- BIO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Bio-Rad Laboratories (BIO) DEF 14ADefinitive proxy

Filed: 29 Mar 23, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

Bio-Rad Laboratories, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

Bio-Rad Laboratories, Inc.

1000 Alfred Nobel Drive

Hercules, California 94547

Tuesday, April 25, 2023

4:00 p.m. Pacific Daylight Time

1000 Alfred Nobel Drive, Hercules, California 94547

TO THE STOCKHOLDERS OF BIO-RAD LABORATORIES, INC.:

The annual meeting of the stockholders of Bio-Rad Laboratories, Inc. will be held at our corporate offices, 1000 Alfred Nobel Drive, Hercules, California 94547 on Tuesday, April 25, 2023 at 4:00 p.m., Pacific Daylight Time to consider and vote on:

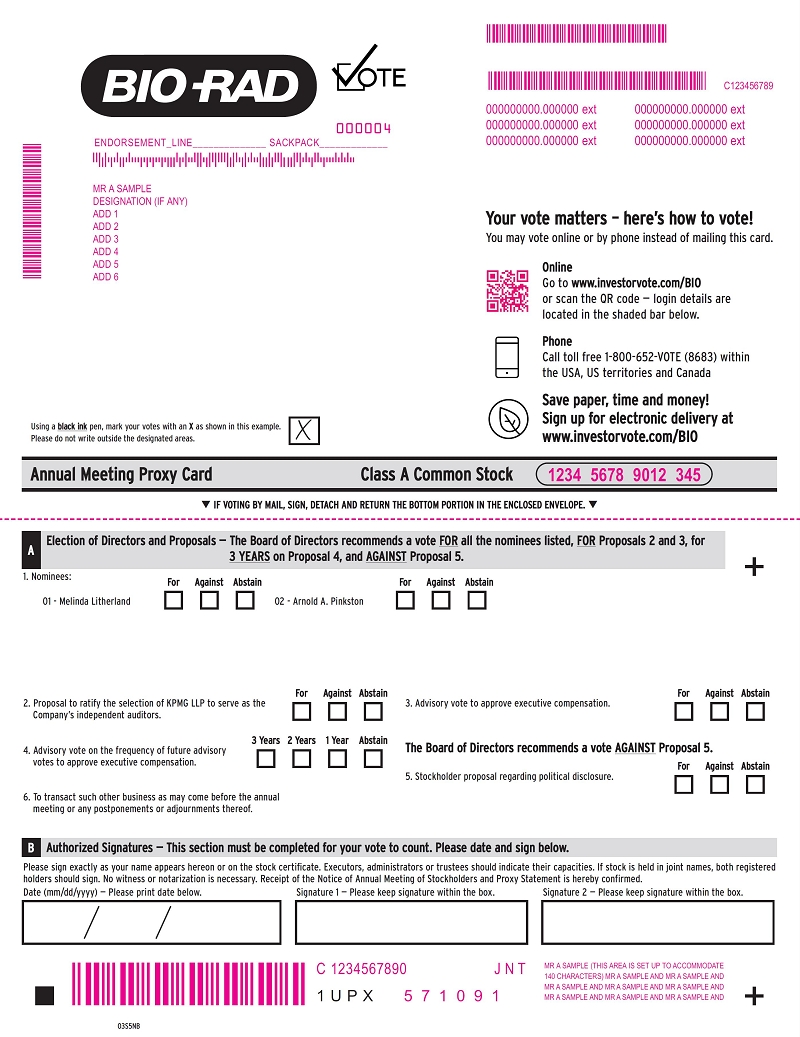

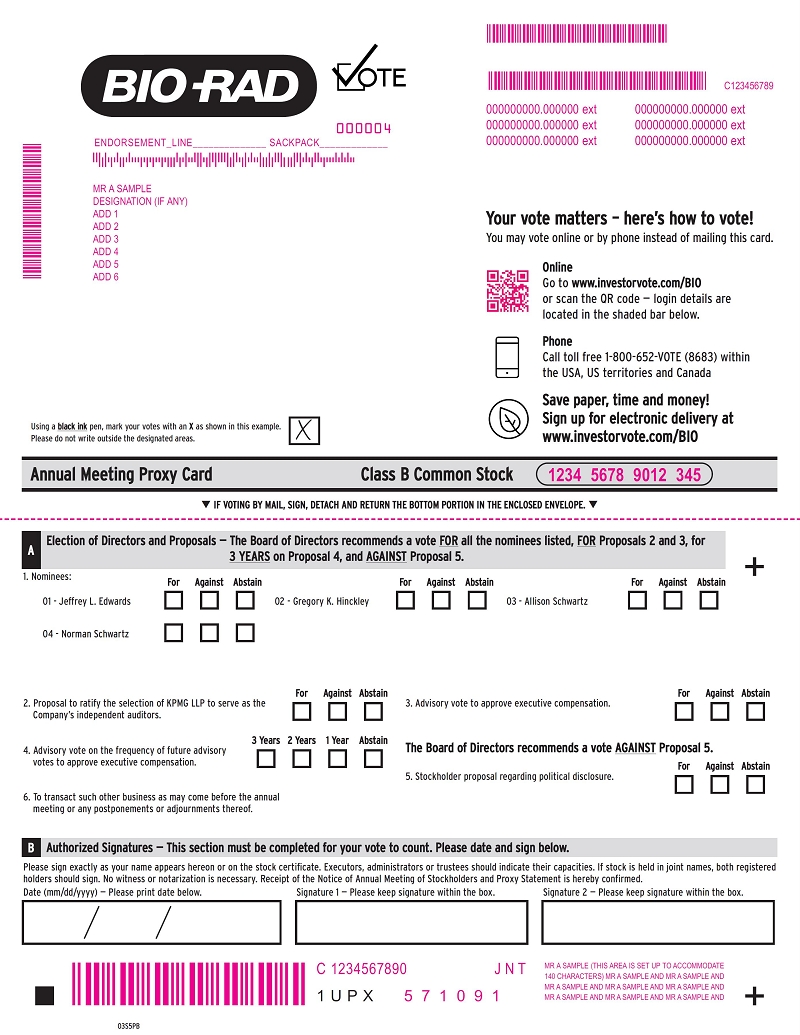

The election of two directors by the holders of outstanding Class A Common Stock and four directors by the holders of outstanding Class B Common Stock;

A proposal to ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2023;

An advisory (non-binding) vote to approve executive compensation;

An advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years;

A stockholder proposal, if properly presented at the annual meeting; and

Such other matters as may properly come before the meeting and at any adjournments or postponements thereof.

Our Board of Directors has fixed the close of business on February 24, 2023 as the record date for the determination of stockholders entitled to notice of and to vote at this annual meeting and at any adjournments or postponements thereof. Our stock transfer books will not be closed.

All stockholders are invited to attend the annual meeting in person, but those who are unable to do so are urged to execute and return promptly the enclosed proxy card(s) in the provided postage-paid envelope. Since the holders of a majority of the outstanding shares of each class of our common stock must be present or represented at the annual meeting to elect directors and the holders of a majority of our Voting Power must be present or represented at the annual meeting to conduct the other business matters referred to above, your promptness in returning the enclosed proxy card(s) will be greatly appreciated. Your proxy is revocable and will not affect your right to vote in person at the annual meeting in the event you attend the meeting and revoke your proxy.

This proxy statement and the accompanying proxy card(s) are first being distributed to stockholders of record on or about March 29, 2023.

Hercules, California

March 29, 2023

| By order of the Board of Directors BIO-RAD LABORATORIES, INC. |

|  |

| Timothy S. Ernst |

| Secretary |

Important Notice Regarding the Internet Availability of Proxy Materials for our 2023 Annual Meeting of Stockholders to be held on April 25, 2023:

The proxy statement and annual report of Bio-Rad Laboratories, Inc. are available at www.bio-radproxy.com.

