||

Trane Technologies plc | 13 | 2,478 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Capital Markets — 3.6% | ||

Charles Schwab Corp. (The) | 39 | 2,013 |

CME Group, Inc. | 8 | 1,613 |

Morgan Stanley | 6 | 446 |

Raymond James Financial, Inc. | 27 | 2,567 |

S&P Global, Inc. | 4 | 1,421 |

8,060 | ||

Chemicals—0.4% | ||

Air Products and Chemicals, Inc. (a) | 2 | 527 |

Dow, Inc. | 2 | 90 |

Linde plc | 1 | 397 |

1,014 | ||

Commercial Services & Supplies — 0.7% | ||

Waste Connections, Inc. | 11 | 1,475 |

Communications Equipment — 0.3% | ||

Arista Networks, Inc. * | 3 | 633 |

Construction Materials — 0.7% | ||

Martin Marietta Materials, Inc. | 4 | 1,594 |

Consumer Staples Distribution & Retail — 1.1% | ||

Costco Wholesale Corp. | 3 | 1,907 |

Maplebear, Inc. * | 19 | 465 |

2,372 | ||

Containers & Packaging — 0.1% | ||

Crown Holdings, Inc. | 3 | 216 |

Diversified REITs — 0.1% | ||

WP Carey, Inc. | 5 | 283 |

Electric Utilities — 1.8% | ||

Entergy Corp. | 3 | 328 |

NextEra Energy, Inc. | 18 | 1,029 |

PG&E Corp. * | 109 | 1,771 |

Southern Co. (The) | 13 | 879 |

4,007 | ||

Electrical Equipment — 0.3% | ||

Eaton Corp. plc | 3 | 723 |

Electronic Equipment, Instruments & Components — 1.0% | ||

Corning, Inc. | 71 | 1,901 |

Keysight Technologies, Inc. * | 3 | 414 |

2,315 | ||

6 | J.P. Morgan Specialty Funds | October 31, 2023 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Long Positions — continued | ||

Common Stocks — continued | ||

Energy Equipment & Services — 0.6% | ||

Baker Hughes Co. | 18 | 632 |

Schlumberger NV | 12 | 636 |

1,268 | ||

Entertainment — 2.6% | ||

Endeavor Group Holdings, Inc., Class A (a) | 120 | 2,729 |

Take-Two Interactive Software, Inc. * | 7 | 1,007 |

Warner Bros Discovery, Inc. * | 75 | 745 |

Warner Music Group Corp., Class A | 42 | 1,308 |

5,789 | ||

Financial Services—4.4% | ||

Block, Inc. * | 29 | 1,153 |

Fidelity National Information Services, Inc. | 33 | 1,625 |

Fiserv, Inc. * (a) | 12 | 1,382 |

FleetCor Technologies, Inc. * | 7 | 1,567 |

Mastercard, Inc., Class A (a) | 8 | 3,192 |

WEX, Inc. * | 6 | 943 |

9,862 | ||

Food Products — 0.5% | ||

Hershey Co. (The) | 1 | 115 |

Mondelez International, Inc., Class A | 16 | 1,060 |

1,175 | ||

Ground Transportation — 1.7% | ||

Canadian National Railway Co. (Canada) | 2 | 213 |

CSX Corp. | 10 | 291 |

Norfolk Southern Corp. | 3 | 575 |

Old Dominion Freight Line, Inc. | 1 | 470 |

Uber Technologies, Inc. * (a) | 34 | 1,479 |

Union Pacific Corp. | 2 | 326 |

XPO, Inc. * | 5 | 415 |

3,769 | ||

Health Care Equipment & Supplies — 1.1% | ||

Boston Scientific Corp. * | 19 | 967 |

Intuitive Surgical, Inc. * | 1 | 429 |

Stryker Corp. | 4 | 1,020 |

2,416 | ||

Health Care Providers & Services — 1.3% | ||

Centene Corp. * | 3 | 195 |

HCA Healthcare, Inc. | 1 | 285 |

Humana, Inc. | 1 | 220 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Health Care Providers & Services — continued | ||

McKesson Corp. | 1 | 502 |

UnitedHealth Group, Inc. (a) | 3 | 1,744 |

2,946 | ||

Health Care REITs — 0.0% ^ | ||

Ventas, Inc. | 1 | 61 |

Hotels, Restaurants & Leisure — 2.7% | ||

Booking Holdings, Inc. * | — | 265 |

Chipotle Mexican Grill, Inc. * | 1 | 1,420 |

Expedia Group, Inc. * | 8 | 778 |

Hilton Worldwide Holdings, Inc. | 4 | 608 |

Royal Caribbean Cruises Ltd. * | 12 | 996 |

Yum! Brands, Inc. (a) | 16 | 1,919 |

5,986 | ||

Household Products — 0.4% | ||

Church & Dwight Co., Inc. | 10 | 940 |

Industrial Conglomerates—0.9% | ||

Honeywell International, Inc. (a) | 12 | 2,114 |

Industrial REITs — 0.2% | ||

Prologis, Inc. | 5 | 482 |

Insurance—4.1% | ||

Chubb Ltd. | 3 | 714 |

Globe Life, Inc. | 18 | 2,098 |

MetLife, Inc. | 6 | 326 |

Progressive Corp. (The) (a) | 27 | 4,310 |

Travelers Cos., Inc. (The) | 11 | 1,765 |

9,213 | ||

Interactive Media & Services—2.5% | ||

Alphabet, Inc., Class A * | 6 | 810 |

Meta Platforms, Inc., Class A * (a) | 13 | 3,792 |

Pinterest, Inc., Class A * | 35 | 1,046 |

5,648 | ||

IT Services — 0.4% | ||

Cognizant Technology Solutions Corp., Class A | 4 | 275 |

MongoDB, Inc. * | 1 | 275 |

Snowflake, Inc., Class A * | 2 | 261 |

811 | ||

October 31, 2023 | J.P. Morgan Specialty Funds | 7 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Long Positions — continued | ||

Common Stocks — continued | ||

Life Sciences Tools & Services — 0.5% | ||

Danaher Corp. | 5 | 915 |

Thermo Fisher Scientific, Inc. | — | 226 |

1,141 | ||

Machinery — 1.6% | ||

Deere & Co. (a) | 4 | 1,672 |

Dover Corp. | 7 | 868 |

Ingersoll Rand, Inc. | 17 | 1,009 |

3,549 | ||

Media — 1.1% | ||

Charter Communications, Inc., Class A * | 2 | 651 |

Comcast Corp., Class A | 10 | 429 |

Liberty Media Corp-Liberty SiriusXM, Class A * | 59 | 1,443 |

2,523 | ||

Multi-Utilities — 1.1% | ||

CenterPoint Energy, Inc. | 24 | 633 |

CMS Energy Corp. | 12 | 627 |

Dominion Energy, Inc. | 6 | 250 |

Public Service Enterprise Group, Inc. | 16 | 1,007 |

2,517 | ||

Oil, Gas & Consumable Fuels — 2.5% | ||

Cheniere Energy, Inc. | 3 | 590 |

ConocoPhillips | 7 | 813 |

Diamondback Energy, Inc. | 5 | 882 |

EOG Resources, Inc. | 8 | 1,003 |

Exxon Mobil Corp. | 13 | 1,344 |

Marathon Oil Corp. | 13 | 345 |

Targa Resources Corp. | 8 | 639 |

5,616 | ||

Personal Care Products — 0.8% | ||

Estee Lauder Cos., Inc. (The), Class A | 9 | 1,242 |

Kenvue, Inc. | 28 | 516 |

1,758 | ||

Pharmaceuticals — 0.6% | ||

Bristol-Myers Squibb Co. (a) | 19 | 992 |

Elanco Animal Health, Inc. * | 30 | 266 |

1,258 | ||

Professional Services — 0.2% | ||

Booz Allen Hamilton Holding Corp. | 4 | 523 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Residential REITs — 0.2% | ||

Sun Communities, Inc. | 2 | 221 |

UDR, Inc. | 7 | 229 |

450 | ||

Retail REITs — 0.1% | ||

Kimco Realty Corp. | 8 | 138 |

Semiconductors & Semiconductor Equipment—10.1% | ||

Advanced Micro Devices, Inc. * (a) | 22 | 2,118 |

Analog Devices, Inc. (a) | 16 | 2,512 |

ASML Holding NV (Registered), NYRS (Netherlands) | 1 | 744 |

Marvell Technology, Inc. | 11 | 500 |

Micron Technology, Inc. | 25 | 1,676 |

Monolithic Power Systems, Inc. | 1 | 596 |

NVIDIA Corp. (a) | 8 | 3,096 |

NXP Semiconductors NV (China) (a) | 24 | 4,170 |

ON Semiconductor Corp. * | 5 | 295 |

Qorvo, Inc. * | 5 | 426 |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) (a) | 44 | 3,829 |

Teradyne, Inc. | 10 | 831 |

Texas Instruments, Inc. | 14 | 2,059 |

22,852 | ||

Software—3.4% | ||

Adobe, Inc. * | 1 | 517 |

Datadog, Inc., Class A * | 2 | 197 |

Intuit, Inc. (a) | 5 | 2,367 |

Microsoft Corp. (a) | 5 | 1,669 |

Oracle Corp. | 7 | 716 |

PTC, Inc. * | 1 | 205 |

Roper Technologies, Inc. | 2 | 793 |

Salesforce, Inc. * | 4 | 824 |

ServiceNow, Inc. * | 1 | 448 |

7,736 | ||

Specialized REITs — 1.2% | ||

American Tower Corp. | 1 | 223 |

Digital Realty Trust, Inc. | 20 | 2,511 |

2,734 | ||

Specialty Retail—3.1% | ||

AutoNation, Inc. * | 4 | 524 |

AutoZone, Inc. * | — | 864 |

Best Buy Co., Inc. | 19 | 1,234 |

8 | J.P. Morgan Specialty Funds | October 31, 2023 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Long Positions — continued | ||

