UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

100 Pearl Street, New York, New York 10004

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Alger Global Equity Fund

Class A / CHUSX

Annual SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the Alger Global Equity Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the annual report by contacting us at (800) 992-3863.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Global Equity Fund

(Class A / CHUSX) | $155 | 1.30% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Global Equity Fund Class A returned 38.05%, excluding sales load, for the fiscal twelve-month period ended October 31, 2024, compared to the 33.40% return of the MSCI ACWI Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Consumer Discretionary sectors provided the largest contributions to relative performance. NVIDIA Corp.; MakeMyTrip Ltd.; Eli Lilly and Co.; Amazon.com, Inc.; and American Express Co. were the top five contributors to absolute performance.

Detractors from Performance

The Communication Services and Energy sectors were the largest detractors from relative performance. Verbio SE; Edenred SA; BYD Company Ltd.; Trex Company, Inc.; and Schlumberger Ltd. were the top five detractors to absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Monetary Policy Easing | Positive | Global central banks initiated interest rate cuts to stimulate economic growth. In the U.S., the Federal Reserve began its rate-cutting cycle in September with a 50-basis point reduction. |

| Corporate Governance Reform | Positive | During the reporting period there was a growing trend, especially in Asian countries, to enhance corporate governance. This trend was most evident in Japan with reductions in cross-shareholdings, increases in board independence, transparency around compensation, and initiated capital returns for buybacks and dividends. This trend helped boost equity valuations and subsequently shareholder returns. |

| Rising Geopolitical Tensions | Negative | Geopolitical conflicts and trade disputes created some uncertainty ahead of the 2024 U.S. presidential election. |

| Weakening U.S. Labor Market | Negative | In August, global equity markets experienced a brief sell-off due to U.S. growth concerns following a weaker-than-expected July payrolls report, which raised fears that the Federal Reserve might be slow to respond to slowing economic conditions. The U.S. unemployment rate increased to 4.3%, triggering the Sahm rule—a recession indicator that signals a likely recession when the three-month moving average of the unemployment rate rises by at least 50 basis points from its twelve-month low. Additionally, an unexpected rate hike by the Bank of Japan led to a rapid unwinding of the yen carry trade, further intensifying the sell-off in global equities. |

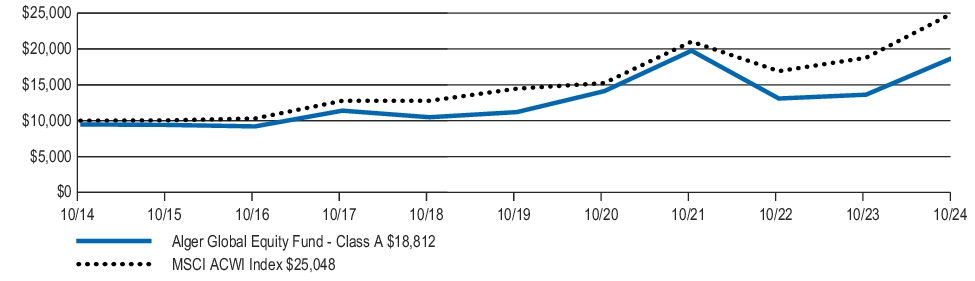

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed ten fiscal years of Class A shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of October 31, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Global Equity Fund Class A | 30.78% | 9.74% | 6.52% |

| Alger Global Equity Fund Class A—excluding sales load | 38.05% | 10.93% | 7.10% |

| MSCI ACWI Index | 33.40% | 11.61% | 9.62% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the fiscal year ended October 31, 2024.

| Fund net assets | $21,584,182 |

| Total number of portfolio holdings1 | 44 |

| Portfolio turnover rate as of the end of the reporting period | 93.65% |

| Total advisory fees paid | $164,216 |

1 | Excludes Money Market Funds. |

| Communication Services | 6.9% |

| Consumer Discretionary | 19.5% |

| Consumer Staples | 7.1% |

| Energy | 3.8% |

| Financials | 8.5% |

| Healthcare | 12.8% |

| Industrials | 13.3% |

| Information Technology | 20.2% |

| Materials | 5.2% |

| Real Estate | 1.3% |

| Short-Term Investments and Other Net Assets | 1.4% |

| 100.0% |

Material and Other Fund Changes

Effective January 29, 2024, the Fund's custodian and administrator transitioned from Brown Brothers Harriman & Company to The Bank of New York.

Effective February 1, 2024, Redwood Investments, LLC became sub-adviser to the Fund and Michael Mufson, Ezra Samet, and Alexi Makkas of Redwood replaced the Fund's previous portfolio managers. No changes were made to the investment objective, principal investment strategies, principal risks or investments restrictions as a result of this change.

Effective August 6, 2024, the name of the Fund changed from Alger Global Focus Fund to Alger Global Equity Fund.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective February 29, 2024, Fred Alger Management, LLC has contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through October 31, 2025 to the extent necessary to limit other expenses and any other applicable share class-specific expenses of the Fund’s Class A Shares to 0.40% of the class’s average daily net assets.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or Alger Global Equity Fund in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Global Equity Fund

Class C / CHUCX

Annual SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the Alger Global Equity Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the annual report by contacting us at (800) 992-3863.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Global Equity Fund

(Class C / CHUCX) | $270 | 2.28% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Global Equity Fund Class C returned 36.65%, excluding contingent deferred sales charge, for the fiscal twelve-month period ended October 31, 2024, compared to the 33.40% return of the MSCI ACWI Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Consumer Discretionary sectors provided the largest contributions to relative performance. NVIDIA Corp.; MakeMyTrip Ltd.; Eli Lilly and Co.; Amazon.com, Inc.; and American Express Co. were the top five contributors to absolute performance.

Detractors from Performance

The Communication Services and Energy sectors were the largest detractors from relative performance. Verbio SE; Edenred SA; BYD Company Ltd.; Trex Company, Inc.; and Schlumberger Ltd. were the top five detractors to absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Monetary Policy Easing | Positive | Global central banks initiated interest rate cuts to stimulate economic growth. In the U.S., the Federal Reserve began its rate-cutting cycle in September with a 50-basis point reduction. |

| Corporate Governance Reform | Positive | During the reporting period there was a growing trend, especially in Asian countries, to enhance corporate governance. This trend was most evident in Japan with reductions in cross-shareholdings, increases in board independence, transparency around compensation, and initiated capital returns for buybacks and dividends. This trend helped boost equity valuations and subsequently shareholder returns. |

| Rising Geopolitical Tensions | Negative | Geopolitical conflicts and trade disputes created some uncertainty ahead of the 2024 U.S. presidential election. |

| Weakening U.S. Labor Market | Negative | In August, global equity markets experienced a brief sell-off due to U.S. growth concerns following a weaker-than-expected July payrolls report, which raised fears that the Federal Reserve might be slow to respond to slowing economic conditions. The U.S. unemployment rate increased to 4.3%, triggering the Sahm rule—a recession indicator that signals a likely recession when the three-month moving average of the unemployment rate rises by at least 50 basis points from its twelve-month low. Additionally, an unexpected rate hike by the Bank of Japan led to a rapid unwinding of the yen carry trade, further intensifying the sell-off in global equities. |

