- MODV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ModivCare (MODV) 8-KFinancial statements and exhibits

Filed: 12 Nov 03, 12:00am

NASDAQ: PRSC

November 2003

Exhibit 99.2

Cautionary Statement

Cautionary Note about Forward-Looking Statements

Certain statements herein, such as any statements about the Company’s confidence or

strategies or its expectations about revenues, results of operations, profitability, future

contracts or market opportunities, constitute “forward-looking statements” within the

meaning of the private Securities Litigation Reform Act of 1995. Such forward looking

statements involve a number of known and unknown risks, uncertainties and other

factors which may cause the Company’s actual results or achievements to be materially

different from those expressed or implied by such forward-looking statements. These

factors include, but are not limited to, reliance on government-funded contracts, risks

associated with government contracting, risks involved in managing government

business, legislative or policy changes, challenges resulting from growth or acquisitions,

adverse media attention and legal, economic and other risks detailed in the Company’s

other filings with the Securities and Exchange Commission. Words such as “believe”,

“demonstrate”, “intend”, “expect”, “estimate”, “anticipate”, “should” and “likely”, and

similar expressions, identify forward-looking statements. Readers are cautioned not to

place undue reliance on those forward-looking statements, which speak only as of the

date the statement was made. The Company undertakes no obligation to update any

forward-looking statement contained herein.

We deliver home and community based

social services to government

beneficiaries.

Home and community-based alternatives to institutional care

We own no beds, facilities or group homes

Scalable, flexible, high return on capital business model

Low cost alternative for government sponsored social services

Reduced costs and improved quality through outsourcing

Multi-state provider in a multi billion dollar market

Funding reallocated from institutional to community-based care

Established national presence

$14.8M in owned and $15.5M (Q3) managed revenue (net of $ 1.5

M management fees) with 12,756 clients in 17 states as of

September 30, 2003

Providence Overview

Provider Network Management

Intake, Assessment and Referral

Monitoring Services

Case Management

Management Services

Foster Care Services

Traditional Foster Care

Therapeutic Foster Care

Home and Community

Based Services

Home Based Counseling

Substance Abuse Treatment

School Support Services

Service Offering Overview

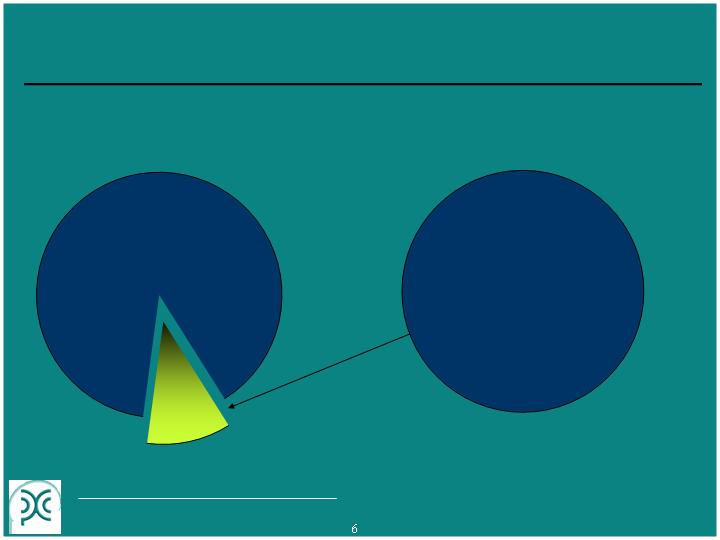

Revenue Composition(1)

Managed revenue

net of management fee

Owned revenue

including management fee

Management fee represents 9% to

18% of managed entity revenue

$54.5 M

$58.0 M

(1) Last Twelve Months (LTM) as of 9/30/03.

