Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SEC. 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2005

Commission File No. 333-103749

Maine & Maritimes Corporation

(Exact name of registrant as specified in its charter)

Maine

(State or other jurisdiction of incorporation or organization)

30-0155348

(I.R.S. Employer Identification No.)

| 209 State Street, Presque Isle, Maine | | 04769 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code:207-760-2499

Securities registered pursuant to Section 12(b) of the Act:

Title of each class:Common Stock, $7.00 par value

Name of each exchange on which registered:American Stock Exchange

Securities registered pursuant to Section 12(g) of the Act:

None

Title of Class

Indicate by check mark if a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer o. Accelerated filer o. Non-accelerated filer ý.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Aggregate market value of the voting stock held by non-affiliates at June 30, 2005: $40,086,092.

The number of shares outstanding of each of the issuer's classes of common stock as of March 24, 2006.

Common Stock, $7.00 par value—1,637,211 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's definitive Proxy Statement to be filed pursuant to Regulation 14A no later than 120 days after December 31, 2005, which is the end of the fiscal year covered by this report, are incorporated by reference into Part III.

MAINE & MARITIMES CORPORATION

FORM 10-K

For the Fiscal Year Ended December 31, 2005

For Glossary of Terms, see Page iii

TABLE OF CONTENTS

i

ii

Glossary of Terms

| AFUDC | | Allowances for the cost of equity and borrowed funds used during construction |

| AMEX | | American Stock Exchange |

| APP | | Aroostook Partnership for Progress |

| BHE | | Bangor Hydro-Electric Company |

| CES | | Competitive Energy Supplier |

| CMMS | | Computerized Maintenance Management System |

| CMP | | Central Maine Power Company |

| Cornwallis | | Cornwallis Court Developments Ltd |

| CPCN | | Certificate of Public Convenience and Necessity |

| DOE | | Department of Energy |

| EA | | Energy Atlantic, LLC |

| Eastcan | | Eastcan Consulting Engineers |

| EMF | | Electro-magnetic Fields |

| Engage | | Engage Energy America, LLC |

| EPS | | Earnings per Share |

| FAME | | Finance Authority of Maine |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FIN | | FASB Interpretation Number |

| Gould | | Gould Electric Company |

| IBEW | | International Brotherhood of Electrical Workers |

| ISFSI | | Independent Spent Fuel Storage Installation |

| kV | | Kilovolt |

| LEED | | Leadership in Energy and Environmental Design |

| LIBOR | | London InterBank Offering Rate |

| LOC | | Letter of Credit |

| MAM | | Maine & Maritimes Corporation |

| M&R | | Morris & Richards Consulting Engineers |

| Me&NB | | Maine & New Brunswick Electrical Power Company, Ltd |

| Mecel | | Mecel Properties Ltd |

| MEPCO | | Maine Electric Power Company, Inc. |

| MPS | | Maine Public Service Company |

| MPUC | | Maine Public Utilities Commission |

| MPUFB | | Maine Public Utility Financing Bank |

| MTI | | Maricor Technologies, Inc. |

| MW | | Megawatt |

| MWH | | Megawatt hour |

| MY | | Maine Yankee |

| NB Power | | New Brunswick Power |

| NEPOOL | | New England Power Pool |

| NMISA | | Northern Maine Independent System Administrator |

| NOI | | Notice of Inquiry |

| NPCC | | Northeastern Power Coordinating Council |

| NRC | | Nuclear Regulatory Commission |

| NRI | | Northeast Reliability Interconnect |

| OATT | | Open Access Transmission Tariff |

| PCB | | Poly Chlorinated Bi-phenol |

| PPA | | Power Purchase Agreement |

| PUHCA | | Public Utility Holding Company Act |

| | | |

iii

| REIT | | Real Estate Investment Trust |

| RES | | RES Engineering, Inc., now The Maricor Group New England |

| SEC | | Securities and Exchange Commission |

| SFAS | | Statement of Financial Accounting Standards |

| SOS | | Standard Offer Service |

| TMG | | The Maricor Group |

| TMGC | | The Maricor Group, Canada Ltd |

| TMGNE | | The Maricor Group New England |

| VCC | | Vitale, Caturano & Company, Ltd |

| VEBA | | Voluntary Employee Benefit Association |

| VERP | | Voluntary Employee Retirement Program |

| WPS | | WPS Resources Corporation |

| WPS-PDI | | WPS-Power Development, Inc. |

| WS | | Wheelabrator-Sherman |

iv

PART I

Item 1. Business

General

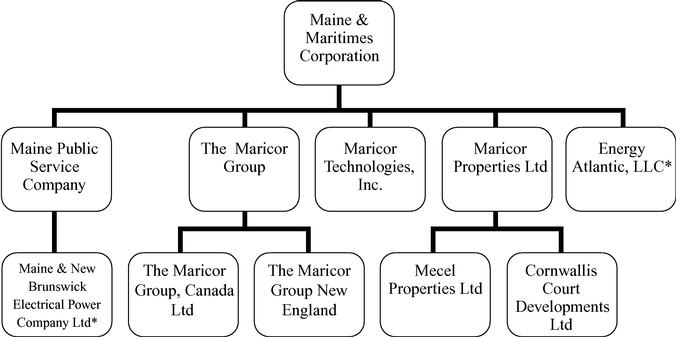

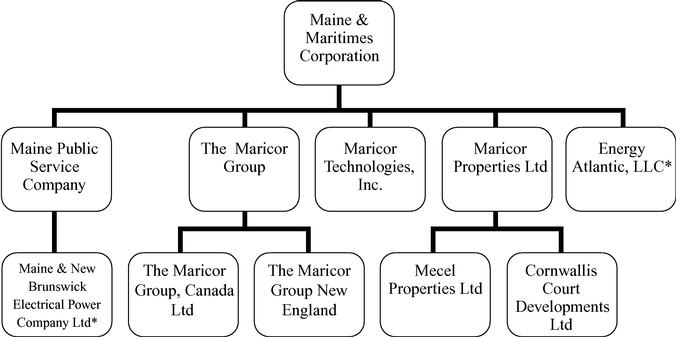

Maine & Maritimes Corporation ("MAM" or the "Company"), a Maine corporation, became a holding company effective June 30, 2003, when all shares of Maine Public Service Company ("MPS") common stock were converted into an equal number of shares of MAM common stock, which are listed on the American Stock Exchange ("AMEX") under the symbol "MAM." MAM is the parent holding company for the following wholly-owned subsidiaries:

- 1.

- The Maricor Group ("TMG," formerly known as Maine & Maritimes Energy Services) and its wholly-owned United States subsidiary The Maricor Group New England ("TMGNE," formerly known as RES Engineering, Inc.) and TMG's wholly-owned Canadian subsidiary The Maricor Group, Canada Ltd ("TMGC," formerly Maricor Ltd);

- 2.

- Maricor Properties Ltd ("Maricor Properties"), a Canadian subsidiary and its wholly-owned Canadian subsidiaries, Cornwallis Court Developments Ltd ("Cornwallis") and Mecel Properties Ltd ("Mecel"), as well as a 50% owner of Maricor Ashford Ltd;

- 3.

- Maricor Technologies, Inc. ("MTI"), a U.S. wholly-owned subsidiary;

- 4.

- Maine Public Service Company ("MPS") and its wholly-owned inactive Canadian subsidiary Maine & New Brunswick Electrical Power Company, Ltd ("Me&NB"); and

- 5.

- Energy Atlantic, LLC ("EA"), an inactive subsidiary.

Maine & Maritimes Corporation and Subsidiaries

- *

- Maine & New Brunswick Electrical Power Company, Ltd and Energy Atlantic, LLC are inactive companies.

