UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

[X] Quarterly report pursuant section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period endedMarch 31, 2007

[ ] Transition report pursuant section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________________ to ________________

Commission file number001-32673

CAPITAL MINERAL INVESTORS, INC.

(Exact name of small business issuer as specified in its charter)

| Nevada | 25-1901892 |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

101 Convention Centre Drive, Suite 700

Las Vegas, Nevada 89109

Tel: (702) 284-5848

(Address and telephone number of Registrant's principal

executive offices and principal place of business)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange

Act during the past 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes [ ] No [X]

Total revenues for quarter ended March 31, 2007 were $0.

As of August 13, 2008, the Company had 9,699,497 outstanding shares of Common Stock.

Transitional Small Business Disclosure Format (Check one): Yes [ ] No [X]

PART I FINANCIAL INFORMATION

ITEM 1. Financial Statements

The following unaudited financial statements for the three months ended March 31, 2007 have been prepared by management and reviewed by an independent public accountant using professional standards and procedures for conducting such reviews.

CAPITAL MINERAL INVESTORS, INC.

(An Exploration Stage Company)

FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2007

(unaudited)

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

March 31, 2007

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Balance Sheets

(Unaudited)

| | | March 31, | | | December 31, | |

| | | 2007 | | | 2006 | |

| | | $ | | | $ | |

| | | | | | | |

| ASSETS | | | | | | |

| Current Assets | | | | | | |

| Cash | | 8,012 | | | 1,994 | |

| Total Current Assets | | 8,012 | | | 1,994 | |

| Equipment, net | | 4,166 | | | 3,529 | |

| Total Assets | | 12,178 | | | 5,523 | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | |

| Current Liabilities | | | | | | |

| Accounts payable and accrued liabilities | | 35,039 | | | 27,888 | |

| Notes payable (Note 3) | | 52,341 | | | 43,341 | |

| Due to related parties (Note 4) | | 40,924 | | | 17,400 | |

| Total Liabilities | | 128,304 | | | 88,629 | |

| Stockholders’ Deficit | | | | | | |

| Common Stock, 75,000,000 shares authorized, $0.001 par value | | | | | | |

| 8,699,497 (December 31, 2006 – 8,699,497) shares issued and outstanding | | 8,700 | | | 8,700 | |

| Additional Paid-in Capital | | 267,250 | | | 267,250 | |

| Deficit Accumulated During the Exploration Stage | | (392,076 | ) | | (359,056 | ) |

| Total Stockholders’ Deficit | | (116,126 | ) | | (83,106 | ) |

| Total Liabilities and Stockholders’ Deficit | | 12,178 | | | 5,523 | |

| Going concern contingency (Note 1) | | | | | | |

| Subsequent events (Note 6) | | | | | | |

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-1

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Statements of Operations

(Unaudited)

| | | Accumulated | | | | | | | |

| | | From | | | For the | | | For the | |

| | | December 31, 2002 | | | Three Months | | | Three Months | |

| | | (Date of Inception) | | | Ended | | | Ended | |

| | | to March 31, | | | March 31, | | | March 31, | |

| | | 2007 | | | 2007 | | | 2006 | |

| | | $ | | | $ | | | $ | |

| Expenses | | | | | | | | | |

| | | | | | | | | | |

| Accounting and audit fees | | 42,877 | | | 1,267 | | | 2,241 | |

| Consulting fees | | 1,200 | | | – | | | – | |

| Depreciation expense | | 3,988 | | | 268 | | | 298 | |

| Incorporation costs | | 1,015 | | | – | | | – | |

| Legal fees | | 107,919 | | | 8,485 | | | 6,060 | |

| Licenses and dues | | 1,082 | | | – | | | – | |

| Management fees (Note 4) | | 30,000 | | | 15,000 | | | – | |

| Mineral property costs (Note 2) | | 147,158 | | | – | | | 21,250 | |

| Office expenses | | 8,332 | | | 1,646 | | | 208 | |

| Rent | | 3,600 | | | 1,200 | | | – | |

| Telephone and utilities | | 7,573 | | | 598 | | | 676 | |

| Transfer and filing fees | | 7,463 | | | 906 | | | 1,217 | |

| Travel and promotion | | 29,869 | | | 3,650 | | | 4,055 | |

| | | | | | | | | | |

| Total Expenses | | 392,076 | | | 33,020 | | | 36,005 | |

| | | | | | | | | | |

| Net Loss | | (392,076 | ) | | (33,020 | ) | | (36,005 | ) |

| | | | | | | | | | |

| Net Loss Per Share – Basic and Diluted | | | | | (0.00 | ) | | (0.00 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| Weighted Average Shares Outstanding | | | | | | | | | |

| - Basic and Diluted | | | | | 8,699,497 | | | 7,749,497 | |

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-2

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Statements of Cash Flows

(Unaudited)

| | | Accumulated From | | | For the | | | For the | |

| | | December 31, 2002 | | | Three Months | | | Three Months | |

| | | (Date of Inception) | | | Ended | | | Ended | |

| | | to March 31, | | | March 31, | | | March 31, | |

| | | 2007 | | | 2007 | | | 2006 | |

| | | $ | | | $ | | | $ | |

| Operating Activities | | | | | | | | | |

| Net loss | | (392,076 | ) | | (33,020 | ) | | (36,005 | ) |

| Adjustment to reconcile net loss to net cash used in | | | | | | | | | |

| operating activities: | | | | | | | | | |

| Depreciation expense | | 3,988 | | | 268 | | | 298 | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Prepaid expenses | | – | | | – | | | (16,250 | ) |

| Accounts payable and accrued liabilities | | 35,038 | | | 7,151 | | | 1,599 | |

| Due to related party | | 40,924 | | | 23,524 | | | – | |

| Net Cash Used in Operating Activities | | (312,126 | ) | | (2,077 | ) | | (50,358 | ) |

| Investing Activities | | | | | | | | | |

| Purchase of equipment | | (8,153 | ) | | (905 | ) | | – | |

| Net Cash Used in Investing Activities | | (8,153 | ) | | (905 | ) | | – | |

| Financing Activities | | | | | | | | | |

| Proceeds from issuance of common stock | | 275,950 | | | – | | | – | |

| Common stock subscriptions received | | – | | | – | | | 25,000 | |

| Notes payable | | 52,341 | | | 9,000 | | | – | |

| Net Cash Provided by Financing Activities | | 328,291 | | | 9,000 | | | 25,000 | |

| Increase (Decrease) In Cash | | 8,012 | | | 6,018 | | | (25,358 | ) |

| Cash - Beginning | | – | | | 1,994 | | | 75,345 | |

| Cash - End | | 8,012 | | | 8,012 | | | 49,987 | |

| | | | | | | | | | |

| Supplemental Disclosures | | | | | | | | | |

| Interest paid | | – | | | – | | | – | |

| Income tax paid | | – | | | – | | | – | |

(The Accompanying Notes are an Integral Part of These Financial Statements)

