UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21296

BARON SELECT FUNDS

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Select Funds

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

Baron Partners Fund

Baron Focused Growth Fund

Baron International Growth Fund

Baron Real Estate Fund

Baron Emerging Markets Fund

Baron Global Advantage Fund

Baron Real Estate Income Fund

Baron Health Care Fund

Baron FinTech Fund

Baron New Asia Fund

Baron Technology Fund

Baron Funds®

Baron Select Funds

Annual Financial Report

DEAR BARON SELECT FUNDS SHAREHOLDER:

In this report, you will find audited financial statements for Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron New Asia Fund, and Baron Technology Fund (the Funds) for the year ended December 31, 2023. The U.S. Securities and Exchange Commission (the SEC) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer February 26, 2024 | | Linda S. Martinson Chairman, President and Chief Operating Officer February 26, 2024 | | Peggy Wong Chief Financial Officer February 26, 2024 |

This Annual Financial Report is for the Baron Select Funds, which currently has 12 series: Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund, Baron Real Estate Fund, Baron Emerging Markets Fund, Baron Global Advantage Fund, Baron Real Estate Income Fund, Baron Health Care Fund, Baron FinTech Fund, Baron WealthBuilder Fund, Baron New Asia Fund, and Baron Technology Fund. Baron WealthBuilder Fund is included in a separate Financial Report. If you are interested in Baron WealthBuilder Fund or Baron Investment Funds Trust, which contains the Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund, Baron Fifth Avenue Growth Fund, Baron Discovery Fund, and Baron Durable Advantage Fund, please visit the Funds’ website at baronfunds.com or contact us at 1-800-99BARON.

The Funds’ Proxy Voting Policy is available without charge and can be found on the Funds’ website at baronfunds.com, by clicking on the “Regulatory Documents” link at the bottom left corner of the homepage or by calling 1-800-99BARON and on the SEC’s website at sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete Portfolios of Investments with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at sec.gov. Portfolios of Investments current to the most recent quarter are also available on the Funds’ website.

Some of the comments contained in this report are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan”, and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (BAMCO or the Adviser) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call, write or go to baronfunds.com for a prospectus or summary prospectus. Read them carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of the Funds, unless accompanied or preceded by the Funds’ current prospectus or summary prospectus.

| | |

| Baron Partners Fund (Unaudited) | | December 31, 2023 |

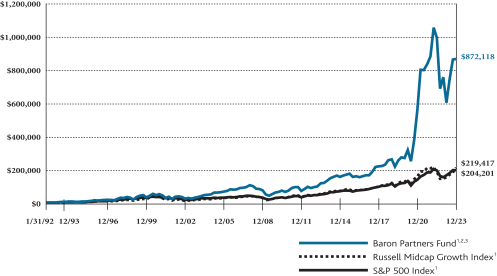

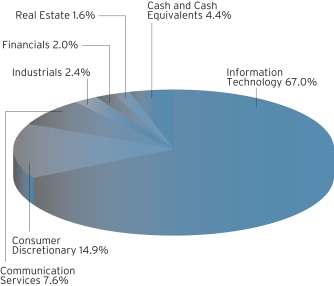

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON PARTNERS FUND (RETAIL SHARES)

IN RELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(January 31,

1992) | |

Baron Partners Fund — Retail Shares1,2,3 | | | 43.10% | | | | 2.60% | | | | 31.23% | | | | 18.80% | | | | 15.03% | |

Baron Partners Fund — Institutional Shares1,2,3,4 | | | 43.47% | | | | 2.86% | | | | 31.57% | | | | 19.11% | | | | 15.17% | |

Baron Partners Fund — R6 Shares1,2,3,4 | | | 43.46% | | | | 2.86% | | | | 31.57% | | | | 19.11% | | | | 15.16% | |

Russell Midcap Growth Index1 | | | 25.87% | | | | 1.31% | | | | 13.81% | | | | 10.57% | | | | 9.91% | |

S&P 500 Index1 | | | 26.29% | | | | 10.00% | | | | 15.69% | | | | 12.03% | | | | 10.16% | |

| 1 | The Russell Midcap® Growth Index measures the performance of medium-sized U.S. companies that are classified as growth. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell Midcap® Growth Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 20% performance fee after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was April 30, 2003. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

2

| | |

| December 31, 2023 (Unaudited) | | Baron Partners Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of Total

Investments* | |

Tesla, Inc. | | | 38.1% | |

Space Exploration Technologies Corp. | | | 9.9% | |

CoStar Group, Inc. | | | 8.1% | |

Arch Capital Group Ltd. | | | 6.1% | |

IDEXX Laboratories, Inc. | | | 5.6% | |

Hyatt Hotels Corporation | | | 5.5% | |

FactSet Research Systems Inc. | | | 4.4% | |

The Charles Schwab Corp. | | | 4.3% | |

Gartner, Inc. | | | 4.0% | |

Vail Resorts, Inc. | | | 3.2% | |

| |

| | | | 89.2% | |

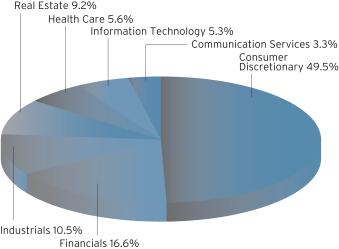

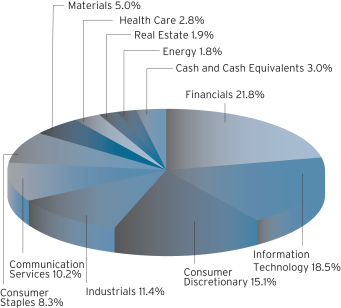

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Partners Fund1 increased 43.10%, outperforming the Russell Midcap Growth Index, which returned 25.87%.

Baron Partners Fund invests primarily in U.S. companies of any size with, in our view, significant long-term growth potential. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. The Fund is non-diversified, so its top 10 holdings are expected to comprise a significant percentage of the portfolio, and the Fund uses leverage, both of which increase risk. In addition, the Fund may be subject to risks associated with potentially being concentrated in the securities of a single issuer or a small number of issuers,

including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

As of December 31, 2023, 43.5% of the Fund’s net assets are invested in Tesla, Inc. stock. Therefore, the Fund is exposed to the risk that were Tesla stock to lose significant value, which could happen rapidly, the Fund’s performance would be adversely affected. Before investing in the Fund, investors should carefully consider publicly available information about Tesla. There can be no assurances that the Fund will maintain its investment in Tesla, as the Adviser maintains discretion to actively manage the Fund’s portfolio, including by decreasing or liquidating the Fund’s investment in Tesla at any time. However, for so long as the Fund maintains a substantial investment in Tesla, the Fund’s performance will be significantly affected by the performance of Tesla stock and any decline in the price of Tesla stock would materially and adversely affect your investment in the Fund.

2023 came as a welcome relief to equity investors following a difficult 2022, with most major market indexes recapturing all their losses from the prior year. Brushing aside macro concerns including the U.S. Federal Reserve’s (the Fed) continuation of its historical tightening cycle, inflation data — although falling — that hovered above the Fed’s target, the recession debate, and geopolitical uncertainties, the markets rallied through the first half of 2023. After a third-quarter dip driven largely by concerns that rates would stay “higher for longer,” lower inflation data and a shift in focus to rate cuts prompted a bull run in the last two months of the year.

Consumer Discretionary, Industrials, and Health Care were the top contributors. There were no sectors that meaningfully detracted.

The top contributor was electric vehicle company Tesla, Inc. Despite slashing sticker prices, margins remained healthy, allowing robust investments in growth. 2023 also represented a record year for the Energy division’s revenues and margins. While Tesla continues to operate in a complex environment, we are getting closer to the release of its next-generation vehicle platform, which we believe can be a milestone for the industry.