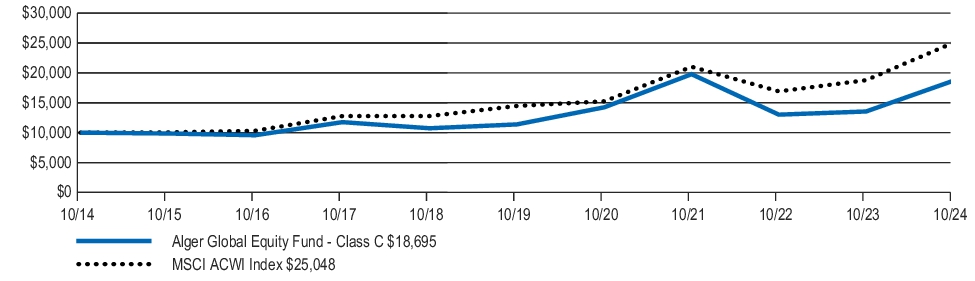

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed ten fiscal years of Class C shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of October 31, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Global Equity Fund Class C | 35.65% | 10.05% | 6.46% |

| Alger Global Equity Fund Class C—excluding contingent deferred sales charge | 36.65% | 10.05% | 6.46% |

| MSCI ACWI Index | 33.40% | 11.61% | 9.62% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the fiscal year ended October 31, 2024.

| Fund net assets | $21,584,182 |

| Total number of portfolio holdings1 | 44 |

| Portfolio turnover rate as of the end of the reporting period | 93.65% |

| Total advisory fees paid | $164,216 |

1 | Excludes Money Market Funds. |

| Communication Services | 6.9% |

| Consumer Discretionary | 19.5% |

| Consumer Staples | 7.1% |

| Energy | 3.8% |

| Financials | 8.5% |

| Healthcare | 12.8% |

| Industrials | 13.3% |

| Information Technology | 20.2% |

| Materials | 5.2% |

| Real Estate | 1.3% |

| Short-Term Investments and Other Net Assets | 1.4% |

| 100.0% |

Material and Other Fund Changes

Effective January 29, 2024, the Fund's custodian and administrator transitioned from Brown Brothers Harriman & Company to The Bank of New York.

Effective February 1, 2024, Redwood Investments, LLC became sub-adviser to the Fund and Michael Mufson, Ezra Samet, and Alexi Makkas of Redwood replaced the Fund's previous portfolio managers. No changes were made to the investment objective, principal investment strategies, principal risks or investments restrictions as a result of this change.

Effective August 6, 2024, the name of the Fund changed from Alger Global Focus Fund to Alger Global Equity Fund.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective February 29, 2024, Fred Alger Management, LLC has contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through October 31, 2025 to the extent necessary to limit other expenses and any other applicable share class-specific expenses of the Fund’s Class C Shares to 1.45% of the class’s average daily net assets.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or Alger Global Equity Fund in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Global Equity Fund

Class I / AFGIX

Annual SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the Alger Global Equity Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the annual report by contacting us at (800) 992-3863.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Global Equity Fund

(Class I / AFGIX) | $146 | 1.23% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Global Equity Fund Class I returned 38.15% for the fiscal twelve-month period ended October 31, 2024, compared to the 33.40% return of the MSCI ACWI Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Consumer Discretionary sectors provided the largest contributions to relative performance. NVIDIA Corp.; MakeMyTrip Ltd.; Eli Lilly and Co.; Amazon.com, Inc.; and American Express Co. were the top five contributors to absolute performance.

Detractors from Performance

The Communication Services and Energy sectors were the largest detractors from relative performance. Verbio SE; Edenred SA; BYD Company Ltd.; Trex Company, Inc.; and Schlumberger Ltd. were the top five detractors to absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Monetary Policy Easing | Positive | Global central banks initiated interest rate cuts to stimulate economic growth. In the U.S., the Federal Reserve began its rate-cutting cycle in September with a 50-basis point reduction. |

| Corporate Governance Reform | Positive | During the reporting period there was a growing trend, especially in Asian countries, to enhance corporate governance. This trend was most evident in Japan with reductions in cross-shareholdings, increases in board independence, transparency around compensation, and initiated capital returns for buybacks and dividends. This trend helped boost equity valuations and subsequently shareholder returns. |

| Rising Geopolitical Tensions | Negative | Geopolitical conflicts and trade disputes created some uncertainty ahead of the 2024 U.S. presidential election. |

| Weakening U.S. Labor Market | Negative | In August, global equity markets experienced a brief sell-off due to U.S. growth concerns following a weaker-than-expected July payrolls report, which raised fears that the Federal Reserve might be slow to respond to slowing economic conditions. The U.S. unemployment rate increased to 4.3%, triggering the Sahm rule—a recession indicator that signals a likely recession when the three-month moving average of the unemployment rate rises by at least 50 basis points from its twelve-month low. Additionally, an unexpected rate hike by the Bank of Japan led to a rapid unwinding of the yen carry trade, further intensifying the sell-off in global equities. |

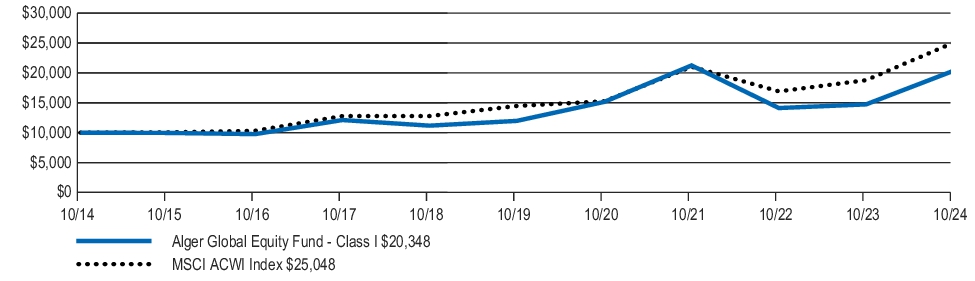

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed ten fiscal years of Class I shares of the Fund. The graph assumes a $10,000 initial investment at the beginning of the first annual period in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of October 31, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Global Equity Fund Class I | 38.15% | 11.19% | 7.36% |

| MSCI ACWI Index | 33.40% | 11.61% | 9.62% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the fiscal year ended October 31, 2024.

| Fund net assets | $21,584,182 |

| Total number of portfolio holdings1 | 44 |

| Portfolio turnover rate as of the end of the reporting period | 93.65% |

| Total advisory fees paid | $164,216 |

1 | Excludes Money Market Funds. |

| Communication Services | 6.9% |

| Consumer Discretionary | 19.5% |

| Consumer Staples | 7.1% |

| Energy | 3.8% |

| Financials | 8.5% |

| Healthcare | 12.8% |

| Industrials | 13.3% |

| Information Technology | 20.2% |

| Materials | 5.2% |

| Real Estate | 1.3% |

| Short-Term Investments and Other Net Assets | 1.4% |

| 100.0% |

Material and Other Fund Changes

Effective January 29, 2024, the Fund's custodian and administrator transitioned from Brown Brothers Harriman & Company to The Bank of New York.

