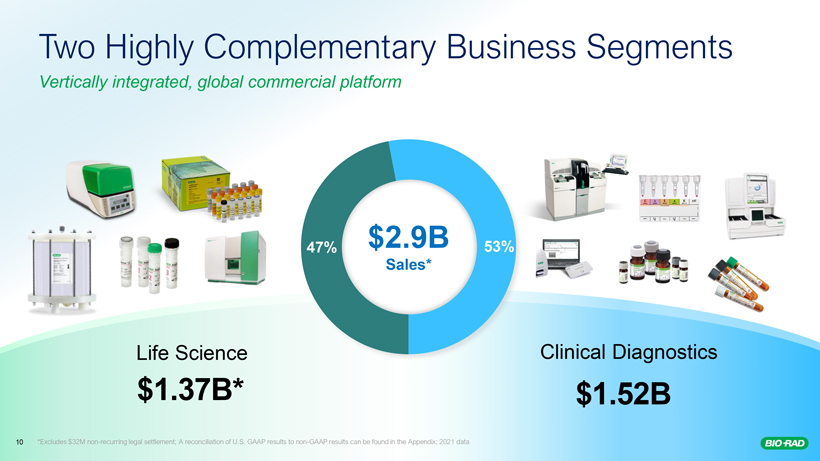

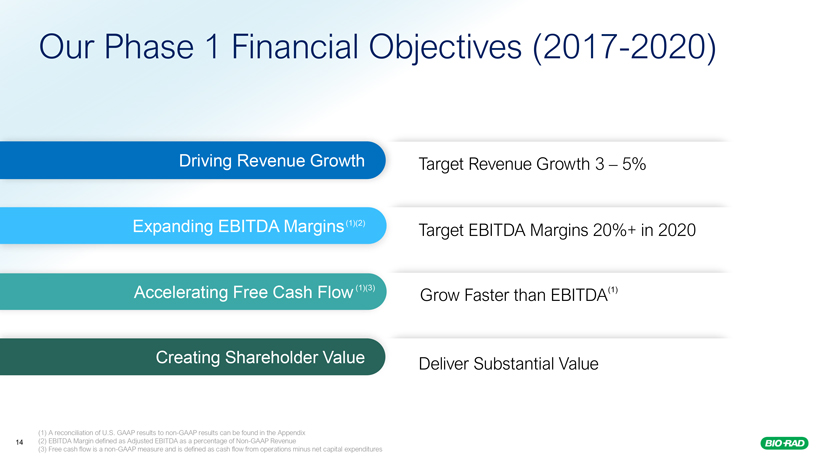

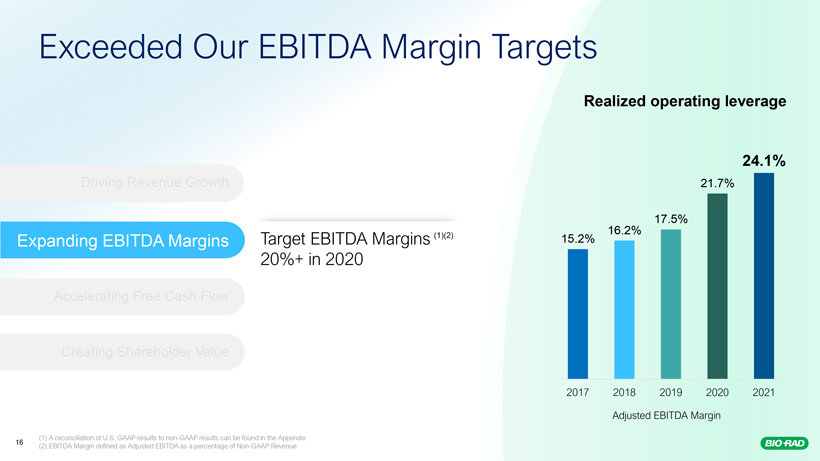

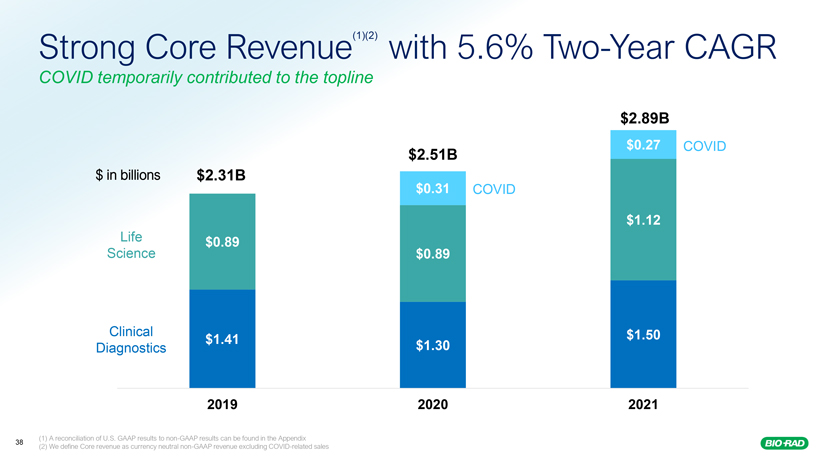

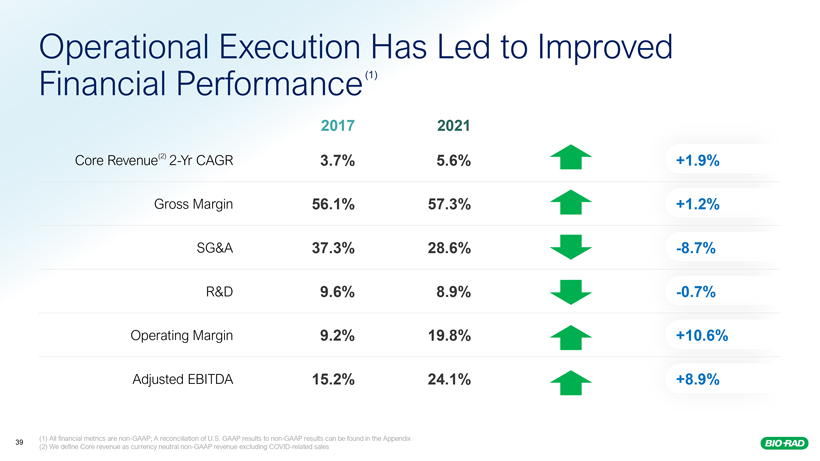

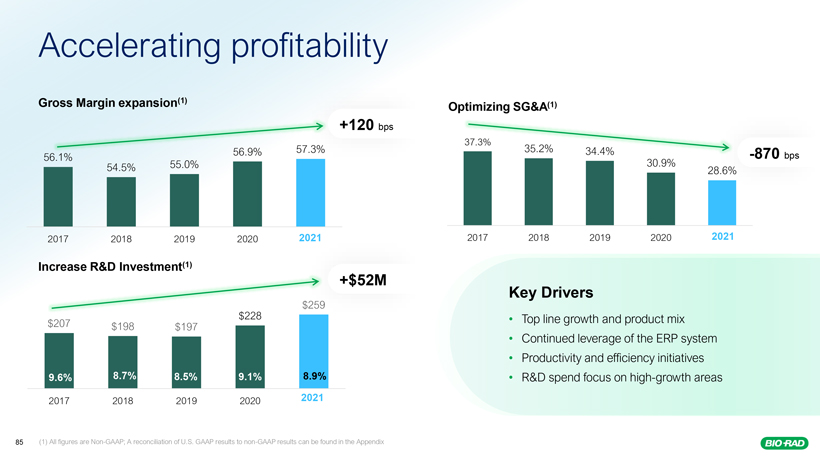

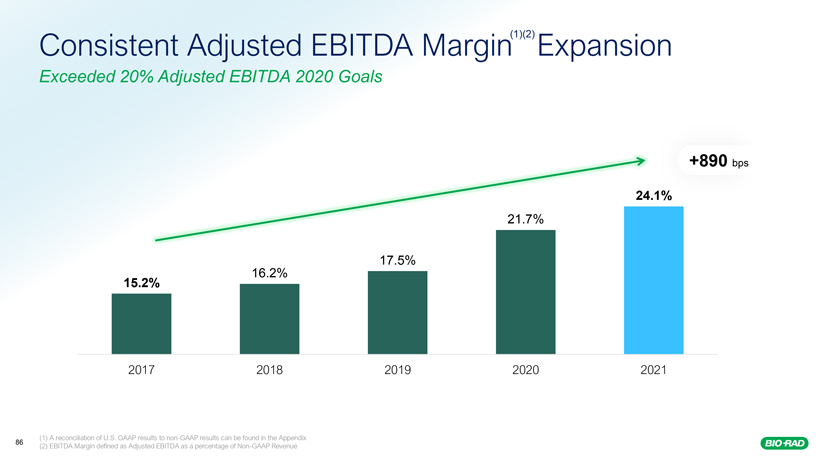

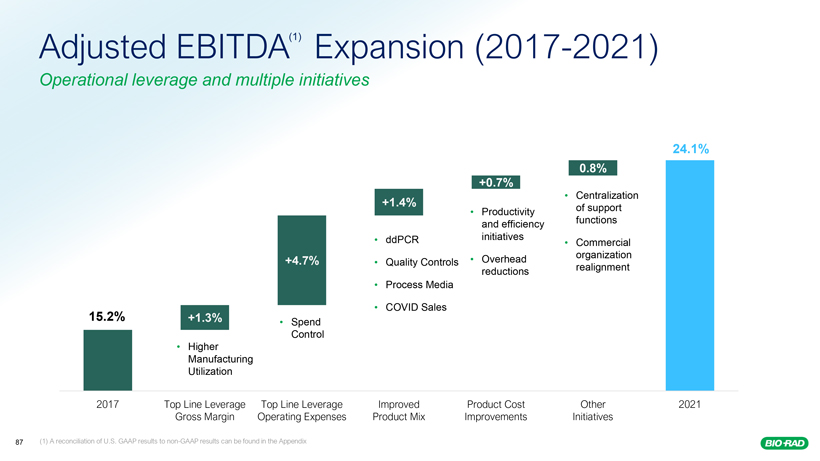

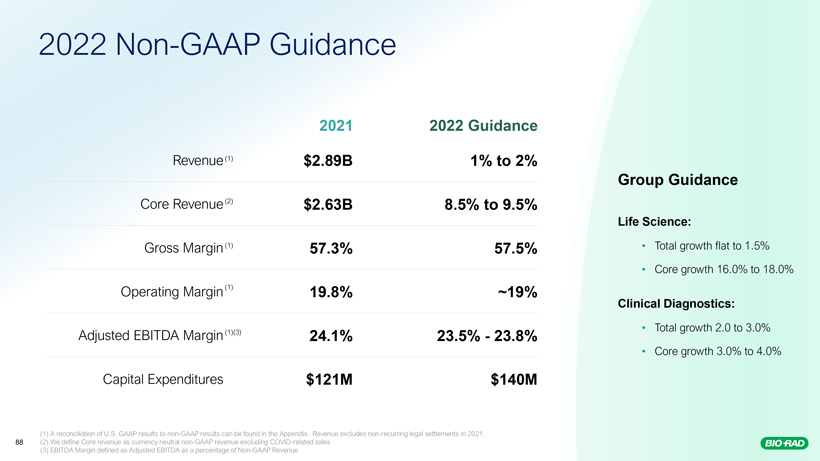

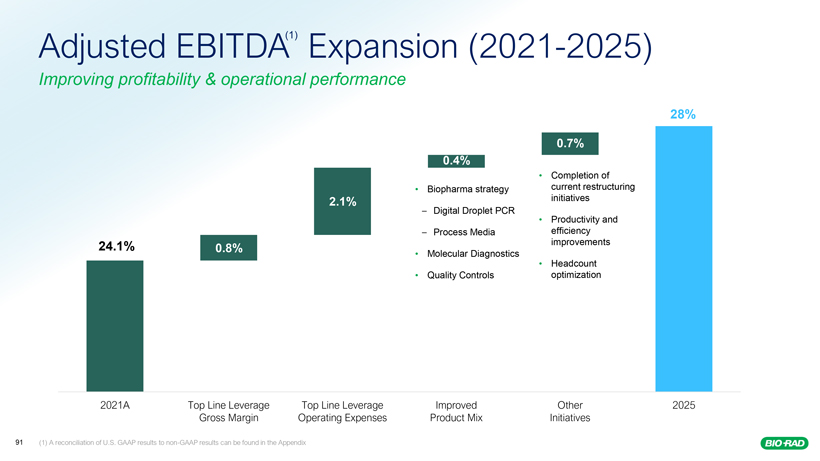

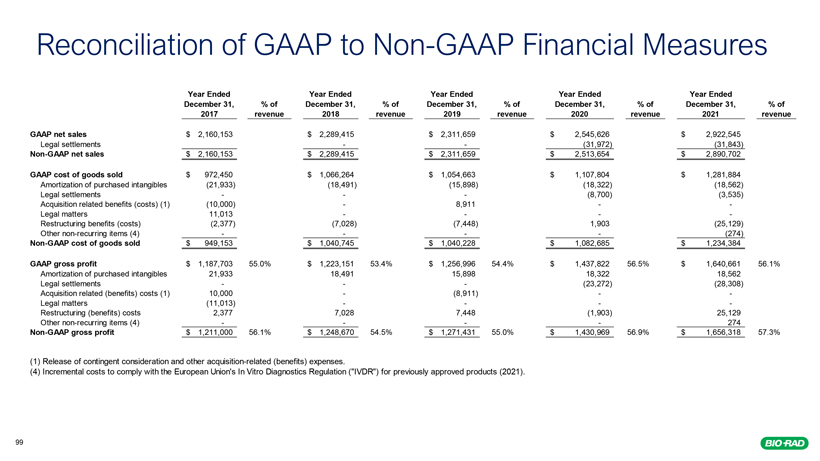

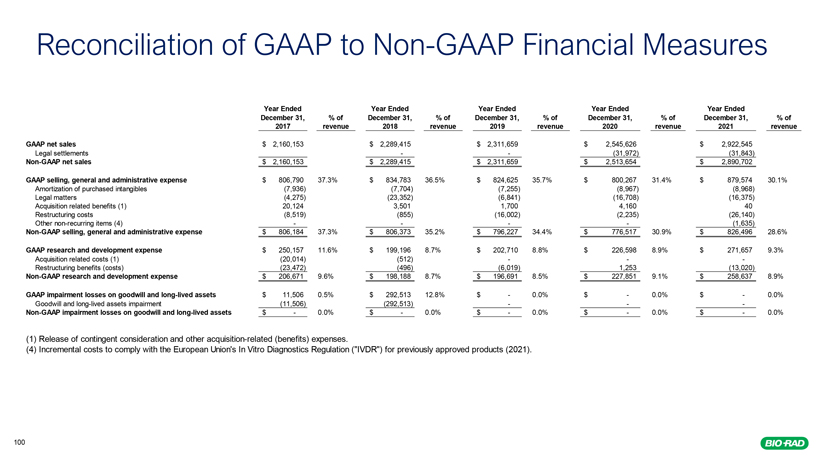

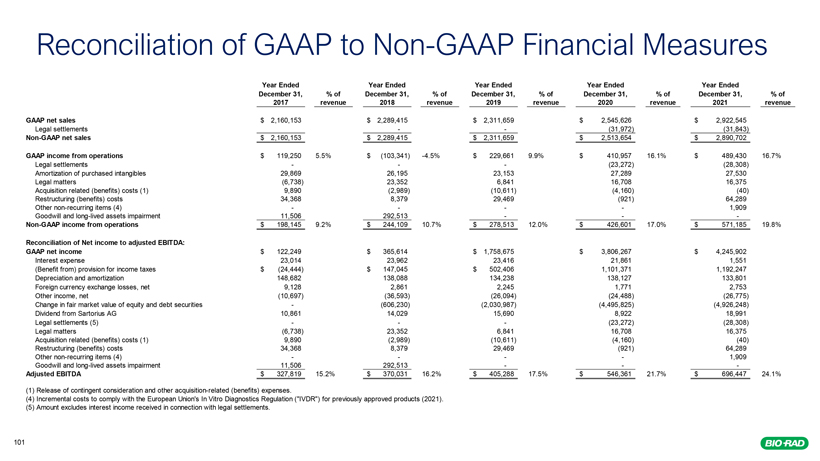

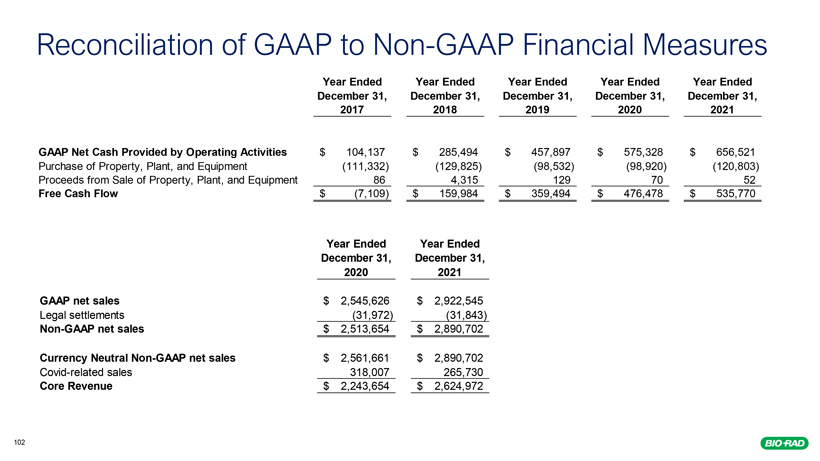