Common Stocks — continued | ||

Specialty Retail — continued | ||

Burlington Stores, Inc. * | 12 | 1,472 |

Lowe's Cos., Inc. | 11 | 2,053 |

O'Reilly Automotive, Inc. * (a) | 1 | 894 |

7,041 | ||

Technology Hardware, Storage & Peripherals—2.7% | ||

Dell Technologies, Inc., Class C | 27 | 1,849 |

Seagate Technology Holdings plc | 53 | 3,620 |

Western Digital Corp. * | 18 | 710 |

6,179 | ||

Trading Companies & Distributors — 0.3% | ||

United Rentals, Inc. | 1 | 216 |

WW Grainger, Inc. | — | 377 |

593 | ||

Wireless Telecommunication Services — 0.2% | ||

T-Mobile US, Inc. * | 4 | 510 |

Total Common Stocks (Cost $156,817) | 170,481 | |

PRINCIPAL AMOUNT (000) | ||

Short-Term Investments—23.0% | ||

U.S. Treasury Obligations—18.5% | ||

U.S. Treasury Bills | ||

5.33%, 11/7/2023(b) | 12,000 | 11,989 |

5.39%, 12/5/2023(b) | 10,500 | 10,448 |

5.39%, 1/4/2024(b) | 10,500 | 10,401 |

5.41%, 1/11/2024(b) | 9,000 | 8,906 |

Total U.S. Treasury Obligations (Cost $41,742) | 41,744 | |

SHARES (000) | ||

Investment Companies—4.5% | ||

JPMorgan Prime Money Market Fund Class Institutional Shares, 5.41% (c) (d)(Cost $10,235) | 10,232 | 10,236 |

Total Short-Term Investments (Cost $51,977) | 51,980 | |

Total Long Positions (Cost $208,794) | 222,461 | |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short Positions—(72.7)% | ||

Common Stocks—(72.7)% | ||

Aerospace & Defense — (2.3)% | ||

Boeing Co. (The) * | (9 ) | (1,593 ) |

General Dynamics Corp. | (5 ) | (1,186 ) |

Huntington Ingalls Industries, Inc. | (4 ) | (906 ) |

L3Harris Technologies, Inc. | (2 ) | (383 ) |

Lockheed Martin Corp. | — | (109 ) |

Northrop Grumman Corp. | (1 ) | (451 ) |

Spirit AeroSystems Holdings, Inc., Class A * | (21 ) | (483 ) |

(5,111 ) | ||

Air Freight & Logistics — (0.5)% | ||

CH Robinson Worldwide, Inc. | (7 ) | (569 ) |

Expeditors International of Washington, Inc. | (5 ) | (598 ) |

(1,167 ) | ||

Automobile Components — (0.2)% | ||

Autoliv, Inc. (Sweden) | (2 ) | (206 ) |

BorgWarner, Inc. | (5 ) | (172 ) |

Phinia, Inc. | — | — |

(378 ) | ||

Automobiles — (0.6)% | ||

Ford Motor Co. | (90 ) | (880 ) |

General Motors Co. | (14 ) | (385 ) |

Harley-Davidson, Inc. | (3 ) | (77 ) |

(1,342 ) | ||

Banks — (1.6)% | ||

Citizens Financial Group, Inc. | (24 ) | (564 ) |

Comerica, Inc. | (5 ) | (212 ) |

Huntington Bancshares, Inc. | (119 ) | (1,145 ) |

M&T Bank Corp. | (5 ) | (555 ) |

PNC Financial Services Group, Inc. (The) | (9 ) | (1,073 ) |

(3,549 ) | ||

Beverages — (0.6)% | ||

Brown-Forman Corp., Class B | (4 ) | (224 ) |

Molson Coors Beverage Co., Class B | (20 ) | (1,181 ) |

(1,405 ) | ||

Biotechnology — (1.8)% | ||

Amgen, Inc. | (6 ) | (1,525 ) |

Gilead Sciences, Inc. | (20 ) | (1,541 ) |

Moderna, Inc. * | (13 ) | (1,020 ) |

(4,086 ) | ||

October 31, 2023 | J.P. Morgan Specialty Funds | 9 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short Positions — continued | ||

Common Stocks — continued | ||

Broadline Retail—(0.7)% | ||

eBay, Inc. | (43 ) | (1,677 ) |

Building Products—(0.6)% | ||

Allegion plc | (2 ) | (165 ) |

Johnson Controls International plc | (25 ) | (1,218 ) |

Masco Corp. | (1 ) | (61 ) |

(1,444 ) | ||

Capital Markets — (3.9)% | ||

Bank of New York Mellon Corp. (The) | (22 ) | (928 ) |

BlackRock, Inc. | (1 ) | (626 ) |

FactSet Research Systems, Inc. | (3 ) | (1,182 ) |

Franklin Resources, Inc. | (41 ) | (933 ) |

Goldman Sachs Group, Inc. (The) | (3 ) | (977 ) |

LPL Financial Holdings, Inc. | (4 ) | (835 ) |

MSCI, Inc. | (1 ) | (650 ) |

Nasdaq, Inc. | (30 ) | (1,502 ) |

Northern Trust Corp. | (3 ) | (195 ) |

T. Rowe Price Group, Inc. | (10 ) | (878 ) |

(8,706 ) | ||

Chemicals — (0.1)% | ||

Westlake Corp. | (2 ) | (190 ) |

Commercial Services & Supplies — (0.1)% | ||

Waste Management, Inc. | (1 ) | (171 ) |

Communications Equipment—(2.6)% | ||

Cisco Systems, Inc. | (74 ) | (3,865 ) |

Juniper Networks, Inc. | (78 ) | (2,104 ) |

(5,969 ) | ||

Consumer Finance — (1.1)% | ||

American Express Co. | (3 ) | (517 ) |

Discover Financial Services | (4 ) | (311 ) |

Synchrony Financial | (57 ) | (1,602 ) |

(2,430 ) | ||

Consumer Staples Distribution & Retail—(3.5)% | ||

Dollar General Corp. | (3 ) | (323 ) |

Kroger Co. (The) | (71 ) | (3,196 ) |

Sysco Corp. | (35 ) | (2,343 ) |

Walgreens Boots Alliance, Inc. | (40 ) | (851 ) |

Walmart, Inc. | (8 ) | (1,265 ) |

(7,978 ) | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Containers & Packaging — (0.5)% | ||

Ball Corp. | (3 ) | (134 ) |

International Paper Co. | (31 ) | (1,061 ) |

(1,195 ) | ||

Diversified Telecommunication Services — (0.9)% | ||

AT&T, Inc. | (45 ) | (691 ) |

Verizon Communications, Inc. | (37 ) | (1,304 ) |

(1,995 ) | ||

Electric Utilities — (3.0)% | ||

American Electric Power Co., Inc. | (19 ) | (1,456 ) |

Edison International | (17 ) | (1,073 ) |

Eversource Energy | (21 ) | (1,110 ) |

Exelon Corp. | (19 ) | (720 ) |

FirstEnergy Corp. | (40 ) | (1,424 ) |

Xcel Energy, Inc. | (15 ) | (902 ) |

(6,685 ) | ||

Electrical Equipment—(0.8)% | ||

Acuity Brands, Inc. | (9 ) | (1,501 ) |

Hubbell, Inc. | (1 ) | (229 ) |

Rockwell Automation, Inc. | (1 ) | (169 ) |

(1,899 ) | ||

Energy Equipment & Services — (0.3)% | ||

Halliburton Co. | (17 ) | (680 ) |

Entertainment — (0.8)% | ||

Electronic Arts, Inc. | (15 ) | (1,858 ) |

Financial Services—(2.8)% | ||

Corebridge Financial, Inc. | (11 ) | (223 ) |

Global Payments, Inc. | (8 ) | (850 ) |

PayPal Holdings, Inc. * | (23 ) | (1,204 ) |

Toast, Inc., Class A * | (30 ) | (476 ) |

Voya Financial, Inc. | (27 ) | (1,784 ) |

Western Union Co. (The) | (165 ) | (1,868 ) |

(6,405 ) | ||

Food Products — (1.5)% | ||

Campbell Soup Co. | (29 ) | (1,179 ) |

General Mills, Inc. | (17 ) | (1,111 ) |

Kraft Heinz Co. (The) | (33 ) | (1,033 ) |

(3,323 ) | ||

Gas Utilities — (0.3)% | ||

National Fuel Gas Co. | (13 ) | (662 ) |

10 | J.P. Morgan Specialty Funds | October 31, 2023 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short Positions — continued | ||

Common Stocks — continued | ||

Ground Transportation — (0.4)% | ||

Heartland Express, Inc. | (24 ) | (281 ) |

JB Hunt Transport Services, Inc. | (2 ) | (270 ) |

Werner Enterprises, Inc. | (8 ) | (287 ) |

(838 ) | ||

Health Care Equipment & Supplies — (0.4)% | ||

Abbott Laboratories | (2 ) | (219 ) |

Dentsply Sirona, Inc. | (12 ) | (358 ) |

Medtronic plc | (5 ) | (317 ) |

(894 ) | ||

Health Care Providers & Services — (0.7)% | ||

Henry Schein, Inc. * | (12 ) | (785 ) |

Quest Diagnostics, Inc. | (6 ) | (746 ) |

(1,531 ) | ||

Hotels, Restaurants & Leisure—(1.0)% | ||

Carnival Corp. * | (29 ) | (334 ) |

Starbucks Corp. | (22 ) | (2,022 ) |

(2,356 ) | ||

Household Durables — (0.5)% | ||

DR Horton, Inc. | (3 ) | (331 ) |

Mohawk Industries, Inc. * | (4 ) | (275 ) |

NVR, Inc. * | — | (81 ) |

PulteGroup, Inc. | (6 ) | (443 ) |

(1,130 ) | ||

Industrial Conglomerates — (0.5)% | ||

3M Co. | (13 ) | (1,221 ) |

Insurance — (4.0)% | ||

Aflac, Inc. | (15 ) | (1,141 ) |

Allstate Corp. (The) | (17 ) | (2,152 ) |

American International Group, Inc. | (7 ) | (420 ) |

Aon plc, Class A | (3 ) | (792 ) |

Arthur J Gallagher & Co. | (3 ) | (801 ) |

Hartford Financial Services Group, Inc. (The) | (3 ) | (230 ) |

Kinsale Capital Group, Inc. | (1 ) | (297 ) |

Marsh & McLennan Cos., Inc. | (3 ) | (599 ) |

Principal Financial Group, Inc. | (13 ) | (894 ) |

Prudential Financial, Inc. | (1 ) | (94 ) |

Ryan Specialty Holdings, Inc. * | (15 ) | (636 ) |

WR Berkley Corp. | (13 ) | (898 ) |

(8,954 ) | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Interactive Media & Services — (0.6)% | ||

