May 2022 Investor Presentation Copyright © 2022 ModivCare® Inc.

Forward Looking Statements Copyright © 2022 ModivCare® Inc. 2 Certain statements contained in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictive in nature and are frequently identified by the use of terms such as “may,” “will,” “should,” “expect,” “believe,” “estimate,” “intend,” and similar words indicating possible future expectations, events or actions. Such forward-looking statements are based on current expectations, assumptions, estimates and projections about our business and our industry, and are not guarantees of our future performance. These statements are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control or predict, which may cause actual events to be materially different from those expressed or implied herein, including but not limited to: the early termination or non-renewal of contracts; our ability to successfully respond to governmental requests for proposal; our ability to fulfill our contractual obligations; our ability to identify and successfully complete and integrate acquisitions; our ability to identify and realize the benefits of strategic initiatives; the loss of any of the significant payors from whom we generate a significant amount of our revenue; our ability to accurately estimate the cost of performing under certain capitated contracts; our ability to match the timing of the costs of new contracts with its related revenue; the outcome of pending or future litigation; our ability to attract and retain senior management and other qualified employees; the accuracy of representations and warranties and strength of related indemnities provided to us in acquisitions or claims made against us for representations and warranties and related indemnities in our dispositions; our ability to effectively compete in the marketplace; inadequacies in or security breaches of our information technology systems, including our ability to protect private data; the impact of COVID-19 on us (including: the duration and scope of the pandemic; governmental, business and individuals’ actions taken in response to the pandemic; economic activity and actions taken in response; the effect on our clients and client demand for our services; and the ability of our clients to pay for our services); seasonal fluctuations in our operations; impairment of long-lived assets; the adequacy of our insurance coverage for automobile, general liability, professional liability and workers’ compensation; damage to our reputation by inaccurate, misleading or negative media coverage; our ability to comply with government healthcare and other regulations; changes in budgetary priorities of government entities that fund our services; failure to adequately comply with patient and service user information regulations; possible actions under Medicare and Medicaid programs for false claims or recoupment of funds for noncompliance; changes in the regulatory landscape applicable to Matrix; changes to our estimated income tax liability from audits or otherwise; our ability to meet restrictive covenants in our credit agreement; and the accuracy of our accounting estimates and assumptions. The Company has provided additional information in our annual report on Form 10-K and subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to update or revise any forward- looking statements contained in this presentation, whether as a result of new information, future events or otherwise, except as required by applicable law. Non-GAAP Financial Information In addition to the financial measures prepared in accordance with generally accepted accounting principles in the United States ("GAAP"), this investor presentation includes EBITDA, Adjusted EBITDA and Adjusted EBITDA margin for the Company and its segments, pro forma presentations of such financial measures that adjust for the acquisitions identified herein, and EBITDA and Adjusted EBITDA for the Company’s Matrix equity investment, which are performance measures that are not recognized under GAAP. EBITDA is defined as income (loss) from continuing operations, net of taxes, before: (1) interest expense, net, (2) provision (benefit) for income taxes and (3) depreciation and amortization. Adjusted EBITDA is calculated as EBITDA before (as applicable): (1) restructuring and related charges, including severance and office closure and professional services costs, (2) certain transaction and related costs, (3) cash settled equity, (4) stock-based compensation, (5) COVID-19 related costs, net of grant income, and (6) equity in net (income) loss of investee. Adjusted EBITDA margin is calculated as Adjusted EBITDA, divided by Service revenue, net. Our non-GAAP performance measures exclude expenses and amounts that are not driven by our core operating results and may be one time in nature. Excluding these expenses makes comparisons with prior periods as well as to other companies in our industry more meaningful. We believe such measures allow investors to gain a better understanding of the factors and trends affecting the ongoing operations of our business. We consider our core operations to be the ongoing activities to provide services from which we earn revenue, including direct operating costs and indirect costs to support these activities. In addition, our net income or loss in equity investee is excluded from these measures, as we do not have the ability to manage the venture, allocate resources within the venture, or directly control its operations or performance. Our non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial measures differently. In addition, there are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP, may be different from non-GAAP financial measures used by other companies, and exclude expenses that may have a material impact on our reported financial results. The presentation of non-GAAP financial measures is not intended to be considered in isolation from or as a substitute for the most directly comparable financial measures prepared in accordance with GAAP. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures included below, and not to rely on any single financial measure to evaluate our business.

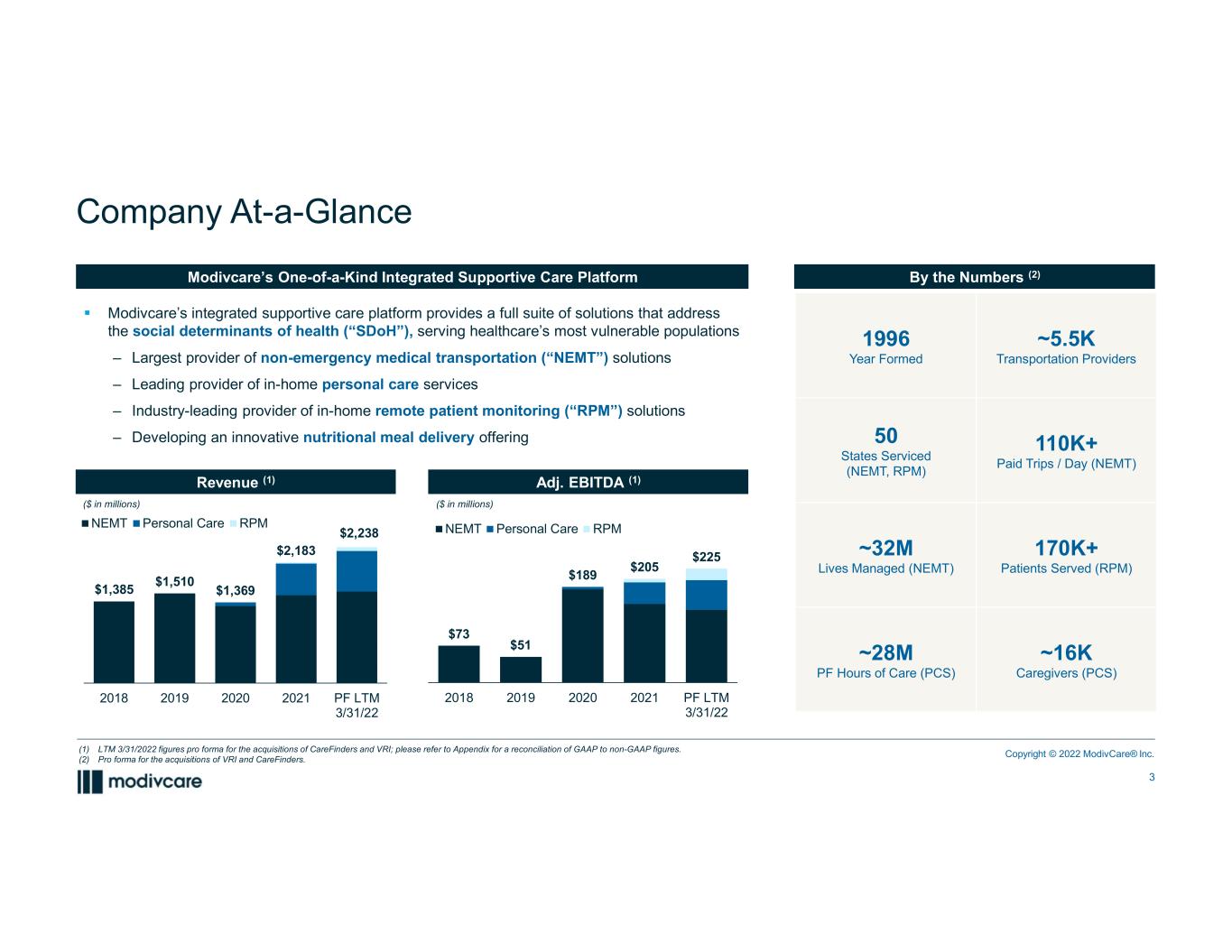

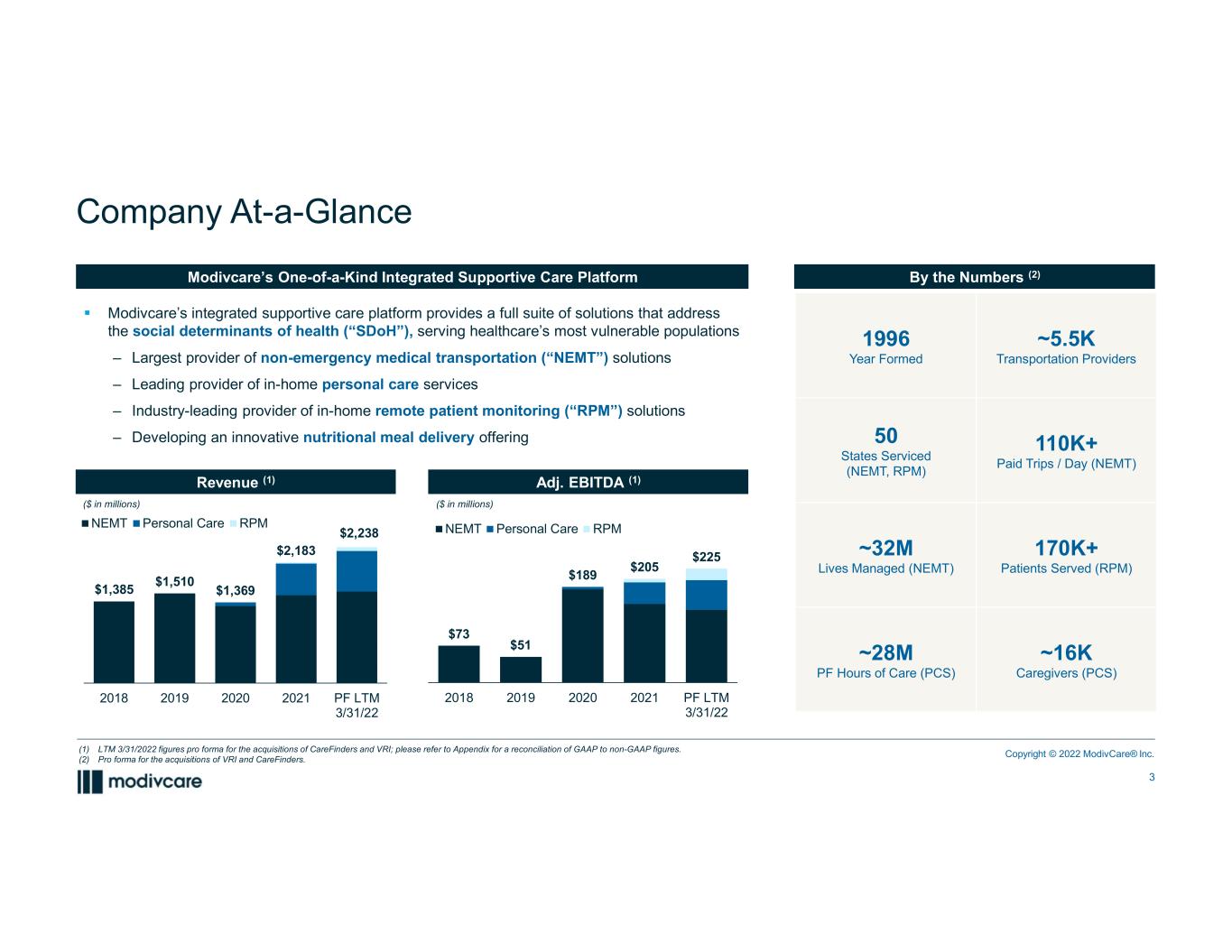

Company At-a-Glance By the Numbers (2)Modivcare’s One-of-a-Kind Integrated Supportive Care Platform 1996 Year Formed ~5.5K Transportation Providers 50 States Serviced (NEMT, RPM) 110K+ Paid Trips / Day (NEMT) ~32M Lives Managed (NEMT) 170K+ Patients Served (RPM) ~28M PF Hours of Care (PCS) ~16K Caregivers (PCS) Revenue (1) Adj. EBITDA (1) $73 $51 $189 $205 $225 2018 2019 2020 2021 PF LTM 3/31/22 NEMT Personal Care RPM ($ in millions) ($ in millions) (1) LTM 3/31/2022 figures pro forma for the acquisitions of CareFinders and VRI; please refer to Appendix for a reconciliation of GAAP to non-GAAP figures. (2) Pro forma for the acquisitions of VRI and CareFinders. $1,385 $1,510 $1,369 $2,183 $2,238 2018 2019 2020 2021 PF LTM 3/31/22 NEMT Personal Care RPM Modivcare’s integrated supportive care platform provides a full suite of solutions that address the social determinants of health (“SDoH”), serving healthcare’s most vulnerable populations ‒ Largest provider of non-emergency medical transportation (“NEMT”) solutions ‒ Leading provider of in-home personal care services ‒ Industry-leading provider of in-home remote patient monitoring (“RPM”) solutions ‒ Developing an innovative nutritional meal delivery offering Copyright © 2022 ModivCare® Inc. 3

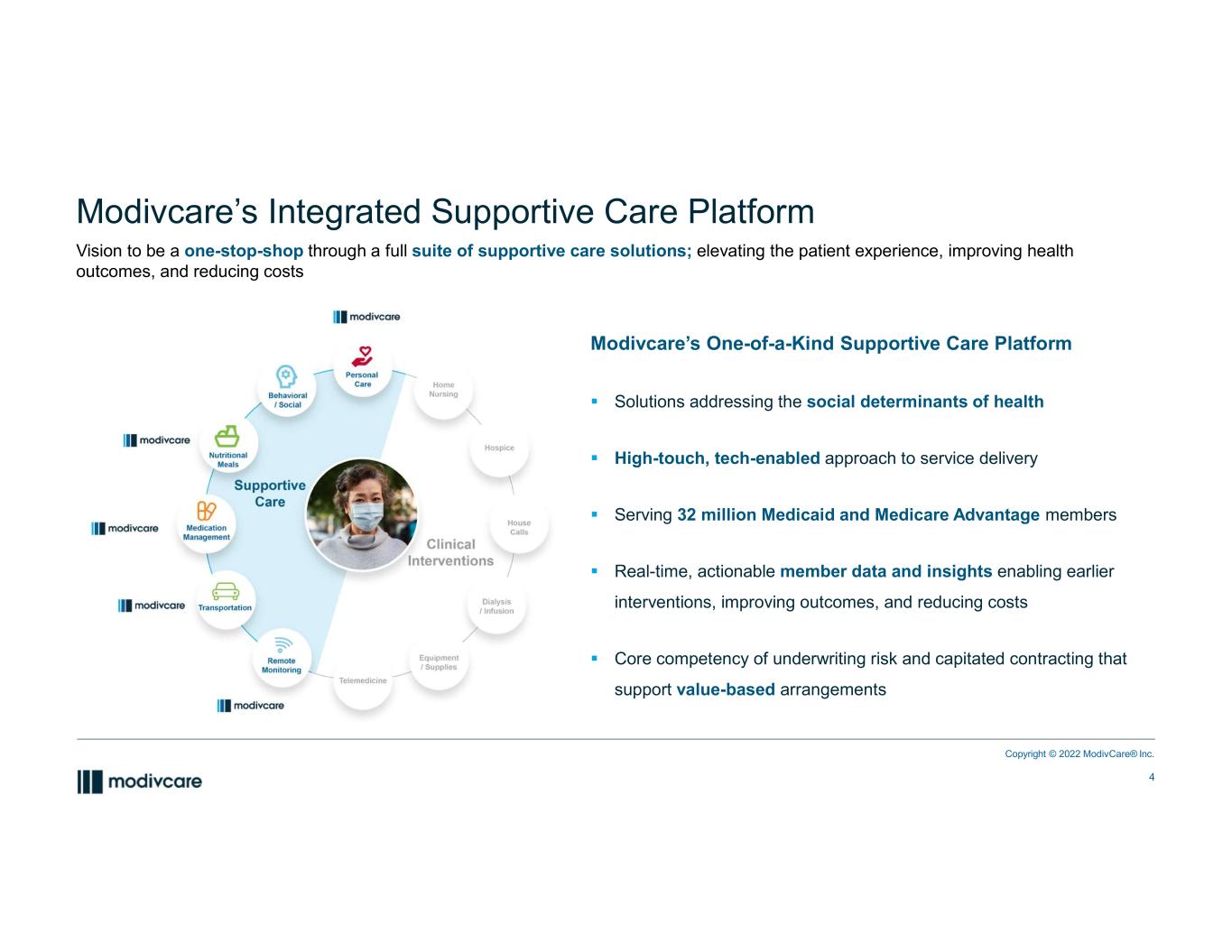

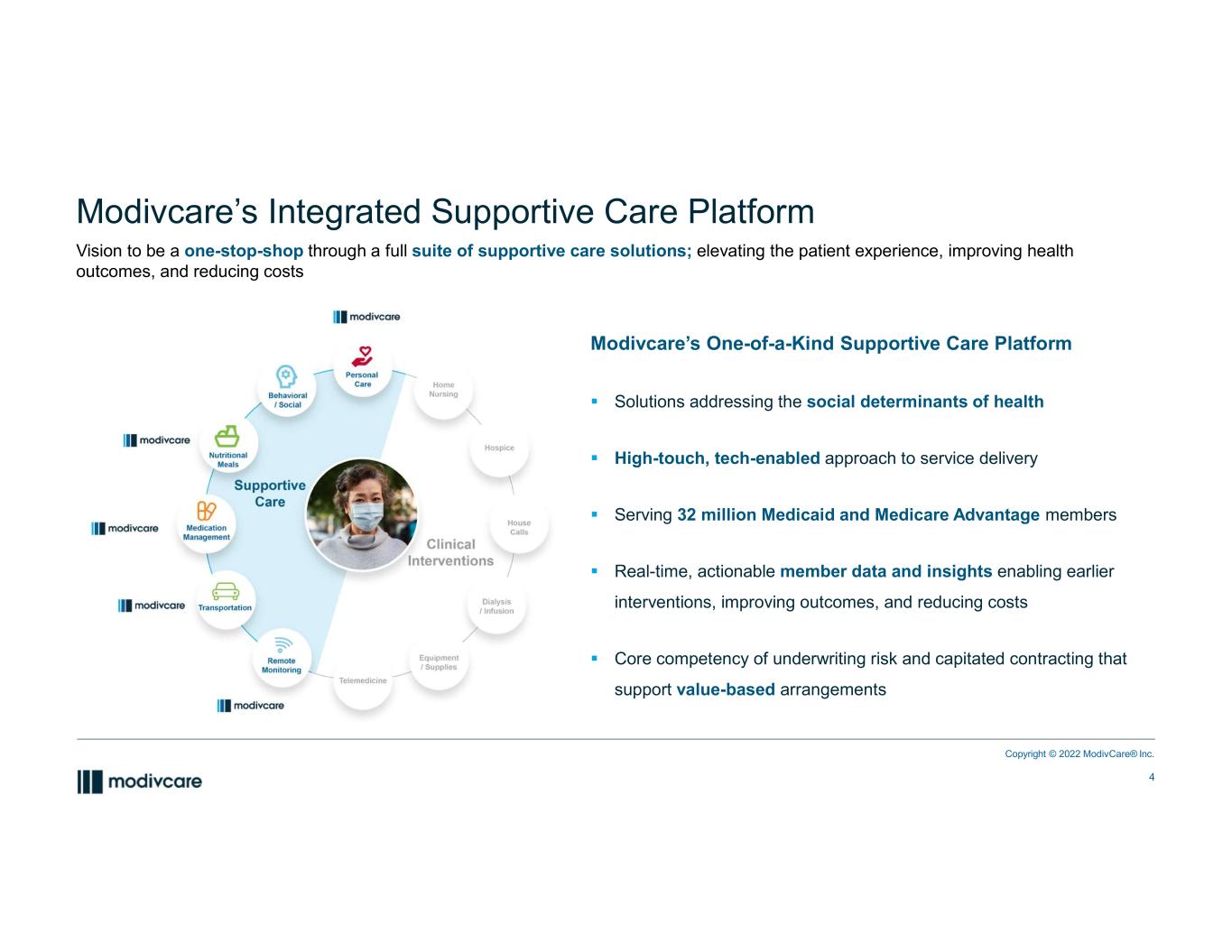

Modivcare’s One-of-a-Kind Supportive Care Platform Solutions addressing the social determinants of health High-touch, tech-enabled approach to service delivery Serving 32 million Medicaid and Medicare Advantage members Real-time, actionable member data and insights enabling earlier interventions, improving outcomes, and reducing costs Core competency of underwriting risk and capitated contracting that support value-based arrangements Modivcare’s Integrated Supportive Care Platform Vision to be a one-stop-shop through a full suite of supportive care solutions; elevating the patient experience, improving health outcomes, and reducing costs Copyright © 2022 ModivCare® Inc. 4

