- MODV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ModivCare (MODV) DEF 14ADefinitive proxy

Filed: 20 Apr 05, 12:00am

United States

Securities and Exchange Commission

Washington, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

The Providence Service Corporation

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction. |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

THE PROVIDENCE SERVICE CORPORATION

5524 East Fourth Street

Tucson, Arizona 85711

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 19, 2005

TO OUR STOCKHOLDERS:

Notice is hereby given that the 2005 Annual Meeting of Stockholders (the “Annual Meeting”) of The Providence Service Corporation (the “Company”) will be held at the JW Marriott Starr Pass Resort, 3800 W. Starr Pass Boulevard, Tucson, Arizona 85745, at 9:00 a.m. (local time) on May 19, 2005. The Annual Meeting is being held for the following purposes:

1. To elect two Class 2 directors to each serve for a three year term until the 2008 annual meeting of stockholders and until their respective successors have been duly elected and qualified, as more fully described in the accompanying Proxy Statement;

2. To amend the 2003 Stock Option Plan to increase the number of shares of Common Stock available for issuance under the 2003 Stock Option Plan, as more fully described in the accompanying Proxy Statement;

3. To ratify the appointment of McGladrey & Pullen, LLP as the Company’s independent auditor for the fiscal year ending December 31, 2005.

4. To transact such other business as may properly come before the Annual Meeting or any of its adjournments or postponements.

Only stockholders of record of the Company’s Common Stock, par value $0.001 per share, as shown by the transfer books of the Company, at the close of business on March 30, 2005 are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, you are urged to mark, sign and return the enclosed proxy as promptly as possible in the postage prepaid envelope enclosed for that purpose.

| By Order of the Board of Directors |

/s/ Fletcher Jay McCusker |

Fletcher Jay McCusker Chief Executive Officer and Chairman of the Board of Directors |

April 20, 2005

Tucson, Arizona

IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING, PLEASE COMPLETE, DATE,

SIGN AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE AS

PROMPTLY AS POSSIBLE. IF YOU DO ATTEND THE MEETING, YOU MAY, IF YOU PREFER,

REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

THE PROVIDENCE SERVICE CORPORATION

5524 East Fourth Street

Tucson, Arizona 85711

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”) of The Providence Service Corporation, a Delaware corporation (“Providence” or the “Company”), for use at the 2005 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the JW Marriott Starr Pass Resort, 3800 W. Starr Pass Boulevard, Tucson, Arizona 85745, at 9:00 a.m. (local time) on May 19, 2005, and at any of its adjournments or postponements, for the purposes set forth herein and in the attached Notice of Annual Meeting of Stockholders. Accompanying this Proxy Statement is the Board of Directors’ proxy for the Annual Meeting, which you may use to indicate your vote on the proposals described in this Proxy Statement. This Proxy Statement and accompanying proxy are first being mailed to Company stockholders on or about April 20, 2005.

Only stockholders of record, as shown on the transfer books of the Company, at the close of business on March 30, 2005 (“Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. On the Record Date, there were 9,411,981 shares of the Company’s common stock, par value $.001 per share (“Common Stock”), outstanding. The Common Stock is the only outstanding class of capital stock of the Company with voting rights.

Sending in a signed proxy will not affect a stockholder’s right to attend the Annual Meeting and vote in person since the proxy is revocable. All proxies which are properly completed, signed and returned to the Company prior to the Annual Meeting, and which have not been revoked, will, unless otherwise directed by the stockholder, be voted in accordance with the recommendations of the Board of Directors set forth in this Proxy Statement. A stockholder may revoke his or her proxy at any time before it is voted either by filing with the Secretary of the Company, at its principal executive offices, a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and expressing a desire to vote his or her shares in person.

The principal executive offices of the Company are located at 5524 East Fourth Street, Tucson, Arizona 85711, and the telephone number of the Company is (520) 747-6600.

VOTING PROCEDURES

The presence, in person or represented by proxy, of the holders of a majority of the outstanding shares of Common Stock will constitute a quorum for the transaction of business at the Annual Meeting. All shares of the Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting, no matter how they are voted or whether they abstain from voting, will be counted in determining the presence of a quorum.

A stockholder is entitled to cast one vote for each share held of record on the Record Date on all matters to be considered at the Annual Meeting. The two nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes of shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting will be elected. Approval of any other proposal will require the affirmative vote of the majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions and broker non-votes (i.e., when a nominee holding shares of Common Stock cannot vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner) will be included in the number of shares present at the Annual Meeting for the purpose of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on the election of directors. Abstentions, but not broker non-votes, on any other proposal will have the same legal effect as votes against the proposal. Broker non-votes will not count as votes against any proposal at the Annual Meeting. Cumulative voting is not permitted.

The enclosed proxies will be voted in accordance with the instructions thereon. Unless otherwise stated, all shares represented by such proxy will be voted as instructed. Proxies may be revoked as noted above.

The Company is not presently aware of any matters that will be brought before the Annual Meeting, which are not reflected in the attached Notice of the Annual Meeting. If any such matters are brought before the Annual Meeting, the persons named in the enclosed proxy will act or vote in accordance with their best judgment.

PROXY SOLICITATION

The entire cost of soliciting proxies, include the costs of preparing, assembling and mailing this Proxy Statement, the proxy and any additional soliciting materials furnished to stockholders, will be borne by the Company. In addition to solicitation by mail, officers, directors or employees of the Company may solicit proxies in person or by telephone, facsimile or similar means without additional compensation. Upon request, the Company will pay the reasonable expenses incurred by record holders of the Common Stock who are brokers, dealers, banks or voting trustees, or their nominees, for sending proxy materials and the 2004 Annual Report to Stockholders to the beneficial owners of the shares they hold of record.

2

VOTING SECURITIES OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of the Record Date, with respect to the beneficial ownership of the Company’s Common Stock by (i) each stockholder known by the Company to own beneficially more than five percent of the Company’s outstanding Common Stock, (ii) all directors of the Company and each nominee for director, (iii) all executive officers of the Company named in the “Summary Compensation Table” which follows and (iv) all directors and executive officers of the Company as a group. Except as otherwise specified, the named beneficial owner has sole voting and investment power with respect to his shares.

Name | No. of shares of Common Stock Beneficially Owned (1) | Percent of Voting Power of Common Stock (1) | |||

Arbor Capital Management, LLC(2) One Financial Plaza 120 South Sixth Street Suite 1000 Minneapolis, MN 55402 | 884,800 | 9.5 | % | ||

Bricoleur Capital Management, LLC(3) 12230 El Camino Real, Suite 100 San Diego, CA 92130 | 502,834 | 5.4 | % | ||

Century Capital Management, LLC(4) 100 Federal Street, Boston, MA 02110 | 719,610 | 7.7 | % | ||

