UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

FORM SB-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Mercer Capital, Inc.

(Name of small business issuer in our charter)

| Delaware | 6200 | 91-2016679 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | IRS I.D. |

1200 N Federal Hwy Suite 315 Boca Raton Fl | 33432 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 1-888-834-9878

File Number: 333-132830

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act of 1933 registration number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit (1) | | Proposed maximum aggregate offering price | | Amount of registration fee | |

Common Stock offered by our Selling Stockholders (2) | | | 994,660 | | $ | 2.00 | | $ | 1,989,320 | | $ | 212.86 | |

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457.

(2) The selling shareholders will offer their shares at $2.00 per share until our shares are quoted on the OTC Bulletin Board and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices. We will not receive proceeds from the sale of shares from the selling shareholders.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

PROSPECTUS

MERCER CAPITAL , INC.

Selling shareholders are offering up to 994,660 shares of common stock. The selling shareholders will offer their shares at $2.00 per share until our shares are quoted on the OTC Bulletin Board and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices. We will not receive proceeds from the sale of shares from the selling shareholders.

There are no underwriting commissions involved in this offering. We have agreed to pay all the costs of this offering. Selling shareholders will pay no offering expenses.

Prior to this offering, there has been no market for our securities. Our common stock is not now listed on any national securities exchange, the NASDAQ stock market, or the OTC Bulletin Board. There is no guarantee that our securities will ever trade on the OTC Bulletin Board or other exchange. Upon effectiveness of this registration statement, we intend to file a registration statement on Form 8-A. This will require us to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity.

This offering is highly speculative and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________________ , 2006.

TABLE OF CONTENTS

| SUMMARY INFORMATION | 5 |

| USE OF PROCEEDS | 14 |

| DETERMINATION OF OFFERING PRICE | |

| DILUTION | 15 |

| SELLING SHAREHOLDERS | 15 |

| PLAN OF DISTRIBUTION | 19 |

| LEGAL PROCEEDINGS | 21 |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS | 21 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 22 |

| DESCRIPTION OF SECURITIES | 23 |

| INTEREST OF NAMED EXPERTS | 24 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES LIABILITIES | 24 |

| GENERAL OVERVIEW OF THE COMMODITIES AND DERIVATIVES BROKERAGE BUSINESS | 24 |

| BUSINESS | 36 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 43 |

| DESCRIPTION OF PROPERTY | 52 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 52 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 52 |

| EXECUTIVE COMPENSATION | 55 |

| GLOSSARY | 56 |

| FINANCIAL STATEMENTS | 60 |

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 81 |

SUMMARY INFORMATION

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes, under the Financial Statements prior to making an investment decision.

Organization

Mercer Capital, Inc. is a Delaware corporation formed on 12-20-1999. Our wholly-owned subsidiary, Mercer Capital Management, Inc. is a Florida corporation formed on July 22, 2004.

Business

Our corporate offices are located at, 1200 N Federal Hwy, Suite 315, Boca Raton, Florida 33432 and 4800 S.W Macadam Ave, Suite 350, Portland, Oregon 97239

We are an independent provider of execution and clearing services for exchange-traded derivatives and a major provider of prime brokerage services in the fixed income and foreign exchange markets. We offer our customers rapid, low-cost trade execution and clearing services on a broad spectrum of derivatives exchanges and OTC markets. We are registered with the Commodities Futures Trading Commission and are a member of the National Futures Association. Our customers include corporations, retail clients and professional traders.

We execute and clear customers' orders for exchange-traded derivatives. Customers use our Derivatives Brokerage & Execution Platform to place buy and sell orders for derivatives contracts, which we direct to the appropriate exchange for matching. We also facilitate confirmation and settlement of our customers' derivatives transactions and ensure that our customers have the appropriate collateral in their accounts to support their derivatives positions.

Our activities to date have included organization, initial capitalization, securing operating facilities in Portland, Oregon, and Boca Raton, Florida, commencing with initial operational plans and thereafter growing our business.

Our revenues are primarily comprised of:

• transaction fees earned from executing and clearing customer orders; and

• Commissions earned on our customers' accounts.

Although we had a profit of $152,668 for fiscal year 2005, we had a loss of $24,033 for fiscal year 2004.

The Offering

As of the date of this prospectus, we had 7,994,660 shares of common stock outstanding.

Selling shareholders are offering up to 994,660 shares of common stock. The selling shareholders will offer their shares at $2.00 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses of registering the securities, estimated at approximately $75,000. We will not receive any proceeds of the sale of these securities.

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. The current absence of a public market for our common stock may make it more difficult for you to sell shares of our common stock that you own.

Financial Summary

Because this is only a financial summary, it does not contain all the financial information that may be important to you. Therefore, you should carefully read all the information in this prospectus, including the financial statements and their explanatory notes before making an investment decision.

Consolidated Statement of Profit (Loss)

For the years ended December 31, 2005 and 2004

(audited)

| | | 2005 | | 2004 | |

| Revenues | | | 1,321,950 | | | 553,403 | |

| | | | | | | | |

| Expenses | | | 1,108,943 | | | 605,134 | |

| | | | | | | | |

| Profit (loss) before income taxes | | | 213,007 | | | (51,731 | ) |

| | | | | | | | |

| Income taxes (benefit) | | | 60,339 | | | (27,698 | ) |

| | | | | | | | |

| Net profit (loss) | | $ | 152,668 | | $ | (24,033 | ) |

| | | | | | | | |

| Earnings (loss) per share | | $ | 0.02 | | $ | (0.00 | ) |

Consolidated Balance Sheet

At December 31, 2005

(audited)

| Total assets | | | 425,174 | |

| | | | | |

| Liabilities | | | 85,743 | |

| | | | | |

| Retained earnings (deficit) | | | 97,609 | ) |

| | | | | |

| Total shareholders' equity | | | 339,431 | |

Risk Factors

In addition to the other information provided in this prospectus, you should carefully consider the following risk factors in evaluating our business before purchasing any of our common stock. All material risks are discussed in this section.

If we experience periods of declining commodity futures and option prices ordecreasing trade volumes, our revenues may be reduced.

Our future revenues are likely to be lower during periods of declining commodity futures and option prices or reduced commodity futures and option markets activity. The commodity futures and option markets have historically experienced significant volatility in the number, size and prices of contracts. As a result, our revenues from brokerage activities may also be adversely affected during periods of declining prices or reduced activity in the commodity futures and option markets.

If we are not be able to adapt with rapid technological change in a cost effective manner, our revenues could be reduced.