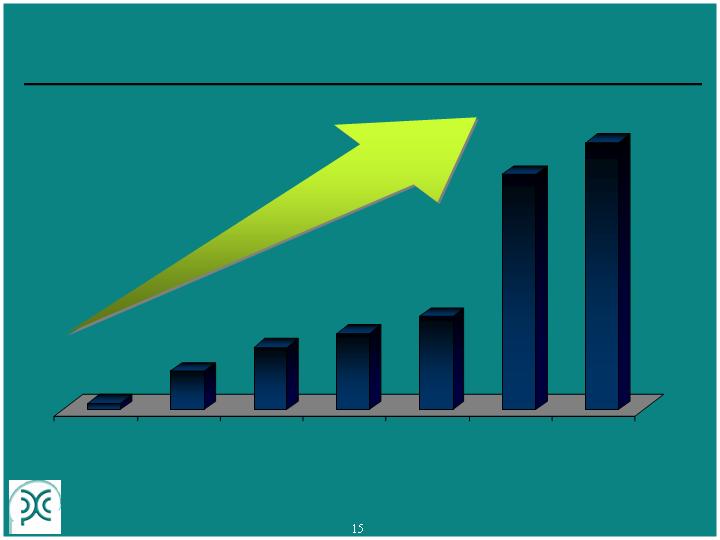

Explosive Growth

Owned Revenue

Managed

Revenue (1)

Contracts

States Served

Clients

Trailing Revenue

12,756

3,069

1,333

1997

2000

9/30/03

192

50

4

1997

2000

9/30/03

17

6

1

1997

2000

9/30/03

$2.5

$17.6

$54.5

$1.4

1997

2000

9/30/03

(1) Managed rev. net of management fees.

$58.0

Significant National Footprint

Strong Potential for Geographic Growth

States of operation

Headquarters

Regional

Directors

Experienced Management

Name

Position

Experience

Fletcher J. McCusker

Chairman of the

Board and CEO

PRSC Chairman and CEO since 1996;

20+ years of healthcare services related

experience

William B. Dover

President

PRSC President since 1997; 20+ years of

healthcare services related experience

Michael N. Deitch

CFO, VP,

Secretary and

Treasurer

PRSC CFO since 1997, and Secretary and

Treasurer since 1998; CPA and served in

various finance and accounting capacities

for 19 years

Mary J. Shea

EVP of Program

Services

Current position since 2003; previously

president of Arizona operation since

1997; 13+ years of healthcare services

related experience

Craig A. Norris

President,

Eastern Division

Current position since 1998; 11+ years

of healthcare services related experience

Martin J. Favis

Fred D. Furman

Chief

Development

Officer

General Counsel

Current position since 2003; previously

COO of Camelot Care since 2000 and

with company since 1998

Joined PRSC in September 2003 following

IPO; 8+ years experience as president

and General Counsel of publicly traded

mental health company

Why Invest in Providence?

Multiple Growth Opportunities

Strong Financial Performance

Large Market in Crisis

Attractive Business and Operating Model

Critical Issues Facing Social Services Delivery

High fixed costs; high depreciation

Excess bed capacity; low occupancy rates

High Cost of

Institutional Delivery

Increasing Number of

Eligible Beneficiaries

Over 33M living in poverty

Record numbers in child welfare

44M Medicaid Enrollees

Legally Mandated

Services

Billions spent annually on social services

Federally mandated for local delivery

$15.9B Medicaid, $23.3B State Mental Health

$20B Child Welfare, $29.7B TANF, $38.1B DOC

Crisis in Social

Services

Situation worsened by record state budget deficits

Many states closing institutions

Privatized social services funding increased 65% since 1996

49 states have Medicaid waivers to develop alternatives to

traditional institutional care, up from 13 in 1999

18 states have Medicaid Research Waivers for comprehensive

change to current delivery systems through pilots or tests

3 states have ongoing privatization initiatives for their child

welfare systems with more than 25 others under review

New Jersey child welfare system flaws exposed

Florida has stated plans to accelerate its privatization efforts

27 states have privatized portions of adult corrections service

The Market is Here

Why Invest in Providence?

Multiple Growth Opportunities

Strong Financial Performance

Large Market in Crisis

Attractive Business and Operating Model

Benefits of the PRSC Business Model

We do not own or lease any facilities

No costs associated with building, maintaining and financing

Highly variable cost structure

Revenue growth not constrained by number of beds

Nominal capital expenditures required to fund growth

High ROI; typically less than 1 year payback

Nominal investment to enter new markets

Predictable and recurring stream of revenue and earnings

High contract renewal and customer retention

History of Success Winning Contracts

4

25

41

50

61

155

192

1997

1998

1999

2000

2001

2002

9/30/03

Virginia

Leveraging Acquisitions

Leveraging the PRSC Model

Maine

De Novo Success

1997

$2.2M Revenue

$12K Loss

11 Contracts

138 Employees

341 Clients

LTM June 2003

$13.6M Revenue

$2.6M Profit

36 Contracts

342 Employees

1,149 Clients

Acquired in late 1997

2000

$89K Revenue

Breakeven

1 Contract

5 Employees

10 Clients

LTM June 2003

$3.8M Revenue

$868K Profit

7 Contracts

99 Employees

143 Clients

Start-up in 2000

Why Invest in Providence?

