UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21317

Stadion Investment Trust

(Exact name of registrant as specified in charter)

1061 Cliff Dawson Road, Watkinsville, Georgia 30677

(Address of principal executive offices)(Zip code)

Sareena Khwaja-Dixon, Esq.

ALPS Fund Services, Inc., 1290 Broadway, Suite 1100, Denver, CO 80203

(Name and address of agent for service)

Registrant's telephone number, including area code: (706) 583-5207

Date of fiscal year end: May 31

Date of reporting period: June 1, 2016 through November 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

November 30, 2016

STADION TACTICAL GROWTH FUND

STADION TACTICAL DEFENSIVE FUND

STADION TRILOGY ALTERNATIVE RETURN FUND

STADION ALTERNATIVE INCOME FUND

STADION DEFENSIVE INTERNATIONAL FUND

STADION MANAGED RISK 100 FUND

TABLE OF CONTENTS

Letter to Shareholders | 1 |

Performance Information | 6 |

Disclosure of Fund Expenses | 18 |

Schedules of Investments | 20 |

Statements of Assets and Liabilities | 33 |

Statements of Operations | 35 |

Statements of Changes in Net Assets | 37 |

Financial Highlights | 40 |

Notes to Financial Statements | 58 |

Additional Information | 71 |

| Stadion Investment Trust | Letter to Shareholders |

| | November 30, 2016 (Unaudited) |

Dear Stadion Shareholder,

We are pleased to present the Stadion Funds’ Semi‐Annual Report for the six months ended November 30, 2016. This letter includes a market overview and a discussion of the prevailing market conditions over the past 6 months, highlighting the purpose and approach of each of our funds. First, let’s briefly look at financial market conditions over the last half year.

6 Month Market Condition Overview

Equity Markets

Global equity markets successfully survived a challenging environment, with U.S. equity markets achieving new all‐time highs. The first major speed bump was the June 23 vote for the United Kingdom to leave the European Union (BREXIT). The repercussions on global growth and resulting political uncertainties lead to immediate equities losses. The MSCI Europe Investable Market Index shed nearly ‐14% in US Dollar terms. U.S. markets fared better, only losing ‐5%. However, sentiment quickly changed from pessimism to optimism as doubts arose about the U.K. actually exiting the European Union and hopes that global central banks would keep monetary policies loose thus providing additional liquidity to stabilize markets.

By August U.S equity markets were trading at new all‐time highs. International markets improved as well, but were unable to set new highs. August and September trading could best be described as range bound as the markets awaited the presidential election results. As the polls tightened stocks drifted lower for nine consecutive days, the longest streak since 1980. Although the string of losses generated headlines it totaled only an approximate 3% setback. As voting results trickled in throughout election night and the edge began to shift toward a surprising win for Donald Trump the market went into a tailspin, with the Dow Jones dropping 800 points overnight. But within a day, the market digested its disbelief and went on a tear, recovering all losses and tacking on another +1.4%. Investors seemed to conclude that with a Republican congress, Trump would be successful in implementing tax cuts and public spending programs leading to faster economic growth and higher U.S. equity prices.

Most of the gains for the 6 month period ending November 30 came in the aftermath of the presidential election. The S&P 500 gained +6.01%, the Dow Jones Industrial Average added +8.98%, and the Russell 2000 index—made up of smaller cap stocks that are perceived to benefit more from Trump’s polices—gained +15.37% for the period. Emerging markets also performed well, with the MSCI Emerging Market Index gaining +8.67%. These global rises contrasted to developed markets where, still somewhat stymied by BREXIT, the MSCI EAFE index lost ‐1.12%

Bond Markets

Over the past 6 months, interest rates have seen three distinct periods of movement. Coming out of May, rates moved solidly lower, with the 10‐ year treasury declining from 1.85% to a low of 1.36% on July 8th. From that point through the presidential election, this trend reversed and there was a relatively slow and steady move higher in rates, with the 10‐year recapturing the entire move lower to close back at 1.85% before the election. Then the surprise outcome of the election threw a Trump‐sized wrench into the bond markets. Rates spiked higher, with the 10‐year eventually closing November at 2.38% just slightly higher than where it closed out the calendar year 2015.

After climbing slightly in June, investment grade and high yield corporate bond spreads gradually tightened through the remainder of the period. Overall, the Barclays Aggregate Bond index was down 0.92% with most of the downside occurring post‐election. Going forward, the elephant in the room will be the Federal Open Market Committee (“FOMC”) mystery of if, when, and to what degree they will raise interest rates for the remainder of the year into early 2017. Almost a given based on current probabilities and recent proclamations.

Stadion’s Tactical Equity Portfolio Line‐up

Stadion’s line‐up of tactical equity funds offer varying degrees of risk management and the ability to diversify across markets. For a more growth oriented strategy that still presents a defensive element, the Tactical Growth Fund (“Growth Fund”) might be a logical choice. For added defense, Stadion’s Tactical Defensive Fund (“Defensive Fund”) seeks to provide persistent market exposure but with an eye always on risk management. Stadion’s Managed Risk 100 Fund (“Managed Fund”) is our most defensive/conservative equity strategy. The Stadion Defensive International Fund (“International Fund”) is designed to provide measured access to developed and emerging international markets while attempting to manage exposure to risk and volatility.

Stadion’s Alternative Portfolio Line‐up

Stadion’s Trilogy Alternative Return Fund (“Trilogy Fund”) is an absolute return strategy designed to be market‐direction agnostic over the course of a year. Stadion’s Alternative Income Fund (“Income Fund”) seeks to generate premium from non‐traditional assets outside of traditional fixed income markets.

| Semi-Annual Report | November 30, 2016 | 1 |

| Stadion Investment Trust | Letter to Shareholders |

| | November 30, 2016 (Unaudited) |

Stadion Tactical Growth Fund

The Growth Fund follows a rules based, disciplined, proprietary model. The model quantitatively ranks all actively traded Exchange Traded Funds (“ETFs”) that have first passed a fundamental review, ranking them on risk‐adjusted return. The holdings of the Growth Fund are adjusted ongoing to favor the purchase and holding of ETFs presenting strength within the model. ETFs perceived as weak by the model are sold or not considered for purchase. The goal of the Growth Fund’s investment process is to produce above market returns while assuming below market risk over a market cycle. What differentiates the Growth Fund from Stadion’s trend following strategies is that instead of allocating to cash, the Growth Fund will attempt to allocate among a mix of defensive and non‐correlated assets during turbulent times.

For the six months ending November 30, 2016, the Growth Fund – Class A returned 7.68%. These numbers exclude the impact of the 5.75% sales load. The Fund’s performance reflects allocation decisions and market performance. Its primary benchmark, the Morningstar Moderately Aggressive Target Risk Index, returned 4.53% for the half‐year period. The secondary benchmark, the S&P 500, returned 6.01% for the half‐year period.

The Growth Fund’s security selection and ranking process allocated the portion of the portfolio dedicated to U.S. equities, which maintained an approximate 80% weighting the portfolio during the period, towards small cap and growth stocks, along with some rotation amongst sectors. For a majority of the quarter, this portion of the account remained somewhat status quo. The equity holdings saw some dispersion from the aforementioned Morningstar Index’s equity holdings, primarily from a lower allocation to the strong performing, albeit volatile, Emerging Markets. Then came the market’s reaction to the surprise win of President‐Elect Trump, with small cap stocks strongly outperforming other market segments, and the fund positioned to take advantage. Additionally, international (emerging market) equities sold off, allowing for the equity performance differential to narrow.

