Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/14. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| | |

| Contents | |

| |

| Shareholder Letter | 1 |

| Annual Report | |

| Franklin Mutual Recovery Fund | 4 |

| Performance Summary | 8 |

| Your Fund’s Expenses | 11 |

| The Fund’s Repurchase Offers | 12 |

| Financial Highlights and | |

| Statement of Investments | 13 |

| Financial Statements | 22 |

| Notes to Financial Statements | 26 |

| Report of Independent Registered | |

| Public Accounting Firm | 39 |

| Tax Information | 40 |

| Board Members and Officers | 41 |

| Shareholder Information | 46 |

Shareholder Letter

Dear Shareholder:

Franklin Mutual Recovery Fund – Class A declined 1.66% (not including the sales charge) for the year ended March 31, 2015. Equity markets were generally positive during the 12-month period but experienced significant volatility with the U.S. market materially outperforming most global markets. Credit market returns were considerably below equity market returns as global central banks continued to hold interest rates down. The broad stock market, as measured by the Standard & Poor’s® 500 Index, gained 12.73% in the same period.1 The Bloomberg/EFFAS U.S. Government 3-5 Years Total Return Index posted a +1.49% total return.2 As managers and fellow shareholders, we were disappointed with the Fund’s absolute and relative results over the past 12 months. The Fund invested globally and substantially in credit as well as equity. Its performance reflected the different results from U.S. and international securities and lower returns in credit markets as well as specific portfolio investments.

During the year under review, U.S. stocks led the rise in global markets. Domestic equities were driven by modest economic growth and low interest rates as the U.S. economy continued to recover, albeit gradually. Outside the U.S., faltering growth raised questions about whether the recovery was truly global. The consistency of the modest U.S. recovery has helped make the U.S. stock market one of the best performing in the world over the past three years.

In Europe, growth stalled amid widespread concerns about deflation. As a result, the European Central Bank (ECB) embarked on a large and open-ended quantitative easing program in January. Weak economic growth and the expanding scope of monetary policy drove European interest rates and the euro lower; in February, five-year German government bonds were sold at a negative yield. We expect, and support, aggressive measures by the ECB to drive inflation to its 2% target.

In Asia, Chinese growth moderated and the Chinese market experienced some volatility, while Japan’s experiments with revitalizing its economy, driven by Prime Minister Shinzo Abe, appeared to have stalled.

The fourth quarter of 2014 and early 2015 were dominated by an extraordinary plunge in global oil prices, as they declined nearly by half. While other commodity prices fell, as might be expected in a period of slowing global growth, the energy price collapse was dramatic and swift, driven by both supply and demand factors. Supply was driven upward by the ongoing U.S. shale revolution, in which new “fracking” techniques have increased U.S. oil production by millions of barrels per day, and by the reduced strength of the Organization of the Petroleum Exporting Countries, which no longer seems to have the ability or desire to lower production to stabilize global prices. Reduced demand resulted from slowing growth, as well as longer term efforts to promote alternative fuels.

| | | | |

| Average Annual Total Return | |

| (including maximum initial sales charge) | |

| Class A | | 3/31/15 | |

| 1-Year | | -7.31 | % |

| 5-Year | + | 5.74 | % |

| 10-Year | + | 2.53 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

1. Source: Morningstar.

2. Source: Bloomberg LP, 3/31/15.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly

in an index, and an index is not representative of the Fund’s portfolio.

Not FDIC Insured | May Lose Value | No Bank Guarantee

franklintempleton.com Not part of the annual report | 1

FRANKLIN MUTUAL RECOVERY FUND

SHAREHOLDER LETTER

The Fund’s equity exposure remains concentrated in shares where we believe events are likely to unlock shareholder value. For example, one of the Fund’s largest equity positions is Symantec, a technology firm with roots in security software and storage.3 Despite these attractive businesses, the company has struggled to innovate and create new revenue enhancing products and to be disciplined in controlling costs. This underperformance has led to management turnover, with new Chief Executive Officer (CEO) Mike Brown being the fourth CEO in six years. Nevertheless, in our view Symantec remains full of potential, with a leading position in security software — one of the technology areas most in demand — and a strong position in storage solutions for the increasing avalanche of data generated globally every day. CEO Brown has announced a plan to separate the company into two focused firms, which we believe should accelerate innovation and create greater emphasis on costs and efficiency. The two separate firms could attract acquisition offers as well. As a result, we anticipate the new companies will be more valuable than Symantec is today.

Within the distressed debt universe, the opportunity set continued to be limited given the low interest rate environment and persistently low default rate among corporate bond issuers. Even so, the Fund was invested in and actively involved in the restructuring of the first lien debt of Caesars Entertainment Operating Company, the largest subsidiary of Caesars Entertainment Corporation, which was purchased by Apollo Management Holdings LP and Texas Pacific Group in a leveraged buyout.4 The gaming, entertainment and hospitality company has struggled for years under the weight of its overleveraged capital structure and was expected to restructure its debt through a bankruptcy filing. The positions held by the Fund are secured by the company’s assets and enjoy a parent guarantee that we feel offers us significant downside protection with the ability to earn compelling returns on a risk-adjusted basis. The Fund is a member of an ad hoc creditor group and is actively involved in the restructuring negotiations.

Further, given oil’s precipitous price decline since mid-summer, the likelihood of a longer U-shaped recovery, significant current and committed future capital expenditures, and the size of the energy and energy services sector, we are optimistic that new and compelling opportunities to deploy capital in the distressed securities asset class may materialize as 2015 progresses. The energy sector is the second-largest high yield issuer and is faced with declining profit margins, reduced cash flow from expiring commodity price hedges, and diminished liquidity as credit limits are automatically lowered in proportion to depressed asset values.

The Fund’s merger arbitrage activity has picked up along with merger and acquisition (M&A) volumes. The Fund has been able to take significant positions in attractive strategic deals like AT&T’s acquisition of DIRECTV.5 In addition, in several cases the Fund invested in a deal target at or prior to deal announcement and we decided to maintain the position. Examples were Reynolds American’s acquisition of Lorillard, where the Fund held Lorillard, or Gaming and Leisure Properties’ unsolicited offer for the real estate assets of Pinnacle Entertainment, which we held.6

Although the past 12 months resulted in underperformance for many value investors including the Fund, we will continue to focus on fundamental security analysis as part of our commitment to shareholders to achieve attractive long-term returns with a focus on containing risk. We thank you for your investment in the Fund.

3. Franklin Mutual Recovery Fund’s holdings are based on total net assets as of 3/31/15: Symantec 2.8%.

4. Franklin Mutual Recovery Fund’s holdings are based on total net assets as of 3/31/15: Caesars Entertainment Operating Company 1.9%.

5. Franklin Mutual Recovery Fund’s holdings are based on total net assets as of 3/31/15: AT&T (short) 1.5%, DIRECTV 3.1%.

6. Franklin Mutual Recovery Fund’s holdings are based on total net assets as of 3/31/15: Lorillard 2.4% and Pinnacle Entertainment 2.2%.

See www.franklintempletondatasources.com for additional data provider information.

2 | Not part of the annual report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

SHAREHOLDER LETTER

Looking forward, the Fund’s Board of Trustees recently approved proposals: (i) to reorganize the Fund into Franklin Mutual Quest Fund, an open-end investment company that is a series of the Franklin Mutual Series Funds, and (ii) to submit the reorganization proposal to the vote of the Fund’s shareholders. For more information about the proposed reorganization, please see the proxy statement, prospectus and related proxy voting card that accompany this report. These documents provide information about the proposal including the Board of Trustees’ recommendation that shareholders vote “FOR” the proposed reorganization. If the Fund’s shareholders approve the reorganization, the transaction is currently expected to be completed in August 2015.

Sincerely,

Peter A. Langerman

Chairman, President and Chief Executive Officer

Franklin Mutual Advisers, LLC

The letter reflects our analysis, opinions and portfolio holdings as of March 31, 2015, the end of the reporting period. The way we implement our

main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions.