Alphabet, Inc., Class C * | (5 ) | (669 ) |

Snap, Inc., Class A * | (36 ) | (358 ) |

ZoomInfo Technologies, Inc. * | (19 ) | (247 ) |

(1,274 ) | ||

IT Services — (1.4)% | ||

Accenture plc, Class A | (2 ) | (551 ) |

DXC Technology Co. * | (12 ) | (254 ) |

EPAM Systems, Inc. * | (4 ) | (777 ) |

Infosys Ltd. (India) | (25 ) | (416 ) |

International Business Machines Corp. | (6 ) | (850 ) |

Shopify, Inc. (Canada), Class A * | (7 ) | (318 ) |

(3,166 ) | ||

Life Sciences Tools & Services — (1.4)% | ||

Agilent Technologies, Inc. | (7 ) | (715 ) |

Bruker Corp. | (9 ) | (491 ) |

Illumina, Inc. * | (4 ) | (436 ) |

Mettler-Toledo International, Inc. * | — | (424 ) |

Waters Corp. * | (4 ) | (991 ) |

(3,057 ) | ||

Machinery—(3.1)% | ||

Caterpillar, Inc. | (1 ) | (273 ) |

Donaldson Co., Inc. | (32 ) | (1,823 ) |

IDEX Corp. | (5 ) | (984 ) |

Illinois Tool Works, Inc. | (10 ) | (2,126 ) |

PACCAR, Inc. | (8 ) | (681 ) |

Stanley Black & Decker, Inc. | (14 ) | (1,178 ) |

(7,065 ) | ||

Media—(3.3)% | ||

Fox Corp., Class A | (90 ) | (2,747 ) |

Interpublic Group of Cos., Inc. (The) | (40 ) | (1,129 ) |

Omnicom Group, Inc. | (26 ) | (1,988 ) |

Paramount Global, Class B | (149 ) | (1,618 ) |

(7,482 ) | ||

Metals & Mining — (0.1)% | ||

Freeport-McMoRan, Inc. | (5 ) | (167 ) |

Office REITs — (0.2)% | ||

Alexandria Real Estate Equities, Inc. | (2 ) | (184 ) |

Orion Office REIT, Inc. | — | — |

October 31, 2023 | J.P. Morgan Specialty Funds | 11 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short Positions — continued | ||

Common Stocks — continued | ||

Office REITs — continued | ||

SL Green Realty Corp. | (5 ) | (157 ) |

Vornado Realty Trust | (9 ) | (169 ) |

(510 ) | ||

Oil, Gas & Consumable Fuels—(2.1)% | ||

APA Corp. | (10 ) | (384 ) |

Coterra Energy, Inc. | (23 ) | (620 ) |

Devon Energy Corp. | (9 ) | (407 ) |

Enbridge, Inc. (Canada) | (26 ) | (845 ) |

Kinder Morgan, Inc. | (38 ) | (622 ) |

Marathon Petroleum Corp. | (2 ) | (342 ) |

ONEOK, Inc. | (5 ) | (329 ) |

Valero Energy Corp. | (5 ) | (623 ) |

Williams Cos., Inc. (The) | (17 ) | (597 ) |

(4,769 ) | ||

Passenger Airlines — (0.6)% | ||

American Airlines Group, Inc. * | (62 ) | (687 ) |

Delta Air Lines, Inc. | (6 ) | (200 ) |

Southwest Airlines Co. | (20 ) | (444 ) |

(1,331 ) | ||

Pharmaceuticals—(2.6)% | ||

Catalent, Inc. * | (7 ) | (238 ) |

Eli Lilly & Co. | (3 ) | (1,914 ) |

Johnson & Johnson | (6 ) | (843 ) |

Merck & Co., Inc. | (13 ) | (1,351 ) |

Pfizer, Inc. | (39 ) | (1,192 ) |

Zoetis, Inc. | (3 ) | (427 ) |

(5,965 ) | ||

Professional Services — (2.2)% | ||

Automatic Data Processing, Inc. | (2 ) | (529 ) |

Ceridian HCM Holding, Inc. * | (20 ) | (1,276 ) |

Equifax, Inc. | (1 ) | (210 ) |

Paychex, Inc. | (9 ) | (1,024 ) |

Paycom Software, Inc. | (5 ) | (1,099 ) |

Robert Half, Inc. | (8 ) | (605 ) |

Verisk Analytics, Inc. | (1 ) | (174 ) |

(4,917 ) | ||

Residential REITs — (0.1)% | ||

AvalonBay Communities, Inc. | — | (84 ) |

Equity LifeStyle Properties, Inc. | (3 ) | (184 ) |

(268 ) | ||

INVESTMENTS | SHARES (000) | VALUE ($000) |

Retail REITs — (0.9)% | ||

NNN REIT, Inc. | (13 ) | (480 ) |

Simon Property Group, Inc. | (15 ) | (1,595 ) |

(2,075 ) | ||

Semiconductors & Semiconductor Equipment—(8.3)% | ||

Applied Materials, Inc. | (36 ) | (4,772 ) |

Broadcom, Inc. | (5 ) | (4,676 ) |

Intel Corp. | (68 ) | (2,469 ) |

KLA Corp. | (4 ) | (1,785 ) |

Lam Research Corp. | (2 ) | (1,035 ) |

Microchip Technology, Inc. | (49 ) | (3,498 ) |

QUALCOMM, Inc. | (3 ) | (376 ) |

(18,611 ) | ||

Software — (0.5)% | ||

Palantir Technologies, Inc., Class A * | (25 ) | (367 ) |

UiPath, Inc., Class A * | (42 ) | (649 ) |

(1,016 ) | ||

Specialized REITs — (0.6)% | ||

Extra Space Storage, Inc. | (4 ) | (368 ) |

Iron Mountain, Inc. | (15 ) | (910 ) |

(1,278 ) | ||

Specialty Retail — (1.3)% | ||

CarMax, Inc. * | (4 ) | (219 ) |

Home Depot, Inc. (The) | (7 ) | (2,135 ) |

Williams-Sonoma, Inc. | (3 ) | (468 ) |

(2,822 ) | ||

Technology Hardware, Storage & Peripherals — (3.5)% | ||

Apple, Inc. | (14 ) | (2,377 ) |

Hewlett Packard Enterprise Co. | (194 ) | (2,982 ) |

NetApp, Inc. | (33 ) | (2,421 ) |

Xerox Holdings Corp. | (6 ) | (76 ) |

(7,856 ) | ||

Textiles, Apparel & Luxury Goods — (0.7)% | ||

NIKE, Inc., Class B | (12 ) | (1,249 ) |

VF Corp. | (20 ) | (289 ) |

(1,538 ) | ||

12 | J.P. Morgan Specialty Funds | October 31, 2023 |

INVESTMENTS | SHARES (000) | VALUE ($000) |

Short Positions — continued | ||

Common Stocks — continued | ||

Trading Companies & Distributors — (0.6)% | ||

Fastenal Co. | (24 ) | (1,371 ) |

Total Common Stocks (Proceeds $(180,341)) | (163,767 ) | |

Total Short Positions (Proceeds $(180,341)) | (163,767 ) | |

Total Investments—26.0% (Cost $28,453) | 58,694 | |

Other Assets Less Liabilities—70.0% | 157,612 | |

Net Assets—96.0% | 216,306 | |

Future share reacquisition adjustment—4.0% | 9,067 | |

Net assets after future share reacquisition adjustment— 100.0% | 225,373 | |

Percentages indicated are based on net assets after future share reacquisition adjustment. | ||

Amounts presented as a dash ("-") represent amounts that round to less than a thousand. |

Abbreviations | |

ADR | American Depositary Receipt |

NYRS | New York Registry Shares |

REIT | Real Estate Investment Trust |

^ | Amount rounds to less than 0.1% of net assets. | |

* | Non-income producing security. | |

(a) | All or a portion of this security is segregated as collateral for short sales. The total value of securities and cash segregated as collateral is $29,972 and $161,903, respectively. | |

(b) | The rate shown is the effective yield as of October 31, 2023. | |

(c) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. | |

(d) | The rate shown is the current yield as of October 31, 2023. | |

DESCRIPTION | NUMBER OF CONTRACTS | EXPIRATION DATE | TRADING CURRENCY | NOTIONAL AMOUNT ($) | VALUE AND UNREALIZED APPRECIATION (DEPRECIATION) ($) |

Short Contracts | |||||

S&P 500 E-Mini Index | (13 ) | 12/15/2023 | USD | (2,738 ) | 198 |

Abbreviations | |

USD | United States Dollar |

October 31, 2023 | J.P. Morgan Specialty Funds | 13 |

JPMorgan Research Market Neutral Fund | |

ASSETS: | |

Investments in non-affiliates, at value | $212,225 |

Investments in affiliates, at value | 10,236 |

Deposits at broker for futures contracts | 424 |

Deposits at broker for securities sold short | 161,903 |

Receivables: | |

Investment securities sold | 1,320 |

Fund shares sold | 146 |

Interest from non-affiliates | 784 |

Dividends from non-affiliates | 99 |

Dividends from affiliates | 76 |

Class Action proceeds | 1,308 |

Due from Adviser | 82 |

Total Assets | 388,603 |

LIABILITIES: | |

Payables: | |

Securities sold short, at value | 163,767 |

Dividend expense to non-affiliates on securities sold short | 169 |

Investment securities purchased | 996 |

Fund shares redeemed | 468 |

Variation margin on futures contracts | 22 |

Accrued liabilities: | |

Investment advisory fees | 50 |

Administration fees | 6 |

Distribution fees | 6 |

Service fees | 45 |

Custodian and accounting fees | 7 |

Trustees’ and Chief Compliance Officer’s fees | — (a) |

Prior period taxes due | 82 |

Due to shareholders upon reprocessing | 6,607 |

Other | 72 |

Total Liabilities | 172,297 |

Net Assets | 216,306 |

Future share reacquisition adjustment | 9,067 |

Net assets after future share reacquisition adjustment | $225,373 |

14 | J.P. Morgan Specialty Funds | October 31, 2023 |

JPMorgan Research Market Neutral Fund | |

NET ASSETS: | |

Paid-in-Capital | $217,743 |

Total distributable earnings (loss) | (1,437 ) |

Net Assets | 216,306 |

Future share reacquisition adjustment | 9,067 |

Net Assets after future share reacquisition adjustment | $225,373 |

Net Assets after future share reacquisition adjustment: | |

Class A | $23,101 |

Class C | 1,762 |

Class I | 200,510 |

Total | $225,373 |

Outstanding units of beneficial interest (shares) ($0.0001 par value; unlimited number of shares authorized): | |

