PROVIDENCE Q2 2018 EARNINGS CALL PRESENTATION AUGUST 8, 2018

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL INFORMATION Forward-looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should” and “likely” and similar expressions identify forward-looking statements. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, our continuing relationship with government entities and our ability to procure business from them, our ability to manage growing and changing operations, the implementation of healthcare reform law, government budget changes and legislation related to the services that we provide, our ability to renew or replace existing contracts that have expired or are scheduled to expire with significant clients, and other risks detailed in the Providence Service Corporation’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31 2017. Providence is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this presentation if any forward- looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise. Non-GAAP Financial Information In addition to the financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this presentation includes EBITDA, Adjusted EBITDA and Segment-level Adjusted EBITDA for the Company and its operating segments, and Adjusted Net Income and Adjusted EPS for the Company, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges including costs related to the corporate reorganization, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) gain or loss on sale of equity investments, (6) management fees, (7) transaction and related costs and (8) asset impairment charges. Segment-level Adjusted EBITDA is calculated as Adjusted EBITDA for the company excluding the Adjusted EBITDA associated with corporate and holding company costs reported as our Corporate and Other Segment. Adjusted Net Income is defined as income (loss) from continuing operations, net of tax, before certain items, including (1) restructuring and related charges, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) intangible amortization expense, (6) gain or loss on sale of equity investments, (7) the impact of the Tax Cuts and Jobs Act, (8) excess tax charges associated with long term incentive plans, (9) the impact of adjustments on non-controlling interests, (10) certain transaction and related costs, (11) asset impairment charges and (12) the income tax impact of such adjustments. Adjusted EPSiscalculatedasAdjustedNet Income less (as applicable): (1) dividends on convertible preferred stock, (2) accretion of convertible preferred stock discount, and (3) income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding. We utilize these non-GAAP performance measures, which exclude certain expenses and amounts, because we believe the timing of such expenses is unpredictable and not driven by our core operating results, and therefore render comparisons with prior periods as well as with other companies in our industry less meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net earnings in equity investees are excluded from these measures, as we do not have the ability to manage these ventures, allocate resources within the ventures, or directly control their operations or performance. Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business. 2

Q2 2018 HIGHLIGHTS • Consolidated revenue up 0.9%(1) • NET Services: New State contracts in Texas and MCO contracts in Indiana Revenue and Illinois Growth • WD Services: Continued ramp up of Work and Health Program and growth in Health (Diabetes) contracts offsetting winddown of legacy Work Program •Matrix (2) : Solid growth on Matrix in-home business. Revenue from mobile health clinics slower than anticipated • Segment level Adjusted EBITDA $18.0mm(3), Consolidated Adjusted EBITDA(3) of $11.5mm • NET Services: Margins impacted by higher transportation costs related to shift in mix to higher cost modes of transportation and higher mileage per trip Profitability • WD Services: Improvement from Work and Health program and benefits from restructuring programs, partially offset by recognition of PbR(4) penalty on offender rehabilitation contract due to pending contract modification. Expect modification to be beneficial to future profitability • Adjusted EPS(3) of $0.13 • Key activities • Repurchased $18.8mm of shares since April 1, 2018 through June 30, 2018 Capital • Entered into agreement and subsequently completed the sale of Ingeus France Allocation • Progressing with organizational consolidation plan • Amended credit agreement to extend maturity date to Aug 2, 2019, maintaining $200mm of capacity (1) As compared to Q2 2017. (2) Providence’s interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue. (3) See appendix for a reconciliation of non-GAAP financial measures. 3 (4) Payment By Result.