Strong Financial Performance

Large Market in Crisis

Multiple Growth Opportunities

Attractive Business and Operating Model

Key Drivers of Growth

Internal growth

Positive demographic/census trends as well as contract pricing

Cross-selling additional services to existing customers

Over the past 12 months, PRSC has added services to more than

50% of its existing contracts

New contract opportunities

RFPs in the US have increased 50% to 7,439 (’01-’02)

Negotiating an additional $12M of owned and $10M managed

revenue

Shift of funding from institutional to community-based services

Key Drivers of Growth

Geographic expansion

Clustering strategy – leverage existing infrastructure through

contiguous expansion

Expansion into new states and regions

Ft. Myers and Palm Beach, Florida and Washington, D.C. are

implementing privatization plans

Targeted acquisitions

Accelerates entry into new geography

Smaller social services providers have limited exit options

Track record of success

Why Invest in Providence?

Multiple Growth Opportunities

Large Market in Crisis

Strong Financial Performance

Attractive Business and Operating Model

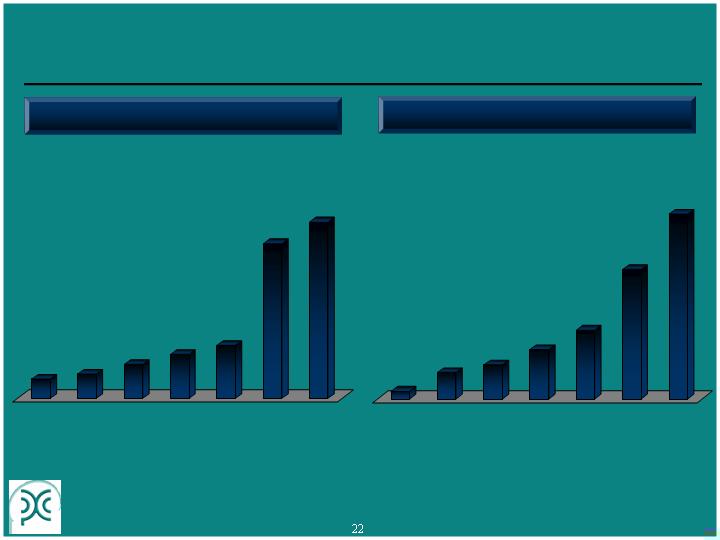

Owned Revenue Mix

Home & Community

Foster Care

Management Services

$8.6

$12.7

$17.6

$24.7

$33.5

$54.5

1998

1999

2000

2001

2002

For the 12 Months Ended June 30,

in millions

9/30/03

Operating Statistics

Historical Client Growth

Historical Employee Growth

1,333

1,691

2,360

3,069

3,697

10,785

12,756

1997

1998

1999

2000

2001

2002

9/30/03

68

236

306

443

615

1,158

1,721

1997

1998

1999

2000

2001

2002

9/30/03

2003 GAAP Performance

(in thousands except per share numbers)

Q1

Q2

Q3

Q4

Year

Actual

Actual

Actual

Est.

Est.

Income

$631

$797

$(3,389)

$1,180

$(1,064)

Shares

5,407

5,499

4,856

8,857

4,432

EPS

$0.12

$0.14

$(0.70)

$0.13

$(0.24)

2003 Non GAAP Performance

(in thousands except per share numbers)

Q1

Q2

Q3

Q4

Year

Actual Actual

Actual

Est.

Est.