These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of

every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment

manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future

results, these insights may help you understand our investment management philosophy.

The foregoing does not constitute an offer of any securities for sale. The Prospectus/Proxy Statement that accompanies this report contains important

information, and shareholders are urged to read it. Additional free copies of the Prospectus/Proxy Statement are available by calling 888-502-0385 or on the

Securities and Exchange Commission’s website at www.sec.gov.

franklintempleton.com

Not part of the annual report | 3

Annual Report

Franklin Mutual Recovery Fund

This annual report for Franklin Mutual Recovery Fund covers the fiscal year ended March 31, 2015.

Your Fund’s Goal and Main Investments

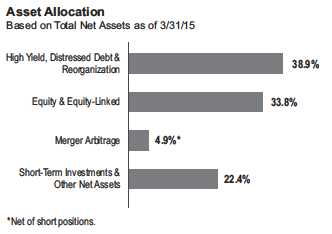

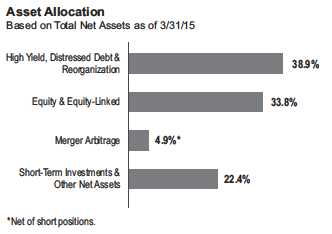

The Fund’s goal is capital appreciation. The Fund seeks to achieve superior risk-adjusted returns with a moderate correlation to U.S. equity markets by investing in distressed companies, merger arbitrage securities and special situation/undervalued securities. The Fund may take long and short positions, with the latter typically utilized in connection with the merger arbitrage strategy.

Performance Overview

For the 12 months under review, the Fund’s Class A shares had a -1.66% cumulative total return. In comparison, U.S. stocks, as measured by the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500®), produced a +12.73% total return for the same period.1

The Bloomberg/EFFAS U.S. Government 3-5 Years Total Return Index, which serves as a transparent benchmark for the U.S. government bond market, had a 12-month total return of +1.49%.2

The performance of the Fund relative to the Bloomberg index is used as the basis for calculating the performance adjustment to the base management fee paid to the Fund’s adviser. (Please refer to Notes 4a and 4b on pages 31 and 32 in the Notes to Financial Statements for additional information related to the performance adjustment, base management fee and related fee waivers or limits.) You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Economic and Market Overview

U.S. economic growth trends were generally encouraging during the 12-month period ended March 31, 2015, although economic expansion slowed in 2015’s first quarter. The economy grew for most of 2014, as greater spending by consumers, businesses, and state and local governments, partially offset the negative impacts of a wider trade deficit and lower federal defense spending. In the first quarter of 2015, factors including low energy prices, harsh weather, labor disruptions and U.S. dollar strength led export levels to fall and businesses and consumers to reduce spending. Manufacturing and non-manufacturing activities increased, and the unemployment rate declined to 5.5% at period-end from 6.6% in March 2014.3 Housing market data were largely positive for most of the period as new and existing home sales rose and mortgage rates declined. Home prices stayed higher than a year earlier. Retail sales moderated toward period-end despite job growth and generally lower gasoline prices. Inflation, as measured by the Consumer Price Index, remained subdued during the 12 months and fell sharply toward period-end amid lower energy and import prices.

1. Source: Morningstar.

2. Source: Bloomberg. Please see Notes to Financial Statements for more information about the performance-based management fee.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

3. Source: Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI

begins on page 16.

4 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

In October 2014, the U.S. Federal Reserve Board (Fed) ended its expansion of the bond buying program, based on its view that underlying economic strength could support ongoing progress in labor market conditions. The Fed maintained its existing policy of holding longer term securities at sizable levels. Although the Fed had repeatedly stated that it could be patient with regard to raising interest rates, toward period-end, the Fed removed the word “patient” from its monetary policy guidance. It added, however, that it might keep interest rates lower than what it viewed as normal.

Investor confidence grew as corporate profits remained healthy, the U.S. economy continued to grow and the Fed maintained its cautious tone on raising interest rates. The market endured sell-offs when many investors reacted to political instability in certain emerging markets, Greece’s debt negotiations and signs of relatively weak economic growth in Europe and Japan, as well as less robust growth in China. U.S. stocks rose overall for the 12 months under review as the S&P 500 and the Dow Jones Industrial Average reached all-time highs.

Global merger and acquisition (M&A) activity continued to increase during the 12 months under review. Based on announced, pending and completed deals at the end of the period, the total number of deals and total deal value increased compared to the prior year’s period. The notable increase in total value and activity was driven by a number of themes, including the increased popularity of tax inversion deals among U.S. corporations, in which they sought to move their headquarters abroad to reduce taxes, as well as consolidation within the telecommunications, pharmaceuticals and oil and gas industries.

North America continued to account for the largest percentage of global deal value and frequency overall. The region’s deal count and total deal value increased. Regionally, western Europe followed North America based on both measures, and its total deal count and total value grew. Many corporations being labeled as targets for U.S. tax inversion deals, along with positive developments throughout the peripheral European economies, helped drive the notable increase over prior year totals. Regionally, eastern Europe experienced the only declines in terms of total deal count and volume due to geopolitical tensions and uncertainties there throughout the period.

Of the global industry groups, pharmaceuticals was a top contributor to merger activity, driven by the influx of deals in Europe and the U.S., spawned from increased demand for specialty drugs and the rising costs associated with bringing new drugs to market. The telecommunications and media industries also contributed significantly to overall volumes, in large part due to AT&T’s announcement of a cash and stock offer to acquire DIRECTV amid the industry’s ongoing battle to provide more customers with bundled services. Compared with the prior year’s period, total values also showed meaningful increases in the oil and gas and real estate industries.

Opportunities in distressed debt investing remained limited. Highly leveraged institutions have benefited from the continued low interest rate environment, and the ease with which these companies have been able to borrow funds or refinance existing debt has resulted in a relatively low number of corporate bankruptcies. Most of our recent investments were in the higher end of the capital structure, with secured and senior securities, as well as refinancing deals. Our ability to invest anywhere in the capital structure allowed us to approach the space opportunistically, and we will continue to seek new investments that, in our opinion, provide favorable risk-reward profiles.

Investment Strategy

We follow a distinctive investment approach and can seek investments in distressed companies, merger arbitrage and special situations/undervalued securities. The availability of investments at attractive prices in each of these categories varies with market cycles. Therefore, the percentage of the Fund’s assets invested in each of these areas will fluctuate as we attempt to take advantage of opportunities afforded by cyclical changes. We employ rigorous, fundamental analysis to find investment opportunities. In choosing investments, we look at the market price of an individual company’s securities relative to our evaluation of its asset value based on such factors as book value, cash flow potential, long-term earnings and earnings multiples. We may invest in distressed companies if we believe the market overreacted to adverse developments or failed to appreciate positive changes.

| | | |

| Top 10 Sectors/Industries | | |

| Based on Equity Securities as of 3/31/15 | | |

| | % of Total | |

| | Net Assets | |

| Media | 7.4 | % |

| Oil, Gas & Consumable Fuels | 4.6 | % |

| Energy Equipment & Services | 4.1 | % |

| Insurance | 4.1 | % |

| Software | 2.8 | % |

| Tobacco | 2.4 | % |

| Wireless Telecommunication Services | 2.3 | % |

| Auto Components | 2.3 | % |

| Hotels, Restaurants & Leisure | 2.2 | % |

| Banks | 2.1 | % |

franklintempleton.com Annual Report | 5

FRANKLIN MUTUAL RECOVERY FUND

Manager’s Discussion

During the 12 months under review, top contributors to absolute performance included investments in pharmaceutical and medical device company Hospira, casino operator Pinnacle Entertainment and medical device firm Covidien.