The non‐US Equity portion of the Growth Fund likewise allocates to ETFs showing ranking strength but with a low correlation to U.S. equities. The purpose of diversified allocations is to help achieve the Growth Fund’s goal of exhibiting below‐market risk over time. Our non‐correlated holdings had a dual effect this quarter of reducing risk while also keeping pace performance‐wise to their equity‐correlated counterparts. Much of this performance boost came from a position in inverse fixed income holdings, meaning as interest rates rose as would the value of these securities. This tailwind was especially beneficial following the election surprise, as US interest rates spiked to levels not seen since the end of calendar year 2015. This portion also maintained a steady allocation to cash and ultrashort duration ETFs, which provided a lower volatility yet steady return stream.

Stadion Tactical Defensive Fund

The Tactical Defensive Fund seeks to focus on longer term cyclical trends to find a balance of preservation and return that also incorporates shorter term intermediate trends. Fifty percent of the portfolio is governed by the long term trend strategy and 50% is governed by the shorter (more safety conscious) intermediate term strategy.

During the 6 months ended November 30, 2016 the Defensive Fund – Class A was up 4.60% excluding the impact of the 5.75% sales load. During this same time period the S&P 500 Index rose 6.01% while the Morningstar Tactical Allocation Category benchmark gained 2.54%.

Both the long term and intermediate term measures had the Tactical Defensive Fund fully invested to begin the period. Soon thereafter the shorter term risk measures began to identify increasing risk levels heading into the U.K. vote to leave the European Union. By the actual vote this portion of the portfolio was in its most defensive positon holding cash equivalents and avoiding a 5% drawdown in the U.S. equity markets. Market sentiment quickly changed from pessimism to optimism in hopes that central banks would keep monetary policies loose and provide liquidity to stabilize markets. In early July this portion of the portfolio was again fully invested and participated as the market reached new all‐time highs before the market drifted sideways‐to‐lower heading into the uncertainty surrounding the U.S. presidential election. The shorter to intermediate term measures again identified increased risk levels in the market and we began to take defensive positons in this portion of the portfolio. These measures helped avoid much of the volatility surrounding the election. Following the Trump win and reduced volatility the shorter term risk measures improved and the strategy was back to a fully invested positon. Through this reporting period the longer term portion of the portfolio stayed full invested capturing most of the markets gains. Security selection also provided a boost to the strategy having an overweight to some of the better performing sectors. The BREXIT vote and the presidential election were significant market events and the strategy performed well relative to the broader market averages while maintaining ongoing risk management.

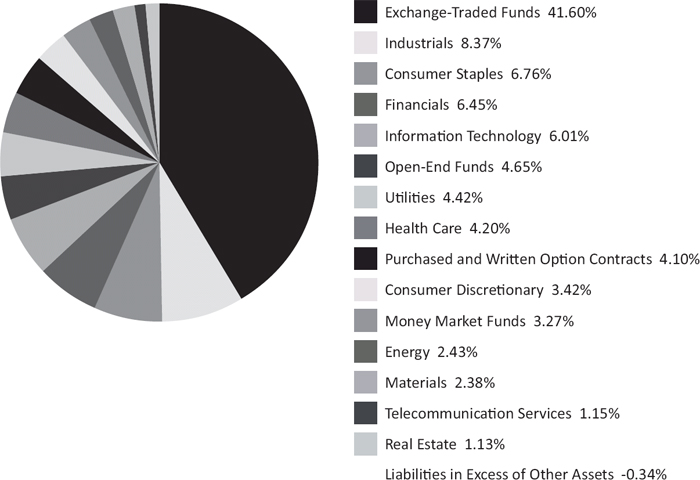

Stadion Trilogy Alternative Return Fund

The Trilogy Fund is a multi‐strategy portfolio designed to generate total returns regardless of market direction, with an emphasis on lower risk and volatility than U.S. equity markets. The Trilogy Fund consists of an equity component, an income component and a trend component, designed so that two of the three should be in favor over a given year. For the six months ended November 30 2016, the Trilogy Fund Class A returned +4.79% excluding the impact of the 5.75% sales load, while the HFRX Absolute Return Index was up +0.16% and the Morningstar Multi‐Alternative Category gained +0.41%. From a collateral standpoint, equities contributed strongly as domestic equity markets rallied off the post‐Brexit lows in June, and then again following the surprise Trump election results in November. The fixed income in the Trilogy Fund declined slightly as rates rose towards the end of the period on expectations of the second rate hike from the Federal Open Market Committee (“ FOMC”) in December. The option strategies that the Trilogy Fund employs mostly helped for the six month period. With a somewhat choppy domestic equity rally over the 6 month period, the shorter term option selling strategy continued to provide yield despite a couple of months of large market moves. The positive overall trend in equity markets has also helped the market movement portion of the fund participate to a small degree in the fundamental move over the time frame.

| Stadion Investment Trust | Letter to Shareholders |

| | November 30, 2016 (Unaudited) |

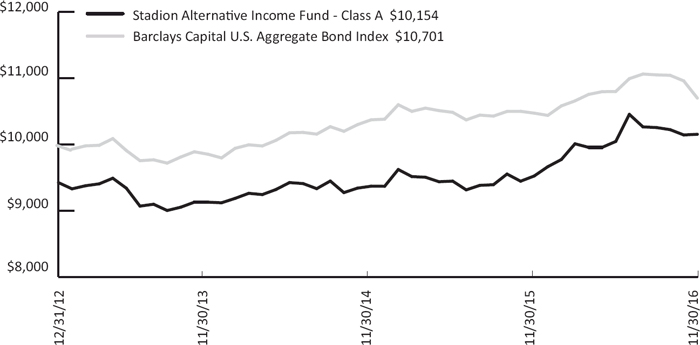

Stadion Alternative Income Fund

The Income Fund seeks to generate income and absolute return while avoiding potential “blow up” risks associated with many income‐producing strategies focused on fixed income. The Income Fund seeks dividend income from equities while utilizing a market collar to limit equity risk, and also sells short term options on a rolling basis to try and collect yield from alternative sources. For the six months ended November 30, 2016, the Income Fund Class A returned +1.67% excluding the impact of the 5.75% sales load, while the Barclays Capital Aggregate Bond Index lost ‐0.92% and the Morningstar Option Writing Category gained +2.68%. The diversified approach to income worked well during the six month period with the equities providing a lift while the collar hedged off some of the equity returns as expected in an up market. The short term options sold in an attempt to collect yield were a slight drag on the portfolio over the time period as volatility was low and a couple of large months of equity moves erased the small premiums collected in the flatter months.