Reconciliation of GAAP to Non-GAAP Financial Measures Year Ended Year Ended Year Ended Year Ended Year Ended December 31, % of December 31, % of December 31, % of December 31, % of December 31, % of 2017 revenue 2018 revenue 2019 revenue 2020 revenue 2021 revenue GAAP net sales $ 2,160,153 $ 2,289,415 $ 2,311,659 $ 2,545,626 $ 2,922,545 Legal settlements - - (31,972) (31,843) Non-GAAP net sales $ 2,160,153 $ 2,289,415 $ 2,311,659 $ 2,513,654 $ 2,890,702 GAAP income from operations $ 119,250 5.5% $ (103,341) -4.5% $ 229,661 9.9% $ 410,957 16.1% $ 489,430 16.7% Legal settlements - - - (23,272) (28,308) Amortization of purchased intangibles 29,869 26,195 23,153 27,289 27,530 Legal matters (6,738) 23,352 6,841 16,708 16,375 Acquisition related (benefits) costs (1) 9,890 (2,989) (10,611) (4,160) (40) Restructuring (benefits) costs 34,368 8,379 29,469 (921) 64,289 Other non-recurring items (4) - - - - 1,909 Goodwill and long-lived assets impairment 11,506 292,513 - - - Non-GAAP income from operations $ 198,145 9.2% $ 244,109 10.7% $ 278,513 12.0% $ 426,601 17.0% $ 571,185 19.8% Reconciliation of Net income to adjusted EBITDA: GAAP net income $ 122,249 $ 365,614 $ 1,758,675 $ 3,806,267 $ 4,245,902 Interest expense 23,014 23,962 