F-3

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

March 31, 2007

(Unaudited)

| 1. | Exploration Stage Company |

| | | | | |

| Capital Mineral Investors, Inc. (the “Company”) was incorporated in the State of Nevada on December 31, 2002. The Company’s principal business is the acquisition and exploration of mineral resources. The Company has not presently determined whether its properties contain mineral reserves that are economically recoverable. |

| | | | | |

| These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never generated revenues since inception and has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. As at March 31, 2007, the Company has accumulated losses of $392,076 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern. |

| | | | | |

| The Company’s plans for the next twelve months are to focus on the exploration of its mineral properties in Quebec and Ontario. There can be no assurance that the Company will be able to raise sufficient funds to pay the expected expenses for the next twelve months. Management intends to finance operating costs over the next twelve months with existing cash on hand and loans from its sole director and, or, a private placement of common stock. |

| | | | | |

| Unaudited Interim Financial Statements |

| | | | | |

| The unaudited interim financial statements have been prepared by the Company in accordance with generally accepted accounting principles in the United States for interim financial information and conforms with instructions to Form 10-QSB of Regulation S-B and reflects all adjustments (all of which are normal and recurring in nature) that, in the opinion of management, are necessary for fair presentation of the interim periods presented. The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for any subsequent quarter or for the entire year ending December 31, 2007. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States have been condensed or omitted. These unaudited interim financial statements and notes included herein should be read in conjunction with the Company’s audited financial statements and notes for the year ended December 31, 2006, included in the Company’s Annual Report on Form 10-KSB. The accounting principles applied in the preparation of these interim financial statements are consistent with those applied for the year ended December 31, 2006. |

| | | | | |

| 2. | Mineral Properties |

| | | | | |

| a) | Que property |

| | | | | |

| | On May 31, 2006 the Company entered into an Option Agreement (the “Que Agreement”) to acquire an option to purchase 80% of certain claims located in Quebec, Canada. The Company agreed to pay a total of $121,500 and issue a total of 1,000,000 shares of common stock of the Company. The details of the Que Agreement are as follows: |

| | | | | |

| | i) | The Company must pay $1,500 upon execution of the agreement (paid); |

| | | | | |

| | ii) | The Company must pay $30,000 within 60 days of execution of the agreement (extended to December 31, 2008; |

| | | | | |

| | iii) | The Company must issue 400,000 common stock upon the execution of the agreement (issued); |

| | | | | |

| | iv) | The Company must pay $40,000 (extended to December 31, 2008) and issue 300,000 common stock on or before May 12, 2007 (issued subsequently); |

| | | | | |

| | v) | The Company must pay $50,000 and issue 300,000 common stock on or before May 12, 2008(extended to December 31, 2009); |

| | | | | |

| | vi) | The Company shall carry out cumulative exploration expenditures on the property over the three years of the Option Agreement as follows: |

| | | | | |

| | | a) | $100,000 on or before May 12th, 2007 (extended to December 31, 2009); |

| | | | | |

| | | b) | $300,000 on or before May 12th, 2008 (cumulative and extended to December 31, 2010); and |

| | | | | |

| | | c) | $500,000 on or before May 12th, 2009 (cumulative and extended to December 31, 2011). |

| | | | | |

| | vii) | The Company will pay a 3% net smelter return (“NSR”), including an annual advance royalty of $10,000 per year commencing on the first anniversary of the Que Agreement (extended to December 31, 2008). |

| | | | | |

| | viii) | The Company may at any time purchase one-half of the Royalty for the sum of $1,000,000. |

| | | | | |

| | Subsequent to March 31, 2007, the Optionor agreed to amend the terms of the Option Agreement. (See Note 6(a)). |

F-4

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

March 31, 2007

(Unaudited)

| 2. | Mineral Properties (continued) |

| | | | | |

| b) | Golden Darling property |

| | | | | |

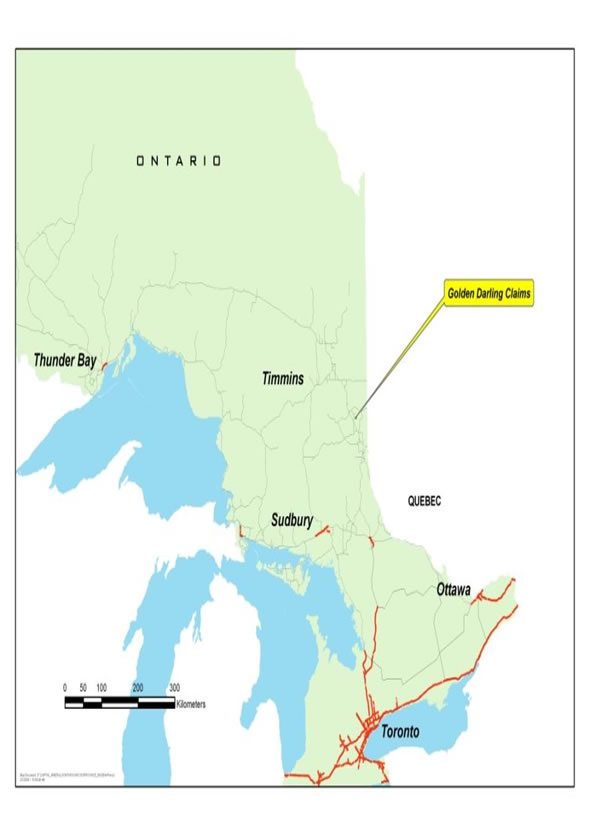

| | On May 31, 2006 the Company entered into an Option Agreement (the “Golden Agreement”) to acquire an option to purchase 80% of certain claims located in Boston Township, Larder Lake Mining Division, Ontario, Canada. The Company agreed to pay a total of $75,000 and issue a total of 1,000,000 shares of common stock of the Company. The details of the Golden Agreement are as follows: |

| | | | | |

| | i) | The Company must pay $25,000 upon execution of the agreement (paid); |

| | | | | |

| | ii) | The Company must issue 300,000 common stock upon the execution of the agreement (issued); |

| | | | | |

| | iii) | The Company must pay $25,000 (extended to December 31, 2008) and issue 300,000 common stock on or before May 12, 2007 (issued subsequently); |

| | | | | |

| | iv) | The Company must pay $25,000 and issue 400,000 common stock on or before May 12, 2008(extended to December 31, 2009); |

| | | | | |

| | v) | The Company shall carry out cumulative exploration expenditures on the property over the three years of the Option Agreement as follows: |

| | | | | |

| | | a) | $50,000 on or before May 12th, 2007 (extended to December 31, 2008); |

| | | | | |

| | | b) | $150,000 on or before May 12th, 2008 (cumulative and extended to December 31, 2009); and |

| | | | | |

| | | c) | $350,000 on or before May 12th, 2009 (cumulative and extended to December 31, 2010). |

| | | | | |

| | vi) | The Company will pay a 3% NSR, including an annual advance royalty of $10,000 per year commencing on the first anniversary of the Golden Agreement (extended to December 31, 2008); |

| | | | | |

| | vii) | The Company may at any time purchase one-half of the Royalty for the sum of $1,000,000. |

| | | | | |

| | Subsequent to March 31, 2007, the Optionor agreed to amend the terms of the Option Agreement. (See Note 6(b)). |

| | | | | |

| c) | Fenton property |

| | | | | |

| | On May 31, 2006 the Company entered into a Purchase Agreement (the “Fenton Agreement”) to purchase 100% of certain claims in the Guercheville Township, Quebec, Canada for $12,500 (paid). The Company will pay a 3% NSR, including an annual advance royalty of $10,000 per year commencing on the first anniversary of the Fenton Agreement (extended to December 31, 2008). |