Traditional and online commodity futures and option services businesses are characterized by rapid technological change, changes in customer requirements, frequent new service and product introductions and enhancements and evolving industry standards. Our future success will depend on our ability to enhance our existing services and products. We must also develop new services and products that address the increasingly sophisticated and varied needs of our customers and prospective customers. We must respond to technological advances and evolving industry standards and practices on a timely and cost-effective basis. The development and enhancement of services and products entails significant technical and financial risks. We may fail to

| · | use new technologies effectively; |

| · | adapt services and products to evolving industry standards; or |

| · | develop, introduce and market service and product enhancements or new services and products. |

In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of our services and products, and our new service and product enhancements may not achieve market acceptance. If we encounter these problems, our revenues could be reduced.

Because we may experience operational risks such as those in information processing and telecommunications systems, our business may be disrupted and our revenues reduced or our potential growth in revenues could be slowed.

Like other commodity futures and option market businesses, we are highly dependent on information processing and telecommunications systems. We face operational risks arising from potential mistakes made in the confirmation or settlement of transactions or from the failure to properly record, evaluate or account for transactions. Our business is highly dependent on our ability, and the ability of our clearing firms, to process, on a daily basis, a large and growing number of transactions across numerous and diverse markets. Consequently, we and our clearing firms rely heavily on our respective financial, accounting, telecommunications and other data processing systems. If any of these systems fail to operate properly or become unavailable due to problems with our physical infrastructure, we could suffer financial loss, a disruption of our business, liability to clients, regulatory intervention or reputational damage. In addition, we are aware that other companies in our industry have had problems due to high volume of telephone and e-mail customer inquiries that has at times strained the capacity of their telecommunications systems and customer service staffs, and has also led to temporary disruptions in website service. Thus, any inability of systems used to accommodate an increasing volume of transactions and customer inquiries could also constrain our ability to expand our businesses and could damage our reputation, reducing our revenues or slowing potential revenue growth.

Pursuant to clearing arrangements, the clearing and depository operations for us and our customers' transactions are provided by two clearing Futures Commission Merchants. We earn commissions as an introducing broker for the transactions of our customers. In the normal course of business, our customer activities involve the execution and settlement of various Commodity transactions. Our customer’s Commodities are transacted on either a cash or margin basis. In margin transactions, the clearing broker extends the credit to our customer, subject to various regulatory margin requirements, collateralized by cash and securities in the customers' accounts. However, we are required to contact the customer and to either obtain additional collateral or to sell the customer's position if such collateral in not forthcoming. We are responsible for any losses on such margin loans, and has agreed to indemnify its clearing brokers for losses that the clearing brokers may sustain from the customer accounts introduced by us.

Because we may be subject to employee misconduct that is difficult to detect and deter, our revenues or profitability could be reduced.

There have been a number of highly publicized cases involving fraud or other misconduct by employees in the financial services industry in recent years, and we run the risk that employee misconduct could occur. Misconduct by employees could bind us to transactions that exceed authorized limits or present unacceptable risks, or hide from us unauthorized or unsuccessful activities. In either case, this type of conduct could result in unknown and unmanaged risks or losses. Employee misconduct could also involve the improper use of confidential information, which could result in regulatory sanctions and serious reputational harm. It is not always possible to deter employee misconduct, and the precautions we take to prevent and detect this activity may not be effective in all cases. Accordingly, employee misconduct could reduce our revenues or profitability.

The securities industry in which we operate is heavily regulated by the CFTC, state regulators, and the NFA. If we fail to comply with applicable laws and regulations, we may face litigation, penalties or other sanctions that may be detrimental to our business and reduce our revenues.

The commodity futures and option markets industry in the United States is subject to extensive regulation under both federal and state laws. Brokers are subject to regulations covering all aspects of the securities business, including:

| | · | trade practices among brokers; |

| | · | use and safekeeping of customers` funds and securities; |

| | · | conduct of directors, officers, and employees; and |

| | · | supervision of employees, particularly those in branch offices. |

Although we have not been the subject of any regulatory actions, many aspects of our business involve substantial liability risks, and we could be exposed to substantial liability under federal and state laws and court decisions, as well as regulatory action by the NFA, the Commodity Futures Trading Commission and other regulatory organizations. These risks include, among others, potential civil litigation triggered by regulatory investigations, potential liability from disputes over terms of a trade, the claim that a system failure or delay caused monetary losses to a customer, that we entered into an unauthorized transaction or that we provided materially false or misleading statements in connection with a transaction. The volume of claims and the amount of damages claimed in litigation and regulatory proceedings against financial intermediaries have been increasing. Dissatisfied customers frequently make claims against their service providers regarding quality of trade execution, improperly settled trades, mismanagement or even fraud. These risks also include potential liability from disputes over the exercise of our rights with respect to customer accounts and collateral. Although our customer agreements generally provide that we may exercise such rights with respect to customer accounts and collateral as we deem reasonably necessary for our protection, our exercise of these rights has at times led to claims by customers that we have exercised these rights improperly. Even if we prevail in this or other cases or claims, we could incur significant legal expenses defending the cases or claims, even those without merit. An adverse resolution of any future cases or claims against us could harm our business and reduce our revenues.

If we fail to remain in compliance with the net capital rule. we may not be able to continue to operate as an independent introducing broker, which could reduce our revenues and otherwise harm our business.

The NFA, the CFTC and various other regulatory agencies have stringent rules with respect to the maintenance of specific levels of net capital by Independent Introducing Brokers, including the NFA`s Uniform Net Capital Rule (the "Net Capital Rule"). Net capital is the net worth of a broker (assets minus liabilities), less certain deductions that result from excluding assets that are not readily convertible into cash and from conservatively valuing certain other assets. Failure to maintain the required net capital may subject a firm to suspension or revocation of registration by the NFA and suspension or expulsion by the CFTC and other regulatory bodies and ultimately could require the firm's liquidation.

In addition, a change in the Net Capital Rules, the imposition of new rules or any unusually large charge against net capital could limit those aspects of our contemplated operations that require the intensive use of capital, such as trading activities and the financing of customer account balances. A significant operating loss or any unusually large charge against net capital could adversely affect our ability to operate and expand, which could have a material adverse effect on our business, financial condition and operating results.

We are presently in compliance with its net capital requirements. There can be no assurance, however, that it will not fall below minimum net capital requirements in the future.

If our brokerage customers fail to meet their margin requirements, we could incur significant liabilities leading to reduced revenues and capital liquidity.

The brokerage business, by its nature, is subject to risks related to defaults by our customers in paying for securities they have agreed to purchase and delivering securities they have agreed to sell. Our clearing broker may make margin loans to our customers in connection with their commodity transactions. We are required by contract to indemnify that broker for, among other things, any loss or expense incurred due to defaults by our customers in failing to repay margin loans or to maintain adequate collateral for those loans. We will be subject to risks inherent in extending credit, especially during periods of volatile markets or in connection with the purchase of highly volatile stocks which could lead to a higher risk of customer defaults. Any default we are required to cover could reduce our revenues and capital liquidity.