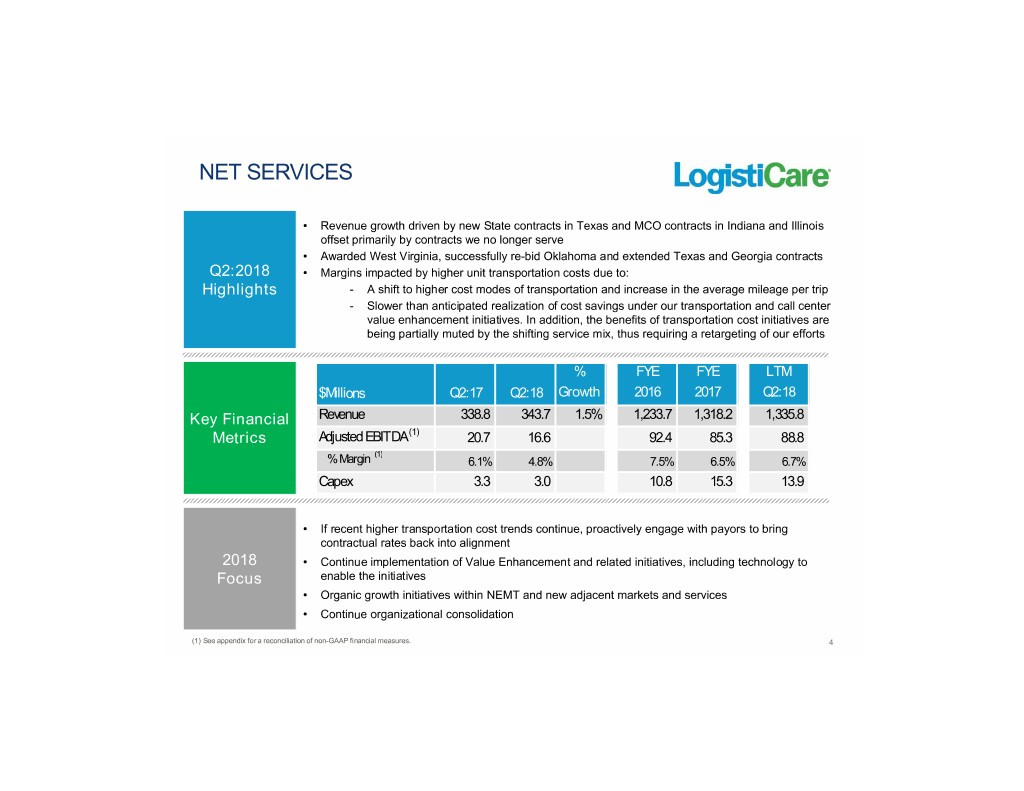

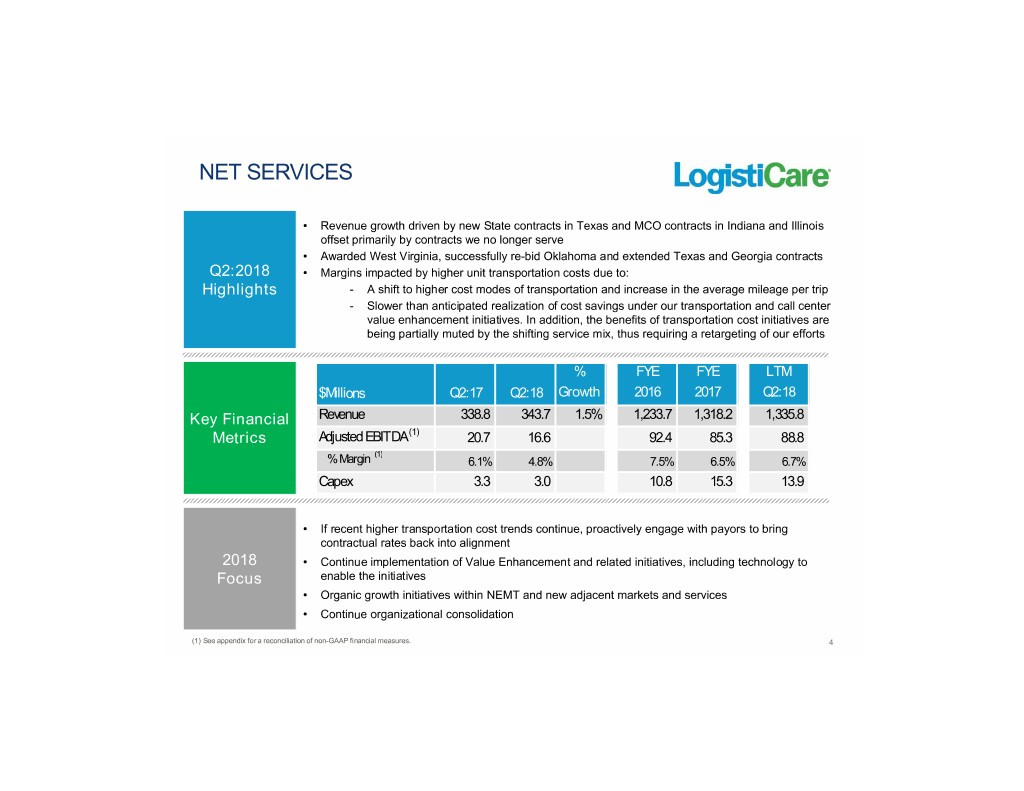

NET SERVICES • Revenue growth driven by new State contracts in Texas and MCO contracts in Indiana and Illinois offset primarily by contracts we no longer serve • Awarded West Virginia, successfully re-bid Oklahoma and extended Texas and Georgia contracts Q2:2018 • Margins impacted by higher unit transportation costs due to: Highlights - A shift to higher cost modes of transportation and increase in the average mileage per trip - Slower than anticipated realization of cost savings under our transportation and call center value enhancement initiatives. In addition, the benefits of transportation cost initiatives are being partially muted by the shifting service mix, thus requiring a retargeting of our efforts % FYE FYE LTM $Millions Q2:17 Q2:18 Growth 2016 2017 Q2:18 Key Financial Revenue 338.8 343.7 1.5% 1,233.7 1,318.2 1,335.8 Metrics Adjusted EBITDA (1) 20.7 16.6 92.4 85.3 88.8 (1) % Margin 6.1% 4.8% 7.5% 6.5% 6.7% Capex 3.3 3.0 10.8 15.3 13.9 • If recent higher transportation cost trends continue, proactively engage with payors to bring contractual rates back into alignment 2018 • Continue implementation of Value Enhancement and related initiatives, including technology to Focus enable the initiatives • Organic growth initiatives within NEMT and new adjacent markets and services • Continue organizational consolidation (1) See appendix for a reconciliation of non-GAAP financial measures. 4

WD SERVICES • Ramp up of Work and Health Program and growth in Health (Diabetes) and certain international businesses, partially offset by continued winddown of legacy Work Program • UK Ministry of Justice announced pending changes to Offender Rehabilitation contract – positive overall impact on our contract over the remaining term through 2020, although in Q2 2018 we Q2:2018 recognized $1.9mm reduction in revenue due to contractual penalty based on recidivism rates Highlights • Entered into agreement and subsequently completed the sale of Ingeus France, a first step in our overall review of strategic options related to WD Services • Awarded two health related contracts in the UK to deliver services for combined mental health and employment support (TCV ~$20M over 4yrs) – increases our presence in the UK preventative health market, building on the success of our diabetes prevention program % FYE FYE LTM $Millions Q2:17 Q2:18 Growth 2016 2017 Q2:18 Key Financial Revenue 69.2 68.1 -1.6% 344.4 305.7 298.4 Metrics Adjusted EBIT DA (1) (0.1) 1.4 5.5 16.3 14.5 (1) % Margin -0.2% 2.0% 1.6% 5.3% 4.9% Capex 1.7 0.8 19.8 4.5 4.0 • Continue evaluation of strategic alternatives for WD Services segment 2018 • Finalize work with UK Ministry of Justice on the Probation System Review to achieve further Focus improvements to the future funding of the Offender Rehabilitation Program • Further business development within the UK Health, Skills and Youth Services markets (1) See appendix for a reconciliation of non-GAAP financial measures. 5