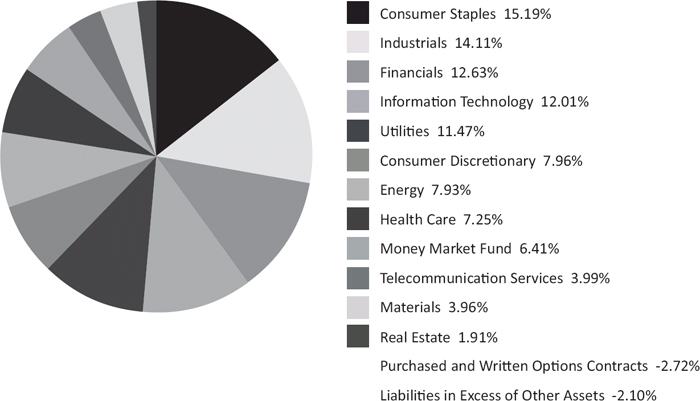

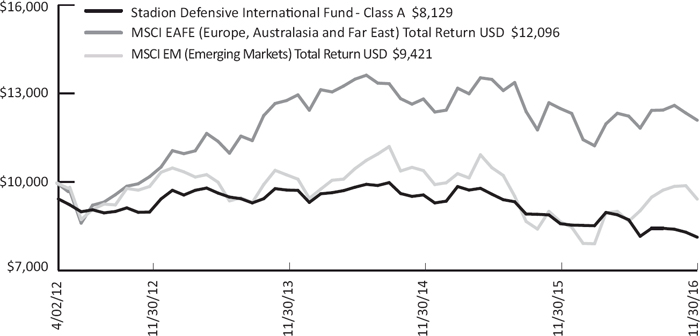

Stadion Defensive International Fund

Similar to Stadion’s other trend following strategies; the International Fund’s investment model assesses market conditions to identify when to be invested. With a security ranking measure to identify leading asset classes, the International Fund can move to fully defensive positions when risk levels are deemed high. The International Fund borrows from Stadion’s domestic model by leveraging cyclical price measures for long term trend exposure, intermediate term price measures for more reactive and adaptive allocations, and a risk management overlay incorporating speculative Emerging Market trends and volatility to help guide shorter term allocations within the intermediate and longer term mandates. When fully defensive, the International Fund has the ability to invest in cash and non‐US short duration fixed income. Due to including both Emerging and Developed market indications into the investment process, analyzing the Defensive International Fund’s returns relative to both a developed‐ market benchmark (MSCI EAFE), and an emerging market benchmark (MSCI EM) is prudent.

For the six month period ending November 30, 2016, the Stadion Defensive International Fund – Class A returned ‐6.75% which does not include a deduction for the 5.75% sales load. During this same six month period, the MSCI EAFE Index returned ‐1.12% while the MSCI EM Index gained +8.67%. A choppy market environment at the beginning of the period (through mid‐July) was the culprit for a majority of the underperformance, while the rest of the period the fund traded more in‐line.

Stadion Managed Risk 100 Fund

The Managed Risk 100 Fund is a fully unconstrained strategy that can tactically shift between as much as 100% equity and as much as 100% cash based on market risk levels as measured by Stadion’s short to intermediate term trend following model.

During the 6 months ended November 30, 2016 the Managed Risk 100 Fund – Class A gained 0.45%, excluding the impact of the 5.75% sales load. During this same time period the S&P 500 Index rose 6.01% and the Morningstar Tactical Allocation Category gained 2.54%

Managed Risk 100 is Stadion’s most defensive strategy in terms of how quickly it will move to a defensive position. The last six months were a challenge for the strategy as it navigated through what many may consider two once‐in‐a‐life time events. Significant volatility‐inducing events such as the BREXIT vote and the presidential election can lead to frequent large tactical shifts resulting in multiple small losing trades. The strategy entered the period fully invested only to be greeted by the U.K.’s unexpected vote to leave the European Union, resulting in unprofitable tactical shifts. Following the U.K. vote risk levels improved and the strategy was back to a fully invested position. Volatility and risk levels increased approaching the U.S. presidential election resulting in additional unprofitable tactical shifts.

At the time no one was certain of the outcome of either vote. As with all defensive trend following managers, we accept the frustration of small losing trades as preferable to potential devastating losses should the outcome of either vote turned into something much more dramatic and devastating.

| Semi-Annual Report | November 30, 2016 | 3 |

| Stadion Investment Trust | Letter to Shareholders |

| | November 30, 2016 (Unaudited) |

Stadion Observations and Market Outlook

The post‐election rise in stocks injected momentum into the market, a piece of the technical equation that was missing for months. The surge in stocks not only brought many of the major indices to new highs but also created a new enthusiasm for stocks. Finally, there are signs of equity inflows starting to emerge. Equity exposures are still below peak levels. We believe those all make an easy case for stocks to continue their run. The question we need to answer is whether this recent rotation from Bonds to Stocks, Large cap stocks to Small cap stocks, Growth to Value, Defense to Offense can reignite the bull, or is it just a short term gyration in the market?

In recent weeks, the dramatic appreciation of the dollar in tandem with a surge in major U.S. indexes has delivered a shocking surprise to all those who expected a broad‐based selloff in the event of an unanticipated outcome in the U.S. presidential election. Market participants appear to have confidently embraced the view that Donald Trump will be successful in implementing his pro‐growth reforms, strengthening and stimulating the U.S. economy. This has been the main narrative of how the dollar has managed to appreciate so rapidly. It is currently at its highest level since 2003.

The post‐election momentum in equities is certainly encouraging. However, we know that markets move in cycles, and we are cognizant of the length and breadth of the current bull market cycle. The law of averages tells us that we should expect the bear market phase of the cycle to occur within this President’s term. The average length of most bull market cycles is approximately 5 years, and this current bull market run has already far exceeded that. The current cyclical bull is already one of the longest in history. For this reason we will continue to prudently manage measured participation in the markets with sound defensive strategies. At Stadion we avoid making market predictions, instead favoring processes designed to play out over full market cycles.

Thank you for entrusting your serious money to Stadion. Please feel free to contact us with any questions or concerns.

Sincerely,

Stadion Money Management

Brad Thompson, CFA

Chief Investment Officer

The views in this report were those of the Funds’ investment adviser as of the date of this Report and may not reflect their views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice.

Investment in the Funds are subject to investment risks, including, without limitation, market risk, management style risk, risks related to “fund of funds” structure, sector risk, fixed income risk, tracking risk, risks related to ETF net asset value and market price, foreign securities risk, risks related to portfolio turnover and small capitalization companies risk. Since the Funds are a “fund of funds,” an investor will indirectly bear fees and expenses charged by the underlying ETFs and investment companies in which the Funds invest in addition to the Funds’ direct fees and expenses.

Derivative instruments can be volatile and the potential loss to the Funds may exceed the Funds’ initial investment. Derivative instruments may be difficult to value and may be subject to wide swings in valuations caused by changes in the value of the underlying instrument. The use of these instruments requires special skills and knowledge of investment techniques that are different than those normally required for purchasing and selling securities. The Funds could also experience losses if they are unable to close out a position because the market for an instrument or position is or becomes illiquid.

Options are financial derivatives that represent a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date).

An Option Collar is a protective options strategy that is implemented after a long postion in a stock has experienced substantial gains. It is created by purchasing an out of the money put option while simultaneously writing an out of the money call option.