Hospira specializes in injectable generic drugs and biosimilars, which are officially approved versions of products that are highly similar to other licensed biologic drugs. Hospira’s performance was driven by the early February 2014 announcement that Pfizer4 reached an agreement to acquire Hospira. Hospira offered Pfizer a strong leadership position in sterile injectables and an attractive high growth market in the generic segment, and positioned Pfizer as a top-tier biosimilars company with a strong pipeline and substantial room for cost synergies. Each of these factors played a part in our investment thesis and initially attracted us to making an investment in Hospira.

Pinnacle Entertainment owns and operates casinos and other entertainment properties across the U.S. The stock surged in mid-March 2014 after Gaming and Leisure Properties,4 a real estate investment trust previously spun off from Penn National Gaming,4 made an unsolicited bid to acquire Pinnacle’s real estate assets.

Ireland-based Covidien was acquired by its U.S.-based rival Medtronic during the period. Covidien shares began to rally in mid-October after Medtronic reaffirmed its commitment to the deal. Investors had been cautious about the deal after the U.S. Treasury issued a new set of rules in late September 2014 intended to limit cross-border M&A deals that could enable U.S.-based companies to lower tax expenses by re-domiciling in countries with lower corporate tax rates. In November, the U.S. Federal Trade Commission approved the company’s acquisition of Covidien with minimal conditions and the deal officially closed in late January 2015. The combination created one of the world’s largest and most diversified medical device companies. We exited our position before period-end.

During the period under review, detractors from Fund performance included offshore engineering firm DeepOcean Group Holding, cosmetics company Avon Products and offshore drilling company Transocean.

DeepOcean operates in the offshore energy industry and provides seabed mapping and subsea services, including installation, inspection, maintenance, repair and decommission-ing. The recent decline in energy prices led oil companies to reassess more expensive projects, such as deepwater drilling,

| | | |

| Top 10 Equity Holdings | | |

| 3/31/15 | | |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| DIRECTV | 3.1 | % |

| Media, U.S. | | |

| Symantec Corp. | 2.8 | % |

| Software, U.S. | | |

| DeepOcean Group Holding BV | 2.7 | % |

| Energy Equipment & Services, Netherlands | | |

| Lorillard Inc. | 2.4 | % |

| Tobacco, U.S. | | |

| Vodafone Group PLC | 2.3 | % |

| Wireless Telecommunication Services, U.K. | | |

| International Automotive Components Group | | |

| North America LLC | 2.3 | % |

| Auto Components, U.S. | | |

| Pinnacle Entertainment Inc. | 2.2 | % |

| Hotels, Restaurants & Leisure, U.S. | | |

| CIT Group Inc. | 2.1 | % |

| Banks, U.S. | | |

| Talisman Energy Inc. | 2.1 | % |

| Oil, Gas & Consumable Fuels, Canada | | |

| Tokyo Electron Ltd., ADR | 1.8 | % |

| Semiconductors & Semiconductor Equipment, Japan | | |

and capital spending plans. In response to weaker demand for its services, the company announced a reorganization in January with the intention of reducing direct and indirect costs.

Avon Products is a direct seller of beauty products. Approximately 80% of its sales are generated from emerging markets including Brazil, Mexico, Russia, Venezuela, Turkey, Argentina and the Philippines. Avon shares came under pressure during the period as unfavorable currency movements and weak economic growth in several of the company’s key markets hurt revenues and profits. In October, the stock declined further as the company reported a difficult third quarter and the chief executive officer indicated that 2016 revenue and margin goals might not be met. On a positive note, the company in December settled a U.S. government investigation under the Foreign Corrupt Practices Act. The settlement with the Department of Justice and the Securities and Exchange Commission, which included a $135 million fine, was in line with market expectations and eliminated a source of longstanding uncertainty.

Transocean is a Switzerland-headquartered company providing offshore contract drilling services. The company and industry have been contending with a glut of new deepwater rigs coinciding with declining demand from oil producers. Drastically

4. Not a Fund holding.

6 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

lower oil prices led companies to push back projects and slash capital spending, leaving a number of new rigs without contracts and increasing potential downtime between jobs for existing rigs. The growing fleet of uncontracted rigs at period-end portended, in our view, weak second-half results and a challenging start to 2015. On a positive note, the company started a Master Limited Partnership (MLP), Transocean Partners, which went public in September 2014. The MLP may provide Transocean with a way to generate cash by selling (dropping down) assets into Transocean Partners while still controlling the operations of those assets.

As fellow shareholders, we found recent relative performance disappointing, but it is not uncommon for our strategy to lag amid a strong equity market. Thank you for your interest and participation in Franklin Mutual Recovery Fund. We look forward to continuing to serve your investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Christian Correa has been a portfolio manager for Franklin Mutual Recovery Fund since 2004. He joined Franklin Mutual Series in 2003 and serves as Director of Research for Franklin Mutual Advisers. Previously, he covered merger arbitrage and special situations at Lehman Brothers Holdings Inc.

Shawn Tumulty has been a portfolio manager for Franklin Mutual Recovery Fund since 2005. He is the head of Franklin Mutual Series’ distressed securities team. Prior to joining Franklin Mutual Series, Mr. Tumulty was an analyst and portfolio manager at Kidder Peabody, Bankers Trust and Hamilton Partners Limited, where he focused on distressed debt investing.

Keith Luh has been a portfolio manager for Franklin Mutual Recovery Fund since 2009. He is also a research analyst specializing in distressed securities, merger and capital structure arbitrage, and event-driven situations. Prior to joining Franklin Mutual Series in 2005, Mr. Luh was an analyst in global investment research at Putnam Investments, where he also helped manage a best ideas research fund. Previously, he worked in the investment banking group at Volpe Brown Whelan and Co., LLC, and the derivative products trading group at BNP. Mr. Luh is also Adjunct Professor in Finance and Economics at the Graduate School of Business, Columbia University and the Gabelli School of Business, Fordham University.

CFA® is a trademark owned by CFA Institute.

franklintempleton.com Annual Report | 7

FRANKLIN MUTUAL RECOVERY FUND

Performance Summary as of March 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 3/31/15 | | 3/31/14 | | Change |

| A (FMRAX) | $ | 11.56 | $ | 12.25 | -$ | 0.69 |

| C (FCMRX) | $ | 11.42 | $ | 12.09 | -$ | 0.67 |

| Advisor (FMRVX) | $ | 11.64 | $ | 12.34 | -$ | 0.70 |

| | | |

| | | Dividend |

| Share Class | | Income |

| A | $ | 0.4774 |

| C | $ | 0.3781 |

| Advisor | $ | 0.5180 |

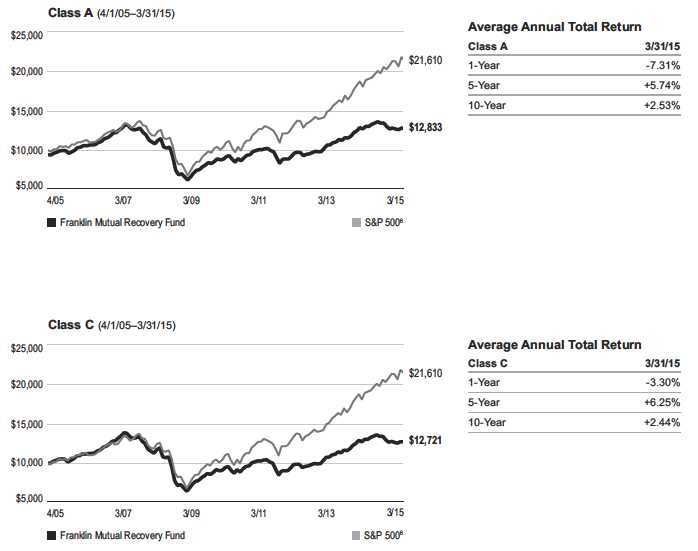

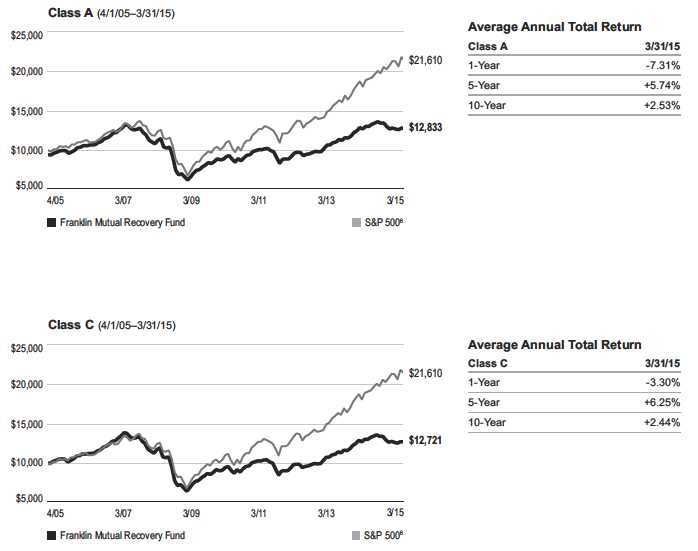

Performance as of 3/31/151

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | | | Value of | Total Annual Operating Expenses5 | |