Table of Contents

PROXY SUMMARY | 4 |

PROXY STATEMENT | 6 |

2023 ANNUAL MEETING | 6 |

GENERAL INFORMATION ABOUT THE MEETING AND VOTING | 6 |

ITEM 1. ELECTION OF DIRECTORS | 9 |

DIRECTOR NOMINEES | 9 |

DIRECTOR COMPENSATION | 12 |

INFORMATION ABOUT THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | 13 |

CONTROLLED COMPANY | 13 |

INDEPENDENT DIRECTORS | 13 |

COMMITTEES OF THE BOARD OF DIRECTORS | 13 |

DIRECTOR QUALIFICATIONS | 15 |

DIVERSITY | 15 |

BOARD LEADERSHIP AND RISK OVERSIGHT | 16 |

BOARD AND STOCKHOLDER MEETING ATTENDANCE | 17 |

TRANSACTIONS WITH RELATED PERSONS | 17 |

COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 17 |

CORPORATE GOVERNANCE DOCUMENTS | 17 |

ITEM 2. RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS | 18 |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 18 |

ITEM 3. ADVISORY (NON-BINDING) VOTE TO APPROVE EXECUTIVE COMPENSATION | 20 |

ITEM 4. ADVISORY (NON-BINDING) VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE EXECUTIVE COMPENSATION EVERY 1, 2 OR 3 YEARS | 21 |

ITEM 5. STOCKHOLDER PROPOSAL: POLITICAL DISCLOSURE | 22 |

EXECUTIVE OFFICERS | 24 |

PRINCIPAL AND MANAGEMENT STOCKHOLDERS | 26 |

COMPENSATION COMMITTEE REPORT | 27 |

COMPENSATION DISCUSSION AND ANALYSIS | 28 |

COMPENSATION PROGRAM OBJECTIVES AND PHILOSOPHY | 28 |

STOCKHOLDER SAY-ON-PAY VOTE | 28 |

THE COMPONENTS OF OUR EXECUTIVE COMPENSATION PROGRAM | 29 |

OUR PROCESS FOR SETTING EXECUTIVE COMPENSATION | 29 |

COMPENSATION TABLES | 34 |

SUMMARY COMPENSATION TABLE | 34 |

GRANTS OF PLAN-BASED AWARDS TABLE | 35 |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | 36 |

OPTION EXERCISES AND STOCK VESTED TABLE | 37 |

PENSION BENEFITS | 37 |

NONQUALIFIED DEFERRED COMPENSATION PLANS | 37 |

POTENTIAL PAYMENTS ON TERMINATION OR CHANGE IN CONTROL | 37 |

PAY RATIO DISCLOSURE | 39 |

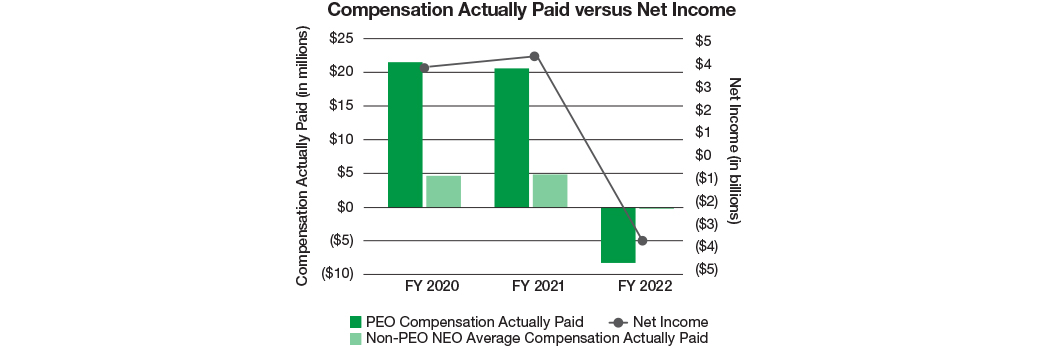

PAY VERSUS PERFORMANCE TABLE | 39 |

NARRATIVE DISCLOSURE TO PAY VERSUS PERFORMANCE TABLE | 41 |

STOCKHOLDER PROPOSALS | 42 |

OTHER MATTERS | 42 |

ANNUAL REPORT | 42 |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

Date and Time: Tuesday, April 25, 2023 at 4 p.m. Pacific Daylight Time

Location: 1000 Alfred Nobel Drive, Hercules, California 94547

Record Date: February 24, 2023

You can vote if you are a holder of our Class A Common Stock or Class B Common Stock at the close of business on February 24, 2023.

You can vote by any of the following methods:

Promptly completing, signing and returning your proxy card(s) by mail;

On the internet or by telephone, pursuant to the instructions provided on the proxy card(s) provided to you with your printed proxy materials; or

In person, at the annual meeting.

If a bank, broker or other nominee is the record holder of your stock on February 24, 2023, you will be able to vote by following the instructions on the voting instruction form or notice that you receive from your bank, broker or other nominee.

Item | Board Vote Recommendation | Page Reference (for more detail) |

1. Election of Directors | FOR each Director Nominee | 9 |

2. Ratification of Auditors | FOR | 18 |

3. Advisory Vote to Approve Executive Compensation | FOR | 20 |

4. Advisory Vote on the Frequency of Future Advisory Votes to Approve Executive Compensation Every 1, 2 or 3 Years | EVERY 3 YEARS | 21 |

5. Stockholder Proposal | AGAINST | 22 |

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 4

Name | Age | Director since | Occupation | Independent | Committee Memberships | Other Public Company Boards |

Jeffrey L. Edwards | 62 | 2017 | Former EVP, Chief Financial Officer of Allergan, Inc. | Yes | – Audit – Compensation – Legal & Regulatory Compliance | FibroGen, Inc. Clearside Biomedical, Inc. Lifecore Biomedical, Inc. |

Gregory K. Hinckley | 76 | 2017 | Former President of Mentor Graphics Corporation | Yes | – Audit – Compensation | SI-BONE, Inc. |

Melinda Litherland | 65 | 2017 | Retired Partner, Deloitte & Touche LLP | Yes | – Audit – Legal & Regulatory Compliance | Rapid Micro Biosystems, Inc. |

Arnold A. Pinkston | 64 | 2017 | Corporate Vice President, General Counsel of Edwards Lifesciences Corporation | Yes | – Legal & Regulatory Compliance |

|

Allison Schwartz | 42 | 2022 | Commercial Director of Bio-Rad Laboratories, (Canada) Limited | No |

|

|

Norman Schwartz | 73 | 1995 | President, Chief Executive Officer and Chairman of the Board of Bio-Rad | No |

|

|

We are asking our stockholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Set forth below is summary information with respect to the aggregate fees billed for professional services rendered for the fiscal years ended December 31, 2022 and 2021 by KPMG LLP.

|

| 2022 |

| 2021 |

Audit Fees | $ | 7,351,000 | $ | 8,281,000 |

Audit-Related Fees |

| 0 |

| 0 |

Tax Fees |

| 0 |

| 0 |

All Other Fees |

| 13,000 |

| 18,000 |

We are asking our stockholders to cast a non-binding advisory vote to approve the compensation of our named executive officers.

We are asking our stockholders to cast a non-binding advisory vote to conduct future advisory votes to approve executive compensation EVERY THREE YEARS.

A stockholder proposal is expected to be presented for a vote at the annual meeting.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 5

Our Board of Directors is soliciting the enclosed proxy in connection with our 2023 annual meeting of stockholders (the “Annual Meeting”) to be held our corporate offices, 1000 Alfred Nobel Drive, Hercules, California 94547 on Tuesday, April 25, 2023 at 4:00 p.m., Pacific Daylight Time, and at any adjournments or postponements thereof. Copies of this proxy statement and the accompanying notice and proxy card(s) are first being mailed on or about March 29, 2023 to all stockholders entitled to vote.

We refer to Bio-Rad Laboratories, Inc. in this proxy statement as “we,” “our,” the “Company” or “Bio-Rad”.

The items of business scheduled to be voted on at the Annual Meeting are:

The election of two directors by the holders of outstanding Class A Common Stock and four directors by the holders of outstanding Class B Common Stock;

A proposal to ratify the selection of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2023;

An advisory (non-binding) vote to approve executive compensation;

An advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years;

A stockholder proposal, if properly presented at the annual meeting; and

Such other matters as may properly come before the meeting and at any adjournments or postponements thereof.

The proxy materials include:

Our proxy statement for the Annual Meeting;

Our 2022 Annual Report to Stockholders, which consists of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022; and

Proxy card(s) for the Annual Meeting.

Our securities entitled to vote at the meeting consist of Class A Common Stock and Class B Common Stock (collectively, “Common Stock”). As of the close of business on February 24, 2023 (the “Record Date”), we had 24,521,581 shares of Class A Common Stock and 5,074,130 shares of Class B Common Stock issued and outstanding.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 6

For all matters where the holders of Class A Common Stock and Class B Common Stock vote together as a class, each share of Class A Common Stock is entitled to one-tenth of a vote and each share of Class B Common Stock is entitled to one vote. For all matters where the holders of Class A Common Stock and Class B Common Stock vote separately, including the election of directors, each share of Class A Common Stock and each share of Class B Common Stock is entitled to one vote. The sum of one-tenth the number of outstanding shares of Class A Common Stock and the number of outstanding shares of Class B Common Stock constitutes our “Voting Power.”

