- MODV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ModivCare (MODV) 8-KResults of Operations and Financial Condition

Filed: 6 Jan 09, 12:00am

NASDAQ: PRSC - January 2009 Forward-Looking Statements Certain statements made in this presentation, such as any statements about Providence's confidence or strategies or its expectations about revenues, results of operations, profitability, earnings per share, contracts, collections, award of contracts, acquisitions and related growth, growth resulting from initiatives in certain states, effective tax rate or market opportunities, constitute "forward-looking statements" within the meaning of the private Securities Litigation Reform Act of 1995. Such forward- looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause Providence's actual results or achievements to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, reliance on government-funded contracts, risks associated with government contracting, risks involved in managing government business, legislative or policy changes, challenges resulting from growth or acquisitions, adverse media and legal, economic and other risks detailed in Providence's filings with the Securities and Exchange Commission. Words such as "believe," "demonstrate," "expect," "estimate," "anticipate," "should" and "likely" and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Providence undertakes no obligation to update any forward-looking statement contained herein. Exhibit 99.1 |

2 Proactively Addressing a Challenging Economic Environment • In mid ‘08, certain payers began to see increasing pressure on state budgets and a reduction in tax based revenue • No reduction in rate taken and Company refused any concessions offered • Requested mediation and, if necessary, binding arbitration regarding Company dispute of Canadian regulatory actions related to previously announced revenue cap enforcement • Actions taken to address current environment: – Overhead reductions and possible sale of non-core assets – Adjusting cost structure in some states to reduce number of fixed salaried personnel in favor of hourly staff to better align revenue and costs – Company-wide salary freeze – Potential EPS-based management bonuses suspended for 2009 – Board has approved health plan benefit modifications to reduce benefits and/or increase employee contribution – Suspended executive parity plan and accelerated all outstanding unvested options and restricted stock awards, reducing operating expenses by approximately $5 million in 2009 |

3 Recent Acquisitions Illinois and Indiana of Camelot Community Care, Inc. AmericanWork, Inc. $11.2 million Florida based not-for-profit tax exempt corporation with operations in Illinois and Indiana that provides home and community based services, foster care and other social services. LTM Sept. 2008 Revenue: LTM Sept. 2008 Revenue: Description: Date: September 30, 2008 Purchase Price: $5.4 million Status of Integration / Other Comments: Previously was managed by Providence Description: Community based mental health provider operating in 23 Georgia locations. Providing among other things, independent living services and training in support of individuals with mental illness, outpatient individual and group behavioral health services, and community based vocational and peer supported vocational and employment services. Date: September 30, 2008 Purchase Price: $3.5 million $12.4 million Status of Integration / Other Comments: Integration is going well, no issues |

4 Medicaid Update and State Budget Deficits • Under current law, Medicaid spending should substantially outpace the rate of growth in the U.S. economy over the next decade – Medicaid expenditures on benefits are expected to increase at an average annual rate of 7.9% to $673.7 billion by 2017, compared to a projected growth rate of 4.8% in the general economy (1) – Home and community based spending is anticipated to outpace overall Medicaid expenditures, growing at an average annual rate of 11.9% through 2017 (1) – Medicaid is expected to grow as a share of the federal budget from 7.0% in 2007 to 8.4% in 2013 (1) • The worsening economy has caused an expected increase in Medicaid enrollment to 50.0 million beneficiaries, a 2.1% increase from 2007 to 2008 (2) – Medicaid enrollment is expected to increase during 2009, a direct result of U.S. poverty population rising between 7.5 million to 10.3 million (3) – The Company believes new beneficiaries are in the worst shape ever seen – direct victims of foreclosures and unemployment • Congress is currently evaluating potential stimulus packages which may allocate $100 billion to assist with state’s Medicaid costs and extend unemployment insurance (4) – Approximately 43 states are facing budget deficits this year; Collectively, states have trimmed approximately $53.0 billion from fiscal 2008 and 2009 budgets (4) – Previous federal relief requests have been granted; In the economic downturn in late 2001, Congress allocated $20.0 billion to states for Medicaid programs (1) Centers for Medicare and Medicaid Services (2) Kaiser Commission on Medicaid Facts – (3) Center on Budget and Policy Priorities – November 2008 (4) Wall Street Journal, December 1, 2008 |

5 • Revenue increased 175% – Social services revenue up 23% • Organic growth 9%, 9% and 12% in first three quarters • Operating income up 43% after $141 million asset impairment charge is excluded • Margins impacted by a few states rationing care • Cash flow from operations of $12.5 million covers $6.5 million of debt repayment • Improvements beginning to be seen with government payers • $167 Million of Senior Debt at LIBOR + 350bp • Cash of $37 Million at 9/30/08 First Nine Month 2008 Highlights |

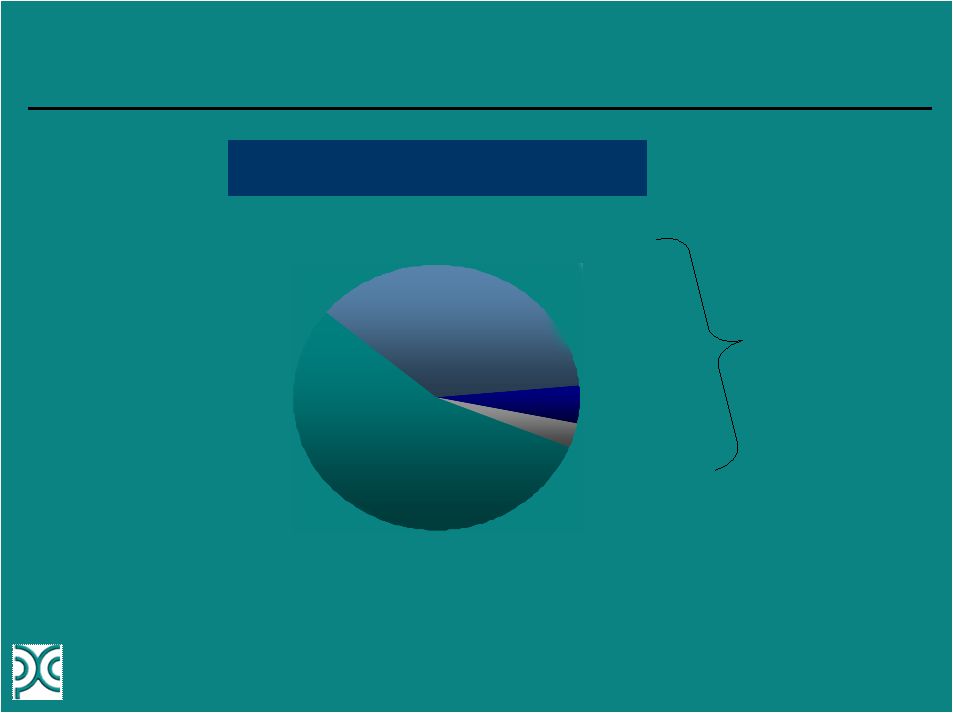

6 Business Segment Contribution Total Revenue by Service (FY 2008E Total Revenue $686.7 million) Transportation 55.0% Social Services 4.4% Foster care services Home and community based services 37.5% Management fee income 3.1% |