| Share Class | | Total Return2 | | | Total Return3 | | $ | 10,000 Investment4 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.53 | % | 3.72 | % |

| 1-Year | | -1.66 | % | | -7.31 | % | $ | 9,269 | | | | |

| 5-Year | + | 40.24 | % | + | 5.74 | % | $ | 13,217 | | | | |

| 10-Year | + | 36.16 | % | + | 2.53 | % | $ | 12,833 | | | | |

| C | | | | | | | | | 2.25 | % | 4.44 | % |

| 1-Year | | -2.36 | % | | -3.30 | % | $ | 9,670 | | | | |

| 5-Year | + | 35.40 | % | + | 6.25 | % | $ | 13,540 | | | | |

| 10-Year | + | 27.21 | % | + | 2.44 | % | $ | 12,721 | | | | |

| Advisor | | | | | | | | | 1.25 | % | 3.44 | % |

| 1-Year | | -1.39 | % | | -1.39 | % | $ | 9,861 | | | | |

| 5-Year | + | 42.30 | % | + | 7.31 | % | $ | 14,230 | | | | |

| 10-Year | + | 40.49 | % | + | 3.46 | % | $ | 14,049 | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

franklintempleton.com Annual Report | 9

FRANKLIN MUTUAL RECOVERY FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1 (continued)

All investments involve risks, including possible loss of principal. The Fund may invest in companies engaged in mergers, reorganizations or liquidations, which involve special risks, as pending deals may not be completed on time or on favorable terms, as well as lower rated bonds, which entail higher credit risk. The Fund is a nondiversified fund and may experience increased susceptibility to adverse economic or regulatory developments affecting similar issuers or securities.

The Fund may invest in foreign securities whose risks include currency fluctuations, and economic and political uncertainties. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| | |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has expense reductions contractually guaranteed through at least 7/31/15. Fund investment results reflect the expense reductions, to the extent applicable;

without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

6. Source: Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

See www.franklintempletondatasources.com for additional data provider information.

10 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 10/1/14 | | Value 3/31/15 | | Period* 10/1/14–3/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 982.60 | $ | 8.35 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.50 | $ | 8.50 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 978.80 | $ | 11.84 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,012.96 | $ | 12.04 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 983.70 | $ | 6.92 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.95 | $ | 7.04 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.69%; C: 2.40%;

and Advisor: 1.40%), multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period.

franklintempleton.com Annual Report | 11

FRANKLIN MUTUAL RECOVERY FUND

The Fund’s Repurchase Offers

The Fund will make quarterly repurchase offers for a portion of its shares. With any repurchase offer, shareholders may elect to tender (have the Fund repurchase) all, a portion or none of their shares. With each repurchase offer, shareholders will be notified in writing about the offer, how to request that the Fund repurchase their shares and the deadline for submitting repurchase requests.

Each quarter the Board of Trustees will set the amount of the repurchase offer, as a percentage of outstanding shares. This amount is known as the repurchase offer amount and will generally be between 5% and 25% of the Fund’s outstanding shares. If repurchase requests exceed the repurchase offer amount, the Fund will prorate requests. The Fund may, however, first accept any requests to repurchase all of a shareholder’s shares if the shareholder owns less than 100 shares. The Board will also determine the date by which the Fund must receive shareholders’ repurchase requests, which is known as the repurchase request deadline. The Board will base these decisions on investment management considerations, market conditions, liquidity of the Fund’s assets, shareholder servicing and administrative considerations and other factors it deems appropriate. Each repurchase request deadline will occur within the period that begins 21 days before, and ends 21 days after, the end of the quarterly interval. The repurchase price of the shares will be the net asset value as of the close of the NYSE on the date the Board sets as the repurchase pricing date. The maximum number of days between the repurchase request deadline and the repurchase pricing date is 14 days.

| | | | | | |

| Summary of Repurchase Offers – 4/1/14 through 3/31/15 | | |

| Repurchase Request | Repurchase Offer | | % of Shares | | Number of Shares |

| Deadline | Amount | | Tendered | | Tendered |

| 4/11/14 | 15 | % | 5.266 | % | 264,133.053 |

| 6/27/14 | 15 | % | 2.746 | % | 131,633.084 |

| 10/3/14 | 15 | % | 4.204 | % | 195,975.702 |

| 12/23/14 | 15 | % | 5.771 | % | 268,496.280 |

12 | Annual Report

franklintempleton.com

| | | | | | | | | | | | | | | | |

| | | | | | FRANKLIN MUTUAL RECOVERY FUND | |

| |

| |

| |

| |

| Financial Highlights | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class A | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 12.25 | | $ | 10.54 | | $ | 9.49 | | $ | 10.20 | | $ | 9.75 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.22 | | | 0.47 | c | | 0.23 | | | 0.17 | | | 0.16 | d |

| Net realized and unrealized gains (losses) | | (0.43 | ) | | 1.53 | | | 0.96 | | | (0.56 | ) | | 0.81 | |

| Total from investment operations | | (0.21 | ) | | 2.00 | | | 1.19 | | | (0.39 | ) | | 0.97 | |

| Less distributions from net investment income | | (0.48 | ) | | (0.29 | ) | | (0.14 | ) | | (0.32 | ) | | (0.52 | ) |

| Net asset value, end of year | $ | 11.56 | | $ | 12.25 | | $ | 10.54 | | $ | 9.49 | | $ | 10.20 | |

| |

| Total returne | | (1.66 | )% | | 19.09 | % | | 12.71 | % | | (3.38 | )% | | 9.95 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductionf | | 3.41 | % | | 3.72 | % | | 2.83 | % | | 2.75 | % | | 3.62 | % |

| Expenses net of waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductionf | | 1.63 | %g | | 1.53 | %g | | 1.62 | % | | 2.25 | % | | 3.62 | % |

| Expenses incurred in connection with securities sold short | | 0.14 | % | | 0.05 | % | | 0.04 | % | | 0.12 | % | | 0.13 | % |

| Net investment income | | 1.81 | % | | 4.14 | %c | | 1.87 | % | | 1.81 | % | | 1.56 | %d |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 20,884 | | $ | 24,329 | | $ | 23,480 | | $ | 32,629 | | $ | 65,043 | |

| Portfolio turnover rate | | 31.50 | % | | 58.30 | % | | 60.11 | % | | 91.52 | % | | 65.17 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.23 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 2.10%.

dNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate real estate

investment trust (REIT) conversion. Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 0.09%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 13

