Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/AVK

...YOUR BRIDGE TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE ADVENT

CONVERTIBLE AND INCOME FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/avk, you will find:

| • | Daily, weekly and monthly data on share prices, net asset values, dividends and more |

| • | Portfolio overviews and performance analyses |

| • | Announcements, press releases and special notices |

| • | Fund and adviser contact information |

Advent Capital Management and Guggenheim Investments are continually updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

| | |

| (Unaudited) | April 30, 2020 |

DEAR SHAREHOLDER

Tracy V. Maitland

President and Chief Executive Officer

We thank you for your investment in the Advent Convertible and Income Fund (the “Fund” or “AVK”). This report covers the Fund’s performance for the six months ended April 30, 2020.

Advent Capital Management, LLC (“Advent” or the “Investment Adviser”) serves as the Fund’s Investment Adviser. Based in New York, New York, with additional investment personnel in London, England, Advent is a credit-oriented firm specializing in the management of global convertible, high-yield and equity securities across three lines of business—long-only strategies, hedge funds and closed-end funds. As of April 30, 2020, Advent managed approximately $7.9 billion in assets.

Guggenheim Funds Distributors, LLC (the “Servicing Agent”) serves as the servicing agent to the Fund. The Servicing Agent is an affiliate of Guggenheim Partners, LLC, a global diversified financial services firm.

The Fund’s investment objective is to provide total return through a combination of capital appreciation and current income. Under normal market conditions, the Fund invests at least 80% of its managed assets in a diversified portfolio of convertible securities and non-convertible income securities. Under normal market conditions, the Fund will invest at least 30% of its managed assets in convertible securities and may invest up to 70% of its managed assets in non-convertible income securities. The Fund may invest without limitation in foreign securities. The Fund also uses a strategy of writing (selling) covered call options on up to 25% of the securities held in the portfolio, thus generating option writing premiums.

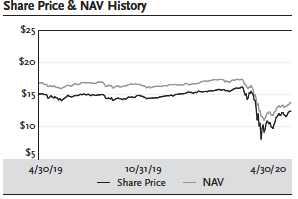

All AVK returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended April 30, 2020, the Fund generated a total return based on market price of -11.80% and a total return of -12.39% based on NAV. As of April 30, 2020, the Fund’s market price of $12.39 represented a discount of 9.43% to NAV of $13.68.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

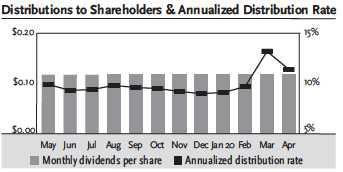

The Fund paid a distribution each month of the semi-annual period. The most recent monthly distribution paid on April 30, 2020 of $0.1172, represents an annualized distribution rate of 11.35% based upon the last closing market price of $12.39 on April 30, 2020.

There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see the Questions and Answers on page 5 for more information on distributions for the period.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 3| | |

| DEAR SHAREHOLDER (Unaudited) continued | April 30, 2020 |

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 67 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time.

The Fund is managed by a team of experienced and seasoned professionals led by myself in my capacity as Chief Investment Officer (as well as President and Founder) of Advent Capital Management, LLC. We encourage you to read the following Questions & Answers section, which provides additional information regarding the factors that influenced the Fund’s performance.

We thank you for your investment in the Fund and we are honored that you have chosen the Advent Convertible and Income Fund as part of your investment portfolio. For the most up-to-date information regarding your investment, including related investment risks, please visit the Fund’s website at guggenheiminvestments.com/avk.

Sincerely,

Tracy V. Maitland

President and Chief Executive Officer of the

Advent Convertible and Income Fund

May 31, 2020

4 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| QUESTIONS & ANSWERS (Unaudited) | April 30, 2020 |

The individuals who are primarily responsible for the day-to-day management of the portfolio (the “Portfolio Managers”) of Advent Convertible and Income Fund (the “Fund” or “AVK”) include Tracy Maitland (President and Chief Investment Officer of Advent), Paul Latronica (Managing Director of Advent) and Tony Huang (Director of Advent). Mr. Maitland and Mr. Latronica are portfolio managers and Mr. Huang is an associate portfolio manager. The Portfolio Managers are supported by teams of investment professionals who make investment decisions for the Fund’s core portfolios of convertible bonds, the Fund’s high yield securities investments and the Fund’s leverage allocation, respectively. In the following interview, the management team discusses the convertible securities and high yield markets and Fund performance for the six-month period ended April 30, 2020.

Please describe the Fund’s objective and management strategies.

The Fund’s investment objective is to provide total return through a combination of capital appreciation and current income. Under normal market conditions, the Fund invests at least 80% of its managed assets in a diversified portfolio of convertible securities and non-convertible income producing securities. Under normal market conditions, the Fund must invest at least 30% of its managed assets in convertible securities and may invest up to 70% of its managed assets in nonconvertible income securities. The Fund may invest without limitation in foreign securities.

The Fund also uses a strategy of writing (selling) covered call options on up to 25% of the securities held in the portfolio. The objective of this strategy is to generate current gains from option premiums to enhance distributions payable to the holders of common shares. In addition, the Fund may invest in other derivatives, such as put options, forward foreign currency exchange contracts, futures contracts, and swaps.

The Fund uses financial leverage to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains earned on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of the financial leverage, shareholders’ return will be less than if financial leverage had not been used.

Discuss Advent’s investment approach.

Advent’s approach involves core portfolios of convertible bonds that are managed, subject to the Fund’s investment policies and restrictions, in a manner similar to that of Advent’s Balanced Convertible Strategy and Global Balanced Convertible Strategy, which seek high total returns by investing in a portfolio of U.S.-dollar convertible securities and global convertible securities, respectively, that provide equity-like returns while seeking to limit downside risk.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 5

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

These core portfolios are supplemented by investments in high yield securities selected in a manner similar to that of Advent’s High Yield Strategy, which seeks income and total return by investing primarily in high yielding corporate credit using fundamental and relative value analysis to identify undervalued securities.

Advent uses a separate portion of the Fund’s portfolio to increase or decrease relative overall exposure to convertible securities, high yield securities, and equities. This portion of the Fund’s portfolio incorporates leverage and operates as an asset-allocation tool reflecting Advent’s conservative management philosophy and its views on the relative value of these three asset classes under changing market conditions.

Please describe the economic and market environment over the last six months.

The period from October 2019 through April 2020 saw two disparate capital markets situations. In the first three months, a continuation of the long bull market appeared at hand as U.S. Gross Domestic Product (“GDP”) grew 2.1% in the fourth calendar quarter of 2019, similar to the other three quarters of the year. The U.S. Federal Reserve (the “Fed”) rate cuts helped boost the economy as industrial production, home construction, and employment all showed upside, staving off a manufacturing slowdown that was imported from weakness that began abroad. A Phase One trade deal between the U.S. and China as well as an orderly British exit from the European Union improved sentiment. Rebounding purchasing manager indices (“PMI”) in Europe and China and an apparent successful soft landing in the U.S. economy gave optimism that 2020 could be a year of accelerating growth. Equity and corporate bond markets marched higher, briefly correcting in January as the Chinese government instituted restrictions to contain a novel corona-virus, named coronavirus disease 2019 (“COVID-19”), which was first identified in Wuhan, China.

The second three months saw the largest sell-off in over a decade as COVID-19 became a global pandemic with mushrooming cases in February, March, and April, principally in Europe and the U.S. while more broadly contained in Asian nations. Civil restrictions on movement curtailed working life and social gatherings in most of the Western world and took economic activity in any industry not deemed essential to a standstill. The interruption of global business caused great fear of liquidity seizures among corporations and consumers, leading to plunging equity valuations and panic in corporate bond markets of both capital market liquidity and borrower solvency. Into the fourth week of March, selling pressure predominated in virtually every fixed-income market except risk-free developed-market government bonds. At that point, government responses kicked in with central banks promising trillions of market support, led by the Fed's $2.3 trillion of various bond-buying and loan programs but also an impressive $1 trillion plus of stimulus in Japan. The breadth of the U.S. programs (reaching into new markets such as high-yield exchange traded funds and direct loans to small and medium businesses) and containment of COVID-19’s spread before it overwhelmed health care facilities helped markets recover into the end of April.

Returns for the various asset classes are discussed in sections below, but the six-month period overall was characterized by a four-to-five-week period of plunging securities prices starting in mid-February that was deeper than the gradually rising prices in the weeks around it.

6 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

How did the Fund perform in this environment?

All AVK returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended April 30, 2020, the Fund generated a total return based on market price of -11.80% and a total return of -12.39% based on NAV. As of April 30, 2020, the Fund’s market price of $12.39 represented a discount of 9.43% to NAV of $13.68. As of October 31, 2019, the Fund’s market price of $14.79 represented a discount of 9.49% to NAV of $16.34.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

How did other markets perform in this environment for the six-month period ended April 30, 2020?

| | |

| Index | Total Return |

Bloomberg Barclays U.S. Aggregate Bond Index | 4.86% |

ICE Bank of America (“BofA”) Merrill Lynch U.S. Convertible Index | 1.44% |

ICE BofA Merrill Lynch U.S. High Yield Index | -7.69% |

Refinitiv Global Focus Convertible U.S. Dollar Hedged Index | 0.85% |

Standard & Poor’s 500® (“S&P 500”) Index | -3.17% |

What contributed to performance?