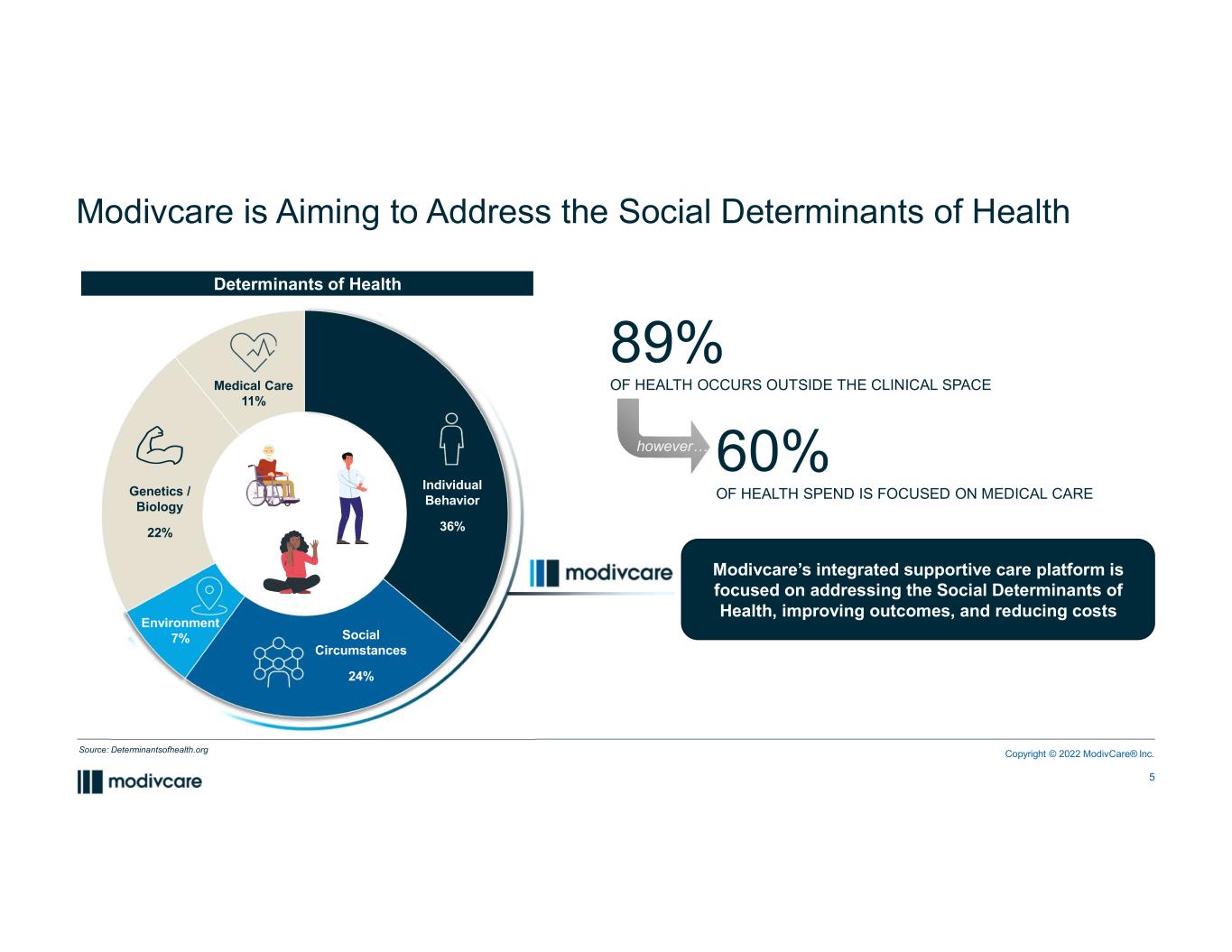

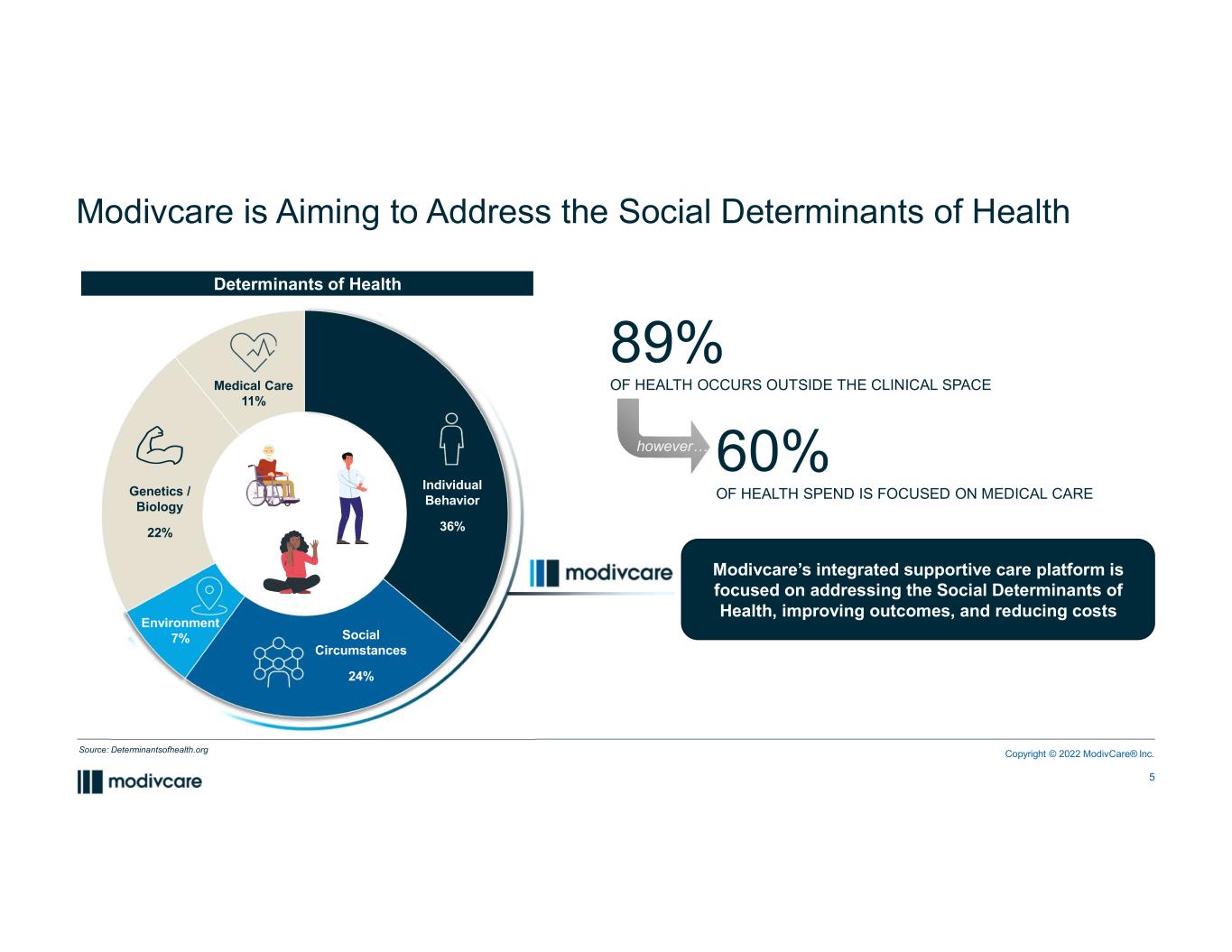

Modivcare is Aiming to Address the Social Determinants of Health Individual Behavior 36% Social Circumstances 24% Medical Care 11% Genetics / Biology 22% Environment 7% Source: Determinantsofhealth.org Determinants of Health 89% OF HEALTH OCCURS OUTSIDE THE CLINICAL SPACE 60% OF HEALTH SPEND IS FOCUSED ON MEDICAL CARE Modivcare’s integrated supportive care platform is focused on addressing the Social Determinants of Health, improving outcomes, and reducing costs however… Copyright © 2022 ModivCare® Inc. 5

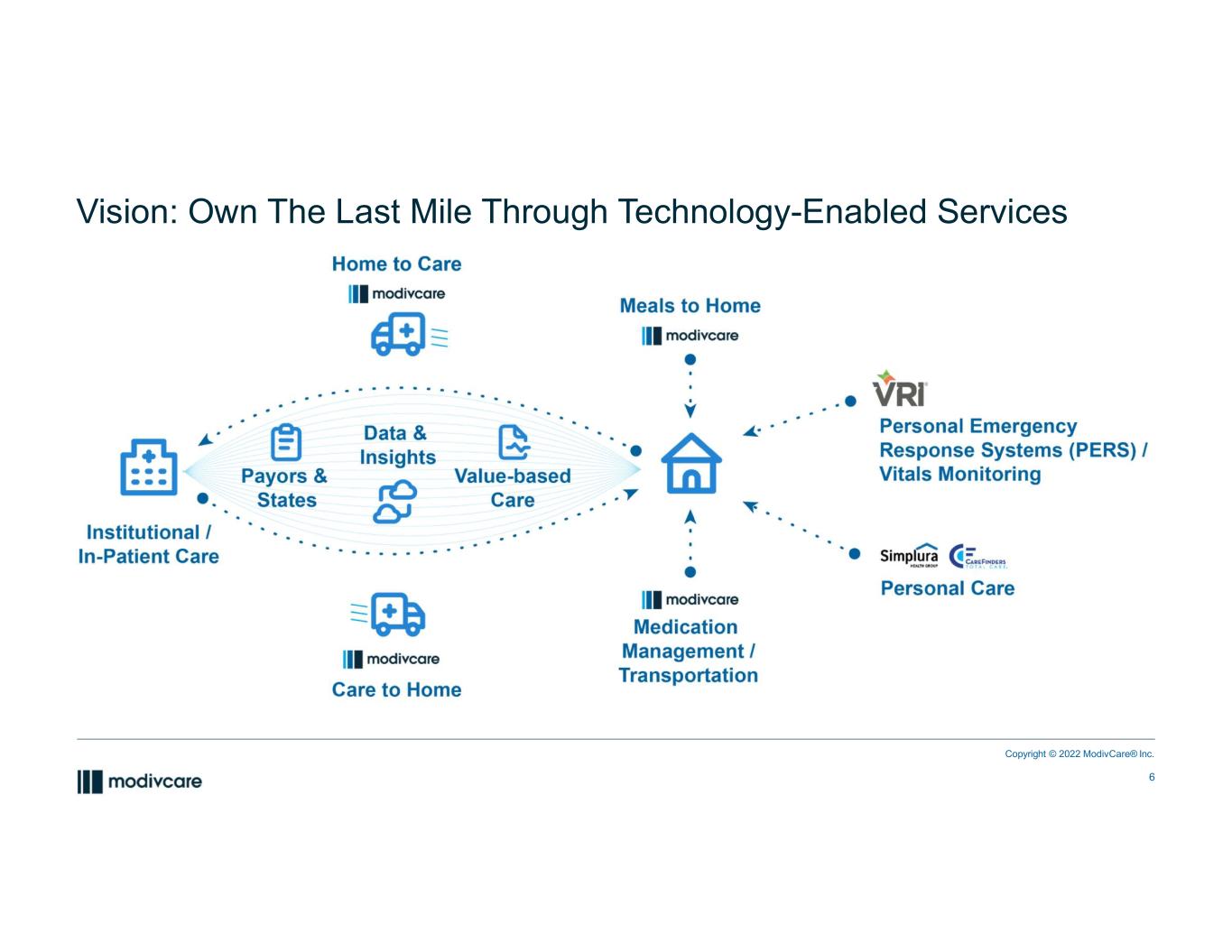

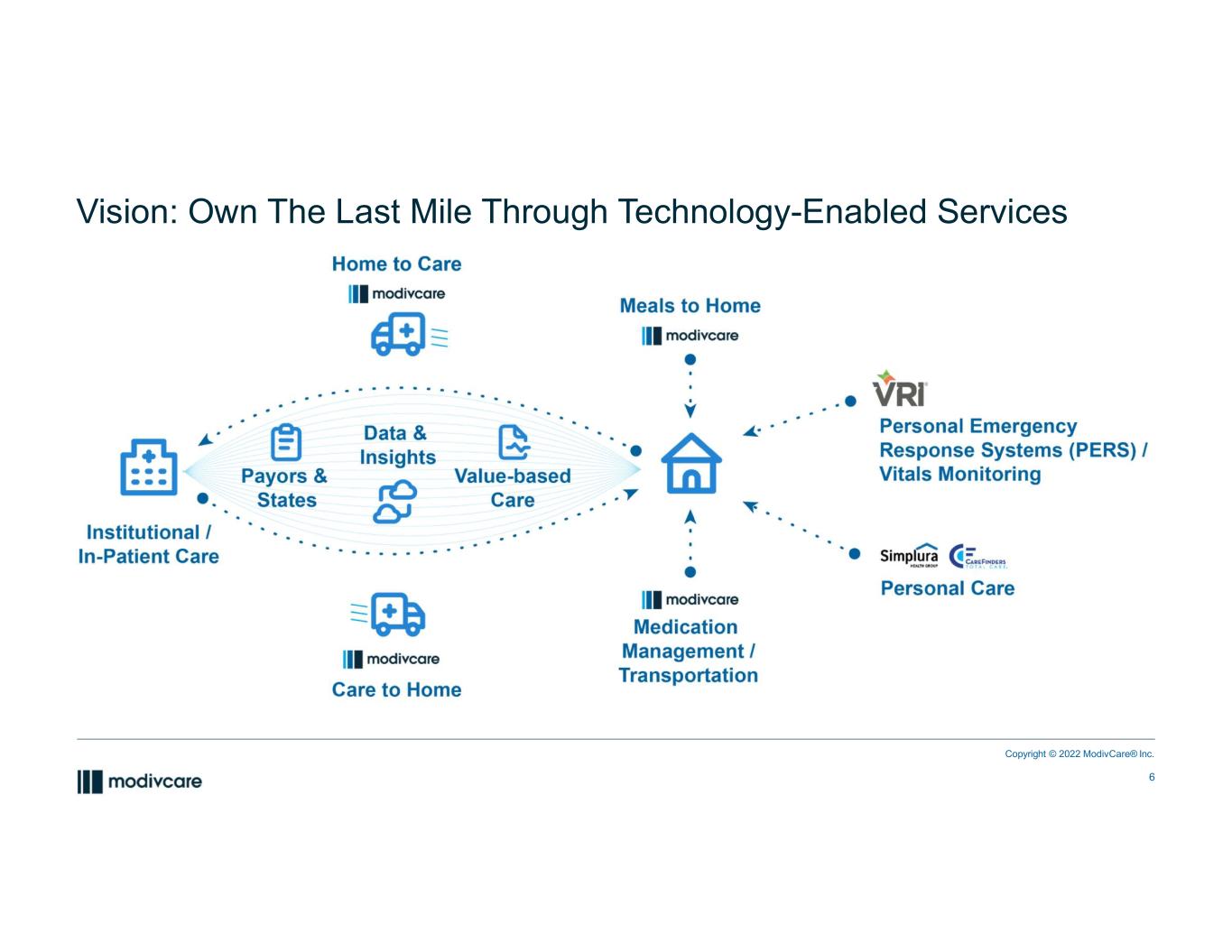

Vision: Own The Last Mile Through Technology-Enabled Services Copyright © 2022 ModivCare® Inc. 6

MCO / State Agency Case Manager Case manager focuses on clinical and supportive care services for members and serves as primary referral source for Modivcare services To the Member ‒ Single point of contact for members to place, schedule, edit, cancel or track their orders for services like food delivery and NEMT ‒ Navigation of options to help members understand their benefits and options, and provide easy access to services ‒ Tailoring of the offerings to cater to unique circumstances of every member, and pro-actively identify and address their needs To the Case Manager ‒ Single point of contact for case managers to streamline management of multiple supportive care services vendors ‒ Enhanced member engagement by interacting with members at multiple touchpoints, ensuring they stay connected Coordinated Connections to Care Value Proposition: Integrated Supportive Care Value Proposition: Integrated Supportive Care Modivcare’s Home offerings are derived through the same referral source: case managers Payor assigns case manager to member post clinical event Remote Monitoring Modivcare’s supportive care offerings built around the case manager create meaningful cross-selling opportunities Member Personal Care Home-Delivered Meals Non-Emergency Transportation 1 2 3 Modivcare coordinates services, gets and transmits member insights from supportive services to the case manager Members can navigate multiple supportive care benefits with single point-of-contact at Modivcare 4 Copyright © 2022 ModivCare® Inc. 7

Seasoned Operators With a Track Record of Execution Excellence Select Executive Leaders Prior Experience DANIEL E. GREENLEAF PRESIDENT & CEO HEATH SAMPSON CHIEF FINANCIAL OFFICER ILIAS SIMPSON PRESIDENT, MODIVCARE MOBILITY JASON ANDERSON PRESIDENT, MODIVCARE HOME Copyright © 2022 ModivCare® Inc. 8