FRANKLIN MUTUAL RECOVERY FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class C | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 12.09 | | $ | 10.41 | | $ | 9.36 | | $ | 10.05 | | $ | 9.60 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.13 | | | 0.38 | c | | 0.11 | | | 0.10 | | | 0.09 | d |

| Net realized and unrealized gains (losses) | | (0.42 | ) | | 1.51 | | | 1.00 | | | (0.54 | ) | | 0.79 | |

| Total from investment operations | | (0.29 | ) | | 1.89 | | | 1.11 | | | (0.44 | ) | | 0.88 | |

| Less distributions from net investment income | | (0.38 | ) | | (0.21 | ) | | (0.06 | ) | | (0.25 | ) | | (0.43 | ) |

| Net asset value, end of year | $ | 11.42 | | $ | 12.09 | | $ | 10.41 | | $ | 9.36 | | $ | 10.05 | |

| |

| Total returne | | (2.36 | )% | | 18.23 | % | | 11.93 | % | | (4.01 | )% | | 9.16 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductionf | | 4.12 | % | | 4.44 | % | | 3.54 | % | | 3.45 | % | | 4.32 | % |

| Expenses net of waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductionf | | 2.34 | %g | | 2.25 | %g | | 2.33 | % | | 2.95 | % | | 4.32 | % |

| Expenses incurred in connection with securities sold short | | 0.14 | % | | 0.05 | % | | 0.04 | % | | 0.12 | % | | 0.13 | % |

| Net investment income | | 1.10 | % | | 3.42 | %c | | 1.16 | % | | 1.11 | % | | 0.86 | %d |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 8,357 | | $ | 10,573 | | $ | 11,615 | | $ | 16,754 | | $ | 27,432 | |

| Portfolio turnover rate | | 31.50 | % | | 58.30 | % | | 60.11 | % | | 91.52 | % | | 65.17 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.23 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 1.38%.

dNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate REIT conversion.

Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been (0.61%).

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

14 | Annual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| | | | | | | | | | | | | | | | |

| | | | | | FRANKLIN MUTUAL RECOVERY FUND | |

| | | | | | | | | FINANCIAL HIGHLIGHTS | |

| |

| |

| |

| |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Advisor Class | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 12.34 | | $ | 10.61 | | $ | 9.56 | | $ | 10.28 | | $ | 9.83 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.26 | | | 0.51 | c | | 0.15 | | | 0.19 | | | 0.17 | d |

| Net realized and unrealized gains (losses) | | (0.44 | ) | | 1.54 | | | 1.08 | | | (0.55 | ) | | 0.83 | |

| Total from investment operations | | (0.18 | ) | | 2.05 | | | 1.23 | | | (0.36 | ) | | 1.00 | |

| Less distributions from net investment income | | (0.52 | ) | | (0.32 | ) | | (0.18 | ) | | (0.36 | ) | | (0.55 | ) |

| Net asset value, end of year | $ | 11.64 | | $ | 12.34 | | $ | 10.61 | | $ | 9.56 | | $ | 10.28 | |

| |

| Total return | | (1.39 | )% | | 19.46 | % | | 13.01 | % | | (3.02 | )% | | 10.22 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductione | | 3.12 | % | | 3.44 | % | | 2.54 | % | | 2.45 | % | | 3.32 | % |

| Expenses net of waiver, payments by affiliates and | | | | | | | | | | | | | | | |

| expense reductione | | 1.34 | %f | | 1.25 | %f | | 1.33 | % | | 1.95 | % | | 3.32 | % |

| Expenses incurred in connection with securities sold short | | 0.14 | % | | 0.05 | % | | 0.04 | % | | 0.12 | % | | 0.13 | % |

| Net investment income | | 2.10 | % | | 4.42 | %c | | 2.16 | % | | 2.11 | % | | 1.86 | %d |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 21,719 | | $ | 26,529 | | $ | 25,707 | | $ | 24,496 | | $ | 29,269 | |

| Portfolio turnover rate | | 31.50 | % | | 58.30 | % | | 60.11 | % | | 91.52 | % | | 65.17 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.23 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 2.38%.

dNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate REIT conversion.

Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 0.39%.

eIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

fBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 15

| | | | | |

| FRANKLIN MUTUAL RECOVERY FUND | | | | |

| |

| |

| |

| |

| Statement of Investments, March 31, 2015 | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| |

| Common Stocks and Other Equity Interests 45.8% | | | | |

| Aerospace & Defense 1.4% | | | | |

| B/E Aerospace Inc. | United States | 8,606 | $ | 547,514 |

| aKLX Inc. | United States | 4,303 | | 165,837 |

| | | | | 713,351 |

| Auto Components 2.3% | | | | |

| a,bInternational Automotive Components Group Brazil LLC | Brazil | 185,241 | | 10,499 |

| a,b,cInternational Automotive Components Group North America LLC | United States | 1,263,310 | | 1,158,116 |

| | | | | 1,168,615 |

| Banks 2.1% | | | | |

| dCIT Group Inc. | United States | 23,470 | | 1,058,966 |

| Chemicals 0.8% | | | | |

| Tronox Ltd., A | United States | 20,435 | | 415,444 |

| Communications Equipment 0.4% | | | | |

| a,c,eSorenson Communications Inc., Membership Interests | United States | 1,508 | | 196,040 |

| Consumer Finance 0.3% | | | | |

| aAlly Financial Inc. | United States | 6,588 | | 138,216 |

| Diversified Consumer Services 0.3% | | | | |

| Cengage Learning Holdings II LP | United States | 7,048 | | 158,580 |

| Diversified Financial Services 1.1% | | | | |

| aCapmark Financial Group Inc. | United States | 114,464 | | 574,609 |

| Diversified Telecommunication Services 1.1% | | | | |

| Koninklijke KPN NV | Netherlands | 167,450 | | 568,833 |

| Energy Equipment & Services 4.1% | | | | |

| Baker Hughes Inc. | United States | 8,160 | | 518,813 |

| aDeepOcean Group Holding BV | Netherlands | 91,357 | | 1,370,355 |

| f Transocean Ltd. | United States | 13,932 | | 204,382 |

| | | | | 2,093,550 |

| Hotels, Restaurants & Leisure 2.2% | | | | |

| aPinnacle Entertainment Inc. | United States | 31,360 | | 1,131,782 |

| Insurance 4.1% | | | | |

| Ageas | Belgium | 12,180 | | 437,531 |

| Direct Line Insurance Group PLC | United Kingdom | 92,432 | | 437,333 |

| RSA Insurance Group PLC | United Kingdom | 111,550 | | 696,383 |

| UNIQA Insurance Group AG | Austria | 55,868 | | 505,914 |

| | | | | 2,077,161 |

| Machinery 1.1% | | | | |

| CNH Industrial NV, special voting (EUR Traded) | United Kingdom | 2,890 | | 23,681 |

| CNH Industrial NV, special voting (USD Traded) | United Kingdom | 53,898 | | 439,808 |

| Vossloh AG | Germany | 1,910 | | 117,238 |

| | | | | 580,727 |

| Media 7.4% | | | | |

| CBS Corp., B | United States | 7,480 | | 453,513 |

| aDIRECTV | United States | 18,560 | | 1,579,456 |

| Nine Entertainment Co. Holdings Ltd. | Australia | 177,936 | | 286,052 |

| Time Warner Cable Inc. | United States | 5,122 | | 767,685 |

16 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

STATEMENT OF INVESTMENTS

| | | | | |

| | | Shares/ | | |

| | Country | Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Media (continued) | | | | |