Various markets listed above had mixed performance in the six-month period ended April 30, 2020. The U.S. equity market performed well relative to its counterparts in foreign countries and the U.S. high yield bond market. The U.S. equity strength was particularly noteworthy in growth sectors such as technology and health care and in large-capitalization companies. More value-oriented sectors underperformed, and this trend intensified during the COVID-19 pandemic sell-off as investors bemoaned the economic effect on the yield curve, commodities and levered companies in general. This led to negative relative performance in the financial, natural resources, and real estate sectors. The U.S. markets continued to outperform in the April rebound as the extent of fiscal and monetary stimulus was not replicated in foreign markets compared to the U.S., with the exception of Japan.

The U.S. convertible market performed better than the S&P 500 Index of U.S. stocks, as its larger exposure to innovative growth companies helped in the context of growth sectors leading the market. Offsetting this advantage was the impact of corporate bond spread widening, as markets feared the disruption to earnings streams. This effect was further illustrated by the negative returns in the U.S. high-yield market, which has a greater duration than the convertible market and more exposure to cyclical and natural resource segments that suffered in recessionary economic conditions.

In the global convertibles index, foreign returns did not keep up with U.S. ones as there was less in the way of central bank stimulus both before and after the COVID-19 pandemic to catalyze securities

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 7

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

markets. European returns in particular lagged those of the U.S. equity markets, but all regions with notable issuance of convertible securities (Europe, Asia ex-Japan, Japan) had negative returns, while the U.S. market returns were positive.

The five-year U.S. Treasury note, which has a duration most closely matching the high-yield bond universe, fell in yield from 1.52% at October 2019 to 0.36% at April 2020, as the COVID-19 pandemic led the Fed to reduce short-term interest rates to zero. The high-yield corporate bond index’s spread widened from 4.15% to 7.61% as investors priced in more default risk. The greater effect of spread widening than risk-free rate compression led to negative returns in the high-yield market.

Please discuss the Fund’s distributions.

The Fund paid a distribution each month of the semi-annual period. The most recent monthly distribution paid on April 30, 2020 of $0.1172, represents an annualized distribution rate of 11.35% based upon the last closing market price of $12.39 on April 30, 2020.

The Fund currently anticipates that some of the 2020 distributions will consist of income and some will be a return of capital. A final determination of the tax character of distributions paid by the Fund in 2020 will be reported to shareholders in January 2021 on form 1099-DIV.

| | |

| Payable Date | Amount |

November 29, 2019 | $0.1172 |

December 31, 2019 | $0.1172 |

January 31, 2020 | $0.1172 |

February 28, 2020 | $0.1172 |

March 31, 2020 | $0.1172 |

April 30, 2020 | $0.1172 |

| Total | $0.7032 |

There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Fund’s distribution rate is not constant and the amount of distributions, when and if declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund.

While the Fund generally seeks to pay distributions that will consist primarily of investment company taxable income and net capital gain, because of the nature of the Fund’s investments and changes in market conditions from time to time, or in order to maintain a more stable distribution level over time, the distributions paid by the Fund for any particular period may be more or less than the amount of net investment income from that period. If the Fund’s total distributions in any year exceed the amount of its investment company taxable income and net capital gain for the year, any such excess would generally be characterized as a return of capital for U.S. federal income tax purposes.

A return of capital distribution is in effect a partial return of the amount a shareholder invested in the Fund. A return of capital does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” A return of capital distribution decreases the

8 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

Fund’s total assets and, therefore, could have the effect of increasing the Fund’s expense ratio. Please see Note 2(g) on page 44 for more information on distributions for the period.

How has the Fund’s leverage strategy affected performance?

As part of its investment strategy, the Fund utilizes leverage to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged.

The Fund had $324 million in leverage outstanding as of April 30, 2020, approximately 41% of the Fund’s total managed assets; $188 million is in the form of borrowings with Société Générale, and $136 million was in a reverse repurchase agreement with Société Générale. Both forms of leverage have tranches that expire in December 2020 and December 2022, and the borrowings has a floating tranche that varies with 3-month London Interbank Offered Rates (LIBOR). The average interest rate of the combined leverage for the period ended April 30, 2020 was 3.34%, a decline from the 3.55% average discussed in the 2019 annual report. The decline is due to reductions in 3-month LIBOR.

There is no guarantee that the Fund’s leverage strategy will be successful, and the Fund’s use of leverage may cause the Fund’s NAV and market price of common shares to be more volatile. The NAV return for the Fund was negative and below the cost of leverage for the six months. Although Advent looks at funds deployed from borrowings differently than funds which use the shareholder equity base, on this simple metric, the Fund’s leverage was not beneficial to shareholders for the fiscal period given the negative aggregate security returns in the portfolio. Positively, the drop in short-term rates as the Fed cut its monetary policy target to zero, and the reset of some of the Fund's leverage to short-term floating tranches after ending some of the fixed swaps, has helped lower borrowing costs going forward. Advent continues to seek attractive and relatively lower-risk opportunities to invest borrowings that provide income above the cost of borrowing and the asymmetry of returns against equity scenarios provided by the convertible asset class.

What was the impact of the Fund’s covered call strategy?

The income generated from writing covered call equity options depends on the volatility perceived in the markets at the time of writing the contracts. The CBOE VIX Volatility Index, or “VIX” for its ticker, which averaged 16.8 during the 2019 fiscal year, spiked during the COVID-19 pandemic, closing April at 34.2 and averaging 26.7 for the half-year. Given the tremendous changes in equity prices in the period, the Fund focused on capital preservation and overall equity allocation rather than income-generation from call options. The VIX has remained at elevated levels as spring 2020 has progressed, but the economic and market environment remains highly unpredictable with steep outcomes either in appreciation or depreciation quite possible. The rebound from the lows in mid-March have been steeper than most rallies in recent years and capping upside in equity positions by writing options may have a worse outcome in total return than not writing at all. The Investment Adviser will continue to judge individual equity positions and the income possible from writing options based on the stock-specific volatility in coming to an optimal solution.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 9

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

How were the Fund’s total investments allocated among asset classes during the six months ended April 30, 2020, and what did this mean for performance?

On April 30, 2020, the Fund’s total investments were invested approximately 55.2% in convertible bonds, convertible preferred securities, and mandatory convertibles; 31.9% in corporate bonds; 6.2% in equities; 5.8% in cash and cash equivalents; and 0.9% in senior floating rate interests.

On October 31, 2019, the Fund’s total investments were invested approximately 47.6% in convertible bonds, convertible preferred securities, and mandatory convertibles; 42.8% in corporate bonds; 5.2% in equities; 3.4% in cash and cash equivalents; and 1.0% in senior floating rate interests.

The changes in asset allocation for the six months reflects the new opportunities available in the Fund's primary asset classes at the end of the reporting period. The Fed's Primary Market Corporate Credit Facility and Secondary Market Corporate Credit Facility have provided a crucial backstop for investors to return to the broader fixed-income markets with confidence. Higher equity volatility and desires for liquidity have made convertible securities more attractive for corporate issuance. As a result, convertible issuance ramped tremendously after the Fed's moves. With corporate spreads wider, the coupons and asymmetry characteristics of this new issuance were highly attractive to the Fund and led to a larger allocation to the convertible asset class.

International investments declined from 22.8% at October 2019 to 19.8% ending April 2020. The Fund’s exposure to foreign issuers remained relatively constant in the early part of the reporting period. A greater level of opportunities in the U.S. compared to foreign ones both in terms of economic opportunity with the Fed’s interest rate cuts and greater growth potential along with greater new issuance resulted in the slight fall in foreign allocation. Returns of domestic securities being higher than foreign ones also led to some of the fall in the international exposure.

Which investments had the greatest effect on the Fund’s performance?

With the positive returns in the convertible market and outperformance of growth sectors over value, it comes as no surprise the top contributors were all convertible issuers in growth companies. The greatest positive contributor for the six month period was electric vehicle maker Tesla, Inc. (0.6% of long-term investments at period end). The company reported strong fourth quarter 2019 and first quarter 2020 results with units exceeding expectations and a second and third quarter of GAAP operating profits. Optimism over the successful ramp of the Gigafactory in China, the upcoming Model Y, and the lack of meaningful competition from traditional automakers more than offset slowdown in production given California’s COVID-19 pandemic restrictions. Medical device maker Wright Medical (not held in portfolio at period end) announced it would be acquired by fellow device company Stryker, which invoked the valuable takeover make-whole provisions in the convertible bond. Online retailer Etsy, Inc. (0.2% of long-term investments at period end) advanced as the company continued to take share of online shopping and to grow 20% organically. The company like many online companies received a boost from the COVID-19 pandemic as more commerce took place from home. Finally, glucose monitoring device maker DexCom, Inc. (0.2% of long-term investments at period end) continued to appreciate as results showed continued growth especially internationally and adoption was only moderately affected by the spread of COVID-19.