Effective February 1, 2024, Redwood Investments, LLC became sub-adviser to the Fund and Michael Mufson, Ezra Samet, and Alexi Makkas of Redwood replaced the Fund's previous portfolio managers. No changes were made to the investment objective, principal investment strategies, principal risks or investments restrictions as a result of this change.

Effective August 6, 2024, the name of the Fund changed from Alger Global Focus Fund to Alger Global Equity Fund.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective February 29, 2024, Fred Alger Management, LLC has contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through October 31, 2025 to the extent necessary to limit other expenses and any other applicable share class-specific expenses of the Fund’s Class I Shares to 0.40% of the class’s average daily net assets.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or Alger Global Equity Fund in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

Alger Global Equity Fund

Class Z / AFGZX

Annual SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about the Alger Global Equity Fund (“Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the annual report by contacting us at (800) 992-3863.

This report describes material changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class/Ticker) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Alger Global Equity Fund

(Class Z / AFGZX) | $119 | 1.00% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Global Equity Fund Class Z returned 38.42% for the fiscal twelve-month period ended October 31, 2024, compared to the 33.40% return of the MSCI ACWI Index. During the reporting period, the largest sector weightings were Information Technology and Consumer Discretionary. The largest sector overweight was Consumer Discretionary and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Consumer Discretionary sectors provided the largest contributions to relative performance. NVIDIA Corp.; MakeMyTrip Ltd.; Eli Lilly and Co.; Amazon.com, Inc.; and American Express Co. were the top five contributors to absolute performance.

Detractors from Performance

The Communication Services and Energy sectors were the largest detractors from relative performance. Verbio SE; Edenred SA; BYD Company Ltd.; Trex Company, Inc.; and Schlumberger Ltd. were the top five detractors to absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Monetary Policy Easing | Positive | Global central banks initiated interest rate cuts to stimulate economic growth. In the U.S., the Federal Reserve began its rate-cutting cycle in September with a 50-basis point reduction. |

| Corporate Governance Reform | Positive | During the reporting period there was a growing trend, especially in Asian countries, to enhance corporate governance. This trend was most evident in Japan with reductions in cross-shareholdings, increases in board independence, transparency around compensation, and initiated capital returns for buybacks and dividends. This trend helped boost equity valuations and subsequently shareholder returns. |

| Rising Geopolitical Tensions | Negative | Geopolitical conflicts and trade disputes created some uncertainty ahead of the 2024 U.S. presidential election. |

| Weakening U.S. Labor Market | Negative | In August, global equity markets experienced a brief sell-off due to U.S. growth concerns following a weaker-than-expected July payrolls report, which raised fears that the Federal Reserve might be slow to respond to slowing economic conditions. The U.S. unemployment rate increased to 4.3%, triggering the Sahm rule—a recession indicator that signals a likely recession when the three-month moving average of the unemployment rate rises by at least 50 basis points from its twelve-month low. Additionally, an unexpected rate hike by the Bank of Japan led to a rapid unwinding of the yen carry trade, further intensifying the sell-off in global equities. |

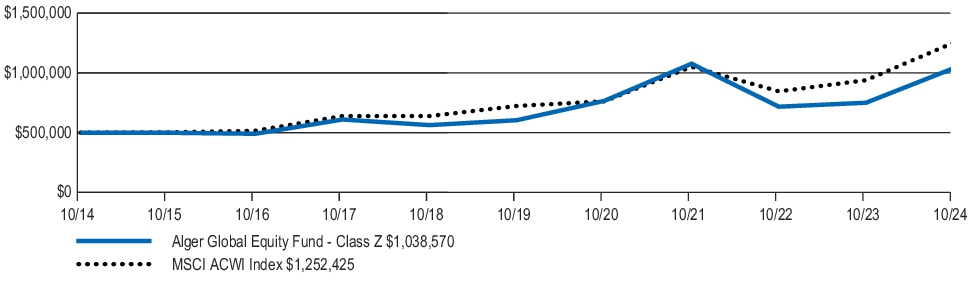

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed ten fiscal years of Class Z shares of the Fund. The graph assumes a $500,000 initial investment at the beginning of the first annual period in an appropriate, broad-based securities market index for the same period.

INITIAL INVESTMENT OF $500,000

| Average Annual Total Returns (As of October 31, 2024) | 1 Year | 5 Years | 10 Years |

| Alger Global Equity Fund Class Z | 38.42% | 11.44% | 7.58% |

| MSCI ACWI Index | 33.40% | 11.61% | 9.62% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the fiscal year ended October 31, 2024.

| Fund net assets | $21,584,182 |

| Total number of portfolio holdings1 | 44 |

| Portfolio turnover rate as of the end of the reporting period | 93.65% |

| Total advisory fees paid | $164,216 |

1 | Excludes Money Market Funds. |

| Communication Services | 6.9% |

| Consumer Discretionary | 19.5% |

| Consumer Staples | 7.1% |

| Energy | 3.8% |

| Financials | 8.5% |

| Healthcare | 12.8% |

| Industrials | 13.3% |

| Information Technology | 20.2% |

| Materials | 5.2% |

| Real Estate | 1.3% |

| Short-Term Investments and Other Net Assets | 1.4% |

| 100.0% |

Material and Other Fund Changes

Effective January 29, 2024, the Fund's custodian and administrator transitioned from Brown Brothers Harriman & Company to The Bank of New York.

Effective February 1, 2024, Redwood Investments, LLC became sub-adviser to the Fund and Michael Mufson, Ezra Samet, and Alexi Makkas of Redwood replaced the Fund's previous portfolio managers. No changes were made to the investment objective, principal investment strategies, principal risks or investments restrictions as a result of this change.

Effective August 6, 2024, the name of the Fund changed from Alger Global Focus Fund to Alger Global Equity Fund.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective February 29, 2024, Fred Alger Management, LLC has contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through October 31, 2025 to the extent necessary to limit other expenses and any other applicable share class-specific expenses of the Fund’s Class Z Shares to 0.19% of the class’s average daily net assets.

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by February 28, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 992-3863.

Availability of Additional Information

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 992-3863 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary or Alger Global Equity Fund in writing at Alger Family of Funds, c/o UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, WI 53212.