The top detractor was online brokerage firm The Charles Schwab Corp. Shares fell following the March bankruptcy of Silicon Valley Bank (SVB). Despite running a much different business than SVB, Schwab faced deposit pressure through cash sorting in the wake of the collapse. We retain long-term conviction. Schwab continued to gain assets, and anticipated rate cuts in 2024 should help Schwab pay off its short-term funds. Long term, we believe Schwab has powerful asset-gathering momentum and scale and a reinvestment tailwind from maturing securities being invested at higher rates. We are encouraged by the firm’s exceptional client loyalty, robust organic growth, and industry-leading operating expense per client assets.

We invest for the long term in businesses we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

3

| | |

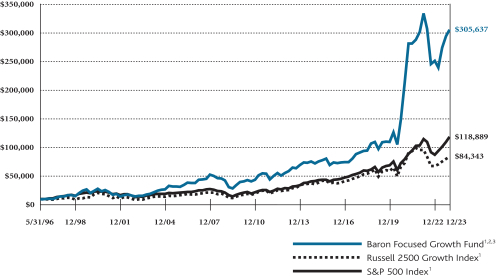

| Baron Focused Growth Fund (Unaudited) | | December 31, 2023 |

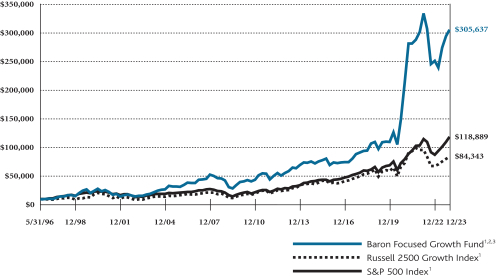

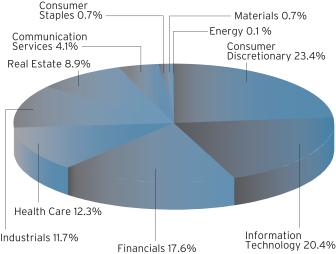

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FOCUSED GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 2500 GROWTH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(May 31,

1996) | |

Baron Focused Growth Fund — Retail Shares1,2,3 | | | 27.40% | | | | 2.77% | | | | 25.69% | | | | 15.25% | | | | 13.20% | |

Baron Focused Growth Fund — Institutional Shares1,2,3,4 | | | 27.73% | | | | 3.05% | | | | 26.01% | | | | 15.54% | | | | 13.35% | |

Baron Focused Growth Fund — R6 Shares1,2,3,4 | | | 27.75% | | | | 3.05% | | | | 26.01% | | | | 15.55% | | | | 13.35% | |

Russell 2500 Growth Index1 | | | 18.93% | | | | (2.68)% | | | | 11.43% | | | | 8.78% | | | | 8.04% | |

S&P 500 Index1 | | | 26.29% | | | | 10.00% | | | | 15.69% | | | | 12.03% | | | | 9.39% | |

| 1 | The Russell 2500™ Growth Index measures the performance of small to medium-sized companies that are classified as growth. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell 2500™ Growth Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 15% performance fee through 2003 after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fees for the years the predecessor partnership charged a performance fee, the returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for periods before the Fund’s registration statement was effective, which was June 30, 2008. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to regulated investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

4

| | |

| December 31, 2023 (Unaudited) | | Baron Focused Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Tesla, Inc. | | | 11.4% | |

Space Exploration Technologies Corp. | | | 9.4% | |

Arch Capital Group Ltd. | | | 5.0% | |

Hyatt Hotels Corporation | | | 4.9% | |

FactSet Research Systems Inc. | | | 4.5% | |

Vail Resorts, Inc. | | | 4.3% | |

Guidewire Software, Inc. | | | 4.3% | |

CoStar Group, Inc. | | | 4.2% | |

MSCI Inc. | | | 3.8% | |

Red Rock Resorts, Inc. | | | 3.8% | |

| |

| | | | 55.6% | |

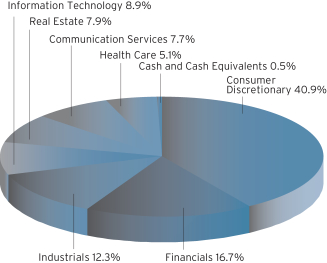

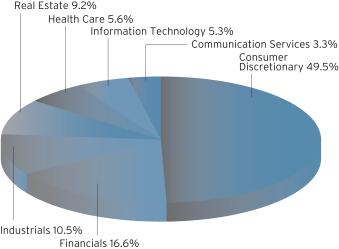

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Focused Growth Fund1 returned 27.40%, outperforming the Russell 2500 Growth Index, which increased 18.93%.

Baron Focused Growth Fund invests in a non-diversified portfolio of companies that we believe are well capitalized and have exceptional management, significant growth potential, and durable barriers to competition. We believe our process can identify investment opportunities that are attractively priced relative to future prospects. In addition, the Fund may be subject to risks associated with potentially being concentrated in the securities of a single issuer or a small number of issuers, including in a particular industry. Of course, there can be no assurance that we will be successful in achieving the Fund’s investment goals.

2023 came as a welcome relief to equity investors following a difficult 2022, with most major market indexes recapturing all their losses from the prior year. Brushing aside macro concerns including the U.S. Federal Reserve’s (the Fed) continuation of its historical tightening cycle, inflation data — although falling — that hovered above the Fed’s target, the recession debate, and geopolitical uncertainties, the markets rallied through the first half of 2023. After a third-quarter dip driven largely by concerns that rates would stay “higher for longer,” lower inflation data and a shift in focus to rate cuts prompted a bull run in the last two months of the year.

Consumer Discretionary, Information Technology, and Industrials were the top contributors. There were no sectors that meaningfully detracted.

The top contributor was electric vehicle company Tesla, Inc. Despite slashing sticker prices, margins remained healthy, allowing robust investments in growth. 2023 also represented a record year for the Energy division’s revenues and margins. Though Tesla continues to operate in a complex environment, we are getting closer to the release of its next-generation vehicle platform, which we believe can be a milestone for the industry.

Timeshare company Marriott Vacations Worldwide Corporation was the top detractor. Share price weakness was driven by soft sales of timeshare units due to higher interest rates and the slow ramp of a new product offering. In addition, a default rate that was higher than the company had anticipated forced it to take a charge to increase its reserves, pressuring earnings and cash flow. We exited our position.

We invest for the long term in businesses that we believe will benefit from secular growth trends, durable competitive advantages, and best-in-class management. We remain optimistic that this approach will generate strong long-term performance regardless of the economic climate.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

5

| | |

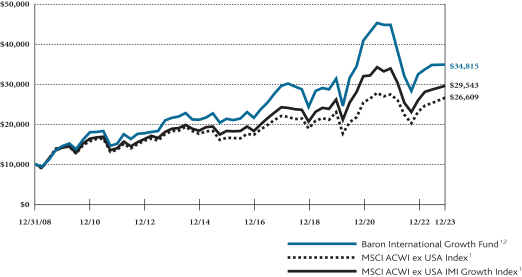

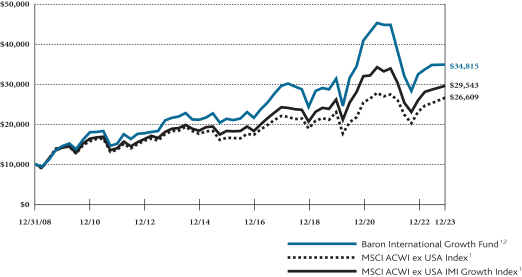

| Baron International Growth Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON INTERNATIONAL GROWTH FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWIEX USA INDEXANDTHE MSCI ACWIEX USA IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2008)^ | |

Baron International Growth Fund — Retail Shares1,2 | | | 7.33% | | | | (5.15)% | | | | 7.53% | | | | 4.92% | | | | 8.67% | |

Baron International Growth Fund — Institutional Shares1,2,3 | | | 7.60% | | | | (4.91)% | | | | 7.79% | | | | 5.18% | | | | 8.94% | |

Baron International Growth Fund — R6 Shares1,2,3 | | | 7.61% | | | | (4.90)% | | | | 7.79% | | | | 5.18% | | | | 8.94% | |