10 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

Among detractors, mandatory convertibles in Stanley Black & Decker, Inc. (0.5% of long-term investments at period end) were hurt by aggressive inventory reduction of its products at retailers. Equity of hospital provider HCA (not held in portfolio at period end), originally bought after the Democratic primary race concluded without a fear of a Medicare-for-all push, fell after COVID-19 reduced near-term hospital capability to perform profitable elective surgeries. High-yield bonds of HCA, Inc. (0.4% of long-term investments at period end) also fell given HCA's leverage and profits being hobbled. High-yield bonds of Canadian oil sands producer MEG Energy (not held in portfolio at period end) fell as global oil supply became obvious with COVID-19 locking up the world's economy. The Fund did not have a noteworthy allocation to energy in its high-yield sleeve, and energy's bottom sector performance have led most portfolios to list some oil producers as among the largest detractors. Finally, colon cancer screener Exact Sciences (0.8% of long-term investments at period end) fell, especially in March as the company's services were curtailed during the COVID-19 pandemic as elective procedures were reduced to focus hospital resources on the virus. However, declines are abating as recent weeks pass and hospitals resume normal screenings.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 11| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

Index Definitions

The following indices are referenced throughout this report. It is not possible to invest directly in an index. These indices are intended as measures of broad market returns. The Fund’s mandate differs materially from each of the individual indices. The Fund also maintains leverage and incurs transaction costs, advisory fees, and other expenses, while these indices do not.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

VIX is the ticker symbol for the Chicago Board Options Exchange Market Volatility Index, a popular measure of the implied volatility of S&P 500 Index options. It is a weighted blend of prices for a range of options on the S&P 500 Index.

ICE BofA Merrill Lynch U.S. Convertible Index consists of convertible bonds traded in the U.S. dollar denominated investment grade and noninvestment grade convertible securities sold into the U.S. market and publicly traded in the United States. The Index constituents are market-value weighted based on the convertible securities prices and outstanding shares, and the underlying index is rebalanced daily.

ICE BofA Merrill Lynch U.S High Yield Index includes USD-denominated, high yield, fixed-rate corporate securities. Securities are classified as high yield if the rating of Moody’s, Fitch, or S&P is Ba1/BB +/BB + or below.

Refinitiv Global Focus Convertible U.S. Dollar Hedged Index (formerly Thomson Reuters Convertible Global Focus USD Hedged Index) is a market-weighted index with a minimum size for inclusion of $500 million (US), €375 million (Europe), ¥22 billion (Japan), and $275 million (Other) of Convertible Bonds with an Equity Link. A rebranding earlier in 2020 resulted in a change to the name of the benchmark.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of U.S. stock market.

AVK Risks and Other Considerations

The views expressed in this report reflect those of the Investment Adviser only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also contain forward-looking statements that involve risk and uncertainty, and there is no guarantee they will come to pass. There can be no assurance that the Fund will achieve its investment objectives or avoid losses. The value of the Fund will fluctuate with the value of the underlying securities.

12 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| QUESTIONS & ANSWERS (Unaudited) continued | April 30, 2020 |

Historically, closed-end funds often trade at a discount to their net asset value. In the normal course of business, the Fund trades financial instruments and enters into financial transactions where risk of potential loss exists due to, among other things, changes in the market (market risk) or the potential inability of a counterparty to meet the terms of an agreement (counterparty risk). The Fund is also exposed to other risks such as, but not limited to, concentration, interest rate, credit and financial leverage risks.

A new respiratory disease spreading from person-to-person and caused by a novel coronavirus was first identified in Wuhan, China in December 2019. The disease has been named coronavirus disease 2019 (“COVID-19”) and has since spread world-wide. The rapid and uncontrolled spread of COVID-19 has significantly overwhelmed existing healthcare infrastructure in many locations and prompted governmental responses and economic shutdowns of unprecedented scale. It is anticipated that the COVID-19 pandemic may result in a significant and prolonged reduction in global economic activity, significant increases in unemployment and financial instability across most of the world, which will exacerbate existing vulnerabilities in local, state and global economies and cause vulnerabilities and acute stresses in areas that were not previously apparent or identifiable. The COVID-19 pandemic could materially disrupt the business of the Investment Adviser and service providers that perform certain critical functions for the Investment Adviser or the Fund, have a material adverse effect on the Investment Adviser’s provision of services to the Fund, and may ultimately cause a partial or complete loss of capital attributable to one or more investments in the Fund.

Please see Note 2(i) beginning on page 45 for a discussion of certain Fund risks and considerations.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 13| | |

| FUND SUMMARY (Unaudited) | April 30, 2020 |

| | |

| Fund Statistics | |

Share Price | $12.39 |

Net Asset Value | $13.68 |

Discount to NAV | -9.43% |

Net Assets ($000) | $472,165 |

| | | | | | |

| AVERAGE ANNUAL TOTAL RETURNS | | | | |

| FOR THE PERIOD ENDED APRIL 30, 2020 | | | | |

| Six Month | | | | |

| (non- | One | Three | Five | Ten |

| annualized) | Year | Year | Year | Year |

Advent Convertible and | | | | | |

Income Fund | | | | | |

| (12.39%) | (11.23%) | 0.50% | 1.21% | 3.85% |

| Market | (11.80%) | (8.70%) | 1.07% | 2.21% | 4.58% |

| | |

| Portfolio Breakdown | % of Net Assets |

Convertible Bonds | 83.0% |

Corporate Bonds | 55.3% |

Convertible Preferred Stocks | 12.7% |

Common Stocks | 10.8% |

Money Market Fund | 10.0% |

Senior Floating Rate Interests | 1.4% |

| Total Investments | 173.2% |

| Other Assets & Liabilities, net | -73.2% |

| Net Assets | 100.0% |

Past performance does not guarantee future results and does not reflect the deductions of taxes that a shareholder would pay on Fund distributions. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. All portfolio data is subject to change daily. For more information, please visit guggenheiminvestments.com/avk.

The above summaries are provided for informational purposes only and should not be viewed as recommendations.

14 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| FUND SUMMARY (Unaudited) continued | April 30, 2020 |

All or a portion of the above distributions may be characterized as a return of capital. For the year ended October 31, 2019, 60% of the distributions were characterized as return of capital. As of April 30, 2020, 77% of the distributions were estimated to be characterized as return of capital. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in January 2021.

| | | |

| Country Diversification |

|

| Country | | % of Long-Term Investments |

United States | | 80.2% |

Cayman Islands | | 4.9% |

Canada | | 2.4% |

Netherlands | | 2.1% |

France | | 1.5% |

Bermuda | | 1.1% |

Luxembourg | | 1.1% |

Virgin Islands (UK) | | 0.9% |

Panama | | 0.9% |

Hong Kong | | 0.8% |

Ireland | | 0.5% |

United Kingdom | | 0.5% |

Japan | | 0.5% |

Marshall Islands | | 0.4% |

China | | 0.3% |

Australia | | 0.3% |

Spain | | 0.3% |

Taiwan, Province of China | | 0.2% |

Sweden | | 0.2% |

Switzerland | | 0.2% |

Austria | | 0.2% |

Germany | | 0.1% |

India | | 0.1% |

Denmark | | 0.1% |

Belgium | | 0.1% |

Israel | | 0.1% |

Total Long-Term Investments | | 100.0% |

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 15

| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) | April 30, 2020 |

| | | |

| Shares | Value |

|

COMMON STOCKS† – 10.8% | | |

| Consumer, Cyclical – 2.4% | | |

Home Depot, Inc.1 | 20,000 | $ 4,396,600 |

Lear Corp.1 | 25,000 | 2,441,250 |

Brinker International, Inc. | 100,000 | 2,328,000 |

MGM Resorts International1 | 119,000 | 2,002,770 |

| Total Consumer, Cyclical | | 11,168,620 |

|

| Consumer, Non-cyclical – 2.2% | | |

Merck & Company, Inc.1 | 56,500 | 4,482,710 |

Medtronic plc1 | 40,000 | 3,905,200 |

Cigna Corp. | 10,000 | 1,957,800 |

| Total Consumer, Non-cyclical | | 10,345,710 |

|

| Financial – 2.1% | | |

Morgan Stanley1 | 120,000 | 4,731,600 |

JPMorgan Chase & Co.1 | 30,000 | 2,872,800 |

Gaming and Leisure Properties, Inc. REIT1 | 91,000 | 2,569,840 |

| Total Financial | | 10,174,240 |

|

| Industrial – 2.1% | | |

Honeywell International, Inc.1 | 40,000 | 5,676,000 |

United Parcel Service, Inc. — Class B1 | 45,000 | 4,259,700 |

| Total Industrial | | 9,935,700 |

|

| Communications – 1.2% | | |

Walt Disney Co. | 30,000 | 3,244,500 |

AT&T, Inc.1 | 75,000 | 2,285,250 |

| Total Communications | | 5,529,750 |

|

| Technology – 0.8% | | |

Lam Research Corp.1 | 15,000 | 3,829,200 |

| Total Common Stocks | | |

| (Cost $49,750,280) | | 50,983,220 |

|

CONVERTIBLE PREFERRED STOCKS† – 12.7% | | |

| Financial – 4.1% | | |

Wells Fargo & Co. | | |

7.50%1 | 6,000 | 8,396,044 |

Bank of America Corp. | | |

7.25%1 | 5,295 | 7,319,808 |

Crown Castle International Corp. | | |

6.88% due 08/01/201 | 1,235 | 1,720,355 |

QTS Realty Trust, Inc. | | |

6.50%1 | 6,712 | 943,304 |

See notes to financial statements.