Michael N. Deitch(5) | 28,154 | * | |||

William Boyd Dover(6) | 11,072 | * | |||

Fred Furman (7) | 68,750 | * | |||

Fletcher Jay McCusker(8) | 247,500 | 2.6 | % | ||

Craig A. Norris(9) | 22,916 | * | |||

Mark L. First(10) | 3,333 | * | |||

Steven I. Geringer(11) | 35,476 | * | |||

Hunter Hurst, III(12) | 11,906 | * | |||

Kristi L. Meints(13) | 4,762 | * | |||

Richard Singleton(14) | 11,907 | * | |||

Warren S. Rustand | — | — | |||

All directors and executive officers as a group (12 persons)(15) | 503,468 | 5.3 | % | ||

| * | Less than 1%. |

| (1) | The securities “beneficially owned” by an individual are determined as of the Record Date in accordance with the definition of “beneficial ownership” set forth in the regulations of the Securities and Exchange Commission (the “SEC”). Accordingly, they may include securities owned by or for, among others, the spouse and/or minor children of the individual and any other relative who has the same home as such individual, as well as other securities as to which the individual has or shares voting or investment power or has the right to acquire under outstanding stock options within 60 days after the Record Date. Beneficial ownership may be disclaimed as to certain of the securities. |

| (2) | Includes 884,800 shares of Common Stock indirectly beneficially owned by Arbor Capital Management, LLC, an investment advisor. As a result of his position with and ownership in Arbor Capital Management, LLC, Rick D. Leggott may be deemed to indirectly beneficially own the 884,800 shares of Common Stock indirectly beneficially owned by Arbor Capital Management, LLC. This is based on the Schedule 13G filed with the SEC on February 4, 2005. |

| (3) | Includes 502,834 shares of Common Stock indirectly beneficially owned by Bricoleur Capital Management, LLC, an investment advisor. It is possible that one or more members, executive officers or |

3

employees of Bricoleur Capital Management, LLC might be deemed a beneficial owner of some or all of these shares in that they might be deemed to share the power to direct the voting or disposition of such shares. This is based on the Schedule 13G filed with the SEC on February 14, 2005.

| (4) | Includes 719,610 shares of Common Stock indirectly beneficially owned by Century Capital Management, LLC, a registered investment advisor. The shares are owned by various accounts managed by Century Capital Management, LLC. Those accounts have the right to receive, or the power to direct the receipt of, dividends from, and the proceeds from the sale of, such shares. This is based on the Schedule 13G filed with the SEC on February 14, 2005. |

| (5) | Includes 19,582 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include an additional 35,418 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (6) | Includes 11,072 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include an additional 7,500 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (7) | Includes 68,750 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 46,250 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (8) | Includes 100,000 shares of Common Stock, which have been pledged to Compass Bank as collateral on a loan. Includes 12,500 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Includes 135,000 shares of Common Stock held by the McCusker Family Trust U/A as to which Mr. McCusker serves as a trustee. Does not include an additional 37,500 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. Does not include 17,450 shares of Common Stock held by The Fletcher J. McCusker GRAT for the benefit of Mr. McCusker’s son, as to which Mr. McCusker disclaims beneficial ownership. |

| (9) | Includes 12,916 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include an additional 32,084 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (10) | Represents shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 16,667 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (11) | Includes 32,143 shares of Common Stock held by the Geringer Family Trust. Mr. Geringer shares voting and investment power over the securities held by the Geringer Family Trust. Includes 3,333 shares of Common Stock held by Mr. Geringer issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 16,667 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (12) | Represents shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 16,667 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (13) | Represents shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 36,667 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (14) | Represents shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date. Does not include 16,667 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

| (15) | Includes 185,538 shares of Common Stock issuable upon the exercise of options that are exercisable within 60 days of the Record Date, 100,000 shares of Common Stock that have been pledged to Compass Bank as collateral on a loan, and 32,143 shares of Common Stock held by the Geringer Family Trust. Does not include 277,087 shares of Common Stock underlying options that are not exercisable within 60 days of the Record Date. |

4

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board of Directors is responsible for the business and affairs of the Company. The Company’s Second Amended and Restated Certificate of Incorporation provides that the number of directors be between five and eleven as determined by the Board of Directors. The Board of Directors is comprised of six directors and is divided into three classes as nearly equal in size as possible, serving staggered three year terms. At each annual meeting of stockholders the successors to the directors whose terms will then expire will be elected to serve from the time of their election and qualification until the third annual meeting following their election or until their successors have been duly elected and qualified, or until their earlier death, resignation or removal.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the proxies will be voted for such other nominee(s) as shall be designated by the current Board of Directors to fill any vacancy. The nominees have consented to being named in the Proxy Statement and to serve if elected. The Company has no reason to believe that any nominee will be unable or unwilling to serve if elected as a director. The Board of Directors proposes the election of the following nominees as Class 2 directors: Richard Singleton and Warren S. Rustand.

The director nominees were nominated by the Company’s Nominating and Corporate Governance Committee, which nominations were confirmed by the Board of Directors. The Chief Executive Officer recommended to the Nominating and Corporate Governance Committee that they consider Mr. Rustand as a nominee for director.

If elected, each nominee is expected to serve until the 2008 annual meeting of stockholders or his successor is duly elected and qualified. The two nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes will be elected. Mr. Singleton is presently a director of the Company.

Unless directed otherwise, the persons named in the enclosed proxy intend to vote such proxy for the election of the listed nominees or, in the event of death, disqualification, refusal or inability of any nominee to serve, for the election of such other persons as the Company’s Board of Directors may recommend in the place of such nominee to fill the vacancy. Information regarding the two nominees is set forth below.

The Board of Directors recommends that the stockholders elect the nominees named below as directors of the Company for the ensuing term.

The following table sets forth certain information with respect to the current directors and director nominees as of April 14, 2005.

Name | Age | Class | Term Expires | |||

Fletcher Jay McCusker | 55 | 3 | 2006 | |||

Mark L. First (2)(3)(5) | 40 | 2 | 2005 | |||

Steven I. Geringer (2)(3) | 59 | 1 | 2007 | |||

Hunter Hurst, III (1)(2)(3) | 66 | 1 | 2007 | |||

Richard Singleton (1)(4) | 69 | 2 | 2005 | |||

Kristi L. Meints (1) | 50 | 3 | 2006 | |||

Warren S. Rustand (4) | 62 | 2 | — |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee. |

| (4) | Director Nominee. |

| (5) | Mr. First’s term expires upon election of directors at the Annual Meeting. |

5

There are no other nominees for director known to the Company at this time. There are no family relationships among the current directors or executive officers of the Company.

The following is a brief summary of the background of each director and director nominee:

Mr. McCusker has served as the Chairman of the Board of Directors and Chief Executive Officer of the Company since it was founded in December 1996. Prior to founding the company, Mr. McCusker served as Executive Vice President of Youth Services International, Inc., a Nasdaq listed company that provided private institutional care for at-risk youth, from July 1995 until December 1996. From September 1992 until July 1995, he served as Chief Executive Officer of Introspect Healthcare Corporation, a large multi-state behavioral health provider. In 1983, Mr. McCusker co-founded a mental health care company, Century Healthcare, which was sold to New York Stock Exchange listed Columbia Healthcare in 1992. Mr. McCusker received a bachelors degree in rehabilitation from the University of Arizona in 1974 and completed the public programs graduate program without a terminal degree at Arizona State University in 1982.

Mr. First has served as a director of the Company since November 1997. Mr. First is a Managing Director of Eos Management, Inc., a wholly owned entity of Eos Partners, L.P., an investment firm, where he has been employed since March 1994. Mr. First was previously an investment banker with Morgan Stanley & Co., Inc. from August 1991 until March 1994. He is also a director of several privately owned companies. Mr. First earned a bachelors degree from The Wharton School of the University of Pennsylvania in 1987, and a masters degree in business administration from the Harvard Business School in 1991.