| Tribune Media Co., B | United States | 9,499 | $ | 580,911 |

| Tribune Publishing Co. | United States | 6,247 | | 121,192 |

| | | | | 3,788,809 |

| Metals & Mining 0.5% | | | | |

| dFreeport-McMoRan Inc., B | United States | 15,252 | | 289,025 |

| Oil, Gas & Consumable Fuels 4.6% | | | | |

| BP PLC | United Kingdom | 122,500 | | 793,449 |

| aCairn Energy PLC | United Kingdom | 216,300 | | 504,002 |

| Talisman Energy Inc. (CAD Traded) | Canada | 4,602 | | 35,285 |

| Talisman Energy Inc. (USD Traded) | Canada | 131,483 | | 1,009,790 |

| | | | | 2,342,526 |

| Paper & Forest Products 0.0%† | | | | |

| aVerso Corp. | United States | 5,455 | | 9,819 |

| Personal Products 0.9% | | | | |

| Avon Products Inc. | United States | 54,716 | | 437,181 |

| Pharmaceuticals 1.0% | | | | |

| aHospira Inc. | United States | 5,673 | | 498,316 |

| Semiconductors & Semiconductor Equipment 1.8% | | | | |

| Tokyo Electron Ltd., ADR | Japan | 51,500 | | 894,555 |

| Software 2.8% | | | | |

| dSymantec Corp. | United States | 60,060 | | 1,403,302 |

| Technology Hardware, Storage & Peripherals 0.8% | | | | |

| aEastman Kodak Co. | United States | 10,185 | | 193,413 |

| aEastman Kodak Co., wts., 9/03/18 | United States | 507 | | 2,738 |

| aEastman Kodak Co., wts., 9/03/18 | United States | 507 | | 2,180 |

| Samsung Electronics Co. Ltd. | South Korea | 149 | | 193,629 |

| | | | | 391,960 |

| Tobacco 2.4% | | | | |

| Lorillard Inc. | United States | 18,602 | | 1,215,641 |

| Wireless Telecommunication Services 2.3% | | | | |

| Vodafone Group PLC | United Kingdom | 359,050 | | 1,173,991 |

| Total Common Stocks and Other Equity Interests | | | | |

| (Cost $24,159,502) | | | | 23,320,999 |

| Preferred Stocks 2.6% | | | | |

| Automobiles 1.5% | | | | |

| Porsche Automobil Holding SE, pfd. | Germany | 6,053 | | 595,387 |

| Volkswagen AG, pfd. | Germany | 600 | | 159,915 |

| | | | | 755,302 |

| Technology Hardware, Storage & Peripherals 1.1% | | | | |

| Samsung Electronics Co. Ltd., pfd. | South Korea | 568 | | 565,505 |

| Total Preferred Stocks (Cost $1,001,188) | | | | 1,320,807 |

franklintempleton.com Annual Report | 17

FRANKLIN MUTUAL RECOVERY FUND

STATEMENT OF INVESTMENTS

| | | | | | |

| | | | Principal | | |

| | | Country | Amount* | | Value |

| Corporate Bonds, Notes and Senior Floating Rate | | | | | |

| Interests 19.0% | | | | | |

| Avaya Inc., | | | | | |

| gsenior note, 144A, 10.50%, 3/01/21 | | United States | 687,000 | $ | 589,103 |

| h,iTranche B-3 Term Loan, 4.676%, 10/26/17 | | United States | 222,902 | | 219,934 |

| h,iTranche B-6 Term Loan, 6.50%, 3/31/18 | | United States | 53,727 | | 53,679 |

| h,iBluestem Brands Inc., First Lien Term Loan, 8.50%, 11/07/20 | | United States | 1,080,000 | | 1,082,700 |

| h,iCengage Learning Acquisitions Inc., First Lien Exit Term Loan, 7.00%, 3/31/20 | | United States | 44,550 | | 44,789 |

| h,iEastman Kodak Co., | | | | | |

| First Lien Term Loan, 7.25%, 9/03/19 | | United States | 151,305 | | 151,966 |

| Second Lien Term Loan, 10.75%, 9/03/20 | | United States | 514,000 | | 513,460 |

| GenOn Americas Generation LLC, senior bond, 9.125%, 5/01/31 | | United States | 1,159,000 | | 1,077,146 |

| h,iiHeartCommunications Inc., | | | | | |

| Tranche D Term Loan, 6.928%, 1/30/19 | | United States | 1,272,694 | | 1,213,514 |

| Tranche E Term Loan, 7.678%, 7/30/19 | | United States | 408,909 | | 395,313 |

| h,iKIK Custom Products Inc., Second Lien Term Loan, 9.50%, 10/29/19 | | United States | 660,000 | | 661,857 |

| gLee Enterprises Inc., senior secured note, first lien, 144A, 9.50%, 3/15/22 | | United States | 745,000 | | 772,937 |

| h,iMoxie Liberty LLC, Construction B-1 Term Loan, 7.50%, 8/21/20 | | United States | 448,000 | | 450,097 |

| h,iMoxie Patriot LLC, Construction B-1 Term Loan, 6.75%, 12/18/20 | | United States | 252,000 | | 253,260 |

| h,iNGPL PipeCo LLC, Term Loan B, 6.75%, 9/15/17 | | United States | 19,126 | | 18,332 |

| c,g,jSorenson Communications Inc., secured note, second lien, 144A, PIK, 9.00%, | | | | | |

| 10/31/20 | | United States | 649,999 | | 610,999 |

| c,g,jSorenson Holdings LLC/Finance Corp., senior note, 144A, PIK, 13.00%, | | | | | |

| 10/31/21 | | United States | 493,999 | | 493,999 |

| h,iToys R US-Delaware Inc., | | | | | |

| Filo Term Loan, 8.25%, 10/24/19 | | United States | 89,000 | | 87,954 |

| kTerm Loan B4, 9.75%, 4/24/20 | | United States | 691,562 | | 644,190 |

| Verso Paper Holdings LLC/Inc., senior secured note, first lien, 11.75%, | | | | | |

| 1/15/19 | | United States | 261,000 | | 245,340 |

| Walter Energy Inc., | | | | | |

| h,iB,Term Loan, 7.25%, 4/01/18 | | United States | 121,250 | | 74,092 |

| gfirst lien, 144A, 9.50%, 10/15/19 | | United States | 71,000 | | 42,955 |

| g,jsecond lien, 144A, PIK, 11.50%, 4/01/20 | | United States | 57,000 | | 5,534 |

| Total Corporate Bonds, Notes and Senior Floating | | | | | |

| Rate Interests (Cost $9,697,543) | | | | | 9,703,150 |

| Corporate Bonds, Notes and Senior Floating Rate | | | | | |

| Interests in Reorganization 11.3% | | | | | |

| h,i,l Caesars Entertainment Operating Co. Inc., Senior Tranche, first lien, 3/01/17, | | | | | |

| B5B, 6.005% | | United States | 155,025 | | 141,944 |

| B6B, 7.005% | | United States | 741,097 | | 681,346 |

| B7, 13.00% | | United States | 177,110 | | 162,056 |

| lNortel Networks Corp., cvt., senior note, | | | | | |

| 1.75%, 4/15/12 | | Canada | 1,752,000 | | 1,688,490 |

| 2.125%, 4/15/14 | | Canada | 171,000 | | 164,609 |

| lNortel Networks Ltd., senior note, | | | | | |

| 10.125%, 7/15/13 | | Canada | 600,000 | | 666,750 |

| 10.75%, 7/15/16 | | Canada | 25,000 | | 28,219 |

| lNorthern Telecom Ltd., 6.875%, 9/01/23 | | Canada | 368,000 | | 136,160 |

| h,i,lTexas Competitive Electric Holdings Co. LLC, Extended Term Loan, | | | | | |

| 4.662%, 10/10/17 | | United States | 2,524,660 | | 1,516,374 |

| g,lTexas Competitive Electric Holdings Co. LLC/Texas Competitive Electric | | | | | |

| Holdings Finance Inc., senior secured note, first lien, 144A, 11.50%, 10/01/20 | | United States | 941,000 | | 592,830 |