The Funds’ foreign investments generally carry more risks than funds that invest strictly in U.S. assets, including currency risk, geographic risk, and emerging market risk. Risks can also result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. More information about these risks and other risks can be found in the Funds’ prospectus.

| Stadion Investment Trust | Letter to Shareholders |

| | November 30, 2016 (Unaudited) |

The MSCI Europe Investable Market Index (IMI) captures large, mid and small cap representation across 15 Developed Markets countries in Europe*. With 1,387 constituents, the index covers approximately 99% of the free float-adjusted market capitalization across the Developed Markets countries of Europe.

Barclays Capital US Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

Barclays U.S. Corporate High Yield Index covers the U.S. dollar-denominated, non-investment grade fixed-rate, taxable corporate bond market.

MSCI EM Index is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

MSCI EAFE Index (Europe, Australasia, Far East) is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The Morningstar Multi-Alternative Category is a benchmark created and published by Morningstar and defines Alternative as “Alternative funds may take short positions or invest in currencies, derivatives, or other instruments.”

The Morningstar Tactical Allocation Category is a benchmark created and published by Morningstar and is defined as “Portfolios seek to provide capital appreciation and income by actively shifting allocations between asset classes.”

The Morningstar Option Writing Category is a benchmark created and published by Morningstar and includes option writing funds that aim to generate a significant portion of their returns from the collection of premiums on options contracts sold. This category includes covered call strategies, put writing strategies, as well as options strategies that target returns primarily from contract premiums. In addition, option writing funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. As a component of the optimization process, the index selects constituents which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance.

Nasdaq Composite Index is a stock market index of common stocks and similar securities listed on the Nasdaq stock market. It is highly followed in the U.S. as an indicator of the performance of technology and growth company stocks.

The S&P 500®Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index.

The Russell 2000 Small Cap Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

One may not invest directly in an index, which is unmanaged and does not incur fees, expenses or taxes.

Correlation is a measure of how investments move in relation to one another. A correlation of 1 means the two asset classes move exactly in line with each other, while a correlation of -1 means they move in the exact opposite direction.

| Semi-Annual Report | November 30, 2016 | 5 |

| Stadion Tactical Growth Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

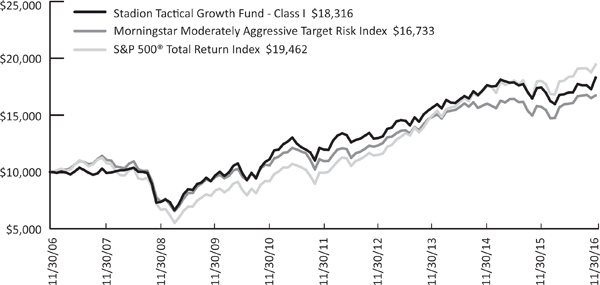

Comparison of the Change in Value of a $10,000 Investment in Stadion Tactical Growth Fund(a), the Morningstar Moderately Aggressive Target Risk Index and the S&P 500® Total Return Index

Average Annual Total Returns(b)(for periods ended November 30, 2016)

| | 6 Month | 1 Year | 5 Year | 10 Year | Since Inception(e) |

Stadion Tactical Growth Fund ‐ A ‐ NAV(c) | 7.68% | 4.92% | 8.61% | 5.97% | 6.31% |

Stadion Tactical Growth Fund ‐ A ‐ POP(c) | 1.48% | ‐1.13% | 7.32% | 5.34% | 5.81% |

Stadion Tactical Growth Fund ‐ C ‐ NAV(c) | 7.28% | 4.06% | 7.79% | 5.18% | 5.51% |

Stadion Tactical Growth Fund ‐ C ‐ CDSC(c) | 6.28% | 3.06% | 7.79% | 5.18% | 5.51% |

| Stadion Tactical Growth Fund ‐ I ‐ NAV | 7.82% | 5.10% | 8.88% | 6.24% | 6.58% |

Morningstar Moderately Aggressive Target Risk Index(d) | 4.53% | 6.38% | 8.85% | 5.28% | 7.01%(f) |

S&P 500® Total Return Index | 6.01% | 8.06% | 14.45% | 6.89% | 7.78%(f) |

| (a) | The line graph above represents performance of Class I shares only, which will vary from the performance of Class A and Class C shares based on the difference in loads and fees paid by shareholders in different classes. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

| (c) | The performance shown includes that of the predecessor Fund, the ETF Market Opportunity Fund, a series of Aviemore Trust, which was reorganized into the Fund, as of the close of business on March 29, 2013. Performance information for Class A and Class C shares prior to April 1, 2013, reflects the performance of Class I shares adjusted for the higher expenses paid by Class A and Class C shares. |

(d) | Effective September 28, 2016, the Morningstar Moderately Aggressive Target Risk Index replaced the S&P® 500 Total Return Index as the Fund’s benchmark. The Morningstar Moderately Aggressive Target Risk Index was selected as it more closely aligns to the Stadion Tactical Growth Fund’s strategies. |

| (e) | Class I, Class A and C shares of the Fund commenced operations on May 3, 2004, April 1, 2013 and April 1, 2013, respectively. The performance shown for Class A and C shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class I shares, the initial share class, calculated using the fees and expenses of Class A and C shares respectively and without the effect of any fee and expense limitations or waivers. If Class A and C shares of the Fund had been available during periods prior to April 1, 2013, the performance shown may have been different. |

(f) | Represents the period from May 3, 2004 (date of original public offering of Class I shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

| Stadion Tactical Growth Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 1.94%, 2.72% and 1.72%, respectively. The Fund’s investment adviser, Stadion Money Management, LLC (the “Advisor”) has entered into an Expense Limitation Agreement with the Fund under which it has contractually agreed to waive Management Fees and to assume other expenses of the Fund, if necessary, in an amount that limits annual operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, Acquired Fund Fees and Expenses and payments, if any, under a Rule 12b-1 Distribution Plan) of Class A, Class C and Class I shares to not more than 1.30% of the average daily net assets allocable to each Class of the Fund. The Expense Limitation Agreement is currently in effect until October 1, 2017.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased share are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The Morningstar Target Risk Index family is designed to meet the needs of investors who would like to maintain a target level of equity exposure through a portfolio diversified across equities, bonds and inflation-hedged instruments. The Morningstar Moderately Aggressive Target Risk Index seeks approximately 80% global equity exposure.

The S&P 500®Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund’s prospectus.