Mr. Geringer has served as a director of the Company since March 2002 and has been a private investor since 1996. Mr. Geringer has thirty years of experience in the health care industry including senior management positions and directorships at publicly-traded and privately-held companies involved in hospital management, managed care, pharmaceutical benefits management and distribution, medical devices, and children’s social services programs. He served as President and Chief Executive Officer of PCS Health Systems, Inc., one of the nations’ largest providers of managed pharmaceutical services to managed care organizations and health insurers, from June 1995 until June 1996, during which time PCS was acquired by Eli Lilly & Company. He also served as PCS’ President and Chief Operating Officer from May 1993 until PCS’ then-parent, McKesson Corporation, acquired Clinical Pharmaceuticals, Inc., a company of which Mr. Geringer was a founder, Chairman and Chief Executive Officer. Mr. Geringer currently serves as a director of Amsurg Corp., a Nasdaq listed ambulatory surgery center company, Chairman of its Compensation Committee and a member of its Nominating and Corporate Governance Committee. Mr. Geringer is also Chairman and a director of Qualifacts Systems, Inc., a specialized health care information technology provider. Mr. Geringer received a bachelors degree in economics from The Wharton School of the University of Pennsylvania in 1968.

Mr. Hurst has served as a director of the Company since it was founded in December 1996. Since 1973, Mr. Hurst has served as director of the National Center for Juvenile Justice, a national juvenile justice research and resource center. He has directed over 30 applied research studies and has authored numerous publications relating to juvenile issues. He received his bachelors degree in psychology and masters degree in social work from Louisiana State University in 1960 and 1965, respectively.

Mr. Singleton has served as a director of the Company since March 1998. Colonel Singleton is a retired United States Army colonel. Colonel Singleton was one of the founders of Youth Services International, Inc., a Nasdaq listed company that provides private institutional care for at-risk youth, in July 1993. He has served as a Superintendent of Boys School for the Department of Juvenile Justice State of Florida from June 1999 to July 2004. From January 1999 until June 1999, Colonel Singleton was a Regional Director of Operations for Three Springs, Inc., located in Huntsville, Alabama, where he was responsible for the overall operations and management of juvenile justice facilities in the State of Georgia. Colonel Singleton received a bachelors degree in education from the South Carolina State University in 1958 and a masters degree in public administration from the University of Missouri in 1972.

Ms. Meints has served as a director of the Company since August 2003. Since January 2005 and from August 1999 until September 2003, she served as the Chief Financial Officer of Chicago Systems Group, Inc., a

6

technology consulting firm based in Chicago, Illinois. From October 2003 through December 2004, Ms. Meints served as Chief Financial Officer of Peter Rabbit Farms, a carrot & vegetable farming business in Southern California. From January 1998 until August 1999, she was Interim Chief Financial Officer for Cordon Corporation, a start-up services company. Ms. Meints was Group Finance Director for Avery Dennison Corporation, a New York Stock Exchange listed company that is a multi-national manufacturer of consumer and industrial products, from March 1996 until December 1997. From February 1977 until June 1995, she held a variety of financial positions at SmithKline Beecham Corporation, including the Director of Finance, Worldwide Manufacturing Animal Health Products; and Manager of Accounting and Budgets for Norden Laboratories, Inc., a wholly owned subsidiary. She received a bachelors degree in accounting from Wayne State College in 1975 and a masters degree in business administration from the University of Nebraska in 1984.

Mr. Rustand has served as the Chief Executive Officer of Summit Capital Consulting, Inc., which specializes in the development of small to mid-size companies by structuring financial and human capital resources for them since September 2001. He has been a strategic partner in Harlingwood Partners, LP, a $200 million private fund focused on leveraged build-ups and consolidations in a variety of industries ranging from business services outsourcing to healthcare and manufacturing since December 1998. Additionally, Mr. Rustand has had a long term interest in public policy, and in 1973, was selected as a White House Fellow. During his fellowship he served in various positions such as Special Assistant to the Secretary of Commerce and Special Assistant to the Vice President. In addition, from 1974 to 1976, he served as the Appointments Secretary to the President. Mr. Rustand serves as a director of TLC Vision Corporation, a Nasdaq listed eye-care services company, and the Chairman of its Audit Committee. He received his bachelors and masters degrees in political science from the University of Arizona in 1965 and 1972, respectively.

Independence of the Board of Directors

The Board of Directors has determined that the following directors, constituting a majority of the members of the Board of Directors, are independent as defined in the applicable listing standards of the Nasdaq National Market: Steven I. Geringer, Hunter Hurst, III, Richard Singleton and Kristi L. Meints. The Board of Directors has determined that if elected as a director that Mr. Rustand would be independent.

Communication with the Board of Directors

Stockholders may communicate with the Board of Directors, including the non-management directors, by sending a letter to an individual director or to the Company’s Board of Directors, c/o Michael N. Deitch, Corporate Secretary, The Providence Service Corporation, 5524 East Fourth Street, Tucson, Arizona 85711. In the letter, the stockholder must identify him or herself as a stockholder. The Corporate Secretary may require reasonable evidence that the communication is being made by or on behalf of a stockholder before the communication is transmitted to the individual director or to the Company’s Board of Directors. All proper stockholder communications received by Mr. Deitch will be delivered to the Company’s Audit Committee Chairperson or to the director to which such correspondence is addressed.

Meetings of the Board of Directors and Committees

The Board of Directors held eight meetings during the 2004 fiscal year. The Audit Committee held ten meetings during the 2004 fiscal year. The Compensation Committee held three meetings during the 2004 fiscal year. The Nominating and Corporate Governance Committee held one meeting during the 2004 fiscal year. During fiscal 2004, none of the directors attended less than 75% of all of the meetings of the Board of Directors (held during the period for which he was a director) and the meetings of all committees of the Board of Directors on which such director served.

Attendance at Annual Meetings of Stockholders

The Board of Directors has an internal policy that all of the directors should attend the annual meeting of stockholders, absent exceptional cause. Five directors attended the 2004 annual meeting of stockholders.

7

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee

The Audit Committee is currently composed of Ms. Meints (Chairperson) and Messrs. Hurst and Singleton. The Audit Committee is directly responsible for:

| • | appointing, overseeing and compensating the work of the outside auditors; |

| • | reviewing the Company’s quarterly financial statements and earnings releases; |

| • | pre-approving all auditing services and permissible non-audit services provided by the Company’s outside auditor; |

| • | engaging in a dialogue with the outside auditor regarding relationships which may impact the independence of the outside auditor and being responsible for oversight of the independence of the outside auditor; |

| • | reviewing and approving the report of the Audit Committee to be filed with the SEC; |

| • | reviewing with the outside auditor the adequacy and effectiveness of the internal controls over financial reporting; |

| • | establishing procedures for the submission of complaints, including the submission by the Company’s employees of anonymous concerns regarding questionable accounting or auditing matters; |

| • | reviewing with the Company’s Chief Executive Officer and Chief Financial Officer any significant deficiencies in the design or operation of the Company’s internal controls and any fraud, whether or not material, that involves the Company’s management or other employees who have a significant role in the Company’s internal controls; and |

| • | reviewing and assessing annually the adequacy of the Audit Committee Charter. |

The Audit Committee is governed by a written charter approved by the Board of Directors, a copy of which is on file with the SEC as Appendix A to the Company’s Proxy Statement filed on April 21, 2004.

The Board of Directors has determined that each member of the Audit Committee is independent as defined in applicable Nasdaq National Market listing standards and Rule 10A-3 of the Securities Exchange Act of 1934, as amended. The Board of Directors has also determined that Ms. Meints is an “audit committee financial expert” as defined under Item 401 of Regulation S-K.