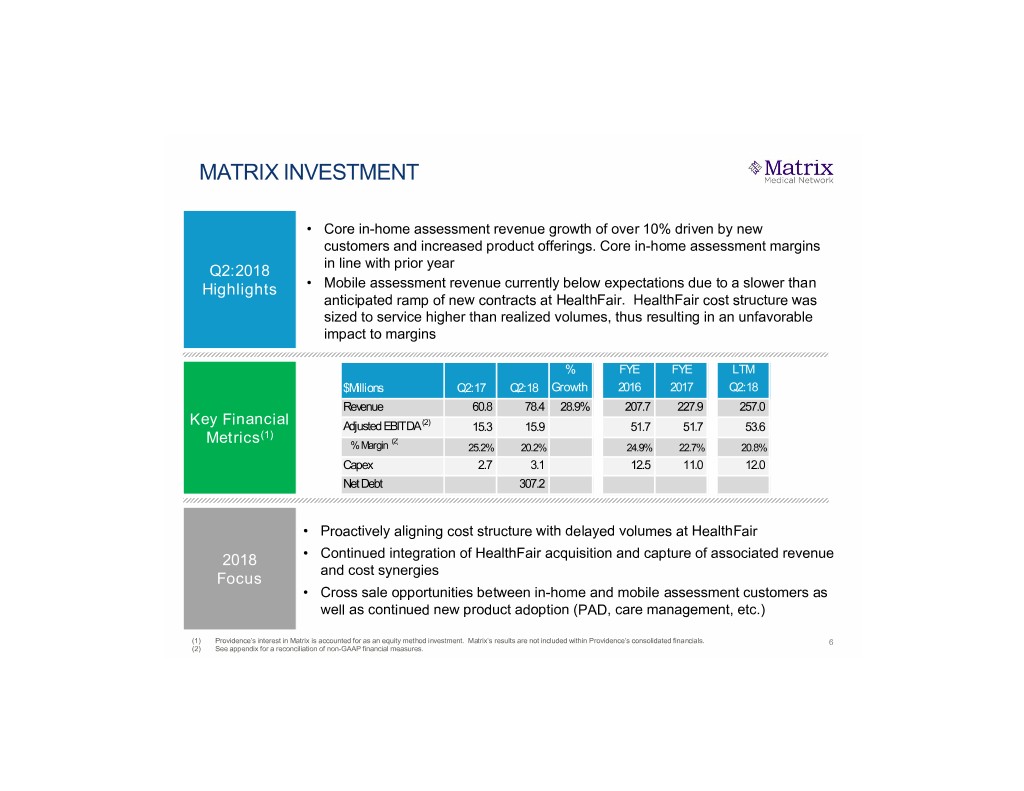

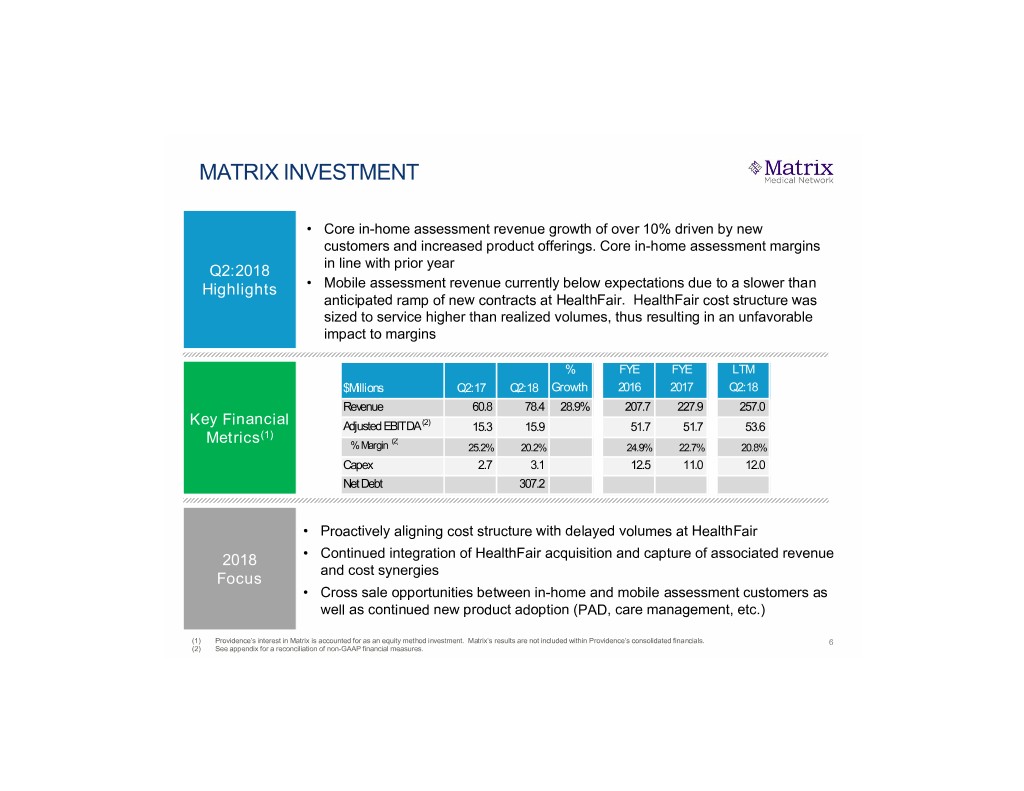

MATRIX INVESTMENT • Core in-home assessment revenue growth of over 10% driven by new customers and increased product offerings. Core in-home assessment margins in line with prior year Q2:2018 Highlights • Mobile assessment revenue currently below expectations due to a slower than anticipated ramp of new contracts at HealthFair. HealthFair cost structure was sized to service higher than realized volumes, thus resulting in an unfavorable impact to margins % FYE FYE LTM $Millions Q2:17 Q2:18 Growth 2016 2017 Q2:18 Revenue 60.8 78.4 28.9% 207.7 227.9 257.0 Key Financial (2) Adjusted EBITDA 15.3 15.9 51.7 51.7 53.6 (1) Metrics (2) % Margin 25.2% 20.2% 24.9% 22.7% 20.8% Capex 2.7 3.1 12.5 11.0 12.0 Net Debt 307.2 • Proactively aligning cost structure with delayed volumes at HealthFair 2018 • Continued integration of HealthFair acquisition and capture of associated revenue and cost synergies Focus • Cross sale opportunities between in-home and mobile assessment customers as well as continued new product adoption (PAD, care management, etc.) (1) Providence’s interest in Matrix is accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated financials. 6 (2) See appendix for a reconciliation of non-GAAP financial measures.

FINANCIAL SUMMARY REVENUE ADJUSTED EBITDA (1) $ MILLIONS $ MILLIONS 1,623.9 1,634.2 1,578.2 1,478.0 5.5 14.5 16.3 305.7 298.4 408.0 411.8 344.4 10.3 395.1 68.1 73.0 69.2 72.2 72.4 66.3 92.4 -0.1 88.8 1,318.2 1,335.8 1.4 85.3 1,233.7 80.7 338.8 343.7 14.9 1,083.0 11.5 20.7 16.6 Q2:2017 Q2:2018 2015 2016 2017 LTM Q2:2017 Q2:2018 2015 2016 2017 LTM Q2:2018 Q2:2018 2 NE T WD Total AfterAfter Corp HoldCo costs(2) (1) See appendix for a reconciliation of non-GAAP financial measures. (2) Represents Adj. EBITDA of NET Services plus WD Services less Corporate costs. 7