The presence, in attendance or by proxy, of the holders of a majority of our Voting Power, as defined above, will constitute a quorum for the transaction of business; provided, however, that the election of the Class A and Class B directors shall require the presence, in attendance or by proxy, of the holders of a majority of the outstanding shares of each respective class.

Six directors are to be elected at the meeting. The holders of Class A Common Stock, voting as a separate class, are entitled to elect two directors. The holders of Class B Common Stock, also voting as a separate class, are entitled to elect the other four directors. Our stockholders do not have any right to vote cumulatively in any election of directors. Directors elected by each class shall be elected by a majority of the votes cast in the respective class.

The proposal to ratify the appointment of our independent auditors, the advisory (non-binding) vote to approve executive compensation, the advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years, and the stockholder proposal must each receive the affirmative vote of a majority of our Voting Power present or represented by proxy at the meeting and entitled to vote on such matter in order for it to be approved.

With respect to the advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years, if none of the frequency alternatives receives the affirmative vote of a majority of our Voting Power, we will consider the frequency that receives the highest number of votes by our Voting Power to be the frequency that has been selected by our stockholders.

The term “broker non-votes” refers to shares held by a brokerage firm or other nominee (for the benefit of its client) that are represented at the meeting, but with respect to which such broker or nominee is not instructed to vote by the beneficial holder on a particular proposal and does not have discretionary authority to vote on that proposal. Brokers and nominees do not have discretionary voting authority on certain non-routine matters, including the election of directors, the advisory (non-binding) vote to approve executive compensation, the advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years, and the stockholder proposal, and accordingly, may not vote on such matters absent instructions from the beneficial holder. Broker non-votes will not be counted in determining the number of votes cast on these non-routine matters. Brokers have discretionary authority to vote on the ratification of the Company’s independent auditors.

For purposes of determining the presence of a quorum, broker non-votes, as well as abstentions, will be counted as shares that are present and entitled to vote. With respect to the election of directors, broker non-votes and abstentions will not affect the outcome of a director’s election. With respect to the proposal to ratify the appointment of our independent auditors, there will be no broker non-votes in connection with this proposal because brokers have discretionary authority to vote on the ratification of the Company’s independent auditors, and abstentions will have the same effect as a vote against this proposal. With respect to the advisory (non-binding) vote to approve executive compensation, the advisory (non-binding) vote on the frequency of future advisory votes to approve executive compensation every 1, 2 or 3 years, and the stockholder proposal, abstentions will have the same effect as a vote against these proposals and broker non-votes will have no effect on the vote for these proposals.

If you are the record holder of your stock as of the Record Date, you may submit a proxy by executing and returning the enclosed proxy card(s) in the provided postage-paid envelope. You may also vote on the internet or by telephone, pursuant to the instructions provided on the proxy card(s) provided to you with your printed proxy materials, or you may attend the Annual Meeting and vote your shares in person.

If a bank, broker or other nominee is the record holder of your stock on the Record Date, you will be able to vote by following the instructions on the voting instruction form or notice that you receive from your bank, broker or other nominee.

Shares for which a properly executed proxy in the enclosed form is returned will be voted at the Annual Meeting in accordance with the directions on such proxy. If no voting instructions are indicated with respect to one or more of the proposals, the proxy will be voted in favor of those proposal(s), and to approve those other matters that may properly come before the Annual Meeting at the discretion of the person named in the proxy. The Board of Directors is not aware of any matters that might come before the meeting other than those mentioned in this proxy statement. If, however, any other matters properly come before the Annual Meeting, it is intended that the proxies

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 7

will be voted in accordance with the judgment of the person or persons voting such proxies.

Yes. Any proxy may be revoked by the record owner of the shares at any time prior to its exercise by filing with our Secretary a written revocation or duly executed proxy bearing a later date or by attending the Annual Meeting and announcing such revocation or voting in person at the meeting. Attendance at the Annual Meeting will not, by itself, constitute revocation of a proxy. For shares held through a broker, the directions received from the broker must be followed in order to revoke a proxy, change a vote or to vote at the Annual Meeting.

There are no statutory or contractual rights of appraisal or similar remedies available to those stockholders who dissent from any matter to be acted upon at the meeting.

We will pay the cost of this proxy solicitation. In addition to solicitation by use of the mails, proxies may be solicited from our stockholders by our directors, officers and employees in person or by telephone, telegram or other means of communication. These directors, officers and employees will not be additionally compensated, but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. Arrangements will be made with brokerage houses, custodians, nominees and fiduciaries for forwarding of proxy materials to beneficial owners of shares held of record by such brokerage houses, custodians, nominees and fiduciaries and for reimbursement of their reasonable expenses incurred in connection therewith.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 8

The Board of Directors recommends that you vote FOR the director nominees named below for the class or classes of Common Stock that you hold.

Our Board of Directors currently has six members. The term of each of our current directors expires as of the date of the annual meeting of stockholders or on election and qualification of his or her successor. All of our current directors are standing for re-election to our Board. The Board of Directors appointed Alice N. Schwartz effective as of April 26, 2022 a Director Emeritus. A Director Emeritus has the option to attend Board meetings and receive Board materials at the discretion of the Secretary of the Company but does not have voting power and does not receive compensation.

At the Annual Meeting, the stockholders will elect six directors. The six persons nominated are: Jeffrey L. Edwards, Gregory K. Hinckley, Melinda Litherland, Arnold A. Pinkston, Allison Schwartz, and Norman Schwartz. The table below includes biographies for each nominee and an indication of the class of Common Stock for which the person is a director nominee. Norman Schwartz is the father of Allison Schwartz. No other family relationships exist among our current and nominated directors or executive officers.

The directors elected at this meeting will serve until the next annual meeting of stockholders or until their respective successors are elected and qualified. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in the event that at the meeting or any adjournments or postponements thereof any nominee declines or is unable to serve, the persons named in the enclosed proxy will, in their discretion, vote the shares subject to such proxy for another person selected by the Board.

JEFFREY L. EDWARDS

Former EVP, Chief Financial Officer of Allergan, Inc.

Director Since: 2017

Age: 62

Class of Common Stock to Elect: Class B

Mr. Edwards retired from Allergan, Inc., a multi-specialty health care company, in February 2015 after nearly 22 years at Allergan. From September 2005 to August 2014, he served as Executive Vice President, Finance and Business Development, Chief Financial Officer at Allergan. From 2003 to 2005 he served as Allergan’s Corporate Vice President, Corporate Development and previously served as Senior Vice President, Treasury, Tax and Investor Relations. Prior to joining Allergan, Mr. Edwards was with Banque Paribas and Security Pacific National Bank, where he held various senior-level positions in the credit and business development functions. Mr. Edwards currently serves on the Board of Directors and as Audit Committee chair of FibroGen, Inc., a publicly traded biopharmaceutical company, on the Board of Directors, the Nominating and Corporate Governance Committee and the Audit Committee of Clearside Biomedical, Inc., a publicly traded development stage pharmaceutical company, and on the Board of Directors and as the Audit Committee Chair of Lifecore Biomedical, Inc., a publicly traded company focused on diversified health and wellness solutions. Mr. Edwards has over 30 years of public company experience. We believe that Mr. Edwards’ deep financial, capital allocation, and business development experience give him the qualifications and skills to serve as a director.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 9

GREGORY K. HINCKLEY

Former President of Mentor Graphics Corporation

Director Since: 2017

Age: 76

Class of Common Stock to Elect: Class B

Mr. Hinckley retired from Mentor Graphics Corporation, a leader in computer automated software for electronics design, in July 2017 after 20 years at Mentor Graphics. From 1999 to July 2017, he served as President of Mentor Graphics. From 1997 to 1999, he served as Mentor Graphics’ Executive Vice President, Chief Operating and Financial Officer. Prior to joining Mentor Graphics in 1997, Mr. Hinckley served as Chief Financial Officer for VLSI Technology, Inc., a publicly traded integrated semiconductor device company, from 1992-1997, for Crowley Maritime Corporation from 1989-1991 and for Bio-Rad from 1983-1989. He currently serves as a director and on the Audit Committee of SI-BONE, Inc., a publicly traded orthopedic device company. Mr. Hinckley also serves as a trustee and as Chair of the Board of Portland State University. Mr. Hinckley previously served as a director for several other publicly traded companies including Intermec, Inc., a publicly traded provider of automated identification and data collection (AIDC) solutions, Super Micro, a publicly traded provider of advanced computer server systems and subsystems, and Amkor Technology, a leading supplier of outsourced semiconductor interconnect services. Mr. Hinckley has over 40 years of public company experience. We believe that Mr. Hinckley’s financial, operational and public board expertise give him the qualifications and skills to serve as a director.