Business Segments

Modivcare’s Divisions MobilityHome NEMT – Largest non-emergency medical transportation manager, serving a $6B market growing to $14B (4) ‒ Enables eligible members whose limited mobility or financial resources hinders their ability to access necessary healthcare and social services ‒ Partners with State Agencies and Managed Care Organizations, with long-term relationships and strong retention rates Payor Mix Contract Type Medicare Advantage Medicaid Capitated (PMPM) Other Personal Care – Leading provider of non-medical personal care services (PCS) to seniors and disabled adults; $55B market growing to $100B (1) Remote Patient Monitoring – Second largest RPM company serving healthcare clients with Connected Devices and Data-Driven Member Engagement; $9B market growing at +10% (2) Meal Delivery – Innovative meal delivery program with a national foodservice provider; $9B market growing to $15B (3) 57% 25% 8% 10% RPM Payor Mix Medicaid Medicare Advantage Care Partners Private Pay By The Numbers (5) ~32M Lives Managed ~110K Paid Trips / Day $1.5B Revenue By The Numbers (5) ~28M PF PCS Hours 170K+ RPM Clients $637M PF PCS Rev $61M PF RPM Rev 88% 7% 5% PCS Payor Mix Note: See Appendix for presentation of Non-GAAP to GAAP reconciliation (1) Represents 2019-2024 Personal Care Services market growth; (2) Represents 2020 Remote Monitoring Core Serviceable Market and CAGR through 2025; (3) Represents Meal Delivery addressable market growth through 2024; (4) Represents 2021 market plus $4B Medicare Advantage market opportunity and $6B Adjacent NEMT market opportunity (5) Figures are pro forma for acquisitions of Simplura, CareFinders, and VRI, for LTM 3/31/22 Medicaid Private Pay Other 88% 12% 85% 15% 1% Both Copyright © 2022 ModivCare® Inc. 10

34% 34% 19% 6% 4% CT 3% One of the largest providers of in-home personal care services (PCS) in the Northeast U.S. following Modivcare’s the acquisitions of Simplura Health Group in November 2020 and CareFinders in September 2021 Modivcare’s personal care aids provide non-medical in-home personal care services to patients, including seniors and disabled adults, in need of assistance with activities of daily living and care monitoring, including: ‒ Grooming, Bathing and Dressing ‒ Light Housecleaning ‒ Grocery Shopping and Light Meal Preparation ‒ Mobility Assistance and Transfers ‒ Medication Reminders ‒ Companionship Services ‒ Recreational Activities and Assistance with Approved Exercise Therapy ‒ Incontinence Care ‒ Respite Care Scaled northeastern operations with regional & local density in 7 states through a network of trusted community-based organizations High customer retention rates with average length of stay of 4 years Industry leading employee retention & low turnover Note: See Appendix for presentation of Non-GAAP to GAAP reconciliation (1) 2019 PCS market per McKinsey research; (2) Represents LTM 3/31/22 pro forma for Simplura and CareFinders acquisitions; (3) Represents actual hours of service, in thousands. ~28M PF Hours of Care ~16K Caregivers $637M PF Revenue ~20K Patients Modivcare’s PCS Geographic Footprint and Revenue by State (2) By the Numbers (2) PA NJ NY MA WV+FL Home: Personal Care Services (PCS) Segment Personal Care Hours (000s) (3) 4,627 4,629 5,075 6,857 6,535 1Q21 2Q21 3Q21 4Q21 1Q22 Copyright © 2022 ModivCare® Inc. 11

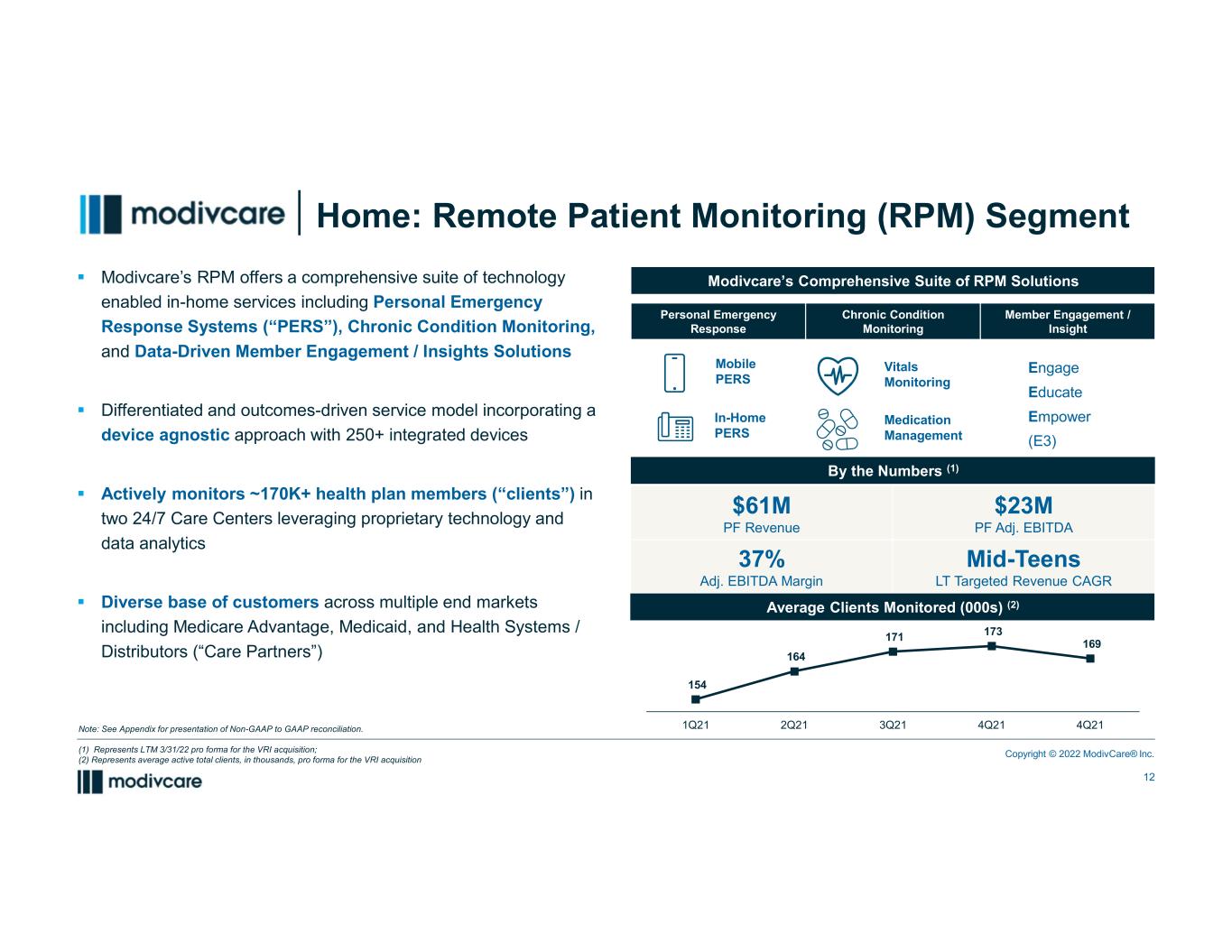

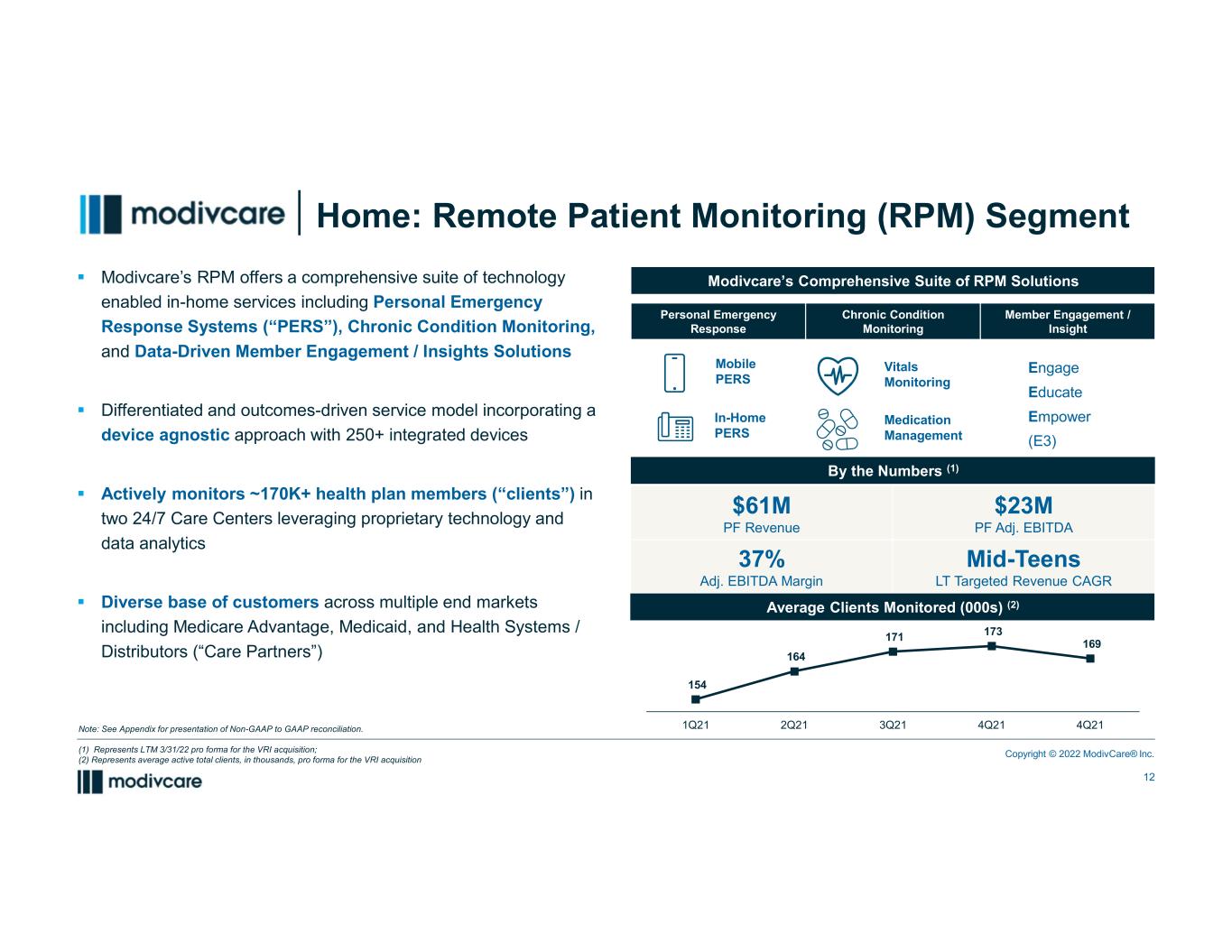

Modivcare’s RPM offers a comprehensive suite of technology enabled in-home services including Personal Emergency Response Systems (“PERS”), Chronic Condition Monitoring, and Data-Driven Member Engagement / Insights Solutions Differentiated and outcomes-driven service model incorporating a device agnostic approach with 250+ integrated devices Actively monitors ~170K+ health plan members (“clients”) in two 24/7 Care Centers leveraging proprietary technology and data analytics Diverse base of customers across multiple end markets including Medicare Advantage, Medicaid, and Health Systems / Distributors (“Care Partners”) Personal Emergency Response Chronic Condition Monitoring Member Engagement / Insight $61M PF Revenue $23M PF Adj. EBITDA 37% Adj. EBITDA Margin Mid-Teens LT Targeted Revenue CAGR Mobile PERS In-Home PERS Vitals Monitoring Medication Management Modivcare’s Comprehensive Suite of RPM Solutions By the Numbers (1) Engage Educate Empower (E3) Note: See Appendix for presentation of Non-GAAP to GAAP reconciliation. (1) Represents LTM 3/31/22 pro forma for the VRI acquisition; (2) Represents average active total clients, in thousands, pro forma for the VRI acquisition Home: Remote Patient Monitoring (RPM) Segment Average Clients Monitored (000s) (2) 154 164 171 173 169 1Q21 2Q21 3Q21 4Q21 4Q21 Copyright © 2022 ModivCare® Inc. 12

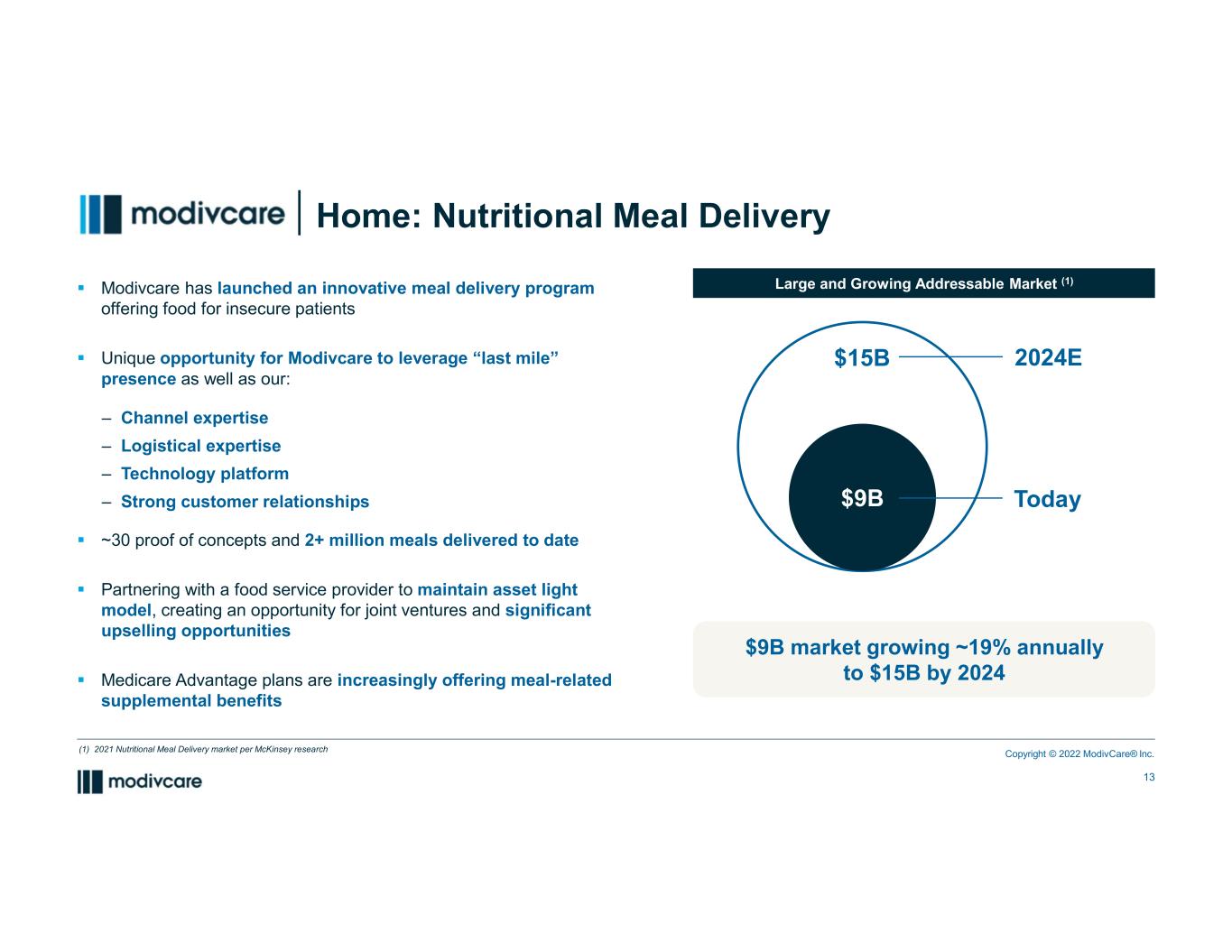

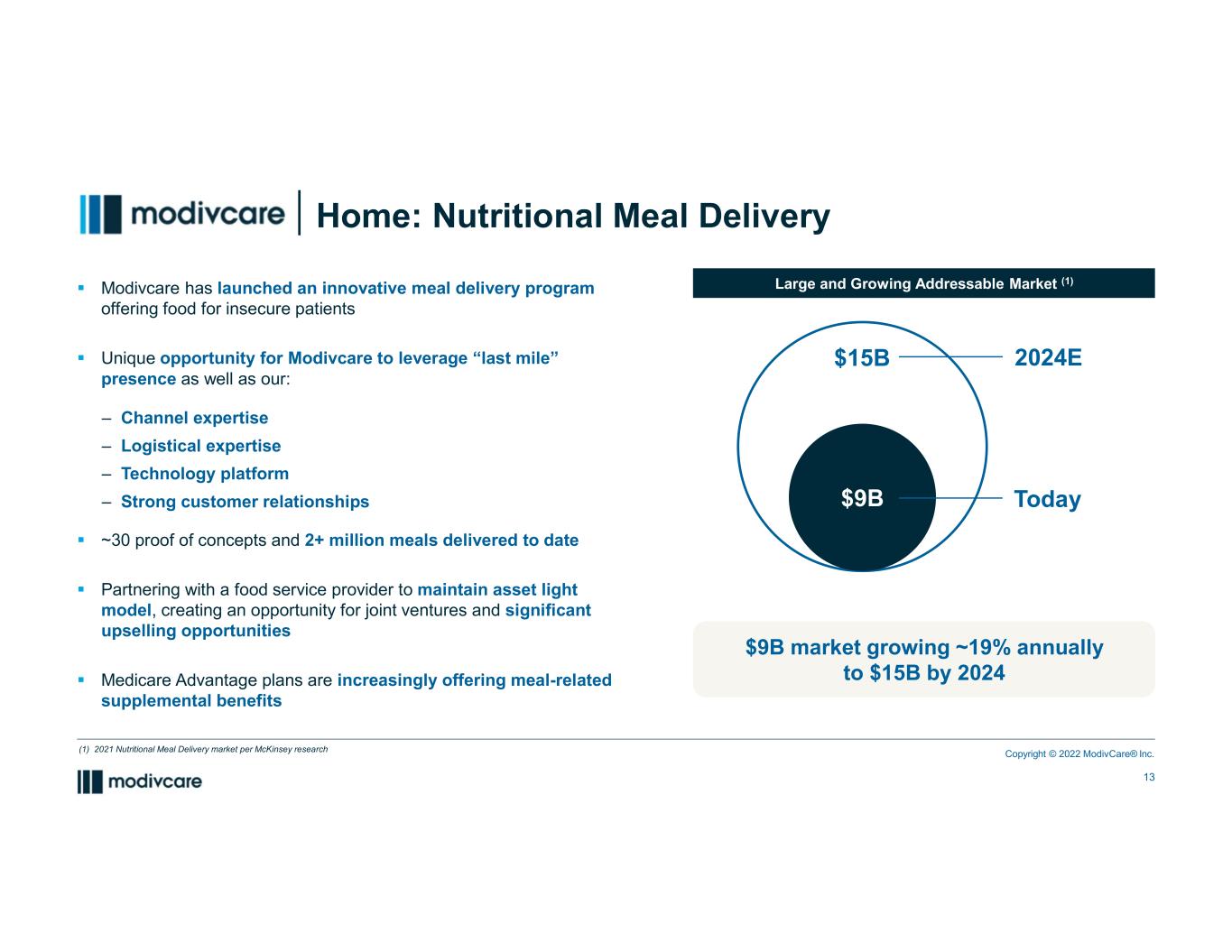

Modivcare has launched an innovative meal delivery program offering food for insecure patients Unique opportunity for Modivcare to leverage “last mile” presence as well as our: ‒ Channel expertise ‒ Logistical expertise ‒ Technology platform ‒ Strong customer relationships ~30 proof of concepts and 2+ million meals delivered to date Partnering with a food service provider to maintain asset light model, creating an opportunity for joint ventures and significant upselling opportunities Medicare Advantage plans are increasingly offering meal-related supplemental benefits Large and Growing Addressable Market (1) $9B Today $15B 2024E $9B market growing ~19% annually to $15B by 2024 Home: Nutritional Meal Delivery (1) 2021 Nutritional Meal Delivery market per McKinsey research Copyright © 2022 ModivCare® Inc. 13