If we are unable to obtain critical goods or services from our suppliers of software and information services, our revenues could be reduced.

We obtain financial information from a number of third-party suppliers of software and information services. We believe we have available to us at comparable cost a number of alternative sources of supply of these items of software and information services, to provide adequate replacements on a timely basis, if arrangements with any of our current suppliers are abrogated. We have established a number of relationships with third-party suppliers of software and information services. There can be no assurance that such relationships will continue or that timely replacement of such services will be available in the future, and if they do not continue or if they need to be replaced and our not, our revenues could be reduced.

Our revenues will be reduced if we are unable to retain our existing customers or attract new customers.

The success of our business depends, in part, on our ability to maintain and increase our customer base. Customers in our market are sensitive to, among other things, the costs of using our services, the quality of the services we offer, the speed and reliability of order execution and the breadth of our service offerings and the products and markets to which we offer access. We may not be able to continue to offer the pricing, service, speed and reliability of order execution or the service, product and market breadth that customers desire. In addition, our existing customers are not obligated to use our services and can switch providers of execution and clearing services or decrease their trading activity conducted through us at any time. As a result, we may fail to retain existing customers or be unable to attract new customers. Our failure to maintain or attract customers could reduce our revenues.

Our operating results are subject to significant fluctuations due to seasonality. As a result, you should not rely on our operating results in any particular period as an indication of our future performance.

Our business experiences seasonal fluctuations. Financial markets often experience reduced trading activity during summer months and in the last fiscal quarter as a result of holidays. Traditional commodity derivatives, such as energy, will reflect changing supply/demand factors related to heating/cooling seasons. As a result of these factors, we may experience relatively higher trading volume and thus revenue during our first and third fiscal quarters and lower trading volume in our second fiscal quarter.

Our networks and those of our third-party service providers may be vulnerable to security risks, including our inadvertent dissemination of non-public information, which could result in the wrongful use of our or our customers' information, interruptions or malfunctions in our operations or damage to our reputation and reduce our revenues.

The secure transmission of confidential information over public networks is a critical element of our operations. Our networks, including our online trading platforms, and those of our third-party service providers, the exchanges and counterparties with whom we trade and our customers may be vulnerable to unauthorized access, computer viruses and other security problems, including our inadvertent dissemination of non-public information. Persons who circumvent security measures or gain access to customer information could wrongfully use our or our customers' information or cause interruptions or malfunctions in our operations, any of which could have a material adverse effect on our business, financial condition and operating results. Additionally, our reputation could be damaged. If an actual, threatened or perceived breach of our or our security providers' security were to occur, or if we were to inadvertently release confidential customer information, the market perception of the effectiveness of our security measures could be harmed and could cause customers to reduce or stop their use of our services, including our online trading platforms. We or our service providers may be required to expend significant resources to protect against the threat of any such security breaches or to alleviate problems, including reputational harm and litigation, caused by any breaches. Any security measures implemented by us or our service providers may prove to be inadequate and could result in incidental system failures and delays that could lower trading volumes and could reduce our revenues.

Procedures and requirements of the PATRIOT Act may expose us to significant costs or penalties, which could reduce our revenues.

As participants in the financial services industry, our subsidiaries are subject to laws and regulations, including the PATRIOT Act of 2001, which require that they know certain information about their customers and monitor transactions for suspicious financial activities. The cost of complying with the PATRIOT Act and related laws and regulations is significant. As an online broker with customers worldwide, we may face particular difficulties in identifying our international customers, gathering the required information about them and monitoring their activities. We face risks that our policies, procedures, technology and personnel directed toward complying with the PATRIOT Act are insufficient and that we could be subject to significant criminal and civil penalties due to noncompliance. Such penalties could reduce our revenues.

Our officers and directors, Robert Flickinger and Joseph Fisher , control approximately 87.5% of our common stock, and we do not have any non-employee directors. As a result, they effectively control all matters requiring director and stockholder approval, including the election of directors, the approval of significant corporate transactions, such as mergers and related party transaction. They also have the ability to block, by their ownership of our stock, an unsolicited tender offer. This concentration of ownership could have the effect of delaying, deterring or preventing a change in control of our company that you might view favorably.

Our management decisions are made by Robert Flickinger and Joseph Fisher; if we lose their services, our revenues may be reduced.

The success of our business is dependent upon the expertise of our Management. Because Robert Flickinger and Joseph Fisher are essential to our operations, you must rely on their management decisions. Our Management will continue to control our business affairs after the filing. We have employment agreements with Mr. Fisher and Mr. Flickinger but have not obtained any key man life insurance. Although we have non-compete agreements with them, they are only while they are employed by us. If we lose their services, we may not be able to hire and retain another key person with comparable experience. As a result, the loss of Mr. Fisher and Mr. Flickinger’s services could reduce our revenues.

Because our common stock will be considered a penny stock, any investment in our common stock is considered a high-risk investment and is subject to restrictions on marketability; you may be unable to sell your shares.

If our common stock trades in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. Further, if a broker dealer is the sole market maker, that broker must disclose this fact and its presumed control over the market and monthly account statements showing the market value of each penny stock held in the customer’s account. These requirements may cause a reduction in the trading activity, if any, of our common stock in any secondary market which may develop for our securities if they are subject to the penny stock rules, which in all likelihood would make it difficult for our shareholders to sell their securities.

Because there is not now and may never be a public market for our common stock, investors may have difficulty in reselling their shares.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

The offering price of $2.00 per share has been arbitrarily set by our Board of Directors and accordingly does not indicate the actual value of our business.

The offering price of $2.00 per share is not based upon earnings or operating history, does not reflect our actual value, and bears no relation to our earnings, assets, book value, net worth or any other recognized criteria of value. No independent investment banking firm has been retained to assist in determining the offering price for the shares. Accordingly, the offering price should not be regarded as an indication of any future price of our stock.

Sales of our common stock under Rule 144 could reduce the price of our stock.

As of March 1, 2006, there are 994,660 shares of our common stock held by non-affiliates and 7,000,000 shares of our common stock held by affiliates that Rule 144 of the Securities Act of 1933 defines as restricted securities. We are registering 994,660 of these shares in this registration statement. No Shares have been sold pursuant to Rule 144 of the Securities Act of 1933; and as of March 1, 2006, there are no shares held by affiliates eligible for resale under 144.

Once this registration statement is effective, the shares of our common stock being offered by our selling shareholders will be freely tradable without restrictions under the Securities Act of 1933, except for any shares held by our "affiliates," which will be restricted by the resale limitations of Rule 144 under the Securities Act of 1933.