MSCI ACWI ex USA Index1 | | | 15.62% | | | | 1.55% | | | | 7.08% | | | | 3.83% | | | | 6.74% | |

MSCI ACWI ex USA IMI Growth Index1 | | | 14.04% | | | | (2.58)% | | | | 7.52% | | | | 4.60% | | | | 7.49% | |

| ^ | Commencement of investment operations was January 2, 2009. |

| 1 | The MSCI ACWI ex USA Index Net (USD) is designed to measure the equity market performance of large-and-mid cap securities across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries. The MSCI ACWI ex USA IMI Growth Index Net (USD) is designed to measure the performance of large-, mid- and small-cap growth securities exhibiting overall growth style characteristics across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

6

| | |

| December 31, 2023 (Unaudited) | | Baron International Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Linde plc | | | 2.8% | |

eDreams ODIGEO SA | | | 2.6% | |

Constellation Software Inc. | | | 2.4% | |

argenx SE | | | 2.3% | |

Arch Capital Group Ltd. | | | 2.1% | |

AstraZeneca PLC | | | 2.1% | |

Taiwan Semiconductor Manufacturing Company Limited | | | 2.0% | |

Industria de Diseno Textil, S.A. | | | 1.9% | |

InPost S.A. | | | 1.9% | |

BNP Paribas S.A. | | | 1.7% | |

| |

| | | | 21.9% | |

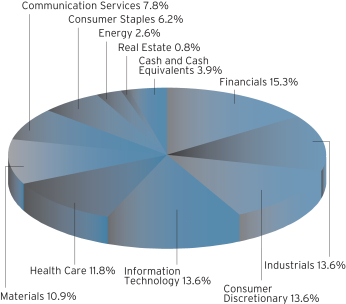

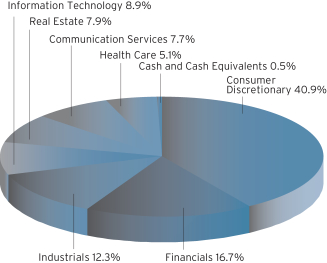

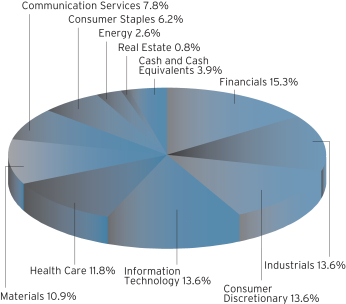

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron International Growth Fund1 increased 7.33%, underperforming the MSCI ACWI ex USA Index, which gained 15.62%.

Baron International Growth Fund is a diversified fund that invests for the long term primarily in securities of non-U.S. growth companies. The Fund expects to diversify among developed and developing countries throughout the world, although total exposure to developing countries will not exceed 35%. The Fund may purchase securities of companies of any size. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

For much of 2023, international equities were fairly volatile as the market reacted to macroeconomic factors including inflation, central bank rate tightening programs, geopolitical unrest, and continued U.S. dollar strength. In the last two months, that changed abruptly after the U.S. Federal Reserve surprised markets by communicating that rate cuts would likely occur sooner and in larger magnitude than expected. While international markets cheered the news, we believe this event also foreshadows the end of the 14-year U.S. dollar bull market and will usher in a cycle of relative outperformance by non-U.S. equities.

Japan, Spain, and India contributed the most. Top detractors were China, Switzerland, and the U.K.

Consumer Discretionary, Financials, and Industrials contributed the most. Energy was a slight detractor.

The top contributor was eDreams ODIGEO SA, a Spanish online subscription-based travel agency. eDreams continued to execute on its Prime subscription shift and came closer toward fiscal year 2025 targets. It has improved its positioning with 5.1 million subscribers and demonstration of competitive strength in Europe. Given strong customer acquisition, an impressive pipeline of new products, and plans for the attractive hotel market, we retain conviction.

Meyer Burger Technology AG, a Swiss solar module supplier, was the top detractor. Shares declined on weak revenue and bottom-line results due to challenging European markets and delays in regulatory support, which prompted the company to halt expansion of its German solar cell factory and move production to the U.S. We retain conviction in Meyer Burger as a long-term beneficiary of greater localization of energy supply chains and reduced reliance on China. Meyer Burger’s next-generation solar modules are more efficient, resulting in premium prices and much higher margins. The company is seeing strong order momentum as it ramps production at its U.S facilities, supported by long-term off-take agreements with key customers.

Developed international markets historically perform favorably in an environment of declining rates and appreciating non-U.S. dollar currencies, as peaking interest rates presage a transition towards re-acceleration of the global economy and such markets tend to be more economically and interest-rate sensitive. We also expect the emerging markets in general, and particularly economies and companies most geared to improvement in domestic growth, consumption, and investment, to benefit from this inflection point in financial conditions and capital flows. We anticipate a sustainable period of enhanced earnings growth potential in most international jurisdictions — essentially a mean reversion or mirror image of the past several years.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

7

| | |

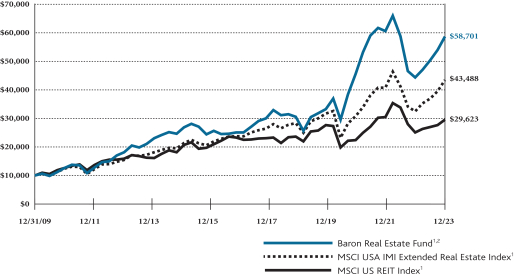

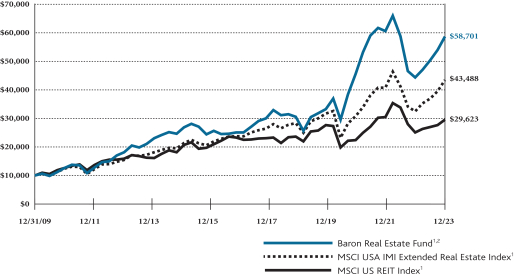

| Baron Real Estate Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI USA IMI EXTENDED REAL ESTATE INDEXAND MSCI US REIT INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2009)^ | |

Baron Real Estate Fund — Retail Shares1,2 | | | 24.70% | | | | 3.36% | | | | 18.01% | | | | 9.78% | | | | 13.48% | |

Baron Real Estate Fund — Institutional Shares1,2 | | | 25.04% | | | | 3.62% | | | | 18.32% | | | | 10.06% | | | | 13.76% | |

Baron Real Estate Fund — R6 Shares1,2,3 | | | 25.04% | | | | 3.62% | | | | 18.32% | | | | 10.07% | | | | 13.77% | |

MSCI USA IMI Extended Real Estate Index1 | | | 23.09% | | | | 8.58% | | | | 11.68% | | | | 9.11% | | | | 11.07% | |

MSCI US REIT Index1 | | | 12.27% | | | | 5.89% | | | | 6.15% | | | | 6.29% | | | | 8.07% | |

| ^ | Commencement of investment operations was January 4, 2010. |

| 1 | The MSCI USA IMI Extended Real Estate Index Net (USD) is an unmanaged custom index calculated by MSCI for, and as requested by, BAMCO, Inc. The index includes real estate and real estate-related GICS classified securities. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The MSCI US REIT Index Net (USD) is designed to measure the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

8

| | |

| December 31, 2023 (Unaudited) | | Baron Real Estate Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Toll Brothers, Inc. | | | 9.9% | |

Prologis, Inc. | | | 5.7% | |

Equinix, Inc. | | | 5.5% | |

D.R. Horton, Inc. | | | 5.5% | |

Lennar Corporation | | | 5.3% | |

Blackstone Inc. | | | 5.1% | |

CoStar Group, Inc. | | | 4.4% | |

MGM Resorts International | | | 3.5% | |

Wynn Resorts, Limited | | | 3.4% | |

Las Vegas Sands Corporation | | | 2.8% | |

| |

| | | | 51.0% | |

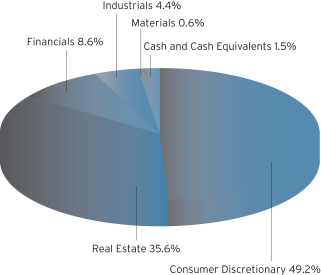

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Real Estate Fund1 increased 24.70%, outperforming the MSCI USA IMI Extended Real Estate Index (the Index), which returned 23.09%.

