PROVIDENCE OVERVIEW DECEMBER 2018

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL INFORMATION Forward-looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,” “anticipate,” “should” and “likely” and similar expressions identify forward-looking statements. In addition, statements that are not historical should also be considered forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. Such forward-looking statements are based on current expectations that involve a number of known and unknown risks, uncertainties and other factors which may cause actual events to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, our continuing relationship with government entities and our ability to procure business from them, our ability to manage growing and changing operations, the implementation of healthcare reform law, government budget changes and legislation related to the services that we provide, our ability to renew or replace existing contracts that have expired or are scheduled to expire with significant clients, and other risks detailed in Providence’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Providence is under no obligation to (and expressly disclaims any such obligation to) update any of the information in this press release if any forward-looking statement later turns out to be inaccurate whether as a result of new information, future events or otherwise. Non-GAAP Financial Information In addition to the financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release includes EBITDA, Adjusted EBITDA and Segment-level Adjusted EBITDA for the Company and its operating segments, and Adjusted Net Income and Adjusted EPS for the Company, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before certain items, including (as applicable): (1) restructuring and related charges including costs related to the corporate reorganization, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) gain or loss on sale of equity investments, (6) management fees and (7) transaction and related costs. Segment-level Adjusted EBITDA is calculated as Adjusted EBITDA for the company excluding the Adjusted EBITDA associated with corporate and holding company costs reported as our Corporate and Other Segment. Adjusted Net Income is defined as income (loss) from continuing operations, net of tax, before certain items, including (1) restructuring and related charges, (2) foreign currency transactions, (3) equity in net earnings or losses of investees, (4) certain litigation related expenses or settlement income, (5) intangible amortization expense, (6) gain or loss on sale of equity investments, (7) the impact of the Tax Cuts and Jobs Act, (8) excess tax charges associated with long term incentive plans, (9) the impact of adjustments on non-controlling interests, (10) certain transaction and related costs and (11) the income tax impact of such adjustments. Adjusted EPS is calculated as Adjusted Net Income less (as applicable): (1) dividends on convertible preferred stock, (2) accretion of convertible preferred stock discount, and (3) income allocated to participating stockholders, divided by the diluted weighted-average number of common shares outstanding. We utilize these non-GAAP performance measures, which exclude certain expenses and amounts, because we believe the timing of such expenses is unpredictable and not driven by our core operating results, and therefore render comparisons with prior periods as well as with other companies in our industry less meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net earnings in equity investees are excluded from these measures, as we do not have the ability to manage these ventures, allocate resources within the ventures, or directly control their operations or performance. Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial information is not meant to be considered in isolation from or as a substitute for the directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business. 2

A LEADING PROVIDER OF TECHNOLOGY ENABLED HEALTHCARE SERVICES PRSC ~$1Bn 1996 ATLANTA, GA TICKER MARKET CAP FOUNDED HEADQUARTERS LTM 9/30/2018 REVENUE NET SERVICES $1.35Bn Primarily operates under the LogistiCare brand, the largest manager of non- emergency medical transportation (“NEMT”) programs for state $1.65Bn governments and managed WD SERVICES care organizations in the $291M U.S. providing better access Announced sale of to care in the community. substantially all of the WD Recent acquisition of Services segment. Circulation Inc. brings a Expected to meet transformative technology to discontinued operations existing operations MATRIX INVESTMENT criteria in the fourth quarter 43.6% non-controlling equity interest in Matrix Medical Network, a leading provider of home and mobile-based healthcare services for health plans in the U.S., including comprehensive health assessments, quality gap closure visits, “level of service” needs assessments, and post-acute and chronic care management 3

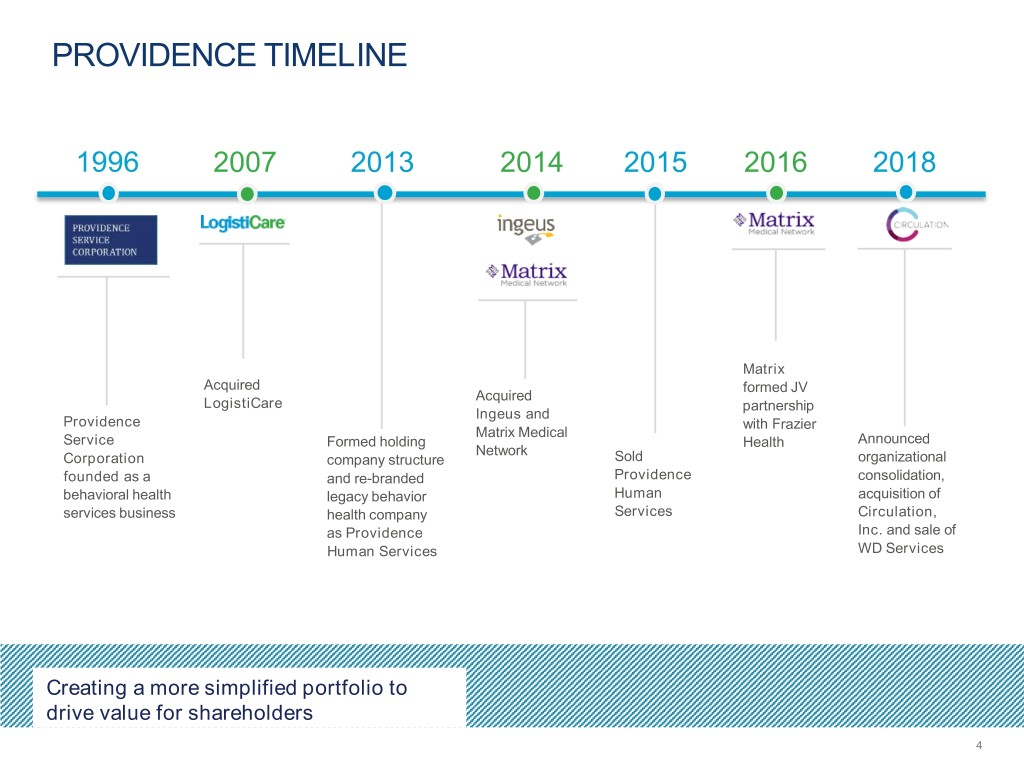

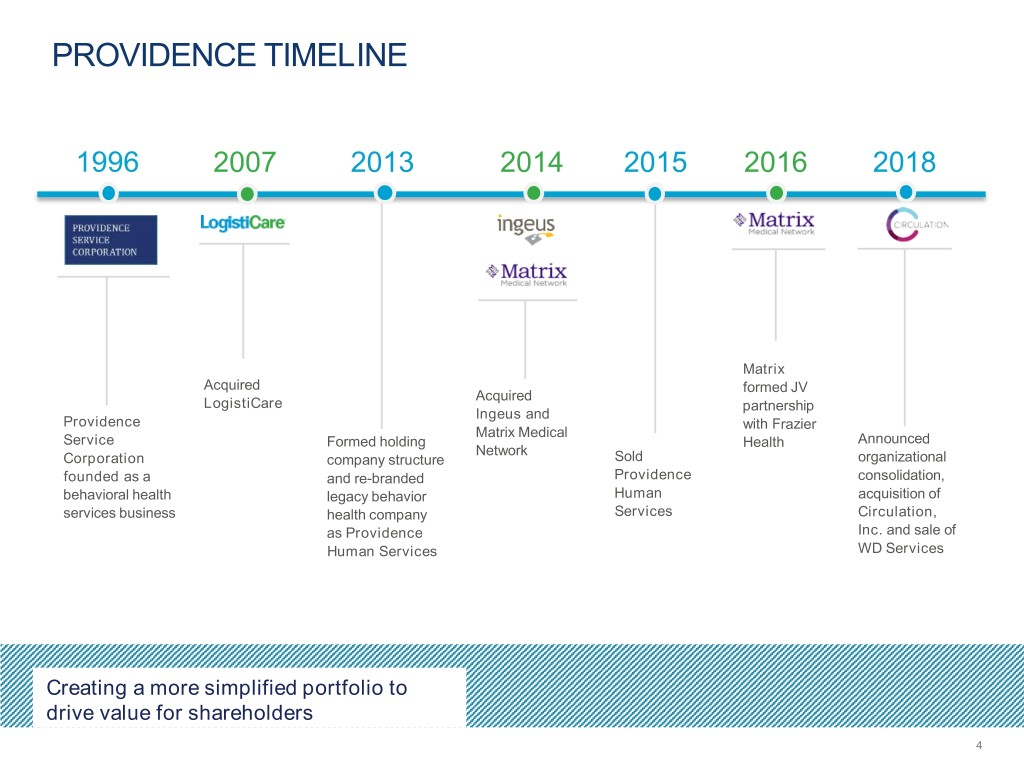

PROVIDENCE TIMELINE 1996 2007 2013 2014 2015 2016 2018 Matrix Acquired formed JV Acquired LogistiCare partnership Ingeus and Providence with Frazier Matrix Medical Service Formed holding Health Announced Network Corporation company structure Sold organizational founded as a and re-branded Providence consolidation, behavioral health legacy behavior Human acquisition of services business health company Services Circulation, as Providence Inc. and sale of Human Services WD Services Creating a more simplified portfolio to drive value for shareholders 4