In addition to the shares available for resale under this registration statement, as a result of the provisions of Rule 144, all restricted securities could be available for sale in a public market, if developed, beginning 90 days from the effective date of this registration statement. The availability for sale of substantial amounts of common stock under Rule 144 could reduce prevailing prices for our securities.

We are authorized to issue preferred stock which, if issued, may reduce the price of the common stock.

Although no preferred stock is currently issued and outstanding, our directors are authorized by our Articles of Incorporation, as amended, to issue preferred stock in series without the consent of our shareholders. Our preferred stock, if and when issued, may rank senior to common stock with respect to payment of dividends and amounts received by shareholders upon liquidation, dissolution or winding up. The issuance of preferred stock in series and the preferences given the preferred stock must be made by a Resolution of Directors, but do not need the approval of our shareholders. The existence of rights, which are senior to common stock, may reduce the price of our common stock.

Because we do not have an audit or compensation committee, shareholders will have to rely on the entire board of directors, all of which are not independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation committee. These functions are performed by the board of directors as a whole. All members of the board of directors are not independent directors. Thus, there is a potential conflict in that board members who are management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

Special Information Regarding Forward Looking Statements

Some of the statements in this prospectus are “forward-looking statements.” These forward-looking statements involve certain known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, among others, the factors set forth above under “Risk Factors.” The words “believe,” “expect,” “anticipate,” “intend,” “plan,” and similar expressions identify forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We undertake no obligation to update and revise any forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements in this document to reflect any future or developments. However, the Private Securities Litigation Reform Act of 1995 is not available to us as a non-reporting issuer. Further, Section 27A(b)(2)(D) of the Securities Act and Section 21E(b)(2)(D) of the Securities Exchange Act expressly state that the safe harbor for forward looking statements does not apply to statements made in connection with an initial public offering.

USE OF PROCEEDS

Not applicable. We will not receive any proceeds from the sale of shares offered by the selling shareholders.

DETERMINATION OF OFFERING PRICE

Our management has determined the offering price for the selling shareholders' shares. The price of the shares we are offering was arbitrarily determined based upon the prior offering price in our private placement. We have no agreement, written or oral, with our selling shareholders about this price. Based upon oral conversations with our selling shareholders, we believe that none of our selling shareholders disagree with this price. The offering price bears no relationship whatsoever to our assets, earnings, book value or other criteria of value. The factors considered were:

| | · | the proceeds to be raised by the offering |

| | · | the amount of capital to be contributed by purchasers in this offering in proportion to the amount of stock to be retained by our existing Stockholders |

| | · | our relative cash requirements |

| | · | the price we believe a purchaser is willing to pay for our stock |

The offering price does not bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. Prior to this offering, there has been no market for our securities.

DILUTION

Not applicable. We are not offering any shares in this registration statement. All shares are being registered on behalf of our selling shareholders.

SELLING SHAREHOLDERS

The selling shareholders named below are selling the securities. The table assumes that all of the securities will be sold in this offering. However, any or all of the securities listed below may be retained by any of the selling shareholders, and therefore, no accurate forecast can be made as to the number of securities that will be held by the selling shareholders upon termination of this offering. These selling shareholders acquired their shares by purchase exempt from registration under section 4(2) of the Securities Act of 1933 and Regulation S under the Securities Act of 1933. We believe that the selling shareholders listed in the table have sole voting and investment powers with respect to the securities indicated. We will not receive any proceeds from the sale of the securities by the selling shareholders. No selling shareholders are broker-dealers or affiliates of broker-dealers.