| | | | | |

| On June 13, 2006, the owner of the optionor of the Que Agreement, Golden Darling Agreement and Fenton Agreement became a significant shareholder of the Company pursuant to a private share purchase agreement with a former shareholder. |

| | | | | |

| 3. | Notes Payable |

| | | | | |

| Notes payable are due to certain of the Company’s directors, officers and a former director. These notes are unsecured, non-interest bearing, and have no specific terms of repayment. |

| | | | | |

| 4. | Related Party Transactions |

| | | | | |

| During the three-month period ended March 31, 2007, the Company had transactions with certain officers and directors of the Company as follows: |

| | | | | |

| a) | incurred $15,000 (2006 - $nil) in management fees; |

| | | | | |

| b) | incurred $1,200 (2006 - $nil) in rental expense; |

| | | | | |

| c) | the President of the Company paid expenses of $4,324 (2006 - $nil) on behalf of the Company. |

| | | | | |

| As at March 31, 2007, $40,924 (December 2006 - $17,400) was owing to the President of the Company. This amount is unsecured, non-interest bearing and has no specific terms of repayment. |

| | | | | |

| All related party transactions were recorded at the exchange amount, which is the value established and agreed to by the related parties reflecting arms length consideration payable for similar services or transfers. |

| | | | | |

| 5. | Warrants |

| | | | | |

| The Company has outstanding share purchase warrants as follows: |

| | | | Number of | | | Weighted average | | | Weighted average | |

| | | | warrants | | | exercise price | | | life (months) | |

| | Balance, December 31, 2006 | | 250,000 | | $ | 0.20 | | | 6 | |

| | Issued during the period | | – | | | – | | | – | |

| | Balance, March 31, 2007 | | 250,000 | | $ | 0.20 | | | 3 | |

To March 31, 2007, the Company has not granted any stock options or recorded any stock-based compensation.

F-5

Capital Mineral Investors, Inc.

(An Exploration Stage Company)

Notes to the Financial Statements

March 31, 2007

(Unaudited)

| 6. | Subsequent Events |

| | | |

| a) | On March 31, 2008, the optionor of the Que Agreement agreed to postpone the payments of $30,000 otherwise payable on December 31, 2006 to December 31, 2008, and $40,000 otherwise payable on May 12, 2007 pursuant to the terms on the Que Agreement, December 31, 2008. The optionor also agreed to extend the payment of the cash Advance Royalty payment of $10,000 otherwise payable on May 31, 2007 until December 31, 2008. On April 1, 2007, the Company issued to the optionor the 300,000 common shares originally due on May 12, 2007 and also issued 200,000 common shares due to the extension of the terms of this agreement. |

| | | |

| b) | On March 31, 2008, the optionor of the Golden Darling Agreement agreed to postpone the payment of $25,000 otherwise payable on May 12, 2007 pursuant to the terms on the Golden Darling Agreement, until December 31, 2008. The optionor also agreed to extend the payment of the cash Advance Royalty payment of $10,000 otherwise payable on May 31, 2007 until December 31, 2008. On April 1, 2007, the Company issued to the optionor the 300,000 common shares originally due on May 12, 2007 and also issued 200,000 common shares due to the extension of the terms of this agreement. |

F-6

ITEM 2. Management's Discussion and Analysis or Plan of Operations.

Business Development

Capital Mineral Investors, Inc. (the “Corporation”) was incorporated under the laws of the State of Nevada on December 31, 2002.

The Corporation’s principal executive offices are located at Suite 700 – 101 Convention Centre Drive, Las Vegas, Nevada 89109 and the telephone number is (702) 284-5848.

The Corporation has not been involved in any bankruptcy, receivership or similar proceedings nor has there been any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of business of the Corporation.

Business of the Corporation

Overview

The Corporation is a start-up, exploration stage company engaged in the business of the exploration and development of mineral properties.

Presently, the Corporation has an active and material interest in the following properties: (collectively, the Properties”).

| 1. | The Fenton Property (Guercheville, Quebec); The Corporation purchased a 100% interest in the 26 claims from Maverick Investment Corporation. The claims are still registered in the name of Patrick O’Brien, the sole shareholder and director of Maverick Investment Corporation but the Corporation is the beneficial owner. These 26 mineral claims total approximately 417 hectares (1,030 acres). |

| | |

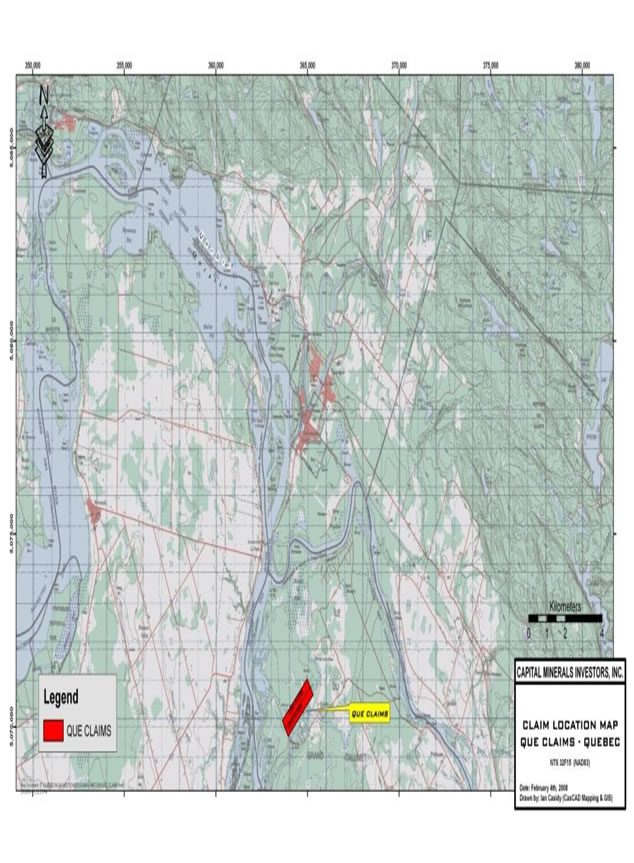

| 2. | The Que Property (Huddersfield, Quebec); The Corporation renewed two mineral claims (numbers 61305 and 61306 in NTS 31F15) and no others for the Que Property. The claims are registered in the name of Patrick O’Brien and the Corporation has an option to acquire 80% of the interest in this property. The size of the claim area is 45.45 (112 acres) and 45.42 hectares (112 acres) respectively. |

| | |

| 3. | The Golden Darling Property (Larder Lake Mining District, Ontario); The Golden Darling Property consists of 5 contiguous claims (numbers 4208000, 3009278, 3009277, 4207999, and 4208001) of approximately 113 hectares (380 acres) in size. The claims are registered in the name of Patrick O’Brien and the Corporation has an option to acquire 80% of the interest in this property. |

Exploration Program Recommendations

The Corporation intends to develop and execute an exploration program for 2008 focused on its Golden Darling Property at a cost of $183,000 subject to the Corporation obtaining adequate financing. Management believes that this property will in the future provide the Corporation with potential for locating economic mineralization once an initial exploration and survey program is conducted. When we have the funds, exploration will be undertaken using modern methods to re-examine and assay previous economic ore grade locations. The exploration program will evaluate historical showings and perform a geophysical survey in conjunction with prospecting and geological mapping. Exploration will be undertaken with the goal of creating targets to test by mechanical trenching and or drilling. Initial exploration activities (grid establishment, geological sampling, soil sampling, rock sampling, geophysical surveys and mechanical trenching where deemed appropriate) do not involve ground disturbance and will not require a work permit. To date this kind of property scale information has not been done on this property. We expect to initiate surveying work during the third quarter of 2008 on the Golden Darling Property.