Baron Real Estate Fund is a diversified fund that under normal circumstances, invests 80% of its net assets in real estate and real

estate-related companies of all sizes, and in companies which, in the opinion of the Adviser, own significant real estate assets at the time of investment. The Fund seeks to invest in well-managed companies that we believe have significant long-term growth opportunities. The Fund’s investment universe extends beyond real estate investment trusts (REITs) to include hotels, senior housing operators, casino and gaming operators, tower operators, infrastructure-related companies and master limited partnerships, data centers, building products companies, real estate service companies, and real estate operating companies. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2023 came as a welcome relief after a brutal 2022, with the Index recapturing most of its losses from the prior year. Brushing aside concerns including the Federal Reserve’s (the Fed) historical tightening cycle, inflation data, the recession debate, and geopolitical uncertainties, the Index climbed through the first six months. After a third-quarter dip driven largely by worries around “higher for longer” rates, lower inflation, and a shift in focus to rate cuts prompted a bull run in the last two months. Real estate equities, which the market views as advantaged by lower rates, benefited. Recession fears were replaced by optimism that the Fed had orchestrated a “soft landing,” generating further cause for cheer.

Homebuilders & land developers, building products/services, and REITs contributed the most. There were no categories that meaningfully detracted.

Homebuilder Toll Brothers, Inc. was the top contributor, as resilient demand for new housing and market share gains drove robust operating and financial results. Performance was also boosted by a drop in mortgage rates toward year end, making home purchases more affordable. New home construction continues to lag demand following a decade of under-building. We think Toll Brothers is well positioned given its sizable land bank, healthy balance sheet, and market share gains.

Timeshare company Marriott Vacations Worldwide Corporation was the top detractor. Share price weakness was driven by soft sales due to higher interest rates and the slow ramp of a new product offering. In addition, a default rate higher than the company had anticipated forced it to take a charge to increase its reserves, pressuring earnings and cash flow. We exited our position.

Real estate has had to absorb a hurricane of headwinds in the last few years, including the pandemic, the Fed’s aggressive tightening campaign, a spike in mortgage rates, fears of a commercial real estate crisis, tighter credit availability, high inflation, and supply-chain challenges. Though we expect market volatility in the year ahead, we believe many of these challenges are finally subsiding. Public real estate generally enjoys favorable demand versus supply prospects, maintains conservatively capitalized balance sheets, and has access to credit.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

9

| | |

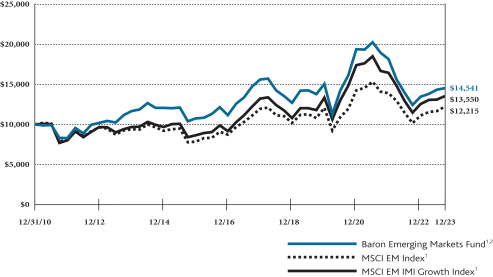

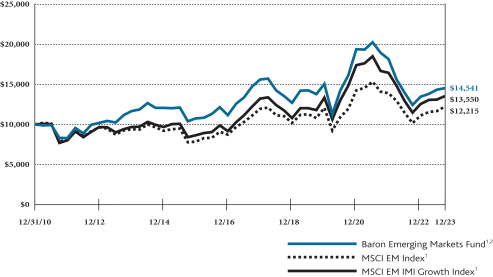

| Baron Emerging Markets Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON EMERGING MARKETS FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI EM INDEXANDTHE MSCI EM IMI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(December 31,

2010)^ | |

Baron Emerging Markets Fund — Retail Shares1, 2 | | | 7.95% | | | | (9.18)% | | | | 2.72% | | | | 2.21% | | | | 2.92% | |

Baron Emerging Markets Fund — Institutional Shares1, 2 | | | 8.29% | | | | (8.96)% | | | | 2.99% | | | | 2.48% | | | | 3.18% | |

Baron Emerging Markets Fund — R6 Shares1, 2, 3 | | | 8.27% | | | | (8.96)% | | | | 2.99% | | | | 2.48% | | | | 3.18% | |

MSCI EM Index1 | | | 9.83% | | | | (5.08)% | | | | 3.68% | | | | 2.66% | | | | 1.55% | |

MSCI EM IMI Growth Index1 | | | 8.09% | | | | (8.05)% | | | | 4.67% | | | | 3.44% | | | | 2.36% | |

| ^ | Commencement of investment operations was January 3, 2011. |

| 1 | The MSCI EM (Emerging Markets) Index Net (USD) is designed to measure equity market performance of large-and mid-cap securities across 24 Emerging Markets countries. The MSCI EM (Emerging Markets) IMI Growth Index Net (USD) is designed to measure equity market performance of large-, mid-, and small-cap securities exhibiting overall growth characteristics across 24 Emerging Markets countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2034 unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares. |

10

| | |

| December 31, 2023 (Unaudited) | | Baron Emerging Markets Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing Company Limited | | | 6.9% | |

Samsung Electronics Co., Ltd. | | | 5.3% | |

Tencent Holdings Limited | | | 3.7% | |

Bajaj Finance Limited | | | 2.5% | |

Suzano S.A. | | | 2.3% | |

Alibaba Group Holding Limited | | | 2.2% | |

HDFC Bank Limited | | | 2.2% | |

HD Korea Shipbuilding & Offshore Engineering Co., Ltd. | | | 2.0% | |

Bharti Airtel Limited | | | 2.0% | |

Bundl Technologies Private Limited | | | 1.9% | |

| |

| | | | 30.9% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Emerging Markets Fund1 returned 7.95%, underperforming the MSCI EM Index, which increased 9.83%.

Baron Emerging Markets Fund is a diversified fund that invests for the long term primarily in companies of any size with their principal business activities or trading markets in developing countries. The Fund may invest up to 20% of its net assets in developed and frontier countries. The Fund seeks to invest in companies with significant long-term growth prospects and purchase them at prices we believe to be favorable. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

For much of 2023, emerging market (EM) equities were volatile as the market reacted to macroeconomic factors including inflation, central bank rate tightening programs, geopolitical unrest, and continued U.S. dollar strength. In the last two months, that changed abruptly after the U.S. Federal Reserve surprised markets by communicating that rate cuts would likely occur sooner and in larger magnitude than expected. While emerging markets cheered the news, we believe this event also foreshadows the end of the 14-year U.S. dollar bull market and will usher in a cycle of outperformance by non-U.S. equities.

India, Taiwan, Korea, and Brazil were the top contributors. China and Hong Kong detracted the most.

Financials, Information Technology, and Industrials contributed the most. Consumer Discretionary and Health Care detracted the most.

Taiwan Semiconductor Manufacturing Company Limited was the top contributor. Shares rose due to investor expectations for a cyclical recovery heading into 2024 and significant demand for artifical intelligence chips. We retain conviction that Taiwan Semiconductor’s technological leadership, pricing power, and exposure to secular growth markets, including high-performance computing, automotive, 5G, and IoT, will allow it to sustain double-digit earnings growth over the next several years.

India-based Think & Learn Private Limited, the parent entity of Byju’s — the Learning App, was the top detractor as COVID-related tailwinds that benefited online/digital education slowed. Byju’s also announced that Deloitte Haskins & Sells had resigned as its auditor along with three investor-appointed directors. These material adverse events required us to adjust down our stake’s fair market value.

Recent EM sentiment have been masked by skepticism toward China. While inconsistent policy signals and geopolitical developments have been frustrating, we believe China’s policymakers have the tools and capacity to engineer a recovery, and we remain cautiously optimistic that incremental efforts will render current valuation and skepticism as too conservative.