1

General Descriptions of the Parent Company and its Subsidiaries:

- •

- Maine & Maritimes Corporation is a holding company incorporated in the State of Maine, and is the ultimate parent company for all business segments. MAM maintains investments in (a) a regulated electric transmission and distribution utility operating within the State of Maine, United States of America, (b) mechanical, electrical and plumbing/fire protection engineering, facility asset lifecycle management, energy efficiency, and asset development companies within the United States and Canada, (c) real estate investment and development companies in Canada, and (d) a facilities asset lifecycle management and sustainability software development company in the United States. MAM is headquartered in Presque Isle, Maine.

- •

- The Maricor Group is an energy asset development and mechanical, electrical and plumbing/fire protection engineering consulting firm providing energy efficiency, facilities lifecycle asset management, facility condition assessment, fee-for-service engineering design and emissions reduction services focusing on sustainability and Leadership in Energy and Environmental Design ("LEED™"). The Maricor Group operates primarily within the New England region of the United States and the eastern Canadian provinces, particularly Atlantic Canada. TMG was formed in November 2003, and is headquartered in Presque Isle, Maine, with offices in Boston, Massachusetts; Moncton and Saint John, New Brunswick; and Halifax, Nova Scotia.

- •

- The Maricor Group New England is a mechanical and electrical engineering subsidiary of The Maricor Group with an office in Boston, Massachusetts, offering the services of The Maricor Group within New England, particularly the greater Boston area and other regions of the Commonwealth of Massachusetts. TMGNE was acquired by TMG on June 15, 2004.

- •

- The Maricor Group, Canada Ltd is the Canadian subsidiary of The Maricor Group offering its parent company's defined services primarily within the eastern Canadian provinces, particularly Atlantic Canada. Headquartered in Moncton, New Brunswick, it maintains offices in Saint John, New Brunswick, as well as Halifax, Nova Scotia. TMGC acquired its first mechanical and electrical engineering services company, Eastcan Consultants, Inc. ("Eastcan") on December 1, 2003. On June 1, 2004, TMGC acquired Morris & Richards Consulting Engineers ("M&R"). Both companies are now operating divisions of TMGC.

- •

- Maricor Properties Ltd is a Canadian real estate development, redevelopment and investment company focused on sustainable development and "smart growth" principles within second and third tier Canadian markets emphasizing the development and revitalization of downtowns and existing suburbs. It seeks to develop or invest in public and private facility projects involving the renewal or development of building infrastructure within revitalization districts promoting renewal of existing areas, thus negating the need for extension of additional infrastructure and promotion of sprawl. It utilizes the services of The Maricor Group in its development and redevelopment projects. Maricor Properties Ltd was organized on May 28, 2004, in Nova Scotia, Canada.

- •

- Mecel Properties Ltd is a Canadian subsidiary of Maricor Properties Ltd and currently owns the office building housing the Halifax, Nova Scotia operating division of The Maricor Group, Canada Ltd. It was acquired on June 1, 2004, in conjunction with the acquisition of M&R by TMGC.

- •

- Cornwallis Court Developments Ltd is a wholly-owned Canadian subsidiary of Maricor Properties, acquired on October 7, 2005. Cornwallis currently owns and operates the J. Angus MacDonald Building located in Halifax, Nova Scotia, Canada.

- •

- Maricor Technologies, Inc., formed on February 14, 2005, is a software technology firm that develops and maintains information-based technologies, which support lifecycle asset management and capital budget planning with an increasing emphasis on capital performance

2

management and asset governance. On February 14, 2005, it purchased, through a three-way transaction, the "Strategic Asset Management" software technology assets of Delinea Corporation of Dallas, Texas, which were formerly owned by HCI Systems Asset Management, LLC. The Maricor Group utilizes the software in the delivery of its lifecycle asset management services and markets its products throughout North America. Maricor Technologies is headquartered in Presque Isle, Maine, with an office in Portland, Maine.

Maricor Technologies' software products currently include "iPlan™," a web-based strategic planning tool used to quantify and prioritize capital investments required to maintain and preserve facilities and infrastructure assets. iPlan™ automates the process of defining an organization's capital needs, and assists in the identification of capital projects, quantifying replacement and renovation costs, and assigning priorities based on various lifecycle, safety, and return-on-investment measures. "Building Blocks™" is a proactive computerized maintenance management system ("CMMS") software solution for managing both the total lifecycle of assets and the daily operation of facilities.

- •

- Maine Public Service Company is a regulated electric transmission and distribution utility serving all of Aroostook County and a portion of Penobscot County in northern Maine. Since March 1, 2000, the date retail electric competition in Maine commenced, customers in MPS's service territory have been purchasing energy from suppliers other than MPS. This energy comes from Competitive Electricity Suppliers ("CES") or, if customers are unable or do not wish to choose a competitive supplier, the Standard Offer Service ("SOS") provider. SOS providers are determined through a bid process conducted by the Maine Public Utilities Commission ("MPUC"). MPS provides the transportation through its transmission and distribution wires infrastructure. Its service area covers approximately 3,600 square miles, with a population of 72,000. The utility is regulated by the Federal Energy Regulatory Commission ("FERC") and the MPUC. MPS is headquartered in Presque Isle, Maine.

MPS was originally incorporated in the United States as the Gould Electric Company ("Gould") in April 1917, by a special act of the Maine legislature in connection with the purchase and lease of all of the assets of the Maine & New Brunswick Electrical Power Company, Ltd, a Canadian company. Following the sale of its assets to Gould, Me&NB remained a subsidiary of Gould, and subsequently MPS. Me&NB was primarily a hydro-electric generating company. It owned and operated the Tinker hydro-electric station in New Brunswick, Canada, until June 8, 1999, when these assets were sold by MPS to WPS Power Development, Inc. ("WPS-PDI"), a subsidiary of WPS Resources Corporation ("WPS").

Following its incorporation in the United States, Gould changed its name to Maine Public Service Company in August 1929. MPS was a privately held subsidiary of the Consolidated Electric & Gas Company until 1947, when its capital stock was sold as a result of Consolidated Electric & Gas Company's forced divestiture. From 1947 until its corporate reorganization in 2003, MPS was the corporate parent and traded under the stock symbol "MAP" on the AMEX. Until its generating assets were sold on June 8, 1999, MPS produced electric energy for retail and wholesale customers. From that date through March 1, 2000, MPS continued to purchase electric energy for sale to these customers. MPS continues to provide transmission services to former wholesale energy customers and transmission and distribution services to retail customers in the service territory; however, it does not provide electric energy supply.

MPS's research and analyses indicate that its service area's economy, once heavily influenced by a significant military presence, continues to be dependent upon agricultural and the forest products industries. Potato farming and processing and the manufacturing of forest products, principally lumber, plywood, and oriented strand board, continue to be dominant economic forces within MPS's service area. The growing of broccoli has added diversity to the region's

3

agricultural economic base. Tourism, particularly related to snowmobiling and skiing, appears to be playing an increasingly significant role in the area's economy. The medical industry represents a significant positive and growing economic force within the region, serving as a leading employer and job creation sector. However, data appears to suggest that the northern Maine economy continues to lag behind national economic trends and is experiencing population losses based on the most recent census data and projections, particularly among the service area's youth and young adults. Attracting new businesses and jobs to northern Maine in an effort to reverse out-migration trends appears to be a continuing challenge to the area's leaders and businesses, including MPS. As a result of its service area's economic challenges, MPS has taken a lead role in forming a public/private partnership for economic progress in cooperation with the Northern Maine Development Commission. Managed by a private-sector investors' council, MPS and its staff are serving as private sector leaders in helping to execute a rational and results-oriented economic development program. The Aroostook Partnership for Progress's ("APP's") efforts are intended to increase the area's emphasis on economic development through improved focus and funding for economic development.

Electric sales in the Company's territory are seasonal, and the Company's results of operations reflect this seasonal nature. The highest usage occurs during the five heating season months, from November through March due to heating-related requirements and shorter daylight hours. The rate year is divided into two periods, with higher rates in place in the winter months to encourage conservation. Also, due to the climate in the northern Maine area, the majority of MPS's construction program is completed during the spring, summer and fall months.