Class A | 1,702 |

Class C | 147 |

Class I | 13,751 |

Net Asset Value (a): | |

(after future share reacquisition adjustment) | |

Class A — Redemption price per share | $13.56 |

Class C — Offering price per share (b) | 12.00 |

Class I — Offering and redemption price per share | 14.58 |

Class A maximum sales charge | 5.25 % |

Class A maximum public offering price per share [net asset value per share/(100% – maximum sales charge)] | $14.31 |

Cost of investments in non-affiliates | $198,559 |

Cost of investments in affiliates | 10,235 |

Proceeds from securities sold short | 180,341 |

October 31, 2023 | J.P. Morgan Specialty Funds | 15 |

JPMorgan Research Market Neutral Fund | |

INVESTMENT INCOME: | |

Interest income from non-affiliates | $687 |

Interest income from non-affiliates on securities sold short | 5,936 |

Dividend income from non-affiliates | 1,817 |

Dividend income from affiliates | 1,277 |

Total investment income | 9,717 |

EXPENSES: | |

Investment advisory fees | 609 |

Administration fees | 131 |

Distribution fees: | |

Class A | 55 |

Class C | 12 |

Service fees: | |

Class A | 55 |

Class C | 4 |

Class I | 376 |

Custodian and accounting fees | 42 |

Professional fees | 74 |

Trustees’ and Chief Compliance Officer’s fees | 26 |

Printing and mailing costs | 36 |

Registration and filing fees | 62 |

Transfer agency fees (See Note 2.H.) | 8 |

Tax expense | 82 |

Dividend expense to non-affiliates on securities sold short | 3,394 |

Other | 10 |

Total expenses | 4,976 |

Less fees waived | (291 ) |

Less expense reimbursements | (84 ) |

Net expenses | 4,601 |

Net investment income (loss) | 5,116 |

REALIZED/UNREALIZED GAINS (LOSSES): | |

Net realized gain (loss) on transactions from: | |

Investments in non-affiliates | 1,904 |

Investments in affiliates | 5 |

Futures contracts | (182 ) |

Securities sold short | (3,997 ) |

Net realized gain (loss) | (2,270 ) |

Change in net unrealized appreciation/depreciation on: | |

Investments in non-affiliates | 3,919 |

Investments in affiliates | (1 ) |

Futures contracts | 199 |

Securities sold short | 10,375 |

Change in net unrealized appreciation/depreciation | 14,492 |

Net realized/unrealized gains (losses) | 12,222 |

Change in net assets resulting from operations | $17,338 |

16 | J.P. Morgan Specialty Funds | October 31, 2023 |

JPMorgan Research Market Neutral Fund | ||

Year Ended October 31, 2023 | Year Ended October 31, 2022 | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | ||

Net investment income (loss) | $5,116 | $(655 ) |

Net realized gain (loss) | (2,270 ) | 863 |

Change in net unrealized appreciation/depreciation | 14,492 | (3,440 ) |

Change in net assets resulting from operations | 17,338 | (3,232 ) |

CAPITAL TRANSACTIONS: | ||

Change in net assets resulting from capital transactions | 44,172 | 68,370 |

NET ASSETS: | ||

Change in net assets | 61,510 | 65,138 |

Beginning of period | 154,796 | 89,658 |

End of period | 216,306 | 154,796 |

Future share reacquisition adjustment | 9,067 | 6,425 |

End of period after future share reacquisition adjustment | $225,373 | $161,221 |

October 31, 2023 | J.P. Morgan Specialty Funds | 17 |

JPMorgan Research Market Neutral Fund | ||

Year Ended October 31, 2023 | Year Ended October 31, 2022 | |

CAPITAL TRANSACTIONS: | ||

Class A | ||

Proceeds from shares issued | $7,679 | $8,418 |

Cost of shares redeemed | (7,148 ) | (4,910 ) |

Change in net assets resulting from Class A capital transactions | 531 | 3,508 |

Class C | ||

Proceeds from shares issued | 355 | 521 |

Cost of shares redeemed | (262 ) | (222 ) |

Change in net assets resulting from Class C capital transactions | 93 | 299 |

Class I | ||

Proceeds from shares issued | 144,273 | 119,488 |

Cost of shares redeemed | (100,725 ) | (54,925 ) |

Change in net assets resulting from Class I capital transactions | 43,548 | 64,563 |

Total change in net assets resulting from capital transactions | $44,172 | $68,370 |

SHARE TRANSACTIONS: | ||

Class A | ||

Issued | 609 | 683 |

Redeemed | (554 ) | (395 ) |

Change in Class A Shares | 55 | 288 |

Class C | ||

Issued | 33 | 48 |

Redeemed | (23 ) | (20 ) |

Change in Class C Shares | 10 | 28 |

Class I | ||

Issued | 10,434 | 9,115 |

Redeemed | (7,253 ) | (4,127 ) |

Change in Class I Shares | 3,181 | 4,988 |

18 | J.P. Morgan Specialty Funds | October 31, 2023 |

Per share operating performance | |||||

Investment operations | Distributions | ||||

Net asset value, beginnng of period * | Net investment income (loss)(a) | Net realized and unrealized gains (losses) on investments | Total from investment operations | Net realized gain | |

JPMorgan Research Market Neutral Fund | |||||

Class A | |||||

Year Ended October 31, 2023 (as restated, See Note 8) | $12.30 | $0.34 | $0.84 | $1.18 | $— |

Year Ended October 31, 2022 (as restated, See Note 8) | 12.63 | (0.10 ) | (0.32 ) | (0.42 ) | — |

Year Ended October 31, 2021 (as restated, See Note 8) | 13.23 | (0.21 ) | 0.41 | 0.20 | (0.91 ) |

Year Ended October 31, 2020 (as restated, See Note 8) | 13.26 | (0.20 ) | 1.51 | 1.31 | (1.49 ) |

Year Ended October 31, 2019 (as restated, See Note 8) | 14.32 | (0.03 ) | 0.41 | 0.38 | (1.45 ) |

Class C | |||||

Year Ended October 31, 2023 (as restated, See Note 8) | 10.94 | 0.25 | 0.77 | 1.02 | — |

Year Ended October 31, 2022 (as restated, See Note 8) | 11.29 | (0.14 ) | (0.30 ) | (0.44 ) | — |

Year Ended October 31, 2021 (as restated, See Note 8) | 11.97 | (0.25 ) | 0.41 | 0.16 | (0.91 ) |

Year Ended October 31, 2020 (as restated, See Note 8) | 12.20 | (0.23 ) | 1.36 | 1.13 | (1.49 ) |

Year Ended October 31, 2019 (as restated, See Note 8) | 13.35 | (0.09 ) | 0.39 | 0.30 | (1.45 ) |

Class I | |||||

Year Ended October 31, 2023 (as restated, See Note 8) | 13.19 | 0.41 | 0.75 | 1.16 | — |

Year Ended October 31, 2022 (as restated, See Note 8) | 13.51 | (0.06 ) | (0.53 ) | (0.59 ) | — |

Year Ended October 31, 2021 (as restated, See Note 8) | 14.03 | (0.20 ) | 0.46 | 0.26 | (0.91 ) |

Year Ended October 31, 2020 (as restated, See Note 8) | 13.96 | (0.19 ) | 1.00 | 0.81 | (1.49 ) |

Year Ended October 31, 2019 (as restated, See Note 8) | 14.96 | — (f) | 0.43 | 0.43 | (1.45 ) |

* | Net asset value per share has been calculated after future share reacquisition adjustment for the impacted periods. |

** | Amount presented after future share reacquisition adjustment. |

(a) | Calculated based upon average shares outstanding. |

(b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(c) | Includes interest expense, if applicable, each of which is less than 0.005% unless otherwise noted. |

(d) | |

October 31, 2023 (as restated, See note 8) | October 31, 2022 (as restated, See note 8) | October 31, 2021 (as restated, See note 8) | October 31, 2020 (as restated, See note 8) | October 31, 2019 (as restated, See note 8) | |

Net expenses (excluding dividend and interest expense for securities sold short) | |||||

Class A | 0.90 % | 0.90 % | 0.92 % | 1.06 % | 1.21 % |

Class C | 1.39 | 1.39 | 1.41 | 1.58 | 1.71 |

Class I | 0.64 | 0.64 | 0.66 | 0.75 | 0.95 |

Expenses without waivers and reimbursements (excluding dividend and interest expense for securities sold short) | |||||

Class A | 1.07 | 1.08 | 1.14 | 1.44 | 1.61 |

Class C | 1.55 | 1.57 | 1.64 | 1.93 | 2.07 |

Class I | 0.81 | 0.82 | 0.87 | 1.11 | 1.31 |

(e) | Interest expense on securities sold short is 0.16%. |

(f) | Amount rounds to less than $0.005. |

20 | J.P. Morgan Specialty Funds | October 31, 2023 |

Ratios/Supplemental data | ||||||||

Ratios to average net assets | ||||||||

Future share reacquistion adjustment | Net asset value, end of period * | Total return (excludes sales charge)(b) | Net assets, end of period (000's) ** | Net expenses (including dividend expense for securities sold short)(c)(d) | Net investment income (loss) | Expenses without waivers and reimbursements (including dividend expense for securities sold short)(d) | Portfolio turnover rate (excluding securities sold short) | Portfolio turnover rate (including securities sold short) |