MELINDA LITHERLAND

Retired Partner, Deloitte & Touche LLP

Director Since: 2017

Age: 65

Class of Common Stock to Elect: Class A

Ms. Litherland retired in 2015 as a Partner at Deloitte & Touche LLP, where she worked since 1981. She is a certified public accountant with 34 years of experience working with life science and technology companies in both audit and consulting capacities. Ms. Litherland currently serves on the Board of Directors and as Audit Committee chair of Rapid Micro Biosystems, Inc., a publicly traded life sciences technology company. Ms. Litherland is a member of the American Institute of CPAs (AICPA) and previously served for 12 years on the Board of Directors of Ronald McDonald House Charities Bay Area, including serving on the Finance Committee. We believe that Ms. Litherland’s extensive financial and life sciences background gives her the qualifications and skills to serve as a director.

ARNOLD A. PINKSTON

Corporate Vice President, General Counsel of Edwards Lifesciences Corporation

Director Since: 2017

Age: 64

Class of Common Stock to Elect: Class A

Mr. Pinkston is currently the Corporate Vice President, General Counsel of Edwards Lifesciences Corporation, a global leader in patient-focused medical innovations for heart disease, as well as critical care and surgical monitoring. Prior to joining Edwards in July 2019, he served as the Chief Legal Officer and Corporate Secretary of CoreLogic, Inc., a leading global property information, analytics and data-enabled solutions provider from January 2018 until June 2019. From 2011 until March 2015, he served as Executive Vice President and General Counsel for Allergan, Inc., a multi-specialty health care company. From 2005 until 2011, Mr. Pinkston served as Senior Vice President, General Counsel and Secretary for Beckman Coulter, Inc., a health care diagnostics and life sciences company. From 1994 until 2005, he held various positions at Eli Lilly and Company, a global pharmaceutical company, including Vice President and Deputy General Counsel. Additionally, Mr. Pinkston was formerly a director of Janus Capital Group, a publicly owned investment firm. Mr. Pinkston has over 25 years of experience at successful public companies. We believe that Mr. Pinkston’s broad corporate governance, regulatory and M&A knowledge give him the qualifications and skills to serve as a director.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 10

ALLISON SCHWARTZ

Commercial Director at Bio-Rad Laboratories (Canada) Limited

Director Since: 2022

Age: 42

Class of Common Stock to Elect: Class B

Ms. Schwartz is currently the Commercial Director at Bio-Rad Laboratories (Canada) Limited (a subsidiary of the Company), a role to which she was appointed in January 2023. Prior to this assignment, Ms. Schwartz served as the Marketing Director at Bio-Rad Laboratories (Canada) Limited from July 2021 to January 2023, and previously as the Commercial Services Director at the Company from 2016 until 2021, with accountabilities in these roles spanning global digital marketing, eCommerce, customer experience, and pricing. Since joining Bio-Rad in 2005, she has held positions in domestic and international brand development, product marketing and logistics management. We believe that Ms. Schwartz’s business experience and expertise give her the qualifications and skills necessary to effectively serve as a director of our Company.

NORMAN SCHWARTZ

Chairman of the Board, President and Chief Executive Officer

Director Since: 1995

Age: 73

Class of Common Stock to Elect: Class B

Mr. Schwartz has been our President and Chief Executive Officer since 2003 and our Chairman of the Board since 2012. He was our Vice President from 1989 to 2002, our Group Manager, Life Science, from 1997 to 2002 and our Group Manager, Clinical Diagnostics, from 1993 to 1997. We believe Mr. Schwartz’s financial and business expertise gained through over 46 years of service with our Company, including as our President and Chief Executive Officer for over 20 years, give him the qualifications and skills to serve as a director.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 11

The compensation of our Board of Directors is established by the Chairman of the Board. Our Human Resources Department periodically provides the Chairman of the Board with market information on, and trends regarding, director compensation from other companies including our peer group (our method of determining our peer group is described in the section titled “Our Process for Setting Executive Compensation” below).

Employee directors receive no additional compensation for Board service.

Our Board of Directors approved the compensation policy that was in effect during the year ended December 31, 2022 for our non-employee directors on December 6, 2019, providing for the payment of cash fees as follows:

Board Role | Cash Fees ($) |

Board Member | 125,000 |

Lead Independent Director | 15,000 |

Audit Committee Chair | 20,000 |

Audit Committee Member | 10,000 |

Legal & Regulatory Compliance Committee Chair | 10,000 |

Legal & Regulatory Compliance Committee Member | 5,000 |

Compensation Committee Chair | 5,000 |

Compensation Committee Member | 3,000 |

Pursuant to this policy, we pay no other types of meeting fees or committee service retainers to Board members. We also reimburse Board members for travel expenses relating to Board meetings. Our directors received no benefits in fiscal 2022 under defined pension or defined contribution plans. We did not award equity to non-employee directors during 2022, and none of our non-employee directors held any equity awards as of December 31, 2022.

In 2022, a special committee of the Board of Directors was formed for a limited purpose. The following fees were approved for service on the special committee: One-time fee for Special Committee Member: $5,000. One-time fee for Special Committee Chair: $8,000.

The following table provides information about director compensation during 2022 for our non-employee directors. Norman Schwartz serves as our Chief Executive Officer and his compensation is disclosed in the “Summary Compensation Table” beginning on page 34 of this Proxy Statement. Allison Schwartz serves as an employee and her compensation is disclosed under “Transactions with Related Persons” beginning on page 17 of this Proxy Statement.

Name | Fees Earned or Paid in Cash ($) | Total ($) |

Jeffrey L. Edwards | 150,000 | 150,000 |

Gregory K. Hinckley | 161,000 | 161,000 |

Melinda Litherland | 155,000 | 155,000 |

Arnold A. Pinkston | 140,000 | 140,000 |

Alice N. Schwartz(1) | 40,179 | 40,179 |

(1) Alice Schwartz retired from her position as a director effective as of April 26, 2022, and the Board of Directors appointed her a Director Emeritus effective as of April 26, 2022. A Director Emeritus has the option to attend Board meetings and receive Board materials at the discretion of the Secretary of the Company but does not have voting power and does not receive compensation. The fees shown are for her service as a director until April 26, 2022. | ||

| ||

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 12

Because the Schwartz family holds more than 50% of our Voting Power and the votes necessary to elect a majority of our Board of Directors through its ownership of our Class B Common Stock, we are a “controlled company” for purposes of the New York Stock Exchange listing standards.

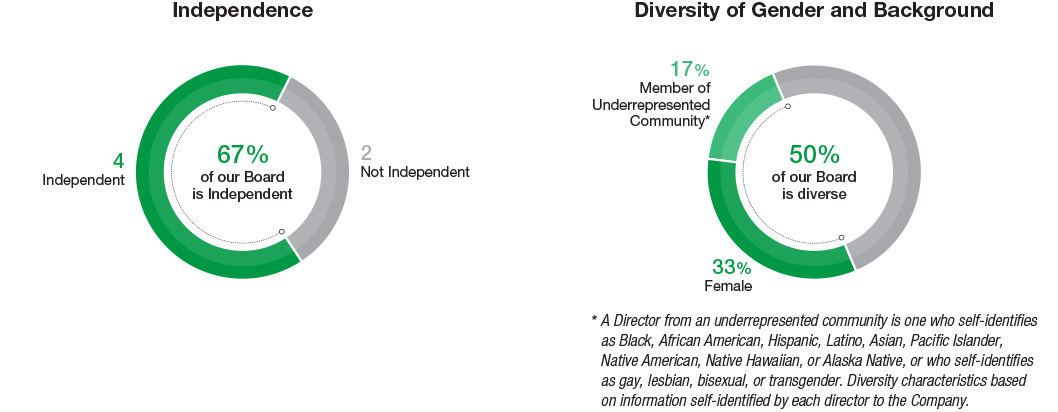

Jeffrey L. Edwards, Gregory K. Hinckley, Melinda Litherland and Arnold A Pinkston are “independent” directors, as determined in accordance with the independence standards set forth in Section 303A.02 of the New York Stock Exchange Listed Company Manual.