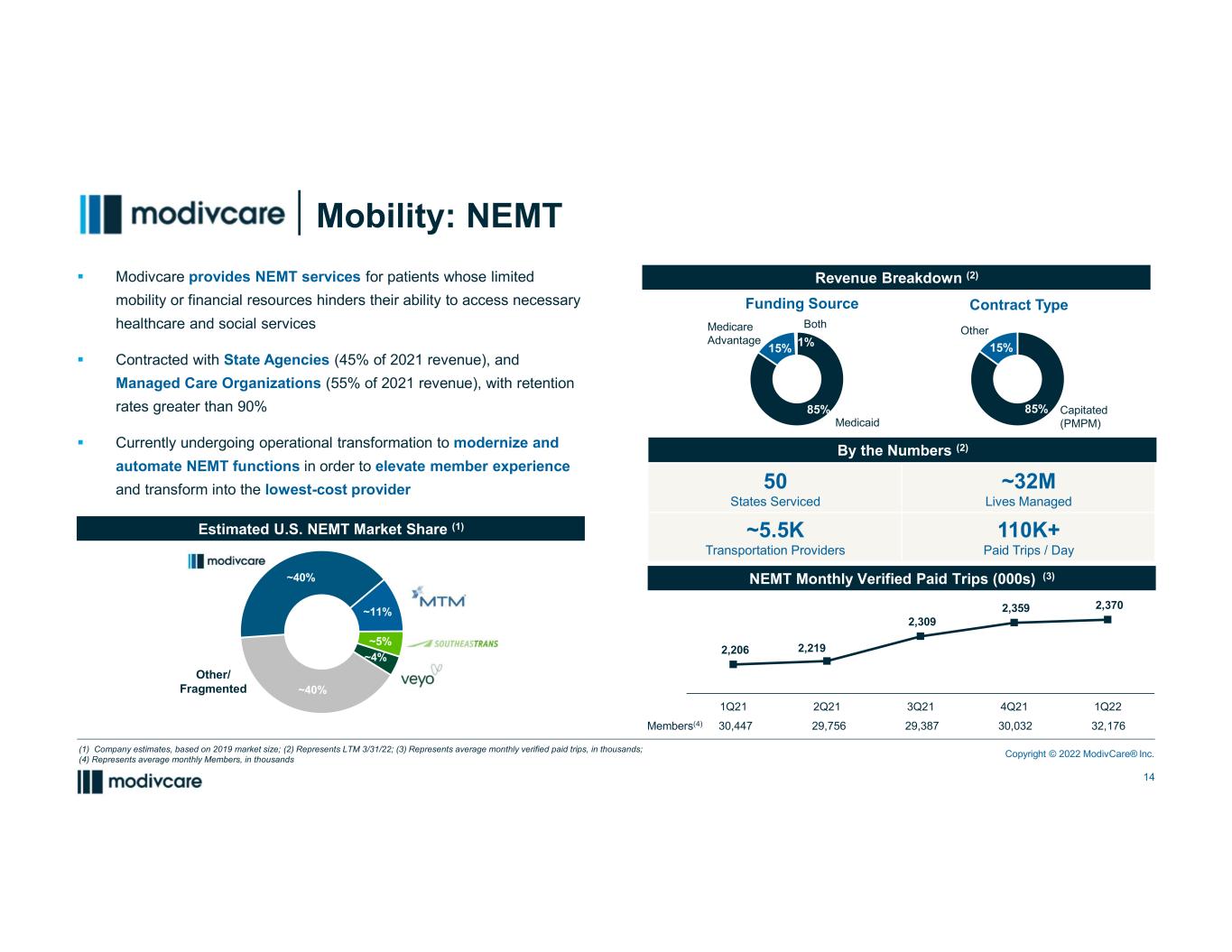

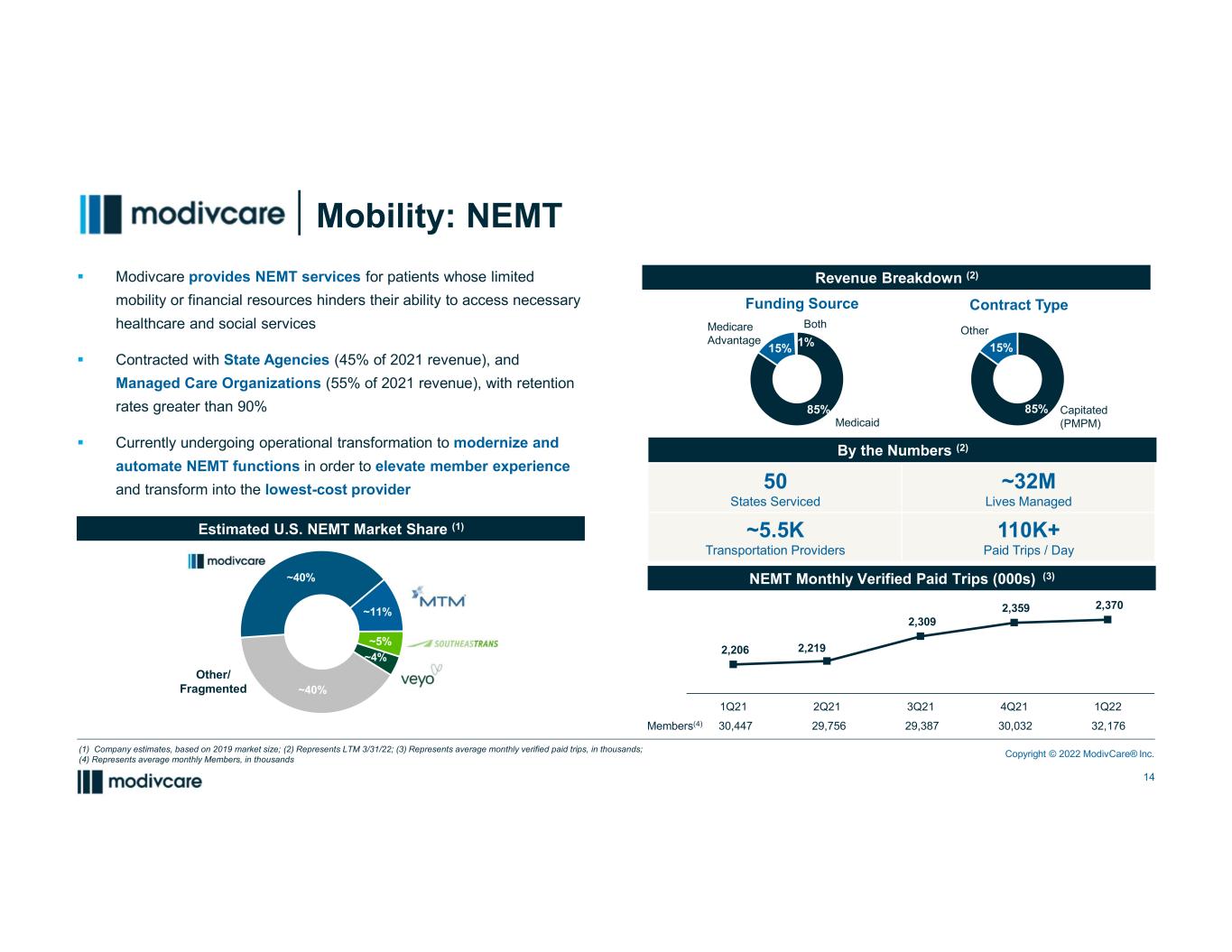

2,206 2,219 2,309 2,359 2,370 1Q21 2Q21 3Q21 4Q21 1Q22 Modivcare provides NEMT services for patients whose limited mobility or financial resources hinders their ability to access necessary healthcare and social services Contracted with State Agencies (45% of 2021 revenue), and Managed Care Organizations (55% of 2021 revenue), with retention rates greater than 90% Currently undergoing operational transformation to modernize and automate NEMT functions in order to elevate member experience and transform into the lowest-cost provider 85% 15% 85% 15% 1% Revenue Breakdown (2) Funding Source Contract Type Medicare Advantage Medicaid Capitated (PMPM) Other By the Numbers (2) Estimated U.S. NEMT Market Share (1) Other/ Fragmented ~11% ~5% ~4% ~40% ~40% 50 States Serviced ~32M Lives Managed ~5.5K Transportation Providers 110K+ Paid Trips / Day (1) Company estimates, based on 2019 market size; (2) Represents LTM 3/31/22; (3) Represents average monthly verified paid trips, in thousands; (4) Represents average monthly Members, in thousands Both Mobility: NEMT NEMT Monthly Verified Paid Trips (000s) (3) Members(4) 30,447 29,756 29,387 30,032 32,176 Copyright © 2022 ModivCare® Inc. 14

Investment Highlights

Investment Highlights • Market Leading Service Offerings • Broadened Addressable Market Through Expanded Solutions Offering • Compelling Value Proposition to Payors • Diversified Growth Strategy • Differentiated Healthcare Mobility Offering • Future Opportunity to Monetize Matrix Equity Investment 1 2 3 4 5 6 Copyright © 2022 ModivCare® Inc. 16

Market Leading Service Offerings1 Remote Patient MonitoringNEMT Personal Care ~40% ~40% 2% Other Other 20-24% 10-12% 8-10% 54-62% ~5% ~4% ~11% Other 98% Transportation Meal delivery (in development) Personal hygiene Dressing Meal preparation Adherence Personal emergency response Vitals / chronic condition monitoring Medication management Health plan member engagement #1 Market Share (1) Leading Provider #2 Market Share (2) (1) Company estimates, based on 2019 market size; Represents Medicaid – PERS, Source: LEK. + Copyright © 2022 ModivCare® Inc. 17

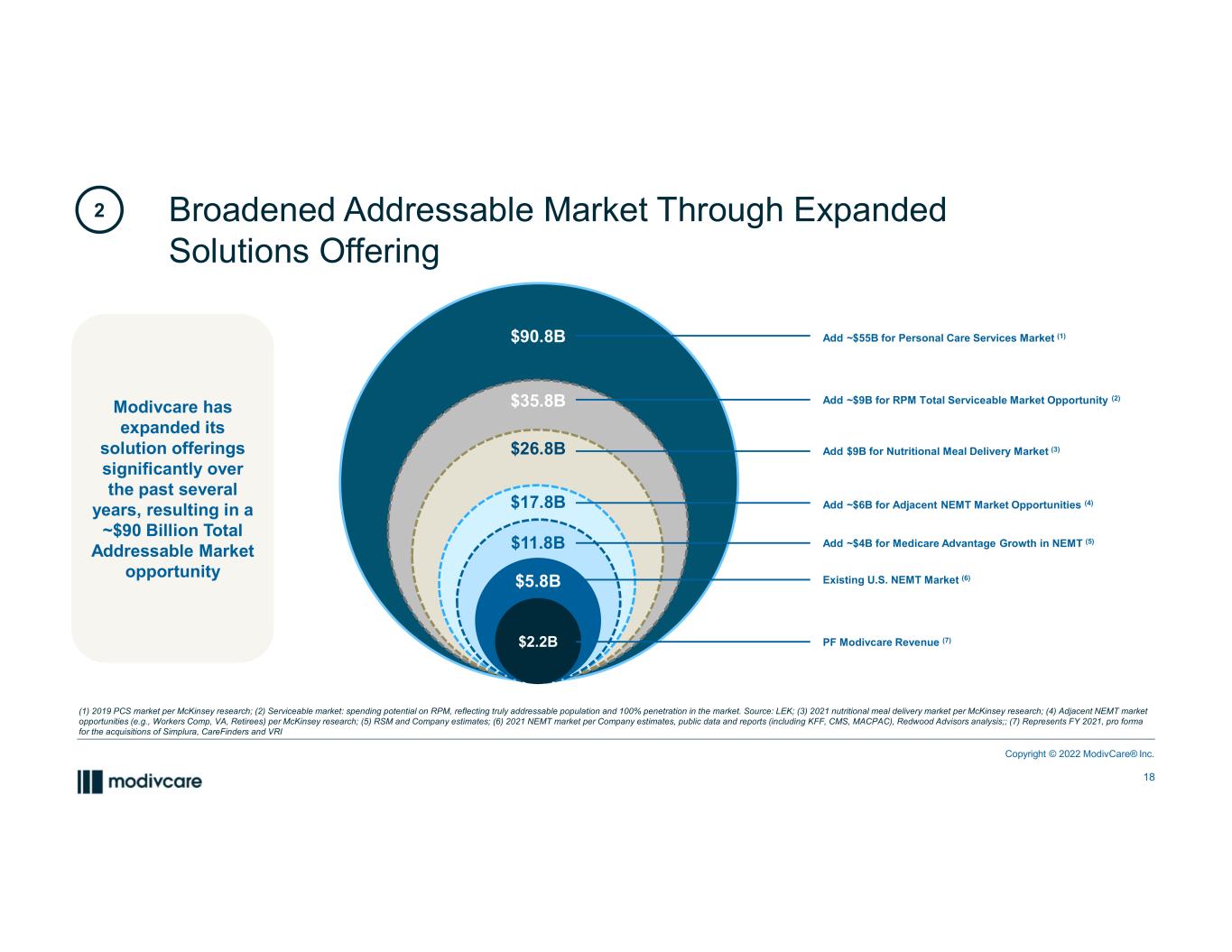

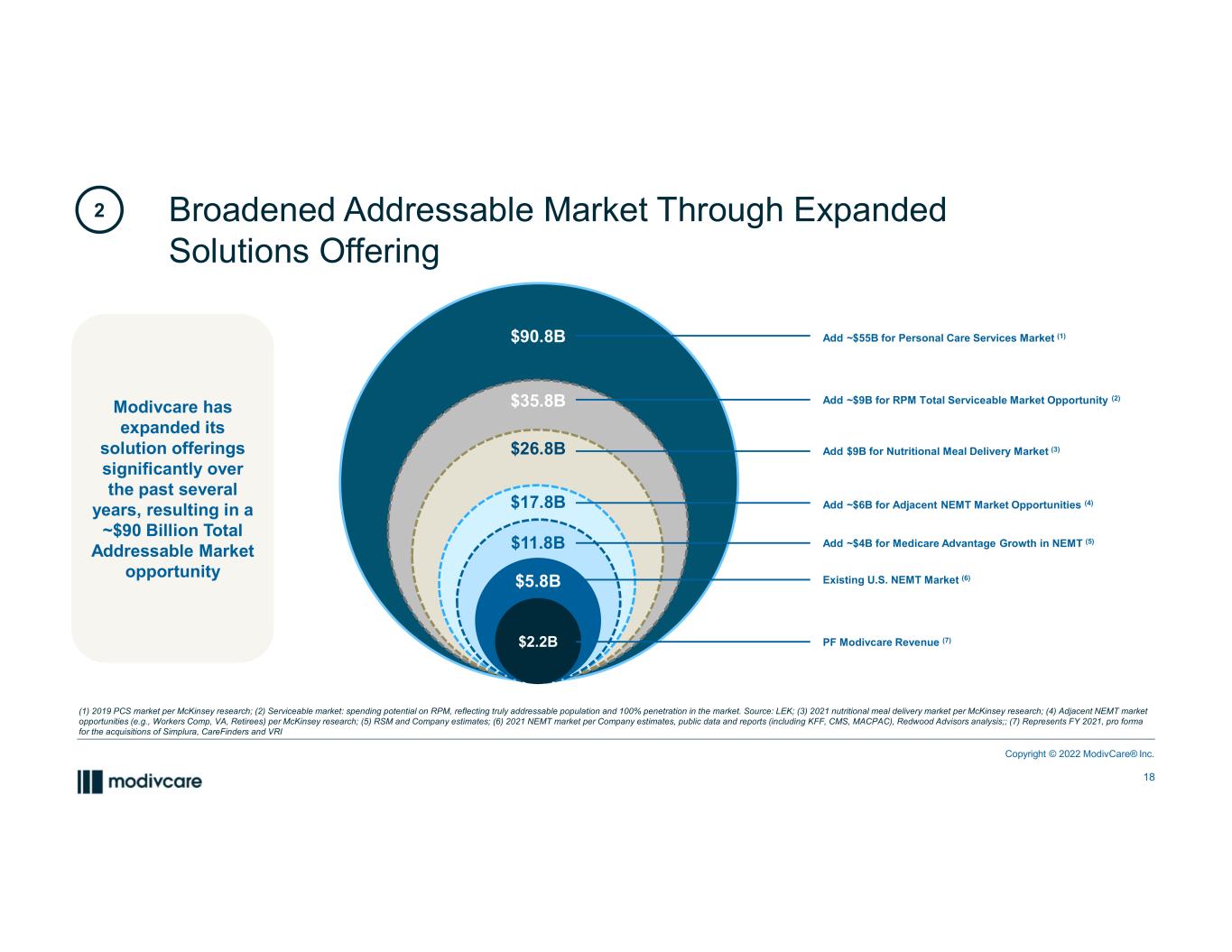

Broadened Addressable Market Through Expanded Solutions Offering 2 Modivcare has expanded its solution offerings significantly over the past several years, resulting in a ~$90 Billion Total Addressable Market opportunity (1) 2019 PCS market per McKinsey research; (2) Serviceable market: spending potential on RPM, reflecting truly addressable population and 100% penetration in the market. Source: LEK; (3) 2021 nutritional meal delivery market per McKinsey research; (4) Adjacent NEMT market opportunities (e.g., Workers Comp, VA, Retirees) per McKinsey research; (5) RSM and Company estimates; (6) 2021 NEMT market per Company estimates, public data and reports (including KFF, CMS, MACPAC), Redwood Advisors analysis;; (7) Represents FY 2021, pro forma for the acquisitions of Simplura, CareFinders and VRI PF Modivcare Revenue (7) Existing U.S. NEMT Market (6) Add ~$4B for Medicare Advantage Growth in NEMT (5) Add ~$55B for Personal Care Services Market (1)$90.8B $35.8B Add ~$9B for RPM Total Serviceable Market Opportunity (2) Add $9B for Nutritional Meal Delivery Market (3) Add ~$6B for Adjacent NEMT Market Opportunities (4) $26.8B $17.8B $2.2B $5.8B $11.8B Copyright © 2022 ModivCare® Inc. 18

Compelling Value Proposition to Payors3 Removes transportation as a barrier to care and addresses the inequities of Social Determinants of Health Facilitates “aging in place” in lower cost settings (patients homes), over higher cost institutional settings Provides increased connectivity inside of the patient’s home, and access to unique patient data and information to close gaps in care and increase patient engagement Focus on value-based care solutions and outcomes that drive lower comprehensive cost of healthcare Leverage data analytics to produce actionable insights to drive proactive patient interventions Promotes better patient outcomes through innovative supporting care solutions that improve quality of care Integrated supportive care model that expands access to care, enhances quality of care and reduces costs Copyright © 2022 ModivCare® Inc. 19