$0.08 | $13.56 | 10.24 % | $23,101 | 2.84 % | 2.69 % | 3.01 % | 92 % | 232 % |

0.09 | 12.30 | (2.61 ) | 20,259 | 2.72 | (0.84 ) | 2.90 | 100 | 252 |

0.11 | 12.63 | 2.67 | 17,161 | 2.92 (e) | (1.71 ) | 3.14 | 119 | 307 |

0.15 | 13.23 | 12.39 | 18,509 | 3.18 | (1.53 ) | 3.56 | 224 | 531 |

0.01 | 13.26 | 2.92 | 14,442 | 3.66 | (0.24 ) | 4.06 | 125 | 356 |

0.04 | 12.00 | 9.69 | 1,762 | 3.33 | 2.20 | 3.50 | 92 | 232 |

0.09 | 10.94 | (3.10 ) | 1,504 | 3.21 | (1.30 ) | 3.39 | 100 | 252 |

0.07 | 11.29 | 2.25 | 1,233 | 3.44 (e) | (2.22 ) | 3.67 | 119 | 307 |

0.13 | 11.97 | 11.76 | 1,982 | 3.70 | (1.94 ) | 4.04 | 224 | 531 |

— | 12.20 | 2.42 | 3,774 | 4.19 | (0.73 ) | 4.55 | 125 | 356 |

0.23 | 14.58 | 10.54 | 200,510 | 2.55 | 2.98 | 2.72 | 92 | 232 |

0.27 | 13.19 | (2.37 ) | 139,458 | 2.41 | (0.47 ) | 2.59 | 100 | 252 |

0.13 | 13.51 | 3.10 | 75,401 | 2.69 (e) | (1.50 ) | 2.90 | 119 | 307 |

0.75 | 14.03 | 12.49 | 123,114 | 2.87 | (1.39 ) | 3.23 | 224 | 531 |

0.02 | 13.96 | 3.21 | 28,014 | 3.40 | 0.03 | 3.76 | 125 | 356 |

October 31, 2023 | J.P. Morgan Specialty Funds | 21 |

Classes Offered | Diversification Classification | |

JPMorgan Research Market Neutral Fund | Class A, Class C and Class I | Diversified |

22 | J.P. Morgan Specialty Funds | October 31, 2023 |

Level 1 Quoted prices | Level 2 Other significant observable inputs | Level 3 Significant unobservable inputs | Total | |

Investments in Securities | ||||

Common Stocks | $170,481 | $— | $— | $170,481 |

Short-Term Investments | ||||

Investment Companies | 10,236 | — | — | 10,236 |

U.S. Treasury Obligations | — | 41,744 | — | 41,744 |

Total Short-Term Investments | 10,236 | 41,744 | — | 51,980 |

Total Investments in Securities | $180,717 | $41,744 | $— | $222,461 |

Liabilities | ||||

Common Stocks | $(163,767 ) | $— | $— | $(163,767 ) |

Total Liabilities for Securities Sold Short | $(163,767 ) | $— | $— | $(163,767 ) |

Appreciation in Other Financial Instruments | ||||

Futures Contracts | $198 | $— | $— | $198 |

October 31, 2023 | J.P. Morgan Specialty Funds | 23 |

For the year ended October 31, 2023 | |||||||||

Security Description | Value at October 31, 2022 | Purchases at Cost | Proceeds from Sales | Net Realized Gain (Loss) | Change in Unrealized Appreciation/ (Depreciation) | Value at October 31, 2023 | Shares at October 31, 2023 | Dividend Income | Capital Gain Distributions |

JPMorgan Prime Money Market Fund Class Institutional Shares, 5.41% (a) (b) | $30,961 | $301,413 | $322,142 | $5 | $(1 ) | $10,236 | 10,232 | $1,277 | $— |

(a) | Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

(b) | The rate shown is the current yield as of October 31, 2023. |

Futures Contracts: | |

Average Notional Balance Short | $(4,921 ) |

Ending Notional Balance Short | (2,738 ) |

24 | J.P. Morgan Specialty Funds | October 31, 2023 |

Class A | Class C | Class I | Total | |

Transfer agency fees | $3 | $— (a) | $5 | $8 |

(a) | Amount rounds to less than one thousand. |

October 31, 2023 | J.P. Morgan Specialty Funds | 25 |

Paid-in-Capital | Accumulated undistributed (distributions in excess of) net investment income | Accumulated net realized gains (losses) | |

$1,115 | $26 | $(1,141 ) |

Class A | Class C | |

0.25 % | 0.75 % |

26 | J.P. Morgan Specialty Funds | October 31, 2023 |

Front-End Sales Charge | CDSC | |

$2 | $— |

Class A | Class C | Class I | |

0.25 % | 0.25 % | 0.25 % |

Class A | Class C | Class I | |

0.95 % | 1.45 % | 0.69 % |

Contractual Waivers | ||||

Investment Advisory Fees | Administration Fees | Service Fees | Total | |

$132 | $88 | $8 | $228 | |

October 31, 2023 | J.P. Morgan Specialty Funds | 27 |

Purchases (excluding U.S. Government) | Sales (excluding U.S. Government) | Securities Sold Short | Covers on Securities Sold Short | |

$181,256 | $124,646 | $198,282 | $132,723 |

Aggregate Cost* | Gross Unrealized Appreciation | Gross Unrealized Depreciation | Net Unrealized Appreciation (Depreciation) | |

$37,608 | $33,522 | $12,239 | $21,283 |

* | The tax cost includes the proceeds from short sales which may result in a net negative cost. |

Current Distributable Ordinary Income | Current Distributable Long-Term Capital Gain (Tax Basis Capital Loss Carryover) | Unrealized Appreciation (Depreciation) | |

$4,822 | $(27,749 ) | $21,242 |

Capital Loss Carryforward Character | |

Short-Term | |

$27,749 * |

* | Amount includes capital loss carryforwards which are limited in future years under Internal Revenue Code sections 381-384. |

28 | J.P. Morgan Specialty Funds | October 31, 2023 |

October 31, 2023 | J.P. Morgan Specialty Funds | 29 |

Previously Reported | Adjustments | As Restated | |

Assets: | |||

Interest from non-affiliates | $669 | $115 | $784 |

Class Action proceeds | — | 1,308 | 1,308 |

Due from Adviser | — | 82 | 82 |

Total Assets | 387,098 | 1,505 | 388,603 |

Liabilities: | |||

Prior period taxes due | — | 82 | 82 |

Due to shareholders upon reprocessing | — | 6,607 | 6,607 |

Total Liabilities | 165,608 | 6,689 | 172,297 |

Net Assets | 221,490 | (5,184 ) | 216,306 |

Future share reacquisition adjustment | — | 9,067 | 9,067 |

Net Assets after future share reacquisition adjustment | $— | $225,373 | $225,373 |

NET ASSETS: | |||

Paid-in-Capital | 223,234 | (5,491 ) | 217,743 |

Total distributable earnings (loss) | (1,744 ) | 307 | (1,437 ) |

Net Assets | 221,490 | (5,184 ) | 216,306 |

Future share reacquisition adjustment | — | 9,067 | 9,067 |

Net Assets after future share reacquisition adjustment | $ — | $225,373 | $225,373 |

Net Assets after future share reacquisition adjustment: | |||

Class A | $22,702 | $399 | $23,101 |

Class C | 1,730 | 32 | 1,762 |

Class I | 197,058 | 3,452 | 200,510 |

Total | $221,490 | $3,883 | $225,373 |

30 | J.P. Morgan Specialty Funds | October 31, 2023 |

Previously Reported | Adjustments | As Restated | |

Net Asset Value (a): | |||

(after future share reacquisition adjustment) | |||

Class A — Redemption price per share | $13.33 | $0.23 | $13.56 |

Class C — Offering price per share (b) | 11.79 | 0.21 | 12.00 |

Class I — Offering and redemption price per share | 14.33 | 0.25 | 14.58 |

Class A maximum public offering price per share | |||

[net asset value per share/(100% – maximum sales charge)] | $14.07 | $0.24 | $14.31 |

As presented above, in order to correct the Fund’s net assets under the Fund’s NAV correction policy, the Fund has recorded a future share reacquisition adjustment to net assets. This amount represents the value of shares the Fund has a unilateral right to reacquire through reprocessing for the Error Period and is estimated by using the corrected NAV at each reprocessing date based on the subscription and redemption information currently available. The Fund’s Adviser will be responsible for any shortfall to the Fund to the extent reprocessing is not completed for any applicable purchases during the Error Period.

STATEMENT OF OPERATIONS

Previously Reported | Adjustments | As Restated | |

INVESTMENT INCOME: | |||

Interest income from non-affiliates | $624 | $63 | $687 |

Total investment income | 9,654 | 63 | 9,717 |

EXPENSES: | |||

Tax expense | — | 82 | 82 |

Total expenses | 4,894 | 82 | 4,976 |

Less expense reimbursements | (2 ) | (82 ) | (84 ) |

Net investment income (loss) | 5,053 | 63 | 5,116 |

REALIZED/UNREALIZED GAINS (LOSSES): | |||

Net realized gain (loss) on transactions from: | |||

Investments in non-affiliates | 1,748 | 156 | 1,904 |

Net realized gain (loss) | (2,426 ) | 156 | (2,270 ) |

Net realized/unrealized gains (losses) | 12,066 | 156 | 12,222 |

Change in net assets resulting from operations | $17,119 | $219 | $17,338 |

Previously Reported | Adjustments | As Restated | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | |||

Net investment income (loss) | $5,053 | $63 | $5,116 |

Net realized gain (loss) | (2,426 ) | 156 | (2,270 ) |

Change in net assets resulting from operations | 17,119 | 219 | 17,338 |

October 31, 2023 | J.P. Morgan Specialty Funds | 31 |

Previously Reported | Adjustments | As Restated | |

CAPITAL TRANSACTIONS: | |||

Change in net assets resulting from capital transactions | 46,025 | (1,853 ) | 44,172 |