Our Board of Directors has an Audit Committee, a Compensation Committee and a Legal and Regulatory Compliance Committee. Because we are a “controlled company,” as explained above, our Board of Directors has no nominating committee or other committees performing similar functions. Our Board of Directors also may from time to time appoint other special committees formed for a particular purpose. In 2022, a special committee of the Board of Directors was formed for a limited purpose, and this special committee has now been disbanded. Gregory K. Hinckley served as Chair of the special committee and Jeffrey L. Edwards, Melinda Litherland and Arnold A. Pinkston served as members of the special committee. The special committee met two times in 2022.

Current Director | Audit Committee | Compensation Committee | Legal & Regulatory Compliance Committee |

Jeffrey L. Edwards |

|

|

|

Gregory K. Hinckley** |

|

|

|

Melinda Litherland |

|

|

|

Arnold A. Pinkston |

|

|

|

* Chair of Committee ** Lead Independent Director | |||

During 2022, the Audit Committee was comprised of Jeffrey L. Edwards, Gregory K. Hinckley and Melinda Litherland, all of whom are “independent” directors as determined in accordance with the independence standards set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, and Section 303A.02 of the New York Stock Exchange Listed Company Manual. Each director on the Audit Committee is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. Our Board of Directors has determined that each of Jeffrey L. Edwards, Gregory K. Hinckley and Melinda Litherland qualifies as an audit committee financial expert.

Our Board of Directors adopted an Audit Committee Charter on June 7, 2000 and amended it most recently on February 21, 2018, a copy of which is available at the Corporate Governance section of our website, www.bio-rad.com. As set forth in the Audit Committee Charter, the purpose of our Audit Committee is to assist our Board of Directors with its oversight responsibilities regarding: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our independent auditor’s qualifications and independence; and (iv) the performance of our internal audit function and independent auditor.

Our Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any independent auditor we engage, including resolution of any disagreements between our management and the independent auditor regarding financial reporting, and is responsible for reviewing and evaluating our accounting policies and system of internal accounting controls. In addition, our Audit Committee reviews the scope of our independent auditor’s audit of our financial statements, reviews and discusses our audited financial statements with management, approves in advance audit and non-audit services performed by our independent auditors,

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 13

reviews significant financial risk exposures, reviews legal matters that could have a significant impact on financial statements, prepares the annual Audit Committee reports that are included in our proxy statements and annually reviews the Audit Committee’s performance and the Audit Committee Charter, among other responsibilities. Our Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from us for, any independent counsel, experts or advisors that the Audit Committee believes to be necessary or appropriate in order to enable it to carry out its duties. Our Audit Committee Charter and Corporate Governance Guidelines provide that the members of the Audit Committee may not serve on the audit committees of the boards of directors of more than two other companies at the same time as they are serving on our Audit Committee unless our Board of Directors determines that such simultaneous service would not impair the ability of such member to effectively serve on our Audit Committee. The Board of Directors has determined that Jeffrey L. Edwards’ service on the audit committee of three other companies at the same time as he serves on our Audit Committee does not impair his ability to effectively serve on our Audit Committee. Our Audit Committee met nine times in 2022. A more complete discussion is provided in the “Report of the Audit Committee of the Board of Directors” of this proxy statement.

During 2022, the Compensation Committee was comprised of Jeffrey L. Edwards and Gregory K. Hinckley. The Compensation Committee met five times in 2022 to make determinations regarding compensation for the senior management team. Mr. Edwards and Mr. Hinckley are “independent” directors, as stated above, and meet the definition of a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. Our Board of Directors adopted a Compensation Committee charter on July 24, 2013 and amended it most recently on October 23, 2019, a copy of which is available at the Corporate Governance section of our website, www.bio-rad.com. The Compensation Committee has overall responsibility for evaluating and approving certain elements of the compensation of our executives. A discussion of the Compensation Committee’s duties and functions is provided in the “Compensation Discussion and Analysis” section of this proxy statement.

No member of our Compensation Committee was at any time during 2022 or at any other time an officer or employee of the Company, except that Gregory K. Hinckley was an officer (Vice President and Chief Financial Officer) of the Company from 1983-1989. No member of our Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission.

None of our executive officers has served on the board of directors or compensation committee of any other entity that has or has had an executive officer who served as a member of our Board of Directors or Compensation Committee during 2022.

The Legal and Regulatory Compliance Committee was formed on April 26, 2017. During 2022, the Legal and Regulatory Compliance Committee was composed of Arnold A. Pinkston, Jeffrey L. Edwards and Melinda Litherland. The Legal and Regulatory Compliance Committee met four times in 2022. Our Board of Directors adopted a Legal and Regulatory Compliance Committee charter on April 26, 2017 and amended it on February 20, 2019, a copy of which is available at the Corporate Governance section of our website, www.bio-rad.com. The Legal and Regulatory Compliance Committee has responsibility for assisting the Board with its oversight of (i) the Company’s compliance with the Foreign Corrupt Practices Act of 1977 and other anti-corruption, anti-kickback and false-claims laws, (ii) the Company’s Compliance Program and related compliance policies, and (iii) the Company’s cybersecurity risk management programs and reviewing with management the Company’s cybersecurity, data privacy and other risks relevant to the Company’s information technology controls and security.

Our Board of Directors does not have a standing nominating committee or a committee performing similar functions. Because we are a “controlled company” as stated above, we are not required to have a standing nominating committee comprised solely of independent directors. Our Board of Directors believes that it is appropriate for us not to have a standing nominating committee because we are controlled by the Schwartz family. Notwithstanding this, each member of our Board of Directors participates in the consideration of director nominees. Gregory K. Hinckley, Jeffrey L. Edwards, Melinda Litherland and Arnold A. Pinkston are all “independent” directors, as stated above; Allison Schwartz and Norman Schwartz are not.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 14

Our Board of Directors has not adopted a charter governing the director nomination process. However, it is the policy of our Board of Directors to consider stockholder nominations for candidates for membership on our Board of Directors that are properly submitted as set forth below under the caption “Communications with the Board of Directors” and the section titled “Stockholder Proposals.” The stockholder must submit a detailed resume of the candidate together with a written explanation of the reasons why the stockholder believes that the candidate is qualified to serve on our Board of Directors. In addition, the stockholder must include the written consent of the candidate, provide any additional information about the candidate that is required to be included in a proxy statement pursuant to the rules and regulations of the Securities and Exchange Commission and the Company’s Amended and Restated Bylaws, and must also describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination.

The director qualifications our Board of Directors has developed to date focus on what our Board of Directors believes to be those competencies that are essential for effective service on our Board of Directors. Qualifications for directors include technical, operational and/or economic knowledge of our business and industries; experience in operational, financial and/or administrative management; financial and risk management acumen; and experience in or familiarity with international business, markets and cultures, technological trends and developments, competence in environmental, social and governance (ESG) issues, including but not limited to issues relating to sustainability and climate change and diversity and inclusion, competence in risk evaluation and mitigation, and corporate securities and tax laws. While a candidate may not possess every one of these qualifications, his or her background should reflect many of these qualifications. In addition, a candidate should possess integrity and commitment according to the highest ethical standards; be consistently available and committed to attending meetings; be able to challenge and share ideas in a positive and constructively critical manner; and be responsive to our needs and fit in with other Board members from a business culture perspective.

Our Board of Directors identifies director nominees by first evaluating the current members of our Board of Directors who are willing to continue in service. Current members with qualifications and skills that are consistent with our Board of Directors’ criteria for Board service are re-nominated. As to new candidates, our Board of Directors generally polls its members and members of our management for their recommendations and may consult third party advisors. Our Board of Directors may also review the composition and qualification of the boards of our competitors and may seek input from industry experts or analysts. Our Board of Directors reviews the qualifications, experience and background of the candidates, and as discussed below, considers diversity in these areas among all the Board members. In making its determinations, our Board of Directors evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate our success and represent stockholder interests through the exercise of sound judgment. Any recommendations properly submitted by stockholders will be processed and are subject to the same criteria as any other candidates.

Each of the nominees included in the enclosed proxy card(s) was recommended for inclusion by all of the members of our Board of Directors.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 15

Our assessment of the qualifications of nominees for the Board of Directors includes consideration of their demographic backgrounds, including, without limitation, gender, race and ethnicity. While a nominee’s demographic background is an important consideration, nominees are not chosen or excluded solely or primarily on that basis; instead, we focus on skills, experience and background that can lead to an effective Board and complement or supplement existing skills and experience of the Board. We seek to nominate directors with a variety of complementary backgrounds and skills so that as a group, the Board will possess the appropriate talent, skills and expertise to oversee our businesses. As set forth above, the qualifications we look for in nominees for directors (both new candidates and current Board members) include technical and operational knowledge of our business and industries; experience in operational, financial and/or risk management; familiarity with international business, markets and cultures and technological trends and developments, competence in environmental, social and governance (ESG) issues, including but not limited to issues relating to sustainability and climate change and diversity and inclusion, competence in risk evaluation and mitigation, as well as corporate securities and tax laws. Because not every nominee will possess all of these qualifications, our Board considers diversity in these and other factors when evaluating each nominee in the context of the Board as a whole. We strive to build a diverse board representing a range of backgrounds, experiences and perspectives. Our Board is committed to building on its diversity in future refreshment opportunities.