ORGANIZATIONAL CONSOLIDATION AND ACQUSITION OF CIRCULATION STRENGTHEN OPERATIONAL EFFECTIVENESS & STRATEGIC FOCUS AROUND LOGISTICARE Substantially all holding company activities and functions are in the process of being integrated with LogistiCare, capitalizing on its full growth and value creation potential Creates an organizational structure with strategic, operational and cultural alignment. New combined organization headquartered in Atlanta, GA to remain listed under ticker symbol: PRSC Consolidation expected to be completed in 1H 2019; Expected to generate annual savings of at least $10 million upon completion Acquisition of Circulation brings technology that will be transformative to LogistiCare’s operations Circulation technology uniquely placed to help deliver cost savings across call centers and at the same time significantly improve the membership experience Announced the sale of substantially all of WD Services Organizational consolidation in process and expected to drive shareholder value by sharpening focus on significant growth opportunities available to LogistiCare such as Circulation 5

COMPELLING INVESTMENT OPPORTUNITY EXPOSURE TO ATTRACTIVE INDUSTRY GROWTH DRIVERS EXPANSION of aging populations, home and community based care VALUE-BASED CARE driving focus on quality care, patient outcomes and reduced costs IMPACTFUL MARKET LEADING BRANDS MARKET LEADERSHIP covering over 24 million lives through LogistiCare FAVORABLE BRAND REPUTATIONS driven by proven ability to meet client needs ACCESS TO SCALE AND REACH NATIONWIDE PARTNER and client networks 67 MILLION RIDES managed annually across 45 states SCALABLE IT PLATFORMS WITH NEW, MARKET PROVEN CIRCULATION TECHNOLOGY providing competitive advantages RECURRING REVENUE, TECHNOLOGY BASED, ASSET LITE MODELS MULTI YEAR client contracts and relationships ACQUISITION OF CIRCULATION, A SIGNIFICANT STEP FORWARD IN TECHNOLOGY that will provide significant automation benefits, data and analytics capabilities together with a differentiated user experience PROVEN TRACK RECORD PROVEN GROWTH and operational improvement strategies DISCIPLINED CAPITAL ALLOCATION with rigorous approach to creating intrinsic value per share Organizational consolidation and integration of Circulation technology underway to create a structure with strategic, operational and cultural alignment focused on LogistiCare 6

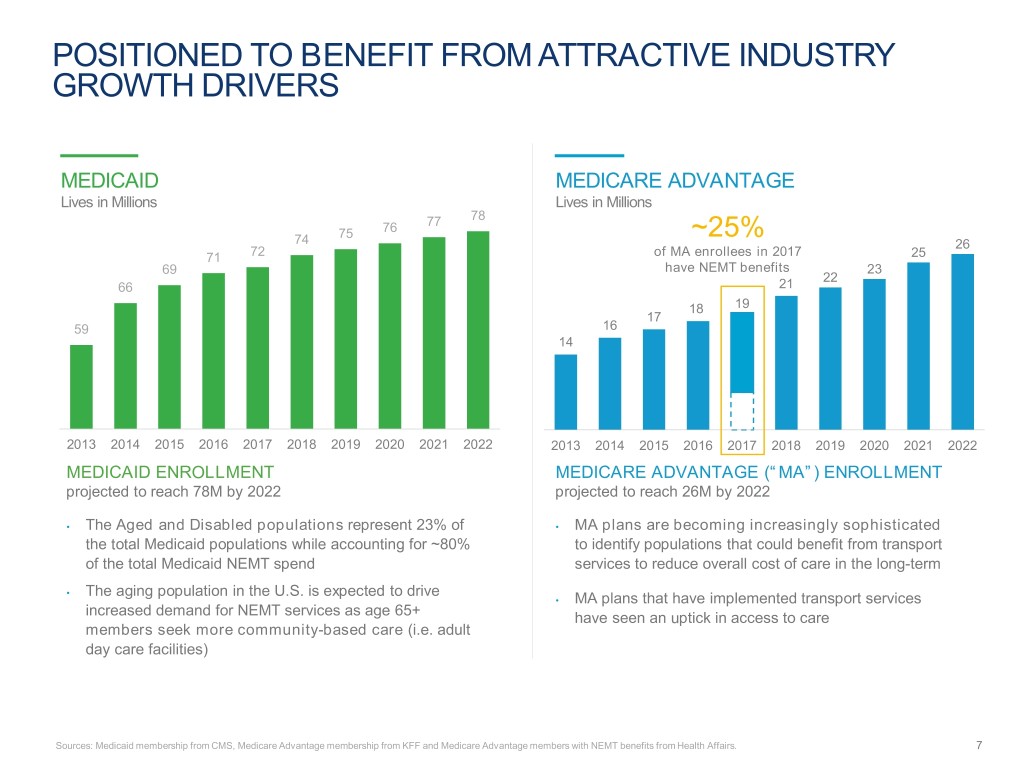

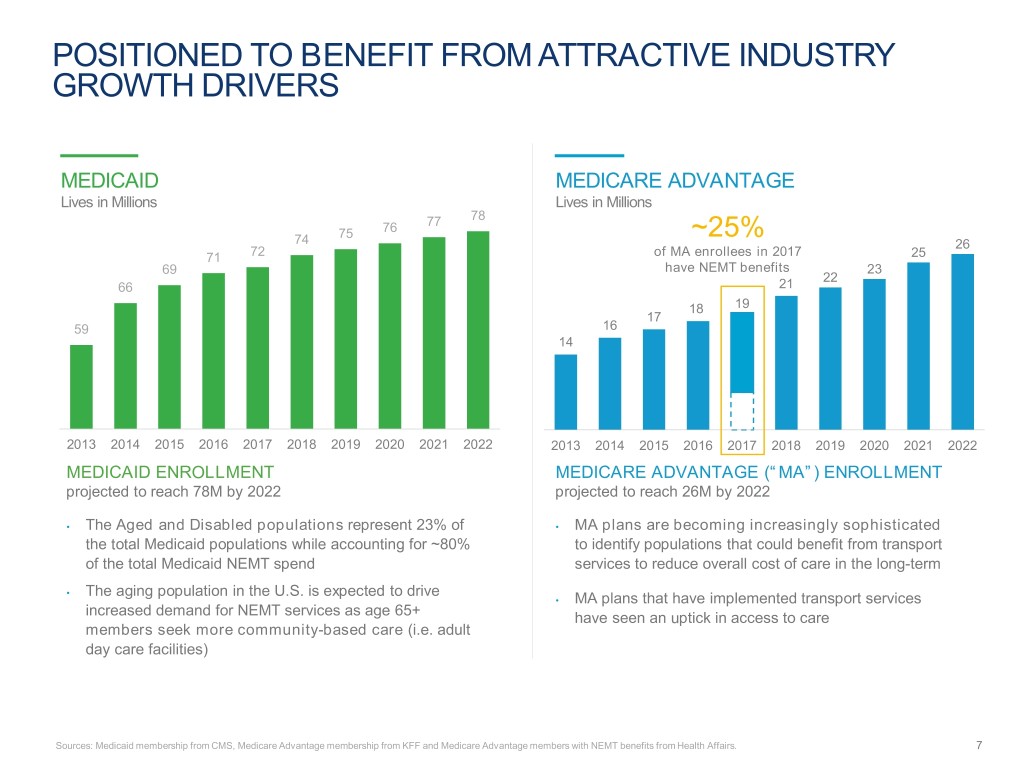

POSITIONED TO BENEFIT FROM ATTRACTIVE INDUSTRY GROWTH DRIVERS MEDICAID MEDICARE ADVANTAGE Lives in Millions Lives in Millions 77 78 75 76 74 ~25% 26 71 72 of MA enrollees in 2017 25 69 have NEMT benefits 23 22 66 21 18 19 17 59 16 14 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 MEDICAID ENROLLMENT MEDICARE ADVANTAGE (“MA”) ENROLLMENT projected to reach 78M by 2022 projected to reach 26M by 2022 • The Aged and Disabled populations represent 23% of • MA plans are becoming increasingly sophisticated the total Medicaid populations while accounting for ~80% to identify populations that could benefit from transport of the total Medicaid NEMT spend services to reduce overall cost of care in the long-term • The aging population in the U.S. is expected to drive • MA plans that have implemented transport services increased demand for NEMT services as age 65+ have seen an uptick in access to care members seek more community-based care (i.e. adult day care facilities) Sources: Medicaid membership from CMS, Medicare Advantage membership from KFF and Medicare Advantage members with NEMT benefits from Health Affairs. 7