Selling Shareholders Who Own Common Shares

Name | Total Shares Owned | Shares Registered [1] | Relationship to Us |

| Binelli Paone | 3,000 | 3,000 | Client |

| David Williams | 20,000 | 20,000 | Client |

| Don Easton | 6,500 | 6,500 | Client |

| Don Wright | 20,000 | 20,000 | Client |

| Donald Cherry | 16,000 | 16,000 | Client |

| Ed Leary | 20,000 | 20,000 | Client |

| Gary Scott | 2,500 | 2,500 | Client |

| George Celesnik | 30,000 | 30,000 | Client |

| Grenville Berliner | 20,000 | 20,000 | Client |

| Ivan Redev | 2,510 | 2,510 | Client |

| Joe Liccardi | 5,000 | 5,000 | Client |

| Joe Selter | 20,000 | 20,000 | Client |

| John Depue | 20,000 | 20,000 | Client |

| Kevin Kuck | 40,000 | 40,000 | Client |

| Lana Scott | 7,000 | 7,000 | Client |

| H. Michael Holbrook | 40,000 | 40,000 | Client |

| Nathaniel Johnson | 1,000 | 1,000 | Client |

| Norman Brewer | 14,500 | 14,500 | Client |

| Robert and Mary Humphrey | 20,000 | 20,000 | Client |

| Paul Stevenson | 20,000 | 20,000 | Client |

| Philip Modelski | 40,000 | 40,000 | Client |

| Renae Manigault | 5,800 | 5,800 | Client |

| Robert Steiner | 2,500 | 2,500 | Client |

| Robin Murray | 30,000 | 30,000 | Client |

| Ronald Grebe | 2,500 | 2,500 | Client |

| Ross Douthart | 5,000 | 5,000 | Client |

| Stein Storslett | 20,000 | 20,000 | Client |

| Tom Banister | 1,250 | 1,250 | Client |

| Vern Habner | 20,000 | 20,000 | Client |

| Vincent Albanese | 2,500 | 2,500 | Client |

| David Bretz | 2,500 | 2,500 | Client |

| Jack Wood | 2,500 | 2,500 | Client |

| James Mazza | 2,500 | 2,500 | Client |

| John Norton | 3,500 | 3,500 | Client |

| Glen F Powell | 5,000 | 5,000 | Client |

| Leon Breeden | 2,000 | 2,000 | Client |

| Mark Morris | 2,500 | 2,500 | Client |

| Matthew Okeke | 2,500 | 2,500 | Client |

| Quinn Owen | 39,800 | 39,800 | Client |

| Richard Kelly | 7,500 | 7,500 | Client |

| Robert Harper | 9,500 | 9,500 | Client |

| Robert Jenniges | 2,500 | 2,500 | Client |

| Suzanne Zipprich | 2,500 | 2,500 | Client |

| William Clark | 2,500 | 2,500 | Client |

| William Kepler | 2,500 | 2,500 | Client |

| Adam Rybowicz | 2,500 | 2,500 | Client |

| Alan Leitko | 3,000 | 3,000 | Client |

| Charles Pinney | 18,500 | 18,500 | Client |

| Claude Baldwin Jr | 1,900 | 1,900 | Client |

| Millenium Trust Co FBO Danh Green IRA | 13,000 | 13,000 | Client |

| Dun Wang | 7,000 | 7,000 | Client |

| Ellen Straub Trust | 3,000 | 3,000 | Client |

| Franklin Durand | 15,500 | 15,500 | Client |

| George Melrose | 6,000 | 6,000 | Client |

| Barbara J Piedmont | 3,000 | 3,000 | Client |

| H & C Martin Family Trust | 6,500 | 6,500 | Client |

| Jason Murray | 4,000 | 4,000 | Client |

| Jim Simmons | 50,000 | 50,000 | Client |

| Demar and Patricia Lewis | 3,000 | 3,000 | Client |

| Joann Knight | 1,500 | 1,500 | Client |

| John Ellefson | 17,500 | 17,500 | Client |

| Patrick Wiley | 2,000 | 2,000 | Client |

| Quintin Gramer | 2,500 | 2,500 | Client |

| Robert Brent III | 750 | 750 | Client |

| Robert & Diane Brown | 14,000 | 14,000 | Client |

| Roger Schafer | 7,100 | 7,100 | Client |

| Jerry Truman | 38,000 | 38,000 | Client |

| Max Miller | 6,500 | 6,500 | Client |

| Alfonso Killinger | 6,500 | 6,500 | Client |

| Brent Miller | 3,500 | 3,500 | Client |

| Charles & Linda Hodge Living Trust | 66,500 | 66,500 | Client |

| Thomas L Smith | 2,500 | 2,500 | Client |

| Craig Pope | 2,700 | 2,700 | Client |

| Daniel Kiyama | 2,500 | 2,500 | Client |

| David E Brodeur | 6,500 | 6,500 | Client |

| Edward Bushnell | 6,000 | 6,000 | Client |

| Eldred Schafer | 3,100 | 3,100 | Client |

| Evelyne Cadet | 15,500 | 15,500 | Client |

| George Mills | 2,500 | 2,500 | Client |

| Herbert Hilton | 7,000 | 7,000 | Client |

| Jack & Paula Sands | 2,500 | 2,500 | Client |

| James & Karen Kurek | 2,500 | 2,500 | Client |

| James Lee | 3,500 | 3,500 | Client |

| James Pounds | 3,500 | 3,500 | Client |

| Jana Goad | 7,000 | 7,000 | Client |

| Janice E Tisdale | 6,500 | 6,500 | Client |

| Keith Loy | 3,000 | 3,000 | Client |

| Millenium Trust Co FBO Kerry Gillespie IRA | 2,500 | 2,500 | Client |

| Kirk Loy | 3,000 | 3,000 | Client |

| Margarita Mendiola | 2,500 | 2,500 | Client |

| Richard J Thomas | 17,500 | 17,500 | Client |

| Robert P Kelly | 5,000 | 5,000 | Client |

| Ravi Kokkirigadda | 2,500 | 2,500 | Client |

| Millenium Trust Co FBO Susan E Hurowitz | 7,000 | 7,000 | Client |

| Robert Rice | 10,500 | 10,500 | Client |

| Millenium Trust Co FBO Robert Shultz IRA | 2,500 | 2,500 | Client |

| Millenium Trust Co FBO Shan Shan Xie IRA | 6,250 | 6,250 | Client |

| Wayne Hughes | 3,000 | 3,000 | Client |

| William Baker | 2,500 | 2,500 | Client |

| William Stutters | 2,500 | 2,500 | Client |

Total | 994,660 | 994,660 | |

[1] All shareholders own less than one percent of our issued and outstanding common stock and are registering all of their shares for resale under this registration statement. No selling shareholder is an affiliate of us.

Blue Sky

Thirty-five states have what is commonly referred to as a “manual exemption” for secondary trading of securities such as those to be resold by selling stockholders under this registration statement. In these states, so long as we obtain and maintain a listing in Standard and Poor’s Corporate Manual, secondary trading can occur without any filing, review or approval by state regulatory authorities in these states. These states are: Alaska, Arizona, Arkansas, Colorado, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, Florida, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Texas, Utah, Washington, West Virginia, and Wyoming. We cannot secure this listing, and thus this qualification, until after this registration statement is declared effective. Once we secure this listing, secondary trading can occur in these states without further action.

Except for Illinois, all our shareholders currently reside in these states or outside the U.S. We intend to make appropriate filings in Illinois, or comply with all secondary trading exemptions in such states, to permit sales of the securities registered in this offering.

We currently do not intend to and may not be able to qualify securities for resale in other states which require shares to be qualified before they can be resold by our shareholders.

PLAN OF DISTRIBUTION

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Selling shareholders are offering up to 994,660 shares of common stock. The selling shareholders will offer their shares at $$2.00 per share until our shares are quoted on the OTC Bulletin Board and, assuming we secure this qualification, thereafter at prevailing market prices or privately negotiated prices. We will not receive proceeds from the sale of shares from the selling shareholders. We will pay all expenses of registering the securities.

The securities offered by this prospectus will be sold by the selling shareholders without underwriters and without commissions. The distribution of the securities by the selling shareholders may be effected in one or more transactions that may take place in the over-the-counter market or privately negotiated transactions.

The selling shareholders may pledge all or a portion of the securities owned as collateral for margin accounts or in loan transactions, and the securities may be resold pursuant to the terms of such pledges, margin accounts or loan transactions. Upon default by such selling shareholders, the pledge in such loan transaction would have the same rights of sale as the selling shareholders under this prospectus. The selling shareholders may also enter into exchange traded listed option transactions, which require the delivery of the securities listed under this prospectus. After our securities are qualified for quotation on the OTC Bulletin Board, the selling shareholders may also transfer securities owned in other ways not involving market makers or established trading markets, including directly by gift, distribution, or other transfer without consideration, and upon any such transfer the transferee would have the same rights of sale as such selling shareholders under this prospectus.

In addition to the above, each of the selling shareholders will be affected by the applicable provisions of the Securities Exchange Act of 1934, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the securities by the selling shareholders or any such other person. We have instructed our selling shareholders that they many not purchase any of our securities while they are selling shares under this registration statement.

Upon this registration statement being declared effective, the selling shareholders may offer and sell their shares from time to time until all of the shares registered are sold; however, this offering may not extend beyond two years from the initial effective date of this registration statement.

There can be no assurances that the selling shareholders will sell any or all of the securities. In various states, the securities may not be sold unless these securities have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

All of the foregoing may affect the marketability of our securities. Pursuant to oral promises we made to the selling shareholders, we will pay all the fees and expenses incident to the registration of the securities.

Should any substantial change occur regarding the status or other matters concerning the selling shareholders or us, we will file a post-effective amendment disclosing such matters.