Our Board of Directors does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interest of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Our Board of Directors has determined that having Norman Schwartz serve as Chief Executive Officer and Chairman of the Board is in the best interest of the Company’s stockholders at this time. This structure permits Mr. Schwartz to manage our day-to-day operations and oversee the Board’s activities efficiently.

Our Corporate Governance Guidelines provide that in the absence of an independent Chairman of the Board, the designation of a Lead Independent Director facilitates Board processes and controls and strengthens the cohesiveness and effectiveness of the Board as a whole. The duties of the Lead Independent Director set forth in our Corporate Governance Guidelines include the following: (i) preparing the agenda for, calling and presiding over executive sessions of the independent directors; (ii) serving as a sounding board for the Chairman and, on certain matters, acting as a liaison between the independent directors and the Chairman; (iii) in the event of the absence or the incapacity of the Chairman, presiding over Board meetings and acting as the spokesperson for the Board, and if requested by the Board, being available for consultation and direct communication with major stockholders; (iv) providing his/her unique perspective, as Lead Independent Director, to the Compensation Committee in connection with its annual formal evaluation of the CEO’s performance; (v) having the capacity to suggest to the Chairman that particular items be placed on the final agenda of each Board meeting; (vi) informally consulting with other directors from time to time regarding the number and length of Board meetings, the quality, quantity, timeliness, scope and organization of pre-meeting materials and Board meeting presentations and providing appropriate suggestions regarding the same to the Chairman; (vii) receiving notice of all committee meetings and having the ability to attend and observe (in an ex-officio capacity) from time to time committee meetings where appropriate to facilitate the execution of the Lead Independent Director’s duties; (viii) in appropriate circumstances, upon consultation with the Board, providing counsel to the Chairman with respect to the retention of consultants, legal counsel or other independent advisors that may assist the Board in the performance of its duties from time to time; and (ix) performing such other functions as directed by the independent directors from time to time. Gregory K. Hinckley is currently the Lead Independent Director.

Companies face a variety of risks, including credit risk, liquidity risk and operational risk. The Board of Directors believes an effective risk management process will timely identify the material risks that the Company faces, communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board of Directors or the relevant Board committee, implement appropriate and responsive risk management strategies consistent with the Company’s risk profile and integrate risk management into the Company’s decision-making. We have a Chief Compliance Officer that reports to the Chief Executive Officer. Our entire Board of Directors oversees general risk management of the Company and continually works, with the input of the Company’s executive officers, to assess and analyze the most likely areas of future risk for the Company. The Board of Directors also encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. Our Board of Directors oversees risks relating to environmental, social and governance (ESG) matters. In addition, our Audit Committee assists our Board of Directors with oversight of the Company’s financial statements, significant financial risk exposures, compliance with legal and regulatory requirements, and oversight of the independent auditor. Also, the Legal and Regulatory Compliance Committee assists the Board with its oversight of (i) the Company’s compliance with the Foreign Corrupt Practices Act of 1977 and other anti-corruption, anti-kickback and false-claims laws, (ii) the Company’s Compliance Program and related compliance policies, and (iii) the Company’s cybersecurity risk management programs and reviewing with management the Company’s cybersecurity, data privacy and other risk relevant to the Company’s information technology controls and security. We believe that the leadership structure of our Board of Directors supports effective oversight of the Company’s risk management.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 16

During 2022, our Board of Directors held a total of ten meetings (including regularly scheduled and special meetings), and no director attended fewer than 75% of such meetings and meetings of any committee on which such director served. Every member of our Board of Directors that is standing for re-election is expected to attend our annual meeting of stockholders, absent extraordinary circumstances such as a personal emergency. All of our directors who were serving at the time of our annual meeting of stockholders last year attended the annual meeting.

We maintain various policies and procedures relating to the review, approval, or ratification of transactions in which we are a participant and in which any of our directors, executive officers, greater than 5% stockholders or their family members have a direct or indirect material interest. Our Management Guidelines provide that our Board or certain executive officers, depending on the dollar value of the transaction, review and approve all material transactions through the expenditure approval procedures set forth in the Management Guidelines. Our Code of Business Ethics and Conduct, which applies to all of our directors, officers, employees, and in some cases, their family members, prohibits arrangements, agreements and acts which are, or may give the impression of being, conflicts of interest with us and requires prompt disclosure to the Corporate Compliance Department and the individual’s manager, if applicable, of an actual or potential conflict of interest. In addition, we have a Conflict of Interest Policy for Executive Officers and Directors which provides additional conflict of interest controls for our executive officers and directors. Each quarter we also require our regional sales managers and financial officers to sign and send a written representation letter to the corporate financial reporting group wherein they are asked to disclose any related party transactions of which they are aware. In addition, each year we require our directors and executive officers to complete a questionnaire which, among other things, identifies transactions or potential transactions with us in which a director or an executive officer or one of their family members or associate entities has an interest.

During 2022 and until January 2023, our director Allison Schwartz was the Marketing Director at Bio-Rad Laboratories (Canada) Limited. For fiscal year 2022, in connection with her employment in this role, Ms. Schwartz received a grant of 167 shares of the Company’s Class A restricted stock units, and base salary and bonus in the amount of $231,114. In addition, Ms. Schwartz received the following benefits relating to her expat assignment for the Company in Canada: (A) $365,410 for Canadian federal and provincial taxes applicable to Allison Schwartz’s overall compensation for her expat assignment in Canada (including a US tax gross up of $49,536); and (B) $57,176 for housing, car lease, utilities, insurance, and moving company expense (including a US tax gross up of $17,721.) Beginning in January 2023, our director Allison Schwartz has been the Commercial Director at Bio-Rad Laboratories (Canada) Limited.

Individuals, including stockholders, may contact an individual director, the Board as a group, or a specified Board committee or group, including the non-employee directors or independent directors as a group, by writing to Attention: Corporate Secretary, Bio-Rad Laboratories, Inc., 1000 Alfred Nobel Drive, Hercules, California 94547. The Corporate Secretary will promptly forward all such communications to the Chairman of the Board. Gregory K. Hinckley is currently the Lead Independent Director and presides over the meetings of our independent directors as a group.

Our commitment to good corporate governance is embodied in our Corporate Governance Guidelines. The Corporate Governance Guidelines set forth the Board’s processes and procedures to assist it in the exercise of its responsibilities and to serve the interests of the Company and its stockholders.

Our Corporate Governance Guidelines, along with our Code of Business Ethics and Conduct, Audit Committee Charter, Compensation Committee Charter, and Legal and Regulatory Compliance Committee Charter, are available at the Corporate Governance section of our website, www.bio-rad.com. Stockholders may also obtain a printed copy of these documents without charge by writing to the Corporate Secretary at the address indicated above.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 17

The Board of Directors recommends that you vote FOR ratification of KPMG LLP to serve as our independent auditors for the fiscal year ending December 31, 2023

Our Board of Directors has selected KPMG LLP, independent registered public accountants, to serve as our auditors for the fiscal year ending December 31, 2023. A representative of KPMG LLP is expected to attend the Annual Meeting to make a statement if he or she desires to do so and to respond to appropriate questions.

Although we are not required to do so, we wish to provide our stockholders with the opportunity to express their opinion on the selection of auditors, and accordingly we are submitting a proposal to ratify the selection of KPMG LLP. If our stockholders should fail to ratify this proposal, our Board of Directors will consider the selection of another auditing firm.

Our Audit Committee was established in 1992. Our Board of Directors adopted an Audit Committee charter on June 7, 2000 and amended it most recently on February 21, 2018, a copy of which is available at the Corporate Governance section of our website, www.bio-rad.com. During the fiscal year ended December 31, 2022, the Audit Committee was comprised of Jeffrey L. Edwards, Gregory K. Hinckley and Melinda Litherland, all of whom are “independent” directors, as determined in accordance with the independence standards set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, and Section 303A.02 of the New York Stock Exchange Listed Company Manual.