Our mineral claims do not have any mineral reserves. The properties that are the subject of our mineral

claims are undeveloped and do not contain any open-pit or underground mines. There is no mining plant or equipment located on the properties. Exploration is currently in the preliminary stages. Our proposed exploration programs described below are exploratory in nature and there is no assurance that mineral reserves will be found.

The Corporation expects to engage a professional geologist to assist us in conducting mineral exploration. The Corporation has not collected any ore samples to date. When field work and sampling are undertaken, quality assurance and quality control protocols will be implemented and supervised by a professional geologist or trained geophysicist to guarantee assay precision and accuracy procedures and protocols. Presently, we have not hired such a professional.

Presently, we do not have any geological justification for each of our proposed exploration budgets described below because we do not have the funds to hire a professional geologist to make such determination in a recommended exploration program. The budgets described below are management’s best estimates on a proposed exploration program based on their experience and initial assessment of the merits of the property. Management gives no reassurances that the exploration program proposed below is accurate or efficient in assessing the merits of any future and more extensive exploration program. We will have to raise a total of $183,000 to conduct survey work on the Golden Darling Property and we do not give any reassurances that we be successful in raising the money.

If we raise the funds in a private financing, the following will be the proposed exploration budgets for the Fenton, Que and Golden Darling Properties, respectively:

Fenton Property Proposed Work Program for 2008 – 2009

Geological mapping, line cutting and magnetometer survey

| Geologist 5 days @ $500/day | $ | 2,500 | |

| | | | |

| Room, Board, Quad | $ | 2,000 | |

| | | | |

| Supplies | $ | 500 | |

| | | | |

| Reports and Maps | $ | 2,000 | |

| | | | |

| Contingencies | $ | 1,000 | |

| | | | |

| Total Fenton | $ | 8,000 | |

Que Property Proposed Work Program for 2009

Geological mapping, line cutting and magnetometer survey

| 2 technicians @ $500/day for 7 days | $ | 3,500 | |

| | | | |

| Room, Board, Quad | $ | 3,000 | |

| | | | |

| Supplies | $ | 2,500 | |

| | | | |

| Reports and Maps | $ | 2,500 | |

| | | | |

| Contingencies | $ | 1,500 | |

| | | | |

| Total Que | $ | 13,000 | |

Golden Darling Property Proposed Work Program for 2008

Prospecting and Sampling

| 2 technicians @ $600/day for 10 days | $ | 6,000 | |

| | | | |

| Travel to property | $ | 5,000 | |

| | | | |

| Room, Board, Quad | $ | 4,000 | |

| | | | |

| Assays 50 @ $20 / sample | $ | 1,000 | |

| | | | |

| Supplies | $ | 1,000 | |

Geological mapping,

| Geologist 10 days @ $500/day | $ | 5,000 | |

| | | | |

| Room, Board, Quad | $ | 4,000 | |

| | | | |

| Supplies | $ | 1,000 | |

| | | | |

| Reports and Maps | $ | 4,000 | |

| | | | |

| Contingencies | $ | 4,000 | |

Diamond Drilling

| 1000 meters - $125/metre (all inclusive) | $ | 125,000 | |

| | | | |

| Report and Maps | $ | 10,000 | |

| | | | |

| Contingencies | $ | 13,000 | |

| | | | |

| Total Golden Darling | $ | 183,000 | |

Competitive Business Conditions, Position and Methods of Competitiveness

The Corporation operates in the highly competitive area of mining and mineral exploration and production. Many of its competitors have much greater financial and other resources than the Corporation possesses. Such competitors have a greater ability to bear the economic risks inherent in all phases of the industry. While the Corporation competes with other mining and mineral exploration and production companies, there is no competition for the exploration or removal of mineral out of the Corporation’s properties. There are readily available markets for minerals that the Corporation is able to recover from its properties. In the exploration and production business, the costs of exploration and drilling program, the development of transportation systems to bring future production to the market and transportation costs of minerals are factors that affect the Corporation’s ability to compete in the marketplace.

Government Approval

The Corporation’s operations require licenses and permits from various governmental authorities. The Corporation believes that it holds, or will hold all necessary licenses and permits under applicable laws and regulations for its operations and believes it will be able to comply in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Corporation will be able to obtain or maintain all necessary licenses and permits that may be required to maintain continued operations that economically justify the cost.

Governmental Regulations

The Corporation’s mineral exploration program is subject to the Canadian Mineral Tenure Act (the "Act"). This Act sets forth rules for locating claims, posting claims, working claims and reporting work performed. The Corporation is also subject to the applicable Ontario and Quebec Mineral Exploration Codes, which sets out how and where the Corporation can explore for minerals. The Corporation must comply with these laws to operate its business. Compliance with these rules and regulations will not adversely affect the Corporation’s operations.

The Corporation is also required to give written or verbal notification to the district inspector prior to the comment of exploration activities.

The Corporation is required to reclaim its mining claim after it completes the exploration program. The Corporation must remove the garbage, drums of fuel, clean the spills and fill in the open trenches.

Costs and Effects of Compliance with Environmental Laws

The Corporation is also subject to the environmental laws of Ontario and QuebecThese laws deal with environmental matters relating to the exploration of mining properties. The goals are to protect the environment through a series of regulations affecting health, safety archeological sites and exploration access.

The Corporation is responsible to provide a safe working environment, not disrupt archeological sites, and conduct its activities to prevent unnecessary damage to the property.

The Corporation will secure all necessary permits for exploration and, if exploration is warranted on the property, will file final plans of operation before the Corporation starts any exploration operation. Management anticipates no discharge of water into active stream, creek, river or lake, or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of the Corporation’s proposed activities cannot be determined until it starts its operations and know what will be involved from an environmental standpoint. Management believes that the Corporation is in compliance with the Act and will continue to comply with the Act in the future. Management believes that compliance with the Act will not adversely affect the Corporation’s business operations in the future.

Number of Total Employees and Full-Time Employees

At present, the Corporation has no employees other than Mr. Jerry Dibble. Mr. Dibble holds offices of President, Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer of the Corporation. Mr. Dibble does not have an employment agreement with the Corporation. For the three month period ended March 31, 2007, management fees of $15,000 and rent expense of $1,200 were payable to Mr. Dibble and Mr. Dibble paid $4,324 on behalf of the Corporation. As at March 31, 2007, $40,924 was owing to Mr. Dibble and the amount is unsecured, non-interest bearing and has no specific terms of repayment.

The Corporation presently does not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans, however, any such plans may be adopted in the future.