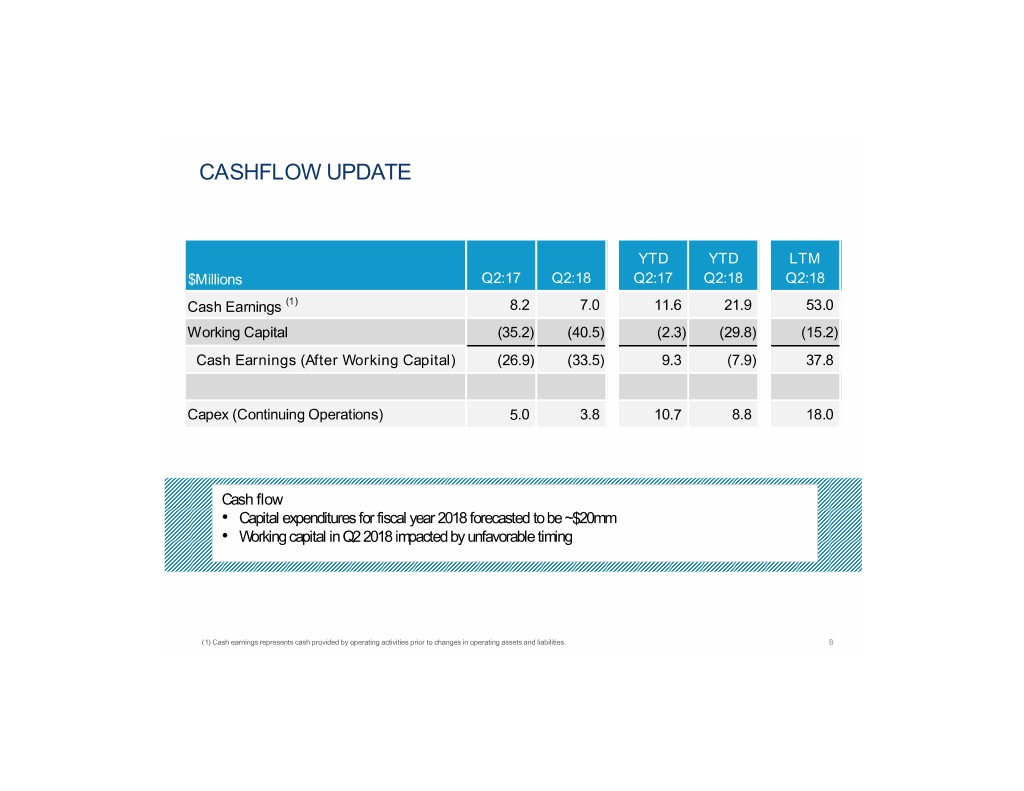

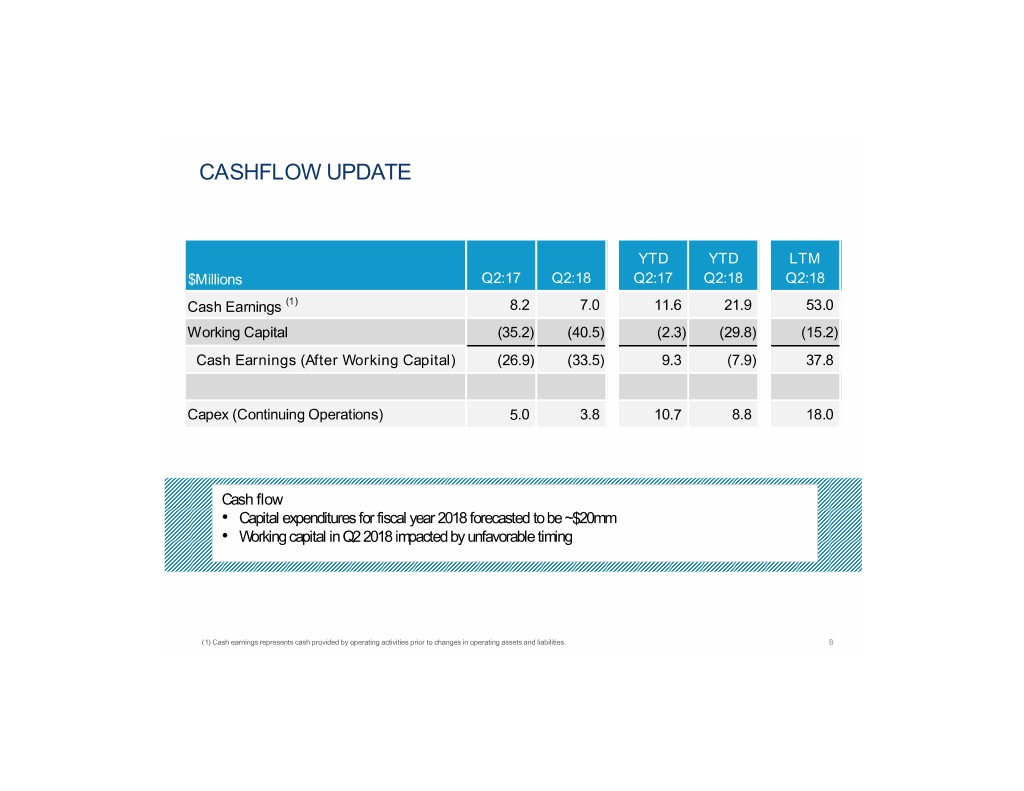

CASHFLOW UPDATE YTD YTD LTM $Millions Q2:17 Q2:18 Q2:17 Q2:18 Q2:18 Cash Earnings (1) 8.2 7.0 11.6 21.9 53.0 Working Capital (35.2) (40.5) (2.3) (29.8) (15.2) Cash Earnings (After Working Capital) (26.9) (33.5) 9.3 (7.9) 37.8 Capex (Continuing Operations) 5.0 3.8 10.7 8.8 18.0 Cash flow • Capital expenditures for fiscal year 2018 forecasted to be ~$20mm • Working capital in Q2 2018 impacted by unfavorable timing (1) Cash earnings represents cash provided by operating activities prior to changes in operating assets and liabilities. 8

BALANCE SHEET UPDATE $Millions 12/31/15 12/31/16 12/31/17 6/30/18 Cash (1) 84.8 72.3 95.3 29.7 Long-term Debt (1) 305.0 - - - Net Debt 220.2 (72.3) (95.3) (29.7) Matrix Carrying Value (2) - 157.2 169.7 165.7 Shares Outstanding (mm) (3) 17.3 15.9 15.4 14.8 Share Repurchase Activity • Since April 1,2018 through Jun 30, 2018, we have repurchased 256k shares for $18.8mm • 24% of common shares repurchased since beginning of Q4 2015 (5) • $81mm of capacity remaining (4) under current share repurchase program (1) Includes Cash and Long-term Debt related to discontinued operations. (2) Represents the carrying value of Providence’s retained equity interest in Matrix. As of 6/30/18, Providence equity ownership in Matrix was 43.6%. (3) Shares outstanding equals common shares outstanding plus total preferred shares on an as-converted basis. As of 8/6/18 shares outstanding equaled 14.8mm. (4) As of 8/6/2018. (5) Represents repurchase of common shares through 6/30/2018 as a percentage of common shares outstanding at the beginning of Q4 2015. 9