OTC Bulletin Board Considerations

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. We have engaged in preliminary discussions with an NASD Market Maker to file our application on Form 211 with the NASD, but as of the date of this prospectus, no filing has been made. Based upon our counsel’s prior experience, we anticipate that after this registration statement is declared effective, it will take approximately 2 - 8 weeks for the NASD to issue a trading symbol.

The OTC Bulletin Board is separate and distinct from the NASDAQ stock market. NASDAQ has no business relationship with issuers of securities quoted on the OTC Bulletin Board. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTC Bulletin Board.

Although the NASDAQ stock market has rigorous listing standards to ensure the high quality of its issuers, and can delist issuers for not meeting those standards, the OTC Bulletin Board has no listing standards. Rather, it is the market maker who chooses to quote a security on the system, files the application, and is obligated to comply with keeping information about the issuer in its files. The NASD cannot deny an application by a market maker to quote the stock of a company. The only requirement for inclusion in the bulletin board is that the issuer be current in its reporting requirements with the SEC.

Although we anticipate listing on the OTC Bulletin board will increase liquidity for our stock, investors may have greater difficulty in getting orders filled because it is anticipated that if our stock trades on a public market, it initially will trade on the OTC Bulletin Board rather than on NASDAQ. Investors’ orders may be filled at a price much different than expected when an order is placed. Trading activity in general is not conducted as efficiently and effectively as with NASDAQ-listed securities.

Investors must contact a broker-dealer to trade OTC Bulletin Board securities. Investors do not have direct access to the bulletin board service. For bulletin board securities, there only has to be one market maker.

Bulletin board transactions are conducted almost entirely manually. Because there are no automated systems for negotiating trades on the bulletin board, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders - an order to buy or sell a specific number of shares at the current market price - it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and getting execution.

Because bulletin board stocks are usually not followed by analysts, there may be lower trading volume than for NASDAQ-listed securities.

LEGAL PROCEEDINGS

There are no pending or threatened lawsuits against us. However, many aspects of our business involve substantial risks of liability. In the normal course of business, we may be named as a defendant or co-defendant in lawsuits creating substantial exposure. There has been an increased incidence of litigation and regulatory investigations in the financial services industry in recent years. We may from time to time be involved in governmental and self-regulatory agency investigations and proceedings. The materiality of legal matters to our future operating results depends on the level of future results of operations as well as the timing and ultimate outcome of any legal matters.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND CONTROL PERSONS

The board of directors elects our executive officers annually. A majority vote of the directors who are in office is required to fill vacancies. Each director shall be elected for the term of one year, and until his successor is elected and qualified, or until his earlier resignation or removal. Our directors and executive officers are as follows:

Name | Age | Position |

| Robert Flickinger | 36 | President and Director |

| Joseph Fisher | 41 | Executive Vice President and Director |

Robert Flickinger joined Mercer Capital Inc December of 1999 as President and Director. He holds a license as Series Three Commodities Broker and a Series Thirty Branch Office Manager from the CFTC.

Joseph Fisher joined us in December 2004 as Executive Vice President and Director. From August 2002 to December 2004, he was Regional Sales Director of Yale Material Handling Inc. which manufactures and sells Industrial forklifts. From Jan 1997 to August 2002, he was Regional Sales Director of Suspa Corporation-Hydraulic Division which Manufactures and sells industrial equipment. He holds a series three and Thirty licenses as a Commodity Broker and Branch Office Manager from the CFTC. In June 1987 he received a Bachelors of Science Degree from Portland State University.

Family Relationships

There are no other family relationships among our officer and directors.

Legal Proceedings

No officer, director, or persons nominated for such positions, promoter or significant employee has been involved in the last five years in any of the following:

| | · | Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| | · | Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | · | Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enj oining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; and |

| | · | Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth the ownership of our common stock by each person known by us to be the beneficial owner of more than 5% of our outstanding voting securities, our directors, our executive officers, and our executive officers and directors as a group. To the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise noted. There are not any pending or anticipated arrangements that may cause a change in control.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as otherwise indicated below and under applicable community property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown. The business address of the shareholders is Bank of America Financial Center, 121 SW Morrison Street, Suite 825, Portland, Oregon 97204.

| Shareholders | # of Shares | Percentage |

| Robert Flickinger | 6,000,000 | 75% |

| Joseph Fisher | 1,000,000 | 12.5% |

| All directors and named executive officers as a group [2 persons] | 7,000,000 | 87.5% |

This table is based upon information derived from our stock records. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, each of the shareholders named in this table has sole or shared voting and investment power with respect to the shares indicated as beneficially owned. Except as set forth above, applicable percentages are based upon 7,994,660 shares of common stock outstanding as of March 1, 2006.

DESCRIPTION OF SECURITIES

The following description as a summary of the material terms of the provisions of our Articles of Incorporation and Bylaws is qualified in its entirety. The Articles of Incorporation and Bylaws have been filed as exhibits to the registration statement of which this prospectus is a part.

Common Stock

We are authorized to issue 25,000,000 shares of common stock with no par value per share. As of the date of this registration statement, there were 7,994,660 shares of common stock issued and outstanding held by 101 shareholders of record.

Each share of common stock entitles the holder to one vote, either in person or by proxy, at meetings of shareholders. The holders are not permitted to vote their shares cumulatively. Accordingly, the shareholders of our common stock who hold, in the aggregate, more than fifty percent of the total voting rights can elect all of our directors and, in such event, the holders of the remaining minority shares will not be able to elect any of such directors. The vote of the holders of a majority of the issued and outstanding shares of common stock entitled to vote thereon is sufficient to authorize, affirm, ratify or consent to such act or action, except as otherwise provided by law.

Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. Except for cash dividends to holders of common stock in the amount of $9,660 during the year ended December 31, 2005, we have not paid any dividends since our inception, and we presently anticipate that all future earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Holders of our common stock have no preemptive rights or other subscription rights, conversion rights, redemption or sinking fund provisions. Upon our liquidation, dissolution or winding up, the holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to shareholders after the payment of all of our debts and other liabilities. There are not any provisions in our Articles of Incorporation or our Bylaws that would prevent or delay change in our control.

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in series as fixed by the Directors without par value. As of the date of this registration statement, there are no preferred shares outstanding.

Preferred stock may be issued in series with preferences and designations as the Board of Directors may from time to time determine. The board may, without shareholders approval, issue preferred stock with voting, dividend, liquidation and conversion rights that could dilute the voting strength of our common shareholders and may assist management in impeding an unfriendly takeover or attempted changes in control. There are no restrictions on our ability to repurchase or reclaim our preferred shares while there is any arrearage in the payment of dividends on our preferred stock.