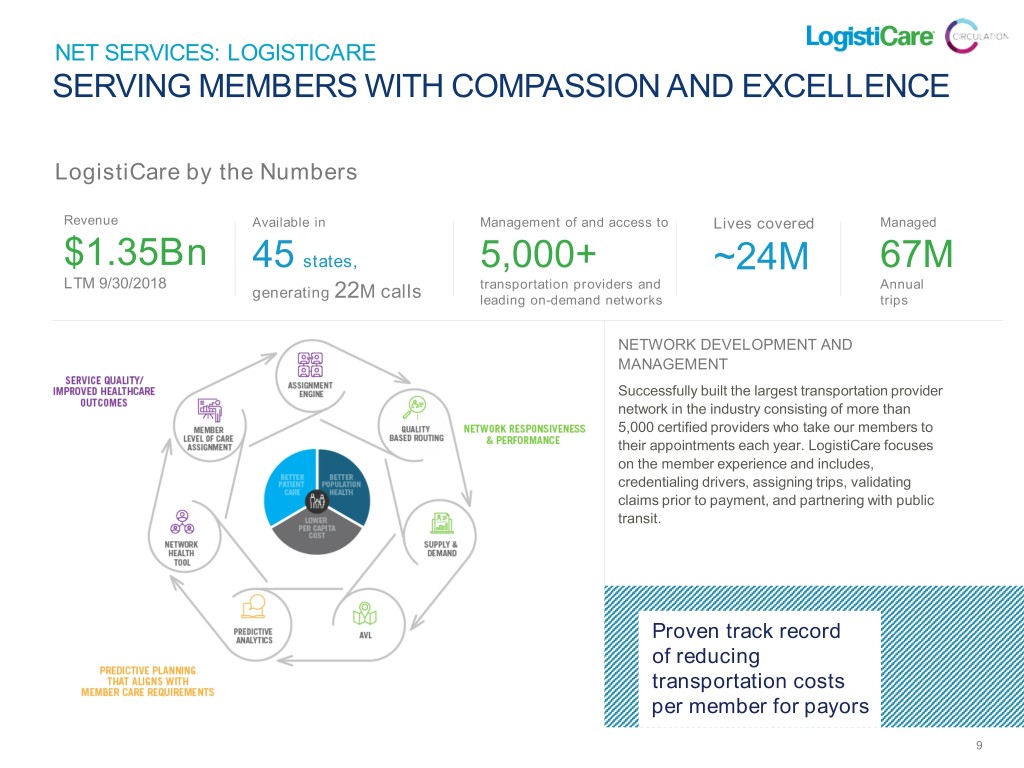

NET SERVICES: LOGISTICARE THE LARGEST NON-EMERGENCY MEDICAL TRANSPORTATION MANAGER IN THE U.S. Powering critical services at scale with networks and technology SERVICES MEMBERS PAYORS and CLIENTS TECH ENABLED • Coordinating non- • Primarily Medicaid and • Contracted with State Medicaid • Recent acquisition of Circulation, emergency medical some Medicare eligible Agencies, Managed Care an on-demand provider of NEMT transportation members whose limited Organizations (MCOs), services for healthcare systems services through its mobility or financial Accountable Care • Uses technology to provide broad extensive 5,000+ resources hinders their Organizations (ACOs), and interconnectivity among credentialed ability to access necessary healthcare providers members, payors and network for transportation healthcare and social transportation providers provider network services • Flexible, highly scalable, capable of supporting substantial growth for existing and future clients 8

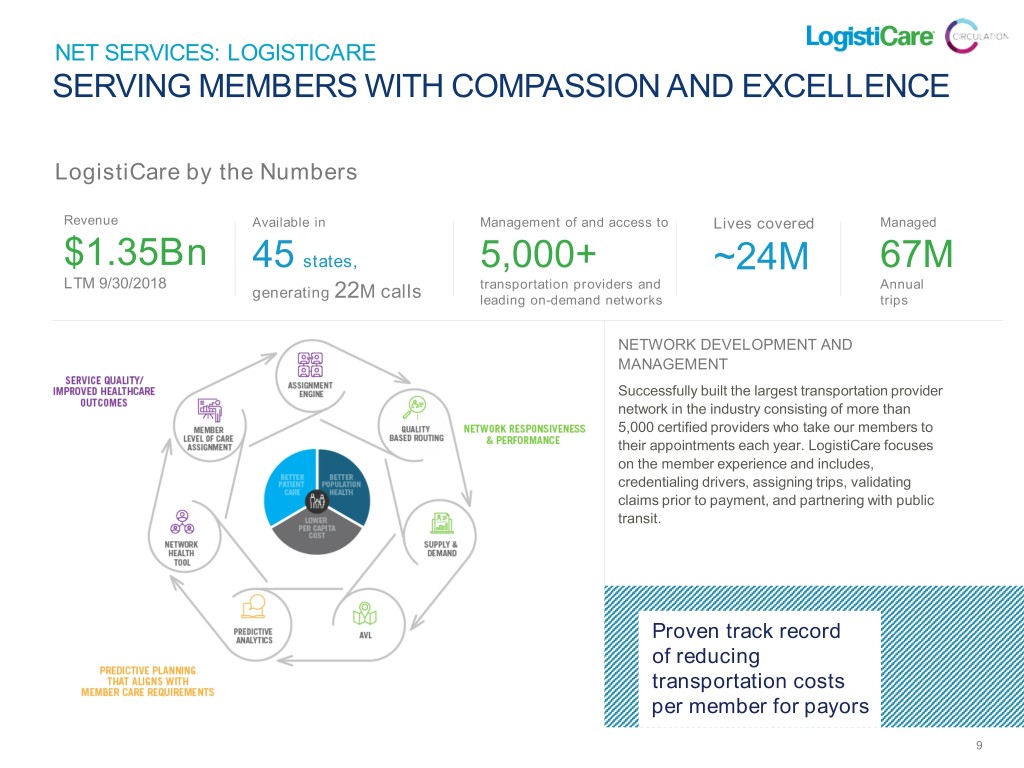

NET SERVICES: LOGISTICARE SERVING MEMBERS WITH COMPASSION AND EXCELLENCE LogistiCare by the Numbers Revenue Available in Management of and access to Lives covered Managed $1.35Bn 45 states, 5,000+ ~24M 67M LTM 9/30/2018 transportation providers and Annual generating 22M calls leading on-demand networks trips NETWORK DEVELOPMENT AND MANAGEMENT Successfully built the largest transportation provider network in the industry consisting of more than 5,000 certified providers who take our members to their appointments each year. LogistiCare focuses on the member experience and includes, credentialing drivers, assigning trips, validating claims prior to payment, and partnering with public transit. Proven track record of reducing transportation costs per member for payors 9