APPENDIX

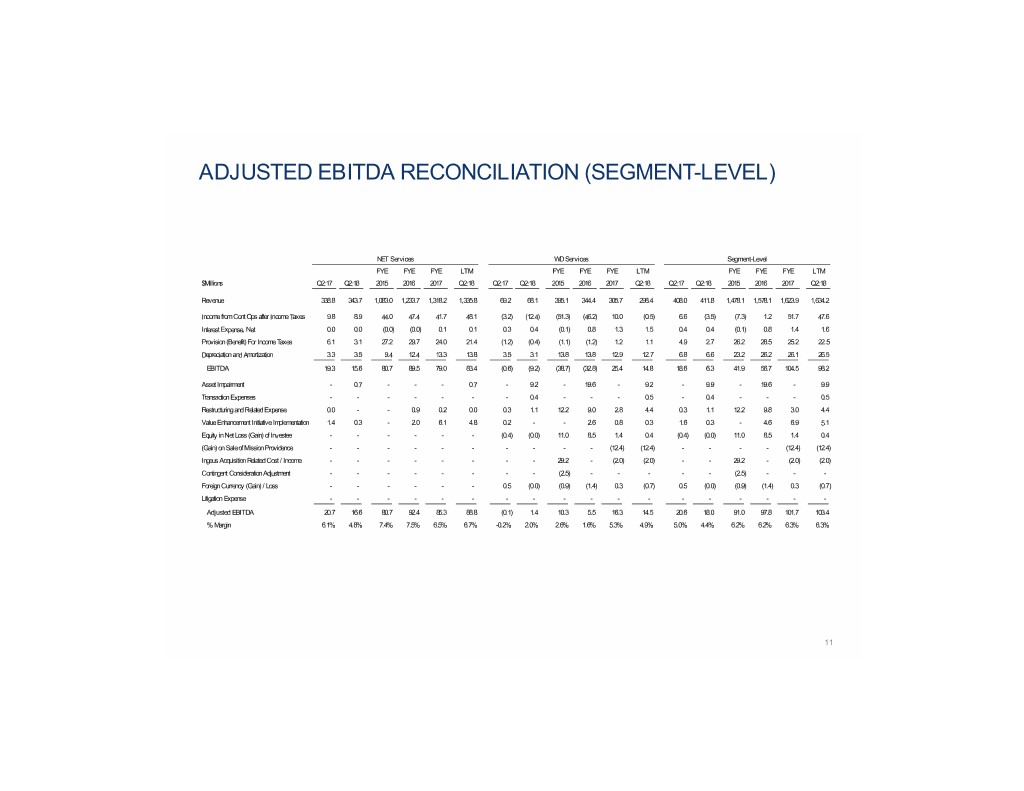

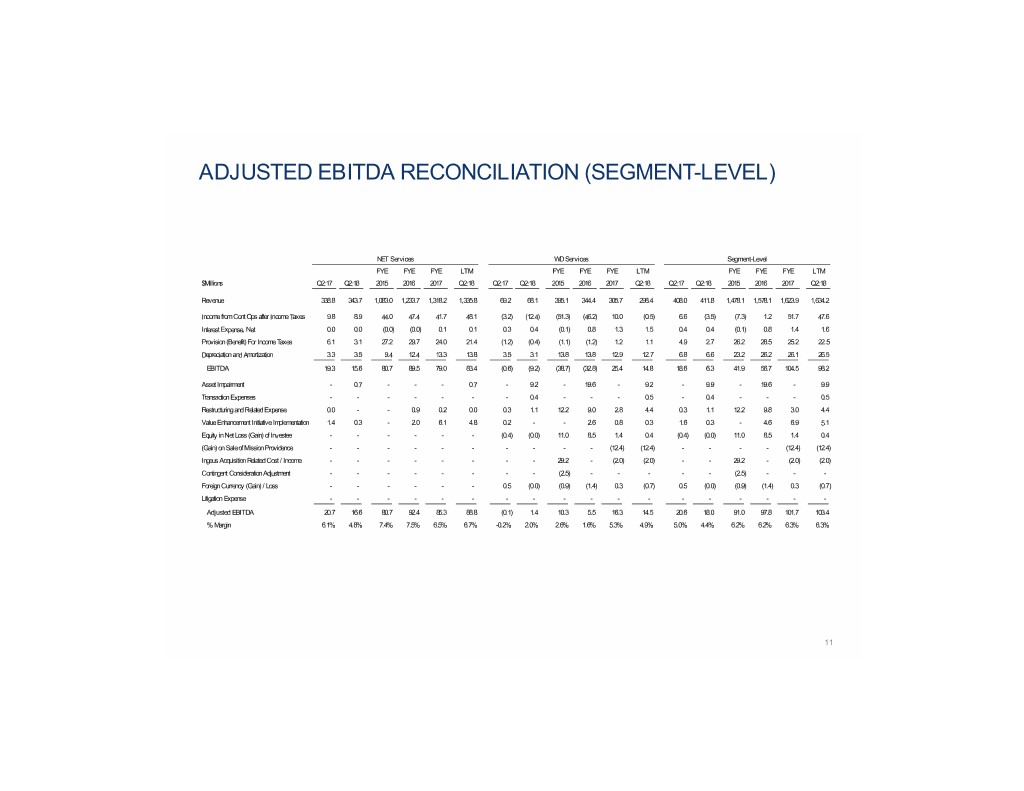

ADJUSTED EBITDA RECONCILIATION (SEGMENT-LEVEL) NET Services WD Services Segment-Level FYE FYE FYE LTM FYE FYE FYE LTM FYE FYE FYE LTM $Millions Q2:17 Q2:18 2015 2016 2017 Q2:18 Q2:17 Q2:18 2015 2016 2017 Q2:18 Q2:17 Q2:18 2015 2016 2017 Q2:18 Rev enue 338.8 343.7 1,083.0 1,233.7 1,318.2 1,335.8 69.2 68.1 395.1 344.4 305.7 298.4 408.0 411.8 1,478.1 1,578.1 1,623.9 1,634.2 Income from Cont Ops after Income Taxes 9.8 8.9 44.0 47.4 41.7 48.1 (3.2) (12.4) (51.3) (46.2) 10.0 (0.5) 6.6 (3.5) (7.3) 1.2 51.7 47.6 Interest Expense, Net 0.0 0.0 (0.0) (0.0) 0.1 0.1 0.3 0.4 (0.1) 0.8 1.3 1.5 0.4 0.4 (0.1) 0.8 1.4 1.6 Prov ision (Benefit) For Income Taxes 6.1 3.1 27.2 29.7 24.0 21.4 (1.2) (0.4) (1.1) (1.2) 1.2 1.1 4.9 2.7 26.2 28.5 25.2 22.5 Depreciation and Amortization 3.3 3.5 9.4 12.4 13.3 13.8 3.5 3.1 13.8 13.8 12.9 12.7 6.8 6.6 23.2 26.2 26.1 26.5 EBITDA 19.3 15.6 80.7 89.5 79.0 83.4 (0.6) (9.2) (38.7) (32.8) 25.4 14.8 18.6 6.3 41.9 56.7 104.5 98.2 Asset Impairment - 0.7 - - - 0.7 - 9.2 - 19.6 - 9.2 - 9.9 - 19.6 - 9.9 Transaction Expenses - - - - - - - 0.4 - - - 0.5 - 0.4 - - - 0.5 Restructuring and Related Ex pense 0.0 - - 0.9 0.2 0.0 0.3 1.1 12.2 9.0 2.8 4.4 0.3 1.1 12.2 9.8 3.0 4.4 Value Enhancement Initiative Implementation 1.4 0.3 - 2.0 6.1 4.8 0.2 - - 2.6 0.8 0.3 1.6 0.3 - 4.6 6.9 5.1 Equity in Net Loss (Gain) of Inv estee - - - - - - (0.4) (0.0) 11.0 8.5 1.4 0.4 (0.4) (0.0) 11.0 8.5 1.4 0.4 (Gain) on Sale of Mission Prov idence - - - - - - - - - - (12.4) (12.4) - - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - 29.2 - (2.0) (2.0) - - 29.2 - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - (2.5) - - - - - (2.5) - - - Foreign Currency (Gain) / Loss - - - - - - 0.5 (0.0) (0.9) (1.4) 0.3 (0.7) 0.5 (0.0) (0.9) (1.4) 0.3 (0.7) Litigation Expense - - - - - - - - - - - - - - - - - - Adjusted EBITDA 20.7 16.6 80.7 92.4 85.3 88.8 (0.1) 1.4 10.3 5.5 16.3 14.5 20.6 18.0 91.0 97.8 101.7 103.4 % Margin 6.1% 4.8% 7.4% 7.5% 6.5% 6.7% -0.2% 2.0% 2.6% 1.6% 5.3% 4.9% 5.0% 4.4% 6.2% 6.2% 6.3% 6.3% 11