Interest of Named Experts

The 2004/2005 financial statements incorporated by reference to this prospectus have been audited by E. Randal Gruber, which are independent certified public accountants, to the extent and for the periods set forth in its report and are incorporated herein in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

The legality of the shares offered under this registration statement is being passed upon by Williams Law Group, P.A., Tampa, Florida. Michael T. Williams, principal of Williams Law Group, P.A., will receive 150,000 shares of our stock for general securities advice for one year following the effectiveness of this registration statement.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES LIABILITIES

Our Bylaws, subject to the provisions of Delaware Law, contain provisions which allow the corporation to indemnify any person against liabilities and other expenses incurred as the result of defending or administering any pending or anticipated legal issue in connection with service to us if it is determined that person acted in good faith and in a manner which he reasonably believed was in the best interest of the corporation. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons, we have been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

GENERAL OVERVIEW OF THE COMMODITIES AND DERIVATIVES BROKERAGE BUSINESS

Overview

Derivatives are contracts that are valued based on the performance of an underlying financial or physical asset, index or other investment. The most common types of derivatives are futures and options. A futures contract is a legally binding agreement to buy or sell a commodity or financial instrument at a future date at a specific price. Options are contracts that provide for a right, but not an obligation, to buy or sell a commodity or financial instrument over a specified period at a specific price. Derivatives contracts are broadly comprised of two underlying categories: financial and physical. Examples of financial derivatives include contracts on interest rates, equity indices, individual equities and foreign currencies. Examples of physical derivatives include contracts on energy products, agricultural commodities and non-precious and precious metals.

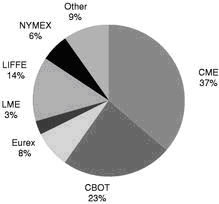

Derivatives contracts are either standardized and traded on exchanges or privately negotiated and traded between specific counterparties in the over the counter or OTC market. There are 61 derivatives exchanges tracked by the Futures Industry Association ("FIA") located in 24 countries, including 17 exchanges in the United States. Major derivatives exchanges in the United States include the Chicago Mercantile Exchange ("CME"), the Chicago Board of Trade ("CBOT"), the New York Mercantile Exchange ("NYMEX"), the Chicago Board Options Exchange ("CBOE") and the New York Board of Trade ("NYBOT"). Major derivatives exchanges outside the United States include Eurex, Euronext.liffe, the International Petroleum Exchange ("IPE"), Mercado Oficial de Futuros y Opciones Financieros ("MEFF"), Euronext N.V., Singapore Derivatives Exchange Ltd. ("SGX") and the Tokyo Stock Exchange ("TSE").

The customer base for derivatives contracts includes professional traders, financial institutions, institutional and individual investors, as well as major corporations, manufacturers, producers and governments. These customers purchase derivatives primarily for hedging or investment purposes. Hedging involves the practice of managing risk inherent in one market position by taking an offsetting position in another market. For example, corporations use the futures markets to protect their businesses from adverse changes in the costs of their raw materials. Investing involves a market participant taking a position in an attempt to earn a profit from buying and selling futures and options contracts in anticipation of future price movements. When entering into exchange-traded derivatives contracts, customers are required to make good faith margin deposits to ensure future performance under the derivatives contract.

Introduction to Derivatives

Futures markets have been described as continuous auction markets and as clearing houses for the latest information about supply and demand. They are the meeting places of buyers and sellers of an ever-expanding list of commodities that today includes agricultural products, metals, petroleum, financial instruments, foreign currencies and stock indexes. Trading has also been initiated in options on futures contracts, enabling option buyers to participate in futures markets with known risks.

Notwithstanding the rapid growth and diversification of futures markets, their primary purpose remains the same as it has been for nearly a century and a half, to provide an efficient and effective mechanism for the management of price risks. By buying or selling futures contracts--contracts that establish a price level now for items to be delivered later--individuals and businesses seek to achieve what amounts to insurance against adverse price changes. This is called hedging.

Other futures market participants are speculative investors who accept the risks that hedgers wish to avoid. Most speculators have no intention of making or taking delivery of the commodity but, rather, seek to profit from a change in the price. That is, they buy when they anticipate rising prices and sell when they anticipate declining prices. The interaction of hedgers and speculators helps to provide active, liquid and competitive markets. Speculative participation in futures trading has become increasingly attractive with the availability of alternative methods of participation. Whereas many futures traders continue to prefer to make their own trading decisions--such as what to buy and sell and when to buy and sell--others choose to utilize the services of a professional trading advisor, or to avoid day-to-day trading responsibilities by establishing a fully managed trading account or participating in a commodity pool which is similar in concept to a mutual fund.

Futures Markets

The frantic shouting and signaling of bids and offers on the trading floor of a futures exchange undeniably convey an impression of chaos. The reality, however, is that chaos is what futures markets replaced. Prior to the establishment of central grain markets in the mid-nineteenth century, the nation's farmers carted their newly harvested crops over plank roads to major population and transportation centers each fall in search of buyers. The seasonal glut drove prices to giveaway levels and, indeed, to throwaway levels as grain often rotted in the streets or was dumped in rivers and lakes for lack of storage. Come spring, shortages frequently developed and foods made from corn and wheat became barely affordable luxuries. Throughout the year, it was each buyer and seller for himself with neither a place nor a mechanism for organized, competitive bidding. The first central markets were formed to meet that need. Eventually, contracts were entered into for forward as well as for spot (immediate) delivery. So-called forwards were the forerunners of present day futures contracts.

Spurred by the need to manage price and interest rate risks that exist in virtually every type of modern business, today's futures markets have also become major financial markets. Participants include mortgage bankers as well as farmers, bond dealers as well as grain merchants, and multinational corporations as well as food processors, savings and loan associations, and individual speculators.

Futures prices arrived at through competitive bidding are immediately and continuously relayed around the world by wire and satellite. A farmer in Nebraska, a merchant in Amsterdam, an importer in Tokyo and a speculator in Ohio thereby have simultaneous access to the latest market-derived price quotations. And, should they choose, they can establish a price level for future delivery--or for speculative purposes--simply by having their broker buy or sell the appropriate contracts. Images created by the fast-paced activity of the trading floor notwithstanding, regulated futures markets are a keystone of one of the world's most orderly envied and intensely competitive marketing systems. Orders to buy or sell would be communicated by phone from the brokerage office you use and then to the trading pit or ring for execution by a floor broker. If you are a buyer, the broker will seek a seller at the lowest available price. If you are a seller, the broker will seek a buyer at the highest available price. That's what the shouting and signaling is about.

In either case, the person who takes the opposite side of your trade may be or may represent someone who is a commercial hedger or perhaps someone who is a public speculator. Or, quite possibly, the other party may be an independent floor trader. In becoming acquainted with futures markets, it is useful to have at least a general understanding of who these various market participants are, what they are doing and why.