Compensation Committee

The Compensation Committee currently consists of Messrs. First (Chairperson), Geringer and Hurst. The Compensation Committee is directly responsible for:

| • | reviewing and determining annually the compensation of the Company’s Chief Executive Officer and other executive officers; |

8

| • | preparing an annual report on executive compensation for inclusion in the Company’s annual proxy statement for each annual meeting of stockholders in accordance with applicable SEC rules and regulations; |

| • | approving the form of employment contracts, severance arrangements, change in control provisions and other compensatory arrangements with executive officers; |

| • | approving compensation programs and grants involving the use of Common Stock and other equity securities; and |

| • | reviewing and assessing annually, the Compensation Committee’s performance and the adequacy of the Compensation Committee Charter. |

In addition, the Compensation Committee administers the 2003 Stock Option Plan.

Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee currently consists of Messrs. First (Chairperson), Geringer and Hurst. The Nominating and Corporate Governance Committee is responsible for, among other things:

| • | selecting the slate of nominees of directors to be proposed for election by the stockholders and recommending to the Board of Directors individuals to be considered by the Board of Directors to fill vacancies; |

| • | developing and implementing policies regarding corporate governance matters and recommending any desirable changes to such policies to the Board of Directors; |

| • | establishing criteria for selecting new directors; and |

| • | reviewing and assessing annually the performance of the Nominating and Corporate Governance Committee and the adequacy of the Nominating and Corporate Governance Committee Charter. |

The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent as defined in applicable Nasdaq National Market listing standards. The Nominating and Corporate Governance Committee is governed by a written charter approved by the Board of Directors, a copy of which is on file with the SEC as Appendix B to the Company’s Proxy Statement filed on April 21, 2004.

Director Nomination Process

Director Qualifications

Nominees for director will be selected on the basis of outstanding achievement in their careers; broad experience; education; independence under applicable Nasdaq National Market listing standards and the SEC rules; financial expertise; integrity; financial integrity; ability to make independent, analytical inquiries; understanding of the business environment; experience in the social services industry and knowledge about the issues affecting the social services industry; and willingness to devote adequate time to Board of Directors and committee duties. The proposed nominee should also be free of conflicts of interest that could prevent such nominee from acting in the best interest of the Company and its stockholders. Additional special criteria apply to directors being considered to serve on a particular committee of the Board of Directors. For example, members of the Audit Committee must meet additional standards of independence and have the ability to read and understand the Company’s financial statements.

9

Director Nominee Selection Process

In the case of an incumbent director whose term of office expires, the Nominating and Corporate Governance Committee reviews such director’s service to the Company during the past term, including, but not limited to, the number of Board of Directors and committee meetings attended, as applicable, quality of participation and whether the candidate continues to meet the general qualifications for a director outlined above, including the director’s independence, as well as any special qualifications required for membership on any committees on which such director serves. In the case of a new director candidate, the selection process for director candidates includes the following steps:

| • | identification of director candidates by the Nominating and Corporate Governance Committee based upon suggestions from current directors and executives and recommendations received from stockholders; |

| • | possible engagement of a director search firm; |

| • | interviews of candidates by the Nominating and Corporate Governance Committee; |

| • | reports to the Board of Directors by the Nominating and Corporate Governance Committee on the selection process; |

| • | recommendations by the Nominating and Corporate Governance Committee; and |

| • | formal nominations by the Board of Directors for inclusion in the slate of directors at the annual meeting. |

The Nominating and Corporate Governance Committee will consider properly submitted stockholder recommendations for director candidates. Director candidates recommended by stockholders are given the same consideration as candidates suggested by directors and executive officers. The Nominating and Corporate Governance Committee has the sole authority to select, or to recommend to the Board of Directors, the nominees to be considered for election as a director. The officer presiding over the stockholders meeting, in such officer’s sole and absolute discretion, may reject any nomination not made in accordance with the procedures outlined in this Proxy Statement and the Company’s amended and restated bylaws. Under the Company’s amended and restated bylaws, a stockholder who desires to nominate directors for election at the Company’s stockholders meeting must comply with the procedures summarized below. The Company’s bylaws are available, at no cost, at the SEC’s website, www.sec.gov, as Exhibit 3.2 to the Company’s Registration Statement on Form S-1 filed with the SEC in June 2004 or upon the stockholder’s written request directed to the Corporate Secretary at the address given below. See “–Stockholder Nominations” below for a description of the procedures that must be followed to nominate a director.

Stockholder Nominations

According to the Company’s amended and restated bylaws, nominations by stockholders for directors to be elected at a meeting of stockholders which have not previously been approved by the Board of Directors must be submitted to the Secretary of the Corporation at 5524 East Fourth Street, Tucson, Arizona 85711 in writing, either by personal delivery, nationally-recognized express mail or United States mail, postage prepaid, at 5524 East Fourth Street, Tucson, Arizona 85711, not later than (i) the latest date upon which stockholder proposals must be submitted to the Company for inclusion in the Company’s proxy statement relating to such meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or other applicable rules or regulations under the federal securities laws or, if no such rules apply, at least 90 days prior to the date one year from the date of the immediately preceding annual meeting of stockholders, and (ii) with respect to an election to be held at a special meeting of stockholders, 30 days prior to the printing of the Company’s proxy materials with respect to such meeting or if no proxy materials are being distributed to stockholders, at least the close of business on the fifth day following the date on which notice of such meeting is first given to stockholders. Each nomination is required to set forth:

| • | the name and address of the stockholder making the nomination and the person or persons nominated; |

10

| • | a representation that the stockholder is a holder of record of capital stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to vote for the person or persons nominated; |

| • | a description of all arrangements and understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination was made by the stockholder; |

| • | such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the nominee been nominated by the Board of Directors; and |

| • | the consent of each nominee to serve as a director of the Company if so elected. |

All nominations that are late will be rejected by the Company.

Audit Committee Report

The Audit Committee of the Board of Directors consists of Messrs. Singleton and Hurst and Ms. Meints. Ms. Meints is the Chairperson of the Audit Committee.

The Audit Committee operates under a written charter adopted by the Board of Directors, a copy of which is on file with the SEC as Appendix A to the Company’s Proxy Statement filed on April 21, 2004.

The Audit Committee has reviewed and discussed with management its assessment and report on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2004, which it made using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework. The Audit Committee has also reviewed and discussed with McGladrey & Pullen, LLP, the Company’s independent auditors, its attestation report on management’s assessment of internal control over financial reporting and its review and report on the Company’s control over financial reporting. The Company published these reports in its Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

The Audit Committee has reviewed and discussed with management and McGladrey & Pullen, LLP the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2004. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States. The Audit Committee also discussed with representatives of McGladrey & Pullen, LLP the matters required to be discussed by Statement on Auditing Standards 61, as amended, “Communication with Audit Committees.”

The Audit Committee received the written disclosures and the confirming letter from McGladrey & Pullen, LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with McGladrey & Pullen, LLP its independence from the Company.

Based on these reviews and discussions and in reliance thereon, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, which was filed with the SEC on March 15, 2005.

| The Audit Committee | ||||

| Kristi L. Meints (Chairperson) | Hunter Hurst, III | Richard Singleton | ||

11

Compensation of Directors

Prior to January 19, 2005, each non-employee member of the Board of Directors received $2,000 per Board of Directors meeting attended in person and was awarded an annual grant of options to purchase 10,000 shares of Common Stock under the Company’s 2003 Stock Option Plan for their service on the Board. In January 2004, each of Messrs. First, Geringer, Hurst and Singleton and Ms. Meints received options to purchase 10,000 shares of the Company’s Common Stock at $17.13.