Risk Factors

There is no assurance that our business will be profitable. We must conduct exploration to determine what amount and type of minerals, if any, exist on our property. We do not claim to have any reserves whatsoever at this time on any of our claims. An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this report before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed.

Because our management does not have formal training specific to the mining industry, there is a higher risk our business will fail.

Our management team does not have any formal training as geologists, or in the technical aspects of management of a company specializing in mining and exploration for base and precious metals. With no direct formal training in these areas, our management may not be fully aware of the specific technical requirements related to working within this industry. Our management team has limited business experience with exploration companies, their decisions and choices may not take into account standard exploration or mining approaches commonly used in the industry. As a result of this inexperience, there is a higher risk of our being unable to complete our business plan for the exploration of our mineral claims. In addition, we will have to rely on the technical services of others with expertise in geological exploration in order for us to carry our planned exploration program. If we are unable to contract for the services of such individuals, it will make it difficult and maybe impossible to pursue our business plan. There is thus a higher risk of business failure.

Because our property has not been physically examined by a professional geologist or mining engineer and no one has visited the sites of our property, you cannot rely on the accuracy of any information provided about our property.

Our property has not been physically examined in the field by a professional geologist or mining engineer. The information provided herein about our property cannot be confirmed as to its accuracy and should not be relied upon in your investment decision. If the property is inaccurately described as to the location, geological history, or historical exploration work, you may suffer losses to your investment in our Corporation because our property may not be valuable with respect to the possibility of finding precious metals.

We may not be able to continue as a going concern; we do not have funds to conduct exploration; and we risk losing our property.

Because of our lack of funds and short operating history incurring only expenses, our independent accountants' audit report states that there is substantial doubt about our ability to continue as a going concern. Our independent auditor pointed out that we incurred only losses since our inception raising substantial doubt about our ability to continue as a going concern. Therefore, our ability to continue as a going concern is highly dependent upon obtaining additional financing for our planned operations. Presently, we do not have any funds to conduct any exploration program. Our property agreements require us to make payments to the optionor and spend money on exploration. If we do not make these commitments, we may lose our interest in these property option agreements.

Patrick O’Brien, the optionor to our property agreements, controls 52% of our shares and may influence corporate decisions that are inconsistent with the best interest of other shareholders. Patrick O’Brien, the sole shareholder and director of Maverick Investment Corporation, controls 52% of our common shares. Accordingly, in accordance with our articles of incorporation and bylaws, Mr. O’Brien is able to control the election of our board of directors and thus could act, or could have the power to act, as our management. The interests of Mr. O’Brien may not be, at all times, the same as that of other shareholders. Since Mr. O’Brien is not simply a passive investor but is also, indirectly, a contractual party as the optionor in the Que and Golden Darling Property Option Agreements, where the Corporation has an option to acquire an 80% interest in the properties, his interests as a contractual party and significant shareholder may be adverse to those of other investors in the shares of our Corporation. Where those conflicts exist, Mr. O’Brien may not exercise powers fairly to our other shareholders. Mr. O’Brien will have the ability to significantly influence the outcome of most corporate actions requiring shareholder approval, including the potential merger with other companies and the sale of all or substantially all of our assets and amendments to our articles of incorporation. This concentration of ownership with Mr. O’Brien may also have the effect of delaying, deferring or preventing a change in control of the Corporation, which may be disadvantageous to minority shareholders.

Title to the Fenton, Que and Golden Darling claims is registered in the name of Mr. Patrick O’Brien and he may transfer title to third parties without our knowledge.

The Que and Golden Darling Property Option Agreements only give us a right to acquire the respective claims by fulfilling our obligations under the contract. We cannot absolutely prevent Mr. O’Brien from transferring the claims to third parties without our knowledge. A third party has no way of knowing that we have rights to such claims since ownership is registered in the name of Mr. O’Brien at the applicable Minerals Title Office. If these claims are transferred to third parties we may have to litigate in order to determine our ownership rights. There is no way of knowing if Mr. O’Brien will or has transferred the claims to third parties. Our only protection is our contractual rights under the Que and Golden Darling Agreements. We have beneficial ownership of the Fenton claims but title is not registered in our name. Presently, there are no arrangements to transfer legal title to us.

DESCRIPTION OF PROPERTY

The Hart Property – British Columbia

In September 2006, the Corporation completed sampling and survey work on the Corporation’s existing mining claim located on the Hart property in British Columbia (the “Hart Claim”). The samples were sent out for analysis, and upon a review thereof, it was determined that the Hart Claim was not valuable for further development.

In December 2006, when the Hart Claim expired, management reviewed the data to date and determined not to renew the Hart Claim.