16 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Shares | Value |

|

CONVERTIBLE PREFERRED STOCKS† – 12.7% (continued) | | |

| Financial – 4.1% (continued) | | |

Assurant, Inc. | | |

6.50% due 03/15/211 | 7,678 | $ 822,314 |

| Total Financial | | 19,201,825 |

|

| Technology – 2.7% | | |

Change Healthcare, Inc. | | |

6.00% due 06/30/221 | 147,857 | 6,839,865 |

Broadcom, Inc. | | |

8.00% due 09/30/221 | 5,750 | 5,850,280 |

| Total Technology | | 12,690,145 |

|

| Consumer, Non-cyclical – 2.3% | | |

Elanco Animal Health, Inc. | | |

5.00% due 02/01/231 | 108,420 | 4,987,320 |

Danaher Corp. | | |

4.75% due 04/15/221 | 2,515 | 2,990,637 |

Bunge Ltd. | | |

4.88%1 | 20,506 | 1,918,541 |

Avantor, Inc. | | |

6.25% due 05/15/221 | 19,355 | 1,114,461 |

| Total Consumer, Non-cyclical | | 11,010,959 |

|

| Utilities – 1.9% | | |

Dominion Energy, Inc. | | |

7.25% due 06/01/221 | 30,757 | 3,042,790 |

NextEra Energy, Inc. | | |

5.28% due 03/01/231 | 54,469 | 2,352,516 |

4.87% due 09/01/221 | 23,854 | 1,143,561 |

American Electric Power Company, Inc. | | |

6.13% due 03/15/221 | 18,997 | 965,048 |

Southern Co. | | |

6.75% due 08/01/221 | 19,892 | 941,687 |

Sempra Energy | | |

6.75% due 07/15/211 | 4,770 | 483,845 |

| Total Utilities | | 8,929,447 |

|

| Industrial – 1.0% | | |

Stanley Black & Decker, Inc. | | |

5.25% due 11/15/221 | 45,712 | 3,634,561 |

Energizer Holdings, Inc. | | |

7.50% due 01/15/221 | 12,842 | 1,094,781 |

| Total Industrial | | 4,729,342 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 17

| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Shares | Value |

|

CONVERTIBLE PREFERRED STOCKS† – 12.7% (continued) | | |

| Basic Materials – 0.7% | | |

International Flavors & Fragrances, Inc. | | |

6.00% due 09/15/211 | 70,888 | $ 3,370,724 |

| Total Convertible Preferred Stocks | | |

| (Cost $59,406,930) | | 59,932,442 |

|

MONEY MARKET FUND† – 10.0% | | |

Morgan Stanley Institutional Liquidity Government Portfolio – | | |

Institutional Class, 0.12%1,2 | 47,070,882 | 47,070,882 |

| Total Money Market Fund | | |

| (Cost $47,070,882) | | 47,070,882 |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% | | |

| Technology – 21.1% | | |

Rapid7, Inc. | | |

1.25% due 08/01/231 | 6,014,000 | 7,525,017 |

2.25% due 05/01/253 | 3,203,000 | 3,269,062 |

Splunk, Inc. | | |

0.50% due 09/15/231 | 7,164,000 | 8,256,489 |

Lenovo Group Ltd. | | |

3.38% due 01/24/241 | 6,550,000 | 6,541,812 |

Microchip Technology, Inc. | | |

1.63% due 02/15/271 | 5,132,000 | 6,426,188 |

Synaptics, Inc. | | |

0.50% due 06/15/221 | 5,000,000 | 5,482,612 |

LivePerson, Inc. | | |

0.75% due 03/01/241,3 | 5,031,000 | 4,696,823 |

Talend S.A. | | |

1.75% due 09/01/241,3 | EUR 4,180,000 | 4,026,965 |

Pegasystems, Inc. | | |

0.75% due 03/01/251,3 | 4,000,000 | 3,887,155 |

New Relic, Inc. | | |

0.50% due 05/01/231 | 4,000,000 | 3,622,400 |

Silicon Laboratories, Inc. | | |

1.38% due 03/01/221 | 3,000,000 | 3,612,516 |

Akamai Technologies, Inc. | | |

0.13% due 05/01/251 | 1,774,000 | 2,114,106 |

0.38% due 09/01/271,3 | 1,321,000 | 1,381,669 |

Health Catalyst, Inc. | | |

2.50% due 04/15/251,3 | 3,053,000 | 3,344,575 |

Workday, Inc. | | |

0.25% due 10/01/221 | 2,707,000 | 3,324,968 |

Western Digital Corp. | | |

1.50% due 02/01/241 | 3,000,000 | 2,769,006 |

See notes to financial statements.

18 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Technology – 21.1% (continued) | | |

MongoDB, Inc. | | |

0.25% due 01/15/261,3 | 2,639,000 | $ 2,768,783 |

Lumentum Holdings, Inc. | | |

0.50% due 12/15/261,3 | 2,508,000 | 2,660,637 |

Insight Enterprises, Inc. | | |

0.75% due 02/15/251,3 | 1,917,000 | 1,928,790 |

Alteryx, Inc. | | |

1.00% due 08/01/261,3 | 1,945,000 | 1,844,054 |

ON Semiconductor Corp. | | |

1.63% due 10/15/231 | 1,465,000 | 1,600,154 |

STMicroelectronics N.V. | | |

due 07/03/221,4 | 1,200,000 | 1,561,212 |

Slack Technologies, Inc. | | |

0.50% due 04/15/251,3 | 1,316,000 | 1,464,479 |

Coupa Software, Inc. | | |

0.13% due 06/15/251,3 | 1,133,000 | 1,446,324 |

Nuance Communications, Inc. | | |

1.25% due 04/01/251 | 1,171,000 | 1,416,910 |

Workiva, Inc. | | |

1.13% due 08/15/263 | 1,721,000 | 1,392,363 |

Verint Systems, Inc. | | |

1.50% due 06/01/211 | 1,382,000 | 1,344,736 |

Atos SE | | |

due 11/06/241,4 | EUR 1,000,000 | 1,309,015 |

Envestnet, Inc. | | |

1.75% due 06/01/231 | 1,150,000 | 1,283,688 |

J2 Global, Inc. | | |

3.25% due 06/15/291 | 510,000 | 654,335 |

1.75% due 11/01/261,3 | 550,000 | 517,317 |

CSG Systems International, Inc. | | |

4.25% due 03/15/361 | 999,000 | 1,077,222 |

Twilio, Inc. | | |

0.25% due 06/01/231 | 620,000 | 1,031,709 |

ServiceNow, Inc. | | |

due 06/01/221,4 | 373,000 | 979,646 |

Innolux Corp. | | |

due 01/22/251,4 | 1,000,000 | 887,500 |

Teradyne, Inc. | | |

1.25% due 12/15/231 | 414,000 | 845,192 |

Tabula Rasa HealthCare, Inc. | | |

1.75% due 02/15/261,3 | 566,000 | 626,002 |

CyberArk Software Ltd. | | |

due 11/15/241,3,4 | 493,000 | 460,208 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 19

| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Technology – 21.1% (continued) | | |

Inphi Corp. | | |

0.75% due 04/15/251,3 | 217,000 | $ 229,451 |

| Total Technology | | 99,611,090 |

|

| Communications – 19.5% | | |

Liberty Media Corp. | | |

2.25% due 12/01/481,3 | 6,571,000 | 6,550,466 |

2.75% due 12/01/491,3 | 6,927,000 | 6,490,309 |

| 1.38% due 10/15/23 | 4,669,000 | 4,890,852 |

Booking Holdings, Inc. | | |

0.75% due 05/01/251,3 | 8,207,000 | 9,301,001 |

0.35% due 06/15/201 | 360,000 | 410,697 |

IAC Financeco 2, Inc. | | |

0.88% due 06/15/261,3 | 9,348,000 | 9,599,228 |

Viavi Solutions, Inc. | | |

1.00% due 03/01/241 | 3,386,000 | 3,811,366 |

1.75% due 06/01/231 | 3,000,000 | 3,313,125 |

Proofpoint, Inc. | | |

0.25% due 08/15/241,3 | 6,293,000 | 6,547,687 |

Zillow Group, Inc. | | |

0.75% due 09/01/241,3 | 4,399,000 | 5,155,188 |

1.50% due 07/01/231 | 1,048,000 | 981,871 |

JOYY, Inc. | | |

1.38% due 06/15/263 | 4,000,000 | 3,657,500 |

0.75% due 06/15/251,3 | 1,673,000 | 1,530,477 |

Farfetch Ltd. | | |

3.75% due 05/01/271,3 | 4,818,000 | 5,179,073 |

DISH Network Corp. | | |

3.38% due 08/15/261 | 6,198,000 | 5,039,594 |

Palo Alto Networks, Inc. | | |

0.75% due 07/01/231 | 4,086,000 | 4,196,322 |

Snap, Inc. | | |

0.75% due 08/01/261,3 | 3,006,000 | 3,120,949 |

Vonage Holdings Corp. | | |

1.75% due 06/01/241,3 | 3,000,000 | 2,704,340 |

GCI Liberty, Inc. | | |

1.75% due 09/30/461,3 | 1,036,000 | 1,432,974 |

Etsy, Inc. | | |

0.13% due 10/01/261,3 | 1,365,000 | 1,389,879 |

Bharti Airtel Ltd. | | |

1.50% due 02/17/251 | 1,050,000 | 1,172,955 |

Yandex N.V. | | |

0.75% due 03/03/251 | 1,200,000 | 1,135,949 |

See notes to financial statements.