- •

- Maine & New Brunswick Electrical Power Company, Ltd is an inactive Canadian subsidiary of MPS, which, prior to deregulation and generation divestiture, owned MPS's Canadian electric generation assets. Me&NB was incorporated in 1903 under the laws of the Province of New Brunswick, Canada.

- •

- Energy Atlantic, LLC is a licensed, but currently inactive, CES of retail electricity, and is classified as discontinued operations. EA formerly competed for electric supply customers within the northern and southern regions of the State of Maine as a CES from March 1, 2000, through February 28, 2004, and also provided the Standard Offer supply for Central Maine Power Company's ("CMP's") territory from March 1, 2000, through February 28, 2002, and 20% of the medium non-residential SOS in MPS's territory from March 1, 2000, through February 28, 2001.

Employees

At the end of 2005, the Company and its subsidiaries had the following employees:

| | Employees

|

|---|

| | 2005

| | 2004

|

|---|

| Maine & Maritimes Corporation | | 5 | | 5 |

| Maine Public Service Company | | 140 | | 134 |

| The Maricor Group | | 68 | | 68 |

| Maricor Technologies, Inc. | | 6 | | — |

| | |

| |

|

| | Total | | 219 | | 207 |

| | |

| |

|

The Company's consolidated payroll costs were $12.1 million for 2005 and $9.5 million for 2004. The increase was due primarily to new employees added through TMG's acquisitions during 2004. Approximately 37% of MPS's labor force are members of the Local 1837 of the International Brotherhood of Electrical Workers ("IBEW") and are covered under a collective bargaining agreement. On September 22, 2005, the IBEW 1837 Union approved a four-year collective bargaining agreement

4

for the term of October 1, 2005, through September 30, 2009. No employees of the Company are covered under collective bargaining agreements that will expire within one year.

Affiliates and Associated Companies

Maricor Properties Ltd is an equal partner in Maricor Ashford Ltd, a joint venture with Ashford Investments, Ltd., an unaffiliated real estate management company. Maricor Ashford Ltd is a real estate development and redevelopment company based in Moncton, New Brunswick, Canada. Management reviewed the characteristics of this joint venture in accordance with Financial Accounting Standards Board Interpretation No. 46(R), "Consolidation of Variable Interest Entities, an Interpretation of ARB 51" ("FIN 46(R)"), and determined that Maricor Properties Ltd is not the primary beneficiary of this joint venture. Accordingly, the activity of Maricor Ashford Ltd has been recorded in these financial statements under the equity method, and Maricor Ashford Ltd is not consolidated with these financial statements.

MPS owns 5% of the common stock of Maine Yankee, which operated an 860 MW nuclear power plant (the "Plant") in Wiscasset, Maine. On August 6, 1997, the Board of Directors of Maine Yankee voted to permanently cease power operations and to begin decommissioning the Plant. The Plant experienced a number of operational and regulatory problems and did not operate after December 6, 1996. The decision to close the Plant permanently was based on an economic analysis of the costs, risks and uncertainties associated with operating the Plant compared to those associated with closing and decommissioning it. The Plant's operating license from the Nuclear Regulatory Commission ("NRC") was due to expire on October 21, 2008.

MPS also owns 7.49% of the common stock of Maine Electric Power Company, Inc., ("MEPCO"). MEPCO owns and operates a 345-KV (kilovolt) transmission line about 180 miles long, which connects the New Brunswick Power ("NB Power") system with the New England Power Pool ("NEPOOL").

Financial Information about Geographic Areas

See Note 4 to the attached financial statements.

Financial Information about Segments

See Note 4 to the attached financial statements

Competitive Conditions

See Item 1a. below.

Company Financial Information

The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The Company is an electronic filer and the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. The Company also maintains an Internet site containing such reports at www.maineandmaritimes.com. All such reports, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, may be downloaded from such site without charge. Also listed at the Company's site under Investor Relations, Corporate Governance, is the Code of Ethics for Senior Financial Officers and all other Principal Executive Officers and Managers, as well as the Company's policy regarding Insider Trading and Dissemination of Inside Information.

5

Item 1a. Risk Factors

As with all companies, MAM is exposed to certain risk factors as a result of their operations. MAM has identified the following key risk factors for the company as a whole and also specific to the various industries in which MAM and its subsidiaries operate.

Liquidity and Capital Formation Risk

MAM's current liabilities of $23.17 million as of December 31, 2005, exceed its current assets of $12.68 million by $10.49 million, exposing MAM to the risk of being unable to fulfill its obligations in 2006. However, of these current liabilities, $14.1 million is short-term borrowings, including the lines of credit and one-year notes payable through Royal Bank of Canada. MAM has taken steps to mitigate this short-term risk before and after year-end, including identification of additional sources of financing and options to reduce or defer costs.

In the long term, Management expects MAM's cash flow to improve, with MPS's recovery of deferred fuel and other stranded costs currently deferred by MPS. The current cash expenditures for deferred fuel and Maine Yankee exceed the recovery of stranded costs. With the expiration of the Wheelabrator-Sherman contract in December 2006, this position will reverse, and recovery of stranded costs will exceed the cash outflows.

Lack of Profitable Operations from Unregulated Business

The unregulated business segments which have been added since 2003 have not been profitable to date. Please read the in-depth analysis in the Management's Discussion and Analysis of Financial Condition and Results of Operations. As noted there, Management believes that the success of these ventures is crucial to the future growth of the Company, but can give no assurances as to the success of these ventures.

Acquisition and Integration Risks

The Maricor Group and Maricor Properties have each acquired several companies over the past three years, in conjunction with MAM's growth strategy. The companies face several risks associated with this process, including lack of suitable available targets, insufficient funds for acquisitions to achieve the growth strategy, lack of synergies and the cost of integration. MAM and its subsidiaries mitigate these risks through a due diligence process intended to identify and mitigate these risks throughout and after the acquisition process.

Legislation and Regulation

Changes in legislation and regulation could impact MAM's earnings and operations positively or negatively. Such changes could include changes in tax rates, changes in environmental or workplace laws or changes in regulation of cross-border transactions. For The Maricor Group, public policies related to energy, energy efficiency, asset lifecycle management, and air emissions may impact the overall market, particularly the governmental sectors.

MPS is a regulated utility, operating its distribution activity under the jurisdiction of the Maine Public Utilities Commission and transmission activity under the jurisdiction of the Federal Energy Regulatory Commission. MPUC and FERC regulate the rates MPS is allowed to charge its customers. MPS filed notice with the MPUC on January 10, 2006, under Docket No. 2006-24, that it intended to seek a 4% increase in distribution rates, a procedure expected to last through most of 2006. Further, the transmission formula under which MPS transmission rates have been determined for the past three years is up for review and negotiation for the rates that will go into effect on June 1, 2006. Finally, the rates for recovery of stranded costs are set to expire in December 2006. The outcome of these rate

6

cases could have a positive or negative impact on earnings and cash flow; their ultimate impact is unknown at this time.

Foreign Operations

MAM subsidiaries Maricor Properties, including its subsidiaries Mecel Properties Ltd and Cornwallis Court Developments Ltd and its joint venture Maricor Ashford Ltd, and The Maricor Group, Canada operate in Canada. Me&NB, an inactive subsidiary of MPS, is also based in Canada. There are a number of risks associated with operations outside of the United States, including differences in laws, policies and measures; regulatory requirements affecting trade and investment; differences in social, political, labor, and economic conditions, including foreign exchange rates; difficulties in staffing and managing foreign operations; and potential adverse foreign tax consequences.

General Economic Conditions

MAM, like all other entities, is exposed to a certain amount of risk as a result of the general economic conditions under which it operates. Such risks include the overall economy of the geographic region in which the entity operates, interest rate risk, risk of loss of value of real estate assets and risk of inflation.

MPS operations are restricted to a territory in Aroostook County and northern Penobscot County, Maine. Limited population growth and economic expansion in the region could negatively impact the utility's ability to maintain this customer base. MPS has been actively involved with the Aroostook Partnership for Progress, an organization with the mission of enhancing the economy in Aroostook County.