Diversified Growth Strategy4 Addition of strategic platforms advances broader technology and data strategy Provide High Quality Supportive Care to At- Risk Populations Strategic Expansion of “one-stop shop” SDoH solution offering Advance Broader Technology Strategy Capitalize on Evolving Medicare Advantage Momentum Drive organic growth with existing customers and patients through enhanced breadth of services, expanded payor and referral source relationships, and de novo sites (personal care) Continue to allocate capital efficiently to generate strong free cash flows Comprehensive integrated solutions offering as the leading provider of SDoH support services and solutions Opportunities to acquire additional personal care operators, and potential to partner and/or acquire providers of behavioral care services Leverage proprietary technology and analytics infrastructure to synthesize member data and gain insights to drive increased member engagement Utilize real time, actionable member data and insights to bend the cost curve and promote early interventions to improve outcomes Massive market opportunity and well-established momentum in a number of MA plans offering transportation, remote monitoring, meal delivery, and personal care benefits Drive value from member engagement, leveraging increasing demand for data and frequent engagement to drive measureable outcomes for MA plans, as part of value-based care Copyright © 2022 ModivCare® Inc. 20

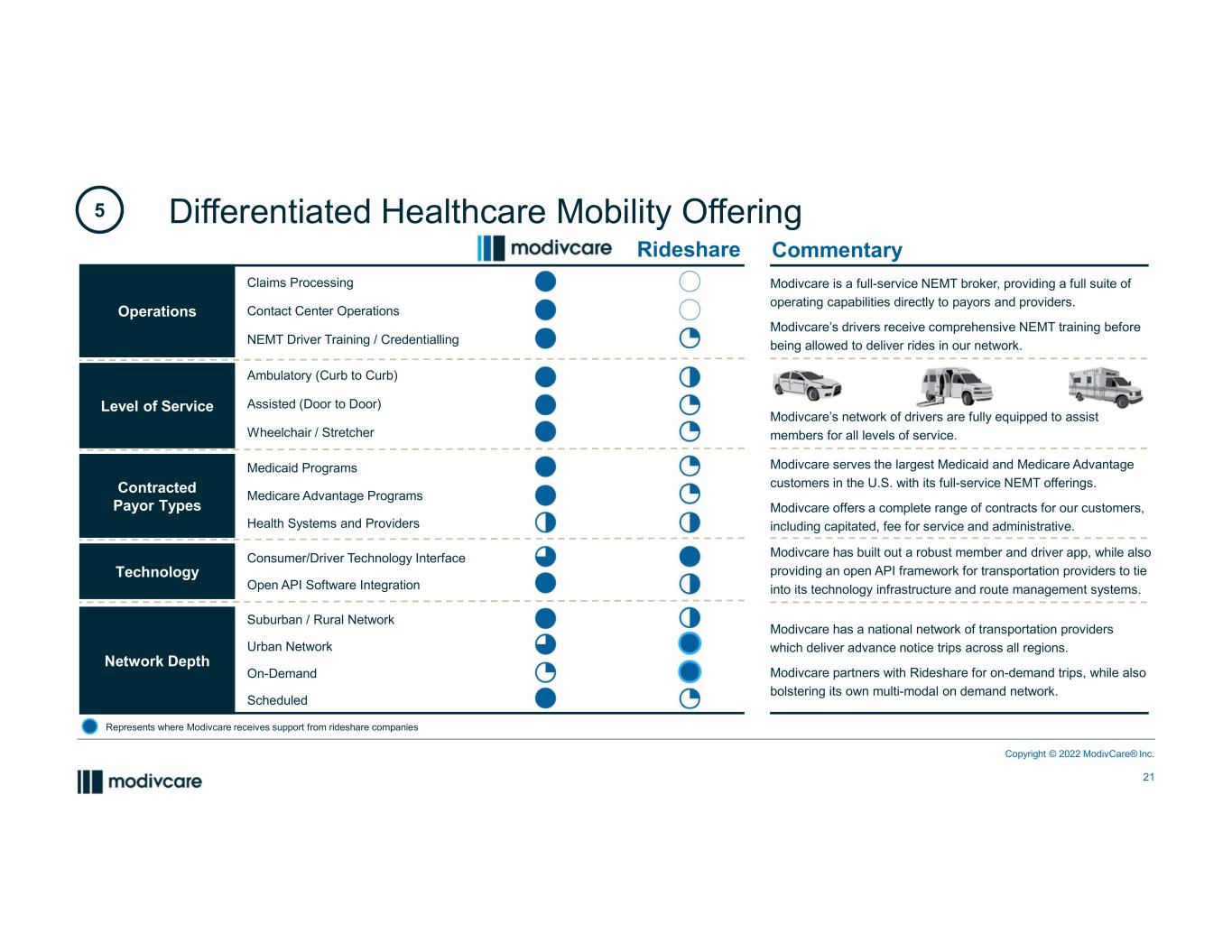

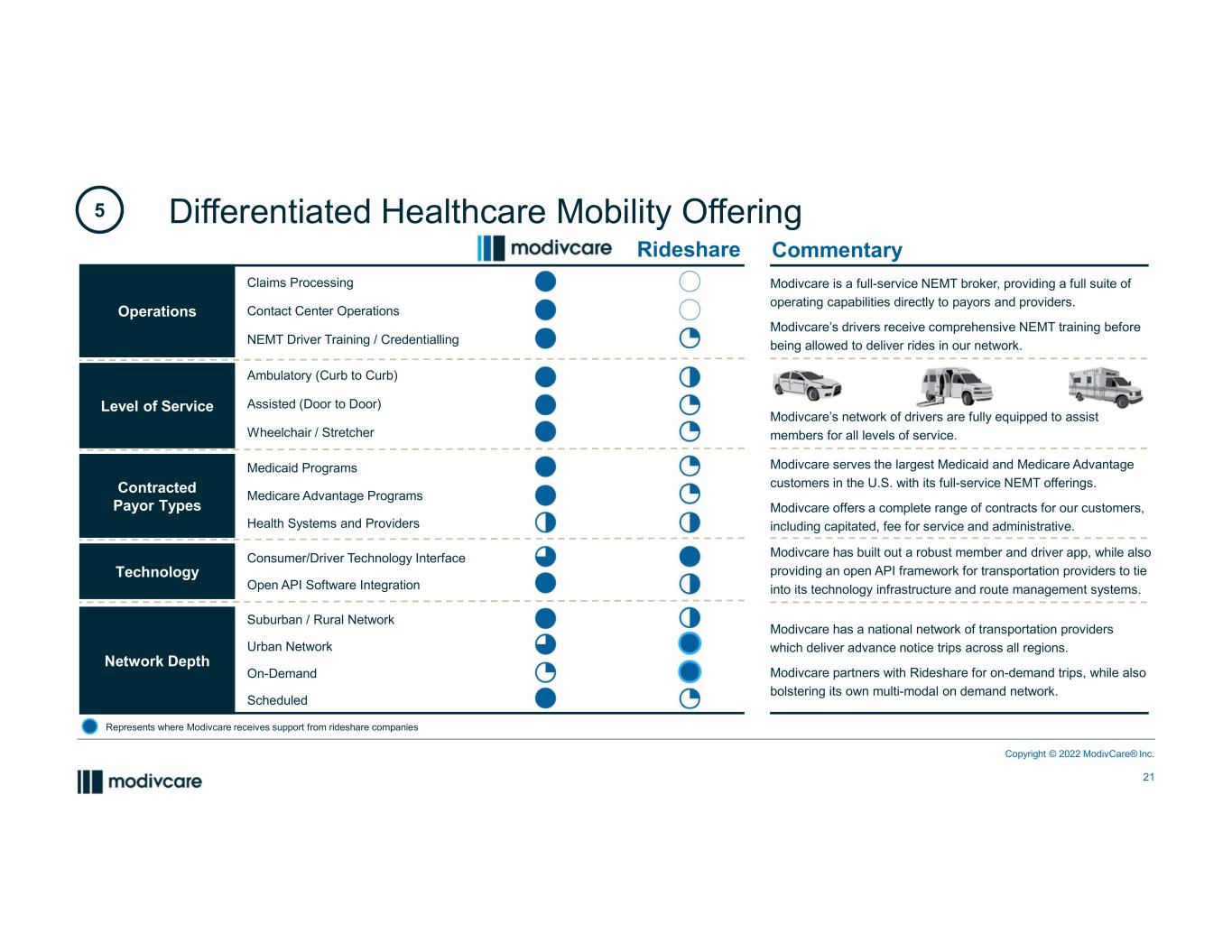

Differentiated Healthcare Mobility Offering Claims Processing Contact Center Operations NEMT Driver Training / Credentialling Ambulatory (Curb to Curb) Assisted (Door to Door) Wheelchair / Stretcher Medicaid Programs Medicare Advantage Programs Health Systems and Providers Consumer/Driver Technology Interface Open API Software Integration Suburban / Rural Network Urban Network On-Demand Scheduled Operations Level of Service Contracted Payor Types Network Depth Technology Rideshare 5 Commentary Modivcare is a full-service NEMT broker, providing a full suite of operating capabilities directly to payors and providers. Modivcare’s drivers receive comprehensive NEMT training before being allowed to deliver rides in our network. Modivcare serves the largest Medicaid and Medicare Advantage customers in the U.S. with its full-service NEMT offerings. Modivcare offers a complete range of contracts for our customers, including capitated, fee for service and administrative. Modivcare has a national network of transportation providers which deliver advance notice trips across all regions. Modivcare partners with Rideshare for on-demand trips, while also bolstering its own multi-modal on demand network. Modivcare has built out a robust member and driver app, while also providing an open API framework for transportation providers to tie into its technology infrastructure and route management systems. Modivcare’s network of drivers are fully equipped to assist members for all levels of service. Represents where Modivcare receives support from rideshare companies Copyright © 2022 ModivCare® Inc. 21

National network of community-based clinicians who deliver in-home and on-site services Advanced engagement approach, help payors manage risks and close care gaps Modivcare owns a 43.6% minority stake in the Company ‒ Represents additional “hidden” value not reflected in Modivcare’s reported adjusted EBITDA Peer market multiples imply significant value- creation potential in a monetization scenario Business Segments By the Numbers (1) CLIA-certified and CAP-accredited laboratory that provides diagnostic services and clinical testing support Provides seniors and other at-risk individuals with high quality of care, improved health outcomes, and identify chronic conditions Design custom workplace health solutions and providing testing, tracing, and clinical care solutions Rapid and scalable decentralized trial solutions to reach broad and diverse trial participant populations $398M Revenue $67M Adj. EBITDA 3,750 Clinicians 43.6% Ownership (1) Represents FY2021 Future Opportunity to Monetize Matrix Equity Investment6 Copyright © 2022 ModivCare® Inc. 22

Financial Summary

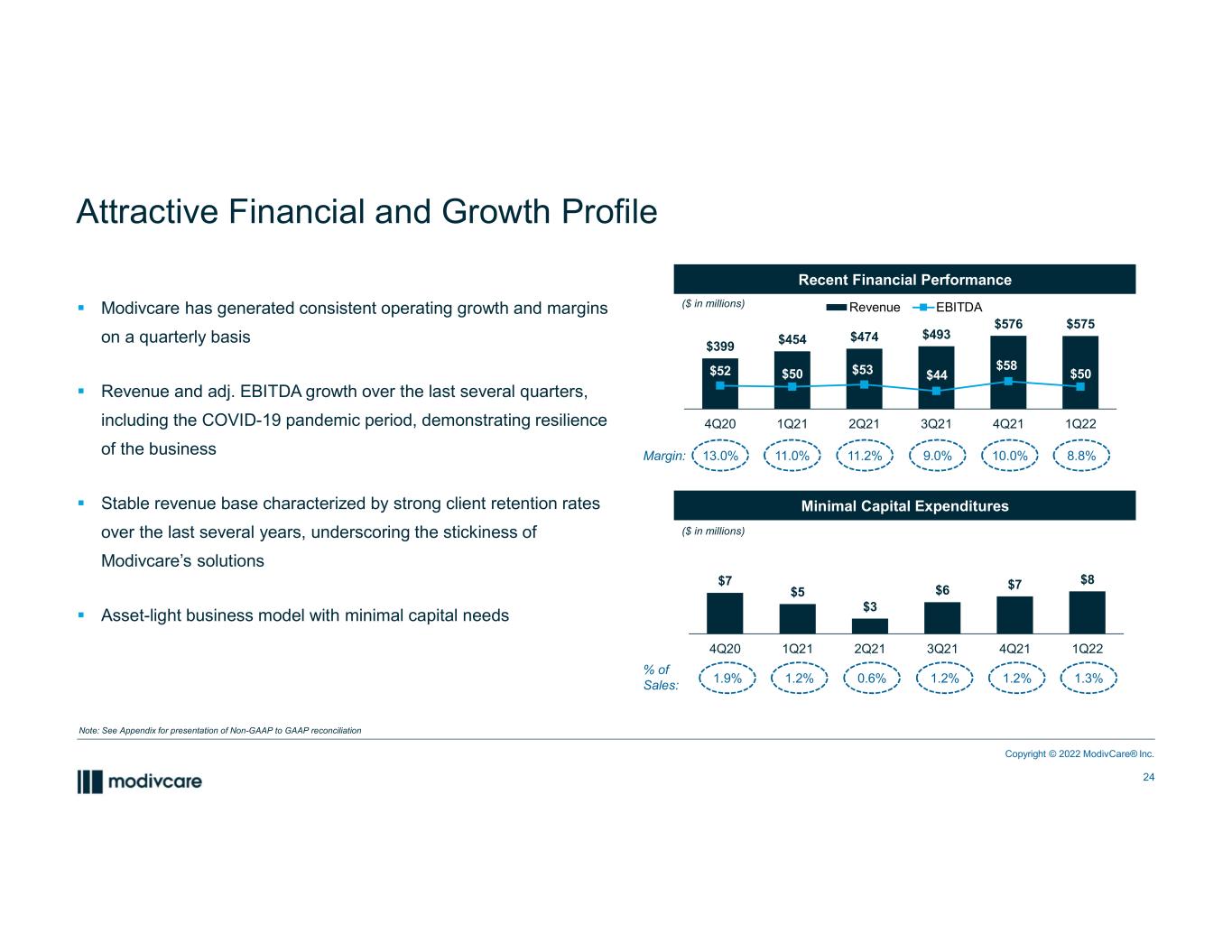

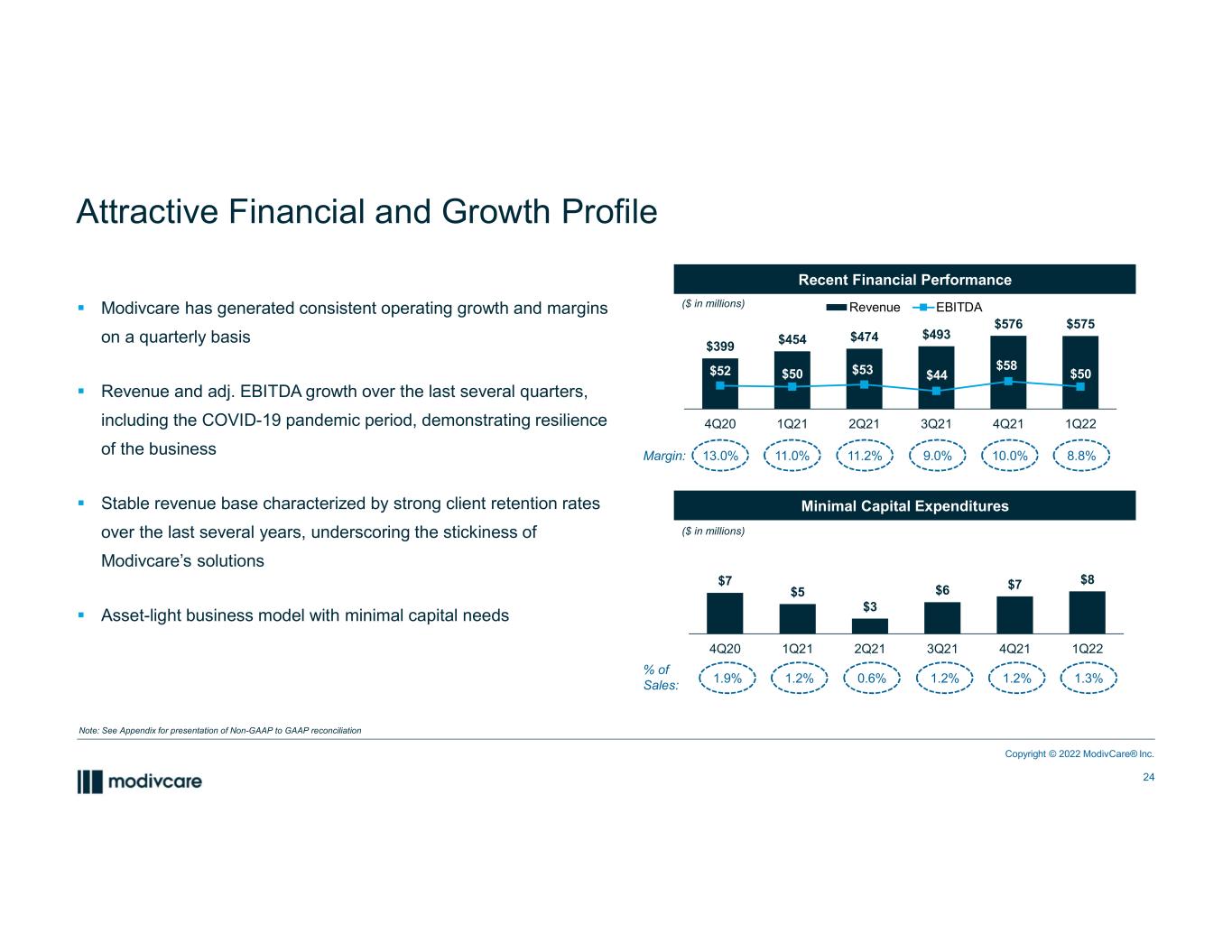

$399 $454 $474 $493 $576 $575 $52 $50 $53 $44 $58 $50 $20 $40 $60 $80 $100 $120 $0 $100 $200 $300 $400 $500 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 Revenue EBITDA Modivcare has generated consistent operating growth and margins on a quarterly basis Revenue and adj. EBITDA growth over the last several quarters, including the COVID-19 pandemic period, demonstrating resilience of the business Stable revenue base characterized by strong client retention rates over the last several years, underscoring the stickiness of Modivcare’s solutions Asset-light business model with minimal capital needs Attractive Financial and Growth Profile Recent Financial Performance Minimal Capital Expenditures ($ in millions) 11.0% 11.2% 9.0% 10.0%Margin: 13.0% 8.8% $7 $5 $3 $6 $7 $8 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 1.2% 0.6% 1.2% 1.2% % of Sales: 1.9% 1.3% ($ in millions) Note: See Appendix for presentation of Non-GAAP to GAAP reconciliation Copyright © 2022 ModivCare® Inc. 24