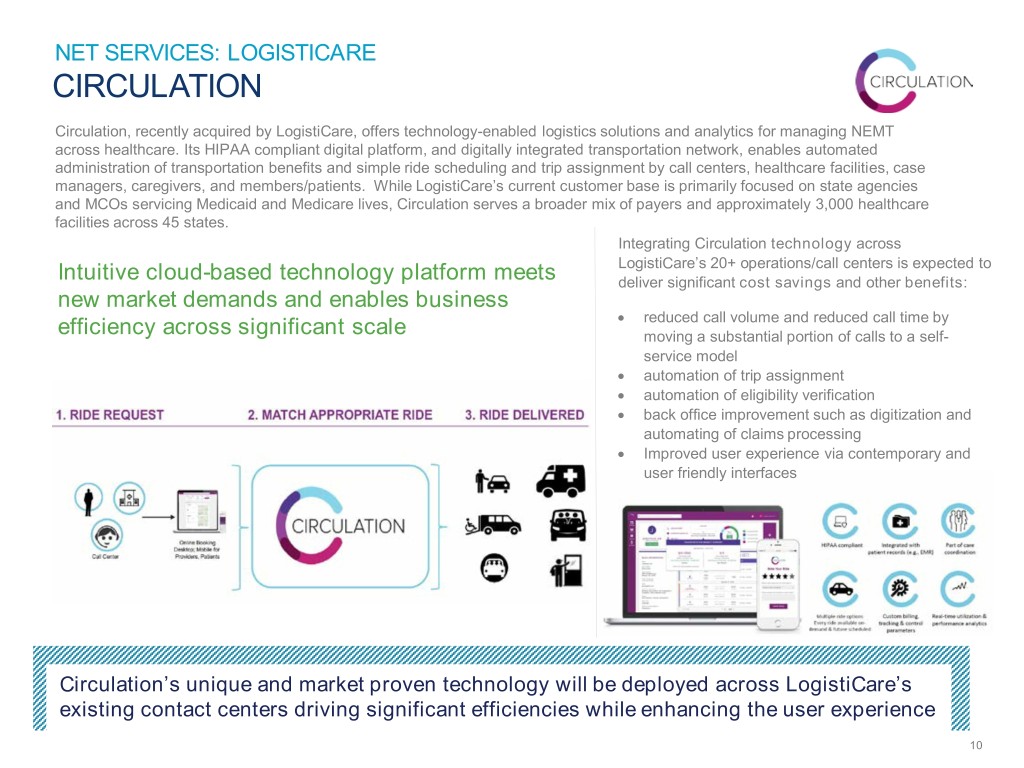

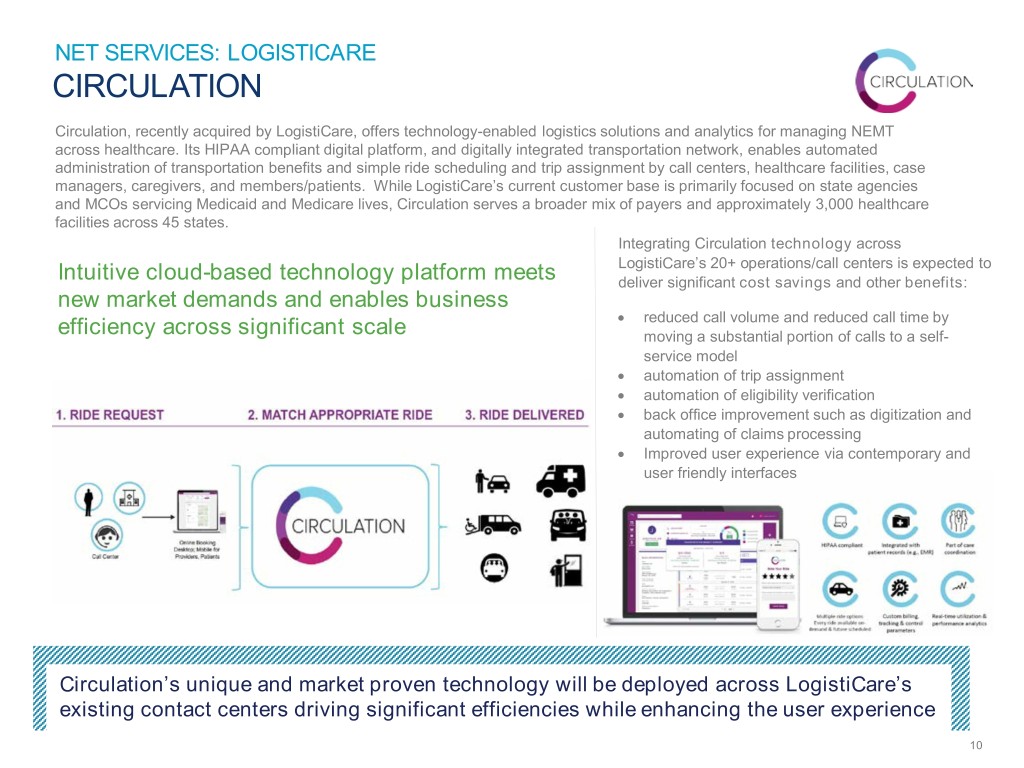

NET SERVICES: LOGISTICARE CIRCULATION Circulation, recently acquired by LogistiCare, offers technology-enabled logistics solutions and analytics for managing NEMT across healthcare. Its HIPAA compliant digital platform, and digitally integrated transportation network, enables automated administration of transportation benefits and simple ride scheduling and trip assignment by call centers, healthcare facilities, case managers, caregivers, and members/patients. While LogistiCare’s current customer base is primarily focused on state agencies and MCOs servicing Medicaid and Medicare lives, Circulation serves a broader mix of payers and approximately 3,000 healthcare facilities across 45 states. Integrating Circulation technology across LogistiCare’s 20+ operations/call centers is expected to Intuitive cloud-based technology platform meets deliver significant cost savings and other benefits: new market demands and enables business • reduced call volume and reduced call time by efficiency across significant scale moving a substantial portion of calls to a self- service model • automation of trip assignment • automation of eligibility verification • back office improvement such as digitization and automating of claims processing • Improved user experience via contemporary and user friendly interfaces Circulation’s unique and market proven technology will be deployed across LogistiCare’s existing contact centers driving significant efficiencies while enhancing the user experience 10

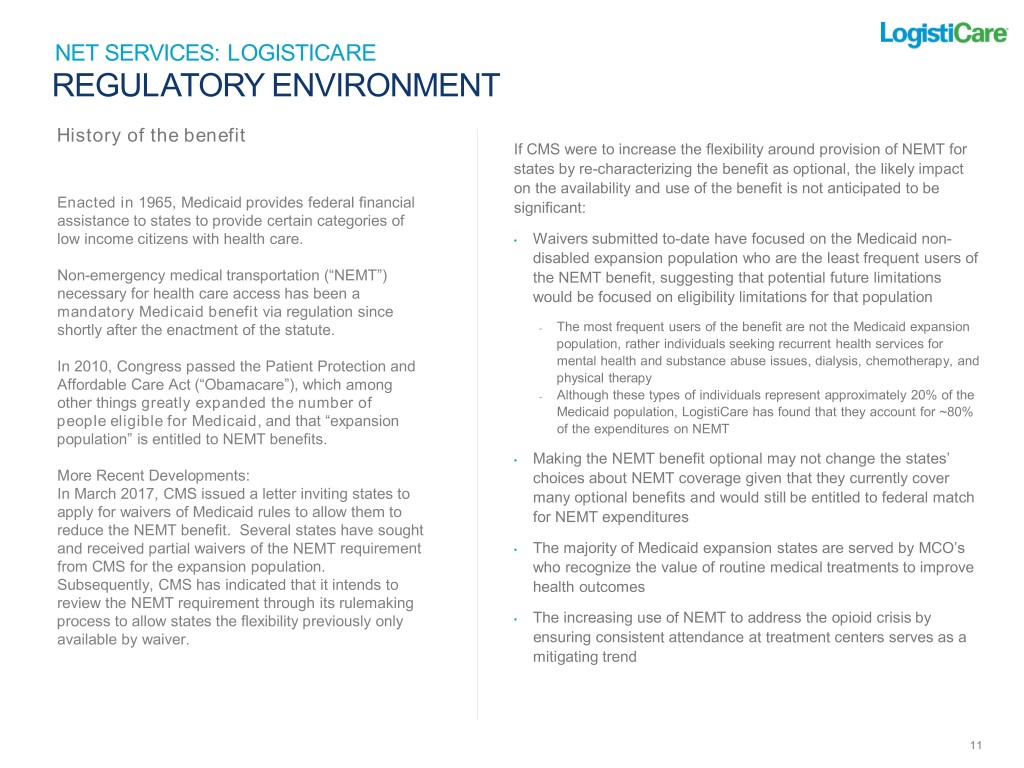

NET SERVICES: LOGISTICARE REGULATORY ENVIRONMENT History of the benefit If CMS were to increase the flexibility around provision of NEMT for states by re-characterizing the benefit as optional, the likely impact on the availability and use of the benefit is not anticipated to be Enacted in 1965, Medicaid provides federal financial significant: assistance to states to provide certain categories of low income citizens with health care. • Waivers submitted to-date have focused on the Medicaid non- disabled expansion population who are the least frequent users of Non-emergency medical transportation (“NEMT”) the NEMT benefit, suggesting that potential future limitations necessary for health care access has been a would be focused on eligibility limitations for that population mandatory Medicaid benefit via regulation since shortly after the enactment of the statute. - The most frequent users of the benefit are not the Medicaid expansion population, rather individuals seeking recurrent health services for In 2010, Congress passed the Patient Protection and mental health and substance abuse issues, dialysis, chemotherapy, and Affordable Care Act (“Obamacare”), which among physical therapy - Although these types of individuals represent approximately 20% of the other things greatly expanded the number of Medicaid population, LogistiCare has found that they account for ~80% , and that “expansion people eligible for Medicaid of the expenditures on NEMT population” is entitled to NEMT benefits. • Making the NEMT benefit optional may not change the states’ More Recent Developments: choices about NEMT coverage given that they currently cover In March 2017, CMS issued a letter inviting states to many optional benefits and would still be entitled to federal match apply for waivers of Medicaid rules to allow them to for NEMT expenditures reduce the NEMT benefit. Several states have sought and received partial waivers of the NEMT requirement • The majority of Medicaid expansion states are served by MCO’s from CMS for the expansion population. who recognize the value of routine medical treatments to improve Subsequently, CMS has indicated that it intends to health outcomes review the NEMT requirement through its rulemaking process to allow states the flexibility previously only • The increasing use of NEMT to address the opioid crisis by available by waiver. ensuring consistent attendance at treatment centers serves as a mitigating trend 11

NET SERVICES: LOGISTICARE CLEAR VALUE PROPOSITION AND STRATEGY FOR GROWTH Multiple levers of growth VALUE PROPOSITION LEVERAGING CIRCULATION TECHNOLOGY • Roadmap to integrate and deploy Circulation’s best-in- • Alleviation of transportation barriers improves class technology across LogistiCare’s significant volume outcomes and reduces healthcare costs for • Targeting run rate synergies of $25mm within 24 months Medicaid agencies and MCO’s of acquisition • Ability to provide capitated, multi-year contracts OPERATIONAL EFFICIENCIES AND IMPROVEMENT allows both lower and more predictable costs • Ongoing rate negotiations with transportation providers expected to yield reduction in transportation cost • Reduction of fraud, waste, and abuse in a fragmented system • Newly formed management team with energy and proven track record of organization and process • High barriers to entry – technology platforms, optimization capabilities leading market share, strong brand reputation FUTURE CAPITAL DEPLOYMENT • Well positioned to take advantage of the shift to • Focus on organic growth initiatives within NEMT and new in-home/community based healthcare services adjacent markets and services • Targeted M&A strategy with opportunities for tuck in of regional / national NEMT providers or complimentary businesses Multiple avenues of both organic and inorganic growth and clear value proposition 12