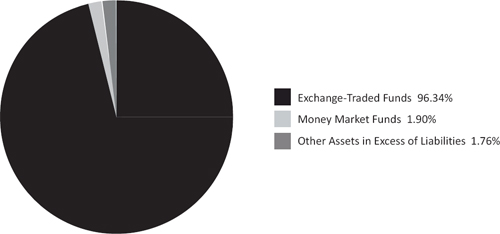

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 7 |

| Stadion Tactical Defensive Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

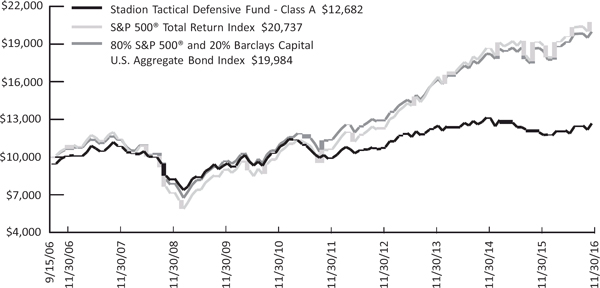

Comparison of the Change in Value of a $10,000 Investment in Stadion Tactical Defensive Fund(a), the S&P 500® Total Return Index and the 80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b)(for periods ended November 30, 2016)

| | 6 Month | 1 Year | 5 Year | 10 Year | Since Inception(c) |

| Stadion Tactical Defensive Fund ‐ A ‐ NAV | 4.60% | 5.94% | 5.16% | 2.38% | 2.95% |

| Stadion Tactical Defensive Fund ‐ A ‐ POP | ‐1.45% | ‐0.17% | 3.92% | 1.77% | 2.35% |

| Stadion Tactical Defensive Fund ‐ C ‐ NAV | 4.29% | 5.20% | 4.34% | 1.59% | 2.15% |

| Stadion Tactical Defensive Fund ‐ C ‐ CDSC | 3.29% | 4.20% | 4.34% | 1.59% | 2.15% |

| Stadion Tactical Defensive Fund ‐ I ‐ NAV | 4.81% | 6.32% | 5.39% | 2.60% | 3.17% |

S&P 500® Total Return Index | 6.01% | 8.06% | 14.45% | 6.89% | 7.41%(d) |

80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index | 4.63% | 6.96% | 12.05% | 6.57% | 7.02%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A, Class C and I shares of the Fund commenced operations on September 15, 2006, October 1, 2009 and May 28, 2010, respectively. The performance shown for Class C and I shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class C and I shares respectively and without the effect of any fee and expense limitations or waivers. If Class C and I shares of the Fund had been available during periods prior to October 1, 2009 and May 28, 2010, respectively, the performance shown may have been different. |

(d) | Represents the period from September 15, 2006 (date of original public offering of Class A shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

| Stadion Tactical Defensive Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.22%, 2.99% and 2.02%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2017.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500®Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund’s prospectus.

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 9 |

| Stadion Trilogy Alternative Return Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

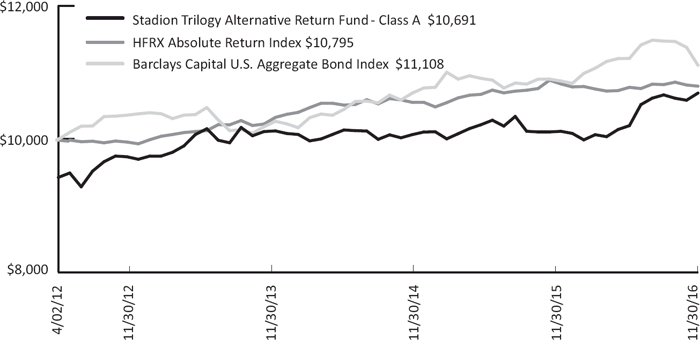

Comparison of the Change in Value of a $10,000 Investment in Stadion Trilogy Alternative Return Fund(a), the HFRX Absolute Return Index and the Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended November 30, 2016)

| | 6 Month | 1 Year | Since Inception(c) |

Stadion Trilogy Alternative Return Fund ‐ A ‐ NAV | 4.79% | 5.67% | 2.74% |

Stadion Trilogy Alternative Return Fund ‐ A ‐ POP | ‐1.23% | ‐0.42% | 1.44% |

Stadion Trilogy Alternative Return Fund ‐ C ‐ NAV | 4.34% | 4.74% | 1.98% |

Stadion Trilogy Alternative Return Fund ‐ C ‐ CDSC | 3.34% | 3.74% | 1.98% |

| Stadion Trilogy Alternative Return Fund ‐ I ‐ NAV | 4.90% | 5.91% | 2.98% |

| HFRX Absolute Return Index | 0.16% | ‐0.31% | 1.65%(d) |

| Barclays Capital U.S. Aggregate Bond Index | ‐0.92% | 2.17% | 2.28%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A inception: 04/02/12; Class C inception: 04/02/12; Class I inception: 04/02/12. |

(d) | Represents the period from April 2, 2012 (date of original public offering of Class A shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 1.97%, 2.75% and 1.76%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2017.

| Stadion Trilogy Alternative Return Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The HFRX Absolute Return Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. As a component of the optimization process, the index selects constituents which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 11 |

| Stadion Alternative Income Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Stadion Alternative Income Fund(a) and the Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended November 30, 2016)

| | 6 Month | 1 Year | Since Inception(c) |

Stadion Alternative Income Fund ‐ A ‐ NAV | 1.08% | 6.61% | 1.92% |

| Stadion Alternative Income Fund ‐ A ‐ POP | ‐4.74% | 0.50% | 0.39% |

Stadion Alternative Income Fund ‐ C ‐ NAV | 0.67% | 5.84% | 1.16% |

Stadion Alternative Income Fund ‐ C ‐ CDSC | ‐0.33% | 4.84% | 1.16% |

| Stadion Alternative Income Fund ‐ I ‐ NAV | 1.26% | 7.00% | 2.20% |

| Barclays Capital U.S. Aggregate Bond Index | ‐0.92% | 2.17% | 1.74%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A inception: 12/31/12; Class C inception: 8/7/15; Class I inception: 2/14/13. The performance shown for Class C and I shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class C and Class I shares, respectively, and without the effect of any fee and expense limitations or waivers. If Class C and Class I shares of the Fund had been available prior to August 7, 2015 and February 14, 2013, respectively, the performance shown may have been different. |

(d) | Represents the period from December 31, 2012 (date of original public offering of Class A shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 1.74%, 2.19% and 1.30%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.15% of the average daily net assets for Class A, Class C and Class I, until at least October 1, 2017.

| Stadion Alternative Income Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A shares at the time of purchase. For additional information please consult the Fund’s Prospectus.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 13 |

| Stadion Defensive International Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Stadion Defensive International Fund(a), the MSCI EAFE (Europe, Australasia and Far East) Total Return USD and the MSCI EM (Emerging Markets) Total Return USD

Average Annual Total Returns(b) (for periods ended November 30, 2016)

| | 6 Month | 1 Year | Since Inception(c) |

Stadion Defensive International Fund ‐ A ‐ NAV | ‐6.64% | ‐5.34% | ‐3.12% |

Stadion Defensive International Fund ‐ A ‐ POP | ‐11.99% | ‐10.79% | ‐4.34% |

Stadion Defensive International Fund ‐ C ‐ NAV | ‐7.04% | ‐6.04% | ‐3.85% |

Stadion Defensive International Fund ‐ C ‐ CDSC | ‐7.97% | ‐6.98% | ‐3.85% |

| Stadion Defensive International Fund ‐ I ‐ NAV | ‐6.59% | ‐5.19% | ‐2.88% |

| MSCI EAFE (Europe, Australasia and Far East) Total Return USD | ‐1.12% | ‐3.17% | 4.17%(d) |

| MSCI EM (Emerging Markets) Total Return USD | 8.67% | 8.86% | ‐1.27%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A inception: 04/02/12; Class C inception: 04/02/12; Class I inception: 04/02/12. |

(d) | Represents the period from April 2, 2012 (date of original public offering of Class A shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.97%, 3.79% and 2.86%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2017.