20 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Communications – 19.5% (continued) | | |

SBI Holdings, Inc. | | |

due 09/14/221,4 | JPY 90,000,000 | $ 1,106,024 |

Pinduoduo, Inc. | | |

due 10/01/241,3,4 | 775,000 | 983,176 |

Twitter, Inc. | | |

0.25% due 06/15/241 | 923,000 | 862,808 |

InterDigital, Inc. | | |

2.00% due 06/01/241,3 | 739,000 | 748,201 |

Q2 Holdings, Inc. | | |

0.75% due 06/01/261,3 | 403,000 | 434,167 |

Liberty Latin America Ltd. | | |

2.00% due 07/15/243 | 411,000 | 318,642 |

| Total Communications | | 92,064,820 |

|

| Consumer, Cyclical – 14.7% | | |

Southwest Airlines Co. | | |

| 1.25% due 05/01/25 | 10,368,000 | 11,378,880 |

Sabre GLBL, Inc. | | |

4.00% due 04/15/251,3 | 5,731,000 | 6,821,976 |

Burlington Stores, Inc. | | |

2.25% due 04/15/251,3 | 5,691,000 | 6,059,180 |

Huazhu Group Ltd. | | |

0.38% due 11/01/221 | 5,635,000 | 5,703,747 |

Tesla, Inc. | | |

1.25% due 03/01/211 | 1,275,000 | 2,817,609 |

2.00% due 05/15/241 | 673,000 | 1,746,132 |

ANLLIAN Capital Ltd. | | |

due 02/05/251,4 | EUR 4,500,000 | 4,434,605 |

Callaway Golf Co. | | |

| 2.75% due 05/01/26 | 3,719,000 | 3,866,068 |

Winnebago Industries, Inc. | | |

1.50% due 04/01/251,3 | 4,000,000 | 3,792,400 |

Dufry One BV | | |

| 1.00% due 05/04/23 | CHF 3,200,000 | 3,688,075 |

Copa Holdings S.A. | | |

4.50% due 04/15/251,3 | 3,460,000 | 3,522,119 |

Carnival Corp. | | |

5.75% due 04/01/231,3 | 1,911,000 | 3,226,857 |

Zhongsheng Group Holdings Ltd. | | |

due 05/23/234 | HKD 17,000,000 | 2,493,630 |

Marriott Vacations Worldwide Corp. | | |

1.50% due 09/15/221 | 2,542,000 | 2,340,229 |

Caesars Entertainment Corp. | | |

5.00% due 10/01/241 | 1,355,000 | 1,927,849 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 21

| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Consumer, Cyclical – 14.7% (continued) | | |

Dick’s Sporting Goods, Inc. | | |

3.25% due 04/15/251,3 | 1,391,000 | $ 1,489,125 |

Sony Corp. | | |

due 09/30/224 | JPY 95,000,000 | 1,231,259 |

Adidas AG | | |

0.05% due 09/12/231 | EUR 800,000 | 959,710 |

RH | | |

due 09/15/241,3,4 | 1,048,000 | 956,959 |

Harvest International Co. | | |

due 11/21/224 | HKD 6,000,000 | 775,998 |

| Total Consumer, Cyclical | | 69,232,407 |

|

| Consumer, Non-cyclical – 14.2% | | |

Herbalife Nutrition Ltd. | | |

2.63% due 03/15/241 | 10,440,000 | 9,526,500 |

Horizon Pharma Investment Ltd. | | |

2.50% due 03/15/221 | 4,557,000 | 6,006,695 |

Exact Sciences Corp. | | |

0.38% due 03/15/271 | 4,627,000 | 4,514,173 |

0.38% due 03/01/281 | 1,392,000 | 1,274,719 |

Ligand Pharmaceuticals, Inc. | | |

0.75% due 05/15/231 | 6,000,000 | 5,285,766 |

Heska Corp. | | |

3.75% due 09/15/261,3 | 3,814,000 | 4,256,433 |

Square, Inc. | | |

0.50% due 05/15/231 | 3,134,000 | 3,529,668 |

Ionis Pharmaceuticals, Inc. | | |

0.13% due 12/15/241,3 | 3,605,000 | 3,461,686 |

Supernus Pharmaceuticals, Inc. | | |

0.63% due 04/01/231 | 4,000,000 | 3,435,000 |

Insulet Corp. | | |

0.38% due 09/01/261,3 | 2,526,000 | 2,846,486 |

BioMarin Pharmaceutical, Inc. | | |

1.50% due 10/15/201 | 2,000,000 | 2,165,124 |

Illumina, Inc. | | |

0.50% due 06/15/211 | 1,382,000 | 1,859,295 |

Coherus Biosciences, Inc. | | |

1.50% due 04/15/261,3 | 1,748,000 | 1,856,542 |

Integra LifeSciences Holdings Corp. | | |

0.50% due 08/15/251,3 | 1,609,000 | 1,519,345 |

Sarepta Therapeutics, Inc. | | |

1.50% due 11/15/241 | 775,000 | 1,368,650 |

ORPEA | | |

0.38% due 05/17/271 | 7,756* | 1,205,453 |

See notes to financial statements.

22 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Consumer, Non-cyclical – 14.2% (continued) | | |

DexCom, Inc. | | |

0.75% due 12/01/231 | 554,000 | $ 1,168,342 |

Intercept Pharmaceuticals, Inc. | | |

2.00% due 05/15/261 | 1,048,000 | 1,076,841 |

WuXi AppTec Company Ltd. | | |

due 09/17/241,4 | 900,000 | 1,069,001 |

Insmed, Inc. | | |

1.75% due 01/15/251 | 1,059,000 | 999,431 |

CONMED Corp. | | |

2.63% due 02/01/241 | 899,000 | 954,626 |

Neurocrine Biosciences, Inc. | | |

| 2.25% due 05/15/24 | 675,000 | 949,146 |

Flexion Therapeutics, Inc. | | |

3.38% due 05/01/241 | 1,169,000 | 876,327 |

China Conch Venture | | |

due 09/05/234 | HKD 6,000,000 | 870,030 |

Almirall S.A. | | |

0.25% due 12/14/211 | EUR 800,000 | 852,231 |

Korian S.A. | | |

| 0.88% due 03/06/27 | 15,020* | 804,638 |

GN Store Nord A/S | | |

due 05/21/241,4 | EUR 700,000 | 754,343 |

NuVasive, Inc. | | |

0.38% due 03/15/251,3 | 813,000 | 751,537 |

Biocartis N.V. | | |

| 4.00% due 05/09/24 | EUR 900,000 | 636,127 |

Anthem, Inc. | | |

2.75% due 10/15/421 | 128,000 | 501,197 |

Revance Therapeutics, Inc. | | |

1.75% due 02/15/271,3 | 515,000 | 433,118 |

Ocado Group plc | | |

0.88% due 12/09/251 | GBP 200,000 | 284,647 |

Just Eat Takeaway.com N.V. | | |

1.25% due 04/30/261 | EUR 100,000 | 116,819 |

| Total Consumer, Non-cyclical | | 67,209,936 |

|

| Industrial – 5.0% | | |

KBR, Inc. | | |

2.50% due 11/01/231 | 3,713,000 | 3,938,101 |

Scorpio Tankers, Inc. | | |

| 3.00% due 05/15/22 | 3,437,000 | 3,344,199 |

SMART Global Holdings, Inc. | | |

2.25% due 02/15/261,3 | 2,637,000 | 2,330,448 |

Asia Cement Corp. | | |

due 09/21/234 | 1,627,000 | 1,851,532 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 23

| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Industrial – 5.0% (continued) | | |