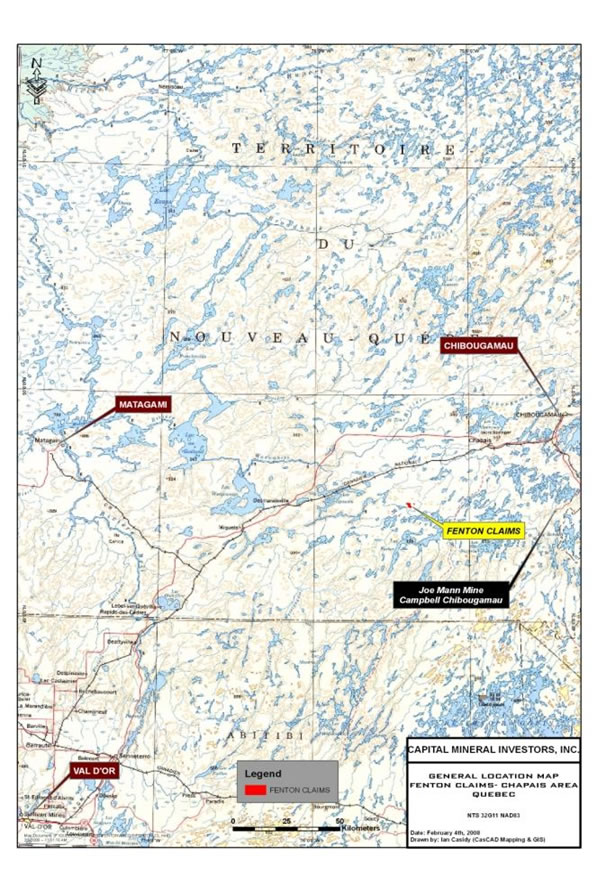

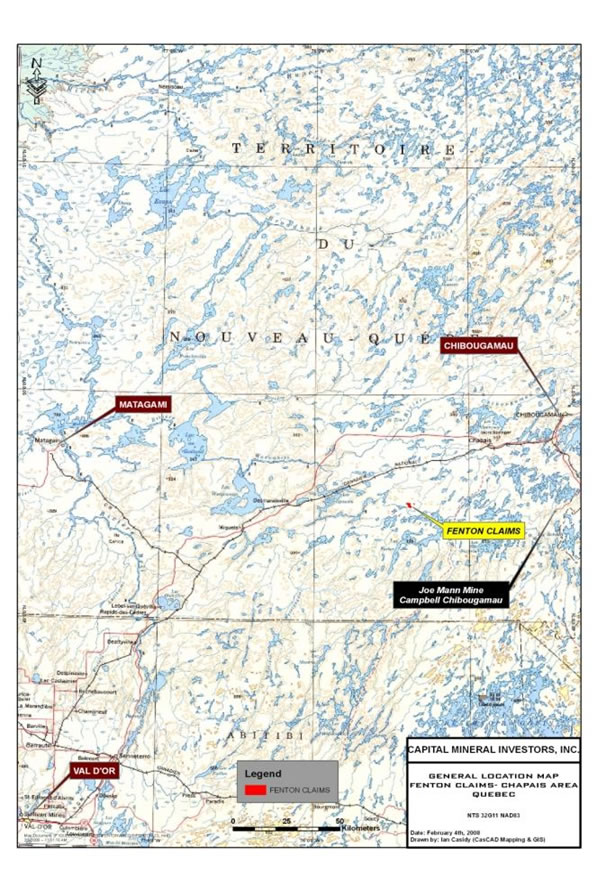

The Fenton Property – Guercheville, Quebec

Overview

On May 31, 2006, the Corporation entered into a purchase agreement (the “Purchase Agreement”) with Maverick Investment Corp. (the “Maverick”), wherein the Corporation purchased for a purchase price of $12,500 from the Vendor an undivided 100% interest in 26 mineral claims totaling approximately 417 hectares and situated on the Fenton property located in Guercheville, Quebec, subject to a net smelter return (a “NSR”) royalty of 3%. An annual advance royalty of $10,000 is payable to Maverick on each anniversary commencing on December 31, 2008 (unpaid for 2008) by an extension agreement dated March 18, 2008. The Fenton Property claims are not in good standing as of April 2008 and will need to be re-staked at a cost of CDN$1,200. The work required to be conducted on the property in order to keep the property in good standing is CDN$500 per claim per year. No exploration has yet been undertaken on the Fenton Property.

The claims are registered in the name of Patrick O’Brien, a contractual party to our other property option agreements and significant shareholder of our Corporation beneficially owning 52% of our shares.

Location & Access

Access to the Fenton property is via paved highway route 113 between the towns of Chapais and Senneterre, Quebec. Access is along a forestry gravel road turnoff at km 318 along the provincial highway 113 about 18 kilometres west of Chapais. This forestry road traverses in a south-west direction along the river Opawica which traverses the property at kilometer 41 and 46. Optional access to the property using a forestry route from the town of Desmaraisville (Lac Short) is also available.

Physiography, Climate and Infrastructure

The Chibougamau/Chapais area has a well-developed infrastructure to supporting mining projects, including transportation, a well-trained labor force, service and maintenance industries and an airport. Hydro-Quebec's electricity substation is nearby in Chapais and Chibougamau. Chapais Energie, Société en Commandite (''Chapais'') owns a 27.0MW electricity generating plant which burns wood waste and is located in the Town of Chapais, Québec.

The topography was carved by glaciers more than 10,000 years ago. Vegetation is bushy, typical of harvested forest, and the rocky surface is rugged. The area characterized by very little broken relief and therefore has badly drained areas, causing vast zones of marshes and peat bogs and shallow lakes. The climate of the Chapais area of Québec is characterized by striking regional variations, by long, cold winters and short, cool summers, and by ample year-round precipitation, about a third of which falls as snow. Winter weather is severe with temperatures to -50C and summer temperatures in the high 20C. Short transitional seasons in spring and fall are the norm for the area.

Claims

The Fenton Property consists of the following claims.

| Claim Numbers | Claim Numbers | Claim Numbers |

| CL 5254001 | CL 5254013 | CL 5254035 |

| CL 5254002 | CL 5254018 | CL 5254060 |

| CL 5254003 | CL 5254019 | CL 5254061 |

| CL 5254004 | CL 5254020 | CL 5254062 |

| CL 5254005 | CL 5254026 | CL 5254063 |

| CL 5254006 | CL 5254031 | CL 5254064 |

| CL 5254007 | CL 5254032 | CL 5254068 |

| CL 5254011 | CL 5254033 | CL 5254069 |

| CL 5254012 | CL 5254034 | |

(Located in NTS Area 32G11, Guercheville Township, Province of Quebec )

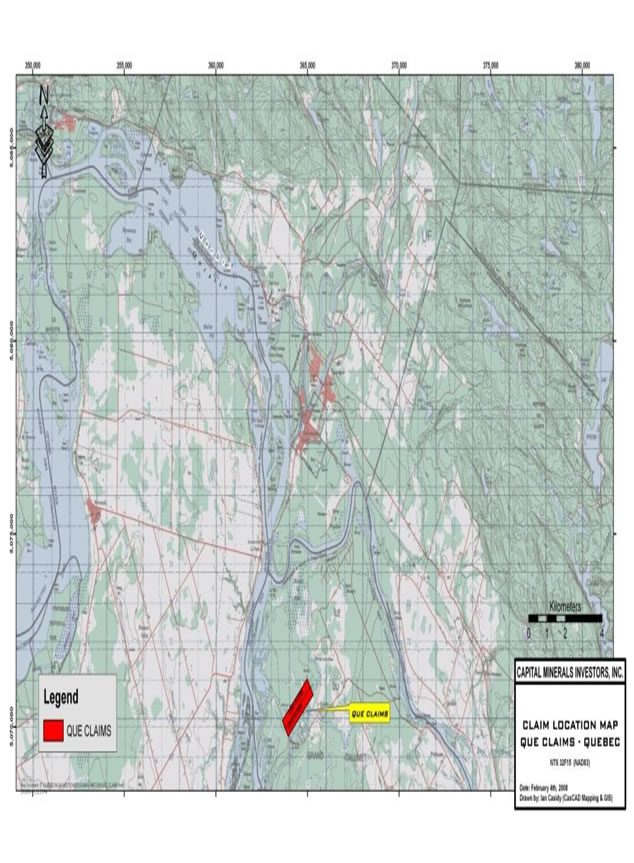

The Que Property – Quebec

Overview

On May 31, 2006, the Corporation entered into an option agreement (the “Quebec Option Agreement”) with Maverick for a two year term, wherein the Corporation acquired an option to purchase a 80% interest in 71 mineral claim cells and 14 mineral claim lots situated on the Que property located in Huddersfield, Quebec, subject to a NSR royalty of 3% for a total of US$121,000 and 1,000,000 Shares in the capital of the Corporation. An advance royalty of $10,000 per year is payable to Maverick and commences on December 31, 2008 and is due on each subsequent anniversary until the commencement of commercial production.

In addition, pursuant to the terms of the Quebec Option Agreement, the Corporation has the option to purchase from Maverick one-half of the 3% NSR royalty for the sum of $1,000,000.

The Corporation renewed, on March 30, 2007, what it considered to be the two most prospective claim cells, numbers 61305 and 61306, situated in NTS 31F15, by paying the required renewal fees of a total of CDN$2,592 for both claim cells. The next renewal date is March 30, 2009. The claims cells are 45.45 and 45.42 hectares in area size, respectively. Now, only two claims are subject to the Que Property Option Agreement.