| Stadion Defensive International Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The MSCI EAFE (Europe, Australasia and Far East) Total Return USD Index (is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The MSCI EM (Emerging Markets) Total Return USD Index is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 15 |

| Stadion Managed Risk 100 Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

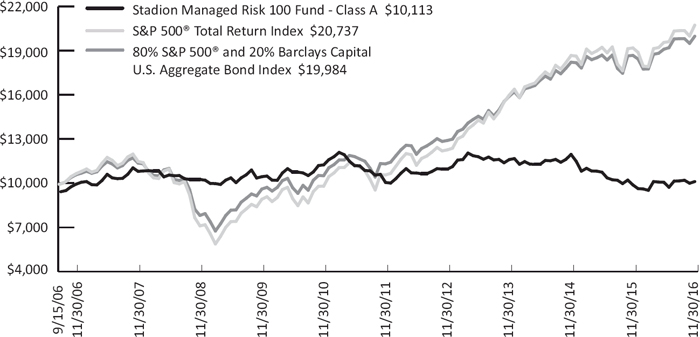

Comparison of the Change in Value of a $10,000 Investment in Stadion Managed Risk 100 Fund(a), the S&P 500® Total Return Index and the 80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended November 30, 2016)

| | 6 Month | 1 Year | 5 Year | 10 Year | Since Inception(c) |

| Stadion Managed Risk 100 Fund ‐ A ‐ NAV | 0.45% | 2.31% | 0.12% | 0.17% | 0.69% |

| Stadion Managed Risk 100 Fund ‐ A ‐ POP | ‐5.34% | ‐3.59% | ‐1.05% | ‐0.42% | 0.11% |

| Stadion Managed Risk 100 Fund ‐ C ‐ NAV | 0.00% | 1.45% | ‐0.65% | ‐0.62% | ‐0.10% |

| Stadion Managed Risk 100 Fund ‐ C ‐ CDSC | ‐1.00% | 0.45% | ‐0.65% | ‐0.62% | ‐0.10% |

| Stadion Managed Risk 100 Fund ‐ I ‐ NAV | 0.56% | 2.39% | 0.30% | 0.39% | 0.91% |

S&P 500® Total Return Index | 6.01% | 8.06% | 14.45% | 6.89% | 7.41%(d) |

80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index | 4.63% | 6.96% | 12.05% | 6.57% | 7.02%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A, Class C and I shares of the Fund commenced operations on September 15, 2006, October 1, 2009 and May 28, 2010, respectively. The performance shown for Class C and I shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class C and I shares respectively and without the effect of any fee and expense limitations or waivers. If Class C and I shares of the Fund had been available during periods prior to October 1, 2009 and May 28, 2010, respectively, the performance shown may have been different. |

(d) | Represents the period from September 15, 2006 (date of original public offering of Class A shares) through November 30, 2016. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

| Stadion Managed Risk 100 Fund | Performance Information |

| | November 30, 2016 (Unaudited) |

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.05%, 2.84% and 1.87%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2017.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

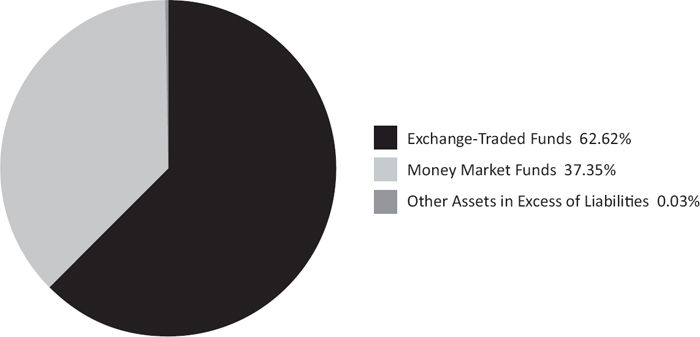

Portfolio Composition (as a % of net assets)

| Semi-Annual Report | November 30, 2016 | 17 |

| Stadion Investment Trust | Disclosure of Fund Expenses |

| | November 30, 2016 (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs, possibly including front‐end and contingent deferred sales loads; and (2) ongoing costs, including management fees, distribution (12b‐1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual funds’ ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the tables that follow are based on an investment of $1,000 made at the beginning of the most recent semi‐annual period (June 1, 2016) and held until the end of the period (November 30, 2016).

The tables that follow illustrate the Funds’ costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Funds’ actual returns, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Funds. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Funds’ ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Funds’ actual returns, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Funds’ ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the tables are meant to highlight and help you compare ongoing costs only and do not reflect any transaction costs, such as sales charges (loads). The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Funds’ expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

| | Beginning

Account Value

6/1/16 | Ending

Account Value

11/30/16 | Expense Ratio(a) | Expenses Paid

During period

6/1/16 - 11/30/16(b) |

Stadion Tactical Growth Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,076.80 | 1.55% | $ 8.07 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,017.30 | 1.55% | $ 7.84 |

Stadion Tactical Growth Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,072.80 | 2.30% | $ 11.95 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,013.54 | 2.30% | $ 11.61 |

Stadion Tactical Growth Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,078.20 | 1.30% | $ 6.77 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,018.55 | 1.30% | $ 6.58 |

| | | | | |

Stadion Tactical Defensive Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,046.00 | 1.95% | $ 10.00 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,015.29 | 1.95% | $ 9.85 |

Stadion Tactical Defensive Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,042.90 | 2.70% | $ 13.83 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,011.53 | 2.70% | $ 13.62 |

Stadion Tactical Defensive Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,048.10 | 1.70% | $ 8.73 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,016.55 | 1.70% | $ 8.59 |

| | | | | |

| Stadion Investment Trust | Disclosure of Fund Expenses |

November 30, 2016 (Unaudited)

| | Beginning

Account Value

6/1/16 | Ending

Account Value

11/30/16 | Expense Ratio(a) | Expenses Paid

During period

6/1/16 - 11/30/16(b) |

Stadion Trilogy Alternative Return Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,047.90 | 1.81% | $ 9.29 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,015.99 | 1.81% | $ 9.15 |

Stadion Trilogy Alternative Return Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,043.40 | 2.60% | $ 13.32 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,012.03 | 2.60% | $ 13.11 |

Stadion Trilogy Alternative Return Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,049.00 | 1.61% | $ 8.27 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,017.00 | 1.61% | $ 8.14 |

| | | | | |

Stadion Alternative Income Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,010.80 | 1.40% | $ 7.06 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,018.05 | 1.40% | $ 7.08 |

Stadion Alternative Income Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,006.70 | 2.12% | $ 10.66 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,014.44 | 2.12% | $ 10.71 |

Stadion Alternative Income Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,012.60 | 1.15% | $ 5.80 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,019.30 | 1.15% | $ 5.82 |

| | | | | |

Stadion Defensive International Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 933.60 | 1.95% | $ 9.45 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,015.29 | 1.95% | $ 9.85 |

Stadion Defensive International Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 929.60 | 2.70% | $ 13.06 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,011.53 | 2.70% | $ 13.62 |

Stadion Defensive International Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 934.10 | 1.70% | $ 8.24 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,016.55 | 1.70% | $ 8.59 |

| | | | | |

Stadion Managed Risk 100 Fund - Class A | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,004.50 | 1.90% | $ 9.55 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,015.54 | 1.90% | $ 9.60 |