Safran S.A. | | |

due 06/21/231,4 | 10,672* | $ 1,599,423 |

Sika A.G. | | |

0.15% due 06/05/251 | CHF 1,320,000 | 1,524,944 |

OSI Systems, Inc. | | |

1.25% due 09/01/221 | 1,545,000 | 1,488,091 |

MINEBEA MITSUMI, Inc. | | |

due 08/03/224 | JPY 120,000,000 | 1,209,489 |

Cellnex Telecom S.A. | | |

1.50% due 01/16/261 | EUR 700,000 | 1,173,338 |

Chart Industries, Inc. | | |

1.00% due 11/15/241,3 | 1,225,000 | 1,102,124 |

Taiwan Cement Corp. | | |

due 12/10/234 | 900,000 | 1,100,996 |

China Railway Construction Corporation Ltd. | | |

due 01/29/214 | 1,000,000 | 1,016,318 |

Vinci S.A. | | |

0.38% due 02/16/221 | 800,000 | 913,024 |

Akka Technologies | | |

| 3.50% due 07/01/68 | EUR 1,200,000 | 818,715 |

| Total Industrial | | 23,410,742 |

|

| Financial – 3.3% | | |

AXA S.A. | | |

7.25% due 05/15/211,3 | 3,358,000 | 2,957,139 |

Poseidon Finance 1 Ltd. | | |

due 02/01/251,4 | 2,424,000 | 2,323,707 |

Smart Insight International Ltd. | | |

| 4.50% due 12/05/23 | HKD 10,000,000 | 1,424,282 |

IMMOFINANZ AG | | |

1.50% due 01/24/241 | EUR 1,300,000 | 1,419,661 |

PRA Group, Inc. | | |

3.50% due 06/01/231 | 1,604,000 | 1,369,353 |

JPMorgan Chase Bank North America | | |

due 09/18/221,4 | EUR 1,100,000 | 1,277,767 |

Blackstone Mortgage Trust, Inc. | | |

4.75% due 03/15/231 | 1,263,000 | 1,111,440 |

Deutsche Wohnen SE | | |

0.33% due 07/26/241 | EUR 800,000 | 910,991 |

Extra Space Storage, LP | | |

3.13% due 10/01/351,3 | 764,000 | 819,529 |

LEG Immobilien AG | | |

0.88% due 09/01/251 | EUR 600,000 | 781,305 |

BofA Finance LLC | | |

0.25% due 05/01/231 | 738,000 | 723,300 |

See notes to financial statements.

24 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CONVERTIBLE BONDS†† – 83.0% (continued) | | |

| Financial – 3.3% (continued) | | |

IH Merger Sub LLC | | |

3.50% due 01/15/221 | 596,000 | $ 690,615 |

| Total Financial | | 15,809,089 |

|

| Basic Materials – 2.2% | | |

SSR Mining, Inc. | | |

2.50% due 04/01/391 | 3,000,000 | 3,675,000 |

Brenntag Finance BV | | |

| 1.88% due 12/02/22 | 3,500,000 | 3,416,577 |

Cleveland-Cliffs, Inc. | | |

1.50% due 01/15/251 | 2,856,000 | 2,098,951 |

Osisko Gold Royalties Ltd. | | |

| 4.00% due 12/31/22 | CAD 1,300,000 | 917,942 |

Symrise AG | | |

0.24% due 06/20/241 | EUR 300,000 | 389,767 |

| Total Basic Materials | | 10,498,237 |

|

| Energy – 1.7% | | |

CNX Resources Corp. | | |

2.25% due 05/01/263 | 3,900,000 | 3,936,193 |

NextEra Energy Partners, LP | | |

1.50% due 09/15/201,3 | 2,229,000 | 2,307,278 |

BP Capital Markets plc | | |

1.00% due 04/28/231 | GBP 700,000 | 910,198 |

Helix Energy Solutions Group, Inc. | | |

| 4.13% due 09/15/23 | 865,000 | 647,149 |

| Total Energy | | 7,800,818 |

|

| Utilities – 1.3% | | |

NRG Energy, Inc. | | |

2.75% due 06/01/481 | 2,962,000 | 2,999,744 |

CenterPoint Energy, Inc. | | |

4.57% due 09/15/291 | 41,637* | 2,201,764 |

China Yangtze Power International BVI 1 Ltd. | | |

due 11/09/211,4 | 975,000 | 992,228 |

| Total Utilities | | 6,193,736 |

| Total Convertible Bonds | | |

| (Cost $374,027,026) | | 391,830,875 |

|

CORPORATE BONDS†† – 55.3% | | |

| Consumer, Cyclical – 11.8% | | |

Ford Motor Co. | | |

9.00% due 04/22/251 | 6,500,000 | 6,361,875 |

4.35% due 12/08/261 | 1,338,000 | 1,070,400 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 25| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Consumer, Cyclical – 11.8% (continued) | | |

Wolverine World Wide, Inc. | | |

5.00% due 09/01/261,3 | 4,220,000 | $ 4,072,300 |

American Airlines Group, Inc. | | |

5.00% due 06/01/221,3 | 5,691,000 | 3,225,943 |

3.75% due 03/01/253 | 1,037,000 | 482,516 |

QVC, Inc. | | |

5.13% due 07/02/221 | 1,807,000 | 1,784,413 |

4.75% due 02/15/271 | 1,177,000 | 1,065,067 |

Hanesbrands, Inc. | | |

| 5.38% due 05/15/25 | 2,677,000 | 2,710,462 |

Truck Hero, Inc. | | |

8.50% due 04/21/241,3 | 2,968,000 | 2,484,216 |

TRI Pointe Group, Inc. | | |

4.88% due 07/01/211 | 2,425,000 | 2,394,081 |

Dana Financing Luxembourg SARL | | |

6.50% due 06/01/261,3 | 2,491,000 | 2,272,415 |

Starbucks Corp. | | |

3.55% due 08/15/291 | 2,004,000 | 2,203,027 |

Enterprise Development Authority | | |

12.00% due 07/15/241,3 | 2,312,000 | 2,103,458 |

Tempur Sealy International, Inc. | | |

5.63% due 10/15/231 | 2,000,000 | 1,984,600 |

Marriott International, Inc. | | |

4.00% due 04/15/281 | 1,317,000 | 1,241,818 |

4.65% due 12/01/281 | 693,000 | 673,074 |

Staples, Inc. | | |

7.50% due 04/15/261,3 | 1,770,000 | 1,406,619 |

10.75% due 04/15/271,3 | 770,000 | 442,480 |

Churchill Downs, Inc. | | |

4.75% due 01/15/281,3 | 1,479,000 | 1,383,826 |

5.50% due 04/01/271,3 | 428,000 | 413,803 |

Ford Motor Credit Company LLC | | |

| 3.81% due 09/01/24 | 2,004,000 | 1,791,075 |

Scientific Games International, Inc. | | |

7.25% due 11/15/293 | 2,469,000 | 1,770,643 |

Scotts Miracle-Gro Co. | | |

5.25% due 12/15/261 | 1,716,000 | 1,753,066 |

Downstream Development Authority of the Quapaw Tribe of Oklahoma | | |

10.50% due 02/15/231,3 | 2,546,000 | 1,546,186 |

Hilton Domestic Operating Company, Inc. | | |

4.88% due 01/15/301 | 1,528,000 | 1,468,103 |

Delta Air Lines, Inc. | | |

3.75% due 10/28/291 | 2,038,000 | 1,429,731 |

See notes to financial statements.

26 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Consumer, Cyclical – 11.8% (continued) | | |

Six Flags Entertainment Corp. | | |

4.88% due 07/31/243 | 1,336,000 | $ 1,182,895 |

Michaels Stores, Inc. | | |

8.00% due 07/15/273 | 1,397,000 | 970,426 |

Tupperware Brands Corp. | | |

4.75% due 06/01/211 | 2,364,000 | 957,420 |

Tenneco, Inc. | | |

| 5.00% due 07/15/26 | 2,031,000 | 921,464 |

William Carter Co. | | |

5.63% due 03/15/271,3 | 703,000 | 716,751 |

Levi Strauss & Co. | | |

5.00% due 05/01/251,3 | 693,000 | 704,400 |

Burlington Coat Factory Warehouse Corp. | | |

6.25% due 04/15/251,3 | 460,000 | 469,200 |

Six Flags Theme Parks, Inc. | | |

7.00% due 07/01/251,3 | 173,000 | 179,885 |

| Total Consumer, Cyclical | | 55,637,638 |

|

| Consumer, Non-cyclical – 10.2% | | |

Encompass Health Corp. | | |

5.75% due 09/15/251 | 3,309,000 | 3,382,791 |

5.75% due 11/01/241 | 1,170,000 | 1,181,934 |

Land O’Lakes Capital Trust I | | |

7.45% due 03/15/281,3 | 3,750,000 | 3,881,250 |

Magellan Health, Inc. | | |

4.90% due 09/22/241 | 3,556,000 | 3,488,614 |

HCA, Inc. | | |

5.63% due 09/01/281 | 1,940,000 | 2,158,599 |

7.69% due 06/15/251 | 1,112,000 | 1,275,798 |

Tenet Healthcare Corp. | | |

6.75% due 06/15/231 | 3,352,000 | 3,366,078 |

Molina Healthcare, Inc. | | |

5.38% due 11/15/221 | 2,860,000 | 2,969,252 |

Horizon Therapeutics USA, Inc. | | |

5.50% due 08/01/271,3 | 2,511,000 | 2,623,116 |

Bausch Health Companies, Inc. | | |

7.25% due 05/30/291,3 | 2,349,000 | 2,517,611 |

Cardtronics Incorporated / Cardtronics USA Inc. | | |

5.50% due 05/01/251,3 | 2,569,000 | 2,459,304 |

HLF Financing SARL LLC / Herbalife International, Inc. | | |

7.25% due 08/15/261,3 | 2,500,000 | 2,443,625 |

Capitol Investment Merger Sub 2 LLC | | |

10.00% due 08/01/241,3 | 2,278,000 | 2,135,169 |

Nielsen Company Luxembourg SARL | | |

5.00% due 02/01/251,3 | 2,096,000 | 2,035,740 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 27| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Consumer, Non-cyclical – 10.2% (continued) | | |