ITEM 2. CODE OF ETHICS.

| (a) | The Registrant has adopted a code of ethics (the “Code of Ethics”) that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. |

| (c) | The Registrant has not amended its Code of Ethics during the period covered by the shareholder report presented in Item 1 hereto. |

| (d) | The Registrant has not granted a waiver or an implicit waiver from a provision of its Code of Ethics during the period covered by the shareholder report presented in Item 1 hereto. |

| (f) | The Registrant’s Code of Ethics is attached as an Exhibit hereto. |

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Board of Trustees of the Registrant determined that Charles F. Baird Jr. is an audit committee financial expert (within the meaning of that phrase specified in the instructions to Form N-CSR) on the Registrant's audit committee. Mr. Baird is an "independent" trustee - i.e., he is not an interested person of the Registrant as defined in the 1940 Act, nor has he accepted directly or indirectly any consulting, advisory or other compensatory fee from the Registrant, other than in his capacity as Trustee

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees:

| | October 31, 2024 | $29,710 | |

| | October 31, 2023 | $28,700 | |

(b) Audit-Related Fees: NONE

(c) Tax Fees for tax advice, tax compliance and tax planning:

| | October 31, 2024 | $6,094 | |

| | October 31, 2023 | $6,050 | |

(d) All Other Fees:

| | October 31, 2024 | $2,428 | |

| | October 31, 2023 | $1,107 | |

Other fees include a review and consent for Registrants registration statement filing and a review of the semi-annual financial statements.

(e) 1) Audit Committee Pre-Approval Policies And Procedures:

Audit and non-audit services provided by the Registrant’s independent registered public accounting firm (the “Auditors”) on behalf the Registrant must be pre-approved by the Audit Committee. Non-audit services provided by the Auditors on behalf of the Registrant’s Investment Adviser or any entity controlling, controlled by, or under common control with the Investment Adviser must be pre-approved by the Audit Committee if such non-audit services directly relate to the operations or financial reporting of the Registrant.

2) All fees in item 4(b) through 4(d) above were approved by the Registrants’ Audit Committee.

(f) Not Applicable

(g) Non-Audit Fees:

| | October31, 2024 | $351,512, | €106,362 | |

| | October31, 2023 | $260,680, | €105,649 | |

(h) The audit committee of the board of trustees has considered whether the provision of the non-audit services that were rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control, with the adviser that provides ongoing services to the registrant that were not approved pursuant to (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable

(j) Not Applicable

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

(a) A Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included as part of the report to shareholders filed under Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

ALGER GLOBAL EQUITY FUND

ANNUAL FINANCIAL STATEMENTS AND OTHER INFORMATION

ALGER GLOBAL EQUITY FUNDSchedule of Investments October 31, 2024

| | |

|

|

|

| | |

|

NU Holdings, Ltd., Cl. A* | | |

|

|

TOTAL BRAZIL

(Cost $473,516) | | |

|

APPLICATION SOFTWARE—1.6% |

The Descartes Systems Group, Inc.* | | |

GENERAL MERCHANDISE STORES—2.1% |

| | |

INTERNET SERVICES & INFRASTRUCTURE—1.5% |

| | |

|

|

TOTAL CANADA

(Cost $964,488) | | |

|

APPAREL ACCESSORIES & LUXURY GOODS—1.5% |

ANTA Sports Products, Ltd. | | |

| | |

|

|

| | |

APPAREL ACCESSORIES & LUXURY GOODS—1.4% |

LVMH Moet Hennessy Louis Vuitton SE | | |

OIL & GAS STORAGE & TRANSPORTATION—2.1% |

Gaztransport Et Technigaz SA | | |

|

|

TOTAL FRANCE

(Cost $804,862) | | |

|

|

| | |

HOTELS RESORTS & CRUISE LINES—2.9% |

| | |

|

|

TOTAL INDIA

(Cost $526,865) | | |

|

|

| | |

| | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDSchedule of Investments October 31, 2024 (Continued)

| | |

COMMON STOCKS—97.3% (CONT.) |

|

|

Flutter Entertainment PLC* | | |

| | |

|

AUTOMOBILE MANUFACTURERS—1.1% |

| | |

| | |

|

HUMAN RESOURCE & EMPLOYMENT SERVICES—1.9% |

Recruit Holdings Co., Ltd. | | |

INDUSTRIAL CONGLOMERATES—2.0% |

| | |

|

Nippon Sanso Holdings Corp. | | |

INTERACTIVE HOME ENTERTAINMENT—2.1% |

| | |

|

|

TOTAL JAPAN

(Cost $1,372,315) | | |

|

LIFE SCIENCES TOOLS & SERVICES—1.5% |

| | |

| | |

|

|

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | |

| | |

|

|

| | |

SOFT DRINKS & NON-ALCOHOLIC BEVERAGES—1.6% |

| | |

|

|

TOTAL UNITED KINGDOM

(Cost $618,447) | | |

|

APPLICATION SOFTWARE—4.1% |

| | |

| | |

| | |

|

| | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDSchedule of Investments October 31, 2024 (Continued)

| | |

COMMON STOCKS—97.3% (CONT.) |

UNITED STATES—55.8% (CONT.) |

COMMUNICATIONS EQUIPMENT—2.2% |

| | |

CONSTRUCTION & ENGINEERING—2.9% |

Comfort Systems USA, Inc. | | |

CONSTRUCTION MATERIALS—2.9% |

| | |

CONSUMER STAPLES MERCHANDISE RETAIL—3.0% |

| | |

|

| | |

DIVERSIFIED SUPPORT SERVICES—1.5% |

| | |

HEALTHCARE EQUIPMENT—2.5% |

| | |

HEALTHCARE FACILITIES—2.1% |

| | |

INTERACTIVE MEDIA & SERVICES—4.7% |

| | |

IT CONSULTING & OTHER SERVICES—2.1% |

| | |

LIFE SCIENCES TOOLS & SERVICES—3.3% |

| | |

OIL & GAS EXPLORATION & PRODUCTION—1.7% |

| | |

PACKAGED FOODS & MEATS—2.5% |

| | |

|

| | |

|

| | |

TRADING COMPANIES & DISTRIBUTORS—3.7% |

Ferguson Enterprises, Inc. | | |

| | |

| | |

|

|

TOTAL UNITED STATES

(Cost $9,446,473) | | |

TOTAL COMMON STOCKS

(Cost $16,251,555) | | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDSchedule of Investments October 31, 2024 (Continued)

| | |

|

|

|

Prosetta Biosciences, Inc., Series D(a),*,@ | | |

| | |

REAL ESTATE INVESTMENT TRUST—1.3% |

|

|

| | |

| | |

| | |

|

|

Dreyfus Treasury Obligations Cash Management Fund,

Institutional Shares, 4.72%(b) | | |

| | |

|

|

Total Investments

(Cost $16,929,424) | | |

Unaffiliated Securities (Cost $16,929,424) | | |

Other Assets in Excess of Liabilities | | |

| | |

| American Depositary Receipts |

| Security is valued in good faith at fair value determined using significant unobservable inputs pursuant to procedures approved by the Board of Trustees. |