23,416 21,861 1,551 (Benefit from) provision for income taxes $ (24,444) $ 147,045 $ 502,406 1,101,371 1,192,247 Depreciation and amortization 148,682 138,088 134,238 138,127 133,801 Foreign currency exchange losses, net 9,128 2,861 2,245 1,771 2,753 Other income, net (10,697) (36,593) (26,094) (24,488) (26,775) Change in fair market value of equity and debt securities - (606,230) (2,030,987) (4,495,825) (4,926,248) Dividend from Sartorius AG 10,861 14,029 15,690 8,922 18,991 Legal settlements (5) - - - (23,272) (28,308) Legal matters (6,738) 23,352 6,841 16,708 16,375 Acquisition related (benefits) costs (1) 9,890 (2,989) (10,611) (4,160) (40) Restructuring (benefits) costs 34,368 8,379 29,469 (921) 64,289 Other non-recurring items (4) - - - - 1,909 Goodwill and long-lived assets impairment 11,506 292,513 - - - Adjusted EBITDA $ 327,819 15.2% $ 370,031 16.2% $ 405,288 17.5% $ 546,361 21.7% $ 696,447 24.1% Release of contingent consideration and other acquisition-related (benefits) expenses. Incremental costs to comply with the European Union’s In Vitro Diagnostics Regulation (“IVDR”) for previously approved products (2021). Amount excludes interest income received in connection with legal settlements.