We expect the emerging markets in general, and particularly those economies and companies most geared to the improvement in domestic growth, consumption, and investment that we expect to result from declining interest rates and appreciating currencies, to benefit most from this inflection point in financial conditions and capital flows. We anticipate a sustainable period of enhanced relative earnings growth potential in EM — essentially a mean reversion or mirror image of the past several years.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

11

| | |

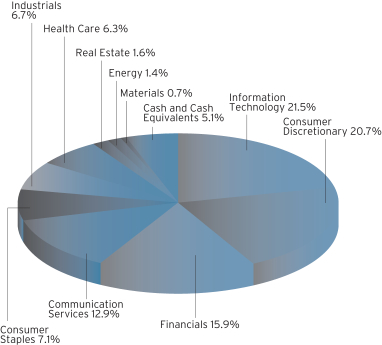

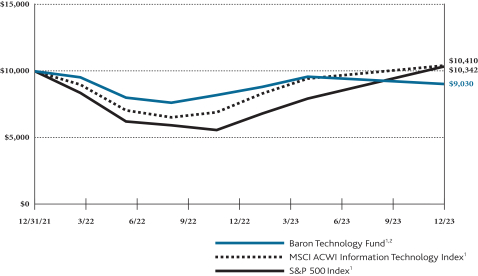

| Baron Global Advantage Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON GLOBAL ADVANTAGE FUND† (RETAIL SHARES)

INRELATIONTOTHE MSCI ACWI INDEXANDTHE MSCI ACWI GROWTH INDEX

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(April 30,

2012) | |

Baron Global Advantage Fund — Retail Shares1, 2 | | | 25.26% | | | | (15.23)% | | | | 9.60% | | | | 8.79% | | | | 10.30% | |

Baron Global Advantage Fund — Institutional Shares1, 2 | | | 25.56% | | | | (15.03)% | | | | 9.88% | | | | 9.04% | | | | 10.55% | |

Baron Global Advantage Fund — R6 Shares1, 2,3 | | | 25.59% | | | | (15.02)% | | | | 9.88% | | | | 9.04% | | | | 10.55% | |

MSCI ACWI Index1 | | | 22.20% | | | | 5.75% | | | | 11.72% | | | | 7.93% | | | | 9.11% | |

MSCI ACWI Growth Index1 | | | 33.22% | | | | 3.66% | | | | 14.58% | | | | 10.06% | | | | 10.85% | |

| † | The Fund’s, 5- and 10-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The MSCI ACWI Index Net (USD) measures the equity market performance of large- and mid-cap securities across developed and emerging markets, including the United States. The MSCI ACWI Growth Index Net (USD) captures large-and mid-cap securities exhibiting overall growth style characteristics across 23 Developed Markets (DM) countries and 24 Emerging Markets (EM) countries. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares. |

12

| | |

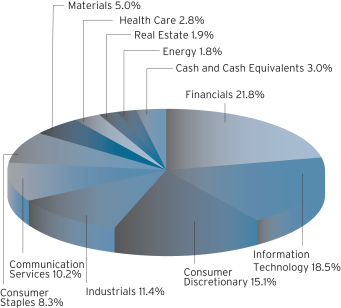

| December 31, 2023 (Unaudited) | | Baron Global Advantage Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Total Investments* | |

MercadoLibre, Inc. | | | 9.2% | |

NVIDIA Corporation | | | 9.2% | |

Shopify Inc. | | | 7.8% | |

Endava plc | | | 6.7% | |

Snowflake Inc. | | | 5.3% | |

Cloudflare, Inc. | | | 4.7% | |

Space Exploration Technologies Corp. | | | 4.6% | |

Tesla, Inc. | | | 4.4% | |

Coupang, Inc. | | | 4.3% | |

Bajaj Finance Limited | | | 4.0% | |

| |

| | | | 60.2% | |

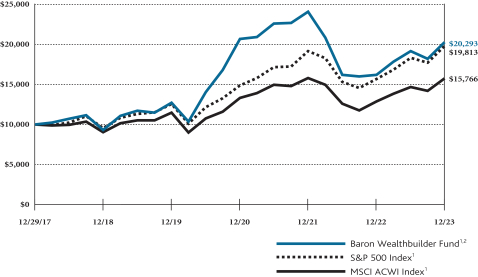

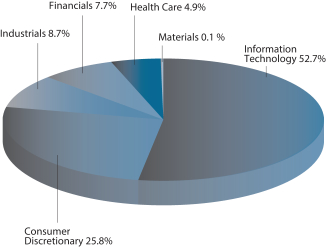

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of total investments)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Global Advantage Fund1 increased 25.26%, outperforming the MSCI ACWI Index (the Index), which increased 22.20%.

The Fund is a diversified fund that, under normal circumstances, invests primarily in equity securities of companies throughout the world, with capitalizations within the range of companies in the

MSCI ACWI Index. At all times, the Fund will have investments in at least three countries outside the U.S. Under normal conditions, at least 40% of net assets will be invested in companies outside the U.S. (at least 30% if non-U.S. market conditions are not favorable). The Adviser seeks to invest in businesses it believes have significant opportunities for growth, durable competitive advantages, exceptional management, and an attractive valuation. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2023 came as a welcome relief after a brutal 2022, with the Index recapturing all its losses from the prior year. Brushing aside macro concerns including the Federal Reserve’s (the Fed) continuation of its historical tightening cycle, inflation data — although falling — that hovered above the Fed’s target, the recession debate, and geopolitical uncertainties, the Index climbed through the first half of 2023. After a third-quarter dip driven largely by concerns that rates would stay “higher for longer,” lower inflation data and a shift in focus to rate cuts prompted a bull run in the last two months.

The U.S., Argentina, and Canada contributed the most. India and China detracted.

Information Technology, Consumer Discretionary, and Industrials contributed the most. Materials and Communication Services detracted.

Semiconductor company NVIDIA Corporation was the top contributor. NVIDIA is seeing the fruits of its nearly 20-year investment in artificial intelligence (AI) and accelerated computing, with the stock finishing 2023 up over 200%, driven by unprecedented demand acceleration for generative AI (GenAI). While the opportunity within the data center installed base is already large at roughly $1 trillion, the pace of innovation in AI in general, and GenAI in particular, should drive significant expansion in the addressable market.

India-based Think & Learn Private Limited, the parent entity of Byju’s — the Learning App, was the top detractor as COVID-related tailwinds that benefited online/digital education slowed. Byju’s also announced Deloitte Haskins & Sells had resigned as its auditor along with three directors. These material adverse events required us to adjust down our stake’s fair market value.

We live and invest in an uncertain world. The constant challenges we face are real and serious, with uncertain outcomes. History suggests that most will prove passing or manageable. The business of capital allocation is the business of taking risk, managing uncertainty, and leveraging long-term opportunities that those risks and uncertainties create. We are optimistic about the prospects of our holdings and continue to search for new ideas and opportunities while investing only when we believe a company is trading at an attractive price relative to intrinsic value.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

13

| | |

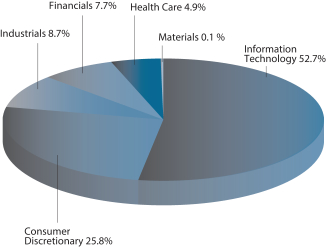

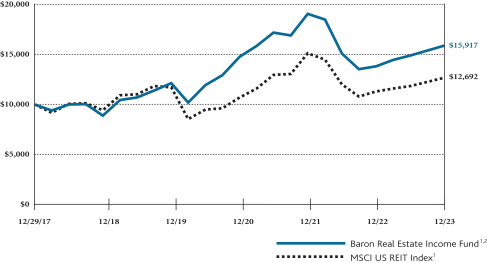

| Baron Real Estate Income Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON REAL ESTATE INCOME FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI US REIT INDEX

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception

December 29,

2017)^ | |

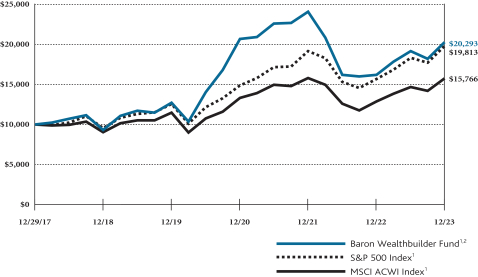

Baron Real Estate Income Fund — Retail Shares1,2 | | | 15.19% | | | | 2.49% | | | | 12.41% | | | | 8.05% | |