Additionally, the Que Property Option Agreement was amended and restated on March 31, 2008. The schedule for the Corporation to make payments, issue shares and undertake exploration expenditures have been amended as follows:

| a. | The Option to acquire 80% of the Que Property shall be exercised by the Corporation paying to Maverick Investment Corp. a total of US$121,500 and issuing a total of 1,000,000 shares of the Corporation to Maverick in the following manner: |

| | | |

| (i) | $1,500 upon execution of the Agreement (paid); |

| | | |

| (ii) | $30,000 within 60 days of the execution of this Agreement (due date extended to December 31, 2008 by mutual agreement); |

| | | |

| (iii) | 400,000 shares upon the execution of this Agreement (issued May 31, 2006); |

| | | |

| (iv) | $40,000 and 300,000 common shares (issued April 1, 2007) on or before December 31, 2008; and |

| | | |

| (v) | $50,000 and 300,000 common shares on or before December 31, 2009. |

| | | |

| b. | The Corporation shall carry out cumulative exploration expenditures on the Que Property over a three year period in the following manner: |

| | | |

| (i) | $100,000 on or before December 31, 2009; |

| | | |

| (ii) | $300,000 on or before December 31, 2010 (cumulative); and |

| | | |

| (iii) | $500,000 on or before December 31, 2011 (cumulative). |

As a result of delaying certain commitments for the year ending December 31, 2006, the Company issued 200,000 common shares on April 1, 2007 to the Optionor as additional compensation.

Under the terms of the Amendment Agreement re: Que Property dated March 18, 2008, if the Corporation fails to keep all of the original claims in good standing for the term of the Option Agreement, the Corporation will, upon the loss of more than the majority plus one of the original claims, compensate Maverick by issuing 600,000 common shares of the Corporation to Maverick. These shares have been authorized for issuance on August 5, 2008 to Maverick but have not been issued.

| ClaimNumbers | NTS | Claim Numbers | NTS | Claim Numbers | NTS |

| CDC 61375 | 31F09 | CDC 61305 | 31F15 | Range VII, Lot 18 (pending) | 31F15 |

| CDC 61376 | 31F09 | CDC 61306 | 31F15 | Range VII, Lot 19 (pending) | 31F15 |

All of the above mineral titles are located in the Province of Quebec, Canada

Location:

The property now consists of 2 claims totaling approximately 91 hectares located in Grand Calumet and Huddersfield Townships, Quebec, being approximately 37 km northwest of Hull on the Ottawa River and 4km NE of the village of Riviere-Berry.

Access:

The property is easily accessible via all weather gravel and paved roads.History:

The Que property assemblage is a grass roots Uranium property and it is up to the Company to develop the geological knowledge base for future exploration. Government records show positive sampling and radiometric surveys indicated significant radioactivity in the area during the early 1950s.

Property in the area was first worked by Calumet Uranium Mines Ltd. from 1953 to 1954 during which period radiometric surveys, along with stripping and sampling were undertaken following the discovery of significant radioactivity. Based on these surveys and the positive sampling results, diamond drilling was started in the spring of 1954 and by June 1955, 20,082 feet of drilling in 39 holes had been completed. Further drilling was undertaken in the area with a reported 80 holes being drilled. Geological mapping, mineralogical studies, and further analysis followed with all work being completed by 1956.

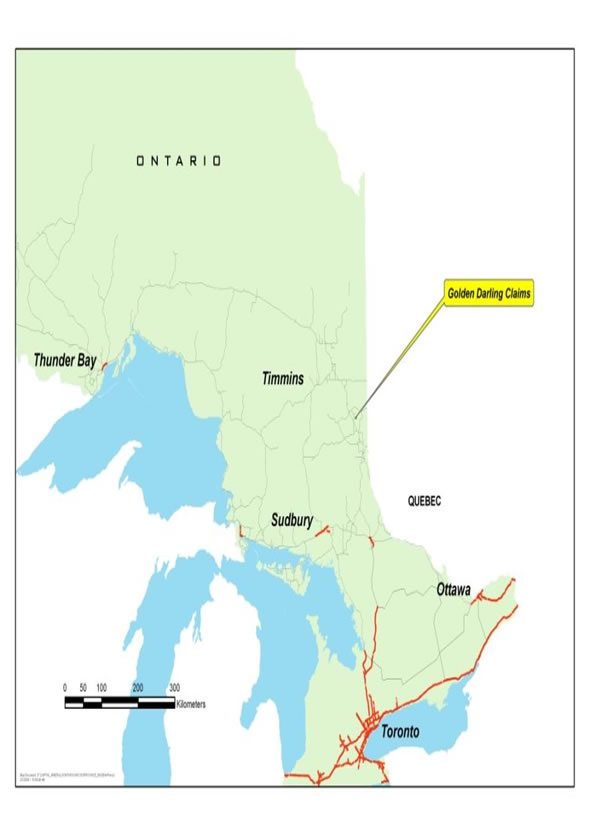

The Golden Darling Property – Ontario

Overview

On May 31, 2006, the Corporation entered into an option agreement (the “Golden Darling Option Agreement”) with Maverick for a two year term, wherein the Corporation acquired an option to purchase an 80% interest in 5 mineral claims situated on the Golden Darling property located in Larder Lake Mining District, Ontario, subject to a NSR royalty of 3% for a total of US$75,000 and 1,000,000 Shares in the capital of the Corporation. An advance royalty of $10,000 per year is payable to Maverick and commences on December 31, 2008 and is due on each subsequent anniversary until the commencement of commercial production.

In addition, pursuant to the terms of the Golden Darling Option Agreement, the Corporation has the option to purchase from Maverick one-half of the 3% NSR royalty for the sum of $1,000,000.

Additionally, the Golden Darling Option Agreement was amended and restated on March 31, 2008. The schedule for the Corporation to make payments, issue shares and undertake exploration expenditures have been amended as follows:

| (a) | The Option to acquire 80% of the Golden Darling Property shall be exercised by the Corporation paying to Maverick Investment Corp. a total of US$75,000 and issuing a total of 1,000,000 shares of the Corporation to Maverick in the following manner: |

| | | |

| (j) | $25,000 upon execution of the Agreement (paid); |

| | | |

| (ii) | 300,000 common shares upon the execution of this Agreement (issued May 31, 2006); |

| | | |

| (iii) | $25,000 and 300,000 common shares (issued April 1, 2007) on or before December 31, 2008; and |

| | | |

| (iv) $25,000 and 400,000 common shares on or before December 31, 2009; |

| | | |

| (b) | The Corporation shall carry out cumulative exploration expenditures on the Golden Darling Property over a three year period in the following manner: |

| | | |

| (i) | $50,000 on or before December 31, 2008; |

| | | |

| (ii) | $150,000 on or before December 31, 2009 (cumulative); and |

| | | |

| (iii) | $350,000 on or before December 31, 2010 (cumulative). |

As a result of delaying certain commitments for the year ending December 31, 2006, the Company issued 200,000 common shares on April 1, 2007 to the Optionor as additional compensation.

Golden Darling Property Description

The Golden Darling Property consists of 5 contiguous claims of approximately 280 acres in size. It consists of claims numbers 4208000, 3009278, 3009277, 4207999, and 4208001, which are located 16

km southeast of Kirkland Lake, Ontario in the gold producing region of Abitibi Greenstone belt. The property is serviced by paved highway and is accessible for twelve months per year. Gold was discovered in 1914 on the property.