Ortho-Clinical Diagnostics Incorporated / Ortho-Clinical Diagnostics S.A. | | |

7.25% due 02/01/283 | 2,164,000 | $ 1,983,566 |

MEDNAX, Inc. | | |

6.25% due 01/15/271,3 | 2,128,000 | 1,940,183 |

Spectrum Brands, Inc. | | |

5.75% due 07/15/251 | 1,758,000 | 1,764,593 |

Central Garden & Pet Co. | | |

6.13% due 11/15/231 | 1,419,000 | 1,443,549 |

5.13% due 02/01/281 | 254,000 | 258,343 |

Constellation Brands, Inc. | | |

3.15% due 08/01/291 | 1,356,000 | 1,410,224 |

Korn Ferry | | |

4.63% due 12/15/271,3 | 1,351,000 | 1,276,019 |

Centene Corp. | | |

4.75% due 05/15/221 | 1,110,000 | 1,126,039 |

LifePoint Health, Inc. | | |

4.38% due 02/15/271,3 | 748,000 | 707,795 |

Service Corporation International | | |

| 8.00% due 11/15/21 | 159,000 | 168,103 |

Land O’ Lakes, Inc. | | |

6.00% due 11/15/221,3 | 45,000 | 46,553 |

| Total Consumer, Non-cyclical | | 48,043,848 |

|

| Communications – 9.4% | | |

Sprint Corp. | | |

7.88% due 09/15/231 | 3,130,000 | 3,533,927 |

7.25% due 09/15/211 | 1,731,000 | 1,823,262 |

Sirius XM Radio, Inc. | | |

5.38% due 04/15/251,3 | 3,500,000 | 3,626,875 |

5.50% due 07/01/291,3 | 1,392,000 | 1,474,963 |

VeriSign, Inc. | | |

4.63% due 05/01/231 | 4,054,000 | 4,101,432 |

AMC Networks, Inc. | | |

4.75% due 12/15/221 | 4,000,000 | 3,977,800 |

Altice France Holding S.A. | | |

10.50% due 05/15/271,3 | 3,594,000 | 3,900,245 |

CommScope, Inc. | | |

8.25% due 03/01/271,3 | 3,006,000 | 2,895,229 |

CCO Holdings LLC / CCO Holdings Capital Corp. | | |

5.50% due 05/01/261,3 | 2,689,000 | 2,812,452 |

MDC Partners, Inc. | | |

6.50% due 05/01/241,3 | 3,285,000 | 2,566,406 |

Photo Holdings Merger Sub, Inc. | | |

8.50% due 10/01/261,3 | 2,808,000 | 2,444,504 |

See notes to financial statements.

28 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Communications – 9.4% (continued) | | |

T-Mobile USA, Inc. | | |

6.38% due 03/01/251 | 2,353,000 | $ 2,427,002 |

CenturyLink, Inc. | | |

5.13% due 12/15/261,3 | 2,342,000 | 2,233,682 |

Netflix, Inc. | | |

5.50% due 02/15/221 | 2,000,000 | 2,092,500 |

Telefonaktiebolaget LM Ericsson | | |

4.13% due 05/15/221 | 1,638,000 | 1,707,615 |

Meredith Corp. | | |

6.88% due 02/01/261 | 1,621,000 | 1,398,599 |

Plantronics, Inc. | | |

5.50% due 05/31/231,3 | 1,496,000 | 1,194,631 |

| Total Communications | | 44,211,124 |

|

| Basic Materials – 5.6% | | |

Alcoa Nederland Holding BV | | |

6.75% due 09/30/241,3 | 4,000,000 | 3,984,200 |

6.13% due 05/15/281,3 | 2,500,000 | 2,430,375 |

Commercial Metals Co. | | |

4.88% due 05/15/231 | 3,000,000 | 3,007,200 |

5.75% due 04/15/261 | 3,019,000 | 3,006,773 |

New Gold, Inc. | | |

6.38% due 05/15/251,3 | 3,357,000 | 3,247,226 |

Valvoline, Inc. | | |

4.25% due 02/15/303 | 2,818,000 | 2,753,750 |

Freeport-McMoRan, Inc. | | |

3.55% due 03/01/221 | 2,243,000 | 2,270,252 |

First Quantum Minerals Ltd. | | |

7.25% due 04/01/233 | 2,454,000 | 2,240,011 |

FMG Resources August 2006 Pty Ltd. | | |

5.13% due 03/15/231,3 | 2,000,000 | 2,031,300 |

Compass Minerals International, Inc. | | |

6.75% due 12/01/271,3 | 1,741,000 | 1,731,686 |

| Total Basic Materials | | 26,702,773 |

|

| Technology – 5.1% | | |

Amkor Technology, Inc. | | |

6.63% due 09/15/271,3 | 6,149,000 | 6,346,691 |

PTC, Inc. | | |

6.00% due 05/15/241 | 4,000,000 | 4,142,000 |

Infor US, Inc. | | |

6.50% due 05/15/221 | 4,000,000 | 4,021,400 |

Seagate HDD Cayman | | |

5.75% due 12/01/341 | 3,272,000 | 3,325,515 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 29| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Technology – 5.1% (continued) | | |

Western Digital Corp. | | |

4.75% due 02/15/261 | 2,519,000 | $ 2,581,169 |

Rackspace Hosting, Inc. | | |

8.63% due 11/15/241,3 | 2,241,000 | 2,221,660 |

Dell, Inc. | | |

7.10% due 04/15/281 | 1,338,000 | 1,478,490 |

| Total Technology | | 24,116,925 |

|

| Industrial – 5.0% | | |

Sealed Air Corp. | | |

4.88% due 12/01/221,3 | 5,000,000 | 5,160,250 |

6.88% due 07/15/331,3 | 805,000 | 895,241 |

MasTec, Inc. | | |

4.88% due 03/15/231 | 2,970,000 | 2,947,131 |

Louisiana-Pacific Corp. | | |

4.88% due 09/15/241 | 2,779,000 | 2,703,133 |

Clean Harbors, Inc. | | |

4.88% due 07/15/271,3 | 2,307,000 | 2,393,513 |

Trident TPI Holdings, Inc. | | |

9.25% due 08/01/241,3 | 2,708,000 | 2,389,268 |

Boeing Co. | | |

| 5.81% due 05/01/50 | 2,004,000 | 2,004,000 |

Covanta Holding Corp. | | |

6.00% due 01/01/271 | 2,043,000 | 1,975,785 |

Mueller Water Products, Inc. | | |

5.50% due 06/15/261,3 | 1,899,000 | 1,956,730 |

EnerSys | | |

4.38% due 12/15/271,3 | 1,120,000 | 1,087,800 |

TTM Technologies, Inc. | | |

5.63% due 10/01/251,3 | 167,000 | 160,704 |

| Total Industrial | | 23,673,555 |

|

| Financial – 4.0% | | |

Iron Mountain, Inc. | | |

4.88% due 09/15/271,3 | 2,962,000 | 2,919,940 |

SBA Communications Corp. | | |

4.00% due 10/01/221 | 2,710,000 | 2,741,300 |

Ardonagh Midco 3 plc | | |

8.63% due 07/15/231,3 | 2,836,000 | 2,687,110 |

Springleaf Finance Corp. | | |

7.75% due 10/01/211 | 2,347,000 | 2,345,944 |

Credit Acceptance Corp. | | |

6.63% due 03/15/261 | 2,512,000 | 2,273,360 |

GMAC, Inc. | | |

8.00% due 11/01/311 | 1,764,000 | 2,164,692 |

See notes to financial statements.