Baron Real Estate Income Fund — Institutional Shares1,2 | | | 15.51% | | | | 2.78% | | | | 12.64% | | | | 8.29% | |

Baron Real Estate Income Fund — R6 Shares1,2 | | | 15.44% | | | | 2.75% | | | | 12.61% | | | | 8.27% | |

MSCI US REIT Index1 | | | 12.27% | | | | 5.89% | | | | 6.15% | | | | 4.05% | |

| ^ | Commencement of investment operations was January 2, 2018. |

| 1 | The MSCI US REIT Index Net (USD) is designed to measure the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The index and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The index is unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

14

| | |

| December 31, 2023 (Unaudited) | | Baron Real Estate Income Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Prologis, Inc. | | | 10.5% | |

Equinix, Inc. | | | 9.3% | |

Welltower Inc. | | | 7.7% | |

American Tower Corporation | | | 6.2% | |

Extra Space Storage Inc. | | | 5.3% | |

AvalonBay Communities, Inc. | | | 4.9% | |

Digital Realty Trust, Inc. | | | 4.5% | |

American Homes 4 Rent | | | 4.3% | |

Equity Residential | | | 4.2% | |

Invitation Homes, Inc. | | | 4.1% | |

| |

| | | | 61.1% | |

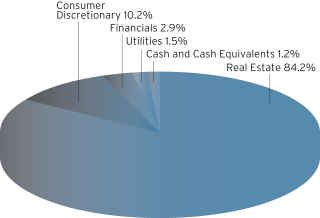

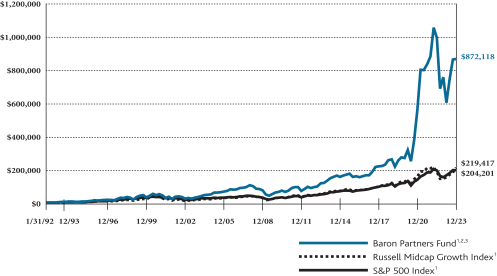

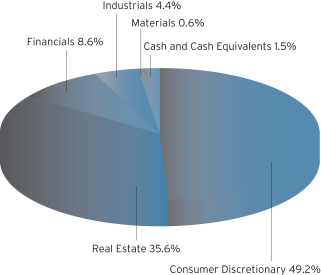

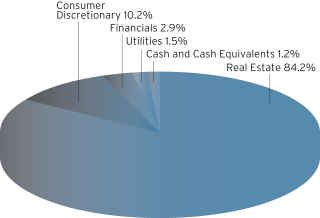

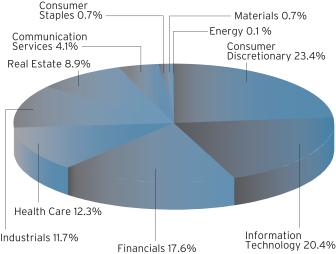

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Real Estate Income Fund1 increased 15.19%, outperforming the MSCI US REIT Index (the Index), which increased 12.27%.

Baron Real Estate Income Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in real estate income-producing securities and other real estate securities of any market capitalization, including common stocks and equity securities, debt and preferred securities, non-U.S. real estate income-producing securities, and any other real estate-

related yield securities. The Fund is likely to maintain a significant portion of its assets in real estate investment trusts that pool money to invest in properties (equity REITs) or mortgages (mortgage REITs), with revenue primarily consisting of rent from owned, income-producing real estate properties, and capital gains from the sale of such properties. The Fund generally invests in equity REITs. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2023 came as a welcome relief after a brutal 2022, with the Index recapturing some of its losses from the prior year. Brushing aside concerns including the Federal Reserve’s historical tightening cycle, inflation data, the recession debate, and geopolitical uncertainties, the Index climbed through the first six months. After a third-quarter dip driven largely by worries around “higher for longer” rates, lower inflation and a shift in focus to rate cuts prompted a bull run in the last two months. Real estate equities, which the market views as advantaged by lower rates, benefited. Recession fears were replaced by optimism that the Fed had orchestrated a “soft landing,” generating further cause for cheer.

Data center REITs, industrial REITs, and non-REIT real estate companies were the top contributors. Multi-family REITs and other REITs detracted.

Prologis, Inc., the world’s largest industrial warehouse REIT, was the top contributor, driven by consistently positive operating and financial results. In addition, the company provided guidance for 2024 as well as the medium term, both of which included growth targets that exceeded investor expectations. Industrial real estate has attractive fundamentals, with organic growth among the highest across all real estate asset types. Given Prologis’s assets, markets, management, and balance sheet, we believe it is positioned to benefit from this favorable backdrop.

Equity Residential, which operates 80,000 apartment units in high-barrier-to-entry coastal locations, was the top detractor due to weak performance in its West Coast markets combined with a slightly lowered full-year outlook for blended rent and net operating income growth. We retain conviction in Equity Residential given its premier asset base in sought-after locations, attractive valuation, lack of housing supply relative to demand, increasing costs limiting new supply, and well-regarded management team.

Real estate has had to absorb a hurricane of headwinds in the last few years, including the pandemic, the Fed’s aggressive tightening campaign, a spike in mortgage rates, fears of a commercial real estate crisis, tighter credit availability, high inflation, and supply- chain challenges. Though we expect market volatility in the year ahead, we believe many of these challenges are finally subsiding. Public real estate generally enjoys favorable demand versus supply prospects, maintains conservatively capitalized balance sheets, and has access to credit.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects the results of Retail Shares. |

15

| | |

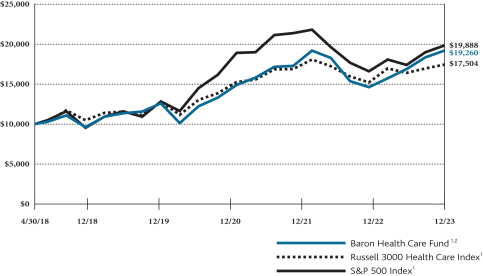

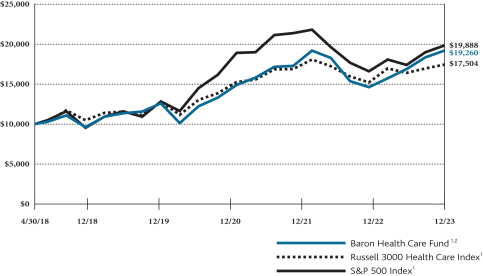

| Baron Health Care Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON HEALTH CARE FUND† (RETAIL SHARES)

INRELATIONTOTHE RUSSELL 3000 HEALTH CARE INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Since

Inception

April 30,

2018) | |

Baron Health Care Fund — Retail Shares1,2 | | | 6.16% | | | | 0.53% | | | | 15.16% | | | | 12.26% | |

Baron Health Care Fund — Institutional Shares1,2 | | | 6.37% | | | | 0.78% | | | | 15.43% | | | | 12.54% | |

Baron Health Care Fund — R6 Shares1,2 | | | 6.42% | | | | 0.79% | | | | 15.46% | | | | 12.54% | |

Russell 3000 Health Care Index1 | | | 2.87% | | | | 4.63% | | | | 10.79% | | | | 10.38% | |

S&P 500 Index1 | | | 26.29% | | | | 10.00% | | | | 15.69% | | | | 12.90% | |

| † | The Fund’s 3-year historical performance was impacted by gains from IPOs, and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| 1 | The Russell 3000® Health Care Index is an unmanaged index representative of companies involved in medical services or health care in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies as determined by total market capitalization. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the Russell 3000® Health Care Index and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

16

| | |

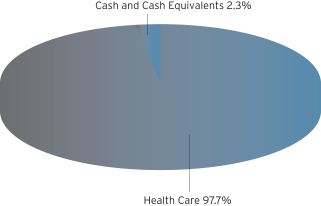

| December 31, 2023 (Unaudited) | | Baron Health Care Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Eli Lilly and Company | | | 9.6% | |

UnitedHealth Group Incorporated | | | 9.4% | |

Intuitive Surgical, Inc. | | | 4.8% | |

Merck & Co., Inc. | | | 4.5% | |

Thermo Fisher Scientific Inc. | | | 4.5% | |

Vertex Pharmaceuticals Incorporated | | | 4.4% | |

Boston Scientific Corporation | | | 4.0% | |

Rocket Pharmaceuticals, Inc. | | | 3.7% | |

argenx SE | | | 3.6% | |

Zoetis Inc. | | | 3.0% | |

| |

| | | | 51.6% | |

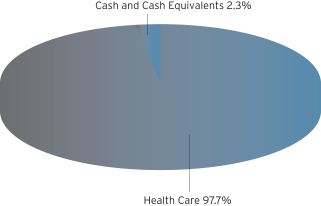

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron Health Care Fund1 increased 6.16%, outperforming the Russell 3000 Health Care Index, which increased 2.87%.