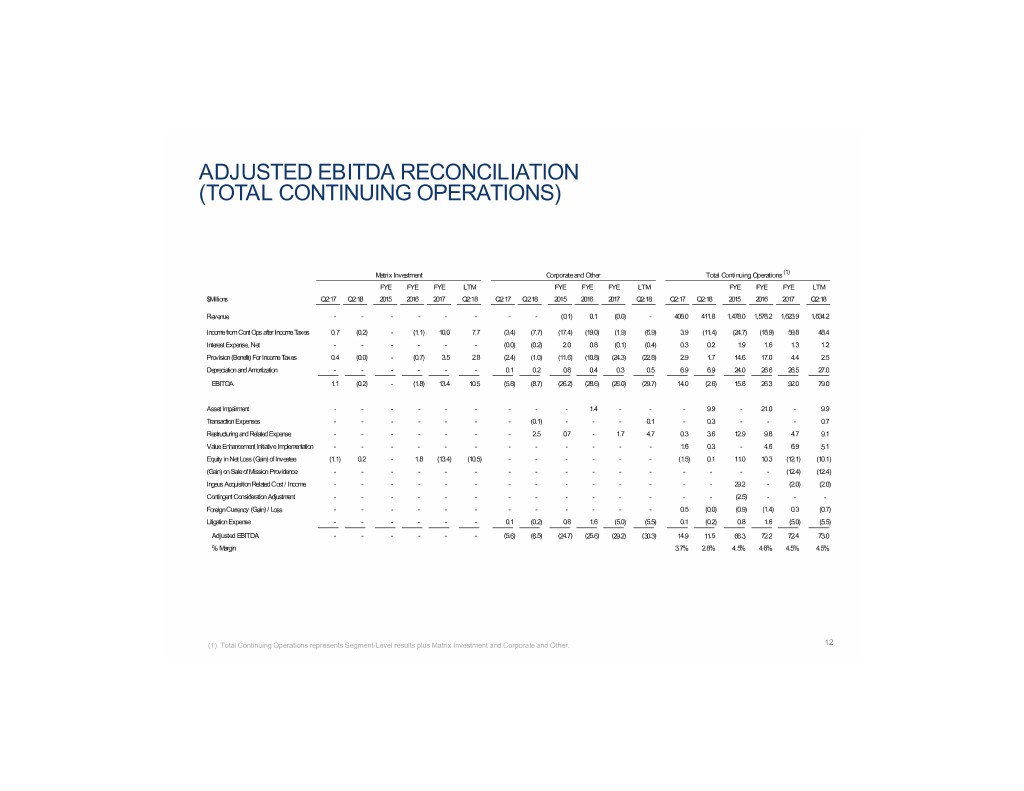

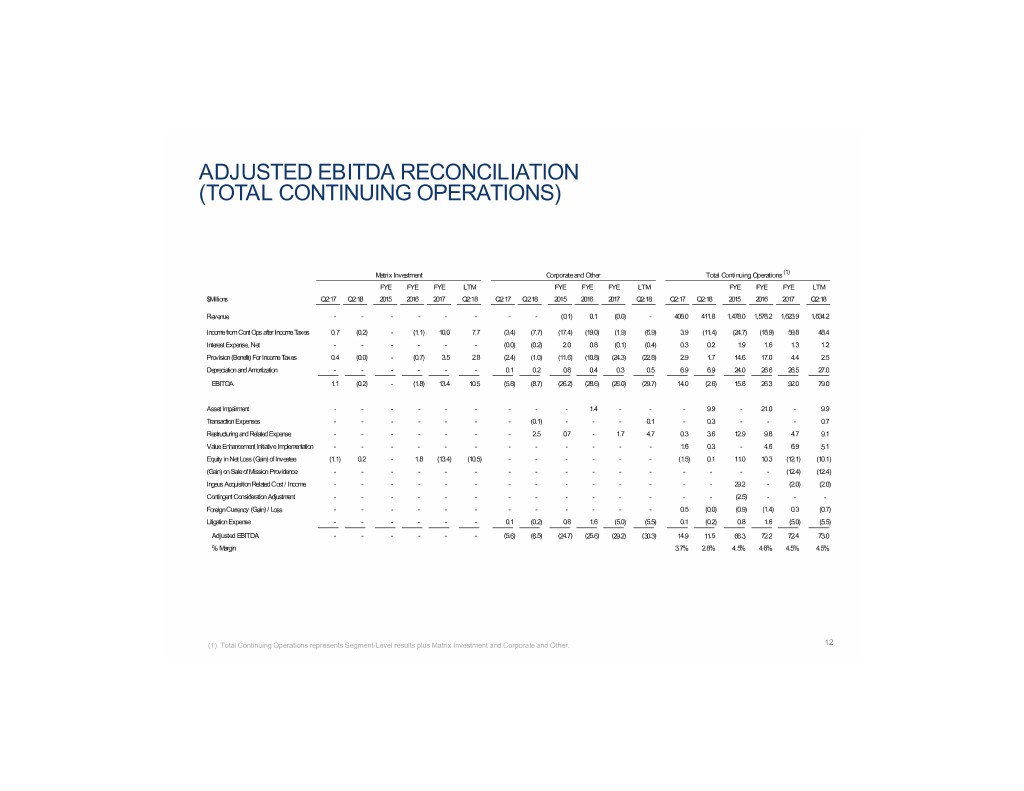

ADJUSTED EBITDA RECONCILIATION (TOTAL CONTINUING OPERATIONS) Matrix Investment Corporate and Other Total Continuing Operations (1) FYE FYE FYE LTM FYE FYE FYE LTM FYE FYE FYE LTM $Millions Q2:17 Q2:18 2015 2016 2017 Q2:18 Q2:17 Q2:18 2015 2016 2017 Q2:18 Q2:17 Q2:18 2015 2016 2017 Q2:18 Revenue - - - - - - - - (0.1) 0.1 (0.0) - 408.0 411.8 1,478.0 1,578.2 1,623.9 1,634.2 Income from Cont Ops after Income Taxes 0.7 (0.2) - (1.1) 10.0 7.7 (3.4) (7.7) (17.4) (19.0) (1.9) (6.9) 3.9 (11.4) (24.7) (18.9) 59.8 48.4 Interest Expense, Net - - - - - - (0.0) (0.2) 2.0 0.8 (0.1) (0.4) 0.3 0.2 1.9 1.6 1.3 1.2 Prov ision (Benefit) For Income Taxes 0.4 (0.0) - (0.7) 3.5 2.8 (2.4) (1.0) (11.6) (10.8) (24.3) (22.8) 2.9 1.7 14.6 17.0 4.4 2.5 Depreciation and Amortization - - - - - - 0.1 0.2 0.8 0.4 0.3 0.5 6.9 6.9 24.0 26.6 26.5 27.0 EBITDA 1.1 (0.2) - (1.8) 13.4 10.5 (5.8) (8.7) (26.2) (28.6) (26.0) (29.7) 14.0 (2.6) 15.8 26.3 92.0 79.0 Asset Impairment - - - - - - - - - 1.4 - - - 9.9 - 21.0 - 9.9 Transaction Expenses - - - - - - - (0.1) - - - 0.1 - 0.3 - - - 0.7 Restructuring and Related Expense - - - - - - - 2.5 0.7 - 1.7 4.7 0.3 3.6 12.9 9.8 4.7 9.1 Value Enhancement Initiative Implementation - - - - - - - - - - - - 1.6 0.3 - 4.6 6.9 5.1 Equity in Net Loss (Gain) of Inv estee (1.1) 0.2 - 1.8 (13.4) (10.5) - - - - - - (1.5) 0.1 11.0 10.3 (12.1) (10.1) (Gain) on Sale of Mission Providence - - - - - - - - - - - - - - - - (12.4) (12.4) Ingeus Acquisition Related Cost / Income - - - - - - - - - - - - - - 29.2 - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - (2.5) - - - Foreign Currency (Gain) / Loss - - - - - - - - - - - - 0.5 (0.0) (0.9) (1.4) 0.3 (0.7) Litigation Expense - - - - - - 0.1 (0.2) 0.8 1.6 (5.0) (5.5) 0.1 (0.2) 0.8 1.6 (5.0) (5.5) Adjusted EBITDA - - - - - - (5.6) (6.5) (24.7) (25.6) (29.2) (30.3) 14.9 11.5 66.3 72.2 72.4 73.0 % Margin 3.7% 2.8% 4.5% 4.6% 4.5% 4.5% (1) Total Continuing Operations represents Segment-Level results plus Matrix Investment and Corporate and Other. 12