NET ASSETS: | |||

Change in net assets | 63,144 | (1,634 ) | 61,510 |

Beginning of period | 158,346 | (3,550 ) | 154,796 |

End of period | 221,490 | (5,184 ) | 216,306 |

Future share reacquisition adjustment | — | 9,067 | 9,067 |

End of period after future share reacquisition adjustment | $— | $225,373 | $225,373 |

CAPITAL TRANSACTIONS: | |||

Class A | |||

Cost of shares redeemed | $(7,025 ) | $(123 ) | $(7,148 ) |

Change in net assets resulting from Class A capital transactions | 654 | (123 ) | 531 |

Class C | |||

Cost of shares redeemed | (257 ) | (5 ) | (262 ) |

Change in net assets resulting from Class C capital transactions | 98 | (5 ) | 93 |

Class I | |||

Cost of shares redeemed | (99,000 ) | (1,725 ) | (100,725 ) |

Change in net assets resulting from Class I capital transactions | 45,273 | (1,725 ) | 43,548 |

Total change in net assets resulting from capital transactions | $46,025 | $(1,853 ) | $44,172 |

Previously Reported | Adjustments | As Restated | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | |||

Net investment income (loss) | $(669 ) | $14 | $(655 ) |

Net realized gain (loss) | 841 | 22 | 863 |

Change in net assets resulting from operations | (3,268 ) | 36 | (3,232 ) |

CAPITAL TRANSACTIONS: | |||

Change in net assets resulting from capital transactions | 69,424 | (1,054 ) | 68,370 |

NET ASSETS: | |||

Change in net assets | 66,156 | (1,018 ) | 65,138 |

Beginning of period | 92,190 | (2,532 ) | 89,658 |

End of period | 158,346 | (3,550 ) | 154,796 |

Future share reacquisition adjustment | — | 6,425 | 6,425 |

End of period after future share reacquisition adjustment | $— | $161,221 | $161,221 |

CAPITAL TRANSACTIONS: | |||

Class A | |||

Cost of shares redeemed | $(4,824 ) | $(86 ) | $(4,910 ) |

Change in net assets resulting from Class A capital transactions | 3,594 | (86 ) | 3,508 |

32 | J.P. Morgan Specialty Funds | October 31, 2023 |

Previously Reported | Adjustments | As Restated | |

Class C | |||

Cost of shares redeemed | (218 ) | (4 ) | (222 ) |

Change in net assets resulting from Class C capital transactions | 303 | (4 ) | 299 |

Class I | |||

Cost of shares redeemed | (53,961 ) | (964 ) | (54,925 ) |

Change in net assets resulting from Class I capital transactions | 65,527 | (964 ) | 64,563 |

Total change in net assets resulting from capital transactions | $69,424 | $(1,054 ) | $68,370 |

October 31, 2023 | J.P. Morgan Specialty Funds | 33 |

Per share operating performance | ||||||

Investment operations | Distributions | |||||

Net asset value, beginning of period * | Net investment income (loss)(a) | Net realized and unrealized gains (losses) on investments | Total from investment operations | Net realized gain | Future share reacquisition adjustment | |

Class A (As Previously Reported) | ||||||

Year Ended October 31, 2023 | $12.08 | $0.34 | $0.91 | $1.25 | $— | $— |

Year Ended October 31, 2022 | 12.41 | (0.10 ) | (0.23 ) | (0.33 ) | — | — |

Year Ended October 31, 2021 | 13.01 | (0.21 ) | 0.52 | 0.31 | (0.91 ) | — |

Year Ended October 31, 2020 | 13.11 | (0.20 ) | 1.59 | 1.39 | (1.49 ) | — |

Year Ended October 31, 2019 | 14.29 | (0.04 ) | 0.31 | 0.27 | (1.45 ) | — |

Adjustment | ||||||

Year Ended October 31, 2023 | 0.22 | — | (0.07 ) | (0.07 ) | — | 0.08 |

Year Ended October 31, 2022 | 0.22 | — | (0.09 ) | (0.09 ) | — | 0.09 |

Year Ended October 31, 2021 | 0.22 | — | (0.11 ) | (0.11 ) | — | 0.11 |

Year Ended October 31, 2020 | 0.15 | — | (0.08 ) | (0.08 ) | — | 0.15 |

Year Ended October 31, 2019 | 0.03 | 0.01 | 0.10 | 0.11 | — | 0.01 |

Class A (As Restated) | ||||||

Year Ended October 31, 2023 | 12.30 | 0.34 | 0.84 | 1.18 | — | 0.08 |

Year Ended October 31, 2022 | 12.63 | (0.10 ) | (0.32 ) | (0.42 ) | — | 0.09 |

Year Ended October 31, 2021 | 13.23 | (0.21 ) | 0.41 | 0.20 | (0.91 ) | 0.11 |

Year Ended October 31, 2020 | 13.26 | (0.20 ) | 1.51 | 1.31 | (1.49 ) | 0.15 |

Year Ended October 31, 2019 | 14.32 | (0.03 ) | 0.41 | 0.38 | (1.45 ) | 0.01 |

34 | J.P. Morgan Specialty Funds | October 31, 2023 |

Ratios/Supplemental data | |||||||

Ratios to average net assets | |||||||

Net Asset value, end of period * | Total return (excludes sales charge)(b) | Net assets, end of period (000's) ** | Net expenses (including dividend expense for securities sold short)(c) | Net expenses (excluding dividend and interest expense for sescurities sold short) | Expenses without waivers and reimbursements (including dividend expense for securities sold short) | Expenses without waivers and reimbursements (excluding dividend and interest expense for sescurities sold short) | Net investment income (loss) |

$13.33 | 10.35 % | $22,702 | 2.89 % | 0.91 % | 3.07 % | 1.09 % | 2.65 % |

12.08 | (2.66 ) | 19,898 | 2.77 | 0.92 | 2.95 | 1.10 | (0.86 ) |

12.41 | 2.72 | 16,867 | 2.99 (d) | 0.93 | 3.22 | 1.16 | (1.77 ) |

13.01 | 11.97 | 18,205 | 3.23 | 1.08 | 3.61 | 1.46 | (1.57 ) |

13.11 | 2.01 | 14,276 | 3.69 | 1.22 | 4.09 | 1.62 | (0.26 ) |

0.23 | (0.11 ) | 399 | (0.05 ) | (0.01 ) | (0.06 ) | (0.02 ) | 0.04 |

0.22 | 0.05 | 361 | (0.05 ) | (0.02 ) | (0.05 ) | (0.02 ) | 0.02 |

0.22 | (0.05 ) | 294 | (0.07 ) | (0.01 ) | (0.08 ) | (0.02 ) | 0.06 |

0.22 | 0.42 | 304 | (0.05 ) | (0.02 ) | (0.05 ) | (0.02 ) | 0.04 |

0.15 | 0.91 | 166 | (0.03 ) | (0.01 ) | (0.03 ) | (0.01 ) | 0.02 |

13.56 | 10.24 | 23,101 | 2.84 | 0.90 | 3.01 | 1.07 | 2.69 |

12.30 | (2.61 ) | 20,259 | 2.72 | 0.90 | 2.90 | 1.08 | (0.84 ) |

12.63 | 2.67 | 17,161 | 2.92 (d) | 0.92 | 3.14 | 1.14 | (1.71 ) |

13.23 | 12.39 | 18,509 | 3.18 | 1.06 | 3.56 | 1.44 | (1.53 ) |

13.26 | 2.92 | 14,442 | 3.66 | 1.21 | 4.06 | 1.61 | (0.24 ) |

* | Net asset value per share has been calculated after future share reacquisition adjustment for the impacted periods. |

** | Amount presented after future share reacquisition adjustment |

(a) | Calculated based upon average shares outstanding. |

(b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(c) | Includes interest expense, if applicable, each of which is less than 0.005% unless otherwise noted. |

(d) | Interest expense on securities sold short is 0.16%. |

October 31, 2023 | J.P. Morgan Specialty Funds | 35 |

Per share operating performance | ||||||

Investment operations | Distributions | |||||

Net asset value, beginning of period * | Net investment income (loss)(a) | Net realized and unrealized gains (losses) on investments | Total from investment operations | Net realized gain | Future share reacquisition adjustment | |

Class C (As Previously Reported) | ||||||

Year Ended October 31, 2023 | $10.74 | $0.24 | $0.81 | $1.05 | $— | $— |

Year Ended October 31, 2022 | 11.09 | (0.14 ) | (0.21 ) | (0.35 ) | — | — |

Year Ended October 31, 2021 | 11.77 | (0.25 ) | 0.48 | 0.23 | (0.91 ) | — |

Year Ended October 31, 2020 | 12.06 | (0.23 ) | 1.43 | 1.20 | (1.49 ) | — |

Year Ended October 31, 2019 | 13.32 | (0.10 ) | 0.29 | 0.19 | (1.45 ) | — |

Adjustment | ||||||

Year Ended October 31, 2023 | 0.20 | 0.01 | (0.04 ) | (0.03 ) | — | 0.04 |

Year Ended October 31, 2022 | 0.20 | — | (0.09 ) | (0.09 ) | — | 0.09 |

Year Ended October 31, 2021 | 0.20 | — | (0.07 ) | (0.07 ) | — | 0.07 |

Year Ended October 31, 2020 | 0.14 | — | (0.07 ) | (0.07 ) | — | 0.13 |

Year Ended October 31, 2019 | 0.03 | 0.01 | 0.10 | 0.11 | — | — |

Class C (As Restated) | ||||||

Year Ended October 31, 2023 | 10.94 | 0.25 | 0.77 | 1.02 | — | 0.04 |

Year Ended October 31, 2022 | 11.29 | (0.14 ) | (0.30 ) | (0.44 ) | — | 0.09 |

Year Ended October 31, 2021 | 11.97 | (0.25 ) | 0.41 | 0.16 | (0.91 ) | 0.07 |

Year Ended October 31, 2020 | 12.20 | (0.23 ) | 1.36 | 1.13 | (1.49 ) | 0.13 |

Year Ended October 31, 2019 | 13.35 | (0.09 ) | 0.39 | 0.30 | (1.45 ) | — |

36 | J.P. Morgan Specialty Funds | October 31, 2023 |

Ratios/Supplemental data | |||||||

Ratios to average net assets | |||||||

Net Asset Value, end of period * | Total return (excludes sales charge)(b) | Net assets, end of period (000's) ** | Net expenses (including dividend expense for securities sold short)(c) | Net expenses (excluding dividend and interest expense for securities sold short) | Expenses without waivers and reimbursements (including dividend expense for securities sold short) | Expenses without waivers and reimbursements (excluding dividend and interest expense for sescurities sold short) | Net investment income (loss) |