Stadion Managed Risk 100 Fund - Class C | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,000.00 | 2.68% | $ 13.44 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,011.63 | 2.68% | $ 13.51 |

Stadion Managed Risk 100 Fund - Class I | | | | |

| Based on Actual Fund Return | $ 1,000.00 | $ 1,005.60 | 1.70% | $ 8.55 |

| Based on Hypothetical 5% Return (before expenses) | $ 1,000.00 | $ 1,016.55 | 1.70% | $ 8.59 |

| (a) | The Fund's expense ratios have been based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183/365). |

| Semi-Annual Report | November 30, 2016 | 19 |

| Stadion Tactical Growth Fund | Schedule of Investments |

November 30, 2016 (Unaudited)

| EXCHANGE‐TRADED FUNDS ‐ 96.34% | | Shares | | | Value | |

iShares® Core S&P® Small‐Cap ETF | | | 247,990 | | | $ | 33,114,105 | |

iShares® Russell 2000® ETF | | | 251,310 | | | | 33,074,909 | |

| PIMCO Enhanced Short Maturity Active ETF | | | 326,280 | | | | 33,110,894 | |

PowerShares® QQQ Trust, Series 1 | | | 138,937 | | | | 16,325,097 | |

ProShares® Short 20+ Year Treasury(a) | | | 1,436,100 | | | | 34,250,985 | |

| SPDR S&P Oil & Gas Exploration & Production ETF | | | 427,390 | | | | 17,920,463 | |

SPDR® S&P 500® ETF Trust | | | 299,930 | | | | 66,098,573 | |

SPDR® S&P® Bank ETF | | | 480,160 | | | | 19,758,584 | |

Technology Select Sector SPDR® Fund | | | 343,730 | | | | 16,327,175 | |

Vanguard® Growth ETF | | | 442,521 | | | | 48,991,500 | |

| | | | | | | | | |

TOTAL EXCHANGE‐TRADED FUNDS (Cost $287,100,850) | | | | | | | 318,972,285 | |

| MONEY MARKET FUNDS ‐ 1.90% | | Shares | | | Value | |

| Morgan Stanley Institutional Liquidity Fund ‐ Government Portfolio, 0.293%, 7‐day effective yield | | | 6,307,693 | | | $ | 6,307,693 | |

| | | | | | | | | |

TOTAL MONEY MARKET FUNDS (Cost $6,307,693) | | | | | | | 6,307,693 | |

| | | | | | | | | |

Total Investments, at Value ‐ 98.24% (Cost $293,408,543) | | | | | | | 325,279,978 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities ‐ 1.76% | | | | | | | 5,823,116 | |

| | | | | | | | | |

| Net Assets ‐ 100.00% | | | | | | $ | 331,103,094 | |

| (a) | Non-income producing security. |

See Notes to Financial Statements.

| Stadion Tactical Defensive Fund | Schedule of Investments |

November 30, 2016 (Unaudited)

| EXCHANGE‐TRADED FUNDS ‐ 98.94% | | Shares | | | Value | |

Guggenheim S&P 500® Pure Value ETF | | | 50,460 | | | $ | 2,864,109 | |

iShares® Core S&P Mid‐Cap ETF | | | 11,900 | | | | 1,933,988 | |

iShares® Currency Hedged MSCI EAFE ETF | | | 150,470 | | | | 3,825,700 | |

iShares® Russell 2000® ETF | | | 58,490 | | | | 7,697,869 | |

SPDR® Dow Jones® Industrial Average ETF Trust | | | 24,800 | | | | 4,746,720 | |

SPDR® S&P 500® ETF Trust | | | 43,450 | | | | 9,575,511 | |

SPDR® S&P MidCap 400® ETF Trust | | | 6,460 | | | | 1,914,938 | |

Technology Select Sector SPDR® Fund | | | 100,330 | | | | 4,765,675 | |

| | | | | | | | | |

TOTAL EXCHANGE‐TRADED FUNDS (Cost $35,866,106) | | | | | | | 37,324,510 | |

| MONEY MARKET FUNDS ‐ 1.43% | | Shares | | | Value | |

| Morgan Stanley Institutional Liquidity Fund ‐ Government Portfolio, 0.293%, 7‐day effective yield | | | 538,620 | | | $ | 538,620 | |

| | | | | | | | | |

TOTAL MONEY MARKET FUNDS (Cost $538,620) | | | | | | | 538,620 | |

| | | | | | | | | |

Total Investments, at Value ‐ 100.37% (Cost $36,404,726) | | | | | | | 37,863,130 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets ‐ (0.37)% | | | | | | | (138,115 | ) |

| | | | | | | | | |

| Net Assets ‐ 100.00% | | | | | | $ | 37,725,015 | |

See Notes to Financial Statements.

| Semi-Annual Report | November 30, 2016 | 21 |

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

November 30, 2016 (Unaudited)

| COMMON STOCKS ‐ 46.72% | | Shares | | | Value | |

| Consumer Discretionary ‐ 3.42% | | | | | | |

| Distributors ‐ 1.09% | | | | | | |

Genuine Parts Co.(a) | | | 9,941 | | | $ | 956,623 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure ‐ 1.15% | | | | | | | | |