In May 2007, the Corporation engaged a geophysicist, J. H. Forbes, to conduct line-cutting grid work and a follow up magnetometer survey on the Golden Darling claims. Mr. Forbes performed the work and

provided a report to the Corporation and subsequently filed to have the work credits applied to renew the claims as follows:

| Claim Number | Renewal Date |

| | |

| 4208000 | May 26, 2010 |

| 3009278 | June 02, 2013 |

| 3009277 | June 02, 2010 |

| 4207999 | May 26, 2009 |

| 4208001 | May 26, 2009 |

Results of Operations

From Inception to March 31, 2007.

Since inception, the Corporation has incurred a net loss of $392,076 and no revenues. Legal fees and accounting and audit fees was $150,796. Mineral property costs was $147,158.

Net cash provided by financing activities from inception to March 31, 2007 was $328,291, which was a result of proceeds received from subscriptions of shares totaling $275,950 and a note payable of $52,341.

Liquidity and Capital Resources

As of March 31, 2007, the Corporation has yet to generate any revenues from its business operations.

The Corporation issued 6,000,000 founders shares on March 4, 2003, which was accounted for as capital of $6,000. The Corporation further raised $34,950 in 2004 though a public offering.

As of March 31, 2007, there has been no direct or indirect payment from the proceeds of the public offering to any directors, officers, persons owning 10% or more of Shares, any affiliates of the public or others. Since inception, Jerry Dibble and Phillip Derry have advanced demand loans to the Corporation in the total sum of $51,341, which was used for organizational and start-up costs and the public offering expenses including, legal and auditing fees. The demand loans do not bear interest. Jerry Dibble and Phillip Derry agreed with the Corporation to accept repayment of the demand loans when the Corporation is able to pay them back.

On May 3, 2005, the Corporation raised $140,000 through a private placement and paid back $25,000 to Phillip Derry as partial repayment of the outstanding demand loans to the Corporation. On June 23, 2006, the Corporation raised $25,000 through a private placement.

As of March 31, 2007, the Corporation had cash of $8,012; accounts payable and accrued liabilities of $35,039; notes payable of $52,341; and, liabilities due to related parties of $40,924. As of March 31, 2007, the Corporation had net working deficiency of $120,292.

As at March 31, 2007, the Corporation’s total assets were $12,178, and total liabilities were $128,304. Under the Amended and Restated Que Property Option Agreement, the Corporation is obligated to make total payments of $80,000 to Maverick on or before December 31, 2008. Also, under the Amendment Agreement re: Que Property dated March 18, 2008, 600,000 shares have been authorized for issuance on August 5, 2008 to Maverick Investment Corp. but have not been issued. Under the Amended and Restated Golden Darling Property Option Agreement, the Corporation is obligated to make total payments of $35,000 to Maverick, and make $50,000 of exploration expenditures on the property on or before December 31, 2008.

The Corporation needs to raise more funds by private placement, public offering or loans in order to continue its exploration programs. If the Corporation fails to raise sufficient funds for the mining programs, it will have to suspend or cease operations. The Corporation is presently considering a variety of financing methods in order to further its business development and exploration activities.

Safe Harbour

This quarterly report on Form 10-QSB (the “Report”) for the three months ended March 31, 2007 contains forward-looking statements. These statements relate to future events or future financial performance of the Corporation. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, that may cause the Corporation or its industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievement expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect current judgment regarding the direction of the Corporation’s business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, the Corporation does not intend to update any of the forward-looking statements to conform these statements to actual results.

ITEM 3. Controls and Procedures

Based on the evaluation of the Corporation’s disclosure controls and procedures required by paragraph (b) of Rule 13a-15 under the Exchange Act, as of March 31, 2007, the end of the financial period covered by this Report, the Corporation’s Principal Chief Executive Officer (the “PEO”) and Principal Financial Officer (the “PFO”) have concluded that the Corporation’s disclosure controls and procedures are effective.

Based on the evaluation of internal control over financial reporting required by paragraph (c) of Rule 13a-15 under the Exchange Act, as of March 31, 2007, the end of the financial period covered by this Report, the Corporation’s PEO and PFO have concluded that:

| 1. | the Corporation is presently unable to segregate duties within the Corporation as a means of internal control over financial reporting; |

| | |

| 2. | the Corporation is presently relying on overriding management short-term review procedures until such time as additional funding is provided to hire additional executive to segregate duties within the Corporation; |

| | |

| 3. | the Corporation’s present internal control over financial reporting is effective in that it provides reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; and |

| | |

| 4. | there has not been any change in the Corporation’s internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rule 13a-15 that occurred during the Corporation’s first quarter ended March 31, 2007 that has materially affected, or is reasonably likely to materially affect, the Corporation’s internal control over financial reporting. |

PART II OTHER INFORMATION

ITEM 1. Legal Proceedings

Not Applicable.

ITEM 2. Unregistered Sales of Equity Securities and Use of Proceeds

Not Applicable.

ITEM 3. Defaults Upon Senior Securities

Not Applicable.

ITEM 4. Submission of Matters to a Vote of Security Holdings

Not Applicable.

ITEM 5. Other Information

Not Applicable.

ITEM 6. Exhibits

| Exhibit No. | Description |

| 3.1* | Articles of Incorporation |

| 3.2* | Bylaws |

| 4.1* | Specimen Stock Certificate |

| 4.2* | Promissory Note to Jerry Dibble for $8,483.50 |

| 4.3** | Promissory Note to Philip Derry for $17,857.23 |

| 10.1*** | Amended and Restated Que Property Option Agreement dated March 31, 2008 |

| 10.2*** | Amended and Restated Golden Darling Property Option Agreement dated March 31, 2008 |

| 10.3*** | Amendment Agreement for Royalty Payment for the Fenton Property dated March 18, 2008 |

| 10.4*** | Amendment Agreement re: Que Property dated March 18, 2008 |

| 99.1**** | Option Agreement for Quebec property dated May 31, 2006 |

| 99.2**** | Option Agreement for Ontario property dated May 31, 2006 |

| 99.3**** | Purchase Agreement for Quebec (Fenton) property dated May 31, 2006 |

| 31.1 | Rule 13(a) – 14(a)/15(d) - 14(a) Certifications |

| 32.1 | Section 1350 Certifications |

*Filed as an Exhibit to the Corporation's Registration Statement on Form SB-2, dated May 23, 2003, and incorporated herein by this reference.

**Filed as an Exhibit to the Corporation's Form 10-KSB/A on April 24, 2006, and incorporated herein by this reference.

***Filed as an Exhibit to the Corporation's Form 10-KSB/A on August 13, 2008, and incorporated herein by this reference.

****Filed as an Exhibit to the Corporation’s Form 8-K on May 31, 2006, and incorporated herein by this reference.

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: August 13, 2008

CAPITAL MINERAL INVESTORS, INC.

| BY: | /s/ “Jerry Dibble” | |

| | Jerry Dibble | |

| | President and Director | |

| | (who also performs the function of Principal Chief Executive Officer, | |

| | Principal Financial Officer and Principal Accounting Officer) | |

| | | |

| BY: | /s/ “Gary Benson” | |

| | Gary Benson | |

| | Director | |