11.79 | 9.78 | $1,730 | 3.39 % | 1.41 % | 3.56 % | 1.58 % | 2.16 % |

10.74 | (3.16 ) | 1,476 | 3.27 | 1.41 | 3.46 | 1.60 | (1.31 ) |

11.09 | 2.29 | 1,211 | 3.49 (d) | 1.43 | 3.73 | 1.67 | (2.25 ) |

11.77 | 11.36 | 1,949 | 3.75 | 1.60 | 4.10 | 1.95 | (2.00 ) |

12.06 | 1.52 | 3,731 | 4.20 | 1.73 | 4.56 | 2.09 | (0.74 ) |

0.21 | (0.09 ) | 32 | (0.06 ) | (0.02 ) | (0.06 ) | (0.03 ) | 0.04 |

0.20 | 0.06 | 28 | (0.06 ) | (0.02 ) | (0.07 ) | (0.03 ) | 0.01 |

0.20 | (0.04 ) | 22 | (0.05 ) | (0.02 ) | (0.06 ) | (0.03 ) | 0.03 |

0.20 | 0.40 | 33 | (0.05 ) | (0.02 ) | (0.06 ) | (0.02 ) | 0.06 |

0.14 | 0.90 | 43 | (0.01 ) | (0.02 ) | (0.01 ) | (0.02 ) | 0.01 |

12.00 | 9.69 | 1,762 | 3.33 | 1.39 | 3.50 | 1.55 | 2.20 |

10.94 | (3.10 ) | 1,504 | 3.21 | 1.39 | 3.39 | 1.57 | (1.30 ) |

11.29 | 2.25 | 1,233 | 3.44 (d) | 1.41 | 3.67 | 1.64 | (2.22 ) |

11.97 | 11.76 | 1,982 | 3.70 | 1.58 | 4.04 | 1.93 | (1.94 ) |

12.20 | 2.42 | 3,774 | 4.19 | 1.71 | 4.55 | 2.07 | (0.73 ) |

* | Net asset value per share has been calculated after future share reacquisition adjustment for the impacted periods. |

** | Amount presented after future share reacquisition adjustment. |

(a) | Calculated based upon average shares outstanding. |

(b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(c) | Includes interest expense, if applicable, each of which is less than 0.005% unless otherwise noted. |

(d) | Interest expense on securities sold short is 0.16%. |

October 31, 2023 | J.P. Morgan Specialty Funds | 37 |

Per share operating performance | ||||||

Investment operations | Distributions | |||||

Net asset value, beginning of period * | Net investment income (loss)(a) | Net realized and unrealized gains (losses) on investments | Total from investment operations | Net realized gain | Future share reacquisition adjustment | |

Class I (As Previously Reported) | ||||||

Year Ended October 31, 2023 | $12.96 | $0.40 | $0.97 | $1.37 | $— | $— |

Year Ended October 31, 2022 | 13.28 | (0.06 ) | (0.26 ) | (0.32 ) | — | — |

Year Ended October 31, 2021 | 13.82 | (0.20 ) | 0.57 | 0.37 | (0.91 ) | — |

Year Ended October 31, 2020 | 13.80 | (0.19 ) | 1.70 | 1.51 | (1.49 ) | — |

Year Ended October 31, 2019 | 14.93 | — (e) | 0.32 | 0.32 | (1.45 ) | — |

Adjustment | ||||||

Year Ended October 31, 2023 | 0.23 | 0.01 | (0.22 ) | (0.21 ) | — | 0.23 |

Year Ended October 31, 2022 | 0.23 | — | (0.27 ) | (0.27 ) | — | 0.27 |

Year Ended October 31, 2021 | 0.21 | — | (0.11 ) | (0.11 ) | — | 0.13 |

Year Ended October 31, 2020 | 0.16 | — | (0.70 ) | (0.70 ) | — | 0.75 |

Year Ended October 31, 2019 | 0.03 | — | 0.11 | 0.11 | — | 0.02 |

Class I (As Restated) | ||||||

Year Ended October 31, 2023 | 13.19 | 0.41 | 0.75 | 1.16 | — | 0.23 |

Year Ended October 31, 2022 | 13.51 | (0.06 ) | (0.53 ) | (0.59 ) | — | 0.27 |

Year Ended October 31, 2021 | 14.03 | (0.20 ) | 0.46 | 0.26 | (0.91 ) | 0.13 |

Year Ended October 31, 2020 | 13.96 | (0.19 ) | 1.00 | 0.81 | (1.49 ) | 0.75 |

Year Ended October 31, 2019 | 14.96 | — (e) | 0.43 | 0.43 | (1.45 ) | 0.02 |

38 | J.P. Morgan Specialty Funds | October 31, 2023 |

Ratios/Supplemental data | |||||||

Ratios to average net assets | |||||||

Net Asset value, end of period * | Total return (excludes sales charge)(b) | Net assets, end of period (000's) ** | Net expenses (including dividend expense for securities sold short)(c) | Net expenses (excluding dividend and interest expense for securities sold short) | Expenses without waivers and reimbursements (including dividend expense for securities sold short) | Expenses without waivers and reimbursements (excluding dividend and interest expense for securities sold short) | Net investment income (loss) |

$14.33 | 10.57 % | $197,058 | 2.60 % | 0.65 % | 2.77 % | 0.82 % | 2.95 % |

12.96 | (2.41 ) | 136,972 | 2.45 | 0.65 | 2.64 | 0.84 | (0.48 ) |

13.28 | 3.01 | 74,112 | 2.74 (d) | 0.68 | 2.95 | 0.89 | (1.50 ) |

13.82 | 12.26 | 121,285 | 2.91 | 0.76 | 3.28 | 1.13 | (1.42 ) |

13.80 | 2.27 | 27,694 | 3.43 | 0.96 | 3.79 | 1.32 | 0.01 |

0.25 | (0.03 ) | 3,452 | (0.05 ) | (0.01 ) | (0.05 ) | (0.01 ) | 0.03 |

0.23 | 0.04 | 2,486 | (0.04 ) | (0.01 ) | (0.05 ) | (0.02 ) | 0.01 |

0.23 | 0.09 | 1,289 | (0.05 ) | (0.02 ) | (0.05 ) | (0.02 ) | — |

0.21 | 0.23 | 1,829 | (0.04 ) | (0.01 ) | (0.05 ) | (0.02 ) | 0.03 |

0.16 | 0.94 | 320 | (0.03 ) | (0.01 ) | (0.03 ) | (0.01 ) | 0.02 |

14.58 | 10.54 | 200,510 | 2.55 | 0.64 | 2.72 | 0.81 | 2.98 |

13.19 | (2.37 ) | 139,458 | 2.41 | 0.64 | 2.59 | 0.82 | (0.47 ) |

13.51 | 3.10 | 75,401 | 2.69 (d) | 0.66 | 2.90 | 0.87 | (1.50 ) |

14.03 | 12.49 | 123,114 | 2.87 | 0.75 | 3.23 | 1.11 | (1.39 ) |

13.96 | 3.21 | 28,014 | 3.40 | 0.95 | 3.76 | 1.31 | 0.03 |

* | Net asset value per share has been calculated after future share reacquisition adjustment for the impacted periods. |

** | Amount presented after future share reacquisition adjustment. |

(a) | Calculated based upon average shares outstanding. |

(b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(c) | Includes interest expense, if applicable, each of which is less than 0.005% unless otherwise noted. |

(d) | Interest expense on securities sold short is 0.16%. |

(e) | Amount rounds to less than $0.005. |

Previously Reported | Adjustments | As Restated | |

Paid-in-Capital | $ — | 1,115 | $1,115 |

Accumulated undistributed (distributions in excess of) net investment income | $44 | (18 ) | $26 |

Accumulated net realized gains (losses) | $(44 ) | (1,097 ) | $(1,141 ) |

October 31, 2023 | J.P. Morgan Specialty Funds | 39 |

40 | J.P. Morgan Specialty Funds | October 31, 2023 |

Name (Year of Birth); Positions With the Funds (1) | Principal Occupation During Past 5 Years | Number of Funds in Fund Complex Overseen by Trustee (2) | Other Directorships Held During the Past 5 Years |

Independent Trustees | |||

John F. Finn (1947); Chair since 2020; Trustee since 1998. | Chairman, Gardner, Inc. (supply chain management company serving industrial and consumer markets) (serving in various roles 1974-present). | 170 | Director, Greif, Inc. (GEF) (industrial package products and services) (2007-present); Trustee, Columbus Association for the Performing Arts (1988-present). |

Stephen P. Fisher (1959); Trustee since 2018. | Retired; Chairman and Chief Executive Officer, NYLIFE Distributors LLC (registered broker-dealer) (serving in various roles 2008-2013); Chairman, NYLIM Service Company LLC (transfer agent) (2008-2017); New York Life Investment Management LLC (registered investment adviser) (serving in various roles 2005-2017); Chairman, IndexIQ Advisors LLC (registered investment adviser for ETFs) (2014-2017); President, MainStay VP Funds Trust (2007-2017), MainStay DefinedTerm Municipal Opportunities Fund (2011-2017) and MainStay Funds Trust (2007-2017) (registered investment companies). | 170 | Honors Program Advisory Board Member, The Zicklin School of Business, Baruch College, The City University of New York (2017-present). |

Gary L. French (1951); Trustee since 2014. | Real Estate Investor (2011-2020); Investment management industry Consultant and Expert Witness (2011-present); Senior Consultant for The Regulatory Fundamentals Group LLC (2011-2017). | 170 | Independent Trustee, The China Fund, Inc. (2013-2019); Exchange Traded Concepts Trust II (2012-2014); Exchange Traded Concepts Trust I (2011-2014). |