McDonald's Corp.(a) | | | 8,457 | | | | 1,008,666 | |

| | | | | | | | | |

| Household Durables ‐ 1.18% | | | | | | | | |

Garmin Ltd.(a) | | | 19,865 | | | | 1,036,158 | |

| | | | | | | | | |

| Consumer Staples ‐ 6.76% | | | | | | | | |

| Food & Staples Retailing ‐ 1.24% | | | | | | | | |

Sysco Corp.(a) | | | 20,411 | | | | 1,086,886 | |

| | | | | | | | | |

| Food Products ‐ 2.17% | | | | | | | | |

General Mills, Inc.(a) | | | 15,813 | | | | 963,644 | |

Kellogg Co.(a) | | | 13,065 | | | | 940,680 | |

| | | | | | | | 1,904,324 | |

| | | | | | | | | |

| Household Products ‐ 1.07% | | | | | | | | |

Procter & Gamble Co.(a) | | | 11,441 | | | | 943,425 | |

| | | | | | | | | |

| Multiline Retail ‐ 1.15% | | | | | | | | |

Wal‐Mart Stores, Inc.(a) | | | 14,270 | | | | 1,005,036 | |

| | | | | | | | | |

| Tobacco ‐ 1.13% | | | | | | | | |

Archer‐Daniels‐Midland Co.(a) | | | 22,913 | | | | 990,529 | |

| | | | | | | | | |

| Energy ‐ 2.43% | | | | | | | | |

| Oil, Gas & Consumable Fuels ‐ 2.43% | | | | | | | | |

Chevron Corp.(a) | | | 9,660 | | | | 1,077,670 | |

Schlumberger Ltd.(a) | | | 12,582 | | | | 1,057,517 | |

| | | | | | | | 2,135,187 | |

| | | | | | | | | |

| Financials ‐ 6.45% | | | | | | | | |

| Banks ‐ 5.34% | | | | | | | | |

BB&T Corp.(a) | | | 25,433 | | | | 1,150,843 | |

Fifth Third Bancorp(a) | | | 49,642 | | | | 1,291,685 | |

US Bancorp(a) | | | 22,087 | | | | 1,095,957 | |

Wells Fargo & Co.(a) | | | 21,711 | | | | 1,148,946 | |

| | | | | | | | 4,687,431 | |

| | | | | | | | | |

| Insurance ‐ 1.11% | | | | | | | | |

Aflac, Inc.(a) | | | 13,701 | | | | 977,977 | |

| | | | | | | | | |

| Health Care ‐ 4.20% | | | | | | | | |

| Health Care Equipment & Supplies ‐ 1.06% | | | | | | | | |

Abbott Laboratories(a) | | | 24,410 | | | | 929,289 | |

| | | | | | | | | |

| Pharmaceuticals ‐ 3.14% | | | | | | | | |

Eli Lilly & Co.(a) | | | 12,550 | | | | 842,356 | |

Johnson & Johnson(a) | | | 8,229 | | | | 915,888 | |

Merck & Co., Inc.(a) | | | 16,355 | | | | 1,000,762 | |

| | | | | | | | 2,759,006 | |

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

November 30, 2016 (Unaudited)

| COMMON STOCKS ‐ 46.72% (continued) | | Shares | | | Value | |

| Industrials ‐ 8.37% | | | | | | |

| Aerospace & Defense ‐ 2.43% | | | | | | |

Lockheed Martin Corp.(a) | | | 4,073 | | | $ | 1,080,363 | |

United Technologies Corp.(a) | | | 9,763 | | | | 1,051,671 | |

| | | | | | | | 2,132,034 | |

| | | | | | | | | |

| Commercial Services & Supplies ‐ 1.22% | | | | | | | | |

Waste Management, Inc.(a) | | | 15,379 | | | | 1,069,148 | |

| | | | | | | | | |

| Electrical Equipment ‐ 1.21% | | | | | | | | |

Emerson Electric Co.(a) | | | 18,867 | | | | 1,064,853 | |

| | | | | | | | | |

| Machinery ‐ 1.24% | | | | | | | | |

Illinois Tool Works, Inc.(a) | | | 8,683 | | | | 1,086,938 | |

| | | | | | | | | |

| Miscellaneous Manufacturing ‐ 1.13% | | | | | | | | |

General Electric Co.(a) | | | 32,344 | | | | 994,901 | |

| | | | | | | | | |

| Trading Companies & Distributors ‐ 1.14% | | | | | | | | |

WW Grainger, Inc.(a) | | | 4,329 | | | | 998,138 | |

| | | | | | | | | |

| Information Technology ‐ 6.01% | | | | | | | | |

| Communications Equipment ‐ 2.39% | | | | | | | | |

Cisco Systems, Inc.(a) | | | 32,224 | | | | 960,919 | |

Harris Corp.(a) | | | 10,998 | | | | 1,138,953 | |

| | | | | | | | 2,099,872 | |

| | | | | | | | | |

| IT Services ‐ 1.23% | | | | | | | | |

Automatic Data Processing, Inc.(a) | | | 11,194 | | | | 1,074,848 | |

| | | | | | | | | |

| Software ‐ 1.23% | | | | | | | | |

Microsoft Corp.(a) | | | 17,938 | | | | 1,080,944 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals ‐ 1.16% | | | | | | | | |

International Business Machines Corp.(a) | | | 6,299 | | | | 1,021,824 | |

| | | | | | | | | |

| Materials ‐ 2.38% | | | | | | | | |

| Chemicals ‐ 1.18% | | | | | | | | |

Dow Chemical Co.(a) | | | 18,628 | | | | 1,037,952 | |

| | | | | | | | | |

| Paper & Forest Products ‐ 1.20% | | | | | | | | |

International Paper Co.(a) | | | 21,508 | | | | 1,047,870 | |

| | | | | | | | | |

| Real Estate ‐ 1.13% | | | | | | | | |

| Equity Real Estate Investment ‐ 1.13% | | | | | | | | |

Weyerhaeuser Co.(a) | | | 32,051 | | | | 988,132 | |

| | | | | | | | | |

| Telecommunication Services ‐ 1.15% | | | | | | | | |

| Diversified Telecommunication Services ‐ 1.15% | | | | | | | | |

AT&T, Inc.(a) | | | 26,214 | | | | 1,012,647 | |

| Semi-Annual Report | November 30, 2016 | 23 |

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

November 30, 2016 (Unaudited)

| COMMON STOCKS ‐ 46.72% (continued) | | Shares | | | Value | |

| Utilities ‐ 4.42% | | | | | | |

| Electric Utilities ‐ 2.13% | | | | | | |

Eversource Energy(a) | | | 18,231 | | | $ | 941,084 | |

Southern Co.(a) | | | 19,785 | | | | 926,334 | |

| | | | | | | | 1,867,418 | |

| | | | | | | | | |

| Energy ‐ 1.12% | | | | | | | | |

Dominion Resources, Inc.(a) | | | 13,492 | | | | 988,829 | |

| | | | | | | | | |

| Gas Utilities ‐ 1.17% | | | | | | | | |

National Fuel Gas Co.(a) | | | 18,195 | | | | 1,025,834 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $32,028,093) | | | | | | | 41,012,719 | |

| EXCHANGE‐TRADED FUNDS ‐ 41.60% | | Shares | | | Value | |

iShares® 10+ Year Credit Bond ETF(a) | | | 52,100 | | | $ | 3,016,069 | |

iShares® 1‐3 Year Credit Bond ETF(a) | | | 67,861 | | | | 7,122,691 | |

iShares® iBoxx® $ Investment Grade Corporate Bond ETF(a) | | | 34,590 | | | | 4,041,496 | |

iShares® Intermediate Credit Bond ETF(a) | | | 37,409 | | | | 4,048,776 | |

iShares® MBS ETF(a) | | | 75,321 | | | | 8,089,475 | |

VanEck Vectors™ Fallen Angel High Yield Bond ETF(a) | | | 143,700 | | | | 4,118,442 | |

Vanguard® Intermediate‐Term Government Bond ETF(a) | | | 94,465 | | | | 6,074,099 | |

| | | | | | | | | |

TOTAL EXCHANGE‐TRADED FUNDS (Cost $36,743,890) | | | | | | | 36,511,048 | |

| OPEN‐END FUNDS ‐ 4.65% | | Shares | | | Value | |

| AllianzGI Short Duration High Income Fund, Institutional Shares | | | 269,801 | | | $ | 4,082,088 | |

| | | | | | | | | |

TOTAL OPEN‐END FUNDS (Cost $4,156,065) | | | | | | | 4,082,088 | |

| PURCHASED OPTION CONTRACTS ‐ 8.42% | Expiration Date | | | Strike Price | | Contracts | | Value | |

| Call Option Contracts ‐ 3.40% | | | | | | | | | | | | |

S&P 500® Index: | | | | | | | | | | | | |

| | 12/02/2016 | | | $ | 2,275 | | | 50 | | $ | 375 | |

| | 12/09/2016 | | | | 2,250 | | | 50 | | | 4,750 | |

| | 12/16/2016 | | | | 2,050 | | | 40 | | | 605,400 | |