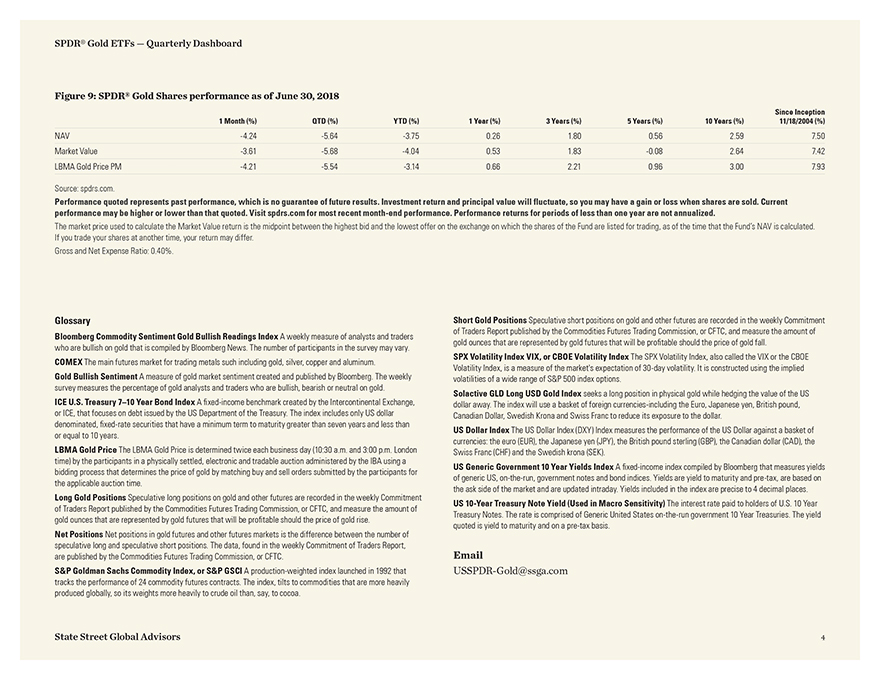

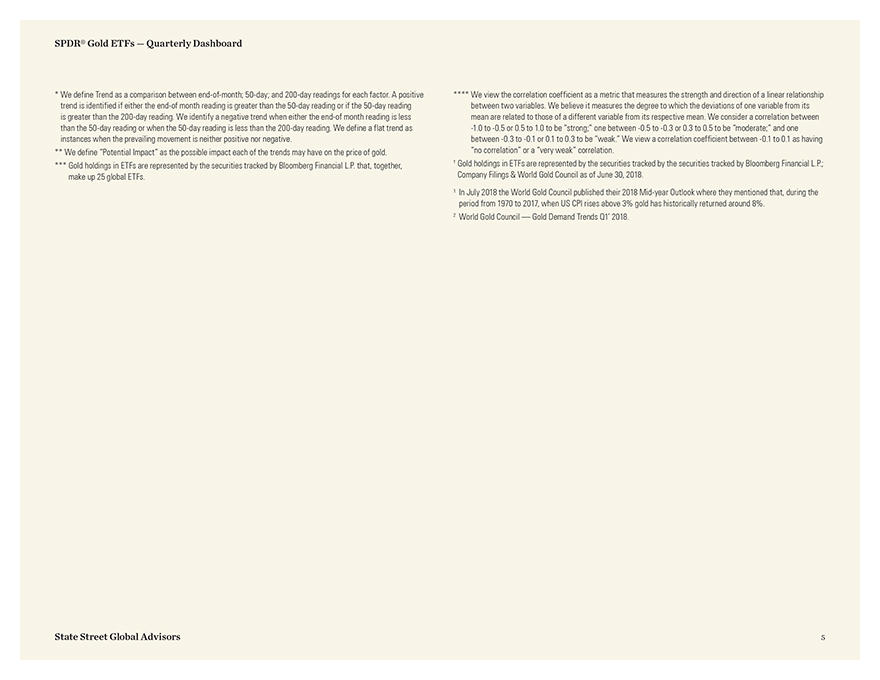

SPDR® Gold ETFs — Quarterly Dashboard Figure 9: SPDR® Gold Shares performance as of June 30, 2018 1 Month (%) QTD (%) YTD (%) 1 Year (%) 3 Years (%) 5 Years (%) 10 Years (%) Since Inception 11/18/2004 (%) NAV-4.24-5.64-3.75 0.26 1.80 0.56 2.59 7.50 Market Value-3.61-5.68-4.04 0.53 1.83-0.08 2.64 7.42 LBMA Gold Price PM-4.21-5.54-3.14 0.66 2.21 0.96 3.00 7.93 Source: spdrs.com. Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit spdrs.com for most recentmonth-end performance. Performance returns for periods of less than one year are not annualized. The market price used to calculate the Market Value return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time, your return may differ. Gross and Net Expense Ratio: 0.40%.Glossary Bloomberg Commodity Sentiment Gold Bullish Readings Index A weekly measure of analysts and traders who are bullish on gold that is compiled by Bloomberg News. The number of participants in the survey may vary. COMEX The main futures market for trading metals such including gold, silver, copper and aluminum. Gold Bullish Sentiment A measure of gold market sentiment created and published by Bloomberg. The weekly survey measures the percentage of gold analysts and traders who are bullish, bearish or neutral on gold. ICE U.S. Treasury 7–10 Year Bond Index A fixed-income benchmark created by the Intercontinental Exchange, or ICE, that focuses on debt issued by the US Department of the Treasury. The index includes only US dollar denominated, fixed-rate securities that have a minimum term to maturity greater than seven years and less than or equal to 10 years. LBMA Gold Price The LBMA Gold Price is determined twice each business day (10:30 a.m. and 3:00 p.m. London time) by the participants in a physically settled, electronic and tradable auction administered by the IBA using a bidding process that determines the price of gold by matching buy and sell orders submitted by the participants for the applicable auction time. Long Gold Positions Speculative long positions on gold and other futures are recorded in the weekly Commitment of Traders Report published by the Commodities Futures Trading Commission, or CFTC, and measure the amount of gold ounces that are represented by gold futures that will be profitable should the price of gold