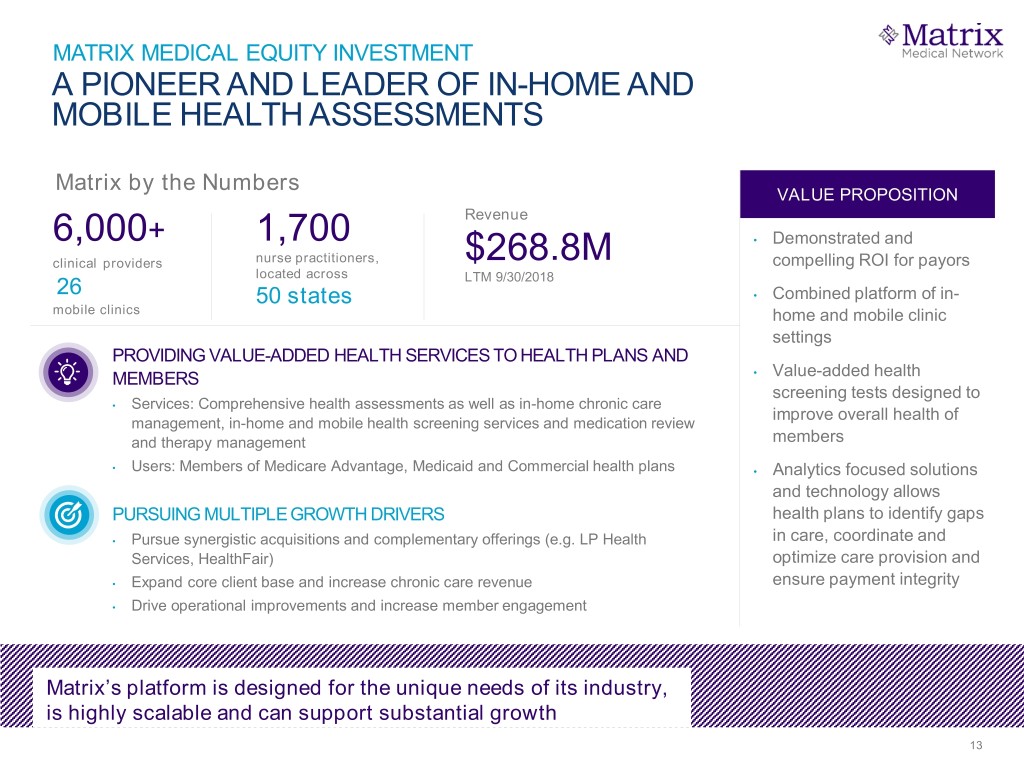

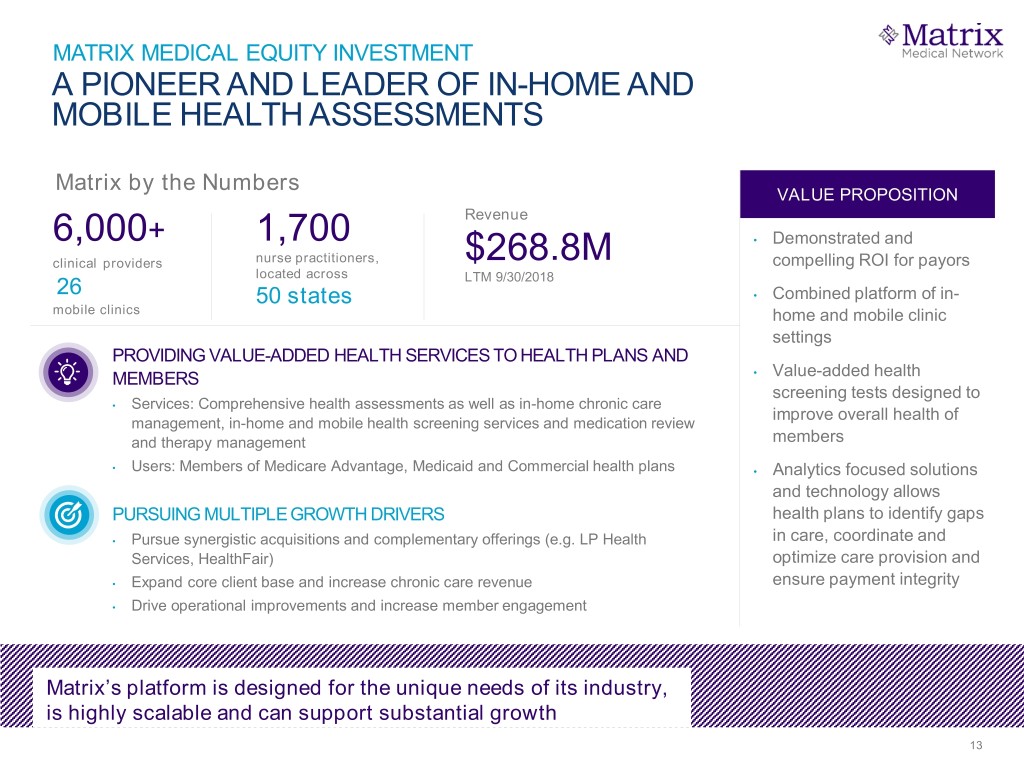

MATRIX MEDICAL EQUITY INVESTMENT A PIONEER AND LEADER OF IN-HOME AND MOBILE HEALTH ASSESSMENTS Matrix by the Numbers VALUE PROPOSITION Revenue 6,000+ 1,700 • Demonstrated and clinical providers nurse practitioners, $268.8M compelling ROI for payors located across LTM 9/30/2018 26 50 states • Combined platform of in- mobile clinics home and mobile clinic settings PROVIDING VALUE-ADDED HEALTH SERVICES TO HEALTH PLANS AND • Value-added health MEMBERS screening tests designed to • Services: Comprehensive health assessments as well as in-home chronic care improve overall health of management, in-home and mobile health screening services and medication review and therapy management members • Users: Members of Medicare Advantage, Medicaid and Commercial health plans • Analytics focused solutions and technology allows PURSUING MULTIPLE GROWTH DRIVERS health plans to identify gaps • Pursue synergistic acquisitions and complementary offerings (e.g. LP Health in care, coordinate and Services, HealthFair) optimize care provision and • Expand core client base and increase chronic care revenue ensure payment integrity • Drive operational improvements and increase member engagement Matrix’s platform is designed for the unique needs of its industry, is highly scalable and can support substantial growth 13