Earnings

$631

$797

$1,075

$1,180

$3,683

Shares

5,407

5,499

6,889

8,857

6,673

EPS

$0.12

$0.14

$0.16

$0.13

$0.55

2003 Diluted EPS—GAAP

(in thousands except per numbers)

| Q1 Actual | Q2 Actual | Q3 Actual | Q4 Est. | Year Est. | |||||||||||||

Numerator: | |||||||||||||||||

Numerator for basic EPS—income (loss) avail. to common stockholders | $ | 490 | $ | 655 | $ | (3,389 | ) | $ | 1,180 | $ | (1,064 | ) | |||||

Effect of dilutive securities: | |||||||||||||||||

Preferred stock dividends and convertible notes | 141 | 142 | — | — | — | ||||||||||||

Numerator for diluted EPS—income (loss) avail. to common stockholders after assumed conversions | $ | 631 | $ | 797 | $ | (3,389 | ) | $ | 1,180 | $ | (1,064 | ) | |||||

Denominator: | |||||||||||||||||

Denominator for basic EPS—weighted avg. shares | 2,185 | 2,201 | 4,856 | 8,482 | 4,432 | ||||||||||||

Effect of dilutive securities: | |||||||||||||||||

Preferred stock conversion | 1,783 | 1,783 | — | — | — | ||||||||||||

Warrants | 708 | 708 | — | — | — | ||||||||||||

Convertible debt | 545 | 544 | — | — | — | ||||||||||||

Common stock options | 186 | 263 | — | 375 | — | ||||||||||||

Dilutive potential common shares | 3,222 | 3,298 | — | 375 | — | ||||||||||||

Denominator for diluted EPS—adj. weighted-avg. shares and assumed conversion | 5,407 | 5,499 | 4,856 | 8,857 | 4,432 | ||||||||||||

Diluted EPS | $ | 0.12 | $ | 0.14 | $ | (0.70 | ) | $ | 0.13 | $ | (0.24 | ) | |||||

25

2003 Diluted EPS—Non-GAAP

(in thousands except per share numbers)

| Q1 Actual | Q2 Actual | Q3 Actual | Q4 Est. | Year Est. | |||||||||||||

Numerator: | |||||||||||||||||

Net income (loss) avail. to common stockholders | $ | 490 | $ | 655 | $ | (3,389 | ) | $ | 1,180 | $ | (1,064 | ) | |||||

Add: | |||||||||||||||||

IPO consent fee to preferred stockholders | — | — | 3,500 | — | 3,500 | ||||||||||||

Settlement of put warrant | — | — | 631 | — | 631 | ||||||||||||

Write-off of deferred financing charges (net of tax) | — | — | 251 | — | 251 | ||||||||||||

Numerator for basic EPS—income avail. to common stockholders excluding IPO related expenses | 490 | 655 | 993 | 1,180 | 3,318 | ||||||||||||

Effect of dilutive securities: | |||||||||||||||||

Preferred stock dividends and convertible notes | 141 | 142 | 82 | — | 365 | ||||||||||||

Numerator for diluted EPS—income avail. to common stockholders excl. IPO related expenses and adjusted for assumed conversions | $ | 631 | $ | 797 | $ | 1,075 | $ | 1,180 | $ | 3,683 | |||||||

Denominator: | |||||||||||||||||

Denominator for basic EPS—weighted avg. shares | 2,185 | 2,201 | 4,856 | 8,482 | 4,432 | ||||||||||||

Effect of dilutive securities: | |||||||||||||||||

Preferred stock conversion | 1,783 | 1,783 | 1,030 | — | 1,149 | ||||||||||||

Warrants | 708 | 708 | 411 | — | 459 | ||||||||||||

Convertible debt | 545 | 544 | 315 | — | 351 | ||||||||||||

Common stock options | 186 | 263 | 277 | 375 | 282 | ||||||||||||

Dilutive potential common shares | 3,222 | 3,298 | 2,033 | 375 | 2,241 | ||||||||||||

Denominator for diluted EPS, excl. IPO related expenses—adj. weighted-avg. shares and assumed conversion | 5,407 | 5,499 | 6,889 | 8,857 | 6,673 | ||||||||||||

Diluted EPS, excluding IPO related expenses | $ | 0.12 | $ | 0.14 | $ | 0.16 | $ | 0.13 | $ | 0.55 | |||||||

26

The President’s New Freedom Commission on Mental Health

July 22, 2003

“…the mental health delivery system is fragmented and is in

disarray…”

“In short, the Nation must replace unnecessary institutional care with

efficient, effective community services that people can count on.”

“…services will be delivered in the most integrated setting possible –

services in communities rather than in institutions.”

27

The Time is Now