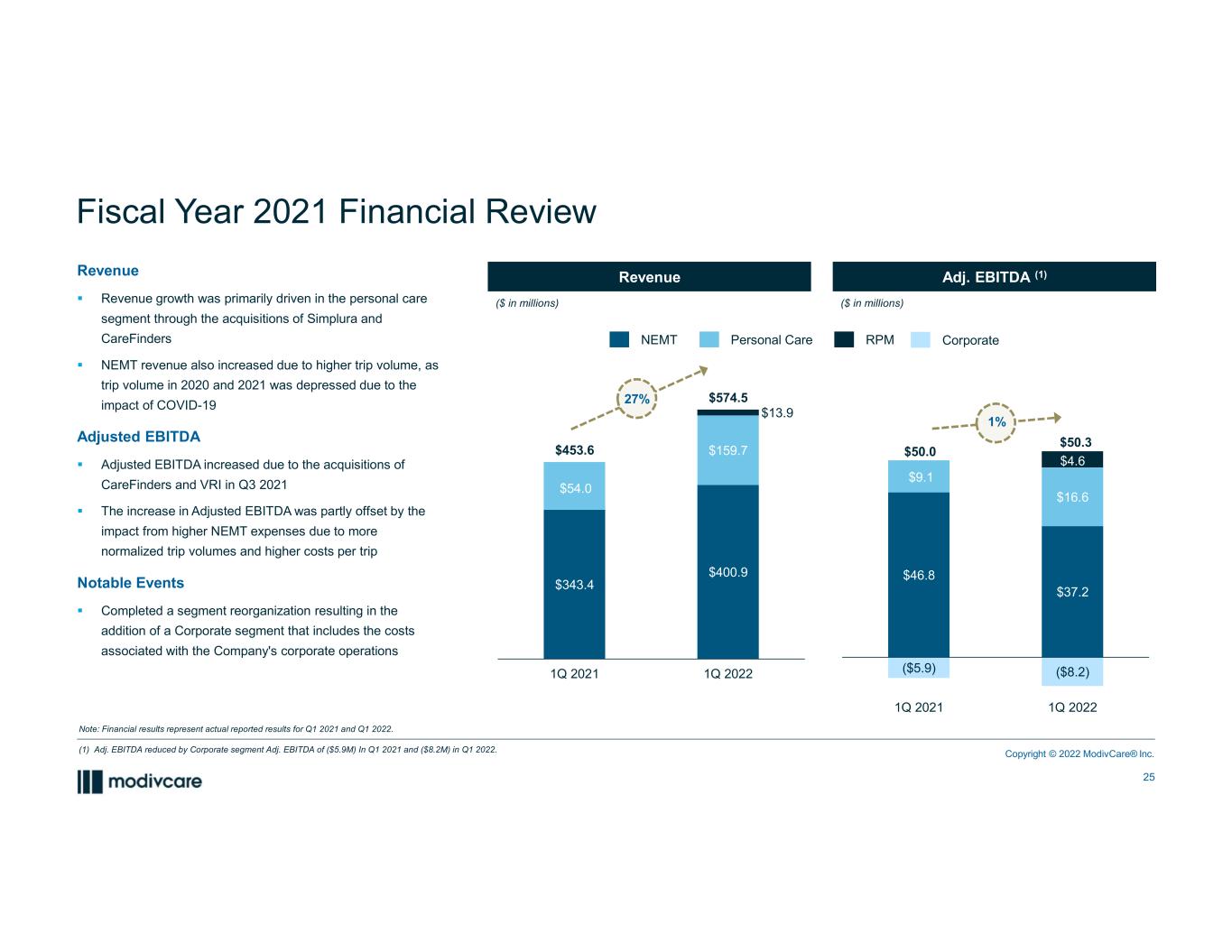

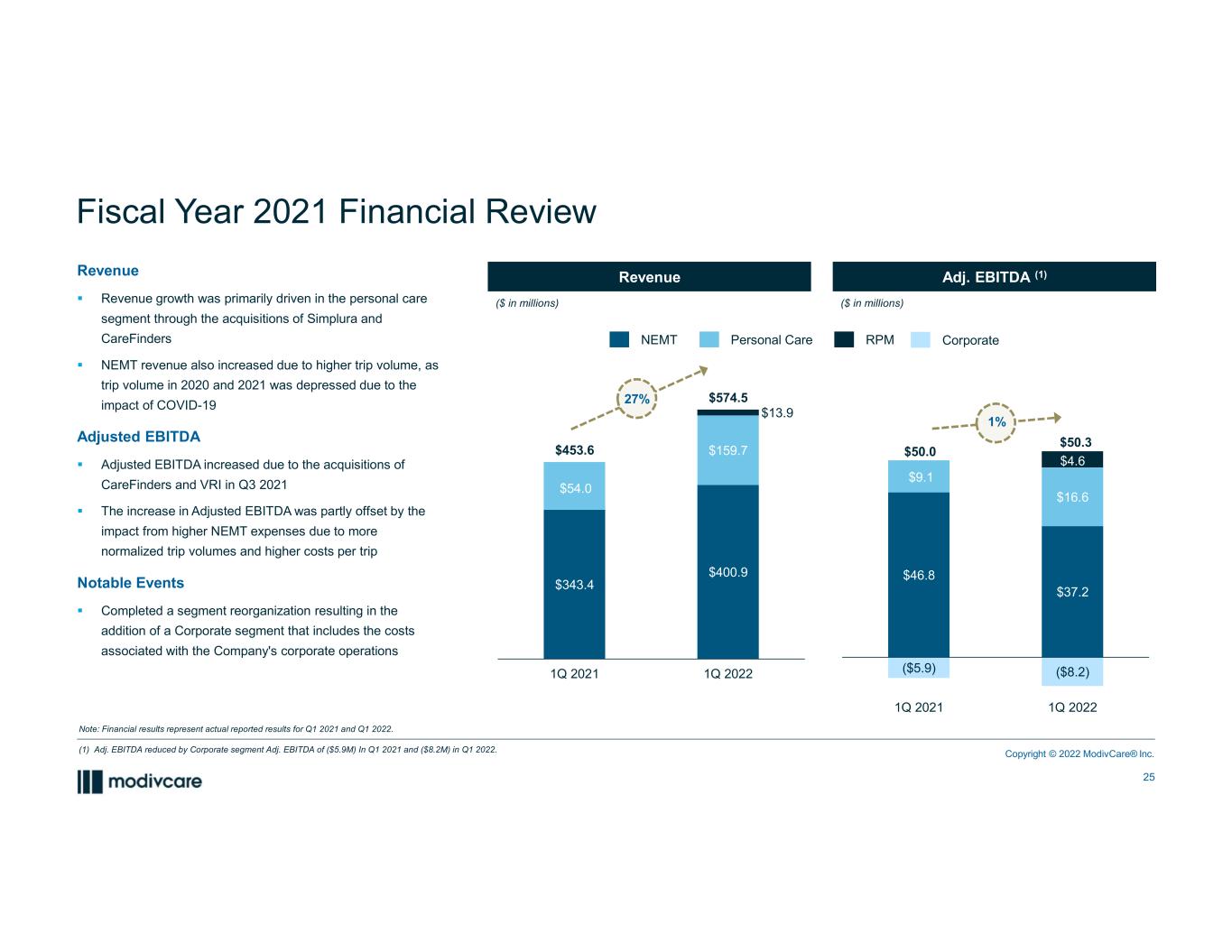

$343.4 $400.9 $54.0 $159.7 $13.9 $453.6 $574.5 1Q 2021 1Q 2022 Revenue Revenue growth was primarily driven in the personal care segment through the acquisitions of Simplura and CareFinders NEMT revenue also increased due to higher trip volume, as trip volume in 2020 and 2021 was depressed due to the impact of COVID-19 Adjusted EBITDA Adjusted EBITDA increased due to the acquisitions of CareFinders and VRI in Q3 2021 The increase in Adjusted EBITDA was partly offset by the impact from higher NEMT expenses due to more normalized trip volumes and higher costs per trip Notable Events Completed a segment reorganization resulting in the addition of a Corporate segment that includes the costs associated with the Company's corporate operations Fiscal Year 2021 Financial Review Revenue Adj. EBITDA (1) ($ in millions) ($ in millions) 27% 1% Note: Financial results represent actual reported results for Q1 2021 and Q1 2022. (1) Adj. EBITDA reduced by Corporate segment Adj. EBITDA of ($5.9M) In Q1 2021 and ($8.2M) in Q1 2022. Copyright © 2022 ModivCare® Inc. 25 $46.8 $37.2 $9.1 $16.6 ($5.9) ($8.2) $4.6 $50.0 $50.3 1Q 2021 1Q 2022 NEMT Personal Care RPM Corporate

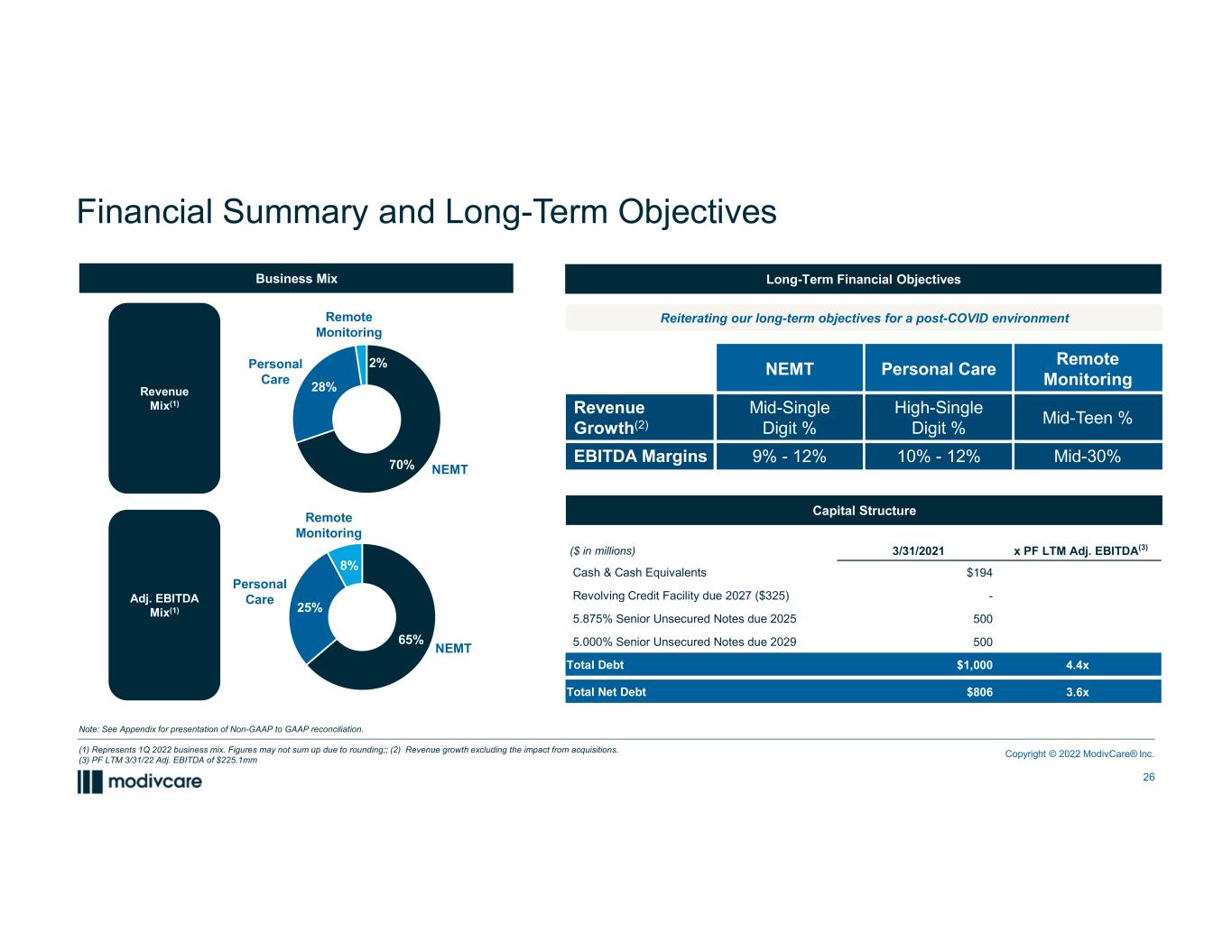

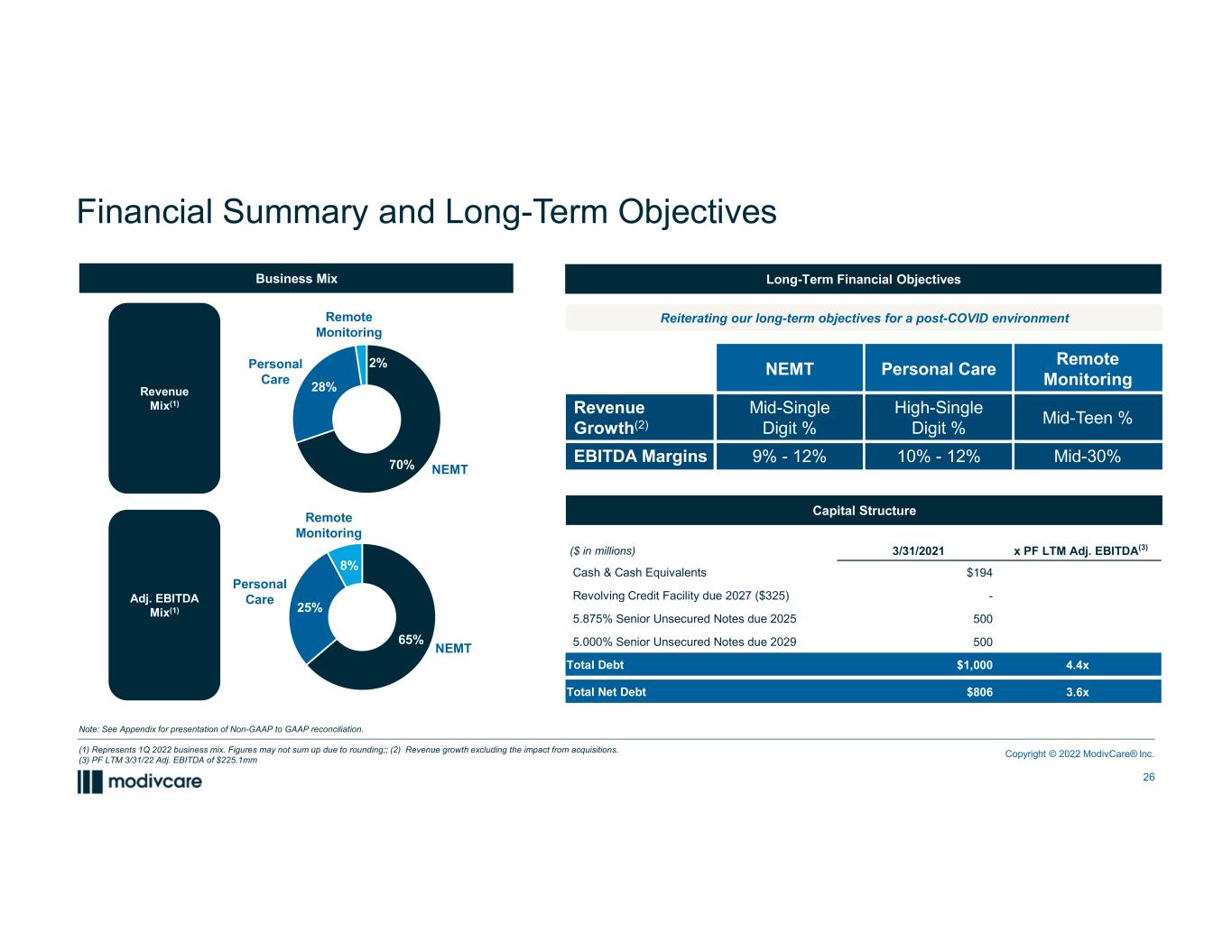

Financial Summary and Long-Term Objectives Note: See Appendix for presentation of Non-GAAP to GAAP reconciliation. (1) Represents 1Q 2022 business mix. Figures may not sum up due to rounding;; (2) Revenue growth excluding the impact from acquisitions. (3) PF LTM 3/31/22 Adj. EBITDA of $225.1mm Copyright © 2022 ModivCare® Inc. 26 NEMT Personal Care Remote Monitoring Revenue Growth(2) Mid-Single Digit % High-Single Digit % Mid-Teen % EBITDA Margins 9% - 12% 10% - 12% Mid-30% Adj. EBITDA Mix(1) Revenue Mix(1) Business Mix Long-Term Financial Objectives Reiterating our long-term objectives for a post-COVID environment 70% 28% 2%Personal Care NEMT 65% 25% 8% Remote Monitoring Personal Care NEMT Remote Monitoring Capital Structure ($ in millions) 3/31/2021 x PF LTM Adj. EBITDA(3) Cash & Cash Equivalents $194 Revolving Credit Facility due 2027 ($325) - 5.875% Senior Unsecured Notes due 2025 500 5.000% Senior Unsecured Notes due 2029 500 Total Debt $1,000 4.4x Total Net Debt $806 3.6x