rise. Net Positions Net positions in gold futures and other futures markets is the difference between the number of speculative long and speculative short positions. The data, found in the weekly Commitment of Traders Report, are published by the Commodities Futures Trading Commission, or CFTC. S&P Goldman Sachs Commodity Index, or S&P GSCI A production-weighted index launched in 1992 that tracks the performance of 24 commodity futures contracts. The index, tilts to commodities that are more heavily produced globally, so its weights more heavily to crude oil than, say, to cocoa. Short Gold Positions Speculative short positions on gold and other futures are recorded in the weekly Commitment of Traders Report published by the Commodities Futures Trading Commission, or CFTC, and measure the amount of gold ounces that are represented by gold futures that will be profitable should the price of gold fall. SPX Volatility Index VIX, or CBOE Volatility Index The SPX Volatility Index, also called the VIX or the CBOE Volatility Index, is a measure of the market’s expectation of30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. Solactive GLD Long USD Gold Index seeks a long position in physical gold while hedging the value of the US dollar away. The index will use a basket of foreign currencies-including the Euro, Japanese yen, British pound, Canadian Dollar, Swedish Krona and Swiss Franc to reduce its exposure to the dollar. US Dollar Index The US Dollar Index (DXY) Index measures the performance of the US Dollar against a basket of currencies: the euro (EUR), the Japanese yen (JPY), the British pound sterling (GBP), the Canadian dollar (CAD), the Swiss Franc (CHF) and the Swedish krona (SEK). US Generic Government 10 Year Yields Index A fixed-income index compiled by Bloomberg that measures yields of generic US,on-the-run, government notes and bond indices. Yields are yield to maturity andpre-tax, are based on the ask side of the market and are updated intraday. Yields included in the index are precise to 4 decimal places. US10-Year Treasury Note Yield (Used in Macro Sensitivity) The interest rate paid to holders of U.S. 10 Year Treasury Notes. The rate is comprised of Generic United Stateson-the-run government 10 Year Treasuries. The yield quoted is yield to maturity and on apre-tax basis. Email USSPDR-Gold@ssga.comState Street Global Advisors 4