ADJUSTED EBITDA RECONCILIATION (MATRIX) (1) Matrix FYE 2016 Q4:2016 FYE FYE LTM HA HA (3) (3) (3) (3) (2) (3) (2) (3) $Millions Q2:17 Q2:18 2016 2017 Q2:18 Services Matrix Total Services Matrix Total Revenue 60.8 78.4 207.7 227.9 257.0 166.1 41.6 207.7 10.7 41.6 52.3 Net Income (Loss) 1.6 (0.9) 110.1 26.7 17.5 114.3 (4.2) 110.1 109.0 (4.2) 104.8 Interest Expense, Net 3.7 5.9 12.9 14.8 23.8 9.9 2.9 12.9 0.6 2.9 3.6 Prov ision (Benefit) For Income Taxes 0.7 (0.4) 60.4 (29.6) (32.6) 63.3 (2.8) 60.4 59.9 (2.8) 57.1 Depreciation and Amortization 8.1 9.4 27.5 33.5 35.8 21.1 6.4 27.5 - 6.4 6.4 EBIT DA 14.1 14.0 210.9 45.4 44.5 208.6 2.3 210.9 169.5 2.3 171.8 Gain on Disposition - - (167.9) - - (167.9) - (167.9) (167.9) - (167.9) Management Fee 0.7 0.7 - 2.3 4.8 - - - - - - Integration Expense - 1.1 - - 1.5 - - - - - - Transaction Costs 0.5 0.1 6.4 3.9 2.7 0.0 6.3 6.4 (0.8) 6.4 5.6 Write-off of Deferred Financing Costs - - 2.3 - - 2.3 - 2.3 2.3 - 2.3 Adjusted EBITDA 15.3 15.9 51.7 51.7 53.6 43.1 8.6 51.7 3.1 8.6 11.7 % Margin 25.2% 20.2% 24.9% 22.7% 20.8% Reconciliation of Income / Loss from Equity Inv estment to Matrix Net Income (4) Equity in Net Gain (Loss) of Inv estee 1.1 (0.2) 13.4 10.5 (1.8) 1.1 Management Fee and Other (0.3) (0.2) (1.0) (2.0) (0.2) (0.2) Net Gain (Loss) - Equity Inv estment 0.8 (0.4) 12.4 8.5 (2.0) 0.9 (5) Divided by: Prov idence % Equity Inv estment in Matrix 46.6% 43.6% 46.6% 43.6% 46.8% 46.8% Matrix Net Income Standalone 1.6 (0.9) 26.7 17.5 (4.2) 1.9 (1) Represents 100% of Matrix’s results including the results of HealthFair since its acquisition of February 16, 2018. Providence’s retained equity interest is now accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. (2) Represents Matrix's results of operation through the Matrix Transaction on October 19, 2016. These results are included within Discontinued Operations on the Company's consolidated financial statements. (3) Represents Matrix's results of operation from October 20, 2016 to June 30, 2018, as applicable. Providence accounts for its proportionate share of Matrix's results during this time period using the equity method. (4) A reconciliation has been provided to bridge from the income from Equity in net gain (loss) of investee to Matrix’s standalone Net Income for periods following the Matrix JV transaction. (5) For FYE 2017, % Equity Interest represents Providence’s equity interest in Matrix as of December 31, 2017. It should be noted that Providence’s equity interest in Matrix decreased from 46.8% to 46.6% primarily due to a rollover of management bonuses into equity during Q3:2017. In addition, Providence’s equity interest in Matrix decreased to 43.6% following the rollover of certain HealthFair equity interests related to the acquisition during Q1:2018. 13