Appendix

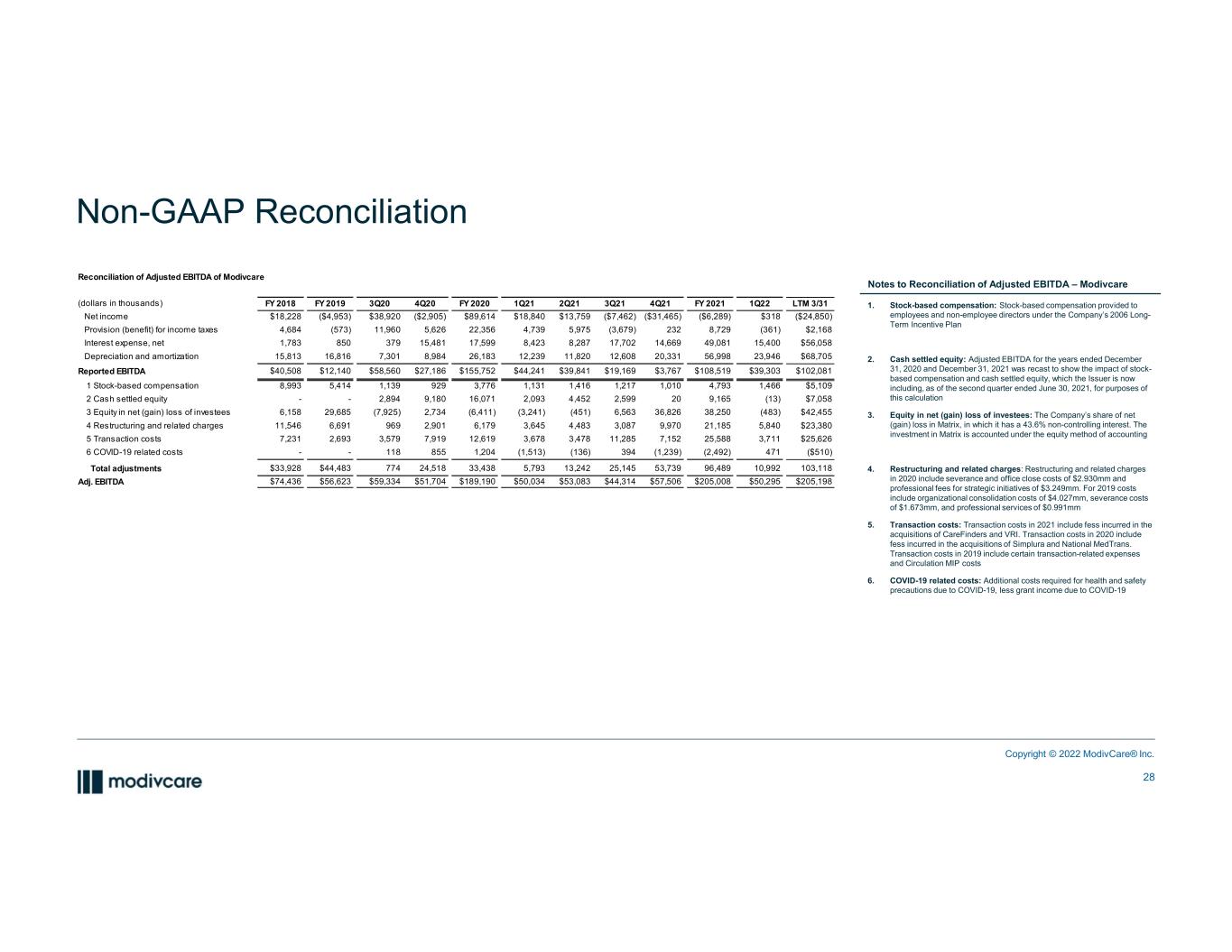

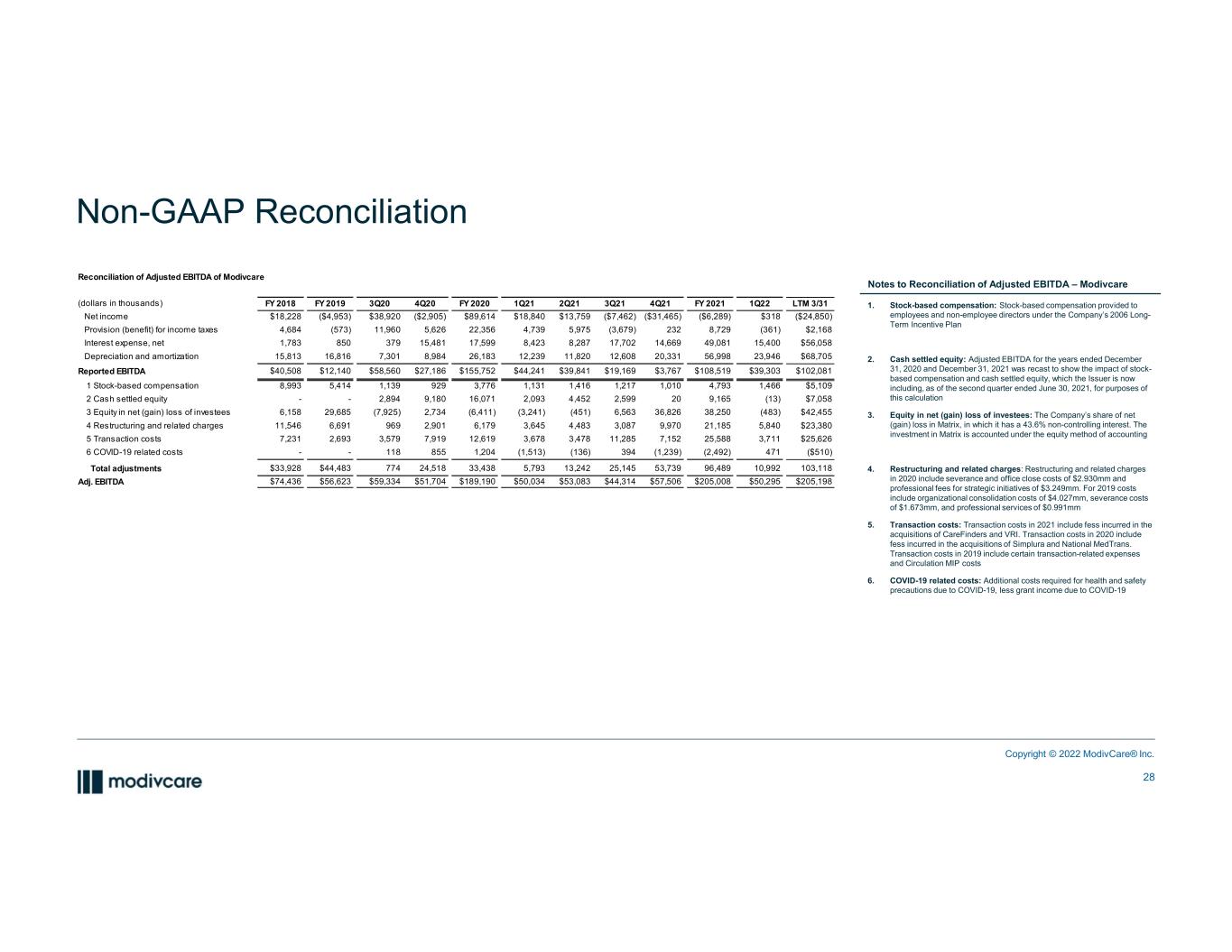

Non-GAAP Reconciliation Copyright © 2022 ModivCare® Inc. 28 1. Stock-based compensation: Stock-based compensation provided to employees and non-employee directors under the Company’s 2006 Long- Term Incentive Plan 2. Cash settled equity: Adjusted EBITDA for the years ended December 31, 2020 and December 31, 2021 was recast to show the impact of stock- based compensation and cash settled equity, which the Issuer is now including, as of the second quarter ended June 30, 2021, for purposes of this calculation 3. Equity in net (gain) loss of investees: The Company’s share of net (gain) loss in Matrix, in which it has a 43.6% non-controlling interest. The investment in Matrix is accounted under the equity method of accounting 4. Restructuring and related charges: Restructuring and related charges in 2020 include severance and office close costs of $2.930mm and professional fees for strategic initiatives of $3.249mm. For 2019 costs include organizational consolidation costs of $4.027mm, severance costs of $1.673mm, and professional services of $0.991mm 5. Transaction costs: Transaction costs in 2021 include fess incurred in the acquisitions of CareFinders and VRI. Transaction costs in 2020 include fess incurred in the acquisitions of Simplura and National MedTrans. Transaction costs in 2019 include certain transaction-related expenses and Circulation MIP costs 6. COVID-19 related costs: Additional costs required for health and safety precautions due to COVID-19, less grant income due to COVID-19 Notes to Reconciliation of Adjusted EBITDA – Modivcare Reconciliation of Adjusted EBITDA of Modivcare (dollars in thousands) FY 2018 FY 2019 3Q20 4Q20 FY 2020 1Q21 2Q21 3Q21 4Q21 FY 2021 1Q22 LTM 3/31 Net income $18,228 ($4,953) $38,920 ($2,905) $89,614 $18,840 $13,759 ($7,462) ($31,465) ($6,289) $318 ($24,850) Provision (benefit) for income taxes 4,684 (573) 11,960 5,626 22,356 4,739 5,975 (3,679) 232 8,729 (361) $2,168 Interest expense, net 1,783 850 379 15,481 17,599 8,423 8,287 17,702 14,669 49,081 15,400 $56,058 Depreciation and amortization 15,813 16,816 7,301 8,984 26,183 12,239 11,820 12,608 20,331 56,998 23,946 $68,705 Reported EBITDA $40,508 $12,140 $58,560 $27,186 $155,752 $44,241 $39,841 $19,169 $3,767 $108,519 $39,303 $102,081 1 Stock-based compensation 8,993 5,414 1,139 929 3,776 1,131 1,416 1,217 1,010 4,793 1,466 $5,109 2 Cash settled equity - - 2,894 9,180 16,071 2,093 4,452 2,599 20 9,165 (13) $7,058 3 Equity in net (gain) loss of investees 6,158 29,685 (7,925) 2,734 (6,411) (3,241) (451) 6,563 36,826 38,250 (483) $42,455 4 Restructuring and related charges 11,546 6,691 969 2,901 6,179 3,645 4,483 3,087 9,970 21,185 5,840 $23,380 5 Transaction costs 7,231 2,693 3,579 7,919 12,619 3,678 3,478 11,285 7,152 25,588 3,711 $25,626 6 COVID-19 related costs - - 118 855 1,204 (1,513) (136) 394 (1,239) (2,492) 471 ($510) Total adjustments $33,928 $44,483 774 24,518 33,438 5,793 13,242 25,145 53,739 96,489 10,992 103,118 Adj. EBITDA $74,436 $56,623 $59,334 $51,704 $189,190 $50,034 $53,083 $44,314 $57,506 $205,008 $50,295 $205,198

Selected Pro Forma Information Note: Represents Modivcare consolidated performance pro forma for CareFinders and VRI financial performance prior to acquisition Note: Represents CareFinders standalone performance based on Quality of Earnings report prior to acquisition by Modivcare which closed on September 14, 2021 Note: Represents VRI standalone performance based on Quality of Earnings report prior to acquisition by Modivcare which closed on September 22, 2021 Twelve Months Ended Mar 31, (dollars in thousands) 2022 Consolidated Reported Revenue $2,117,757 CareFinders Reported Revenue (Pre-Acquisition) 91,486 VRI Reported Revenue (Pre-Acquisition) 29,136 Consolidated Pro Forma Revenue $2,238,379 Pro Forma Consolidated Revenue Twelve Months Ended Mar 31, (dollars in thousands) 2022 Modivcare Personal Care Revenue $545,083 CareFinders Reported Revenue (Pre-Acquis ition) 91,486 Personal Care Pro Forma Revenue $636,569 Pro Forma Personal Care Segment Revenue Twelve Months Ended Mar 31, (dollars in thousands) 2022 Modivcare Personal Care EBITDA $43,129 Restructuring and related charges 485 Transaction costs 7,158 Stock-based compensation 35 COVID-19 related costs, net of grant income (1,010) Modivcare Personal Care Adj. EBITDA 49,797 CareFinders Adj. EBITDA (Pre-Acquis ition) 8,861 Personal Care Pro Forma Adj. EBITDA $58,658 Pro Forma Personal Care Segment Adj. EBITDA Twelve Months Ended Mar 31, (dollars in thousands) 2022 Modivcare Remote Patient Monitoring Revenue $31,474 VRI Revenue (Pre-Acquisition) 29,136 Remote Patient Monitoring Pro Forma Revenue $60,610 Pro Forma Remote Patient Monitoring Segment Revenue Twelve Months Ended Mar 31, (dollars in thousands) 2022 Modivcare Remote Patient Monitoring EBITDA $10,149 Restructuring and Related Charges 24 Transaction Costs 1,368 Transaction Costs 29 Modivcare Remote Patient Monitoring Adj. EBITDA 11,570 VRI Adj. EBITDA (Pre-Acquisition) 11,060 Remote Patient Monitoring Pro Forma Adj. EBITDA $22,630 Pro Forma Remote Patient Monitoring Segment Adj. EBITDA Twelve Months Ended Mar 31, (dollars in thousands) 2022 Consolidated Adj. EBITDA $215,459 Pre-acquisition Adj. EBITDA (CareFinders) 8,861 Pre-acquisition Adj. EBITDA (VRI) 11,060 Consolidated Pro Forma Adj. EBITDA (ex. Corporate) $235,381 Corporate EBITDA (8,151) Consolidated Pro Forma Adj. EBITDA $227,230 Pro Forma Consolidated Adj. EBITDA Copyright © 2022 ModivCare® Inc. 29

Non-GAAP Reconciliation | 1Q 2022 1. Restructuring and related charges include professional services costs and severance and recruiting costs. 2. Transaction costs include SOX integration efforts at recently acquired subsidiaries and acquisition costs. 3. Effective January 1, 2022, the Company completed its segment reorganization which resulted in the addition of a Corporate segment that includes the costs associated with the Company's corporate operations. Through this reorganization, it was also determined that the Matrix Investment is no longer a reportable segment, and is now reported within the Corporate segment. Prior period segment amounts have been reclassified to conform to the current presentation. Notes to Reconciliation of Adjusted EBITDA Copyright © 2022 ModivCare® Inc. 30

Non-GAAP Reconciliation | 1Q 2021 1. Restructuring and related charges include professional services costs of $3.2 million and severance and office closure costs of $0.4 million. 2. Transaction costs include Circulation management incentive plan costs and acquisition costs related to Simplura Health Group and National MedTrans. 3. Adjusted EBITDA for Q1 2021 was recast to show the impact of cash settled equity, which the Company is now including for the purpose of this calculation. 4. Effective January 1, 2022, the Company completed its segment reorganization which resulted in the addition of a Corporate segment that includes the costs associated with the Company's corporate operations. Through this reorganization, it was also determined that the Matrix Investment is no longer a reportable segment, and is now reported within the Corporate segment. Prior period segment amounts have been reclassified to conform to the current presentation, with the exception of the RPM segment, which is not included in Q1 of 2021 as it was purchased in Q3 of 2021. Notes to Reconciliation of Adjusted EBITDA Copyright © 2022 ModivCare® Inc. 31

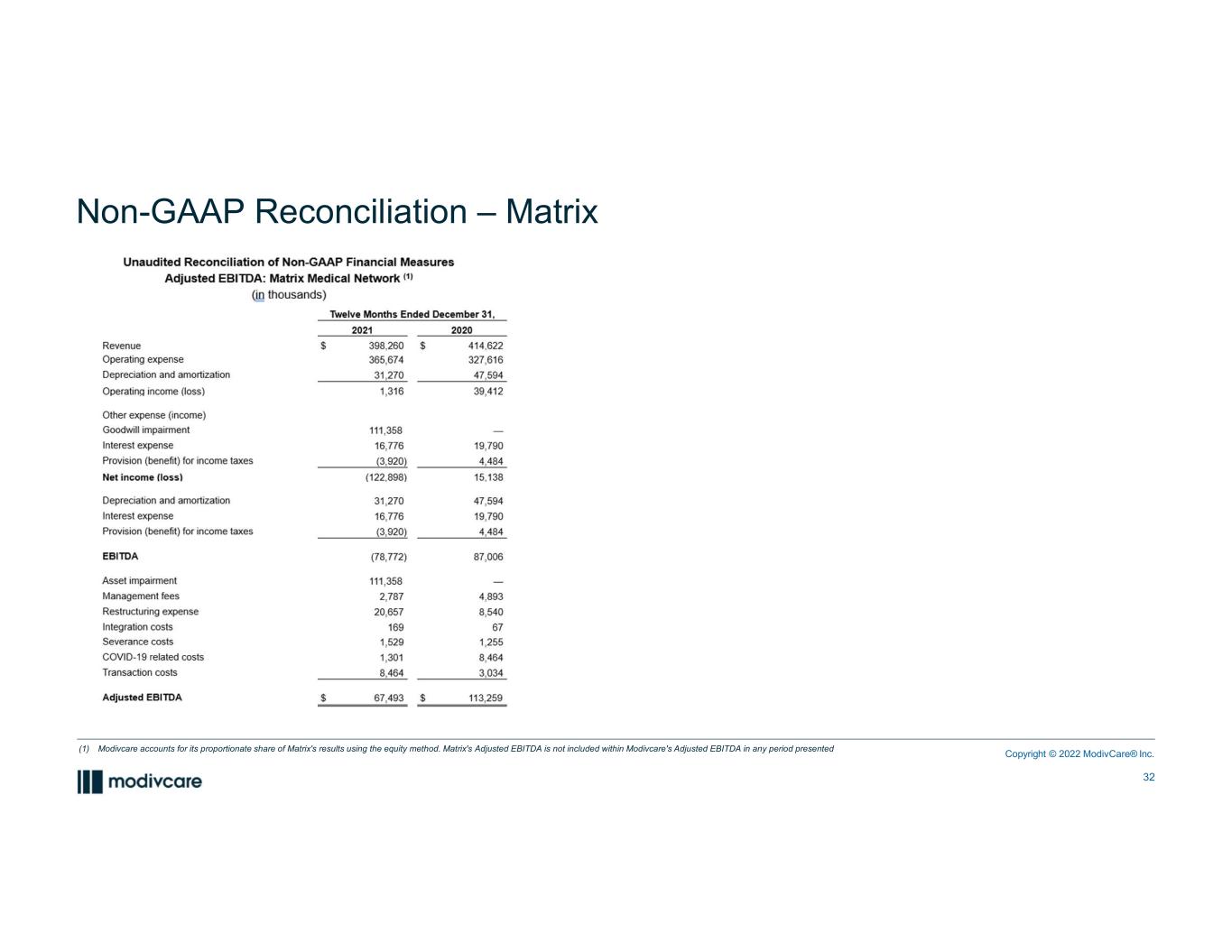

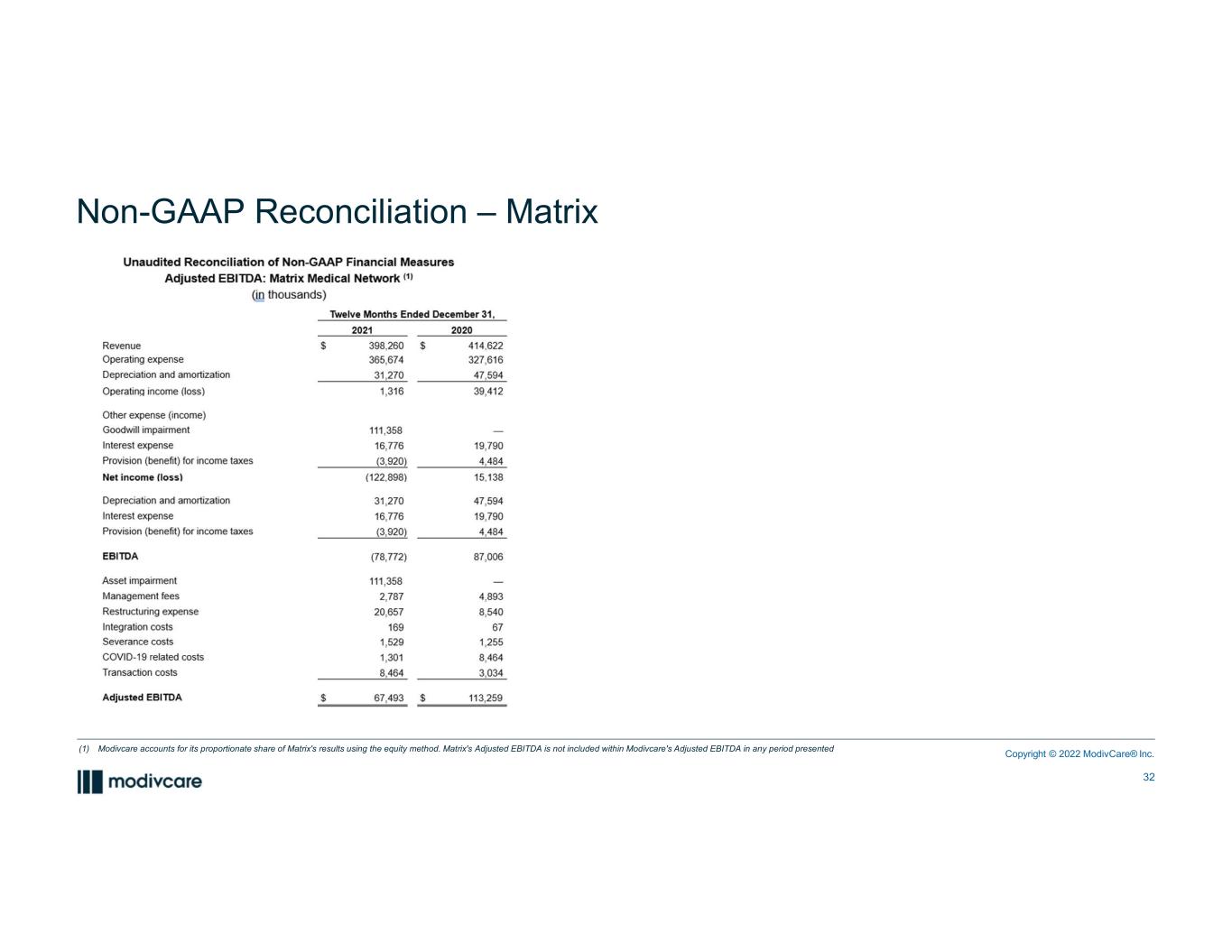

Non-GAAP Reconciliation – Matrix (1) Modivcare accounts for its proportionate share of Matrix's results using the equity method. Matrix's Adjusted EBITDA is not included within Modivcare's Adjusted EBITDA in any period presented Copyright © 2022 ModivCare® Inc. 32