The Maricor Group and its subsidiaries generally operate within Atlantic Canada and New England. The nature of work available may differ depending on various economic and political conditions, including cost of energy, interest rates, and other factors.

MAM, TMG, Maricor Properties and MPS each have interest rate risk due to variable interest rates on financing arrangements. The Company has mitigated a portion of this risk by fixing interest rates on three MPS variable rate debt issues with a derivative interest rate swap transaction on September 9, 2003. See Item 8 of this Form 10-K, Note 7 to the Consolidated Financial Statements, "Accumulated Other Comprehensive Income (Loss)," which is hereby incorporated by this reference, for a discussion on the impact on MPS's financial statements and further description of the interest rate swaps.

The Company has observed that increasing interest rates generally tend to negatively impact the market for fee-for-service mechanical and electrical engineering services. However, increasing interest rates also appear to increase the demand for energy efficiency and asset lifecycle management services. The Company cannot warrant or predict these economic effects and makes no predictive statement as to future market or competitive trends.

The net book value of Maricor Properties' real estate totaled $7.82 million at December 31, 2005. MAM is exposed to risk associated with the local real estate markets in Moncton, New Brunswick and Halifax, Nova Scotia, and its impact on the value of these properties. The most recent appraisals

7

obtained during 2005 and 2006 indicate that the appraised value of the properties currently exceeds the book value; however, this position could reverse with changes in the real estate markets.

MAM is exposed to inflation risk in both the United States and Canada.

Franchises and Competition

Except for consumers served by municipal electric utilities within MPS's service area, MPS has a nearly exclusive franchise to deliver electric energy in its service territory, and has little exposure to risk from competition.

The Maricor Group, Canada Ltd and The Maricor Group New England operate in competitive markets and do not have exclusive franchises. Competition for contracts comes from local, regional and mechanical and electrical engineering firms, as well as local, regional or national energy services, energy asset development and energy controls companies. TMGC also faces risks associated with their relationships with the local architectural firms. The majority of its current business is obtained through local architects, and a deterioration of this relationship could negatively impact financial performance.

Maricor Properties Ltd, Cornwallis Court Developments Ltd and Mecel Properties Ltd compete in the open market for tenants for facilities owned and operated by these subsidiaries. Competition is driven by per square foot lease costs, operating costs, quality of the work environment, availability of parking, management services and other factors that could influence a tenant to lease office space. These companies have greatly mitigated this risk with their existing long-term leases for tenants.

In addition to competition for tenants, the subsidiaries compete in the market with other real estate and development companies regarding the potential acquisition of additional real estate. Market conditions driven by supply and demand issues, as well as interest rates typically drive the subsidiaries' markets to acquire, lease or sell real estate holdings. Maricor Properties and Mecel Properties compete with individual real estate developers, regional real estate developers, real estate investment trusts ("REITs"), national real estate developers, insurance companies and others that invest in commercial real estate.

Maricor Technologies, Inc. competes in the open market and does not have an exclusive franchise. Factors affecting its market include the economic needs of facilities owners, the age of facilities infrastructure, the availability or lack thereof of capital, public policies and other issues. It competes with existing and potential additional providers and/or developers of similar software solutions. Maintaining the market viability of their software assets through product enhancements and new versions is a critical part of ensuring its market competitiveness. Additionally, its competitiveness may be impacted by its ability to expand its product offerings to address a more comprehensive array of facility infrastructure information management and planning needs.

Environmental Risks

MAM, particularly MPS, bear environmental risks associated with former ownership of nuclear, diesel and oil fired generation, as well as the ownership of transformers containing Poly Chlorinated Bi-phenols ("PCB's"). Further, MPS has potential risks concerning claims related to electro-magnetic fields ("EMF's"). While the Company takes significant steps to ensure prudent environmental practices, it cannot assure that risks do not exist from past or future environmental practices. Additionally, while the Company does not believe EMF's represent a danger, particularly due to its lack of ownership of bulk transmission, it cannot warrant that claims could not be filed.

8

Aging Infrastructure and Reliability

MPS has risks associated with aging infrastructure assets that may in some instances be beyond the useful life of the asset. The failure of such assets could result in the loss of power that could result in harm to property or person. MPS works diligently through on-site inspection and testing programs to ensure the integrity of its infrastructure, but cannot warrant that outages will not occur due to the age of some infrastructure. MPS does maintain substantial back-up equipment and the capability to repair or rebuild such assets in a timely manner, including the maintenance of mobile transformers.

Debt Covenants

MAM and certain of its subsidiaries have obtained financing with financial and other covenants, such as debt service coverage ratios. In a default, the lender can require immediate repayment of the debt. This could also trigger increases in interest rates, difficulty obtaining other sources of financing and cross-default provisions within the debt agreements.

Collections Risk

MAM's subsidiaries sometimes extend credit to their customers. This may be regulated, as in the case of MPS, or under the terms of contracts or leases. In these situations, MAM bears the risk that it may not collect these funds. MAM partly mitigates this risk through the use of credit checks and monitoring of the accounts receivable aging. MAM also maintains an allowance for uncollectible accounts for accounts receivable that are unlikely to be collected.

Attraction and Retention of Qualified Employees

MAM primarily operates in service sectors, and is heavily dependent on the attraction and retention of qualified employees, including engineers and electricians. MAM maintains competitive wage and benefits packages for its employees to aid in attracting and retaining staff.

Equity Price Risk

The Maricor Group and its subsidiaries incurred equity price risk when it bought the stock of certain of its subsidiaries. Part of the consideration was MAM stock. In the event that the price of MAM common stock is below a specified price when the seller wishes to dispose of it, The Maricor Group (or the applicable subsidiary) has agreed to pay the difference. There were 41,151 shares outstanding pursuant to this kind of agreement as of December 31, 2005. At a market price of $15.49 per share on that date, the total exposure was approximately $814,000. A $1.00 change in the market price would impact this exposure by approximately $41,000.

Market price protection of a different sort was given by Maricor Technologies when it acquired the HCI assets. Part of the consideration for that acquisition was MAM preferred stock which is convertible into 26,000 shares of MAM common stock on February 15, 2008, subject to some other conditions. To the extent that the market price of MAM common stock is then below $25 per share, the number of shares issuable on conversion is ratably increased, which could result in further dilution of MAM's common stock.

Professional Liability

The Maricor Group and its subsidiaries are subject to risks associated with engineering design errors and/or omissions. The Company carries insurance to address errors and omissions to mitigate certain risks.

9

Technological Obsolescence

Due to the nature of their business, Maricor Technologies is subject to risks associated with changing technologies and obsolescence of their products. As a result, MTI monitors technology and competitor trends to ensure its product offerings remain market competitive.

Weather

MPS and its electric wires infrastructure are at risk to natural phenomena, especially those caused by the weather. Storms, such as ice storms and major winter snow storms may have an impact on the integrity of MPS infrastructure assets in the field.

Vandalism, Terrorism and Other Illegal Acts

MAM and its asset-owning subsidiaries are subject to the risks of damage to others' properties or human harm due to the failure of infrastructure. While MAM and its subsidiaries exercise diligent asset management and asset inspections, it cannot warrant that such risks can be fully eliminated. MPS and its electric wires and information technology infrastructure are particularly at risk to vandalism and acts of terrorism. While the Company takes steps to protect against such illegal acts through various risk insurance policies and other protective measures, including restricting access to assets, it cannot warrant that they cannot happen.

Information Technology

MAM is subject to systemic risks associated with information technology systems that could impact the calculative outcome of billing determinations or the unintended release of confidential consumer information. MAM goes to significant lengths to stress test its systems and protect against such events; however, the Company cannot warrant that such risks do not exist.

Alternative Generation Options

MPS does face technology and product substitution risks associated with the evolution of distributed generation, non-utility generation, and other alternative fuel forms. The primary risk in this area is non-utility generation, which the utility successfully competed with to date. However, as electric commodity prices increase, the viability of alternative fuel from non-utility generation may become more practical. Such projects could result in reduced usage of MPS's delivery system.