In 2004, Messrs. First, Geringer, Hurst and Singleton and Ms. Meints received $8,000, $6,000, $6,000, and $8,000 and $6,000, respectively, for attending at meetings of the Board of Directors. Additionally, members of the Board of Directors are reimbursed for reasonable expenses incurred in connection with attending meetings of the Board of Directors and of committees of the Board of Directors.

On January 19, 2005, the Nominating and Corporate Governance Committee of the Board of Directors approved an increase in compensation to non-employee members of the Board of Directors to be effective on that day. Currently, non-employee directors receive a $10,000 annual stipend, except for the Audit Committee Chair who receives a $28,800 annual stipend. Payment of the annual stipends is made on a quarterly basis following each quarter of service. Additionally, each non-employee director receives $3,500 for each Board of Directors meeting attended in person, $1,000 for each telephonic meeting of the Board of Directors participated in, and $1,000 for each committee meeting attended or participated in by telephone of which such non-employee director is a member that is not held the same day as a Board of Directors meeting, except that the Audit Committee Chair will receive $2,500 for each Audit Committee meeting attended or participated in by telephone that is not held the same day as a Board of Directors meeting. In addition, each non-employee director receives an annual grant of options under the Company’s 2003 Stock Option Plan to purchase up to 10,000 shares of Common Stock with an exercise price equal to the closing market price of the Common Stock on the date of grant. Such options will vest in three equal installments on each of the first, second and third anniversary of the date of grant. The directors are also eligible to receive discretionary grants.

On January 19, 2005, the Audit Committee Chair received an option to purchase 20,000 shares of Common Stock under the 2003 Stock Option Plan. Such option vests in three equal installments on each October 7, 2005, 2006 and 2007 and has an exercise price of $20.30, the closing market price of the Common Stock on the date of grant. In addition, each non-employee director received an option to purchase 10,000 shares of Common Stock under the Company’s 2003 Stock Option Plan on January 19, 2005. Such options vest in three equal installments on each of the first, second and third anniversary of the date of grant and has an exercise price of $20.30, the closing market price of the Common Stock on the date of grant. Additionally, as of March 30, 2005, Messrs. Hurst and Singleton, had options to purchase, in the aggregate, 2,858 shares of Common Stock at $3.50 per share, 11,431 shares of Common Stock at $4.73 per share and 2,858 shares of Common Stock at $7.00 per share, and Ms. Meints had options to purchase 1,429 shares of Common Stock at $7.00 per share. Further, each non-employee director had options to purchase 10,000 shares of Common Stock at $17.13 as of March 30, 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers, directors and persons who beneficially own more than ten percent of a registered class of the Common Stock to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Executive officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that, Martin Favis filed a statement of changes in beneficial ownership on Form 4 reporting the exercise of stock options late and that all other Section 16(a) executive officers, directors and greater than ten percent beneficial stockholders complied with applicable Section 16(a) requirements during the year ended December 31, 2004.

12

Executive Compensation

Compensation Committee Report

The Compensation Committee of the Board of Directors is composed of directors who are not employees of the Company, and is responsible for establishing executive compensation programs. In addition, the Compensation Committee, pursuant to authority delegated by the Board of Directors, determines on an annual basis the compensation to be paid to the Chief Executive Officer and each of the other executive officers of the Company. The members of the Compensation Committee of the Board of Directors during 2004 were Messrs. Geringer, First and Hurst. Mr. First is the Chairperson of the Compensation Committee

The policies of the Company’s executive compensation program are to:

| 1. | provide compensation that will attract and retain superior executive talent through a base salary, annual incentive compensation and stock options as more fully described below; |

| 2. | support the achievement of the goals contained in the Company’s annual internal business plan by linking a portion of the executive officer’s compensation to the achievement of such goals; and |

| 3. | enhance stockholder value by the use of stock options to further align the interests of the executive officers with those of stockholders. |

The Compensation Committee believes that its executive compensation program provides an overall level of compensation opportunity that is competitive to that offered within the Company’s industry. Actual compensation levels may be greater or less than competitive levels based on surveys that are reviewed by the Compensation Committee.

The Company’s executive compensation program is comprised of base salary, annual incentive compensation, the executive benefit program consisting of salary continuation and supplemental retirement income, long term incentive compensation in the form of stock options, group medical benefits and participation in the 401(k) plan. In determining the level of base salary, annual incentive compensation and stock options for executive officers, the Compensation Committee reviews the recommendations made by the Chief Executive Officer with respect to subordinate executive officers, reviews surveys of compensation data for comparable companies and uses its discretion to set compensation for individual executive officers, including the Chief Executive Officer, at levels where, in its judgment, external, internal or individual circumstances warrant.

Base Salary. Base salary levels for the Company’s executive officers are set competitively relative to companies in Providence’s industry and companies of comparable size in the United States. In determining salaries, the Compensation Committee also takes into account individual experience and performance of the executive officers and how it relates to the particular needs of the Company. Some executive officers are entitled to receive annual base salary under an employment agreement. All annual base salaries for executive officers are reviewed annually or more frequently as events or circumstances warrant as determined by the Compensation Committee.

Annual Incentive Compensation. Annual incentive compensation may be awarded to executive officers, which may be in the form of cash bonuses. The purpose of such cash bonuses is to provide a direct financial incentive to the executives to achieve the annual goals of the Company as set forth in the beginning of the year in the annual plan. In 2004, the following measures were taken into consideration by the Compensation Committee in evaluating the payment of bonuses:

| 1. | performance of the Company in comparison to the Company’s budget for the fiscal year; |

| 2. | change in net income compared to the prior fiscal year; and |

| 3. | individual performance. |

13

If the Compensation Committee determined the Company did not achieve its objectives, no bonuses would be awarded. In 2004, Messrs. McCusker, Dover, Deitch, Furman and Norris were each awarded a bonus of $20,000 for meeting the Company’s budget and exceeding net income and earnings per share for the fiscal year 2004 as compared to fiscal year 2003. The Company’s budget is determined by the various divisional executive directors and approved by the Board of Directors at the beginning of the fiscal year.

For fiscal year 2005, to further align executive compensation with executive officer performance and enhance the Company’s overall performance and investment value, the Compensation Committee is evaluating alternative annual incentive compensation programs to award executives for achieving or exceeding the Company’s net income and earnings per share goals as approved by the Board of Directors. The alternative annual compensation programs under consideration may include cash bonuses based on a sliding scale measure of net income and earnings per share achievements as compared to the Company’s annual goals which are approved by the Board of Directors. The amount of any cash bonuses paid to executives may be based upon the level of performance achieved during the fiscal year, financial position of the Company, prevailing market rates in the Company’s industry, companies of comparable size and the Compensation Committee’s judgment of the executives’ individual performance. While it is anticipated that the Compensation Committee will establish an incentive compensation program for fiscal year 2005, no such program has been established as of the date of this proxy statement.