Kathleen M. Gallagher (1958); Trustee since 2018. | Retired; Chief Investment Officer — Benefit Plans, Ford Motor Company (serving in various roles 1985-2016). | 170 | Non- Executive Director, Legal & General Investment Management (Holdings) (2018-present); Non-Executive Director, Legal & General Investment Management America (U.S. Holdings) (financial services and insurance) (2017-present); Advisory Board Member, State Street Global Advisors Total Portfolio Solutions (2017-present); Member, Client Advisory Council, Financial Engines, LLC (registered investment adviser) (2011-2016); Director, Ford Pension Funds Investment Management Ltd. (2007-2016). |

Robert J. Grassi (1957); Trustee since 2014. | Sole Proprietor, Academy Hills Advisors LLC (2012-present); Pension Director, Corning Incorporated (2002-2012). | 170 | None |

October 31, 2023 | J.P. Morgan Specialty Funds | 41 |

Name (Year of Birth); Positions With the Funds (1) | Principal Occupation During Past 5 Years | Number of Funds in Fund Complex Overseen by Trustee (2) | Other Directorships Held During the Past 5 Years |

Independent Trustees (continued) | |||

Frankie D. Hughes (1952); Trustee since 2008. | President, Ashland Hughes Properties (property management) (2014-present); President and Chief Investment Officer, Hughes Capital Management, Inc. (fixed income asset management) (1993-2014). | 170 | None |

Raymond Kanner (1953); Trustee since 2017. | Retired; Managing Director and Chief Investment Officer, IBM Retirement Funds (2007-2016). | 170 | Advisory Board Member, Penso Advisors, LLC (2020-present); Advisory Board Member, Los Angeles Capital (2018-present); Advisory Board Member, State Street Global Advisors Total Portfolio Solutions (2017- present); Acting Executive Director, Committee on Investment of Employee Benefit Assets (CIEBA) (2016-2017); Advisory Board Member, Betterment for Business (robo advisor) (2016- 2017); Advisory Board Member, BlueStar Indexes (index creator) (2013-2017); Director, Emerging Markets Growth Fund (registered investment company) (1997-2016); Member, Russell Index Client Advisory Board (2001-2015). |

Thomas P. Lemke (1954); Trustee since 2014. | Retired since 2013. | 170 | (1) Independent Trustee of Advisors’ Inner Circle III fund platform, consisting of the following: (i) the Advisors’ Inner Circle Fund III, (ii) the Gallery Trust, (iii) the Schroder Series Trust, (iv) the Delaware Wilshire Private Markets Fund (since 2020), (v) Chiron Capital Allocation Fund Ltd., and (vi) formerly the Winton Diversified Opportunities Fund (2014-2018); and (2) Independent Trustee of the Symmetry Panoramic Trust (since 2018). |

Lawrence R. Maffia (1950); Trustee since 2014. | Retired; Director and President, ICI Mutual Insurance Company (2006-2013). | 170 | Director, ICI Mutual Insurance Company (1999-2013). |

Mary E. Martinez (1960); Vice Chair since 2021; Trustee since 2013. | Associate, Special Properties, a Christie’s International Real Estate Affiliate (2010-present); Managing Director, Bank of America (asset management) (2007-2008); Chief Operating Officer, U.S. Trust Asset Management, U.S. Trust Company (asset management) (2003-2007); President, Excelsior Funds (registered investment companies) (2004-2005). | 170 | None |

Marilyn McCoy (1948); Trustee since 1999. | Retired; Vice President of Administration and Planning, Northwestern University (1985-2023). | 170 | None |

42 | J.P. Morgan Specialty Funds | October 31, 2023 |

Name (Year of Birth); Positions With the Funds (1) | Principal Occupation During Past 5 Years | Number of Funds in Fund Complex Overseen by Trustee (2) | Other Directorships Held During the Past 5 Years |

Independent Trustees (continued) | |||

Dr. Robert A. Oden, Jr. (1946); Trustee since 1997. | Retired; President, Carleton College (2002-2010); President, Kenyon College (1995-2002). | 170 | Trustee, The Coldwater Conservation Fund (2017-present); Trustee, American Museum of Fly Fishing (2013-present); Trustee and Vice Chair, Trout Unlimited (2017-2021); Trustee, Dartmouth- Hitchcock Medical Center (2011-2020). |

Marian U. Pardo* (1946); Trustee since 2013. | Managing Director and Founder, Virtual Capital Management LLC (investment consulting) (2007-present); Managing Director, Credit Suisse Asset Management (portfolio manager) (2003-2006). | 170 | Board Chair and Member, Board of Governors, Columbus Citizens Foundation (not-for-profit supporting philanthropic and cultural programs) (2006-present). |

Emily A. Youssouf (1951); Trustee since 2014. | Adjunct Professor (2011-present) and Clinical Professor (2009-2011), NYU Schack Institute of Real Estate; Board Member and Member of the Audit Committee (2013–present), Chair of Finance Committee (2019-present), Member of Related Parties Committee (2013-2018) and Member of the Enterprise Risk Committee (2015-2018), PennyMac Financial Services, Inc.; Board Member (2005-2018), Chair of Capital Committee (2006-2016), Chair of Audit Committee (2005-2018), Member of Finance Committee (2005-2018) and Chair of IT Committee (2016-2018), NYC Health and Hospitals Corporation. | 170 | Trustee, NYC School Construction Authority (2009-present); Board Member, NYS Job Development Authority (2008-present); Trustee and Chair of the Audit Committee of the Transit Center Foundation (2015-2019). |

Interested Trustees | |||

Robert F. Deutsch** (1957); Trustee since 2014. | Retired; Head of ETF Business for JPMorgan Asset Management (2013-2017); Head of Global Liquidity Business for JPMorgan Asset Management (2003-2013). | 170 | Treasurer and Director of the JUST Capital Foundation (2017-present). |

Nina O. Shenker** (1957); Trustee since 2022. | Vice Chair (2017-2021), General Counsel and Managing Director (2008-2016), Associate General Counsel and Managing Director (2004-2008), J.P. Morgan Asset & Wealth Management. | 170 | Director and Member of Legal and Human Resources Subcommittees, American Jewish Joint Distribution Committee (2018-present). |

(1) | The year shown is the first year in which a Trustee became a member of any of the following: the JPMorgan Mutual Fund Board, the JPMorgan ETF Board, the heritage J.P. Morgan Funds or the heritage One Group Mutual Funds. Trustees serve an indefinite term, until resignation, retirement, removal or death. The Board's current retirement policy sets retirement at the end of the calendar year in which the Trustee attains the age of 75, provided that any Board member who was a member of the JPMorgan Mutual Fund Board prior to January 1, 2022 and was born prior to January 1, 1950 shall retire from the Board at the end of the calendar year in which the Trustee attains the age of 78. | ||

(2) | A Fund Complex means two or more registered investment companies that hold themselves out to investors as related companies for purposes of investment and investor services or have a common investment adviser or have an investment adviser that is an affiliated person of the investment adviser of any of the other registered investment companies. The J.P. Morgan Funds Complex for which the Board of Trustees serves currently includes nine registered investment companies (170 J.P. Morgan Funds). | ||

* | In connection with prior employment with JPMorgan Chase, Ms. Pardo was the recipient of non-qualified pension plan payments from JPMorgan Chase in the amount of approximately $2,055 per month, which she irrevocably waived effective January 1, 2013, and deferred compensation payments from JPMorgan Chase in the amount of approximately $7,294 per year, which ended in January 2013. In addition, Ms. Pardo receives payments from a fully-funded qualified plan, which is not an obligation of JPMorgan Chase. | ||

October 31, 2023 | J.P. Morgan Specialty Funds | 43 |

** | Designation as an “Interested Trustee” is based on prior employment by the Adviser or an affiliate of the Adviser or interests in a control person of the Adviser. | ||

The contact address for each of the Trustees is 277 Park Avenue, New York, NY 10172. | |||

44 | J.P. Morgan Specialty Funds | October 31, 2023 |

Name (Year of Birth), Positions Held with the Trust (Since) | Principal Occupations During Past 5 Years |

Brian S. Shlissel (1964), President and Principal Executive Officer (2016) | Managing Director and Chief Administrative Officer for J.P. Morgan pooled vehicles, J.P. Morgan Investment Management Inc. since 2014. |

Timothy J. Clemens (1975), Treasurer and Principal Financial Officer (2018) | Managing Director, J.P. Morgan Investment Management Inc. Mr. Clemens has been with J.P. Morgan Investment Management Inc. since 2013. |

Gregory S. Samuels (1980), Secretary (2019) (formerly Assistant Secretary 2010-2019) | Managing Director and Assistant General Counsel, JPMorgan Chase & Co. Mr. Samuels has been with JPMorgan Chase & Co. since 2010. |

Stephen M. Ungerman (1953), Chief Compliance Officer (2005) | Managing Director, JPMorgan Chase & Co. Mr. Ungerman has been with JPMorgan Chase & Co. since 2000. |

Kiesha Astwood-Smith (1973), Assistant Secretary (2021) | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since June 2021; Senior Director and Counsel, Equitable Financial Life Insurance Company (formerly, AXA Equitable Life Insurance Company) from September 2015 through June 2021. |

Matthew Beck (1988), Assistant Secretary (2021)* | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since May 2021; Senior Legal Counsel, Ultimus Fund Solutions from May 2018 through May 2021; General Counsel, The Nottingham Company from April 2014 through May 2018. |

Elizabeth A. Davin (1964), Assistant Secretary (2005)* | Executive Director and Assistant General Counsel, JPMorgan Chase & Co. Ms. Davin has been with JPMorgan Chase & Co. (formerly Bank One Corporation) since 2004. |

Jessica K. Ditullio (1962) Assistant Secretary (2005)* | Executive Director and Assistant General Counsel, JPMorgan Chase & Co. Ms. Ditullio has been with JPMorgan Chase & Co. (formerly Bank One Corporation) since 1990. |

Anthony Geron (1971), Assistant Secretary (2018) | Vice President and Assistant General Counsel, JPMorgan Chase & Co. since September 2018; Lead Director and Counsel, AXA Equitable Life Insurance Company from 2015 to 2018 and Senior Director and Counsel, AXA Equitable Life Insurance Company from 2014 to 2015. |