18 | Annual Report franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

STATEMENT OF INVESTMENTS

| | | | | |

| | | Principal | | |

| | Country | Amount* | | Value |

| Total Corporate Bonds, Notes and Senior Floating Rate | | | | |

| Interests in Reorganization (Cost $6,650,541) | | | $ | 5,778,778 |

| | | Shares | | |

| Companies in Liquidation 2.0% | | | | |

| aAdelphia Recovery Trust | United States | 11,280,134 | | 32,712 |

| a,mAdelphia Recovery Trust, Arahova Contingent Value Vehicle, Contingent | | | | |

| Distribution | United States | 1,018,915 | | 11,310 |

| a,b,cCB FIM Coinvestors LLC | United States | 1,439,821 | | — |

| a,e,mCentury Communications Corp., Contingent Distribution | United States | 2,826,000 | | — |

| EME Reorganization Trust | United States | 3,653,879 | | 146,155 |

| a,bFIM Coinvestor Holdings I, LLC | United States | 1,801,197 | | — |

| a,gKGen Power Corp., 144A | United States | 141,643 | | 43,788 |

| a,nLehman Brothers Holdings Inc., Bankruptcy Claim | United States | 5,404,577 | | 763,397 |

| a,e,mNewPage Corp., Litigation Trust, Contingent Distribution | United States | 723,000 | | — |

| a,e,mTribune Media Litigation Trust, Contingent Distribution | United States | 20,126 | | — |

| a,e,mTropicana Litigation Trust, Contingent Distribution | United States | 12,892,000 | | — |

| Total Companies in Liquidation (Cost $2,200,605) | | | | 997,362 |

| | | | | |

| | | | Principal | |

| | | | Amount* | |

| Municipal Bonds (Cost $187,114) 0.3% | | | | |

| Puerto Rico Commonwealth GO, Refunding, Series A, 8.00%, 7/01/35 | | United States | 200,000 | 164,500 |

| Total Investments before Short Term Investments | | | | |

| (Cost $43,896,493) | | | | 41,285,596 |

| |

| Short Term Investments 2.0% | | | | |

| U.S. Government and Agency Securities (Cost $800,000) 1.6% | | | | |

| oFHLB, 4/01/15 | | United States | 800,000 | 800,000 |

| Total Investments before Repurchase Agreements | | | | |

| (Cost $44,696,493) | | | | 42,085,596 |

| pInvestments from Cash Collateral Received for Loaned | | | | |

| Securities 0.4% | | | | |

| qJoint Repurchase Agreements 0.4% | | | | |

| BNP Paribas Securities Corp., 0.11%, 4/01/15 (Maturity Value $113,325) | | | | |

| Collateralized by U.S. Treasury Notes, 0.375% - 2.75%, 4/15/15 - 4/30/19; | | | | |

| U.S. Treasury Strips, 8/15/15 - 11/15/23 (valued at $115,592) | | United States | 113,325 | 113,325 |

| BNP Paribas Securities Corp., 0.12%, 4/01/15 (Maturity Value $51,266) | | | | |

| Collateralized by U.S. Government and Agency Securities, 0.12% - 6.09%, | | | | |

| 4/17/15 - 7/15/37; U.S. Government and Agency Securities, zero cpn., | | | | |

| 6/01/17; oU.S. Government Agency Discount Notes, 5/01/15; and U.S. | | | | |

| Government Agency Strips, 5/15/27 (valued at $52,291) | | United States | 51,266 | 51,266 |

| HSBC Securities (USA) Inc., 0.11%, 4/01/15 (Maturity Value $51,266) | | | | |

| Collateralized by U.S. Government and Agency Securities, 0.30% - 7.25%, | | | | |

| 7/02/15 - 7/15/32; U.S. Government and Agency Securities, zero cpn., | | | | |

| 12/01/15 - 3/17/31; and U.S. Government Agency Strips, 4/15/15 - 4/15/30 | | | | |

| (valued at $52,291) | | United States | 51,266 | 51,266 |

| Total Investments from Cash Collateral Received for Loaned | | | | |

| Securities (Cost $215,857) | | | | 215,857 |

franklintempleton.com

Annual Report

| 19

FRANKLIN MUTUAL RECOVERY FUND

STATEMENT OF INVESTMENTS

| | | | | | |

| | Country | Shares | | Value | |

| Total Investments (Cost $44,912,350) 83.0% | | | $ | 42,301,453 | |

| Securities Sold Short (3.4)% | | | | (1,731,780 | ) |

| Other Assets, less Liabilities 20.4% | | | | 10,390,662 | |

| Net Assets 100.0% | | | $ | 50,960,335 | |

| rSecurities Sold Short (3.4)% | | | | | |

| Common Stocks (3.4)% | | | | | |

| Diversified Telecommunication Services (1.5)% | | | | | |

| AT&T Inc. | United States | 24,128 | $ | (787,779 | ) |

| Semiconductors & Semiconductor Equipment (1.9)% | | | | | |

| Applied Materials Inc. | United States | 41,844 | | (944,001 | ) |

| Total Securities Sold Short (Proceeds $1,677,175) | | | $ | (1,731,780 | ) |

†Rounds to less than 0.1% of net assets.

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aNon-income producing.

bSee Note 9 regarding restricted securities.

cAt March 31, 2015, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading these securities for a limited or

extended period of time.

dSecurity or a portion of the security has been pledged as collateral for securities sold short. At March 31, 2015, the aggregate value of these securities and/or cash pledged

as collateral was $4,010,174, representing 7.87% of net assets.

eSecurity has been deemed illiquid because it may not be able to be sold within seven days. At March 31, 2015, the aggregate value of these securities was $196,040,

representing 0.38% of net assets.

fA portion or all of the security is on loan at March 31, 2015. See Note 1(h).

gSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At

March 31, 2015, the aggregate value of these securities was $3,152,145, representing 6.19% of net assets.

hSee Note 1(i) regarding senior floating rate interests.

iThe coupon rate shown represents the rate at period end.

jIncome may be received in additional securities and/or cash.

kA portion or all of the security purchased on a delayed delivery basis. See Note 1(d).

lSee Note 8 regarding credit risk and defaulted securities.

mContingent distributions represent the right to receive additional distributions, if any, during the reorganization of the underlying company. Shares represent total underlying

principal of debt securities.

nBankruptcy claims represent the right to receive distributions, if any, during the liquidation of the underlying pool of assets. Shares represent amount of allowed unsecured

claims.

oThe security is traded on a discount basis with no stated coupon rate.

pSee Note 1(h) regarding securities on loan.

qSee Note 1(c) regarding joint repurchase agreements.

rSee Note 1(g) regarding securities sold short.

20 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL RECOVERY FUND

STATEMENT OF INVESTMENTS

At March 31, 2015, the Fund had the following forward exchange contracts outstanding. See Note 1(e).

| | | | | | | | | | | | |

| Forward Exchange Contracts | | | | | | | | | | | |

| | | | | | Contract | Settlement | | Unrealized | | Unrealized | |

| Currency | Counterpartya Type | Quantity | | Amount | Date Appreciation Depreciation | |

| Australian Dollar | HSBC | Sell | 373,577 | $ | 290,121 | 4/23/15 | $ | 5,893 | $ | — | |

| Euro | BANT | Sell | 97,660 | | 121,948 | 5/18/15 | | 16,861 | | — | |

| Euro | DBFX | Sell | 103,492 | | 129,206 | 5/18/15 | | 17,844 | | — | |

| Euro | FBCO | Sell | 123,254 | | 153,558 | 5/18/15 | | 20,931 | | — | |

| Euro | HSBC | Sell | 10,224 | | 12,705 | 5/18/15 | | 1,703 | | — | |

| Euro | SSBT | Buy | 17,200 | | 19,461 | 5/18/15 | | — | | (953 | ) |

| Euro | SSBT | Sell | 14,813 | | 18,541 | 5/18/15 | | 2,601 | | — | |

| Norwegian Krone | BANT | Buy | 180,920 | | 25,070 | 5/21/15 | | — | | (2,630 | ) |

| Norwegian Krone | BONY | Buy | 47,950 | | 6,649 | 5/21/15 | | — | | (702 | ) |

| Norwegian Krone | DBFX | Buy | 1,509,045 | | 200,580 | 5/21/15 | | — | | (13,410 | ) |