Stock Options. The Compensation Committee uses the 2003 Stock Option Plan as the Company’s long-term incentive plan for directors, executive officers, key employees and consultants. The objectives of the 2003 Stock Option Plan are to align the long-term interests of executive officers and stockholders by creating a direct link between executive compensation and stockholder return and to enable executives to develop and maintain a significant long-term equity interest in the Company. The 2003 Stock Option Plan authorizes the Compensation Committee to award stock options to directors, officers, key employees and consultants. In general, under the 2003 Stock Option Plan, options are granted with an exercise price equal to the fair market value of the Common Stock on the date of grant. Awards are made at a level calculated to be competitive within the Company’s industry based on reviews of industry surveys. In 2004, stock options were awarded to Messrs. Deitch and Norris. See “Option Grants in 2004.” As of December 31, 2004, there were 530,000 stock options awarded under the 2003 Stock Option Plan.

Discussion of 2004 Compensation for the Chief Executive Officer. In determining the compensation for Mr. McCusker, the Chief Executive Officer, the Compensation Committee considered his existing compensation arrangements, compensation levels of other social services companies and the compensation levels of companies of comparable size. For 2004, the Compensation Committee made the determination that the annual compensation for the Chief Executive Officer remain at $190,000 as was established in 2003.

On February 16, 2005, Mr. McCusker’s annual base salary was increased from $190,000 to $250,000 effective April 1, 2005 based on the Compensation Committee’s review of his existing compensation arrangements, compensation levels of other social services companies and compensation levels of companies of comparable size. Also on February 16, 2005, the Compensation Committee awarded Mr. McCusker ten year options to purchase 50,000 shares of the Company’s common stock under the 2003 Stock Option Plan. This award was granted to Mr. McCusker in accordance with the Compensation Committee’s methodology for awarding stock options to executives described above. These options have an exercise price equal to the market closing price of the Company’s common stock of $20.62 on the date of grant and vest 25% immediately and 25% on the first, second and third anniversary of the date of grant.

| The Compensation Committee | ||||

| Mark L. First (Chairperson) | Steven I. Geringer | Hunter Hurst, III | ||

14

Summary Compensation Table

The following table sets forth certain information with respect to compensation paid by the Company for services rendered in all capacities to the Company and its subsidiaries during the fiscal years ended December 31, 2004 and 2003 and the twelve months ended December 31, 2002 to (1) the Chief Executive Officer of the Company and (2) each of the four most highly compensated executive officers of the Company whose salary and bonus exceeded $100,000 during the fiscal year ended December 31, 2004 (the “Named Executive Officers”).

| Annual Compensation | Long Term Compensation | ||||||||||||||||

Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Other Annual Compensation ($)(3) | Securities Underlying Options (#) | All Other Compensation ($)(4) | |||||||||||

Fletcher Jay McCusker Chairman and Chief Executive Officer | 2004 2003 2002 | | $ | 190,000 174,600 156,875 | $ | 20,000 15,000 30,000 | | — — — | — — — | $ | 27,448 26,399 23,568 | ||||||

William Boyd Dover President | 2004 2003 2002 | | $ | 165,000 152,500 131,458 | $ | 20,000 15,000 22,500 | $ | 24,800 — — | — — — | $ | 8,981 7,642 8,713 | ||||||

Michael N. Deitch Chief Financial Officer, Vice President, Secretary and Treasurer | 2004 2003 2002 | | $ | 159,167 134,498 116,458 | $ | 20,000 15,000 658,580 | | — — — | 20,000 10,000 — | $ | 12,813 19,801 13,162 | ||||||

Fred D. Furman General Counsel | 2004 2003 | (5) | $ | 175,000 46,442 | $ | 20,000 — | $ | 22,675 18,501 | — 110,000 | $ | 8,477 1,201 | ||||||

Craig A. Norris Chief Operating Officer | 2004 2003 2002 | | $ | 175,833 147,667 126,667 | $ | 20,000 25,000 607,500 | | — — — | 20,000 — — | $ | 10,904 8,286 5,983 | ||||||

| (1) | Includes amounts deferred under the 401(k) plan. |

| (2) | Included in the bonuses for Messrs. Deitch and Norris for the twelve months ended December 31, 2002 is $628,580 and $600,000, respectively, representing the fair market value of 62,858 and 60,000 shares of Common Stock that were granted to them in October 2002 ($10.00 per share on the date of grant) in exchange for, and upon termination of, options previously granted to them for the purchase of an equal number of shares with a weighted average exercise price of $4.00 per share. The options that were terminated in connection with this exchange were granted to Messrs. Deitch and Norris at various times during the period from April 1997 to February 2002. |

| (3) | Messrs. Dover and Furman work in states other than their primary state of residency. Included in other annual compensation for Messrs. Dover and Furman for the fiscal year ended December 31, 2004 are payments for expenses of $24,800 and $22,675, respectively, related to the cost to maintain a secondary residency in the state of their employment. Of the total expenses for Mr. Dover for the fiscal year ended December 31, 2004, $24,800 related to rent for his secondary residency. Of the total expenses for Mr. Furman for the fiscal years ended December 31, 2004 and 2003, $23,676 related to rent for his secondary residency, $15,257 related to transportation and $2,243 for other miscellaneous expenses. |

| (4) | The Company provides the Named Executive Officers with certain group life, health, medical and other non-cash benefits generally available to all salaried employees and not included in this column pursuant to SEC rules. For Messrs. McCusker, Dover, Deitch, Furman and Norris, the Company also paid for the premiums of certain health and dental benefits for their family, which are not available to all salaried employees and are included in this column. The amounts in this column include the following: |

| • | Health and dental insurance premiums that the Company paid on behalf of Messrs. McCusker, Dover, Deitch, Furman and Norris in the following amounts, respectively: $12,413, $8,581, $12,413, $8,077 and $10,504 for the fiscal year ended December 31, 2004. |

15

| • | Matching contributions by the Company under its retirement savings plan were made on behalf of Messrs. Dover, Deitch, Furman and Norris in the amount of $400 each for the fiscal year ended December 31, 2004. |

| • | Insurance premiums under an insurance plan that the Company provides for Mr. McCusker with coverage of up to $500,000. The Company paid $15,035 in premiums on this policy on behalf of Mr. McCusker in the fiscal year ended December 31, 2004. |

| (5) | Mr. Furman began his employment with the Company in September 2003. His compensation for 2003 reflects amounts he received from September 2003 through December 31, 2003. |

Option Grants in 2004

The following table sets forth information concerning the number of stock options granted during 2004 to each of the Named Executive Officers.

| Individual Grants | ||||||||||||||||

Name | Number of Securities Underlying Options Granted (1) | % of Total in 2004 | Exercise Price Per Share | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) | |||||||||||

| 5% | 10% | |||||||||||||||

Fletcher Jay McCusker | — | — | — | — | — | — | ||||||||||

William Boyd Dover | — | — | — | — | — | — | ||||||||||

Michael N. Deitch | 20,000 | 5.9 | % | $ | 19.56 | 7/26/14 | $ | 246,020 | $ | 623,500 | ||||||

Fred D. Furman | — | — | — | — | — | — | ||||||||||

Craig A. Norris | 20,000 | 5.9 | % | $ | 19.56 | 7/26/14 | $ | 246,020 | $ | 623,500 | ||||||

| (1) | The options are 10 year options which are subject to acceleration upon a “Change of Control” as defined in the stock option agreement related to the options, a form of which is on file with the SEC as Exhibit 10.1 to the Company’s Form 10-Q for the quarterly period ended June 30, 2004. In addition, the options vest one third on the grant date and one third on each of the first and second anniversary of the grant date. |

| (2) | Potential realizable value represents the difference between the market value of the Common Stock for which the option may be exercised, assuming that the market of the Common Stock on the date of grant appreciates in value to the end of the ten-year option term at annualized rates of 5% and 10%, respectively, and the exercise price of the option. The rates of appreciation used in this table are prescribed by regulation of the SEC and are not intended to forecast future appreciation of the market value of the Common Stock. |

16

Aggregated Option Exercises in 2004 and 2004 Year-End Option Values

The following table sets forth certain information concerning the number of unexercised options and the value of unexercised options at December 31, 2004 held by the Named Executive Officers.