Baron Health Care Fund is a non-diversified fund that under normal circumstances, invests at least 80% of its net assets in equity securities of companies engaged in the research, development, production, sale, delivery, or distribution of products and services related to the health care industry. The Fund’s allocation among the sub-industries of the Health Care sector will vary depending upon the relative potential the Fund

sees within each area. The Adviser seeks to invest in businesses it believes have significant growth opportunities, durable competitive advantages, exceptional management, and attractive valuations. The Fund may purchase securities of companies of any market capitalization and may invest in non-U.S. stocks. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

The big headline in health care was excitement surrounding a new category of weight loss drugs, sending shares of the manufacturers of these drugs surging. Elsewhere in the sector, headwinds continued to pressure performance. Managed care companies grappled with political and regulatory scrutiny of the Medicare Advantage program and the pharmacy benefit management industry, less favorable Medicare Advantage rates for 2024, and an uptick in medical costs. The challenging funding environment for biotechnology continued. Life sciences tools companies faced a pullback in pharmaceutical spending, less biotechnology funding, a slowdown in China, and inventory destocking. From a sector perspective, Health Care was simply out of favor as investors eschewed “defensive” sectors to focus on large-cap growth stocks, especially those seen as potential beneficiaries of artificial intelligence.

Pharmaceuticals, biotechnology, and health care equipment contributed the most. Managed health care, health care services, and life sciences tools & services detracted.

Eli Lilly and Company was the top contributor. Performance was strong for much of 2023 due to consistent financial growth and the constant drumbeat surrounding the obesity and diabetes franchises that potentially could reach $100 billion a year in revenue. Current limitations on growth have been the manufacturer’s capacity to produce enough to meet demand and insurance coverage questions. We retain conviction given opportunities in Alzheimer’s and obesity and continued strong operational execution.

Ascendis Pharma A/S, which makes long-acting versions of already de-risked drugs, was the top detractor. In May 2023, the FDA delayed approval of Ascendis’ hypoparathyroidism drug, citing issues with the drug’s release from the device’s needle and the resulting impact on the amount injected. The total dose has implications for the potential safety profile of this drug particularly as it relates to bone composition. We exited our position.

The Health Care sector has many favorable long-term attributes. Valuations are attractive, balance sheets are generally solid, and major advances in science, medicine, and technology are transforming the industry. We focus on identifying high-quality, competitively advantaged companies with great management teams that we believe will benefit from the secular trends we have identified.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

17

| | |

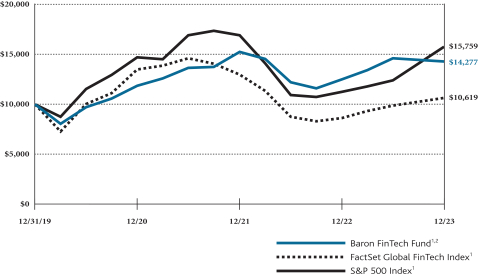

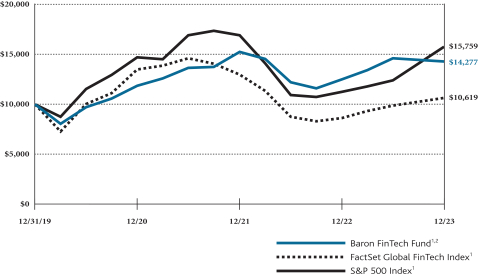

| Baron FinTech Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON FINTECH FUND† (RETAIL SHARES)

INRELATIONTOTHE FACTSET GLOBAL FINTECH INDEXANDTHE S&P 500 INDEX

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Three

Years | | | Since

Inception

December 31,

2019^ | |

Baron FinTech Fund — Retail Shares1,2 | | | 26.96% | | | | (0.95)% | | | | 9.31% | |

Baron FinTech Fund — Institutional Shares1,2 | | | 27.31% | | | | (0.69)% | | | | 9.58% | |

Baron FinTech Fund — R6 Shares1,2 | | | 27.31% | | | | (0.71)% | | | | 9.58% | |

FactSet Global FinTech Index1 | | | 23.34% | | | | (7.64)% | | | | 1.51% | |

S&P 500 Index1 | | | 26.29% | | | | 10.00% | | | | 12.04% | |

| † | The Fund’s 3-year historical performance was impacted by gains from IPOs and there is no guarantee that these results can be repeated or that the Fund’s level of participation in IPOs will be the same in the future. |

| ^ | Commencement of investment operations was January 2, 2020. |

| 1 | The FactSet Global FinTech Index™ is an unmanaged and equal-weighted index that measures the equity market performance of companies engaged in Financial Technologies, primarily in the areas of software and consulting, data, and analytics, digital payment processing, money transfer, and payment transaction-related hardware across 30 developed and emerging markets. The S&P 500 Index measures the performance of 500 widely held large-cap U.S. companies. The Fund includes reinvestment of dividends, net of foreign withholding taxes, while the FactSet Global Fintech Index™ and S&P 500 Index include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. As of February 3, 2023, the Fund has changed its primary benchmark from the S&P 500 Index to the FactSet Global FinTech Index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

18

| | |

| December 31, 2023 (Unaudited) | | Baron FinTech Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Intuit Inc. | | | 5.2% | |

Visa Inc. | | | 4.9% | |

S&P Global Inc. | | | 4.9% | |

Mastercard Incorporated | | | 4.8% | |

Fair Isaac Corporation | | | 4.3% | |

MercadoLibre, Inc. | | | 3.7% | |

Apollo Global Management, Inc. | | | 3.6% | |

The Progressive Corporation | | | 3.5% | |

MSCI Inc. | | | 3.1% | |

Fiserv, Inc. | | | 3.0% | |

| |

| | | | 41.0% | |

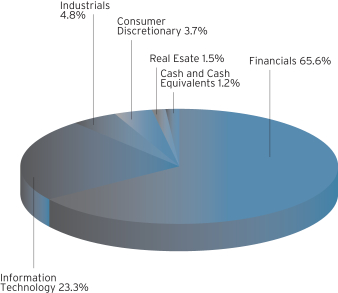

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron FinTech Fund1 increased 26.96%, outperforming the FactSet Global FinTech Index, which increased 23.34%.2

Baron FinTech Fund is a non-diversified fund that invests in companies of any market capitalization that develop or use innovative technologies related in a significant way to financial services. The Fund invests principally in U.S. securities but may invest up to 25% in non-U.S. securities. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

2023 came as a welcome relief to equity investors following a difficult 2022, with most major market indexes recapturing all their losses from the prior year. Brushing aside macro concerns including the Federal Reserve’s (the Fed) continuation of its historical tightening cycle, inflation data — although falling — that hovered above the Fed’s target, the recession debate, and geopolitical uncertainties, the markets rallied through the first half of 2023. After a third-quarter dip driven largely by concerns that rates would stay “higher for longer,” lower inflation data and a shift in focus to rate cuts prompted a bull run in the last two months of the year.