| Rate shown reflects 7-day effective yield as of October 31, 2024. |

| Non-income producing security. |

| Restricted security - Investment in security not registered under the Securities Act of 1933. Sales or transfers of the investment may be restricted only to qualified buyers. |

| | | | % of net assets

as of

10/31/2024 |

Prosetta Biosciences, Inc., Series D | | | | |

| | | | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDStatement of Assets and Liabilities October 31, 2024

| |

|

Investments in unaffiliated securities, at value (Identified cost below)* see accompanying schedule of investments | |

| |

Dividends and interest receivable | |

Receivable from Investment Manager | |

| |

| |

|

Payable for shares of beneficial interest redeemed | |

Accrued investment advisory fees | |

Accrued distribution fees — Note 3 | |

Accrued shareholder administrative fees | |

Accrued administrative fees | |

Accrued professional fees | |

Accrued fund accounting fees | |

Accrued transfer agent fees | |

| |

| |

| |

| |

| |

| |

|

Paid in capital (par value of $.001 per share) | |

| |

| |

| |

| |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDStatement of Assets and Liabilities October 31, 2024 (Continued)

| |

|

| |

| |

| |

| |

SHARES OF BENEFICIAL INTEREST OUTSTANDING — Note 6: |

| |

| |

| |

| |

NET ASSET VALUE PER SHARE: |

| |

Class A - Offering Price Per Share (includes a 5.25% sales charge) | |

| |

| |

| |

| At October 31, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $16,929,424, amounted to $4,558,755, which consisted of aggregate gross unrealized appreciation of $5,001,892, and aggregate gross unrealized depreciation of $443,137. |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDStatement of Operations for the year ended October 31, 2024

| |

|

Dividends (net of foreign withholding taxes*) | |

| |

| |

|

Investment advisory fees — Note 3 | |

Distribution fees — Note 3 | |

| |

| |

| |

Shareholder administrative fees — Note 3 | |

Administration fees — Note 3 | |

| |

Fund accounting fees — Note 3 | |

| |

| |

Transfer agent fees — Note 3 | |

| |

| |

Interest expense — Note 3 | |

| |

| |

Less, expense reimbursements/waivers — Note 3 | |

| |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

Net realized gain on unaffiliated investments | |

Net realized gain on foreign currency transactions | |

Net realized gain on investments and foreign currency | |

Net change in unrealized appreciation on unaffiliated investments | |

Net change in unrealized appreciation on affiliated investments | |

Net change in unrealized appreciation on foreign currency | |

Net change in unrealized appreciation on investments and foreign currency | |

Net realized and unrealized gain on investments and foreign currency | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

* Foreign withholding taxes | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDStatements of Changes in Net Assets

| |

| For the

Year Ended

October 31, 2024 | For the

Year Ended

October 31, 2023 |

| | |

Net realized gain on investments and foreign currency | | |

Net change in unrealized appreciation on investments and foreign currency | | |

Net increase in net assets resulting from operations | | |

Dividends and distributions to shareholders: |

| | |

| | |

| | |

| | |

Total dividends and distributions to shareholders | | |

Decrease from shares of beneficial interest transactions: |

| | |

| | |

| | |

| | |

Net decrease from shares of beneficial interest transactions — Note 6 | | |

Total increase (decrease) | | |

|

| | |

| | |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDFinancial Highlights for a share outstanding throughout the period

| |

| | | | | |

Net asset value, beginning of period | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | | | |

Total from investment operations | | | | | |

Dividends from net investment income | | | | | |

Distributions from net realized gains | | | | | |

Net asset value, end of period | | | | | |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | |

Ratio of gross expenses to average net assets | | | | | |

Ratio of expense reimbursements to average net assets | | | | | |

Ratio of net expenses to average net assets | | | | | |

Ratio of net investment loss to average net assets | | | | | |

| | | | | |

| Amount was computed based on average shares outstanding during the period. |

| Does not reflect the effect of sales charges, if applicable. |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDFinancial Highlights for a share outstanding throughout the period

| |

| | | | | |

Net asset value, beginning of period | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | | | |

Total from investment operations | | | | | |

Dividends from net investment income | | | | | |

Distributions from net realized gains | | | | | |

Net asset value, end of period | | | | | |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | |

Ratio of gross expenses to average net assets | | | | | |

Ratio of expense reimbursements to average net assets | | | | | |

Ratio of net expenses to average net assets | | | | | |

Ratio of net investment loss to average net assets | | | | | |

| | | | | |

| Amount was computed based on average shares outstanding during the period. |

| Does not reflect the effect of sales charges, if applicable. |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDFinancial Highlights for a share outstanding throughout the period

| |

| | | | | |

Net asset value, beginning of period | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | | | |

Total from investment operations | | | | | |

Dividends from net investment income | | | | | |

Distributions from net realized gains | | | | | |

Net asset value, end of period | | | | | |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | |

Ratio of gross expenses to average net assets | | | | | |

Ratio of expense reimbursements to average net assets | | | | | |

Ratio of net expenses to average net assets | | | | | |

Ratio of net investment loss to average net assets | | | | | |

| | | | | |

| Amount was computed based on average shares outstanding during the period. |

| Does not reflect the effect of sales charges, if applicable. |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDFinancial Highlights for a share outstanding throughout the period

| |

| | | | | |

Net asset value, beginning of period | | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

| | | | | |

Net realized and unrealized gain (loss) on investments | | | | | |

Total from investment operations | | | | | |

Dividends from net investment income | | | | | |

Distributions from net realized gains | | | | | |

Net asset value, end of period | | | | | |

| | | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | | |

Ratio of gross expenses to average net assets | | | | | |

Ratio of expense reimbursements to average net assets | | | | | |

Ratio of net expenses to average net assets | | | | | |

Ratio of net investment loss to average net assets | | | | | |

| | | | | |

| Amount was computed based on average shares outstanding during the period. |

| Does not reflect the effect of sales charges, if applicable. |

See Notes to Financial Statements.

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS

NOTE 1 — General:

Alger Global Equity Fund (the “Fund”) is an open-end registered investment company organized as a business trust under the laws of the Commonwealth of Massachusetts. Effective August 6, 2024, the name of the Fund changed from Alger Global Focus Fund to Alger Global Equity Fund. The Fund qualifies as an investment company as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 – Financial Services – Investment Companies. The Fund’s investment objective is long-term capital appreciation. It seeks to achieve its objective by investing in equity securities in the United States and foreign countries. The Fund’s foreign investments will include securities of companies in both developed and emerging market countries.