Item 2. Properties

As of December 31, 2005, MPS owned approximately 380 circuit miles of transmission lines and approximately 1,767 miles of distribution lines, all in Aroostook County and a portion of Penobscot County in northern Maine. In addition, MPS owns eight buildings that consist of office, warehouse and/or operating facilities within its service area, as well as various tracts of vacant land. Substantially all of the properties owned by MPS are subject to the liens of its First and Second Mortgage Indentures and Deeds of Trust.

In response to a Maine environmental regulation to phase out PCB transformers, MPS has implemented a program to eliminate transformers on its system that do not meet the new State environmental guidelines. The program is in the process of testing almost 7,400 distribution transformers over a ten-year period. MPS is currently in its fifth year of this ten-year program. In addition, transformers that pass the inspection criteria will be refurbished and refitted with lightning arrestors and animal guards. The current estimated cost of the ten-year program is $2.7 million and, as of December 31, 2005, $1.40 million has been spent to remediate approximately 45% of the transformers in this effort.

10

In March 2005, the FASB issued FASB Interpretation No. 47, "Accounting for Conditional Asset Retirement Obligations" ("FIN 47"), effective for fiscal years ending after December 15, 2005. FIN 47 clarifies the term "conditional asset retirement obligation", used in FASB Statement No. 143, "Accounting for Asset Retirement Obligations", as referring to a "legal obligation to perform an asset retirement activity in which the timing and/or method of settlement are conditional on a future event that may or may not be within the control of the entity." Based on this interpretation, MPS recognized an associated asset retirement obligation of $1.30 million with the PCB Transformer phase-out program, described more fully in Note 1 of these Consolidated Financial Statements.

Additional assets of the Company include three office buildings owned by Maricor Properties Ltd and its subsidiaries Cornwallis Court Developments Ltd and Mecel Properties Ltd. These office buildings are located in Moncton, New Brunswick and Halifax, Nova Scotia. The Moncton, New Brunswick multi-tenant office building consists of approximately 40,000 square feet and is located along a downtown thoroughfare. The facility houses The Maricor Group, Canada Ltd's Moncton operations, in addition to third party tenants. The J. Angus MacDonald Building, located in downtown Halifax, is a 60,000 square foot facility, and is fully leased to third parties, primarily Canadian government entities. The other Halifax office is approximately 10,000 square feet and is located in a revitalization district near the historic downtown Citadel. The facility houses The Maricor Group, Canada Ltd's Halifax operations.

MPS System Security and Reliability

MPS has implemented a transmission inspection program, part of its asset lifecycle management efforts, and has begun implementation of a distribution inspection program. Such inspection programs include regular testing of transformers located within substations. Management believes that full implementation of asset lifecycle management programs can reduce future demands for capital expenditures related to MPS's renewal and replacement needs. However, before reducing annual capital expenditures, baseline improvements are being undertaken. While future plans will attempt to reduce capital expenditures to a level approximately equal to its rate of depreciation, interim steps may include potential consolidation of facilities to help ensure increased system reliability and reduce long-term costs. Such expenditure levels do not include the possible construction of additional transmission plant as later described.

As a result of uncertainty concerning merchant and non-merchant generation facilities within the Maritimes and northern Maine regions, MPS evaluates system security on an ongoing basis, particularly from an on-peak generation resource perspective. Through load-flow analysis and utilization of specific contingency or transmission outage scenarios, it has been determined that under a single contingency or outage condition and during peak load situations, a system-wide outage is possible if approximately 50 MW's of on-system generation are not operating. Additionally, under certain conditions, the analyses noted that a second contingency or transmission line outage could not be survived within a thirty-minute time frame when similar conditions existed after a single contingency. Although Maine Public Service Company does not have a bulk delivery transmission system as defined by the Northeastern Power Coordinating Council ("NPCC"), MPS is using NPCC's standards for planning criteria. It should be noted that potential contingencies that were studied focused on situations that could impact MPS's transmission and distribution systems, even though certain transmission assets are located in Canada and are owned by other companies or organizations. MPS has load reduction contingency plans to mitigate such conditions or events in the case that a major transmission outage or system outage occurred.

In order to address system security and reliability needs, MPS filed a request with the MPUC requesting authorization to construct, subject to all required permitting, a new 138 kV transmission line that would interconnect with NB Power. This filing is more fully described in Item 3 below and is incorporated by reference herein. MPS believes that the construction of the proposed transmission line,

11

an approximate $4 million regulated investment, would significantly improve system reliability and allow the MPS system to meet NPCC standards for single and dual transmission contingencies. MPS continues to evaluate projects and actions that could increase available and total transmission capacities.

Item 3. Legal Proceedings

Federal Energy Regulatory Commission 2005 Open Access Transmission Tariff Formula Rate Filing

On May 31, 2005, pursuant to Section 205 of the Federal Power Act, 16 U.S.C. Section 824d, and Title 18 CFR Sections 35.11 and 35.13 of the regulations of the FERC, MPS submitted for filing its proposed revisions to its FERC Open Access Transmission Tariff in Docket No. ER 05 (the "2005 OATT") to modify its transmission rate formula. MPS filed its updated rates under the 2005 OATT formula on June 15, 2005, pursuant to Docket ER00-1053 with an effective date of June 1, 2005, for both wholesale and retail customers, subject to a customer refund that may occur as a result of the proceeding and potential settlement negotiations. The retail transmission revenue requirement was increased by $288,670 on June 1, 2005, under the 2005 OATT. This represented an increase of 8% to the transmission component of retail delivery rates or an overall impact on total retail delivery rates of 0.7%. The primary reasons for the increase were the increase to costs due to mandated Sarbanes-Oxley requirements, and the purchase of a new Oracle-based accounting system.

As part of the settlement data request process, the Company identified adjustments to its FERC Form 1 filing for 2004, which flow through the Company's transmission rate formula. The approximate net impact of these corrections, once implemented, will be to reduce the overall increase to the projected retail transmission revenue and result in a revised projected net increase to the retail transmission revenue requirement of $238,422 instead of the previously projected increase of $388,923. This adjustment will flow through Schedule 1.1.2 of the MPS OATT to be effective June 1, 2006, and will be passed through retail rates on July 1, 2006, when the retail rates are next adjusted. The Company has reported to FERC as scheduled that the parties are proceeding with the settlement process and will continue to provide progress reports as required. Because the Company is currently in the midst of a settlement process, it cannot predict the exact dollar outcome of this proceeding at this time.

MPUC Approves the Pass-Thru of Retail Transmission Rates to MPS Retail Jurisdictional Customers, and the Increase to DSM Mil Rate, MPUC Docket No. 2003-516

Per agreement with the Maine Public Utilities Commission, the new transmission rates for retail customers (above) were put into retail rates on July 1, 2005, to coincide with MPS's related State jurisdictional compliance filing in MPUC Docket No. 2003-516 to increase the DSM Mil Rate. These rates were approved by the MPUC on June 20, 2005. Per this filing, total retail delivery rates increased by 1.1%.

Requests for Issuance of Certificates of Public Convenience and Necessity in Connection With the Construction of a Proposed Transmission Line and Various Transmission Service Reservations

On October 4, 2004, MPS filed a Petition with the MPUC requesting the issuance of Certificate of Public Convenience and Necessity ("CPCN") pursuant to 35-A M.R.S.A. Section 3132 to construct a 138 kV transmission line originating at an existing substation in Limestone, Maine and extending to the Canadian Border near Hamlin, Maine.

The project was proposed in order to ensure the reliability and integrity of the MPS transmission grid under scenarios of reduced on-system generator availability and peak load growth. MPS submitted that the available firm transfer capability of the transmission system when added to the remaining on-system hydro generation was not sufficient to meet peak load conditions, should existing on-system

12

wood-fired generation become unavailable. The proposed line would address this by significantly increasing the load-serving capability of the northern Maine region and would serve to reinforce the vital transmission ties between northern Maine and the New Brunswick transmission grid. Additional benefits of the proposed line include the potential for increasing the number of competitive retail electric suppliers and increasing the attractiveness of the region for development of additional generation, such as wind farms, by providing increased transmission export capacity.