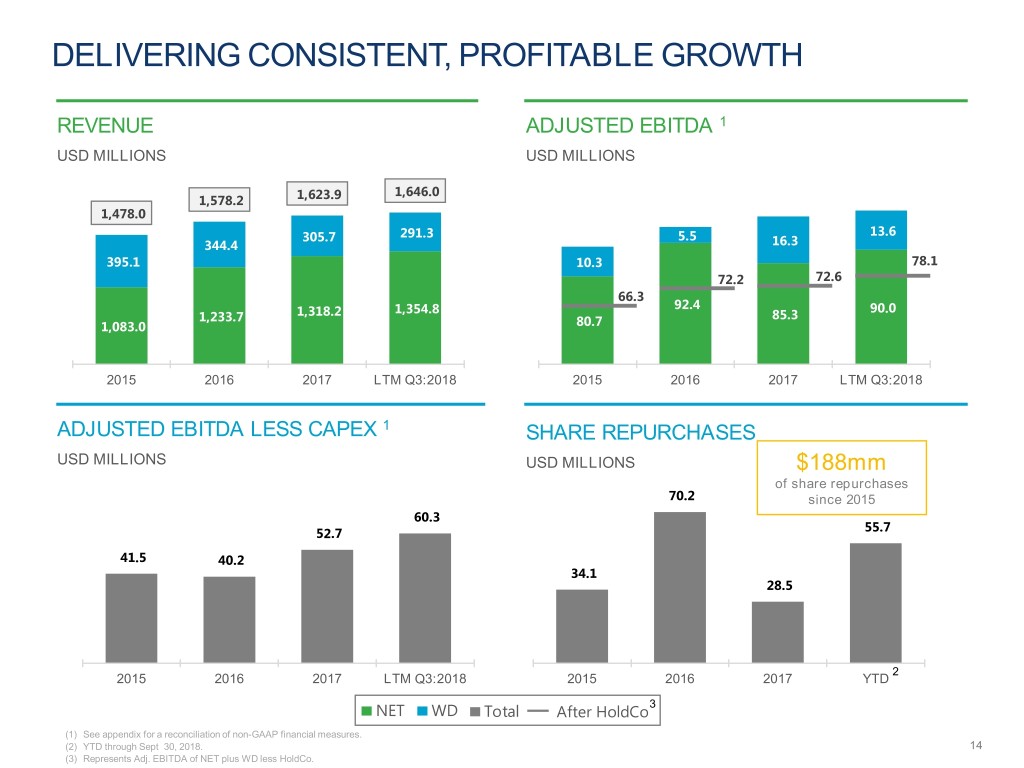

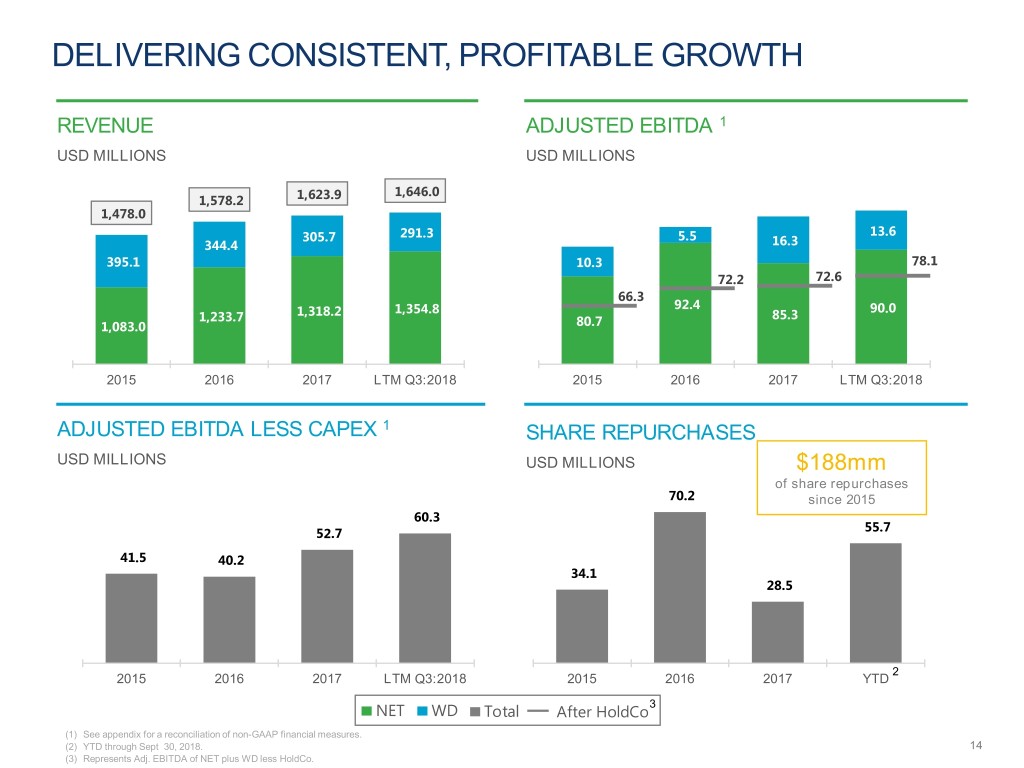

DELIVERING CONSISTENT, PROFITABLE GROWTH REVENUE ADJUSTED EBITDA 1 USD MILLIONS USD MILLIONS 1,646.0 1,578.2 1,623.9 1,478.0 305.7 291.3 5.5 13.6 344.4 16.3 395.1 10.3 78.1 72.2 72.6 66.3 1,354.8 92.4 90.0 1,233.7 1,318.2 85.3 1,083.0 80.7 2015 2016 2017 LTM Q3:2018 2015 2016 2017 LTM Q3:2018 ADJUSTED EBITDA LESS CAPEX 1 SHARE REPURCHASES USD MILLIONS USD MILLIONS $188mm of share repurchases 70.2 since 2015 60.3 52.7 55.7 41.5 40.2 34.1 28.5 2 2015 2016 2017 LTM Q3:2018 2015 2016 2017 YTD NET WD Total After HoldCo3 (1) See appendix for a reconciliation of non-GAAP financial measures. (2) YTD through Sept 30, 2018. 14 (3) Represents Adj. EBITDA of NET plus WD less HoldCo.

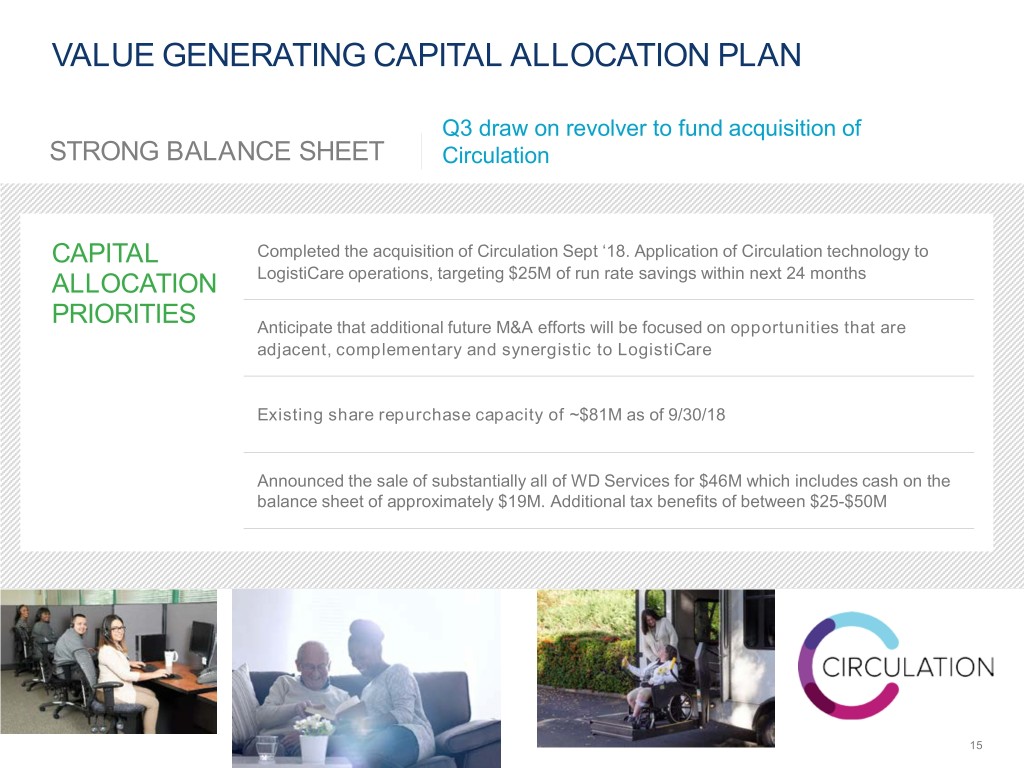

VALUE GENERATING CAPITAL ALLOCATION PLAN Q3 draw on revolver to fund acquisition of STRONG BALANCE SHEET Circulation CAPITAL Completed the acquisition of Circulation Sept ‘18. Application of Circulation technology to LogistiCare operations, targeting $25M of run rate savings within next 24 months ALLOCATION PRIORITIES Anticipate that additional future M&A efforts will be focused on opportunities that are adjacent, complementary and synergistic to LogistiCare Existing share repurchase capacity of ~$81M as of 9/30/18 Announced the sale of substantially all of WD Services for $46M which includes cash on the balance sheet of approximately $19M. Additional tax benefits of between $25-$50M 15

APPENDIX

Q3 ADJUSTED EBITDA RECONCILIATION NET Services WD Services Segment-Level FYE FYE FYE LTM FYE FYE FYE LTM FYE FYE FYE LTM $Millions Q3:17 Q3:18 2015 2016 2017 Q3:18 Q3:17 Q3:18 2015 2016 2017 Q3:18 Q3:17 Q3:18 2015 2016 2017 Q3:18 Revenue 324.8 343.8 1,083.0 1,233.7 1,318.2 1,354.8 84.7 77.5 395.1 344.4 305.7 291.3 409.5 421.3 1,478.1 1,578.1 1,623.9 1,646.0 Income from Cont Ops after Income Taxes 8.7 10.9 44.0 47.4 41.7 50.3 12.6 (3.1) (51.3) (46.2) 10.0 (17.1) 21.2 7.8 (7.3) 1.2 51.7 33.2 Interest Expense, Net 0.0 (0.0) (0.0) (0.0) 0.1 0.0 0.4 0.6 (0.1) 0.8 1.3 1.7 0.4 0.6 (0.1) 0.8 1.4 1.8 Provision (Benefit) For Income Taxes 5.5 3.7 27.2 29.7 24.0 19.6 (0.0) 0.5 (1.1) (1.2) 1.2 2.6 5.5 4.2 26.2 28.5 25.2 22.3 Depreciation and Amortization 3.3 3.5 9.4 12.4 13.3 14.1 3.2 2.9 13.8 13.8 12.9 12.4 6.5 6.4 23.2 26.2 26.1 26.4 EBITDA 17.5 18.2 80.7 89.5 79.0 84.1 16.1 0.8 (38.7) (32.8) 25.4 (0.4) 33.6 19.0 41.9 56.7 104.5 83.7 Asset Impairment - - - - - 0.7 - - - 19.6 - 9.2 - - - 19.6 - 9.9 Transaction Expense - 1.6 - - - 1.6 - - - - - 0.5 - 1.6 - - - 2.1 Restructuring and Related Expense 0.0 - - 0.9 0.2 - 0.3 0.0 12.2 9.0 2.8 4.2 0.3 0.0 12.2 9.8 3.0 4.2 Value Enhancement Initiative Implementation 2.2 1.1 - 2.0 6.1 3.7 0.2 - - 2.6 0.8 0.0 2.4 1.1 - 4.6 6.9 3.7 Equity in Net Loss (Gain) of Investee - - - - - - 0.5 (0.0) 11.0 8.5 1.4 (0.1) 0.5 (0.0) 11.0 8.5 1.4 (0.1) (Gain) on Sale of Business - - - - - - (12.6) 0.7 - - (12.4) 0.9 (12.6) 0.7 - - (12.4) 0.9 Ingeus Acquisition Related Cost / Income - - - - - - - - 29.2 - (2.0) (2.0) - - 29.2 - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - (2.5) - - - - - (2.5) - - - Foreign Currency (Gain) / Loss - - - - - - 0.2 (0.2) (0.9) (1.4) 0.3 (1.1) 0.2 (0.2) (0.9) (1.4) 0.3 (1.1) Litigation Expense - - - - - - - - - - - - - - - - - - Other - - - - - - - 2.4 - - - 2.4 - 2.4 - - - 2.4 Adjusted EBITDA 19.7 20.9 80.7 92.4 85.3 90.0 4.6 3.7 10.3 5.5 16.3 13.6 24.3 24.6 91.0 97.8 101.7 103.7 % Margin 6.1% 6.1% 7.4% 7.5% 6.5% 6.6% 5.5% 4.8% 2.6% 1.6% 5.3% 4.7% 5.9% 5.8% 6.2% 6.2% 6.3% 6.3% Latest available financials – At Q3 WD Services had not met the criteria to be presented as discontinued operations 17