The Fund offers Class A, C, I and Z shares. Class A shares are generally subject to an initial sales charge while Class C shares are generally subject to a deferred sales charge. Class C shares will automatically convert to Class A shares on the fifth business day of the month following the eighth anniversary of the purchase date of a shareholder’s Class C shares, without the imposition of any sales load, fee or other charge. Class C shares held at certain dealers may not convert to Class A shares or may be converted on a different schedule. At conversion, a proportionate amount of shares representing reinvested dividends and distributions will also be converted into Class A shares. Effective August 27, 2019, Class C shares were closed to direct shareholders and are only available for purchase through certain financial intermediaries and group retirement plan recordkeeping platforms. Class I shares are generally sold to institutional investors and are sold without an initial or deferred sales charge. Class Z shares are generally subject to a minimum initial investment of $500,000. Each class has identical rights to assets and earnings, except that each share class bears the pro rata allocation of the Fund’s expenses other than a class expense (not including advisory or custodial fees or other expenses related to the management of the Fund’s assets).

Alger Group Holdings, LLC, the parent company of Fred Alger Management, LLC the Fund's investment adviser, (“Alger Management” or the “Investment Manager”), acquired Redwood Investments, LLC (“Redwood”) effective January 31, 2024. Redwood became the sub-adviser to the Fund effective February 1, 2024. No changes were made to the investment objective, principal investment strategies, principal risks or investment restrictions as a result of this change.

Effective January 29, 2024, the Fund’s custodian and administrator transitioned from Brown Brothers Harriman & Company to The Bank of New York (collectively, the "Custodian").

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

NOTE 2 — Significant Accounting Policies:

(a) Investment Valuation: The Fund values its financial instruments at fair value using independent dealers or pricing services under policies approved by the Board. Investments held by the Fund are valued on each day the New York Stock Exchange (the “NYSE”) is open, as of the close of the NYSE (normally 4:00 p.m. Eastern Time).

The Board of Trustees of the Trust (the "Board") has designated, pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended (the “1940 Act”), the Fund's Investment Manager as its valuation designee (the “Valuation Designee”) to make fair value determinations subject to the Board’s review and oversight. The Valuation Designee has established a Valuation Committee (“Committee”) comprised of representatives of the Investment Manager and officers of the Fund to assist in performing the duties and responsibilities of the Valuation Designee.

The Valuation Designee has established valuation processes including but not limited to: (i) making fair value determinations when market quotations for financial instruments are not readily available in accordance with valuation policies and procedures adopted by the Board; (ii) assessing and managing material risks associated with fair valuation determinations; (iii) selecting, applying and testing fair valuation methodologies; and (iv) overseeing and evaluating pricing services used by the Fund. The Valuation Designee regularly reports its fair valuation determinations and related valuation information to the Board. The Committee generally meets quarterly and on an as-needed basis to review and evaluate the effectiveness of the valuation policies and procedures in accordance with the requirements of Rule 2a-5.

Investments in short-term securities held by the Fund having a remaining maturity of sixty days or less are valued at amortized cost which approximates market value. Investments in other open-end investment companies registered under the 1940 Act, including money market funds, are valued at such investment companies' net asset value per share.

Equity securities, including traded rights, warrants and option contracts for which valuation information is readily available, are valued at the last quoted sales price or official closing price on the primary market or exchange on which they are traded as reported by an independent pricing service. In the absence of quoted sales, such securities are generally valued at the bid price or, in the absence of a recent bid price, the equivalent as obtained from one or more of the major market makers for the securities to be valued.

Securities in which the Fund invests may be traded in foreign markets that close before the close of the NYSE. Developments that occur between the close of the foreign markets and the close of the NYSE may result in adjustments to the closing foreign prices to reflect what the Valuation Designee, through its

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

Committee, believes to be the fair value of these securities as of the close of the NYSE. The Fund may also fair value securities in other situations, for example, when a particular foreign market is closed but the NYSE is open.

FASB Accounting Standards Codification 820 – Fair Value Measurements and Disclosures (“ASC 820”) defines fair value as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability and may be observable or unobservable. Observable inputs are based on market data obtained from sources independent of the Fund. Unobservable inputs are inputs that reflect the Fund's own assumptions based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below. Each Fund's quantitative summary by Level can be found in Note 8.

• Level 1 – quoted prices in active markets for identical investments

• Level 2 – significant other observable inputs (including quoted prices for similar or identical investments, amortized cost, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The Fund's valuation techniques are generally consistent with either the market or the income approach to fair value. The market approach considers prices and other relevant information generated by market transactions involving identical or comparable assets to measure fair value. The income approach converts future amounts to a current, or discounted, single amount. These fair value measurements are determined on the basis of the value indicated by current market expectations about such future events. Inputs for Level 1 include exchange-listed prices and broker quotes in an active market. Inputs for Level 2 include the last trade price in the case of a halted security, an exchange-listed price which has been adjusted for fair value factors, and prices of closely related securities. Additional Level 2 inputs include an evaluated price which is based upon a compilation of observable market information such as spreads for fixed income and preferred securities. Inputs for Level 3 include, but are not limited to, revenue multiples, earnings before interest, taxes, depreciation and amortization (“EBITDA”) multiples, discount rates, time to exit and the probabilities of success of certain outcomes. Such unobservable market information may be obtained from a company’s financial statements and from industry studies, market data, and market indicators such as benchmarks and indexes. Because of the inherent

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

uncertainty and often limited markets for restricted securities, the valuations assigned to such securities by the Fund may significantly differ from the valuations that would have been assigned by the Fund had there been an active market for such securities.

(b) Cash and Cash Equivalents: Cash and cash equivalents include U.S. dollars and foreign cash.

(c) Securities Transactions and Investment Income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income is recognized on the accrual basis.

Premiums and discounts on debt securities purchased are amortized or accreted over the lives of the respective securities.

(d) Foreign Currency Transactions: The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at the prevailing rates of exchange on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of such transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are included in realized and unrealized gain or loss on investments in the accompanying Statement of Operations.

(e) Forward Foreign Exchange Contracts: The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of foreign currency denominated portfolio transactions. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price on a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. Realized gains or losses equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed are recorded upon delivery or receipt of the currency.

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

These contracts may involve market risk in excess of the unrealized gain or loss reflected on the Statement of Assets and Liabilities. In addition, the Fund could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably to the base currency.

(f) Dividends to Shareholders: Dividends and distributions payable to shareholders are recorded by the Fund on the ex-dividend date. The Fund declares and pays dividends from net investment income, if available, annually. Dividends from net realized gains, offset by any loss carryforward, are declared and paid annually after the end of the fiscal year in which earned. Each share class is treated separately in determining the amount of dividends from net investment income payable to holders of its shares.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules. Therefore, the source of the Fund’s distributions may be shown in the accompanying financial statements as either from, or in excess of, net investment income, net realized gain on investment transactions, or return of capital, depending on the type of book/tax differences that may exist. Capital accounts within the financial statements are adjusted for permanent book/tax differences. Reclassifications result primarily from the differences in tax treatment of net operating losses, passive foreign investment companies, and foreign currency transactions. The reclassifications are done annually at year-end and have no impact on the net asset value of the Fund and are designed to present the Fund’s capital accounts on a tax basis.