Shares on Exercise | Value Realized | Number of Securities December 31, 2004 | Value of Unexercised In-the-Money Options at | |||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

Fletcher Jay McCusker | — | — | — | — | — | — | ||||||||

William Boyd Dover | — | — | 8,572 | — | $ | 149,839 | — | |||||||

Michael N. Deitch | — | — | 13,332 | 16,668 | $ | 60,127 | $ | 44,273 | ||||||

Fred D. Furman | — | — | 82,500 | 27,500 | $ | 622,050 | $ | 207,350 | ||||||

Craig A. Norris | — | — | 6,666 | 13,334 | $ | 9,466 | $ | 18,934 | ||||||

| (1) | Values for “in-the-money” options/SARs represent the positive spread between the respective exercise prices of outstanding options/SARs and the fiscal year-end value of the Common Stock at December 31, 2004, which was $20.98. |

Equity Employee Benefit Plans

2003 Stock Option Plan. The purpose of the Company’s 2003 Stock Option Plan is to provide additional incentives to officers, other key employees, and directors of, and important consultants to the Company and each present or future parent or subsidiary corporation, by encouraging them to invest in shares of the Company’s Common Stock, and thereby acquire a proprietary interest in us and an increased personal interest in the Company’s continued success and progress.

The aggregate number of shares of Common Stock that may be issued under the 2003 Stock Option Plan is 1,000,000. Notwithstanding the foregoing, in the event of any change in the outstanding shares of Common Stock by reason of a stock dividend, stock split, combination of shares, recapitalization, merger, consolidation, transfer of assets, reorganization, conversion or similar circumstances as determined by the Compensation Committee of the Board of Directors in its sole discretion, the aggregate number and kind of shares which may be issued under the 2003 Stock Option Plan shall be appropriately adjusted in a manner determined in the sole discretion of the Compensation Committee. Reacquired shares of Common Stock, as well as unissued shares, may be used for the purpose of the 2003 Stock Option Plan. The shares of Common Stock subject to options, which have terminated unexercised, either in whole or in part, shall be available for future option grants under the 2003 Stock Option Plan.

All of the Company’s officers, key employees, and officers and key employees of any present or future parent or subsidiary corporation are eligible to receive an option or options under the 2003 Stock Option Plan. All directors of, and important consultants to the Company and of any of the Company’s present or future parent or subsidiary corporations are also eligible to receive an option or options under the 2003 Stock Option Plan. No individual may receive options under the 2003 Stock Option Plan for more than 80% of the total number of shares of the Common Stock authorized for issuance under the 2003 Stock Option Plan. The individuals who receive an option or options shall be selected by the Board of Directors or the Compensation Committee of the Board of Directors. Currently, the Compensation Committee administers the 2003 Stock Option Plan and has delegated authority to Mr. McCusker, the Company’s Chief Executive Officer, to grant options to key employees and consultants, subject to limitations.

As of December 31, 2004, 530,000 stock options had been awarded under the 2003 Stock Option Plan. As of April 14, 2005, stock options for an aggregate of 895,000 shares were awarded under the 2003 Stock Option Plan of which options to purchase an aggregate of 315,000 shares were awarded to executive officers at exercise prices ranging from $13.38 to $20.62 per share and an aggregate of 120,000 shares were awarded to directors at exercise prices ranging from $17.13 to $20.30 per share.

17

1997 Stock Option and Incentive Plan. The Company’s 1997 Stock Option and Incentive Plan adopted in 1997 authorized the issuance of 428,572 shares of Common Stock. As of December 31, 2004, 164,365 stock options had been awarded and outstanding under the Stock Option and Incentive Plan. No further awards may be granted under the 1997 Stock Option and Incentive Plan.

Employment Agreements

The Company entered into employment agreements, effective as of August 22, 2003, with the following named executive officers: Fletcher Jay McCusker, Chief Executive Officer; William Boyd Dover, President; Michael N. Deitch, Chief Financial Officer; and Craig A. Norris, Chief Operating Officer. Each of Messrs. McCusker, Dover, Norris and Deitch have employment agreements for a term of three years. Each employment agreement establishes, among other things, base salary levels at amounts designed to be competitive with executive positions at similarly situated companies. Under their employment agreements, Messrs. McCusker, Dover, Norris and Deitch were entitled to receive initial annual base salaries of $190,000, $165,000, $160,000 and $150,000, respectively. In fiscal 2004, the Compensation Committee increased the base salary of each of Messrs. Norris and Deitch to $180,000 and $170,000, respectively. The Compensation Committee approved an increase in the base salaries effective April 1, 2005, of Messrs. McCusker, Dover, Norris and Deitch to $250,000, $190,000, $200,000 and $195,000, respectively. Generally, the annual base salaries are reviewed annually and may be modified by the Board of Directors or Compensation Committee. In addition to their base salaries, each executive is eligible to participate in any bonus plans or incentive compensation programs that the Company may establish from time to time. For fiscal 2004, Messrs. McCusker, Dover, Norris and Deitch each were awarded a bonus of $20,000.

Under the employment agreements with each of the executive officers, the Company may be obligated to make severance payments to the executive officers. Pursuant to the employment agreements, the Company may terminate the employment agreements for cause at any time and without cause upon 30 days written notice. Mr. McCusker may terminate his employment agreement for good reason, upon 60 days written notice, if his duties are substantially altered or reduced, his salary is reduced, he is relocated more than 150 miles from Tucson, Arizona, the Company materially breaches his agreement or there is a change in the majority of the Company’s incumbent directors. “Incumbent directors” means the Company’s directors as of August 22, 2003 and any subsequent director nominated or elected by two-thirds of the then existing incumbent directors. In addition, the other executive officers may terminate these employment agreements for good reason upon 30 days prior written notice if the Company materially breaches such employment agreements. If an executive officer’s employment is terminated by the Company without cause or if an executive officer terminates the agreement for good reason, the Company must pay the executive his or her base salary for a stated severance term; provided, however, that in order to receive the severance payment, the executive officer must sign a general release. Pursuant to the employment agreements, each of Messrs. McCusker, Dover, Norris and Deitch has a stated severance term of one year.

Each of the employment agreements contains restrictive covenants providing for the employee’s non-competition, non-solicitation/non-piracy and non-disclosure. The term of Mr. McCusker’s non-competition and non-solicitation covenants is two years. Messrs. Dover, Norris and Deitch have 18 month non-competition covenants and two year non-solicitation covenants.

Certain Relationships and Related Transactions

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Messrs. First, Geringer and Hurst. No person who served as a member of the Compensation Committee during the fiscal year ended December 31, 2004 was a current or former officer or employee or engaged in certain transactions with us, required to be disclosed by regulations of the SEC. There were no compensation committee “interlocks” during the fiscal year ended December 31, 2004, which generally means that none of the Company’s executive officers served as a director or member of the compensation committee of another entity, one of whose executive officers served as the Company’s director or member of the Company’s Compensation Committee.

18

Transactions with Eos Partners SBIC, L.P. and Eos Partners SBIC II, L.P.