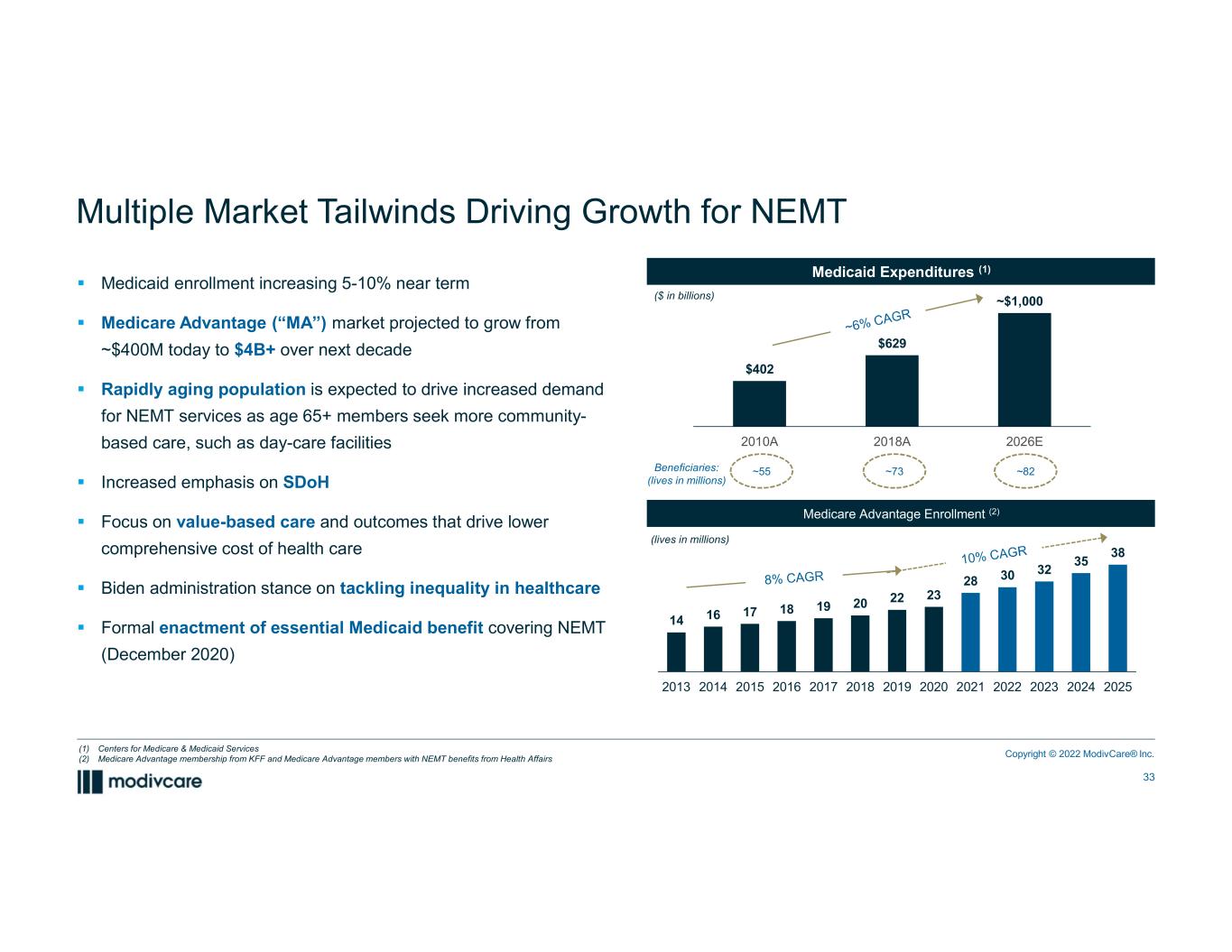

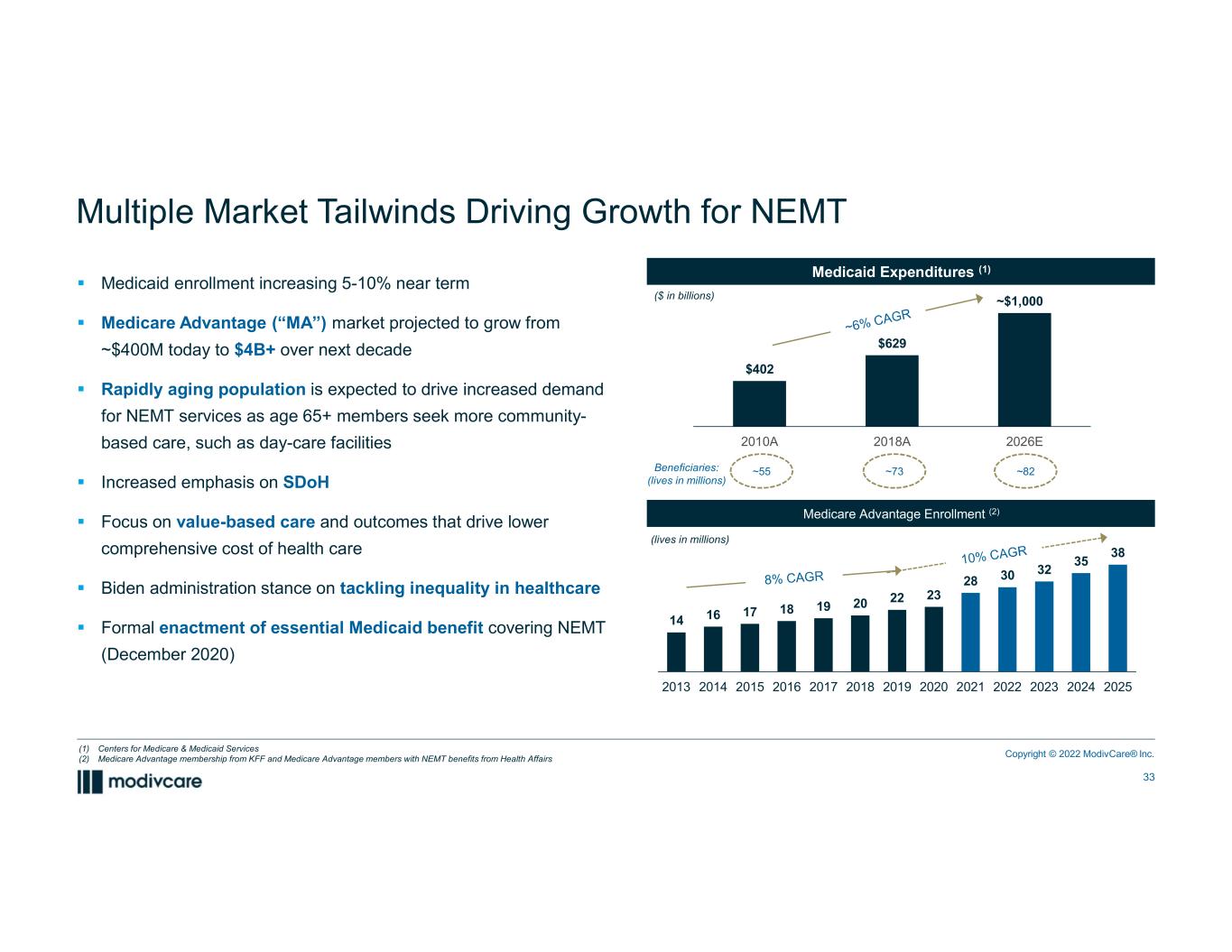

14 16 17 18 19 20 22 23 28 30 32 35 38 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Medicaid enrollment increasing 5-10% near term Medicare Advantage (“MA”) market projected to grow from ~$400M today to $4B+ over next decade Rapidly aging population is expected to drive increased demand for NEMT services as age 65+ members seek more community- based care, such as day-care facilities Increased emphasis on SDoH Focus on value-based care and outcomes that drive lower comprehensive cost of health care Biden administration stance on tackling inequality in healthcare Formal enactment of essential Medicaid benefit covering NEMT (December 2020) Multiple Market Tailwinds Driving Growth for NEMT Medicaid Expenditures (1) Medicare Advantage Enrollment (2) (lives in millions) $402 $629 ~$1,000 2010A 2018A 2026E ($ in billions) Beneficiaries: (lives in millions) ~55 ~73 ~82 (1) Centers for Medicare & Medicaid Services (2) Medicare Advantage membership from KFF and Medicare Advantage members with NEMT benefits from Health Affairs Copyright © 2022 ModivCare® Inc. 33

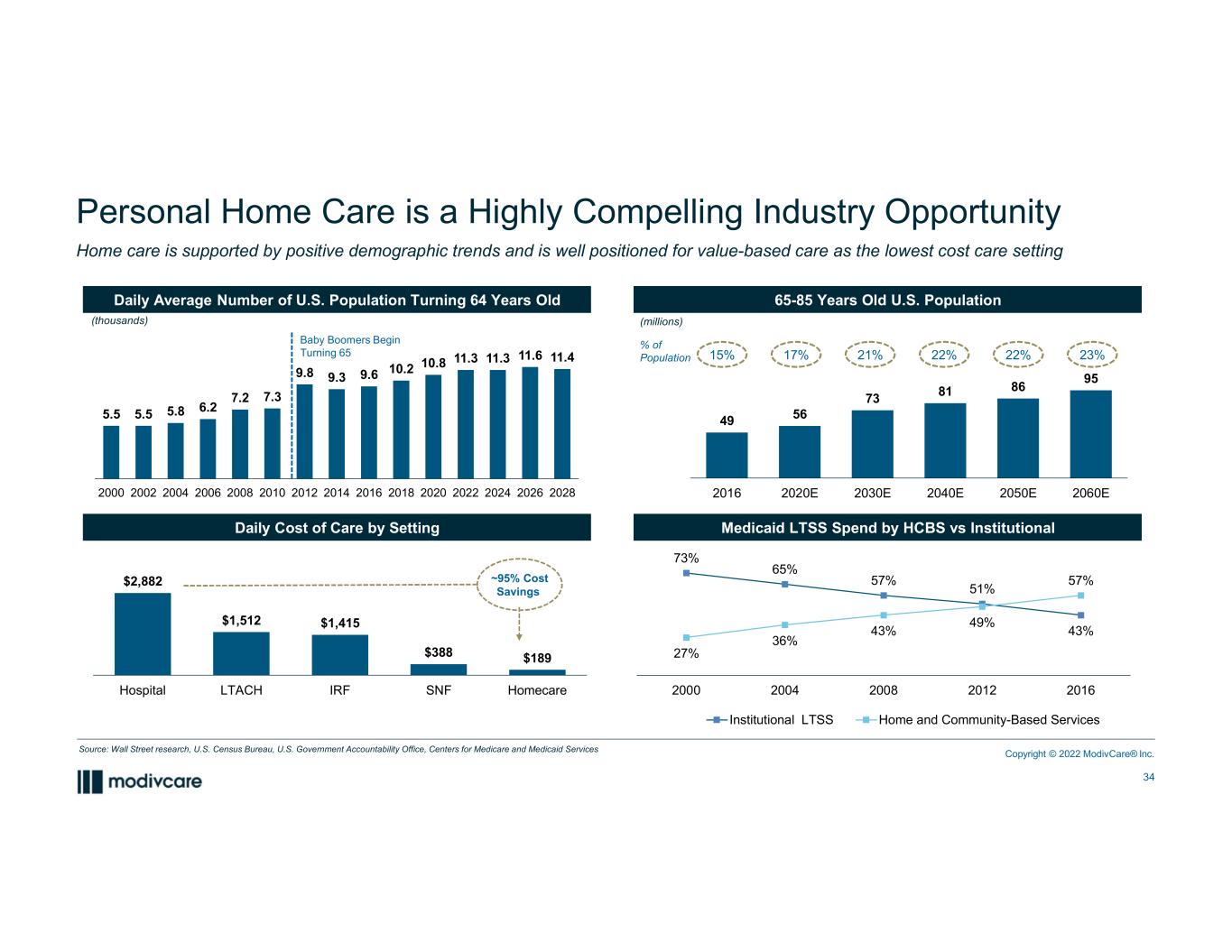

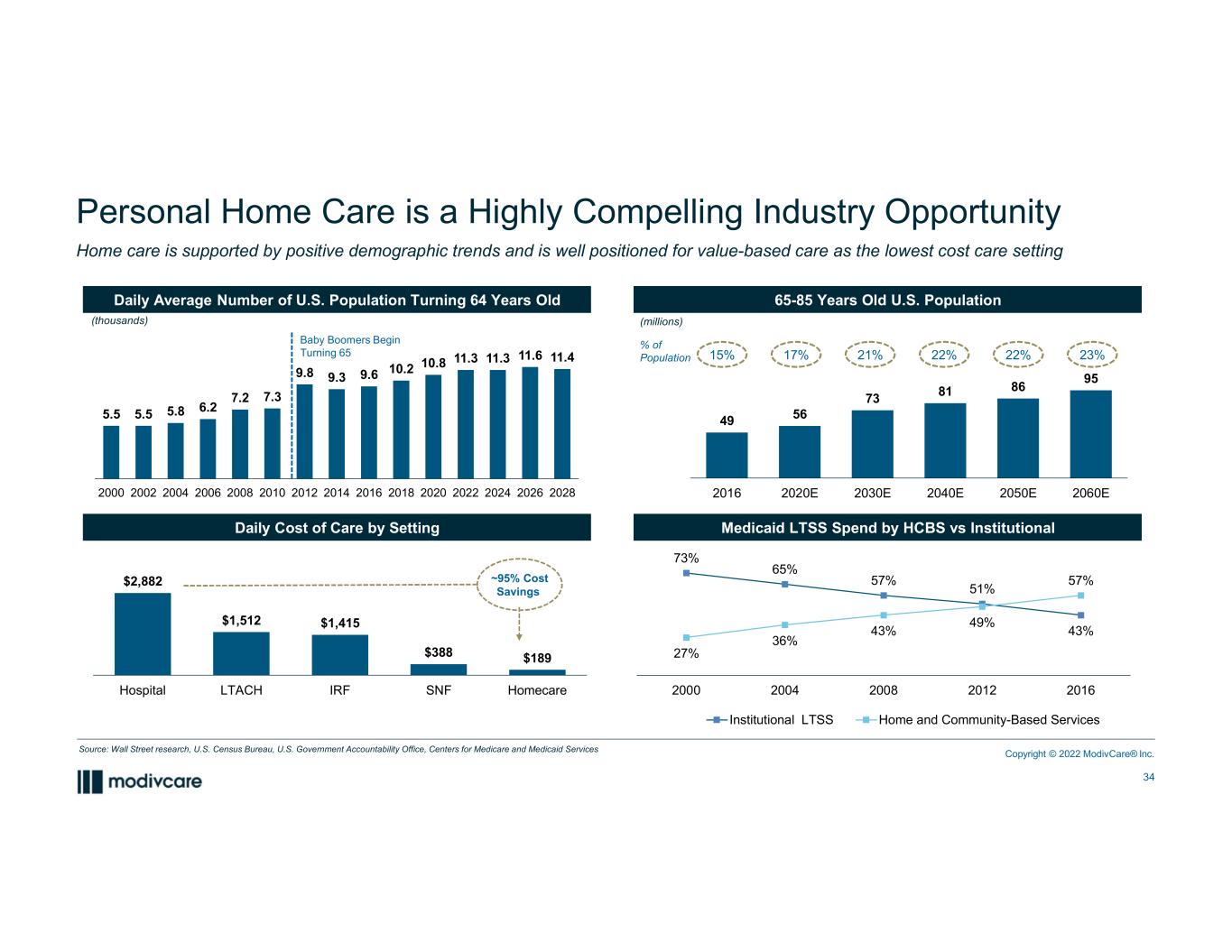

$2,882 $1,512 $1,415 $388 $189 Hospital LTACH IRF SNF Homecare Personal Home Care is a Highly Compelling Industry Opportunity Home care is supported by positive demographic trends and is well positioned for value-based care as the lowest cost care setting 65-85 Years Old U.S. Population Medicaid LTSS Spend by HCBS vs Institutional Daily Average Number of U.S. Population Turning 64 Years Old Daily Cost of Care by Setting 5.5 5.5 5.8 6.2 7.2 7.3 9.8 9.3 9.6 10.2 10.8 11.3 11.3 11.6 11.4 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 (thousands) (millions) 49 56 73 81 86 95 2016 2020E 2030E 2040E 2050E 2060E % of Population 15% 17% 21% 22% 22% 23% ~95% Cost Savings 73% 65% 57% 51% 43% 27% 36% 43% 49% 57% 2000 2004 2008 2012 2016 Institutional LTSS Home and Community-Based Services Baby Boomers Begin Turning 65 Source: Wall Street research, U.S. Census Bureau, U.S. Government Accountability Office, Centers for Medicare and Medicaid Services Copyright © 2022 ModivCare® Inc. 34

Significant Growth Opportunity through Medicare Advantage and Medicaid Multiple tailwinds driving demand for Modivcare’s RPM solutions in Medicare Advantage (MA) and Medicaid patient populations Increasing desire of seniors & individuals to “age-in-place” Expanding insurance coverage Shifting focus to value-based care models Increased chronic disease prevalence Decreasing stigma for technology COVID-19 56 65 73 787 8 9 12 63 73 82 90 2020E 2025E 2030E 2035E Age 65-85 Age 85+ 11 16 20 23 2010 2014 2018 2020 133 171 2005 2030E Growing Senior Population (in millions) Growing Medicaid and MA Enrollment (in millions) Increasing Prevalence of Chronic Conditions (in millions) Positive Market Trends Are Expected to Increase Adoption In cr e as in g L ev el o f Im p ac t U.S. Population with Chronic Disease 26 42 53 67 2010 2014 2018 2020 Managed Medicaid Medicare Advantage Sources: LEK, Administration on Aging: Profile of Older Americans, Kaiser Family Foundation, AARP, Population Reference Bureau Copyright © 2022 ModivCare® Inc. 35