(g) Federal Income Taxes: It is the Fund’s policy to comply with the requirements of the Internal Revenue Code Subchapter M applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Provided that the Fund maintains such compliance, no federal income tax provision is required.

FASB Accounting Standards Codification 740 – Income Taxes (“ASC 740”) requires the Fund to measure and recognize in its financial statements the benefit of a tax position taken (or expected to be taken) on an income tax return if such position will more likely than not be sustained upon examination based on the technical merits of the position. No tax years are currently under investigation. The Fund files income tax returns in the U.S. Federal jurisdiction, as well as the New York State and New York City jurisdictions. The statute of limitations on the Fund's tax returns remains open for the tax years 2020-2023. Alger Management does not believe there are any uncertain tax positions that require recognition of a tax liability.

(h) Allocation Methods: Income, realized and unrealized gains and losses, and expenses of the Fund are allocated among the Fund’s classes based on relative

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

net assets, with the exception of distribution fees, transfer agency fees, and shareholder servicing and related fees.

(i) Estimates: These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America, which require using estimates and assumptions that affect the reported amounts therein. Actual results may differ from those estimates. All such estimates are of a normal recurring nature.

NOTE 3 — Investment Advisory Fees and Other Transactions with Affiliates:

(a) Investment Advisory Fees: Fees incurred by the Fund, pursuant to the provisions of the Fund's Investment Advisory Agreement with the Investment Manager, are payable monthly and computed based on the following annual rates. The actual rate paid as a percentage of average daily net assets, for the year ended October 31, 2024, is set forth below under the heading “Actual Rate”:

| Tier 1 rate is paid on assets up to $500 million, Tier 2 rate is paid on assets in excess of $500 million. |

The sub-adviser to the Fund, Redwood, is paid a sub-advisory fee from the advisory fee that Alger Management receives at no additional cost to the Fund. The sub-advisory fee is equal to 100% of the net advisory fee paid by the Fund to Alger Management with respect to the assets sub-advised by Redwood. From February 1, 2024 (the date Redwood began sub-advising the Fund) through October 31, 2024, Alger Management paid a sub-advisory fee of $93,477 to Redwood.

Alger Management has contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through October 31, 2025 to the extent necessary to limit other expenses and any other applicable share class-specific expenses to the rates, based on average daily net assets, as listed in the table below. On October 22, 2024, the Board approved exclusion of all cost related to the August 16, 2024 joint special meeting of shareholders from the expense reimbursement with Alger Management.

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

| | FEES WAIVED /

REIMBURSED FOR THE

YEAR ENDED

OCTOBER 31,

2024 |

| | | | |

| | | | | |

| | | | | |

| Prior to February 29, 2024, Alger Management agreed to waive and/or reimburse Fund expenses for Class A shares and Class I shares to limit operating expenses to 0.70% and 0.45%, respectively. |

Alger Management may recoup any fees waived or expenses reimbursed pursuant to the contract; however, the Fund will only make repayments to the Investment Manager if such repayment does not cause the Fund’s expense ratio, after the repayment is taken into account, to exceed both (i) the expense cap in place at the time such amounts were waived or reimbursed, and (ii) the Fund’s current expense cap. Such recoupment is limited to two years from the date the amount is initially waived or reimbursed. For the year ended October 31, 2024, the recoupments made by the Fund to the Investment Manager were $949.

(b) Administration Fees: Fees incurred by the Fund, pursuant to the provisions of the Fund's Fund Administration Agreement with Alger Management, are payable monthly and computed based on the average daily net assets of the Fund at the annual rate of 0.0275%.

(c) Distribution/Shareholder Servicing Fees: The Fund has adopted distribution plans for its Class A, Class C and Class I shares pursuant to which the Fund pays Fred Alger & Company, LLC, the Fund's distributor and an affiliate of the Investment Manager (the "Distributor" or "Alger LLC"), a fee at the annual rate of 0.25% of the average daily net assets of the Class A and Class I shares and 1.00% of the average daily net assets of the Class C shares to compensate Alger LLC for its activities and expenses incurred in distributing and/or administering the Fund's shares and/or shareholder servicing. The fees paid may be more or less than the expenses incurred by Alger LLC.

(d) Sales Charges: Sales of shares of the Fund may be subject to contingent deferred sales charges. The contingent deferred sales charges are used by Alger LLC to offset distribution expenses previously incurred. Sales charges do not represent expenses of the Fund. For the year ended October 31, 2024, there were no contingent deferred sales charges imposed.

(e) Brokerage Commissions: During the year ended October 31, 2024, the Fund paid Alger LLC $140 in connection with securities transactions.

(f) Shareholder Administrative Fees: The Fund has entered into a Shareholder Administrative Services Agreement with Alger Management to compensate Alger Management for liaising with, and providing administrative oversight of, the Fund's transfer agent, and for other related services. The Fund compensates

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

Alger Management at the annual rate of 0.0165% of the respective average daily net assets of Class A and Class C shares and 0.01% of the respective average daily net assets for the Class I and Class Z shares for these services.

Alger Management makes payments to intermediaries that provide sub-accounting services to omnibus accounts invested in the Fund. A portion of the fees paid by Alger Management to intermediaries that provide sub-accounting services are charged back to the Fund, subject to certain limitations, as approved by the Board. For the year ended October 31, 2024, Alger Management charged back $4,800 to the Fund for these services, which are included in transfer agent fees in the accompanying Statement of Operations.

(g) Trustee Fees: Each trustee who is not an “interested person” of the Fund, as defined in the 1940 Act (“Independent Trustee”), receives a fee of $165,400 per annum, paid pro rata based on net assets by each fund in the Alger Fund Complex, plus travel expenses incurred for attending board meetings. Prior to January 1, 2024, each Independent Trustee received $156,000 per annum, paid pro rata based on net assets by each fund in the Alger Fund Complex, plus travel expenses incurred for attending board meetings. The term “Alger Fund Complex” refers to the Fund, The Alger Institutional Funds, The Alger Funds, The Alger Portfolios, The Alger Funds II and The Alger ETF Trust, each of which is a registered investment company managed by Alger Management. The Independent Trustee appointed as Chairman of the Board receives additional compensation of $22,000 per annum paid pro rata based on net assets by each fund in the Alger Fund Complex. Additionally, each member of the Audit Committee receives a fee of $13,000 per annum, paid pro rata based on net assets by each fund in the Alger Fund Complex.