Our management is responsible for our internal controls and our financial reporting process. Our independent accountants are responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted accounting practices, attesting to the effectiveness of the Company’s internal control over financial reporting and issuing reports thereon. Our Audit Committee’s responsibility is to monitor and oversee these processes. The following is our Audit Committee’s report submitted to the Board of Directors for the fiscal year ended December 31, 2022.

Our Audit Committee has:

reviewed and discussed our audited financial statements with management;

reviewed and discussed our assessment of internal control over financial reporting with management;

discussed with KPMG LLP, our independent auditors, the matters required to be discussed by the applicable requirements of the Public Accounting Oversight Board and the Securities and Exchange Commission; and

received the written disclosures and the letter from KPMG LLP, our independent auditors, required by applicable requirements of the Public Accounting Oversight Board regarding our independent auditors’ communications with the Audit Committee concerning independence, and has discussed with our independent auditors the independent auditors’ independence.

Based on the review and discussions referred to above, our Audit Committee recommended to our Board of Directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 for filing with the Securities and Exchange Commission.

THE AUDIT COMMITTEE Melinda Litherland |

The Audit Committee report shall not be deemed “soliciting material” or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act and shall not otherwise be deemed filed under these Acts.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 18

Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees: Set forth below are the aggregate fees billed for professional services rendered for the fiscal years ended December 31, 2022 and 2021 by KPMG LLP.

| 2022 | 2021 | ||

Audit Fees(1) | $ | 7,351,000 | $ | 8,281,000 |

Audit-Related Fees(2) | 0 | 0 | ||

Tax Fees(3) | 0 | 0 | ||

All Other Fees(4) | 13,000 | 18,000 | ||

(1) Audit Fees included aggregate fees for professional services performed in connection with the audit of our annual consolidated financial statements and internal controls, the reviews of our consolidated financial statements included in our Quarterly Reports on Form 10-Q, issuance of comfort letters and consents related to SEC registration statements, and attestation services for the statutory audits of international subsidiaries. The fees incurred for KPMG LLP’s services for fiscal year 2021 are set forth in our 2022 Proxy Statement filed with the SEC on March 30, 2022 and have been updated in this 2023 Proxy Statement to reflect final amounts of fees incurred. Such fees for fiscal year 2022 are subject to subsequent adjustment in our 2024 Proxy Statement if final amounts billed differ from the current estimates. (2) Audit-Related Fees included aggregate fees for services rendered during the fiscal year for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” (3) Tax Fees included aggregate fees for professional services performed in connection with tax planning and tax compliance. (4) All Other Fees included fees for (i) performing agreed upon procedures in relation to the Company’s submission to the California Department of Toxic Substance Control and Contra Costa County Health and Services Hazardous Materials Program in 2021 and 2022, and (ii) providing negative assurance associated with Switzerland gender pay gap analysis in 2021. | ||||

The Audit Committee pre-approves each and every service performed by our independent auditors, including the services described in each of the four subcategories above.

Our Audit Committee has considered whether the provision of services described above under the caption “Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees” is compatible with maintaining our independent auditors’ independence and has determined that the provision of such service to us does not compromise the independent auditor’s independence.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 19

The Board of Directors recommends that you vote FOR the approval of the advisory resolution to approve executive compensation.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which we refer to as the Dodd-Frank Act, provides our stockholders with an opportunity to vote on a proposal to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement in the Compensation Discussion and Analysis section and the related executive compensation tables. Accordingly, we are asking stockholders to approve, on an advisory (non-binding) basis, the following advisory resolution (the “Advisory Resolution”) at our annual meeting of stockholders:

“RESOLVED, that the compensation of the Company’s named executive officers, as disclosed in the Annual Proxy Statement for the 2023 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Compensation Tables, and the other related tables and disclosure, is hereby APPROVED.”

The Board of Directors recommends a vote FOR this resolution because it believes that the policies and practices described in the Compensation Discussion and Analysis are effective in achieving the Company’s goals of attracting, retaining and motivating our executives, rewarding individual and Company performance and aligning the executives’ long-term interests with those of the stockholders.

We encourage stockholders to read the Compensation Discussion and Analysis beginning on page 28 of this proxy statement, as well as the Compensation Tables and related narrative, appearing on pages 34 through 42, which provide detailed information on the Company’s compensation policies and practices and the compensation of our named executive officers.

This “say-on-pay” vote is a non-binding advisory vote. The approval or disapproval of this proposal by stockholders will not require the Board of Directors or the Compensation Committee to take any action regarding our executive compensation practices. The final decision on the compensation and benefits of our named executive officers and on whether, and if so, how, to address stockholder disapproval of this proposal remains with the Board of Directors and the Compensation Committee.

Unless the Board of Directors modifies its determination on the frequency of future “say-on-pay” advisory votes, the next “say-on-pay” advisory vote will be held at the 2026 annual meeting of stockholders.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 20

The Board of Directors recommends that you vote for conducting future advisory votes to approve executive compensation EVERY THREE YEARS.

The Dodd-Frank Act also provides our stockholders with an opportunity to vote on a proposal, on an advisory (non-binding) basis, regarding how frequently we should seek an advisory vote to approve the compensation of our named executive officers, as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules, such as Item 3 above. In this Item 4, we are asking stockholders to vote on whether future advisory votes on executive compensation (similar to Item 3) should occur every year, every two years or every three years. Stockholders will be able to specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. Stockholders are not voting to approve or disapprove the Board’s recommendation. This advisory vote on the frequency of future advisory votes on executive compensation is non-binding on the Board.

The Board understands that there are different views as to what is an appropriate frequency for advisory votes on executive compensation. After careful consideration of this proposal, our Board of Directors has determined that an advisory vote on executive compensation that occurs every THREE YEARS is the most appropriate alternative for the Company, and therefore our Board of Directors recommends that you vote for a three-year interval for the advisory vote on executive compensation.

With respect to this item, if none of the frequency alternatives (one year, two years or three years) receives the affirmative vote of a majority of our Voting Power, we will consider the frequency that receives the highest number of votes by our Voting Power to be the frequency that has been selected by our stockholders. However, because this vote is advisory and not binding on us or our Board of Directors in any way, our Board of Directors may decide that it is in our and our stockholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 21

The Board of Directors recommends that you vote AGAINST this Stockholder Proposal: Political Disclosure.

James McRitchie and Myra K. Young, 9295 Yorkship Court, Elk Grove, CA 95758, beneficial owners of 25 shares of Bio-Rad common stock, have notified Bio-Rad that their designee, John Chevedden, intends to present the following proposal for consideration at the annual meeting. In accordance with the applicable proxy regulations, the text of the stockholder proposal, supporting statement and any graphics are set forth immediately below.

Bio-Rad is not responsible for the content of this stockholder proposal or the accuracy of the supporting statement.

Stockholder Proposal:

Proposal 5 –Political Disclosure

Resolved: James McRitchie, of CorpGov.net, requests Bio-Rad Laboratories Inc. (“Bio-Rad” or “Company”) provide a report, updated semiannually, disclosing Bio-Rad’s:

Policies and procedures for making, with corporate funds or assets, contributions and expenditures (direct or indirect) to (a) participate or intervene in any campaign on behalf of (or in opposition to) any candidate for public office, or (b) influence the general public, or any segment thereof, with respect to an election or referendum.

Monetary and non-monetary contributions and expenditures (direct and indirect) used in the manner described in section 1 above, including:

The identity of the recipient as well as the amount paid to each; and

The title(s) of the person(s) in the Company responsible for decision-making.

The report shall be presented to the board of directors or relevant board committee and posted on Bio-Rad’s website within 12 months after the annual meeting. This proposal does not encompass lobbying spending.

Supporting Statement: As long-term shareholders of Bio-Rad, we support transparency and accountability in corporate electoral spending. This includes any activity considered intervention in a political campaign under the Internal Revenue Code, such as direct and indirect contributions to political candidates, parties, or organizations, and independent expenditures or electioneering communications on behalf of federal, state, or local candidates.

Political spending can adversely impact a company’s reputation, value, and bottom line. The risk is especially serious when involving trade associations, Super PACs, 527 committees, and “social welfare” organizations – groups that routinely pass money to or spend on behalf of candidates and political causes companies might not otherwise support.

The Conference Board’s “Under a Microscope”(1) details these risks, recommends the process suggested in this proposal, and warns:

a new era of stakeholder scrutiny, social media, and political polarization has propelled corporate political activity—and the risks that come with it—into the spotlight. Political activity can pose increasingly significant risks for companies, including the perception that political contributions—and other forms of activity—are at odds with core company values.