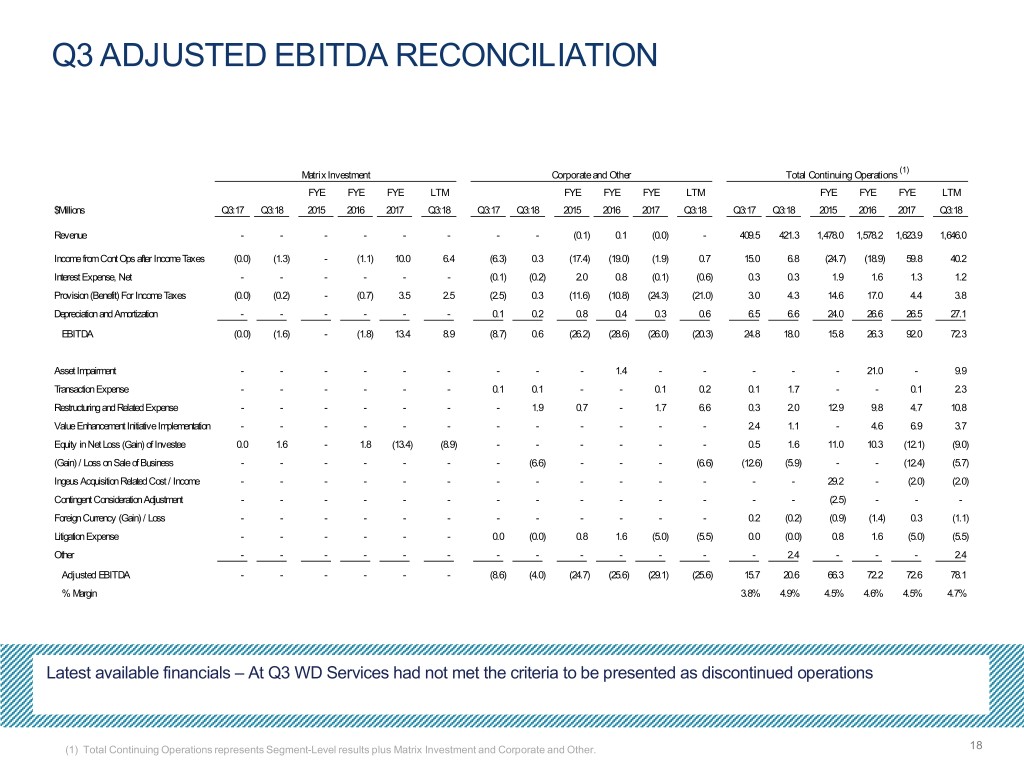

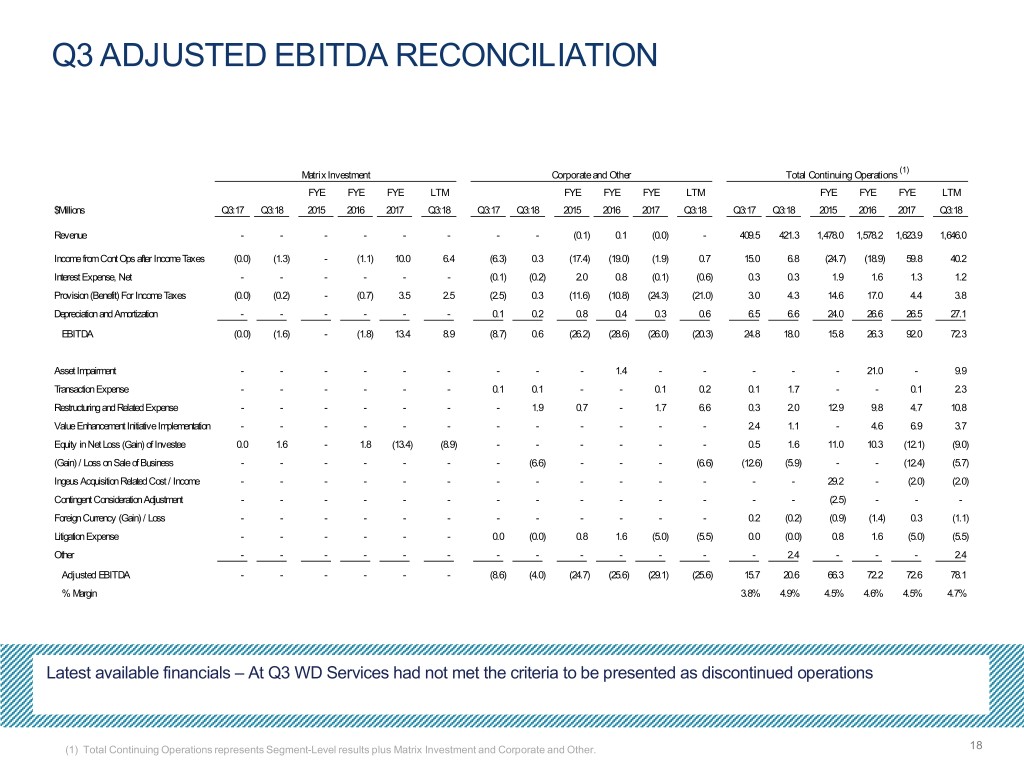

Q3 ADJUSTED EBITDA RECONCILIATION (1) Matrix Investment Corporate and Other Total Continuing Operations FYE FYE FYE LTM FYE FYE FYE LTM FYE FYE FYE LTM $Millions Q3:17 Q3:18 2015 2016 2017 Q3:18 Q3:17 Q3:18 2015 2016 2017 Q3:18 Q3:17 Q3:18 2015 2016 2017 Q3:18 Revenue - - - - - - - - (0.1) 0.1 (0.0) - 409.5 421.3 1,478.0 1,578.2 1,623.9 1,646.0 Income from Cont Ops after Income Taxes (0.0) (1.3) - (1.1) 10.0 6.4 (6.3) 0.3 (17.4) (19.0) (1.9) 0.7 15.0 6.8 (24.7) (18.9) 59.8 40.2 Interest Expense, Net - - - - - - (0.1) (0.2) 2.0 0.8 (0.1) (0.6) 0.3 0.3 1.9 1.6 1.3 1.2 Provision (Benefit) For Income Taxes (0.0) (0.2) - (0.7) 3.5 2.5 (2.5) 0.3 (11.6) (10.8) (24.3) (21.0) 3.0 4.3 14.6 17.0 4.4 3.8 Depreciation and Amortization - - - - - - 0.1 0.2 0.8 0.4 0.3 0.6 6.5 6.6 24.0 26.6 26.5 27.1 EBITDA (0.0) (1.6) - (1.8) 13.4 8.9 (8.7) 0.6 (26.2) (28.6) (26.0) (20.3) 24.8 18.0 15.8 26.3 92.0 72.3 Asset Impairment - - - - - - - - - 1.4 - - - - - 21.0 - 9.9 Transaction Expense - - - - - - 0.1 0.1 - - 0.1 0.2 0.1 1.7 - - 0.1 2.3 Restructuring and Related Expense - - - - - - - 1.9 0.7 - 1.7 6.6 0.3 2.0 12.9 9.8 4.7 10.8 Value Enhancement Initiative Implementation - - - - - - - - - - - - 2.4 1.1 - 4.6 6.9 3.7 Equity in Net Loss (Gain) of Investee 0.0 1.6 - 1.8 (13.4) (8.9) - - - - - - 0.5 1.6 11.0 10.3 (12.1) (9.0) (Gain) / Loss on Sale of Business - - - - - - - (6.6) - - - (6.6) (12.6) (5.9) - - (12.4) (5.7) Ingeus Acquisition Related Cost / Income - - - - - - - - - - - - - - 29.2 - (2.0) (2.0) Contingent Consideration Adjustment - - - - - - - - - - - - - - (2.5) - - - Foreign Currency (Gain) / Loss - - - - - - - - - - - - 0.2 (0.2) (0.9) (1.4) 0.3 (1.1) Litigation Expense - - - - - - 0.0 (0.0) 0.8 1.6 (5.0) (5.5) 0.0 (0.0) 0.8 1.6 (5.0) (5.5) Other - - - - - - - - - - - - - 2.4 - - - 2.4 Adjusted EBITDA - - - - - - (8.6) (4.0) (24.7) (25.6) (29.1) (25.6) 15.7 20.6 66.3 72.2 72.6 78.1 % Margin 3.8% 4.9% 4.5% 4.6% 4.5% 4.7% Latest available financials – At Q3 WD Services had not met the criteria to be presented as discontinued operations (1) Total Continuing Operations represents Segment-Level results plus Matrix Investment and Corporate and Other. 18