The Board has adopted a policy requiring Independent Trustees to receive a minimum of 10% of their annual compensation in shares of one or more of the funds in the Alger Fund Complex.

(h) Interfund Trades: The Fund may engage in purchase and sale transactions with other funds advised by Alger Management or sub-advised by Weatherbie Capital, LLC or Redwood, affiliates of the Alger Management. For the year ended October 31, 2024, there were no interfund trades.

(i) Interfund Loans: The Fund, along with other funds in the Alger Fund Complex, may borrow money from and lend money to each other for temporary or emergency purposes. To the extent permitted under its investment restrictions, the Fund may lend uninvested cash in an amount up to 15% of its net assets to other funds in the Alger Fund Complex. If the Fund has borrowed from other funds in the Alger Fund Complex and has aggregate borrowings from all sources that exceed 10% of the Fund’s total assets, the Fund will secure all of its loans from other funds in the Alger Fund Complex. The interest rate charged on interfund loans is equal to the average of the overnight U.S. Treasury money

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

market rate and bank loan rate available to the Funds. There were no interfund loans outstanding as of October 31, 2024.

During the year ended October 31, 2024, the Fund incurred interfund loan interest expense of $35, which is included in interest expense in the accompanying Statement of Operations.

(j) Other Transactions with Affiliates: Certain officers and one Trustee of the Fund are directors and/or officers of Alger Management, the Distributor, or their affiliates. At October 31, 2024, Alger Management and its affiliated entities owned the following shares:

NOTE 4 — Securities Transactions:

The following summarizes the securities transactions by the Fund, other than U.S. Government securities and short-term securities, for the year ended October 31, 2024:

The Fund may borrow from the Custodian, on an uncommitted basis. The Fund pays the Custodian a market rate of interest, generally based upon a rate of return with respect to each respective currency borrowed, taking into consideration relevant overnight and short-term reference rates and the range of distribution between and among the interest rates paid on deposits to other institutions, less applicable commissions, if any. Borrowings from the Custodian, if any, are included in Bank overdraft in the Statement of Assets and Liabilities. The Fund may also borrow from other funds in the Alger Fund Complex, as discussed in Note 3(i). For the year ended October 31, 2024, the Fund had the following borrowings from the Custodian and other funds in the Alger Fund Complex:

| | WEIGHTED AVERAGE

INTEREST RATE |

| | |

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

The highest amount borrowed from the Custodian and other funds in the Alger Fund Complex during the year ended October 31, 2024 was as follows:

The Fund has an unlimited number of authorized shares of beneficial interest of $.001 par value. During the year ended October 31, 2024, and the year ended October 31, 2023, transactions of shares of beneficial interest were as follows:

| FOR THE YEAR ENDED

October 31, 2024 | FOR THE YEAR ENDED

October 31, 2023 |

| | | | |

|

| | | | |

| | | | |

Shares converted from Class C | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Shares converted to Class A | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

NOTE 7 — Income Tax Information:

The tax character of distributions paid during the year ended October 31, 2024 and the year ended October 31, 2023 was as follows:

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

| FOR THE YEAR ENDED

October 31, 2024 | FOR THE YEAR ENDED

October 31, 2023 |

|

| | |

| | |

| | |

| | |

As of October 31, 2024, the components of accumulated earnings (losses) on a tax basis were as follows:

| |

Undistributed ordinary income | |

Undistributed long-term gains | |

| |

Capital loss carryforwards | |

Late year ordinary income losses | |

Net unrealized appreciation | |

Total accumulated earnings | |

During the year ended October 31, 2024, the Fund utilized capital loss carryforwards of $224,510.

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is determined annually and is attributable primarily to the tax deferral of losses on wash sales, U.S. Internal Revenue Code Section 988 currency transactions, tax treatment of partnership investments, the realization of unrealized appreciation of passive foreign investment companies, and the return of capital from real estate investment trust investments.

The Fund accrues tax on unrealized gains in foreign jurisdictions that impose a foreign capital tax, if applicable.

Permanent differences, primarily from net operating losses and real estate investment trusts and partnership investments sold by the Fund's resulted in the following reclassifications among the Fund's components of net assets at October 31, 2024:

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

NOTE 8 — Fair Value Measurements:

The following is a summary of the inputs used as of October 31, 2024 in valuing the Fund's investments carried at fair value on a recurring basis. Based upon the nature, characteristics, and risks associated with its investments, the Fund has determined that presenting them by security type and sector is appropriate.

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

REAL ESTATE INVESTMENT TRUST | | | | |

| | | | |

| | | | |

| | | | |

TOTAL INVESTMENTS IN SECURITIES | | | | |

| Prosetta Biosciences, Inc., Series D shares are classified as a Level 3 investment and are fair valued at zero as of October 31, 2024. |

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

| FAIR VALUE

MEASUREMENTS

USING SIGNIFICANT

UNOBSERVABLE

INPUTS (LEVEL 3) |

| |

Opening balance at November 1, 2023 | |

| |

| |

| |

Included in net realized gain (loss) on investments | |

Included in net change in unrealized appreciation (depreciation) on investments | |

Purchases and Sales/Distributions | |

| |

| |

Closing balance at October 31, 2024 | |

Net change in unrealized appreciation (depreciation) attributable to investments

still held at October 31, 2024** | |

| Includes securities that are fair valued at zero. |

| Net change in unrealized appreciation (depreciation) is included in the net change in unrealized appreciation

(depreciation) on investments in the accompanying Statement of Operations. |

The following table provides quantitative information about the Fund's Level 3 fair value measurements of its investments as of October 31, 2024. The table below is not intended to be all-inclusive, but rather provides information on the Level 3 inputs as they relate to the Fund's fair value measurements.

| Fair Value

October 31,

2024 | | | | |

|

| | | | | |

| Security type listed represents only one investment. |

| Prosetta Biosciences, Inc., Series D shares are classified as a Level 3 investment and are fair valued at zero as of October 31, 2024. |

The significant unobservable inputs used in the fair value measurement of the Fund's securities are revenue and EBITDA multiples, discount rates, and the probability of success of certain outcomes. Significant increases and decreases in these inputs in isolation and interrelationships between these inputs would have resulted in significantly higher or lower fair value measurements than those noted in the table above. Generally, all other things being equal, increases in revenue and EBITDA multiples, decreases in discount rates, and increases in the probability of success result in higher fair value measurements, whereas decreases in revenues and EBITDA multiples, increases in discount rates, and

ALGER GLOBAL EQUITY FUNDNOTES TO FINANCIAL STATEMENTS (Continued)

decreases in the probability of success result in lower fair value measurements. For the year ended October 31, 2024, there were no changes in valuation methodology on Level 3 investments.

FASB Accounting Standards Codification 815 – Derivatives and Hedging (“ASC 815”) requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of and gains and losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative agreements.