We ask Bio-Rad to disclose all its electoral spending, including payments to trade associations and other tax-exempt organizations, which may be used for electoral purposes–and are otherwise undisclosed. This would bring our Company in line with leading companies, including Becton, Dickinson and Company, Bristol-Myers Squibb Company, and Boston Scientific Corp.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 22

Without knowing the recipients of Bio-Rad’s political dollars, we cannot assess alignment with its policies on climate change and sustainability or other areas of concern. Bio-Rad is a controlled company with a dual-class structure. It is, therefore, even more critical that the Board hear from independent shareholders on this issue to avoid groupthink and risk. Bio-Rad ranks in the bottom tier for 2022 CPA-Zicklin Index disclosure(2).

(1) https://www.conference-board.org/publications/

(2) https://www.politicalaccountability.net/wp-content/uploads/2022/10/2022-CPA-Zicklin-Index.pdf

Enhance Shareholder Value, Vote FOR Political Disclosure – Proposal 5

Board’s Statement in Opposition:

Bio-Rad’s Code of Business Ethics and Conduct prohibits use of the “company’s time, funds, or other resources to advance or support any political cause or candidate.” Pursuant to these principles, the Company does not intend to make any monetary or non-monetary contributions or expenditures to participate in or intervene in any political campaigns, elections or referendums. Accordingly, the Board of Directors believes that the report described in the stockholder proposal is unnecessary and recommends that you vote AGAINST the stockholder proposal.

The Board of Directors recommends that you vote AGAINST this stockholder proposal.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 23

Executive officers of Bio-Rad during the period between January 2022 and the date of this proxy statement are listed in the table below.

Name | Position with Bio-Rad | Age |

Norman Schwartz | President, Chief Executive Officer and Chairman of the Board | 73 |

Michael Crowley | Executive Vice President, Global Commercial Operations | 61 |

Diane Dahowski | Executive Vice President, Global Supply Chain | 61 |

Ilan Daskal | Executive Vice President and Chief Financial Officer | 57 |

Timothy S. Ernst | Executive Vice President, General Counsel and Secretary | 63 |

Dara Grantham Wright | Executive Vice President and President, Clinical Diagnostics Group | 47 |

Andrew J. Last | Executive Vice President and Chief Operating Officer | 63 |

Simon May | Executive Vice President and President, Life Science Group | 51 |

Biographical information regarding Norman Schwartz is provided in the preceding pages. Biographical information regarding Michael Crowley, Diane Dahowski, Ilan Daskal, Timothy S. Ernst, Dara Grantham Wright, Andrew J. Last, and Simon May, is set forth below.

Michael Crowley was appointed Executive Vice President, Global Commercial Operations in December 2014. Previously he was Vice President, Commercial Manager, Europe from 2012 to 2014 and Commercial Manager, Clinical Diagnostics Group, Europe from 2011 to 2012 and Division Manager of the Clinical Diagnostics Group North American Sales Organization from 2008 to 2011. Prior to that, he was the Clinical Diagnostics U.S. National Sales Manager since joining Bio-Rad in 1998.

Diane Dahowski was appointed Executive Vice President, Global Supply Chain in February 2020. Previously she was Senior Vice President, Global Technology & Systems from 2014 to 2020, and SVP, Clinical Diagnostics Group U.S. Operations from 2008 to 2014. Prior to that she held various positions within Bio-Rad since joining us in 1988, including VP, Clinical Immunology Division, VP Clinical Systems Division, and VP, North America Commercial Operations.

Ilan Daskal was appointed Executive Vice President and Chief Financial Officer in April 2019. Prior to joining Bio-Rad, Mr. Daskal, was the Chief Financial Officer of Lumileds, a global leader in advanced lighting technology, from May 2017 to January 2019. From 2015 through 2016, Mr. Daskal held multiple short-term Chief Financial Officer roles with private and public companies including Aricent Inc., a global design and engineering company, Cepheid, a molecular diagnostic company, and SunEdison Inc., a renewable energy company. Prior to that, from 2008 to 2015, Mr. Daskal was the Executive Vice President and Chief Financial Officer at International Rectifier Corporation, a leader in power management semi-conductor technology that was publicly traded until it was acquired by Infineon Technologies in 2015.

Timothy S. Ernst was appointed Executive Vice President, General Counsel and Secretary in June 2016. Previously he was Senior Vice President, General Counsel and Secretary of Big Heart Pet Brands, a manufacturer and marketer of branded pet food products, from 2014 to 2015. Prior to that, he was the Senior Vice-President, General Counsel and Secretary of Del Monte Foods, a manufacturer and marketer of consumer food products, from 2012 to 2014, and Associate General Counsel and Assistant Secretary of Del Monte Foods from 1995 to 2012. He was the Associate General Counsel of California and Hawaiian Sugar Company, a refiner and marketer of sugar and sugar products, from 1990 to 1995. He is a member of the California Bar and Association of Corporate Counsel.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 24

Dara Grantham Wright was appointed Executive Vice President, President, Clinical Diagnostics Group in January 2020. Prior to joining Bio-Rad, from 2016 to November 2019 Ms. Grantham Wright was Vice President and General Manager, Biosciences Division, Life Science Solutions Group, Protein & Cell Analysis at Thermo Fisher Scientific Inc., a biotechnology product development company. From 2014 to 2016, Ms. Grantham Wright was Senior Vice President & General Manager, eBioscience Business Unit at Affymetrix, Inc., a manufacturer of DNA microarrays that was acquired by Thermo Fisher Scientific in 2016. Prior to that, from 2013 to 2014, she was Chief Commercial Officer at Boreal Genomics, Inc., a company that develops new technologies for blood-based detection and monitoring of circulating tumor DNA. From 2010 to 2013 she was Global Vice President of Strategic Marketing and Clinical Applications at Affymetrix, Inc.

Andrew J. Last was appointed Executive Vice President and Chief Operating Officer in April 2019. Prior to joining Bio-Rad, Dr. Last was the Chief Commercial Officer of Berkeley Lights, Inc., a digital cell biology company that develops and commercializes platforms for the acceleration of discovery, development and delivery of cell-based products and therapies, from December 2017 to April 2019. From 2016 through 2017, Dr. Last was the Chief Operating Officer of Intrexon Corporation, a publicly traded biotechnology company. Prior to that, from 2010 to 2016, Dr. Last held senior roles at Affymetrix, Inc., a company that manufactures DNA microarray solutions, including most recently the role of Executive Vice President and Chief Operating Officer. Dr. Last’s other previous global leadership roles have included senior positions with Becton, Dickinson and Company from 2004 to 2010; Applied Biosystems from 2002 to 2004; Incyte Genomics from 1999 to 2002; and Monsanto Company from 1987 to 1999. Dr. Last also currently serves on the Board of Directors of OncoCyte Corporation, a publicly traded molecular diagnostics company.

Simon May was appointed Executive Vice President, President, Life Science Group in January 2022. Previously Dr. May was Senior Vice President and General Manager of the Digital Biology Group from 2020 to 2022, Senior Vice President, Commercial Manager from 2015 to 2020, and Vice President, North American Sales from 2014 to 2015. Prior to joining Bio-Rad in 2014, Dr. May held various leadership roles in sales and product/portfolio management at Thermo Fisher Scientific Inc., a biotechnology product development company, from 2004 to 2014. He holds a PhD in Molecular Biology and acquired hands-on expertise in molecular biology and tissue culture techniques as a Postdoctoral Research Fellow at the University of Liverpool.

Our executive officers also serve in various management capacities with our wholly owned subsidiaries.

BIO-RAD LABORATORIES, INC. - 2023 Proxy Statement 25

The following table presents certain information as of February 24, 2023 (except as noted below), with respect to our Class A Common Stock and Class B Common Stock beneficially owned by: (i) any person who is known to us to be the beneficial owner of more than five percent of the outstanding Common Stock of either class, (ii) each of our directors and our director nominees, (iii) certain of our executive officers named in the “Summary Compensation Table” of this proxy statement and (iv) all of our directors and executive officers as a group. The address for all executive officers and directors is c/o Bio-Rad Laboratories, Inc., 1000 Alfred Nobel Drive, Hercules, California, 94547.

Name and, with Respect to Owner of 5% or More, Address | Class A Common Stock(1) |

| Class B Common Stock |

| ||

Number of Shares and Nature of Ownership(2) | Percent of Class | Number of Shares and Nature of Ownership(2) | Percent of Class | |||

Blue Raven Partners, L.P.(3) 1000 Alfred Nobel Drive | — | 0.0 | % | 4,060,054 | 80.0 | % |