The MPUC Commissioners deliberated the Docket on August 29, 2005, and denied the petition, determining that there was no immediate reliability risk in northern Maine. The Commission concluded that the risk of losing on-system wood-fired generation was not sufficient to warrant the new transmission line. The Commission issued the Order on October 21, 2005, that described actions to be taken by MPS and the Northern Maine Independent System Administrator ("NMISA") to reduce certain risks identified by MPS. The Company filed for reconsideration of the Order on November 8, 2005 based on the likelihood that Linekin Bay Energy Company, LLC may elect to utilize the CPCN filed in this Docket in order to construct transmission facilities necessary to connect their proposed generation project to the MPS electrical system. The Commission approved the request for reconsideration and will revisit the issue on or before March 31, 2006. Additionally, on November 23, 2005, the Commission granted an MPS request for waiver of the specific requirements of the October 21, 2005 Order until the NMISA finalizes currently proposed market rule changes that are currently scheduled to be presented to the Commission on March 1, 2006. Through December 31, 2005, approximately $844,000 was spent on this transmission project. MPS expects to seek recovery of these costs in its transmission rates and is currently pursuing other recovery options. MPS believes it is probable the amounts deferred can be recovered, either through future rate cases or through sale of the assets to a third party.

In September 2004, MPS entered into a Commitment Agreement with NB Power. Under this Agreement, which is subject to MPS obtaining all necessary regulatory approvals, MPS will reserve 35 MW of transmission capacity on the NB Power system in conjunction with the construction of a new 345 kV transmission line to be constructed from Point Lepreau near Saint John, NB to Orrington, Maine. NB Power will own and operate the portion of the line on its side of the border, while Bangor Hydro-Electric Company ("BHE") will own and operate the portion of the line on the U.S. side of the border known as the Northeast Reliability Interconnect ("NRI"). BHE filed for a Certificate of Public Convenience and Necessity for this line on November 5, 2004, in MPUC Docket No. 2004-771. MPS filed a petition with the MPUC seeking approval to make the reservation required under the Commitment Agreement on December 13, 2004, in MPUC Docket No. 2004-775 which was subsequently changed to MPUC Docket No. 2004-538 Phase II. On October 7, 2005 MPS proposed several changes to the Commitment Agreement, to include a reduction in the reservation quantity from 35 MW to 20 MW. Hearings on Phase II were conducted on December 6 and 7, 2005. A Commission Order is expected during March 2006. As noted above, MPS's obligations under the Commitment Agreement are dependent upon securing regulatory approval. MPS cannot predict the outcome of Phase II of this case at this time.

Item 4. Submission of Matters to a Vote of Security Holders

None.

13

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Maine & Maritimes Corporation became a holding company effective June 30, 2003. All 1,574,582 shares of MPS common stock were converted on that date into an equal number of shares of MAM common stock, which are listed and traded on the American Stock Exchange under the symbol "MAM". As of March 1, 2006, there were 753 holders of record of the Company's common stock.

Dividend data and market price related to the common stock are tabulated as follows for 2005, 2004 and 2003:

| |

| |

| | Dividends

|

|---|

| | Market Price

|

|---|

| | Paid Per Share

| | Declared Per Share

|

|---|

| | High

| | Low

|

|---|

| 2005 | | | | | | | | | | | | |

| First Quarter | | $ | 27.79 | | $ | 24.87 | | $ | 0.20 | | $ | 0.25 |

| Second Quarter | | $ | 27.25 | | $ | 24.04 | | | 0.25 | | | 0.25 |

| Third Quarter | | $ | 24.85 | | $ | 19.70 | | | 0.25 | | | 0.25 |

| Fourth Quarter | | $ | 19.55 | | $ | 15.25 | | | 0.25 | | | 0.00 |

| | | | | | | | |

| |

|

| Total Dividends | | | | | | | | $ | 0.95 | | $ | 0.75 |

| | | | | | | | |

| |

|

2004 |

|

|

|

|

|

|

|

|

|

|

�� |

|

| First Quarter | | $ | 34.75 | | $ | 31.98 | | $ | 0.38 | | $ | 0.38 |

| Second Quarter | | $ | 34.42 | | $ | 30.20 | | | 0.38 | | | 0.38 |

| Third Quarter | | $ | 31.75 | | $ | 29.00 | | | 0.38 | | | 0.38 |

| Fourth Quarter | | $ | 29.50 | | $ | 25.40 | | | 0.38 | | | 0.20 |

| | | | | | | | |

| |

|

| Total Dividends | | | | | | | | $ | 1.52 | | $ | 1.34 |

| | | | | | | | |

| |

|

2003 |

|

|

|

|

|

|

|

|

|

|

|

|

| First Quarter | | $ | 32.26 | | $ | 24.99 | | $ | 0.37 | | $ | 0.37 |

| Second Quarter | | $ | 32.95 | | $ | 26.36 | | | 0.37 | | | 0.37 |

| Third Quarter | | $ | 36.90 | | $ | 31.60 | | | 0.37 | | | 0.37 |

| Fourth Quarter | | $ | 35.95 | | $ | 34.37 | | | 0.37 | | | 0.38 |

| | | | | | | | |

| |

|

| Total Dividends | | | | | | | | $ | 1.48 | | $ | 1.49 |

| | | | | | | | |

| |

|

Dividends declared within the quarter are paid on the first day of the next quarter.

To date, the Company's payment of dividends has been based on dividends from MPS, which are limited by restrictions imposed by the MPUC. MPS dividends to MAM are subject to a common dividend payout ratio (dividends per share divided by earnings per share), which cannot exceed 1.0 (i.e. 100%) on a two-year rolling average.

The most recent and current financial and cash flow performance of the Company resulted in no shareholder dividend during the fourth quarter of 2005. Until such performance improves, the Company cannot warrant that it will continue to pay dividends on a quarter-on-quarter basis. The Company's Board of Directors has adopted a dividend policy which provides for a dividend based on 55% to 80% of the net income contribution from MPS, provided that the Company is projected to generate net earnings per share and requisite free cash flows from its regulated and unregulated operations.

14

The Company has determined that the common stock dividends paid in 2005 are fully taxable for federal income tax purposes. These determinations are subject to review by the Internal Revenue Service, and shareholders will be notified of any significant changes.

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation plans (excluding securities reflected in column (a))

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity compensation plan approved by security holders | | 21,000 | | $ | 29.80 | | 136,046 |

| Equity compensation plan not approved by security holders | | — | | | n/a | | — |

| | |

| | | | |

|

| Total | | 21,000 | | | | | 136,046 |

| | |

| | | | |

|

The Company maintains two equity compensation plans. The 2002 Stock Option Plan included 150,000 shares available for issuance. Of this total, 21,000 options have been issued for executive compensation. See Note 9, "Stock Compensation Plan," in Item 8. An additional 20,000 shares were originally available for issuance to the Company's Board of Directors pursuant to the Stock Plan for Outside Directors. There are 7,046 of these shares remaining available for future issuance.

In February 2005, MAM issued 9,500 shares of preferred stock in conjunction with the acquisition of software now owned by MTI. The entity to which these securities were issued was HCI Systems Asset Management, LLC. No underwriter was used in this transaction. The securities were issued under the exemption provided by Section 4(2) of the Securities Act of 1933 as a transaction by an issuer not involving a public offering.

As mentioned previously, the Company established a stock repurchase program in January 2005 as part of the Dividend Policy announced when the January 3, 2005, dividend was declared. Execution of the share repurchase program will be based on market conditions and is subject to the MAM cash position and investment opportunities. There were no stock repurchases by the Company during 2005.