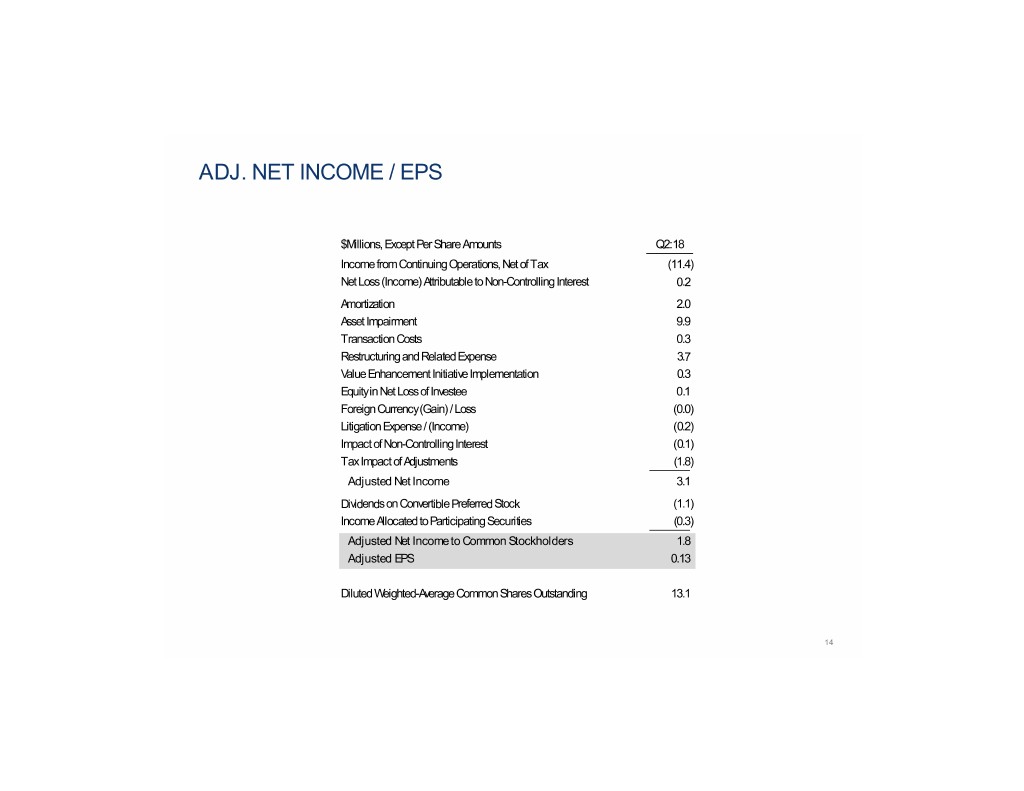

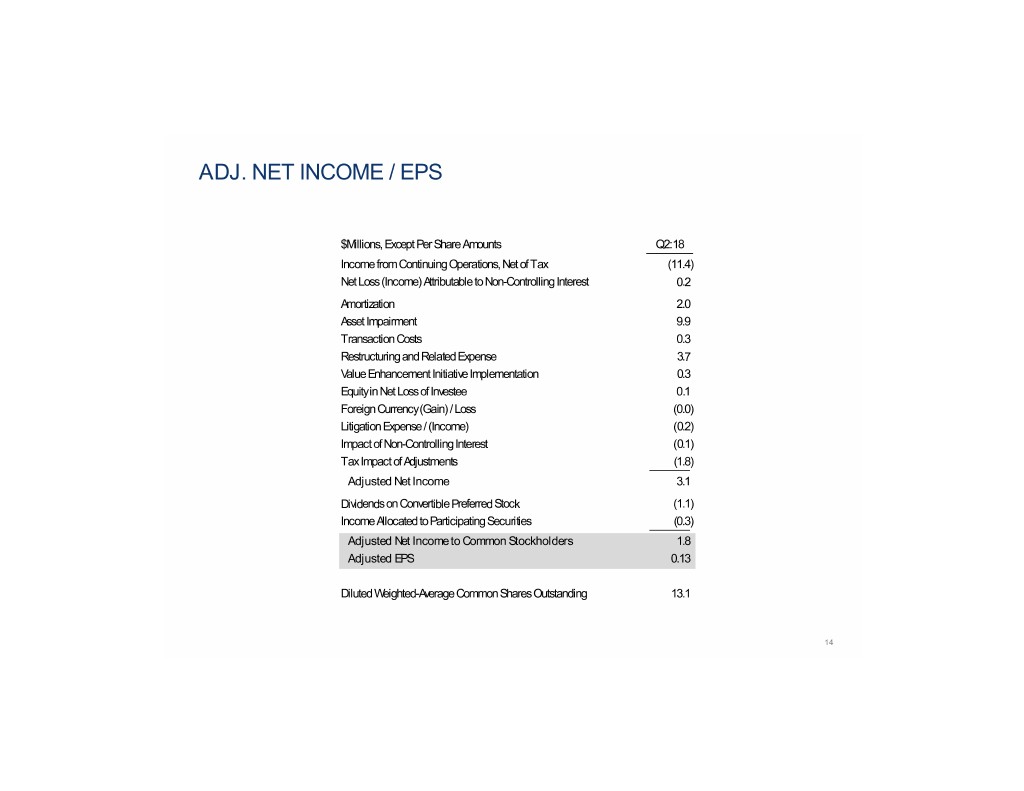

ADJ. NET INCOME / EPS $Millions, Except Per Share Amounts Q2:18 Income from Continuing Operations, Net of Tax (11.4) Net Loss (Income) Attributable to Non-Controlling Interest 0.2 Amortization 2.0 Asset Impairment 9.9 Transaction Costs 0.3 Restructuring and Related Expense 3.7 Value Enhancement Initiative Implementation 0.3 Equity in Net Loss of Investee 0.1 Foreign Currency (Gain) / Loss (0.0) Litigation Expense / (Income) (0.2) Impact of Non-Controlling Interest (0.1) Tax Impact of Adjustments (1.8) Adjusted Net Income 3.1 Dividends on Convertible Preferred Stock (1.1) Income Allocated to Participating Securities (0.3) Adjusted Net Income to Common Stockholders 1.8 Adjusted EPS 0.13 Diluted Weighted-Average Common Shares Outstanding 13.1 14