| Norwegian Krone | DBFX | Sell | 1,737,915 | | 254,200 | 5/21/15 | | 38,642 | | — | |

| Euro | BANT | Sell | 71,598 | | 79,864 | 7/20/15 | | 2,941 | | (195 | ) |

| Euro | BBU | Sell | 6,586 | | 7,412 | 7/20/15 | | 318 | | — | |

| Euro | DBFX | Sell | 822,131 | | 950,415 | 7/20/15 | | 65,214 | | (314 | ) |

| Euro | FBCO | Sell | 79,485 | | 88,273 | 7/20/15 | | 3,076 | | (416 | ) |

| Euro | HSBC | Sell | 79,706 | | 88,761 | 7/20/15 | | 3,184 | | (274 | ) |

| Euro | SSBT | Sell | 809,794 | | 938,124 | 7/20/15 | | 66,044 | | (147 | ) |

| South Korean Won | BANT | Buy | 11,013,995 | | 9,929 | 8/12/15 | | — | | (35 | ) |

| South Korean Won | BANT | Sell | 252,652,186 | | 227,473 | 8/12/15 | | 694 | | (183 | ) |

| South Korean Won | FBCO | Sell | 262,319,195 | | 235,891 | 8/12/15 | | 501 | | (256 | ) |

| South Korean Won | HSBC | Sell | 329,568,674 | | 296,097 | 8/12/15 | | 504 | | (464 | ) |

| British Pound | BANT | Buy | 162,318 | | 243,601 | 8/19/15 | | 641 | | (3,707 | ) |

| British Pound | BANT | Sell | 855,553 | | 1,309,253 | 8/19/15 | | 41,430 | | — | |

| British Pound | DBFX | Buy | 2,612 | | 3,878 | 8/19/15 | | — | | (8 | ) |

| British Pound | FBCO | Sell | 596,835 | | 913,157 | 8/19/15 | | 28,723 | | — | |

| British Pound | HSBC | Sell | 598,887 | | 916,297 | 8/19/15 | | 28,821 | | — | |

| British Pound | SSBT | Buy | 8,318 | | 12,387 | 8/19/15 | | — | | (61 | ) |

| Unrealized appreciation (depreciation) | | | | | | | 346,566 | | (23,755 | ) |

| Net unrealized appreciation (depreciation) | | | | | | $ | 322,811 | | | |

| |

| See Abbreviations on page 38. | | | | | | | | | | | |

| aMay be comprised of multiple contracts with the same counterparty, currency and settlement date. | | | | | | | | |

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 21

FRANKLIN MUTUAL RECOVERY FUND

Financial Statements

Statement of Assets and Liabilities

March 31, 2015

| | | | |

| Assets: | | | |

| Investments in securities: | | | |

| Cost - Unaffiliated issuers | $ | 44,696,493 | |

| Cost - Repurchase agreements | | 215,857 | |

| Total cost of investments | $ | 44,912,350 | |

| Value - Unaffiliated issuers | $ | 42,085,596 | |

| Value - Repurchase agreements | | 215,857 | |

| Total value of investments (includes securities loaned in the amount of $201,448) | | 42,301,453 | |

| Cash | | 8,058,559 | |

| Restricted Cash (Note 1f) | | 110,000 | |

| Foreign currency, at value (cost $71,617) | | 71,799 | |

| Receivables: | | | |

| Investment securities sold | | 39,042 | |

| Capital shares sold | | 13,508 | |

| Dividends and interest | | 258,503 | |

| Due from brokers | | 1,980,408 | |

| Unrealized appreciation on forward exchange contracts | | 346,566 | |

| Total assets | | 53,179,838 | |

| Liabilities: | | | |

| Payables: | | | |

| Investment securities purchased | | 24,838 | |

| Capital shares redeemed | | 12,350 | |

| Management fees | | 21,580 | |

| Administrative fees | | 4,724 | |

| Distribution fees | | 22,822 | |

| Transfer agent fees | | 13,456 | |

| Securities sold short, at value (proceeds $1,677,175) | | 1,731,780 | |

| Payable upon return of securities loaned | | 215,857 | |

| Due to brokers | | 110,000 | |

| Unrealized depreciation on forward exchange contracts | | 23,755 | |

| Accrued expenses and other liabilities | | 38,341 | |

| Total liabilities | | 2,219,503 | |

| Net assets, at value | $ | 50,960,335 | |

| Net assets consist of: | | | |

| Paid-in capital | $ | 194,721,945 | |

| Undistributed net investment income | | 4,702 | |

| Net unrealized appreciation (depreciation) | | (2,349,627 | ) |

| Accumulated net realized gain (loss) | | (141,416,685 | ) |

| Net assets, at value | $ | 50,960,335 | |

22 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| | | |

| | | FRANKLIN MUTUAL RECOVERY FUND |

| | | FINANCIAL STATEMENTS |

| |

| |

| Statement of Assets and Liabilities (continued) | | |

| March 31, 2015 | | |

| |

| Class A: | | |

| Net assets, at value | $ | 20,884,488 |

| Shares outstanding | | 1,806,877 |

| Net asset value per sharea | $ | 11.56 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | $ | 12.27 |

| Class C: | | |

| Net assets, at value | $ | 8,356,670 |

| Shares outstanding | | 731,633 |

| Net asset value and maximum offering price per sharea | $ | 11.42 |

| Advisor Class: | | |

| Net assets, at value | $ | 21,719,177 |

| Shares outstanding | | 1,865,354 |

| Net asset value and maximum offering price per share | $ | 11.64 |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 23

| | | | |

| FRANKLIN MUTUAL RECOVERY FUND | | | |

| FINANCIAL STATEMENTS | | | |

| |

| |

| Statement of Operations | | | |

| for the year ended March 31, 2015 | | | |

| |

| Investment income: | | | |

| Dividends | $ | 852,718 | |

| Interest | | 1,057,599 | |

| Income from securities loaned | | 8,715 | |

| Total investment income | | 1,919,032 | |

| Expenses: | | | |

| Management fees (Note 4a) | | 1,143,510 | |

| Administrative fees (Note 4b) | | 111,828 | |

| Distribution fees: (Note 4c) | | | |

| Class A | | 66,411 | |

| Class C | | 95,648 | |

| Transfer agent fees: (Note 4e) | | | |

| Class A | | 27,399 | |

| Class C | | 11,603 | |

| Advisor Class | | 28,714 | |

| Custodian fees (Note 5) | | 2,319 | |

| Reports to shareholders | | 29,166 | |

| Registration and filing fees | | 59,135 | |

| Professional fees | | 203,937 | |

| Trustees’ fees and expenses | | 22,218 | |

| Dividends and interest on securities sold short | | 75,646 | |

| Other | | 29,508 | |

| Total expenses | | 1,907,042 | |

| Expense reductions (Note 5) | | (68 | ) |

| Expenses waived/paid by affiliates (Notes 4a and 4f) | | (997,781 | ) |

| Net expenses | | 909,193 | |

| Net investment income | | 1,009,839 | |

| Realized and unrealized gains (losses): | | | |

| Net realized gain (loss) from: | | | |

| Investments | | 3,533,853 | |

| Written options | | 53,973 | |

| Foreign currency transactions | | 834,424 | |

| Securities sold short | | (332,029 | ) |

| Net realized gain (loss) | | 4,090,221 | |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investments | | (6,403,165 | ) |

| Translation of other assets and liabilities denominated in foreign currencies | | 395,445 | |

| Net change in unrealized appreciation (depreciation) | | (6,007,720 | ) |

| Net realized and unrealized gain (loss) | | (1,917,499 | ) |

| Net increase (decrease) in net assets resulting from operations | $ | (907,660 | ) |

24 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| | | | | | | |

| | | FRANKLIN MUTUAL RECOVERY FUND | |

| | | FINANCIAL STATEMENTS | |

| |

| |