In June 2004, the Company issued 54,332 shares of its common stock in connection with two acquisitions. On June 1, 2004, the Company, through its Canadian subsidiary, Maricor Ltd, now doing business as The Maricor Group, Canada Ltd, acquired all of the outstanding common shares of Morris & Richard Consulting Engineers Limited, a Canadian-based engineering firm. The persons who acquired the securities were the former principals of M&R. On June 17, 2004, the Company completed a second acquisition by its subsidiary Maine & Maritimes Energy Services Company, now doing business as The Maricor Group, of RES Engineering, Inc., now The Maricor Group New England, of Boston and Hudson, Massachusetts. The person acquiring the shares was the former principal of RES. No underwriter was used in either transaction. Refer to Note 14 to the Consolidated Financial Statements, "Acquisitions." The securities were issued under the exemption provided by Section 4(2) of the Securities Act of 1933 as a transaction by an issuer not involving a public offering.

15

Item 6. Selected Financial Data

A five-year summary of selected financial data (2001-2005) is as follows:

Five-Year Summary of Selected Financial Data(1)

(In thousands of dollars except per share amounts)

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

|

|---|

| Income Statement Data: | | | | | | | | | | | | | | | |

| Revenues | | $ | 39,974 | | $ | 37,138 | | $ | 31,797 | | $ | 31,401 | | $ | 31,780 |

| Net (Loss) Income From Continuing Operations | | | (224 | ) | | 1,726 | | | 2,949 | | | 3,090 | | | 4,340 |

| Income (Loss) From Discontinued Operations | | | 4 | | | (408 | ) | | (143 | ) | | 3,453 | | | 897 |

| | |

| |

| |

| |

| |

|

| Net (Loss) Income Available for Common Stock | | $ | (220 | ) | $ | 1,318 | | $ | 2,806 | | $ | 6,543 | | $ | 5,237 |

| | |

| |

| |

| |

| |

|

| Basic (Loss) Earnings Per Share of Common Stock From Continuing Operations | | $ | (0.13 | ) | $ | 1.07 | | $ | 1.87 | | $ | 1.97 | | $ | 2.76 |

| Basic (Loss) Earnings Per Share of Common Stock From Discontinued Operations | | | 0.00 | | | (0.25 | ) | | (0.09 | ) | | 2.19 | | | 0.57 |

| | |

| |

| |

| |

| |

|

| Basic (Loss) Earnings Per Share of Common Stock From Net Income | | $ | (0.13 | ) | $ | 0.82 | | $ | 1.78 | | $ | 4.16 | | $ | 3.33 |

| | |

| |

| |

| |

| |

|

| Diluted (Loss) Earnings Per Share of Common Stock From Continuing Operations | | $ | (0.13 | ) | $ | 1.06 | | $ | 1.86 | | $ | 1.96 | | $ | 2.76 |

| Diluted (Loss) Earnings Per Share of Common Stock From Discontinued Operations | | | 0.00 | | | (0.25 | ) | | (0.09 | ) | | 2.19 | | | 0.57 |

| | |

| |

| |

| |

| |

|

| Diluted (Loss) Earnings Per Share of Common Stock From Net Income | | $ | (0.13 | ) | $ | 0.81 | | $ | 1.77 | | $ | 4.15 | | $ | 3.33 |

| | |

| |

| |

| |

| |

|

| Dividends Paid per Common Share | | $ | 0.95 | | $ | 1.52 | | $ | 1.48 | | $ | 1.42 | | $ | 1.31 |

| | |

| |

| |

| |

| |

|

| Balance Sheet Data: | | | | | | | | | | | | | | | |

| Total Assets(2)(3) | | $ | 157,775 | | $ | 150,806 | | $ | 141,269 | | $ | 141,986 | | $ | 143,335 |

| | |

| |

| |

| |

| |

|

| Capitalization: | | | | | | | | | | | | | | | |

| Long-Term Debt Outstanding | | $ | 38,226 | | $ | 39,380 | | $ | 30,680 | | $ | 33,765 | | $ | 34,940 |

| Less amount due within one year | | | 2,612 | | | 2,225 | | | 1,450 | | | 3,085 | | | 1,175 |

| | |

| |

| |

| |

| |

|

| Long-Term Debt | | | 35,614 | | | 37,155 | | | 29,230 | | | 30,680 | | | 33,765 |

| Common Shareholders' Equity(4) | | | 47,786 | | | 48,157 | | | 46,988 | | | 47,029 | | | 42,731 |

| | |

| |

| |

| |

| |

|

| Total Capitalization | | $ | 83,400 | | $ | 85,312 | | $ | 76,218 | | $ | 77,709 | | $ | 76,496 |

| | |

| |

| |

| |

| |

|

- (1)

- Data from periods ending prior to June 30, 2003, is from MPS.

- (2)

- For 2005, 2004, 2003 and 2002, total assets reflect the reclassification of accrued removal obligations as a liability from accumulated depreciation. For 2005, the estimated accrued removal obligation includes the PCB Mitigation Project as required under FIN 47.

See Item 1a. "Risk Factors" and Item 7a, "Quantitative and Qualitative Disclosures about Market Risk," incorporated in this section by this reference, concerning material risks and uncertainties which could cause the data reflected herein not to be indicative of the Company's future financial condition or results of operations.

- (3)

- Total assets reflect assets from Discontinued Operations of $235 for 2005, $467 for 2004, $2,024 for 2003, $6,324 for 2002, and $5,632 for 2001.

- (4)

- Common Shareholders' Equity reflects equity from Discontinued Operations of $229 for 2005, $451 for 2004, $1,559 for 2003, $5,674 for 2002, and $3,206 for 2001.

16

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Information

This Management's Discussion and Analysis contains certain forward-looking statements, as defined by the SEC, such as forecasts and projections of expected future performance or statements of Management's plans and objectives. These forward-looking statements may be contained in filings with the SEC and in press releases and oral statements. The reader can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe" and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are based on the current expectations, estimates or projections of Management and are not guarantees of future performance. Some or all of these forward-looking statements may not turn out to be what the Company expected. Actual results could potentially differ materially from these statements. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved.

Factors that could cause actual results to differ materially from our projections include, among other matters, electric utility restructuring; future economic and demographic conditions within MPS's service area and unregulated markets; changes in tax rates; interest rates or rates of inflation; ability to raise capital; pace and success of merger and acquisition efforts; terrorism; changes in the construction industry; changes in Canadian currency rates; length of sales cycles; developments in state, provincial and national legislative and regulatory environments in the United States and Canada; ability to recruit individuals with necessary skill sets; increased competition by existing or new competitors in the Company's unregulated markets; changes in technology; new innovations; changes in NAFTA; increased environmental regulations and other regulatory or market-based conditions.

Annual Performance Summary

Financial results were diminished for the year 2005 compared to 2004 and 2003 due to a myriad of cost factors. During the year MPS's performance was lower than historically expected with cost of service rising such that its return on its distribution rate base was inadequate. TMG did not achieve its targets as a result of a lack of adequate capitalization, costs associated with transitioning acquisitions from small privately held firms to publicly traded company standards, lagging business development, and the slowed pace of accretive acquisitions. MTI's performance was impacted by its lack of business development and need to upgrade its software solutions. Maricor Properties was in a start-up phase during 2005 as real estate assets were leased-up and/or acquired. While MAM's overall financial performance in 2005 was less than anticipated, it made meaningful progress in advancing its growth strategy that remains in its infancy. Management is taking steps to improve future performance and believes it must increase its speed and focus on growing its unregulated operations.

Collectively, MAM's unregulated diversification and growth strategy remains in its infancy stages. It continues to experience cash flow challenges. Management is taking steps to bridge necessary cash flows until 2007 when MAM's cash flow situation should improve. Improved economic performance of existing unregulated subsidiary operations is important and steps are being taken to improve such performance. However, Management believes that adequate capitalization, increased pace of acquisitions, and enhanced business development are critical keys to MAM's unregulated organizations' collective financial performance, both in the near and long-terms.