Pursuant to a series of private offerings between November 1997 and March 2000, the Company issued 3,750,000 shares of Series A Preferred Stock and 625,000 shares of Series B Preferred Stock to Eos Partners SBIC in exchange for $3.5 million and the Company issued 962,964 shares of Series D Preferred Stock to Eos Partners SBIC II in exchange for $1.3 million. Following those private offerings, Eos Partners SBIC owned 100% of the Company’s Series A Preferred Stock and 94% of the Company’s Series B Preferred Stock, and Eos Partners SBIC II owned 100% of the Company’s Series D Preferred Stock.

Holders of the Company’s Series A Preferred Stock, Series B Preferred Stock and Series D Preferred Stock were entitled to cumulative dividends, when declared by the Board of Directors, at 8.0% per annum, and all of their preferred shares were mandatorily redeemable and convertible into shares of Common Stock. Upon the consummation of the Company’s initial public offering, these preferred stockholders were paid all accrued dividends and their preferred shares were converted into shares of Common Stock. Accordingly, Eos Partners SBIC and Eos Partners SBIC II received $776,222 and $288,311, respectively, in accrued dividends, and their shares of preferred stock were converted into 1,497,254 and 275,134 shares of Common Stock, respectively.

In addition, the consent of the holders of the Company’s Series A Preferred Stock, Series B Preferred Stock and Series D Preferred Stock was required before the Company could consummate a public offering or, subject to certain exceptions, issue or sell any other shares of the Company’s capital stock. Prior to the Company’s initial public offering, the Company agreed to pay Eos Partners SBIC and Eos Partners SBIC II an aggregate consent fee of $3.5 million upon the consummation of that offering, which fee was payable by the Company’s delivery of subordinated promissory notes. On August 22, 2003, the Company issued to them subordinated promissory notes in the aggregate principal amount of $3.5 million. Principal on these notes was payable in five equal semi-annual payments beginning June 30, 2004 and ending June 30, 2006, and interest on the notes, at the rate of 4.0% per annum, was payable quarterly on every March 31, June 30, September 30 and December 31. These subordinated notes were prepayable, without penalty, at any time. On January 27, 2004, the Company repaid the principal amount of the notes in full plus accrued interest thereon in the amount of $10,500. Prior to their extinguishment on such date, the Company had paid a total of $50,502 in interest on these subordinated notes.

Pursuant to an agreement dated June 1, 2003, Eos Partners SBIC and Eos Partners SBIC II were paid an advisory fee in the aggregate amount of $1.0 million upon consummation of the Company’s initial public offering for services rendered.

On April 2, 2004, Eos Partners SBIC and Eos Partners SBIC II sold all of the shares of Common Stock held by them.

Mr. First, one of the Company’s directors, is a managing director of Eos Management, Inc., a wholly owned subsidiary of Eos Partners, L.P., which is the ultimate owner of Eos Partners SBIC and Eos Partners SBIC II.

Transaction with Mr. McCusker the Company’s Chief Executive Officer

Beginning in 2004, the Company began chartering a plane from Las Montanas Aviation, LLC for business travel purposes on an as needed basis. Las Montanas Aviation, LLC is owned by Mr. McCusker, the Company’s Chief Executive Officer. The Company pays market rates for similar chartered planes and for 2004, the Company paid $12,811 to Las Montanas Aviation, LLC for use of the plane for business travel purposes.

19

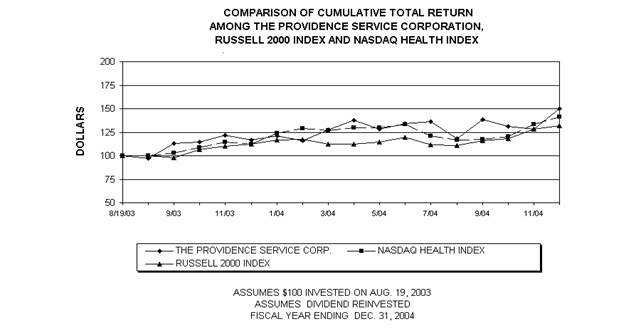

STOCK PERFORMANCE GRAPH

The following graph shows a comparison of the cumulative total return for the Company’s Common Stock, Russell 2000 Index and Nasdaq Health Index, assuming an investment of $100 in each on August 19, 2003, the date the Company’s Common Stock began trading on the Nasdaq National Market.

Performance Graph Data Points | 8/19/03 | 8/03 | 9/03 | 10/03 | 11/03 | 12/03 | ||||||||||||

THE PROVIDENCE SERVICE CORP. | $ | 100.00 | $ | 97.14 | $ | 112.86 | $ | 114.29 | $ | 121.43 | $ | 116.64 | ||||||

NASDAQ HEALTH INDEX | 100.00 | 100.00 | 102.96 | 108.75 | 114.26 | 112.10 | ||||||||||||

RUSSELL 2000 INDEX | 100.00 | 100.00 | 98.04 | 106.19 | 109.87 | 111.96 | ||||||||||||

Performance Graph Data Points | 1/04 | 2/04 | 3/04 | 4/04 | 5/04 | 6/04 | ||||||||||||

THE PROVIDENCE SERVICE CORP. | $ | 121.29 | $ | 115.86 | $ | 127.29 | $ | 137.86 | $ | 128.00 | $ | 134.21 | ||||||

NASDAQ HEALTH INDEX | 124.26 | 128.81 | 126.99 | 129.68 | 129.83 | 133.65 | ||||||||||||

RUSSELL 2000 INDEX | 116.75 | 117.72 | 112.54 | 112.54 | 114.73 | 119.42 | ||||||||||||

Performance Graph Data Points | 7/04 | 8/04 | 9/04 | 10/04 | 11/04 | 12/04 | ||||||||||||

THE PROVIDENCE SERVICE CORP. | $ | 136.43 | $ | 117.86 | $ | 138.36 | $ | 131.43 | $ | 128.57 | $ | 149.86 | ||||||

NASDAQ HEALTH INDEX | 121.20 | 116.50 | 117.41 | 120.13 | 133.39 | 141.66 | ||||||||||||

RUSSELL 2000 INDEX | 111.30 | 110.62 | 115.67 | 117.86 | 127.95 | 131.55 | ||||||||||||

20

PROPOSAL 2 – AMENDMENT TO 2003 STOCK OPTION PLAN

General

In January 2005, upon the recommendation of the Compensation Committee the Board of Directors approved an amendment to the 2003 Stock Option Plan, subject to approval by the stockholders of the Company, to increase the number of shares of Common Stock authorized for issuance under the 2003 Stock Option Plan by 400,000 shares from 1,000,000 shares to 1,400,000 shares. Pursuant to the 2003 Stock Option Plan, stock options may be granted that are intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code of 1986, as well as stock options not intended to so qualify which are referred to as non-qualified stock options. The purpose of the 2003 Stock Option Plan is to provide additional incentive to directors, officers, key employees and consultants by encouraging them to invest in the Common Stock and thereby acquire a further proprietary interest in the Company and an increased personal interest in the Company’s continued success and progress.

The following summary of the 2003 Stock Option Plan does not purport to be complete and is qualified in its entirety by the full text of the 2003 Stock Option Plan, a copy of which is attached hereto as Appendix A.

Eligibility and Administration

All of the Company’s directors, officers, key employees and certain consultants and directors, officers, key employees and certain consultants of any of the Company’s present or future parent or subsidiary corporations are eligible to receive stock options under the 2003 Stock Option Plan.