Hedgers

The details of hedging can be somewhat complex but the principle is simple. Hedgers are individuals and firms that make purchases and sales in the futures market solely for the purpose of establishing a known price level--weeks or months in advance--for something they later intend to buy or sell in the cash market (such as at a grain elevator or in the bond market). In this way they attempt to protect themselves against the risk of an unfavorable price change in the interim. Or hedgers may use futures to lock in an acceptable margin between their purchase cost and their selling price. Consider this example:

A jewelry manufacturer will need to buy additional gold from his supplier in six months. Between now and then, however, he fears the price of gold may increase. That could be a problem because he has already published his catalog for a year ahead.

To lock in the price level at which gold is presently being quoted for delivery in six months, he buys a futures contract at a price of, say, $350 an ounce.

If, six months later, the cash market price of gold has risen to $370, he will have to pay his supplier that amount to acquire gold. However, the extra $20 an ounce cost will be offset by a $20 an ounce profit when the futures contract bought at $350 is sold for $370. In effect, the hedge provided insurance against an increase in the price of gold. It locked in a net cost of $350, regardless of what happened to the cash market price of gold. Had the price of gold declined instead of risen, he would have incurred a loss on his futures position but this would have been offset by the lower cost of acquiring gold in the cash market.

The number and variety of hedging possibilities is practically limitless. A cattle feeder can hedge against a decline in livestock prices and a meat packer or supermarket chain can hedge against an increase in livestock prices. Borrowers can hedge against higher interest rates, and lenders against lower interest rates. Investors can hedge against an overall decline in stock prices, and those who anticipate having money to invest can hedge against an increase in the over-all level of stock prices. And the list goes on.

Whatever the hedging strategy, the common denominator is that hedgers willingly give up the opportunity to benefit from favorable price changes in order to achieve protection against unfavorable price changes.

Speculators

Were you to speculate in futures contracts, the person taking the opposite side of your trade on any given occasion could be a hedger or it might well be another speculator--someone whose opinion about the probable direction of prices differs from your own.

The arithmetic of speculation in futures contracts--including the opportunities it offers and the risks it involves--will be discussed in detail later on. For now, suffice it to say that speculators are individuals and firms who seek to profit from anticipated increases or decreases in futures prices. In so doing, they help provide the risk capital needed to facilitate hedging.

Someone who expects a futures price to increase would purchase futures contracts in the hope of later being able to sell them at a higher price. This is known as "going long." Conversely, someone who expects a futures price to decline would sell futures contracts in the hope of later being able to buy back identical and offsetting contracts at a lower price. The practice of selling futures contracts in anticipation of lower prices is known as "going short." One of the attractive features of futures trading is that it is equally easy to profit from declining prices (by selling) as it is to profit from rising prices (by buying).

Floor Traders

Persons known as floor traders or locals, who buy and sell for their own accounts on the trading floors of the exchanges, are the least known and understood of all futures market participants. Yet their role is an important one. Like specialists and market makers at securities exchanges, they help to provide market liquidity. If there isn't a hedger or another speculator who is immediately willing to take the other side of your order at or near the going price, the chances are there will be an independent floor trader who will do so, in the hope of minutes or even seconds later being able to make an offsetting trade at a small profit. In the grain markets, for example, there is frequently only one-fourth of a cent a bushel difference between the prices at which a floor trader buys and sells.

Floor traders, of course, have no guarantee they will realize a profit. They may end up losing money on any given trade. Their presence, however, makes for more liquid and competitive markets. It should be pointed out, however, that unlike market makers or specialists, floor traders are not obligated to maintain a liquid market or to take the opposite side of customer orders.

| | Reasons for Buying futures contracts | Reasons for Selling futures contracts |

| Hedgers | To lock in a price and thereby obtain protection against rising prices | To lock in a price and thereby obtain protection against declining prices |

| Speculators and Floor Traders | To profit from rising prices | To profit from declining prices |

What is a Futures Contract?

There are two types of futures contracts, those that provide for physical delivery of a particular commodity or item and those which call for a cash settlement. The month during which delivery or settlement is to occur is specified. Thus, a July futures contract is one providing for delivery or settlement in July.

It should be noted that even in the case of delivery-type futures contracts, very few actually result in delivery. [When delivery does occur it is in the form of a negotiable instrument (such as a warehouse receipt) that evidences the holder's ownership of the commodity, at some designated location.]

Not many speculators have the desire to take or make delivery of, say, 5,000 bushels of wheat, or 112,000 pounds of sugar, or a million dollars worth of U.S. Treasury bills for that matter. Rather, the vast majority of speculators in futures markets choose to realize their gains or losses by buying or selling offsetting futures contracts prior to the delivery date. Selling a contract that was previously purchased liquidates a futures position in exactly the same way, for example, that selling 100 shares of IBM stock liquidates an earlier purchase of 100 shares of IBM stock. Similarly, a futures contract that was initially sold can be liquidated by an offsetting purchase. In either case, gain or loss is the difference between the buying price and the selling price.

Even hedgers generally don't make or take delivery. Most, like the jewelry manufacturer illustrated earlier, find it more convenient to liquidate their futures positions and (if they realize a gain) use the money to offset whatever adverse price change has occurred in the

Why Delivery?

Since delivery on futures contracts is the exception rather than the rule, why do most contracts even have a delivery provision? There are two reasons. One is that it offers buyers and sellers the opportunity to take or make delivery of the physical commodity if they so choose. More importantly, however, the fact that buyers and sellers can take or make delivery helps to assure that futures prices will accurately reflect the cash market value of the commodity at the time the contract expires--i.e., that futures and cash prices will eventually converge. It is convergence that makes hedging an effective way to obtain protection against an adverse change in the cash market price. Convergence occurs at the expiration of the futures contract because any difference between the cash and futures prices would quickly be negated by profit-minded investors who would buy the commodity in the lowest-price market and sell it in the highest-price market until the price difference disappeared. This is known as arbitrage and is a form of trading generally best left to professionals in the cash and futures markets.

Cash settlement futures contracts are precisely that, contracts which are settled in cash rather than by delivery at the time the contract expires. Stock index futures contracts, for example, are settled in cash on the basis of the index number at the close of the final day of trading. There is no provision for delivery of the shares of stock that make up the various indexes. That would be impractical. With a cash settlement contract, convergence is automatic.

The Process of Price Discovery

Futures prices increase and decrease largely because of the myriad factors that influence buyers' and sellers' judgments about what a particular commodity will be worth at a given time in the future (anywhere from less than a month to more than two years).

As new supply and demand developments occur and as new and more current information becomes available, these judgments are reassessed and the price of a particular futures contract may be bid upward or downward. The process of reassessment--of price discovery--is continuous.