Management does recognize a number of short-term financial and operating challenges; however, we believe our long-term outlook is encouraging. To improve long-term shareholder value and earnings, Management believes that the Company must increase its pace of organic and inorganic unregulated growth, while forming capital in an equally timely manner supportive of such growth. As previously noted, Management does not believe a status quo or "stay as you are" strategic option exists to create

17

long-term shareholder value for MAM. Further, given the impact of electric deregulation, generation divestiture, and disaggregation of the electric utility industry within Maine, combined with the lagging economy of MPS's service area, Management does not believe reverting solely to its core regulated wires business can generate adequate long-term shareholder value. However, Management also believes that its regulated operation's performance must be continually enhanced. As a result of increasing costs of service, MPS filed in March 2006 a request for a distribution rate increase. The outcome of this docket will not be known, in all probability, until the third quarter of 2006. Although a request for an increase in distribution rates has been made, MPS cannot predict the outcome or the rate of increase that may be allowed. Further, given recent interest in MPS's service area by several wind generators, there are over 500 MW's of proposed wind generation planned for the utility's service area. Should these projects move forward, they hold potential for contract work associated with the construction of additional transmission and substation facilities, as well as the potential rebuilding of part or all of MPS's transmission system funded by the developers. While MPS cannot predict with certainty that these projects will be constructed, Management does believe they are potentially positive projects for its service area.

Through more timely execution of MAM's inorganic unregulated growth strategy, including formation of growth capital, as well as improved organic growth, and MPS's proposed distribution rate increase, Management is focused on increasing earnings across all business lines. Should the Company not achieve a level of unregulated growth consistent with the need to create long-term shareholder value within a reasonable timeframe, Management and the Board of Directors will need to assess strategic alternatives to its current growth strategy. Resulting actions could involve the sale or partial sale of certain or all unregulated assets or other alternatives, recognizing the need to act prudently in protecting and enhancing long-term shareholder value. Further, if the Company does not receive an adequate distribution rate increase to cover its utility costs and allowing for a fair return on rate base, Management will need to assess its strategic options to preserve and grow shareholder value. However, Management does believe that the timely and efficient implementation of the Company's growth strategy, cost control within its utility operations, and implementation of prudent rate increase requests when warranted can result in achieving desired long-term shareholder value.

Given MAM's need to reinvest in its future and expand its scale to improve its overall financial performance, particularly its unregulated operations, Management cannot warrant that it will continue to pay dividends at historic levels or on a continuing basis until its cash flows and earning performances improve. Further, Management believes that it must address the under capitalization issues facing the Company before considering a dividend for its common shareholders. However, it is the goal of Management to expeditiously enhance the performance of the Company and to continue as a yield and growth-at-a-reasonable price stock. Management believes its strategy is sound and that meaningful progress is being made in the firm's overall structural and economic transition.

Overview of Company Strategy

MAM's overall strategy was developed in response to a number of converging macro-economic trends that Management believes will drive market opportunities both in the near and long-term. The year 2005 underscored the reality that turbulence within the energy industry, exacerbated by geo-political conflicts and growing third-world demand for energy, are predicted to have significant price, supply, and security impacts on businesses and organizations within North America. While an increasing emphasis is being placed on supply-side issues by North American governments, we see expanding governmental mandates and a renewed customer-driven need to improve energy efficiency and control energy-related costs. As energy-related issues remain at the forefront of public policy issues, and an increasing cost and reliability concern for businesses and organizations, MAM believes there will be an increasing demand for energy efficiency-related services and solutions, including an expanded market-place interest in "on-site" and alternative energy electric generation.

18

While energy costs and reliability remain a concern, businesses and organizations are facing a significant financial challenge as they realize the economic threats created by escalating deferred maintenance liabilities. As businesses and organizations underfunded their capital renewal and asset maintenance programs year after year, many are now faced with staggering deferred maintenance liabilities. In many cases the deferred maintenance on facility and energy-related assets threatens the continued viability of such assets. Increasingly, MAM believes businesses and organizations are requiring more intensive capital expenditure planning, working to ensure that every capital dollar spent is the most optimal investment they can make. Further, to address burgeoning deferred maintenance liabilities, organizations are looking to advanced business processes that can help extend the functional and economic lifecycle of physical assets. MAM believes that by enhancing the energy efficiency and controlling organizations energy-related expenditures that an entity can "free-up" capital to address their deferred maintenance liabilities. Further, by designing and building new energy-related and energy efficient facilities-related infrastructure, operating costs can be reduced while built environment assets are renewed.

While energy and deferred maintenance liabilities are of growing concern within the marketplace, Management believes there is an increasing North American awareness of climate change and the need to address emissions reductions. We believe that energy efficiency, alternative "on-site" generation, and sustainable asset management techniques are key to reducing emissions from the built environment. We continue to see growing business interests and government mandates to address climate change, particularly within the northeast United States and Canada. As more and more businesses and governments adopt a sustainable approach to their actions, we believe opportunities will evolve related to the market demand for sustainable asset management and energy-related solutions.

As evidenced by the passage of the Sarbanes-Oxley Act and other regulatory actions, there are increasing interests in and growing mandates to improve the transparency of asset governance reporting. Businesses and organizations are being pressed to provide increasing details concerning the performance of owned assets, both from an economic and environmental perspective. Consequently, we also see an emergence of market interests in improved asset governance reporting, a critical part of MTI's sustainability-centric solutions that also address organization's energy, emissions reductions, and deferred maintenance needs.

We believe the convergence of these issues will create a substantial marketplace demand, with current solutions and services being minimal. Addressing these issues and advancing businesses' and organizations' achievement of a stakeholder-centric "triple bottom line" requires the integration of physical, intellectual, and technology-based assets that when combined result in dynamic solutions to growing challenges regarding the aging infrastructure, climate change, energy pricing and security, and our ability to support the changing needs of society. Through the amalgamation of diverse, but relevant skills and technologies in the building sciences, engineering, information technology, and energy consulting fields, MAM is positioning itself to be a leading professional services, product and asset-based solutions company.

MAM's unregulated operations are increasingly focused on sustainable solutions, progressively building professional services competencies to provide products, services, and solutions, such as, but not limited to (a) sustainable university and college campus planning with a strong focus on on-campus energy infrastructure, (b) energy efficiency evaluations and solutions focused on the governments, hospitals, universities, schools, institutional and office commercial markets, (c) sustainable asset management ranging from facility infrastructure condition assessments to capital planning to facility renewal, (d) on-site energy asset development including co-generation, alternative fuel and distributed generation solutions, (e) energy supply management, (f) sustainable real estate development and renewal, including public and private partnerships such as the construction and ownership of university dormitories, (g) sustainable and transparent asset governance and reporting, and (h) LEED™ engineering design services.

19

MAM's execution strategy involves a combination of organic and inorganic strategies. However, key to amassing the requisite talent and core competencies is a proposed aggressive acquisitions program. Simply hiring one individual talent at a time will not enable the necessary ramping-up of the business to achieve the required scale and desired level of profitability. Recognizing that there are limited acquisition opportunities across North America, MAM's efficiency in identifying potential targets, undertaking due diligence, forming capital and closing transactions in a timely manner is critical. Given that few, if any, potential acquisition candidates exist today that provide the array of proposed integrated sustainable services, products, and assets, MAM recognizes its need to acquire companies that bring discreet portions of the value proposition and amalgamate integrated services offerings across acquired companies through the organic development of a high level business development and transaction structuring organization. Such a high level, organically grown business development staff will require experienced individuals with a high degree of relative domain knowledge, as well as experience in structuring financial transactions, often referred to as financial engineers. Through these senior staff members, solutions to clients' needs are crafted using multiple discreet offerings or capabilities, integrated into a seamless solution. Each individual offering will continue to be sold on a "one-off" basis, such as selling engineering design services. However, the more complex and higher value integrated offerings will be sold and managed by a higher level business development organization currently being organized and staffed.