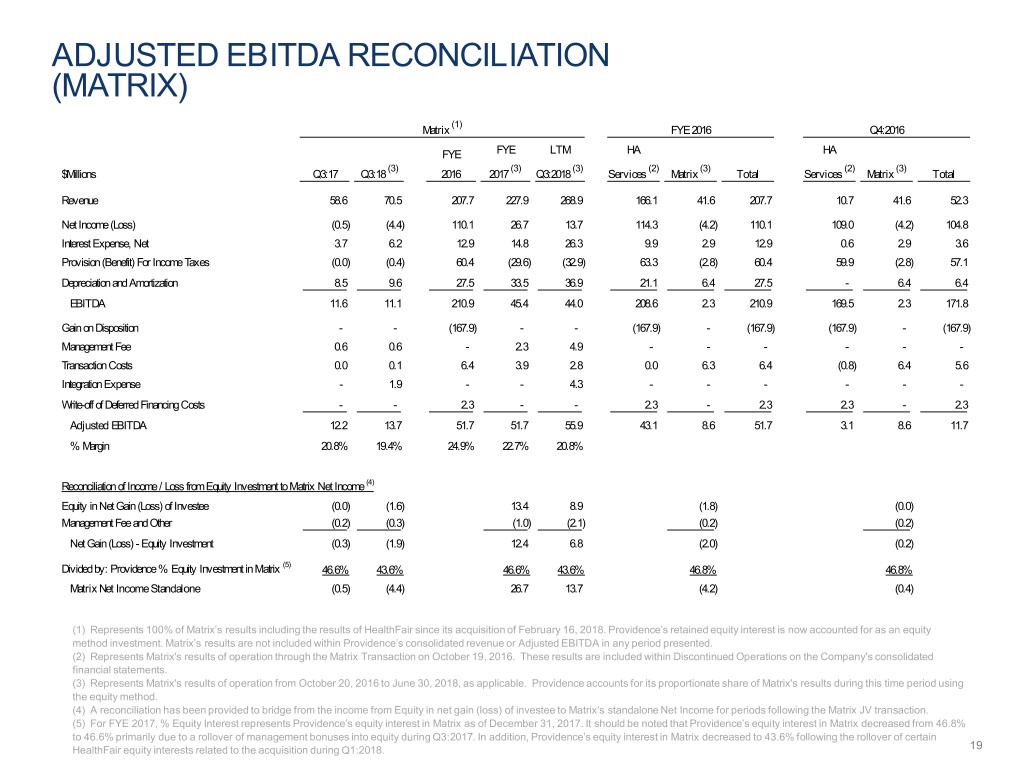

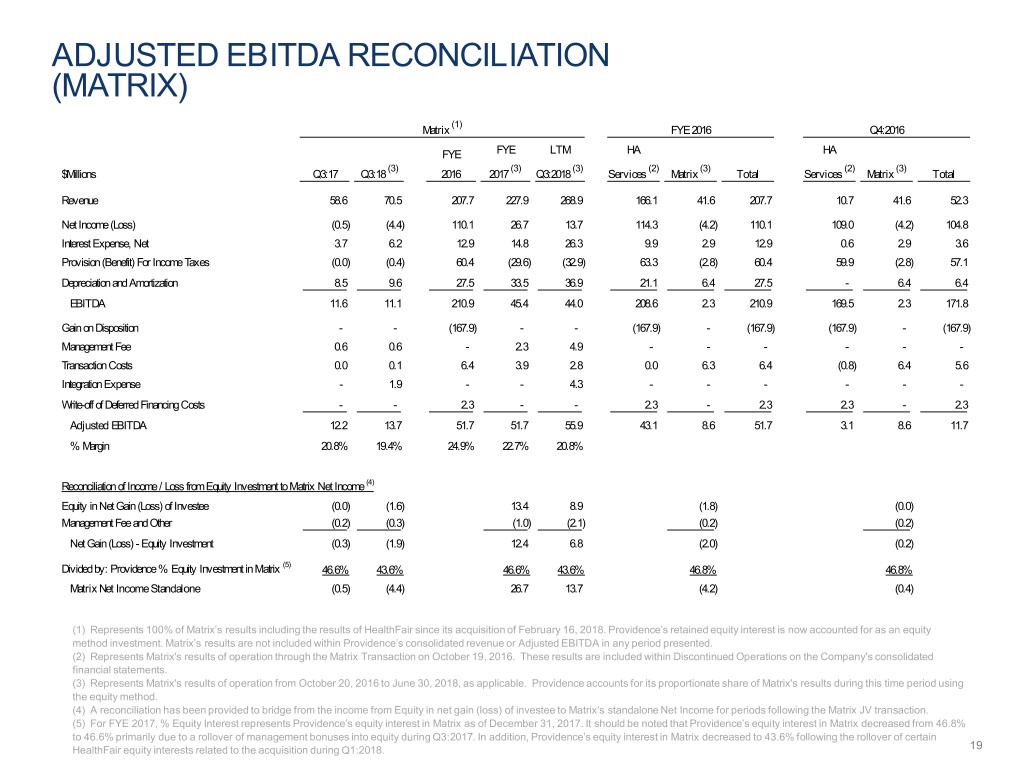

ADJUSTED EBITDA RECONCILIATION (MATRIX) (1) Matrix FYE 2016 Q4:2016 FYE FYE LTM HA HA (3) (3) (3) (2) (3) (2) (3) $Millions Q3:17 Q3:18 2016 2017 Q3:2018 Services Matrix Total Services Matrix Total Revenue 58.6 70.5 207.7 227.9 268.9 166.1 41.6 207.7 10.7 41.6 52.3 Net Income (Loss) (0.5) (4.4) 110.1 26.7 13.7 114.3 (4.2) 110.1 109.0 (4.2) 104.8 Interest Expense, Net 3.7 6.2 12.9 14.8 26.3 9.9 2.9 12.9 0.6 2.9 3.6 Provision (Benefit) For Income Taxes (0.0) (0.4) 60.4 (29.6) (32.9) 63.3 (2.8) 60.4 59.9 (2.8) 57.1 Depreciation and Amortization 8.5 9.6 27.5 33.5 36.9 21.1 6.4 27.5 - 6.4 6.4 EBITDA 11.6 11.1 210.9 45.4 44.0 208.6 2.3 210.9 169.5 2.3 171.8 Gain on Disposition - - (167.9) - - (167.9) - (167.9) (167.9) - (167.9) Management Fee 0.6 0.6 - 2.3 4.9 - - - - - - Transaction Costs 0.0 0.1 6.4 3.9 2.8 0.0 6.3 6.4 (0.8) 6.4 5.6 Integration Expense - 1.9 - - 4.3 - - - - - - Write-off of Deferred Financing Costs - - 2.3 - - 2.3 - 2.3 2.3 - 2.3 Adjusted EBITDA 12.2 13.7 51.7 51.7 55.9 43.1 8.6 51.7 3.1 8.6 11.7 % Margin 20.8% 19.4% 24.9% 22.7% 20.8% Reconciliation of Income / Loss from Equity Investment to Matrix Net Income (4) Equity in Net Gain (Loss) of Investee (0.0) (1.6) 13.4 8.9 (1.8) (0.0) Management Fee and Other (0.2) (0.3) (1.0) (2.1) (0.2) (0.2) Net Gain (Loss) - Equity Investment (0.3) (1.9) 12.4 6.8 (2.0) (0.2) (5) Divided by: Providence % Equity Investment in Matrix 46.6% 43.6% 46.6% 43.6% 46.8% 46.8% Matrix Net Income Standalone (0.5) (4.4) 26.7 13.7 (4.2) (0.4) (1) Represents 100% of Matrix’s results including the results of HealthFair since its acquisition of February 16, 2018. Providence’s retained equity interest is now accounted for as an equity method investment. Matrix’s results are not included within Providence’s consolidated revenue or Adjusted EBITDA in any period presented. (2) Represents Matrix's results of operation through the Matrix Transaction on October 19, 2016. These results are included within Discontinued Operations on the Company's consolidated financial statements. (3) Represents Matrix's results of operation from October 20, 2016 to June 30, 2018, as applicable. Providence accounts for its proportionate share of Matrix's results during this time period using the equity method. (4) A reconciliation has been provided to bridge from the income from Equity in net gain (loss) of investee to Matrix’s standalone Net Income for periods following the Matrix JV transaction. (5) For FYE 2017, % Equity Interest represents Providence’s equity interest in Matrix as of December 31, 2017. It should be noted that Providence’s equity interest in Matrix decreased from 46.8% to 46.6% primarily due to a rollover of management bonuses into equity during Q3:2017. In addition, Providence’s equity interest in Matrix decreased to 43.6% following the rollover of certain HealthFair equity interests related to the acquisition during Q1:2018. 19