30 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

CORPORATE BONDS†† – 55.3% (continued) | | |

| Financial – 4.0% (continued) | | |

Advisor Group Holdings, Inc. | | |

10.75% due 08/01/271,3 | 2,510,000 | $ 1,921,154 |

CoreCivic, Inc. | | |

4.63% due 05/01/231 | 1,512,000 | 1,438,290 |

AG Issuer LLC | | |

6.25% due 03/01/281,3 | 764,000 | 679,517 |

| Total Financial | | 19,171,307 |

|

| Energy – 3.4% | | |

Parkland Fuel Corp. | | |

5.88% due 07/15/271,3 | 3,040,000 | 2,932,536 |

Calumet Specialty Products Partners Limited Partnership / Calumet Finance Corp. | | |

11.00% due 04/15/253 | 2,628,000 | 2,053,125 |

Indigo Natural Resources LLC | | |

6.88% due 02/15/261,3 | 2,154,000 | 2,016,790 |

PBF Holding Company LLC / PBF Finance Corp. | | |

7.25% due 06/15/251 | 2,207,000 | 1,666,726 |

Tallgrass Energy Partners Limited Partnership / Tallgrass Energy Finance Corp. | | |

5.50% due 01/15/283 | 2,369,000 | 1,636,505 |

PBF Logistics Limited Partnership / PBF Logistics Finance Corp. | | |

6.88% due 05/15/231 | 1,565,000 | 1,214,753 |

Alliance Resource Operating Partners Limited Partnership / Alliance Resource Finance Corp. | | |

7.50% due 05/01/253 | 1,757,000 | 1,150,835 |

Genesis Energy Limited Partnership / Genesis Energy Finance Corp. | | |

| 6.25% due 05/15/26 | 774,000 | 651,786 |

| 7.75% due 02/01/28 | 195,000 | 166,364 |

Canadian Natural Resources Ltd. | | |

3.85% due 06/01/271 | 806,000 | 742,585 |

Diamondback Energy, Inc. | | |

| 3.50% due 12/01/29 | 806,000 | 696,090 |

Parsley Energy LLC / Parsley Finance Corp. | | |

5.63% due 10/15/273 | 742,000 | 637,860 |

Ascent Resources Utica Holdings LLC / ARU Finance Corp. | | |

7.00% due 11/01/261,3 | 535,000 | 303,399 |

| Total Energy | | 15,869,354 |

|

| Utilities – 0.8% | | |

AmeriGas Partners, LP / AmeriGas Finance Corp. | | |

5.75% due 05/20/271 | 1,977,000 | 2,023,064 |

Talen Energy Supply LLC | | |

10.50% due 01/15/261,3 | 2,143,000 | 1,780,555 |

| Total Utilities | | 3,803,619 |

| Total Corporate Bonds | | |

| (Cost $269,995,948) | | 261,230,143 |

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 31| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | |

| Face | |

| Amount~ | Value |

|

SENIOR FLOATING RATE INTERESTS††,5 – 1.4% | | |

| Consumer, Cyclical – 1.2% | | |

PetSmart, Inc. | | |

| 4.66% (3 Month USD LIBOR + 3.00%, Rate Floor: 1.00%) due 03/11/22 | 3,857,868 | $ 3,754,998 |

Intrawest Resorts Holdings, Inc. | | |

| 3.74% (1 Month USD LIBOR + 2.75%, Rate Floor: 0.00%) due 07/31/24 | 2,388,175 | 2,225,481 |

| Total Consumer, Cyclical | | 5,980,479 |

|

| Consumer, Non-cyclical – 0.2% | | |

Refinitiv US Holdings, Inc. | | |

| 4.24% (3 Month USD LIBOR + 3.75%, Rate Floor: 0.00%) due 10/01/25 | 987,500 | 968,678 |

| Total Senior Floating Rate Interests | | |

| (Cost $7,239,638) | | 6,949,157 |

| Total Investments – 173.2% | | |

| (Cost $807,490,704) | | $ 817,996,719 |

| Other Assets & Liabilities, net – (73.2)% | | (345,832,025) |

| Total Net Assets – 100.0% | | $ 472,164,694 |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS††

| | | | | | | |

| | | | | | Unrealized |

| | | Settlement | Settlement | Value at | Appreciation |

| Counterparty | Contracts to Sell | Currency | Date | Value | April 30, 2020 | (Depreciation) |

Bank of New York Mellon | 25,016,344 | EUR | 06/12/20 | $28,412,579 | $27,425,045 | $ 987,534 |

Bank of New York Mellon | 1,298,951,900 | JPY | 06/12/20 | 12,415,841 | 12,154,984 | 260,857 |

Bank of New York Mellon | 2,202,255 | CHF | 06/12/20 | 2,366,266 | 2,284,582 | 81,684 |

Bank of New York Mellon | 2,574,546 | GBP | 06/12/20 | 3,328,092 | 3,248,003 | 80,089 |

Bank of New York Mellon | 1,297,918 | CAD | 06/12/20 | 946,758 | 934,583 | 12,175 |

Bank of New York Mellon | 87,503,000 | JPY | 05/07/20 | 811,993 | 818,598 | (6,605) |

Bank of New York Mellon | 200,000 | GBP | 06/12/20 | 242,948 | 252,317 | (9,369) |

Bank of New York Mellon | 56,412,400 | HKD | 06/12/20 | 7,261,189 | 7,272,390 | (11,201) |

Bank of New York Mellon | 3,690,840 | EUR | 06/12/20 | 4,020,272 | 4,046,213 | (25,941) |

Bank of New York Mellon | 3,391,000 | CHF | 06/12/20 | 3,483,767 | 3,517,766 | (33,999) |

| | | | | | $1,335,224 |

See notes to financial statements.

32 l AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

| | | | | | | |

| | | | | | Unrealized |

| | | Settlement | Settlement | Value at | Appreciation |

| Counterparty | Contracts to Buy | Currency | Date | Value | April 30, 2020 | (Depreciation) |

Bank of New York Mellon | 1,892,133 | GBP | 06/12/20 | $2,255,423 | $2,387,082 | $131,659 |

Bank of New York Mellon | 790,540,000 | JPY | 06/12/20 | 7,284,514 | 7,397,503 | 112,989 |

Bank of New York Mellon | 6,588,300 | EUR | 06/12/20 | 7,118,256 | 7,222,655 | 104,399 |

Bank of New York Mellon | 725,000 | CHF | 06/12/20 | 743,040 | 752,103 | 9,063 |

Bank of New York Mellon | 14,300,000 | HKD | 06/12/20 | 1,842,761 | 1,843,481 | 720 |

Bank of New York Mellon | 900,000 | EUR | 06/12/20 | 996,574 | 986,657 | (9,917) |

Bank of New York Mellon | 185,162,500 | JPY | 06/12/20 | 1,772,791 | 1,732,664 | (40,127) |

| | | | | | $ 308,786 |

| | |

| ~ | The face amount is denominated in U.S. dollars unless otherwise indicated. |

| * | Represents shares. |

| † | Value determined based on Level 1 inputs — See Note 6. |

| †† | Value determined based on Level 2 inputs — See Note 6. |

| 1 | All or a portion of these securities have been physically segregated in connection with the borrowings and reverse repurchase agreements. As of April 30, 2020, the total value of securities segregated was $641,384,727. |

| 2 | Rate indicated is the 7-day yield as of April 30, 2020. |

| 3 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be liquid under guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) securities is $290,310,999 (cost $291,299,701), or 61.5% of total net assets. |

| 4 | Zero coupon rate security. |

| 5 | Variable rate security. Rate indicated is the rate effective at April 30, 2020. In some instances, the effective rate is limited by a minimum rate floor or a maximum rate cap established by the issuer. The settlement status of a position may also impact the effective rate indicated. In some cases, a position may be unsettled at period end and may not have a stated effective rate. In instances where multiple underlying reference rates and spread amounts are shown, the effective rate is based on a weighted average. |

| | |

| CAD | Canadian Dollar |

| CHF | Swiss Franc |

| EUR | Euro |

| GBP | British Pound |

| HKD | Hong Kong Dollar |

| JPY | Japanese Yen |

| LIBOR | London Interbank Offered Rate |

| LLC | Limited Liability Company |

| plc | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SARL | Société à Responsabilité Limitée |

See Sector Classification in Other Information section.

See notes to financial statements.

AVK l ADVENT CONVERTIBLE AND INCOME FUND SEMI-ANNUAL REPORT l 33| | |

| PORTFOLIO OF INVESTMENTS (Unaudited) continued | April 30, 2020 |

The following table summarizes the inputs used to value the Fund’s investments at April 30, 2020 (See Note 6 in the Notes to Financial Statements):

| | | | | | | | | | | | | |

| | | | | Level 2 | | | Level 3 | | | | |

| | Level 1 | | | Significant | | | Significant | | | | |

| | Quoted | | | Observable | | | Unobservable | | | | |

| Investments in Securities (Assets) | | Prices | | | Inputs | | | Inputs | | | Total | |

Common Stocks | | $ | 50,983,220 | | | $ | — | | | $ | — | | | $ | 50,983,220 | |

Convertible Preferred Stocks | | | 59,932,442 | | | | — | | | | — | | | | 59,932,442 | |

Money Market Fund | | | 47,070,882 | | | | — | | | | — | | | | 47,070,882 | |

Convertible Bonds | | | — | | | | 391,830,875 | | | | — | | | | 391,830,875 | |

Corporate Bonds | | | — | | | | 261,230,143 | | | | — | | | | 261,230,143 | |

Senior Floating Rate Interests | | | — | | | | 6,949,157 | | | | — | | | | 6,949,157 | |

Forward Foreign Currency | | | | | | | | | | | | | | | | |

| Exchange Contracts* | | | — | | | | 1,781,169 | | | | — | | | | 1,781,169 | |

Total Assets | | $ | 157,986,544 | | | $ | 661,791,344 | | | $ | — | | | $ | 819,777,888 | |

| | |

| | | | | | Level 2 | | | Level 3 | | | | | |

| | Level 1 | | | Significant | | | Significant | | | | | |

| | Quoted | | | Observable | | | Unobservable | | | | | |

| Investments in Securities (Liabilities) | | Prices | | | Inputs | | | Inputs | | | Total | |

Forward Foreign Currency | | | | | | | | | | | | | | | | |