Financials, Information Technology, and Consumer Discretionary contributed the most. There were no sectors that meaningfully detracted.

Fair Isaac Corporation, a data and analytics company focused on predicting consumer behavior, contributed the most. The company reported good earnings results throughout 2023 and gave preliminary fiscal year 2024 guidance that looks quite conservative, especially given that pricing initiatives in the Scores business remain on track. CEO Will Lansing expressed confidence that the business can perform relatively well across different economic backdrops and optimism about momentum in the software business. We retain conviction, as we believe that Fair Isaac will be a steady earnings compounder, which should drive solid returns for the stock over a multi-year period.

The top detractor was online brokerage firm The Charles Schwab Corp. Shares fell following the March bankruptcy of Silicon Valley Bank (SVB). Despite running a much different business than SVB, Schwab faced deposit pressure through cash sorting in the wake of the collapse. We retain long-term conviction. Schwab continued to gain assets, and anticipated rate cuts in 2024 should help Schwab pay off its short-term funds. Long term, we believe Schwab has powerful asset-gathering momentum and scale and a reinvestment tailwind from maturing securities being invested at higher rates. We are encouraged by the firm’s exceptional client loyalty, robust organic growth, and industry-leading operating expense per client assets.

We have curated a diversified portfolio of fintech businesses to reduce the exposure to any single economic outcome. The portfolio is balanced across seven themes, each of which is influenced by idiosyncratic factors. We include a mix of Leaders and Challengers, with the relative mix driven by top-down risk considerations and bottom-up opportunities. We believe fintech remains in the early innings of growth as incumbent financial institutions still have a long digitization journey ahead and younger consumers continue favoring digital solutions.

| * | Individual weights may not sum to 100% or displayed total due to rounding. |

| † | Sector levels are provided from the Global Industry Classification Standard (GICS), developed and exclusively owned by MSCI Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

| 1 | Performance information reflects results of the Retail Shares. |

| 2 | As of February 3, 2023, the Fund has changed its primary benchmark from the S&P 500 Index to the FactSet Global FinTech Index. |

19

| | |

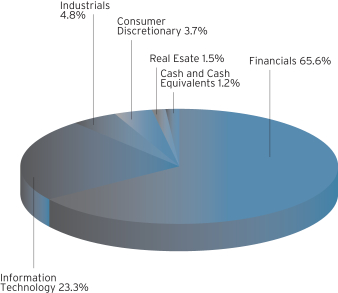

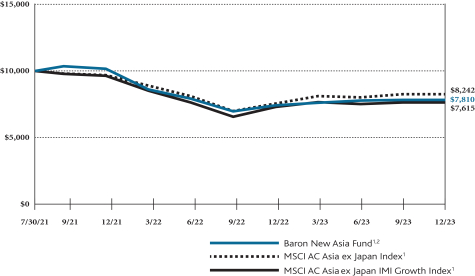

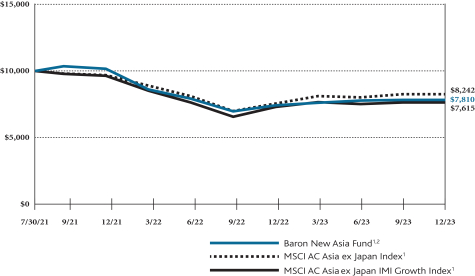

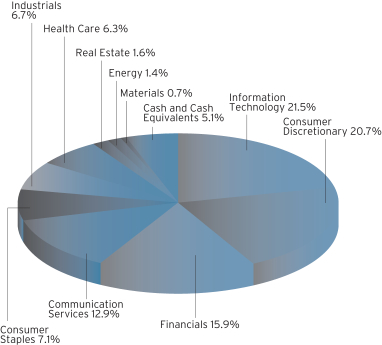

| Baron New Asia Fund (Unaudited) | | December 31, 2023 |

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENTIN BARON NEW ASIA FUND (RETAIL SHARES)

INRELATIONTOTHE MSCI AC ASIAEX JAPAN INDEXAND MSCI AC ASIAEX JAPAN IMI GROWTH INDEX

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2023 | |

| | | One

Year | | | Since

Inception

July 30,

2021 | |

Baron New Asia Fund — Retail Shares1,2 | | | 5.54% | | | | (9.72)% | |

Baron New Asia Fund — Institutional Shares1,2 | | | 5.79% | | | | (9.48)% | |

Baron New Asia Fund — R6 Shares1,2 | | | 5.65% | | | | (9.48)% | |

MSCI AC Asia ex Japan Index1 | | | 5.98% | | | | (7.69)% | |

MSCI AC Asia ex Japan IMI Growth Index1 | | | 4.37% | | | | (10.66)% | |

| 1 | The MSCI AC Asia ex Japan Index Net (USD) is designed to measure the performance of large- and mid-cap equity securities representation across 2 of 3 developed markets countries (excluding Japan) and 8 emerging markets countries in Asia. The MSCI AC Asia ex Japan IMI Growth Index Net (USD) is designed to measure the performance of large-, mid-, and small-cap securities exhibiting overall growth style characteristics across 2 of 3 developed markets countries (excluding Japan) and 8 emerging market countries in Asia. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The indexes and the Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. The indexes are unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser waives and/or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

20

| | |

| December 31, 2023 (Unaudited) | | Baron New Asia Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2023

| | | | |

| | | Percent of

Net Assets* | |

Taiwan Semiconductor Manufacturing Company Limited | | | 7.4% | |

Samsung Electronics Co., Ltd. | | | 5.7% | |

Bharti Airtel Limited | | | 4.4% | |

Tencent Holdings Limited | | | 4.0% | |

Zomato Limited | | | 3.8% | |

Bajaj Finance Limited | | | 3.3% | |

Trent Limited | | | 3.0% | |

Alibaba Group Holding Limited | | | 2.3% | |

Jio Financial Services Limited | | | 2.3% | |

Godrej Consumer Products Limited | | | 2.2% | |

| |

| | | | 38.5% | |

SECTOR BREAKDOWNASOF DECEMBER 31, 2023*†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the 12 months ended December 31, 2023, Baron New Asia Fund1 increased 5.54%, slightly underperforming the MSCI AC Asia ex Japan Index, which increased 5.98%.

Baron New Asia Fund is a diversified fund that invests primarily in companies of all sizes with significant growth potential located in Asia. The Fund emphasizes securities in developing Asian markets, including frontier markets. Under normal circumstances, the Fund invests 80% of its net assets in companies located in Asia. The Fund seeks to invest in companies with significant long-term growth prospects and purchase them at prices we believe to be favorable. Of course, there can be no guarantee that we will be successful in achieving the Fund’s investment goals.

For much of 2023, Asian emerging market (EM) equities were relatively volatile as the market reacted to macroeconomic factors including China’s slow recovery after the lifting of its COVID lockdown, central bank rate tightening programs, and continued U.S. dollar strength. After hitting a low for the year in late October, the market abruptly pivoted after the U.S. Federal Reserve signaled it would likely cut rates sooner and in larger magnitude than anticipated. While Asian EM cheered the news, we believe this event also foreshadows the end of the 14-year U.S. dollar bull market and will usher in a cycle of outperformance by non-U.S. equities.

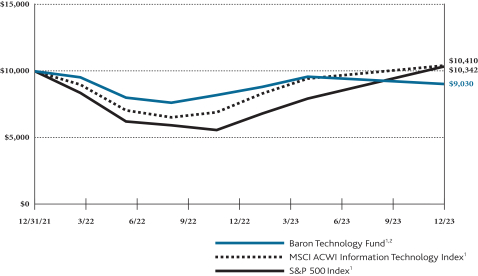

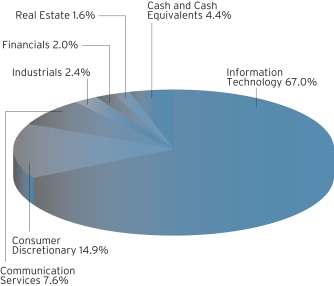

India, Taiwan, and Korea were the top contributors. China and Hong Kong detracted the most.